Clinical Alarm Management Market by Component (Software, Services), Product (Nurse Call Systems, Physiological Monitors, EMR Integration, Ventilators), End User (Hospitals, Long Term Care Centers, Ambulatory, Home Care Centers) & Region - Global Forecast to 2027

Updated on : June 18, 2023

The global clinical alarm management market in terms of revenue was estimated to be worth $3.3 billion in 2022 and is poised to reach $5.4 billion by 2027, growing at a CAGR of 10.4% from 2023 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The increasing demand for healthcare and the rising patient population have resulted in an increasing frequency of patient alarms, regardless of priority. This has resulted in alarm fatigue (sensory overload when clinicians are exposed to an excessive number of alarms). Clinical alarms have the potential to cut costs and facilitate better patient management, which, with the rising disease prevalence and growing geriatric population, is a key contributor to market growth. However, the current lack of interoperability in healthcare solutions and the high investment needed to build an effective and supporting infrastructure for HCIT capabilities among end users are expected to restrict the growth of the market in the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Clinical Alarm Management Market Dynamics

Driver: Increasing alarm fatigue

The number of alerts of low clinical significance, resulting in alarm fatigue, has increased in recent years, mainly due to the increasing number of alarm-based devices, the increasing number of patients connected to various devices, and the lack of standardization across devices. Alarm fatigue, due to the high frequency of alarms, can desensitize healthcare personnel, which, in turn, can result in alarms being ignored or switched off. This may result in potential critical notifications being overridden or avoided, resulting in severe consequences and placing future strains on hospital resources. In addition to causing frustration and stress for caregivers, inaccurate and nuisance alarms can keep patients from resting and hinder recovery.

The ECRI Institute identified alarm hazards as the second-highest patient safety risk in its Top 10 Health Technology Hazards for 2017. According to the ECRI Institute, 216 reports of alarm-related deaths were filed with the FDA between 2005 and 2010. Moreover, the US Joint Commission (the largest standards and accrediting body in healthcare in the US) estimates that 85–99% of alarms do not require immediate clinical intervention. According to an AACN practice alert, the average number of alarms in an ICU has increased from six in 1983 to more than 40 different alarms in 2011.

Restraint: Lack of interoperability

The lack of interoperability serves as a prime restraint to the effective implementation of clinical alarm management solutions and services. Interoperability among electronic systems is a key requirement for data integration and analysis efforts. Without adequate data exchange and analysis, clinical alarm management cannot be effective. According to the National Electronic Health Records Survey carried out from 2015 to 2017, only around 10% of physicians were able to send, receive, and integrate health data into their respective EHR systems. While many hospitals are able to use their current EHRs for some information exchange activities that promote interoperability (such as finding, sending, or receiving information), only 23% of hospitals can perform all four information exchange activities (find, send, receive, and use). According to Premier, Inc. (US) and the eHealth Initiative survey of accountable care organizations (ACOs), ~95% of the organizations surveyed cited interoperability as a major obstacle to effectively using and meeting the potential of HCIT.

Challenge: Resistance from traditional healthcare providers

Currently, many traditional healthcare providers are hesitant to use clinical alarm management solutions, mainly due to a lack of IT knowledge. Some feel that the noise and chaos caused by alarms are normal; hence, the utilization of these solutions is a time-consuming task with limited or no clinical benefits. The adoption rate of these solutions can be potentially improved by increasing awareness and offering inputs or incentives to nurses and caregivers for recommending the use of clinical alarm management. Awareness can also be created by engaging physicians during phases of software development and the pilot testing of these solutions. This would also help in ensuring the clinical relevance of the solution and hence promote its utility for achieving clinical benefits. Although the adoption of clinical alarm management solutions is gradually increasing, the lack of nurse acceptance may decelerate market growth.

Opportunity: Growing adoption of EHRs

Electronic health records generally include complex, confidential, and often unstructured patient data. Merging this information into the healthcare delivery process is a challenge that has to be met to realize the opportunities for improving patient care. Although EHRs have been in use for more than a decade, the market has picked up pace due to government initiatives in various countries aimed at improving patient security. The next phase of the EHR development process is likely to use context-specific information about the clinical care setting and patients to refine functionality and improve the relevance of reference content and alerts that are delivered to the patient at the point of care. In particular, when EHRs can harness greater patient context from the medical records stored in the patient’s profile, that information can influence alerts provided to clinicians in a way that makes them less voluminous and more relevant. Thus, with the expected double-digit market growth of EHR systems by 2027, hospitals will increasingly focus on building their capabilities through the integration of various hospital systems with EHRs. This, in turn, is expected to offer potential growth opportunities to market players in the coming years.

The solutions segment is expected to grow at the highest rate in the clinical alarm management industry during the forecast period.

The clinical alarm management market is divided into solutions and services based on component. The market was dominated by the solutions segments based on component. The market was dominated by the solutions segment. The substantial proportion of this market can be attributed to the ongoing requirement for software application upgrades and enhancements.

The nurse call systems segment accounted for the largest share of the global clinical alarm management industry.

The clinical alarm management market is divided based on product into ventilators, nurse call systems, physiological monitoring, EMR integration systems, and other products. In 2021, the nurse call systems market category held the greatest market share. The large share of this market can be attributed to research organisations' efforts to reduce the dangers of alarm fatigue, the rise in the number of technologically advanced nurse call systems introduced to the market, and healthcare providers' increased focus on creating alarm management strategies to lessen alarm fatigue.

During the forecast period, the hospital segment is expected to grow at the fastest CAGR in the clinical alarm management industry.

Based on end users, the clinical alarm management market is segmented into hospitals, long-term care centers, and ambulatory care centers & home care settings. The hospitals segment accounted for the largest share of the market. The significant market share of this category may be attributed to the increased hospital use of clinical alarm management solutions and the rise in government-led initiatives to raise the standard of healthcare.

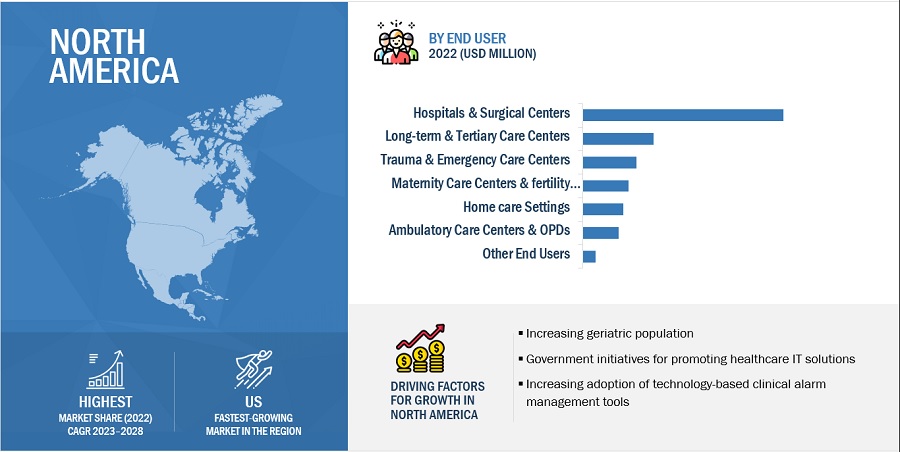

North America accounted for the largest share of the global clinical alarm management industry.

North America accounted for the largest share of the global clinical alarm management market. The large share of the North American market is due to increasing cases of alarm fatigue, governmental efforts to lessen the impacts of alarm fatigue, and the increasing need for integrated healthcare IT systems to ensure reliability, efficient maintenance of data, data integrity, and timely availability of patient data to authorized healthcare professionals.

To know about the assumptions considered for the study, download the pdf brochure

Some of the prominent players operating in the clinical alarm management market are Koninklijke Philips N.V. (Netherlands), Vocera Communications (US), GE Healthcare (US), Ascom (Switzerland), Spok, Inc. (US), Masimo (US), Connexall (Canada), Capsule Technologies, Inc. (US), Cornell Communications (US), Mobile Heartbeat (US), Drägerwerk AG & Co. KGaA (Germany), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), Baxter (US), Intercall Systems Inc. (US), Medtronic (Ireland), Johnson Controls (Ireland), West-Com Nurse Call Systems (US), Critical Alert (US), CSinc (India), Live Sentinel (US), Amplion Clinical Communications, Inc. (US), Cerner Corporation (US), Alpha Communications (US), Fujian Huanyutong Technology Co., Ltd. (China), and Tunstall Group (UK).

Scope of the Clinical Alarm Management Industry

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$3.3 billion |

|

Projected Revenue by 2027 |

$5.4 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 10.4% |

|

Market Driver |

Increasing alarm fatigue |

|

Market Opportunity |

Growing adoption of EHRs |

This research report categorizes the clinical alarm management market to forecast revenue and analyze trends in each of the following submarkets

By Component

- Solutions

- Services

By Product

- Nurse call systems

- Physiological monitors

- EMR integration systems

- Ventilators

- Other products

By End User

- Hospitals

- Long-term care centers

- Ambulatory care centers & home care settings Passive CDSS

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC (RoAPAC)

- RoW

Below are the highlights of the revamped version of the Clinical Alarm Management Market Report

- The new research study comprises the operational drivers for every segment in the market.

- The new research study consists of the further segmentation of nurse call systems in the products chapter.

- The new research study consist of industry trends of the market

- The new research study consists of the value chain analysis of the market.

- The new research study consists of the technology analysis of the market.

- The new research study comprises the ecosystem analysis of the market.

- The new research study comprises the Value Chain analysis of the market.

- The new research study consists of porter’s five forces analysis

- The new research study consists of case study analysis

- The new research study consists of regulatory analysis

- The new research study consists of Pricing analysis

- The new research study consists of Conference and webinars, and key stakeholders, and buying behavior in the market

- The new research study consists of additional country-wise segmentation for Mexico, Spain, Italy, Japan, China, India, and the RoAPAC.

- The new research study provides the company evaluation quadrant for 25 companies operating in the market.

- The new research study comprises the startup/SME company evaluation quadrant for companies operating in the market.

- The new research study provides the market ranking analysis of the top three players.

- The new research study comprises the profiles of 25 players including startups, as compared to 10 players in the previous study.

- Updated financial information/service portfolio of players: The new edition of the report provides updated financial information in the context of the market from 2019 to 2021 for each listed company in a graphical representation.

- Updated market developments of profiled players: The current report includes the market developments from 2020 to 2022.

Recent Developments of Clinical Alarm Management Industry

- In July 2022, Spok (US) partnered with inTechnology Distribution (Australia). Through this partnership, inTechnology relaunched the Spok Partner Program in the APAC channel. Through the partner program, inTechnology Distribution and Spok will offer various tools such as business planning, technical support, training, marketing, and co-development to support partners in scaling their respective businesses.

- In June 2022, Ascom (Switzerland) collaborated with the German Healthcare Foundation (Germany). Through this collaboration, the German Healthcare Foundation commissioned Ascom to roll out the Ascom Digistat software to improve care efficiency at three of its hospital sites. The contract is worth approximately EUR 1.4 million.

- In February 2022, Vocera partnered with Jupiter Medical Center to further enhance team communication and collaboration across the 248-bed hospital. Vocera's solutions will help to achieve several clinical and operational objectives, including streamlining communication among clinicians, fostering patient and team safety, creating a quiet healing environment, and enhancing communication with patients' families.

Frequently Asked Questions (FAQs):

What is the projected market value of the global clinical alarm management market?

The global clinical alarm management market boasts a total revenue value of $3.3 billion in 2022 and is projected to register a revenue value of $5.4 billion by 2027.

What is the estimated growth rate (CAGR) of the global clinical alarm management market for the next five years?

The clinical alarm management market in terms of revenue is poised to grow at a CAGR of 10.4%.

What does the current study of the clinical alarm management market consist of?

The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 CLINICAL ALARM MANAGEMENT INDUSTRY DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 CLINICAL ALARM MANAGEMENT MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.5.1 SCOPE-RELATED LIMITATIONS

1.5.2 METHODOLOGY-RELATED LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key industry insights

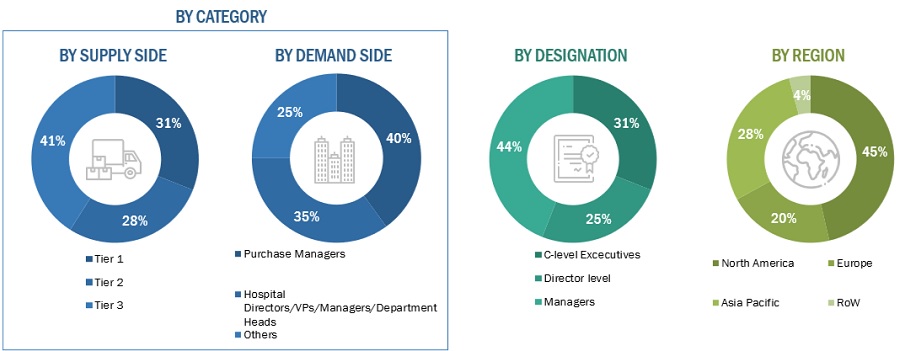

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 SUPPLY-SIDE MARKET SIZE ESTIMATION

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION

2.2.1 GROWTH FORECAST

FIGURE 7 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022–2027)

FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 9 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 MARKET SIZING ASSUMPTIONS

2.6 STUDY ASSUMPTIONS

2.7 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 11 CLINICAL ALARM MANAGEMENT MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

FIGURE 12 CLINICAL ALARM MANAGEMENT INDUSTRY, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 14 GEOGRAPHICAL SNAPSHOT OF MARKET

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 CLINICAL ALARM MANAGEMENT MARKET OVERVIEW

FIGURE 15 NEED FOR COST-CONTAINMENT IN HEALTHCARE INDUSTRY TO DRIVE MARKET

4.2 NORTH AMERICA: MARKET, BY COMPONENT AND COUNTRY (2021)

FIGURE 16 SOLUTIONS ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2021

4.3 MARKET SHARE, BY COMPONENT, 2022 VS. 2027

FIGURE 17 SOLUTIONS WILL CONTINUE TO DOMINATE MARKET IN 2027

4.4 MARKET SHARE, BY END USER, 2022 VS. 2027

FIGURE 18 HOSPITALS TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

4.5 MARKET SHARE, BY PRODUCT, 2022 VS. 2027

FIGURE 19 NURSE CALL SYSTEMS DOMINATE MARKET

4.6 CLINICAL ALARM MANAGEMENT INDUSTRY: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 20 ASIA PACIFIC MARKET TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

FIGURE 21 MARKET DYNAMICS

5.1.1 DRIVERS

5.1.1.1 Increasing alarm fatigue

5.1.1.2 High prevalence of chronic diseases

5.1.1.3 Growing geriatric population

5.1.1.4 Need for cost-containment in healthcare delivery

5.1.1.5 Rising prominence and usage of big data and mHealth tools

5.1.2 RESTRAINTS

5.1.2.1 Lack of interoperability

5.1.2.2 High investments required to build IT infrastructure

5.1.3 OPPORTUNITIES

5.1.3.1 Emerging markets for HCIT

5.1.3.2 Growing adoption of EHRs

5.1.4 CHALLENGES

5.1.4.1 Resistance from traditional healthcare providers

5.2 VALUE CHAIN ANALYSIS

FIGURE 22 CLINICAL ALARM MANAGEMENT MARKET: VALUE CHAIN ANALYSIS (2021)

5.3 CASE STUDIES

5.3.1 FOCUS ON IMPROVING STAFF RESPONSE, EFFICIENCY, AND TIME

5.3.1.1 Case 1: Reducing alarm fatigue in ICUs

5.3.2 IMPROVING EFFICIENCY WITH DATA-DRIVEN APPROACH

5.3.2.1 Case 2: Data-driven approach helps hospitals build effective clinical alarm management programs

5.3.3 IMPROVING OUTCOMES IN GENERAL WARDS WITH PATIENT SAFETYNET

5.3.3.1 Case 3: Focus on quality and safety

5.4 ECOSYSTEM ANALYSIS

FIGURE 23 CLINICAL ALARM MANAGEMENT MARKET: ECOSYSTEM ANALYSIS (2021)

5.5 TECHNOLOGY ANALYSIS

5.5.1 MACHINE LEARNING

5.5.2 ARTIFICIAL INTELLIGENCE

5.5.3 INTERNET OF THINGS

5.6 REGULATORY ANALYSIS

5.6.1 NORTH AMERICA

5.6.2 EUROPE

5.6.3 ASIA PACIFIC

5.6.4 MIDDLE EAST AND AFRICA

5.6.5 LATIN AMERICA

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 CLINICAL ALARM MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8 MARKET TRENDS

5.8.1 SHIFT TOWARD VALUE-BASED PATIENT-CENTRIC CARE AND OUTCOMES

5.8.2 GRADUAL SHIFT OF ACCOUNTABILITY FROM PAYERS TO PROVIDERS

5.8.3 GROWING DEMAND FOR VALUE-BASED HEALTHCARE

5.9 PRICING ANALYSIS

TABLE 3 AVERAGE SELLING PRICE OF CLINICAL ALARM MANAGEMENT SYSTEMS, BY SERVICE (2021)

5.10 KEY CONFERENCES AND EVENTS

TABLE 4 CLINICAL ALARM MANAGEMENT MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

5.11.2 BUYING CRITERIA

FIGURE 25 KEY BUYING CRITERIA FOR END USERS

TABLE 6 KEY BUYING CRITERIA FOR END USERS

6 CLINICAL ALARM MANAGEMENT MARKET, BY COMPONENT (Page No. - 69)

6.1 INTRODUCTION

TABLE 7 CLINICAL ALARM MANAGEMENT INDUSTRY, BY COMPONENT, 2020–2027 (USD MILLION)

6.2 SOLUTIONS

6.2.1 FASTEST-GROWING COMPONENT SEGMENT

TABLE 8 CLINICAL ALARM MANAGEMENT SOLUTIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 SERVICES

TABLE 9 CLINICAL ALARM MANAGEMENT SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 10 CLINICAL ALARM MANAGEMENT SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1 IMPLEMENTATION AND INTEGRATION

6.3.1.1 Increasing adoption of clinical alarm management solutions by healthcare providers to drive market

6.3.2 CONSULTING

6.3.2.1 Consulting services provide strategic alarm and noise management

7 MARKET, BY PRODUCT (Page No. - 75)

7.1 INTRODUCTION

TABLE 11 MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

7.2 NURSE CALL SYSTEMS

TABLE 12 MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 13 MARKET FOR NURSE CALL SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

7.2.1 BUTTON-BASED SYSTEMS

7.2.1.1 Low cost, ease of use, high reliability, and fast response time—advantages of button-based systems

TABLE 14 BUTTON-BASED NURSE CALL SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

7.2.2 INTEGRATED COMMUNICATION SYSTEMS

7.2.2.1 Integrated communication systems to register highest growth during forecast period

TABLE 15 INTEGRATED COMMUNICATION NURSE CALL SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

7.2.3 OTHER NURSE CALL SYSTEMS

TABLE 16 OTHER NURSE CALL SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 PHYSIOLOGICAL MONITORS

7.3.1 RISING PREVALENCE OF CHRONIC DISEASES AND GROWING GERIATRIC POPULATION—KEY FACTORS DRIVING MARKET

TABLE 17 MARKET FOR PHYSIOLOGICAL MONITORS, BY REGION, 2020–2027 (USD MILLION)

7.4 EMR INTEGRATION SYSTEMS

7.4.1 EMR INTEGRATION SYSTEMS TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 18 MARKET FOR EMR INTEGRATION SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

7.5 VENTILATORS

7.5.1 RISING PREVALENCE OF RESPIRATORY DISEASES TO INCREASE ADOPTION OF VENTILATORS

TABLE 19 MARKET FOR VENTILATORS, BY REGION, 2020–2027 (USD MILLION)

7.6 OTHER PRODUCTS

TABLE 20 OTHER CLINICAL ALARM MANAGEMENT PRODUCTS MARKET, BY REGION, 2020–2027 (USD MILLION)

8 MARKET, BY END USER (Page No. - 85)

8.1 INTRODUCTION

TABLE 21 CLINICAL ALARM MANAGEMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

8.2 HOSPITALS

8.2.1 LARGEST END USERS OF CLINICAL ALARM MANAGEMENT SOLUTIONS

TABLE 22 MARKET FOR HOSPITALS, BY REGION, 2020–2027 (USD MILLION)

8.3 LONG-TERM CARE CENTERS

8.3.1 GROWING GERIATRIC POPULATION TO DRIVE MARKET

TABLE 23 MARKET FOR LONG-TERM CARE CENTERS, BY REGION, 2020–2027 (USD MILLION)

8.4 AMBULATORY CARE CENTERS AND HOME CARE SETTINGS

8.4.1 THESE SETTINGS USE CLINICAL ALARM MANAGEMENT SOLUTIONS TO MANAGE POPULATION HEALTH

TABLE 24 MARKET FOR AMBULATORY CARE CENTERS AND HOME CARE SETTINGS, BY REGION, 2020–2027 (USD MILLION)

9 MARKET, BY REGION (Page No. - 91)

9.1 INTRODUCTION

TABLE 25 MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 26 NORTH AMERICA: MARKET SNAPSHOT

TABLE 26 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 27 NORTH AMERICA: MARKET,BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 28 NORTH AMERICA: CLINICAL ALARM MANAGEMENT SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 31 NORTH AMERICA: CLINICAL ALARM MANAGEMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Implementation of federal mandates encouraged adoption of mHealth and telehealth solutions & services

TABLE 32 US: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 33 US: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 34 US: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 35 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Rising healthcare spending to drive MARKET

TABLE 36 CANADA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 37 CANADA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 38 CANADA: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 39 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Growing number of COVID-19 cases and need to curtail healthcare costs—key growth drivers

TABLE 40 MEXICO: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 41 MEXICO: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 42 MEXICO: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 43 MEXICO: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3 EUROPE

TABLE 44 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 45 EUROPE: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 46 EUROPE: CLINICAL ALARM MANAGEMENT SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 47 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 48 EUROPE: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 49 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Government initiatives to modernize healthcare system propelling adoption of clinical alarm management systems

TABLE 50 GERMANY: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 51 GERMANY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 52 GERMANY: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 53 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 NHS programs for implementing digital health systems to increase adoption of clinical alarm management solutions

TABLE 54 UK: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 55 UK: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 56 UK: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 57 UK: CLINICAL ALARM MANAGEMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Growing initiatives to promote adoption of healthcare IT solutions to drive market

TABLE 58 FRANCE: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 59 FRANCE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 60 FRANCE: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 61 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.4 SPAIN

9.3.4.1 Need for optimization in healthcare workflows to drive market

TABLE 62 SPAIN: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 63 SPAIN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 64 SPAIN: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 65 SPAIN: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.5 ITALY

9.3.5.1 Rising geriatric population and increasing prevalence of chronic diseases to drive adoption of nurse call systems

TABLE 66 ITALY: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 67 ITALY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 68 ITALY: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 69 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 70 REST OF EUROPE: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 71 REST OF EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 72 REST OF EUROPE: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 74 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 76 ASIA PACIFIC: CLINICAL ALARM MANAGEMENT SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 77 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 79 ASIA PACIFIC: CLINICAL ALARM MANAGEMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Well-developed healthcare infrastructure and government initiatives to drive market

TABLE 80 JAPAN: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 81 JAPAN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 82 JAPAN: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Large population and high burden of chronic diseases to drive market

TABLE 84 CHINA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 85 CHINA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 86 CHINA: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Improvements in healthcare infrastructure to support market growth

TABLE 88 INDIA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 89 INDIA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 90 INDIA: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 INDIA: CLINICAL ALARM MANAGEMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 92 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 93 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 94 REST OF ASIA PACIFIC: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 95 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 96 REST OF THE WORLD: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 97 REST OF THE WORLD: CLINICAL ALARM MANAGEMENT SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 98 REST OF THE WORLD: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 99 REST OF THE WORLD: MARKET FOR NURSE CALL SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 REST OF THE WORLD: CLINICAL ALARM MANAGEMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 130)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 101 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN MARKET

10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 28 REVENUE ANALYSIS OF KEY PLAYERS IN MARKET

10.4 MARKET RANKING ANALYSIS

FIGURE 29 MARKET RANKING, BY KEY PLAYER, 2021

10.5 COMPETITIVE BENCHMARKING

TABLE 102 CLINICAL ALARM MANAGEMENT INDUSTRY: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 103 MARKET: END-USER FOOTPRINT OF KEY PLAYERS

TABLE 104 MARKET: REGIONAL FOOTPRINT OF KEY PLAYERS

10.6 COMPETITIVE LEADERSHIP MAPPING

10.6.1 STARS

10.6.2 EMERGING LEADERS

10.6.3 PERVASIVE PLAYERS

10.6.4 PARTICIPANTS

FIGURE 30 MARKET: COMPANY EVALUATION MATRIX, 2021

10.7 COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS/SMES

10.7.1 PROGRESSIVE COMPANIES

10.7.2 STARTING BLOCKS

10.7.3 RESPONSIVE COMPANIES

10.7.4 DYNAMIC COMPANIES

FIGURE 31 CLINICAL ALARM MANAGEMENT INDUSTRY: COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS/SMES, 2021

10.8 COMPETITIVE SITUATIONS AND TRENDS

TABLE 105 KEY PRODUCT LAUNCHES AND APPROVALS, JANUARY 2019–JULY 2022

TABLE 106 KEY DEALS, JANUARY 2019–JULY 2022

11 COMPANY PROFILES (Page No. - 144)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats) *

11.1 KEY PLAYERS

11.1.1 KONINKLIJKE PHILIPS N.V.

TABLE 107 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

FIGURE 32 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2021)

11.1.2 VOCERA COMMUNICATIONS

TABLE 108 VOCERA COMMUNICATIONS: BUSINESS OVERVIEW

FIGURE 33 VOCERA COMMUNICATIONS: COMPANY SNAPSHOT (2021)

11.1.3 GE HEALTHCARE

TABLE 109 GE HEALTHCARE: BUSINESS OVERVIEW

FIGURE 34 GE HEALTHCARE: COMPANY SNAPSHOT (2021)

11.1.4 ASCOM

TABLE 110 ASCOM: BUSINESS OVERVIEW

FIGURE 35 ASCOM: COMPANY SNAPSHOT (2021)

11.1.5 SPOK, INC. (SUBSIDIARY OF SPOK HOLDINGS, INC.)

TABLE 111 SPOK, INC.: BUSINESS OVERVIEW

FIGURE 36 SPOK HOLDINGS, INC.: COMPANY SNAPSHOT (2021)

11.1.6 MASIMO

TABLE 112 MASIMO: BUSINESS OVERVIEW

FIGURE 37 MASIMO: COMPANY SNAPSHOT (2022)

11.1.7 CONNEXALL

TABLE 113 CONNEXALL: BUSINESS OVERVIEW

11.1.8 CAPSULE TECHNOLOGIES, INC.

TABLE 114 CAPSULE TECHNOLOGIES, INC.: BUSINESS OVERVIEW

11.1.9 CORNELL COMMUNICATIONS

TABLE 115 CORNELL COMMUNICATIONS: BUSINESS OVERVIEW

11.1.10 MOBILE HEARTBEAT (SUBSIDIARY OF HOSPITAL CORPORATION OF AMERICA)

TABLE 116 MOBILE HEARTBEAT: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 DRÄGERWERK AG & CO. KGAA

11.2.2 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

11.2.3 BAXTER INTERNATIONAL, INC.

11.2.4 INTERCALL SYSTEMS INC.

11.2.5 MEDTRONIC

11.2.6 JOHNSON CONTROLS

11.2.7 WEST-COM NURSE CALL SYSTEMS, INC.

11.2.8 CRITICAL ALERT

11.2.9 CSI COMPUTECH INDIA PVT. LTD.

11.2.10 LIVE SENTINEL

11.2.11 AMPLION CLINICAL COMMUNICATIONS, INC.

11.2.12 CERNER CORPORATION

11.2.13 ALPHA COMMUNICATIONS

11.2.14 FUJIAN HUANYUTONG TECHNOLOGY CO., LTD.

11.2.15 TUNSTALL GROUP

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view

(Key strengths/Right to win, Strategic choices made, Weakness/competitive threats) * might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 177)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the clinical alarm management market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as WHO, ATA, AHA, and AAHM. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global clinical alarm management market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (such as individual physicians, physician groups, hospitals, clinics, and other healthcare facilities); the payer side (such as private and public insurance bodies); and the other end user side (such as employer groups and government bodies)—across five major regions—North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Both top-down and bottom-up approaches were used to estimate and validate the size of the Clinical alarm management market and various other dependent submarkets. The research methodology used to estimate the market size includes the following details:

- Key players in the global clinical alarm management market were identified through secondary research, and their global market shares were determined through primary and secondary research

- The research methodology included the study of the annual and quarterly financial reports and regulatory filings, data books of major market players, and interviews with industry experts for detailed market insights

- All percentage shares, splits, and breakdowns for the global market were determined by using secondary sources and verified through primary sources

- All key macroindicators affecting the revenue growth of market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get validated and verified quantitative and qualitative data

- The gathered market data was consolidated and added with detailed inputs and analysis and presented in this report

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the Clinical alarm management market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the market.

Report Objectives

- To define, describe, and forecast the clinical alarm management market on the basis of component, product, end user, and region

- To provide detailed information regarding factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To strategically analyze the market structure and profile the key players of the market and comprehensively analyze their core competencies

- To forecast the size of the market segments with respect to four regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To track and analyze competitive developments such as product launches, expansions, acquisitions, partnerships, collaborations, and agreements

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (up to 20)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Clinical Alarm Management Market