Business Jets Market by Aircraft Type (Light, Mid-Sized, Large, Airliner), Systems (OEM Systems, Aftermarket Systems), End-Use (Private User, Operator), Point of Sale (OEM, Aftermarket), Services, Range and Region - Global Forecast to 2030

Updated on : March 23, 2023

[242 Pages Report] The business jets market is projected to reach USD 41.8 billion by 2030, at a CAGR of 4.2% during the forecast period. An increasing number of high net worth personnel and the replacement of aging aircraft fleets are expected to drive the growth of the Business Jets Industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Business Jets Market Dynamics:

Driver: Replacement of old aircraft fleets

New business jets are majorly procured by existing owners and operators to either replace their old jets or to expand their fleets. Bombardier, Inc. (Canada) expects that 2,000 business aircraft will retire between 2016 and 2025, with the average age of a business jet being 17 years. However, environmental regulations and airspace modernization have reduced the retirement age of business jets, leading to an increase in their replacement. Due to environmental regulations and steps of various governing bodies toward a greener environment, it is expected that many business jets across the globe will face restrictions in terms of operating limitations. The older a business jet is, the lower is its fuel efficiency and the higher its carbon footprint. This acts as an important driving factor for the business jets market.

Restraint: Uncertainty of orders

The business jets market has witnessed uncertainty in terms of orders since 2019. This market is dependent on multiple variables such as the global economy, the number of HNWI, fuel prices, and demand, resulting in uncertainties. Factors impacting orders include economic growth, HNWIs, fuel prices, infrastructure availability, and funds to procure business jets, among others. Unlike the commercial aircraft market, where buyers are few and orders are provided in advance, in the business jets market, due to a larger share of individual buyers and high level of customization, the forecast of orders is unpredictable, which constrains market growth.

Opportunity: Emergence of e-VTOL aircraft

With intracity travel becoming increasingly congested, travel time within a city has increased. In such cases, traditional business jets cannot be used, as they take off from and land at airports, the availability of which is mostly restricted within cities. For intracity travel, VTOL aircraft can be beneficial as they can take off and land at multiple vertiports within a city. With eVTOL aircraft, part of the urban air mobility concept, the ease of travel within the city increases as they are cheaper and less noisy. For the concept to commercialize, there is a need for technological advancements in terms of battery capacity; building infrastructure such as vertiports and charging pods; and a robust regulatory framework. With the advent of eVTOL technology, the business aircraft market is expected to witness growth, as demand is already present.

Challenge: High jet fuel prices

The business jets market faces the challenge of rising fuel prices, which leads to lower purchases. Customers tend to withhold their purchase as they may not wish to spend excessively on operating a business jet after investing hugely in acquiring the jet. In addition, not every nation has the budget to purchase business jets and the expensive fuel they require. The business jets services market also gets impacted largely, as the higher fuel price is, the higher is the cost of charter services, subsequently impacting all operators in the market. The rise in fuel prices results in budget issues, which adversely impact the market growth globally. High fuel prices have made the growth of the business jets market sluggish in some countries, posing a challenge for the market.

“Based on system, the aftermarket systems segment is projected to grow at the highest CAGR in the business jets market during the forecast period”

Increasing demand for enabling premium facilities onboard aircraft is responsible for the growth of aftermarket systems. The aftermarket systems segment of the business jets market covers MRO activities, which include replacement, repairs, and maintenance of critical business jet systems and their components. The components and systems under the aftermarket segment include aerostructures, avionics, aircraft systems, cabin interiors, doors, windows, and windshields.

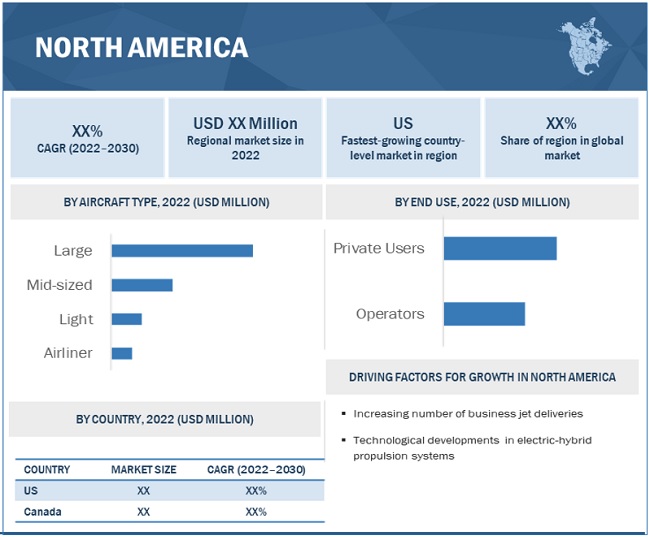

North America is expected to account for the largest share in 2022

Based on region, the business jets market has been segmented into 6 regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa. North America is estimated to account for the largest share of the global business jets market in 2022. This can be attributed to the presence of a large number of high-net-worth individuals coupled with the existence of major business jets manufacturers such as Textron Inc. (US), Bombardier Inc. (Canada), Gulfstream Aerospace (US), and Piper Aircraft (US), among others. Additionally, the availability of airports across North America enables ease in business travel across the region. Geographically, North America is the biggest region, by area, hence it is critical for business travelers to opt for the fastest mode of transport to save time, resulting in increasing demand for business jets.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Business Jets Companies are dominated by a few globally established players such as Textron Inc. (US), Embraer SA (Brazil), Gulfstream Aerospace (US), Bombardier Inc. (Canada), Dassault Aviation (France), Boeing (US), Airbus (Netherlands), Honda Aircraft Company (US), Syberjet Aircraft (US) and Piper Aircraft (US) among others.

Business Jet Market Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 30.1 billion |

| Projected Market Size | USD 41.8 billion |

| Growth Rate | 4.2% |

|

Market size available for years |

2018-2030 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2030 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Aircraft Type, End Use, Point of Sale, System, Range and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Latin America, Middle East, Africa |

|

Companies covered |

Textron Inc. (US), Embraer SA (Brazil), Gulfstream Aerospace (US) , Bombardier (Canada), Airbus (Netherlands), Boeing (US), Dassault Aviation (France), Pilatus Aircraft (Switzerland), Honda Aircraft Company (US) and Syberjet Aircraft (US) are some of the leading players |

This research report categorizes the Business Jets Market based on aircraft type, end use, point of sale, systems, range and region.

By Aircraft Type

- Light

- Mid-sized

- Large

- Airliner

By End Use

- Private User

- Operator

By Point of Sale

-

OEM

- Conventional

- Hybrid & Electric

-

Aftermarket

- MRO

- Parts Replacement

By Systems

-

OEM Systems

- Aerostructures

- Avionics

- Aircraft Systems

- Cabin Interiors

- Doors, Windows, and Windshields

-

Aftermarket Systems

- Aerostructures

- Avionics

- Aircraft Systems

- Cabin Interiors

- Doors, Windows, and Windshields

By Range

- Less than 3,000 nm

- 3,000 nm -5000 nm

- More than 5,000 nm

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Recent Developments

- In April 2022, Textron Aviation announced a purchase agreement with Exclusive Jets, LLC, which, operating as FlyExclusive, is a leading provider of premium private jet charter experiences for up to 30 Cessna Citation CJ3+ jets. FlyExclusive expects to take delivery of five aircraft by 2023, with the purchase of additional aircraft for delivery by 2025.

- In November 2021, Airbus Corporate Jets, a business unit of Airbus, signed an agreement with Alpha Star Aviation for the installation of new and unique In-flight Entertainment (IFE) technology in business jets.

- In October 2021, Gulfstream Aerospace introduced the Gulfstream G800, the longest-range aircraft in Gulfstream history. It can travel at a speed of Mach 0.85, that is, nearly the speed of a supersonic jet.

- In October 2021, Embraer SA and NetJets Inc. (US), an executive jet airway, signed a deal to procure 100 Phenom 300E of Embraer SA by the second quarter of 2023.

Frequently Asked Questions (FAQ):

What is the current size of the business jets market?

The business jets market is projected to grow from an estimated USD 30.1 billion in 2022 to USD 41.4 billion by 2030, at a CAGR of 4.2% from 2022 to 2030.

Who are the winners in the business jets market?

Textron Inc. (US), Embraer SA (Brazil), Gulfstream Aerospace (US), Bombardier Inc. (Canada), and Dassault Aviation (France) are some of the winners in the market.

What are some of the opportunities of the business jets market?

Advent of hybrid-electric aircraft propulsion technology and entry of new business jet OEMs are few of the opportunities of the business jets market.

What are some of the technological advancements in the market?

Sophistication of cabin interiors, autonomous aircraft, electric propulsion, urban air mobility, among others.

What are the factors driving the growth of the market?

Demand for improved passenger experience, replacement of old aircraft fleets and increase in number of high-net-worth individuals are some of the key factors driving the growth in the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 STUDY SCOPE

1.3.1 BUSINESS JETS MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.4.1 USD EXCHANGE RATES

1.5 INCLUSIONS & EXCLUSIONS

TABLE 1 BUSINESS JETS MARKET: INCLUSIONS & EXCLUSIONS

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH FLOW

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

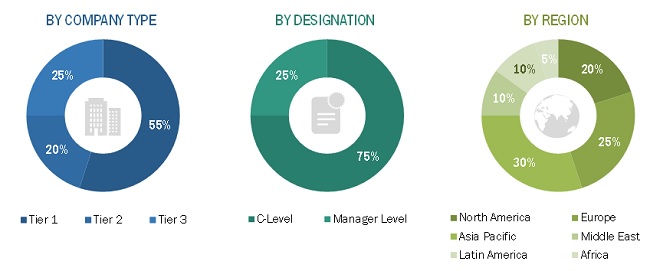

2.1.2.2 Breakdown of primaries: By company type, designation, and region

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.3 SUPPLY-SIDE INDICATORS

2.3 MARKET SIZE ESTIMATION

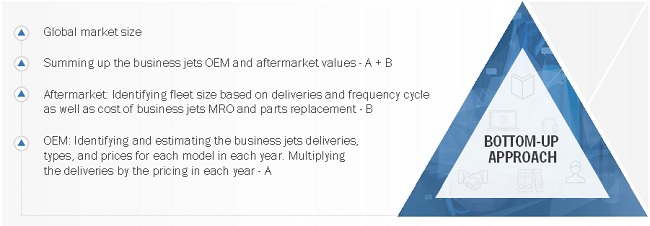

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

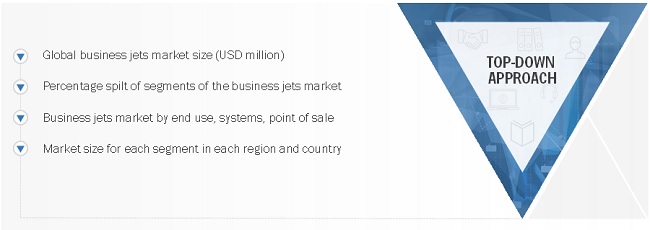

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.5 ASSUMPTIONS

2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 6 LIGHT AIRCRAFT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 7 OPERATORS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 8 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF BUSINESS JETS MARKET

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 BUSINESS JETS MARKET, 2022–2030

FIGURE 9 INCREASING DEMAND FOR IMPROVED PASSENGER EXPERIENCE DRIVES BUSINESS JETS MARKET

4.2 BUSINESS JETS MARKET, BY AIRCRAFT TYPE

FIGURE 10 LARGE AIRCRAFT SEGMENT TO DOMINATE IN 2022

4.3 BUSINESS JETS MARKET, BY END USE

FIGURE 11 OPERATORS SEGMENT EXPECTED TO LEAD DURING FORECAST PERIOD

4.4 BUSINESS JETS MARKET, BY COUNTRY

FIGURE 12 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 BUSINESS JETS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Demand for improved passenger experience

5.2.1.2 Replacement of old aircraft fleets

5.2.1.3 Increase in number of high-net-worth individuals

5.2.2 RESTRAINTS

5.2.2.1 Complex product certification procedure

5.2.2.2 Uncertainty of orders

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of e-VTOL aircraft

5.2.3.2 Advent of hybrid-electric aircraft propulsion technology

5.2.3.3 Entry of new business jet OEMs

5.2.3.4 High demand for private jets and chartered airplanes

5.2.4 CHALLENGES

5.2.4.1 Unavailability of infrastructure in developing countries

5.2.4.2 High jet fuel prices

FIGURE 14 JET FUEL PRICE TREND (JUNE 2021 TO JUNE 2022)

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS

FIGURE 15 REVENUE SHIFT IN BUSINESS JETS MARKET

5.4 BUSINESS JETS MARKET ECOSYSTEM

5.4.1 PROMINENT COMPANIES

5.4.2 START-UPS AND SMALL ENTERPRISES

5.4.3 END USERS

5.4.4 AFTERMARKET

FIGURE 16 BUSINESS JETS MARKET ECOSYSTEM MAP

TABLE 2 BUSINESS JETS MARKET ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.5.1 ON-BOARD JET WAVE TECHNOLOGY

5.5.2 URBAN AIR MOBILITY

5.6 USE CASE ANALYSIS

5.6.1 USE CASE: JET-SHARE CO. MANAGES OPERATIONS IN TIME-SHARED BUSINESS JETS

TABLE 3 TIME-SHARED BUSINESS JETS

5.6.2 USE CASE: JET SHARING DUE TO PROBLEMS WITH AVAILABILITY OF COMMERCIAL AIRLINES

TABLE 4 PROBLEMS ASSOCIATED WITH COMMERCIAL AIRPLANES

5.6.3 USE CASE: PEGASUS UNIVERSAL AEROSPACE CARRIES OUT FIRST VTOL BUSINESS JET OUTING AT EBACE

5.7 VALUE CHAIN ANALYSIS

FIGURE 17 VALUE CHAIN ANALYSIS

5.8 AVERAGE SELLING PRICE ANALYSIS

FIGURE 18 SELLING PRICE

5.9 VOLUME DATA

TABLE 5 BUSINESS JETS MARKET, BY AIRCRAFT TYPE (2018-2021) (UNITS)

5.10 PORTER'S FIVE FORCES ANALYSIS

TABLE 6 BUSINESS JETS MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 19 BUSINESS JETS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 KEY STAKEHOLDERS & BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP TWO SOLUTIONS

TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP TWO SOLUTIONS (%)

5.11.2 BUYING CRITERIA

FIGURE 21 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

TABLE 8 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13 TRADE DATA ANALYSIS

TABLE 14 COUNTRY-WISE IMPORTS, 2020-2021 (USD THOUSAND)

TABLE 15 COUNTRY-WISE EXPORTS, 2020-2021 (USD THOUSAND)

5.14 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 16 BUSINESS JETS MARKET: CONFERENCES & EVENTS

6 INDUSTRY TRENDS (Page No. - 78)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 SOPHISTICATED CABIN INTERIORS

6.2.1.1 Cabin lighting

6.2.1.2 IFEC

6.2.1.3 Cabin management systems

6.2.2 AUTONOMOUS BUSINESS AIRCRAFT

6.2.3 ELECTRIC PROPULSION

6.2.3.1 Hybrid-electric propulsion system design

FIGURE 22 HYBRID-ELECTRIC PROPULSION SYSTEM ARCHITECTURE

6.2.3.2 All-electric propulsion system design

FIGURE 23 ALL-ELECTRIC PROPULSION SYSTEM ARCHITECTURE

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 24 SUPPLY CHAIN ANALYSIS

6.4 IMPACT OF MEGATRENDS

6.4.1 IMPLEMENTATION OF SUSTAINABILITY

6.4.2 ALTERNATE POWER SOURCES

6.4.3 ACCELERATION OF URBANIZATION

6.4.4 DIGITALIZATION

6.4.5 SHARING ECONOMIES

6.4.6 ARTIFICIAL INTELLIGENCE

6.5 INNOVATION & PATENT REGISTRATIONS

TABLE 17 INNOVATION & PATENT REGISTRATIONS (2019-2022)

7 BUSINESS JETS MARKET, BY AIRCRAFT TYPE (Page No. - 87)

7.1 INTRODUCTION

FIGURE 25 LIGHT AIRCRAFT PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2030

TABLE 18 BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 19 BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

7.2 LIGHT

7.2.1 DEMAND FOR INTERCITY TRAVEL DRIVES SEGMENT

7.3 MID-SIZED

7.3.1 AVAILABILITY OF CUSTOMIZED JETS ATTRACTS CLIENTS

7.4 LARGE

7.4.1 DEMAND FOR LUXURY AND LONG-RANGE TRAVEL CONTRIBUTES TO SEGMENT GROWTH

7.5 AIRLINER

7.5.1 DEMAND FOR COMFORT DURING VVIP TRAVEL FUELS SEGMENT

8 BUSINESS JETS MARKET, BY END USE (Page No. - 91)

8.1 INTRODUCTION

FIGURE 26 OPERATORS SEGMENT TO LEAD BUSINESS JETS MARKET BY 2030

TABLE 20 BUSINESS JETS MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 21 BUSINESS JETS MARKET, BY END USE, 2022–2030 (USD MILLION)

8.2 PRIVATE USERS

8.2.1 EASE OF TRAVEL INCREASES POPULARITY

8.3 OPERATORS

8.3.1 AVAILABILITY OF VARIETY OF CHARTER SERVICES

9 BUSINESS JETS MARKET, BY POINT OF SALE (Page No. - 94)

9.1 INTRODUCTION

FIGURE 27 OEM SEGMENT TO LEAD MARKET FROM 2022 TO 2030

TABLE 22 BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 23 BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

9.2 OEM

TABLE 24 BUSINESS JETS OEM MARKET, BY PROPULSION TYPE, 2019–2021 (USD MILLION)

TABLE 25 BUSINESS JETS OEM MARKET, BY PROPULSION TYPE, 2022–2030 (USD MILLION)

9.2.1 CONVENTIONAL

9.2.1.1 Easy implementation of conventional engines boosts market growth

9.2.2 HYBRID-ELECTRIC

9.2.2.1 Adoption of aircraft electrification promotes segment

9.3 AFTERMARKET

TABLE 26 BUSINESS JETS AFTERMARKET, BY OPERATION, 2019–2021 (USD MILLION)

TABLE 27 BUSINESS JETS AFTERMARKET, BY OPERATION, 2022–2030 (USD MILLION)

9.3.1 MAINTENANCE, REPAIR, AND OVERHAUL (MRO)

9.3.1.1 Upgrade of existing business jet fleets contributes to segment growth

9.3.2 PARTS REPLACEMENT

9.3.2.1 Long flight hours affect growth of parts replacement segment

10 BUSINESS JETS MARKET, BY RANGE (Page No. - 99)

10.1 INTRODUCTION

FIGURE 28 BUSINESS JETS MARKET, BY RANGE, 2022 & 2030 (USD MILLION)

TABLE 28 BUSINESS JETS MARKET, BY RANGE, 2019–2021 (USD MILLION)

TABLE 29 BUSINESS JETS MARKET, BY RANGE, 2022–2030 (USD MILLION)

10.2 LESS THAN 3,000 NM

10.2.1 TYPICALLY USED FOR SHORT-HAUL TRAVEL

10.3 3,000–5,000 NM

10.3.1 INTERCITY TRAVEL TO BOOST SEGMENT

10.4 MORE THAN 5,000 NM

10.4.1 INCREASE IN LONG-HAUL FLIGHTS FUELS SEGMENT GROWTH

11 BUSINESS JETS MARKET, BY SYSTEM (Page No. - 102)

11.1 INTRODUCTION

FIGURE 29 OEM SYSTEMS TO GROW FASTEST DURING FORECAST PERIOD

TABLE 30 BUSINESS JETS MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 31 BUSINESS JETS MARKET, BY SYSTEM, 2022–2030 (USD MILLION)

11.2 OEM SYSTEMS

TABLE 32 BUSINESS JETS MARKET, BY OEM SYSTEM, 2019–2021 (USD MILLION)

TABLE 33 BUSINESS JETS MARKET, BY OEM SYSTEM, 2022–2030 (USD MILLION)

11.2.1 AEROSTRUCTURES

TABLE 34 AEROSTRUCTURES: BUSINESS JETS MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 35 AEROSTRUCTURES: BUSINESS JETS MARKET, BY SUBSYSTEM, 2022–2030 (USD MILLION)

11.2.1.1 Fuselage

11.2.1.1.1 High demand for light aircraft components that use molded composites

11.2.1.2 Empennage

11.2.1.2.1 Demand for aircraft configuration-friendly empennage drives market

11.2.1.3 Flight control surfaces

11.2.1.3.1 Introduction of fiber control surfaces boosts segment

11.2.1.4 Wings

11.2.1.4.1 Development of lightweight wings promotes segment

11.2.1.5 Nacelle & pylon

11.2.1.5.1 Advancements in aerospace materials resulting in development of high-strength structures

11.2.1.6 Nose

11.2.1.6.1 Need to enhance aerodynamics of business jets boosts segment

11.2.2 AVIONICS

TABLE 36 AVIONICS: BUSINESS JETS MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 37 AVIONICS: BUSINESS JETS MARKET, BY SUBSYSTEM, 2022–2030 (USD MILLION)

11.2.2.1 Flight management systems

11.2.2.1.1 Autonomous guidance for business jets to boost FMS segment

11.2.2.2 Communication systems

11.2.2.2.1 Commercialization of 5G in business aviation likely to drive segment

11.2.2.3 Navigation systems

11.2.2.3.1 Autonomous navigation technology drives segment

11.2.2.4 Software

11.2.2.4.1 Development of analytical software algorithms fuels growth

11.2.3 AIRCRAFT SYSTEMS

TABLE 38 AIRCRAFT SYSTEMS: BUSINESS JETS MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 39 AIRCRAFT SYSTEMS: BUSINESS JETS MARKET, BY SUBSYSTEM, 2022–2030 (USD MILLION)

11.2.3.1 Hydraulic systems

11.2.3.1.1 Reliability of hydraulic systems responsible for segment growth

11.2.3.2 Pneumatic systems

11.2.3.2.1 Increasing demand for aircraft valves to drive segment

11.2.3.3 Environmental control systems

11.2.3.3.1 Segment booster – demand for enhanced passenger comfort

11.2.3.4 Emergency systems

11.2.3.4.1 Growing awareness regarding aircraft safety expected to drive demand

11.2.3.5 Electrical systems

11.2.3.5.1 Demand for more electric aircraft presents opportunities

11.2.3.6 Propulsion systems

11.2.3.6.1 Introduction of hybrid propulsion – likely driver

11.2.3.7 Landing systems

11.2.3.7.1 Electrification of landing systems contributes to segment growth

11.2.4 CABIN INTERIORS

TABLE 40 CABIN INTERIORS: BUSINESS JETS MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 41 CABIN INTERIORS: BUSINESS JETS MARKET, BY SUBSYSTEM, 2022–2030 (USD MILLION)

11.2.4.1 Seats

11.2.4.1.1 Demand for seats with premium facilities expected to drive segment

11.2.4.2 IFEC

11.2.4.2.1 Implementation of on-board internet connectivity fuels segment

11.2.4.3 Galleys

11.2.4.3.1 Segment driven by availability of customized galley components

11.2.4.4 Panels

11.2.4.4.1 Provide support to internal wires and critical systems

11.2.4.5 Stowage bins

11.2.4.5.1 Demand for extra luggage space expected to boost segment

11.2.4.6 Lavatory

11.2.4.6.1 High-tech lavatories in business jets drive growth

11.2.5 DOORS, WINDOWS, AND WINDSHIELDS

11.3 AFTERMARKET SYSTEMS

TABLE 42 BUSINESS JETS AFTERMARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 43 BUSINESS JETS AFTERMARKET, BY SYSTEM, 2022–2030 (USD MILLION)

11.3.1 AEROSTRUCTURES

11.3.2 AVIONICS

11.3.2.1 Flight management systems

11.3.2.2 Communication systems

11.3.2.3 Navigation systems

11.3.2.4 Software

11.3.3 AIRCRAFT SYSTEMS

TABLE 44 AIRCRAFT SYSTEMS: BUSINESS JETS AFTERMARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 45 AIRCRAFT SYSTEMS: BUSINESS JETS AFTERMARKET, BY SUBSYSTEM, 2022–2030 (USD MILLION)

11.3.3.1 Hydraulic systems

11.3.3.2 Pneumatic systems

11.3.3.3 Environmental control systems

11.3.3.4 Emergency systems

11.3.3.5 Electrical systems

11.3.3.6 Propulsion systems

11.3.3.7 Landing systems

11.3.4 CABIN INTERIORS

TABLE 46 CABIN INTERIORS: BUSINESS JETS AFTERMARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 47 CABIN INTERIORS: BUSINESS JETS MARKET, BY SUBSYSTEM, 2022–2030 (USD MILLION)

11.3.4.1 Seats

11.3.4.2 IFEC

11.3.4.3 Galleys

11.3.4.4 Panels

11.3.4.5 Stowage bins

11.3.4.6 Lavatories

11.3.5 DOORS, WINDOWS, AND WINDSHIELDS

12 BUSINESS JET SERVICES MARKET (Page No. - 120)

12.1 INTRODUCTION

FIGURE 30 MAJOR PLAYERS IN BUSINESS JET SERVICES MARKET

12.2 BUSINESS JET SERVICES MARKET, BY TYPE

12.2.1 CHARTER SERVICES

12.2.1.1 Shared private jet services help optimize charter fleet operations

12.2.2 JET CARD PROGRAMS

12.2.2.1 Debit as you fly programs – popular with frequent flyers

12.2.3 FRACTIONAL OWNERSHIP

12.2.3.1 Offers shared ownership with benefits of charter services

12.3 AIRCRAFT MANAGEMENT SERVICES

12.4 BUSINESS JET SERVICES MARKET, BY LEASE TYPE

12.4.1 WET LEASE

12.4.1.1 Leasing aircraft with all supporting services – Short-term lease

12.4.2 DRY LEASE

12.4.2.1 Leasing aircraft with no additional services – Long-term lease

TABLE 48 AVERAGE DRY LEASING PRICE FOR BUSINESS JETS

13 REGIONAL ANALYSIS (Page No. - 125)

13.1 INTRODUCTION

FIGURE 31 NORTH AMERICA TO HOLD DOMINANT SHARE OF BUSINESS JETS MARKET IN 2022

TABLE 49 BUSINESS JETS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 50 BUSINESS JETS MARKET, BY REGION, 2022–2030 (USD MILLION)

13.2 NORTH AMERICA

13.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 32 NORTH AMERICA: BUSINESS JETS MARKET SNAPSHOT

TABLE 51 NORTH AMERICA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 52 NORTH AMERICA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 53 NORTH AMERICA: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 54 NORTH AMERICA: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

TABLE 55 NORTH AMERICA: BUSINESS JETS MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 56 NORTH AMERICA: BUSINESS JETS MARKET, BY END USE, 2022–2030 (USD MILLION)

TABLE 57 NORTH AMERICA: BUSINESS JETS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 58 NORTH AMERICA: BUSINESS JETS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

13.2.2 US

13.2.2.1 Home to top private jet manufacturers

TABLE 59 US: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 60 US: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 61 US: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 62 US: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.2.3 CANADA

13.2.3.1 High demand for lightweight business jets

TABLE 63 CANADA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 64 CANADA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 65 CANADA: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 66 CANADA: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.3 EUROPE

13.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 33 EUROPE: BUSINESS JETS MARKET SNAPSHOT

TABLE 67 EUROPE: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 68 EUROPE: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 69 EUROPE: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 70 EUROPE: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

TABLE 71 EUROPE: BUSINESS JETS MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 72 EUROPE: BUSINESS JETS MARKET, BY END USE, 2022–2030 (USD MILLION)

TABLE 73 EUROPE: BUSINESS JETS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 74 EUROPE: BUSINESS JETS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

13.3.2 UK

13.3.2.1 Increasing adoption of business jets for domestic air transportation

TABLE 75 UK: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 76 UK: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 77 UK: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 78 UK: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.3.3 FRANCE

13.3.3.1 Increasing competition between business jet airliners

TABLE 79 FRANCE: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 80 FRANCE: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 81 FRANCE: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 82 FRANCE: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.3.4 GERMANY

13.3.4.1 Considerable scope for aftermarket growth

TABLE 83 GERMANY: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 84 GERMANY: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 85 GERMANY: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 86 GERMANY: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.3.5 SWITZERLAND

13.3.5.1 Rapid developments in business jets architecture

TABLE 87 SWITZERLAND: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 88 SWITZERLAND: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 89 SWITZERLAND: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 90 SWITZERLAND: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.3.6 RUSSIA

13.3.6.1 Border conflicts affect market growth

TABLE 91 RUSSIA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 92 RUSSIA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 93 RUSSIA: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 94 RUSSIA: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.3.7 ITALY

13.3.7.1 Presence of key MRO service providers

TABLE 95 ITALY: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 96 ITALY: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 97 ITALY: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 98 ITALY: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.3.8 SPAIN

13.3.8.1 Growing VVIP air travel in country

TABLE 99 SPAIN: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 100 SPAIN: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 101 SPAIN: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 102 SPAIN: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.3.9 REST OF EUROPE

13.3.9.1 Growing focus on timely maintenance of business jets

TABLE 103 REST OF EUROPE: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 104 REST OF EUROPE: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 105 REST OF EUROPE: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 106 REST OF EUROPE: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.4 ASIA PACIFIC

13.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: BUSINESS JETS MARKET SNAPSHOT

TABLE 107 ASIA PACIFIC: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 108 ASIA PACIFIC: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 109 ASIA PACIFIC: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 110 ASIA PACIFIC: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

TABLE 111 ASIA PACIFIC: BUSINESS JETS MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 112 ASIA PACIFIC: BUSINESS JETS MARKET, BY END USE, 2022–2030 (USD MILLION)

TABLE 113 ASIA PACIFIC: BUSINESS JETS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 114 ASIA PACIFIC: BUSINESS JETS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

13.4.2 CHINA

13.4.2.1 Increasing use of and demand for private jets

TABLE 115 CHINA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 116 CHINA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 117 CHINA: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 118 CHINA: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.4.3 AUSTRALIA

13.4.3.1 Implementation of electric-hybrid air travel

TABLE 119 AUSTRALIA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 120 AUSTRALIA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 121 AUSTRALIA: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 122 AUSTRALIA: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.4.4 SINGAPORE

13.4.4.1 Increasing preference for private travel among passengers

TABLE 123 SINGAPORE: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 124 SINGAPORE: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 125 SINGAPORE: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 126 SINGAPORE: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.4.5 JAPAN

13.4.5.1 Increasing number of new aircraft orders

TABLE 127 JAPAN: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 128 JAPAN: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 129 JAPAN: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 130 JAPAN: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.4.6 INDIA

13.4.6.1 High demand for business jets from ultra-rich clients

TABLE 131 INDIA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 132 INDIA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 133 INDIA: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 134 INDIA: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.4.7 REST OF ASIA PACIFIC

13.4.7.1 Aging business jet fleets drive market growth

TABLE 135 REST OF ASIA PACIFIC: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 136 REST OF ASIA PACIFIC: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 137 REST OF ASIA PACIFIC: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 138 REST OF ASIA PACIFIC: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.5 MIDDLE EAST

13.5.1 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 35 MIDDLE EAST: BUSINESS JETS MARKET SNAPSHOT

TABLE 139 MIDDLE EAST: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 140 MIDDLE EAST: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 141 MIDDLE EAST: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 142 MIDDLE EAST: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

TABLE 143 MIDDLE EAST: BUSINESS JETS MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 144 MIDDLE EAST: BUSINESS JETS MARKET, BY END USE, 2022–2030 (USD MILLION)

TABLE 145 MIDDLE EAST: BUSINESS JETS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 146 MIDDLE EAST: BUSINESS JETS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

13.5.2 UAE

13.5.2.1 Shift in preference from business class to executive jets among millionaires

TABLE 147 UAE: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 148 UAE: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 149 UAE: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 150 UAE: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.5.3 SAUDI ARABIA

13.5.3.1 Presence of advanced aerospace capabilities

TABLE 151 SAUDI ARABIA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 152 SAUDI ARABIA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 153 SAUDI ARABIA: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 154 SAUDI ARABIA: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.5.4 TURKEY

13.5.4.1 Growth of tourism industry - key driver

TABLE 155 TURKEY: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 156 TURKEY: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 157 TURKEY: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 158 TURKEY: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.5.5 QATAR

13.5.5.1 High prevalence of in-flight business meetings

TABLE 159 QATAR: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 160 QATAR: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 161 QATAR: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 162 QATAR: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.5.6 KUWAIT

13.5.6.1 Availability of variety of executive jets

TABLE 163 KUWAIT: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 164 KUWAIT: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 165 KUWAIT: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 166 KUWAIT: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.5.7 REST OF MIDDLE EAST

13.5.7.1 Demand for long-range business jets

TABLE 167 REST OF MIDDLE EAST: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 168 REST OF MIDDLE EAST: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 169 REST OF MIDDLE EAST: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 170 REST OF MIDDLE EAST: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.6 LATIN AMERICA

13.6.1 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 36 LATIN AMERICA: BUSINESS JETS MARKET SNAPSHOT

TABLE 171 LATIN AMERICA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 172 LATIN AMERICA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 173 LATIN AMERICA: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 174 LATIN AMERICA: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

TABLE 175 LATIN AMERICA: BUSINESS JETS MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 176 LATIN AMERICA: BUSINESS JETS MARKET, BY END USE, 2022–2030 (USD MILLION)

TABLE 177 LATIN AMERICA: BUSINESS JETS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 178 REST OF LATIN AMERICA: BUSINESS JETS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

13.6.2 BRAZIL

13.6.2.1 Presence of innovative business jet programs

TABLE 179 BRAZIL BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 180 BRAZIL: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 181 BRAZIL: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 182 BRAZIL: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.6.3 MEXICO

13.6.3.1 Presence of globally recognized charter operators

TABLE 183 MEXICO: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 184 MEXICO: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 185 MEXICO: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 186 MEXICO: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.6.4 REST OF LATIN AMERICA

13.6.4.1 Heavy investments in business aviation infrastructure

TABLE 187 REST OF LATIN AMERICA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 188 REST OF LATIN AMERICA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 189 REST OF LATIN AMERICA: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 190 REST OF LATIN AMERICA: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

13.7 AFRICA

13.7.1 PESTLE ANALYSIS: AFRICA

FIGURE 37 AFRICA: BUSINESS JETS MARKET SNAPSHOT

TABLE 191 AFRICA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 192 AFRICA: BUSINESS JETS MARKET, BY AIRCRAFT TYPE, 2022–2030 (USD MILLION)

TABLE 193 AFRICA: BUSINESS JETS MARKET, BY POINT OF SALE, 2019–2021 (USD MILLION)

TABLE 194 AFRICA: BUSINESS JETS MARKET, BY POINT OF SALE, 2022–2030 (USD MILLION)

TABLE 195 AFRICA: BUSINESS JETS MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 196 AFRICA: BUSINESS JETS MARKET, BY END USE, 2022–2030 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 184)

14.1 INTRODUCTION

TABLE 197 KEY DEVELOPMENTS BY LEADING PLAYERS BETWEEN 2019 AND 2022

14.2 REVENUE ANALYSIS OF KEY PLAYERS, 2021

FIGURE 38 REVENUE ANALYSIS OF KEY COMPANIES (2017-2021)

14.3 MARKET SHARE ANALYSIS, 2021

FIGURE 39 BUSINESS JETS: MARKET SHARE ANALYSIS

TABLE 198 BUSINESS JETS MARKET: DEGREE OF COMPETITION

14.4 COMPANY EVALUATION QUADRANT

14.4.1 BUSINESS JETS MARKET: COMPETITIVE LEADERSHIP MAPPING

14.4.1.1 Stars

14.4.1.2 Pervasive players

14.4.1.3 Emerging leaders

14.4.1.4 Participants

FIGURE 40 BUSINESS JETS MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2021

14.4.2 BUSINESS JETS MARKET: COMPETITIVE LEADERSHIP MAPPING (SME)

14.4.2.1 Progressive companies

14.4.2.2 Responsive companies

14.4.2.3 Starting blocks

14.4.2.4 Dynamic companies

FIGURE 41 BUSINESS JETS MARKET (SME): COMPANY LEADERSHIP MAPPING, 2021

TABLE 199 BUSINESS JETS MARKET: KEY START-UPS/SMES

TABLE 200 BUSINESS JETS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

14.4.2.5 COMPETITIVE BENCHMARKING

TABLE 201 COMPANY PRODUCT FOOTPRINT

TABLE 202 COMPANY AIRCRAFT TYPE FOOTPRINT

TABLE 203 COMPANY OFFERING FOOTPRINT

TABLE 204 COMPANY REGION FOOTPRINT

14.5 COMPETITIVE SCENARIO AND TRENDS

14.5.1 PRODUCT LAUNCHES

TABLE 205 BUSINESS JETS MARKET: PRODUCT LAUNCHES, 2019–APRIL 2022

14.5.2 DEALS

TABLE 206 BUSINESS JETS MARKET: DEALS, 2019– APRIL 2022

15 COMPANY PROFILES (Page No. - 203)

15.1 INTRODUCTION

15.2 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

15.2.1 TEXTRON INC.

TABLE 207 TEXTRON INC.: BUSINESS OVERVIEW

FIGURE 42 TEXTRON INC.: COMPANY SNAPSHOT

TABLE 208 TEXTRON INC.: PRODUCTS OFFERED

TABLE 209 TEXTRON INC.: PRODUCT LAUNCHES

TABLE 210 TEXTRON INC.: DEALS

15.2.2 EMBRAER SA

TABLE 211 EMBRAER SA: BUSINESS OVERVIEW

FIGURE 43 EMBRAER SA: COMPANY SNAPSHOT

TABLE 212 EMBRAER SA: PRODUCTS OFFERED

TABLE 213 EMBRAER SA: PRODUCT LAUNCHES

TABLE 214 EMBRAER SA: DEALS

15.2.3 GULFSTREAM AEROSPACE

TABLE 215 GULFSTREAM AEROSPACE: BUSINESS OVERVIEW

TABLE 216 GULFSTREAM AEROSPACE: PRODUCTS OFFERED

TABLE 217 GULFSTREAM AEROSPACE: PRODUCT LAUNCHES

TABLE 218 GULFSTREAM AEROSPACE: DEALS

15.2.4 BOMBARDIER, INC.

TABLE 219 BOMBARDIER, INC.: BUSINESS OVERVIEW

FIGURE 44 BOMBARDIER, INC.: COMPANY SNAPSHOT

TABLE 220 BOMBARDIER, INC.: PRODUCTS OFFERED

TABLE 221 BOMBARDIER, INC.: PRODUCT LAUNCHES

TABLE 222 BOMBARDIER, INC.: DEALS

15.2.5 DASSAULT AVIATION

TABLE 223 DASSAULT AVIATION: BUSINESS OVERVIEW

FIGURE 45 DASSAULT AVIATION: COMPANY SNAPSHOT

TABLE 224 DASSAULT AVIATION: PRODUCTS OFFERED

TABLE 225 DASSAULT AVIATION: PRODUCT LAUNCHES

TABLE 226 DASSAULT AVIATION: DEALS

15.2.6 BOEING

TABLE 227 BOEING: BUSINESS OVERVIEW

FIGURE 46 BOEING: COMPANY SNAPSHOT

TABLE 228 BOEING: PRODUCTS OFFERED

TABLE 229 BOEING: DEALS

15.2.7 AIRBUS

TABLE 230 AIRBUS: BUSINESS OVERVIEW

FIGURE 47 AIRBUS: COMPANY SNAPSHOT

TABLE 231 AIRBUS: PRODUCTS OFFERED

TABLE 232 AIRBUS: PRODUCT LAUNCHES

TABLE 233 AIRBUS: DEALS

15.2.8 PILATUS AIRCRAFT

TABLE 234 PILATUS AIRCRAFT: BUSINESS OVERVIEW

TABLE 235 PILATUS AIRCRAFT: PRODUCTS OFFERED

TABLE 236 PILATUS AIRCRAFT: DEALS

15.2.9 HONDA AIRCRAFT COMPANY

TABLE 237 HONDA AIRCRAFT COMPANY: BUSINESS OVERVIEW

TABLE 238 HONDA AIRCRAFT COMPANY: PRODUCT LAUNCHES

15.2.10 SYBERJET AIRCRAFT

TABLE 239 SYBERJET AIRCRAFT: BUSINESS OVERVIEW

15.2.11 PIPER AIRCRAFT

TABLE 240 PIPER AIRCRAFT: BUSINESS OVERVIEW

15.2.12 CIRRUS AIRCRAFT

TABLE 241 CIRRUS AIRCRAFT: BUSINESS OVERVIEW

15.2.13 VERTICAL AEROSPACE

TABLE 242 VERTICAL AEROSPACE: BUSINESS OVERVIEW

15.2.14 ONE AVIATION CORPORATION

TABLE 243 ONE AVIATION CORPORATION: BUSINESS OVERVIEW

16 OTHER PLAYERS (Page No. - 231)

16.1 VOLOCOPTER GMBH

TABLE 244 VOLOCOPTER GMBH: COMPANY OVERVIEW

16.2 EVIATION AIRCRAFT

TABLE 245 EVIATION AIRCRAFT: COMPANY OVERVIEW

16.3 ZUNUM AERO

TABLE 246 ZUNUM AERO: COMPANY OVERVIEW

16.4 LILIUM GMBH

TABLE 247 LILIUM GMBH: COMPANY OVERVIEW

16.5 JOBY AVIATION

TABLE 248 JOBY AVIATION: COMPANY OVERVIEW

16.6 KAREM AIRCRAFT, INC.

TABLE 249 KAREM AIRCRAFT, INC.: COMPANY OVERVIEW

16.7 LIFT

TABLE 250 LIFT: COMPANY OVERVIEW

16.8 XTI AIRCRAFT

TABLE 251 XTI AIRCRAFT: COMPANY OVERVIEW

16.9 SAMAD AEROSPACE

TABLE 252 SAMAD AEROSPACE: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

17 APPENDIX (Page No. - 236)

17.1 DISCUSSION GUIDE

17.1.1 BUSINESS JETS MARKET (2022–2030)

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

The research study conducted on the business jets market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the business jets market. The primary sources considered included industry experts from the business jets market as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the business jets market as well as to assess the growth prospects of the market.

Secondary Research

The secondary sources referred for this research study included government sources, such as the Federal Aviation Industry (FAA), the European Aviation Safety Agency (EASA), the General Civil Aviation Authority (GCAA), the International Air Transport Association (IATA), and corporate filings, such as annual reports, investor presentations, and financial statements of trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall market size, which primary respondents further validated. Other secondary sources referred for this research study included Airfleets, Bombardier, and Embraer Market Outlook 2021, General Aviation Manufacturers Association (GAMA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information such as market statistics, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand industry trends, type, range, aftermarket systems, services, and region. Stakeholders from the demand side included government telecommunication organizations, system integrators, technology providers, and solution providers.

After obtaining information regarding the business jets market scenario, extensive primary research was conducted with market experts from the demand and supply sides across six regions, namely, North America, Europe, Asia Pacific, Middle East, Africa, and Latin America. This primary data is obtained through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the business jets market. The following figure offers a representation of the overall market size estimation process employed for the purpose of this study on the business jets market.

The research methodology used to estimate the market size includes the following details:

- Key players in this market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the armored vehicles market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Market size estimation methodology: Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market size estimation methodology: Top down approac

Data triangulation

After arriving at the overall size of the business jets market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated sizes of different market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report objectives

- To define, describe, segment, and forecast the size of the business jets market based on aircraft type, end use, point of sale, system, range and region

- To forecast the market size of various segments of the business jets market with respect to 6 major regions: North America, Europe, Asia Pacific, Latin America, Middle East and Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of business jets market

- To identify and analyze various regional contracts in the business jets market

- To identify industry trends, market trends, and technology trends currently prevailing in the business jets market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the degree of competition in the business jets market by identifying key market players

- To analyze competitive developments such as contracts, agreements, mergers & acquisitions, and new product launches & developments of key players in the business jets market

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the business jets market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies2

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the business jets market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Business Jets Market

more info about middle east ?

I want to know an approximate market size of business jets, and which aircraft (model/pax) this is assessed against. Private vs operator split.

Our company is based in Sri Lanka and Maldives and it deals with servicing private aircraft. I am looking out for the global trends to understand the market size of my surrounding regions.

I am looking for more information about Africa and possible growth on this continent?