Carbon Fiber Market by Raw Material Type(Pan, Pitch), Fiber Type(Virgin, Recycled), Modulus (Standard, Intermediate, High), Product Type(Continuous, Long, Short), Application(Composites, Non-Composites), End-use Industry, Region - Global Forecast to 2032

Carbon Fiber Market

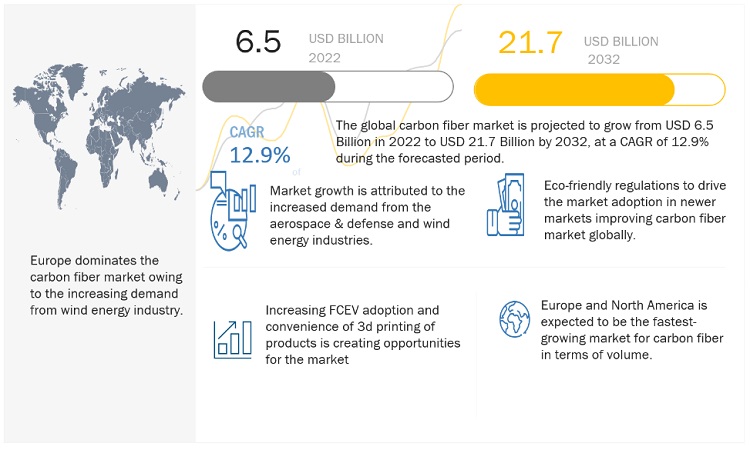

The global carbon fiber market was valued at USD 6.5 billion in 2022 and is projected to reach USD 21.7 billion by 2032, growing at a cagr 12.9% from 2022 to 2032. The market's growth is attributed to carbon fibers have high tensile strength, superior chemical resistance and temperature tolerance, low weight and distinguished thermal expansion. These properties of the fiber are expected to raise its demand in the imminent time, which in turn is predicted to boost the market growth. Furthermore, imposition of stringent eco-friendly regulations in developed and developing nations is projected to offer abundant growth opportunities to the market in the upcoming years. However, high cost of carbon fiber is a fundamental concern associated with carbon fiber market growth. Carbon fiber composites, including carbon fiber tapes, are only employed in luxury vehicles in the automobile industry. Furthermore, alternative carbon fiber composites represent a severe threat to carbon fiber industry growth. The Aerospace & Defense industry accounted for a share of 44.2% in terms of value in the carbon fiber market in 2022 and is projected to reach USD 8.5 Billion by 2032 at a CAGR of 11.6%. The Pipe & Tank industry is projected to witness the highest CAGR of 22.4%, growing from USD 0.65 Billion in 2022 to USD 4.9 Billion by 2032

Global Carbon Fiber Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Carbon Fiber Market Dynamics

Driver: Stringent Eco-friendly Regulations & Rising Popularity of 3D Printing

Large-scale implementation of stringent eco-friendly regulations in developed and developing countries has prompted the increased adoption of more sustainable construction materials.

Weight reduction and increased fuel efficiency are what carbon fibers, and their related composites have to offer. Hence, the activated carbon fiber market is experiencing heightened demand from the luxury and sports cars market. Carbon fiber is being extensively deployed in the automotive industry for the creation of 3D-printed car parts. Carbon fiber is extremely strong and causes the filament to increase in strength and stiffness. This also means that the 3D printed parts will be much lighter and more dimensionally stable, as fiber will help prevent the shrinking of the part as it cools. These latest trends in carbon fiber are driving market growth.

Restraint: High cost of PAN-based carbon fiber

In the automotive industry, carbon fiber is currently used only in racing cars and some high-end sports car as the cost of carbon fiber at present is about USD 10 to USD 20/lb. If the cost of carbon fiber decreases to about USD 5 to USD 7/lb., it will be used on a much larger scale in automobiles. Usage of carbon fiber composite structural parts is expected to increase to a great extent, provided the cost is reduced. Oak Ridge National Laboratory (ORNL), located in the US, is aggressively working to develop low-cost carbon fiber (LCCF) technologies. The price for aerospace-grade carbon fiber currently ranges from USD 80 to USD 120/lb. In other applications such as industrial, sporting goods, and wind energy, the price ranges from USD 10 to USD 20/lb. There are many new applications of carbon fiber-based composite which are not yet commercially feasible as they are expensive.

Opportunity: Increasing demand from FCEVs

Carbon fiber and composites are used in manufacturing hydrogen tanks that are used in fuel tank and mobile pipeline applications. The market for FCEVs is expected to grow rapidly on the back of stringent eco-friendly rules focused on using clean fuel. Currently, the market for FCEVs is very small. However, it is expected to grow rapidly during the forecast period. US aims to achieve a target of 5.3 million units of buses and coaches and 3 million units of forklifts by 2030. Europe has the highest number of hydrogen refuelling stations and targets to reach a market of 3.7 million units of hydrogen-powered FCEVs and 45,000 fuel cell trucks and buses by 2030. South Korea has also designed a roadmap to produce 1.8 million units of FCEVs by 2030. These factors are expected to increase the penetration and demand for hydrogen tanks in the next ten years. This presents significant potential for the growth of carbon fibers.

Challenge: Presence of Substitutes & High Cost of Carbon Fiber

The high cost of carbon fiber is a fundamental concern associated with carbon fiber market growth. Carbon fiber composites, including carbon fiber tapes, are only employed in luxury vehicles in the automobile industry. Furthermore, alternative carbon fiber composites represent a severe Challenge to carbon fiber industry growth.

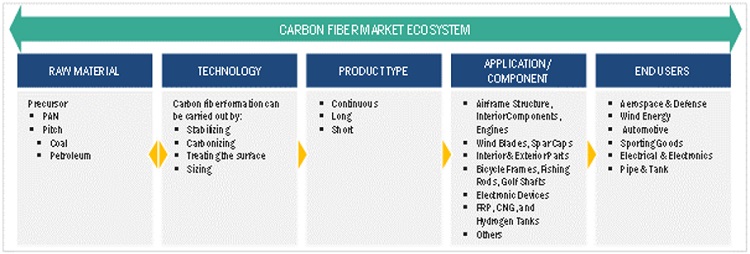

Carbon Fiber Market Ecosystem

Wind Energy industry accounts for the second largest share in terms of value

Wind Energy industry accounts for the second largest 14.7% of share in terms of value. Wind turbine blades are the key components in wind power generation systems. As per industry experts, only PAN-based carbon fibers are used in wind energy applications. They are widely used in structural spar caps of long wind turbine blades. Carbon fiber and carbon fiber composites are used in the manufacturing of wind blades as they reduce the weight of the turbine blade, resulting in increased length for more electricity generation. Carbon fibers provide the best combination of stiffness, strength, and weight, helping manufacturers to achieve larger blades and higher energy output. Due to its corrosion resistance properties, carbon fibers have helped the wind energy industry to grow by allowing wind turbines to work in the toughest environments.

The use of carbon fiber reduces the overall weight, optimizes the stiffness-to-weight ratio in longer blades, and increases blade stiffness to prevent tower strikes in the event of sudden wind gusts. Reduction of the weight of wind turbine blades is necessary to reduce the cyclical compression exerted by turbine blades. The European wind energy industry is growing due to stricter environmental regulations. In Europe, two-thirds of non-nuclear research budget has been allocated to R&D on renewable and energy-efficient systems. Europe has the most offshore wind energy farms, which makes it the largest consumer of carbon fiber for spar caps.

PAN-based carbon fiber accounted for the largest market share, in terms of value and volume.

PAN fibers are combined with resins that offer additional strength and ability to survive at high temperature and corrosive environments. These properties make them suitable for industries ranging from aerospace to general industrial parts and sports equipment. PAN-based carbon fiber carbon fiber-reinforced composites are used in the form of prepregs, fabrics, pultrusion, and windings. The composite applications of PAN-based carbon fibers are well known in aircraft and automobile manufacturing. However, the composite application of PAN-based carbon fiber would grow significantly in pipes & tanks and wind energy industries due to the increasing number of hydrogen tanks in FCEVs and wind capacity installations global.

To know about the assumptions considered for the study, download the pdf brochure

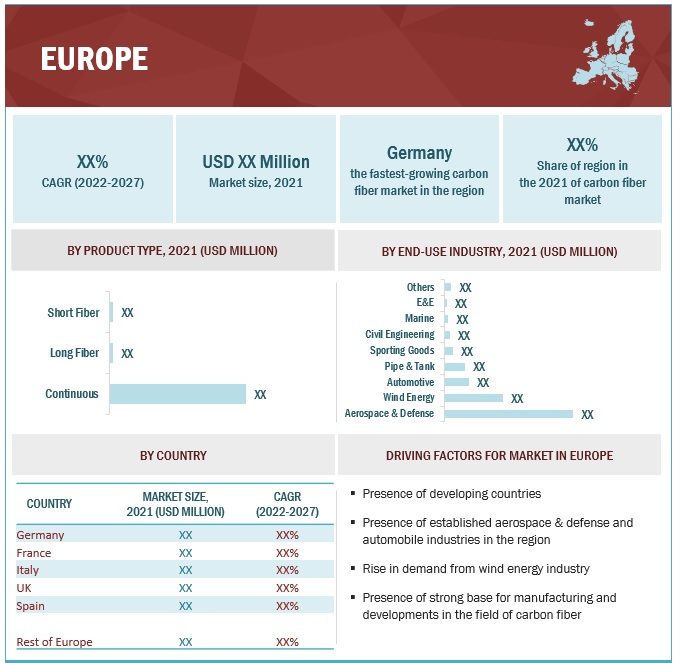

Europe held the largest market share in the carbon fiber market

Europe is the largest market for carbon fiber in 2021. It has a significant number of manufacturers that are actively participating in development activities, especially in expansions and new product launches. The region has the presence of major carbon fiber manufacturers. The European region is segmented into Germany, France, the UK, Italy, Spain, and the Rest of Europe. The growing automotive industry in the region is bolstering the demand for carbon fiber. Carbon fiber is widely used in different end-use industries such as aerospace & defense, automotive, sporting goods, wind energy, and pipe & tank. The aerospace industry accounts for the maximum share in the European carbon fiber market due to the presence of the huge aerospace industry in France and the UK. The expanding manufacturing facilities in Europe promise a high potential for market growth in the coming years.

Carbon Fiber Market Players

Some of the key players in the global carbon fiber market are Toray Industries Inc., (Japan), DowAksa (Turkey), Mitsubishi Chemical corporation (Japan), Solvay (Belgium), Teijin Limited (Japan), SGL Carbon (Germany), Hexcel Corporation (US), Hyosung Advanced Materials (South Korea), Zhongfu Shenying Carbon Co., Ltd. (China), Formosa Plastics Corporation (Taiwan), Jiangsu Hengshen Co., Ltd. (China), and Jilin Chemical Fiber Group Co., Ltd. (China).

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the carbon fiber market. The study includes an in-depth competitive analysis of these key players in the carbon fiber market, with their company profiles, recent developments, and key market strategies.

Carbon Fiber Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 6.5 billion |

|

Revenue Forecast in 2032 |

USD 21.7 billion |

|

CAGR |

12.9% |

|

Years considered for the study |

2018-2021 |

|

Base year |

2021 |

|

Forecast period |

2022-2027 and 2022-2032 |

|

Units considered |

Value (USD million), Volume (Tons) |

|

Segments |

Raw Material Type, Fiber Type, Modulus, Product Type, Application, End-use Industry, Region |

|

Regions |

Europe, North America, Asia Pacific, Latin America, Middle East and Africa |

|

Companies |

Toray Industries Inc., (Japan), DowAksa (Turkey), Mitsubishi Chemical corporation (Japan), Solvay (Belgium), Teijin Limited (Japan), SGL Carbon (Germany), Hexcel Corporation (US), Hyosung Advanced Materials (South Korea), Zhongfu Shenying Carbon Co., Ltd. (China), Formosa Plastics Corporation (Taiwan), Jiangsu Hengshen Co., Ltd. (China), and Jilin Chemical Fiber Group Co., Ltd. (China). |

This research report categorizes the carbon fiber market based on By Raw Material Type, Fiber Type, Modulus, Product Type, Application, End-use Industry, and Region.

By Raw Material Type:

- Pan-based carbon fiber

- Pitch-based carbon fiber

By Fiber Type:

- Virgin carbon fiber

- Recycled carbon fiber

By Modulus Type:

- Standard modulus

- Intermediate modulus

- High modulus

By Product Type:

- Continuous carbon fiber

- Short carbon fiber

- Long carbon fiber

By Application Type:

- Composite

- Non-Composite

By End-use Industry Type:

- Aerospace & Defense,

- Automotive

- Wind Energy

- Pipes & Tanks

- Sporting Goods

- Others

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments

- In July 2022, Hexcel announced that it has signed a long-term agreement with Dassault to supply carbon fiber prepreg for the Falcon 10X program. This is the first Dassault business jet program to incorporate high-performance advanced carbon fiber composites in the manufacture of its aircraft wings.

- In April 2021, Hyosung Advanced Materials signed a contract with Hanhwa Solutions. The company announced that it signed a long-term contract to supply reinforced carbon fiber to be used for strengthening fuel tanks in hydrogen vehicles for six years, beginning 2021. The total supply is worth about 160 billion won. This agreement will boost the sales of carbon fiber.

- In April 2021, Mitsubishi Chemical Corporation integrated subsidiaries at the national level in three countries: the US, the UK, and Germany. By sharing and integrating expertise and resources, this integration will enhance cooperation and further strengthen overall business capabilities in each of these three countries. The company will also attempt to strengthen customer responsiveness based in these countries and provide solutions to each country. Nine subsidiaries in the US, five subsidiaries in the UK, and five subsidiaries in Germany were integrated on April 1, 2021.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the carbon fiber market?

High demand from aerospace and defence due to superior performance of carbon fiber has driven the market.

Which is the fastest-growing region-level market for Carbon fiber?

Europe is the fastest-growing carbon fiber market due to the presence of carbon fiber manufacturers.

What are the factors contributing to the final price of carbon fiber?

Raw material and technical route adopted for carbon fiber manufacturers plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of carbon fiber.

What are the challenges in the carbon fiber market?

High initial costs and developing low-cost carbon fiber is the major challenge in the carbon fiber market

Which type of carbon fiber holds the largest market share?

PAN-based carbon fiber holds the largest share in terms of both value and volume.

How is the carbon fiber market aligned?

The market is growing at a moderate pace. It is a potential market, and many manufacturers are undertaking business strategies to expand their business especially in the developing countries.

Who are the major manufacturers?

Toray Industries Inc., (Japan), DowAksa (Turkey), Mitsubishi Chemical corporation (Japan), Solvay (Belgium), Teijin Limited (Japan), SGL Carbon (Germany), Hexcel Corporation (US),

What are the major end use industry for carbon fiber?

The major end-use industries for carbon fiber are aerospace & defense, automotive, wind energy and pipes and tanks industries.

What is the biggest restraint in the carbon fiber?

High cost of carbon fiber is the biggest restraint in the carbon fiber market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

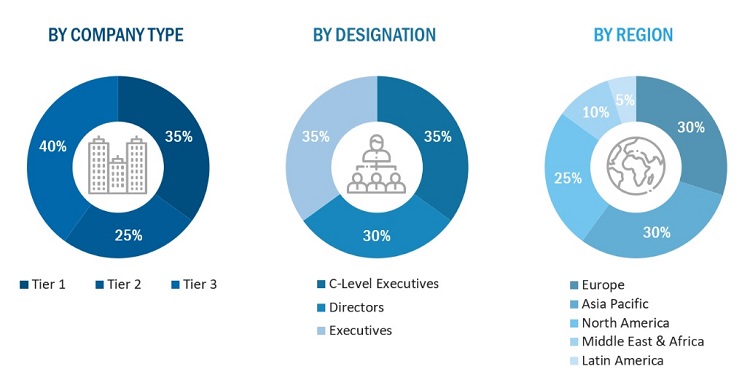

The study involves two major activities in estimating the current market size for carbon fiber market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Carbon Fiber Market Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases, and investor presentations of companies; certified publications; articles from recognized authors; gold & silver standard websites; and various databases were referred to for identifying and collecting information for this study. Also, Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the total pool of players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Carbon Fiber Market Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and related key executives from various leading companies and organizations operating in the carbon fiber market. Primary sources from the demand side included procurement managers and experts from end-use industries.

Following is the breakdown of primary respondents:

Notes: Tiers of companies are selected based on their ownership and revenues in 2021.

Others include sales managers, marketing managers, and product managers.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Carbon Fiber Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total carbon fiber market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Carbon Fiber Market Data Triangulation

After arriving at the overall carbon fiber market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in aerospace & defense, automotive, wind energy, pipes & tanks, sporting goods, and others end-use industries.

Carbon Fiber Market Report Objectives

- To analyze and forecast the global market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To provide detailed information about the technological advancements influencing the growth of the market.

- To define, describe, and forecast the market based on five regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Carbon Fiber Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Carbon Fiber Market Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Carbon Fiber Market Regional Analysis

- Further breakdown of Rest of Asia Pacific carbon fiber market

- Further breakdown of Rest of European carbon fiber market

- Further breakdown of Rest of Middle East & Africa carbon fiber market

- Further breakdown of Rest of Latin American carbon fiber market

Carbon Fiber Market Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Carbon Fiber Market