Photovoltaic Market by Component (Modules, Inverters, BOS), Material (Silicon, Compounds), Installation Type (Ground Mounted, BIPV, Floating PV), Application (Residential, Commercial & Industrial, Utilities), Cell Type and Region - Global Forecast to 2028

Updated on : March 06, 2023

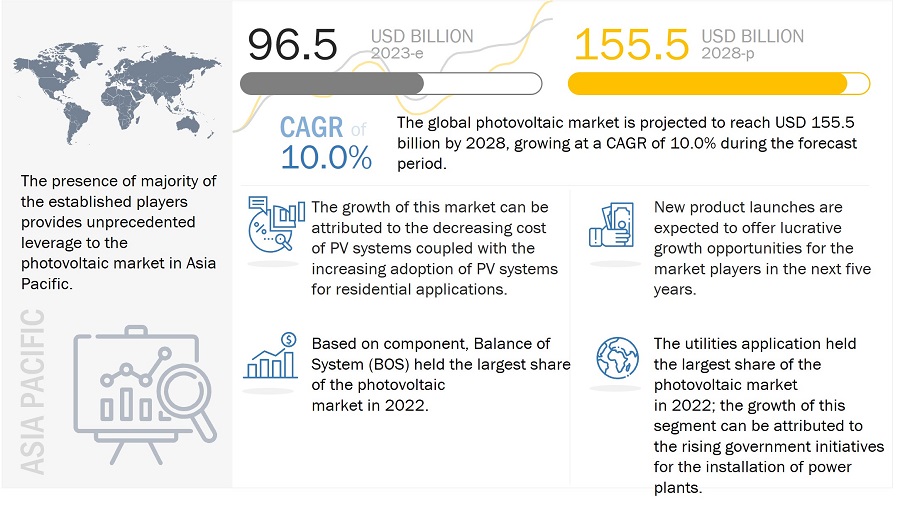

The photovoltaic market is projected to grow from USD 96.5 billion in 2023 to reach USD 155.5 billion by 2028; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 10.0% from 2023 to 2028.

The rise in the number of solar installations owing to government-led incentives and schemes, growth in the adoption of PV systems for residential applications, decrease in the cost of PV systems and energy storage devices is expected to propel the growth of the photovoltaic market. However, issues related to land acquisition for deployment of solar projects is a major factor limiting the growth of the market.

Photovoltaic Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Photovoltaic Market Dynamics

Drivers: Decreasing cost of PV systems and energy storage devices

The prices of solar systems and PV products have been decreasing continually over the past few years. The installation cost of these systems is undoubtedly higher than the conventional alternatives. However, once installed, these systems require very little maintenance and incur lower operational costs. A large number of players are present in the PV market. These players are constantly launching innovative and efficient products at competitive prices. This has resulted in a decline in the prices of PV products. Other factors that are leading to a drop in the prices of PV/solar systems include decreasing raw material prices, government subsidies, and large-scale production of the said systems. The decline can be mainly attributed to the improvement in material efficiency, production optimization, and economies of scale.

Restraint: Safety risks associated with high DC voltages

In traditional PV systems, PV panels, wires, and other equipment are energized with high DC voltages. Installers, maintenance personnel, and firefighters are at risk because of this high DC voltages.

Solar inverters with PV arrays involve high DC voltages, making it difficult to isolate DC electric devices from PV arrays using DC isolation switches. PV modules, when connected in series, create a high voltage, which can be dangerous for installers during system installation. Under the condition of short-circuit current, there is a possibility of electric arcs, which can result in fire and a resulting threat to people in the vicinity of a PV system. As these DC arcs are difficult to extinguish, there is a risk posed to the firefighters. Damage can be caused by this fire to the DC cables in PV arrays, thereby leading inverters to shut down automatically while manually isolating DC cables and other components. Safety mechanisms mandated by the National Electric Code (NEC) and the Electrical Safety Authority (ESA) of the US do not eliminate all risks, which hamper the growth of the photovoltaic market.

Opportunity: Increasing investments in renewable energy

There has been a rise in demand for renewable energy over the past couple of years. With governments across the world coming together for initiatives such as the Paris Climate Agreement, the demand for renewable energy, such as solar, is set to rise in the coming years. According to the International Energy Agency (IEA), by 2026, global renewable electricity capacity is expected to rise by more than 60% from 2020 levels to over 4,800 GW, equivalent to the current total global power capacity of fossil fuels and nuclear combined. Renewables are set to account for almost 95% of the increase in global power capacity through 2026, with solar PV alone providing more than half. The amount of renewable capacity added throughout 2021 to 2026 is expected to be 50% higher than from 2015 to 2020. The amount of energy produced via renewable sources surpassed 8,000 TWh in 2021, a record 500 TWh over 2020 while PV solar output grew by 170 TWh. This is driven by stronger support from government policies and more ambitious clean energy goals announced before and during the COP26 Climate Change Conference. China, India, the US, and major European countries, including Germany and the UK, have increased their investments in renewable energy resources. As renewable energy sources have become increasingly attractive, investments in new renewable power projects have grown significantly in the past few years. Solar energy costs are already below retail electricity prices in major countries such as China, and the cost of solar power is anticipated to fall further by 15% to 35% by 2024, which is expected to spur the demand for PV systems.

Challenge: Issues related to land acquisition for deployment of solar projects

When it comes to obtaining a land parcel for a solar plant, there are numerous legalities to consider. The land is governed by various issues of environment, wildlife, legal title, ceiling limit, SEBI monitored assets of PACL, government land allotment, state laws on ancestral property sale, and more. The conflicts between conservationists and land seekers are unavoidable, and this presents an enormous challenge for the inception of solar projects. Private players are generally prohibited from acquiring large tracts of land in rural areas due to the existence of state land-ceiling laws. Hence, there are systematic measures that address these gaps in land allotment for large-scale solar projects toward a more sustainable response to the exponential rise in renewable investments. Solar or PV systems for utility applications require large areas of land. Some estimates show that the land requirements for utility-scale PV systems are in the range of 5 acres per megawatt (depending on the technology and availability of sunlight), which indicates a hike in the requirement for serviceable land in the coming years. This might evoke concerns regarding land degradation and habitat loss in some locations. Unlike wind power, there is a minimal possibility for solar projects to share land for agricultural uses. The acquisition of operational land is a major challenge, especially in developing countries such as India and China-major markets for PVs. However, this problem can be solved by setting up solar plants on low-quality lands such as brownfields, abandoned mining land, or existing transportation and transmission corridors. Also, floating PVs can be appropriately deployed in places where land acquisition is a problem.

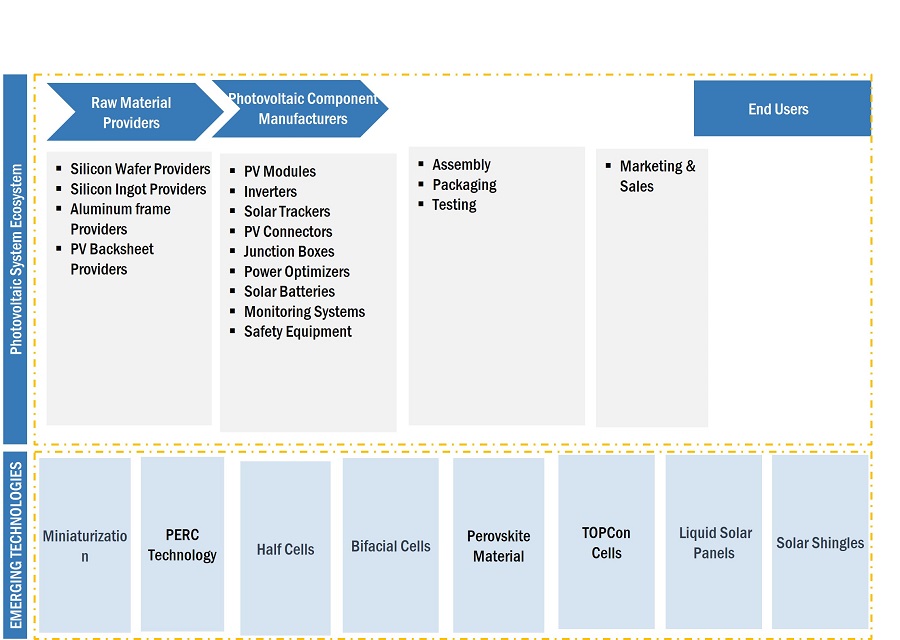

Photovoltaic Market Ecosystem

Inverters to exhibit highest growth during the forecast period.

The photovoltaic industry for inverters is expected to grow at the highest CAGR during the forecast period. The growth of the PV inverters market can be attributed to their increasing adoption in residential and utilities applications. In the last few years, inverter technologies have significantly advanced such that in addition to converting DC to AC, they offer several other capabilities and services to ensure that the inverter can operate at an optimal performance level. This includes controlling and monitoring the entire plant. Thus, PV inverters ensure that PV modules always function at their radiation- and temperature-dependent maximum power while continuously monitoring the power grid for adherence to various safety standards. This includes controlling and monitoring the entire system. With the increasing adoption of rooftop solar systems across the world, the demand for inverters is also rising, which, in turn, is expected to drive the inverters market.

Photovoltaic market for residential application is expected to grow at a significant CAGR from during forecast period

The market for the residential application is projected to grow at a significant CAGR during the forecast period. This is due to the declining cost of PV systems in the past few years. For residential applications, PV systems are installed on the rooftop or where adequate sunlight is available in order to fulfill the home electricity needs. Governments across various countries such as India, China, and the US provide incentives and tax rebate to residential users to install PV systems, which is expected to foster the growth of the market for PV systems in residential applications during the forecast period. . For example, China's National Development and Reform Commission (NDRC) has allocated RMB 500 million (USD 78.1 million) for the incentive scheme for residential PV in 2021. With the current subsidy level of RMB0.03 per watt, this total amount will feed around 16 GW of residential PV, according to government estimations.

Photovoltaic market for full-cell PV modules to hold a larger share during forecast period

Full-cell PV modules are expected to hold a larger market share during the forecast period. This module is an assembly of photovoltaic cells mounted in a framework for installation. In traditional full-cell solar panels, cells are wired together in rows, known as series wiring. In series wiring schemes, if one cell in a row is shaded and not producing energy, the entire row of cells will stop producing power. Standard panels typically have 3 separate rows of cells wired together, so the shade of one cell on one row would eliminate one-third of the panel’s power production. The advancements in the materials used and technology in designing PV module have led to the growth of full-cell photovoltaic modules. For instance, Swiss start-up Insolight is using integrated lenses as optical boosters in the panels’ protective glass to concentrate light beams by 200 times while reaching an efficiency of 30%.

Balance of System (BOS) component segment to hold the largest share of the photovoltaic market during the forecast period

By component, the BOS segment held the largest market share in 2022 and is expected to exhibit a similar growth trend during the forecast period. BOS includes electrical BOS, structural BOS, and installation costs. BOS is an essential component of PV systems. Other electrical and structural BOS include trackers, solar cables, batteries, mounting structures, monitoring, and metering systems. Solar trackers have been gaining popularity in the recent past, mainly due to the higher returns solar panel developers achieve on their solar investments. In the last five years, innovations centered around enhanced designs, improved reliability and durability in challenging environments, higher efficiency, and enhanced module capacity have driven the solar tracking solutions market. In addition, government incentives in the form of solar rebates and feed-in tariffs favor the adoption of solar trackers, which, in turn, drive the adoption of these type of equipment for solar PV systems.

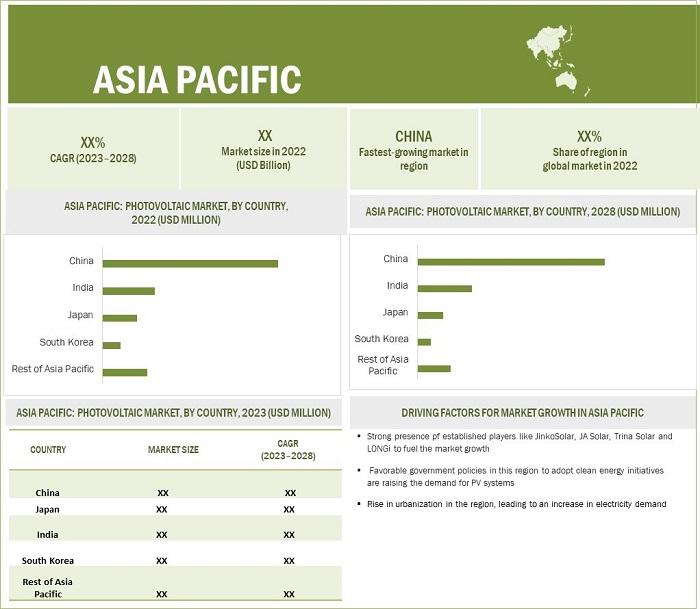

Photovoltaic market in Asia Pacific estimated to grow at the fastest rate during the forecast period

The photovoltaic market in Asia Pacific is projected to grow at the highest CAGR during the forecast period. This is due to presence of key players such as JinkoSolar (China), JA Solar (China), Trina Solar (China), and LONGi (China) in Asia Pacific. The growth in the adoption of PV modules in countries such as China, Japan, and India is contributing the growth of the market. The Asia Pacific region is the largest producer and consumer of PV modules and related PV components. Several initiatives and favorable policies launched by governments of different countries in Asia Pacific to promote the use of solar energy are expected to result in an increased demand for PV systems in the region during the forecast period. As per the International and Renewable Energy Agency (IRENA), rapid urbanization and industrialization are increasing energy demand and, thus, creating opportunities for the countries in the region to boost their renewable energy potential.

Photovoltaic Market by Region

To know about the assumptions considered for the study, download the pdf brochure

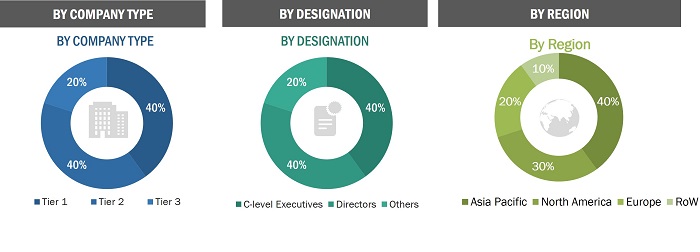

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the photovoltaic space. The break-up of primary participants for the report has been shown below:

- By Company Type: Tier 1 – 40%, Tier 2 – 40%, and Tier 3 – 20%

- By Designation: C-level Executives – 40%, Directors –40%, and Others – 20%

- By Region: North America –30%, Asia Pacific– 40%, Europe – 20%, and RoW – 10%

Key Market Players in Photovoltaic Market

Major vendors in the photovoltaic companies include JinkoSolar (China), JA Solar (China), Trina Solar (China), LONGi (China), Canadian Solar (Canada), First Solar (US), Hanwha Q CELLS (South Korea), Wuxi Suntech Power (China), Sharp (Japan), Mitsubishi Electric (Japan), ABB (Switzerland), Huawei (China), SMA Solar Technology (Germany), Sungrow Power Supply (China). Array Technologies (US), Chint Solar (China), GCL System Integration Technology (China), NEXTracker (US), Risen Energy (China), Tongwei Solar (China), Eaton Corp. (Ireland), LG Electronics (South Korea), Power Electronics (Spain), Fimer (Italy), AllEarth Renewables (US), Emmvee Photovoltaic Power Private Limited (India), ShunFeng International Clean Energy (China), Waaree Energies Ltd. (India) and Yingli Solar (China) are among a few emerging companies in the market.

Photovoltaic Market Report Scope

|

Report Metric |

Details |

|

Estimated Value |

USD 96.5 billion |

|

Expected Value |

USD 155.5 billion |

|

Growth Rate |

CAGR of 10.0% |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Segments Covered |

Component, Material, Cell Type, Installation Type, Application, and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

JinkoSolar (China), JA Solar (China), Trina Solar (China), LONGi (China), Canadian Solar (Canada), First Solar (US), Hanwha Q CELLS (South Korea), Wuxi Suntech Power (China), Sharp (Japan), Mitsubishi Electric (Japan), Array Technologies (US), Chint Solar (China), GCL System Integration Technology (China), Huawei (China), LG Electronics (South Korea), NEXTracker (US), Risen Energy (China), SMA Solar Technology (Germany), Sungrow Power Supply (China), Tongwei Solar (China), and Yingli Solar (China), Eaton Corp. (Ireland), ABB (Switzerland), Power Electronics (Spain), Fimer (Italy), AllEarth Renewables (US), Emmvee Photovoltaic Power Private Limited (India), ShunFeng International Clean Energy (China), Waaree Energies Ltd. (India) |

Photovoltaic Market Highlights

This research report categorizes the photovoltaic market based on Component, Material, Cell Type, Installation Type, Application, and Region

|

Aspect |

Details |

|

Photvoltaic Market, Component : |

|

|

Photovoltaic Market, by Material: |

|

|

Photovoltaic Market, by Cell Type: |

|

|

Photovoltaic Market, By Installation Type |

|

|

Photovoltaic Market, By Application |

|

|

Photovoltaic Market, By Region: |

|

Recent Developments

- In March 2022, Canadian Solar announced it has started the mass production of new 54-cell format module with 182 mm cell for residential, commercial, and industrial rooftop solar systems. CS6R-MS, the new module type under HiKu6 series, has the power output of up to 420 W and module efficiency of up to 21.5%. The CS6R-MS module is especially suitable for rooftop solar applications given its small module size (1.95 m² ? 30 mm), lightweight (21.3 kg), and outstanding aesthetic design for a homogenous appearance

- In February 2022, LONGi (China), announced that it has released a new module, the Hi-MO 5m 54c. With 54 cells, this new Hi-MO 5m module is designed mainly for residential and C&I rooftop systems, produces a maximum power output of 415W, and achieves an efficiency of 21.25%.

- In January 2022, TrinaTracker, a business unit of Trina Solar (China) launched Vanguard 1P single-row tracker at the World Future Energy Summit in Abu Dhabi. The new Vanguard 1P series, fully compatible with ultra-high-power modules ranging from 400W to 670W+, enables new application scenarios for TrinaTracker.

Frequently Asked Questions (FAQ):

What will be the dynamics for the adoption of photovoltaic market based on application?

The utilities segment held the largest share of the photovoltaic in 2022 and is expected to retain its dominant position throughout the forecast period. This application includes solar power plants based on PV systems. These solar power plants are environmentally friendly; therefore, governments across several countries promote the installation of such plants. Thus, governments’ special schemes and financial support for the installation of solar power projects is expected to boost the demand for PV systems to be installed for utility applications during the forecast period. Currently, many solar/PV power plants are functional in the US, China, Germany, India, Japan, Italy, Canada, and Thailand, among many others.

Which photovoltaic component will contribute more to the overall market share by 2027?

The Balance of System (BOS) will contribute the most to the photovoltaic market. BOS components consist of the majority of the items needed for a Solar PV Plant and account for 10-40% of the system cost with Installation & Commissioning. In the coming years PV modules will not drive the economics of a solar plant as prices are reducing. Therefore, other components under Balance of System (BOS) such as inverters, cables, design work, installation etc., are increasingly being looked upon for being cost competitive.

How will technological developments such as PERC technology, bifacial cells technology change the photovoltaic landscape in the future?

The increasing demand for passivated emitter and rear cell (PERC) modules—a technology that aims to achieve higher efficiency than standard solar cells by adding a dielectric passivation layer on the rear of the cell—is likely to offer growth opportunities for the PV market.

Which region is expected to adopt PV systems at a fast rate?

Asia Pacific region is expected to adopt PV systems at the fastest rate. Developing countries such as India and China are expected to have a high potential for the future growth of the market.

What are the key market dynamics influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

Rising number of solar installations attributed to government-led incentives and schemes. Governments in various regions are constantly working towards formulating policies to provide PV projects with grid connection convenience. Countries such as China, Canada, the US, and France are aggressively promoting the use of solar energy. The demand for distributed PV in Europe has been driven by incentives provided by governments of different countries to promote residential and small commercial PV installations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the size for photovoltaic market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, and certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the supply chain of the industry, the total pool of market players, classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the photovoltaic market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the photovoltaic market scenario through secondary research. Several primary interviews have been conducted with experts from both demand (end users) and supply side (photovoltaic offering providers) across 4 major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews have been conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the photovoltaic market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Photovoltaic Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both demand and supply side. Along with this, the market has been validated using top-down and bottom-up approaches.

Report Objectives

- To describe, segment, and forecast the photovoltaic (PV) market based on component, material, cell type, installation type, and application, in terms of value

- To describe and forecast the photovoltaic (PV) market, by component, in terms of value and volume

- To describe the photovoltaic (PV) market by power capacity and photovoltaic (PV) concentration systems

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the PV market

- To provide a detailed overview of the supply chain and ecosystem pertaining to the PV market, along with the average selling price of PV components

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches and developments, expansions, partnerships, collaborations, contracts, and mergers and acquisitions in the PV market

- To strategically profile the key players in the PV market and comprehensively analyze their market ranking and core competencies2

Outlook and Growth on PV Modules and PV Inverters Market Approch:

PV modules are crucial components of solar PV systems that convert sunlight into electricity. They consist of multiple solar cells connected together and are installed on rooftops or in large solar power plants. Monocrystalline, polycrystalline, and thin-film modules are the three primary types available in the market. Monocrystalline modules are the most efficient but also the most expensive, while polycrystalline modules are less efficient but more affordable. Thin-film modules are less efficient than crystalline modules but are lighter and more flexible. A few large manufacturers dominate the PV module market, including Chinese companies such as JinkoSolar, Trina Solar, and Canadian Solar, as well as international companies such as First Solar and SunPower, and they produce modules for both residential and commercial applications, driving the growth of the solar PV market.

PV inverters are critical components of solar photovoltaic systems that convert DC power generated by solar panels into AC power for household and business use. The PV inverter market is growing rapidly due to increasing demand for solar PV systems and the continuous improvement of inverter products to increase efficiency and reduce costs. The article also mentions that key players in the PV inverter market, such as Huawei and Sungrow, are investing heavily in research and development to meet the growing demand for PV inverters and stay ahead of the competition.

Growth Opportunities and Niche Threats for PV Modules Market in the Future

The PV modules market is expected to grow significantly in the coming years due to the increasing demand for renewable energy sources and the declining cost of solar power. However, there are also some niche threats that may impact the growth of this market. Here are some growth opportunities and niche threats for the PV modules market in the future:

Growth Opportunities for the PV Modules market

Increasing demand for renewable energy: With the increasing focus on reducing greenhouse gas emissions and combating climate change, there is a growing demand for renewable energy sources such as solar power. This is expected to drive the growth of the PV modules market in the coming years.

Technological advancements: The PV modules market is constantly evolving with the introduction of new technologies and innovations. Advances in solar cell technology, materials, and manufacturing processes are expected to improve the efficiency and cost-effectiveness of PV modules, making them more competitive with traditional energy sources.

Government incentives: Many governments around the world are offering incentives and subsidies for the installation of solar power systems. These incentives are expected to encourage more people and businesses to invest in solar power, which will drive the growth of the PV modules market.

Emerging markets: The PV modules market is still relatively untapped in many parts of the world, particularly in emerging markets. As these economies continue to develop and demand for energy increases, there will be significant opportunities for growth in the PV modules market.

Niche Threats for the PV Modules market

Competition from other renewable energy sources: While solar power is expected to continue growing, it faces competition from other renewable energy sources such as wind, hydro, and geothermal power. As these technologies become more efficient and cost-effective, they may impact the growth of the PV modules market.

Regulatory changes: Changes in government policies and regulations can have a significant impact on the PV modules market. For example, if subsidies and incentives for solar power are reduced or eliminated, it could slow down the growth of the market.

Manufacturing challenges: The manufacturing of PV modules requires a significant amount of energy and resources. As demand for solar power increases, there may be challenges in securing sufficient resources and managing the environmental impact of manufacturing.

Supply chain disruptions: The PV modules market relies on a complex global supply chain, and disruptions to this supply chain, such as natural disasters, trade disputes, or pandemics, can impact the availability and cost of PV modules.

Industries That Will Be Impacted in the Future by PV Modules

The growing adoption of PV modules and solar power is expected to have a significant impact on several industries in the future. These industries include the energy industry, construction industry, transportation industry, agriculture industry, and technology industry. As more homes and businesses switch to solar power, traditional energy companies may see a decline in demand for their services, while builders and contractors will need to incorporate solar-friendly designs and installation methods into their projects. Solar-powered electric vehicles and charging stations could become more common in the future, and solar-powered irrigation systems could help farmers reduce their energy costs. Additionally, there will be an increased demand for energy management systems, smart home technologies, and other technologies that can help optimize energy use. Overall, the impact of PV modules and solar power will create new opportunities for innovation, job growth, and sustainability across various industries.

Market Scope of PV Inverters Market:

The PV (photovoltaic) inverter market is a critical component of the solar energy system, which is expected to grow significantly in the coming years due to the increasing demand for renewable energy sources. The PV inverter is a device that converts the direct current (DC) electricity generated by the PV modules into alternating current (AC) electricity that can be used by the electrical grid or a building.

Market Scope

Growing demand for solar energy: The PV inverter market is expected to grow significantly due to the increasing demand for solar energy, driven by government initiatives and incentives, as well as the declining cost of solar power.

Technological advancements: The PV inverter market is constantly evolving with the introduction of new technologies and innovations. Advances in power electronics, digital controls, and communication technologies are expected to improve the efficiency and reliability of PV inverters, making them more competitive with traditional energy sources.

Residential and commercial applications: The PV inverter market is expected to grow in both residential and commercial applications. The residential market is driven by the increasing number of homeowners installing solar panels on their rooftops, while the commercial market is driven by businesses looking to reduce their energy costs and carbon footprint.

Futuristic Growth use-cases of PV Modules market?

The PV modules market has several futuristic growth use-cases, including the development of integrated solar solutions, powering smart cities infrastructure, building floating solar farms, solar-powered transportation, and exploring emerging markets. These use-cases are driven by the increasing demand for renewable energy, the desire to reduce carbon footprint, and the need for sustainable energy solutions. The PV modules market is well-positioned to capitalize on these opportunities and drive significant growth in the coming years.

Key challenges for Growing PV Modules Market in the future:

While the PV modules market presents several growth opportunities, there are also key challenges that could impact its growth in the future. Here are some of the challenges facing the PV modules market:

Competition from other renewable energy sources: One of the biggest challenges facing the PV modules market is competition from other renewable energy sources such as wind and hydro power. These technologies can be more effective in certain locations, and their growth could impact the demand for PV modules.

Cost and Efficiency: Cost and efficiency are two critical factors that could impact the growth of the PV modules market. While the cost of PV modules has decreased significantly in recent years, they still represent a significant investment for homeowners and businesses. Improvements in efficiency and cost reductions will be necessary to continue to drive adoption.

Limited geographic suitability: Another challenge for the PV modules market is that not all locations are suitable for solar power generation due to climate, shading, and other factors. This can limit the potential customer base for PV modules, particularly in certain regions of the world.

Dependence on government policies and incentives: The PV modules market is highly dependent on government policies and incentives, which can change over time. Changes in government policies or reductions in incentives could impact the demand for PV modules, particularly in regions where they are heavily subsidized.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Photovoltaic Market

I would like to receive, if possible, detailed data on the current North American market in the field of energy banks and photovoltaics, as well as projected photovoltaic market forecasts for the coming years. Thank you in advance and best regards

Interested in PV market(month/year) according to application (residential, industrial and utility scale) in the US for current and estimates in 2020 and 2030

I am Master's Student, I would like to have market prices for solar cells as capital cost, replacement cost, O&M as well. I hope can find the report help me in my research.

Please forward brochure. No purchase at this time, but wish to follow for possible future reference.

Hello, sir good day please help us to give input of the African solar PV market possibility.

I work at the Federal Housing Finance Agency and would like to better understand PV systems market size.

Interested in knowing the penetration of thin film PV application in South Africa and market share of the main players.