Cardiac Safety Services Market by Type (Standalone, Integrated), Services (ECG/Holter measurement, Blood Pressure measurement, Cardiac Imaging, Thorough QT Studies), End User (Pharmaceutical, Biopharma, CROs), Region - Global Forecasts to 2027

The global Cardiac Safety Services Market in terms of revenue was estimated to be worth $0.6 billion in 2022 and is poised to reach $1.0 billion by 2027, growing at a CAGR of 11.2% from 2022 to 2027. The growing R&D expenditure in the pharmaceutical & biopharmaceutical industry coupled with surge in outsourcing of R&D activities are the key factors driving the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Cardiac Safety Services Market Dynamics

Drivers: Rising R&D expenditure in pharmaceutical & biopharmaceutical industry

Pharmaceutical companies invest in R&D to deliver high-quality and innovative products in the market. Current trends suggest that top pharmaceutical companies are increasing their R&D efficiencies through heavy R&D investments to see returns on their investment in the longer term and through collaborative R&D efforts. This will contribute to the increased demand for preclinical and clinical services including cardiac safety evaluation.

Opportunities: Growth in biosimilars and biologics markets

Many companies are investing heavily in the development of biologics and biosimilar molecules. More than half of the drug candidates in the discovery stage are biologics, such as proteins, peptides, and monoclonal antibodies. As newer biologics are being discovered or are in the pipeline, pharmaceutical and biopharmaceutical companies are heavily investing in their R&D. Further, biosimilars are cost-effective because they are not required to comply with stringent regulatory requirements, as they are generic versions of patented biologic drugs. Thus, compared to small molecules, biologics and biosimilars require specialized testing services. This will bring opportunities for safety assessment providers to expand their portfolios and capabilities

Restraints: High cost of cardiac safety services

The rising costs of drug development and the decline in the number of new drugs approved in the US are significant problems that threaten public health. Cardiac safety evaluations of off-target drug effects are generally expensive, time-consuming, and contribute to the termination of many new molecular entities. This affects the demand for cardiac safety evaluation studies and hinders overall drug development.

The Integrated services segment is expected to have the dominant share of the market by type in 2021:

Integrated services are provided as a bundle of services to pharmaceutical and biopharmaceutical companies. These state-of-the-art core lab services offer an end-to-end suite of cardiac safety services, such as imaging services, TQT studies, and profile QT studies. They also monitor off-target cardiovascular liability and onsite multichannel telemetry conducted by certified nurses to aid in the real-time assessment of heart rate and rhythm. As a result, these services help enhance and expedite clinical trials in the pharmaceutical and biopharmaceutical development cycle.

To know about the assumptions considered for the study, download the pdf brochure

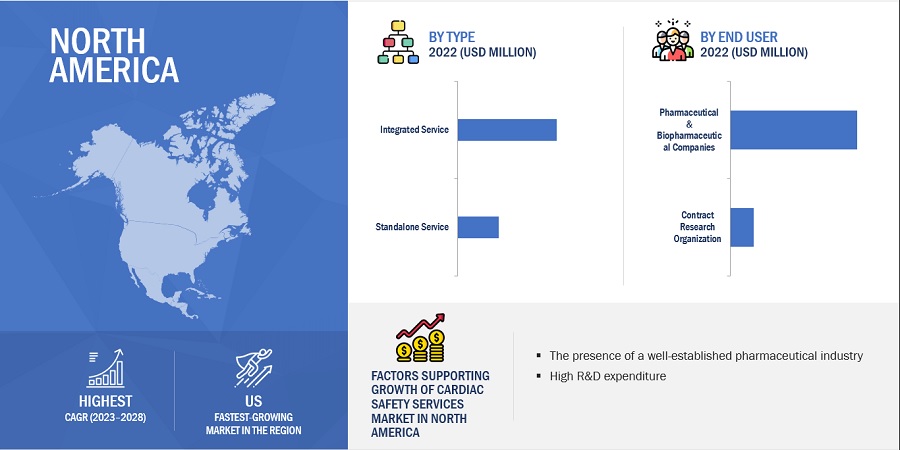

North America was the largest regional market for cardiac safety services market in 2021.

The market is segmented into major regions—North America, Europe, the Asia Pacific, Rest of World. North America is a mature market for cardiac safety services and is estimated to grow at a highest CAGR during the forecast period. This can be attributed to the increasing number of clinical trials in the region that are driving the demand for cardiac safety services.

Key players in the market include Laboratory Corporation of America Holdings (US), Koninklijke Philips N.V. (Netherlands), Clario (US), Banook Group (France), IQVIA (US), Biotrial (France), Certara (US), Celerion (US), Medpace (US), Ncardia (Netherlands), Richmond Pharmacology (UK), PhysioStim (France), Shanghai Medicilon (China), Pharmaceutical Product Development (US), and SGS (Switzerland).

Cardiac Safety Services Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$0.6 billion |

|

Estimated Value by 2027 |

$1.0 billion |

|

Growth Rate |

poised to grow at a CAGR of 11.2% |

|

Largest Share Segments |

Integrated Services |

|

Market Report Segmentation |

Type, Type of Services, End User & Region |

|

Growth Drivers |

|

|

Growth Opportunities |

|

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

This report categorizes the global cardiac safety services market into the following segments and subsegments

By Type

- Integrated Services

- Standalone Services

By Type of Service

- ECG/Holter Measurement

- Blood Pressure Measurement

- Cardiovascular Imaging

- Thorough QT Studies

- Other Services

By End User

- Pharmaceutical & Biopharmaceutical Companies

- Contract Research Organizations

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

- Rest of the World

Recent Developments

- In February 2021, Koninklijke Philips N.V. (Netherlands) acquired Biotelemetry (US). This acquisition enhanced the company’s cardiac care portfolio and transformed care delivery along the health continuum with integrated solutions.

- In March 2019, BioTelemetry acquired Geneva Healthcare, Inc., a leading provider of remote monitoring for implantable cardiac devices.

Frequently Asked Questions (FAQs):

What is the size of Cardiac Safety Services Market ?

The global cardiac safety services market size is projected to reach USD 1.0 billion by 2027, growing at a CAGR of 11.2% .

Why is Cardiac Safety Services Market Growing?

The growing R&D expenditure in the pharmaceutical & biopharmaceutical industry coupled with surge in outsourcing of R&D activities are the key factors driving the growth of this market.

Who all are the prominent players of Cardiac Safety Services Market ?

Key players in the market include Laboratory Corporation of America Holdings (US), Koninklijke Philips N.V. (Netherlands), Clario (US), Banook Group (France), IQVIA (US), Biotrial (France), Certara (US), Celerion (US), Medpace (US), Ncardia (Netherlands), Richmond Pharmacology (UK), PhysioStim (France), Shanghai Medicilon (China), Pharmaceutical Product Development (US), and SGS (Switzerland). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 CARDIAC SAFETY SERVICES MARKET

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

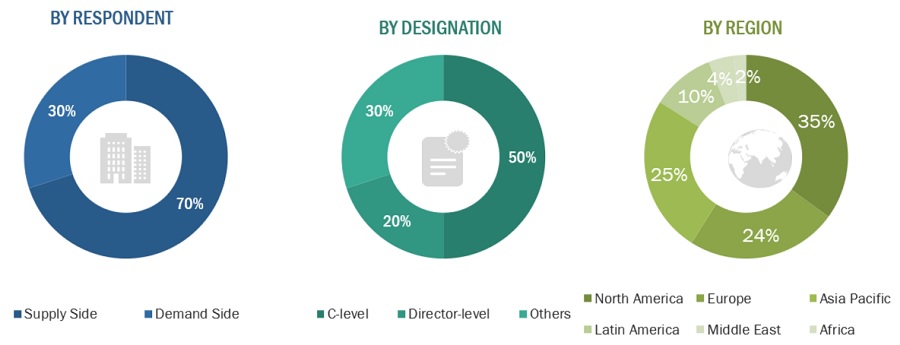

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 TOP-DOWN APPROACH

2.2.3 GROWTH FORECAST

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 31)

FIGURE 7 CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2022 VS. 2027 (USD MILLION)

FIGURE 8 CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 9 CARDIAC SAFETY SERVICES MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 10 GEOGRAPHICAL SNAPSHOT OF CARDIAC SAFETY SERVICES MARKET

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 CARDIAC SAFETY SERVICES MARKET OVERVIEW

FIGURE 11 INCREASING NUMBER OF CLINICAL TRIALS TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET SHARE, BY TYPE AND COUNTRY (2021)

FIGURE 12 INTEGRATED SERVICES ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2021

4.3 CARDIAC SAFETY SERVICES MARKET SHARE, BY TYPE OF SERVICE, 2022 VS. 2027

FIGURE 13 ECG/HOLTER MEASUREMENT SERVICES SEGMENT TO DOMINATE MARKET IN 2027

4.4 CARDIAC SAFETY SERVICES MARKET SHARE, BY END USER, 2022

FIGURE 14 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4.5 CARDIAC SAFETY SERVICES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 15 EUROPEAN COUNTRIES TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 CARDIAC SAFETY SERVICES MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing R&D expenditure in pharmaceutical & biopharmaceutical industry

FIGURE 17 GLOBAL PHARMACEUTICAL R&D SPENDING, 2012–2026

5.2.1.2 Increased outsourcing of R&D activities

FIGURE 18 ACTIVE PHARMACEUTICAL DRUG PIPELINE, JANUARY 2011 TO JANUARY 2021

5.2.1.3 Increasing number of clinical trials

FIGURE 19 INCREASING NUMBER OF CLINICAL TRIALS REGISTERED WORLDWIDE (2000–2021)

5.2.2 OPPORTUNITIES

5.2.2.1 Introduction of new technologies and methods

5.2.2.2 Growth in biosimilars and biologics markets

5.2.3 CHALLENGES

5.2.3.1 High cost of cardiac safety evaluation

6 CARDIAC SAFETY SERVICES MARKET, BY TYPE (Page No. - 43)

6.1 INTRODUCTION

TABLE 1 CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.2 INTEGRATED SERVICES

6.2.1 INTEGRATED SERVICES TO DOMINATE CARDIAC SAFETY SERVICES MARKET

TABLE 2 INTEGRATED CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 3 NORTH AMERICA: INTEGRATED CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 4 EUROPE: INTEGRATED CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 5 ASIA PACIFIC: INTEGRATED CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 STANDALONE SERVICES

6.3.1 STANDALONE SERVICES SEGMENT WITNESSING GROWTH DUE TO COST-EFFECTIVENESS

TABLE 6 STANDALONE CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 7 NORTH AMERICA: STANDALONE CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 8 EUROPE: STANDALONE CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 9 ASIA PACIFIC: STANDALONE CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7 CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE (Page No. - 49)

7.1 INTRODUCTION

TABLE 10 CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

7.2 ECG/HOLTER MEASUREMENT SERVICES

7.2.1 ECG/HOLTER MEASUREMENT SERVICES SUPPORT R&D IN NOVEL METHODS FOR CLINICAL TRIALS AND DRUG DISCOVERY

TABLE 11 ECG/HOLTER MEASUREMENT SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 12 NORTH AMERICA: ECG/HOLTER MEASUREMENT SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 13 EUROPE: ECG/HOLTER MEASUREMENT SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 14 ASIA PACIFIC: ECG/HOLTER MEASUREMENT SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 BLOOD PRESSURE MEASUREMENT SERVICES

7.3.1 INCREASING R&D ACTIVITIES TO DRIVE MARKET GROWTH

TABLE 15 BLOOD PRESSURE MEASUREMENT SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 16 NORTH AMERICA: BLOOD PRESSURE MEASUREMENT SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 17 EUROPE: BLOOD PRESSURE MEASUREMENT SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 18 ASIA PACIFIC: BLOOD PRESSURE MEASUREMENT SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 CARDIOVASCULAR IMAGING SERVICES

7.4.1 CARDIOVASCULAR IMAGING SERVICES HELP IN DRUG EVALUATION

TABLE 19 CARDIOVASCULAR IMAGING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 20 NORTH AMERICA: CARDIOVASCULAR IMAGING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 21 EUROPE: CARDIOVASCULAR IMAGING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 22 ASIA PACIFIC: CARDIOVASCULAR IMAGING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.5 THOROUGH QT STUDIES

7.5.1 NEED TO MEET STRINGENT REGULATORY REQUIREMENTS TO DRIVE DEMAND FOR THOROUGH QT STUDIES

TABLE 23 THOROUGH QT STUDIES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 24 NORTH AMERICA: THOROUGH QT STUDIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 25 EUROPE: THOROUGH QT STUDIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 26 ASIA PACIFIC: THOROUGH QT STUDIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.6 OTHER SERVICES

TABLE 27 OTHER CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 28 NORTH AMERICA: OTHER CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 29 EUROPE: OTHER CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 30 ASIA PACIFIC: OTHER CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 CARDIAC SAFETY SERVICES MARKET, BY END USER (Page No. - 60)

8.1 INTRODUCTION

TABLE 31 CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

8.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

8.2.1 INCREASING R&D BY PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES TO DRIVE DEMAND FOR CARDIAC SAFETY SERVICES

TABLE 32 CARDIAC SAFETY SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY REGION, 2020–2027 (USD MILLION)

TABLE 33 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 34 EUROPE: CARDIAC SAFETY SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 35 ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 CONTRACT RESEARCH ORGANIZATIONS

8.3.1 INCREASING OUTSOURCING OF DRUG DISCOVERY PROCESSES TO SUPPORT SEGMENT GROWTH

TABLE 36 CARDIAC SAFETY SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 37 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 38 EUROPE: CARDIAC SAFETY SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 39 ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9 CARDIAC SAFETY SERVICES MARKET, BY REGION (Page No. - 66)

9.1 INTRODUCTION

TABLE 40 CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 20 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET SNAPSHOT

TABLE 41 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 42 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 US dominates global cardiac safety services market

TABLE 45 US: TOTAL NUMBER OF CLINICAL TRIALS (2019)

TABLE 46 US: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 47 US: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 48 US: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Canada has high-quality clinical trial infrastructure and expertise

TABLE 49 CANADA: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 50 CANADA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 51 CANADA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3 EUROPE

FIGURE 21 EUROPE: CARDIAC SAFETY SERVICES MARKET SNAPSHOT

TABLE 52 EUROPE: CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 53 EUROPE: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 54 EUROPE: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 55 EUROPE: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Availability of skilled staff and flexible labor laws have made Germany a popular EU hub for clinical trials

TABLE 56 GERMANY: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 57 GERMANY: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 GERMANY: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Steady growth of pharmaceutical R&D expenditure indicates favorable prospects for cardiac safety services

TABLE 59 UK: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 60 UK: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 61 UK: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 High clinical trial activity for cancer therapies to drive market growth

TABLE 62 FRANCE: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 63 FRANCE: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 64 FRANCE: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Strong pharma industry and availability of funding for drug development fuel market growth

TABLE 65 NUMBER OF CLINICAL TRIALS STARTED IN ITALY, BY COMPANY (JANUARY 2021)

TABLE 66 ITALY: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 67 ITALY: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 68 ITALY: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Growing investment in pharmaceutical R&D and a favorable climate for approvals boost market growth

TABLE 69 SPAIN: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 70 SPAIN: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 71 SPAIN: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 72 ROE: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 73 ROE: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 74 ROE: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

TABLE 75 APAC: CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 76 APAC: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 77 APAC: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 78 APAC: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China dominates APAC market for cardiac safety services

TABLE 79 CHINA: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 80 CHINA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 CHINA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Strong IP rights and supportive policies have strengthened R&D sector in Japan

TABLE 82 JAPAN: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 83 JAPAN: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 84 JAPAN: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Lack of language barriers and availability of trained resources make India an attractive destination for clinical trials

TABLE 85 INDIA: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 86 INDIA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 INDIA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.4 AUSTRALIA

9.4.4.1 Favorable R&D tax incentives and cash rebates have driven clinical trial activity in Australia

TABLE 88 AUSTRALIA: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 89 AUSTRALIA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 90 AUSTRALIA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.5 REST OF ASIA PACIFIC

TABLE 91 ROAPAC: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 92 ROAPAC: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 93 ROAPAC: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 94 ROW: CARDIAC SAFETY SERVICES MARKET, BY TYPE OF SERVICE, 2020–2027 (USD MILLION)

TABLE 95 ROW: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 ROW: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 97)

10.1 OVERVIEW

FIGURE 22 KEY GROWTH STRATEGIES ADOPTED BY MARKET PLAYERS FROM 2019–2022

10.2 MARKET PLAYER RANKING

TABLE 97 GLOBAL CARDIAC SAFETY SERVICES MARKET PLAYER RANKING, 2021

10.3 COMPETITIVE LEADERSHIP MAPPING

10.3.1 VISIONARY LEADERS

10.3.2 DYNAMIC DIFFERENTIATORS

10.3.3 INNOVATORS

10.3.4 EMERGING COMPANIES

FIGURE 23 CARDIAC SAFETY SERVICES MARKET: COMPETITIVE LEADERSHIP MAPPING

10.4 COMPETITIVE SITUATION AND TRENDS

10.4.1 ACQUISITIONS

TABLE 98 ACQUISITIONS, 2019–2022

10.4.2 PARTNERSHIPS, ALLIANCES, AND AGREEMENTS

TABLE 99 PARTNERSHIPS, ALLIANCES, AND AGREEMENTS, 2019–2022

10.4.3 EXPANSIONS

TABLE 100 EXPANSIONS, 2019–2022

10.4.4 OTHER STRATEGIES

TABLE 101 OTHER STRATEGIES, 2019–2022

11 COMPANY PROFILES (Page No. - 103)

(Business overview, Products offered, Recent Developments, MNM view)*

11.1 KEY PLAYERS

11.1.1 LABORATORY CORPORATION OF AMERICA HOLDINGS

TABLE 102 LABORATORY CORPORATION OF AMERICA HOLDINGS: BUSINESS OVERVIEW

FIGURE 24 LABORATORY CORPORATION OF AMERICA HOLDINGS: COMPANY SNAPSHOT

11.1.2 KONINKLIJKE PHILIPS

TABLE 103 KONINKLIJKE PHILIPS: BUSINESS OVERVIEW

FIGURE 25 KONINKLIJKE PHILIPS: COMPANY SNAPSHOT

11.1.3 CLARIO

TABLE 104 CLARIO: BUSINESS OVERVIEW

11.1.4 BANOOK GROUP

TABLE 105 BANOOK GROUP: BUSINESS OVERVIEW

11.1.5 IQVIA

TABLE 106 IQVIA: BUSINESS OVERVIEW

FIGURE 26 IQVIA: COMPANY SNAPSHOT

11.1.6 BIOTRIAL

TABLE 107 BIOTRIAL: BUSINESS OVERVIEW

11.1.7 CERTARA

TABLE 108 CERTARA: BUSINESS OVERVIEW

FIGURE 27 CERTARA: COMPANY SNAPSHOT

11.1.8 CELERION

TABLE 109 CELERION: BUSINESS OVERVIEW

11.1.9 MEDPACE

TABLE 110 MEDPACE: BUSINESS OVERVIEW

FIGURE 28 MEDPACE: COMPANY SNAPSHOT

11.1.10 NCARDIA

TABLE 111 NCARDIA: BUSINESS OVERVIEW

11.1.11 RICHMOND PHARMACOLOGY

TABLE 112 RICHMOND PHARMACOLOGY: BUSINESS OVERVIEW

11.1.12 PHYSIOSTIM

TABLE 113 PHYSIOSTIM: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 SHANGHAI MEDICILON

11.2.2 PHARMACEUTICAL PRODUCT DEVELOPMENT LLC.

11.2.3 SGS S.A.

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 126)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the cardiac safety services market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the market. The secondary sources used for this study include Annual Reports, SEC Filings, Investor Presentations, World Health Organization (WHO), US Food and Drug Administration (FDA), National Institutes of Health (NIH), National Center for Biotechnology Information (NCBI), Association of Clinical Research Organizations (ACRO), Clinical Research Society (CRS), Clinical Research Association of Canada (CRAC), Association of International Contract Research Organizations (AICROS), Clinical and Contract Research Association (CCRA), American Association of Pharmaceutical Scientists (AAPS), Pharmaceutical Research and Manufacturers of America (PhRMA), European Medicines Agency (EMA), International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), Safety Pharmacology Society (SPS), Cardiac Safety Research Consortium (CSRC). These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Cardiac Safety Services Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the cardiac safety services business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global cardiac safety services market based on the type, type of services, end user and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, challenges, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall cardiac safety services market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, Asia Pacific, Rest of World

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the cardiac safety services market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cardiac Safety Services Market

The following categories can be used to broadly group the macro to micro growth drivers for the cardiac safety services market:

Macro drivers:

Micro drivers:

What are the macro to micro growth drivers for the cardiac safety services industry?