Brushless DC Motor Market by Type (Inner Rotor and Outer Rotor), End-User (Consumer Electronics, Automotive, Manufacturing, Medical Devices, and Others ), Rated Output Power ( Up to 350W, 351-750W, 751-1,000W), Speed, and Region - Global Forecast to 2025

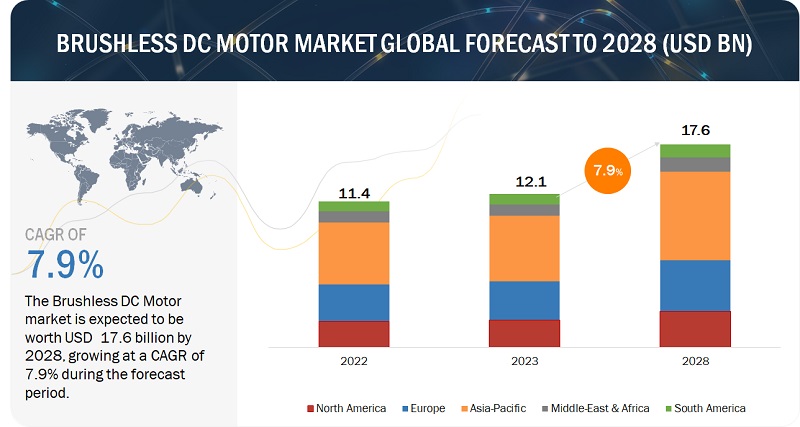

[181 Pages Report] The global brushless DC Motor market size is projected to reach a size of USD 15.2 billion by 2025, at a CAGR of 9.5%, from an estimated USD 9.6 billion in 2020. Increasing industrial applications of these motors and surging adoption of brushless DC motors in HVAC, automotive, and consumer electronics applications are expected to be the key factors driving the brushless DC Motor market.

To know about the assumptions considered for the study, Request for Free Sample Report

Brushless DC Motor Market Dynamics

Driver: Increased Demand for HVAC systems

Heating, ventilation, and air conditioning (HVAC) systems provide thermal comfort and ensure the air quality in indoor spaces. They are one of the core building blocks of modern infrastructures, especially for large office buildings or shopping malls. Electric DC motors are widely used in HVAC systems to achieve high efficiency in airflow systems and maximize their life and power. The demand for HVAC systems is increasing in APAC, especially in China and India owing to the continuous growth in its industrial and commercial sectors. According to a report by Timetric Construction Intelligence Center (CIC), a market intelligence company, an amount of ~USD 1.08 trillion is expected to be invested in the global construction sector, especially for the development of industrial buildings during the next 4 to 5 years. India alone has projects worth USD 411.0 billion, followed by China with USD 200.0 billion planned investments, and Indonesia with USD 124.0 billion investments, by 2020 in their construction sectors.

Moreover, companies operating in the HVAC industry have started automating their sales and service processes, which allows them to cut their customer acquisition costs and keep pricing competitive. The deployment of smart technologies, such as the use of smartphone applications, helps users control lighting, ventilation, and other systems from one control point. All these factors fuel the use of brushless DC motors in HVAC applications.

Expansions of commercial spaces, development of new office premises, corporate hubs, residential buildings, and organized retail outlets, and increased income levels of the middle-class population of countries of Southeast Asia and the Middle East make HVAC equipment highly accessible to a large number of consumers. The gradual growth of the housing sector in the US and Western Europe is also expected to propel the demand for HVAC equipment, such as vacuum contactors. According to the US Department of Energy, the country is expecting 10% more demand for HVAC equipment by 2020 than 2019. Thus, this increased demand for HVAC systems is expected to lead to rise in demand for brushless DC motors, thereby fueling the growth of the market.

Restraint: High Cost of brushless DC motors and requirement of controllers in them

Brushless DC motors are costlier than other types of motors as they require electric controllers to ensure their smooth operations. These motors have been designed for use in applications wherein they are to replace brushed DC motors, which are inexpensive. Though brushed DC motors are cheap, their brushes wear out from rubbing against the contact point and axles, thus impeding their performance. Thus, the high costs of brushless DC motors and the requirement of controllers in them act as a restraint for the growth of the market.

Opportunity: Transition of global automotive industry toward electric vehicles

The global automotive industry is transitioning toward electric mobility with significant changes in electric vehicle technology. Advancements in battery technologies for lowering costs of batteries and improving their charging speed, as well as increasing government support in the form of tax redemptions and incentives to promote eco-friendly electrical vehicles that use brushless DC motors, are acting as opportunities for the growth of the market. According to IEA, China is expected to account for a share of 50% of the global passenger electrical vehicles by 2025. Moreover, the proactive measures taken in Europe for the decarbonization of society are also leading to the increased adoption of electrical vehicles that use brushless DC motors.

Brushless DC motors are 80 to 90% more efficient than conventional brushed motors. As electrical vehicles are battery-powered and require energy-efficient motors to ensure less energy consumption, it is expected to act as an opportunity for the growth of the market.

Challenge: Easy availability of low-quality and inexpensive brushless DC motors

The brushless DC motor market is highly fragmented with a large number of local and international players operating in it. The product quality is a primary parameter for differentiation in this market. The organized sector in the market mainly targets industrial buyers and maintains excellent product quality, while the unorganized sector of the market offers low-cost alternatives to tap the potential of the local markets. Local manufacturers of brushless DC motors in most of the countries target the unorganized sector and compete strongly with the global suppliers in the respective markets. Leading market players are currently exposed to intense competition from such unorganized new entrants in the market, supplying inexpensive and low-quality brushless DC motors. This acts as a key challenge for the growth of the market.

Market Interconnection

To know about the assumptions considered for the study, download the pdf brochure

By type, the inner rotor segment is the largest contributor in the brushless DC motor market during the forecast period.

In inner rotor type motors, rotors are positioned at the center of motors and are surrounded by stator winding. Since rotors are located in the middle, rotor magnets prevent heat insulation from penetrating inside, and as such, the heat gets dissipated easily. This leads to the production of a large amount of torque by inner rotor brushless DC motors. These motors are used in manufacturing, automotive, and consumer electronics industries for robotics, CNC machine, automatic door opener, and metal cutting and forming machine applications. These applications require motors that can carry out the fast acceleration and deceleration of speed, offer high starting torque, have reversible action capability, and are compact. According to the IEA, EV Outlook 2020, the global sales of electric cars reached 2 million in 2019, that was 40% higher than the car sales of 2018. This indicates the trend of increased demand for electric vehicles and their accelerated manufacturing in coming years.

By end-user, the consumer electronics segment is expected to grow at the fastest rate during the forecast period.

With the advent of Industry 4.0, the global industrial manufacturing has been undergoing significant changes. Digitalization of data, automation of machines, and connectivity among assets in manufacturing facilities are fueling the evolution of technological infrastructures. The growing competition in the consumer electronics industry is driving companies to adopt innovative technologies and analyses to ensure the optimum utilization of their resources. The automated electronics deployed in industrial manufacturing facilities require a continuous power supply for their operations. As such, they use batteries and nanomaterials. Brushless DC motors are widely used in office equipment, such as printing machines, electric curtains, fax machines, and copiers, and also in high-end home appliances, such as vacuum cleaners, DVD players, and air purifiers. They are also gaining traction in commercial, as well as domestic refrigeration and air conditioning appliances. Outer rotor brushless DC motors are mainly used in cooling fans in computers and servers, while spindle motors are used in hard disk drives. These consumer electronics require electric motors for converting electrical energy into mechanical energy.

By speed, the 2001-10,000 RPM segment is expected to be the largest contributor during the forecast period.

Brushless DC motors with speed ranging from 2,001 to 10,000 RPM are widely used in medical equipment such as gas analyzer membrane pumps, dental instruments, pumps, anesthesia ventilators, and breathing system pumps. They are also used in industrial applications such as laser scanning instruments, industrial laser bar code readers, CNC machine spindle rotors, and industrial automation actuators. These motors are also used in home appliances, traction motors, solar pump DC systems, and bus A/C systems.

Asia Pacific is expected to account for the largest market size during the forecast period.

Asia Pacifc is expected to dominate the brushless DC Motor market during the forecast period as the region is hub for manufacturing electronics components and devices corresponding to various industries. In addition, the region has also been witnessing high investments for manufacturing electric vehicle components, majorly batteries systems. The figure below shows the projected market sizes of various regions with respective CAGRs for 2025.

Key Market Players

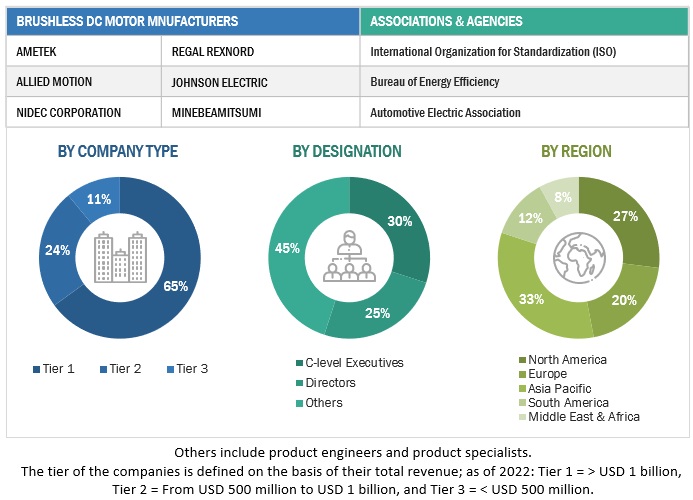

AMETEK (US), Allied Motion (US), Nidec Corporation (Japan), Johnson Electric (China), and MinebeaMitsumi (Japan) are the leading players in the brushless DC motor market. Maxon Motor (Switzerland), Regal Beloit Corporation (US), Oriental Motor (Japan), Portescap (US), and ElectroCraft(US) are other players operating in the market are the leading players in the global market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

20162025 |

|

Base year considered |

2019 |

|

Forecast period |

20202025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, End User, Speed, and Region. |

|

Geographies covered |

Asia Pacific, South America, North America, Europe, The Middle East, and Africa. |

|

Companies covered |

AMETEK (US), Allied Motion (US), Nidec Corporation (Japan), Johnson Electric (China), MinebeaMitsumi (Japan), Maxon Motor (Switzerland), Regal Beloit Corporation (US), Oriental Motor (Japan), Portescap (US), and ElectroCraft(US) (Total 24 Companies) |

This research report categorizes the brushless DC Motor market based on type, end-user, speed, and region.

Based on the type:

- Inner Rotor

- Outer Rotor

Based on the end-user:

- Consumer Electronics

- Automotive

- Manufacturing

- Medical Devices

- Others (including HVAC, agricultural, solar pumps, and aerospace & defense applications)

Based on the speed:

- <500 RPM

- 501 2,000 RPM

- 2,001 10,000 RPM

- >10,000 RPM

Based on the Region:

- Asia Pacific

- Europe

- North America

- Middle East

- South America

- Africa

Recent Developments

- In November 2019, Allied Motion introduced the KinetiMaxTM high-power density (HPD) motor series. These new outer rotor brushless motors are designed for high-torque, low-cogging applications such as robotics, AGVs, and handheld power tools.

- In October 2019, Nidec Corporation acquired OMRON Automotive Electronics from OMRON Corporation. OMRON Automotive Electronics carries out research and development, manufacturing, and sales of automotive electronic products. It is known for its control equipment and electronic components equipped with sensing and control technologies. Through this acquisition, Nidec Corporation developed a new module and system products by combining motors, pumps, gears, etc. of Nidec with automotive electronics of OMRON.

- In July 2018, Dunkermotoren, a unit of AMETEK Advanced Motion Solutions, launched BG 65/BG 66 dMove servomotors as successors to its BG 65(S) servomotors with completely integrated motor electronics.

Frequently Asked Questions (FAQ):

What is the current size of the brushless DC Motor market?

The size of the global brushless DC Motor market is 24.1 billion in 2019.

What are the major drivers for the brushless DC Motor market?

The brushless DC Motor market is driven by major factors such as the new technological advancements, increased Return on Investment (ROI), and the rising need to scale up production from mature wells to optimize production.

Which region dominates during the forecasted period in the brushless DC Motor market?

Asia Pacific is projected to lead the brushless DC motor market. The market in the region is projected to grow at the highest CAGR of 11.1% from 2020 to 2025. The growth of the brushless DC motor market in Asia Pacific can be attributed to the extensive manufacturing activities leading to the increased use of brushless DC motors across the key industries of the region.

Which is the fastest-growing type segment during the forecasted period in the brushless DC Motor market?

The inner rotor segment is the fastest-growing during the forecasted period. Owing to the trend of increased demand for electric vehicles and their accelerated manufacturing in coming years. This, in turn, is expected to fuel the demand for inner rotor brushless DC motors. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION AND SCOPE

1.2.1 MARKET, BY END USER: INCLUSIONS & EXCLUSIONS

1.2.2 MARKET, BY SPEED: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

1.8.1 MARKET SIZE CHANGES

FIGURE 1 MNM SHOWS DIP IN GROWTH OF MARKET FROM 2019 TO 2020

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 SCOPE

FIGURE 3 KEY METRICS CONSIDERED FOR ASSESSING DEMAND FOR BRUSHLESS DC MOTORS

2.3 MARKET SIZE ESTIMATION

2.3.1 DEMAND-SIDE ANALYSIS

2.3.1.1 Calculations

2.3.1.2 Assumptions

2.3.2 SUPPLY-SIDE ANALYSIS

FIGURE 4 SUPPLY-SIDE ANALYSIS

2.3.2.1 Calculations

FIGURE 5 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF BRUSHLESS DC MOTORS

2.3.2.2 Assumptions

FIGURE 6 COMPANY REVENUE ANALYSIS, 2019

2.3.3 FORECAST

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.5 PRIMARY INSIGHTS

FIGURE 8 POINT OF VIEW OF KEY SERVICE PROVIDERS

3 EXECUTIVE SUMMARY (Page No. - 39)

3.1 SCENARIO ANALYSIS

FIGURE 9 SCENARIO ANALYSIS: MARKET, 20182025

3.1.1 OPTIMISTIC SCENARIO

3.1.2 REALISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

TABLE 1 MARKET SNAPSHOT

FIGURE 10 ASIA PACIFIC HELD LARGEST SHARE OF MARKET IN 2019

FIGURE 11 INNER ROTOR SEGMENT TO ACCOUNT FOR LARGE SHARE OF MARKET IN 2020

FIGURE 12 2,00110,000 RPM SEGMENT TO LEAD MARKET FROM 2020 TO 2025

FIGURE 13 CONSUMER ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 14 INCREASED GLOBAL DEMAND FOR BRUSHLESS DC MOTORS FOR USE IN VARIOUS APPLICATIONS FUELING MARKET GROWTH

4.2 BRUSHLESS DC MOTORS MARKET, BY TYPE

FIGURE 15 INNER ROTOR SEGMENT OF MARKET TO GROW AT HIGH CAGR FROM 2020 TO 2025

4.3 BRUSHLESS DC MOTORS MARKET, BY SPEED

FIGURE 16 2,00110,000 RPM SEGMENT OF MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

4.4 BRUSHLESS DC MOTORS MARKET, BY END USER

FIGURE 17 AUTOMOTIVE SEGMENT OF MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

4.5 MARKET, BY REGION

FIGURE 18 MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

4.6 MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY

FIGURE 19 CONSUMER ELECTRONICS SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES OF MARKET IN ASIA PACIFIC IN 2019

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 20 GLOBAL PROPAGATION OF COVID-19

FIGURE 21 PROPAGATION OF COVID-19 IN SELECT COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 22 RECOVERY ROAD FOR 2020

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 24 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Increased demand for HVAC systems

5.5.1.2 Low maintenance costs of brushless DC motors

5.5.1.3 Surged adoption of energy-efficient brushless DC motors across the world

5.5.2 RESTRAINTS

5.5.2.1 High costs of brushless DC motors and requirement of controllers in them

5.5.3 OPPORTUNITIES

5.5.3.1 Transition of global automotive industry toward electric vehicles

5.5.4 CHALLENGES

5.5.4.1 Easy availability of low-quality and inexpensive brushless DC motors

5.6 VALUE CHAIN ANALYSIS

FIGURE 25 BRUSHLESS DC MOTOR VALUE CHAIN

5.6.1 RAW MATERIAL PROVIDERS

5.6.2 ORIGINAL EQUIPMENT MANUFACTURERS

5.6.3 ASSEMBLERS/MANUFACTURERS

5.6.4 DISTRIBUTORS

5.6.5 END USERS

6 SCENARIO ANALYSIS (Page No. - 59)

6.1 SCENARIO ANALYSIS

FIGURE 26 CRITERIA IMPACTING GLOBAL ECONOMY

6.1.1 OPTIMISTIC SCENARIO

TABLE 2 OPTIMISTIC SCENARIO: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

6.1.2 REALISTIC SCENARIO

TABLE 3 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

6.1.3 PESSIMISTIC SCENARIO

TABLE 4 PESSIMISTIC SCENARIO: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

7 MARKET, BY TYPE (Page No. - 63)

7.1 INTRODUCTION

FIGURE 27 INNER ROTOR SEGMENT TO LEAD MARKET FROM 2020 TO 2025

TABLE 5 MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

7.2 INNER ROTOR

7.2.1 INCREASING MANUFACTURING OF ELECTRICAL VEHICLES TO FUEL DEMAND FOR INNER ROTOR BRUSHLESS DC MOTORS

TABLE 6 INNER ROTOR: MARKET, BY REGION, 20182025 (USD MILLION)

7.3 OUTER ROTOR

7.3.1 SURGING DEMAND FOR OUTER ROTOR BRUSHLESS DC MOTORS FROM LOW-CURRENT CONSUMPTION DEVICES

TABLE 7 OUTER ROTOR: MARKET, BY REGION, 20182025 (USD MILLION)

8 MARKET, BY SPEED (Page No. - 67)

8.1 INTRODUCTION

FIGURE 28 2,00110,000 RPM SEGMENT PROJECTED TO LEAD MARKET FROM 2020 TO 2025

TABLE 8 MARKET SIZE, BY SPEED, 20182025 (USD MILLION)

8.2 <500 RPM

8.2.1 HIGH DEMAND FOR LOW-SPEED BRUSHLESS DC MOTORS FROM ROBOTICS APPLICATIONS

TABLE 9 <500 RPM: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

8.3 5012,000 RPM

8.3.1 INCREASED USE OF 5012,000 RPM SPEED BRUSHLESS DC MOTORS IN HVAC APPLICATIONS

TABLE 10 5012,000 RPM: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

8.4 2,00110,000 RPM

8.4.1 SURGED DEMAND FOR 2,00110,000 RPM BRUSHLESS DC MOTORS IN MEDICAL EQUIPMENT

TABLE 11 2,00110,000 RPM: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

8.5 >10,000 RPM

8.5.1 INCREASED ADOPTION OF 10,000 RPM BRUSHLESS DC MOTORS IN ARMS AND AIRCRAFT MANUFACTURING FACILITIES

TABLE 12 >10,000 RPM: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9 MARKET, BY END USER (Page No. - 73)

9.1 INTRODUCTION

FIGURE 29 CONSUMER ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FROM 2020 TO 2025

TABLE 13 MARKET SIZE, BY END USER, 20182025 (USD MILLION)

9.2 CONSUMER ELECTRONICS

9.2.1 INCREASING POPULARITY OF MINIATURIZED BRUSHLESS DC MOTORS IN HIGH-END CONSUMER ELECTRONICS

TABLE 14 CONSUMER ELECTRONICS: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.3 AUTOMOTIVE

9.3.1 GROWING ADOPTION OF BRUSHLESS DC MOTORS IN AUTOMOBILES TO REPLACE HYDRAULIC SYSTEMS

TABLE 15 AUTOMOTIVE: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.4 MANUFACTURING

9.4.1 RISING USE OF BRUSHLESS DC MOTORS IN MANUFACTURING INDUSTRY TO REPLACE CONVENTIONAL DC MOTORS

TABLE 16 MANUFACTURING: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.5 MEDICAL DEVICES

9.5.1 GROWING INCORPORATION OF BRUSHLESS DC MOTORS IN MEDICAL DEVICES OWING TO THEIR HIGH RELIABILITY

TABLE 17 MEDICAL DEVICES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.6 OTHERS

TABLE 18 OTHERS: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

10 MARKET, BY REGION (Page No. - 80)

10.1 INTRODUCTION

FIGURE 30 REGIONAL SNAPSHOT: MARKET

FIGURE 31 MARKET SIZE, BY REGION, 20202025 (USD MILLION)

TABLE 19 MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 20 MARKET SIZE, BY REGION, 20182025 (MILLION UNITS)

10.2 IMPACT OF COVID-19 ON MARKET

TABLE 21 COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS OF BRUSHLESS DC MOTOR SIZE, 20182025 (USD MILLION)

FIGURE 32 MARKET: COVID-19 IMPACT

10.3 NORTH AMERICA

FIGURE 33 NORTH AMERICA: BRUSHLESS DC MOTORS MARKET SNAPSHOT

TABLE 22 NORTH AMERICA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 23 NORTH AMERICA: MARKET SIZE, BY SPEED, 20182025 (USD MILLION)

TABLE 24 NORTH AMERICA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 25 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

10.3.1 IMPACT OF COVID-19 ON NORTH AMERICA

TABLE 26 NORTH AMERICA: COMPARISON OF PRE-AND POST-COVID-19 SCENARIOS OF BRUSHLESS DC MOTOR SIZE, 2018-2025 (MILLION)

FIGURE 34 NORTH AMERICA: COVID-19 IMPACT ON MARKET, 20182025 (USD MILLION)

10.3.2 US

10.3.2.1 Ongoing investments for developing new and advanced manufacturing technologies to fuel demand for brushless DC motors in US

TABLE 27 US: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 28 US: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.3.3 CANADA

10.3.3.1 Flourishing automotive industry in Canada to contribute to demand for brushless DC motors in country

TABLE 29 CANADA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 30 CANADA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.3.4 MEXICO

10.3.4.1 Increasing automobile production in Mexico to drive demand for brushless DC motors in country

TABLE 31 MEXICO: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 32 MEXICO: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.4 EUROPE

TABLE 33 EUROPE: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 34 EUROPE: MARKET SIZE, BY SPEED, 20182025 (USD MILLION)

TABLE 35 EUROPE: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 36 EUROPE: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

10.4.1 IMPACT OF COVID-19 ON EUROPE

TABLE 37 EUROPE: COMPARISON OF PRE-AND POST-COVID-19 SCENARIOS OF BRUSHLESS DC MOTOR SIZE, 2018-2025 (MILLION)

FIGURE 35 EUROPE: COVID-19 IMPACT ON MARKET, 20182025 (USD MILLION)

10.4.2 UK

10.4.2.1 Surging sales of vehicles and flourishing aerospace & defense industry in UK to drive growth of market in country

TABLE 38 UK: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 39 UK: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.4.3 GERMANY

10.4.3.1 Increasing medical equipment and electrical vehicle production in Germany to fuel demand for brushless DC motors in country

TABLE 40 GERMANY: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 41 GERMANY: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.4.4 ITALY

10.4.4.1 Rising demand for medical equipment manufacturing and consumer electronic testing leading to growth of market in Italy

TABLE 42 ITALY: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 43 ITALY: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.4.5 RUSSIA

10.4.5.1 Ongoing modernization of manufacturing sector in Russia to contribute to growth of brushless DC motor in country

TABLE 44 RUSSIA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 45 RUSSIA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.4.6 REST OF EUROPE

TABLE 46 REST OF EUROPE: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 47 REST OF EUROPE: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.5 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 48 ASIA PACIFIC: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 49 ASIA PACIFIC: MARKET SIZE, BY SPEED, 20182025 (USD MILLION)

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 51 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

10.5.1 IMPACT OF COVID-19 ON ASIA PACIFIC

TABLE 52 ASIA PACIFIC: COMPARISON OF PRE-AND POST-COVID-19 SCENARIOS OF BRUSHLESS DC MOTOR SIZE, 2018-2025 (MILLION)

FIGURE 37 ASIA PACIFIC: COVID-19 IMPACT ON MARKET, 20182025 (USD MILLION)

10.5.2 CHINA

10.5.2.1 Increasing manufacturing activities in China to contribute to growth of market in country

TABLE 53 CHINA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 54 CHINA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.5.3 INDIA

10.5.3.1 Ongoing industrialization in India to drive demand for brushless DC motors in country

TABLE 55 INDIA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 56 INDIA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.5.4 AUSTRALIA

10.5.4.1 Ongoing transition of automotive industry of Australia toward automation leading to growth of market in country

TABLE 57 AUSTRALIA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 58 AUSTRALIA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.5.5 JAPAN

10.5.5.1 Growing focus on technologically-advanced industrial equipment and manufacturing processes to contribute to demand for brushless DC motors in Japan

TABLE 59 JAPAN: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 60 JAPAN: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.5.6 SOUTH KOREA

10.5.6.1 Increasing electronic and automobile manufacturing in South Korea to drive growth of market in country

TABLE 61 SOUTH KOREA: BRUSHLESS DC MOTORS MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 62 SOUTH KOREA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.5.7 TAIWAN

10.5.7.1 Growing aviation industry in Taiwan to contribute to increased demand for brushless DC motors in country

TABLE 63 TAIWAN: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 64 TAIWAN: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.5.8 REST OF ASIA PACIFIC

TABLE 65 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 66 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.6 SOUTH AMERICA

TABLE 67 SOUTH AMERICA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 68 SOUTH AMERICA: MARKET SIZE, BY SPEED, 20182025 (USD MILLION)

TABLE 69 SOUTH AMERICA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 70 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

10.6.1 IMPACT OF COVID-19 ON SOUTH AMERICA

TABLE 71 SOUTH AMERICA: COMPARISON OF PRE-AND POST-COVID-19 SCENARIOS OF BRUSHLESS DC MOTOR SIZE, 2018-2025 (MILLION)

FIGURE 38 SOUTH AMERICA: COVID-19 IMPACT ON MARKET, 20182025 (USD MILLION)

10.6.2 BRAZIL

10.6.2.1 Flourishing automotive industry in Brazil fueling demand for brushless DC motors in country

TABLE 72 BRAZIL: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 73 BRAZIL: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.6.3 ARGENTINA

10.6.3.1 Rising demand for brushless DC motors from consumer electronics industry of Argentina to fuel market growth in country

TABLE 74 ARGENTINA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 75 ARGENTINA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.6.4 REST OF SOUTH AMERICA

TABLE 76 REST OF SOUTH AMERICA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 77 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.7 MIDDLE EAST

TABLE 78 MIDDLE EAST: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 79 MIDDLE EAST: MARKET SIZE, BY SPEED, 20182025 (USD MILLION)

TABLE 80 MIDDLE EAST: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 81 MIDDLE EAST: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

10.7.1 IMPACT OF COVID-19 ON MIDDLE EAST

TABLE 82 MIDDLE EAST: COMPARISON OF PRE-AND POST-COVID-19 SCENARIOS OF BRUSHLESS DC MOTOR SIZE, 2018-2025 (MILLION)

FIGURE 39 MIDDLE EAST: COVID-19 IMPACT ON BRUSHLESS DC MOTORS MARKET, 20182025 (USD MILLION)

10.7.2 SAUDI ARABIA

10.7.2.1 Increasing automotive production to drive growth of market in Saudi Arabia

TABLE 83 SAUDI ARABIA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 84 SAUDI ARABIA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.7.3 UAE

10.7.3.1 Growing share of automobile sector in economy of UAE driving demand for brushless DC motors in country

TABLE 85 UAE: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 86 UAE: BRUSHLESS MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.7.4 IRAN

10.7.4.1 Surging use of locally manufactured diesel engines in automobiles to contribute to growth of market in Iran

TABLE 87 IRAN: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 88 IRAN: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.7.5 REST OF MIDDLE EAST

TABLE 89 REST OF MIDDLE EAST: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 90 REST OF MIDDLE EAST: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.8 AFRICA

TABLE 91 AFRICA: BRUSHLESS DC MOTORS MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 92 AFRICA: MARKET SIZE, BY SPEED, 20182025 (USD MILLION)

TABLE 93 AFRICA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 94 AFRICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

10.8.1 IMPACT OF COVID-19 ON AFRICA

TABLE 95 AFRICA: COMPARISON OF PRE-AND POST-COVID-19 SCENARIOS OF BRUSHLESS DC MOTOR SIZE, 2018-2025 (MILLION)

FIGURE 40 AFRICA: COVID-19 IMPACT ON MARKET, 20182025 (USD MILLION)

10.8.2 SOUTH AFRICA

10.8.2.1 Increasing investments to boost industrial manufacturing in South Africa to contribute to demand for brushless DC motors in country

TABLE 96 SOUTH AFRICA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 97 SOUTH AFRICA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.8.3 EGYPT

10.8.3.1 Rising investments for industrial growth in Egypt leading to growth of market in country

TABLE 98 EGYPT: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 99 EGYPT: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

10.8.4 REST OF AFRICA

TABLE 100 REST OF AFRICA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 101 REST OF AFRICA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 131)

11.1 OVERVIEW

FIGURE 41 KEY DEVELOPMENTS IN BRUSHLESS DC MOTORS MARKET FROM JANUARY 2016 TO JUNE 2020

11.2 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

FIGURE 42 REVENUE ANALYSIS, 2019

11.3 MARKET EVALUATION FRAMEWORK

TABLE 102 MARKET EVALUATION FRAMEWORK

11.4 KEY MARKET DEVELOPMENTS

11.4.1 NEW PRODUCT LAUNCHES

11.4.2 INVESTMENTS & EXPANSIONS

11.4.3 CONTRACTS & AGREEMENTS

11.4.4 MERGERS & ACQUISITIONS

12 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 137)

12.1 COMPANY EVALUATION MATRIX DEFINITION AND METHODOLOGY

12.1.1 STAR

12.1.2 INNOVATORS

12.1.3 PERVASIVE

12.1.4 EMERGING COMPANIES

FIGURE 43 BRUSHLESS DC MOTORS MARKET COMPANY EVALUATION MATRIX

12.2 COMPANY PROFILES

(Business overview, Products offered, Recent Developments, SWOT analysis, Right to win)*

12.2.1 AMETEK

FIGURE 44 AMETEK: COMPANY SNAPSHOT

FIGURE 45 AMETEK: SWOT ANALYSIS

12.2.2 ALLIED MOTION

FIGURE 46 ALLIED MOTION: COMPANY SNAPSHOT

FIGURE 47 ALLIED MOTION: SWOT ANALYSIS

12.2.3 NIDEC CORPORATION

FIGURE 48 NIDEC CORPORATION: COMPANY SNAPSHOT

FIGURE 49 NIDEC CORPORATION: SWOT ANALYSIS

12.2.4 MINEBEAMITSUMI

FIGURE 50 MINEBEAMITSUMI: COMPANY SNAPSHOT

FIGURE 51 MINEBEAMITSUMI: SWOT ANALYSIS

12.2.5 JOHNSON ELECTRIC

FIGURE 52 JOHNSON ELECTRIC: COMPANY SNAPSHOT

FIGURE 53 JOHNSON ELECTRIC: SWOT ANALYSIS

12.2.6 REGAL BELOIT CORPORATION

FIGURE 54 REGAL BELOIT CORPORATION: COMPANY SNAPSHOT

12.2.7 ELECTROCRAFT

12.2.8 MAXON MOTOR

12.2.9 ORIENTAL MOTOR

12.2.10 PORTESCAP

12.2.11 ARC SYSTEMS

12.2.12 BUHLER MOTOR

12.2.13 ANAHEIM AUTOMATION

12.2.14 LINIX MOTOR

12.2.15 MOONS INDUSTRIES

12.2.16 TECO ELECTRIC

12.2.17 SHENZHEN FUNTAIN MOTOR

12.2.18 JIANGSU WHEATSTONE ELECTRICAL TECHNOLOGY

12.2.19 ASSUN MOTOR

12.2.20 3X MOTION TECHNOLOGIES

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, Right to win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 174)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

This study involved four major activities in estimating the current market size for brushless DC Motor. Exhaustive secondary research was done to collect information on the market and the peer market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The brushless DC Motor market comprises several stakeholders, such as service providers, contractors, and third-party vendors. The demand side of this market is characterized by the huge demand for digitalization from operators/service providers. Advancements in new technology in consumer electronics on the demand side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as following

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Automotive Brushless DC Motor Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global market by type, speed, end user, and region

- To provide detailed information on the major factors influencing the growth of the digital oil field market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze the impact of COVID-19 on the market for the estimation of the market size

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the market with respect to the major regions (Asia Pacific, Europe, North America, South America, the Middle East, and Africa)

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments such as contracts & agreements, expansions, new product developments, mergers & acquisitions, and partnerships in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Brushless DC Motor Market