Building Automation System Market Size, Share & Industry Growth Analysis Report by Offering (Facility Management Systems, Security & Access Controls, Fire Protection Systems, BEM Software, BAS Services), Communication Technology (Wireless, Wired), Application and Region - Global Growth Driver and Industry Forecast to 2027

Updated on : April 05, 2023

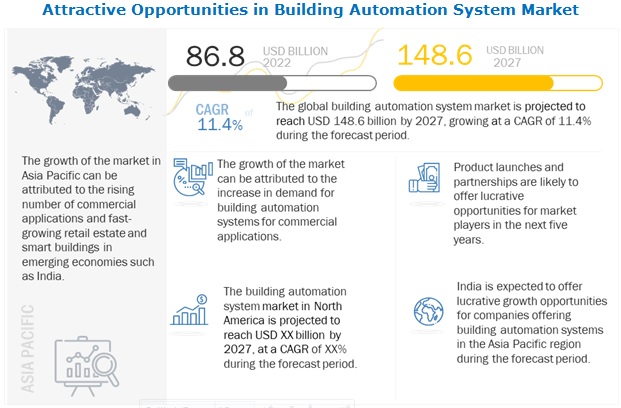

The global building automation system market size was valued at USD 86.8 billion in 2022 and it is projected to reach USD 148,600 million by 2027, growing at a compound annual growth rate (CAGR) of 11.4% during the forecast period.

Building automation is an easy way of controlling and monitoring systems installed in buildings. These systems include facility management systems, security and access controls, and fire and life safety alarms. Building automation helps reduce energy consumption in buildings, enhances the comfort level of occupants, and manages building operations effectively.

The growth of the building automation system industry is fueled by the increasing requirement for energy-efficient facilities with enhanced security systems. Besides this, advancements in wireless communication technologies have reduced the complexity and the cost of installing building automation systems in the existing buildings.

The combination of IoT and building automation has also enabled the exchange of information among several electronic devices and the cloud without the need for direct human intervention that makes buildings smart. This factor has also accelerated the growth of the building automation system market. However, the key restraints faced by the companies operating in this market include the false notion about the high installation costs of building automation systems and technical difficulties in their deployment.

The increasing global concerns for energy conservation and the rising energy costs are fueling the demand for building automation systems for making buildings energy efficient. This is one of the key factors driving the growth of the building automation system market.

The surging demand for building automation systems for use in commercial applications can be attributed to the ability of these systems to reduce the operating costs of buildings. The easy maintenance of temperature and lighting levels, along with enhanced security levels offered by building automation systems, fuel market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on building automation system market

The outbreak of the COVID-19 pandemic led to the closure or partial shutdown of factories, warehouses, businesses, and institutes globally. This was complemented by implementing other lockdown measures, including strict social distancing norms, restricted travel, and limited entry to warehouses, industries, and electronic businesses.

Globally, most of the industries witnessed disruptions in supply chain operations and logistics in related services. The building automation system market is prominently dependent upon real estate activities. The real estate market in various countries in North America, Asia Pacific, and Europe took a big hit due to lockdowns, material shortages, as well as government reforms. The real sector in the US, UK, Germany, China, Japan and India has been impacted significantly by the pandemic. This has affected the growth of the building automation system market as these geographies are the largest consumers of building automation systems.

Various construction-related segments, including architecture and design, equipment and material manufacture, transportation, and energy and waste management, which require building automation systems for construction purposes in some geographies, were impacted. In some countries, construction activities were deemed essential with timely construction of emergency facilities and hospitals, for example, was crucial in China and Italy. In other countries, containment measures involved total or partial shutdowns of construction sites. In South Africa, the maintenance of the country’s national roads was declared an essential service in Eritrea. The construction sector, along with other major sectors deemed essential, was exempt from national lockdowns.

Where construction sites had been shut down, they were among the first to re-open in the early phases of reactivation plans after the first wave, such as in Austria, Barbados, and the Russian Federation. Construction investors have been exposed to the impacts of the COVID-19 outbreak as delays in completion dates of construction projects may jeopardize project profitability. Due to these disruptions, many contractors in the UK, India, the US, Germany, as well as South Africa, have had to activate specific contractual provisions giving entitlements to additional time and financial resources.

Building Automation System Market Dynamics:

Driver: Heightened focus on developing energy-efficient and eco-friendly buildings

The building sector is one of the largest energy-consuming sectors and usually accounts for more than one-third of the total energy consumption worldwide. It is an equally important source of carbon dioxide (CO2) emissions.

According to the International Energy Agency (IEA), energy use in buildings represents as much as 80% of the total energy use across specific regions that are highly dependent on traditional biomass. The number of electrical systems used in buildings is rising, which increases energy consumption, as well as CO2 emissions. Hence, the sustainable and efficient use of energy is crucial.

The demand for building automation systems is increasing with the growing focus on the reduction of energy consumption and maintenance costs of buildings. Building automation systems play an important role in optimizing energy usage and reducing energy costs. HVAC and lighting control systems consume maximum energy. According to the IEA, currently, air heating and cooling, together with water heating, account for ~60% of the global energy consumption in buildings. Therefore, they represent a major opportunity to reduce the energy consumption of buildings. Building automation systems also help automate HVAC and lighting systems, saving 5–30% of the overall energy consumption of a building. Moreover, building automation systems assist in reducing the overall building maintenance cost by providing building operators with early diagnosis of operational issues in equipment, if any. This helps prevent losses and inconvenience due to unexpected breakdowns.

Restraint: False notion about high installation costs of building automation systems

Building automation systems help in saving energy and reducing operating and maintenance costs. However, end users and building owners are reluctant to these systems due to their false perception that the installation costs of these systems are high.

They are unaware of the fact that the cost is primarily dependent on the complexity of integration pertaining to a specific application. End users demand affordable building automation systems but fail to realize the extent of the energy savings and the associated benefits of long-term cost savings. On an average, lighting accounts for about 25% of a building’s energy usage. With lighting control systems, the lighting cost can be reduced by 30–60% while enhancing lighting quality and reducing environmental impact. Besides this, the initial investment in building automation and control systems can be easily recovered in a few years as it helps reduce energy costs, maintenance costs, and repair and replacement costs.

The perception of the high cost of building automation systems and the lack of awareness about their benefits in terms of long-term cost savings can hinder the adoption and growth of the building automation system market globally.

Opportunity: Rise in government and stakeholder funding for developing smart cities

Nowadays, cities need innovative solutions to overcome long-term challenges such as controlling traffic flows, managing waste, meeting energy-efficiency targets, controlling security breaches, and managing city surveillance owing to rapid urbanization.

Governments in developing economies, including China and India, are focusing on developing smart cities through huge government and stakeholder funding to curb the long-term challenges arising from growing urbanization. With increasing threats from terrorism, both international and domestic, public-concentrated areas, including government offices, buildings, schools, and prisons, are exposed to security threats. Thus, governments across the world, especially in developing countries, are concentrating on investing in video surveillance, access control, and fire protection systems for building automation projects in smart cities.

Challenge: Absence of standard communication protocols

The power of building automation systems lies in synchronization and communication among various equipment used in the overall system. Communication protocols play a vital role in ensuring the proper integration of various devices and equipment for the smooth functioning of BAS.

However, the lack of common open communication protocols may lead to the use of different protocols by these devices. It restricts the communication between different devices and obstructs the effortless functioning of building automation systems as all protocols may not be directly compatible with each other. For instance, BACnet and LonWorks do not work well with each other but work well with DALI. The building operator needs to select the products based on protocols that are used by several different vendors to avoid complexities. For instance, Clipsal C-Bus is the commonly used building automation system in Australia, while M-Bus is popular in Europe.

Manufacturers are looking forward to having proprietary protocols and standards to gain a competitive advantage in the marketplace. This intense competition in the market is leading to the lack of development of products with common standards and communication protocols, thereby hampering the growth of the building automation system market.

Building Automation System Market Segment Overview

In offering segment, the security & access controls segment is expected to hold the largest market share during the forecast period

The security and access control segment is projected to contribute the largest market share during the forecast period. These systems enhance the security and safety of buildings. The requirement for increased security level, activity monitoring, and access control has led to a rise in demand for security and access controls.

The commercial applications of these systems, such as in offices, retail stores, educational buildings, and healthcare facilities, are the key contributors to the growth of the security and access controls segment of the building automation system market. The building energy management software segment is projected to grow at the highest CAGR during the forecast period.

The growth of the building automation software segment can be attributed to the ability of building automation systems to reduce energy consumption, which leads to energy and cost savings. The growth of the security and access controls segment of the building automation system market can be attributed to the significant implementation of various products such as access control and video surveillance systems in residential and commercial buildings, government offices, and financial institutions. In a number of European countries, including Germany, the UK, and France, governments are implementing security products such as access control systems and video surveillance cameras.

In communication technology segment, the wireless segment is expected to grow at higher CAGR during the forecast period

The wired technology segment accounted for a larger share of the building automation system market in 2021 than the wireless technology segment. The wireless technology segment of the market is projected to grow at a higher CAGR than the wired technology segment.

The growth of this segment can be attributed to advantages offered by wireless technology in the form of increased mobility and reduced costs of building automation systems. Moreover, it also minimizes the installation complexity for building automation systems, especially in existing buildings. This wireless medium uses different security algorithms and, hence, provide reliable network for consumers or users. They provide an extremely scalable and link-reliable medium and offer real-time capability and energy independence when deployed with energy-harvesting devices, especially when it comes to building management systems. Furthermore, wireless technology network can be used on a large scale for healthcare, surveillance, agriculture, and industrial applications. ZigBee, EnOcean, Z-Wave, and Wi-Fi are a few prominent wireless technologies used in building automation systems.

To know about the assumptions considered for the study, download the pdf brochure

The building automation system market in APAC is expected to grow at highest CAGR during the forecast period (2022-2027)

Asia Pacific is expected to lead the building automation system market from 2022 to 2027, in terms of growth rate. The increasing adoption of the Internet of Things (IoT) and leading technologies in lighting solutions in commercial buildings and the industrial sector has fueled the demand for building automation systems in the region.

Chinese & Indian cities are offering a perfect mix of cost-effective land, good infrastructure, and abundant workforce to attract investments in industrial development. Strong economic growth and increasing infrastructure and new constructions have also accelerated the adoption of building automation systems in APAC. The growth of the building automation system market in APAC can be attributed to the economic growth in the region, along with a surge in construction and industrial activities witnessed by the key countries in Asia Pacific.

The prime objective of consumers in the region is to achieve energy savings with the implementation of building automation systems that directly translate into monetary savings. Countries such as China and India have increasingly started developing smart cities. Building automation systems act as key enablers in achieving energy-saving objectives in these countries. The intensifying global concerns for energy conservation and the rising energy costs are fueling the demand for building automation systems to make buildings energy efficient. This is one of the key factors driving the growth of the building automation system market. Various benefits offered by these systems with enhanced security levels, offered by building automation systems fuel their demand in APAC. Asia Pacific houses a large portion of the global population. The consumers in this region are actively deploying building automation systems in residential and commercial areas owing to improvements in economic conditions. Moreover, increasing construction activities in China play a key role in driving the growth of the building automation system market in Asia Pacific.

Top Building Automation System Companies - Key Market Players

Some of the dominating building automation system companies are Honeywell International (US), Siemens AG (Germany), Johnson Control (US), Schneider Electric (France), Carrier (US), Robert Bosch (Germany), Legrand (France), Hubbell (US), ABB (Zurich), Trane Technologies (Ireland), Lutron Electronics (US), Creston Electronics (US), Hitachi (Japan), Delta Controls (Canada), Beckhoff Automation (Germany), Lennox International (US), General Electric (US), Distech Controls (Canada), Dialight PLC (UK), Cisco Systems (US), Rockwell Automation (US), Control4 (US), Signify (Philips Lighting) (Netherlands), Emerson Electric (US), and Leviton Manufacturing Company (US)

Building Automation System Market Growth Prospects

Due to the rising need for energy-efficient and smart building solutions, the trend towards automation and digitalization, and the incorporation of IoT technologies, the market for building automation systems (BAS) is predicted to expand. By automating and controlling building operations like lighting, security, heating, ventilation, and air conditioning, BAS systems increase energy efficiency and create a more cosy and secure environment. The demand for smart cities and the integration of IoT technology with BAS systems is what is causing the industry to grow.

Building Automation System Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size by 2022 |

USD 86.8 billion |

|

Projected Market Size by 2027 |

USD 148.6 billion |

|

Growth Rate |

11.4% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million ) |

|

Segments Covered |

|

|

Geographies Covered |

|

|

Key Companies Covered |

|

| Key Market Driver | Heightened focus on developing energy-efficient and eco-friendly buildings |

| Key Market Opportunity | Rise in government and stakeholder funding for developing smart cities |

| Largest Growing Region | APAC |

| Largest Market Share Segment | Security & Access Controls |

| Highest CAGR Segment | Wireless Technology |

In this report, the Building automation systemmarket has been segmented into the following categories:

By Offering:

- Facility Management Systems

- Security & Access Controls

- Fire Protection Systems

- BEM Software

- BAS Services

By Communication Technology:

- Wireless Technology

- Wired Technology

By Application:

- Commercial

- Residential

- Industrial

By Region:

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments in Building Automation System Industry

- In January 2022, Johnson controls unveils industry-first OpenBlue Indoor Air Quality as a service solution to help organizations keep occupants safe and healthy. OpenBlue Indoor Air Quality as a Service offering combines Johnson Controls technology and science-backed expertise to help customers meet complex health and safety compliance, while improving occupants' comfort and productivity.

- In January 2022, Johnson controls acquired foghorn, expanding leadership in smart and autonomous buildings. Acquisition is expected to accelerate Johnson Controls' innovation and vision for Smart Autonomous Buildings by pervasively integrating Foghorn's industry leading Edge AI platform throughout OpenBlue.

- In December 2021, Honeywell announced it has agreed to acquire privately held US Digital Designs, Inc., a Tempe, Ariz.-based company, for a purchase multiple of ~14X EBITDA in an all-cash transaction. The company delivers alerting and dispatch communications solutions, which enhance first responders' efficacy and enable faster emergency response times. The acquisition will be integrated into Honeywell's Fire and Connected Life Safety systems business and will expand Honeywell's line of solutions for public safety communications, providing first responders with better situational awareness of building emergencies and improved life safety.

- In May 2021, Honeywell launched a cloud-based solution that streamlines and combines operational and business data for building owners and managers to support better decision-making, drive greater efficiencies and reach sustainability goals. The new solution, Honeywell Forge Real Estate Operations, extends the capabilities of Honeywell Forge enterprise performance management software and was jointly developed with SAP on the SAP Business Technology Platform.

- In April 2021, Siemens AG launched new version of the fire protection system, Cerberus FIT. Siemens expands its offering for the small to medium-sized buildings market. Various small to medium-sized buildings can now be covered with a simple and cost-efficient solution. Cerberus FIT maximizes fire safety, thanks to greater functionality and enhanced productivity for those working on protecting the buildings.

Frequently Asked Questions (FAQ):

Which are the major companies in the building automation system market? What are their major strategies to strengthen their market presence?

The major companies in building automation system market are – Honeywell International (US), Siemens AG (Germany), Johnson Control (US), Schneider Electric (France), Carrier (US), Robert Bosch (Germany), Legrand (France), Hubbell (US), ABB (Zurich), Trane Technologies (Ireland), Lutron Electronics (US), Creston Electronics (US), Hitachi (Japan), Delta Controls (Canada), Beckhoff Automation (Germany), Lennox International (US), General Electric (US), Distech Controls (Canada), Dialight PLC (UK), Cisco Systems (US), Rockwell Automation (US), Control4 (US), Signify (Philips Lighting) (Netherlands), Emerson Electric (US), and Leviton Manufacturing Company (US). The major strategies adopted by these players are product launches, collaborations, agreements and acquisitions.

Which is the potential market for building automation system in terms of region?

North America is the largest market for building automation system. North America, being one of the fastest-growing markets for technology solutions, provides attractive opportunities for players offering building automation system; as a result, many companies are expanding their footprint in this region. US, Canada and MExico are among the key hubs in North America that occupy the maximum share of the market of the region.

Which application segment is expected to drive the growth of the building automation system market in the next 5 years?

Industrial application segment among all others is expected to grow at the highest CAGR in coming years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 GENERAL INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 BUILDING AUTOMATION SYSTEM MARKET SEGMENTATION

1.3.2 GEOGRAPHIC ANALYSIS

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 2 BUILDING AUTOMATION SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.1.2 Key secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key participants in primary processes across value chain of building automation system market

2.1.2.3 Breakdown of primary interviews

2.1.2.4 Key industry insights

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY MARKET PLAYERS IN BUILDING AUTOMATION SYSTEM MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY PLAYERS IN BUILDING AUTOMATION SYSTEM MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE) —BOTTOM-UP ESTIMATION OF BUILDING AUTOMATION SYSTEM MARKET, BY GEOGRAPHY

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

2.3 MARKET SHARE ESTIMATION

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RISK ASSESSMENT

TABLE 1 RISK FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.6.1 ASSUMPTIONS

2.6.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 55)

FIGURE 9 SCENARIO-BASED IMPACT OF COVID-19 ON BUILDING AUTOMATION SYSTEM MARKET

TABLE 2 COVID-19 IMPACT: BUILDING AUTOMATION SYSTEM MARKET, 2018-2027 (USD BILLION)

3.1 SCENARIO ANALYSIS

3.1.1 REALISTIC SCENARIO (POST-COVID-19)

3.1.2 PESSIMISTIC SCENARIO (POST-COVID-19)

3.1.3 OPTIMISTIC SCENARIO (POST-COVID-19)

FIGURE 10 SECURITY & ACCESS CONTROLS SEGMENT EXPECTED TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 11 LIGHTING CONTROL SEGMENT IS EXPECTED TO GROW AT HIGHER CAGR DURING 2022–2027 (USD BILLION)

FIGURE 12 COMMERCIAL APPLICATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING 2022–2027

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 GROWTH OPPORTUNITIES IN BUILDING AUTOMATION SYSTEM MARKET

FIGURE 14 ASIA PACIFIC TO EMERGE AS LUCRATIVE GROWTH AVENUE FOR BUILDING AUTOMATION SYSTEM MARKET

4.2 BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING

FIGURE 15 SECURITY & ACCESS CONTROLS SEGMENT TO LEAD BUILDING AUTOMATION SYSTEM MARKET FROM 2022 TO 2027

4.3 BUILDING AUTOMATION SYSTEM MARKET FOR SECURITY & ACCESS CONTROLS, BY SYSTEM TYPE

FIGURE 16 BIOMETRIC SYSTEM SEGMENT TO HOLD LARGER MARKET SHARE DURING 2022–2027

4.4 BUILDING AUTOMATION SYSTEM MARKET IN ASIA PACIFIC, BY OFFERING AND COUNTRY

FIGURE 17 SECURITY & ACCESS CONTROLS SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARES IN ASIA PACIFIC IN 2027

4.5 BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY

FIGURE 18 BUILDING AUTOMATION SYSTEM MARKET TO RECORD HIGHEST CAGR IN INDIA DURING 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 IMPACT OF DRIVERS AND OPPORTUNITIES ON BUILDING AUTOMATION SYSTEM MARKET

FIGURE 20 IMPACT OF RESTRAINTS AND CHALLENGES ON BUILDING AUTOMATION SYSTEM MARKET

FIGURE 21 RISING DEMAND FOR MODERN SOC DESIGNS AND MULTICORE TECHNOLOGY TO PROPEL GROWTH OF BUILDING AUTOMATION SYSTEM MARKET

5.2.1 DRIVERS

5.2.1.1 Heightened focus on developing energy-efficient and eco-friendly buildings

5.2.1.2 Rise in adoption of automated security systems in buildings

5.2.1.3 Integration of IoT with building automation systems

5.2.1.4 Development of wireless protocols and wireless sensor network technology for building automation systems

5.2.1.5 Rapid infrastructure development in emerging economies

5.2.2 RESTRAINTS

5.2.2.1 False notion about high installation costs of building automation systems

5.2.2.2 Technical difficulties and dearth of skilled experts

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in government and stakeholder funding for developing smart cities

5.2.3.2 Favorable government initiatives and incentives

5.2.3.3 Advancements in building technologies and integration with data analytics

5.2.4 CHALLENGES

5.2.4.1 Absence of standard communication protocols

5.3 REVENUE SHIFT AND NEW REVENUE POCKETS FOR BUILDING AUTOMATION SYSTEM MARKET PLAYERS

FIGURE 22 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.4 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDITION DURING MANUFACTURING AND DISTRIBUTION PHASES

5.5 ECOSYSTEM/MARKET MAP

FIGURE 24 BUILDING AUTOMATION SYSTEM MARKET: ECOSYSTEM

FIGURE 25 BUILDING AUTOMATION SYSTEM MARKET PLAYER ECOSYSTEM

5.5.1 R&D INSTITUTES

5.5.2 BAS PROVIDERS

5.5.3 END USERS

TABLE 3 BUILDING AUTOMATION SYSTEM MARKET: SUPPLY CHAIN

5.6 TECHNOLOGY ANALYSIS & TRENDS

5.6.1 IP-BASED BUILDING AUTOMATION SYSTEMS

5.6.2 IOT-POWERED BUILDING AUTOMATION SYSTEMS

5.6.3 CLOUD-BASED FIRE PROTECTION SYSTEMS

5.6.4 USE OF THERMAL CAMERAS IN ACCESS CONTROLS

5.6.5 MOBILE ACCESS CONTROL SYSTEMS

5.6.6 INTEGRATION OF DIGITAL TWIN TECHNOLOGY IN BUILDING AUTOMATION

5.7 PRICE TREND ANALYSIS

FIGURE 26 AVERAGE SELLING PRICE (ASP) TREND FOR LIGHTING CONTROL AND HVAC CONTROL SYSTEMS

5.8 PATENT ANALYSIS

FIGURE 27 NUMBER OF PATENTS RELATED TO BUILDING AUTOMATION SYSTEM MARKET GRANTED DURING 2011–2021

5.8.1 LIST OF MAJOR PATENTS

5.9 TRADE DATA

5.9.1 TRADE DATA FOR HVAC SYSTEMS

FIGURE 28 IMPORTS DATA FOR HS CODE 8415, BY COUNTRY, 2017–2021

TABLE 4 IMPORTS DATA FOR HS CODE 8415, BY COUNTRY, 2017–2021 (USD BILLION)

FIGURE 29 EXPORTS DATA FOR HS CODE 8415, BY COUNTRY, 2017–2021

TABLE 5 EXPORTS DATA FOR HS CODE 8415, BY COUNTRY, 2017–2021 (USD BILLION)

5.9.2 TRADE DATA FOR VIDEO SURVEILLANCE

FIGURE 30 IMPORTS DATA FOR HS CODE 8525, BY COUNTRY, 2017–2021

TABLE 6 IMPORTS DATA FOR HS CODE 8525, BY COUNTRY, 2017–2021 (USD BILLION)

FIGURE 31 EXPORTS DATA FOR HS CODE 8525, BY COUNTRY, 2017–2021

TABLE 7 EXPORTS DATA FOR HS CODE 8525, BY COUNTRY, 2017–2021 (USD BILLION)

5.9.3 TRADE DATA FOR FIRE PROTECTION SYSTEMS

FIGURE 32 IMPORTS DATA FOR HS CODE 8424, BY COUNTRY, 2017–2021

TABLE 8 IMPORTS DATA FOR HS CODE 8424, BY COUNTRY, 2017–2021 (USD BILLION)

FIGURE 33 EXPORTS DATA FOR HS CODE 8424, BY COUNTRY, 2017–2021

TABLE 9 EXPORTS DATA FOR HS CODE 8424, BY COUNTRY, 2017–2021 (USD BILLION)

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 BUILDING AUTOMATION SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 PORTER’S FIVE FORCES ANALYSIS: BUILDING AUTOMATION SYSTEM MARKET

5.10.1 INTENSITY OF COMPETITIVE RIVALRY

5.10.2 THREAT OF NEW ENTRANTS

5.10.3 THREAT OF SUBSTITUTES

5.10.4 BARGAINING POWER OF SUPPLIERS

5.10.5 BARGAINING POWER OF BUYERS

5.11 EVENTS AND CONFERENCES

5.12 KEY STAKEHOLDERS & BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 35 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.12.2 BUYING CRITERIA

TABLE 12 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.13 STANDARDS & REGULATIONS

5.13.1 REGULATORY IMPLICATIONS

5.13.1.1 Building automation system installation and operation regulations

5.13.1.2 Fire protection and safety regulations

TABLE 13 FIRE PROTECTION STANDARDS IN EUROPEAN COUNTRIES

5.13.1.3 Video surveillance privacy and wiretapping regulations

5.13.1.4 Government regulations related to fair and transparent use of biometric system-powered access controls

5.13.2 GLOBAL STANDARDS

5.13.2.1 North America

5.13.2.2 Europe

5.14 CASE STUDIES

5.14.1 HIPPODROME PARIS-LONGCHAMP SPORTS FACILITY (FRANCE) UTILIZED LDALI-ME204-U DALI CONTROLLERS FROM LOYTEC FOR DETECTION AND MONITORING APPLICATIONS

5.14.2 400 OCEANGATE SELECTED COMPUTROLS LX CONTROLLERS FOR HIGH-EFFICIENCY CONTROL AND AUTOMATION CAPABILITIES

5.14.3 SAN DIEGO INTERNATIONAL AIRPORT – RENTAL CAR CENTER UTILIZED COMPUTROLS’ NEW DELTA CONTROLLERS TO GAIN BETTER CONTROL OVER THEIR HVAC SYSTEM

5.14.4 SIEMENS PROVIDED ITS DATA ANALYTICS AND SMART BUILDING TECHNOLOGIES TO DUBAI AIRPORT

5.14.5 CHESHIRE FIRE AND RESCUE SERVICE CENTER SELECTED FIRE PROTECTION SOLUTIONS FROM CHUBB TO MONITOR FIRE ALARM SYSTEMS

5.14.6 CLIMATEC PROVIDED ITS BUILDING AUTOMATION SOLUTION FOR NEW TEXAS RANGERS BASEBALL STADIUM FOR CENTRAL MONITORING AND CONTROL PURPOSES

6 BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING (Page No. - 104)

6.1 INTRODUCTION

FIGURE 36 BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING

FIGURE 37 SECURITY AND ACCESS CONTROLS SEGMENT TO HOLD LARGEST SIZE OF BUILDING AUTOMATION SYSTEM MARKET FROM 2022 TO 2027

TABLE 14 BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 15 BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.2 FACILITY MANAGEMENT SYSTEMS

TABLE 16 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 17 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 18 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 19 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 20 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 22 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 23 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 24 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 25 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 26 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 27 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 28 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

FIGURE 38 BUILDING AUTOMATION SYSTEM MARKET SHIPMENT, BY FACILITY MANAGEMENT SYSTEM

TABLE 30 BUILDING AUTOMATION SYSTEM MARKET, BY FACILITY MANAGEMENT SYSTEM TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 31 BUILDING AUTOMATION SYSTEM MARKET, BY FACILITY MANAGEMENT SYSTEM TYPE, 2022–2027 (THOUSAND UNITS)

6.2.1 LIGHTING CONTROLS

6.2.1.1 Lighting controls are extensively deployed for indoor and outdoor lighting in industrial, commercial, and residential buildings

TABLE 32 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY LIGHTING CONTROL TYPE, 2018–2021 (USD MILLION)

TABLE 33 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY LIGHTING CONTROL TYPE, 2022–2027 (USD MILLION)

TABLE 34 LIGHTING CONTROL: FACILITY MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 35 LIGHTING CONTROL: FACILITY MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 36 LIGHTING CONTROL: FACILITY MANAGEMENT SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 LIGHTING CONTROL: FACILITY MANAGEMENT SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1.2 Occupancy sensors

6.2.1.3 Daylight sensors

6.2.1.4 Relays

6.2.1.5 Timers

6.2.1.6 Dimming actuators

6.2.1.7 Switch actuators

6.2.1.8 Blind/shutter actuators

6.2.1.9 Transmitters

6.2.1.10 Receivers

6.2.2 HVAC CONTROLS

6.2.2.1 HVAC controls are majorly used in commercial buildings

TABLE 38 HVAC CONTROL: FACILITY MANAGEMENT SYSTEMS MARKET, BY HVAC COMPONENT, 2018–2021 (USD MILLION)

TABLE 39 HVAC CONTROL: FACILITY MANAGEMENT SYSTEMS MARKET, BY HVAC COMPONENT, 2022–2027 (USD MILLION)

TABLE 40 HVAC CONTROL: FACILITY MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 41 HVAC CONTROL: FACILITY MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 42 HVAC CONTROL: FACILITY MANAGEMENT SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 HVAC CONTROL: FACILITY MANAGEMENT SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2.2 Sensors

6.2.2.3 Smart thermostats

6.2.2.4 Control valves

6.2.2.4.1 Two-way valves

6.2.2.4.2 Three-way valves

6.2.2.5 Heating and cooling coils

6.2.2.6 Dampers

6.2.2.6.1 Low-leakage dampers

6.2.2.6.2 Parallel- and opposed-blade dampers

6.2.2.6.3 Round dampers

6.2.2.7 Actuators

6.2.2.7.1 Hydraulic actuators

6.2.2.7.2 Pneumatic actuators

6.2.2.7.3 Electric actuators

6.2.2.8 Pumps and fans

6.2.2.9 Smart vents

6.3 SECURITY AND ACCESS CONTROLS

TABLE 44 SECURITY & ACCESS CONTROLS: BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 45 SECURITY & ACCESS CONTROLS: BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 46 SECURITY & ACCESS CONTROLS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 47 SECURITY & ACCESS CONTROLS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 48 SECURITY & ACCESS CONTROLS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 SECURITY & ACCESS CONTROLS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 SECURITY & ACCESS CONTROLS: BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 51 SECURITY & ACCESS CONTROLS: BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 52 SECURITY & ACCESS CONTROLS: BUILDING AUTOMATION SYSTEM MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 53 SECURITY & ACCESS CONTROLS: BUILDING AUTOMATION SYSTEM MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 54 SECURITY & ACCESS CONTROLS: BUILDING AUTOMATION SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 55 SECURITY & ACCESS CONTROLS: BUILDING AUTOMATION SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 56 SECURITY & ACCESS CONTROLS: BUILDING AUTOMATION SYSTEM MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 SECURITY & ACCESS CONTROLS: BUILDING AUTOMATION SYSTEM MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

6.3.1 VIDEO SURVEILLANCE SYSTEMS

6.3.1.1 Video surveillance systems improve safety in public places

TABLE 58 VIDEO SURVEILLANCE SYSTEMS: SECURITY & ACCESS CONTROLS MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 59 VIDEO SURVEILLANCE SYSTEMS: SECURITY & ACCESS CONTROLS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 60 VIDEO SURVEILLANCE: SECURITY & ACCESS CONTROLS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 61 VIDEO SURVEILLANCE: SECURITY & ACCESS CONTROLS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

6.3.1.2 Hardware

TABLE 62 VIDEO SURVEILLANCE SYSTEMS MARKET FOR HARDWARE, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 63 VIDEO SURVEILLANCE SYSTEMS MARKET FOR HARDWARE, BY PRODUCT, 2022–2027 (USD MILLION)

6.3.1.2.1 Cameras

6.3.1.2.2 Monitors

6.3.1.2.3 Storage systems

6.3.1.2.4 Accessories

6.3.1.3 Software/video analytics

6.3.1.4 Services

6.3.2 BIOMETRIC SYSTEMS

6.3.2.1 Biometric systems use behavioral and biological characteristics of individuals for recognition

TABLE 64 BIOMETRIC SYSTEMS: SECURITY & ACCESS CONTROLS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 65 BIOMETRIC SYSTEMS: SECURITY & ACCESS CONTROLS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

6.4 FIRE PROTECTION SYSTEMS

TABLE 66 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 67 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 68 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 69 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 70 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 72 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 73 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 74 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 75 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 76 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 77 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

6.4.1 SENSORS AND DETECTORS

6.4.1.1 Sensors and detectors are used to detect emergency situations at initial stages

6.4.1.2 Smoke detectors

6.4.1.3 Flame detectors

6.4.1.4 Others

6.4.2 FIRE SPRINKLERS

6.4.2.1 Fire sprinklers can be activated automatically or manually to control fire

6.4.3 FIRE ALARMS

6.4.3.1 Fire alarms warn occupants about occurrence of fire breakouts

6.4.4 EMERGENCY LIGHTING, VOICE EVACUATION, AND PUBLIC ALERT DEVICES

6.4.4.1 Emergency lighting voice evacuation and public alert devices are mainly deployed in crowded establishments

6.5 BUILDING ENERGY MANAGEMENT SOFTWARE

TABLE 80 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 81 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 82 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 84 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 85 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 86 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 87 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 88 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 89 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 90 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

6.6 BAS SERVICES

TABLE 92 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 93 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 94 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 96 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 97 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 98 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 99 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 100 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 101 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 102 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET IN ROW, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 103 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

6.6.1 INSTALLATION AND MAINTENANCE

6.6.1.1 Maintenance services are necessary to ensure efficient working and long operational life of BAS systems

6.6.2 TRAINING

6.6.2.1 Training services help personnel to carry out effective operations and monitoring of BAS systems

6.7 OTHERS

TABLE 104 OTHERS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 105 OTHERS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 106 OTHERS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 107 OTHERS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 108 OTHERS: BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 109 OTHERS: BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 110 OTHERS: BUILDING AUTOMATION SYSTEM MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 111 OTHERS: BUILDING AUTOMATION SYSTEM MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 112 OTHERS: BUILDING AUTOMATION SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 113 OTHERS: BUILDING AUTOMATION SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 114 OTHERS: BUILDING AUTOMATION SYSTEM MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 115 OTHERS: BUILDING AUTOMATION SYSTEM MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

6.8 IMPACT OF COVID 19 ON OFFERINGS

7 BUILDING AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY (Page No. - 150)

7.1 INTRODUCTION

FIGURE 39 BUILDING AUTOMATION SYSTEM MARKET, BY COMMUNICATION TECHNOLOGY

FIGURE 40 WIRELESS TECHNOLOGY SEGMENT TO LEAD BUILDING AUTOMATION SYSTEM MARKET

TABLE 116 BUILDING AUTOMATION SYSTEM MARKET, BY COMMUNICATION TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 117 BUILDING AUTOMATION SYSTEM MARKET, BY COMMUNICATION TECHNOLOGY, 2022–2027 (USD MILLION)

7.2 WIRELESS TECHNOLOGIES

7.2.1 ZIGBEE

7.2.1.1 Mostly ideal for residential and commercial applications due to low cost and reduced power consumption

7.2.2 ENOCEAN

7.2.2.1 EnOcean is based on energy harvesting technology and gains energy from motion

7.2.3 Z-WAVE

7.2.3.1 Z–Wave is designed for automating processes to remotely control several devices and applications

7.2.4 WI-FI

7.2.4.1 Numerous building automation products use Wi-Fi as their primary communication technology

7.2.5 BLUETOOTH

7.2.5.1 Bluetooth is ideal for smart short-range communication systems in commercial and industrial environments

7.2.6 THREAD

7.2.6.1 Thread fulfills need for highly secure and scalable network technology for building automation

7.2.7 INFRARED

7.2.7.1 Infrared technology is suitable for lighting controls, HVAC systems, security controls, and access control systems

7.3 WIRED TECHNOLOGIES

7.3.1 DIGITAL ADDRESSABLE LIGHTING INTERFACE (DALI)

7.3.1.1 DALI is used for communication purposes among different building automation systems

7.3.2 KONNEX (KNX)

7.3.2.1 Konnex is used as open standard for building control and automation

7.3.3 LONWORKS

7.3.3.1 LonWorks is useful for developing automation applications designed for low-bandwidth networking devices

7.3.4 BUILDING AUTOMATION AND CONTROL NETWORKS (BACNET)

7.3.4.1 BACnet enables building automation systems to control devices working on same networks

7.3.5 MODBUS

7.3.5.1 Modbus is application-layer messaging protocol for connecting various industrial electronic devices

8 BUILDING AUTOMATION MARKET, BY APPLICATION (Page No. - 159)

8.1 INTRODUCTION

FIGURE 41 BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION

FIGURE 42 INDUSTRIAL APPLICATION SEGMENT TO REGISTER HIGHEST CAGR IN BUILDING AUTOMATION SYSTEM MARKET FROM 2022 TO 2027

TABLE 118 BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 119 BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 RESIDENTIAL

8.2.1 DEVELOPMENT OF SMART HOMES FUELING DEMAND FOR BUILDING AUTOMATION TECHNOLOGIES IN RESIDENTIAL SECTOR

8.2.2 DIY HOME AUTOMATION

TABLE 120 RESIDENTIAL: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 121 RESIDENTIAL: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027(USD MILLION)

TABLE 122 RESIDENTIAL: BUILDING AUTOMATION SYSTEM MARKET, BY FACILITY MANAGEMENT SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 123 RESIDENTIAL: BUILDING AUTOMATION SYSTEM MARKET, BY FACILITY MANAGEMENT SYSTEM TYPE, 2022–2027(USD MILLION)

TABLE 124 RESIDENTIAL: BUILDING AUTOMATION SYSTEM MARKET, BY SECURITY & ACCESS CONTROLS TYPE, 2018–2021 (USD MILLION)

TABLE 125 RESIDENTIAL: BUILDING AUTOMATION SYSTEM MARKET, BY SECURITY & ACCESS CONTROLS TYPE, 2022–2027(USD MILLION)

8.3 COMMERCIAL

8.3.1 OFFICE BUILDINGS

8.3.1.1 Office buildings are prominent commercial end users of building automation systems

8.3.2 RETAIL AND PUBLIC ASSEMBLY BUILDINGS

8.3.2.1 Increasing security needs in retail and public buildings are increasing opportunity for building automation system deployment

8.3.3 HOSPITALS AND HEALTHCARE FACILITIES

8.3.3.1 Smart ventilation technologies used in building automation systems help in reducing risk of healthcare-associated infections

8.3.4 AIRPORTS AND RAILWAY STATIONS

8.3.4.1 Increase in usage of monitoring points and readers at airports and railway stations is encouraging installation of building automation systems

TABLE 126 COMMERCIAL: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 127 COMMERCIAL: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 128 COMMERCIAL: BUILDING AUTOMATION SYSTEM MARKET, BY FACILITY MANAGEMENT SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 129 COMMERCIAL: BUILDING AUTOMATION SYSTEM MARKET, BY FACILITY MANAGEMENT SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 130 COMMERCIAL: BUILDING AUTOMATION SYSTEM MARKET, BY SECURITY & ACCESS CONTROLS TYPE, 2018–2021 (USD MILLION)

TABLE 131 COMMERCIAL: BUILDING AUTOMATION SYSTEM MARKET, BY SECURITY & ACCESS CONTROLS TYPE, 2022–2027 (USD MILLION)

8.4 INDUSTRIAL

8.4.1 INDUSTRIAL FACILITIES ADOPT BUILDING AUTOMATION SOLUTIONS TO ACHIEVE ENERGY AND COST SAVINGS

FIGURE 43 BUILDING ENERGY MANAGEMENT SOFTWARE SEGMENT TO SEGMENT TO GROW AT HIGHEST CAGR IN INDUSTRIAL BAS MARKET DURING FORECAST PERIOD

TABLE 132 INDUSTRIAL: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 133 INDUSTRIAL: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 134 INDUSTRIAL: BUILDING AUTOMATION SYSTEM MARKET, BY FACILITY MANAGEMENT SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 135 INDUSTRIAL: BUILDING AUTOMATION SYSTEM MARKET, BY FACILITY MANAGEMENT SYSTEM TYPE, 2022–2027(USD MILLION)

TABLE 136 INDUSTRIAL: BUILDING AUTOMATION SYSTEM MARKET, BY SECURITY & ACCESS CONTROLS TYPE, 2018–2021 (USD MILLION)

TABLE 137 INDUSTRIAL: BUILDING AUTOMATION SYSTEM MARKET, BY SECURITY & ACCESS CONTROLS TYPE, 2022–2027(USD MILLION)

8.5 IMPACT OF COVID-19 ON APPLICATIONS

9 REGIONAL ANALYSIS (Page No. - 173)

9.1 INTRODUCTION

FIGURE 44 ASIA PACIFIC BUILDING AUTOMATION SYSTEM MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 45 BUILDING AUTOMATION SYSTEM MARKET IN ASIA PACIFIC TO HOLD HIGHEST MARKET SHARE DURING FORECAST PERIOD

TABLE 138 BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 139 BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 46 NORTH AMERICA: BUILDING AUTOMATION SYSTEM MARKET SNAPSHOT

FIGURE 47 BUILDING AUTOMATION SYSTEM MARKET IN CANADA TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 140 NORTH AMERICA: BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 141 NORTH AMERICA: BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 142 NORTH AMERICA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 143 NORTH AMERICA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Initiation of energy-efficient buildings and retrofit projects to spur market growth

TABLE 144 US: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 145 US: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027(USD MILLION)

9.2.2 CANADA

9.2.2.1 Focus on establishment of low-carbon economy to support market growth

TABLE 146 CANADA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 147 CANADA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Growth in residential and commercial construction activities to drive building automation market

TABLE 148 MEXICO: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 149 MEXICO: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027(USD MILLION)

9.3 EUROPE

FIGURE 48 EUROPE: BUILDING AUTOMATION SYSTEM MARKET SNAPSHOT

FIGURE 49 BUILDING AUTOMATION SYSTEM MARKET IN GERMANY TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 150 EUROPE: BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 151 EUROPE: BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 152 EUROPE: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 153 EUROPE: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027(USD MILLION)

9.3.1 UK

9.3.1.1 Focus on formulating regulations for increasing energy efficiency of buildings to favor market growth

TABLE 154 UK: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 155 UK: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 Implementation of mandatory energy efficiency performance ordinance and regulations to drive market growth

TABLE 156 GERMANY: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 157 GERMANY: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Mandated targets for energy savings to drive market growth

TABLE 158 FRANCE: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 159 FRANCE: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Government measures to promote energy efficiency to augment market growth

TABLE 160 ITALY: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 161 ITALY: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.3.5 REST OF EUROPE

TABLE 162 REST OF EUROPE: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 163 REST OF EUROPE: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 50 ASIA PACIFIC: BUILDING AUTOMATION SYSTEM MARKET SNAPSHOT

FIGURE 51 BUILDING AUTOMATION SYSTEM MARKET IN CHINA TO GROW HIGHEST CAGR FROM 2022 TO 2027

TABLE 164 ASIA PACIFIC: BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 165 ASIA PACIFIC: BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 166 ASIA PACIFIC: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 167 ASIA PACIFIC: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Initiation of various commercial and industrial construction projects to underpin market growth

TABLE 168 CHINA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 169 CHINA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Continuous need for infrastructural development, especially for commercial purposes, to drive the market

TABLE 170 JAPAN: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 171 JAPAN: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Various government reforms and initiatives to propel market growth

TABLE 172 INDIA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 173 INDIA: BUILDING AUTOMATION SYSTEM MARKET IN INDIA, BY OFFERING, 2022–2027 (USD MILLION)

9.4.4 SOUTH KOREA

9.4.4.1 Focus on efficient and rational energy use fuels market growth

TABLE 174 SOUTH KOREA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 175 SOUTH KOREA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.4.5 REST OF ASIA PACIFIC

TABLE 176 REST OF ASIA PACIFIC: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 177 REST OF ASIA PACIFIC: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.5 ROW

FIGURE 52 BUILDING AUTOMATION SYSTEM MARKET IN SOUTH AMERICA TO GROW AT HIGHER CAGR FROM 2022 TO 2027

TABLE 178 ROW: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 179 ROW: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 180 ROW: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 181 ROW: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 Ongoing industrialization to provide opportunities for building automation system providers

TABLE 182 SOUTH AMERICA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 183 SOUTH AMERICA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Growing construction activities to drive market in Middle East and Africa

TABLE 184 MIDDLE EAST & AFRICA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.6 IMPACT OF COVID-19 ON REGIONS

10 COMPETITIVE LANDSCAPE (Page No. - 209)

10.1 OVERVIEW

FIGURE 53 KEY DEVELOPMENTS UNDERTAKEN BY LEADING PLAYERS IN BUILDING AUTOMATION SYSTEM MARKET FROM 2019 TO 2022

10.2 MARKET SHARE AND RANKING ANALYSIS

TABLE 186 DEGREE OF COMPETITION

FIGURE 54 RANKING ANALYSIS OF TOP 5 PLAYERS IN BUILDING AUTOMATION SYSTEM MARKET

10.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 55 FIVE-YEAR REVENUE ANALYSIS OF KEY COMPANIES

10.4 COMPANY EVALUATION QUADRANT, 2021

10.4.1 STAR

10.4.2 EMERGING LEADER

10.4.3 PERVASIVE

10.4.4 PARTICIPANT

FIGURE 56 BUILDING AUTOMATION SYSTEM MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

10.5 COMPETITIVE BENCHMARKING

TABLE 187 COMPANY FOOTPRINT (25 COMPANIES)

TABLE 188 APPLICATION FOOTPRINT (25 COMPANIES)

TABLE 189 REGIONAL FOOTPRINT (25 COMPANIES)

10.6 STARTUP/SME EVALUATION QUADRANT, 2021

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 57 BUILDING AUTOMATION SYSTEM (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2021

TABLE 190 BUILDING AUTOMATION SYSTEM MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 191 BUILDING AUTOMATION SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

10.7 COMPETITIVE SCENARIO AND TRENDS

10.7.1 PRODUCT LAUNCHES

TABLE 192 PRODUCTS LAUNCHES, JANUARY 2019 TO JANUARY 2022

10.7.2 DEALS

TABLE 193 DEALS, JANUARY 2019 TO JANUARY 2022

11 COMPANY PROFILES (Page No. - 231)

11.1 INTRODUCTION

11.2 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

11.2.1 HONEYWELL INTERNATIONAL

TABLE 194 HONEYWELL INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 58 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

TABLE 195 HONEYWELL INTERNATIONAL: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 196 HONEYWELL INTERNATIONAL: DEALS

11.2.2 SIEMENS AG

TABLE 197 SIEMENS AG: BUSINESS OVERVIEW

FIGURE 59 SIEMENS AG: COMPANY SNAPSHOT

TABLE 198 SIEMENS AG: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 199 SIEMENS AG: DEALS

11.2.3 JOHNSON CONTROLS

TABLE 200 JOHNSON CONTROLS: BUSINESS OVERVIEW

FIGURE 60 JOHNSON CONTROLS: COMPANY SNAPSHOT

TABLE 201 JOHNSON CONTROLS: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 202 JOHNSON CONTROLS: DEALS

11.2.4 SCHNEIDER ELECTRIC

TABLE 203 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 61 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 204 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 205 SCHNEIDER ELECTRIC: DEALS

11.2.5 CARRIER

TABLE 206 CARRIER: BUSINESS OVERVIEW

FIGURE 62 CARRIER: COMPANY SNAPSHOT

TABLE 207 CARRIER: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 208 CARRIER: DEALS

TABLE 209 CARRIER: OTHERS

11.2.6 ROBERT BOSCH

TABLE 210 ROBERT BOSCH: BUSINESS OVERVIEW

FIGURE 63 ROBERT BOSCH: COMPANY SNAPSHOT

TABLE 211 ROBERT BOSCH: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 212 ROBERT BOSCH TECHNOLOGY: DEALS

11.2.7 LEGRAND

TABLE 213 LEGRAND: BUSINESS OVERVIEW

FIGURE 64 LEGRAND: COMPANY SNAPSHOT

TABLE 214 LEGRAND: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 215 LEGRAND: DEALS

11.2.8 HUBBELL

TABLE 216 HUBBELL: BUSINESS OVERVIEW

FIGURE 65 HUBBELL INCORPORATED: COMPANY SNAPSHOT

TABLE 217 HUBBELL: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 218 HUBBELL: DEALS

11.2.9 ABB

TABLE 219 ABB: BUSINESS OVERVIEW

FIGURE 66 ABB: COMPANY SNAPSHOT

TABLE 220 ABB: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 221 ABB: DEALS

11.2.10 TRANE TECHNOLOGIES

TABLE 222 TRANE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 67 TRANE TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 223 TRANE TECHNOLOGIES: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 224 TRANE TECHNOLOGIES: DEALS

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

11.3 OTHER KEY PLAYERS

11.3.1 LUTRON ELECTRONICS

11.3.2 CRESTRON ELECTRONICS

11.3.3 HITACHI

11.3.4 DELTA CONTROLS

11.3.5 BECKHOFF AUTOMATION

11.3.6 LENNOX INTERNATIONAL

11.3.7 GE CURRENT

11.3.8 DISTECH CONTROLS

11.3.9 DIALIGHT PLC

11.3.10 CISCO SYSTEMS

11.3.11 ROCKWELL AUTOMATION

11.3.12 CONTROL4

11.3.13 SIGNIFY (PHILIPS LIGHTING)

11.3.14 EMERSON ELECTRIC

11.3.15 LEVITON MANUFACTURING COMPANY, INC.

12 APPENDIX (Page No. - 299)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 QUESTIONNAIRE FOR BUILDING AUTOMATION SYSTEM MARKET

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

This study involves the usage of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource to identify and collect information useful for this technical, market-oriented, and commercial study of the building automation system market. Primary sources include several industry experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, and technology developers. In-depth interviews have been conducted with key industry participants, subject matter experts (SMEs), C-level executives of key companies operating in the building automation system market, and industry consultants, among other experts, to obtain and verify qualitative and quantitative information, as well as to assess prospects. The following illustrative figure shows the market research methodology applied in making this report on the building automation system market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study on the building automation system market. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases.

The global size of the building automation system market has been obtained from the secondary data made available through paid and unpaid sources. It has also been determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research has been used to gather key information about the industry’s supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. It has also been conducted to identify and analyze the industry trends in the market and key developments that have been undertaken from both the market- and technology perspectives.

Primary Research

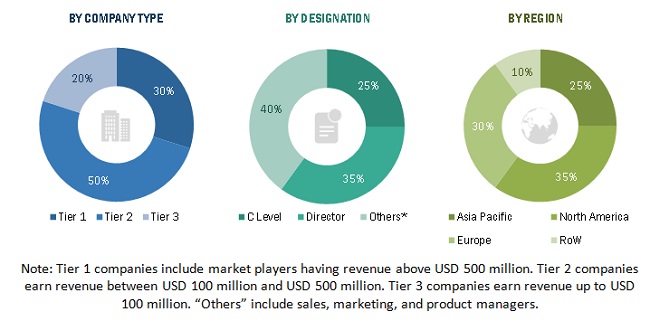

In the primary research process, various primary sources have been interviewed to obtain the qualitative and quantitative information related to the market across 4 main regions—Asia Pacific, North America, Europe, and RoW (the Middle East, Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and some other related key executives from major companies and organizations operating in the building automation system market or related markets.

After the completion of market engineering, primary research has been conducted to gather information and verify and validate critical numbers obtained from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Most of the primary interviews have been conducted with the supply side of the market. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used extensively in the market engineering process. Several data triangulation methods have also been used to perform the market forecasting and market estimation for the overall market segments and sub-segments in the report. Multiple qualitative and quantitative analyses have been performed on the market engineering process to gain key insights throughout the report.

Secondary research has been used to identify the key players of the building automation system market. The revenues of those key players have been determined through both primary and secondary research. The revenues have been identified geographically as well as market segment-wise, using financial statements and analyzing annual reports of the key market players. Interviews with CEOs, VPs, directors, and marketing executives were also conducted to gain insights on the key players and the building automation system market. All the market shares have been estimated using secondary and primary research. This data has been consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been then split into several segments and sub-segments. The data triangulation procedure has been employed to complete the market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Study Objectives

- To describe and forecast the building automation system (BAS) market size, by communication technology, offering, application, and region, in terms of value

- To describe and forecast the market, in terms of value, for various segments with regard to four key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To provide a detailed overview of the building automation system value chain and its industry trends

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the building automation system market

- To profile the key players and comprehensively analyze their market position in terms of the market share and core competencies, along with a detailed competitive landscape for the market leaders

- To analyze competitive developments such as partnerships, collaborations and acquisitions, and product launches in the building automation system market

Report Scope

The report covers the demand- and supply-side segmentation of the building automation system market. The supply-side market segmentation includes the offering and communication technology, whereas the demand-side market segmentation includes application, and region.

The following are the years considered:

Available Customizations:

With the given market data, MarketsandMarkets offers customizations based on the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to five)

- Country-level market analysis for the market in the Middle East and Africa, as well as in South America

Outlook and Growth of Building Automation System and Building Control System Market

A Building Automation System (BAS) is a centralized, computerized system that enables building operators to monitor and control a building's mechanical and electrical systems, including HVAC (heating, ventilation, and air conditioning), lighting, security, and fire safety. The BAS collects data from various sensors and devices throughout the building and uses algorithms to optimize energy efficiency, occupant comfort, and safety.

A Building Control System (BCS) is a subset of a BAS that focuses specifically on controlling the HVAC system. The BCS typically includes sensors that monitor temperature, humidity, and air quality, as well as actuators that control the heating and cooling systems. The BCS can also include algorithms that adjust the HVAC system based on occupancy patterns, weather conditions, and other factors to optimize energy efficiency.

The Building Automation System (BAS) and Building Control System (BCS) market have been experiencing significant growth in recent years and are expected to continue growing in the future. The market growth can be attributed to the increasing demand for energy-efficient buildings, advancements in IoT and cloud computing technologies, and the rising awareness of environmental sustainability.

The growth of the Building Automation System (BAS) market can be attributed to various factors. One of the main drivers of the BAS market is the increasing demand for energy-efficient buildings. The use of BAS can help reduce energy consumption by optimizing HVAC, lighting, and other building systems, resulting in significant energy savings. Furthermore, the rising awareness of environmental sustainability has led to increased adoption of BAS in buildings, as they contribute to reducing carbon emissions.

Another factor contributing to the growth of the BAS market is advancements in IoT and cloud computing technologies. The integration of these technologies with BAS systems enables building operators to remotely monitor and control building systems, leading to more efficient building operations and cost savings. Additionally, the adoption of data analytics and machine learning algorithms in BAS systems can provide valuable insights into building performance, enabling building operators to make data-driven decisions.

Similarly, the Building Control System (BCS) market is also expected to witness significant growth in the coming years. The adoption of IoT and AI technologies has led to the development of advanced BCS systems, which can optimize HVAC systems based on occupancy patterns, weather conditions, and other factors. The increasing demand for energy-efficient buildings is also driving the growth of the BCS market, as these systems can help reduce energy consumption and costs.

How Building Control Systems is going to impact the BAS Market?

Building Control Systems (BCS) are a subset of Building Automation Systems (BAS) that focus on controlling the HVAC system. However, the impact of BCS on the BAS market is significant, as BCS can be integrated with other building systems to create a comprehensive BAS.

One of the main impacts of building control systems on the BAS market is increased energy efficiency. HVAC systems are a significant contributor to building energy consumption, and BCS can optimize HVAC performance by controlling heating, cooling, and ventilation systems based on occupancy patterns, weather conditions, and other factors. By integrating building control systems with other building systems, such as lighting and security systems, building operators can create a comprehensive BAS that optimizes energy consumption across all building systems.

Furthermore, building control systems can also help improve occupant comfort and indoor air quality. By monitoring temperature, humidity, and air quality, BCS can adjust HVAC systems to maintain optimal indoor conditions, leading to increased occupant satisfaction and productivity. This can also contribute to a better indoor environment, reducing the risk of health problems associated with poor indoor air quality.

Another impact of building control systems on the BAS market is the increasing adoption of IoT and AI technologies. BCS systems can be integrated with IoT sensors and devices to collect real-time data on building performance, which can be analyzed using AI algorithms to optimize building operations. This can lead to increased energy efficiency, cost savings, and improved occupant comfort and safety.

Some futuristic growth use-cases of building control system market?

The Building Control System (BCS) market is expected to witness significant growth in the coming years, driven by advancements in technology and the increasing demand for energy-efficient and sustainable buildings. Here are some futuristic growth use-cases of the BCS market:

Integration with renewable energy sources: BCS systems can be integrated with renewable energy sources such as solar panels and wind turbines to optimize energy production and consumption. By monitoring energy production and building energy demand, BCS systems can control the flow of energy to and from the building, leading to increased energy efficiency and cost savings.

Predictive maintenance: BCS systems can leverage IoT sensors and data analytics to predict equipment failures and maintenance needs. By collecting data on equipment performance and analyzing it using AI algorithms, BCS systems can detect potential issues before they become major problems, leading to reduced downtime and maintenance costs.

Smart lighting: BCS systems can be integrated with smart lighting systems to optimize lighting based on occupancy patterns, daylight levels, and other factors. By adjusting lighting levels and color temperature, BCS systems can create a more comfortable and productive indoor environment, while also reducing energy consumption.

Indoor air quality monitoring: BCS systems can monitor indoor air quality parameters such as CO2 levels, temperature, and humidity. By analyzing this data, BCS systems can adjust HVAC systems to maintain optimal indoor air quality, leading to improved occupant health and productivity.

Building automation as a service (BaaS): BCS systems can be offered as a service, enabling building owners and operators to access advanced building automation capabilities without the need for significant upfront investments in hardware and software. This can help democratize access to building automation technology, leading to increased adoption and growth in the BCS market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Building Automation System Market

Do circuit breakers fits into this building automation and controls market? Which report calls them out specifically.

I am interested in the Building Automation sector in India. What types of controls are sold? What types of building automation software are in play? Who are the major players?

Hi, I am looking at a potential investment in a sensor start up and would like to understand more about the market for in-building sensors.

Interested in market size and change from controls to integrated along with workforce challenges.