Bio-based Leather Market by Source (Mushroom, Pineapple, Cork, Leftover Fruits), End-use (Footwear, Garment & Accessories),and Region (North America, APAC, Middle East & Arica, South America, and Europe) - Global Forecast to 2028

Get the updated report with forecasts to 2028 : Inquire Now

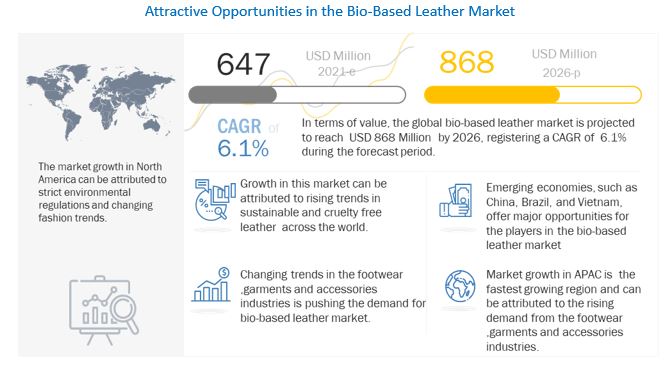

Bio-Based Leather Market was valued at USD 647 million in 2021 and is projected to reach USD 868 million by 2026, growing at a cagr 6.1% from 2021 to 2026. The bio-based leather market is mainly driven by the rising trend for sustainable and cruelty free leather. Price sensitivity in the emerging regions is a major restraint. However, continuous R&D in bio-based leather market will act as an opportunity for the market. North America is the key market for bio-based leather, globally, in terms of value. APAC is the fastest-growing region in the bio-based leather market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Bio-based leather Market

The global pandemic has affected almost every sector in the world. The bio-based leather market has shown slightly negative growth as it was affected due to disruptions in the global supply chain and fluctuation in the raw material prices. This situation arose due to fall in demand from the footwear, automotive, garments & accessories sector. The market is highly dependent on the fashion industry. North America is the largest region in terms of value for the bio-based leather market.

North America has always been a strong market for bio-based leather. Globally, North America has been one of the leaders in demand and product innovation, in terms of quality and application development. Key countries in the North American market are the US (the most dominant market, accounting for a significant regional market share), Canada, and Mexico. The bio-based leather market is experiencing significant growth due to the increasing demand for sustainable leather in the fashion industry.

Bio-based leather market is highly influenced by the strict environmental regulations in this region. Various regulatory bodies including PETA are promoting vegan leather or bio-based leather. North America is also a highly developed region, which plays an important role in the growth of this market. The growth of footwear and garments & accessories plays a key role in this market.

Market Dynamics

Driver: Harmful effects of leather on humans are promoting the use of bio-based leather

Conventional methods of pre-tanning and tanning have the largest discharges accounting for nearly 90% of the total pollution from a tannery. Tannery effluent contains large amounts of pollutants, such as salt, lime sludge, sulfides, and acids. In addition, raising the animals whose skin eventually becomes leather requires vast quantities of water and pastureland, which must be cleared of trees.

Tannery chemical such as arsenic has long been associated with lung cancer in workers who are exposed to it on a regular basis. Studies of leather-tannery workers in Sweden and Italy found cancer risks.

Huge amounts of fossil fuels are consumed in livestock production as well, and real leather has almost three times the negative environmental impact as its synthetic counterparts, including polyurethane (PU) leather.

PU and PVC, the major raw materials used to manufacture synthetic leather, have some harmful effects on human and animal health and on the surrounding environment. PU is an isocyanate, which possesses a potential harm to lungs, as it causes asthma attacks and lung irritation. It irritates the skin and also causes difficulty in breathing due to lung infections. PVC on the other hand contains various harmful carcinogens such as vinyl chloride monomer (VCM), phthalates, and dioxin. Dioxin is highly toxic and harmful, and it is generally released when the plastic that contains chlorine is burned.

The manufacturing process of bio-based leather does not have any harmful traits as compared to real leather or PU/PVC based leather. The manufacturers are focusing on production of bio-based leather by natural fibers such as flax or fibers of cotton mixed with palm, soybean, corn, and other plants.

The pineapple leaves are considered as a waste product which is used for upscaling it into something of value without using many resources. Shoes, handbags, and other accessories made of pineapple fibers have already hit the marketplace. Similarly, there are various cell-based, mycelium based, byproduct-based sources which can be used to manufacture bio-based leather such as collagen based on yeast fermentation, mushrooms, byproducts from food industries, cacti and others. All these factors collectively are driving the demand for bio-based leather in the various end-use industries.

Restraints: Minor drawbacks related to processing and degradability

Although the bio-based leather or the vegan leather has been proven to be better than the real leather and are a significant improvement over the plastic-based fake leathers, they still rely on chemical processing to give them a leather-like feel and durability presenting environmental problems of their own. For instance, Pinatex is just one type of vegan leather that is being preferred in the fashion industry, especially by the sustainable sneaker brands such as Po-Zu, EcoAlf, and No Saints. The products are made from pineapple leaves, a normally wasted byproduct that typically gets burned by the fruit industry. The pineapple fibers have surprising strength and flexibility. Pinatex is made from waste, its production does not require any additional agricultural inputs or water. Unfortunately, it is coated with a petroleum-based material for greater durability, making it non-biodegradable. Similarly, apple leather is being made with 50% apple waste mixed with 50% polyurethane, coated onto a cotton/polyester canvas. This polyurethane can have a harmful effect on the environment during the degradation process.

Opportunities: Scope for green entrepreneurship and continuous R&D

Increasing awareness related to cruelty towards farmed animals and the widespread environmental degradation has caught the interest of many entrepreneurs who are encashing on the opportunity to bring change. Consumers also seems interested in the concept. Many startups are coming up with bio-based leathers made up of various raw materials such as cork, coconut, mycelium, fruit based, cactus and hemp among the others. Ananas Anam Ltd., a vegan leather company is making a leather-like material from the fibers of pineapple leaves, which are a by-product of pineapple harvest. Whereas MycoWorks is using mushroom mycelium to make leather. After 20 years of research, they have developed an eco-friendly leather alternative that is strong, water-resistant and completely biodegradable. Similarly, companies such as Vegea, Modern Meadow, Will’s Vegan Shoes, and Wilby are few major startups who are manufacturing bio-based leather after continuous research and development. As the market is at a nascent stage, there is a lot of scope for new entrants. There is also a scope for developing better versions of bio-based leather with 100% biodegradable property.

Challenges: Nascent market with scalability issue

Bio-based leather especially plant-based leather is still at a nascent stage, which is rapidly accelerated by large global brands such as H&M, Hugo Boss, and Volkswagen seeking to establish themselves as early adopters. The most common source of leather is pineapple (Pinatex), mushroom and Apple. As production scales are concerned only few small-scale producers are manufacturing these products hence it is not available in large quantities across the globe. Moreover, the already established real leather market and other synthetic leathers market have a large customer base which is a major challenge for the bio-based leather manufacturers.

Pineapple is estimated to be the largest source of bio-based leather market in 2020.

Pineapple based leather is estimated to dominate the overall bio-based leather market, in terms of value, in 2020. Pineapple is a perennial and abundantly grown fruit across the globe. It generates a lot of wastes which includes leaves, stem, pulps and skin. Pinatex is made by the waste from the pineapple harvesting process. The textile has leather-like qualities, but is slightly rougher, giving it a weathered vintage appeal that is well suited for watches, boots, and others. Pinatex is currently preferred by various brands such as Hugo Boss, Altiir, Bourgeois Boheme, Nike. and Drew Veloric.

Footwear was the largest end-use for bio-based leather market in 2020.

The bio-based leather market for footwear industry has been driven by the shift of preference by the customers and fashion brands for a sustainable and cruelty-free alternative to leather. North America and Europe are using various plant or mushroom sources to obtain bio-based leather. These plant or mushroom sources are easily cultivated and harvested. Many bio-based leather companies claim to manufacture 100% biodegradable products. Many companies use a blend of plant source and polymer resin to manufacture a durable footwear. Research and developments are going on in various countries to make the products 100% biodegradable in future. Plant-based leather has 40 times less carbon impact than traditional leather and 17 times less carbon than synthetic leather made from plastics. Many start-up companies have manufactured shoes out of cork, pineapple and coconut husks. This is expected to drive the growth of the bio-based leather in footwear industry between 2021 and 2026.

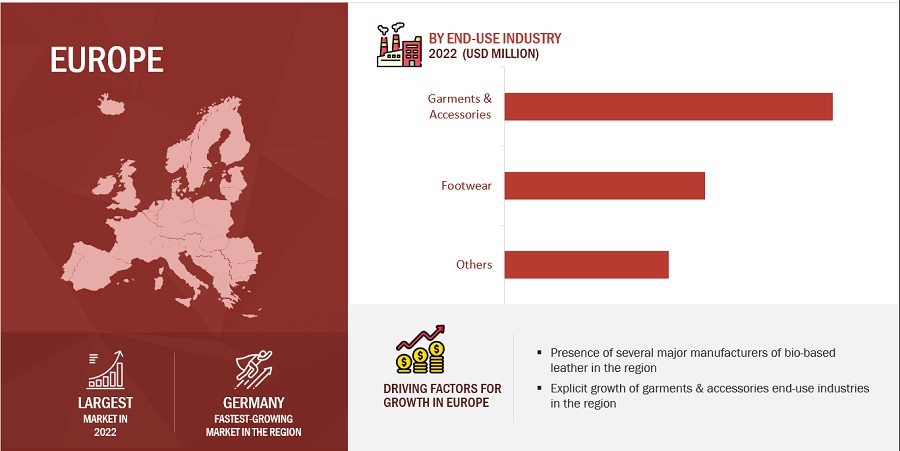

Europe was estimated to be the second-largest bio-based leather market in 2020

The bio-based leather market in Europe is highly regulated with Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) closely monitoring and issuing guidelines to ensure a high level of protection for the environment and human health from the risks that can be posed by chemicals. Due to the implementation of stringent environmental regulations in the EU and rising demand for footwear, garments & accessories made of bio-based leather in the region, the market is expected to grow moderately during the forecast period.

The demand for footwear from fashion industries and sports industries are driving the bio-based leather market in Europe. There are major fashion brands in this region which are preferring bio-leather over conventional leather to reduce carbon footprints. The use of sustainable materials for footwear production has been expanding in the last 25 years. Nowadays, all shoe parts can be made from bio-based materials. Bio-based leather shoes are renewable and can provide comparable or even enhanced performance. Some materials are lighter, and others can provide a unique combination of characteristics, like a combination of rigidity and flexibility and reduced moisture uptake. And finally, bio-based footwear can be compostable or even biodegradable. These factors will drive the bio-based leather market for footwear industry in Europe.

To know about the assumptions considered for the study, download the pdf brochure

APAC was estimated to be the fastest-growing region in bio-based leather market in the forecast period.

APAC was the third-largest consumer of bio-based leather in 2020, in terms of value, and is projected to grow at the highest CAGR during the forecast period. High economic growth in the emerging countries and the increasing disposable income of people make APAC an attractive market for bio-based leather. The significant growth in industrial production, increased trade, and the rise in fashion and accessories are primarily responsible for the high consumption of bio-based leather in the region. China, Indonesia and Vietnam are the major markets for bio-based leather in the region. Additionally, government regulations are being implemented for carbon emission, which is further expected to boost the demand for bio-based leather during the forecast period.

Key Market Players

The key market players profiled in the report include Toray Industries Inc. (Japan), Bolt Threads Inc. (US), Ananas Anam Ltd. (UK), Modern Meadows (US), Nat-2 (Germany), Natural Fiber Welding Inc. (US), Ultrafabrics (US), MycoWorks(US), ECCO Leather (Netherlands), VEGEA(Italy), Fruitleather Rotterdam (Netherlands), and Tjeerd Veenhoven studio (Netherlands).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

| Years considered for the study | 2016-2026 |

| Base Year | 2021 |

| Forecast period | 2021–2026 |

| Units considered | Value (USD Thousand), Volume(Thousand Sq. Meter) |

| Segments | Source, End-Use Industry and Region |

| Regions | APAC, North America, Europe, Middle East & Africa, and South America |

| Companies | Toray Industries Inc. (Japan), Bolt Threads Inc. (US), Ananas Anam Ltd. (UK), Modern Meadows (US), Nat-2 (Germany), Natural Fiber Welding Inc. (US), Ultrafabrics (US), MycoWorks(US), ECCO Leather (Netherlands), VEGEA(Italy), Fruitleather Rotterdam (Netherlands), and Tjeerd Veenhoven studio (Netherlands). |

This report categorizes the global bio-based leather market based on source, end-use industry, and region.

On the basis of source, the bio-based leather market has been segmented as follows:

- Mushroom

- Pineapple

- Cork

- Leftover Fruits (apple & grapes)

- Others(includes corn, coconut husk, palm, and cactus)

On the basis of end-use, the bio-based leather market has been segmented as follows:

- Footwear

- Garments & Accessories

- Others(includes furniture and automotive)

On the basis of region, the bio-based leather market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In July 2021, Ananas Anam Ltd. entered a partnership with Dole, Philippines to access a larger volume of pineapple fibers, to meet the increasing demand of Pinatex.

- In January 2020, Toray completes the acquisition of Alva Sweden AB, a manufacturer of cushions for automotive airbag systems to expand its fiber & textiles business segment.

Key questions addressed by the report

What are the factors influencing the growth of bio-based leather?

Rising trend for sustainable and cruelty free leather are driving this market.

What are different sources of bio-based leather?

It is classified into five categories- mushroom, pineapple, cork, leftover fruits, others

What is the biggest restraint for bio-based leather?

Price sensitivity in the emerging regions is a major restraint of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 BIO-BASED LEATHER MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 MARKET: DEFINITION AND INCLUSION, BY SOURCE

1.2.3 MARKET: DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

1.3 MARKET SCOPE

1.3.1 BIO-BASED LEATHER MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews –demand and supply sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY-SIDE ANALYSIS

2.4.2 DEMAND-SIDE ANALYSIS

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 36)

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ATTRACTIVE OPPORTUNITIES FOR BIO-BASED LEATHER MANUFACTURERS

4.2 BIO-BASED LEATHER MARKET, BY REGION

4.3 MARKET SHARE, REGION AND END-USE INDUSTRIES

4.4 NORTH AMERICA: BIO-BASED LEATHER MARKET, BY SOURCE AND COUNTRY, 2020

4.5 BIO-BASED LEATHER MARKET ATTRACTIVENESS

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Harmful effects of leather on humans promoting use of bio-based leather

5.2.1.2 Rising trend for sustainable and cruelty-free leather

5.2.2 RESTRAINTS

5.2.2.1 Minor drawbacks related to processing and degradability

5.2.2.2 Price sensitivity in emerging regions

5.2.3 OPPORTUNITIES

5.2.3.1 Scope for green entrepreneurship and continuous R&D

5.2.4 CHALLENGES

5.2.4.1 Nascent market with scalability issue

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 FUTURE MARKET TRENDS

5.4.1 SUSTAINABLE

5.4.2 ETHICAL

5.4.3 INNOVATIVE

5.4.4 AWARENESS

5.4.5 PRICE SENSITIVITY

5.4.6 SCALABILITY ISSUES

5.5 CONSORTIUM & ASSOCIATION

5.6 SUPPLY CHAIN ANALYSIS

5.6.1 RAW MATERIAL

5.6.2 MANUFACTURING OF BIO-BASED LEATHER

5.6.3 DISTRIBUTION TO END USERS

5.7 TECHNOLOGY ANALYSIS

5.8 INNOVATIONS AND UPCOMING MATERIALS

5.8.1 INNOVATIONS & UPCOMING MATERIALS

5.9 AVERAGE SELLING PRICES OF BIO-BASED LEATHER

5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.10.1 REVENUE SHIFTS AND REVENUE POCKETS FOR BIO-BASED LEATHER MANUFACTURERS

5.11 ECOSYSTEM/ MARKET MAP

5.12 CASE STUDIES

5.12.1 A CASE STUDY ON CAR INTERIORS MADE OF APPLE SKIN

5.12.2 A CASE STUDY ON SHOES MADE OF PINEAPPLE LEATHER

5.13 TARIFF AND REGULATORY LANDSCAPE

5.13.1 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON BIO-BASED LEATHER MARKET

5.14 MACROECONOMIC INDICATOR

5.14.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

5.15 BIO-BASED LEATHER: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

5.15.1 NON-COVID-19 SCENARIO

5.15.2 OPTIMISTIC SCENARIO

5.15.3 PESSIMISTIC SCENARIO

5.15.4 REALISTIC SCENARIO

5.16 PATENT ANALYSIS

5.16.1 INTRODUCTION

5.16.2 APPROACH

5.16.3 DOCUMENT TYPE

5.16.4 INSIGHTS

5.16.5 JURISDICTION ANALYSIS

5.16.6 TOP APPLICANTS

5.17 COVID-19 IMPACT

5.17.1 INTRODUCTION

5.17.2 COVID-19 HEALTH ASSESSMENT

5.17.3 COVID-19 ECONOMIC ASSESSMENT

5.17.3.1 COVID-19 Impact on Economy—Scenario Assessment

6 BIO-BASED LEATHER MARKET, BY SOURCE (Page No. - 72)

6.1 INTRODUCTION

6.2 MUSHROOM

6.2.1 SUSTAINABILITY AND SCALABILITYTO SUPPORT DEMAND GROWTH

6.3 PINEAPPLE

6.3.1 INCREASING DEMAND FROM FOOTWEAR AND GARMENT INDUSTRIES DRIVING MARKET

6.4 CORK

6.4.1 DEMAND FOR LIGHTER ACCESSORIES TO DRIVE CORK-BASED LEATHER MARKET

6.5 LEFTOVER FRUITS

6.5.1 INCREASED DEMAND FROM AUTOMOTIVE INDUSTRY DRIVING MARKET

6.6 OTHERS

6.6.1 LOW IMPACT CROP TO DRIVE MARKET FOR OTHER BIO-BASED LEATHER

7 BIO-BASED LEATHER MARKET, BY END-USE INDUSTRY (Page No. - 87)

7.1 INTRODUCTION

7.2 FOOTWEAR

7.2.1 HIGH CONSUMPTION IN NORTH AMERICA AND EUROPE TO DRIVE MARKET

7.3 GARMENTS & ACCESSORIES

7.3.1 HIGH DEMAND FROM NORTH AMERICA TO DRIVE MARKET IN GARMENTS & ACCESSORIES INDUSTRY

7.4 OTHERS

7.4.1 HIGH CONSUMPTION OF FURNITURE AND AUTOMOBILES IN DEVELOPED NATIONS TO DRIVE MARKET

8 BIO-BASED LEATHER MARKET, BY REGION (Page No. - 97)

8.1 INTRODUCTION

8.2 NORTH AMERICA

8.2.1 NORTH AMERICA BIO-BASED LEATHER MARKET, BY SOURCE

8.2.2 NORTH AMERICA MARKET, BY END-USE INDUSTRY

8.2.3 NORTH AMERICA MARKET, BY COUNTRY

8.2.3.1 US

8.2.3.1.1 Growth of the footwear industry is expected to drive the bio-based leather market

8.2.3.2 Canada

8.2.3.2.1 The furniture and automotive industry are expected to boost the demand for bio-based leather in Canada

8.2.3.3 Mexico

8.2.3.3.1 Industrial investment is expected to propel market growth in Mexico

8.3 APAC

8.3.1 APAC BIO-BASED LEATHER MARKET, BY SOURCE

8.3.2 APAC MARKET, BY END-USE INDUSTRY

8.3.3 APAC MARKET, BY COUNTRY

8.3.3.1 China

8.3.3.1.1 The country's economic growth is a major driver for the bio-based leather market

8.3.3.2 Indonesia

8.3.3.2.1 Demand from the automotive sector to drive the bio-based leather market in Indonesia

8.3.3.3 Vietnam

8.3.3.3.1 Footwear industry in Vietnam to drive the bio-based leather market

8.4 EUROPE

8.4.1 EUROPE BIO-BASED LEATHER MARKET, BY SOURCE

8.4.2 EUROPE MARKET, BY END-USE INDUSTRY

8.4.3 EUROPE MARKET, BY COUNTRY

8.4.3.1 Germany

8.4.3.1.1 Rising government investments offer opportunities for the bio-based leather market

8.4.3.2 UK

8.4.3.2.1 Stringent environmental norms are one of the major drivers for the growth in the UK market

8.4.3.3 Italy

8.4.3.3.1 Growth in the footwear end-use industry is propelling the market growth in Italy

8.4.3.4 Spain

8.4.3.4.1 Well-established footwear industry is expected to augment the demand for bio-based leather in Spain

8.5 MIDDLE EAST & AFRICA

8.5.1 MIDDLE EAST & AFRICA BIO-BASED LEATHER MARKET, BY SOURCE

8.5.2 MIDDLE EAST & AFRICA MARKET, BY END-USE INDUSTRY

8.5.3 MIDDLE EAST & AFRICA MARKET, BY REGION

8.5.3.1 Middle East

8.5.3.1.1 Purchasing power and evolving fashion trend driving market

8.5.3.2 Africa

8.5.3.2.1 Demand from automotive and garment & accessories industry to propel market growth

8.6 SOUTH AMERICA

8.6.1 SOUTH AMERICA BIO-BASED LEATHER MARKET, BY SOURCE

8.6.2 SOUTH AMERICA MARKET, BY END-USE INDUSTRY

8.6.3 SOUTH AMERICA MARKET, BY COUNTRY

8.6.3.1 Brazil

8.6.3.1.1 Growing footwear and clothing industries to support market growth

8.6.3.2 Argentina

8.6.3.2.1 Increasing vehicle sales expected to drive market

9 COMPETITIVE LANDSCAPE (Page No. - 148)

9.1 INTRODUCTION

9.2 STRATEGIES ADOPTED BY KEY PLAYERS

9.2.1 OVERVIEW OF STRATEGIES ADOPTED BY BIO-BASED LEATHER MARKET PLAYERS

9.3 MARKET SHARE ANALYSIS

9.3.1 RANKING OF KEY MARKET PLAYERS

9.3.2 MARKET SHARE OF KEY PLAYERS, 2020

9.3.2.1 Toray Industries Inc.

9.3.2.2 Ananas Anam Ltd.

9.3.2.3 ECCO Leather

9.3.2.4 Bolt Threads Inc.

9.3.2.5 Natural Fiber Welding Inc.

9.3.3 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2016-2020

9.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

9.5 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

9.5.1 RESPONSIVE COMPANIES

9.5.2 PROGRESSIVE COMPANIES

9.5.3 STARTING BLOCKS

9.6 COMPETITIVE SITUATIONS AND TRENDS

9.6.1 NEW PRODUCT LAUNCHES

9.6.2 DEALS

9.6.3 OTHER DEVELOPMENTS

10 COMPANY PROFILES (Page No. - 159)

10.1 MAJOR PLAYERS

10.1.1 TORAY INDUSTRIES INC.

10.1.1.1 TORAY INDUSTRIES INC.: BUSINESS OVERVIEW

10.1.1.2 PRODUCTS OFFERED

10.1.1.3 TORAY INDUSTRIES INC.: RECENT DEVELOPMENTS

10.1.1.3.1 TORAY INDUSTRIES INC: NEW PRODUCT LAUNCH

10.1.1.3.2 TORAY INDUSTRIES INC.: DEALS

10.1.1.3.3 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

10.1.1.4 MNM VIEW

10.1.1.4.1 Key Strengths/Right to win

10.1.1.4.2 Strategic choice made

10.1.1.4.3 Weaknesses and competitive threats

10.1.2 BOLT THREADS INC.

10.1.2.1 BOLT THREADS INC.: BUSINESS OVERVIEW

10.1.2.2 PRODUCTS OFFERED

10.1.2.3 BOLT THREADS INC.: RECENT DEVELOPMENTS

10.1.2.3.1 BOLT THREADS INC.: NEW PRODUCT LAUNCH

10.1.2.4.1 Key Strengths/Right to win

10.1.2.4.2 Weaknesses and competitive threats

10.1.3 ANANAS ANAM LTD.

10.1.3.1 ANANAS ANAM LTD.: BUSINESS OVERVIEW

10.1.3.2 PRODUCTS OFFERED

10.1.3.3 ANANAS ANAM LTD.: RECENT DEVELOPMENTS

10.1.3.3.1 ANANAS ANAM LTD.: DEALS

10.1.4 MODERN MEADOWS

10.1.4.1 MODERN MEADOWS: BUSINESS OVERVIEW

10.1.4.2 PRODUCTS OFFERED

10.1.5 NAT-2

10.1.5.1 NAT-2: BUSINESS OVERVIEW

10.1.5.2 PRODUCTS OFFERED

10.1.6 NATURAL FIBER WELDING INC.

10.1.6.1 BUSINESS OVERVIEW

10.1.6.2 NATURAL FIBER WELDING, INC.: BUSINESS OVERVIEW

10.1.6.3 PRODUCTS OFFERED

10.1.6.4 NATURAL FIBER WELDING, INC.: RECENT DEVELOPMENTS

10.1.6.4.1 NATURAL FIBER WELDING, INC.: DEALS

10.1.6.4.2 NATURAL FIBER WELDING, INC.: OTHER DEVELOPMENTS

10.1.7 ULTRAFABRICS

10.1.7.1 ULTRAFABRICS: BUSINESS OVERVIEW

10.1.7.2 PRODUCTS OFFERED

10.1.7.3 ULTRAFABRICS: RECENT DEVELOPMENTS

10.1.7.3.1 ULTRAFABRICS: NEW PRODUCT LAUNCH

10.1.8 MYCOWORKS

10.1.8.1 MYCOWORKS: BUSINESS OVERVIEW

10.1.8.2 PRODUCTS OFFERED

10.1.8.3 MYCOWORKS: RECENT DEVELOPMENTS

10.1.8.3.1 MYCOWORKS: NEW PRODUCT LAUNCH

10.1.9 ECCO LEATHER

10.1.9.1 ECCO LEATHER: BUSINESS OVERVIEW

10.1.9.2 PRODUCTS OFFERED

10.1.10 VEGEA

10.1.11 FRUITLEATHER ROTTERDAM

10.1.12 TJEERD VEENHOVEN STUDIO

11 KEY CUSTOMERS, BY REGION (Page No. - 175)

11.1 EUROPE

11.1.1 CUSTOMER 1: STELLA MCCARTNEY

11.1.1.1 Strategies/ Growth Plans

11.1.2 CUSTOMER 2: ADIDAS AG

11.1.2.1 Strategies/ Growth Plans

11.1.3 CUSTOMER 3: GUCCI

11.1.3.1 Strategies/ Growth Plans

11.1.4 CUSTOMER 4: H&M

11.1.4.1 Strategies/ Growth Plans

11.1.5 CUSTOMER 5: HUGO BOSS

11.1.5.1 Strategies/ Growth Plans

11.1.6 CUSTOMER 4: BAYERISCHE MOTOREN WERKE AG (BMW )

11.1.6.1 Strategies/ Growth Plans

11.2 NORTH AMERICA

11.2.1 CUSTOMER 1: ALLBIRDS, INC.

11.2.1.1 Strategies/ Growth Plans

11.2.2 CUSTOMER 2: LULULEMON ATHLETICA

11.2.2.1 Strategies/ Growth Plans

11.2.3 CUSTOMER 3: DREW VALORIC

11.2.3.1 Strategies/ Growth Plans

11.2.4 CUSTOMER 4: SAMARA

11.2.4.1 Strategies/ Growth Plans

11.2.5 CUSTOMER 5: NOVACAS

11.2.5.1 Strategies/ Growth Plans

11.3 APAC

11.3.1 CUSTOMER 1: FUGU

11.3.1.1 Strategies/ Growth Plans

11.3.2 CUSTOMER 2: PRETTY SIMPLE

11.3.2.1 Strategies/ Growth Plans

11.3.3 CUSTOMER 3: THE LOVELY THINGS

11.3.3.1 Strategies/ Growth Plans

11.3.4 CUSTOMER 4:PAIO

11.3.4.1 Strategies/ Growth Plans

11.3.5 CUSTOMER 5: THE SOPHIA LABEL

11.3.5.1 Strategies/ Growth Plans

11.4 MIDDLE EAST & AFRICA

11.4.1 CUSTOMER 1: WE ALL SHARE ROOTS

11.4.1.1 Strategies/ Growth Plans

11.4.2 CUSTOMER 2: VANINA

11.4.2.1 Strategies/ Growth Plans

11.4.3 CUSTOMER 3: EURTHLIN

11.4.3.1 Strategies/ Growth Plans

11.5 SOUTH AMERICA

11.5.1 CUSTOMER 1: HOLYFANCY

11.5.1.1 Strategies/ Growth Plans

11.5.2 CUSTOMER 2:FURF DESIGN STUDIO

11.5.2.1 Strategies/ Growth Plans

11.5.3 CUSTOMER 3:AHIMSA

11.5.3.1 Strategies/ Growth Plans

11.5.4 CUSTOMER 4: CORKSTYLE

11.5.4.1 Strategies/ Growth Plans

12 ADJACENT & RELATED MARKETS (Page No. - 183)

12.1 INTRODUCTION

12.2 LIMITATION

12.3 SYNTHETIC LEATHER (ARTIFICIAL LEATHER) MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.4 SYNTHETIC LEATHER (ARTIFICIAL LEATHER), BY REGION

12.4.1 NORTH AMERICA

12.4.1.1 By country

12.4.1.2 By End-use Industry

12.4.2 APAC

12.4.2.1 By country

12.4.2.2 By End-use Industry

12.4.3 EUROPE

12.4.3.1 By country

12.4.3.2 By End-use Industry

12.4.4 MIDDLE EAST & AFRICA

12.4.4.1 By Region

12.4.4.2 By End-use Industry

12.4.5 SOUTH AMERICA

12.4.5.1 By country

12.4.5.2 By End-use Industry

13 APPENDIX (Page No. - 202)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (219 Tables)

TABLE 1 BIO-BASED LEATHER MARKET: RISK ASSESSMENT

TABLE 2 CHEMICALS USED IN LEATHER PRODUCTION: RESTRICTED UNDER REGISTRATION, EVALUATION, AUTHORISATION AND RESTRICTION OF CHEMICALS (REACH)

TABLE 3 BIO-BASED LEATHER MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 1 LIST OF ASSOCIATIONS PROMOTING BIO-BASED LEATHER

TABLE 2 LIST OF VARIOUS INNOVATIONS & UPCOMING MATERIALS IN BIO-BASED LEATHER MARKET

TABLE 3 AVERAGE SELLING PRICES OF BIO-BASED LEATHER, BY REGION, (USD/SQ. METER)

TABLE 4 BIO BASED LEATHER MARKET: ECOSYSTEM

TABLE 5 GDP TRENDS AND FORECAST BY MAJOR ECONOMY, 2018 – 2026 (USD BILLION)

TABLE 6 BIO-BASED LEATHER MARKET: MARKET FORECAST SCENARIOS, 2018- 2026 (USD THOUSAND)

TABLE 7 GRANTED PATENTS ARE 26% OF TOTAL COUNT BETWEEN 2010 AND 2020

TABLE 8 TOP 10 PATENT OWNERS IN US, 2010-2020

TABLE 9 BIO-BASED LEATHER MARKET, BY SOURCE, 2016–2019 (USD THOUSAND)

TABLE 10 MARKET, BY SOURCE, 2020–2026 (USD THOUSAND)

TABLE 11 MARKET, BY SOURCE, 2016–2019 (THOUSAND SQ. METER)

TABLE 12 MARKET, BY SOURCE, 2020–2026 (THOUSAND SQ. METER)

TABLE 13 MUSHROOM-BASED LEATHER MARKET SIZE, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 14 MUSHROOM-BASED LEATHER MARKET SIZE, BY REGION, 2020–2026 (USD THOUSAND)

TABLE 15 MUSHROOM-BASED LEATHER MARKET SIZE, BY REGION, 2016–2019 (THOUSAND SQ. METER)

TABLE 16 MUSHROOM-BASED LEATHER MARKET SIZE, BY REGION, 2020–2026 (THOUSAND SQ. METER)

TABLE 17 PINEAPPLE-BASED LEATHER MARKET SIZE, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 18 PINEAPPLE-BASED LEATHER MARKET SIZE, BY REGION, 2020–2026 (USD THOUSAND)

TABLE 19 PINEAPPLE-BASED LEATHER MARKET SIZE, BY REGION, 2016–2019 (THOUSAND SQ. METER)

TABLE 20 PINEAPPLE-BASED LEATHER MARKET SIZE, BY REGION, 2020–2026 (THOUSAND SQ. METER)

TABLE 21 CORK-BASED LEATHER MARKET SIZE, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 22 CORK-BASED LEATHER MARKET SIZE, BY REGION, 2020–2026 (USD THOUSAND)

TABLE 23 CORK-BASED LEATHER MARKET SIZE BY REGION, 2016–2019 (THOUSAND SQ. METER)

TABLE 24 CORK-BASED LEATHER MARKET SIZE, BY REGION, 2020–2026 (THOUSAND SQ. METER)

TABLE 25 LEFTOVER FRUITS-BASED LEATHER MARKET SIZE, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 26 LEFTOVER FRUITS-BASED LEATHER MARKET SIZE, BY REGION, 2020–2026 (USD THOUSAND)

TABLE 27 LEFTOVER FRUITS-BASED LEATHER MARKET SIZE, BY REGION, 2016–2019 (THOUSAND SQ. METER)

TABLE 28 LEFTOVER FRUITS-BASED LEATHER MARKET SIZE, BY REGION, 2020–2026 (THOUSAND SQ. METER)

TABLE 29 OTHER BIO-BASED LEATHER MARKET SIZE, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 30 OTHER MARKET SIZE, BY REGION, 2020–2026 (USD THOUSAND)

TABLE 31 OTHER MARKET SIZE, BY REGION, 2016–2019 (THOUSAND SQ. METER)

TABLE 32 OTHER MARKET SIZE, BY REGION, 2020–2026 (THOUSAND SQ. METER)

TABLE 33 BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 34 MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 35 MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 36 MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 37 MARKET SIZE IN FOOTWEAR INDUSTRY, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 38 MARKET SIZE IN FOOTWEAR, BY REGION, 2020–2026 (USD THOUSAND)

TABLE 39 MARKET SIZE IN FOOTWEAR, BY REGION, 2016–2019 (THOUSAND SQ. METER)

TABLE 40 MARKET SIZE IN FOOTWEAR, BY REGION, 2020–2026 (THOUSAND SQ. METER)

TABLE 41 MARKET SIZE IN GARMENTS & ACCESSORIES, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 42 MARKET SIZE IN GARMENTS & ACCESSORIES, BY REGION, 2020–2026 (USD THOUSAND)

TABLE 43 MARKET SIZE IN GARMENTS & ACCESSORIES, BY REGION, 2016–2019 (THOUSAND SQ. METER)

TABLE 44 MARKET SIZE IN GARMENTS & ACCESSORIES, BY REGION, 2020–2026 (THOUSAND SQ. METER)

TABLE 45 MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 46 MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2020–2026 (USD THOUSAND)

TABLE 47 MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2016–2019 (THOUSAND SQ. METER)

TABLE 48 MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2020–2026 (THOUSAND SQ. METER)

TABLE 49 MARKET SIZE, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 50 MARKET SIZE, BY REGION, 2020–2026 (USD THOUSAND)

TABLE 51 MARKET SIZE, BY REGION, 2016–2019 (THOUSAND SQ. METER)

TABLE 52 MARKET SIZE, BY REGION, 2020–2026 (THOUSAND SQ. METER)

TABLE 53 NORTH AMERICA: BIO-BASED LEATHER MARKET SIZE, BY SOURCE, 2016–2019 (USD THOUSAND)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2020–2026 (USD THOUSAND)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2016–2019 (THOUSAND SQ. METER)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2020–2026 (THOUSAND SQ. METER)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD THOUSAND)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 65 US: BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 66 US: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 67 US: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 68 US: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 69 CANADA: BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 70 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 71 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 72 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 73 MEXICO: BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 74 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 75 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 76 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 77 APAC: BIO-BASED LEATHER MARKET SIZE, BY SOURCE, 2016–2019 (USD THOUSAND)

TABLE 78 APAC: MARKET SIZE, BY SOURCE, 2020–2026 (USD THOUSAND)

TABLE 79 APAC: MARKET SIZE, BY SOURCE, 2016–2019 (THOUSAND SQ. METER)

TABLE 80 APAC: MARKET SIZE, BY SOURCE, 2020–2026 (THOUSAND SQ. METER)

TABLE 81 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 82 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 83 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 84 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 85 APAC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE 86 APAC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD THOUSAND)

TABLE 87 APAC: MARKET SIZE, BY COUNTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 88 APAC: MARKET SIZE, BY COUNTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 89 CHINA: BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 90 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 91 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 92 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 93 INDONESIA: BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 94 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 95 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 96 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 97 VIETNAM: BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 98 VIETNAM: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 99 VIETNAM: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 100 VIETNAM: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 101 EUROPE: BIO-BASED LEATHER MARKET SIZE, BY SOURCE, 2016–2019 (USD THOUSAND)

TABLE 102 EUROPE: MARKET SIZE, BY SOURCE, 2020–2026 (USD THOUSAND)

TABLE 103 EUROPE: MARKET SIZE, BY SOURCE, 2016–2019 (THOUSAND SQ. METER)

TABLE 104 EUROPE: MARKET SIZE, BY SOURCE, 2020–2026 (THOUSAND SQ. METER)

TABLE 105 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 106 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 107 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 108 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 109 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE 110 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD THOUSAND)

TABLE 111 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 112 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 113 GERMANY: BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 114 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 115 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 116 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 117 UK: BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 118 UK: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 119 UK: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 120 UK: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 121 ITALY: BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 122 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 123 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 124 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 125 SPAIN: BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 126 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (USD THOUSAND)

TABLE 127 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 128 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 129 MIDDLE EAST & AFRICA: BIO-BASED LEATHER MARKET SIZE, BY SOURCE, 2016–2019 (USD THOUSAND)

TABLE 130 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOURCE, 2020–2026 (USD THOUSAND)

TABLE 131 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOURCE, 2016–2019 (THOUSAND SQ. METER)

TABLE 132 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOURCE, 2020–2026 (THOUSAND SQ. METER)

TABLE 133 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 134 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 135 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 136 MIDDLE EAST: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 137 MIDDLE EAST & AFRICA: MARKET SIZE, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 138 MIDDLE EAST & AFRICA: MARKET SIZE, BY REGION, 2020-2026 (USD THOUSAND)

TABLE 139 MIDDLE EAST & AFRICA: MARKET SIZE, BY REGION, 2016–2019 (THOUSAND SQ. METER)

TABLE 140 MIDDLE EAST & AFRICA: MARKET SIZE, BY REGION, 2020-2026 (THOUSAND SQ. METER)

TABLE 141 MIDDLE EAST: BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 142 MIDDLE EAST: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 143 MIDDLE EAST: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 144 MIDDLE EAST: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 145 AFRICA: BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 146 AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 147 AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 148 AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 149 SOUTH AMERICA: BIO-BASED LEATHER MARKET SIZE, BY SOURCE, 2016–2019 (USD THOUSAND)

TABLE 150 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2020–2026 (USD THOUSAND)

TABLE 151 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2016–2019 (THOUSAND SQ. METER)

TABLE 152 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2020–2026 (THOUSAND SQ. METER)

TABLE 153 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 154 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 155 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 156 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 157 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE 158 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD THOUSAND)

TABLE 159 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 160 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 161 BRAZIL: BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 162 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 163 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 164 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 165 ARGENTINA: BIO-BASED LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD THOUSAND)

TABLE 166 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

TABLE 167 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (THOUSAND SQ. METER)

TABLE 168 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (THOUSAND SQ. METER)

TABLE 169 BIO-BASED LEATHER MARKET: DEGREE OF COMPETITION

TABLE 170 MARKET: SOURCE FOOTPRINT

TABLE 171 MARKET: END-USE INDUSTRY FOOTPRINT

TABLE 172 MARKET: COMPANY REGION FOOTPRINT

TABLE 173 MARKET: NEW PRODUCT LAUNCHES, JANUARY 2019 TO DECEMBER 2020

TABLE 174 MARKET: DEALS, JANUARY 2019 TO JULY 2021

TABLE 175 MARKET: OTHER DEVELOPMENTS, JANUARY 2019 TO DECEMBER 2020

TABLE 176 SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2016–2019 (MILLION SQ. METER)

TABLE 177 SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2020–2025 (MILLION SQ. METER)

TABLE 178 SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 179 SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 180 NORTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION SQ. METER)

TABLE 181 NORTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2020–2025 (MILLION SQ. METER)

TABLE 182 NORTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 183 NORTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 184 NORTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (MILLION SQ. METER)

TABLE 185 NORTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (MILLION SQ. METER)

TABLE 186 NORTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 187 NORTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 188 APAC: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION SQ. METER)

TABLE 189 APAC: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2020–2025 (MILLION SQ. METER)

TABLE 190 APAC: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 191 APAC: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 192 APAC: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (MILLION SQ. METER)

TABLE 193 APAC: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (MILLION SQ. METER)

TABLE 194 APAC: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 195 APAC: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 196 EUROPE: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION SQ. METER)

TABLE 197 EUROPE: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2020–2025 (MILLION SQ. METER)

TABLE 198 EUROPE: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 199 EUROPE: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 200 EUROPE: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (MILLION SQ. METER)

TABLE 201 EUROPE: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (MILLION SQ. METER)

TABLE 202 EUROPE: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 203 EUROPE: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 204 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2016–2019 (MILLION SQ. METER)

TABLE 205 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2020–2025 (MILLION SQ. METER)

TABLE 206 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 207 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 208 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (MILLION SQ. METER)

TABLE 209 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (MILLION SQ. METER)

TABLE 210 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 211 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 212 SOUTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION SQ. METER)

TABLE 213 SOUTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2020–2025 (MILLION SQ. METER)

TABLE 214 SOUTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 215 SOUTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 216 SOUTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (MILLION SQ. METER)

TABLE 217 SOUTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (MILLION SQ. METER)

TABLE 218 SOUTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 219 SOUTH AMERICA: SYNTHETIC LEATHER MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 USD MILLION)

LIST OF FIGURES (50 Figures)

FIGURE 1 BIO-BASED LEATHER MARKET: RESEARCH DESIGN

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF COMPANIES

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 –BOTTOM-UP (DEMAND SIDE): END-USE INDUSTRY

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 –TOP-DOWN

FIGURE 6 BIO-BASED LEATHER MARKET: DATA TRIANGULATION

FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

FIGURE 9 FOOTWEAR INDUSTRY TO DOMINATE BIO-BASED LEATHER MARKET DURING FORECAST PERIOD

FIGURE 10 PINEAPPLE TO BE LARGEST SOURCE OF BIO-BASED LEATHER DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2020

FIGURE 12 RISING TREND OF SUSTAINABLE ALTERNATIVES PROPELLING MARKET

FIGURE 13 NORTH AMERICA TO BE LARGEST BIO-BASED LEATHER MARKET BETWEEN 2021 AND 2026

FIGURE 14 FOOTWEAR INDUSTRY DOMINATED BIO-BASED LEATHER MARKET

FIGURE 15 US AND MUSHROOM SEGMENT ACCOUNTED FOR LARGEST SHARES

FIGURE 16 VIETNAM TO WITNESS HIGH DEMAND FOR BIO-BASED LEATHER BETWEEN 2021 AND 2026

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BIO-BASED LEATHER MARKET

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS OF BIO-BASED LEATHER MARKET

FIGURE 19 FUTURE MARKET TRENDS IN MARKET

FIGURE 20 BIO-BASED LEATHER MARKET: SUPPLY CHAIN

FIGURE 21 REVENUE SHIFT FOR MARKET

FIGURE 22 MARKET: ECOSYSTEM

FIGURE 23 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

FIGURE 24 PATENTS REGISTERED FOR BIO-BASED LEATHER, 2010–2020

FIGURE 25 PATENT PUBLICATION TRENDS FOR BIO-BASED LEATHER, 2010–2020

FIGURE 26 MAXIMUM PATENTS FILED BY COMPANIES IN US

FIGURE 27 BAYER MATERIALSCIENCE AG REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2010 AND 2020

FIGURE 28 COUNTRY-WISE SPREAD OF COVID-19

FIGURE 29 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2021

FIGURE 30 FACTORS IMPACTING GLOBAL ECONOMY

FIGURE 31 PINEAPPLE TO BE LARGEST SOURCE OF BIO-BASED LEATHER MARKET DURING FORECAST PERIOD

FIGURE 32 NORTH AMERICA TO BE LARGEST MUSHROOM-BASED LEATHER MARKET BETWEEN 2021 AND 2026

FIGURE 33 APAC TO BE FASTEST-GROWING MARKET FOR PINEAPPLE-BASED LEATHER MARKET DURING FORECAST PERIOD

FIGURE 34 NORTH AMERICA TO BE LARGEST MARKET FOR CORK-BASED LEATHER MARKET BETWEEN 2021 AND 2026

FIGURE 35 APAC TO BE FASTEST-GROWING MARKET FOR LEFTOVER FRUITS-BASED LEATHER DURING FORECAST PERIOD

FIGURE 36 EUROPE TO BE LARGEST MARKET FOR OTHER BIO-BASED LEATHER BETWEEN 2021 AND 2026

FIGURE 37 FOOTWEAR TO BE LARGEST END-USE INDUSTRY OF BIO-BASED LEATHER DURING FORECAST PERIOD

FIGURE 38 NORTH AMERICA TO BE LARGEST BIO-BASED LEATHER MARKET IN FOOTWEAR INDUSTRY DURING FORECAST PERIOD

FIGURE 39 NORTH AMERICA TO BE LARGEST BIO-BASED LEATHER MARKET IN GARMENTS & ACCESSORIES INDUSTRY DURING FORECAST PERIOD

FIGURE 40 EUROPE TO BE SECOND-LARGEST MARKET IN OTHER END-USE INDUSTRIES DURING FORECAST PERIOD

FIGURE 41 NORTH AMERICA IS ESTIMATED TO BE LARGEST BIO-BASED LEATHER MARKET BETWEEN 2021 AND 2026

FIGURE 42 NORTH AMERICA: BIO-BASED LEATHER MARKET SNAPSHOT

FIGURE 43 APAC: MARKET SNAPSHOT

FIGURE 44 EUROPE: MARKET SNAPSHOT

FIGURE 45 RANKING OF TOP FIVE PLAYERS IN BIO-BASED LEATHER MARKET, 2020

FIGURE 46 BIO-BASED LEATHER MARKET SHARE, BY COMPANY, 2020

FIGURE 47 REVENUE ANALYSIS OF KEY COMPANIES FOR PAST FIVE YEARS

FIGURE 48 MARKET: COMPANY PRODUCT FOOTPRINT

FIGURE 49 START-UP/SMES EVALUATION QUADRANT FOR BIO-BASED LEATHER MARKET

FIGURE 50 TORAY INDUSTRIES INC.: COMPANY SNAPSHOT

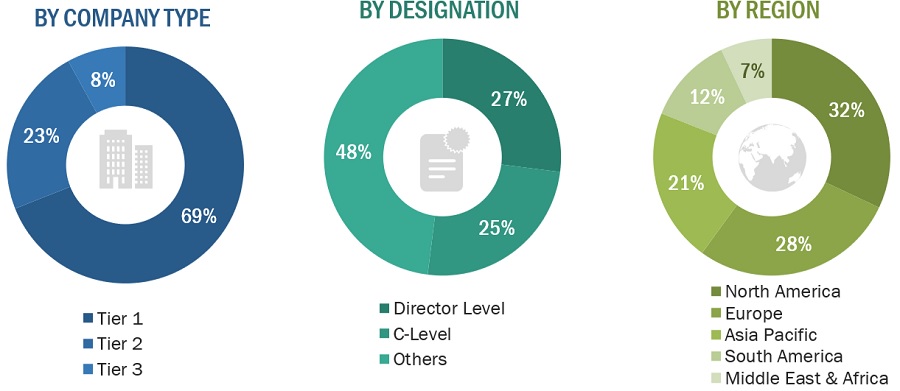

The study involved four major activities to estimate the market size for bio-based leather. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The bio-based leather market comprises several stakeholders such as raw material suppliers, manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development in end-use industries such as footwear, garments & accessories, automotive and furniture. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the bio-based leather market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the bio-based leather market, in terms of value

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities influencing the growth of the market

- To define, describe, and segment the bio-based leather market on the basis of source and end use industry.

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as new product launch, merger & acquisition in the bio-based leather market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bio-based Leather Market