Ceramic Substrates Market by Product Type (Alumina, Aluminum Nitride, Silicon Nitride, Beryllium oxide), End-use Industry (Consumer Electronics, Automotive, Telecom, Industrial, Military & Avionics), and Region - Global Forecast to 2025

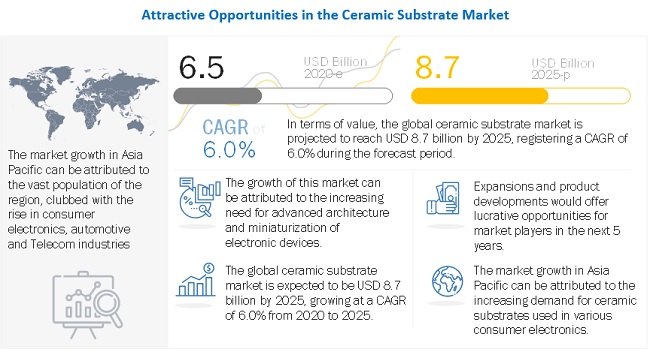

The ceramic substrates market is projected to reach USD 8.7 billion by 2025, at a CAGR of 6.0%. The market is mainly driven by the rising demand for ceramic substrates from industries such as consumer electronics, automotive, teleom, industrial, military & avionics, and others. . Factors such as Increasing need for advanced architecture and miniaturization of electronics devices and increasing demand for ceramic substrates over traditional metal substrate will drive the ceramic substrate market. Asia Pacific is the key market for ceramic substrate, globally, followed by Europe and North America, in terms of volume and value.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Ceramic Substrate Market

Due to COVID-19, several major economies like China, US, Italy, France, Spain, Germany, and India are affected. In a research by the American Chamber of Commerce in Shanghai, found that two-thirds of US businesses operating in China expect demand to be lower as a result of COVID-19 due to lack of sufficient staff. The shutdown of retail points of major brands for a definite period of time was anticipated to affect the sales of various electronics products. Apart from this, COVID-19 has also disrupted the global supply chain of major electronic brands. China is one of the leading producer and exporter of various electronics input supplies that are essentially used to produce finished electronic goods. The ongoing production halt in China has forced the other electronic manufacturers based in the US and Europe to hold the production of the finished goods on a temporary basis, which caused a gap in the demand and supply of the electronic products. Some of the major companies in the electronics companies which got affected due to COVID-19 include LG Electronics Inc., Canon Inc., Apple Inc., GoPro Inc., Nikon Corp., Panasonic Corp., Hitachi Ltd., Huawei Technologies Co. Ltd., Samsung Electronics Co., Ltd., Toshiba Corp., and several others. The market players are taking the necessary measures to reduce the adverse impact of this crisis. For example, Both Hyundai and Nissan have announced production suspension in the South Korean plant due to the delay of the electronics parts. Apple Inc. delayed the launch of the iPhone 9 due to this pandemic outbreak in China.

Ceramic Substrates Market Dynamics

Driver: Increasing need for advanced architecture and miniaturization of electronic devices

Rapid R&D and technological advancements have created demand for reliable and compact electronic devices. This has led to the growing demand for miniaturized electronic devices. Many electronic products have become more advanced with the development of semiconductor technology that required the use of hybrid circuits, which are embedded in ceramic substrates. Miniaturization is one of the three benefits provided by ceramic substrates: the other two being hermetic sealing and heat conduction. Incorporation of thin film ceramic substrates has led to the miniaturization of many electronic devices such as smartphones, tablet personal computers, e-book readers, and video cameras, which are composed of a wide variety of hybrid circuits. Initially, glass epoxy resin substrates were used as hybrid circuit substrates. Ceramic substrates technology helped in reducing the size of electronic devices by scaling down the electrical hybrid circuits. The growing demand for these electronic devices is expected to play a major role in driving the market for ceramic substrates.

Restraints: Volatility in raw material prices

As aluminium is the raw material for various electronic materials including ceramic substrates such as aluminium nitride and alumina the prices of these can vary due to the fluctuation in raw material prices. In January 2020, at the London Metal Exchange (LME), the spot price of aluminum was USD 1,775/ton, which was about five per cent down from the levels a year ago.

According to a report of World Aluminum Organization in May 2020, it was estimated that, the impact of the COVID-19 pandemic on global economic activity will be profound and potentially an extended recession is inevitable. The global aluminium demand seemed affected with the automotive and aerospace sectors in particular feeling the full force of the downturn. Global aluminium demand was estimated to contract by in 2020, followed by a prolonged period of slow and staggered recovery.

Opportunities: Growing demand for nanotechnology and high-end computing system

Ceramic substrates have a wide range of applications in the electrical & electronics sector. Increasing usage of semiconductors, microfabrication, and surface science have created new growth opportunities for the ceramic substrates market. Nanomaterials, nanopillars, nanoparticles, nanorods, and others are used in the field of medicine, space, and energy & power. All these applications require ceramic substrates because of their properties such as high wear, temperature, and corrosion resistance. All these factors provide growth opportunities to the ceramic substrates market.

Alumina Substrates is estimated to be the largest product type in 2019.

Alumina is the most widely used advanced oxide ceramic material, which has a wide range of applications. The parts for alumina substrates are manufactured using the following technologies: uniaxial (die) pressing, isostatic pressing, injection molding, extrusion, and slip casting. It is characterized by high strength and hardness, high wear and corrosion resistance, and temperature stability. Alumina substrates meet all the requirements of insulating materials for applications in electrical & electronics engineering. Alumina substrates are widely used in thick and thin film applications as they are an inexpensive option as compared to other ceramic substrates.

The consumer electronics industry is projected to account for the largest share, in terms of volume and value, of the overall ceramic substrate market between 2020 and 2025.

The consumer electronics sector deals with electronic devices which are intended to be utilized on a daily basis, most often in entertainment and communication equipment. This section includes all ceramics systems in packaging applications in the consumer electronics sector. Ceramic substrates are the most versatile and cost-effective thick film technology used in consumer electronics products. Printed thick film ceramic substrates are used in circuitry games, membrane touch switch, digital products lighting, and signage. Multilayer LTCC ceramic substrates are widely used in digital cameras as they help in reducing the volume of the printed wiring board, thereby, significantly reducing the size and cost. As miniaturization is a key capability of ceramic substrates, they are also used in hearing aids/earphones where compact packaging is a requirement. High-volume manufacturing for mobile consumer products such as smartphones, tablets, laptops, desktop PCs, set-top boxes, portable game consoles, video cameras, speakers, earphones, and others is likely to impact the ceramic substrates market.

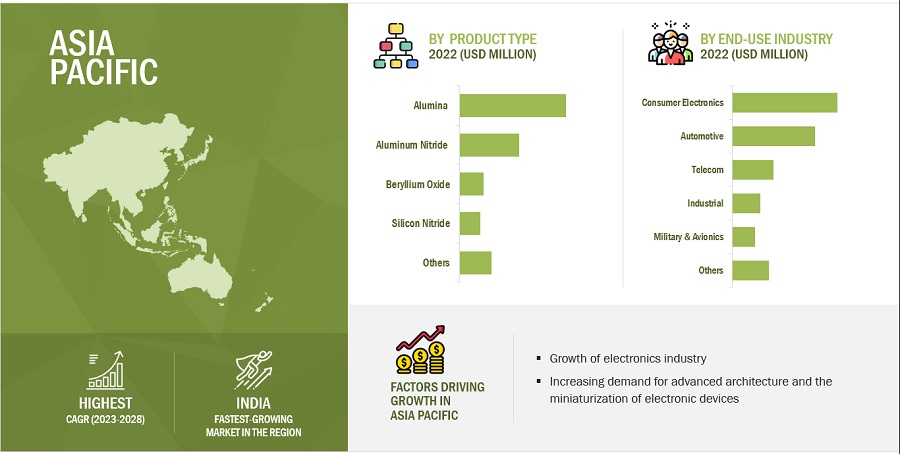

“Asia Pacific is expected to be the largest ceramic substrate market during the forecast period, in terms of value and volume.”

The demand for ceramic substrates is highly dependent on the economic growth of a region. Therefore, high growth in the region is attributed to the rapid economic expansion. According to IMF, China and India are among the fastest-growing economies, globally. In addition, India is expected to outpace China with the highest growth rate, thus driving the global economy. Such economic developments in these countries will lead to the growth of the manufacturing sector. In addition, the rapidly growing end-use industries, competitive manufacturing costs, and high economic growth rate are the favorable factors for the growth of the ceramic substrates market in this region. These factors are also attracting the market players for expanding their businesses in APAC.

To know about the assumptions considered for the study, download the pdf brochure

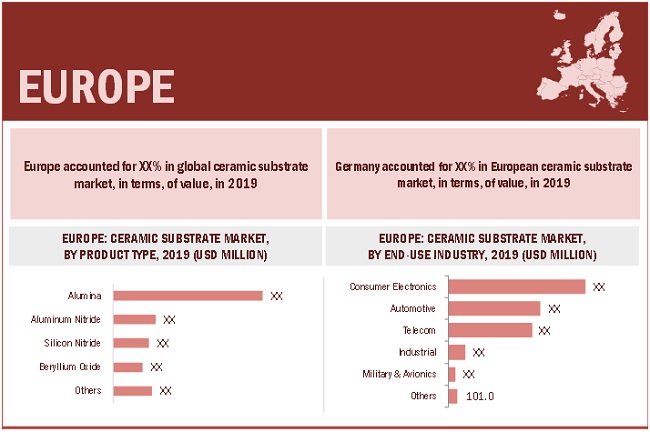

Europe is estimated to be the second largest ceramic substrate market during the forecast period.

The European market for ceramic substrates is quite mature, primarily due to the gradual shift of the manufacturing industry to countries with higher demand and lower production cost. The financial crisis also had a significant impact on the European manufacturing industries which are still recovering, leading to a relatively stagnant demand for ceramic substrates. The market players are emphasizing on increasing the production of oxide ceramics in Europe, which is driving the market for ceramic substrates. The prices of ceramic substrates are higher in Europe than North America due to the lower production of ceramic fibers and higher import duties in this region.

The key market players profiled in the report include Kyocera Corporation (Japan), Murata Manufacturing Co. Ltd. (Japan), Coorstek Inc. (US), Ceramtec (Germany), Maruwa Co. Ltd. (Japan), Koa Corporation (Japan), Yokowo Co. Ltd. (Japan), Tong Hsing Electronics Industries (Taiwan), Leatec Fine Ceramics (Taiwan), and Nikko Company (Japan).

Ceramic Substrates Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018-2025 |

|

Base Year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Volume (Ton); Value (USD Million) |

|

Segments |

Product Type, End-Use Industry, and Region |

|

Regions |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Kyocera Corporation (Japan), Murata Manufacturing Co. Ltd. (Japan), Coorstek Inc. (US), Ceramtec (Germany), Maruwa Co. Ltd. (Japan), Koa Corporation (Japan), Yokowo Co. Ltd. (Japan), Tong Hsing Electronics Industries (Taiwan), Leatec Fine Ceramics (Taiwan), and Nikko Company (Japan). |

This report categorizes the global ceramic substrates market based on product type, end-use industry, and region.

On the basis of Product Type, the ceramic substrates market has been segmented as follows:

- Alumina Substrates

- Aluminum Nitride Substrates

- Beryllium Oxide Substrates

- Silicon Nitride Substrates

- Other Ceramic Substrates

On the basis of End-Use Industry, the ceramic substrates market has been segmented as follows

- Consumer Electronics

- Automotive

- Telecom

- Military & Avionics

- Industrial

- Others

On the basis of region, the ceramic substrates market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Frequently Asked Questions (FAQ):

What are the factors Influencing the growth of Ceramic substrate?

Increasing need for advanced architecture and miniaturization of electronics devices

What are Alumina and Aluminum Nitride Substrate?

Alumina substrates contain at least 80% of aluminum oxide (AL2O3). Lesser amounts of silica (SiO2), magnesia (MgO), and zirconia (ZrO2) can also be added to these ceramic substrates. Aluminum nitride (AlN) substrate has very good thermal conductivity and excellent thermal shock and corrosion resistance.

What is the biggest Restraint for ceramic substrate?

High volatility in raw material prices

How many types of ceramic substrate are available in the market?

Alumina, aluminum nitride, silicon nitride, beryllium oxide, and others. Alumina is amongst the most widely used ceramic substrate. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 CERAMIC SUBSTRATE MARKET: INCLUSIONS & EXCLUSIONS

1.2.2 CERAMIC SUBSTRATE: MARKET DEFINITION AND INCLUSIONS, BY PRODUCT TYPE

1.2.3 CERAMIC SUBSTRATE: MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 BASE NUMBER CALCULATION

2.1.1 SUPPLY-SIDE APPROACH

2.1.2 DEMAND-SIDE APPROACH

2.2 FORECAST NUMBER CALCULATION

2.2.1 SUPPLY SIDE

2.2.2 DEMAND SIDE

2.3 RESEARCH DATA

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

2.3.2.1 Primary interviews – Demand and Supply Side

2.3.2.2 Breakdown of primary interviews

2.3.2.3 Key industry insights

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

2.5 DATA TRINGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS & RISK ASSOCIATED WITH CERAMIC SUBSTRATE MARKET

3 EXECUTIVE SUMMARY (Page No. - 29)

4 PREMIUM INSIGHTS (Page No. - 33)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CERAMIC SUBSTRATES MARKET

4.2 CERAMIC SUBSTRATES MARKET, BY REGION

4.3 ASIA PACIFIC CERAMIC SUBSTRATES MARKET, BY PRODUCT TYPE & COUNTRY

4.4 CERAMIC SUBSTRATES MARKET, END-USE INDUSTRY VS REGION

4.5 CERAMIC SUBSTRATES MARKET, BY MAJOR COUNTRIES

5 MARKET OVERVIEW (Page No. - 36)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing need for advanced architecture and miniaturization of electronic devices

5.2.1.2 Increasing demand for ceramic substrates over traditional metal substrates

5.2.1 RESTRAINTS

5.2.1.1 Volatility in raw material prices

5.2.2 OPPORTUNITIES

5.2.2.1 Growing demand for nanotechnology and high-end computing system

5.2.2.2 Increasing demand from medical industry

5.2.3 CHALLENGES

5.2.3.1 Issues related to recyclability and reparability

5.2.3.2 High price of ceramic substrates

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC OVERVIEW AND KEY TRENDS

5.4.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

5.4.2 TRENDS AND FORECAST OF ELECTRONICS INDUSTRY AND ITS IMPACT ON CERAMIC SUBSTRATES MARKET

5.5 CERAMIC SUBSTRATE MARKET SCENARIOS, 2018-2025

6 INDUSTRY TRENDS (Page No. - 45)

6.1 SUPPLY CHAIN ANALYSIS

6.1.1 RAW MATERIALS

6.1.2 INTERMEDIATE MATERIAL

6.1.3 ASSEMBLY

6.1.4 PRODUCTS

6.2 AVERAGE SELLING PRICE TREND

6.3 REGULATORY LANDSCAPE

6.4 COVID-19 IMPACT

6.4.1 INTRODUCTION

6.4.2 COVID-19 HEALTH ASSESSMENT

6.4.3 COVID-19 ECONOMIC ASSESSMENT

6.4.3.1 COVID-19 Impact on the Economy—Scenario Assessment

6.4.4 COVID-19 IMPACT ON THE CERAMIC SUBSTRATES MARKET

6.5 PATENT ANALYSIS

5.7.1 APPROACH

5.7.2 DOCUMENT TYPE

5.7.3 JURISDICTION ANALYSIS

5.7.4 TOP APPLICANTS

6.6 CERAMIC SUBSTRATE: ECOSYSTEM

6.7 CHANGE IN INDUSTRY SHIFT IMPACTING FUTURE REVENUE MIX

6.8 CASE STUDIES

6.9 TRADE DATA STATISTICS

6.1 TECHNOLOGY ANALYSIS

7 CERAMIC SUBSTRATES MARKET, BY PRODUCT TYPE (Page No. - 59)

7.1 INTRODUCTION

7.2 ALUMINA SUBSTRATES

7.3 ALUMINUM NITRIDE SUBSTRATES

7.4 BERYLLIUM OXIDE SUBSTRATES

7.5 SILICON NITRIDE SUBSTRATES

7.6 OTHER CERAMIC SUBSTRATES

8 CERAMIC SUBSTRATES MARKET, BY END-USE INDUSTRY (Page No. - 75)

8.1 INTRODUCTION

8.2 CONSUMER ELECTRONICS

8.3 AUTOMOTIVE

8.4 TELECOM

8.5 INDUSTRIAL

8.6 MILITARY & AVIONICS

8.7 OTHERS

9 CERAMIC SUBSTRATES MARKET, BY REGION (Page No. - 92)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.2 CANADA

9.2.3 MEXICO

9.3 EUROPE

9.3.1 GERMANY

9.3.2 FRANCE

9.3.3 UK

9.3.4 ITALY

9.3.5 POLAND

9.3.6 NETHERLANDS

9.3.7 RUSSIA

9.3.8 REST OF EUROPE

9.4 APAC

9.4.1 CHINA

9.4.2 JAPAN

9.4.3 SOUTH KOREA

9.4.4 TAIWAN

9.4.5 MALAYSIA

9.4.6 SINGAPORE

9.4.7 INDIA

9.4.8 AUSTRALIA

9.4.9 REST OF APAC

9.5 MIDDLE EAST & AFRICA

9.5.1 UAE

9.5.2 SAUDI ARABIA

9.5.3 TURKEY

9.5.4 SOUTH AFRICA

9.5.5 REST OF MIDDLE EAST & AFRICA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.2 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 170)

10.1 INTRODUCTION

10.2 MARKET EVALUATION FRAMEWORK

10.3 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2019

10.4 MARKET SHARE ANALYSIS, KEY PLAYERS (2019)

10.5 KEY MARKET DEVELOPMENTS

10.5.1 NEW PRODUCT LAUNCHES/DEVELOPMENTS

10.5.2 PARTNERSHIPS, AGREEMENTS, INVESTMENTS, FUNDING, EXPANSIONS, & ACQUISITIONS

10.5 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

10.6 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

10.6.1 STAR

10.6.2 EMERGING LEADERS

10.6.3 PERVASIVE

10.6.4 PARTICIPANTS

10.7 STARTUP & SMALL AND MEDIUM-SIZE ENTERPRISES (SMES) MATRIX, 2019

10.8 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS, 2019

10.9 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS, 2019

11 COMPANY PROFILES (Page No. - 179)

11.1 KYOCERA CORPORATION

11.1.1 BUSINESS OVERVIEW

11.1.2 PRODUCTS OFFERED

11.1.3 RECENT DEVELOPMENTS

11.1.4 SWOT ANALYSIS

11.1.5 WINNING IMPERATIVES

11.1.6 CURRENT STRATEGIES

11.1.7 KYOCERA’S RIGHT TO WIN

11.2 MURATA MANUFACTURING CO., LTD.

11.2.1 BUSINESS OVERVIEW

11.2.2 PRODUCTS OFFERED

11.2.3 RECENT DEVELOPMENTS

11.2.4 SWOT ANALYSIS

11.2.5 WINNING IMPERATIVES

11.2.6 CURRENT STRATEGIES

11.2.7 MURATA’S RIGHT TO WIN

11.3 COORSTEK INC.

11.3.1 BUSINESS OVERVIEW

11.3.2 PRODUCTS OFFERED

11.3.3 RECENT DEVELOPMENTS

11.3.4 SWOT ANALYSIS

11.3.5 WINNING IMPERATIVES

11.3.6 CURRENT STRATEGIES

11.3.7 COORSTEK’S RIGHT TO WIN.

11.4 CERAMTEC

11.4.1 BUSINESS OVERVIEW

11.4.2 PRODUCTS OFFERED

11.4.3 RECENT DEVELOPMENTS

11.4.4 SWOT ANALYSIS

11.4.5 WINNING IMPERATIVES

11.4.6 CURRENT STRATEGIES

11.4.7 CERAMTEC’S RIGHT TO WIN

11.5 MARUWA CO., LTD.

11.5.1 BUSINESS OVERVIEW

11.5.2 PRODUCTS OFFERED

11.5.3 SWOT ANALYSIS

11.5.4 WINNING IMPERATIVES

11.5.5 CURRENT STRATEGIES

11.5.6 MARUWA’S RIGHT TO WIN

11.6 KOA CORPORATION

11.6.1 BUSINESS OVERVIEW

11.6.2 PRODUCTS OFFERED

11.6.3 CURRENT STRATEGIES

11.7 YOKOWO CO., LTD.

11.7.1 BUSINESS OVERVIEW

11.7.2 PRODUCTS OFFERED

11.7.3 CURRENT STRATEGIES

11.8 TONG HSING ELECTRONIC INDUSTRIES

11.8.1 BUSINESS OVERVIEW

11.8.2 PRODUCTS OFFERED

11.8.3 CURRENT STRATEGIES

11.9 LEATEC FINE CERAMICS

11.9.1 BUSINESS OVERVIEW

11.9.2 PRODUCTS OFFERED

11.9.3 CURRENT STRATEGIES

11.10 NIKKO COMPANY

11.10.1 BUSINESS OVERVIEW

11.10.2 PRODUCTS OFFERED

11.10.3 CURRENT STRATEGIES

11.11 OTHER KEY MARKET PLAYERS

11.11.1 NGK SPARK PLUG

11.11.2 ENRG

11.11.3 NIPPON CARBIDE INDUSTRIES

11.11.4 TA-I TECHNOLOGY CO.

11.11.5 ECOCERA OPTOELECTRONICS

11.11.6 TOSHIBA MATERIALS

11.11.7 ICP TECHNOLOGY

11.11.8 ADVANCED SUBSTRATE MICROTECHNOLOGY

11.11.9 ANAREN

11.11.10 CHAOZHOU THREE-CIRCLE (GROUP)

11.11.11 ASAHI GLASS CO., LTD. (AGC)

11.11.12 HITECH CERAMICS

11.11.13 ORTECH ADVANCED CERAMICS

11.11.14 STANFORD ADVANCED MATERIALS

11.11.15 ANTS CERAMICS

12 APPENDIX (Page No. - 206)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 INTRODUCING RT: REAL-TIME MARKET INTELLIGENCE

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

13 ADJACENT & RELATED MARKETS

13.1 INTRODUCTION

13.2 LIMITATION

13.3 TECHNICAL CERAMICS MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.4 PIPE INSULATION MARKET, BY REGION

13.4.1 ASIA PACIFIC

13.4.1.1 By country

13.4.1.2 By application

13.4.2 EUROPE

13.4.2.1 By country

13.4.2.2 By application

13.4.3 NORTH AMERICA

13.4.3.1 By country

13.4.3.2 By application

13.4.4 SOUTH AMERICA

13.4.4.1 By country

13.4.4.2 By application

13.4.5 MIDDLE EAST & AFRICA

13.4.5.1 By country

13.4.5.2 By application

LIST OF TABLES (234 TABLES)

TABLE 1 CERAMIC SUBSTRATES MARKET SNAPSHOT, 2020 & 2025

TABLE 2 TRENDS AND FORECAST OF GDP, 2018–2025 (GROWTH RATE)

TABLE 3 GLOBAL ELECTRICAL & ELECTRONICS INDUSTRY PRODUCTION

TABLE 4 AVERAGE PRICES OF CERAMIC SUBSTRATES, BY REGION (USD/KG)

TABLE 5 REGULATIONS ON USE OF HAZARDOUS SUBSTANCES IN ELECTRICAL AND ELECTRONIC EQUIPMENTS, BY COUNTRY

TABLE 6 CERAMIC SUBSTRATES FABRICATION TECHNOLOGY

TABLE 7 THERMAL CONDUCTIVITY OF VARIOUS CERAMICS

TABLE 8 CERAMIC SUBSTRATE MARKET, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 9 CERAMIC SUBSTRATE MARKET, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 10 CERAMIC SUBSTRATE MARKET, BY PRODUCT TYPE, 2016–2019 (TON)

TABLE 11 CERAMIC SUBSTRATE MARKET, BY PRODUCT TYPE, 2020–2025 (TON)

TABLE 12 ALUMINA SUBSTRATES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 ALUMINA SUBSTRATES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 14 ALUMINA SUBSTRATES MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 15 ALUMINA SUBSTRATES MARKET SIZE, BY REGION, 2020–2025 (TON)

TABLE 16 ALUMINUM NITRIDE SUBSTRATES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 ALUMINUM NITRIDE SUBSTRATES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 18 ALUMINUM NITRIDE SUBSTRATES MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 19 ALUMINA SUBSTRATES MARKET SIZE, BY REGION, 2020–2025 (TON)

TABLE 20 BERYLLIUM OXIDE SUBSTRATES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 BERYLLIUM OXIDE SUBSTRATES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 22 BERYLLIUM OXIDE SUBSTRATES MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 23 BERYLLIUM OXIDE SUBSTRATES MARKET SIZE, BY REGION, 2020–2025 (TON)

TABLE 24 SILICON NITRIDE SUBSTRATES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 SILICON NITRIDE SUBSTRATES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 26 SILICON NITRIDE SUBSTRATES MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 27 SILICON NITRIDE SUBSTRATES MARKET SIZE, BY REGION, 2020–2025 (TON)

TABLE 28 OTHER CERAMIC SUBSTRATES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 OTHER CERAMIC SUBSTRATES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 30 OTHER CERAMIC SUBSTRATES MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 31 OTHER CERAMIC SUBSTRATES MARKET SIZE, BY REGION, 2020–2025 (TON)

TABLE 32 CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 33 CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 34 CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 35 CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 36 CERAMIC SUBSTRATES MARKET SIZE IN CONSUMER ELECTRONICS, BY REGION, 2016-2019 (USD MILLION)

TABLE 37 CERAMIC SUBSTRATES MARKET SIZE IN CONSUMER ELECTRONICS, BY REGION, 2020-2025 (USD MILLION)

TABLE 38 CERAMIC SUBSTRATES MARKET SIZE IN CONSUMER ELECTRONICS, BY REGION, 2016–2019 (TON)

TABLE 39 CERAMIC SUBSTRATES MARKET SIZE IN CONSUMER ELECTRONICS, BY REGION, 2020-2025 (TON)

TABLE 40 CERAMIC SUBSTRATES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2016-2019 (USD MILLION)

TABLE 41 CERAMIC SUBSTRATES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2020-2025 (USD MILLION)

TABLE 42 CERAMIC SUBSTRATES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2016–2019 (TON)

TABLE 43 CERAMIC SUBSTRATES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2020-2025 (TON)

TABLE 44 CERAMIC SUBSTRATES MARKET SIZE IN TELECOM, BY REGION, 2016-2019 (USD MILLION)

TABLE 45 CERAMIC SUBSTRATES MARKET SIZE IN TELECOM, BY REGION, 2020-2025 (USD MILLION)

TABLE 46 CERAMIC SUBSTRATES MARKET SIZE IN TELECOM, BY REGION, 2016–2019 (TON)

TABLE 47 CERAMIC SUBSTRATES MARKET SIZE IN TELECOM, BY REGION, 2020-2025 (TON)

TABLE 48 CERAMIC SUBSTRATES MARKET SIZE IN INDUSTRIAL, BY REGION, 2016-2019 (USD MILLION)

TABLE 49 CERAMIC SUBSTRATES MARKET SIZE IN INDUSTRIAL, BY REGION, 2020-2025 (USD MILLION)

TABLE 50 CERAMIC SUBSTRATES MARKET SIZE IN INDUSTRIAL, BY REGION, 2016–2019 (TON)

TABLE 51 CERAMIC SUBSTRATES MARKET SIZE IN INDUSTRIAL, BY REGION, 2020-2025 (TON)

TABLE 52 CERAMIC SUBSTRATES MARKET SIZE IN MILITARY & AVIONICS, BY REGION, 2016-2019 (USD MILLION)

TABLE 53 CERAMIC SUBSTRATES MARKET SIZE IN MILITARY & AVIONICS, BY REGION, 2020-2025 (USD MILLION)

TABLE 54 CERAMIC SUBSTRATES MARKET SIZE IN MILITARY & AVIONICS, BY REGION, 2016–2019 (TON)

TABLE 55 CERAMIC SUBSTRATES MARKET SIZE IN MILITARY & AVIONICS, BY REGION, 2020-2025 (TON)

TABLE 56 CERAMIC SUBSTRATES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2016-2019 (USD MILLION)

TABLE 57 CERAMIC SUBSTRATES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020-2025 (USD MILLION)

TABLE 58 CERAMIC SUBSTRATES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2016–2019 (TON)

TABLE 59 CERAMIC SUBSTRATES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020-2025 (TON)

TABLE 60 CERAMIC SUBSTRATES MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 61 CERAMIC SUBSTRATES MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 62 CERAMIC SUBSTRATES MARKET SIZE, BY REGION, 2016-2019 (TON)

TABLE 63 CERAMIC SUBSTRATES MARKET SIZE, BY REGION, 2020-2025 (TON)

TABLE 64 NORTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 65 NORTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 66 NORTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2016-2019 (TON)

TABLE 67 NORTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2020- 2025 (TON)

TABLE 68 NORTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2016-2019 (USD MILLION)

TABLE 69 NORTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2020-2025(USD MILLION)

TABLE 70 NORTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2016-2019 (TON)

TABLE 71 NORTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2020-2025 (TON)

TABLE 72 NORTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 73 NORTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 74 NORTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 75 NORTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (TON)

TABLE 76 US: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 77 US: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 78 US: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (TON)

TABLE 79 US: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 80 CANADA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 81 CANADA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 82 CANADA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (TON)

TABLE 83 CANADA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 84 MEXICO: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 85 MEXICO: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 86 MEXICO: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 87 MEXICO: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 88 EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 89 EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 90 EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2015–2022 (TON)

TABLE 91 EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2020-2025 (TON)

TABLE 92 EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2016-2019 (USD MILLION)

TABLE 93 EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2020-2025 (USD MILLION)

TABLE 94 EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2016-2019 (TON)

TABLE 95 EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2020-2025 (TON)

TABLE 96 EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 97 EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 98 EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 99 EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 100 GERMANY: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 101 GERMANY: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 102 GERMANY: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 103 GERMANY: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 104 FRANCE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 105 FRANCE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 106 FRANCE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 107 FRANCE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 108 UK: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 109 UK: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 110 UK: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 111 UK: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 112 ITALY: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 113 ITALY: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 114 ITALY: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 115 ITALY: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 116 POLAND: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 117 POLAND: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 118 POLAND: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 119 POLAND: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 120 NETHERLANDS: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 121 NETHERLANDS: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 122 NETHERLANDS: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 123 NETHERLANDS: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 124 RUSSIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 125 RUSSIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 126 RUSSIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 127 RUSSIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 128 REST OF EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 129 REST OF EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 130 REST OF EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 131 REST OF EUROPE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 132 APAC: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 133 APAC: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 134 APAC: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2016-2019 (TON)

TABLE 135 APAC: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2020-2025 (TON)

TABLE 136 APAC: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2016-2019 (USD MILLION)

TABLE 137 APAC: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2020-2025 (USD MILLION)

TABLE 138 APAC: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2016-2019 (TON)

TABLE 139 APAC: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2020-2025 (TON)

TABLE 140 APAC: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 141 APAC: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 142 APAC: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 143 APAC: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 144 CHINA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 145 CHINA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 146 CHINA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 147 CHINA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 148 JAPAN: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 149 JAPAN: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 150 JAPAN: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 151 JAPAN: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 152 SOUTH KOREA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 153 SOUTH KOREA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 154 SOUTH KOREA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 155 SOUTH KOREA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 156 TAIWAN: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 157 TAIWAN: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 158 TAIWAN: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 159 TAIWAN: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 160 MALAYSIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 161 MALAYSIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 162 MALAYSIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 163 MALAYSIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 164 SINGAPORE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 165 SINGAPORE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 166 SINGAPORE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 167 SINGAPORE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 168 INDIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 169 INDIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 170 INDIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 171 INDIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 172 AUSTRALIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 173 AUSTRALIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 174 AUSTRALIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 175 AUSTRALIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 176 REST OF APAC: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 177 REST OF APAC: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 178 REST OF APAC: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 179 REST OF APAC: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 180 MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2016-2019 (TON)

TABLE 183 MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2020-2025 (TON)

TABLE 184 MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2016-2019 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2020-2025 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2016-2019 (TON)

TABLE 187 MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2020-2025 (TON)

TABLE 188 MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 191 MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 192 UAE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 193 UAE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 194 UAE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 195 UAE: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 196 SAUDI ARABIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 197 SAUDI ARABIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 198 SAUDI ARABIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 199 SAUDI ARABIA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 200 TURKEY: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 201 TURKEY: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 202 TURKEY: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 203 TURKEY: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 204 SOUTH AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 205 SOUTH AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 206 SOUTH AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 207 SOUTH AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 208 REST OF MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 209 REST OF MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 210 REST OF MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 211 REST OF MIDDLE EAST & AFRICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 212 SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 213 SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 214 SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2016-2019 (TON)

TABLE 215 SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY COUNTRY, 2020-2025 (TON)

TABLE 216 SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2016-2019 (USD MILLION)

TABLE 217 SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2020-2025 (USD MILLION)

TABLE 218 SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2016-2019 (TON)

TABLE 219 SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY PRODUCT TYPE, 2020-2025 (TON)

TABLE 220 SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 221 SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 222 SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 223 SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 224 BRAZIL: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 225 BRAZIL: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 226 BRAZIL: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 227 BRAZIL: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 228 REST OF SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 229 REST OF SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 230 REST OF SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (TON)

TABLE 231 REST OF SOUTH AMERICA: CERAMIC SUBSTRATES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (TON)

TABLE 232 OVERVIEW OF STRATEGIES DEPLOYED BY KEY CERAMIC SUBSTRATES MARKET PLAYERS

TABLE 233 NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2017–2020

TABLE 234 PARTNERSHIPS, AGREEMENTS, INVESTMENTS, EXPANSIONS, FUNDING, & ACQUISITIONS, 2014–2020

LIST OF FIGURES (50 FIGURES)

FIGURE 1 CERAMIC SUBSTRATE MARKET: BOTTOM-UP APPROACH

FIGURE 2 CERAMIC SUBSTRATE MARKET: TOP-DOWN APPROACH

FIGURE 3 CERAMIC SUBSTRATE MARKET: DATA TRINGULATION

FIGURE 4 ALUMINA PRODUCT TYPE SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2019

FIGURE 5 CONSUMER ELECTRONICS END USE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2019

FIGURE 6 ASIA PACIFIC EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2020

FIGURE 7 INCREASING NEED FOR ADVANCE ARCHITECHTURE AND MINIATURIZATION OF ELECTRONIC DEVICES IS DRIVING THE MARKET

FIGURE 8 ASIA PACIFIC MARKET PROJECTED TO GROW AT HIGHEST RATE DURING THE FORECAST PERIOD

FIGURE 9 ALUMINA PRODUCT SEGMENT AND CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2019

FIGURE 10 CERAMIC SUBSTRATES MARKET IN INDIA PROJECTED TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 11 DRIVERS, OPPORTUNITIES, AND CHALLENGES IN CERAMIC SUBSTRATES MARKET

FIGURE 12 CERAMIC SUBSTRATES MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 13 THE CERAMIC SUBSTRATES VALUE CHAIN

FIGURE 14 COUNTRY-WISE SPREAD OF COVID-19

FIGURE 15 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 16 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 17 SCENARIOS OF COVID-19 IMPACT

FIGURE 18 CERAMIC SUBSTRATE FABRICATION PROCESS

FIGURE 19 ALUMINUM NITRIDE SUBSTRATES TO REGISTER HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 20 APAC TO BE THE LARGEST MARKET FOR ALUMINA CERAMIC SUBSTRATES DURING THE FORECAST PERIOD

FIGURE 21 APAC TO BE THE LARGEST MARKET FOR ALUMINUM NITRIDE SUBSTRATES DURING THE FORECAST PERIOD

FIGURE 22 APAC TO BE THE LARGEST MARKET FOR BERYLLIUM OXIDE SUBSTRATES DURING FORECAST PERIOD

FIGURE 23 APAC TO BE THE LARGEST MARKET FOR SILICON NITRIDE SUBSTRATES AS CERAMIC SUBSTARTES

FIGURE 24 APAC TO BE THE LARGEST MARKET FOR OTHER CERAMIC SUBSTRATES DURING THE FORECAST PERIOD

FIGURE 25 AUTOMOTIVE TO BE THE FASTEST GROWING END USE INDUSTRY FOR CERAMIC SUBSTRATES

FIGURE 26 APAC TO LEAD THE CERAMIC SUBSTRATES MARKET IN THE CONSUMER ELECTRONICS INDUSTRY

FIGURE 27 APAC TO LEAD THE CERAMIC SUBSTRATES MARKET IN THE AUTOMOTIVE INDUSTRY

FIGURE 28 APAC TO LEAD THE CERAMIC SUBSTRATES MARKET IN THE TELECOM INDUSTRY

FIGURE 29 APAC TO LEAD THE CERAMIC SUBSTRATES MARKET IN THE INDUSTRIAL APPLICATIONS

FIGURE 30 APAC TO LEAD THE CERAMIC SUBSTRATES MARKET IN THE MILITARY & AVIONICS INDUSTRY

FIGURE 31 APAC TO LEAD THE CERAMIC SUBSTRATES MARKET IN THE OTHER END-USE INDUSTRIES

FIGURE 32 APAC TO BE THE LARGEST AND FASTEST GROWING MARKET FOR CERAMIC SUBSTRATE

FIGURE 33 NORTH AMERICA CERAMIC SUBSTRATES MARKET SNAPSHOT

FIGURE 34 EUROPEAN CERAMIC SUBSTRATES MARKET SNAPSHOT

FIGURE 35 APAC CERAMIC SUBSTRATES MARKET SNAPSHOT

FIGURE 36 RANKING ANALYSIS OF TOP 5 PLAYERS IN CERAMIC SUBSTRATES MARKET, 2019

FIGURE 37 KYOCERA CORPORATION: COMPANY SNAPSHOT

FIGURE 38 KYOCERA CORPORATION: WINNING IMPERATIVES

FIGURE 39 MURATA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

FIGURE 40 MURATA MANUFACTURING CO., LTD.: WINNING IMPERATIVES

FIGURE 41 COORSTEK INC.: WINNING IMPERATIVES

FIGURE 42 CERAMTEC: COMPANY SNAPSHOT

FIGURE 43 CERAMTEC: WINNING IMPERATIVES

FIGURE 44 MARUWA CO., LTD.: COMPANY SNAPSHOT

FIGURE 45 MARUWA CO., LTD.: WINNING IMPERATIVES

FIGURE 46 KOA CORPORATION: COMPANY SNAPSHOT

FIGURE 47 YOKOWO CO., LTD.: COMPANY SNAPSHOT

FIGURE 48 TONG HSING ELECTRONIC INDUSTRIES: COMPANY SNAPSHOT

FIGURE 49 LEATEC FINE CERAMICS: COMPANY SNAPSHOT

FIGURE 50 NIKKO COMPANY: COMPANY SNAPSHOT

The study involved four major activities to estimate the market size for ceramic substrates. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

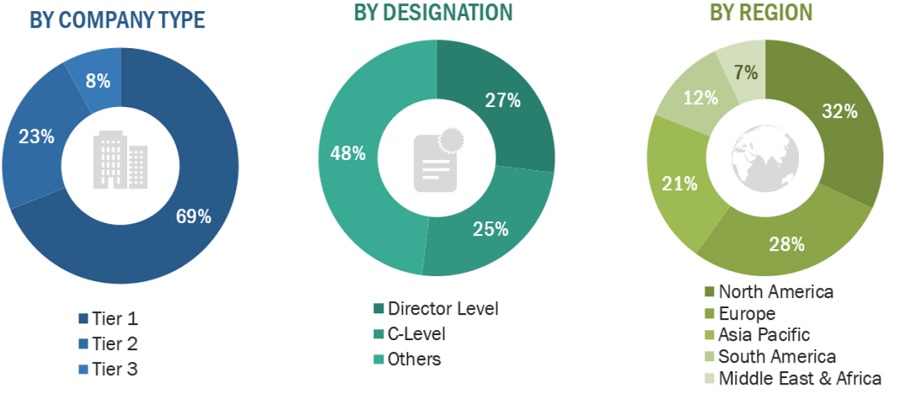

The ceramic substrates market comprises several stakeholders such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of consumer electronics, automotive, telecom, military & avionics, industrial, and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ceramic substrates market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume and value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the ceramic substrates market, in terms of volume and value

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities influencing the growth of the market

- To define, describe, and segment the ceramic substrates market on the basis of product type and end-use industry

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansion, new product launch, merger & acquisition, and agreement in the ceramic substrates market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional end-use industry

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Ceramic Substrates Market