Ceramic Matrix Composites Market by Matrix Type (C/C, C/Sic, Oxide/Oxide, Sic/Sic), Fiber Type (Continuous, Woven), End-use Industry (Aerospace and Defense, Automotive, Energy and Power, Industrial), and Region - Global Forecasts to 2028

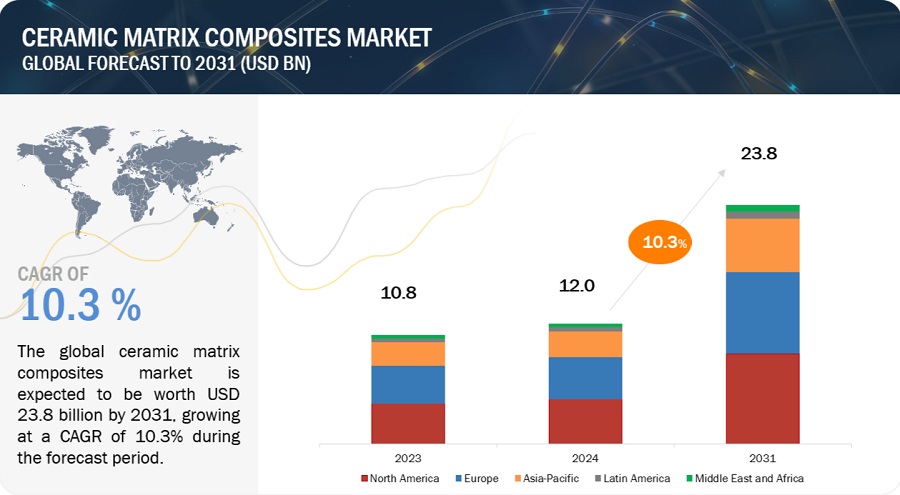

The ceramic matrix composites market is projected to grow from USD 11.9 billion in 2022 to USD 21.6 billion by 2028, at a CAGR of 10.5%. Over the world, the ceramic matrix composites market is expanding significantly, and during the forecast period, a similar trend is anticipated.

The demand for ceramic matrix composites has been driven by several factors, including the need to increase the efficiency of operations, reduce maintenance costs, and enhance safety. The major applications of ceramic matrix composites include aerospace and defense, automotive, Energy & power, and others.

In the aerospace and defense industry, ceramic matrix composites are extensively used in the aerospace sector due to their exceptional properties. They are employed in components such as turbine blades, combustor liners, nozzle vanes, and thermal protection systems. ceramic matrix composites offer high-temperature resistance, excellent strength-to-weight ratio, and improved fuel efficiency, making them ideal for aerospace applications.

In the automotive industry, ceramic matrix composites are finding increasing use in the automotive sector, primarily for lightweighting purposes. By replacing traditional metal components with ceramic matrix composites, vehicles can achieve weight reduction, resulting in improved fuel efficiency and reduced emissions. ceramic matrix composites are employed in brake systems, engine components, and exhaust systems.

Attractive Opportunities in Ceramic Matrix Composites Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Ceramic Matrix Composites Market Dynamics

Driver: Higher demand for lightweight, fuel-efficient vehicles

The use of ceramic matrix composites in the automotive industry is increasing due to its lightweight, high strength, and durability. Luxury and sports car manufacturers have started to use ceramic matrix composites in their engine components as they are strong, lighter, and can withstand very high temperatures. Thus, this growing need to improve efficiency, cut fuel costs, lower pollution, and develop lightweight automobiles is driving the demand for ceramic matrix composites.

Restraint: Limitations of ceramic matrix composites in various applications

The processing route of ceramic matrix composites involves high temperature and, therefore, they can only be employed with high-temperature reinforcements. The high-temperature requirements bring many complexities in the manufacturing processes, and hence the manufacturing process becomes expensive. The other problems include low impact resistance, brittle fracture, and part size and shape limitations.

Opportunity: Mass manufacture and standardization of ceramic matrix composites production process

Most of the big manufacturers of ceramic matrix composites must meet the customer specifications of various end-use industries and OEMs. This customization involves much higher cost, time, and labour. The fabrication and inspection processes have also become longer due to the high temperature involved in the manufacturing process. The additional costs incurred increase the cost of ceramic matrix composites and put them at a disadvantage cost-wise to traditional components. Therefore, if there is standardization in shape, size, and specifications and mass production is done, the time consumed will be lesser, and it can be made more cost-efficient as the effort involved in manufacturing and fabrication is significantly cut off.

Challenge: Growing competition and Stringent regulations

The ceramic matrix composites market is in a growing competition phase, with numerous players operating in the market. This makes it challenging for new entrants to establish a foothold in the market. The ceramic matrix composites market is subject to various regulations and standards regarding product quality, safety, and environmental impact. Compliance with these regulations can be a challenge for manufacturers, especially small and medium-sized enterprises.

Based on the end-use industry, the energy power segment is estimated to account for the largest market share during the forecast period

Based on the end-use industry type of energy power segment is estimated to account for the third largest market share. The energy sector, including power generation and renewable energy, offers significant opportunities for ceramic matrix composites. Gas turbine engines, used for power plants, require materials with high-temperature resistance and improved efficiency. ceramic matrix composites can contribute to increased power output, reduced emissions, and improved overall energy efficiency. Additionally, ceramic matrix composites can play a role in emerging renewable energy technologies such as concentrated solar power (CSP) systems. These factors will contribute to market growth.

Based on fiber type, the Continuous fiber type segment is anticipated to register the second-highest CAGR

Based on fiber type, the market is segmented into continuous fiber, woven, and others. Ceramic matrix composites can be categorized based on the type of continuous fibers used in their reinforcement. Ongoing research and development in ceramic matrix composites are focused on the development of new and advanced fibers that can further enhance the properties of the composites. These next-generation fibers include fibers based on materials like hafnium carbide (HfC), zirconium carbide (ZrC), and other ceramic materials with improved properties for high-temperature applications. Due to these factors, the continuous fiber type of ceramic matrix composites is expected to witness the second-highest CAGR between 2023 and 2028.

Asia Pacific to hold the third largest market share during the forecast period

According to the World Bank, Asia Pacific is the fastest-growing region in terms of population and economic growth. Accounting for over a third of the world’s GDP, the region has experienced significant growth in the last decade. The high economic growth, coupled with the mounting population, is expected to boost the aerospace & defence and automotive sectors in the region, which will increase the need for ceramic matrix composites from industries. Continuous and easy availability of raw materials and low-cost labour driving the ceramic matrix composites in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The ceramic matrix composites market is dominated by a few globally established players such as General Electric (US), Rolls-Royce PLC (UK), SGL Carbon (Germany), Raytheon Technologies Corporation (US), Axiom Materials Inc. (US), CoorsTek (US), Lancer Systems (US), COI Ceramics (US), Applied Thin Films (US), Ultramet (US), CFC Carbon co., ltd. (China), among others, are the key manufacturers that secured major contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements across the world.

These companies are pursuing a variety of inorganic and organic strategies in order to gain a foothold in the ceramic matrix composites market. The research includes a detailed competitive analysis of these key players in the ceramic matrix composites market, including company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD billion/million), Volume (Kiloton) |

|

Segments Covered |

By Fiber Type, By Matrix Type, By End-use Industry, Region |

|

Geographies covered |

Europe, North America, Asia Pacific, Latin America, the Middle East, and Africa |

|

Companies covered |

General Electric (US), Rolls-Royce PLC (UK), SGL Carbon (Germany), Raytheon Technologies Corporation (US), Axiom Materials Inc. (US), CoorsTek (US), Lancer Systems (US), COI Ceramics (US), Applied Thin Films (US), Ultramet (US), CFC Carbon co., ltd. (China). |

The study categorizes the ceramic matrix composites market based on Fiber type, Matrix type, End-use Industry, and Region.

By Fiber Type:

- Continuous

- Woven

- Others (felt/mat, chopped, twill, braided. ropes & belts)

By Matrix Type:

- C/C

- C/SiC

- Oxide/Oxide

- SiC/SiC

By End-use Industry:

- Aerospace & Defense

- Automotive

- Energy & Power

- Industrial

- Others (Other includes electrical & electronics, biomedical, and marine)

By Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Recent Developments

- In April 2023, SGL Carbon announced a new partnership with Lancer Systems to develop ceramic matrix composites for use in thermal protection systems. The partnership with Lancer Systems will focus on the development of ceramic matrix composites for use in thermal protection systems. Thermal protection systems are used to protect aircraft and spacecraft from the high temperatures generated during atmospheric re-entry. ceramic matrix composites are a promising new material for this application because they can withstand high temperatures and are lightweight.

- In January 2023, Rolls-Royce signed a Memorandum of Understanding with the University of Sheffield in the UK to collaborate on the development of new ceramic matrix composite materials.

- In April 2021, NIAR Automated Technologies Laboratory for Aerospace Systems (ATLAS) partnered with Axiom Materials for investigating the automated fiber placement (AFP) of AX-7810-610, a solvent-based ceramic matrix composites prepreg that can be used for high-temperature applications such as engine components. Several material variants were slit using NIAR slitter capable of continuous in-process inspections to investigate the slit-tape quality in order to ensure that the material will process through the AFP system without producing manufacturing defects.

Frequently Asked Questions (FAQ):

Which are the major companies in the ceramic matrix composites market? What are their major strategies to strengthen their market presence?

Some of the key players in the ceramic matrix composites market are General Electric (US), Rolls-Royce PLC (UK), SGL Carbon (Germany), Raytheon Technologies Corporation (US), Axiom Materials Inc. (US), CoorsTek (US), Lancer Systems (US), COI Ceramics (US), Applied Thin Films (US), Ultramet (US), CFC Carbon co., ltd. (China) among others, are the key manufacturers that secured contracts, deals in the last few years. Contracts and deals were the key strategies adopted by these companies to strengthen their position in the ceramic matrix composites market.

What are the drivers and opportunities for the ceramic matrix composites market?

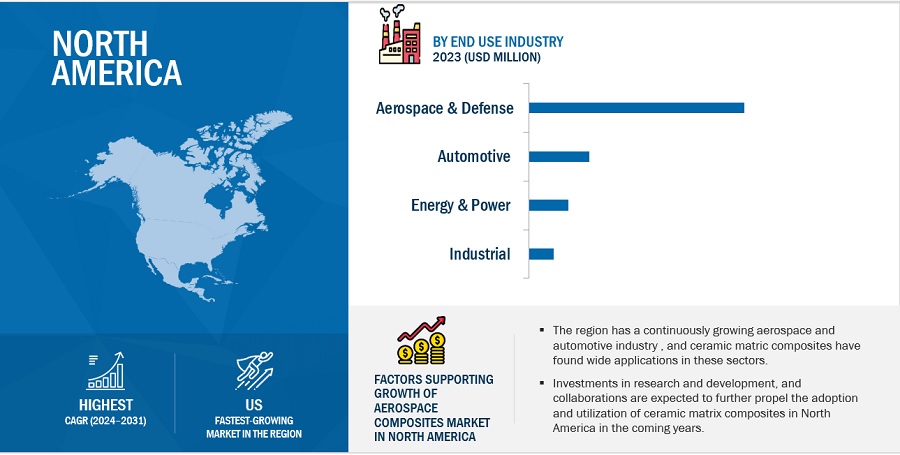

The need for ceramic matrix composites has increased significantly around the world, particularly in North America, followed by Europe, where the major ceramic matrix composites manufacturers are present. Rising R&D efforts and growing technological advancement in manufacturing are anticipated to accelerate market expansion globally.

Which region is expected to hold the highest market share?

North America dominated the market share in 2022, showcasing strong demand for ceramic matrix composites from this region. Well-established and prominent manufacturers in this region include General Electric (US), CoorsTek (US), Lancer Systems (US), COI Ceramics (US), Applied Thin Films (US), Ultramet (US).

What is the total CAGR expected to be recorded for the ceramic matrix composites market during 2023-2028?

The CAGR is expected to record a CAGR of 10.5% from 2023-2028.

How is the ceramic matrix composites market aligned?

The market is growing at a significant pace. The market is a potential market, and many manufacturers are planning business strategies to expand their existing business. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

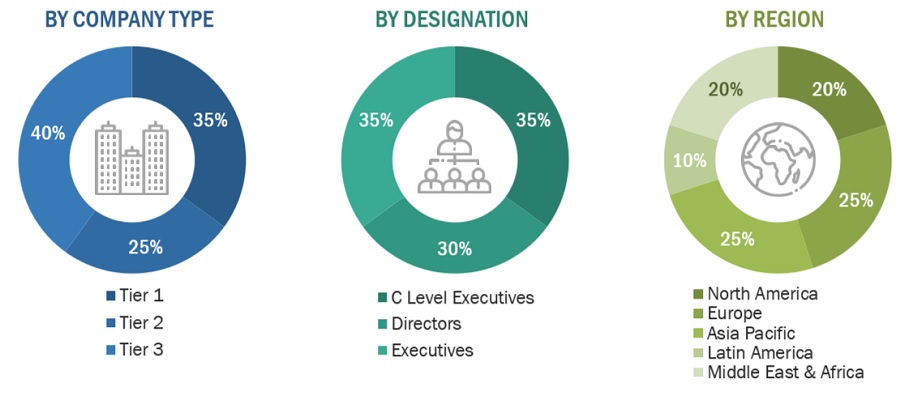

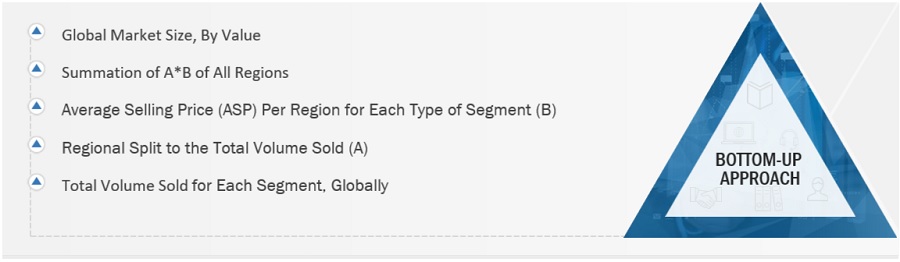

The study involves two major activities in estimating the current market size for the ceramic matrix composites market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering ceramic matrix composites and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the ceramic matrix composites market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the ceramic matrix composites market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from ceramic matrix composites industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using the ceramic matrix composites industry, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of ceramic matrix composites and future outlook of their business which will affect the overall market.

The Breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Axiom Materials Inc. |

Product Development Head |

|

CoorsTek |

CEO & Founder |

|

Ultramet |

Consultant |

|

General Electric |

Sales Head |

Market Size Estimation

The research methodology used to estimate the size of the ceramic matrix composites market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in ceramic matrix composites in different applications of the fiberglass industry at a regional level. Such procurements provide information on the demand aspects of the ceramic matrix composites for each end-use industry. For each end-use industry, all possible segments of the ceramic matrix composites market were integrated and mapped.

Ceramic Matrix Composites Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Ceramic Matrix Composites Market Size: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

A ceramic matrix composite is a combination of at least two materials, out of which one is a binding material (called the matrix), and the other is a reinforcement material (which is generally a fiber). The matrices can be oxide and non-oxide. The fibers can be carbon, oxide, silicon carbide, and others. Ceramic matrix composites are classified into oxide and non-oxide based on the fiber used. Oxide fibers are reinforced into the oxide matrix, whereas non-oxide fibers are reinforced into the non-oxide matrix. These are high-performance composites, which are mainly used in high-temperature applications.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the size of the ceramic matrix composites market based on by fiber type, matrix type, end-use industry, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Latin America, Middle East & Africa, along with major countries in each region

- Europe, Asia Pacific, Latin America, Middle East & Africa, along with major countries in each region restraints, opportunities, and challenges) influencing the growth of the market

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the ceramic matrix composites market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the ceramic matrix composites market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ceramic Matrix Composites Market