Battery Separators Market by Battery Type (Lead Acid and Li-ion), Material (Polyethylene and Polypropylene), Technology (Dry and Wet), End-Use (Automotive, Consumer Electronics, Industrial), and Region - Global Forecast to 2027

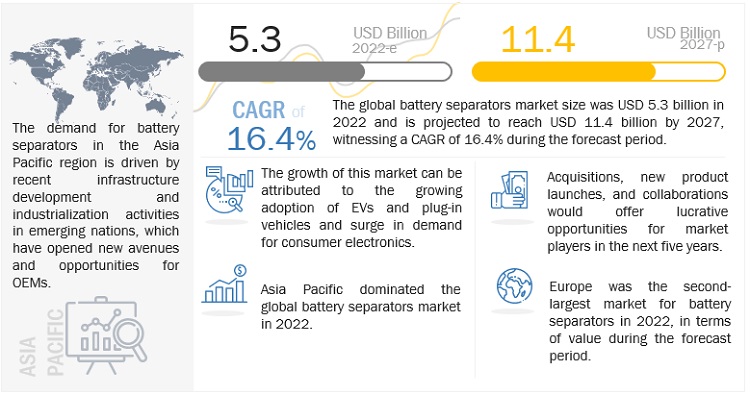

The global battery separators market was valued at USD 5.3 billion in 2022 and is projected to reach USD 11.4 billion by 2027, growing at a cagr 16.4% from 2022 to 2027. Factors such as the surge in demand for consumer electronics and the growing adoption of EVs and plug-in vehicles are driving the market. However, factors such as maintaining consistency in material quality and proper storage and transportation of batteries act as major restraints to the growth of the market.

Global Battery Separators Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Battery Separators Market Dynamics

Driver: Increasing adoption of lithium-ion batteries in the renewable sector

Lead-acid and lithium-ion deep-cycle batteries are two of the major solutions for renewable energy storage. Lithium batteries are considerably new to the renewable energy storage market; however, they are beginning to address some of the drawbacks of lead-acid competitors. Due to its benefits, lithium batteries are now frequently used to replace lead-acid batteries in a variety of applications, including homes, businesses, and recreational vehicles (RVs). As more sectors see the advantages of transitioning to renewable energy, efforts to create better batteries are growing. For instance, the expanding market for electric vehicles has fueled the development of safer, lighter, and more capable batteries. Renewable energy is an option for the environment and the economy due to the development of lithium batteries, which have redefined and enlarged the possibilities for energy storage. Thus, the increasing adoption of lithium-ion batteries in the renewable sector will consequently drive the market for battery separators.

Restraints: Proper storage and transportation of batteries

Handling batteries of any kind comes with risks they might pose. If the proper precautions are not taken, they could be hazardous to nearby persons and structures, whether they're in use, charging, or just being stored. The possible problems include overheating, burning, or detonating battery chargers which leads to electrical shock and heat burns. These battery-related risks can result in accidents, fatalities, and property loss. For instance, poor handling of lithium-ion batteries leads to a significant number of occupational injuries each year. Besides lithium-ion batteries, traditional lead acid batteries and even 9-volt dry cell batteries purchased at the grocery store can seriously endanger the health and safety of those nearby. Thus, the lack of proper storage and transportation of batteries is propelling governments to take strict action against manufacturers of these batteries, which will hamper the growth of the battery separators market.

Opportunity: Battery usage in energy storage devices

One of the technologies in the sustainable energy sector, which is expanding rapidly is battery energy storage systems. Systems for storing energy are now widely recognized as effective methods that have come up for lowering dependency on fossil fuels and frequently unstable power providers. Lithium-ion batteries are one of the major battery types utilized in energy storage devices. Around 90% of the market for grid battery storage is made up of lithium-ion batteries. Also, lead-acid batteries, according to the ESA, are an excellent choice for a battery energy storage system because they are a more affordable battery option and are recyclable. They are also safer than some other chemistries because their active components are not flammable. These batteries are designed for superior performance with high power output in various applications, such as data centers. As data centers use lead-acid batteries, their demand is expected to increase, and this further provides an opportunity for the growth of the battery separators market.

Challenge: Lack of government support and infrastructure in emerging economies

To encourage the renewable form of energy, governments of various countries are focusing on subsidies and incentives to support the production of lithium-ion batteries. Grid-connected power storage facilities are also granted exemptions from levy and grid tariffs. To encourage the adoption of electric vehicles, some nations have implemented policies including exemptions from or rebates on road tolls. However, in emerging markets, such as Africa, there is not much contribution from the governments of many countries to enhance the production of batteries. Countries in Africa must create a diversified capital market that supports battery research, early-stage products, and the scale-up of manufacturing for the EV industry. To meet present and future demands for energy storage, India's thriving lead acid battery manufacturing sector needs to be expanded. Support for R&D is anticipated to reduce initial investment costs, utilize the Indian supply chain, increase profit margins, and include SMEs in the production of industrial units for the eco-system which produces rechargeable battery cells. Thus, the lack of government support and infrastructure in emerging economies is expected to be a challenge to the growth of the battery separators market.

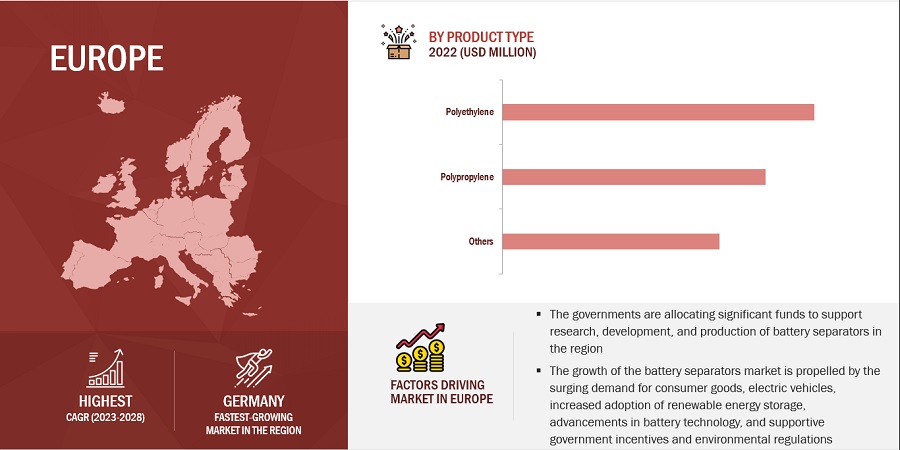

"Polypropylene segment, by material, is estimated to account for the highest CAGR during the forecast period."

Polypropylene (PP) is one of the most versatile polymers available and can be used as fiber and plastic in various applications. Polypropylene separators are widely used in batteries for EVs. The need for polypropylene is expected to increase as a result of its rising demand in automotive components, fashion apparel, and healthcare devices, among others.

"Others segment, by battery type, is estimated to account for the highest CAGR during the forecast period."

Others include batteries such as nickel-metal hydride, nickel cadmium, and alkaline systems. Alkaline batteries are used in a wide range of household items, such as portable CD players, torches, remote controls, and digital cameras, among others. Growth in the overall battery industry, along with rising demands for low-cost and high-quality battery materials, is the key driver supporting the demand for battery separators.

"Automotive segment, by end-use, is estimated to account for the highest CAGR during the forecast period."

Automotive is the biggest end-user of battery separators. Battery-driven vehicles such as hybrid electric vehicles and plug-in hybrid electric vehicles are major consumers of lithium-ion batteries. Also, there are several developments related to automotive lead-acid batteries to cater to the rising electrical requirements of modern automobiles and the increasing need for efficiency. This further increases the usage of batteries in the automotive sector, which, in turn, will propel the demand for battery separators.

"Europe region is estimated to account for the highest CAGR during the forecast period."

Europe is home to some of the largest battery manufacturers, such as Saft (France) and FIAMM (Italy). Batteries have major applications as clean, sustainable, and compact sources of power in automotive and consumer electronics. The consumer electronics market for wearable devices is also witnessing a positive growth curve in Europe. Hence, the region is estimated to account for the highest CAGR during the forecast period.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major companies in the battery separators market include Shanghai Energy New Materials Technology Co., Ltd. (China), Asahi Kasei Corporation (Japan), SK ie Technology (South Korea), Toray Industries, Inc. (Japan), and Sinoma Science & Technology Co., Ltd. (China) among others. A total of 26 major players have been covered. These players have adopted product launches, agreements, joint ventures, investments, acquisitions, mergers, and expansions as the major strategies to consolidate their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

Type, Material, Thickness, Technology, Battery Type, End-use, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

|

Companies Covered |

The major market players include Shanghai Energy New Materials Technology Co., Ltd. (China), Asahi Kasei Corporation (Japan), SK ie Technology (South Korea), Toray Industries, Inc. (Japan), and Sinoma Science & Technology Co., Ltd. (China), Ahlstrom (Finland), Bernard Dumas (France), Cangzhou Mingzhu Plastic Co. (China), among others. |

This research report categorizes the battery separators market based on Type, Material, Thickness, Technology, Battery Type, End-use, and Region.

Based on Type, the battery separators market has been segmented as follows:

- Coated Separators

- Non-coated Separators

Based on material, the battery separators market has been segmented as follows:

- Polypropylene

- Polyethylene

- Others

Based on Thickness, the battery separators market has been segmented as follows:

- 5µM–10µm

- 10µM–20µM

Based on Technology, the battery separators market has been segmented as follows:

- Dry Battery Separator

- Wet Battery Separator

Based on Battery Type, the battery separators market has been segmented as follows:

- Lithium-ion (Li-ion)

- Lead-acid

- Others

Based on End-use, the battery separators market has been segmented as follows:

- Automotive

- Consumer Electronics

- Industrial

- Others

Based on region, the battery separators market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In August 2022, Celgard, LLC and American Battery Factory (ABF), a producer of lithium iron phosphate (LFP) battery cells, formed a strategic agreement. Celgard is a subsidiary of Polypore International, LP, an Asahi Kasei company. According to the terms of the contract, Celgard is required to meet all of ABF's separator requirements for LFP battery cells in the US.

- In April 2022, ENTEK announced the expansion of the US lithium-ion battery separator business to meet the growing demand. The US Department of Energy's requirement for a resilient and sustainable domestic US lithium battery supply chain has been met by ENTEK's commitment to a transformational expansion of its US lithium-ion battery separator footprint.

- In April 2021, Ahlstrom signed a marketing license agreement with Soteria for a fiber-based separator for lithium-ion batteries. Through this agreement, Ahlstrom advanced further into the energy storage market.

Frequently Asked Questions (FAQ):

What is the current size of the global battery separators market?

The global battery separators market is projected to grow from USD 5.3 Billion in 2022 to USD 11.4 Billion by 2027, at a CAGR of 16.4% during the forecast period.

Who are the leading players in the global battery separators market?

Some of the key players operating in the battery separators market are Shanghai Energy New Materials Technology Co., Ltd. (China), Asahi Kasei Corporation (Japan), SK ie Technology (South Korea), Toray Industries, Inc. (Japan), and Sinoma Science & Technology Co., Ltd. (China) among others.

Which is the largest segment, by battery type, in the global battery separators market?

Lead acid, by battery type, is the largest segment in the global battery separators market. Lead-acid batteries are utilized as energy storage in the renewable energy industry for solar and wind power.

Which is the largest segment, by end-use, in the global battery separators market?

The automotive segment, by end-use, is the largest segment in the global battery separators market. The demand for battery separators is increasing in the automotive sector due to the rising demand for lithium-ion and lead-acid batteries in the sector.

Which is the largest region in the global battery separators market?

Asia Pacific, by region, is the largest battery separators market. The major economies of the Asia Pacific region contributing significantly to the growth of the battery separators market are China, Japan, India, Malaysia, Taiwan, and South Korea. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

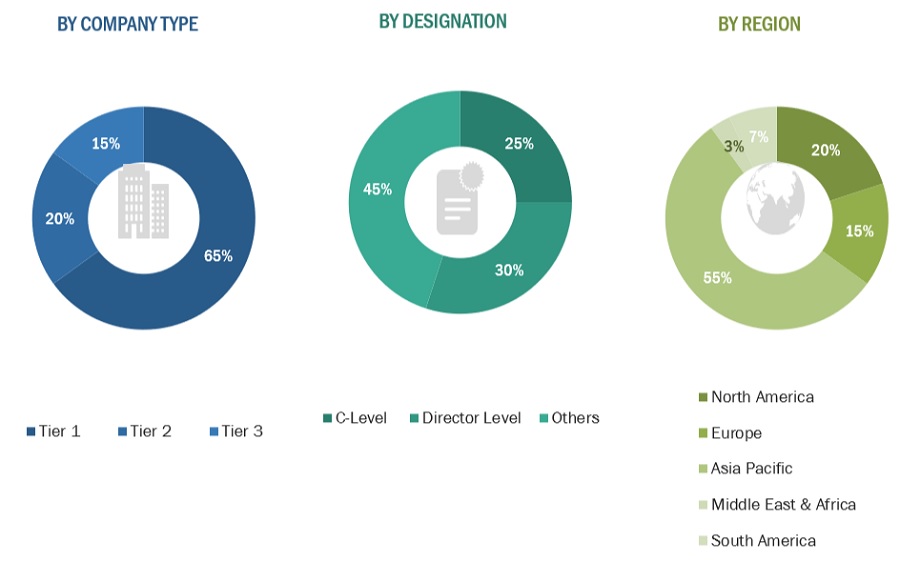

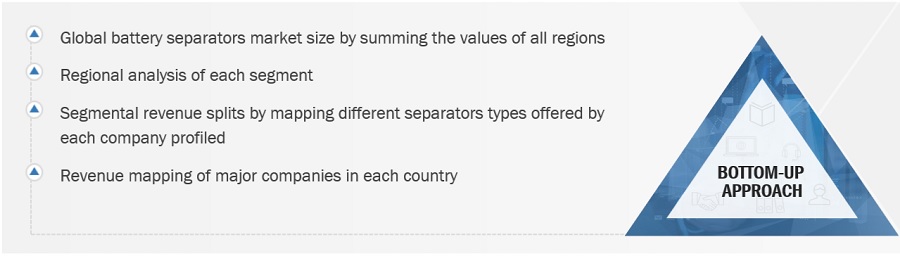

The study involved four major activities in estimating the current size of the battery separators market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the battery separators value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors; gold- and silver-standard websites; battery separators manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The battery separators market comprises several stakeholders, such as raw material suppliers, processors, end-use industries, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of battery separator manufacturers, importers/exporters, and manufacturers engaged in the production of various products. The supply side is characterized by key technology providers for battery separators, end-users, researchers, and service providers.

In the primary research process, various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of manufacturing companies. The primary sources from the supply side included research institutions involved in R&D activities to introduce new technologies, key opinion leaders, distributors, and battery separators manufacturing companies.

Breakdown of primary interviews

Notes: Other designations include consultants and sales, marketing, and procurement managers.

Tier 1 company—revenue >USD 5 billion, tier 2 company—revenue between USD 1 billion and USD 5 billion, and tier 3 company—revenue <USD 1 billion

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the battery separators market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the battery separators market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Battery Separators Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To analyze and forecast the size of the battery separators market in terms of value

- To define, describe, and forecast the market size by battery type, material, end-use, and region

- To forecast the market size with respect to five main regions, namely, Asia Pacific, Europe, North America, Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as agreements, joint ventures, mergers, investments, and expansions in the battery separators market

Competitive Intelligence

- To identify and profile the key players in the battery separators market

- To determine the top players offering various products in the battery separators market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Battery Separators Market