Basalt Fiber Market by Usage (Composites, Non-Composites), End-Use Industry (Construction & Infrastrastructure, Automotive & Transportation, Wind Energy, Electrical & Electronics, Marine), Form (Continuous, Discrete) and Region - Global Forecast to 2027

Basalt Fiber Market

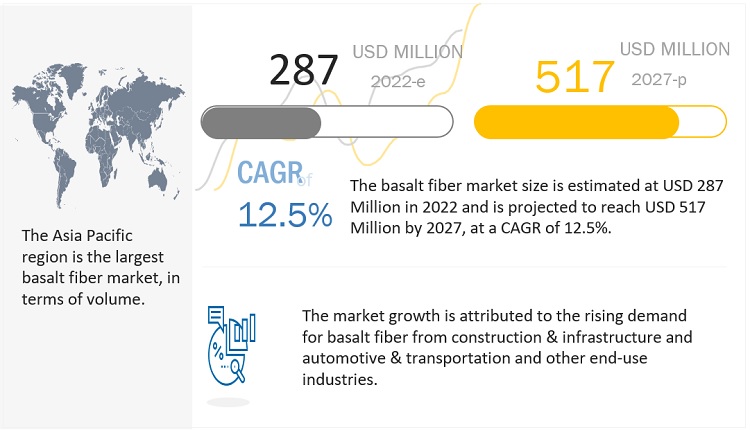

The global basalt fiber market was valued at USD 287 million in 2022 and is projected to reach USD 517 million by 2027, growing at a cagr 12.5% from 2022 to 2027. The rising demand from construction & infrastructure, automotive & transportation, electrical & electronics, wind energy, and many other end-use industries is driving the growth of the market across the globe. Moreover, wide range of superior properties such as heat and sound insulation, thermal stability, high durability, vibration resistance, and many more is pushing the adoption of basalt fiber for various applications in multiple end-use industries.

Global Basalt Fiber Market Trends

Note e-estimated; p-projected.

To know about the assumptions considered for the study, Request for Free Sample Report

Basalt Fiber Market Dynamics

DRIVERS: Environmentally friendly and easily recyclable material

Basalt fiber is made from basalt rock, which is naturally available. Basalt is a fine-grained, extrusive, igneous rock composed of plagioclase, feldspar, pyroxene, and magnetite. It contains olivine, which has not more than 53 wt% SiO2 and less than 5 wt% total alkalis. This fiber offers a wide range of superior mechanical properties, such as higher tensile strength and lower manufacturing cost as compared to glass fibers. Basalt fibers are recycled and are, therefore, environmentally friendly. Basalt fibers are classified as sustainable materials as they are made of naturally occurring material, and when the basalt fibers in the resin are recycled, the material obtained is the same as natural basalt powder. Owing to their recyclable and environmentally friendly properties, the demand for basalt fiber is increasing and is replacing glass fiber.

Moreover, the stringent regulations against the use of glass fibers are expected to increase the use of basalt fiber and basalt composites in automotive & transportation, construction & infrastructure, and other end-use industries.

Restraints: Competition of basalt fiber with other matured products

Basalt fiber get widely preferred in the variety of construction & infrastructure applications. Although basalt fiber possesses range of superior properties as compared to S-glass fiber and E-glass fiber, it is not getting used commercially in many applications due to a lack of information and clarity regarding the uses of basalt fiber. There is huge potential for basalt fiber in automotive & transportation, marine, sporting goods, aerospace & defense, and wind applications.

Opportunities: Growing adoption of recyclable and environmentally friendly materials

The demand for easily recyclable fiber and environmentally friendly fiber reinforced composites is continuously increasing. This is due to many new stringent government rules and regulations. Many consumers are shifting towards the use recyclable products that will not harm the environment.

Some of the developed countries including the US, Japan, and Germany are shifting from the use of petroleum-based products to environmentally friendly products and bio-based materials. Many countries are encouraging recyclability of vehicle components or making the automotive manufacturers responsible for disposal at the end of vehicles service life. The rules and regulations from the government are expected to boost the use of natural fiber, and environment friendly composites such as basalt fiber in construction & infrastructure, automotive & transportation, and in many ither end-use industries.

Challenges: Difficulty in the promotion of basalt fiber

Basalt fiber is a relatively new material in the fiber and structural composites industry. However, it has a similar chemical composition and functionality as that of glass fiber. Also, it has better strength characteristics than glass, and it is highly resistant to alkaline, acidic, and salt attack. The price of basalt fibers is slightly higher than those made of E-glass but less than that of S-glass, aramid, or carbon fiber. As global production increases, its cost of production should reduce in the coming years. There are some technical complexities in the production of basalt fiber, which creates difficulties for the product to compete with other matured products. There are a number of advantages of basalt fiber over conventional glass fiber; however, it is not recommended by governments, and no initiatives have been taken by other agencies to develop this industry. There are very few countries such as Russia, China, the US, Germany, Belgium, and Ukraine which are focusing on the expansion of basalt fiber. Emerging economies such as Brazil, India, and others have not undertaken any initiatives for the development of this market. Manufacturers are trying to promote the use of basalt fiber on their own in various industries by attending exhibitions and composites conferences.

Construction & infrastructure industry dominated the market in 2021

Basalt fiber composite materials are slowly replacing steel in the construction industry due to their unique combination of properties, such as high strength to weight ratio, chemical & corrosion resistance, low thermal conductivity, and zero electrical & magnetic conduction. Basalt fibers are used in assembled houses and structures, cold floor heating plates, fire partitions, firewalls, fire doors, and for other construction applications. These fibers are used in a number of forms such as reinforced rebars, pultruded load-bearing profiles, biaxial & triaxial basalt fabrics, basalt reinforcing meshes, and in basalt fiber reinforced concrete in the construction & infrastructure industry.

Composites usage segment accounted the largest market share in 2021

Basalt fibers are majorly used in composites. Owing to their superior mechanical and chemical properties, basalt fiber is replacing glass fiber in a number of applications. High demand for basalt fiber is witnessed in composites, mainly from the civil engineering sector, to enhance the safety features of buildings. Basalt fibers are also used in the form of composites in automotive & transportation, wind energy, marine, and sporting goods industries. Basalt fibers in non-composites are applicable in insulation in the building & construction and transportation industries.

Discrete form holds the second- largest share of the basalt fiber market in 2021

Discrete basalt fiber is found to be extremely useful in the construction & infrastructure industry. This form of basalt fibers is used in fiber reinforced concrete which contains uniformly distributed discrete fibers. Asia Pacific is the largest consumer of discrete basalt fibers due to the demand from leading economies such as China, Japan, and India. The rapidly growing construction & infrastructure and transportation industries are driving the demand for discrete basalt fibers at the global level.

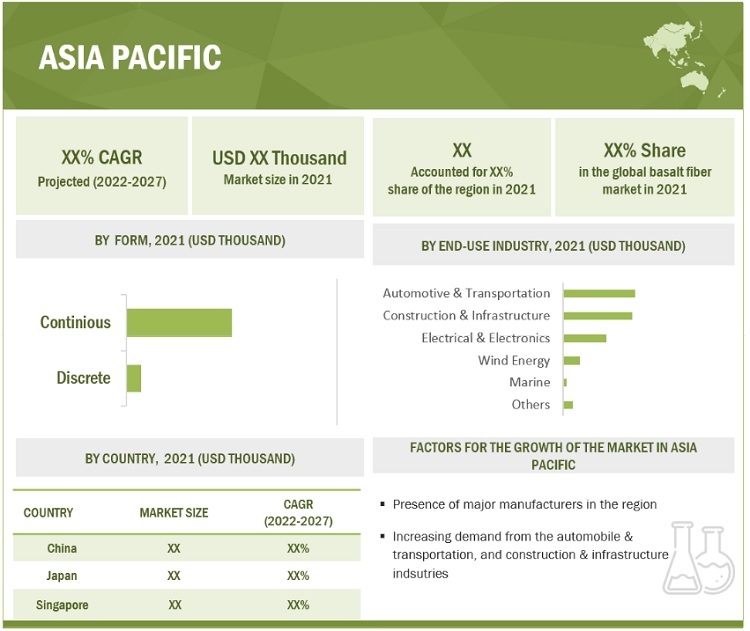

Asia Pacific is expected to be the fastest growing region during forecast period

The growth of the basalt fiber market in Asia Pacific is expected to be driven by the increasing consumption of basalt fiber in various industries such as wind energy, construction & infrastructure, electrical & electronics, and automotive transportation. This growth is also because of the increased industrial development in countries such as China and Japan. The market in these end-use industries is led by China, India, Japan, and South Korea. The growing focus of the region on renewable energy resources has led to increased wind turbine installations, further leading to the growth of the basalt fiber market.

To know about the assumptions considered for the study, download the pdf brochure

Basalt Fiber Market Players

The basalt fiber market is dominated by a few globally established players such as Kamenny Vek (Russia), Zhejiang GBF Basalt Fiber Co. (China), JFE RockFiber Corp. (Japan), Mafic SA (Ireland), Technobasalt-Invest LLC (Ukraine), Russian Basalt (Russia), ISOMATEX SA (Belgium), among others.

Basalt Fiber Market Report Scope

|

Report Metric |

Details |

| Years considered for the study | 2018–2027 |

| Base year | 2021 |

| Forecast period | 2022–2027 |

| Units considered | Value (USD Thousand/Million), Volume (Ton) |

| Segments | Form, Usage, End-use Industry and Region |

| Regions | Europe, North America, APAC, MEA, and Latin America |

| Companies | Kamenny Vek (Russia), Zhejiang GBF Basalt Fiber Co. (China), JFE RockFiber Corp. (Japan), Mafic SA (Ireland), Technobasalt-Invest LLC (Ukraine), Russian Basalt (Russia), ISOMATEX SA (Belgium), INCOTELOGY GmbH (Germany), Sudaglass Basalt Fiber Technology (US), Shanxi Basalt Fiber Technology Co., Ltd (China), Mudanjiang Basalt Fiber Co. (China) |

This research report categorizes the basalt fiber market based on form, usage, end-use industry, and region.

By Form:

- Continuous

- Discrete

By Usage:

- Composites

- Non-Composites

By end-use industry:

- Automotive & Transportation

- Construction & Infrastructure

- Electrical & Electronics

- Wind Energy

- Marine

- Others

By region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In April 2021, Kamenny Vek started production of basalt direct roving 22 microns 2400 tex, basalt assembled roving 18 micron 4800 tex and basalt assembled roving 18 micron 3000 tex.

- In June 2017, Kamenny Vek started production of 2,000 tex direct basalt fiber roving. These direct rovings offer benefits such as zero catenary and high mechanical properties where high tex is required.

- In December 2017, Mafic SA and Michelman, Inc. (Ohio, US) entered into a partnership to develop innovative basalt fiber products. This helped the company in increasing the performance and surface characteristics of basalt fibers and their use in high-performance composites.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the basalt fiber tanks market?

The growing emerging applications of basalt fiber in various end-use industries

Which is the fastest-growing country-level market for basalt fiber?

China is the fastest-growing basalt fiber market due to high demand

What are the factors contributing to the final price of basalt fiber?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of basalt fiber.

What are the challenges in the basalt fiber market?

Difficulty in the promotion is the major challenge in the basalt fiber market.

Which form of basalt fiber holds the largest market share?

Continuous form of basalt fiber holds the largest share due to efficient properties.

How is the basalt fiber market aligned?

The market is growing at a significant pace. It is a potential market, and many manufactures are planning business strategies to expand their business.

Who are the major manufacturers?

Kamenny Vek (Russia), Zhejiang GBF Basalt Fiber Co. (China), JFE RockFiber Corp. (Japan), Mafic SA (Ireland), Technobasalt-Invest LLC (Ukraine), Russian Basalt (Russia), ISOMATEX SA (Belgium), INCOTELOGY GmbH (Germany), Sudaglass Basalt Fiber Technology (US), Shanxi Basalt Fiber Technology Co., Ltd (China)

What are the usage types for basalt fiber?

Composites and non-composites are the usage types of basalt fibers.

What are the major end-use industries for basalt fiber?

The major end-use industries for basalt fibers are construction & infrastructure, automotive & transportation, electrical & electronics, marine, and wind energy.

What is the biggest restraint in the basalt fiber market?

Competition with matured products. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 BASALT FIBER MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.3.4 CURRENCY

1.3.5 UNIT CONSIDERED

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 BASALT FIBER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

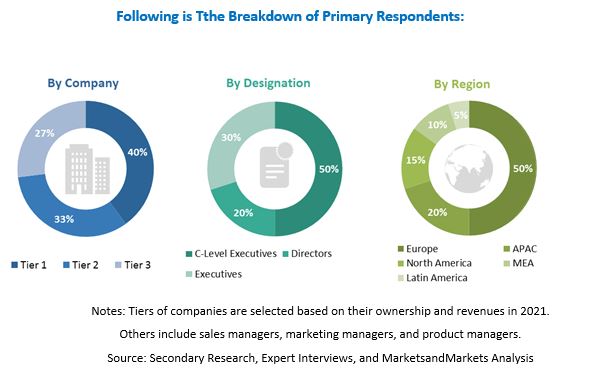

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews - top basalt fiber manufacturers

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Key industry insights

2.2 BASE NUMBER CALCULATION

2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

2.2.2 APPROACH 2: DEMAND-SIDE ANALYSIS

2.3 FORECAST NUMBER CALCULATION

2.3.1 SUPPLY-SIDE

2.3.2 DEMAND-SIDE

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 4 BASALT FIBER MARKET: DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 5 AUTOMOTIVE & TRANSPORTATION SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

FIGURE 6 CONTINUOUS BASALT FIBER ACCOUNTED FOR DOMINANT SHARE OF MARKET IN 2021

FIGURE 7 COMPOSITES SEGMENT ACCOUNTED FOR MAXIMUM SHARE OF OVERALL BASALT FIBER MARKET IN 2021

FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST GROWTH IN BASALT FIBER MARKET

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN BASALT FIBER MARKET

FIGURE 9 ASIA PACIFIC TO BE MOST PROMISING MARKET FOR BASALT FIBER

4.2 BASALT FIBER MARKET, BY REGION AND END-USE INDUSTRY

FIGURE 10 CONSTRUCTION & INFRASTRUCTURE INDUSTRY LED OVERALL BASALT FIBER MARKET IN 2021

4.3 BASALT FIBER MARKET, BY FORM

FIGURE 11 CONTINUOUS BASALT FIBER SEGMENT DOMINATED OVERALL MARKET IN 2021

4.4 BASALT FIBER MARKET, BY USAGE TYPE

FIGURE 12 COMPOSITES SEGMENT ACCOUNTS FOR LARGER SHARE OF BASALT FIBER MARKET

4.5 BASALT FIBER MARKET, BY COUNTRY

FIGURE 13 CHINA TO REGISTER HIGHEST CAGR IN BASALT FIBER MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BASALT FIBER MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in demand for non-corrosive materials

5.2.1.2 Enhanced physical, mechanical, and chemical properties

TABLE 1 MECHANICAL & PHYSICAL PROPERTIES OF FIBERS

TABLE 2 TEMPERATURE RANGE OF FIBERS

5.2.1.3 Environmentally friendly and easily recyclable material

5.2.2 RESTRAINTS

5.2.2.1 Competition from matured products

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in demand for basalt fiber in Europe and Asia Pacific

5.2.3.2 Growing adoption of environmentally friendly and recyclable materials

5.2.4 CHALLENGES

5.2.4.1 Complex manufacturing process and high cost compared to E-glass fibers

5.2.4.2 Difficulty in promotion of basalt fiber

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 BASALT FIBER MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 3 BASALT FIBER MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 PRICING ANALYSIS

5.5 AVERAGE SELLING PRICE

TABLE 4 BASALT FIBER AVERAGE SELLING PRICE, BY REGION

5.6 BASALT FIBER MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

TABLE 5 BASALT FIBER MARKET: CAGR (BY VALUE) IN REALISTIC, PESSIMISTIC, AND OPTIMISTIC SCENARIOS

5.6.1 OPTIMISTIC SCENARIO

5.6.2 PESSIMISTIC SCENARIO

5.6.3 REALISTIC SCENARIO

5.7 VALUE CHAIN ANALYSIS

FIGURE 16 VALUE CHAIN ANALYSIS: MORE VALUE ADDED DURING COMPOSITE DESIGN AND COMPOSITE PROCESSING PHASES

5.8 TECHNOLOGY ANALYSIS

TABLE 6 COMPARATIVE STUDY OF MAJOR BASALT FIBER COMPOSITE MANUFACTURING PROCESSES

5.9 TECHNOLOGICAL ADVANCEMENTS

5.9.1 USE OF BASALT FIBER IN HYBRID FABRICS

5.10 PATENT ANALYSIS

5.10.1 INTRODUCTION

5.10.2 METHODOLOGY

5.10.3 DOCUMENT TYPE

TABLE 7 BASALT FIBER: GLOBAL PATENTS

FIGURE 17 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

FIGURE 18 GLOBAL PATENT PUBLICATION TREND ANALYSIS: 2011–2021

5.10.4 INSIGHTS

5.10.5 LEGAL STATUS OF PATENTS

FIGURE 19 BASALT FIBER MARKET: LEGAL STATUS OF PATENTS

5.10.6 JURISDICTION ANALYSIS

FIGURE 20 GLOBAL JURISDICTION ANALYSIS, 2011–2021

5.10.7 TOP APPLICANTS’ ANALYSIS

FIGURE 21 SICHUAN AEROSPACE WU YUAN COMPOSITE CO. LTD. POSSESSES HIGHEST NUMBER OF PATENTS

5.10.8 LIST OF PATENTS BY SICHUAN AEROSPACE WU YUAN COMPOSITE CO. LTD.

5.10.9 LIST OF PATENTS BY ZHENGZHOU DENGDIAN CBF CO. LTD.

5.10.10 LIST OF PATENTS BY SICHUAN FIBERGLASS GROUP CO. LTD.

5.10.11 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.11 CASE STUDY

6 BASALT FIBER MARKET, BY USAGE TYPE (Page No. - 62)

6.1 INTRODUCTION

TABLE 8 CHEMICAL COMPOSITION OF GLASS AND BASALT FIBERS

TABLE 9 TENSILE STRENGTH OF FIBERS

TABLE 10 BASALT FIBER STIFFNESS PROPERTIES

FIGURE 22 BASALT FIBER COMPOSITES TO GROW AT FASTER RATE BETWEEN 2022 AND 2027

TABLE 11 BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2018–2021 (USD THOUSAND)

TABLE 12 BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2018–2021 (TON)

TABLE 13 BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2022–2027 (USD THOUSAND)

TABLE 14 BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2022–2027 (TON)

6.2 BASALT FIBER IN COMPOSITES

6.2.1 BASALT FIBER IN COMPOSITES IMPROVES STRUCTURAL SAFETY AND SUSTAINABILITY OF CONSTRUCTION

FIGURE 23 ASIA PACIFIC TO DRIVE BASALT FIBER MARKET IN COMPOSITES

TABLE 15 BASALT FIBER MARKET SIZE IN COMPOSITES, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 16 BASALT FIBER MARKET SIZE IN COMPOSITES, BY REGION, 2018–2021 (TON)

TABLE 17 BASALT FIBER MARKET SIZE IN COMPOSITES, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 18 BASALT FIBER MARKET SIZE IN COMPOSITES, BY REGION, 2022–2027 (TON)

6.3 BASALT FIBER IN NON-COMPOSITES

6.3.1 BASALT FIBERS INCREASINGLY USED IN FABRICS, MESH, FELTS, INSULATION SLEEVES, AND CONCRETE REINFORCEMENTS

TABLE 19 COMPARATIVE CHARACTERISTICS OF FIBERS

TABLE 20 BASALT FIBER MARKET SIZE IN NON-COMPOSITES, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 21 BASALT FIBER MARKET SIZE IN NON-COMPOSITES, BY REGION, 2018–2021 (TON)

TABLE 22 BASALT FIBER MARKET SIZE IN NON-COMPOSITES, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 23 BASALT FIBER MARKET SIZE IN NON-COMPOSITES, BY REGION, 2022–2027 (TON)

7 BASALT FIBER MARKET, BY FORM (Page No. - 71)

7.1 INTRODUCTION

FIGURE 24 CONTINUOUS BASALT FIBER TO GROW AT FASTER RATE BETWEEN 2021 AND 2027

TABLE 24 BASALT FIBER MARKET SIZE, BY FORM, 2018–2021 (USD THOUSAND)

TABLE 25 BASALT FIBER MARKET SIZE, BY FORM, 2018–2021 (TON)

TABLE 26 BASALT FIBER MARKET SIZE, BY FORM, 2022–2027 (USD THOUSAND)

TABLE 27 BASALT FIBER MARKET SIZE, BY FORM, 2022–2027 (TON)

7.2 CONTINUOUS BASALT FIBER

7.2.1 CONTINUOUS BASALT FIBERS POSSESS SUPERIOR EFFICIENCY AND HIGHER TENSILE STRENGTH

FIGURE 25 ASIA PACIFIC TO DOMINATE CONTINUOUS BASALT FIBER MARKET

TABLE 28 CONTINUOUS BASALT FIBER MARKET SIZE, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 29 CONTINUOUS BASALT FIBER MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 30 CONTINUOUS BASALT FIBER MARKET SIZE, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 31 CONTINUOUS BASALT FIBER MARKET SIZE, BY REGION, 2022–2027 (TON)

7.3 DISCRETE BASALT FIBER

7.3.1 GROWING CONSTRUCTION AND TRANSPORTATION INDUSTRIES DRIVING DEMAND FOR DISCRETE BASALT FIBERS

TABLE 32 DISCRETE BASALT FIBER MARKET SIZE, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 33 DISCRETE BASALT FIBER MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 34 DISCRETE BASALT FIBER MARKET SIZE, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 35 DISCRETE BASALT FIBER MARKET SIZE, BY REGION, 2022–2027 (TON)

8 BASALT FIBER MARKET, BY END-USE INDUSTRY (Page No. - 78)

8.1 INTRODUCTION

FIGURE 26 CONSTRUCTION & INFRASTRUCTURE TO BE LARGEST CONSUMER OF BASALT FIBER

TABLE 36 BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 37 BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 38 BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 39 BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.2 CONSTRUCTION & INFRASTRUCTURE

8.2.1 BASALT FIBER REPLACING STEEL IN CONSTRUCTION INDUSTRY DUE TO ITS UNIQUE COMBINATION OF PROPERTIES

FIGURE 27 ASIA PACIFIC TO DRIVE BASALT FIBER MARKET IN CONSTRUCTION & INFRASTRUCTURE INDUSTRY

TABLE 40 BASALT FIBER MARKET SIZE IN CONSTRUCTION & INFRASTRUCTURE, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 41 BASALT FIBER MARKET SIZE IN CONSTRUCTION & INFRASTRUCTURE, BY REGION, 2018–2021 (TON)

TABLE 42 BASALT FIBER MARKET SIZE IN CONSTRUCTION & INFRASTRUCTURE, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 43 BASALT FIBER MARKET SIZE IN CONSTRUCTION & INFRASTRUCTURE, BY REGION, 2022–2027 (TON)

8.3 AUTOMOTIVE & TRANSPORTATION

8.3.1 BASALT FIBER POSSESSES ENVIRONMENTALLY FRIENDLY PROPERTIES AND ALSO REDUCES COST OF VEHICLES

FIGURE 28 ASIA PACIFIC TO BE FASTEST-GROWING MARKET IN AUTOMOTIVE & TRANSPORTATION INDUSTRY

TABLE 44 BASALT FIBER MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 45 BASALT FIBER MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018–2021 (TON)

TABLE 46 BASALT FIBER MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 47 BASALT FIBER MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2022–2027 (TON)

8.4 ELECTRICAL & ELECTRONICS

8.4.1 BASALT FIBER REPLACING GLASS MATERIALS IN IMPORTANT ELECTRICAL & ELECTRONIC APPLICATIONS

FIGURE 29 ASIA PACIFIC TO DOMINATE BASALT FIBER MARKET IN ELECTRICAL & ELECTRONICS INDUSTRY

TABLE 48 BASALT FIBER MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 49 BASALT FIBER MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2018–2021 (TON)

TABLE 50 BASALT FIBER MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 51 BASALT FIBER MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2022–2027 (TON)

8.5 WIND ENERGY

8.5.1 HIGH DEMAND FOR BASALT FIBERS IN PRODUCTION OF WIND TURBINES

TABLE 52 BASALT FIBER MARKET SIZE IN WIND ENERGY, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 53 BASALT FIBER MARKET SIZE IN WIND ENERGY, BY REGION, 2018–2021 (TON)

TABLE 54 BASALT FIBER MARKET SIZE IN WIND ENERGY, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 55 BASALT FIBER MARKET SIZE IN WIND ENERGY, BY REGION, 2022–2027 (TON)

8.6 MARINE

8.6.1 INCREASING DEMAND FOR BASALT FIBER FOR BUILDING PONTOONS

TABLE 56 BASALT FIBER MARKET SIZE IN MARINE, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 57 BASALT FIBER MARKET SIZE IN MARINE, BY REGION, 2018–2021 (TON)

TABLE 58 BASALT FIBER MARKET SIZE IN MARINE, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 59 BASALT FIBER MARKET SIZE IN MARINE, BY REGION, 2022–2027 (TON)

8.7 OTHERS

TABLE 60 BASALT FIBER MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 61 BASALT FIBER MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2021 (TON)

TABLE 62 BASALT FIBER MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 63 BASALT FIBER MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2027 (TON)

9 BASALT FIBER MARKET, BY REGION (Page No. - 94)

9.1 INTRODUCTION

FIGURE 30 CHINA TO BE FASTEST-GROWING BASALT FIBER MARKET

TABLE 64 BASALT FIBER MARKET SIZE, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 65 BASALT FIBER MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 66 BASALT FIBER MARKET SIZE, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 67 BASALT FIBER MARKET SIZE, BY REGION, 2022–2027 (TON)

9.2 NORTH AMERICA

FIGURE 31 NORTH AMERICA: BASALT FIBER MARKET SNAPSHOT

TABLE 68 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 69 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 70 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 71 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 72 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2018–2021 (USD THOUSAND)

TABLE 73 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2018–2021 (TON)

TABLE 74 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2022–2027 (USD THOUSAND)

TABLE 75 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2022–2027 (TON)

TABLE 76 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY FORM, 2018–2021 (USD THOUSAND)

TABLE 77 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY FORM, 2018–2021 (TON)

TABLE 78 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY FORM, 2022–2027 (USD THOUSAND)

TABLE 79 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY FORM, 2022–2027 (TON)

TABLE 80 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 81 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 82 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 83 NORTH AMERICA: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

9.2.1 US

9.2.1.1 Manufacturers offering new basalt fiber products in US

TABLE 84 US: NEW WIND ENERGY INSTALLATIONS, 2010–2020 (MW)

9.2.2 CANADA

9.2.2.1 Well-established aerospace industry in Canada driving market

9.3 EUROPE

FIGURE 32 EUROPE: BASALT FIBER MARKET SNAPSHOT

TABLE 85 EUROPE: BASALT FIBER MARKET SIZE, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 86 EUROPE: BASALT FIBER MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 87 EUROPE: BASALT FIBER MARKET SIZE, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 88 EUROPE: BASALT FIBER MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 89 EUROPE: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2018–2021 (USD THOUSAND)

TABLE 90 EUROPE: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2018–2021 (TON)

TABLE 91 EUROPE: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2022–2027 (USD THOUSAND)

TABLE 92 EUROPE: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2022–2027 (TON)

TABLE 93 EUROPE: BASALT FIBER MARKET SIZE, BY FORM, 2018–2021 (USD THOUSAND)

TABLE 94 EUROPE: BASALT FIBER MARKET SIZE, BY FORM, 2018–2021 (TON)

TABLE 95 EUROPE: BASALT FIBER MARKET SIZE, BY FORM, 2022–2027 (USD THOUSAND)

TABLE 96 EUROPE: BASALT FIBER MARKET SIZE, BY FORM, 2022–2027 (TON)

TABLE 97 EUROPE: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 98 EUROPE: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 99 EUROPE: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 100 EUROPE: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

9.3.1 GERMANY

9.3.1.1 Germany is second-largest market for basalt fiber in Europe

9.3.2 UK

9.3.2.1 Presence of well-known automotive companies driving demand for basalt fiber

9.3.3 BELGIUM

9.3.3.1 Automotive & transportation industry bolstering demand for basalt fiber in Belgium

9.3.4 UKRAINE

9.3.4.1 Presence of basalt rock in neighboring regions drives market in Ukraine

9.3.5 RUSSIA

9.3.5.1 Russia is largest market for basalt fiber in European region

9.3.6 IRELAND

9.3.6.1 High demand witnessed in construction & infrastructure and wind energy industries

9.4 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: BASALT FIBER MARKET SNAPSHOT

TABLE 101 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 102 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 103 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 104 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 105 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2018–2021 (USD THOUSAND)

TABLE 106 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2018–2021 (TON)

TABLE 107 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2022–2027 (USD THOUSAND)

TABLE 108 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2022–2027 (TON)

TABLE 109 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY FORM, 2018–2021 (USD THOUSAND)

TABLE 110 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY FORM, 2018–2021 (TON)

TABLE 111 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY FORM, 2022–2027 (USD THOUSAND)

TABLE 112 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY FORM, 2022–2027 (TON)

TABLE 113 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 114 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 115 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 116 ASIA PACIFIC: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

9.4.1 CHINA

9.4.1.1 China is fastest-growing market for basalt fiber, globally

9.4.2 JAPAN

9.4.2.1 Growing automotive industry boosting demand for basalt fibers

9.4.3 SINGAPORE

9.4.3.1 Singapore is second-largest market in Asia Pacific

9.5 LATIN AMERICA

TABLE 117 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 118 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 119 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 120 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 121 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2018–2021 (USD THOUSAND)

TABLE 122 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2018–2021 (TON)

TABLE 123 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2022–2027 (USD THOUSAND)

TABLE 124 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2022–2027 (TON)

TABLE 125 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY FORM, 2018–2021 (USD THOUSAND)

TABLE 126 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY FORM, 2018–2021 (TON)

TABLE 127 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY FORM, 2022–2027 (USD THOUSAND)

TABLE 128 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY FORM, 2022–2027 (TON)

TABLE 129 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 130 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 131 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 132 LATIN AMERICA: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

9.5.1 BRAZIL

9.5.1.1 Brazil dominates basalt fiber market in Latin America

9.5.2 MEXICO

9.5.2.1 Growing wind energy sector in country driving demand for basalt fiber

9.6 MIDDLE EAST & AFRICA

TABLE 133 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 134 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 135 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 136 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 137 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2018–2021 (USD THOUSAND)

TABLE 138 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2018–2021 (TON)

TABLE 139 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2022–2027 (USD THOUSAND)

TABLE 140 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY USAGE TYPE, 2022–2027 (TON)

TABLE 141 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY FORM, 2018–2021 (USD THOUSAND)

TABLE 142 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY FORM, 2018–2021 (TON)

TABLE 143 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY FORM, 2022–2027 (USD THOUSAND)

TABLE 144 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY FORM, 2022–2027 (TON)

TABLE 145 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 146 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 147 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 148 MIDDLE EAST & AFRICA: BASALT FIBER MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

9.6.1 SOUTH AFRICA

9.6.1.1 South Africa is largest market in Middle East & Africa

9.6.2 SAUDI ARABIA

9.6.2.1 Saudi Arabia is fastest-growing market in Middle East & Africa

9.6.3 UAE

9.6.3.1 Increasing demand from construction & infrastructure industry driving demand for basalt fiber

10 COMPETITIVE LANDSCAPE (Page No. - 130)

10.1 INTRODUCTION

10.2 MARKET SHARE ANALYSIS

FIGURE 34 ZHEJIANG GBF BASALT FIBER CO. LED MARKET IN 2021

TABLE 149 DEGREE OF COMPETITION: BASALT FIBER MARKET

10.3 MARKET RANKING

FIGURE 35 MARKET RANKING OF TOP FIVE PLAYERS IN BASALT FIBER MARKET

10.4 COMPANY EVALUATION MATRIX

TABLE 150 COMPANY PRODUCT FOOTPRINT

TABLE 151 COMPANY END-USE INDUSTRY FOOTPRINT

TABLE 152 COMPANY REGION FOOTPRINT

10.5 COMPETITIVE LEADERSHIP MAPPING

10.5.1 STARS

10.5.2 PERVASIVE

10.5.3 PARTICIPANTS

10.5.4 EMERGING LEADERS

FIGURE 36 BASALT FIBER MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2021

10.5.5 STRENGTH OF PRODUCT PORTFOLIO

10.5.6 BUSINESS STRATEGY EXCELLENCE

10.6 START-UP/ SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 DYNAMIC COMPANIES

10.6.4 STARTING BLOCKS

FIGURE 37 BASALT FIBER MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2020

10.7 MARKET EVALUATION FRAMEWORK

TABLE 153 BASALT FIBER MARKET: DEALS, 2016–2021

TABLE 154 BASALT FIBER MARKET: OTHERS, 2016–2021

TABLE 155 BASALT FIBER MARKET: NEW PRODUCT DEVELOPMENT, 2016–2021

11 COMPANY PROFILES (Page No. - 140)

11.1 KEY COMPANIES

(Business Overview, Products Offered, Recent Developments, New Product Launch, Other Deals, and MnM View)*

11.1.1 KAMENNY VEK

TABLE 156 KAMENNY VEK: COMPANY OVERVIEW

11.1.2 ZHEJIANG GBF BASALT FIBER CO.

TABLE 157 ZHEJIANG GBF BASALT FIBER CO.: COMPANY OVERVIEW

11.1.3 MAFIC SA

TABLE 158 MAFIC SA: COMPANY OVERVIEW

11.1.4 TECHNOBASALT-INVEST LLC

TABLE 159 TECHNOBASALT-INVEST LLC: COMPANY OVERVIEW

11.1.5 RUSSIAN BASALT

TABLE 160 RUSSIAN BASALT: COMPANY OVERVIEW

11.1.6 ISOMATEX S.A.

TABLE 161 ISOMATEX S.A.: COMPANY OVERVIEW

11.1.7 INCOTELOGY GMBH

TABLE 162 INCOTELOGY GMBH: COMPANY OVERVIEW

11.1.8 SUDAGLASS BASALT FIBER TECHNOLOGY

TABLE 163 SUDAGLASS BASALT FIBER TECHNOLOGY: COMPANY OVERVIEW

11.1.9 SHANXI BASALT FIBER TECHNOLOGY CO. LTD.

TABLE 164 SHANXI BASALT FIBER TECHNOLOGY CO. LTD.: COMPANY OVERVIEW

11.1.10 MUDANJIANG JINSHI BASALT FIBER CO. LTD.

TABLE 165 MUDANJIANG JINSHI BASALT FIBER CO. LTD.: COMPANY OVERVIEW

11.1.11 JFE ROCKFIBER CORP.

TABLE 166 JFE ROCKFIBER CORP.: COMPANY OVERVIEW

* (Business Overview, Products Offered, Recent Developments, New Product Launch, Other Deals, and MnM View might not be captured in case of unlisted companies.

11.2 OTHER COMPANIES

11.2.1 BASALT TECHNOLOGY UK LIMITED

11.2.2 SICHUAN AEROSPACE TUOXIN BASALT INDUSTRIAL CO., LTD.

11.2.3 ASA. TEC GMBH

11.2.4 SICHUAN FIBERGLASS GROUP CO., LTD.

11.2.5 NMG COMPOSITES CO., LTD.

11.2.6 FIBERBAS CONSTRUCTION AND BUILDING TECHNOLOGIES

11.2.7 LIAONING JINSHI TECHNOLOGY GROUP CO., LTD.

11.2.8 JIANGSU GREEN MATERIALS VALLY NEW MATERIAL T&D CO., LTD. (GMV)

11.2.9 YINGKOU HONGYUAN FIBERGLASS TECHNOLOGY CO., LTD.

11.2.10 JILIN PROVINCE HUAYANG NEW COMPOSITE MATERIAL CO., LTD.

12 APPENDIX (Page No. - 164)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORT

12.5 AUTHOR DETAILS

The study involved two major activities in estimating the current size of the basalt fiber market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The basalt fiber market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly the automotive & transportation, construction & infrastructure, electrical & electronics, wind energy, marine, and other end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total basalt fiber market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall basalt fiber market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the a automotive & transportation, construction & infrastructure, electrical & electronics end-use industries.

Report Objectives

- To define, describe, and forecast the size of the basalt fiber market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on form, usage, and end-use industry

- To analyze and project the market based on five regions, namely, Europe, North America, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC basalt fiber market

- Further breakdown of Rest of Europe basalt fiber market

- Further breakdown of Rest of NA basalt fiber market

- Further breakdown of Rest of MEA basalt fiber market

- Further breakdown of Rest of Latin American basalt fiber market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Basalt Fiber Market

Looking for market information on basalt products

General information on Basalt market in Europe and North America

Report on composites based on basalt fire

Specific interest on basakt fiber for South Africa

General information on construction chemicals market