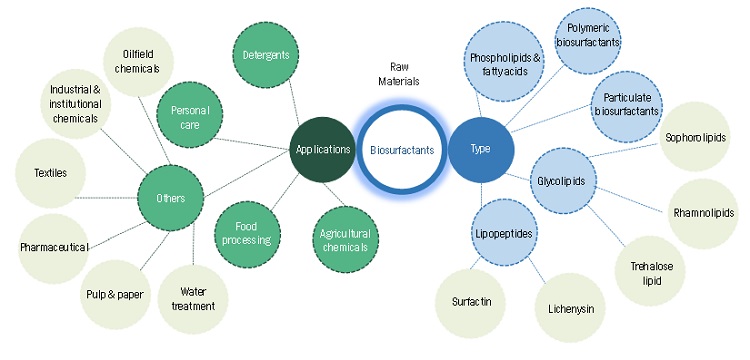

Biosurfactants Market by Type (Glycolipids, Lipopeptides), Application (Detergent, Personal care, Food processing, Agricultural chemicals) and Region (North America, Europe, Asia Pacific, Rest of the World) - Global Forecast to 2027

Biosurfactants Market

The global biosurfactants market was valued at USD 1.2 billion in 2022 and is projected to reach USD 1.9 billion by 2027, growing at a cagr 11.2% from 2022 to 2027. Glycolipids are the most widely used biosurfactants that contain mono or disaccharides linked to hydroxy aliphatic or long-chain fatty acids. Sophorolipids are widely-used glycolipids and are mostly used in detergents, cosmetics, and agricultural applications due to their efficient functionality and low cost. Detergents are a major application of biosurfactants globally. The huge demand for eco-friendly solutions and growing awareness among consumers and manufacturers are the key factors responsible for the high demand for biosurfactant-based detergents.

Attractive Opportunities in the Biosurfactants Market

To know about the assumptions considered for the study, Request for Free Sample Report

Biosurfactants Market Dynamics

Driver: Increasing demand for green solutions

Biosurfactants are microbial surfactants having superior functions to chemically synthesized agents. These types of surfactants are considered eco-friendly raw materials due to their high level of safety and biodegradability. The rising awareness among consumers for the use of renewable and natural ingredients in their day-to-day products is boosting the demand for biosurfactants and the development of greener solutions for various applications such as cosmetics, pharmaceuticals, industrial cleaning, and biochemical. The manufacturers are, therefore, keen on adapting to this changing trend of utilizing green solutions in their products.

Restraint: Lack of production technology and cost-competitiveness of rhamnolipids

Rhamnolipids are well-characterized and scientifically proven biosurfactants slowly and steadily becoming highly sought-after biomolecules. Among other biosurfactants, rhamnolipids have the highest number of patents and research publications. However, cost-competitiveness is one of the significant factors that is holding rhamnolipids back from becoming the champions of their field. Research needs to be focused on suitable vigorous production strains, cheap substrates, and nominal bioreactor technology.

Opportunity: Rising demand from petroleum industry

According to IEA, world oil demand is forecast to reach 101.6 million barrels per day in 2023, surpassing pre-pandemic levels. With this consumption rate, medium and light oil will be exhausted, and reliance will be placed on heavy and extra-heavy oils. Consequently, surfactants will be required to extract such heavy oils from reservoirs for global energy consumption. Biosurfactants have proved their usefulness in residual oil recovery by solubilizing trapped oil in rock formations, which is a prerequisite for Enhanced Oil Recovery (EOR). By the same principle, they have also been used in washing contaminated vessels and facilitating pipeline transport of heavy crude oil. Their anti-corrosion e?ects on oil-prospecting assets are based on the orientation of their polar groups and their antimicrobial activities.

Biosurfactants Market Ecosystem

“Sophorolipids was the largest sub type of glycolipids of biosurfactants market, in terms of value, in 2021”

The larger share of this segment is due to the high demand for low-cost and environmentally friendly biodegradable surfactants, being used mainly in the home care and personal care industries. Sophorolipids can occur in the lactonic form, in which the carboxylic end is attached to the sophorose head, or in the acidic form, where the fatty acid tail is free. Depending on the form and composition, the properties of sophorolipids vary. For instance, for better antimicrobial and surface tension lowering activity, lactonic sophorolipids are used, whereas, for enhanced solubility and foam production, acidic sophorolipids are used.

“Personal care is projected to be the fastest growing application of biosurfactants market, in terms of value, during the forecast period”

The market in personal care is mainly driven by the strong demand for cosmetic products such as body washes, lotions, hair products, acne treatments, anti-wrinkle products, skin smoothing, and deodorants. The demand for personal care products is increasing due to its growing population, demand for green solutions, rising disposable income, and increased consumer spending. The retail sector is also getting organized in this region, which is boosting the demand for environmentally friendly personal care products.

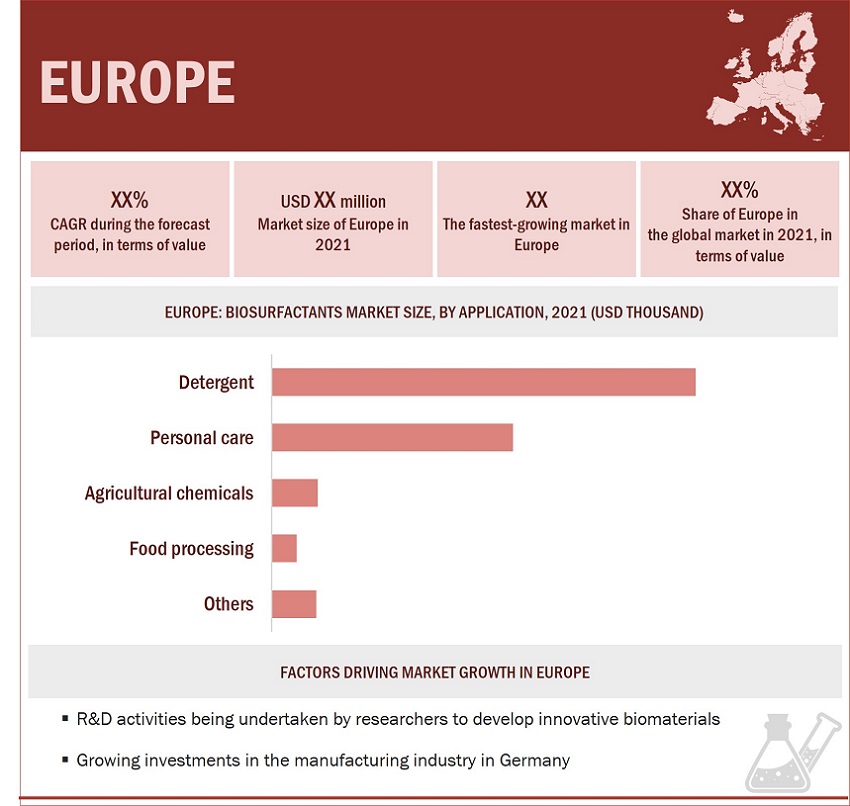

“Europe to account for the largest share of the global biosurfactants market, in terms of value, in 2021”

The largest market share is due to the increased demand from the home care, personal care, and agricultural industries. The demand for less toxic and highly biodegradable products due to rising concerns for environmental protection is the major reason for the high demand for biosurfactants in Europe. Stringent environmental regulations imposed by REACH have increased the demand for eco-friendly and biologically derived surfactants.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Biosurfactants Market Players

The key market players profiled in the report include Evonik Industries AG (Germany), Deguan Biosurfactant Supplier (China), Biotensidon GmbH (Germany), Saraya Co., Ltd. (Japan), Allied Carbon Solutions Co., Ltd. (Japan), Daqing VICTEX Chemical Industries Co., Ltd. (China), Jeneil Biotech, Inc. (US), BASF SE (Germany), Holiferm Limited (UK), Solvay S.A. (Belgium) and others.

Biosurfactants Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 1.2 billion |

|

Revenue Forecast in 2027 |

USD 1.9 billion |

|

CAGR |

11.2% |

|

Years considered for the study |

2017-2027 |

|

Base year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast units |

Value (USD Thousand/Billion), Volume (Ton) |

|

Segments covered |

Type, Application, and Region |

|

Geographies Covered |

Europe, North America, Asia Pacific and Rest of World< |

|

Companies profiled |

Evonik Industries AG (Germany), Deguan Biosurfactant Supplier (China), Biotensidon GmbH (Germany), Saraya Co., Ltd. (Japan), Allied Carbon Solutions Co., Ltd. (Japan), Daqing VICTEX Chemical Industries Co., Ltd. (China), Jeneil Biotech, Inc. (US), BASF SE (Germany), Holiferm Limited (UK), Solvay S.A. (Belgium) and others Top 32 major players covered

|

This report categorizes the global biosurfactants market based on type, application, and region.

On the basis of type, the biosurfactants market has been segmented as follows:

-

Glycolipids

- Sophorolipids

- Rhamnolipids

- Lipopeptides

On the basis of application, the biosurfactants market has been segmented as follows:

- Detergent

- Personal Care

- Food processing

- Agricultural chemicals

- Others

On the basis of region, the biosurfactants market has been segmented as follows:

- Europe

- North America

- Asia Pacific

- Rest of World (RoW)

Recent Developments:

- In June 2022, Locus Fermentation Solutions announced the launch of FloBoost. FloBoost outperforms traditional injectivity aids to boost the efficiency of saltwater disposal wells (SWDs) and reduce costs in oilfield applications.

- In March 2022, Holiferm Limited announced a partnership with Sasol Limited to develop new biosurfactants and commercialize sophorolipids in the Middle East.

- In December 2021, Locus Fermentation Solutions announced a distributorship agreement with Creedence Energy Services. Creedence Energy Services will distribute the biosurfactants of Locus Fermentation Solutions across the Williston Basin.

- In December 2021, Holiferm Limited announced a partnership with An’du. An’du uses Holiferm Limited’s sophorolipids to manufacture a shampoo bar that will be biodegradable, environmentally friendly and come in compostable packaging.

Frequently Asked Questions (FAQ):

What is the current size and CAGR of the global biosurfactants market?

The global biosurfactants market will grow to USD 1.9 Billion by 2027, at a CAGR of 11.2% from USD 1.2 Billion in 2022.

What are the major factors impacting market growth during the forecast period?

The huge demand for eco-friendly solutions and growing awareness among consumers and manufacturers are the key factors responsible for the high demand for biosurfactant-based detergents. .

Which region will lead the biosurfactant market in the future?

Europe is expected to lead the biosurfactant market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 BIOSURFACTANTS MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 MARKET DEFINITION AND INCLUSIONS, BY TYPE

1.2.3 MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

1.3 MARKET SCOPE

FIGURE 1 BIOSURFACTANTS MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 BIOSURFACTANTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews – demand and supply sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of Primary Interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF MAJOR PLAYERS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE) COLLECTIVE REVENUE OF ALL PRODUCTS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE) PRODUCTS SOLD

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 TOP-DOWN

2.3 DATA TRIANGULATION

FIGURE 7 BIOSURFACTANTS MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY SIDE

FIGURE 8 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

2.4.2 DEMAND SIDE

FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 BIOSURFACTANTS MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 10 GLYCOLIPIDS SEGMENT TO LEAD BIOSURFACTANTS MARKET DURING FORECAST PERIOD

FIGURE 11 DETERGENTS APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 12 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BIOSURFACTANTS MARKET

FIGURE 13 GROWING PERSONAL CARE APPLICATION TO DRIVE BIOSURFACTANTS MARKET DURING FORECAST PERIOD

4.2 BIOSURFACTANTS MARKET SIZE, BY REGION

FIGURE 14 EUROPE TO BE LARGEST MARKET FOR BIOSURFACTANTS DURING FORECAST PERIOD

4.3 EUROPE: MARKET, BY APPLICATION AND COUNTRY, 2021

FIGURE 15 DETERGENT APPLICATION AND GERMANY ACCOUNTED FOR LARGEST SHARES

4.4 MARKET SIZE, BY TYPE

FIGURE 16 SOPHOROLIPIDS ARE LARGEST TYPE IN BIOSURFACTANTS MARKET

4.5 MARKET SIZE, APPLICATION VS. REGION

FIGURE 17 DETERGENT SEGMENT LED BIOSURFACTANTS MARKET ACROSS REGIONS

4.6 MARKET: MAJOR COUNTRIES

FIGURE 18 GERMANY TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, AND OPPORTUNITIES IN BIOSURFACTANTS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for green solutions

5.2.1.2 Regulations on use of synthetic surfactants

5.2.1.3 Personal care product manufacturers going green

5.2.2 RESTRAINTS

5.2.2.1 Less commercialization due to high production cost

5.2.2.2 Conventional but bio-based products gaining popularity

5.2.2.3 Lack of production technology and cost-competitiveness of rhamnolipids

5.2.3 OPPORTUNITIES

5.2.3.1 Development of cost-effective production techniques

TABLE 2 POTENTIAL APPLICATIONS OF BIOSURFACTANTS FOR INDUSTRIAL USES

5.2.3.2 Rhamnolipids as antitumor agents and immunomodulators

5.2.3.3 Rising demand from the petroleum industry

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 20 BIOSURFACTANTS: PORTER'S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 3 BIOSURFACTANTS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.4 KEY STAKEHOLDERS & BUYING CRITERIA

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

5.4.2 BUYING CRITERIA

FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 5 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.5 MACROECONOMIC INDICATORS

5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

TABLE 6 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2019–2027 (USD BILLION)

6 INDUSTRY TRENDS (Page No. - 52)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 23 BIOSURFACTANTS: SUPPLY CHAIN

6.1.1 RAW MATERIALS

6.1.2 MANUFACTURERS

6.1.3 DISTRIBUTION NETWORK

6.1.4 END USERS

6.2 BIOSURFACTANTS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

FIGURE 24 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

TABLE 7 BIOSURFACTANTS MARKET FORECAST SCENARIO, 2019–2027 (USD THOUSAND)

6.2.1 NON-COVID-19 SCENARIO

6.2.2 OPTIMISTIC SCENARIO

6.2.3 PESSIMISTIC SCENARIO

6.2.4 REALISTIC SCENARIO

6.3 PRICING ANALYSIS

6.3.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

FIGURE 25 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE APPLICATIONS

TABLE 8 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE APPLICATIONS, USD/KG

6.3.2 AVERAGE SELLING PRICE, BY REGION

FIGURE 26 AVERAGE SELLING PRICE OF BIOSURFACTANTS, BY REGION, USD/KG

TABLE 9 AVERAGE SELLING PRICE OF BIOSURFACTANTS, BY REGION, USD/KG

6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

6.4.1 REVENUE SHIFTS & REVENUE POCKETS FOR BIOSURFACTANTS MARKET

FIGURE 27 REVENUE SHIFT FOR BIOSURFACTANTS MARKET

6.5 CONNECTED MARKETS: ECOSYSTEM

TABLE 10 BIOSURFACTANTS MARKET: ECOSYSTEM

FIGURE 28 BIOSURFACTANTS: ECOSYSTEM

6.6 TECHNOLOGY ANALYSIS

6.6.1 SOLID-STATE FERMENTATION PROCESS

6.6.2 SPECIFIC YIELD ENHANCEMENT BY MEDIA MODULATIONS

6.6.3 BIOSURFACTANT COPRODUCTION FOR PROCESS ECONOMIZATION

6.7 CASE STUDY ANALYSIS

6.7.1 CASE STUDY ON BIOSURFACTANT FLUSHING WITH MULTI-PHASE EXTRACTION

6.8 TRADE DATA STATISTICS

6.8.1 IMPORT SCENARIO OF SURFACTANTS

FIGURE 29 IMPORTS OF SURFACTANTS, BY KEY COUNTRIES (2012–2021)

TABLE 11 IMPORTS OF SURFACTANTS, BY REGION, 2012–2021 (USD MILLION)

6.8.2 EXPORT SCENARIO OF SURFACTANTS

FIGURE 30 EXPORTS OF SURFACTANTS BY KEY COUNTRY (2012–2021)

TABLE 12 EXPORTS OF SURFACTANTS, BY REGION, 2012–2021 (USD MILLION)

6.9 REGULATORY LANDSCAPE

6.9.1 REGULATIONS RELATED TO BIOSURFACTANTS

6.10 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 13 BIOSURFACTANTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.11 PATENT ANALYSIS

6.11.1 APPROACH

6.11.2 DOCUMENT TYPE

FIGURE 31 PATENTS REGISTERED FOR BIOSURFACTANTS, 2011–2021

FIGURE 32 PATENT PUBLICATION TRENDS FOR BIOSURFACTANTS, 2011–2021

6.11.3 LEGAL STATUS OF PATENTS

FIGURE 33 LEGAL STATUS OF PATENTS FILED FOR BIOSURFACTANTS

6.11.4 JURISDICTION ANALYSIS

FIGURE 34 HIGHEST NUMBER OF PATENTS FILED BY COMPANIES IN US

6.11.5 TOP APPLICANTS

FIGURE 35 EVONIK INDUSTRIES AG REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2011 AND 2021

TABLE 14 PATENTS BY EVONIK INDUSTRIES AG

TABLE 15 PATENTS BY CUBIST PHARMACEUTICALS

TABLE 16 PATENTS BY THE COUNCIL OF SCIENTIFIC & INDUSTRIAL RESEARCH

TABLE 17 TOP TEN PATENT OWNERS (US) DURING LAST TEN YEARS

7 BIOSURFACTANTS MARKET, BY TYPE (Page No. - 69)

7.1 INTRODUCTION

TABLE 18 BIOSURFACTANTS: BREAKDOWN OF TYPES AND MICROORGANISMS

FIGURE 36 SOPHOROLIPIDS TO DOMINATE BIOSURFACTANTS MARKET DURING FORECAST PERIOD

TABLE 19 MARKET SIZE, BY TYPE, 2017–2020 (USD THOUSAND)

TABLE 20 MARKET SIZE, BY TYPE, 2021–2027 (USD THOUSAND)

TABLE 21 MARKET SIZE, BY TYPE, 2017–2020 (TON)

TABLE 22 MARKET SIZE, BY TYPE, 2021–2027 (TON)

7.2 GLYCOLIPIDS

7.2.1 HIGH BIODEGRADABILITY, HIGH SELECTIVITY, AND ENVIRONMENTAL COMPATIBILITY

7.2.2 SOPHOROLIPIDS

7.2.3 RHAMNOLIPID

7.3 LIPOPEPTIDES

7.3.1 REDUCED SURFACE TENSION AND STRONG ANTIBIOTIC EFFECT

7.3.2 SURFACTIN

7.3.3 LICHENYSIN

8 BIOSURFACTANTS MARKET, BY APPLICATION (Page No. - 75)

8.1 INTRODUCTION

TABLE 23 BIOSURFACTANTS: BREAKDOWN OF APPLICATIONS

FIGURE 37 PERSONAL CARE TO BE FASTEST-GROWING APPLICATION IN BIOSURFACTANTS MARKET

TABLE 24 MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 25 MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

TABLE 26 MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 27 MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

8.2 DETERGENTS

8.2.1 USE OF ENVIRONMENTALLY FRIENDLY DETERGENTS IN HOME CARE INDUSTRY

TABLE 28 BIOSURFACTANTS MARKET SIZE IN DETERGENTS, BY REGION 2017–2020 (USD THOUSAND)

TABLE 29 MARKET SIZE IN DETERGENTS, BY REGION, 2021–2027 (USD THOUSAND)

TABLE 30 MARKET SIZE IN DETERGENTS, BY REGION, 2017–2020 (TON)

TABLE 31 MARKET SIZE IN DETERGENTS, BY REGION, 2021–2027 (TON)

8.3 PERSONAL CARE

8.3.1 CONSUMER AWARENESS REGARDING USE OF ENVIRONMENTALLY FRIENDLY PRODUCTS

TABLE 32 BIOSURFACTANTS MARKET SIZE IN PERSONAL CARE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 33 MARKET SIZE IN PERSONAL CARE, BY REGION, 2021–2027 (USD THOUSAND)

TABLE 34 MARKET SIZE IN PERSONAL CARE, BY REGION, 2017–2020 (TON)

TABLE 35 MARKET SIZE IN PERSONAL CARE, BY REGION, 2021–2027 (TON)

8.4 FOOD PROCESSING

8.4.1 INCREASING USE OF BIOSURFACTANTS AS BIOCIDES

TABLE 36 BIOSURFACTANTS MARKET SIZE IN FOOD PROCESSING, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 37 MARKET SIZE IN FOOD PROCESSING, BY REGION, 2021–2027 (USD THOUSAND)

TABLE 38 MARKET SIZE IN FOOD PROCESSING, BY REGION, 2017–2020 (TON)

TABLE 39 MARKET SIZE IN FOOD PROCESSING, BY REGION, 2021–2027 (TON)

8.5 AGRICULTURAL CHEMICALS

8.5.1 DEMAND FOR CROP PROTECTION AND IMPROVED SHELF LIFE

TABLE 40 BIOSURFACTANTS MARKET SIZE IN AGRICULTURAL CHEMICALS, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 41 MARKET SIZE IN AGRICULTURAL CHEMICALS, BY REGION, 2021–2027 (USD THOUSAND)

TABLE 42 MARKET SIZE IN AGRICULTURAL CHEMICALS, BY REGION, 2017–2020 (TON)

TABLE 43 MARKET SIZE IN AGRICULTURAL CHEMICALS, BY REGION, 2021–2027 (TON)

8.6 OTHERS

TABLE 44 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 45 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2027 (USD THOUSAND)

TABLE 46 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (TON)

TABLE 47 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2027 (TON)

9 BIOSURFACTANTS MARKET, BY REGION (Page No. - 87)

9.1 INTRODUCTION

FIGURE 38 EUROPE TO BE FASTEST-GROWING BIOSURFACTANTS MARKET BETWEEN 2022 AND 2027

TABLE 48 MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 49 MARKET SIZE, BY REGION, 2021–2027 (USD THOUSAND)

TABLE 50 MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 51 MARKET SIZE, BY REGION, 2021–2027 (TON)

9.2 EUROPE

FIGURE 39 EUROPE: BIOSURFACTANTS MARKET SNAPSHOT

9.2.1 EUROPE MARKET, BY APPLICATION

TABLE 52 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 53 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

TABLE 54 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 55 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

9.2.2 EUROPE MARKET, BY COUNTRY

TABLE 56 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 57 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2027 (USD THOUSAND)

TABLE 58 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 59 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

9.2.2.1 Germany

9.2.2.1.1 Investments from major biosurfactant manufacturing companies

TABLE 60 GERMANY: BIOSURFACTANTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 61 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

TABLE 62 GERMANY: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 63 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

9.2.2.2 UK

9.2.2.2.1 Strong industrial base and easy availability of raw materials

TABLE 64 UK: BIOSURFACTANTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 65 UK: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

TABLE 66 UK: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 67 UK: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

9.2.2.3 France

9.2.2.3.1 Economic stability, progressive industrial hubs, and high labor productivity

TABLE 68 FRANCE: BIOSURFACTANTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 69 FRANCE: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

TABLE 70 FRANCE: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 71 FRANCE: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

9.3 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: BIOSURFACTANTS MARKET SNAPSHOT

9.3.1 ASIA PACIFIC MARKET, BY APPLICATION

TABLE 72 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 73 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

TABLE 74 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 75 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

9.3.2 ASIA PACIFIC MARKET, BY COUNTRY

TABLE 76 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 77 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (USD THOUSAND)

TABLE 78 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 79 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

9.3.2.1 Japan

9.3.2.1.1 Versatile, low-cost, and high-performance biosurfactant products

TABLE 80 JAPAN: BIOSURFACTANTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 81 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

TABLE 82 JAPAN: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 83 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

9.3.2.2 China

9.3.2.2.1 Changing consumer demands and consecutive increases in industrial output

TABLE 84 CHINA: BIOSURFACTANTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 85 CHINA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

TABLE 86 CHINA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 87 CHINA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

9.3.2.3 South Korea

9.3.2.3.1 Presence of technologically advanced manufacturers

TABLE 88 SOUTH KOREA: BIOSURFACTANTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 89 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

TABLE 90 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 91 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

9.4 NORTH AMERICA

FIGURE 41 NORTH AMERICA: BIOSURFACTANTS MARKET SNAPSHOT

9.4.1 NORTH AMERICA MARKET, BY APPLICATION

TABLE 92 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

9.4.2 NORTH AMERICA MARKET, BY COUNTRY

TABLE 96 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD THOUSAND)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

9.4.2.1 US

9.4.2.1.1 Shift in focus toward use of sustainable plastics across industries

TABLE 100 US: BIOSURFACTANTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 101 US: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

TABLE 102 US: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 103 US: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

9.5 REST OF WORLD (ROW)

9.5.1 REST OF WORLD BIOSURFACTANTS MARKET, BY APPLICATION

TABLE 104 ROW: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 105 ROW: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

TABLE 106 ROW: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 107 ROW: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

9.5.2 REST OF WORLD MARKET, BY COUNTRY

TABLE 108 ROW: MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 109 ROW: MARKET SIZE, BY COUNTRY, 2021–2027 (USD THOUSAND)

TABLE 110 ROW: MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 111 ROW: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

9.5.2.1 Brazil

9.5.2.1.1 Rising exploration activities and discovery of new oilfields

TABLE 112 BRAZIL: BIOSURFACTANTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 113 BRAZIL: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

TABLE 114 BRAZIL: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 115 BRAZIL: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

10 COMPETITIVE LANDSCAPE (Page No. - 119)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY BIOSURFACTANT MANUFACTURERS

10.3 MARKET SHARE ANALYSIS

10.3.1 RANKING OF KEY MARKET PLAYERS, 2021

FIGURE 42 RANKING OF TOP FIVE PLAYERS IN BIOSURFACTANTS MARKET, 2021

10.3.2 MARKET SHARE OF KEY PLAYERS

TABLE 116 MARKET: DEGREE OF COMPETITION

FIGURE 43 EVONIK INDUSTRIES AG: LEADING PLAYER IN BIOSURFACTANTS MARKET

10.3.2.1 Evonik Industries AG

10.3.2.2 Deguan Biosurfactant Supplier

10.3.2.3 Biotensidon GmbH

10.3.2.4 Saraya Co., Ltd.

10.3.2.5 Allied Carbon Solutions Co., Ltd. (ACS)

10.3.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS

FIGURE 44 REVENUE ANALYSIS FOR KEY COMPANIES, 2017–2021

10.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 45 MARKET: OVERALL COMPANY FOOTPRINT

TABLE 117 MARKET: TYPE FOOTPRINT

TABLE 118 MARKET: APPLICATION FOOTPRINT

TABLE 119 MARKET: REGION FOOTPRINT

10.5 COMPANY EVALUATION MATRIX (TIER 1)

FIGURE 46 COMPANY EVALUATION QUADRANT FOR BIOSURFACTANTS MARKET (TIER 1)

10.6 COMPETITIVE BENCHMARKING

TABLE 120 BIOSURFACTANTS MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 121 MARKET: COMPETITIVE BENCHMARKING OF KEY START-USP/SMES

10.7 START-UPS/SMES EVALUATION QUADRANT

FIGURE 47 START-UPS/SME EVALUATION QUADRANT FOR BIOSURFACTANTS MARKET

10.8 COMPETITIVE SITUATIONS AND TRENDS

10.8.1 PRODUCT LAUNCHES

TABLE 122 BIOSURFACTANTS MARKET: PRODUCT LAUNCHES, 2018–2021

10.8.2 DEALS

TABLE 123 BIOSURFACTANTS MARKET: DEALS (2018–2022)

10.8.3 OTHER DEVELOPMENTS

TABLE 124 BIOSURFACTANTS MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2018– 2022)

11 COMPANY PROFILE (Page No. - 136)

11.1 MAJOR PLAYERS

(Business Overview, Products, Recent Developments, MnM View)*

11.1.1 EVONIK INDUSTRIES AG

TABLE 125 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

FIGURE 48 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

11.1.2 DEGUAN BIOSURFACTANT SUPPLIER

TABLE 126 DEGUAN BIOSURFACTANT SUPPLIER: COMPANY OVERVIEW

11.1.3 BIOTENSIDON GMBH

TABLE 127 BIOTENSIDON GMBH: COMPANY OVERVIEW

11.1.4 SARAYA CO., LTD.

TABLE 128 SARAYA CO., LTD.: COMPANY OVERVIEW

11.1.5 ALLIED CARBON SOLUTIONS CO., LTD.

TABLE 129 ALLIED CARBON SOLUTIONS CO., LTD.: COMPANY OVERVIEW

11.1.6 JENEIL BIOTECH, INC.

TABLE 130 JENEIL BIOTECH, INC.: COMPANY OVERVIEW

11.1.7 BASF SE

TABLE 131 BASF SE: COMPANY OVERVIEW

FIGURE 49 BASF SE: COMPANY SNAPSHOT

11.1.8 HOLIFERM LIMITED

TABLE 132 HOLIFERM LIMITED: COMPANY OVERVIEW

11.1.9 STEPAN COMPANY

TABLE 133 STEPAN COMPANY: COMPANY OVERVIEW

FIGURE 50 STEPAN COMPANY: COMPANY SNAPSHOT

11.1.10 KANEKA CORPORATION

TABLE 134 KANEKA CORPORATION: COMPANY OVERVIEW

FIGURE 51 KANEKA CORPORATION: COMPANY SNAPSHOT

11.1.11 RHAMNOLIPID INC.

TABLE 135 RHAMNOLIPID INC.: COMPANY OVERVIEW

11.1.12 AGAE TECHNOLOGIES, LLC

TABLE 136 AGAE TECHNOLOGIES, LLC: COMPANY OVERVIEW

11.1.13 GLYCOSURF, LLC

TABLE 137 GLYCOSURF, LLC: COMPANY OVERVIEW

11.1.14 LOCUS FERMENTATION SOLUTIONS

TABLE 138 LOCUS FERMENTATION SOLUTIONS: COMPANY OVERVIEW

11.1.15 GIVAUDAN SA

TABLE 139 GIVAUDAN SA: COMPANY OVERVIEW

FIGURE 52 GIVAUDAN SA: COMPANY SNAPSHOT

11.1.16 SOLVAY S.A.

TABLE 140 SOLVAY S.A.: COMPANY OVERVIEW

FIGURE 53 SOLVAY S.A.: COMPANY SNAPSHOT

11.1.17 WHEATOLEO

TABLE 141 WHEATOLEO: COMPANY OVERVIEW

11.1.18 DAQING VICTEX CHEMICAL INDUSTRIES CO., LTD.

TABLE 142 DAQING VICTEX CHEMICAL INDUSTRIES CO., LTD.: COMPANY OVERVIEW

11.2 OTHER KEY MARKET PLAYERS

11.2.1 TENSIOGREEN TECHNOLOGY CORP.

TABLE 143 TENSIOGREEN TECHNOLOGY CORP.: COMPANY OVERVIEW

11.2.2 HUB.TECH. S.A.

TABLE 144 HUB.TECH. S.A.: COMPANY OVERVIEW

11.2.3 KEMIN INDUSTRIES, INC.

TABLE 145 KEMIN INDUSTRIES, INC.: COMPANY OVERVIEW

11.2.4 DISPERSA INC.

TABLE 146 DISPERSA INC.: COMPANY OVERVIEW

11.2.5 VETLINE

TABLE 147 VETLINE: COMPANY OVERVIEW

11.2.6 FRAUNHOFER IGB

TABLE 148 FRAUNHOFER IGB: COMPANY OVERVIEW

11.2.7 ZFA TECHNOLOGIES INC.

TABLE 149 ZFA TECHNOLOGIES INC.: COMPANY OVERVIEW

11.2.8 BIOFUTURE LIMITED

TABLE 150 BIOFUTURE LIMITED: COMPANY OVERVIEW

11.2.9 TOYOBO CO., LTD.

TABLE 151 TOYOBO CO., LTD.: COMPANY OVERVIEW

11.2.10 KANEBO COSMETICS INC.

TABLE 152 KANEBO COSMETICS INC.: COMPANY OVERVIEW

11.2.11 MG INTOBIO CO., LTD.

TABLE 153 MG INTOBIO CO., LTD.: COMPANY OVERVIEW

11.2.12 SYNTHEZYME LLC

TABLE 154 SYNTHEZYME LLC: COMPANY OVERVIEW

11.2.13 SASOL LTD.

TABLE 155 SASOL LTD.: COMPANY OVERVIEW

11.2.14 TEEGENE BIOTECH LTD.

TABLE 156 TEEGENE BIOTECH LTD.: COMPANY OVERVIEW

*Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 181)

12.1 INTRODUCTION

12.2 LIMITATION

12.3 SURFACTANTS MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.4 SURFACTANTS, BY REGION

TABLE 157 SURFACTANTS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 158 SURFACTANTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12.4.1 ASIA PACIFIC

12.4.1.1 By country

TABLE 159 ASIA PACIFIC: SURFACTANTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 160 ASIA PACIFIC: SURFACTANTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.1.2 By type

TABLE 161 ASIA PACIFIC: SURFACTANTS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 162 ASIA PACIFIC: SURFACTANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

12.4.2 EUROPE

12.4.2.1 By country

TABLE 163 EUROPE: SURFACTANTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 164 EUROPE: SURFACTANTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.2.2 By type

TABLE 165 EUROPE: SURFACTANTS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 166 EUROPE: SURFACTANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

12.4.3 NORTH AMERICA

12.4.3.1 By country

TABLE 167 NORTH AMERICA: SURFACTANTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 168 NORTH AMERICA: SURFACTANTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.3.2 By type

TABLE 169 NORTH AMERICA: SURFACTANTS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 170 NORTH AMERICA: SURFACTANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

12.4.4 MIDDLE EAST & AFRICA

12.4.4.1 By country

TABLE 171 MIDDLE EAST & AFRICA: SURFACTANTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 172 MIDDLE EAST & AFRICA: SURFACTANTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.4.2 By type

TABLE 173 MIDDLE EAST & AFRICA: SURFACTANTS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 174 MIDDLE EAST & AFRICA: SURFACTANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

12.4.5 SOUTH AMERICA

12.4.5.1 By country

TABLE 175 SOUTH AMERICA: SURFACTANTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 176 SOUTH AMERICA: SURFACTANTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.5.2 By type

TABLE 177 SOUTH AMERICA: SURFACTANTS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 178 SOUTH AMERICA: SURFACTANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

13 APPENDIX (Page No. - 190)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

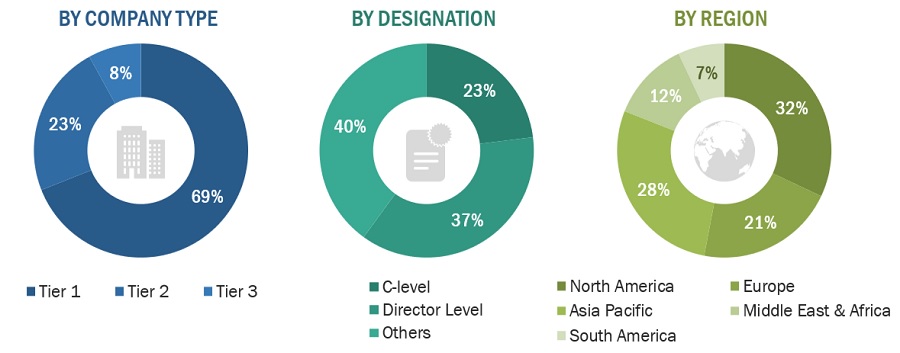

The study involved four major activities in estimating the market size for the biosurfactants market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The biosurfactants market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of cleaning products and cosmetics. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the biosurfactants market.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various material of biosurfactants.

- Several primary interviews have been conducted with key opinion leaders related to biosurfactants manufacturing and development.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the cleaning and cosmetic industry.

Report Objectives

- To analyze and forecast the size of the biosurfactants market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the biosurfactants market based on type and application.

- To forecast the size of the market segments for regions such as Europe, North America, Asia Pacific and Rest of World.

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biosurfactants Market