Circuit Breaker Market by Insulation Type (Vacuum, Air, Gas, & Oil), Voltage (Medium, High), Installation (Indoor, Outdoor), End User (Transmission & Distribution Utilities, Power Generation, Renewables, & Railways) and Region - Global Forecast to 2025

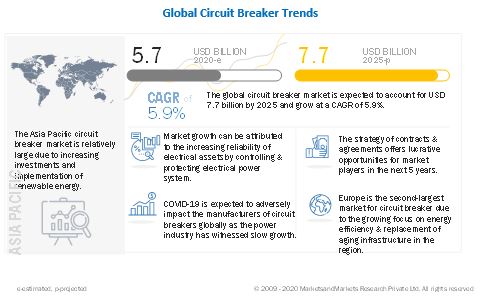

Circuit breaker is an electrical device that is designed to automatically interrupt the flow of electric current in the event of an over-current or short circuit. The global circuit breaker market size was valued at USD 5.7 billion in 2020 and is expected to grow at a CAGR of 5.9% from 2021 to 2025. Increasing investment in the development of smart grid infrastructure and growing demand for energy-efficient solutions are the key factors driving the market growth. In addition, the increasing demand for reliable and safe electrical systems in residential, commercial and industrial sectors is also contributing to the growth of the circuit breaker market. The market is segmented based on type, voltage, end-user, and geography.

To know about the assumptions considered for the study, Request for Free Sample Report

Circuit Breaker Market Dynamics

Driver: Growing investments in power generation, specifically from renewable energy sources

According to the International Energy Agency (IEA), globally, the expected total investment in renewables generation in 2020 is USD 281 billion. Global investments in the power sector in renewable power were found to be USD 308 billion in 2018. Renewable sources such as photovoltaic and wind generators require a dedicated protection system. Hence, the circuit breaker is required to connect the power generating stations to switchyards and the electrical grid. It is one of the most important and critical components in an electrical system. It ensures power system protection and regulates power supply. Growing concerns over the reliability of renewable power have boosted the market for renewable generation and distribution, in turn, driving the global market

According to the BP Statistical Review of World Energy, in 2019, renewable electricity generation accounted for 2805.51 Terawatt-hours of global electricity generation. Many utilities are focusing on renewable energy integration to decarbonize the power distribution system while ensuring environmental protection. Hence, renewable sources are likely to have a significant share in the total power generation mix in the future. An increase in renewable energy generation is stimulating a rise in demand for circuit breakers as they are essential for protecting and controlling electrical power systems.

Restraint: Stringent environmental and safety regulations for SF6 circuit breaker

According to the Kyoto Protocol, SF6 is one of the most potent greenhouse gases (GHGs) with a global warming potential (GWP) of 23,000. It has been listed as an extremely harmful GHG by the Intergovernmental Panel on Climate Change (IPCC). Accordingly, the Kyoto Protocol stipulates the reduction of emissions. Currently, no nearest alternative could work as efficiently as SF6. Thus, high procurement costs, along with policies against SF6, are expected to hamper growth. Imperfect joints in the manufacturing of SF6 circuit breakers lead to the leakage of the SF6 gas, which is a choking gas to some extent. At the time of leakage in the breaker tank, the SF6 gas settles in the surroundings as it is heavier than air, and this gas precipitation may lead to the suffocation of the operating personnel. The arced form of the SF6 gas is poisonous and can be harmful if inhaled. The Environmental Protection Agency (EPA) in the US has taken measures to find a solution to detect the leakage of the SF6 gas in the breaker tank of SF6 circuit breakers, as the leakage is destructive when an arc is formed

The internal parts of SF6 circuit breakers require exhaustive cleaning during periodic maintenance under a clean and dry environment. The sensitive parts of the device are damaged if not cleaned at a regular interval. Special amenities are required for the transportation and maintenance of the quality of this gas. Any deterioration in the quality of the gas would affect its performance, which, in turn, would affect the reliability of SF6 circuit breakers. The innovation of SF6 proved to be a challenge for the circuit breaker and fuse industry, which needs to be addressed by the industry players and technical experts in the industry.

Opportunity: Replacement of aging grid infrastructure and the need for reliable T&D networks

Growing energy demand has resulted in the need for a stable and reliable T&D network. According to the Department of Energy and the North American Electric Reliability Corp., uninterrupted power can only be ensured through a system capable of handling sudden power surges and drops. The US endures more blackouts than any other developed country. Power outages here last more than an hour and have increased steadily in the past few years, costing American businesses about USD 150 billion per year. The main reasons behind the increasing number of blackouts are aging infrastructure, lack of investments, and the lack of clear policies to modernize the grid. According to the Canadian Electricity Association, the Canadian electricity sector requires an investment of USD 350 billion for the next 20 years. The North American Energy Working Group initiative was formed by the US, Canada, and Mexico to know the full range of energy development, production, transport and transmission, distribution, and consumption in North America. It considers the full range of energy sources, as well as efficient and clean production and use of energy.

Recent regulations to reduce/limit the power blackouts and upgrade the aging power networks across the world (particularly in North America, Europe, and parts of APAC) are creating a market for the entire power sector equipment value chain. Power systems depend on long chains of transmission lines, substations with transformers and circuit breakers, and many other equipment such as feeder circuits, reclosers, sectionalizers, fuses, cutouts, service transformers, and service drops. All must function well if the utility is to deliver power to its customers. Circuit breakers are required in utilities for the safe operation of grids. Circuit breakers protect assets such as generators and transformers that are involved in power generation plants. The function of a circuit breaker is to detect the fault caused due to short circuit on the power transmission system and disconnect the equipment from the grid. Hence, replacing aging infrastructure will create an opportunity for the market to grow.

Challenge Impact of COVID-19 on circuit breaker

The COVID-19 pandemic has slowed the growth of the power industry as more and more countries are resorting to nationwide lockdowns to prevent further spikes in the spread of the disease. The renewable energy industry, which until recently was growing at a rapid pace, has been witnessing slow growth during the past few months. This slowdown is mainly due to economic contractions, which have resulted in the reduction of power demand from various end-use industries. With the decrease in power demand, it is estimated that there would be very negligible investments from the utilities for replacing aging grid infrastructure and new renewable installations. For instance, in India, about 40% of the electricity demand is generated from industrial and commercial establishments and accounts for a higher percentage of sales revenue. However, during the lockdown, India’s demand for electricity is expected to drop down by about 20–25%, which would adversely impact the revenue of distribution utilities in the near term. The revenue deficit for the distribution companies is estimated to be about USD 1.7 billion per month in the country.

Furthermore, the spread of COVID-19 is likely to have an adverse effect on the manufacturers of circuit breakers due to the global shutdown and issues along the supply chain. The price for procuring raw materials is also expected to increase due to the shortage of supply, which ultimately will lead to delays in order closures. For instance, ABB expects to have a decline in revenue across all its business segments compared to a year ago. Siemens witnessed a sharp fall in demand from China, Germany, and Italy, where the impact of COVID-19 is high. This demand loss will eventually impact the company’s overall revenue. However, the software market is estimated to experience low to moderate impact when compared with hardware.

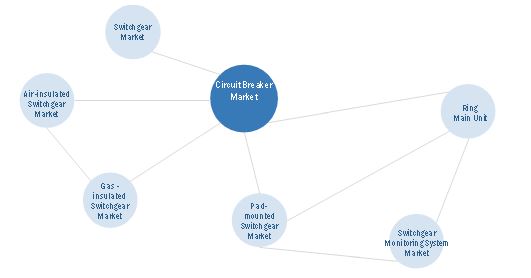

Ecosystem Interconnection

By insulation type, the gas circuit breaker segment is the largest contributor in the circuit breaker during the forecast period.

The gas circuit breakers segment is estimated to lead the circuit breaker market during the forecast period. The market for gas circuit breaker is driven by high dielectric property and less space requirement. Asia Pacific is estimated to hold the largest share of the gas circuit breakers market, followed by Europe because of increasing investments in renewable energy resulting in the demand for the upgrades of the existing substations or the installation of new ones are expected to drive the market for SF6-based gas-insulated switchgear.

By voltage, the high voltage segment is expected to be the largest market for circuit breaker during the forecast period.

The high voltage segment held the largest share of the circuit breaker market, by voltage in 2019. The growth of the high voltage segment is driven by the investments in electrical transmission network to propel demand for high voltage circuit breaker. The market for the high-voltage segment in Asia Pacific is expected to grow at the highest CAGR during the forecast period. To cater to the increasing demand for electricity in residential areas and to provide power supply with high reliability, many utilities are investing in high-voltage circuit breakers, which is expected to drive the high-voltage market.

By installation, the outdoor segment is expected to be the largest contributor during the forecast period.

The outdoor segment held the largest share of the market, by installation in 2019. Increasing installations of solar and wind power plants is expected to drive the market. In addition, the demand for outdoor circuit breakers is increasing as infrastructural developments are taking place in countries with high urbanization rates.

By end user, the T&D utilities segment is expected to be the largest contributor during the forecast period.

The T&D Utilities segment held the largest share of the market, by end user in 2019. Increasing demand for electricity and replacement ofaging infrastructures is expected to drive the market. In addition, the increasing smart grid investments by T&D utilities is one of the key reasons behind the largest market shares of distribution utilities.

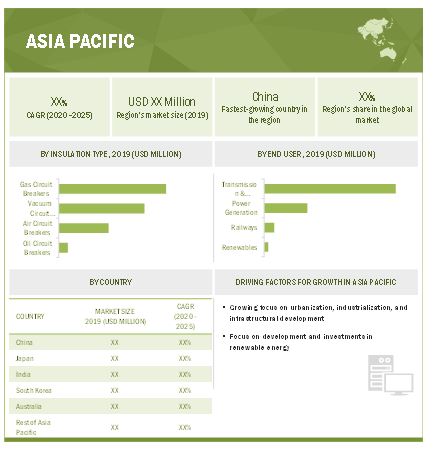

Asia Pacific held the largest share of the circuit breaker market in 2019.

Asia Pacific accounted for the largest share of the global market in 2019. The region has been segmented, by country, into China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific. China is the largest and fastest-growing market in the region. China is considered the leading country in the world in power transmission & distribution. The country mostly focuses on developing transmission lines that are capable of high-load transfer over long distances and creating a nation-wide reliable power system. There are rapid development and growth of renewable energy projects such as wind and solar in China. Furthermore, the Government of China has passed the Renewable Energy Law, which would target 20% of the primary energy consumption from renewable sources by 2020. The Government of China has launched a wind project Three Gorges on Land in the Gansu province with a power-generating capacity of 22 GW. Thus, with the increase in the number of renewable projects, the number of installations in substations is also likely to increase in the future.

Key Market Players

ABB, Schneider Electric Siemens, Mitsubishi Electric, Eaton, are the leading players in the circuit breaker market. CG Power and Industrial Solutions, XIGAO Group, LS ELECTRIC, Huayi Electric, Myers Power Products, Larsen & Toubro, TE Connectivity, Meidensha, Toshiba, Powell Industries and others players operating in the market are the leading players in the global circuit breaker.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Insulation Type, Voltage, Installation End User, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America. |

|

Companies covered |

ABB, Schneider Electric, Siemens, Mitsubishi Electric, Eaton, Mitsubishi Electric, CG Power and Industrial Solutions, XIGAO Group, LS ELECTRIC, Huayi Electric, Myers Power Products, Larsen & Toubro, TE Connectivity, Meidensha, Toshiba, Powell Industries and others |

This research report categorizes the circuit breaker market based on Insulation Type, Voltage, Installation End User, and Region.

Based on the insulation type:

- Vacuum Circuit Breaker

- Air Circuit Breaker

- Gas Circuit Breaker

- Oil Circuit Breaker

Based on the voltage:

- Medium Voltage

- High Voltage

Based on the installation:

- Indoor

- Outdoor

Based on the end user:

- T&D Utilities

- Power Generation

- Renewables

- Railways

Based on the region:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

Recent Developments

- In September 2020, Siemens launched the type SDV-R non-arc-resistant and type SDV-R-AR arc-resistant medium-voltage outdoor distribution circuit breakers that are designed for renewable energy applications, such as wind power generation.

- In January 2020, Siemens acquired C&S Electric, a manufacturer of electrical and electronic equipment, to cater to the growing need for electrification products. . The scope of the acquisition included the Indian operations of C&S Electric’s low-voltage switchgear components and panels, low and medium voltage power busbars as well as protection and metering devices businesses.

- In September 2020, Eaton Cummins Automated Transmission Technologies announced the expansion of the Endurant Automated Transmission lineup with the launch of the Endurant XD series. The series is high-performance automated transmissions designed for on-highway applications, such as double and triple trailer trucks, and severe-duty on/off highway applications like dump and logging trucks.

- In July 2019, Eaton acquired Innovative Switchgear Solutions to enhance the product portfolio of medium-voltage electrical equipment. Innovative Switchgear Solutions is a manufacturer of medium-voltage electrical equipment. The company served in the North American region. This acquisition helped Eaton to strengthen its Systems and Services business segment.

- In November 2018, Mitsubishi Electric built an HVDC verification facility at its T&D Systems Center in Amagasaki, Japan. This would eventually support the company's entry into the global market for voltage-source converters (VSCs).

Frequently Asked Questions (FAQ):

What is a circuit breaker market?

A circuit breaker market refers to the industry that provides circuit breakers, which are devices used to protect electrical systems from damage caused by overloading or short circuits. This market encompasses the manufacturers, suppliers, distributors, and retailers of circuit breakers, as well as the demand for these products from various end-users such as residential, commercial, and industrial sectors. The circuit breaker market is characterized by a range of products including air circuit breakers, molded case circuit breakers, miniaturized circuit breakers, and others, and is influenced by factors such as technological advancements, government regulations, and economic conditions.

How big is the global circuit breaker market?

Forecast Year 2020 to 2025, the global circuit breaker market size is projected to reach USD 7.7 billion by 2025.

What are the major drivers for the circuit breaker market?

The circuit breaker is driven by factors such as growing investments in power generation, specifically from renewable energy sources; rising demand for reliable and secure power supply worldwide; increasing capacity additions and enhancements for T&D networks; and accelerating investments in railways sectors.

Which region dominates during the forecasted period in the circuit breaker market?

Asia Pacific is projected to be the fastest-growing market during the forecast period. The growth of the circuit breaker in Asia Pacific can be attributed to the rapid development and growth of renewable energy projects such as wind and solar across countries such as China, South Korea, and others. Furthermore, the Government of China has passed the Renewable Energy Law, which would target 20% of the primary energy consumption from renewable sources by 2020. The Government of China has launched a wind project Three Gorges on Land in the Gansu province with a power-generating capacity of 22 GW. Thus, with the increase in the number of renewable projects, the number of installations of substations is also likely to increase in the future.

Which is the fastest-growing type segment during the forecasted period in the circuit breaker market?

The gas circuit breaker segment is the fastest-growing during the forecasted period. The market for gas circuit breaker is driven by high dielectric property and less space requirement.

Who are the leading players in the global circuit breaker market?

ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Mitsubishi Electric (Japan), and Eaton (Ireland) are the leading players in the circuit breaker market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 CIRCUIT BREAKERS MARKET, BY VOLTAGE: INCLUSIONS & EXCLUSIONS

1.2.2 CIRCUIT BREAKERS MARKET, BY END USER: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 CIRCUIT BREAKERS MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 SCOPE

FIGURE 3 MAIN METRICS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR MARKET

2.4 MARKET SIZE ESTIMATION

2.4.1 DEMAND-SIDE ANALYSIS

FIGURE 4 MARKET: INDUSTRY-REGION/COUNTRY-WISE ANALYSIS

2.4.1.1 Calculation for demand side

2.4.1.2 Assumptions for demand side

2.4.2 SUPPLY-SIDE ANALYSIS

FIGURE 5 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF CIRCUIT BREAKERS

FIGURE 6 MARKET: SUPPLY-SIDE ANALYSIS

2.4.2.1 Calculations for supply side

2.4.2.2 Assumptions for supply side

FIGURE 7 COMPANY REVENUE ANALYSIS, 2019

2.4.3 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 46)

3.1 SCENARIO ANALYSIS

FIGURE 8 SCENARIO ANALYSIS: MARKET, 2019–2021

3.1.1 OPTIMISTIC SCENARIO

3.1.2 REALISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

TABLE 1 MARKET SNAPSHOT

FIGURE 9 ASIA PACIFIC DOMINATED IN 2019

FIGURE 10 GAS CIRCUIT BREAKER SEGMENT TO CONTINUE TO HOLD LARGEST SHARE OF MARKET, BY INSULATION TYPE, DURING FORECAST PERIOD

FIGURE 11 HIGH VOLTAGE SEGMENT TO CONTINUE TO HOLD LARGEST SHARE OF MARKET, BY VOLTAGE, DURING FORECAST PERIOD

FIGURE 12 OUTDOOR SEGMENT TO CONTINUE TO HOLD LARGEST SHARE OF MARKET, BY INSTALLATION, DURING FORECAST PERIOD

FIGURE 13 T&D UTILITIES TO CONTINUE TO LEAD MARKET, BY END USER, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 14 GROWING EMPHASIS ON RENEWABLE ENERGY INTEGRATION TO DRIVE MARKET DURING 2020–2025

4.2 MARKET, BY REGION

FIGURE 15 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET IN ASIA PACIFIC, BY END USER & COUNTRY

FIGURE 16 T&D UTILITIES AND CHINA DOMINATED ASIA PACIFIC MARKET, BY END USER AND COUNTRY, RESPECTIVELY, IN 2019

4.4 MARKET, BY INSTALLATION

FIGURE 17 OUTDOOR SEGMENT PROJECTED TO CONTINUE TO DOMINATE MARKET, BY INSTALLATION, IN 2025

4.5 MARKET, BY VOLTAGE

FIGURE 18 HIGH VOLTAGE SEGMENT EXPECTED TO HOLD LARGER SHARE OF MARKET, BY VOLTAGE, IN 2025

4.6 MARKET, BY END USER

FIGURE 19 T&D UTILITIES SEGMENT LIKELY TO CONTINUE TO HOLD LARGEST SHARE OF MARKET, BY END USER, IN 2025

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 20 COVID-19 GLOBAL PROPAGATION

FIGURE 21 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 22 RECOVERY ROAD FOR 2020 & 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 24 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Growing investments in power generation, specifically from renewable energy sources

FIGURE 25 GLOBAL INVESTMENTS IN POWER SECTOR, BY TECHNOLOGY, 2017-2020

FIGURE 26 RENEWABLES GENERATION BY SOURCE (TERAWATT-HOURS)

5.5.1.2 Rising demand for reliable and secure power supply worldwide

5.5.1.3 Increasing capacity additions and enhancements for T&D networks

FIGURE 27 GLOBAL T&D INVESTMENTS (2017-2020) (USD BILLION)

FIGURE 28 GLOBAL T&D INVESTMENTS, BY REGION, 2018, MARKET SHARE (%)

5.5.1.4 Accelerating investments in railway sector

5.5.2 RESTRAINTS

5.5.2.1 Stringent environmental and safety regulations for SF6 circuit breakers

5.5.2.2 Competition from market’s unorganized sector

5.5.3 OPPORTUNITIES

5.5.3.1 Growth in investments in smart grid technologies to protect and control power equipment

FIGURE 29 GLOBAL INVESTMENTS IN SMART GRIDS, BY TECHNOLOGY AREA, 2014–2019 (USD BILLION)

5.5.3.2 Replacement of aging grid infrastructure and need for reliable T&D networks

5.5.4 CHALLENGES

5.5.4.1 Risk of cybersecurity attacks and installation of modernized circuit breakers

5.5.4.2 Impact of COVID-19 on circuit breakers

5.6 TRENDS

5.6.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR CIRCUIT BREAKER MANUFACTURERS

FIGURE 30 REVENUE SHIFT FOR SWITCHGEAR MONITORING SYSTEMS

5.7 AVERAGE SELLING PRICE

FIGURE 31 AVERAGE SELLING PRICE (2018-2025)

5.8 MARKET MAP

FIGURE 32 MARKET MAP FOR CIRCUIT BREAKER

5.9 TRADE DATA STATISTICS

TABLE 2 COUNTRY-WISE EXPORT, 2018 & 2019 (USD MILLION)

TABLE 3 COUNTRY-WISE IMPORT, 2018 & 2019 (USD MILLION)

5.10 VALUE CHAIN ANALYSIS

FIGURE 33 CIRCUIT BREAKER VALUE CHAIN ANALYSIS

5.10.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.10.2 COMPONENT MANUFACTURERS

5.10.3 ASSEMBLERS/MANUFACTURERS

5.10.4 DISTRIBUTORS (BUYERS)/ END USERS AND POST-SALES SERVICES

5.11 TECHNOLOGY ANALYSIS

5.11.1 TECHNOLOGY TRENDS FOR VARIOUS CIRCUIT BREAKER TECHNOLOGIES

5.12 CIRCUIT BREAKER: CODES AND REGULATIONS

5.13 INNOVATIONS & PATENT REGISTRATION

5.14 CASE STUDY ANALYSIS

5.14.1 CIRCUIT BREAKERS FOR ENERGY MARKET

5.14.1.1 ABB introduced HVDC (high voltage direct current) circuit breakers to transform energy market

6 SCENARIO ANALYSIS (Page No. - 76)

6.1 INTRODUCTION

6.1.1 OPTIMISTIC SCENARIO

TABLE 4 OPTIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.2 REALISTIC SCENARIO

TABLE 5 REALISTIC SCENARIO: MARKET, BY REGION,2018–2025 (USD MILLION)

6.1.3 PESSIMISTIC SCENARIO

TABLE 6 PESSIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

7 MARKET, BY INSULATION TYPE (Page No. - 79)

7.1 INTRODUCTION

FIGURE 34 MARKET, BY INSULATION TYPE, 2019

TABLE 7 MARKET SIZE, BY INSULATION TYPE,2018–2025 (USD MILLION)

7.2 VACUUM CIRCUIT BREAKERS

7.2.1 GROWING FOCUS ON CIRCUIT BREAKERS BEING ENVIRONMENT-FRIENDLY AND HAVING LONG SERVICE LIFE IS LIKELY TO THEIR INCREASE DEMAND

TABLE 8 VACUUM CIRCUIT BREAKER: MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3 AIR CIRCUIT BREAKERS

7.3.1 SURGING DEMAND FOR ENERGY STORAGE IS LIKELY TO DRIVE MARKET

TABLE 9 AIR CIRCUIT BREAKER: MARKET, BY REGION, 2018–2025 (USD MILLION)

7.4 GAS CIRCUIT BREAKERS

7.4.1 HIGH DIELECTRIC PROPERTY AND LESS SPACE REQUIREMENT FOR INSTALLATION TO INCREASE DEMAND

TABLE 10 GAS CIRCUIT BREAKER: MARKET, BY REGION, 2018–2025 (USD MILLION)

7.5 OIL CIRCUIT BREAKERS

7.5.1 HIGH DIELECTRIC STRENGTH & INSULATION ARE LIKELY TO BOOST DEMAND

TABLE 11 OIL CIRCUIT BREAKER: MARKET, BY REGION, 2018–2025 (USD MILLION)

8 MARKET, BY VOLTAGE (Page No. - 85)

8.1 INTRODUCTION

FIGURE 35 MARKET, BY VOLTAGE, 2019

TABLE 12 MARKET SIZE, BY VOLTAGE, 2018–2025 (USD MILLION)

8.2 MEDIUM VOLTAGE

8.2.1 GROWING POWER DISTRIBUTION INFRASTRUCTURES ARE EXPECTED TO DRIVE MARKET DURING FORECAST PERIOD

TABLE 13 MEDIUM VOLTAGE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.3 HIGH VOLTAGE

8.3.1 INVESTMENTS IN ELECTRICAL TRANSMISSION NETWORK TO PROPEL DEMAND FOR HIGH-VOLTAGE CIRCUIT BREAKERS

TABLE 14 HIGH VOLTAGE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9 MARKET, BY INSTALLATION (Page No. - 89)

9.1 INTRODUCTION

FIGURE 36 MARKET, BY INSTALLATION, 2019

TABLE 15 MARKET SIZE, BY INSTALLATION, 2018–2025 (USD MILLION)

9.2 INDOOR CIRCUIT BREAKERS

9.2.1 GROWING INDUSTRIAL & COMMERCIAL SECTORS IN DEVELOPING COUNTRIES TO BOOST MARKET GROWTH

TABLE 16 INDOOR MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.3 OUTDOOR CIRCUIT BREAKERS

9.3.1 INCREASING INSTALLATIONS OF SOLAR AND WIND POWER PLANTS TO DRIVE MARKET FOR THIS SEGMENT

TABLE 17 OUTDOOR MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10 MARKET, BY END USER (Page No. - 93)

10.1 INTRODUCTION

FIGURE 37 MARKET, BY END USER, 2019

TABLE 18 MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

10.2 T&D UTILITIES

10.2.1 INCREASING DEMAND FOR ELECTRICITY AND REPLACEMENT OF AGING INFRASTRUCTURE TO DRIVE MARKET FOR THIS SEGMENT

TABLE 19 T&D UTILITIES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.3 POWER GENERATION

10.3.1 GROWING SAFETY AND RELIABILITY OF POWER PLANTS TO PROPEL MARKET GROWTH

TABLE 20 POWER GENERATION: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.4 RENEWABLES

10.4.1 RISING INVESTMENTS TO REDUCE CARBON DIOXIDE EMISSION TO ACCELERATE MARKET GROWTH

TABLE 21 RENEWABLES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.5 RAILWAYS

10.5.1 INCREASING INVESTMENTS IN RAILWAY ELECTRIFICATION SYSTEMS TO DRIVE MARKET

TABLE 22 RAILWAYS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11 MARKET, BY REGION (Page No. - 99)

11.1 INTRODUCTION

FIGURE 38 REGIONAL SNAPSHOT: ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 39 MARKET SHARE (VALUE), BY REGION, 2019

TABLE 23 MARKET, BY REGION, 2018–2025 (USD MILLION)

11.2 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

11.2.1 IMPORT AND EXPORT DATA

TABLE 24 ASIA PACIFIC: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD MILLION)

11.2.2 BY INSULATION TYPE

TABLE 25 ASIA PACIFIC: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.2.3 BY VOLTAGE

TABLE 26 ASIA PACIFIC: MARKET, BY VOLTAGE,2018–2025 (USD MILLION)

11.2.4 BY INSTALLATION

TABLE 27 ASIA PACIFIC: MARKET, BY INSTALLATION,2018–2025 (USD MILLION)

11.2.5 BY END USER

TABLE 28 ASIA PACIFIC: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

11.2.6 BY COUNTRY

TABLE 29 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.2.6.1 China

11.2.6.1.1 Increasing focus on developing transmission lines to drive market

11.2.6.1.2 By insulation type

TABLE 30 CHINA: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.2.6.1.3 By voltage

TABLE 31 CHINA: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.2.6.1.4 By installation

TABLE 32 CHINA: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.2.6.1.5 By end user

TABLE 33 CHINA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.2.6.2 Japan

11.2.6.2.1 Increasing focus on rebuilding of power grid & substations to drive demand

11.2.6.2.2 By insulation type

TABLE 34 JAPAN: MARKET, BY INSULATION TYPE,2018–2025 (USD MILLION)

11.2.6.2.3 By voltage

TABLE 35 JAPAN: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.2.6.2.4 By installation

TABLE 36 JAPAN: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.2.6.2.5 By end user

TABLE 37 JAPAN: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.2.6.3 India

11.2.6.3.1 Renovating existing power plants and rising power generation to drive demand

11.2.6.3.2 By insulation type

TABLE 38 INDIA: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.2.6.3.3 By voltage

TABLE 39 INDIA: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.2.6.3.4 By installation

TABLE 40 INDIA: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.2.6.3.5 By end user

TABLE 41 INDIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.2.6.4 South Korea

11.2.6.4.1 Government initiatives toward renewable power generation accelerating market growth

11.2.6.4.2 By insulation type

TABLE 42 SOUTH KOREA: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.2.6.4.3 By voltage

TABLE 43 SOUTH KOREA: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.2.6.4.4 By installation

TABLE 44 SOUTH KOREA: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.2.6.4.5 By end user

TABLE 45 SOUTH KOREA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.2.6.5 Australia

11.2.6.5.1 Growing renewable power generation and replacement of aging infrastructure to drive demand for circuit breakers

11.2.6.5.2 By insulation type

TABLE 46 AUSTRALIA: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.2.6.5.3 By voltage

TABLE 47 AUSTRALIA: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.2.6.5.4 By installation

TABLE 48 AUSTRALIA: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.2.6.5.5 By end user

TABLE 49 AUSTRALIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.2.6.6 Rest of Asia pacific

11.2.6.6.1 By insulation type

TABLE 50 REST OF ASIA PACIFIC: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.2.6.6.2 By voltage

TABLE 51 REST OF ASIA PACIFIC: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.2.6.6.3 By installation

TABLE 52 REST OF ASIA PACIFIC: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.2.6.6.4 By end user

TABLE 53 REST OF ASIA PACIFIC: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3 EUROPE

FIGURE 41 EUROPE: MARKET SNAPSHOT

11.3.1 IMPORT AND EXPORT DATA

TABLE 54 EUROPE: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD MILLION)

11.3.2 BY INSULATION TYPE

TABLE 55 EUROPE: MARKET, BY INSULATION TYPE,2018–2025 (USD MILLION)

11.3.3 BY VOLTAGE

TABLE 56 EUROPE: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.3.4 BY INSTALLATION

TABLE 57 EUROPE: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.3.5 BY END USER

TABLE 58 EUROPE: MARKET SIZE, BY END USER,2018–2025 (USD MILLION)

11.3.6 BY COUNTRY

TABLE 59 EUROPE: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.3.6.1 Germany

11.3.6.1.1 Sustainable growth in renewable sector to drive market growth

11.3.6.1.2 By insulation type

TABLE 60 GERMANY: MARKET, BY INSULATION TYPE,2018–2025 (USD MILLION)

11.3.6.1.3 By voltage

TABLE 61 GERMANY: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.3.6.1.4 By installation

TABLE 62 GERMANY: MARKET, BY INSTALLATION,2018–2025 (USD MILLION)

11.3.6.1.5 By end user

TABLE 63 GERMANY: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.6.2 France

11.3.6.2.1 Growing focus on renewable power sources propelling market growth

11.3.6.2.2 By insulation type

TABLE 64 FRANCE: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.3.6.2.3 By voltage

TABLE 65 FRANCE: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.3.6.2.4 By installation

TABLE 66 FRANCE: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.3.6.2.5 By end user

TABLE 67 FRANCE: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.6.3 UK

11.3.6.3.1 Growing investments in renewables to drive market growth

11.3.6.3.2 By insulation type

TABLE 68 UK: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.3.6.3.3 By voltage

TABLE 69 UK: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.3.6.3.4 By installation

TABLE 70 UK: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.3.6.3.5 By end user

TABLE 71 UK: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.6.4 Russia

11.3.6.4.1 Growing need for investments in T&D sector boosting market growth

11.3.6.4.2 By insulation type

TABLE 72 RUSSIA: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.3.6.4.3 By voltage

TABLE 73 RUSSIA: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.3.6.4.4 By installation

TABLE 74 RUSSIA: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.3.6.4.5 By end user

TABLE 75 RUSSIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.6.5 Italy

11.3.6.5.1 Growing government initiatives toward renewable energy to stimulate demand

11.3.6.5.2 By insulation type

TABLE 76 ITALY: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.3.6.5.3 By voltage

TABLE 77 ITALY: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.3.6.5.4 By installation

TABLE 78 ITALY: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.3.6.5.5 By end user

TABLE 79 ITALY: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.6.6 Rest of Europe

11.3.6.6.1 By insulation type

TABLE 80 REST OF EUROPE: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.3.6.6.2 By voltage

TABLE 81 REST OF EUROPE: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.3.6.6.3 By installation

TABLE 82 REST OF EUROPE: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.3.6.6.4 By end user

TABLE 83 REST OF EUROPE: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4 NORTH AMERICA

11.4.1 IMPORT AND EXPORT DATA

TABLE 84 NORTH AMERICA: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD MILLION)

11.4.2 BY INSULATION TYPE

TABLE 85 NORTH AMERICA: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.4.3 BY VOLTAGE

TABLE 86 NORTH AMERICA: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.4.4 BY INSTALLATION

TABLE 87 NORTH AMERICA: MARKET, BY INSTALLATION,2018–2025 (USD MILLION)

11.4.5 BY END USER

TABLE 88 NORTH AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4.6 BY COUNTRY

TABLE 89 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.4.6.1 US

11.4.6.1.1 Existing power infrastructure upgrades driving market growth

11.4.6.1.2 By insulation type

TABLE 90 US: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.4.6.1.3 By voltage

TABLE 91 US: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.4.6.1.4 By installation

TABLE 92 US: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.4.6.1.5 By end user

TABLE 93 US: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4.6.2 Canada

11.4.6.2.1 Growing investments in T&D networks & upgrading infrastructure to accelerate market growth

11.4.6.2.2 By insulation type

TABLE 94 CANADA: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.4.6.2.3 By voltage

TABLE 95 CANADA: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.4.6.2.4 By installation

TABLE 96 CANADA: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.4.6.2.5 By end user

TABLE 97 CANADA: MARKET, BY END USER,2018–2025 (USD MILLION)

11.4.6.3 Mexico

11.4.6.3.1 Growing focus on power infrastructure and development of smart grid to boost market growth

11.4.6.3.2 By insulation type

TABLE 98 MEXICO: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.4.6.3.3 By voltage

TABLE 99 MEXICO: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.4.6.3.4 By installation

TABLE 100 MEXICO: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.4.6.3.5 By end user

TABLE 101 MEXICO: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.5 SOUTH AMERICA

11.5.1 IMPORT AND EXPORT DATA

TABLE 102 SOUTH AMERICA: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD MILLION)

11.5.2 BY INSULATION TYPE

TABLE 103 SOUTH AMERICA: MARKET, BY INSULATION TYPE,2018–2025 (USD MILLION)

11.5.3 BY VOLTAGE

TABLE 104 SOUTH AMERICA: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.5.4 BY INSTALLATION

TABLE 105 SOUTH AMERICA: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.5.5 BY END USER

TABLE 106 SOUTH AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.5.6 BY COUNTRY

TABLE 107 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.5.6.1 Brazil

11.5.6.1.1 Modernization of existing power infrastructures and high electricity demand to drive market

11.5.6.1.2 By insulation type

TABLE 108 BRAZIL: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.5.6.1.3 By voltage

TABLE 109 BRAZIL: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.5.6.1.4 By installation

TABLE 110 BRAZIL: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.5.6.1.5 By end user

TABLE 111 BRAZIL: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.5.6.2 Argentina

11.5.6.2.1 Increasing investments in renewable sector and growing focus on T&D utilities propelling market growth

11.5.6.2.2 By insulation type

TABLE 112 ARGENTINA: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.5.6.2.3 By voltage

TABLE 113 ARGENTINA: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.5.6.2.4 By installation

TABLE 114 ARGENTINA: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.5.6.2.5 By end user

TABLE 115 ARGENTINA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.5.6.3 Rest of South America

11.5.6.3.1 By insulation type

TABLE 116 REST OF SOUTH AMERICA: MARKET, BY INSULATION TYPE, 2018–2025 (USD THOUSAND)

11.5.6.3.2 By voltage

TABLE 117 REST OF SOUTH AMERICA: MARKET, BY VOLTAGE,2018–2025 (USD THOUSAND)

11.5.6.3.3 By installation

TABLE 118 REST OF SOUTH AMERICA: MARKET, BY INSTALLATION, 2018–2025 (USD THOUSAND)

11.5.6.3.4 By end user

TABLE 119 REST OF SOUTH AMERICA: MARKET, BY END USER, 2018–2025 (USD THOUSAND)

11.6 MIDDLE EAST & AFRICA

11.6.1 IMPORT AND EXPORT DATA

TABLE 120 MIDDLE EAST & AFRICA: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD MILLION)

11.6.2 BY INSULATION TYPE

TABLE 121 MIDDLE EAST & AFRICA: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.6.3 BY VOLTAGE

TABLE 122 MIDDLE EAST & AFRICA: MARKET, BY VOLTAGE,2018–2025 (USD MILLION)

11.6.4 BY INSTALLATION

TABLE 123 MIDDLE EAST & AFRICA: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.6.5 BY END USER

TABLE 124 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.6.6 BY COUNTRY

TABLE 125 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.6.6.1 Saudi Arabia

11.6.6.1.1 Increasing investments in power projects to drive market

11.6.6.1.2 By insulation type

TABLE 126 SAUDI ARABIA: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.6.6.1.3 By voltage

TABLE 127 SAUDI ARABIA: MARKET, BY VOLTAGE,2018–2025 (USD MILLION)

11.6.6.1.4 By installation

TABLE 128 SAUDI ARABIA: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.6.6.1.5 By end user

TABLE 129 SAUDI ARABIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.6.6.2 UAE

11.6.6.2.1 Increasing number of power projects for upgrading distribution networks boosts market growth

11.6.6.2.2 By insulation type

TABLE 130 UAE: MARKET, BY INSULATION TYPE,2018–2025 (USD MILLION)

11.6.6.2.3 By voltage

TABLE 131 UAE: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.6.6.2.4 By installation

TABLE 132 UAE: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.6.6.2.5 By end user

TABLE 133 UAE: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.6.6.3 South Africa

11.6.6.3.1 Rising investments in power capacity addition and energy efficiency to accelerate market growth

11.6.6.3.2 By insulation type

TABLE 134 SOUTH AFRICA: MARKET, BY INSULATION TYPE, 2018–2025 (USD THOUSAND)

11.6.6.3.3 By voltage

TABLE 135 SOUTH AFRICA: MARKET, BY VOLTAGE, 2018–2025 (USD THOUSAND)

11.6.6.3.4 By installation

TABLE 136 SOUTH AFRICA: MARKET, BY INSTALLATION, 2018–2025 (USD THOUSAND)

11.6.6.3.5 By end user

TABLE 137 SOUTH AFRICA: MARKET, BY END USER,2018–2025 (USD THOUSAND)

11.6.6.4 Kuwait

11.6.6.4.1 Growing investments in power generation and distribution to propel market growth

11.6.6.4.2 By insulation type

TABLE 138 KUWAIT: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.6.6.4.3 By voltage

TABLE 139 KUWAIT: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.6.6.4.4 By installation

TABLE 140 KUWAIT: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.6.6.4.5 By end user

TABLE 141 KUWAIT: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.6.6.5 Rest of Middle East & Africa

11.6.6.5.1 By insulation type

TABLE 142 REST OF MIDDLE EAST & AFRICA: MARKET, BY INSULATION TYPE, 2018–2025 (USD MILLION)

11.6.6.5.2 By voltage

TABLE 143 REST OF MIDDLE EAST & AFRICA: MARKET, BY VOLTAGE, 2018–2025 (USD MILLION)

11.6.6.5.3 By installation

TABLE 144 REST OF MIDDLE EAST & AFRICA: MARKET, BY INSTALLATION, 2018–2025 (USD MILLION)

11.6.6.5.4 By end user

TABLE 145 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 162)

12.1 KEY PLAYERS STRATEGIES

TABLE 146 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, 2017–2020

12.2 SHARE ANALYSIS OF TOP 5 PLAYERS

FIGURE 42 MARKET SHARE ANALYSIS, 2019

12.3 MARKET EVALUATION FRAMEWORK

TABLE 147 MARKET EVALUATION FRAMEWORK

12.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

FIGURE 43 TOP 5 PLAYERS DOMINATED MARKET IN LAST 5 YEARS

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE

12.5.4 PARTICIPANTS

FIGURE 44 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2019

12.6 COMPETITIVE LEADERSHIP MAPPING OF START-UPS

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 STARTING BLOCKS

12.6.4 DYNAMIC COMPANIES

FIGURE 45 COMPETITIVE LEADERSHIP MAPPING OF START-UPS, 2019

12.7 COMPETITIVE SCENARIO

12.7.1 PRODUCT LAUNCHES

12.7.2 CONTRACTS & AGREEMENTS

12.7.3 MERGERS & ACQUISITIONS

13 COMPANY PROFILES (Page No. - 172)

(Business and Financial Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats))*

13.1 ABB

FIGURE 46 ABB: COMPANY SNAPSHOT

13.2 SIEMENS

FIGURE 47 SIEMENS: COMPANY SNAPSHOT

13.3 EATON

FIGURE 48 EATON: COMPANY SNAPSHOT

13.4 SCHNEIDER ELECTRIC

FIGURE 49 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

13.5 MITSUBISHI ELECTRIC

FIGURE 50 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

13.6 TOSHIBA

FIGURE 51 TOSHIBA: COMPANY SNAPSHOT

13.7 POWELL INDUSTRIES

FIGURE 52 POWELL INDUSTRIES: COMPANY SNAPSHOT

13.8 CG POWER AND INDUSTRIAL SOLUTIONS

FIGURE 53 CG POWER: COMPANY SNAPSHOT

13.9 FUJI ELECTRIC

FIGURE 54 FUJI ELECTRIC: COMPANY SNAPSHOT

13.10 LARSEN & TOUBRO

FIGURE 55 LARSEN & TOUBRO: COMPANY SNAPSHOT

13.11 BRUSH GROUP

13.12 TAVRIDA ELECTRIC

13.13 SÉCHERON

13.14 EFACEC POWER SOLUTIONS

13.15 HYUNDAI ELECTRIC

13.16 TE CONNECTIVITY

FIGURE 56 TE CONNECTIVITY: COMPANY SNAPSHOT

13.17 ENTEC ELECTRIC & ELECTRONIC

13.18 LS ELECTRIC

13.19 SCHALTBAU

13.2 KIRLOSKAR ELECTRIC

13.20.1 YUEQING AISO ELECTRIC

13.21 SRIWIN ELECTRIC

13.22 ORECCO

13.23 ORMAZABAL

13.24 YUEQING LIYOND ELECTRIC

13.25 SAFVOLT SWITCHGEARS

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View (Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats) might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 218)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

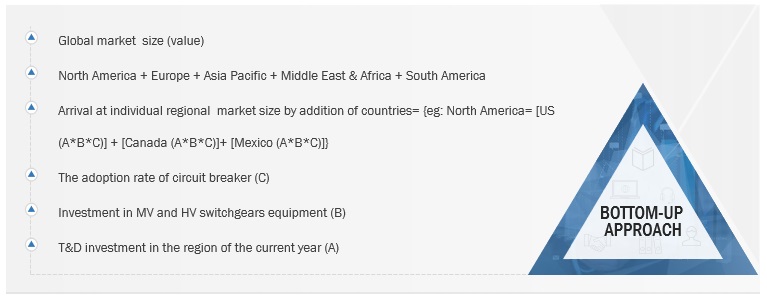

This study involved four major activities in estimating the current market size for circuit breaker. Exhaustive secondary research was done to collect information on the market and the peer market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, World Bank, US DOE, IEA, to identify and collect information useful for a technical, market-oriented, and commercial study of the global market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

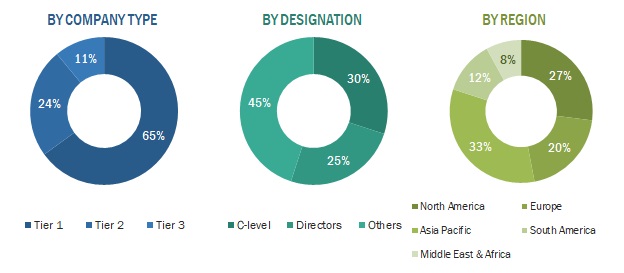

Primary Research

The market comprises several stakeholders, such as public and private electric utilities, distribution companies, circuit breaker manufacturers, dealers, and suppliers, circuit breaker component manufacturers, energy & power sector consulting companies and others. The demand side of this market is characterized by estimating the year on year investment on electrical equipment and historical investment trends in T&D networks. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as following

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Circuit breaker Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, market, based on insulation type, voltage, installation, and end user

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze the impact of COVID-19 on the market for the estimation of the market size

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the market with respect to the major regions (Asia Pacific, Europe, North America, South America, the Middle East, & Africa)

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments, such as new product launches, contracts & agreements, investments & expansions, and mergers & acquisitions, in the market

Miniature circuit breakers & Its impact on Circuit Breaker Market

Miniature circuit breakers (MCBs) are a type of circuit breaker found in both residential and commercial electrical systems. They are intended to protect electrical circuits from overloads and short circuits, and they can be easily reset once they have tripped. The Circuit Breaker Market refers to the overall circuit breaker market, which includes MCBs as well as other types such as moulded case circuit breakers (MCCBs), air circuit breakers (ACBs), and others. The circuit breaker market is being driven by a number of factors, including rising electricity demand, increased construction activity, and increased investment in renewable energy projects.

MCBs are an important product in the Circuit Breaker Market, and their popularity has grown in recent years due to their small size, ease of installation, and low cost. Indeed, MCBs are now among the most widely used types of circuit breakers in the residential and commercial sectors.

By extending the reach of miniature circuit breakers services, companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Increasing demand: MCBs have become increasingly popular in recent years due to their compact size, cost-effectiveness, and ease of installation.

- Shifting market share: As the demand for MCBs has grown, the market share of other types of circuit breakers, such as molded case circuit breakers (MCCBs) and air circuit breakers (ACBs), has declined.

- Technological advancements: MCBs are also driving technological advancements in the Circuit Breaker Market, such as the development of smart circuit breakers that can be remotely controlled and monitored.

- Regulatory requirements: Many countries are introducing regulations that require the use of MCBs in new buildings and renovations.

The top players in the miniature circuit breakers market are ABB Ltd., Eaton Corporation plc., Schneider Electric SE, Siemens AG, Legrand SA, Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., Hager Group, LSIS Co., Ltd., Rockwell Automation, Inc.

Some of the key industries that are going to get impacted because of the growth of miniature circuit breakers are,

1. Construction Industry: MCBs are widely used in the construction industry to provide electrical safety in residential and commercial buildings.

2. Automotive Industry: MCBs are increasingly being used in electric and hybrid vehicles to protect the electrical circuits from overloads and short circuits.

3. Renewable Energy Industry: MCBs play an important role in the protection of renewable energy systems such as solar and wind power plants.

4. Data Center Industry: MCBs are used in data centers to protect the electrical circuits and equipment from damage caused by overloads and short circuits.

5. Industrial Automation Industry: MCBs are used in industrial automation systems to protect electrical equipment from damage caused by overloads and short circuits.

Speak to our Analyst today to know more about Miniature Circuit Breakers Market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Product Analysis:

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Circuit Breaker Market