Big Data Market by Component, Deployment Mode, Organization Size, Business Function (Finance, Marketing & Sales), Industry Vertical (BFSI, Manufacturing, Healthcare & Life Sciences) and Region - Global Forecast to 2026

Big Data Market Size, Global Industry Forecast

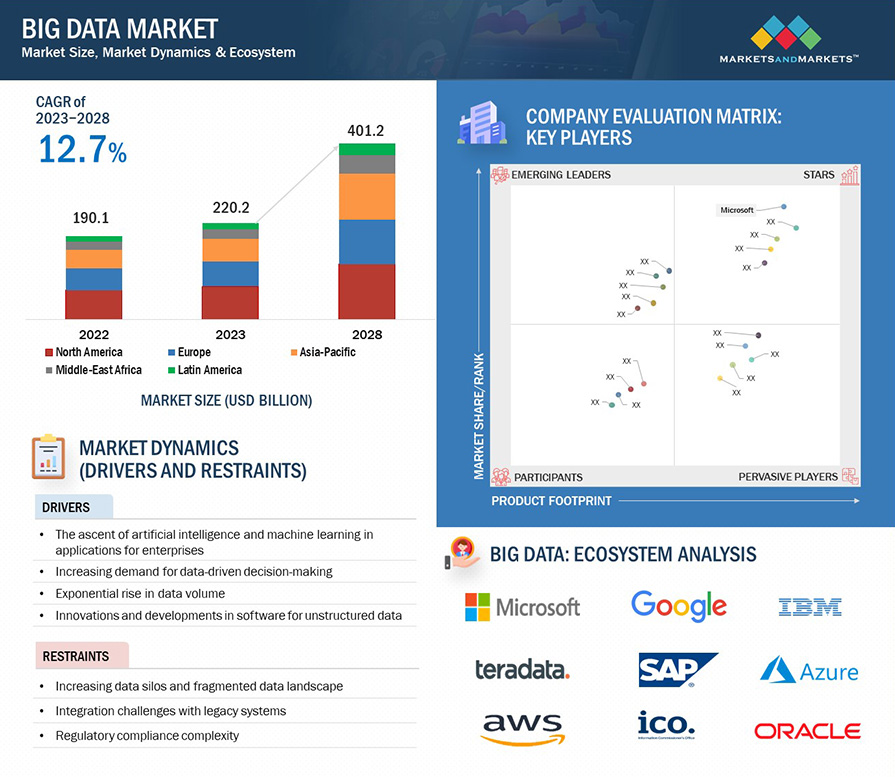

The global big data market in terms of revenue was estimated to be worth $162.6 billion in 2021 and is poised to reach $273.4 billion by 2026, growing at a CAGR of 11.0% from 2021 to 2026. The Big Data industry is driven by a sharp increase in data volume. However, rise in data connectivity through cloud computing and incorporation of digital transformation in top-level strategies. Various factors such as plummeting technology costs and development of open source big data software frameworks, data connectivity through hybrid and multi-cloud environments, and incorporation of digital transformation in top-level strategies are expected to drive the adoption of big data solutions and services.

To know about the assumptions considered for the study, Request for Free Sample Report

Businesses across industry verticals are deploying big data solutions to harness the power of big data by managing it efficiently and analyzing it to get actionable insights. The massive growth of data and an increase in the number of mobile apps and IoT devices are the factors contributing to the growth of the big data market. Big data is widely used in various industries, such as banking, financial services, and insurance (BFSI); government and defense; healthcare and life sciences; manufacturing; retail and consumer goods; media and entertainment; telecommunications and IT; transportation and logistics; and others (real estate, energy and utilities, travel and hospitality, education, and research).

Big Data Market Dynamics

Driver: Sharp increase in data volume

The volume of data captured by organizations is continuously increasing due to the rise of social media, the Internet of Things (IoT), and multimedia, which have produced an overwhelming flow of data in either structured or unstructured format. For instance, almost 90% of the world’s data has been created in the past two years. Machine-based as well as human-generated data are witnessing an overall growth rate of 10 times faster than conventional business data. For instance, machine data is experiencing an exponential 50 times faster growth rate. Big data is largely consumer-driven and consumer-oriented; most of the data in the world is generated by consumers, who are ‘always-on.’ Most people spend 4 to 6 hours per day consuming and generating data through a variety of devices and (social) applications. With every click, swipe or message, new data is created in a database somewhere around the world. Because everyone now has a smartphone in their pocket, the data creation sums to incomprehensible amounts.

The increasing volume of business data, rapid technological changes, and declining average selling prices of smart devices eventually contribute to the generation of a massive amount of structured and unstructured data. More than 80% of all data collected by organizations is not in a standard relational database. Instead, it’s trapped in unstructured documents, social media posts, machine logs, images, and other sources. Many organizations face challenges in managing this deluge of unstructured data. Big data solutions play a key role in managing data for organizations of all shapes and sizes, particularly in the cloud computing era. The need for a framework to aggregate and manage diverse sources of big data and data analytics and extract the maximum value is indisputable.

Restraint: Data security concerns and stringent data security regulations

Users store their sensitive data and information regarding business activities on big data platforms. However, there are numerous possible liabilities and vulnerabilities present in managing and storing the documents. With the gaining popularity, the security concerns about data breaches, unforeseen emergencies, application vulnerabilities, and information loss are also increasing. Information security and privacy concerns can reduce the revenues in some industries such as academia & research, federal government departments, and financial services. This can severely damage the reputation of the enterprises and eventually hinder the confidence of people running the business. This, in turn, may create criminal penalties and even liability to lawsuits. Sensitive information and data are often stored in databases and on-cloud, allowing cybercriminals to subvert valuable company information and enter unlawful dealing. Hence security and privacy threats are expected to impede the market growth during the forecast period.

The regulatory landscape related to data privacy and security has strengthened over the past years. General Data Protection Regulation (GDPR) came into force across the European Union (EU) in May 2018. GDPR is a set of data protection rules for all companies operating in the EU, wherever they are based. California Consumer Privacy Act (CCPA) became law on January 1, 2020, enabling state residents to reclaim their right to access and control their personal data. According to CCPA, companies must notify users of the intent to monetize their data and give them a straightforward means of opting out of said monetization. Data security concerns and stringent data security regulations are also negatively impacting the growth of the market to a certain extent.

Opportunity: Rise in adoption of technologies and big data analytics

The rising adoption of technologies such as AI, ML, IoT, blockchain and data analytics is changing the landscape of big data technology. The integration of such technologies with big data helps organizations augment their visualization capabilities to make complicated data usable and more accessible over visual representation. ML tools utilize business intelligence solutions to investigate structured and unstructured data. End-users can use ML and data analytics integrated with big data technology to analyze the information and draw insights about the prize, sales, and quantity to reach the target customers. This helps end-users to predict future conditions and efficiently manage the transportation and supply chain components. The AI solution provides real-time insights to enterprises, enabling them to improve network security, accelerate digital businesses, and offer a better consumer experience. The integration of big data platforms with AI helps to optimize business operations, decision-making speed, and customer experience. The rising adoption of such technologies is anticipated to drive the growth of the market. Key players in the market are focused on completing partnerships with other players to launch advanced solutions based on core technologies such as AI and others. For instance, in May 2020, HSBC Holdings plc partnered with EquBot, Inc., and IBM Watson launched its US Equity Index (AiPEX) family powered by big data and AI. The aim is to offer unique and value-driven retirement solutions for the retail market.

Challenge: Data silos and poor data quality

The problem with any data in any organization is always kept in different places and different formats. A simple task like looking at production costs might be daunting for a manager when finance is keeping tabs on supplies expenses, payroll, and other financial data, as it should do, while information from machines on the manufacturing floor is unintegrated in the production department’s database. With big data, the silo challenge looms larger. This is because of not only the sheer volume of data, but also the variety of its internal and external sources and different security and privacy requirements that apply. Legacy systems also play a role, making it difficult or even impossible to consolidate data in a way helpful for analytics.

Another major challenge with big data is that it cannot be completely consistent. The data is prone to errors. With more datasets, one can get the same data misstated with different types and margins of error. There can also be duplicate records multiplying challenges for your big data analytics. The analytics algorithms and AI applications built on big data can generate bad results when data quality issues creep into big data systems. These problems can become more significant and harder to audit as data management and analytics teams attempt to pull in more and different types of data.

Based on Component, the service segment is expected to grow at a higher CAGR during the forecast period

The service segment of the Big Data Market is further segmented into professional services (support and maintenance, and deployment and integration) and managed services. This section discusses each service subsegment's market size and growth rate based on type (for selected subsegments) and region.

Based on deployment mode, on-premises segment is segmented to account for a larger market size during the forecast period Most

Cloud computing refers to the storage, management, and processing of data via networks of remote servers, which are typically accessed via the Internet. Enterprises mostly in heavily regulated industry verticals, such as BFSI, healthcare and life sciences, and manufacturing, opt for the on-premises deployment model of big data solutions. Furthermore, large enterprises with sufficient IT resources are expected to opt for the on-premises deployment model. On-premises is the most reliable deployment mode, which an enterprise can rely on for a high level of control and security. Enterprises need to purchase a license or a copy to deploy cloud-based solutions.

Based on organization size, large enterprise segment to account for a larger market size during the forecast period

The adoption of Big Data solutions and services among large enterprises is high due to the ever-increasing adoption of the cloud, and the trend is expected to continue during the forecast period. Large enterprises accumulate huge chunks of data that can be attributed to the widespread client base. In large enterprises, data plays a major role in evaluating the overall performance of organizations. Large enterprises are leveraging real-time data coming from various sources; for instance, social media feeds or sensors and cameras, each record needs to be processed in a way that preserves its relation to other data and sequence in time.

Based on solution, big data analytics segment to grow at a higher CAGR during the forecast period

The adoption of Big Data analytics among large enterprises is high as it provides an almost limitless source of business and informational knowledge, which can lead to operational improvements and new income prospects for businesses in practically any industry. The value hidden in company data has firms trying to develop a cutting-edge analytics operation for use cases like consumer personalization, risk reduction, fraud detection, internal operations analysis, and other new use cases arising on a near-daily basis

Based on cloud type, public cloud segment to account for a larger market size during the forecast period

A public cloud is a collection of hardware, networking, storage, services, applications, and interfaces owned and controlled by a third party and made available to other businesses and individuals. These commercial companies build a highly scalable data center that conceals the underlying technology from the end user. Because they often handle relatively repetitive or straightforward tasks, public clouds are viable. Electronic mail, for example, is a relatively simple application. As a result, a cloud service provider can optimize the environment to accommodate a big number of clients. Similarly, public cloud providers who provide storage or computing services optimize their hardware and software to accommodate these unique workloads. The conventional data center, on the other hand, supports so many diverse applications and workloads that it is difficult to optimize. When a business is working on a sophisticated data analysis project that requires more processing cycles, a public cloud might be quite useful. Furthermore, businesses may opt to store data in a public cloud, where the cost per gigabyte is lower than that of purchased storage. The security requirements and the amount of delay that is acceptable are the most pressing concerns with public clouds for big data.

Based on vertical, the BFSI segment is expected to account for a larger market size during the forecast period

Big Data are gaining acceptance among all verticals to improve profitability and reduce overall costs. The major verticals adopting Big Data software are BFSI, Government and Defense, Healthcare and Life Sciences, Manufacturing, Retail and Consumer Goods, Media and Entertainment, Telecommunications and IT, Transportation and Logistics, other verticals (real estate, energy and utilities, travel and hospitality, and education and research). BFSI segment is expected to account for a larger market size during the forecast period. The rising demand for tracking the feedback on services in real-time is driving the adoption of big data in the BFSI industry vertical.

APAC to have highest CAGR while North America to hold the largest market size during the forecast period

APAC is expected to have highest CAGR during to the forecast period can be attributed to the massive growth in business deals and transactions such as mergers and acquisitions, joint ventures, across all the industry verticals. North America is estimated to account for the largest market share during the forecast period. The rising adoption of IoT devices by various enterprises to have more accurate real-time big data for decision-making would boost the demand of big data solutions in the region.

To know about the assumptions considered for the study, download the pdf brochure

Market Interconnection

Big Data Market - Key Players

Major Big Data vendors include IBM(US), Google(US), Oracle(US), Microsoft(US), SAS(US), SAP(Germany), Alteryx(US), TIBCO(US), Cloudera(US), Teradata(US), AWS(US), Informatica(US), Sisense(US), Salesforce(US), HPE(US), Qlik(US), Splunk(US), VMware(US), Accenture(Ireland), Ataccama (Canada), COGITO(US), Centerfield(US), RIB datapine (Berlin), Fusionex (Malaysia), BigPanda (US), Bigeye(US), Imply(US), Rivery (US), YugabyteDB (US), Airbyte (US), Cardagraph (US), Firebolt(US), and Syncari (US). These market players have adopted various growth strategies, such as partnerships, collaborations, and new product launches, to expand have been the most adopted strategies by major players from 2018 to 2022, which helped companies innovate their offerings and broaden their customer base.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2016–2026 |

|

Base year considered |

2021 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Component, Deployment Mode, Organization Size, Business Function, Industry Vertical, and Region |

|

Estimated Year Market Size |

USD 162.6 billion in 2021 |

|

Forecast Year Market Size |

USD 273.4 billion by 2026 |

|

CAGR for the Forecast Period |

11.0% |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM(US), Google(US), Oracle(US), Microsoft(US), SAS(US), SAP(Germany), Alteryx(US), TIBCO(US), Cloudera(US), Teradata(US), AWS(US), Informatica(US), Sisense(US), Salesforce(US), HPE(US), Qlik(US), Splunk(US), VMware(US), Accenture(Ireland), Ataccama(Canada), COGITO(US), Centerfield(US), RIB datapine(Berlin), Fusionex(Malaysia), BigPanda(US), Bigeye(US), Imply(US), Rivery(US), YugabyteDB (US), Airbyte(US), Cardagraph(US), Firebolt(US), Syncari(US). |

This research report categorizes the Big Data Market to forecast revenues and analyze trends in each of the following submarkets:

Based on Component, the Big Data Market has the following segments:

- Solutions

- Big Data Analytics

- Data Discovery

- Data Visualization

- Data Management

-

Services

- Professional Services

- Support and maintenance

- Consulting

-

Deployment and Integration

- Managed Services

Based on Deployment Mode, the market has the following segments:

- Cloud

- Public Cloud

- Private Cloud

- Hybrid Cloud

- On-premises

Based on Organization Size, the Big Data Market has the following segments:

- Small and Medium-Sized Enterprises

- Large Enterprises

Based on Business Function, the market has the following segments:

- Finance

- Marketing and Sales

- Human Resources

- Operations

Based on Vertical, the Big Data Market has the following segment

- BFSI

- Government and Defense

- Healthcare and Life Sciences

- Manufacturing

- Retail and Consumer Goods

- Media and Entertainment

- Telecommunications and IT

- Transportation and Logistics

- Other Verticals (real estate, energy and utilities, travel and hospitality, and education and research).

Based on regions, the market has the following segments:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- KSA

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In, August 2021 IBM launched IBM Db2-based, which could be used in both traditional corporate and containerized micro-service environments, with the recent version. It would also be the engine that powers other single-container Db2-based products.

- In January 2022 Oracle updates Oracle Analytics Cloud, Oracle's new redwood design experience would help users to identify, display, and act on crucial insights with a sparkling new style, greater spacing, and typefaces that are suitable for dense data.

- In December 2021, Microsoft launched the Azure Data Lake Storage soft delete for blobs feature. This feature protected files and folders from inadvertent deletion by storing destroyed data in the system for a set amount of time. Users could restore a soft-deleted object, such as a file or directory, to its previous state throughout the retention period. The object would be permanently erased after the retention period has finished.

- In December 2021, Snowflake would be supported as a data source in Azure Purview, allowing users to create a comprehensive map of the data environment using automated data discovery. Users could scan Snowflake databases for information to be quickly imported into the Azure Purview data map and then manage and govern the Snowflake data in Azure Purview.

- In September 2021, SAP released a new version of SAP Analytics Cloud 2021.20. It updated new dashboard and analytics platform services to enhance user experience.

Frequently Asked Questions (FAQ):

How big is the Big Data market?

What is the Big Data market growth?

Which region have the highest market share Big Data market?

Which component segment is expected to witness a higher adoption rate in the coming years?

Who are the major vendors in the Big Data market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATE, 2018–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 6 BIG DATA MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF THE MARKET

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 3 TOP-DOWN (DEMAND SIDE): SHARE OF BIG DATA THROUGH THE OVERALL BIG DATA SPENDING

FIGURE 10 BIG DATA MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

2.4 COMPANY EVALUATION MATRIX

FIGURE 11 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.5 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 12 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 2 BIG DATA MARKET SIZE AND GROWTH RATE, 2016–2020 (USD MILLION, Y-O-Y)

TABLE 3 MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y-O-Y)

FIGURE 13 BIG DATA SOLUTIONS TO ACCOUNT FOR A LARGER MARKET SIZE IN 2021

FIGURE 14 BIG DATA ANALYTICS SOLUTION SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE IN 2021

FIGURE 15 PROFESSIONAL SERVICES TO HOLD A LARGER MARKET SIZE IN 2021

FIGURE 16 SUPPORT AND MAINTENANCE SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2021

FIGURE 17 ON-PREMISES SEGMENT TO ACCOUNT FOR A LARGER MARKET SIZE IN 2021

FIGURE 18 PUBLIC CLOUD SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2021

FIGURE 19 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR A LARGER MARKET SIZE IN 2021

FIGURE 20 MARKETING AND SALES SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2021

FIGURE 21 HEALTHCARE AND LIFE SCIENCE CONTRIBUTED THE HIGHEST MARKET REVENUE IN 2021

FIGURE 22 NORTH AMERICA TO BE AN EMERGING DOMINANT REGION IN TERMS OF MARKET SIZE IN 2021

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 ATTRACTIVE OPPORTUNITIES IN THE BIG DATA MARKET

FIGURE 23 INCREASED DIGITALIZATION AND EMERGING TECHNOLOGIES SUCH AS ANALYTICS, IOT, AND AI TO DRIVE THE MARKET GROWTH

4.2 MARKET: TOP THREE VERTICALS

FIGURE 24 BFSI SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 25 NORTH AMERICA TO ACCOUNT FOR THE HIGHEST MARKET SHARE IN 2021

4.4 NORTH AMERICA: MARKET, BY APPLICATION AND INDUSTRY VERTICAL

FIGURE 26 DATA DISCOVERY SOLUTION AND BFSI INDUSTRY VERTICAL TO ACCOUNT FOR THE HIGHEST SHARES IN THE MARKET IN 2021

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: BIG DATA MARKET

5.2.1 DRIVERS

5.2.1.1 Sharp increase in data volume

5.2.1.2 Rise in data connectivity through cloud computing

5.2.1.3 Incorporation of digital transformation in top-level strategies

5.2.2 RESTRAINTS

5.2.2.1 Data security concerns and stringent data security regulations

5.2.2.2 High big data handling costs

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in adoption of technologies and big data analytics

5.2.3.2 The growth of investment in IT sectors by the businesses

5.2.4 CHALLENGES

5.2.4.1 Data silos and poor data quality

5.2.4.2 Lack of data professionals

5.3 USE CASES

5.3.1 BANKING, FINANCIAL SERVICES, AND INSURANCE

5.3.1.1 Use Case 1: Erste Group Bank gains a 360-degree view of customers using Oracle Big Data Appliance on a single cloud platform

5.3.2 TELECOMMUNICATION AND INFORMATION TECHNOLOGY

5.3.2.1 Use Case 2: Robi Axiata Limited uses the Cloudera platform to enhance customer experience

5.3.3 RETAIL AND CONSUMER GOODS

5.3.3.1 Use Case 4: Myntra uses Azure Synapse Analytics and Azure HDInsight to stabilize services and increase year-over-year traffic

5.3.4 GOVERNMENT AND DEFENSE

5.3.4.1 Use Case 5: Indian Oil uses Qlik to achieve business value by providing analytics on the real-time and big data

5.3.5 MEDIA AND ENTERTAINMENT

5.3.5.1 Use Case 6: Dwango Company Ltd. uses the Cloudera Big data platform, and advanced analytics enables expansion and business growth

5.3.6 MANUFACTURING

5.3.6.1 Use Case 7: Brembo uses TIBCO Spotfire to enhance production processes with the help of big data

5.3.7 HEALTHCARE AND LIFE SCIENCE

5.3.7.1 Use Case 8: IQVIA uses Qlik big data analytics to help UK healthcare services

5.3.8 TRANSPORT AND LOGISTICS

5.3.8.1 Use Case 9: CargoSmart uses TIBCO Spotfire for greater visibility and benchmarking

5.4 PATENT ANALYSIS

5.4.1 METHODOLOGY

5.4.2 DOCUMENT TYPE

TABLE 4 PATENTS FILED, 2018–2021

5.4.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 28 ANNUAL NUMBER OF PATENTS GRANTED, 2018–2021

5.4.3.1 Top applicants

FIGURE 29 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2021

5.5 BIG DATA: EVOLUTION

FIGURE 30 BIG DATA: EVOLUTION

5.6 BIG DATA: ARCHITECTURE

FIGURE 31 FUNCTIONAL ELEMENTS OF A BIG DATA SOLUTION

5.7 BIG DATA TYPES

5.8 BIG DATA ANALYTICS TYPES

5.9 BIG DATA ECOSYSTEM

TABLE 5 BIG DATA MARKET: ECOSYSTEM

5.10 SUPPLY CHAIN ANALYSIS

FIGURE 32 SUPPLY CHAIN ANALYSIS

5.11 PRICING MODEL ANALYSIS

TABLE 6 PRICING MODEL

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS IN THE MARKET

FIGURE 33 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.13 PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT OF NEW ENTRANTS

5.13.2 THREAT OF SUBSTITUTES

5.13.3 BARGAINING POWER OF SUPPLIERS

5.13.4 BARGAINING POWER OF BUYERS

5.13.5 INTENSITY OF COMPETITIVE RIVALRY

5.14 TECHNOLOGICAL ANALYSIS

5.14.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.14.2 INTERNET OF THINGS

5.14.3 CLOUD COMPUTING

5.15 REGULATORY IMPLICATIONS

5.15.1 GENERAL DATA PROTECTION REGULATION

5.15.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.15.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.15.4 SARBANES-OXLEY ACT OF 2002

5.15.5 SOC 2 TYPE II COMPLIANCE

5.15.6 ISO/IEC 27001

5.15.7 THE GRAMM–LEACH–BLILEY ACT

5.16 BIG DATA MARKET: COVID-19 IMPACT

FIGURE 35 MARKET TO GROW BETWEEN 2021 AND 2026

6 BIG DATA MARKET, BY COMPONENT (Page No. - 90)

6.1 INTRODUCTION

6.1.1 COVID-19 IMPACT ON THE MARKET, BY COMPONENT

FIGURE 36 BIG DATA SERVICES TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 8 MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 9 MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

6.1.2 COMPONENT: MARKET DRIVERS

6.2 SOLUTIONS

TABLE 10 BIG DATA SOLUTIONS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 11 BIG DATA SOLUTIONS MARKET, BY REGION, 2021–2026 (USD MILLION)

FIGURE 37 BIG DATA ANALYTICS TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 12 MARKET, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 13 BIG DATA MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

6.2.1 BIG DATA ANALYTICS

TABLE 14 BIG DATA ANALYTICS MARKET, BY REGION, 2016–2020 (USD MILLION0

TABLE 15 BIG DATA ANALYTICS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2 DATA DISCOVERY

TABLE 16 DATA DISCOVERY MARKET, BY REGION, 2016–2020 (USD MILLION0

TABLE 17 DATA DISCOVERY MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.3 DATA VISUALIZATION

TABLE 18 DATA VISUALIZATION MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 19 DATA VISUALIZATION MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.4 DATA MANAGEMENT

TABLE 20 DATA MANAGEMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 21 DATA MANAGEMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

FIGURE 38 MANAGED SERVICES TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 22 BIG DATA MARKET, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 23 MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 24 BIG DATA SERVICES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 25 BIG DATA SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.1 MANAGED SERVICES

TABLE 26 MANAGED BIG DATA SERVICES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 27 MANAGED BIG DATA SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2 PROFESSIONAL SERVICES

TABLE 28 PROFESSIONAL BIG DATA SERVICES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 29 PROFESSIONAL BIG DATA SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

FIGURE 39 SUPPORT AND MAINTENANCE SERVICES TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 30 PROFESSIONAL BIG DATA SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 31 PROFESSIONAL BIG DATA SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.3.2.1 Consulting

TABLE 32 CONSULTING BIG DATA SERVICES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 33 CONSULTING BIG DATA SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.2 Deployment and Integration

TABLE 34 BIG DATA DEPLOYMENT AND INTEGRATION SERVICES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 35 BIG DATA DEPLOYMENT AND INTEGRATION SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.3 Support and maintenance

TABLE 36 BIG DATA SUPPORT AND MAINTENANCE SERVICES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 37 BIG DATA SUPPORT AND MAINTENANCE SERVICES MARKET T, BY REGION, 2021–2026 (USD MILLION)

7 BIG DATA MARKET, BY BUSINESS FUNCTION (Page No. - 107)

7.1 INTRODUCTION

7.1.1 COVID-19 IMPACT ON THE MARKET, BY BUSINESS FUNCTION

FIGURE 40 BIG DATA IN OPERATIONS TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 38 MARKET, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 39 MARKET, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

7.1.2 BUSINESS FUNCTION: MARKET DRIVERS

7.2 MARKETING AND SALES

TABLE 40 MARKET IN MARKETING AND SALES, BY REGION, 2016–2020 (USD MILLION)

TABLE 41 MARKET IN MARKETING AND SALES, BY REGION, 2021–2026 (USD MILLION)

7.3 OPERATIONS

TABLE 42 MARKET IN OPERATIONS, BY REGION, 2016–2020 (USD MILLION)

TABLE 43 MARKET IN OPERATIONS, BY REGION, 2021–2026 (USD MILLION)

7.4 FINANCE

TABLE 44 MARKET IN FINANCE, BY REGION, 2016–2020 (USD MILLION)

TABLE 45 MARKET IN FINANCE, BY REGION, 2021–2026 (USD MILLION)

7.5 HUMAN RESOURCES

TABLE 46 MARKET IN HUMAN RESOURCES, BY REGION, 2016–2020 (USD MILLION)

TABLE 47 MARKET IN HUMAN RESOURCES, BY REGION, 2021–2026 (USD MILLION)

8 BIG DATA MARKET, BY DEPLOYMENT MODE (Page No. - 115)

8.1 INTRODUCTION

8.1.1 COVID-19 IMPACT ON THE MARKET, BY DEPLOYMENT MODE

FIGURE 41 CLOUD DEPLOYMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 48 MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 49 MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

8.1.2 DEPLOYMENT MODE: MARKET DRIVERS

8.2 ON-PREMISES

TABLE 50 ON-PREMISES DEPLOYMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 51 ON-PREMISES DEPLOYMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3 CLOUD

FIGURE 42 HYBRID CLOUD SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 52 CLOUD DEPLOYMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 53 CLOUD DEPLOYMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 54 CLOUD DEPLOYMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 55 CLOUD DEPLOYMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3.1 PUBLIC CLOUD

TABLE 56 PUBLIC CLOUD DEPLOYMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 57 PUBLIC CLOUD DEPLOYMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3.2 PRIVATE CLOUD

TABLE 58 PRIVATE CLOUD DEPLOYMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 59 PRIVATE CLOUD DEPLOYMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3.3 HYBRID CLOUD

TABLE 60 HYBRID CLOUD DEPLOYMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 61 HYBRID CLOUD DEPLOYMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

9 BIG DATA MARKET, BY ORGANIZATION SIZE (Page No. - 125)

9.1 INTRODUCTION

9.1.1 COVID-19 IMPACT ON THE MARKET, BY ORGANIZATION SIZE

FIGURE 43 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 62 MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 63 MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

9.1.2 ORGANIZATIONS SIZE: MARKET DRIVERS

9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 64 MARKET IN SMALL AND MEDIUM-SIZED ENTERPRISES, BY REGION, 2016–2020 (USD MILLION)

TABLE 65 MARKET IN SMALL AND MEDIUM-SIZED ENTERPRISES, BY REGION, 2021–2026 (USD MILLION)

9.3 LARGE ENTERPRISES

TABLE 66 MARKET IN LARGE ENTERPRISES, BY REGION, 2016–2020 (USD MILLION)

TABLE 67 MARKET IN LARGE ENTERPRISES, BY REGION, 2021–2026 (USD MILLION)

10 BIG DATA MARKET, BY INDUSTRY VERTICAL (Page No. - 131)

10.1 INTRODUCTION

10.1.1 COVID-19 IMPACT ON MARKET, BY INDUSTRY VERTICAL

FIGURE 44 ENERGY AND UTILITIES INDUSTRY VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 68 MARKET, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 69 MARKET, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

10.1.2 VERTICAL: MARKET DRIVERS

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 70 MARKET IN BANKING, FINANCIAL SERVICES, AND INSURANCE, BY REGION, 2016–2020 (USD MILLION)

TABLE 71 MARKET IN BANKING, FINANCIAL SERVICES, AND INSURANCE, BY REGION, 2021–2026 (USD MILLION)

10.3 TELECOMMUNICATIONS AND IT

TABLE 72 BIG DATA MARKET IN TELECOMMUNICATIONS AND IT, BY REGION, 2016–2020 (USD MILLION)

TABLE 73 MARKET IN TELECOMMUNICATIONS AND IT, BY REGION, 2021–2026 (USD MILLION)

10.4 RETAIL AND CONSUMER GOODS

TABLE 74 MARKET IN RETAIL AND CONSUMER GOODS, BY REGION, 2016–2020 (USD MILLION)

TABLE 75 RETAIL AND CONSUMER GOODS, BY REGION, 2021–2026 (USD MILLION)

10.5 HEALTHCARE AND LIFE SCIENCES

TABLE 76 MARKET IN HEALTHCARE AND LIFE SCIENCES, BY REGION, 2016–2020 (USD MILLION)

TABLE 77 MARKET IN HEALTHCARE AND LIFE SCIENCES, BY REGION, 2021–2026 (USD MILLION)

10.6 GOVERNMENT AND DEFENSE

TABLE 78 MARKET IN GOVERNMENT AND DEFENSE, BY REGION, 2016–2020 (USD MILLION)

TABLE 79 MARKET IN GOVERNMENT AND DEFENSE, BY REGION, 2021–2026 (USD MILLION)

10.7 MEDIA AND ENTERTAINMENT

TABLE 80 BIG DATA MARKET IN MEDIA AND ENTERTAINMENT, BY REGION, 2016–2020 (USD MILLION)

TABLE 81 MARKET IN MEDIA AND ENTERTAINMENT, BY REGION, 2021–2026 (USD MILLION)

10.8 MANUFACTURING

TABLE 82 MARKET IN MANUFACTURING, BY REGION, 2016–2020 (USD MILLION)

TABLE 83 MARKET IN MANUFACTURING, BY REGION, 2021–2026 (USD MILLION)

10.9 TRANSPORTATION AND LOGISTICS

TABLE 84 MARKET IN TRANSPORTATION AND LOGISTICS, BY REGION, 2016–2020 (USD MILLION)

TABLE 85 MARKET IN TRANSPORTATION AND LOGISTICS, BY REGION, 2021–2026 (USD MILLION)

10.10 OTHER INDUSTRY VERTICALS

TABLE 86 MARKET IN OTHER INDUSTRY VERTICALS, BY REGION, 2016–2020 (USD MILLION)

TABLE 87 MARKET IN OTHER INDUSTRY VERTICALS, BY REGION, 2021–2026 (USD MILLION)

11 BIG DATA MARKET, BY REGION (Page No. - 147)

11.1 INTRODUCTION

FIGURE 45 ASIA PACIFIC TO ACHIEVE HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

FIGURE 46 INDIA EXPECTED TO ACHIEVE THE HIGHEST GROWTH IN THE MARKET DURING THE FORECAST PERIOD

TABLE 88 MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 89 MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: BIG DATA MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATIONS

11.2.3.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

11.2.3.2 Gramm-Leach-Bliley (GLB) Act

11.2.3.3 Health Insurance Portability and Accountability Act (HIPAA) of 1996

11.2.3.4 Federal Information Security Management Act (FISMA)

11.2.3.5 Federal Information Processing Standards (FIPS)

11.2.3.6 California Consumer Privacy Act (CSPA)

FIGURE 47 NORTH AMERICA: MARKET SNAPSHOT

TABLE 90 NORTH AMERICA: BIG DATA MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 94 NORTH AMERICA: BIG DATA SERVICES MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 95 NORTH AMERICA: BIG DATA SERVICES MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET, BY CLOUD TYPE, 2016–2020 (USD MILLION)

TABLE 101 NORTH AMERICA: BIG DATA MARKET, BY CLOUD TYPE, 2021–2026 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.4 UNITED STATES

TABLE 110 US: BIG DATA MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 111 UNITED STATES: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 112 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 113 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.2.5 CANADA

TABLE 114 CANADA: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 115 CANADA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 116 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 117 CANADA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: BIG DATA MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: TARIFFS AND REGULATIONS

11.3.3.1 GDPR 2016/679 is a regulation in the EU

11.3.3.2 General Data Protection Regulation

11.3.3.3 European Committee for Standardization

11.3.3.4 European Technical Standards Institute

11.3.4 EUROPE GOVERNMENT CASE STUDIES

11.3.4.1 Case study 1: INVITALIA, ITALY

11.3.4.2 Case study 2: COMUNE DI CATANIA, ITALY

11.3.4.3 Case study 3: ITALY’S NATIONAL INSTITUTE FOR INSURANCE AGAINST ACCIDENTS AT WORK (INAIL)

11.3.4.4 Case study 4: CITY OF WIESBADEN, GERMANY

11.3.4.5 Case study 5: NHS BUSINESS SERVICES AUTHORITY (NHSBSA), ENGLAND

11.3.4.6 Case study 6: NATIONAL GENDARMERIE, FRANCE

11.3.4.7 Case study 7: AGENCIA TRIBUTARIA DE CATALUÑA (ATC), SPAIN

11.3.4.8 Case study 8: MINISTRY OF INDUSTRY, FOREIGN TRADE AND SERVICES (MDIC), BRAZIL

11.3.4.9 Case study 9: NETHERLANDS MINISTRY OF DEFENSE

11.3.4.10 Case study 10: BUNDESPOLIZEI, GERMANY

11.3.4.11 Case study 11: AVON AND SOMERSET CONSTABULARY, ENGLAND

11.3.4.12 Case study 12: SCOTTISH ENVIRONMENT PROTECTION AGENCY (SEPA), SCOTLAND

11.3.4.13 Case study 13: DE RECHTSPRAAK, NETHERLANDS

11.3.4.14 Case study 14: CITY OF ESPOO, FINLAND

11.3.4.15 Case study 15: EUROPEAN ORGANIZATION FOR NUCLEAR RESEARCH (CERN), SWITZERLAND

11.3.4.16 Case study 16: MINISTRY OF ECOLOGY, SUSTAINABLE DEVELOPMENT, TRANSPORTATION AND HOUSING (MEDDE), FRANCE

TABLE 118 EUROPE: BIG DATA MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 122 EUROPE: BIG DATA SERVICES MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 123 EUROPE: BIG DATA SERVICES MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 124 EUROPE: MARKET, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 126 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 127 EUROPE: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 128 EUROPE: MARKET, BY CLOUD TYPE, 2016–2020 (USD MILLION)

TABLE 129 EUROPE: BIG DATA MARKET, BY CLOUD TYPE, 2021–2026 (USD MILLION)

TABLE 130 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 131 EUROPE: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 132 EUROPE: MARKET, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 133 EUROPE: MARKET, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 134 EUROPE: MARKET, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 135 EUROPE: MARKET, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 136 EUROPE: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 137 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.5 UNITED KINGDOM

TABLE 138 UK: BIG DATA MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 139 UK: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.3.6 GERMANY

TABLE 140 GERMANY: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 141 GERMANY: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.3.7 FRANCE

TABLE 142 FRANCE: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 143 FRANCE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.3.8 REST OF EUROPE

TABLE 144 REST OF EUROPE: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 145 REST OF EUROPE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: BIG DATA MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: REGULATIONS

11.4.3.1 Privacy Commissioner for Personal Data

11.4.3.2 Act on the Protection of Personal Information

11.4.3.3 Critical Information Infrastructure

11.4.3.4 International Organization for Standardization 27001

11.4.3.5 Personal Data Protection Act

FIGURE 48 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 146 ASIA PACIFIC: BIG DATA MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 150 ASIA PACIFIC: BIG DATA SERVICE MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 151 ASIA PACIFIC: BIG DATA SERVICE MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 155 ASIA PACIFIC: BIG DATA MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY CLOUD TYPE, 2016–2020 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY CLOUD TYPE, 2021–2026 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.4 CHINA

TABLE 166 CHINA: BIG DATA MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 167 CHINA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.4.5 JAPAN

TABLE 168 JAPAN: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 169 JAPAN: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.4.6 INDIA

TABLE 170 INDIA: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 171 INDIA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 172 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 173 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

11.5.1 MIDDLE EAST & AFRICA: BIG DATA MARKET DRIVERS

11.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST & AFRICA: REGULATIONS

11.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

11.5.3.2 GDPR Applicability in KSA

11.5.3.3 Cloud Computing Framework:

11.5.3.4 Electronic Transactions Law

11.5.3.5 Electronic Commerce Law

11.5.3.6 Protection of Personal Information Act (POPIA)

TABLE 174 MIDDLE EAST & AFRICA: BIG DATA MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: BIG DATA SERVICES MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 179 MIDDLE EAST & AFRICA: BIG DATA SERVICES MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: MARKET, BY CLOUD TYPE, 2016–2020 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: BIG DATA MARKET, BY CLOUD TYPE, 2021–2026 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: MARKET, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: MARKET, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: MARKET, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: MARKET, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 192 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 193 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.5.4 KINGDOM OF SAUDI ARABIA

TABLE 194 KINGDOM OF SAUDI ARABIA: BIG DATA MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 195 KINGDOM OF SAUDI ARABIA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.5.5 SOUTH AFRICA

TABLE 196 SOUTH AFRICA: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 197 SOUTH AFRICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.5.6 UNITED ARAB EMIRATES

TABLE 198 UNITED ARAB OF EMIRATES: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 199 UNITED ARAB OF EMIRATES: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.5.7 REST OF THE MIDDLE EAST AND AFRICA

TABLE 200 REST OF THE MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 201 REST OF THE MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.5.8 COMPETITIVE ANALYSIS

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: BIG DATA MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: REGULATIONS

11.6.3.1 Brazil Data Protection Law

11.6.3.2 Argentina Personal Data Protection Law No. 25.326

TABLE 202 LATIN AMERICA: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 206 LATIN AMERICA: BIG DATA SERVICES MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 207 LATIN AMERICA: BIG DATA SERVICES MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 211 LATIN AMERICA: BIG DATA MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET, BY CLOUD TYPE, 2016–2020 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET, BY CLOUD TYPE, 2021–2026 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 215 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 216 LATIN AMERICA: MARKET, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 218 LATIN AMERICA: MARKET, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 219 LATIN AMERICA: MARKET, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 220 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 221 LATIN AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.6.4 BRAZIL

TABLE 222 BRAZIL: BIG DATA MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 223 BRAZIL: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.6.5 MEXICO

TABLE 224 MEXICO: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 225 MEXICO: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.6.6 REST OF LATIN AMERICA

TABLE 226 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 227 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 230)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES

12.3 MARKET SHARE ANALYSIS

FIGURE 49 BIG DATA MARKET SHARE ANALYSIS OF KEY PLAYERS

TABLE 228 MARKET: DEGREE OF COMPETITION

12.4 HISTORIC REVENUE ANALYSIS

FIGURE 50 HISTORIC REVENUE ANALYSIS FOR LEADING PLAYERS, 2016–2020

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 51 KEY BIG DATA MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2021

12.6 COMPETITIVE BENCHMARKING

TABLE 229 COMPANY PRODUCT FOOTPRINT

TABLE 230 COMPANY REGION FOOTPRINT

TABLE 231 CONSOLIDATED FOOTPRINT

12.7 START-UP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 52 STARTUP/SME BIG DATA MARKET EVALUATION MATRIX, 2021

12.8 COMPETITIVE SCENARIO

12.8.1 PRODUCT LAUNCHES

TABLE 232 PRODUCT LAUNCHES, JUNE 2019–AUGUST 2021

12.8.2 DEALS

TABLE 233 DEALS, AUGUST 2019–AUGUST 2021

13 COMPANY PROFILES (Page No. - 288)

13.1 INTRODUCTION

13.2 MAJOR PLAYERS

(Business Overview, Products & Services, Recent Developments, COVID-19 related developments, MnM View)*

13.2.1 IBM

TABLE 234 IBM: BUSINESS OVERVIEW

FIGURE 53 IBM: COMPANY SNAPSHOT

TABLE 235 IBM: PRODUCTS OFFERED

TABLE 236 IBM: SERVICES OFFERED

TABLE 237 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 238 IBM: DEALS

13.2.2 GOOGLE

TABLE 239 GOOGLE: BUSINESS OVERVIEW

FIGURE 54 GOOGLE: COMPANY SNAPSHOT

TABLE 240 GOOGLE: PRODUCTS OFFERED

TABLE 241 GOOGLE: SERVICES OFFERED

TABLE 242 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 243 GOOGLE: DEALS

13.2.3 ORACLE

TABLE 244 ORACLE: BUSINESS OVERVIEW

FIGURE 55 ORACLE: COMPANY SNAPSHOT

TABLE 245 ORACLE: PRODUCTS OFFERED

TABLE 246 ORACLE: SERVICES OFFERED

TABLE 247 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 248 ORACLE: DEALS

13.2.4 MICROSOFT

TABLE 249 MICROSOFT: BUSINESS OVERVIEW

FIGURE 56 MICROSOFT: COMPANY SNAPSHOT

TABLE 250 MICROSOFT: PRODUCTS OFFERED

TABLE 251 MICROSOFT: SERVICES OFFERED

TABLE 252 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 253 MICROSOFT: DEALS

13.2.5 SAP

TABLE 254 SAP: BUSINESS OVERVIEW

FIGURE 57 SAP: COMPANY SNAPSHOT

TABLE 255 SAP: PRODUCTS OFFERED

TABLE 256 SAP: SERVICES OFFERED

TABLE 257 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 258 SAP: DEALS

13.2.6 SAS

TABLE 259 SAS: BUSINESS OVERVIEW

FIGURE 58 SAS: COMPANY SNAPSHOT

TABLE 260 SAS: PRODUCTS OFFERED

TABLE 261 SAS: SERVICES OFFERED

TABLE 262 SAS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 263 SAS: DEALS

13.2.7 CLOUDERA

TABLE 264 CLOUDERA: BUSINESS OVERVIEW

FIGURE 59 CLOUDERA: COMPANY SNAPSHOT

TABLE 265 CLOUDERA: PRODUCTS OFFERED

TABLE 266 CLOUDERA: SERVICES OFFERED

TABLE 267 CLOUDERA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 268 CLOUDERA: DEALS

13.2.8 TERADATA

TABLE 269 TERADATA: BUSINESS OVERVIEW

FIGURE 60 TERADATA: COMPANY SNAPSHOT

TABLE 270 TERADATA: PRODUCTS OFFERED

TABLE 271 TERADATA: SERVICES OFFERED

TABLE 272 TERADATA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 273 TERADATA: DEALS

13.2.9 TIBCO

TABLE 274 TIBCO: BUSINESS OVERVIEW

TABLE 275 TIBCO: PRODUCTS OFFERED

TABLE 276 TIBCO: SERVICES OFFERED

TABLE 277 TIBCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 278 TIBCO: DEALS

13.2.10 AWS

TABLE 279 AWS: BUSINESS OVERVIEW

FIGURE 61 AWS: COMPANY SNAPSHOT

TABLE 280 AWS: PRODUCTS OFFERED

TABLE 281 AWS: SERVICES OFFERED

TABLE 282 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 283 AWS: DEALS

13.2.11 ALTERYX

TABLE 284 ALTERYX: BUSINESS OVERVIEW

FIGURE 62 ALTERYX: COMPANY SNAPSHOT

TABLE 285 ALTERYX: PRODUCTS OFFERED

TABLE 286 ALTERYX: SERVICES OFFERED

TABLE 287 ALTERYX: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 288 ALTERYX: DEALS

13.2.12 INFORMATICA

TABLE 289 INFORMATICA: BUSINESS OVERVIEW

FIGURE 63 INFORMATICA: COMPANY SNAPSHOT

TABLE 290 INFORMATICA: PRODUCTS OFFERED

TABLE 291 INFORMATICA: SERVICES OFFERED

TABLE 292 INFORMATICA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 293 INFORMATICA: DEALS

13.2.13 SISENSE

TABLE 294 SISENSE: BUSINESS OVERVIEW

TABLE 295 SISENSE: PRODUCTS OFFERED

TABLE 296 SISENSE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 297 SISENSE: DEALS

13.2.14 SALESFORCE

TABLE 298 SALESFORCE: BUSINESS OVERVIEW

FIGURE 64 SALESFORCE: COMPANY SNAPSHOT

TABLE 299 SALESFORCE: SOLUTIONS OFFERED

TABLE 300 SALESFORCE: SERVICES OFFERED

TABLE 301 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 302 SALESFORCE: DEALS

13.2.15 HPE

TABLE 303 HPE: BUSINESS OVERVIEW

FIGURE 65 HPE: COMPANY SNAPSHOT

TABLE 304 HPE: PRODUCTS OFFERED

TABLE 305 HPE: SERVICES OFFERED

TABLE 306 HPE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 307 HPE: DEALS

13.2.16 QLIK

TABLE 308 QLIK: BUSINESS OVERVIEW

TABLE 309 QLIK: PRODUCTS OFFERED

TABLE 310 QLIK: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 311 QLIK: DEALS

13.2.17 SPLUNK

TABLE 312 SPLUNK: BUSINESS OVERVIEW

FIGURE 66 SPLUNK: COMPANY SNAPSHOT

TABLE 313 SPLUNK: PRODUCTS OFFERED

TABLE 314 SPLUNK: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 315 SPLUNK: DEALS

13.2.18 VMWARE

TABLE 316 VMWARE: BUSINESS OVERVIEW

FIGURE 67 VMWARE: COMPANY SNAPSHOT

TABLE 317 VMWARE: PRODUCTS OFFERED

TABLE 318 VMWARE: DEALS

13.2.19 ACCENTURE

TABLE 319 ACCENTURE: BUSINESS OVERVIEW

FIGURE 68 ACCENTURE: COMPANY SNAPSHOT

TABLE 320 ACCENTURE: PRODUCTS OFFERED

TABLE 321 ACCENTURE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 322 ACCENTURE: DEALS

*Details on Business Overview, Products & Services, Recent Developments, COVID-19 related developments, MnM View might not be captured in case of unlisted companies.

13.3 SMES/START-UPS

13.3.1 ATACCAMA

13.3.2 COGITO

13.3.3 CENTERFIELD

13.3.4 RIB DATAPINE

13.3.5 FUSIONEX

13.3.6 BIGPANDA

13.3.7 BIGEYE

13.3.8 IMPLY

13.3.9 RIVERY

13.3.10 YUGABYTE DB

13.3.11 AIRBYTE

13.3.12 CARDAGRAPH

13.3.13 FIREBOLT

13.3.14 SYNCARI

14 ADJACENT AND RELATED MARKETS (Page No. - 400)

14.1 DATA GOVERNANCE MARKET—GLOBAL FORECAST TO 2025

14.1.1 MARKET DEFINITION

14.1.2 MARKET OVERVIEW

14.1.2.1 Data governance market, by application

TABLE 323 DATA GOVERNANCE MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 324 DATA GOVERNANCE MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

14.1.2.2 Data governance market, by component

TABLE 325 DATA GOVERNANCE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 326 DATA GOVERNANCE MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

14.1.2.3 Data governance market, by deployment model

TABLE 327 DATA GOVERNANCE MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 328 DATA GOVERNANCE MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

14.1.2.4 Data governance market, by organization size

TABLE 329 DATA GOVERNANCE MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 330 DATA GOVERNANCE MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

14.1.2.5 Data governance market, by vertical

TABLE 331 DATA GOVERNANCE MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 332 DATA GOVERNANCE MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

14.1.2.6 Data governance market, by region

TABLE 333 DATA GOVERNANCE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 334 DATA GOVERNANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

14.1.3 DATA DISCOVERY MARKET—GLOBAL FORECAST TO 2025

14.1.3.1 Market definition

14.1.3.2 Market overview

14.1.3.3 Data discovery market, by component

TABLE 335 DATA DISCOVERY MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 336 DATA DISCOVERY MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 337 DATA DISCOVERY MARKET SIZE, BY SERVICE,2014–2019 (USD MILLION)

TABLE 338 DATA DISCOVERY MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 339 PROFESSIONAL SERVICES: DATA DISCOVERY MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 340 PROFESSIONAL SERVICES: DATA DISCOVERY MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

14.1.3.4 Data discovery market, by organization size

TABLE 341 DATA DISCOVERY MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 342 DATA DISCOVERY MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

14.1.3.5 Data discovery market, by deployment mode

TABLE 343 DATA DISCOVERY MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 344 DATA DISCOVERY MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 345 CLOUD: DATA DISCOVERY MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 346 CLOUD: DATA DISCOVERY MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

14.1.3.6 Data discovery market, by functionality

TABLE 347 DATA DISCOVERY MARKET SIZE, BY FUNCTIONALITY, 2014–2019 (USD MILLION)

TABLE 348 DATA DISCOVERY MARKET SIZE, BY FUNCTIONALITY, 2019–2025 (USD MILLION)

14.1.3.7 Data discovery market, by application

TABLE 349 DATA DISCOVERY MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 350 DATA DISCOVERY MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

14.1.3.8 Data discovery market, by vertical

TABLE 351 DATA DISCOVERY MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 352 DATA DISCOVERY MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

14.1.3.9 Data discovery market, by region

TABLE 353 DATA DISCOVERY MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 354 DATA DISCOVERY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

15 APPENDIX (Page No. - 415)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

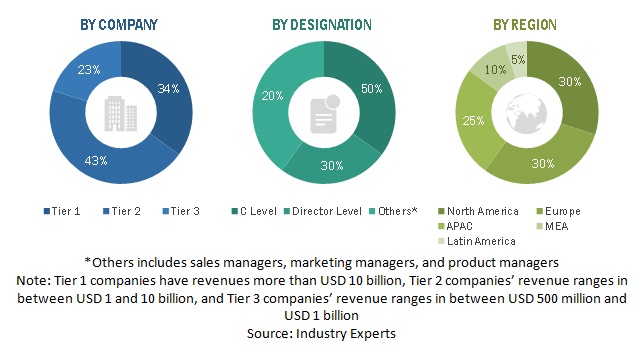

The research study for the Big data market report involved the use of extensive secondary sources, directories, as well as several journals and magazines, to identify and collect information that is useful for this technical and market-oriented study. During the production cycle of the report, in-depth interviews were conducted with various primary respondents, including key opinion leaders, subject-matter experts, high-level executives of various companies offering Big data software and services, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of Big data vendors; white papers, certified publications, and articles from recognized industry associations; statistics bureaus; and government publishing sources. The secondary research was carried out to obtain key information about the industry’s value and supply chain, the total pool of key players, market classifications, and segmentations from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the big data market ecosystem were interviewed to obtain qualitative and quantitative information for the study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives of various vendors providing Big data, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Big Data Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global big data market and estimate the size of various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players in the market were identified through secondary research and their revenue contributions in the respective regions were determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data was consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global Big Data Market with COVID-19 Impact Analysis, by Component, Deployment Mode, Organization Size, Business Function (Finance, Marketing & Sales), Industry Vertical (BFSI, Manufacturing, Healthcare & Life Sciences), and Region—Global Forecast to 2026 and analyze the various macroeconomic and microeconomic factors that affect market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Big data market

-

To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

To track and analyze the competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Big Data Market

Interested to know an in-depth analysis of the market from various perspectives

Interested in logistics big data market

Interested in health care market segmentation