Clinical Decision Support Systems Market by Component (Services, Software), Delivery (On-premise, Cloud), Product (Standalone, Integrated), Application (Advanced, Therapeutic, Diagnostic), Interactivity (Active, Passive) - Global Forecast to 2027

Updated on : May 18, 2023

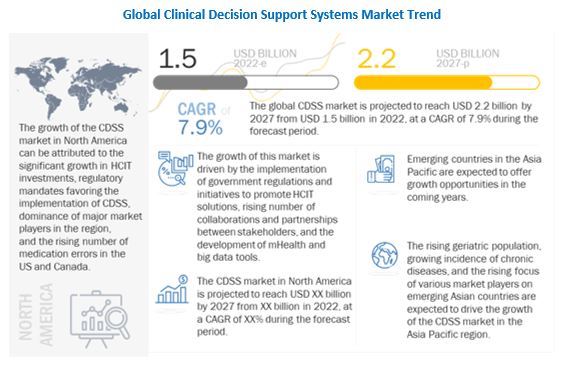

The global clinical decision support systems market in terms of revenue was estimated to be worth $1.5 billion in 2022 and is poised to reach $2.2 billion by 2027, growing at a CAGR of 7.9% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth of the CDSS market is driven by the various government regulations and initiatives that are implemented to promote the adoption of HICT solutions, an increase in the adoption of CDSS-enabled EHRs, growing collaborations and partnerships between stakeholders and various market players, an increase in medication errors, and the development of mHealth and big data tools. However, high investments for the implementation of CDSS and inadequate interoperability, coupled with rising data security concerns, are factors that are expected to restrain the growth of this market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Clinical Decision Support Systems Market Dynamics

Driver: Implementation of government regulations and initiatives to promote the adoption of HCIT solutions

In December 2021, CMS announced the publication of a Federal Register Notice to formalize its decision to exercise enforcement discretion not to take action against certain payer-to-payer data exchange provisions of the May 2020 Interoperability and Patient Access final rule.

In Europe, in 2020, EU Health Ministers signed a declaration to collaborate and set up an eHealth common area that will allow for the free movement of electronic health records across Europe. The declaration also calls for eHealth to be an integral part of the Europe 2020 strategy.

Such initiatives and regulations are expected to further drive the demand and adoption of EHR, which will influence the adoption of CDSS in major markets worldwide.

Restraint: Data security concerns related to cloud-based CDSS

A major concern with cloud-based CDSS is that data that is hosted by the vendor is not as secure as its on-premise counterpart. Information related to patients is considered very sensitive, and a high level of privacy needs to be maintained so that this information is accessible to authorised users only. Patient information across various countries is always under the scanner of legal frameworks, such as the data privacy requirements legislated through HIPAA (the Health Insurance Portability and Accountability Act). Similarly, the European Union has the EU Data Protection Regulation in place, which has implications for protecting sensitive health data. Although private clouds offer more access protocols and systems, the healthcare industry is not assured of their effectiveness.

Challenge: Shortage of skilled IT professionals in the healthcare industry

The effective utilisation of healthcare IT solutions demands strong IT infrastructure and support within the organisation and at the solution provider's end. In a healthcare organization, there is a continuous need for technical support to maintain the server and network for the operation of clinical workflows and optimum interface speed for healthcare IT systems. If the maintenance of the server or network is inadequate, it leads to the generation of screen loads, which slow down the clinical workflow. The shortage of a trained and skilled workforce in major markets is restraining the adoption and implementation of web-based and on-premise HCIT solutions.

Opportunity: social media integration and rising technological advancements

Access to media platforms is also an emerging trend in CDSS solutions. For instance, the cloud-based Smart Clinical Decision Support System (Smart CDSS) developed by private researchers has integrated social media data captured for patients with chronic conditions. It combines this data with clinical observations from real encounters in healthcare facilities. The system monitors patients' health conditions, emotions, and interests from their social media interactions. It extracts keywords, concepts, and sentiments from Twitter, e-mail analysis, and other social media platforms and supplies patient-specific data to healthcare providers. This helps health practitioners understand a patient's behaviour and lifestyle, thus improving clinical decision-making. Smart CDSS further uses the input to suggest patient-specific recommendations.

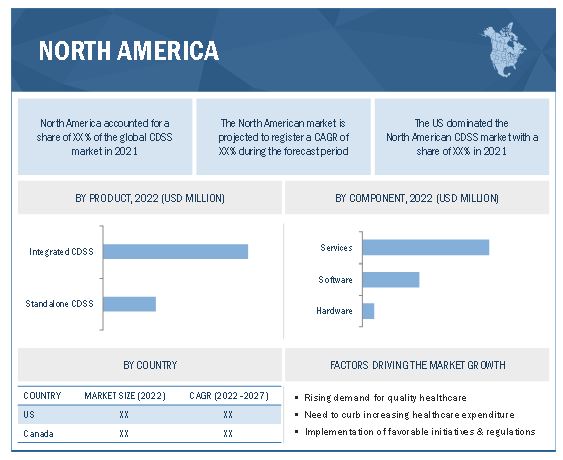

North America accounted for the largest share of the global clinical decision support systems market.

North America accounted for the largest share of the global CDSS market. The large share of the North American market can be attributed to the significant investments in HCIT solutions, regulatory mandates favouring the implementation of CDSS, the presence of major market players in the region, and the rising number of medication errors in the US and Canada.

To know about the assumptions considered for the study, download the pdf brochure

Some of the prominent players operating in the clinical decision support systems market are Cerner Corporation (US), Change Healthcare (US), Epic Systems (US), MEDITECH (US), Philips Healthcare (Netherlands), Wolters Kluwer N.V. (Netherlands), Zynx Health (US), Elsevier B.V. (UK), IBM Watson Health (US), Allscripts Healthcare LLC (US), athenahealth (US), NextGen Healthcare (US), Siemens Healthineers (US), EBSCO Health (US), GE Healthcare (US), eClinicalWorks (US), RAMPMedical (Germany), The Medical Algorithms Company Limited (UK), Hera-MI (France), CureMD Healthcare (US), CareCloud, Inc (US), Visual DX (US), Stanson Health (US), First Databank, Inc (US), and Strata Decision Technology (US).

Clinical Decision Support Systems Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$1.5 billion |

|

Projected Revenue by 2027 |

$2.2 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 7.9% |

|

Market Driver |

Implementation of government regulations & initiatives to promote the adoption of HCIT solutions |

|

Market Opportunity |

Social media integration and rising technological advancements |

The study categorizes the clinical decision support systems market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Integrated CDSS

- Standalone CDSS

By Delivery Mode

- On Premise

- Cloud based

By Model

- Knowledge based

- Non-Knowledge based

By Type

- Therapeutic

- Diagnostic

By Component

- Services

- Software

- Hardware

By Application

- Advanced CDSS

- Conventional CDSS

By Level of Interactivity

- Active CDSS

- Passive CDSS

By Settings

- In Patient

- Ambulatory care settings

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC (RoAPAC)

-

RoW

- Latin America

- Middle East and Africa

Recent Developments:

- In 2022, Allscripts (US) made an agreement to sell Constellation (Canada), the net assets of Allscripts Hospitals and Large Physician Practices business segment. The Hospitals and Large Physician Practices business segment includes the Sunrise™, Paragon®, Allscripts TouchWorks®, Allscripts® Opal, STAR™, HealthQuest™, and dbMotion™ solutions.

- In 2021, Change Healthcare (US) launched InterQual in partnership with the American Society of Addiction Medicine (ASAM). InterQual seamlessly integrates into existing care-management workflows, significantly reduces the time required for substance use disorder (SUD) patient assessments, increases consistency, and streamlines the prior-authorization process using industry-standard criteria

- In 2021, (GHA) announced plans to expand Allscripts Sunrise™ electronic health records (EHR) across Victoria, Australia of Gippsland. Phase 3 of GHA’s EHR Community Health project will see the implementation of the Sunrise Emergency Care module (within the Sunrise EHR platform of health) at the emergency department facilities of the Central Gippsland Health Service, Bairnsdale Regional Health Service (servicing east Gippsland), West Gippsland Healthcare Group and Bass Coast Health, which covers the southern part of the region. Sunrise will then be deployed across inpatient services at all four hospitals.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the clinical decision support systems market?

The clinical decision support systems market boasts a total revenue value of $2.2 billion by 2027.

What is the estimated growth rate (CAGR) of the clinical decision support systems market?

The global clinical decision support systems market has an estimated compound annual growth rate (CAGR) of 7.9% and a revenue size in the region of $1.5 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 CDSS MARKET: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 CDSS MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.5.1 SCOPE-RELATED LIMITATIONS

1.5.2 METHODOLOGY-RELATED LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key industry insights

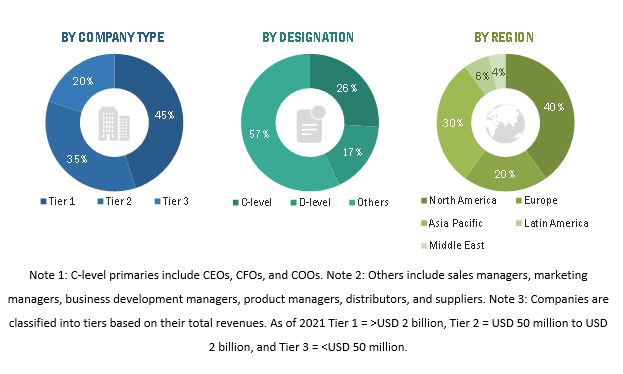

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3 MARKET ESTIMATION

FIGURE 6 RESEARCH METHODOLOGY: MARKET ESTIMATION

2.3.1 APPROACH: END USER-BASED MARKET ESTIMATION

FIGURE 7 MARKET-SIZE ESTIMATION

2.4 MARKET DATA ESTIMATION AND TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: CDSS MARKET

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 9 CDSS MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

FIGURE 10 CDSS MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 11 CDSS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 12 CDSS MARKET, BY MODEL, 2022 VS. 2027 (USD MILLION)

FIGURE 13 CDSS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 14 CDSS MARKET, BY DELIVERY MODE, 2022 VS. 2027 (USD MILLION)

FIGURE 15 CDSS MARKET, BY INTERACTIVITY LEVEL, 2022 VS. 2027 (USD MILLION)

FIGURE 16 CDSS MARKET, BY SETTING, 2022 VS. 2027 (USD MILLION)

FIGURE 17 GEOGRAPHICAL SNAPSHOT OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 MARKET OVERVIEW

FIGURE 18 RISING GOVERNMENT INITIATIVES FOR THE ADOPTION OF HCIT SOLUTIONS DRIVE THE MARKET GROWTH

4.2 NORTH AMERICA: CDSS MARKET, BY PRODUCT AND COUNTRY

FIGURE 19 US DOMINATED THE MARKET IN NORTH AMERICA (2021)

4.3 CDSS MARKET SHARE, BY PRODUCT

FIGURE 20 INTEGRATED CDSS SEGMENT TO DOMINATE THE MARKET FROM 2022 TO 2027

4.4 CDSS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 21 ASIA PACIFIC TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 CDSS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Implementation of government regulations & initiatives to promote the adoption of HCIT solutions

5.2.1.2 Increasing adoption of CDSS-enabled EHRs

5.2.1.3 Growing collaborations & partnerships among stakeholders

TABLE 2 INDICATIVE LIST OF COLLABORATIONS BETWEEN ORGANIZATIONS FROM 2020 TO 2022

5.2.1.4 Growing incidence of medication errors

5.2.1.5 Development of big data and mHealth tools

5.2.2 RESTRAINTS

5.2.2.1 Data security concerns related to cloud-based CDSS

5.2.2.2 Inadequate interoperability

5.2.3 OPPORTUNITIES

5.2.3.1 The growth potential of emerging markets

5.2.3.2 Social media integration and rising technological advancements

5.2.4 CHALLENGES

5.2.4.1 Requirement of high investments for the implementation of CDSS infrastructure

5.2.4.2 Shortage of skilled IT professionals in the healthcare industry

5.3 IMPACT OF COVID-19 ON THE CDSS MARKET

5.4 VALUE-CHAIN ANALYSIS

FIGURE 23 CDSS MARKET: VALUE-CHAIN ANALYSIS (2021)

5.5 CASE STUDIES

5.5.1 IMPROVING RESPONSE PHYSICIAN EFFICIENCY AND TIME

TABLE 3 CASE 1: NEED TO PROVIDE BETTER FACILITIES

5.5.2 IMPROVING EFFICIENCY AND CARE WITH AI

TABLE 4 CASE 2: IMPROVING EFFICIENCY, ADOPTION, AND CARE EXPERIENCES WITH AI-POWERED CDS

5.5.3 PROVIDING THE BEST PATIENT CARE

TABLE 5 CASE 3: FOCUS ON QUALITY AND SAFETY

5.6 ECOSYSTEM ANALYSIS

FIGURE 24 CDSS MARKET: ECO SYSTEM ANALYSIS (2021)

5.7 TECHNOLOGY ANALYSIS

TABLE 6 TECHNOLOGICAL DEVELOPMENTS BY LEADING VENDORS

5.8 REGULATORY ANALYSIS

5.8.1 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996 (HIPAA)

5.8.2 HEALTH INFORMATION TECHNOLOGY FOR ECONOMIC AND CLINICAL HEALTH ACT OF 2009 (HITECH)

5.8.3 CONSUMER PRIVACY PROTECTION ACT OF 2017

5.8.4 NATIONAL CYBERSECURITY PROTECTION ADVANCEMENT ACT OF 2015

5.8.5 CYBERSECURITY LAW OF THE PEOPLE’S REPUBLIC OF CHINA

5.8.6 AFFORDABLE CARE ACT, 2010

5.9 PORTER'S FIVE FORCES ANALYSIS

TABLE 7 CDSS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10 INDUSTRY TRENDS

5.10.1 RISING NEED FOR INTEROPERABILITY & INTEGRATION FOR HCIT SOLUTIONS

5.10.2 GRADUAL SHIFT OF ACCOUNTABILITY FROM PAYERS TO PROVIDERS

5.10.3 GROWING DEMAND FOR VALUE-BASED HEALTHCARE

5.11 PRICING ANALYSIS

TABLE 8 AVERAGE SELLING PRICE OF CDSS SOLUTIONS, BY PRODUCT (2021)

5.12 CONFERENCES AND WEBINARS

5.13 BUSINESS MODELS

FIGURE 25 BENEFITS OF HYBRID BUSINESS MODELS

6 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT (Page No. - 66)

6.1 INTRODUCTION

TABLE 9 CLINICAL DECISION SUPPORT SYSTEM MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

6.2 SERVICES

6.2.1 SERVICES SEGMENT TO DOMINATE THE MARKET FROM 2022–2027

TABLE 10 CLINICAL DECISION SUPPORT SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 SOFTWARE

6.3.1 THE USE OF EMR/EHR-INTEGRATED CDSS ENABLES ACCESS TO CENTRALIZED PATIENT DATABASES

TABLE 11 CLINICAL DECISION SUPPORT SOFTWARE MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 HARDWARE

6.4.1 HARDWARE MUST BE FREQUENTLY UPGRADED OR REPLACED FOR THE OPTIMAL USE OF ADVANCED SOFTWARE

TABLE 12 CLINICAL DECISION SUPPORT HARDWARE MARKET, BY REGION, 2020–2027 (USD MILLION)

7 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT (Page No. - 71)

7.1 INTRODUCTION

TABLE 13 CLINICAL DECISION SUPPORT SYSTEM MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

7.2 INTEGRATED CDSS

7.2.1 INTEGRATED CDSS IS WIDELY USED BY HEALTHCARE PROVIDERS TO IMPROVE THE QUALITY OF CARE AND REDUCE MEDICATION ERRORS

TABLE 14 INTEGRATED CLINICAL-DECISION SUPPORT SYSTEM MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 STANDALONE CDSS

7.3.1 LACK OF INTEROPERABILITY WITH CPOE AND EHR TO RESTRAIN THE MARKET DEMAND

TABLE 15 STANDALONE CLINICAL-DECISION SUPPORT SYSTEM MARKET, BY REGION, 2020–2027 (USD MILLION)

8 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE (Page No. - 75)

8.1 INTRODUCTION

TABLE 16 MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.2 THERAPEUTIC CDSS

8.2.1 THERAPEUTIC CDSS IS MOST EFFECTIVE IN INTEGRATED CLINICAL WORKFLOWS AS IT REDUCES MEDICATION ERRORS

TABLE 17 THERAPEUTIC CLINICAL-DECISION SUPPORT SYSTEM MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 DIAGNOSTIC CDSS

8.3.1 DIAGNOSTIC CDSS GUIDES PHYSICIANS THROUGH A SYSTEMATIC DIAGNOSIS PROCESS

TABLE 18 DIAGNOSTIC CLINICAL-DECISION SUPPORT SYSTEM MARKET, BY REGION, 2020–2027 (USD MILLION)

9 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL (Page No. - 78)

9.1 INTRODUCTION

TABLE 19 MARKET, BY MODEL, 2020–2027 (USD MILLION)

9.2 KNOWLEDGE-BASED CDSS

9.2.1 KNOWLEDGE-BASED CDSS MODELS USE CONDITIONAL LOGIC FOR DECISION-MAKING AND PROBLEM ANALYSIS

TABLE 20 KNOWLEDGE-BASED CLINICAL-DECISION SUPPORT SYSTEM MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 NON-KNOWLEDGE-BASED CDSS

9.3.1 NON-KNOWLEDGE-BASED CDSS IMPLEMENTS ML AND AI ALGORITHMS TO EXPAND ITS USER-DEFINED KNOWLEDGE BASE

TABLE 21 NON-KNOWLEDGE-BASED CLINICAL-DECISION SUPPORT SYSTEM MARKET, BY REGION, 2020–2027 (USD MILLION)

10 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE (Page No. - 82)

10.1 INTRODUCTION

TABLE 22 CLINICAL DECISION SUPPORT SYSTEM MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

10.2 ON-PREMISE CDSS

10.2.1 LICENSED SOFTWARE IS INSTALLED ON ON-PREMISE CDSS DELIVERY MODES

TABLE 23 ON-PREMISE CLINICAL-DECISION SUPPORT SYSTEM MARKET, BY REGION, 2020–2027 (USD MILLION)

10.3 CLOUD-BASED CDSS

10.3.1 CLOUD-BASED CDSS IS PROJECTED TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

TABLE 24 CLOUD-BASED CLINICAL-DECISION SUPPORT SYSTEM MARKET, BY REGION, 2020–2027 (USD MILLION)

11 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION (Page No. - 86)

11.1 INTRODUCTION

TABLE 25 CLINICAL DECISION SUPPORT SYSTEM MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

11.2 CONVENTIONAL CDSS

11.2.1 CONVENTIONAL CDSS IS USED TO ENHANCE HEALTH-RELATED DECISION-MAKING

TABLE 26 CONVENTIONAL CLINICAL-DECISION SUPPORT SYSTEM MARKET, BY REGION, 2020–2027 (USD MILLION)

11.3 ADVANCED CDSS

11.3.1 ADVANCED CDSS SEGMENT TO WITNESS HIGH GROWTH DURING THE FORECAST PERIOD

TABLE 27 ADVANCED CLINICAL-DECISION SUPPORT SYSTEM MARKET, BY REGION, 2020–2027 (USD MILLION)

12 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL (Page No. - 90)

12.1 INTRODUCTION

TABLE 28 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

12.2 ACTIVE CDSS

12.2.1 ACTIVE CDSS IS THE LARGEST AND THE FASTEST-GROWING SEGMENT IN THE CDSS MARKET

TABLE 29 ACTIVE CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

12.3 PASSIVE CDSS

12.3.1 PASSIVE CDSS CAUSES MINIMAL DISRUPTION TO WORKFLOWS

TABLE 30 PASSIVE CDSS MARKET, BY REGION, 2020–2027 (USD MILLION)

13 CDSS MARKET, BY SETTING (Page No. - 94)

13.1 INTRODUCTION

TABLE 31 CDSS MARKET, BY SETTING, 2020–2027 (USD MILLION)

13.2 INPATIENT SETTINGS

13.2.1 THE ADOPTION OF CDSS FOR INPATIENT SETTINGS HELPS IMPROVE PATIENT CARE WORKFLOWS

TABLE 32 CDSS MARKET FOR INPATIENT SETTINGS, BY REGION, 2020–2027 (USD MILLION)

13.3 AMBULATORY CARE SETTINGS

13.3.1 THE RISING NEED TO CONTROL HEALTHCARE COSTS DRIVES THE DEMAND FOR CDSS IN AMBULATORY CARE SETTINGS

TABLE 33 CDSS MARKET FOR AMBULATORY CARE SETTINGS, BY REGION, 2020–2027 (USD MILLION)

14 CDSS MARKET, BY REGION (Page No. - 98)

14.1 INTRODUCTION

FIGURE 26 NORTH AMERICA TO DOMINATE THE CDSS MARKET FROM 2022 TO 2027

TABLE 34 CDSS MARKET, BY REGION, 2020–2027 (USD MILLION)

14.2 NORTH AMERICA

FIGURE 27 NORTH AMERICA: CDSS MARKET SNAPSHOT

TABLE 35 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: CDSS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 37 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 40 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 42 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.2.1 US

14.2.1.1 The US is the largest market for CDSS solutions

TABLE 44 US: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 45 US: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 46 US: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 47 US: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 48 US: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 49 US: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 50 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 51 US: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.2.2 CANADA

14.2.2.1 The rising requirement for cost containment drives the market growth in Canada

TABLE 52 CANADA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 53 CANADA: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 54 CANADA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 55 CANADA: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 56 CANADA: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 57 CANADA: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 58 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 59 CANADA: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.3 EUROPE

TABLE 60 EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 61 EUROPE: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 62 EUROPE: MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 63 EUROPE: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 64 EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 65 EUROPE: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 67 EUROPE: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.3.1 GERMANY

14.3.1.1 Government initiatives to boost the adoption of EMRs drives the market growth in Germany

TABLE 69 GERMANY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 70 GERMANY: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 71 GERMANY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 72 GERMANY: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 GERMANY: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 74 GERMANY: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 75 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 76 GERMANY: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.3.2 UK

14.3.2.1 Favorable government initiatives drive the demand for CDSS solutions in the UK

TABLE 77 UK: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 78 UK: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 79 UK: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 80 UK: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 UK: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 82 UK: MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 83 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 84 UK: MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.3.3 FRANCE

14.3.3.1 The rising focus on improving the healthcare system in France drives the market demand for CDSS

TABLE 85 FRANCE: CDSS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 86 FRANCE: CDSS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 87 FRANCE: CDSS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 88 FRANCE: CDSS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 FRANCE: CDSS MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 90 FRANCE: CDSS MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 91 FRANCE: CDSS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 92 FRANCE: MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.3.4 ITALY

14.3.4.1 The growing burden of chronic diseases drives the adoption of EHR solutions in Italy

TABLE 93 ITALY: CDSS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 94 ITALY: CDSS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 95 ITALY: CDSS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 96 ITALY: CDSS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 ITALY: CDSS MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 98 ITALY: CDSS MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 99 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 100 ITALY: MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.3.5 SPAIN

14.3.5.1 Growing cases of COVID-19 have driven the demand for evidence-based solutions in Spain

TABLE 101 SPAIN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 102 SPAIN: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 103 SPAIN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 104 SPAIN: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 SPAIN: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 106 SPAIN: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 107 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 108 SPAIN: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.3.6 REST OF EUROPE

TABLE 109 ROE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 110 ROE: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 111 ROE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 112 ROE: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 ROE: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 114 ROE: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 115 ROE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 116 ROE: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.4 ASIA PACIFIC

FIGURE 28 ASIA PACIFIC: CDSS MARKET SNAPSHOT

TABLE 117 ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.4.1 JAPAN

14.4.1.1 The rising geriatric population in Japan supports the adoption of evidence-based clinical decisions using CDSS

TABLE 126 JAPAN: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 127 JAPAN: MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 128 JAPAN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 129 JAPAN: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 JAPAN: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 131 JAPAN: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 132 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 133 JAPAN: CLINICAL DECISION SUPPORT SYSTEM MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.4.2 CHINA

14.4.2.1 China is a lucrative market for HCIT solutions due to strong government support for healthcare reforms

TABLE 134 CHINA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 135 CHINA: MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 136 CHINA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 137 CHINA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 138 CHINA: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 139 CHINA: MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 140 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 141 CHINA: MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.4.3 INDIA

14.4.3.1 The high burden of chronic diseases in India supports the market adoption of CDSS-based solutions

TABLE 142 INDIA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 143 INDIA: MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 144 INDIA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 145 INDIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 146 INDIA: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 147 INDIA: MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 148 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 149 INDIA: MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.4.4 REST OF ASIA PACIFIC (ROAPAC)

TABLE 150 ROAPAC: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 151 ROAPAC: MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 152 ROAPAC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 153 ROAPAC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 154 ROAPAC: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 155 ROAPAC: MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 156 ROAPAC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 157 ROAPAC: MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.5 REST OF THE WORLD

TABLE 158 ROW: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 159 ROW: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 160 ROW: MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 161 ROW: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 162 ROW: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 163 ROW: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 164 ROW: MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 165 ROW: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 166 ROW: MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.5.1 LATIN AMERICA

14.5.1.1 Developments in healthcare infrastructure support the market growth in Latin America

TABLE 167 LATIN AMERICA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 174 LATIN AMERICA: MARKET, BY SETTING, 2020–2027 (USD MILLION)

14.5.2 MIDDLE EAST & AFRICA

14.5.2.1 Growing medical tourism supports the market adoption of CDSS in the Middle East & Africa

TABLE 175 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 179 MIDDLE EAST & AFRICA: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: MARKET, BY INTERACTIVITY LEVEL, 2020–2027 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY SETTING, 2020–2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE (Page No. - 160)

15.1 OVERVIEW

15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 183 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN THE MARKET

15.3 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

FIGURE 29 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET

15.4 MARKET RANKING OF PLAYERS, 2021

FIGURE 30 MARKET RANKING, BY KEY PLAYER, 2021

15.5 COMPETITIVE BENCHMARKING

TABLE 184 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 185 MARKET: APPLICATION & PRODUCT FOOTPRINT OF KEY PLAYERS

TABLE 186 MARKET: REGIONAL FOOTPRINT OF KEY PLAYERS

15.6 COMPETITIVE LEADERSHIP MAPPING

15.6.1 STARS

15.6.2 EMERGING LEADERS

15.6.3 PERVASIVE PLAYERS

15.6.4 PARTICIPANTS

FIGURE 31 MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2021

15.7 COMPETITIVE LEADERSHIP MAPPING – START-UPS/SMES

15.7.1 PROGRESSIVE COMPANIES

15.7.2 STARTING BLOCKS

15.7.3 RESPONSIVE COMPANIES

15.7.4 DYNAMIC COMPANIES

FIGURE 32 COMPETITIVE LEADERSHIP MAPPING, START-UP/SME MATRIX MARKET

15.8 COMPETITIVE SITUATIONS AND TRENDS

TABLE 187 PRODUCT LAUNCHES/ENHANCEMENTS

15.8.1 DEALS

TABLE 188 DEALS, JANUARY 2019–MAY 2022

16 COMPANY PROFILES (Page No. - 180)

(Business overview, Products & services offered, Recent developments & MnM View)*

16.1 KEY PLAYERS

16.1.1 CERNER CORPORATION

TABLE 189 CERNER: BUSINESS OVERVIEW

FIGURE 33 CERNER CORPORATION: COMPANY SNAPSHOT (2019)

16.1.2 IBM WATSON HEALTH

TABLE 190 IBM: BUSINESS OVERVIEW

FIGURE 34 IBM: COMPANY SNAPSHOT (2021)

16.1.3 CHANGE HEALTHCARE

TABLE 191 CHANGE HEALTHCARE: BUSINESS OVERVIEW

FIGURE 35 CHANGE HEALTHCARE: COMPANY SNAPSHOT (2021)

16.1.4 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

TABLE 192 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: BUSINESS OVERVIEW

FIGURE 36 ALLSCRIPTS HEALTHCARE, LLC: COMPANY SNAPSHOT (2021)

16.1.5 ATHENAHEALTH

TABLE 193 ATHENAHEALTH: BUSINESS OVERVIEW

16.1.6 EPIC SYSTEMS CORPORATION

TABLE 194 EPIC SYSTEMS CORPORATION: BUSINESS OVERVIEW

16.1.7 ELSEVIER B.V. (A DIVISION OF RELX GROUP)

TABLE 195 ELSEVIER B.V.: BUSINESS OVERVIEW

16.1.8 ZYNX HEALTH

TABLE 196 ZYNX HEALTH: BUSINESS OVERVIEW

16.1.9 WOLTERS KLUWER N.V.

TABLE 197 WOLTERS KLUWER N.V.: BUSINESS OVERVIEW

FIGURE 37 WOLTERS KLUWER N.V.: COMPANY SNAPSHOT (2021)

16.1.10 PHILIPS HEALTHCARE (A SUBSIDIARY OF ROYAL PHILIPS)

TABLE 198 PHILIPS HEALTHCARE: BUSINESS OVERVIEW

FIGURE 38 PHILIPS HEALTHCARE: COMPANY SNAPSHOT (2021)

16.1.11 MEDITECH

TABLE 199 MEDITECH: BUSINESS OVERVIEW

*Details on Business overview, Products & services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

16.2 OTHER KEY PLAYERS

16.2.1 NEXTGEN HEALTHCARE

16.2.2 SIEMENS HEALTHINEERS

16.2.3 EBSCO HEALTH (A DIVISION OF EBSCO INDUSTRIES, INC.)

16.2.4 GE HEALTHCARE

16.2.5 ECLINICALWORKS

16.2.6 RAMPMEDICAL

16.2.7 THE MEDICAL ALGORITHMS COMPANY

16.2.8 HERA-MI

16.2.9 CUREMD

16.2.10 CARECLOUD

16.2.11 VISUALDX

16.2.12 STANSON HEALTH

16.2.13 FIRST DATABANK

16.2.14 STRATA DECISION TECHNOLOGY

17 APPENDIX (Page No. - 224)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the Clinical decision support systems market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the Clinical decision support systems market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as WHO, ATA, AHA and AAHM. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global Clinical decision support systems market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global Clinical decision support systems market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (such as Individual Physicians, Physician Groups, Hospitals, Clinics and Other Healthcare Facilities, Payers- Private and Public Insurance Bodies, Other End Users- Employer Groups and Government Bodies) and supply-side (such as C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East and the Africa. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the CDSS market and various other dependent submarkets. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and markets have been identified through extensive secondary research.

- The revenue generated from the sale of CDSS products by leading players has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the clinical decision support systems market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the remote patient monitoring market

Report Objectives

- To define, describe, and forecast the global CDSS market based on product, component, delivery mode, type, model, application, interactivity level, setting, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall clinical decision support systems market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions—North America, Europe, the Asia Pacific, and the Rest of the World (Latin America & the Middle East & Africa)

- To strategically analyze the market structure and profile the key players and comprehensively analyze their market shares and core competencies2

- To track and analyze competitive developments such as acquisitions, product launches & enhancements, expansions, agreements, collaborations, and partnerships in the global CDSS market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (up to 20)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Clinical Decision Support Systems Market

Which segment accounted for the largest market share for the clinical decision support systems market?

Which factors are major growth restraints for the global clinical decision support system market?