Bare Metal Cloud Market by Service Type (Compute, Networking, Database, Security, Storage, Professional, and Managed), Organization Size, Vertical (BFSI, Manufacturing, Healthcare and Life Sciences, and Government), and Region - Global Forecast to 2026

Updated on : April 3, 2023

Bare Metal Cloud Market Analysis

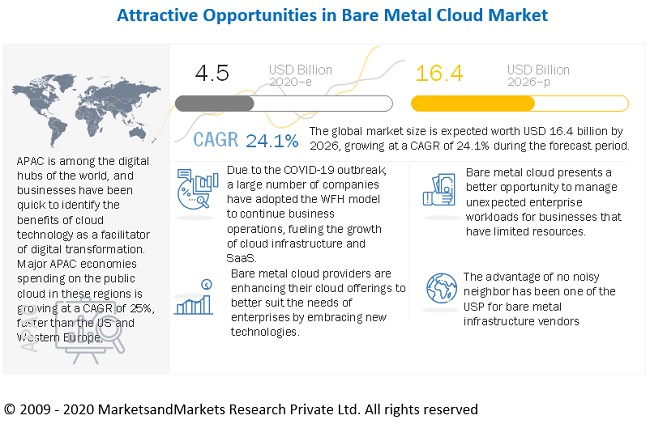

The global Bare Metal Cloud Market in terms of revenue was estimated to be worth $4.5 billion in 2020 and is poised to reach $16.4 billion by 2026, growing at a CAGR of 24.1% from 2020 to 2026. Major factors that are expected to drive the growth of the bare metal cloud market include increasing critical need for reliable load balancing of data-intensive and latency-sensitive operations, necessity of non-locking compute and storage resources, increased usage of IoT platforms and devices to manage workload with high performance computing, elimination of overheads caused due to adherence to compliance, convergence of technologies such as AI, IoT, and analytics, and increase in mobility usage among end users.

An analysis of market trends is part of the new research report. The latest research study includes conference and webinar materials, patent analysis, important stakeholder information, and pricing analysis.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. The technological ecosystem has been playing a pivotal role across the globe. Owing to the COVID-19 pandemic, the requirement of bare metal cloud services for businesses has increased significantly for load balancing to improve the distribution of workloads, customize networks for extensive performance, ensure high security of data, provide multiple database homes on a single server, optimize IT resource access and physical security, and achieve strategic business initiatives.

Bare Metal Cloud Market Dynamics

Drivers: Increased need for reliable load balancing of data-intensive and latency-sensitive operations

Load balancing improves the distribution of additional workloads across the bare metal cloud servers to enable smoother functioning and allocation of resources to multiple processes. Load balancing solutions enable ease in configurability and flexibility to manage traffic and resource usage across server nodes in the real-time end-user environment. Hence, it becomes critical to deploy reliable load balancing operations over the cloud.

Restraints: Lightweight Hypervisors

Virtual cloud computing providers are investing heavily in the R&D of hypervisors to make them more monolithic, lightweight, portable, and flexible. In addition to public cloud vendors are offering their dedicated instances of computing for high-performance workloads. These hypervisors provide high performance and low memory footprint virtualization solutions for multiple CPU architectures and have been termed as a cheap alternative for bare metal cloud infrastructure. One of the primary reasons for the popularity of lightweight hypervisors is the ease in commissioning Virtual Machine (VMs) and at the same time enabling a smother backup and disaster recovery of large datasets. Lightweight hypervisors are being considered as an alternative since it offers greater flexibility to end users with respect to non-locking resources and a complete cloud virtualization model without the additional overhead of server-side processing.

Challenges: Hinderences faced in the bare metal restore

The bare metal restore concept deals with restoring all of the data stored on a failed server system without the need for reloading and installing the previously installed software that the hardware was running on. Commercial entities need to deploy a backup and replication server having similar configuration making the maintenance and deployment costs increase significantly. The backup and replication server requires exactly the same hardware while restoring the failed bare metal system. For most organizations restoring bare metal is a difficult process and vendors require intensive exercise through the dry run of restoring.

Opportunities: Bare metal cloud for big data and DevOps applications

A higher degree of compute operations for large datasets requires significant processing power and storage, which cannot be offered by traditional virtualized cloud infrastructure. The advent of artificial intelligence will boost the deployments of bare metal servers across a multitude of vertical markets attributed to the fact that AI requires large data sets, significant processing, and I/O power. DevOps institutes an environment in which building, testing, and releasing software can happen frequently, rapidly, securely, and reliably. DevOps also upholds a set of processes and methods for the communication and collaboration between development, QA, and IT operations.

To know about the assumptions considered for the study, download the pdf brochure

Based on service types, the compute service segment is expected to be a larger contributor to the bare metal cloud market growth during the forecast period

The bare metal compute service segment is expected to grow at a higher CAGR during the forecast period. The bare metal cloud compute services provide the flexibility to run the demanding workloads and less compute-intensive applications in a secure and highly available cloud environment. Compute services are used for load balancing, which improves the distribution of workloads across multiple computing resources, such as computer clusters, network links, central processing units, or disk drives. Compute services provide flexibility for workload, monetization and termination of instances as per the requirement, and high speed and low latency in computing operations.

Based on vertical segment, the banking, financial services, and insurance (BFSI) segment is expected to be a larger contributor to the bare metal cloud market growth during the forecast period

Banking, Financial, Services, and Insurance (BFSI) is one of the fastest-growing segment. The banking vertical predominantly requires bare-metal cloud services with the rise in the transactions and details related to them. Moreover, the critical need for high security and data protection during online banking, secure transactions, and access violations has also pushed the data traffic demanding the use of bare metal cloud solutions. In areas, such as risk analytics, derivatives pricing, quantitative modeling, portfolio optimization, and bank stress-testing, the use of High-Performance Computing (HPC) for a quick performance of complex calculations on large data sets is becoming increasingly prevalent.

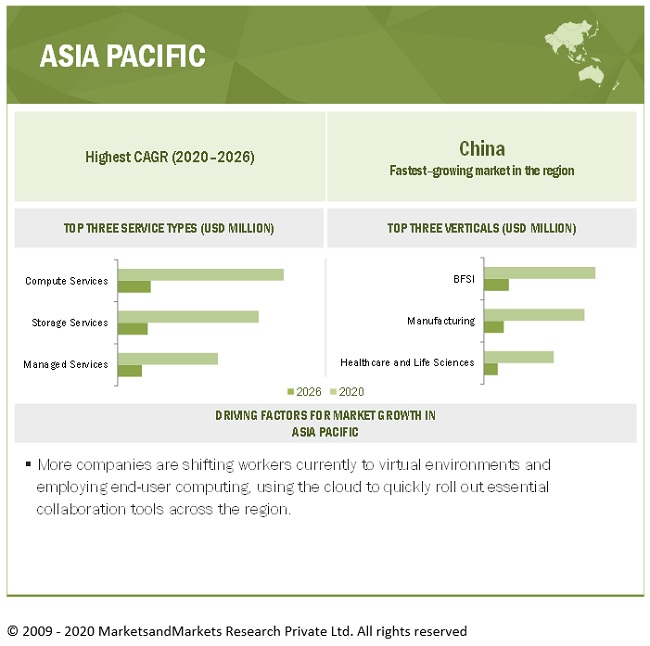

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

APAC is one of the fastest-growing regions in terms of technology adoption, and the demand for digitization is driven by various initiatives carried out by different governments and large enterprises in the region. Countries such as China, Japan, Australia, Singapore, India, and Indonesia are leading this technology adoption, which includes embracing new-age technologies such as AI, edge, IoT, analytics, and cloud. The region houses a large number of enterprises related to retail and consumer goods, telecommunications, healthcare and Lifesciences, manufacturing, and media and entertainment, which is further expected to drive the demand for bare metal cloud. The governments of the APAC region are also adopting cloud by various initiatives, such as smart cities initiatives will be one of the prime catalysts for the adoption of public cloud bare metal professional and managed services. Government agencies are preferring the transformation of their incumbent IT infrastructure to handle data-intensive workloads with customized, on-demand, highly flexible secured single-tenant bare metal servers.

Key Market Players

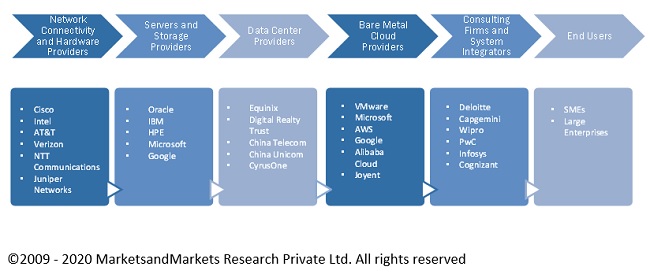

The bare metal cloud market is dominated by companies such as IBM (US), Oracle (US), Oracle (US Lumen (US), Internap (US), Rackspace (US), AWS (US), Dell (US), Equinix (US), Google (US), Microsoft (US), Alibaba Cloud (China), Scaleway (France), Joyent (US), HPE (US), OVHcloud (France), and others. These vendors have a large customer base and strong geographic footprint along with organized distribution channels, which helps them to increase revenues.

Scope of Report

|

Report Metric |

Details |

|

Market size value in 2020 |

USD 4.5 billion |

|

Revenue forecast for 2026 |

USD 16.4 billion |

|

Growth Rate |

24.1% CAGR |

|

Market size available for years |

2016-2026 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Service, Organization Size, Verticals, and Region |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM (US), Oracle (US), Lumen (US), Internap (US), Rackspace (US), AWS (US), Dell (US), Equinix (US), Google (US), Microsoft (US), Alibaba Cloud (China), Scaleway (France), Joyent (US), HPE (US), OVHcloud (France), Limestone Networks (US), Media Temple (US), Bigstep (UK), Zenlayer (US), and phoenixNAP (US). |

This research report categorizes the bare metal cloud market to forecast revenue and analyze trends in each of the following submarkets:

Based on the Component:

- Services

Based on the Service type:

- Compute Services

- Networking Services

- Database Services

- Security Services

- Storage Services

- Professional Services

- Managed Services

Based on organization size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on verticals:

- Banking, Financial, Services, and Insurance (BFSI)

- Retail and Consumer Goods

- IT and ITeS

- Telecommunications

- Healthcare and Life Sciences

- Manufacturing

- Media and Entertainment

- Government

- Others

Based on regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- Rest of APAC

-

MEA

- Saudi Arabia

- Rest of MEA

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments in Bare Metal Cloud Market

- In February 2021, IBM launched high-speed, flash storage systems, hybrid cloud, and container-centric updates to make enterprise-class storage accessible to businesses of all sizes and needs.

- In March 2020, Equinix acquired Packet, a leading bare metal automation platform provider to rapidly deploy digital infrastructure by leveraging Packet's innovative and developer-oriented bare metal service offering in order to accelerate its organic bare metal solution development, thereby aims to cater to customers with rich ecosystems, global reach, and interconnection platform.

Frequently Asked Questions (FAQ):

How big is the bare metal cloud market?

What is growth rate of the bare metal cloud market?

What are the key trends affecting the global bare metal cloud market?

Who are the key players in bare metal cloud market?

Who will be the leading hub for bare metal cloud market?

What is the bare metal cloud market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 6 BARE METAL CLOUD MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 BARE METAL CLOUD MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF BARE METAL CLOUD FROM VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF BARE METAL CLOUD VENDORS

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (1/2)

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (2/2)

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 14 BARE METAL CLOUD MARKET: GLOBAL SNAPSHOT

FIGURE 15 TOP-GROWING SEGMENTS IN THE MARKET

FIGURE 16 COMPUTE SERVICES SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 17 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD

THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD 44

FIGURE 18 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE BARE METAL CLOUD MARKET

FIGURE 19 CRITICAL NEED FOR RELIABLE LOAD BALANCING OF DATA-INTENSIVE AND LATENCY-SENSITIVE OPERATIONS TO DRIVE THE MARKET GROWTH

4.2 MARKET, BY SERVICE TYPE, 2020 VS. 2026

FIGURE 20 COMPUTE SERVICES SEGMENT TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY ORGANIZATION SIZE, 2020

FIGURE 21 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2020

4.4 MARKET, BY VERTICAL, 2020 VS. 2026

FIGURE 22 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.5 MARKET: REGIONAL SCENARIO, 2020–2026

FIGURE 23 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET DYNAMICS AND INDUSTRY TRENDS (Page No. - 49)

5.1 MARKET DYNAMICS

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: BARE METAL CLOUD MARKET

5.1.1 DRIVERS

5.1.1.1 Critical need for reliable load balancing of data-intensive and latency-sensitive operations

5.1.1.2 Necessity of non-locking compute and storage resources

5.1.1.3 Advent of fabric virtualization

5.1.1.4 No noisy neighbors and hypervisor tax

5.1.1.5 Decommissioning of workloads after the termination of SLAs

5.1.2 RESTRAINTS

5.1.2.1 Stringent cloud regulations

5.1.2.2 Lightweight hypervisors

5.1.3 OPPORTUNITIES

5.1.3.1 Bare metal cloud for big data and DevOps applications

5.1.3.2 Bare metal cloud for microservices and batch processing applications

5.1.3.3 Growing interest in OCP

5.1.4 CHALLENGES

5.1.4.1 Premium pricing model

5.1.4.2 Hindrances faced in the bare metal restore

5.2 ECOSYSTEM

TABLE 3 BARE METAL CLOUD: ECOSYSTEM

FIGURE 25 BARE METAL CLOUD MARKET: ECOSYSTEM

5.3 PRICING ANALYSIS

TABLE 4 PRICING ANALYSIS OF BARE METAL CLOUD VENDORS

5.4 USE CASES

5.4.1 USE CASE 1: RACKSPACE

5.4.2 USE CASE 2: INAP

5.4.3 USE CASE 3: SCALEWAY

5.4.4 USE CASE 4: ZENLAYER

5.5 COVID-19-DRIVEN MARKET DYNAMICS

5.5.1 DRIVERS AND OPPORTUNITIES

5.5.2 RESTRAINS AND CHALLENGES

5.6 COVID-19 IMPACT: BARE METAL CLOUD MARKET

FIGURE 26 COVID-19 ANALYSIS

5.6.1 REGIONAL INSIGHTS

5.6.2 VERTICAL INSIGHTS

5.6.3 KEY DEVELOPMENTS

5.6.4 DRIVING FACTORS

6 BARE METAL CLOUD MARKET, BY SERVICE TYPE (Page No. - 61)

6.1 INTRODUCTION

FIGURE 27 COMPUTE SERVICES SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

6.1.1 SERVICE TYPE: MARKET DRIVERS

6.1.2 SERVICE TYPE: COVID-19 IMPACT

TABLE 5 MARKET SIZE, BY SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 6 MARKET SIZE, BY SERVICE TYPE, 2020–2026 (USD MILLION)

6.2 COMPUTE SERVICES

TABLE 7 COMPUTE SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 8 COMPUTE SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 NETWORKING SERVICES

TABLE 9 NETWORKING SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 10 NETWORKING SERVICES: BARE METAL CLOUD MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.4 DATABASE SERVICES

TABLE 11 DATABASE SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 DATABASE SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.5 SECURITY SERVICES

TABLE 13 SECURITY SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 SECURITY SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.6 STORAGE SERVICES

TABLE 15 STORAGE SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 STORAGE SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.7 PROFESSIONAL SERVICES

TABLE 17 PROFESSIONAL SERVICES: BARE METAL CLOUD MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.8 MANAGED SERVICES

TABLE 19 MANAGED SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 MANAGED SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE (Page No. - 71)

7.1 INTRODUCTION

FIGURE 28 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

7.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

TABLE 21 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 22 BARE MARKET CLOUD MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

7.2 LARGE ENTERPRISES

TABLE 23 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 25 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 BARE METAL CLOUD MARKET, BY VERTICAL (Page No. - 76)

8.1 INTRODUCTION

FIGURE 29 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

8.1.1 VERTICALS: MARKET DRIVERS

8.1.2 VERTICALS: COVID-19 IMPACT

TABLE 27 MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 28 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

8.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 29 BANKING, FINANCIAL SERVICES, AND INSURANCE: BARE METAL CLOUD MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 31 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 32 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.3 RETAIL AND CONSUMER GOODS

TABLE 33 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 34 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 35 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 36 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.4 IT AND ITES

TABLE 37 IT AND ITES: BARE METAL CLOUD MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 IT AND ITES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 39 IT AND ITES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 40 IT AND ITES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.5 TELECOMMUNICATIONS

TABLE 41 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 43 TELECOMMUNICATIONS: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 44 TELECOMMUNICATIONS: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.6 HEALTHCARE AND LIFE SCIENCES

TABLE 45 HEALTHCARE AND LIFE SCIENCES: BARE METAL CLOUD MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 46 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 47 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 48 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.7 MANUFACTURING

TABLE 49 MANUFACTURING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 50 MANUFACTURING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 51 MANUFACTURING: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 52 MANUFACTURING: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.8 MEDIA AND ENTERTAINMENT

TABLE 53 MEDIA AND ENTERTAINMENT: BARE METAL CLOUD MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 54 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 55 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 56 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.9 GOVERNMENT

TABLE 57 GOVERNMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 58 GOVERNMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 59 GOVERNMENT: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 60 GOVERNMENT: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.10 OTHER VERTICALS

TABLE 61 OTHER VERTICALS: BARE METAL CLOUD MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 62 OTHER VERTICALS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 63 OTHER VERTICALS: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 64 OTHER VERTICALS: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9 BARE METAL CLOUD MARKET, BY REGION (Page No. - 94)

9.1 INTRODUCTION

FIGURE 30 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 65 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 66 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: MARKET DRIVERS

9.2.2 NORTH AMERICA: COVID-19 IMPACT

9.2.3 NORTH AMERICA: REGULATIONS

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

TABLE 67 NORTH AMERICA: BARE METAL CLOUD MARKET SIZE, BY SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY SERVICE TYPE, 2020–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.2.4 UNITED STATES

TABLE 75 UNITED STATES: BARE METAL CLOUD MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 76 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.2.5 CANADA

TABLE 77 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 78 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.3 EUROPE

9.3.1 EUROPE: MARKET DRIVERS

9.3.2 EUROPE: COVID-19 IMPACT

9.3.3 EUROPE: REGULATIONS

TABLE 79 EUROPE: BARE METAL CLOUD MARKET SIZE, BY SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE, BY SERVICE TYPE, 2020–2026 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.3.4 UNITED KINGDOM

TABLE 87 UNITED KINGDOM: BARE METAL CLOUD MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 88 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.3.5 GERMANY

TABLE 89 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 90 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.3.6 FRANCE

TABLE 91 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 92 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.3.7 REST OF EUROPE

TABLE 93 REST OF EUROPE: BARE METAL CLOUD MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: MARKET DRIVERS

9.4.2 ASIA PACIFIC: COVID-19 IMPACT

9.4.3 ASIA PACIFIC: REGULATIONS

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 95 ASIA PACIFIC: BARE METAL CLOUD MARKET SIZE, BY SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY SERVICE TYPE, 2020–2026 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.4.4 CHINA

TABLE 103 CHINA: BARE METAL CLOUD MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 104 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.4.5 JAPAN

TABLE 105 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 106 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.4.6 REST OF ASIA PACIFIC

TABLE 107 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 108 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.5 MIDDLE EAST AND AFRICA

9.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

9.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

9.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

TABLE 109 MIDDLE EAST AND AFRICA: BARE METAL CLOUD MARKET SIZE, BY SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 110 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE TYPE, 2020–2026 (USD MILLION)

TABLE 111 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 112 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 113 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 114 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 115 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 116 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.5.4 SAUDI ARABIA

TABLE 117 SAUDI ARABIA: BARE METAL CLOUD MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 118 SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.5.5 REST OF MIDDLE EAST AND AFRICA

TABLE 119 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 120 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: MARKET DRIVERS

9.6.2 LATIN AMERICA: COVID-19 IMPACT

9.6.3 LATIN AMERICA: REGULATIONS

TABLE 121 LATIN AMERICA: BARE METAL CLOUD MARKET SIZE, BY SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 122 LATIN AMERICA: MARKET SIZE, BY SERVICE TYPE, 2020–2026 (USD MILLION)

TABLE 123 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 124 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 125 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 126 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 127 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 128 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.6.4 BRAZIL

TABLE 129 BRAZIL: BARE METAL CLOUD MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 130 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.6.5 REST OF LATIN AMERICA

TABLE 131 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 132 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 132)

10.1 INTRODUCTION

10.2 MARKET SHARE OF TOP VENDORS

TABLE 133 BARE METAL CLOUD: DEGREE OF COMPETITION

FIGURE 33 BARE METAL CLOUD MARKET: VENDOR SHARE ANALYSIS

10.3 HISTORICAL REVENUE ANALYSIS OF TOP FIVE VENDORS

FIGURE 34 HISTORICAL REVENUE ANALYSIS

10.4 COMPANY EVALUATION QUADRANT

10.4.1 DEFINITIONS AND METHODOLOGY

TABLE 134 COMPANY EVALUATION QUADRANT: CRITERIA

10.4.2 STAR

10.4.3 EMERGING LEADER

10.4.4 PERVASIVE

10.4.5 PARTICIPANT

FIGURE 35 BARE METAL CLOUD MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2020

TABLE 135 COMPANY PRODUCT FOOTPRINT

TABLE 136 COMPANY INDUSTRY FOOTPRINT

TABLE 137 COMPANY REGION FOOTPRINT

10.5 COMPETITIVE SCENARIO

10.5.1 NEW LAUNCHES

TABLE 138 BARE METAL CLOUD: NEW LAUNCHES, JULY 2019 FEBRUARY 2021

10.5.2 DEALS

TABLE 139 BARE METAL CLOUD: DEALS, NOVEMBER 2019 FEBRUARY 2021

11 COMPANY PROFILES (Page No. - 141)

11.1 MAJOR PLAYERS

(Business Overview, Products & Services, Key Insights, Recent Developments, MnM View)*

11.1.1 IBM

TABLE 140 IBM: BUSINESS OVERVIEW

FIGURE 36 IBM: COMPANY SNAPSHOT

TABLE 141 IBM: BARE METAL CLOUD MARKET: NEW LAUNCHES

TABLE 142 IBM: MARKET: DEALS

11.1.2 ORACLE

TABLE 143 ORACLE: BUSINESS OVERVIEW

FIGURE 37 ORACLE: COMPANY SNAPSHOT

TABLE 144 ORACLE: MARKET: NEW LAUNCHES

TABLE 145 ORACLE: MARKET: DEALS

11.1.3 LUMEN

TABLE 146 LUMEN: BUSINESS OVERVIEW

FIGURE 38 LUMEN: COMPANY SNAPSHOT

TABLE 147 LUMEN: BARE METAL CLOUD MARKET: NEW LAUNCHES

TABLE 148 LUMEN: MARKET: DEALS

11.1.4 INTERNAP

TABLE 149 INTERNAP: BUSINESS OVERVIEW

FIGURE 39 INTERNAP: COMPANY SNAPSHOT

TABLE 150 INTERNAP: MARKET: NEW LAUNCHES

TABLE 151 INTERNAP: MARKET: DEALS

11.1.5 RACKSPACE

TABLE 152 RACKSPACE: BUSINESS OVERVIEW

FIGURE 40 RACKSPACE: COMPANY SNAPSHOT

TABLE 153 RACKSPACE: BARE METAL CLOUD MARKET: NEW LAUNCHES

TABLE 154 RACKSPACE: MARKET: DEALS

11.1.6 AWS

TABLE 155 AWS: BUSINESS OVERVIEW

FIGURE 41 AWS: COMPANY SNAPSHOT

TABLE 156 AWS: MARKET: NEW LAUNCHES

TABLE 157 AWS: MARKET: DEALS

11.1.7 DELL

TABLE 158 DELL: BUSINESS OVERVIEW

FIGURE 42 DELL: COMPANY SNAPSHOT

TABLE 159 DELL: BARE METAL CLOUD MARKET: NEW LAUNCHES

TABLE 160 DELL: MARKET: DEALS

11.1.8 EQUINIX

TABLE 161 EQUINIX: BUSINESS OVERVIEW

FIGURE 43 EQUINIX: COMPANY SNAPSHOT

TABLE 162 EQUINIX: MARKET: NEW LAUNCHES

TABLE 163 EQUINIX: MARKET: DEALS

11.1.9 GOOGLE

TABLE 164 GOOGLE: BUSINESS OVERVIEW

FIGURE 44 GOOGLE: COMPANY SNAPSHOT

TABLE 165 GOOGLE: BARE METAL CLOUD MARKET: NEW LAUNCHES

TABLE 166 GOOGLE: BARE METAL CLOUD: DEALS

11.1.10 MICROSOFT

TABLE 167 MICROSOFT: BUSINESS OVERVIEW

FIGURE 45 MICROSOFT: COMPANY SNAPSHOT

TABLE 168 MICROSOFT: MARKET: NEW LAUNCHES

TABLE 169 MICROSOFT: MARKET: DEALS

11.1.11 ALIBABA CLOUD

11.1.12 SCALEWAY

11.1.13 JOYENT

11.1.14 HPE

11.1.15 OVHCLOUD

11.1.16 LIMESTONE NETWORKS

11.1.17 MEDIA TEMPLE

11.1.18 BIGSTEP

11.1.19 ZENLAYER

11.1.20 PHOENIXNAP

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

12 ADJACENT MARKET (Page No. - 181)

12.1 INTRODUCTION

12.2 CLOUD COMPUTING MARKET

TABLE 170 CLOUD COMPUTING MARKET SIZE, BY REGION, 2016–2019 (USD BILLION)

TABLE 171 CLOUD COMPUTING MARKET SIZE, BY REGION, 2020–2025 (USD BILLION)

TABLE 172 CLOUD COMPUTING MARKET SIZE, BY SERVICE MODEL, 2016–2019 (USD BILLION)

TABLE 173 CLOUD COMPUTING MARKET SIZE, BY SERVICE MODEL, 2020–2025 (USD BILLION)

TABLE 174 CLOUD COMPUTING MARKET SIZE, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 175 CLOUD COMPUTING MARKET SIZE, BY VERTICAL, 2020–2025 (USD BILLION)

13 APPENDIX (Page No. - 184)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

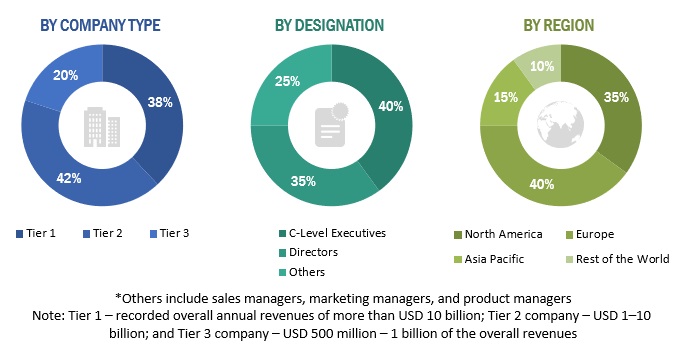

This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, data center associations, vendor data sheets, product demos, Cloud Computing Association (CCA), Asia Cloud Computing Association, and The Software Alliance. All these sources were referred to identify and collect information useful for this technical, market-oriented, and commercial study of the bare metal cloud market. The primary sources were mainly several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all the segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

The market size of companies offering bare metal cloud was derived on the basis of the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from bare metal cloud vendors, industry associations, and independent consultants; and key opinion leaders.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the bare metal cloud market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the cloud system market.

Report Objectives

- To define, segment, and project the global market size of the bare metal cloud market

- To understand the structure of the bare metal cloud market by identifying its various subsegments

- To provide detailed information about the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the 5 major regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments, such as expansions and investments, new product launches, mergers and acquisitions, joint ventures, and agreements, in the bare metal cloud market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bare Metal Cloud Market