Clinical Chemistry Analyzers Market by Product (Fully-automated and PoC Analyzers, Reagents), Test Type (Basic Metabolic, Liver, Renal, Lipid, Thyroid Function), End User (Hospitals, Clinics, Laboratories, Research) & Region - Global Forecast to 2028

Updated on : July 10, 2023

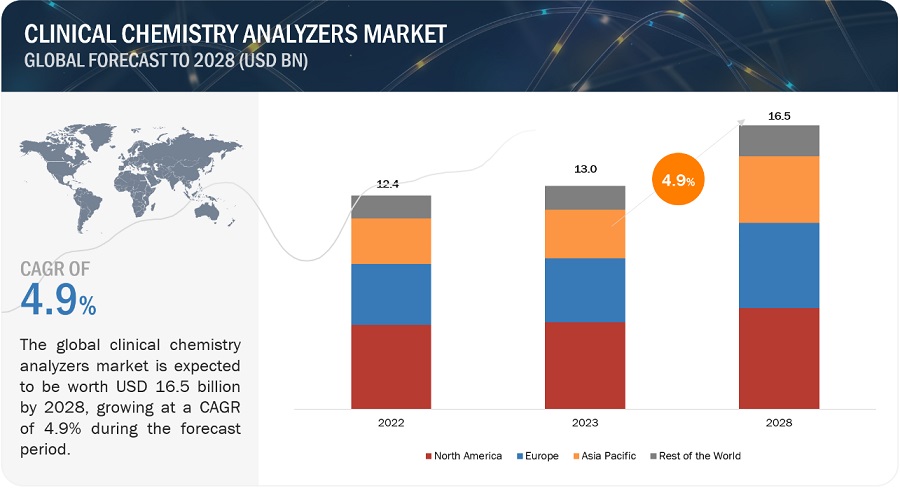

The global clinical chemistry analyzers market in terms of revenue was estimated to be worth $13.0 billion in 2023 and is poised to reach $16.5 billion by 2028, growing at a CAGR of 4.9% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The market's progress is propelled by factors such as the increasing number of elderly individuals, the rise in chronic and lifestyle diseases, the growing utilization of Point-of-Care testing devices, and the surging demand for laboratory automation. Nonetheless, the lack of adequately trained professionals and the high expenses associated with clinical chemistry analyzers are anticipated to impede the market's advancement throughout the forecast period.

Attractive Opportunities in the Clinical Chemistry Analyzers Market

To know about the assumptions considered for the study, Request for Free Sample Report

Clinical Chemistry Analyzers Market Dynamics

Driver: Expanding geriatric population and the increasing prevalence of chronic & lifestyle diseases

Both developed and developing regions are experiencing a significant increase in the elderly population, leading to a higher incidence of age-related ailments such as hypertension, diabetes, cardiovascular diseases, as well as liver and kidney disorders. Consequently, there is a greater need for diagnostic and management tools, including various tests like basic metabolic panel, lipid profile, and liver and renal panel. The demand for these tests, which are essential for prevention, diagnosis, and treatment of chronic diseases, is on the rise. Additionally, the growing emphasis on preventive medicine further contributes to the demand for clinical chemistry analyzers. As these tests are conducted using clinical chemistry analyzers, the market is expected to benefit from these factors, driving its growth in the forecast period.

Restraint: The requirement of high capital investments and a shortage of skilled laboratory technicians

The growth of the clinical chemistry analyzers market is hindered by several factors. Firstly, the affordability of high-volume clinical chemistry analyzers is limited to larger hospitals and reference laboratories with substantial capital budgets. Small laboratories, physician's offices, and sole practitioners often lack the financial resources to invest in large or very large-sized analyzers, which hampers their ability to adopt advanced equipment. The high fixed-cost requirements associated with these analyzers pose a barrier to market growth, particularly among smaller healthcare facilities.

Secondly, there is a significant shortage of laboratory technicians in both developed and developing nations. This shortage is primarily driven by factors such as the expanding patient population, the retirement of experienced technicians, and the closure of clinical lab programs in financially strained colleges. As a result, there exists a gap between the supply and demand of pathologists and lab technicians on a global scale. This shortage of skilled professionals hampers the effective utilization of clinical chemistry analyzers and acts as a constraint on the growth of the market.

Taken together, the limited affordability of high-volume analyzers for smaller healthcare facilities and the shortage of laboratory technicians globally contribute to restraining the market growth of clinical chemistry analyzers.

Opportunity: Clinical chemistry analyzers are constantly evolving

During the forecast period, the clinical chemistry analyzers market is expected to benefit from advancements in technology, presenting numerous lucrative opportunities for expansion. An example of this is Transasia's exhibition of improved in-vitro diagnostic (IVD) products at the Medical Fair 2022, including the Erba XL 640, a clinical chemistry analyzer equipped with an autoloader. This advanced equipment enhances productivity, reduces manual labor for staff members, and enables faster turnaround time (TAT), thereby improving overall client experience.

Furthermore, the market is anticipated to receive a boost from government initiatives, programs, and financial support aimed at promoting the growth of laboratories and diagnostics. These beneficial measures create favorable prospects for businesses operating in the clinical chemistry analyzers market. Considering these factors, the market is expected to witness significant expansion opportunities during the forecast period, leading to an increase in market size.

Challenge: Increasing Regulatory Requirements

Clinical chemistry analyzers must comply with stringent regulatory guidelines and quality standards to ensure accurate and reliable test results. Adhering to evolving regulations can be a significant challenge for manufacturers, as it requires continuous updates to software, hardware, and processes. Clinical chemistry analyzer manufacturers are often required to establish and maintain a quality management system (QMS) to ensure compliance with regulatory standards. This includes implementing processes and procedures for design, development, manufacturing, installation, servicing, and post-market surveillance of the analyzers. Manufacturers must carefully navigate the regulatory landscape and comply with the applicable regulations to gain market approval for their clinical chemistry analyzers.

In 2022, reagents segment accounted for the largest share of the clinical chemistry analyzers industry, by product

The clinical chemistry analyzers market is categorized into analyzers, reagents, and other products based on product segmentation. In 2022, the reagents segment held the largest share in the market. This can be attributed to the recurring demand for reagents in larger quantities compared to analyzers. The continuous need for reagents for performing clinical chemistry tests and analysis is a significant factor driving the growth of this segment. Reagents play a crucial role in facilitating accurate and reliable laboratory testing, making them an essential component in clinical chemistry analyzers

In 2022, basic metabolic panel tests segment accounted for the largest share in the clinical chemistry analyzers industry, by test type

The clinical chemistry analyzers market is segmented based on test type into various categories, including basic metabolic panels, electrolyte panels, liver panels, lipid profiles, renal profiles, thyroid function panels, and specialty chemical tests. In 2022, the basic metabolic panel tests segment held the largest share in the market. This can be attributed to several factors. Overall, the rising incidence of diabetes and other lifestyle and chronic diseases, as well as the growing emphasis on preventive healthcare, have played significant roles in propelling the growth of the basic metabolic panel tests segment in the clinical chemistry analyzers market.

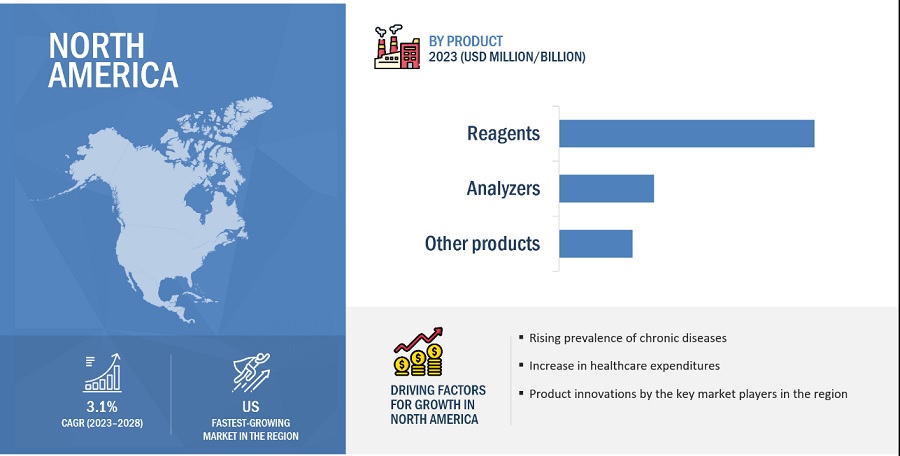

North America is the largest regional market for clinical chemistry analyzers industry

The global clinical chemistry analyzers market is segmented into different regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2022, North America emerged as the leading region in terms of market share in the clinical chemistry analyzers market. Several factors contributed to the growth of the North American market. Factors, such as the growing geriatric population, increasing prevalence of chronic conditions, favourable government initiatives, healthcare expenditure, well-developed healthcare infrastructure, and availability of advanced instruments, North America has attained a significant market share in the global clinical chemistry analyzers market.

To know about the assumptions considered for the study, download the pdf brochure

The major players in this market are F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (US), Abbott Laboratories (US), Thermo Fisher Scientific Inc. (US) and Siemens Healthineers AG (Germany). These players lead the market because of their extensive product portfolios and wide geographic presence. These dominant market players also have numerous advantages, such as more robust marketing and distribution networks, larger budgets for R&D, and better brand recognition.

Scope of the Clinical Chemistry Analyzers Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$13.0 billion |

|

Projected Revenue by 2028 |

$16.5 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 4.9% |

|

Market Driver |

Expanding geriatric population and the increasing prevalence of chronic & lifestyle diseases |

|

Market Opportunity |

Clinical chemistry analyzers are constantly evolving |

This report categorizes the clinical chemistry analyzers market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Reagents

- Analyzers

- Other Products

By Test Type

- Basic Metabolic Panels

- Liver Panels

- Renal Panels

- Lipid Profiles

- Thyroid Function Panels

- Electrolyte Panels

- Specialty Chemical Tests

By End User

- Hospitals and Clinics

- Diagnostic Laboratories

- Research Laboratories & Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Rest of Europe (RoE)

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Middle East & Africa

Recent Developments of Clinical Chemistry Analyzers Industry

- In May 2023, Siemens Healthineers AG(Germany) launched two new solutions for high-volume hematology testing, the Atellica HEMA 570 and 580 Analyzer.

- In May 2022, Mindray Medical International Ltd. (China) launched the BS-600M, a powerful, efficient chemistry analyzer that is designed to empower medium-volume laboratories with increased productivity, efficiency, and reliability.

- In February 2021, Thermo Fisher Scientific Inc. (US) partnered with Mindray Medical International ltd. (China) to provide customers in the United States and Canada with two clinical chemistry analyzers for drug screening in clinical and forensic laboratories.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global clinical chemistry analyzers market?

The global clinical chemistry analyzers market boasts a total revenue value of $16.5 billion by 2028.

What is the estimated growth rate (CAGR) of the global clinical chemistry analyzers market?

The global clinical chemistry analyzers market has an estimated compound annual growth rate (CAGR) of 4.9% and a revenue size in the region of $13.0 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships of the leading players, the competitive landscape of the clinical chemistry analyzers market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, market breakdown and data triangulation were used.

The four steps involved in estimating the market size are:

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the clinical chemistry analyzers market. A database of the key industry leaders was also prepared using secondary research.

Collecting Primary Data

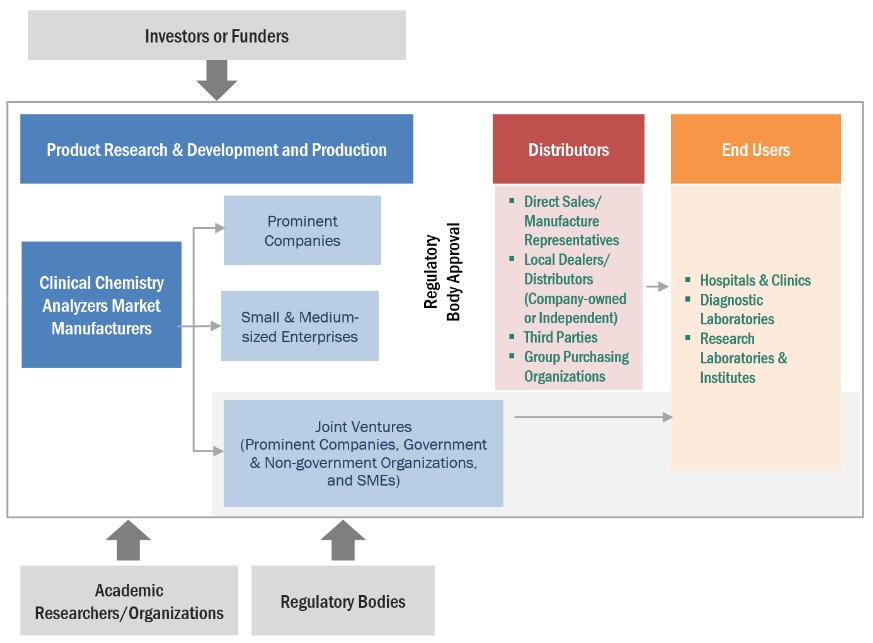

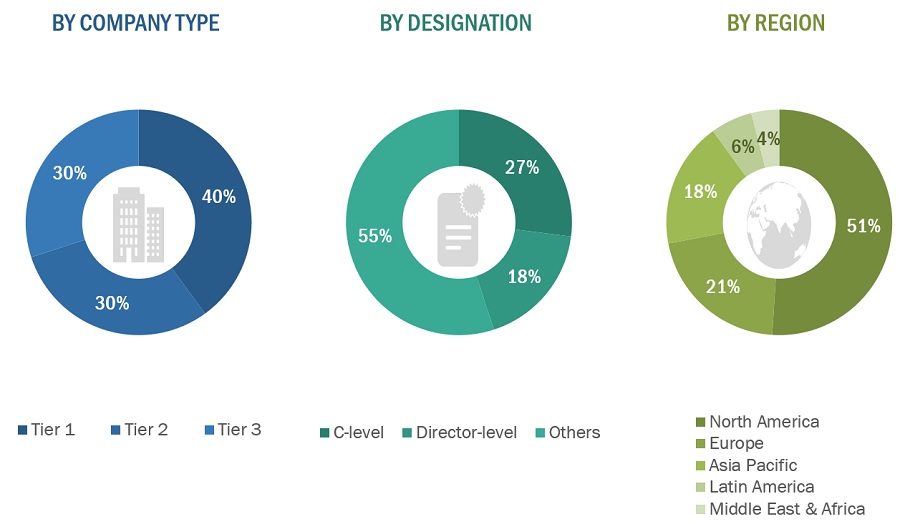

The primary research data was conducted after acquiring knowledge about the clinical chemistry analyzers market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such as hospitals & ICUs, diagnostic laboratories, research institutes, research laboratories and point-of-care settings) and supply side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Note 1: *Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2022: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the clinical chemistry analyzers industry.

Market Definition

Clinical chemistry analyzers are various types of instruments and reagents used to determine the concentration of certain metabolites, electrolytes, proteins, and/or drugs in samples of serum, plasma, urine, cerebrospinal fluid, and/or other body fluids.

Key Stakeholders

- Manufacturers & distributors of clinical chemistry analyzers, reagents, and consumables

- Data management solutions users and providers

- Associations related to clinical chemistry analyzers

- Academic research institutes

- Hospitals and clinics

- Diagnostic laboratories

- Pharmaceutical and biotechnology companies

- Clinical Research Organizations (CROs)

Report Objectives

- To define, describe, segment, and forecast the global clinical chemistry analyzers market by product, test type, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as acquisitions, product launches and approvals, expansions, and other developments in the clinical chemistry analyzers market.

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

Clinical Chemistry Analyzers market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa

Company profiles

- Additional fifteen company profiles of players operating in the clinical chemistry analyzers market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Clinical Chemistry Analyzers Market