Carbon Capture, Utilization, and Storage Market by Service (Capture, Transportation, Utilization, Storage), Technology (Chemical Looping, Solvents & Sorbent, Membrane), End-Use Industry, and Region - Global Forecast to 2030

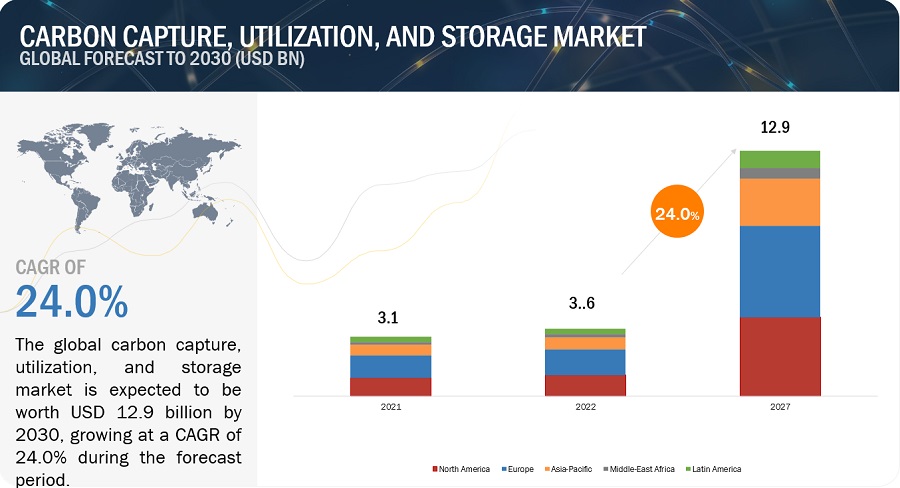

The carbon capture, utilization, transportation and storage market is projected to grow from USD 3.0 billion in 2022 and is projected to reach USD 14.2 billion by 2030, at a CAGR of 21.5%. Over the world, the carbon capture, utilization, transportation and storage market is expanding significantly, and during the forecast period, a similar trend is anticipated.

The demand for carbon capture, utilization, transportation and storage has been driven by several factors, including the need to increase the efficiency of operations, reduce maintenance costs, and enhance safety. The major applications of carbon capture, utilization, transportation and storage include construction, transportation, wind energy, aerospace and defense, marine, electrical and electronics, and others.

In the construction industry, carbon capture, utilization, transportation and storage is used in the form of panels, insulation, and roofing materials, whereas carbon capture, utilization, transportation and storage is used to manufacture lightweight and durable parts for automobiles, trains, and aircraft in the transportation industry.

In the wind energy industry, carbon capture, utilization, transportation and storage is used to manufacture wind turbine blades. In the aerospace and defense industry, carbon capture, utilization, transportation and storage is used to manufacture various components, such as radomes, fairings, and wingtips. In the marine industry, carbon capture, utilization, transportation and storage is used to manufacture boats, yachts, and other watercraft. In the electrical and electronics industry, carbon capture, utilization, transportation and storage is used to manufacture circuit boards, electrical insulation materials, and other components.

Attractive Opportunities in Carbon capture, utilization, transportation and storage Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Carbon capture, utilization, transportation and storage Market Dynamics

Driver: Rising environmental awareness to increase natural gas demand

Stringent environmental norms and regulations are also boosting the demand for carbon capture, utilization, and storage. The most important energy fuel sources prevailing globally are gasoline, diesel, petroleum products, and natural gas. The exploration and production of these fuels are harmful and risk the environment. Still, natural gas is considered the alternative fuel for sustainable development as it reduces carbon emissions, slows down global warming, and lessens GHG emissions. In order to minimize the risks associated with the usage of gasoline or diesel as a fuel and promote the usage of natural gas, the US government has set up various rules and regulations. Countries with major natural gas reserves are looking at the advantages of using carbon capture, utilization, and storage, resulting in lower carbon emissions.

China and the US, countries with a major contribution to the global GHG emissions, entered into a collaboration in 2010—The US-China Energy Cooperation Program. This global climate agreement includes action plans on clean energy, energy efficiency, and climate change. According to the Energy Information Administration and Institute of Energy Economics Japan, world energy consumption will increase by 50% by 2035, leading to an increased demand for carbon capture, utilization, and storage.

Restraint: Safety concerns over storage techniques and sites to restrict the market growth

The leakage of CO2 is one of the major issues while storing CO2 under the Earth’s surface. The leakage of CO2 can result in the contamination of water, acidification of soils, alteration of groundwater, and cryogenic burns. Hence, proper site selection for CO2 storage is the major factor for determining the magnitude and likelihood of risks. CO2 injected underground can later break through multiple channels, including geological features, such as fractures in the rock. Another problem can be leakage through wells. Both active and abandoned wells can be ways of CO2 leakage and can take the form of either well blowouts or continuous leakage.

Continuous leakage is a slow leakage due to improper well construction, such as cement degradation or failures in casing and well blowouts that are generally abrupt events arising when the pressure control fails. Though well blowout is a rare incident, it can result in rapid leakage and could have serious consequences to the environment, potentially triggering the death of humans and animals. There is a possibility for CO2 to leak from storage points as well. Such leakage could occur if the seal at the point of the storage fails, which will result in the release of sequestered CO2.

Opportunity: Increasing project announcements in Asia Pacific region to create lucrative opportunities for the market

Current and upcoming projects of carbon capture, utilization, and storage in the Asia Pacific region have created opportunities for market players. China and Australia are the early adopters of carbon capture, utilization, and storage in the region. Other than Australia and China, South Korea and India also focus on adopting carbon capture, utilization, and storage.

South Korea has already taken a step toward carbon capture, utilization, and storage in the Korea CCS 1&2 project, which is currently in an early developmental stage. Moreover, in 2016, India initiated the operation of carbon capture and utilization system, which was capable of capturing 60,000 tons of C02 per year from coal-fired power plants. Furthermore, various projects in China, including CHEERS (Chinese-European Emission-Reducing Solutions), Huaneng GreenGen, and Sinopec Qilu Petrochemical, are expected to start in the coming few years.

Challenge: Reducing carbon capturing cost to be a major challenge for market growth

Investments in product innovation and technology development are of utmost importance to overcome current technical limitations. Various companies are working on developing new solutions and investing significant resources to intensify R&D initiatives. Carbon capture, utilization, and storage system can be installed in new energy utilization plants or retrofitted to existing plants. If CO2 capture is to be introduced rapidly, it needs to be retrofitted to existing plants. However, some complications can hamper this approach. Plants with carbon capture, utilization, and storage retrofits can have site constraints, such as the availability of land for the capture equipment.

In addition to this, the remaining plant life may not be able to justify the large expense of installing capture equipment. Also, older plants are likely to have low energy efficiencies, and including a carbon capture system will have a proportionally greater monetary impact on the output. Hence, these factors limit the potential usage of carbon capture, utilization, and storage. It is highly desirable to decrease this cost to expand the current horizon of carbon capture, utilization, and storage.

Solvents & Sorbents technology accounted for the largest market share, in terms of value and volume

The solvents & sorbents technology dominates the carbon capture, utilization, and storage market. Currently, this technology is majorly used by the oil & gas, chemical, and power generation industry. This technology accounted for 43.9% share, in terms of volume, of the overall market in 2022. It is followed by chemical looping technology, which had a market share of 37.9%, in terms of volume, in 2022. Membrane and other technology possess relatively low market share both in terms of value and volume.

Capture service segment dominated the carbon capture, utilization, and storage market, in terms of value and volume

Capture holds the biggest share in the CCUS market. Carbon capture is the first stage of the CCUS process and involves capturing CO2 from its emission source. It can be applied to any large-scale emission process, including coal-fired power generation plants; gas and oil production; and manufacturing industries, such as cement, iron, and steel. There are three main methods to capture CO2 for industrial and power plant applications: post-combustion, pre-combustion, and oxy-fuel, Direct Air Capture, and Bio Energy CCS.

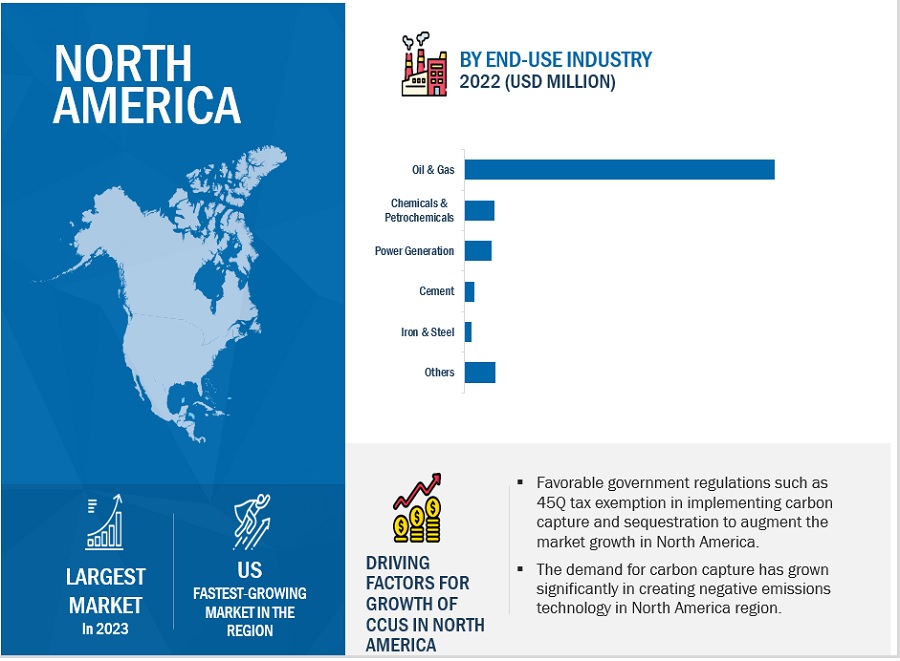

Oil & gas end-use industry segment dominated the carbon capture, utilization, and storage market, in terms of value and volume

The oil & gas industry dominates the carbon capture, utilization, and storage market. This is due to the industry's high initial adoption rate in the early days. The trend is expected to continue during the forecast period as the oil & gas industry is one of the major sources of carbon emissions. Power generation is expected to be the fastest-growing end-use industry for the carbon capture, utilization, and storage market. The adoption of carbon capture, utilization, and storage technology in the power generation industry is booming in all regions.

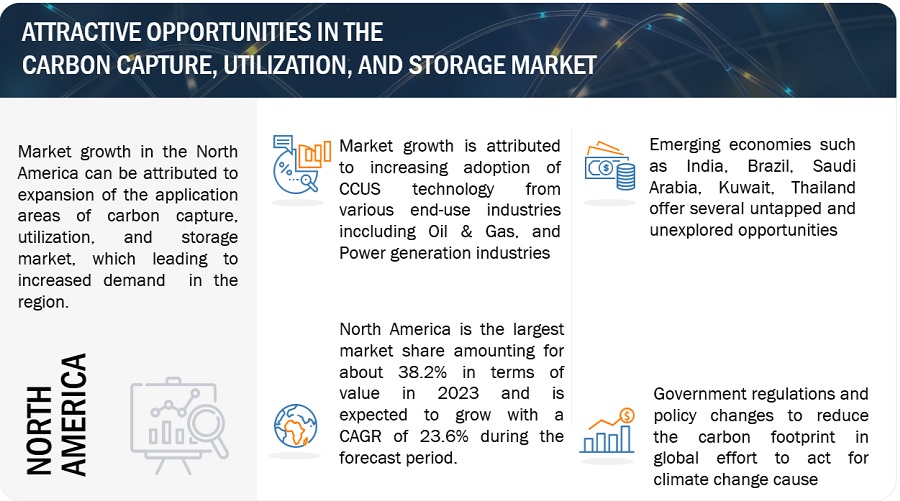

North America held the largest market share in the carbon capture, utilization, and storage market

North America led the carbon capture, utilization, and storage market, in terms of value, in 2021 and is projected to register a CAGR of 21.5% between 2023 and 2030. The growth of the region's market is driven by the early adoption of CCUS technology in the region and the execution of various large-scale projects in the US and Canada. Major projects such as the Petra Nova Carbon Capture Project (US) and Boundary Dam CCS Project (Canada) supported the market in North America.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The carbon capture, utilization, transportation and storage market is dominated by a few globally established players such as Fluor Corporation (US), ExxonMobil Corporation (US), Linde PLC (UK), Royal Dutch Shell (Netherlands), Mitsubishi Heavy Industries Ltd., (Japan), JGC Holdings Corporation (Japan), Schlumberger Ltd., (US), Aker Solutions (Norway), Honeywell International (US), Equinor ASA (Norway) among others, are the key manufacturers that secured major contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements across the world.

These companies are pursuing a variety of inorganic and organic strategies in order to gain a foothold in the carbon capture, utilization, transportation and storage market. The research includes a detailed competitive analysis of these key players in the carbon capture, utilization, transportation and storage market, including company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2030 |

|

Units considered |

Value (USD billion/million), Volume (Kiloton) |

|

Segments Covered |

By Service, By Technology, By End-Use Industries, Region |

|

Geographies covered |

Europe, North America, Asia Pacific, South America, the Middle East, and Africa |

|

Companies covered |

Shell PLC (UK), Fluor Corporation (US), Mitsubishi Heavy Industries, Ltd. (Japan), Exxon Mobil Corporation (US), and Linde Plc (UK), JGC Holdings (Japan), Schlumberger Ltd (US), Aker Solutions (Norway), Honeywell International (US), Equinor ASA (Norway). |

The study categorizes the carbon capture, utilization, transportation and storage market based on Glass type, Product type, Application, and Region.

By Service:

- Capture

- Transportation

- Utilization

- Storage

By Technology:

- Chemical Looping

- Solvents & Sorbents

- Membranes

- Others

By End-User:

- Oil & Gas

- Power Generation

- Chemicals & Petrochemicals

- Cement

- Iron & Steel

- Others

By Region:

- North America

- Asia Pacific

- Europe

- South America

- Middle East & Africa

Recent Developments

- In August 2022, Shell PLC took over Sprang Energy group, which is a renewable energy company aiming to lower carbon emissions. This acquisition is aimed at boosting the carbon capture and storage potential of Shell PLC and improving its market share.

- In June 2022, ExxonMobil Corporation, Shell & Guangdong Provincial Development & Reform Commission will work together to evaluate the potential for carbon capture and storage project at Dayawan petrochemical industrial park in Huizhou, China.

- In November 2021, ExxonMobil Corporation and Petronas signed a memorandum of understanding, will jointly explore potential carbon capture and storage project in Malaysia.

- In May 2020, Royal Dutch Shell, together with Equinor ASA (Norway) and TotalEnergies SE (France), invested USD 682.3 million in the Northern Lights carbon capture and storage (carbon capture, utilization, and storage) project in Norway. With this investment, the trio intends to set up a joint-venture company.

- In November 2019, ExxonMobil Corporation and FuelCell Energy (US) signed a new, two-year expanded joint-development agreement for USD 60 million to improve carbonate fuel cell technology further to capture CO2 from industrial facilities. The agreement focuses on efforts for optimizing the core technology, overall process integration, and large-scale deployment of carbon capture solutions.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the carbon capture, utilization, and storage market?

Increasing demand for CO2 in EOR techniques.

Which is the largest country-level market for carbon capture, utilization, and storage market?

US is the largest carbon capture, utilization, and storage market due to high demand from well-established end-use industries.

What are the factors contributing to the final price of capture, utilization, and storage market?

Type of technology used for capturing carbon from sources and the end-use industry determine the final price of carbon capture, utilization and storage market.

What are the challenges in the carbon capture, utilization, and storage market?

Reducing capturing cost of carbon is the major challenge in the carbon capture, utilization, and storage market. .

Which type of carbon capture, utilization, and storage service holds the largest market share?

Capture service type hold the largest share in terms of value and volume, in the carbon capture, utilization, and storage market.

How is the carbon capture, utilization, and storage market aligned?

The market is growing at the fastest pace. It is a potential market and many manufacturers are undertaking business strategies to expand their business.

Who are the major manufacturers?

Royal Dutch Shell (Netherlands), Fluor Corporation (US), Mitsubishi Heavy Industries, Ltd. (Japan), Exxon Mobil Corporation (US), and Linde Plc (UK), JGC Holdings (Japan), Schlumberger Ltd (US), Aker Solutions (Norway), Honeywell International (US), Equinor ASA (Norway).

What is the biggest restraint in the carbon capture, utilization, and storage market?

Safety concerns over storage techniques and sites is one of the biggest restraining factors for the market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

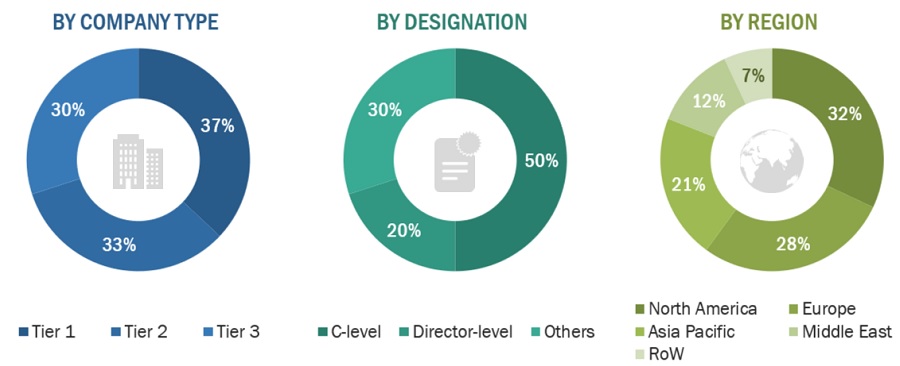

The study involves two major activities in estimating the current size of the carbon Capture, Utilization, and Storage market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, information has been sourced from annual reports, press releases & investor presentations of companies; white papers; certified publications; trade directories; articles from recognized authors; and databases. Secondary research has been used to obtain critical information about the industry's value chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. These have also been utilized to obtain information about the key developments from a market-oriented perspective. Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the total pool of players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The stakeholders in the value chain of the carbon capture, utilization, and storage market include raw material suppliers, processors, end-product manufacturers, and end users. Various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Primary sources from the demand side include key opinion leaders from various end-use industries in the carbon capture, utilization, and storage market. Primary sources from the supply side include experts from companies involved in carbon capture, utilization, and storage.

The Breakup of Primary Research

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the carbon capture, utilization, transportation and storage market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in carbon capture, utilization, transportation and storage in different applications of the carbon capture, utilization, transportation and storage industry at a regional level. Such procurements provide information on the demand aspects of the carbon capture, utilization, transportation and storage industry for each application. For each application, all possible segments of the carbon capture, utilization, transportation and storage market were integrated and mapped.

Carbon capture, utilization, transportation and storage Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Carbon capture, utilization, transportation and storage Market Size: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Carbon capture, utilization, and storage (also referred to as CCUS) is a process that involves capturing carbon dioxide (CO2), transporting it through pipelines, ships, and other modes of transport, and storing it under the Earth's surface to prevent CO2 emissions, leading to a better atmosphere. There are various technology of carbon capture, utilization, transportation and storage products available in the market, including chemical looping, solvents & sorbents, Membranes.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To analyze and forecast the global carbon Capture, Utilization, and Storage market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on technology, service type, and end-use industry.

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and South America.

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the carbon capture, utilization, transportation and storage market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Carbon Capture, Utilization, and Storage Market