Barrier Films Market by Materials (Polyethylene (PE), Polypropylene (PP), Polyester (PET), Polyamide, Organic Coatings, Inorganic Oxide Coatings), Packaging Type (Pouches, Bags, Blister Packs), End-use, Type and Region - Global Forecast to 2028

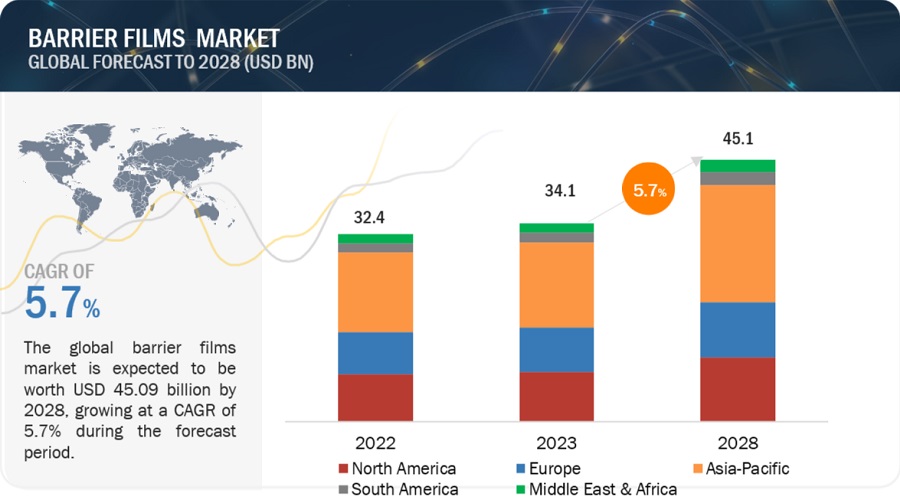

The market for barrier films is approximated to be USD 34.1 billion in 2023, and it is projected to reach USD 45.1 billion by 2028 at a CAGR of 5.7%. Barrier films are specialized packaging materials designed to provide a barrier against the permeation of gases, moisture, and other external substances. They are used to protect sensitive products, such as food, pharmaceuticals, electronics, and industrial goods, from degradation caused by exposure to air, moisture, light, or other environmental factors. The global barrier films market has been growing steadily in recent years and is expected to continue to grow in the coming years. The market is segmented on the basis of materials such as Polyethylene (PE), Polypropylene (PP), Polyester (PET), polyamide, organic coatings, inorganic oxide coatings, and others. Barrier films market by packaging type are pouches, bags, blister packs, and others. The barrier films market is segmented on the basis of type such as metalized, transparent, and white. The barrier films are used in several end-use industries such as food & beverage packaging, Pharmaceutical packaging, agriculture, and others.

Attractive Opportunities in the Barrier Films Market

To know about the assumptions considered for the study, Request for Free Sample Report

Barrier Films Market Dynamics

Driver: Rising number of retail chains in developing countries

Retail chains have dominated the food & beverage market in advanced countries for many years. Food & beverage retailing has been traditionally dominated by local, small, and independent artisan stores offering unpacked food in developing regions, such as Central and Eastern Europe, South America, and Asia. This trend is changing, and the number of domestic hypermarkets and supermarkets is increasing in many of the major cities in developing countries. This change in trend has helped these supermarkets to increase their shares in the food & beverages market. The demand for barrier packaging films is benefitting from the growing market share of large retail chains as these retail chains provide packed food products with convenient and user-friendly packaging. Furthermore, these chains have extended the market for packaged food with a strong focus on cost reduction and shelf life extension. There has also been growth in the number of discount stores and private label products, which enable lower-income groups to purchase packaged food and drinks at more affordable prices.

Restraint: Susceptibility to degradation

Barrier films can be susceptible to degradation under certain conditions. The susceptibility to degradation depends on various factors, including the specific material used, the environmental conditions, and the duration of exposure. Many barrier films, especially those made from polymers, can absorb moisture over time. Moisture absorption can lead to dimensional changes, loss of mechanical strength, and increased permeability to gases and other substances. It is essential to store barrier films in a controlled environment with low humidity to minimize moisture absorption.

Opportunities: Biodegradable barrier films

Biodegradable barrier films are a type of packaging material designed to provide the necessary barrier properties while also being environmentally friendly and capable of breaking down naturally over time. These films are engineered to degrade through biological processes, such as microbial activity or enzymatic action, into simpler, non-toxic substances, such as water, carbon dioxide, and biomass. The rate of biodegradation for these films can vary depending on factors such as film thickness, composition, environmental conditions, and the presence of specific microorganisms or enzymes. It is important to note that the biodegradability of these films is often optimized in industrial composting facilities or specific environmental conditions that provide the necessary microorganisms, temperature, and humidity for degradation to occur.

Challenges: Issue related to recycling of multilayer films

Multilayer barrier films pose challenges when it comes to recycling due to their complex structure and combination of different materials. Multilayer barrier films often consist of layers made from different types of polymers, additives, and coatings. These materials may have different melting points, chemical compositions, and recycling compatibilities. Separating and recycling each layer individually becomes challenging because they require specialized processes. The recycling of multilayer barrier films can be more expensive compared to the recycling of single-material films. The costs associated with collection, sorting, and processing of multilayer films may outweigh the economic benefits of recycling, especially when the market demand for recycled materials is uncertain.

Ecosystem

By material, organic coatings segment is projected to register the highest CAGR during the forecast period.

Organic coating barrier films refer to packaging films that incorporate organic coatings or surface treatments to enhance their barrier properties. These coatings are typically applied to a base film made from materials like polyethylene (PE), polypropylene (PP), or polyethylene terephthalate (PET) to provide additional barriers against gases, moisture, and other external factors. Organic coatings can improve the barrier properties of the base film by reducing the permeability of gases and moisture. These coatings are typically applied using techniques such as extrusion coating, lamination, or surface coating. The coating thickness can vary depending on the desired level of barrier protection.

By End-Use Industry, the Agriculture segment projected to register the highest CAGR during the forecast period.

Barrier films play a significant role in agriculture by providing protection and enhancing the quality and shelf life of agricultural products. Silage films are used to cover and protect silage, which is fermented and stored livestock feed. Barrier silage films, usually made from multi-layered co-extruded plastics, provide an airtight seal that prevents oxygen penetration and inhibits spoilage. These films preserve the nutritional value and freshness of silage, enabling farmers to store feed for extended periods without quality deterioration. Barrier films are widely used as greenhouse covers to create an optimal growing environment for crops. These films provide a physical barrier against pests, insects, and adverse weather conditions, while also allowing light transmission for photosynthesis. They regulate temperature and humidity inside the greenhouse, promoting optimal plant growth and higher yields. Barrier films in agriculture offer numerous benefits, including improved crop yield, enhanced product quality, reduced waste, and increased profitability for farmers and growers. They contribute to sustainable agricultural practices by minimizing resource wastage and improving the efficiency of production and post-harvest processes.

Asia Pacific is projected to account for the highest CAGR in the barrier films market during the forecast period.

The Asia Pacific region is currently experiencing significant market drivers that are influencing the demand for barrier films. The Asia Pacific region is witnessing a substantial increase in population, coupled with rapid urbanization. This demographic trend has resulted in higher consumption of packaged goods, including food, beverages, personal care products, and pharmaceuticals. Consequently, there is an increased demand for barrier films to protect and preserve these products during storage and transportation. There is a significant surge in demand for packaged food and beverages in the Asia Pacific region. Packaged products offer convenience, safety, and extended shelf life, driving the use of barrier films. Moreover, the growth of e-commerce and online grocery platforms has further fueled the demand for effective barrier packaging solutions, as they require robust protective films to withstand various handling and shipping processes. The pharmaceutical and healthcare sectors in the Asia Pacific region are experiencing rapid growth. Barrier films are indispensable in pharmaceutical packaging to protect products from moisture, oxygen, UV light, and other external factors that could compromise their quality and efficacy. Factors such as population growth, rising healthcare expenditure, and the expansion of generic drug manufacturing contribute to the increasing demand for barrier films in the pharmaceutical industry. Asia Pacific region is witnessing a shift in the retail landscape, with the growth of modern retail formats such as supermarkets, hypermarkets, and convenience stores. These formats require efficient packaging solutions to extend the shelf life of products and ensure their quality and safety. Barrier films play a vital role in meeting these requirements.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Barrier films market comprises major manufacturers such as Berry Global Inc. (US), Amcor Plc (Australia), Sealed Air (US), Toppan Printing Co., Ltd. (Japan), Cosmo Films Ltd. (India), Jindal Poly Films Ltd. (India), Dupont Teijin Films (US) and Uflex Ltd. (India) among others were the leading players in the barrier films market. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the barrier films market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

application, type, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

Royal Dutch Shell (Netherlands), Chevron Phillips Chemical Company (Texas), INEOS Group Limited (UK), SABIC (Saudi Arabia), Evonik Industries AG (Germany), Dow Chemical Company (Michigan), Sasol Limited (South Africa), ExxonMobil (US), Qatar Chemical Company (Qatar), PJSC Nizhnekamskneftekhim (Russia). |

|

|

This research report categorizes the barrier films market by fuel, applications, product type, power rating, end user, and region

Based on type, the Alpha olefins market has been segmented as follows:

- 1-Hexene

- 1-Octene

- 1-Butene

- Others

Based on application, the Alpha olefins market has been segmented as follows:

- Polyolefins comonomer

- Surfactants and intermediates

- Lubricants

- Fine chemicals

- Plasticizer

- Oil field chemicals

- Others

Based on region, the Alpha olefins market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In May 2023, The Amcor a leader in developing and producing responsible packaging solutions, announced that it has signed a definitive agreement to acquire Moda Systems, a leading manufacturer of state-of-the-art, automated protein packaging machines.

- In April 2023, Sealed Air and Koenig & Bauer AG announced they have signed a non-binding letter of intent to expand their strategic partnership for digital printing machines. The partnership aims to significantly improve packaging design capabilities by developing state-of-the art digital printing technology, equipment, and services.

- In July 2021, Toppan has acquired the InterFlex Group (InterFlex), a global flexible packaging converter with bases in the United States and the United Kingdom on July 23, 2021.

- Interflex is a provider of various packaging solutions to a wide range of consumer goods markets. With five production facilities located in the United States and the United Kingdom, Interflex offers a diverse product portfolio. Their offerings include printed shrink films, stand-up pouches, pre-formed bags, wax coated papers, surface print and laminate roll stocks, as well as barrier and non-barrier film laminations. By providing these packaging options, Interflex caters to the specific needs of different industries and ensures effective protection and presentation of their customers' products.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the Barrier films market?

The major driver influencing the growth of the Barrier films market are Growing Demand for Packaged Food and Beverages and Increasing Focus on Product Protection and Shelf Life Extension.

What are the major challenges in the Barrier films market?

The major challenge in the Barrier films market is Issue related to recycling of multilayer films.

What are the restraining factors in the Barrier films market?

The major restraining factor faced by the Barrier films market is Susceptibility to degradation.

What is the key opportunity in the Barrier films Market?

The policy changes regarding the use of Barrier films have a new opportunity for the Barrier films market and Biodegradable barrier films.

What are the end-uses of Barrier films?

Barrier films play a significant role in agriculture by providing protection and enhancing the quality and shelf life of agricultural products. It is also primarily used in food and beverages industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

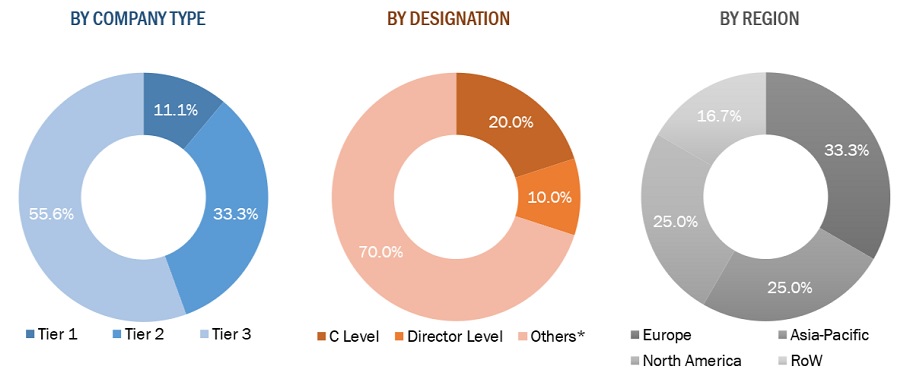

The study involved major activities in estimating the current size of the barrier films market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources, such as annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from recognized authors, and databases, were considered for identifying and collecting information for this study. Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total number of market players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, consultants, and related key executives from major companies and organizations operating in the market. Primary sources from the demand side include lab technicians, technologists, and sales/purchase managers in the industry. Following is the breakdown of primary respondents:

Note: Others include product engineers and product specialists.

The tier of the companies is defined on the basis of their total revenue; as of 2018: Tier 1 = > USD 1 billion, Tier 2 = From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

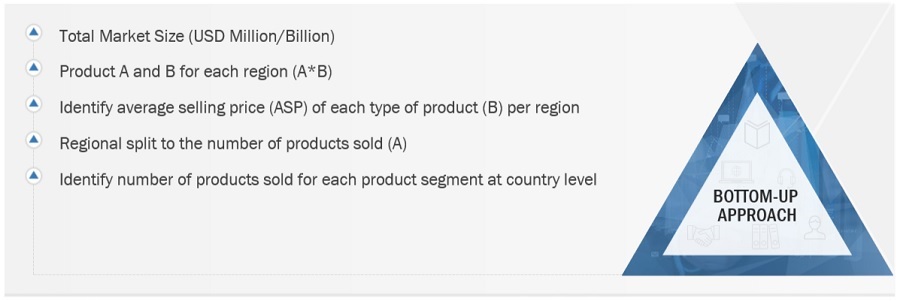

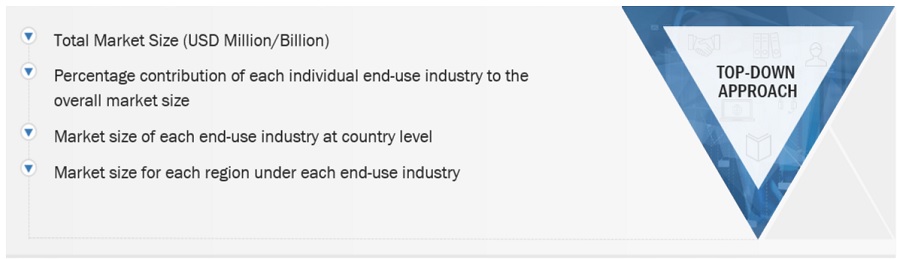

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Alpha Olefins market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions has been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Alpha olefins Market Size: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Alpha Olefins Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

The Alpha Olefins market encompasses the utilization of continuous Alpha Olefins principles and technologies, including various types, applications across industries, and regional market dynamics. The alpha olefins market refers to the global marketplace for the group of chemical compounds known as alpha olefins. Alpha olefins are unsaturated hydrocarbons containing a double bond at the primary carbon atom, which is the carbon atom directly adjacent to the end of the carbon chain. These compounds are versatile and are used to manufacture a variety of products in industries, such as plastics, chemicals, lubricants, and surfactants.

Key Stakeholders

Objectives of the Study

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

Asia (China, Japan, South Korea, India, Singapore, and the Rest of Asia-Pacific), Europe (Germany, Italy, Belgium, France, Netherlands, Russia, and rest of Europe), North America (US, Canada, and Mexico), South America (Brazil, Venezuela, Argentina, Columbia, rest of South America), Middle East & Africa (Qatar, Saudi Arabia, UAE, Iran, rest of Middle East).

-

- Alpha Olefins Manufacturers

- End-Use Industries

- Distributors and Suppliers

- Research and Development (R&D) Organizations

- Consumers and Consumer Advocacy Groups

- To define, describe, segment, and forecast the Alpha olefins market size by technology, meter type, component, and application

- To provide detailed information on the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the Alpha olefins market

- To strategically analyze the Alpha olefins market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide a detailed competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five main regions (along with countries), namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as new product developments, contracts & agreements, investments & expansions, and mergers & acquisitions in the Alpha Olefins market

Growth opportunities and latent adjacency in Barrier Films Market