Biostimulants Market by Active Ingredient (Humic Substances, Amino Acids, Seaweed Extracts, and Microbial Amendments), Mode of Application (Foliar, Soil Treatment, and Seed Treatment), Form (Liquid and Dry), Crop Type and Region - Global Forecast to 2027

Biostimulants Market

The global biostimulants market was valued at USD 3.5 billion in 2022 and is projected to reach USD 6.2 billion by 2027, growing at a cagr 11.8%from 2022 to 2027.

Food and agricultural production systems worldwide are facing unprecedented challenges, from the increasing demand for food for a growing population, rising hunger and malnutrition, adverse climate change effects, overexploitation of natural resources, loss of biodiversity, and food loss and waste. These challenges can undermine the world’s capacity to meet its food needs now and in the future.

According to FAO, in 2021, organic agriculture will be practiced in 187 countries, and 72.3 million hectares of agricultural land will be managed organically. The global sales of organic food and drinks reached more than USD 103.68 billion in 2019. There is a paradigm shift in India post the COVID-19 pandemic as consumers began to buy more organic foods as a preventive health measure. Organically grown fresh fruit has taken a leading position in international trade. The production and sales of organic food are from developed countries, but even developing countries have begun to produce and export organic foods and products. According to APEDA, India is the leading exporter of organic tea and coffee, spices, and condiments. India also exports organic fruits and vegetables. The rich nutritional value of organic fruits and vegetables is the main reason for their demand in the domestic and global markets. Organic foods have more antioxidants than conventionally grown varieties, making them more beneficial for health, including cancer prevention.

To know about the assumptions considered for the study, Request for Free Sample Report

Biostimulants Market Dynamics

Drivers: Increase in need for sustainable agriculture

A high level of hunger and malnutrition is one of the major challenges that the world is facing today. To meet the increasing demand for food from over 9 billion people by 2050, immense pressure on agriculture will be exerted to produce crops with a high-quality yield. Simultaneously, one-third of the total food production is wasted globally throughout the supply chain, incurring enormous environmental and financial costs.

Agricultural producers are required to identify possible ways to be more efficient and effective in the coming decade. Biostimulants can sustainably address this issue by providing protection against stress, thereby stimulating the plant’s growth. The market for biostimulants is expected to grow in the coming years due to the increasing consumer awareness about the benefits of organic foods, the implementation of organic regulations, and the adoption of GLOBALGAP (Global Good Agricultural Practices) policies. A large variety of crops, such as fruits & vegetables and cereals, have been gaining support for organic practices from government subsidies and financial aids as well as research assistance from organizations and regulatory bodies, such as FiBL (Research Institute of Organic Agriculture, Switzerland), and USDA (US).

Restraints: Commercialization of low quality biostimulant products

Lack of transparency in patent protection laws in various countries has led to the prevalence of low-quality products. Even though the biostimulants market has limited entry barriers and allowed many competitors to commence operations, the nature of the market has become fragmented into smaller pockets of market holdings. This has been a factor in introducing low-quality products in the market by regional or local manufacturers to reap the benefits of the growing demand for biostimulants. The low prices of these products from small-scale domestic manufacturers also attract farmers to purchase them. Similar product formulations from many competitors reduce consumer loyalty as well as the brand value of the products. The biostimulants market is expected to be a niche market experiencing strong growth trends, which has to be capitalized on by developing innovative products that act on a wide range of crops with better results. When a company does not develop its unique selling proposition in the biostimulants market, it would find difficulty expanding its presence other than in the regional market.

Opportunities: Growing demands for seed treatment

According to MarketsandMarkets insights, there is a growing demand for biostimulant treated seeds globally. The production of high-quality and effective seeds is essential for obtaining a higher crop yield. Biostimulants facilitate an increase of seed vigor during the crucial growth phases, due to which they are being used globally for seed treatment purposes. In addition, many companies have already started exploring this segment with increased investments in R&D activities. The right combination of synthetic crop protection and biological-based seed treatments is proving to be useful. Cotton seedlings were the first to be treated on a large scale with biological solutions in the US in 1999; the industry has grown since. Seed treatment provides an efficient mechanism for enhancing the activity of seeds in the soil environment, where they are appropriately positioned to colonize seedlings and roots and protect them against soil-borne diseases and pests.

Global initiatives such as the “Good Seed Initiative by Commonwealth Agricultural Bureaux International (CABI) for the Sub-Saharan, African and Asian countries and the SeEdQUAL by Consultative Group on International Agricultural Research (CGIAR) are driving the use of effective biostimulants in the global seed treatment industry. The biostimulant seed treatment products not only help in protecting seeds but also act as seed enhancers. With the intervention of changes in different formulations and active ingredients, these biostimulants, in combination with biopesticides, bioinsecticides, and other biocontrols, provide a broad spectrum of protection from insects, diseases, and nematodes. By establishing a symbiotic relationship between roots and soil, biostimulants provide essential benefits to crop efficiency and productivity. Such innovations are expected to offer growth opportunities for key players in the market.

Challenges: Regulatory barriers

Biostimulants have not yet been governed under any standard categorization across the globe. They are not classified as a specific category with a consistent global definition. According to EBIC, in Europe, there is uncertainty about whether biostimulants should be categorized under plant protection or plant nutrition category; and this has resulted in a divided set of contradicting opinions on the products. They are considered additives in France, whereas they are marketed as plant straighteners or growth enhancers in Germany.

To consolidate the regulatory framework concerning biostimulants in Europe, the European Biostimulants Industry Consortium (EBIC) has drafted a directive based on the views and suggestions of manufacturers and research institutes and tabulated it for EU approval. However, biostimulant products must undergo repetitive registration processes under each European country’s respective regulations. The data requirements and parameter ranges also vary according to each country in the EU.

Liquid segment is projected to dominate the biostimulants market by form type in the forecast period due to its long- lasting effect and better performance

The market for the liquid form of biostimulants is expected to dominate the global biostimulants market by 2027. This is due to various factors, such as ease of application, application to larger areas in a shorter period, and easy combinations with biopesticides and biofertilizers for dual benefits to crops.Liquid formulations provide various options to crop growers, as biostimulants can be mixed with pesticides, fertilizers, or adjuvants. Some biostimulant active ingredients dissolve readily in liquid solvents, such as water or a petroleum-based solvent. When mixed, they form a solution that will not settle out or separate. Formulations of these biostimulants usually contain the active ingredient, the solvent, and one or more other ingredients. However, considerable investments need to be made initially for liquid biostimulant storage facilities. A liquid form does not offer much advantage over dry forms of biostimulants in terms of material cost. Compared to the dry form, fewer liquid biostimulants are enough to cover larger crop areas.

Nanoencapsulation Technology to Create New Effective Products is one of the Major Trends

Natural antimicrobials and biostimulants hamper the negative impact of agrochemicals, and their delivery needs a proper carrier system. Nanoencapsulation technologies are widely applied in the field of food and pharmaceuticals and are rapidly taking center stage in agricultural applications. Nanoencapsulation techniques such as those based on lipid-based delivery systems, electro-spinning, electro-spraying, and complex coacervation are being developed. New-generation delivery systems, such as nanostructured lipid carriers, solid lipid nanoparticles, and biological nanocarriers, are proving to be highly effective with their functionalities for entrapping bioactive compounds. With a substantial improvement over conventional agricultural methodologies, these promising nanoencapsulation technologies have tremendous scope for the effective and sustained release of bioactive for precision crop protection and production.

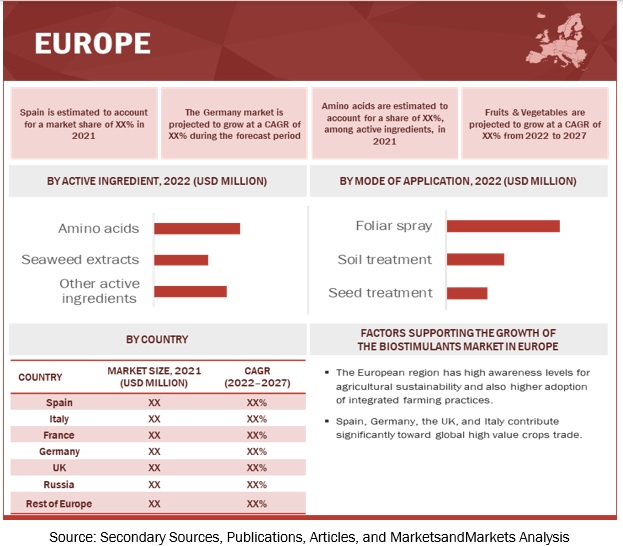

Europe dominated the biostimulants industry and is projected to grow at a CAGR of 11.5% during the forecast period

Europe accounted for the largest share in the biostimulants market in 2021. An increase in land degradation, the need for quality parameters, and the need for high product yield have strengthened the European regulatory authorities demand for clean and sustainable input solutions. The concept of organic production has also gained popularity among farmers and consumers in the last decade. The need for organic products, such as biostimulants, has seen a rising trend in the EU. This has boosted various European biostimulant companies expanding their global network to reach the untapped market. The region has also launched the ‘European Green Deal’ initiative, which aims to expand the use of sustainable practices, such as precision agriculture, organic farming, agroecology, agroforestry, and stricter animal welfare standards. The new ‘Farm to Fork’ Strategy aims at reducing the environmental and climate footprint of the EU food system, strengthening its resilience, ensuring food security, facilitating the transition toward competitive sustainability from farm to fork, and making use of new business opportunities.

To know about the assumptions considered for the study, download the pdf brochure

In Europe, consumer awareness regarding sustainability and environmental safety is high. This has resulted in the highest vegan population in the region, especially in the UK and Germany. The Berlin-based vegan supermarket chain ‘Veganz’ has researched veganism in Europe. The study concluded that within four years, between 2016 and 2020, the number of vegans had doubled from 1.3 million to 2.6 million. This trend is boosting the consumption of high-value crops, such as vegetables and fruits, in the region.

Top Companies in Biostimulants Market:

The key players in this market include BASF SE (Germany), UPL Limited (India), Adama Ltd. (Israel) and FMC Corporation (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 3.5 billion |

|

Revenue forecast in 2027 |

USD 6.2 billion |

|

Growth Rate |

CAGR of 11.8% from 2022 to 2027 |

|

Base year for estimation |

2021 |

|

Historical data |

2022-2027 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million/Billion) |

|

Segments covered |

Active ingredient, Form, Mode of application, Formulation, Crop types, and Region |

|

Regional scope |

North America, Europe, Asia Pacific, South America, and RoW |

|

Dominant Geography |

Europe |

|

Key companies profiled |

|

This research report categorizes the biostimulants market, based on Active ingredients, Mode of Application, Formulation, Crop type and Region.

By Active Ingredients

- Seaweed Extracts

- Amino Acids

- Humic Substances

- Microbial Amendments

- Other Active Ingredients

By Formulation

- Liquid

- Dry

By Mode of Application

- Foliar

- Soil Treatment

- Seed Treatment

By Crop Type

-

Cereals and Grains

- Corn

- Wheat

- Rice

- Other Cereals & Grains

-

Oilseeds and Pulses

- Soybean

- Sunflower

- Other Oilseeds & Pulses

-

Fruits and Vegetables

- Pome Fruits

- Citrus Fruits

- Berries

- Root & Tuber Vegetables

- Leafy Vegetables

- Other Fruits & Vegetables

- Other Crop types (Turf & Ornamentals, Plantation Crops, Fiber Crops, Silage & Forage Crops)

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Target Audience:

- Biostimulants material suppliers

- Biostimulants manufacturers

- Intermediate suppliers, such as traders and distributors of biostimulants

- Manufacturers of food & beverages, raw material suppliers and distributors

- Government and research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- World Health Organization (WHO)

- Food Industry Association of Austria (FIAA)

- United States Department of Agriculture (USDA)

Recent Developments

- In 2020 BASF SE (Germany) and Delair (France) collaborated to scale up BASF SE research and development projects for seeds, traits, and crop protection. The agreement will enable BASF’s agricultural research stations worldwide to use the delair.ai cloud platform to streamline and standardize the information gained through drone-based field studies.

- In 2021 UPL Limited (India), and Chr Hansen Holdings A/s announced a partnership to develop microbial-based biostimulants and biopesticides for improving crop quality and yield. This will help the companies enter the crop protection sector in various geographies.

- In 2021 UPL Limited (India), and Novozymes (Denmark) announced a partnership to provide a range of biological products to the Argentinian market. Biological products made by Novozymes and marketed under the ‘Nitragin’ brand will now become part of UPL’s portfolio, providing a complete range of bio-solutions and crop protection products.

- In 2021, ADAMA. (Israel), closed the acquisition of a 51% stake in Huifeng's key crop protection synthesis and formulation facilities. Through this, the company expects a significantly bolstered commercial reach in China and competitive operational capabilities to support its global business.

- In 2021, FMC Corporation (US) announced a new brand identity for its plant health business segment under the name of Biologicals by FMC. It will now sell biostimulants, bio fungicides and other plant health products under this label.

Frequently Asked Questions (FAQ):

What is the projected market value of the global biostimulants market?

The global biostimulants market as per revenue was estimated to be worth $3.5 billion in 2022 and is poised to reach $6.2 billion by 2027

What is the estimated growth rate (CAGR) of the global biostimulants market for the next five years?

The global biostimulants market is expected to grow at a compound annual growth rate (CAGR) of 11.8% from 2022 to 2027

What are the major revenue pockets in the biostimulants market currently?

Europe accounted for the largest share in the biostimulants market in 2021. An increase in land degradation, the need for quality parameters, and the need for high product yield have strengthened the European regulatory authorities demand for clean and sustainable input solutions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

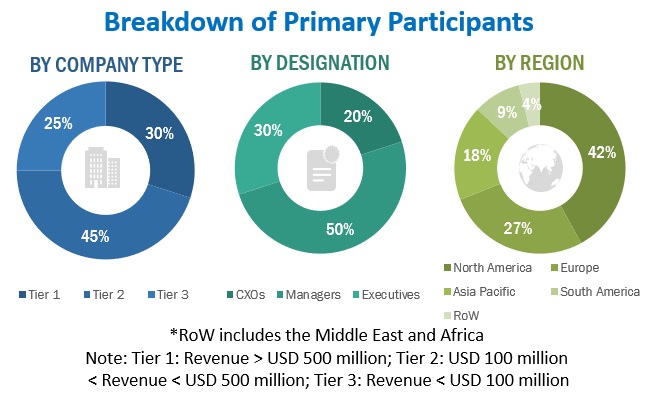

This research study involved the extensive use of secondary sources—directories and databases such as Food and Agriculture Organization and World Health Organization—to identify and collect information useful for a technical, market-oriented, and commercial study of the biostimulants market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the research design applied in drafting this report on the biostimulants market.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the biostimulants market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the biostimulants market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major biostimulants were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- All macroeconomic and microeconomic factors affecting the growth of the biostimulants market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for biostimulants on the basis of Active ingredients, Mode of application, Formulation, Crop type and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the biostimulants market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe for biostimulants market includes the Netherlands, Russia, Greece, Austria, and Denmark

- Further breakdown of the Rest of South America for biostimulants market includes Chile, Venezuela, and Peru.

- Further breakdown of the Rest of Asia Pacific for biostimulants market includes the Philippines, Thailand, Vietnam, and New Zealand

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biostimulants Market