Blood Culture Tests Market by Method (Automated, Conventional), Product (Consumable, Media, Instruments), Technology (PCR, Microarray, Proteomic), Application (Bacteremia, Mycobacterial), End User (Hospital, Academic Research) - Global Forecasts to 2028

Inquire Now to get the Global Forecasts Data upto 2028

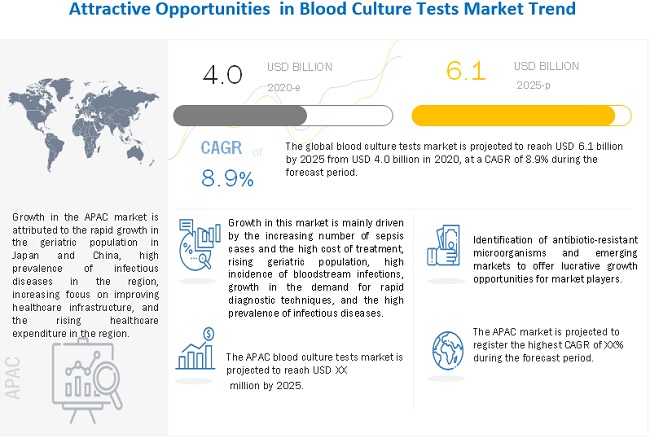

The global blood culture tests market size is projected to reach USD 6.1 billion by 2025, at a CAGR of 8.9%. Factors such as growing demand for rapid diagnostic techniques, increasing geriatric population, high prevalence of bloodstream infections, presence of advanced healthcare infrastructure, growing regulatory approvals, and strong government support are driving the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Blood Culture Tests Market Dynamics

Drivers: High incidence of blood stream infections

Nosocomial (hospital-acquired) bloodstream infections are one of the important causes of death across the globe. In the US alone, nearly 250,000 cases of hospital-acquired bacterial blood stream infections (BSIs) occur each year. Bloodstream infections affect about 30 million people leading to 6 million deaths, with 3 million new-borns and 1.2 million children suffering from sepsis annually worldwide. In Eastern African countries, the ratio of patients with bloodstream infections is reported to range from 11 percent to 28 percent. Bloodstream infection rates are estimated to be in the scale of 9.3 percent to 11.2 percent in Ghana (Source: Journal of Tropical Medicine, 2019). The incidence of these infections raises the overall duration of hospitalization as well as the cost of treatment. With the high incidence of bacterial blood stream infections (BSIs), the need for advanced blood culture techniques that help in the early detection of infections is expected to increase.

Restraints: High price of automated instruments

Automated blood culture instruments are provided with enhanced features and functionalities and thus are valued at a premium. The price of automated instruments such as PCR is around USD 10,000 to USD 15,000, and that of MALDI-TOF MS systems is around USD 150,000 to USD 850,000. Academic research laboratories generally cannot offer such high-price systems as they have restricted budgets. Additionally, the maintenance price and several other indirect expenditures result in a rise in the total price of ownership of these instruments. This is a key factor restricting the adoption of automated blood culture instruments, mainly among small-scale end users.

Challenges: Market cannibalization

In recent years, several technologically innovative products that offer enhanced solutions for the detection of microorganisms present in the bloodstream have been introduced in the market. These innovative products are anticipated to cannibalize the market for conventional products, such as microscopes and polystainers, thereby impacting the growth of conventional blood culture testing products. In order to retain a competitive position in the market, players will have to expand their product portfolio by implementing new technologies. This will be a challenging task for market players who have a recognized collection of conventional products.

Opportunities: Emerging Markets

Emerging markets such as China, India, and other countries in Southeast Asia and countries in the Middle East and Latin America are becoming focal points for the development of the blood culture tests market. The high development in these markets can primarily be attributed to the increase in the prevalence of infectious diseases, fast growth in the geriatric population, the increasing number of product approvals, and increasing healthcare expenditure. For instance, the healthcare expenditure in China increased to 5.35 percent of the GDP in 2019 from USD 5.07 percent of GDP in 2017 (Source: World Bank, OECD). Such significant spending will result in the implementation of advanced systems, such as automated blood culture systems, among hospital and reference laboratories in these regions. This, in turn, is expected to deliver potential growth chances for players operating in the blood culture tests market in the coming years.

Based on product, the consumables segment is expected to grow at the highest CAGR during the forecast period.

Based on product, the blood culture tests market is segmented into consumables, instruments, and software and services. The consumables segment is expected to grow at the highest CAGR during the forecast period. Factors such as the recurring need of consumables as compared to instruments are driving the growth of this segment.

Based on application, bacteremia segment to grow at the highest CAGR in the blood culture tests market during the forecast period

Based on applications, the blood culture tests market is segmented into bacteremia, fungemia, and mycobacterial detection. Bacteremia segment is expected to grow at the highest CAGR during the forecast period. Growing number of bloodstream infections and the rising number of sepsis cases worldwide are the major factor supporting its growth.

Based on method, conventional/manual blood culture method is expected to account for the largest share of blood culture tests market

Based on method, the blood culture tests market is segmented into conventional/manual blood culture and automated blood culture methods. In 2020, the conventional/manual blood culture methods segment is expected to account for the largest share of the blood culture tests market. However, the automated blood culture methods segment is expected to register the highest CAGR during the forecast period. Factors such as the fast turnaround time and reduced risk of contamination due to decrease manual intervention are contributing to market growth of this segment.

Based on technology, molecular technologies segment to grow at the highest CAGR in the blood culture tests market during the forecast period

Based on technology, the blood culture tests market is segmented into culture-based technologies, molecular technologies, and proteomics. The molecular technologies segment is anticipated to grow at the highest CAGR during the forecast period. Factors such as the growing incidence of sepsis, growing demand of rapid diagnostic techniques for detecting the presence of bacteria, fungi, and mycobacteria from blood samples are contributing to market growth of this segment.

Based on end users, reference laboratories segment to grow at the highest CAGR in the blood culture tests market during the forecast period

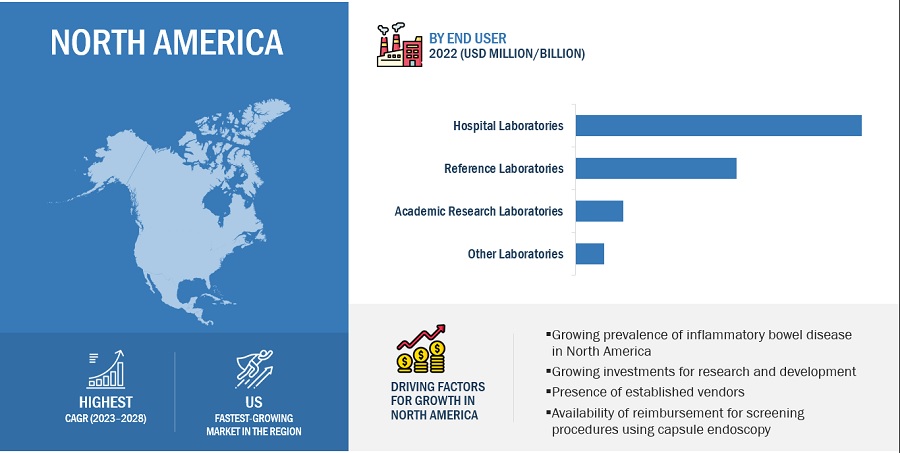

Based on end users, the blood culture tests market is segmented into hospital laboratories, reference laboratories, academic research laboratories, and other laboratories (includes pathology laboratories, bacteriological laboratories, physician office laboratories, and independent research laboratories). The reference laboratories segment is anticipated to grow at the highest CAGR during the forecast period. Factors such as enhancing outsourcing of blood culture tests by hospitals to reference laboratories are driving the growth of this segment.

North America to dominate blood culture tests market

On the basis of region, the blood culture tests market is segmented into five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2020, North America is expected to dominate the market followed by Europe. The large share of this segment is attributed to factors such as the significant presence of blood culture test providers, growing product approvals and presence of large number of prominent players in this region.

To know about the assumptions considered for the study, download the pdf brochure

The major players in the blood culture tests market are Becton, Dickinson and Company (US), bioMérieux SA (France), and Thermo Fisher Scientific Inc. (US). These companies together accounted for a share of more than 60% of the blood culture tests market in 2019. Other players in the market include Luminex Corporation (US), Danaher Corporation (US), Bruker Corporation (US), IRIDICA (a subsidiary of Abbott Laboratories) (US), Roche Diagnostics (Switzerland), T2 Biosystems, Inc. (US), Anaerobe Systems, Inc. (US), OpGen, Inc. (US), Meditech Technologies India Private Limited (India), Carl Zeiss AG (Germany), Nikon Corporation (Japan), BINDER GmbH (Germany), Biobase Biotech (Jinan) Co., Ltd. (China), Scenker Biological Technology Co., Ltd. (China), Bulldog Bio, Inc. (US), Axiom Laboratories (India), and HiMedia Laboratories Pvt. Ltd. (India)among others.

Blood Culture Tests Market Scope

|

Report Metrics |

Details |

|

Market Size value 2025 |

USD 6.1 billion |

|

Growth Rate |

8.9% CAGR |

|

Largest Market |

North America |

|

Market Dynamics |

Drivers, Opportunities, Restraints & Challenges |

|

Largest Share Segments |

Conventional/Manual Blood Culture |

|

Forecasts up to |

2025 |

|

Market Segmentation |

By Method, Product, Technology, Application, End User and Region |

|

Blood Culture Tests Market Growth Drivers |

|

|

Blood Culture Tests Market Growth Opportunities |

|

|

Report Highlights |

|

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

This research report categorizes the blood culture tests market into the following segments:

By Method

- Conventional/Manual Methods

- Automated Methods

By Product

-

Consumables

-

Blood Culture Media

- Aerobic Blood Culture Media

- Pediatric Aerobic Blood Culture Media

- Anaerobic Blood Culture Media

- Mycobacterial Blood Culture Media

- Fungi/Yeast Blood Culture Media

- Assay Kits & Reagents

- Blood Culture Accessories

-

Blood Culture Media

-

Instruments

- Automated Blood Culture Systems

-

Supporting Laboratory Equipment

- Incubators

- Colony Counters

- Microscopes

- Gram Stainers

- Software and Services

By Technology

- Culture-Based Technology

- Molecular Technologies

- Microarrays

- PCR (Polymerase Chain Reaction)

- PNA-FiSH (Peptide Nucleic Acid – Fluroscent in Situ Hybridization)

- Proteomics Technology

By Application

- Bacteremia

- Fungemia

- Mycobacterial Detection

By End User

- Hospital Laboratories

- Reference Laboratories

- Academic Research Laboratories

- Other Laboratories

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

-

Latin America

- Middle East & Africa

Recent Developments:

- In 2020, Becton, Dickinson and Company (US), had an agreement with Babson Diagnostics (US).The companies signed an agreement to enable small-volume blood collection for diagnostic testing in retail settings.

- In 2019, bioMérieux SA (France), partnerd with Wellcome Trust (UK), to coordinate VALUE-Dx, a European public-private partnership to fight antimicrobial resistance through diagnostics.

- In 2018, bioMérieux SA (France), received FDA clearance for BPA and BPN culture bottles used with BACT/ALERT VIRTUO for the quality control testing of platelets

Frequently Asked Questions (FAQ):

Which product segment will dominate the blood culture tests market in the future?

The consumables segment will dominate the blood culture tests market in the future

Emerging countries have immense opportunities for the growth and adoption of blood culture tests; will this scenario continue in the next five years?

Asia Pacific is expected to register the highest CAGR during the forecast period, emerging markets such as China and India are witnessing growth due to the increasing healthcare expenditure. This has resulted in the increasing acceptance of advanced systems in the Asia Pacific region.

Other factors such as large patient population (leading to more surgeries, invasive medical procedures, and infectious diseases); increasing cases of sepsis, bloodstream infections, and tuberculosis; poor adherence to infection control guidelines leading to greater chances of developing bloodstream infections; growing elderly population (especially in Japan); increasing healthcare expenditure; and increasing awareness about sepsis are contributing to the growth of the blood culture tests market in the Asia Pacific.

Who are the leading players in the blood culture tests market?

Prominent players in the market are Becton, Dickinson and Company (US), Thermo Fisher Scientific, Inc. (US), bioMérieux SA (France), Luminex Corporation (US), Danaher Corporation (US), Bruker Corporation (US), IRIDICA (US), Roche Diagnostics (Switzerland), T2 Biosystems, Inc. (US), Anaerobe Systems, Inc. (US), OpGen, Inc. (US), Meditech Technologies India Private Limited (India), Carl Zeiss AG (Germany), Nikon Corporation (Japan), BINDER GmbH (Germany), Biobase Biotech (Jinan) Co., Ltd. (China), Scenker Biological Technology Co., Ltd. (China), Bulldog Bio, Inc. (US), Axiom Laboratories (India), and HiMedia Laboratories Pvt. Ltd. (India).

What are the major end users in the blood culture tests market?

The blood culture tests market is segmented into hospital laboratories, reference laboratories, academic research laboratories, and other laboratories (includes pathology laboratories, bacteriological laboratories, physician office laboratories, and independent research laboratories). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKETS COVERED

1.2.2 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

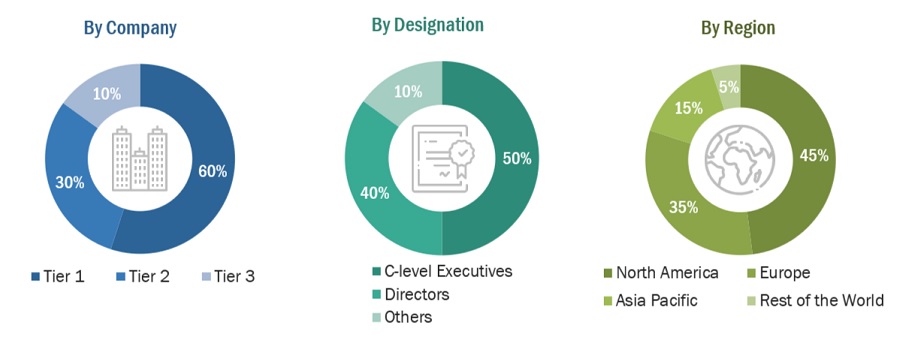

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 GROWTH FORECAST

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 5 BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 6 BLOOD CULTURE TESTS MARKET, BY METHOD, 2020 VS. 2025 (USD MILLION)

FIGURE 7 BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 8 BLOOD CULTURE TESTS MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 9 BLOOD CULTURE TESTS MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 BLOOD CULTURE TESTS MARKET OVERVIEW

FIGURE 10 RISING PREVALENCE OF INFECTIOUS DISEASES TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY METHOD & COUNTRY (2019)

FIGURE 11 CONVENTIONAL/MANUAL BLOOD CULTURE METHODS SEGMENT ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

4.3 BLOOD CULTURE TESTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 12 ASIA PACIFIC COUNTRIES TO REGISTER HIGH GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 BLOOD CULTURE TESTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing number of sepsis cases and high cost of treatment

TABLE 1 US: FIVE MOST EXPENSIVE CONDITIONS TREATED IN HOSPITALS

5.2.1.2 Rising geriatric population

TABLE 2 GERIATRIC POPULATION: KEY STATISTICS

5.2.1.3 High incidence of bloodstream infections

5.2.1.4 Growing demand for rapid diagnostic techniques

5.2.1.5 High prevalence of infectious diseases

5.2.2 RESTRAINTS

5.2.2.1 High cost of automated instruments

5.2.2.2 Lack of trained laboratory technicians

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging economies

5.2.3.2 Identification of antibiotic-resistant microorganisms

5.2.4 CHALLENGES

5.2.4.1 Market cannibalization

5.2.4.2 Survival of new entrants

5.2.5 TRENDS

5.2.5.1 Laboratory automation for increased efficiency and accurate diagnosis

5.3 VALUE CHAIN ANALYSIS

FIGURE 14 MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASES

5.4 ECOSYSTEM ANALYSIS OF THE BLOOD CULTURE PRODUCTS MARKET

FIGURE 15 ECOSYSTEM ANALYSIS

5.5 COVID-19 IMPACT ON THE BLOOD CULTURE TESTS MARKET

6 BLOOD CULTURE TESTS MARKET, BY METHOD (Page No. - 55)

6.1 INTRODUCTION

TABLE 3 BLOOD CULTURE TESTS MARKET, BY METHOD, 2018–2025 (USD MILLION)

6.2 CONVENTIONAL/MANUAL BLOOD CULTURE

6.2.1 CONVENTIONAL/MANUAL BLOOD CULTURE METHODS ACCOUNT FOR THE LARGER SHARE OF THE MARKET

TABLE 4 EXAMPLES OF CONVENTIONAL/MANUAL BLOOD CULTURE PRODUCTS

TABLE 5 CONVENTIONAL/MANUAL BLOOD CULTURE METHODS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3 AUTOMATED BLOOD CULTURE

6.3.1 AUTOMATED BLOOD CULTURE METHODS SEGMENT TO REGISTER THE HIGHEST GROWTH IN THE FORECAST PERIOD

TABLE 6 EXAMPLES OF AUTOMATED BLOOD CULTURE PRODUCTS

TABLE 7 AUTOMATED BLOOD CULTURE METHODS MARKET, BY REGION, 2018–2025 (USD MILLION)

7 BLOOD CULTURE TESTS MARKET, BY PRODUCT (Page No. - 60)

7.1 INTRODUCTION

TABLE 8 BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

7.2 CONSUMABLES

TABLE 9 BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 10 BLOOD CULTURE CONSUMABLES MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.1 BLOOD CULTURE MEDIA

TABLE 11 EXAMPLES OF BLOOD CULTURE MEDIA

TABLE 12 BLOOD CULTURE MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 13 BLOOD CULTURE MEDIA MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.1.1 Aerobic blood culture media

7.2.1.1.1 Aerobic blood culture media is the fastest-growing segment of the blood culture media market

TABLE 14 AEROBIC BLOOD CULTURE MEDIA MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.1.2 Pediatric aerobic blood culture media

7.2.1.2.1 This type of culture media is used to recover pathogens from the bloodstream of children

TABLE 15 PEDIATRIC AEROBIC BLOOD CULTURE MEDIA MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.1.3 Anaerobic blood culture media

7.2.1.3.1 Anaerobic microorganisms account for 1—17% of the positive blood cultures

TABLE 16 ANAEROBIC BLOOD CULTURE MEDIA MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.1.4 Mycobacterial blood culture media

7.2.1.4.1 Rising prevalence of tuberculosis to drive market growth

TABLE 17 MYCOBACTERIAL BLOOD CULTURE MEDIA MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.1.5 Fungi/yeast blood culture media

7.2.1.5.1 Fungi/yeast blood culture media is used to detect fungemia

TABLE 18 FUNGI/YEAST BLOOD CULTURE MEDIA MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.2 ASSAY KITS & REAGENTS

7.2.2.1 Reagents are key components of conventional blood culture tests

TABLE 19 EXAMPLES OF BLOOD CULTURE ASSAY KITS

TABLE 20 ASSAY KITS & REAGENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.3 BLOOD CULTURE ACCESSORIES

7.2.3.1 Growing number of blood culture tests to support market growth

TABLE 21 EXAMPLES OF BLOOD CULTURE ACCESSORIES

TABLE 22 BLOOD CULTURE ACCESSORIES MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3 INSTRUMENTS

TABLE 23 BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

7.3.1 AUTOMATED BLOOD CULTURE SYSTEMS

7.3.1.1 Automated blood culture systems is the largest & fastest-growing segment of the instruments market

TABLE 24 EXAMPLES OF AUTOMATED BLOOD CULTURE SYSTEMS

TABLE 25 AUTOMATED BLOOD CULTURE SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3.2 SUPPORTING LABORATORY EQUIPMENT

TABLE 26 SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 27 SUPPORTING LABORATORY EQUIPMENT MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3.2.1 Incubators

7.3.2.1.1 Incubators provide an optimal environment with respect to temperature, humidity, and oxygen level for microbial growth

TABLE 28 INCUBATORS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3.2.2 Colony counters

7.3.2.2.1 Colony counters increase direct image scanning and analysis capability

TABLE 29 COLONY COUNTERS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3.2.3 Microscopes

7.3.2.3.1 Favorable funding scenario for R&D in microscopy to drive market growth

TABLE 30 MICROSCOPES MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3.2.4 Gram stainers

7.3.2.4.1 Gram staining offers relatively quicker results

TABLE 31 GRAM STAINERS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.4 SOFTWARE & SERVICES

7.4.1 NEED FOR AUTOMATED SYSTEMS IN HOSPITAL-BASED LABORATORIES TO DRIVE MARKET GROWTH

TABLE 32 BLOOD CULTURE SOFTWARE & SERVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

8 BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY (Page No. - 76)

8.1 INTRODUCTION

TABLE 33 BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

8.2 CULTURE-BASED TECHNOLOGIES

8.2.1 DRAWBACKS ASSOCIATED WITH TRADITIONAL CULTURE-BASED TECHNOLOGIES TO RESTRAIN MARKET GROWTH

TABLE 34 BLOOD CULTURE TESTS MARKET FOR CULTURE-BASED TECHNOLOGIES, BY REGION, 2018-2025 (USD MILLION)

8.3 MOLECULAR TECHNOLOGIES

TABLE 35 BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 36 BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY REGION, 2018-2025 (USD MILLION)

8.3.1 MICROARRAYS

8.3.1.1 Microarrays is the largest & fastest-growing segment of the molecular technologies market

TABLE 37 BLOOD CULTURE TESTS MARKET FOR MICROARRAYS, BY REGION, 2018-2025 (USD MILLION)

8.3.2 PCR

8.3.2.1 PCR is used with genetic markers to analyze pathogens directly from whole blood samples

TABLE 38 BLOOD CULTURE TESTS MARKET FOR PCR, BY REGION, 2018-2025 (USD MILLION)

8.3.3 PNA-FISH

8.3.3.1 PNA-FISH tests help hospitals reduce time to pathogen identification

TABLE 39 BLOOD CULTURE TESTS MARKET FOR PNA-FISH, BY REGION, 2018-2025 (USD MILLION)

8.4 PROTEOMICS

8.4.1 MALDI-TOF MS IS ASSOCIATED WITH HIGH ACCURACY

TABLE 40 EXAMPLES OF MALDI-TOF MS SYSTEMS

TABLE 41 BLOOD CULTURE TESTS MARKET FOR PROTEOMICS, BY REGION, 2018-2025 (USD MILLION)

9 BLOOD CULTURE TESTS MARKET, BY APPLICATION (Page No. - 83)

9.1 INTRODUCTION

TABLE 42 BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

9.2 BACTEREMIA

9.2.1 RISING PREVALENCE OF SEPSIS TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 43 BLOOD CULTURE TESTS MARKET FOR BACTEREMIA, BY REGION, 2018-2025 (USD MILLION)

9.3 FUNGEMIA

9.3.1 INCREASING INCIDENCE OF BLOODSTREAM INFECTIONS IS SUPPORTING THE GROWTH OF THIS SEGMENT

TABLE 44 BLOOD CULTURE TESTS MARKET FOR FUNGEMIA, BY REGION, 2018-2025 (USD MILLION)

9.4 MYCOBACTERIAL DETECTION

9.4.1 RISING NUMBER OF TB CASES—KEY FACTOR DRIVING MARKET GROWTH

TABLE 45 BLOOD CULTURE TESTS MARKET FOR MYCOBACTERIAL DETECTION, BY REGION, 2018-2025 (USD MILLION)

10 BLOOD CULTURE TESTS MARKET, BY END USER (Page No. - 87)

10.1 INTRODUCTION

TABLE 46 BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

10.2 HOSPITAL LABORATORIES

10.2.1 HOSPITAL LABORATORIES ARE THE LARGEST END USERS OF BLOOD CULTURE TESTS

TABLE 47 BLOOD CULTURE TESTS MARKET FOR HOSPITAL LABORATORIES, BY REGION, 2018-2025 (USD MILLION)

10.3 REFERENCE LABORATORIES

10.3.1 REFERENCE LABORATORIES ARE THE FASTEST-GROWING END USERS OF BLOOD CULTURE TESTS

TABLE 48 BLOOD CULTURE TESTS MARKET FOR REFERENCE LABORATORIES, BY REGION, 2018-2025 (USD MILLION)

10.4 ACADEMIC RESEARCH LABORATORIES

10.4.1 INCREASING FOCUS ON THE R&D OF INNOVATIVE TESTS FOR BLOODSTREAM INFECTIONS TO DRIVE THE MARKET GROWTH

TABLE 49 BLOOD CULTURE TESTS MARKET FOR ACADEMIC RESEARCH LABORATORIES, BY REGION, 2018-2025 (USD MILLION)

10.5 OTHER LABORATORIES

TABLE 50 BLOOD CULTURE TESTS MARKET FOR OTHER LABORATORIES, BY REGION, 2018-2025 (USD MILLION)

11 BLOOD CULTURE TESTS MARKET, BY REGION (Page No. - 92)

11.1 INTRODUCTION

TABLE 51 BLOOD CULTURE TESTS MARKET, BY REGION, 2018-2025 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 16 NORTH AMERICA: BLOOD CULTURE TESTS MARKET SNAPSHOT

TABLE 52 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 53 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 54 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 55 NORTH AMERICA: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 56 NORTH AMERICA: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 57 NORTH AMERICA: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 58 NORTH AMERICA: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 59 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 60 NORTH AMERICA: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 61 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 62 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.2.1 US

11.2.1.1 The US is the largest market for blood culture tests

TABLE 63 US: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 64 US: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 65 US: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 66 US: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 67 US: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 68 US: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 69 US: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 70 US: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Increasing incidence of bloodstream infections to drive market growth

TABLE 71 CANADA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 72 CANADA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 73 CANADA: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 74 CANADA: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 75 CANADA: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 76 CANADA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 77 CANADA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 78 CANADA: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3 EUROPE

TABLE 79 EUROPE: BLOOD CULTURE TESTS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 80 EUROPE: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 81 EUROPE: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 82 EUROPE: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 83 EUROPE: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 84 EUROPE: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 85 EUROPE: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 86 EUROPE: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 87 EUROPE: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 88 EUROPE: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 89 EUROPE: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany is the largest market for blood culture test products in Europe

TABLE 90 GERMANY: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 91 GERMANY: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 92 GERMANY: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 93 GERMANY: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 94 GERMANY: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 95 GERMANY: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 96 GERMANY: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 97 GERMANY: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.2 UK

11.3.2.1 High burden of sepsis in the UK to drive the adoption of blood culture testing products

TABLE 98 UK: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 99 UK: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 100 UK: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 101 UK: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 102 UK: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 103 UK: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 104 UK: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 105 UK: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Rising geriatric population in France to drive the adoption of blood culture testing products

TABLE 106 FRANCE: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 107 FRANCE: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 108 FRANCE: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 109 FRANCE: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 110 FRANCE: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 111 FRANCE: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 112 FRANCE: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 113 FRANCE: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Sluggish growth in the Italian healthcare sector to hamper the market growth

TABLE 114 ITALY: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 115 ITALY: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 116 ITALY: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 117 ITALY: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 118 ITALY: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 119 ITALY: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 120 ITALY: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Improving healthcare infrastructure to support market growth

TABLE 121 SPAIN: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 122 SPAIN: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 123 SPAIN: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 124 SPAIN: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 125 SPAIN: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 126 SPAIN: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 127 SPAIN: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 128 SPAIN: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.6 REST OF EUROPE (ROE)

TABLE 129 ROE: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 130 ROE: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 131 ROE: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 132 ROE: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 133 ROE: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 134 ROE: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 135 ROE: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 136 ROE: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4 ASIA PACIFIC

TABLE 137 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 138 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 139 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 140 ASIA PACIFIC: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 141 ASIA PACIFIC: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 142 ASIA PACIFIC: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 143 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 144 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 145 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 146 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 147 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4.1 JAPAN

11.4.1.1 Japan is the largest market for blood culture tests in the APAC

TABLE 148 JAPAN: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 149 JAPAN: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 150 JAPAN: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 151 JAPAN: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 152 JAPAN: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 153 JAPAN: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 154 JAPAN: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 155 JAPAN: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4.2 CHINA

11.4.2.1 China is the fastest-growing market for blood culture tests

TABLE 156 CHINA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 157 CHINA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 158 CHINA: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 159 CHINA: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 160 CHINA: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 161 CHINA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 162 CHINA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 163 CHINA: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Rising prevalence of infectious diseases to propel market growth

TABLE 164 INDIA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 165 INDIA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 166 INDIA: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 167 INDIA: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 168 INDIA: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 169 INDIA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 170 INDIA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 171 INDIA: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4.4 REST OF ASIA PACIFIC (ROAPAC)

TABLE 172 ROAPAC: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 173 ROAPAC: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 174 ROAPAC: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 175 ROAPAC: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 176 ROAPAC: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 177 ROAPAC: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 178 ROAPAC: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 179 ROAPAC: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.5 LATIN AMERICA

11.5.1 FAVORABLE GOVERNMENT INITIATIVES TO FAVOR MARKET GROWTH

TABLE 180 LATAM: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 181 LATAM: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 182 LATAM: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 183 LATAM: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 184 LATAM: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 185 LATAM: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 186 LATAM: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 187 LATAM: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 188 LATAM: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 189 LATAM: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

11.6.1 INFRASTRUCTURAL DEVELOPMENTS TO SUPPORT MARKET GROWTH IN THE REGION

TABLE 190 MEA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 191 MEA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 192 MEA: BLOOD CULTURE CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 193 MEA: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 194 MEA: BLOOD CULTURE INSTRUMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 195 MEA: BLOOD CULTURE TESTS MARKET FOR SUPPORTING LABORATORY EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 196 MEA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 197 MEA: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 198 MEA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 199 MEA: BLOOD CULTURE TESTS MARKET, BY END USER, 2018-2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 147)

12.1 OVERVIEW

FIGURE 17 KEY DEVELOPMENTS IN THE BLOOD CULTURE TESTS MARKET

FIGURE 18 MARKET EVOLUTION FRAMEWORK

12.2 COMPETITIVE SITUATIONS & TRENDS

12.2.1 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS (2017–2020)

12.2.2 PRODUCT LAUNCHES & APPROVALS (2017-2020)

12.2.3 ACQUISITIONS (2017-2020)

13 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 150)

13.1 OVERVIEW

13.2 COMPANY EVALUATION MATRIX DEFINITION AND METHODOLOGY

13.3 MARKET SHARE ANALYSIS

13.3.1 INTRODUCTION

FIGURE 19 MARKET SHARE ANALYSIS, BY KEY PLAYER, 2019

13.4 COMPANY EVALUATION MATRIX

13.4.1 STARS

13.4.2 EMERGING LEADERS

13.4.3 PERVASIVE PLAYERS

13.4.4 PARTICIPANTS

FIGURE 20 MNM VENDOR DIVE COMPARISON MATRIX: BLOOD CULTURE TESTS MARKET

14 COMPANY PROFILES (Page No. - 153)

(Business overview, Products offered, Recent developments, MNM view)*

14.1 BECTON, DICKINSON AND COMPANY

FIGURE 21 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2019)

14.2 BIOMÉRIEUX SA

FIGURE 22 BIOMÉRIEUX SA: COMPANY SNAPSHOT (2019)

14.3 THERMO FISHER SCIENTIFIC, INC.

FIGURE 23 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2019)

14.4 DANAHER CORPORATION

FIGURE 24 DANAHER CORPORATION: COMPANY SNAPSHOT (2019)

14.5 LUMINEX CORPORATION

FIGURE 25 LUMINEX CORPORATION: COMPANY SNAPSHOT (2019)

14.6 BRUKER CORPORATION

FIGURE 26 BRUKER CORPORATION: COMPANY SNAPSHOT (2019)

14.7 ROCHE DIAGNOSTICS (A DIVISION OF F. HOFFMANN-LA ROCHE LTD.)

FIGURE 27 ROCHE DIAGNOSTICS: COMPANY SNAPSHOT (2019)

14.8 IRIDICA (A SUBSIDIARY OF ABBOTT LABORATORIES)

FIGURE 28 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2019)

14.9 T2 BIOSYSTEMS, INC.

FIGURE 29 T2 BIOSYSTEMS: COMPANY SNAPSHOT (2019)

14.10 BINDER GMBH

14.11 BIOBASE BIOTECH (JINAN) CO., LTD.

14.12 SCENKER BIOLOGICAL TECHNOLOGY CO., LTD

14.13 BULLDOG BIO, INC.

14.14 AXIOM LABORATORIES

14.15 HIMEDIA LABORATORIES PVT. LTD.

14.16 ANAEROBE SYSTEMS, INC.

14.17 OPGEN, INC.

14.18 MEDITECH TECHNOLOGIES INDIA PRIVATE LIMITED

14.19 CARL ZEISS AG

14.20 NIKON CORPORATION

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 182)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for blood culture tests. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter market breakdown and data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess future prospects.

Primary research was conducted to identify segmentation types; industry trends; key players; and key market dynamics such as drivers, opportunities, challenges, industry trends, and strategies adopted by key players.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the blood culture tests market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and to arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the fluoroscopy industry.

Report Objectives

- To define, describe, and measure the blood culture tests market by method, product, technology, application, end user and region

- To provide detailed information about the major factors influencing market growth (such as drivers, restraints, growth opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the blood culture tests market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa

- To strategically analyze the market structure and profile key players and their core competencies3 in the blood culture tests market

- To track and analyze competitive developments such as product launches, expansions, acquisitions, and partnerships & collaborations in the blood culture tests market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present blood culture tests market report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company (Top 3 companies)

Company Information

- Detailed analysis and profiling of additional market players (up to 3)

Market outlook for the top 10 for Blood Infection Testing Market

here is a market outlook for the top 10 players in the blood infection testing market:

- Abbott Laboratories

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche AG

- bioMérieux SA

- Bruker Corporation

- Cepheid Inc. (Danaher Corporation)

- Luminex Corporation

- T2 Biosystems Inc.

- Thermo Fisher Scientific Inc.

The global blood infection testing market is expected to grow at a significant rate in the coming years due to increasing prevalence of infectious diseases, rising demand for rapid and accurate diagnostic tests, and growing adoption of automated testing systems. The COVID-19 pandemic has also led to increased awareness and demand for blood infection testing, as sepsis is a potential complication of COVID-19.

The market for blood infection testing is expected to be driven by the increasing adoption of molecular diagnostic tests, which offer high sensitivity and specificity for the detection of infectious agents. Other factors driving market growth include the increasing adoption of point-of-care testing (POCT) devices, which offer fast and accurate diagnosis of infectious diseases, and the development of novel biomarkers and technologies for the detection of blood infections.

However, the market for blood infection testing also faces several challenges, including the high cost of diagnostic tests and the lack of awareness and access to testing in developing countries. In addition, there is a growing concern about antimicrobial resistance, which is leading to the development of new diagnostic tests and treatments for infectious diseases.

Overall, the top 10 players in the blood infection testing market are expected to continue to dominate the market due to their strong market presence, extensive product portfolio, and research and development capabilities. The market outlook for the blood infection testing market is positive, with significant growth potential in the coming years, driven by increasing prevalence of infectious diseases, rising demand for rapid and accurate diagnostic tests, and growing adoption of automated testing systems.

Growth drivers for Blood Infection Testing Market from macro to micro

Macro-level drivers:

- Increasing prevalence of infectious diseases: The rising incidence of infectious diseases is driving demand for rapid and accurate blood infection testing to diagnose and manage infections in a timely manner.

- Aging population: The aging population is more susceptible to infections and is driving demand for blood infection testing as the elderly population grows.

- Technological advancements: The development of novel technologies for the detection of blood infections, such as molecular diagnostics and point-of-care testing (POCT), is driving demand for blood infection testing.

- Government initiatives: Governments around the world are investing in healthcare infrastructure and promoting public health programs, which is driving demand for blood infection testing.

Micro-level drivers:

- Increasing demand for automated testing systems: Automated testing systems are gaining popularity due to their ability to offer faster and more accurate diagnosis of blood infections.

- Rising demand for molecular diagnostic tests: Molecular diagnostic tests offer high sensitivity and specificity for the detection of infectious agents, which is driving demand for blood infection testing.

- Growing adoption of point-of-care testing (POCT) devices: POCT devices offer fast and accurate diagnosis of infectious diseases and are gaining popularity due to their ease of use and ability to deliver results at the point of care.

- Development of novel biomarkers and technologies for the detection of blood infections: Advances in biomarker discovery and technology development are driving the development of new diagnostic tests for blood infections, which is driving demand for blood infection testing.

Hypothetic challenges of Blood Infection Testing Market in future

Competition from alternative diagnostic methods: As new diagnostic technologies are developed, blood infection testing may face competition from alternative diagnostic methods, such as biomarker-based tests or imaging-based tests.

Stringent regulatory requirements: Regulatory requirements for approval of new blood infection testing products are becoming increasingly stringent, which may slow down the introduction of new products into the market.

High cost of diagnostic tests: The high cost of diagnostic tests for blood infections may limit their adoption, particularly in resource-limited settings.

Lack of awareness and access to testing in developing countries: Lack of awareness and access to blood infection testing in developing countries may limit the growth potential of the market in these regions.

Emergence of new infectious diseases: The emergence of new infectious diseases that require novel diagnostic approaches may pose a challenge to the blood infection testing market.

Antibiotic resistance: Antibiotic resistance is a growing concern and may require the development of new diagnostic tests and treatments for infectious diseases.

Privacy and data security concerns: As more diagnostic tests are performed electronically and transmitted digitally, privacy and data security concerns may arise, potentially limiting adoption of blood infection testing.

Future use cases of Blood Infection Testing Market along with commentary of adaption, market potential, risk

Point-of-care testing (POCT): The use of POCT devices for blood infection testing is gaining popularity due to their ability to deliver rapid results at the point of care. These devices are particularly useful in settings where immediate diagnosis and treatment is critical, such as emergency departments and intensive care units. The market potential for POCT devices is significant, particularly as the trend toward decentralization of healthcare continues. However, the adoption of POCT devices may be limited by the high cost of equipment and the need for trained personnel to operate and maintain them.

Molecular diagnostics: Molecular diagnostic tests, such as PCR and next-generation sequencing (NGS), are becoming increasingly important in the diagnosis of blood infections. These tests offer high sensitivity and specificity, and can detect a wide range of infectious agents. The market potential for molecular diagnostics is significant, particularly as the technology continues to improve and become more affordable. However, the adoption of molecular diagnostics may be limited by the need for specialized equipment and trained personnel, as well as the high cost of testing.

Antibiotic resistance testing: Antibiotic resistance is a growing concern, and there is a need for rapid and accurate tests to guide antibiotic therapy. The market potential for antibiotic resistance testing is significant, particularly as the trend toward personalized medicine continues. However, the adoption of antibiotic resistance testing may be limited by the lack of standardization in testing methodologies and the high cost of testing.

Home testing: There is a growing trend toward home testing for various health conditions, and this trend may extend to blood infection testing in the future. Home testing kits for blood infections could offer convenience and ease of use, particularly for patients who are at high risk for infections or who live in remote areas. The market potential for home testing kits is significant, particularly as the trend toward patient-centered care continues. However, the adoption of home testing kits may be limited by the need for trained personnel to interpret test results and provide appropriate treatment.

Industry impact of Blood Infection Testing Market

Healthcare: The healthcare industry is the primary beneficiary of blood infection testing, as accurate and timely diagnosis is critical in the treatment of infectious diseases. The adoption of new blood infection testing technologies and methodologies will have a significant impact on the healthcare industry, improving patient outcomes and reducing healthcare costs.

Pharmaceutical: The pharmaceutical industry will also be impacted by the blood infection testing market, as accurate diagnosis is essential in the development of new antibiotics and other antimicrobial therapies. The ability to rapidly identify antibiotic-resistant infections will help pharmaceutical companies develop new drugs that can combat these infections.

Biotechnology: The biotechnology industry is also poised to benefit from the blood infection testing market, as the development of new testing technologies and methodologies requires significant investment in research and development. Biotechnology companies that specialize in infectious disease diagnostics and therapeutics will be at the forefront of this industry.

Research: The blood infection testing market will also impact the research industry, as accurate diagnosis is critical in the study of infectious diseases. The ability to rapidly and accurately identify infectious agents will help researchers better understand the epidemiology of these diseases, develop new therapies, and improve public health.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Blood Culture Tests Market