Clinical Trials Market by Phase (Phase I, II, III), Service Type (Site Identification, Laboratory Services, Decentralized Clinical Trial), Therapy Area (Oncology, Infectious Disease), and Application (Vaccines, Cell & Gene Therapy) - Global Forecast to 2026

Updated on : June 18, 2023

The global clinical trials market in terms of revenue was estimated to be worth $38.7 billion in 2021 and is poised to reach $52.0 billion by 2026, growing at a CAGR of 6.1% from 2021 to 2026. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Expanding number of clinical trials along with robust investment in pharmaceutical R&D are some of the key driving factors of the market. Maximum number of pharmaceutical, biopharmaceutical, and medical device companies continue to make large investments to develop novel therapeutics and devices. The R&D-intensive nature of pharmaceutical industry, propels companies to outsource clinical trials for expediating launch of therapeutics to the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Clinical Trials Market Dynamics

Driver: Increase in number of clinical trials

The demand for clinical trial services is anticipated to increase as a result of the significant increase in clinical trials taking place around the world, which will subsequently fuel market expansion. As of June 2021, North America and Europe were home to the most clinical trials, according to the WHO's clinical trials registry. By February 2023, more than 30% of clinical trials had been registered in the US. Decentralized clinical trials have also become more common, rising by more than 25% in 2022. The decentralization of clinical trial components has significantly increased the volume of trials conducted annually.

Challenge: Requirement of unique analytical testing approaches for innovative drug molecules

The race to create novel treatments and secure patent exclusivity through expedited drug development has become increasingly fierce in the pharmaceutical and biopharmaceutical industries over time. Bioanalytical testing, which is the most outsourced process among all the chemistry, manufacturing, and control (CMC) activities, plays a significant role in all stages of pharmaceutical and biopharmaceutical development. To satisfy regulatory requirements and obtain approval for an investigational new drug (IND), CMC data is also crucial. The development of novel drug delivery systems and the diversity of CMC requirements for biopharmaceutical IND present a number of challenges and necessitate a wide range of analytical techniques for testing new drug molecules.

Market Trend: Adoption of artificial intelligence-based tools for drug discovery

The early stages of drug development see significantly higher success rates thanks to the use of artificial intelligence (AI) and machine learning (ML) in the drug discovery process. AI algorithms can quickly identify potential drug candidates because they can process and analyze a large amount of data. Additionally, deep learning systems can be used to create molecules with characteristics that are likely to be effective against a variety of diseases without causing unfavorable side effects. These benefits have encouraged a number of pharmaceutical and biotechnology companies to use AI for drug discovery. Consider Benevolent Ltd. (UK) places special emphasis on using deep learning and natural language processing to comprehend and examine massive amounts of data for drug discovery.

By phase, Phase IV of clinical trials industry is expected to grow at a fast pace during the forecast period.

Based on phase, the clinical trials market is segmented into Phase I, Phase II, Phase III, & Phase IV. Phase III dominated the market, whereas Phase IV registered highest growth rate during the forecast period. Variety of formulations, therapy duration, dosages, and other interactions are studied in this phase as a part of post-marketing surveillance. Increase in number of service providers offering post-marketing surveillance has contributed to the highest growth rate registered by this segment.

By service type, the laboratory services segment accounted for the largest share of the clinical trials industry.

Based on service type, the clinical trials market is segmented into protocol designing, site identification, patient recruitment, laboratory services, bioanalytical testing, analytical testing, clinical trial supply & logistic services, decentralized clinical services, clinical trial data management services, medical device testing services, and other services. Laboratory services are used to provide support to all stages of the drug development process, including clinical development. The quality and efficacy of the products are determined through various qualitative and quantitative processes.

By therapy area, oncology segment dominated the clinical trials industry

Based on the therapy area, the clinical trials market is segmented into oncology, infectious diseases, cardiology, neurology, women’s health, genetic diseases, immunology, and other therapy areas. Oncology segment dominated the market. The list of drugs in development for oncology has increased over the years due to the rising number of clinical trials and growing R&D expenditure by pharmaceutical companies on oncology-based drugs.

By application, the vaccine segment of clinical trials industry is set to grow at the fastest pace through the forecast period.

Based on application, the global clinical trials market is segmented into small applications, vaccines, cell & gene therapy, and others. Companies are enforcing their expertise on COVID-19 vaccine trials to drive the successful commercialization of COVID-19 vaccines. Approximately 194 COVID-19 vaccine candidates were in pre-clinical development, whereas 138 were in the clinical development phase as of January 2022. This has contributed to the segment’s fastest growth.

North America accounted for the largest share of the clinical trials industry.

North America accounted for the largest share of the clinical trials market, followed by Europe. Fast growth in the biologics and biosimilars market, increasing investments towards advancing clinical research is attributive to the large share of North America in market. North America is the largest pharmaceutical market in the world, with many global pharmaceutical and medical device giants, such as Pfizer, Inc. (US), AbbVie, Inc. (US), Abbott Laboratories (US), and Johnson & Johnson (US) headquartered in the region.

To know about the assumptions considered for the study, download the pdf brochure

IQVIA (US), LabCorp (US), Charles River Laboratories (US), WuXi AppTec (China), Syneos Health (US), PPD (US), and ICON Plc (US) are the prominent players operating in the clinical trials market.

Scope of the Clinical Trials Industry

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$38.7 billion |

|

Projected Revenue by 2026 |

$52.0 billion |

|

Revenue Rate |

poised to grow at a CAGR of 6.1% |

|

Market Driver |

Increasing number of clinical trials |

|

Market Opportunity |

Rising demand for specialized testing services among end users |

This research report categorizes the clinical trials market to forecast revenue and analyze trends in each of the following submarkets:

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Service Type

- Protocol Designing

- Site Identification

- Patient Recruitment

- Laboratory Services

-

Bioanalytical Testing Services

- Cell-based Assays

- Virology Testing

- Method Development, Optimization, & Validation

- Serology, Immunogenicity, & Neutralizing Antibodies

- Biomarker Testing Services

- PK/PD (Pharmacokinetics/Pharmacodynamics) Testing Services

- Other Bioanalytical Testing Services

- Analytical Testing Services

- Clinical Trial Supply & Logistic Services

- Decentralized Clinical Services

- Clinical Trial Data Management Services

- Medical Device Testing Services

- Other Clinical Trial Services

By Therapy Area

- Oncology

- Infectious Diseases

- Cardiology

- Neurology

- Women's Health

- Genetic Diseases

- Immunology

- Other Therapy Areas

By Application

- Vaccine

- Cell & Gene Therapy

- Small Molecules

- Other Applications

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- The Middle East and Africa

Recent Developments of Clinical Trials Industry

- In November 2022, Calit Health Services (Israel) collaborated with IQVIA (US) to work on clinical trial delivery.

- In October 2022, PPD (business of Thermo Fisher Scientific) introduced Decentralized Clinical Trials Network to facilitate participation in decentralized clinical trials.

- In September 2021, Syneos Health collaborated with Ride Health to co-develop non-emergency medical transportation (NEMT) for clinical trial participants.

- In April 2021, Q2 Solutions was acquired by IQVIA; this acquisition is set to strengthen the market position of IQVIA.

Frequently Asked Questions (FAQ):

How big is the global clinical trials market?

Global clinical trials market revenue was estimated at $38.7 billion in 2021 and is projected to reach $52.0 billion by 2026, with a robust growth rate of 6.1% CAGR from 2021 to 2026.

Which major factors are influencing global growth of clinical trials market?

Expanding number of clinical trials along with robust investment in pharmaceutical R&D are some of the key driving factors of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 CLINICAL TRIALS INDUSTRY DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 CLINICAL TRIALS MARKET

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

FIGURE 3 MARKET: BREAKDOWN OF PRIMARIES

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF CLINICAL TRIALS IN THE MARKET

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS, 2020

FIGURE 6 AVERAGE MARKET SIZE ESTIMATION, 2020

2.3 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

FIGURE 7 GLOBAL CLINICAL TRIALS INDUSTRY: CAGR PROJECTIONS, 2021–2026

FIGURE 8 GLOBAL MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, AND OPPORTUNITIES

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.5 INSIGHTS FROM PRIMARIES

FIGURE 11 MARKET VALIDATION FROM PRIMARY EXPERTS

2.6 RESEARCH ASSUMPTIONS

2.6.1 COVID-19 SPECIFIC ASSUMPTIONS

2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 12 CLINICAL TRIALS MARKET, BY PHASE, 2021 VS. 2026

FIGURE 13 MARKET, BY THERAPY AREA, 2021 VS. 2026

FIGURE 14 CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2021 VS. 2026

FIGURE 15 MARKET, BY SERVICE TYPE, 2021 VS. 2026

FIGURE 16 GEOGRAPHICAL SNAPSHOT: GLOBAL CLINICAL TRIALS INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 CLINICAL TRIALS MARKET OVERVIEW

FIGURE 17 RISING INVESTMENTS IN THE PHARMACEUTICAL INDUSTRY TO DRIVE THE MARKET GROWTH

4.2 NORTH AMERICA: MARKET SHARE, BY PHASE & COUNTRY (2020)

FIGURE 18 PHASE III SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2020

4.3 MARKET, BY BIOANALYTICAL SERVICE TYPE, 2021 VS. 2026

FIGURE 19 CELL-BASED ASSAY SEGMENT CONTINUES TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 CLINICAL TRIALS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

TABLE 1 GLOBAL CLINICAL TRIALS INDUSTRY: IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing investments in pharmaceutical R&D

FIGURE 21 INCREASE IN GLOBAL PHARMACEUTICAL R&D SPENDING, 2012–2026

FIGURE 22 ACTIVE PHARMACEUTICAL PIPELINE, 2011–2021

5.2.1.2 Increasing number of clinical trials

FIGURE 23 NUMBER OF CLINICAL TRIALS REGISTERED WORLDWIDE (2000–2021)

5.2.1.3 High cost of in-house drug development

FIGURE 24 AVERAGE COST TO DEVELOP A PHARMACEUTICAL COMPOUND FROM DISCOVERY TO LAUNCH, 2010–2020

5.2.1.4 Rising prevalence of orphan and rare diseases

5.2.2 OPPORTUNITIES

5.2.2.1 Growth in drugs and biologics market despite COVID-19 pandemic

FIGURE 25 TOTAL NUMBER OF NEW DRUGS (NEW CHEMICAL ENTITIES AND BIOLOGICS) APPROVED BY US FDA (2001–2020)

TABLE 2 LIST OF BIOLOGICS APPROVED BY US FDA, 2020

5.2.2.2 Rising demand for specialized testing services among end users

5.2.2.3 Need for novel clinical trial designs for complex cell and gene therapies

5.2.3 CHALLENGES

5.2.3.1 Shortage of skilled professionals for clinical trials

5.2.3.2 Requirement of unique analytical testing approaches for innovative drug molecules

5.2.4 MARKET TRENDS

5.2.4.1 Adoption of artificial intelligence-based tools for drug discovery

5.2.4.2 Increasing outsourcing activities in emerging Asian economies

5.2.4.3 Integrated end-to-end R&D service solutions

5.3 RANGES/SCENARIOS

FIGURE 26 SPECTRUM OF SCENARIOS BASED ON THE IMPACT OF UNCERTAINTIES ON THE GROWTH OF THE GLOBAL MARKET

5.4 IMPACT OF COVID-19 ON THE GLOBAL MARKET

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 GLOBAL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 BARGAINING POWER OF SUPPLIERS

5.5.5 DEGREE OF COMPETITION

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 27 REVENUE SHIFT & NEW POCKETS FOR CLINICAL TRIAL SERVICE PROVIDERS

5.7 ECOSYSTEM ANALYSIS

FIGURE 28 ECOSYSTEM ANALYSIS: MARKET

TABLE 4 SUPPLY CHAIN ECOSYSTEM

5.8 REGULATORY ANALYSIS

6 CLINICAL TRIALS MARKET, BY PHASE (Page No. - 69)

6.1 INTRODUCTION

TABLE 5 CLINICAL TRIALS INDUSTRY, BY PHASE, 2019–2026

FIGURE 29 DRUGS IN THE PIPELINE, BY DEVELOPMENT PHASE, 2019 VS. 2020

6.2 CLINICAL TRIALS PLANNING AND DESIGNING SOLUTION

FIGURE 30 CLINICAL TRIAL PLANNING & DESIGNING

6.3 PHASE I

6.3.1 ROBUST PIPELINE OF PHARMACEUTICAL COMPANIES DRIVES THE GROWTH OF THIS SEGMENT

TABLE 6 EXAMPLES OF PHASE I STUDY OF DRUGS

TABLE 7 PHASE I MARKET, BY REGION, 2019–2026

TABLE 8 NORTH AMERICA: PHASE I MARKET, BY COUNTRY, 2019–2026

TABLE 9 EUROPE: PHASE I MARKET, BY COUNTRY, 2019–2026

TABLE 10 ASIA PACIFIC: PHASE I CLINICAL TRIALS MARKET, BY COUNTRY, 2019–2026

6.4 PHASE II

6.4.1 THE LONG DURATION OF PHASE II STUDIES PROVIDES GROWTH OPPORTUNITIES FOR CROS

TABLE 11 EXAMPLES OF DRUGS THAT HAVE COMPLETED PHASE II STUDIES

TABLE 12 PHASE II MARKET, BY REGION, 2019–2026

TABLE 13 NORTH AMERICA: PHASE II MARKET, BY COUNTRY, 2019–2026

TABLE 14 EUROPE: PHASE II MARKET, BY COUNTRY, 2019–2026

TABLE 15 ASIA PACIFIC: PHASE II MARKET, BY COUNTRY, 2019–2026

6.5 PHASE III

6.5.1 RISING COSTS OF PHASE III TRIALS INCREASE THE DEMAND FOR COST-EFFECTIVE CLINICAL RESEARCH SERVICES

TABLE 16 EXAMPLES OF DRUGS THAT HAVE COMPLETED THE PHASE III STUDY

TABLE 17 PHASE III MARKET, BY REGION, 2019–2026

TABLE 18 NORTH AMERICA: PHASE III MARKET, BY COUNTRY, 2019–2026

TABLE 19 EUROPE: PHASE III MARKET, BY COUNTRY, 2019–2026

TABLE 20 ASIA PACIFIC: PHASE III MARKET, BY COUNTRY, 2019–2026

6.6 PHASE IV

6.6.1 RISING NUMBER OF CLINICAL RESEARCH ENTITIES PROVIDING POST-MARKETING SURVEILLANCE TO DRIVE THE SEGMENT GROWTH

TABLE 21 EXAMPLES OF DRUGS THAT HAVE COMPLETED PHASE IV CLINICAL STUDIES

TABLE 22 PHASE IV CLINICAL TRIALS MARKET, BY REGION, 2019–2026

TABLE 23 NORTH AMERICA: PHASE IV MARKET, BY COUNTRY, 2019–2026

TABLE 24 EUROPE: PHASE IV MARKET, BY COUNTRY, 2019–2026

TABLE 25 ASIA PACIFIC: PHASE IV MARKET, BY COUNTRY, 2019–2026

7 CLINICAL TRIALS MARKET, BY SERVICE TYPE (Page No. - 84)

7.1 INTRODUCTION

TABLE 26 CLINICAL TRIALS INDUSTRY, BY SERVICE TYPE, 2019–2026

7.2 PROTOCOL DESIGNING

7.2.1 PROTOCOL DESIGNING SERVICES SERVE AS AN EFFECTIVE STRATEGY TO ENSURE RAPID & EFFECTIVE PLANNING FOR CLINICAL TRIAL STUDIES

TABLE 27 PROTOCOL DESIGNING MARKET, BY REGION, 2019–2026

TABLE 28 NORTH AMERICA: PROTOCOL DESIGNING MARKET, BY COUNTRY, 2019–2026

TABLE 29 EUROPE: PROTOCOL DESIGNING MARKET, BY COUNTRY, 2019–2026

TABLE 30 ASIA PACIFIC: PROTOCOL DESIGNING MARKET, BY COUNTRY, 2019–2026

7.3 SITE IDENTIFICATION

7.3.1 NEW DIGITAL TECHNOLOGIES THAT ENABLE DATA VARIABILITY ENHANCES SITE IDENTIFICATION SERVICE EFFICACY

TABLE 31 SITE IDENTIFICATION MARKET, BY REGION, 2019–2026

TABLE 32 NORTH AMERICA: SITE IDENTIFICATION MARKET, BY COUNTRY, 2019–2026

TABLE 33 EUROPE: SITE IDENTIFICATION MARKET, BY COUNTRY, 2019–2026

TABLE 34 ASIA PACIFIC: SITE IDENTIFICATION MARKET, BY COUNTRY, 2019–2026

7.4 PATIENT RECRUITMENT

7.4.1 THE GROWING REQUIREMENT TO WORK WITH A PATIENT-CENTRIC CLINICAL TRIAL COMPANY SUPPORTS THE GROWTH OF THIS SEGMENT

TABLE 35 SOME OF THE PATIENT RECRUITMENT SERVICE PROVIDERS

TABLE 36 PATIENT RECRUITMENT MARKET, BY REGION, 2019–2026

TABLE 37 NORTH AMERICA: PATIENT RECRUITMENT MARKET, BY COUNTRY, 2019–2026

TABLE 38 EUROPE: PATIENT RECRUITMENT MARKET, BY COUNTRY, 2019–2026

TABLE 39 ASIA PACIFIC: PATIENT RECRUITMENT MARKET, BY COUNTRY, 2019–2026

7.5 LABORATORY SERVICES

7.5.1 INCREASING IMPORTANCE OF LABORATORY SERVICES TO ENSURE REGULATORY COMPLIANCE PROPELS THE GROWTH OF THIS SEGMENT

TABLE 40 EXAMPLES OF LABORATORY SERVICES OFFERED BY PROMINENT PLAYERS

TABLE 41 LABORATORY SERVICES MARKET, BY REGION, 2019–2026

TABLE 42 NORTH AMERICA: LABORATORY SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 43 EUROPE: LABORATORY SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 44 ASIA PACIFIC: LABORATORY SERVICES MARKET, BY COUNTRY, 2019–2026

7.5.2 ANALYTICAL TESTING SERVICES

7.5.2.1 Increasing demand for analytical testing for drug development to drive the growth of this segment

TABLE 45 ANALYTICAL TESTING SERVICES MARKET, BY REGION, 2019–2026

TABLE 46 NORTH AMERICA: ANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 47 EUROPE: ANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 48 ASIA PACIFIC: ANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

7.6 BIOANALYTICAL TESTING SERVICES

7.6.1 HIGH DEMAND FOR BIOANALYTICAL TESTING DUE TO THE GROWING USE OF MACROMOLECULES AND BIOSIMILARS TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 49 BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2019–2026

TABLE 50 BIOANALYTICAL TESTING SERVICES MARKET, BY REGION, 2019–2026

TABLE 51 NORTH AMERICA: BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 52 EUROPE: BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 53 ASIA PACIFIC: BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

7.6.2 CELL-BASED ASSAYS

7.6.2.1 Increasing number of service providers offering customized cell-based assay testing services to drive the growth of this segment

TABLE 54 CELL-BASED ASSAYS MARKET, BY REGION, 2019–2026

TABLE 55 NORTH AMERICA: CELL-BASED ASSAYS MARKET, BY COUNTRY, 2019–2026

TABLE 56 EUROPE: CELL-BASED ASSAYS MARKET, BY COUNTRY, 2019–2026

TABLE 57 ASIA PACIFIC: CELL-BASED ASSAYS MARKET, BY COUNTRY, 2019–2026

7.6.3 VIROLOGY TESTING

7.6.3.1 Higher uptake of in vitro virology assays in the development of antiviral pharmaceuticals to drive the growth of this segment

TABLE 58 VIROLOGY TESTING MARKET, BY REGION, 2019–2026

TABLE 59 NORTH AMERICA: VIROLOGY TESTING MARKET, BY COUNTRY, 2019–2026

TABLE 60 EUROPE: VIROLOGY TESTING MARKET, BY COUNTRY, 2019–2026

TABLE 61 ASIA PACIFIC: VIROLOGY TESTING MARKET, BY COUNTRY, 2019–2026

7.6.4 PK/PD (PHARMACOKINETICS/PHARMACODYNAMICS) TESTING SERVICES

7.6.4.1 Rising importance of studies to determine the pharmacokinetic behavior of drug candidates to drive the growth of this segment

TABLE 62 PK/PD (PHARMACOKINETICS/PHARMACODYNAMICS) TESTING SERVICES MARKET, BY REGION, 2019–2026

TABLE 63 NORTH AMERICA: PK/PD (PHARMACOKINETICS/PHARMACODYNAMICS) TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 64 EUROPE: PK/PD (PHARMACOKINETICS/PHARMACODYNAMICS) TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 65 ASIA PACIFIC: PK/PD (PHARMACOKINETICS/PHARMACODYNAMICS) TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

7.6.5 METHOD DEVELOPMENT, OPTIMIZATION, & VALIDATION

7.6.5.1 Increasing preference of biopharmaceutical companies to outsource method validation services for clinical trials to drive this segment

TABLE 66 METHOD DEVELOPMENT, OPTIMIZATION, & VALIDATION MARKET, BY REGION, 2019–2026

TABLE 67 NORTH AMERICA: METHOD DEVELOPMENT, OPTIMIZATION, & VALIDATION MARKET, BY COUNTRY, 2019–2026

TABLE 68 EUROPE: METHOD DEVELOPMENT, OPTIMIZATION, & VALIDATION MARKET, BY COUNTRY, 2019–2026

TABLE 69 ASIA PACIFIC: METHOD DEVELOPMENT, OPTIMIZATION, & VALIDATION MARKET, BY COUNTRY, 2019–2026

7.6.6 SEROLOGY, IMMUNOGENICITY, & NEUTRALIZING ANTIBODIES

7.6.6.1 High demand for immunogenicity and neutralizing antibody assays in biosimilar development to propel market growth

TABLE 70 USEROLOGY, IMMUNOGENICITY, & NEUTRALIZING ANTIBODIES MARKET, BY REGION, 2019–2026

TABLE 71 NORTH AMERICA: SEROLOGY, IMMUNOGENICITY, & NEUTRALIZING ANTIBODIES MARKET, BY COUNTRY, 2019–2026

TABLE 72 EUROPE: SEROLOGY, IMMUNOGENICITY, & NEUTRALIZING ANTIBODIES MARKET, BY COUNTRY, 2019–2026

TABLE 73 ASIA PACIFIC: SEROLOGY, IMMUNOGENICITY, & NEUTRALIZING ANTIBODIES MARKET, BY COUNTRY, 2019–2026

7.6.7 BIOMARKER TESTING SERVICES

7.6.7.1 Growing emphasis on biomarker testing to develop personalized medicines and companion diagnostics to augment segment growth

TABLE 74 BIOMARKER TESTING SERVICES MARKET, BY REGION, 2019–2026

TABLE 75 NORTH AMERICA: BIOMARKER TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 76 EUROPE: BIOMARKER TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 77 ASIA PACIFIC: BIOMARKER TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

7.6.8 OTHER BIOANALYTICAL TESTING SERVICES

TABLE 78 OTHER BIOANALYTICAL TESTING SERVICES MARKET, BY REGION, 2019–2026

TABLE 79 NORTH AMERICA: OTHER BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 80 EUROPE: OTHER BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 81 ASIA PACIFIC: OTHER BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

7.7 CLINICAL TRIAL DATA MANAGEMENT SERVICES

7.7.1 DATA MANAGEMENT SERVICES SEGMENT IS EXPECTED TO RECORD THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 82 EXAMPLES OF DATA MANAGEMENT SERVICES OFFERED BY PROMINENT PLAYERS

TABLE 83 CLINICAL TRIAL DATA MANAGEMENT SERVICES MARKET, BY REGION, 2019–2026

TABLE 84 NORTH AMERICA: CLINICAL TRIAL DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 85 EUROPE: CLINICAL TRIAL DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 86 ASIA PACIFIC: CLINICAL TRIAL DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2019–2026

7.8 CLINICAL TRIAL SUPPLY & LOGISTIC SERVICES

7.8.1 ADVANCED DATA ANALYTICS INCORPORATED IN CLINICAL TRIAL SUPPLY MANAGEMENT IS EXPECTED TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 87 CLINICAL TRIAL SUPPLY & LOGISTIC SERVICES MARKET, BY REGION, 2019–2026

TABLE 88 NORTH AMERICA: CLINICAL TRIAL SUPPLY & LOGISTIC SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 89 EUROPE: CLINICAL TRIAL SUPPLY & LOGISTIC SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 90 ASIA PACIFIC: CLINICAL TRIAL SUPPLY & LOGISTIC SERVICES MARKET, BY COUNTRY, 2019–2026

7.9 DECENTRALIZED CLINICAL TRIAL SERVICES

7.9.1 THE SARS-COV-2 OUTBREAK HAS SIGNIFICANTLY CATALYZED THE DEMAND FOR DECENTRALIZED CLINICAL TRIALS

TABLE 91 DECENTRALIZED CLINICAL TRIAL SERVICES MARKET, BY REGION, 2019–2026

TABLE 92 NORTH AMERICA: DECENTRALIZED CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 93 EUROPE: DECENTRALIZED CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 94 ASIA PACIFIC: DECENTRALIZED CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2019–2026

7.10 MEDICAL DEVICE TESTING SERVICES

7.10.1 INCREASING R&D FOR THE DEVELOPMENT OF ADVANCED MEDICAL DEVICES TO DRIVE THE GROWTH OF THIS MARKET

TABLE 95 MEDICAL DEVICE TESTING SERVICES MARKET, BY REGION, 2019–2026

TABLE 96 NORTH AMERICA: MEDICAL DEVICE TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 97 EUROPE: MEDICAL DEVICE TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 98 ASIA PACIFIC: MEDICAL DEVICE TESTING SERVICES MARKET, BY COUNTRY, 2019–2026

7.11 OTHER CLINICAL TRIAL SERVICES

7.11.1 OTHER CLINICAL TRIAL SERVICES SEGMENT INCLUDES CONSULTING SERVICES, MEDICAL WRITING SERVICES, AND PHARMACOGENOMICS TESTING SERVICES

TABLE 99 OTHER CLINICAL TRIAL SERVICES MARKET, BY REGION, 2019–2026

TABLE 100 NORTH AMERICA: OTHER CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 101 EUROPE: OTHER CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2019–2026

TABLE 102 ASIA PACIFIC: OTHER CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2019–2026

8 CLINICAL TRIALS MARKET, BY THERAPY AREA (Page No. - 122)

8.1 INTRODUCTION

TABLE 103 CLINICAL TRIALS MARKET, BY THERAPY AREA, 2019–2026

8.2 ONCOLOGY

8.2.1 RISING INCIDENCE OF CANCER TO DRIVE MARKET GROWTH

FIGURE 31 GLOBAL CANCER INCIDENCE, BY TYPE (2020)

FIGURE 32 ONCOLOGY CLINICAL TRIALS GLOBALLY, 2010-2018 (THOUSAND)

TABLE 104 LIST OF FDA DRUGS APPROVED FOR ONCOLOGY (2020)

TABLE 105 GLOBAL MARKET FOR ONCOLOGY, BY REGION, 2019–2026

TABLE 106 NORTH AMERICA: MARKET FOR ONCOLOGY, BY COUNTRY, 2019–2026

TABLE 107 EUROPE: MARKET FOR ONCOLOGY, BY COUNTRY, 2019–2026

TABLE 108 ASIA PACIFIC: MARKET FOR ONCOLOGY, BY COUNTRY, 2019–2026

8.3 INFECTIOUS DISEASES

8.3.1 INFECTIOUS DISEASES SEGMENT TO REGISTER THE HIGHEST GROWTH RATE IN THE FORECAST PERIOD

TABLE 109 CLINICAL TRIALS MARKET FOR INFECTIOUS DISEASES, BY REGION, 2019–2026

TABLE 110 NORTH AMERICA: MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2019–2026

TABLE 111 EUROPE: MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2019–2026

TABLE 112 ASIA PACIFIC: MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2019–2026

8.4 NEUROLOGY

8.4.1 INCREASING INVESTMENTS IN R&D AND GRANTS FOR NEUROLOGICAL DISORDERS TO DRIVE MARKET GROWTH

TABLE 113 LIST OF PIPELINE DRUGS FOR NEUROLOGICAL DISORDERS (2020)

TABLE 114 GLOBAL MARKET FOR NEUROLOGY, BY REGION, 2019–2026

TABLE 115 NORTH AMERICA: MARKET FOR NEUROLOGY, BY COUNTRY, 2019–2026

TABLE 116 EUROPE: MARKET FOR NEUROLOGY, BY COUNTRY, 2019–2026

TABLE 117 ASIA PACIFIC: MARKET FOR NEUROLOGY, BY COUNTRY, 2019–2026

8.5 IMMUNOLOGY

8.5.1 GROWING PIPELINE OF IMMUNOLOGICAL DRUGS HAS RESULTED IN INCREASING OUTSOURCING ACTIVITIES

TABLE 118 CLINICAL TRIALS MARKET FOR IMMUNOLOGY, BY REGION, 2019–2026

TABLE 119 NORTH AMERICA: MARKET FOR IMMUNOLOGY, BY COUNTRY, 2019–2026

TABLE 120 EUROPE: MARKET FOR IMMUNOLOGY, BY COUNTRY, 2019–2026

TABLE 121 ASIA PACIFIC: MARKET FOR IMMUNOLOGY, BY COUNTRY, 2019–2026

8.6 CARDIOLOGY

8.6.1 HIGH MORTALITY RATES ARE DRIVING PHARMACEUTICAL COMPANIES TO DEVELOP NEW TREATMENT OPTIONS

TABLE 122 LIST OF PIPELINE DRUGS FOR CARDIOVASCULAR DISEASES (2020)

TABLE 123 GLOBAL MARKET FOR CARDIOLOGY, BY REGION, 2019–2026

TABLE 124 NORTH AMERICA: MARKET FOR CARDIOLOGY, BY COUNTRY, 2019–2026

TABLE 125 EUROPE: MARKET FOR CARDIOLOGY, BY COUNTRY, 2019–2026

TABLE 126 ASIA PACIFIC: MARKET FOR CARDIOLOGY, BY COUNTRY, 2019–2026

8.7 GENETIC DISEASES

8.7.1 PROMISING DRUGS IN THE PIPELINE FOR RARE DISEASES TO SUPPORT MARKET GROWTH

TABLE 127 GLOBAL MARKET FOR GENETIC DISEASES, BY REGION, 2019–2026

TABLE 128 NORTH AMERICA: MARKET FOR GENETIC DISEASES, BY COUNTRY, 2019–2026

TABLE 129 EUROPE: MARKET FOR GENETIC DISEASES, BY COUNTRY, 2019–2026

TABLE 130 ASIA PACIFIC: MARKET FOR GENETIC DISEASES, BY COUNTRY, 2019–2026

8.8 WOMEN’S HEALTH

8.8.1 THE RISING PREVALENCE OF CHRONIC DISORDERS IN WOMEN DRIVES MARKET GROWTH

TABLE 131 CLINICAL TRIALS MARKET FOR WOMEN’S HEALTH, BY REGION, 2019–2026

TABLE 132 NORTH AMERICA: MARKET FOR WOMEN’S HEALTH, BY COUNTRY, 2019–2026

TABLE 133 EUROPE: MARKET FOR WOMEN’S HEALTH, BY COUNTRY, 2019–2026

TABLE 134 ASIA PACIFIC: MARKET FOR WOMEN’S HEALTH, BY COUNTRY, 2019–2026

8.9 OTHER THERAPY AREAS

FIGURE 33 ESTIMATED NUMBER OF INDIVIDUALS WITH DIABETES, 2000-2045 (MILLION)

TABLE 135 LIST OF PIPELINE DRUGS FOR SKIN DISEASES (2020)

TABLE 136 GLOBAL MARKET FOR OTHER THERAPY AREAS, BY REGION, 2019–2026

TABLE 137 NORTH AMERICA: MARKET FOR OTHER THERAPY AREAS, BY COUNTRY, 2019–2026

TABLE 138 EUROPE: MARKET FOR OTHER THERAPY AREAS, BY COUNTRY, 2019–2026

TABLE 139 ASIA PACIFIC: MARKET FOR OTHER THERAPY AREAS, BY COUNTRY, 2019–2026

9 CLINICAL TRIALS MARKET, BY APPLICATION (Page No. - 143)

9.1 INTRODUCTION

TABLE 140 CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

9.2 SMALL MOLECULE

9.2.1 INCREASING INVESTMENTS BY VIRTUAL AND SMALLER COMPANIES TO DRIVE SMALL MOLECULE DEVELOPMENT PROJECTS SUPPORTS THE GROWTH OF THIS SEGMENT

FIGURE 34 SMALL MOLECULE PIPELINE: NEW CHEMICAL ENTITY, 2014-2019

TABLE 141 CLINICAL TRIALS MARKET FOR SMALL MOLECULES, BY REGION, 2019–2026

TABLE 142 NORTH AMERICA: MARKET FOR SMALL MOLECULES, BY COUNTRY, 2019–2026

TABLE 143 EUROPE: MARKET FOR SMALL MOLECULES, BY COUNTRY, 2019–2026

TABLE 144 ASIA PACIFIC: CLINICAL TRIAL MARKET FOR SMALL MOLECULES, BY COUNTRY, 2019–2026

9.3 VACCINES

9.3.1 OUTBREAK OF THE COVID-19 PANDEMIC IS EXPECTED TO EMERGE AS A MARKET DISRUPTOR, IMPOSING LONG-TERM POSITIVE EFFECTS ON THE INDUSTRY OPERATIONS

FIGURE 35 COVID-19 VACCINE CANDIDATES IN CLINICAL DEVELOPMENT, BY PHASE (AS OF JANUARY 2022)

TABLE 145 MARKET FOR VACCINES, BY REGION, 2019–2026

TABLE 146 NORTH AMERICA: MARKET FOR VACCINES, BY COUNTRY, 2019–2026

TABLE 147 EUROPE: MARKET FOR VACCINES, BY COUNTRY, 2019–2026

TABLE 148 ASIA PACIFIC: MARKET FOR VACCINES, BY COUNTRY, 2019–2026

9.4 CELL & GENE THERAPY

9.4.1 THE RISING TREND OF OUTSOURCING SERVICES AND THE ONGOING EFFORTS OF SERVICE PROVIDERS TO EXPAND OFFERINGS DRIVES THE SEGMENT GROWTH

FIGURE 36 ACTIVE CLINICAL TRIALS FOR CELL & GENE THERAPY, BY INDICATION (AS OF 2020)

FIGURE 37 ACTIVE CLINICAL TRIALS FOR CELL & GENE THERAPY, BY PHASE (2020)

TABLE 149 CLINICAL TRIALS MARKET FOR CELL & GENE THERAPY, BY REGION, 2019–2026

TABLE 150 NORTH AMERICA: MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2019–2026

TABLE 151 EUROPE: MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2019–2026

TABLE 152 ASIA PACIFIC: MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2019–2026

9.5 OTHER APPLICATIONS

9.5.1 INCREASE IN R&D FOR THE DEVELOPMENT OF HORMONES AND BLOOD COMPONENTS SUPPORTS MARKET GROWTH

TABLE 153 MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2026

TABLE 154 NORTH AMERICA: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026

TABLE 155 EUROPE: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026

TABLE 156 ASIA PACIFIC: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026

10 CLINICAL TRIALS MARKET, BY REGION (Page No. - 155)

10.1 INTRODUCTION

TABLE 157 CLINICAL TRIALS MARKET, BY REGION, 2019–2026

10.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA SNAPSHOT

TABLE 158 NORTH AMERICA: CLINICAL TRIALS INDUSTRY, BY COUNTRY, 2019–2026

TABLE 159 NORTH AMERICA: MARKET, BY PHASE, 2019–2026

TABLE 160 NORTH AMERICA: CLINICAL RESEARCH SERVICES MARKET, BY SERVICE TYPE, 2019–2026

TABLE 161 NORTH AMERICA: CLINICAL RESEARCH SERVICES MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 162 NORTH AMERICA: ANALYTICAL TESTING SERVICES MARKET, BY THERAPY AREA, 2019–2026

TABLE 163 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2026

10.2.1 US

10.2.1.1 Robust clinical research activities to become a key factor supporting the US market growth

FIGURE 39 US CONTINUES TO DOMINATE THE DISTRIBUTION OF R&D COMPANIES BY REGION (2020 VS. 2019)

TABLE 164 US: CLINICAL TRIALS MARKET, BY PHASE, 2019–2026

TABLE 165 US: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 166 US: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 167 US: MARKET, BY THERAPY AREA, 2019–2026

TABLE 168 US: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

10.2.2 CANADA

10.2.2.1 Increasing number of clinical trials in Canada to support market growth

TABLE 169 CANADA: MARKET, BY PHASE, 2019–2026

TABLE 170 CANADA: CLINICAL TRIALS MARKET, BY SERVICE TYPE, 2019–2026

TABLE 171 CANADA: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 172 CANADA: MARKET, BY THERAPY AREA, 2019–2026

TABLE 173 CANADA: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

10.3 EUROPE

FIGURE 40 CLINICAL TRIALS CONDUCTED IN EUROPE SINCE 2008 (2018)

TABLE 174 EUROPE: CLINICAL TRIALS MARKET, BY COUNTRY, 2019–2026

TABLE 175 EUROPE: MARKET, BY PHASE, 2019–2026

TABLE 176 EUROPE: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 177 EUROPE: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 178 EUROPE: MARKET, BY THERAPY AREA, 2019–2026

TABLE 179 EUROPE: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

10.3.1 GERMANY

10.3.1.1 Government support and flexible labor laws have made Germany a favorable location for clinical trials

TABLE 180 GERMANY: CLINICAL TRIALS MARKET, BY PHASE, 2019–2026

TABLE 181 GERMANY: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 182 GERMANY: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 183 GERMANY: MARKET, BY THERAPY AREA, 2019–2026

TABLE 184 GERMANY: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

10.3.2 UK

10.3.2.1 Investments by pharmaceutical sponsors in the UK for drug discovery services to support market growth

FIGURE 41 UK: PHARMACEUTICAL R&D EXPENDITURE, 2013–2017

TABLE 185 UK: CLINICAL TRIALS MARKET, BY PHASE, 2019–2026

TABLE 186 UK: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 187 UK: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 188 UK: MARKET, BY THERAPY AREA, 2019–2026

TABLE 189 UK: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

10.3.3 FRANCE

10.3.3.1 High number of oncology clinical trials in France is expected to drive market growth in France

TABLE 190 FRANCE: CLINICAL TRIALS MARKET, BY PHASE, 2019–2026

TABLE 191 FRANCE: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 192 FRANCE: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 193 FRANCE: MARKET, BY THERAPY AREA, 2019–2026

TABLE 194 FRANCE: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

10.3.4 ITALY

10.3.4.1 Low drug approval times along with the growing number of clinical trials in Italy to drive market growth

TABLE 195 NUMBER OF CLINICAL TRIALS STARTED IN ITALY, BY COMPANY (JANUARY 2021)

TABLE 196 ITALY: CLINICAL TRIALS MARKET, BY PHASE, 2019–2026

TABLE 197 ITALY: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 198 ITALY: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 199 ITALY: MARKET, BY THERAPY AREA, 2019–2026

TABLE 200 ITALY: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

10.3.5 SPAIN

10.3.5.1 Rising R&D expenditure to boost market growth for clinical trials in Spain

FIGURE 42 SPAIN: PHARMACEUTICAL R&D EXPENDITURE , 2011–2017

TABLE 201 SPAIN: CLINICAL TRIALS MARKET, BY PHASE, 2019–2026

TABLE 202 SPAIN: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 203 SPAIN: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 204 SPAIN: MARKET, BY THERAPY AREA, 2019–2026

TABLE 205 SPAIN: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

10.3.6 REST OF EUROPE (ROE)

TABLE 206 ROE: CLINICAL TRIALS MARKET, BY PHASE, 2019–2026

TABLE 207 ROE: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 208 ROE: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 209 ROE: MARKET, BY THERAPY AREA, 2019–2026

TABLE 210 ROE: CLINICAL TRIALS INDUSTRY, BY MOLECULE, 2019–2026

10.4 ASIA PACIFIC (APAC)

FIGURE 43 ASIA PACIFIC SNAPSHOT

TABLE 211 ASIA PACIFIC: CLINICAL TRIALS MARKET, BY COUNTRY, 2019–2026

TABLE 212 ASIA PACIFIC: MARKET, BY PHASE, 2019–2026

TABLE 213 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 214 ASIA PACIFIC: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 215 ASIA PACIFIC: MARKET, BY THERAPY AREA, 2019–2026

TABLE 216 ASIA PACIFIC: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

10.4.1 CHINA

10.4.1.1 China dominates the clinical trials services market owing to a robust pharmaceutical industry and the presence of prominent clinical trial service providers

TABLE 217 CHINA: CLINICAL TRIALS MARKET, BY PHASE, 2019–2026

TABLE 218 CHINA: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 219 CHINA: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 220 CHINA: MARKET, BY THERAPY AREA, 2019–2026

TABLE 221 CHINA: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

10.4.2 JAPAN

10.4.2.1 Strong focus on R&D activities in Japan is expected to drive market growth

TABLE 222 TOTAL NUMBER OF CLINICAL TRIALS IN JAPAN, BY THERAPEUTIC AREA, 2017 VS. 2019

TABLE 223 JAPAN: CLINICAL TRIALS MARKET, BY PHASE, 2019–2026

TABLE 224 JAPAN: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 225 JAPAN: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 226 JAPAN: MARKET, BY THERAPY AREA, 2019–2026

TABLE 227 JAPAN: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

10.4.3 INDIA

10.4.3.1 Growing pharmaceutical industry in India to drive the market growth for clinical trials

TABLE 228 TOTAL NUMBER OF CLINICAL TRIALS IN INDIA, BY THERAPEUTIC AREA, 2017 VS. 2019

TABLE 229 INDIA: CLINICAL TRIALS MARKET, BY PHASE, 2019–2026

TABLE 230 INDIA: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 231 INDIA: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 232 INDIA: MARKET, BY THERAPY AREA, 2019–2026

TABLE 233 INDIA: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

10.4.4 REST OF ASIA PACIFIC

TABLE 234 TOTAL NUMBER OF CLINICAL TRIALS IN SINGAPORE AND MALAYSIA, BY THERAPEUTIC AREA, 2017 VS. 2019

TABLE 235 ROAPAC: CLINICAL TRIALS MARKET, BY PHASE, 2019–2026

TABLE 236 ROAPAC: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 237 ROAPAC: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 238 ROAPAC: MARKET, BY THERAPY AREA, 2019–2026

TABLE 239 ROAPAC: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

10.5 LATIN AMERICA

10.5.1 GROWING R&D EXPENDITURE IN THE PHARMACEUTICAL & BIOPHARMACEUTICAL SECTOR TO DRIVE THE MARKET GROWTH IN LATIN AMERICA

TABLE 240 LATIN AMERICA: CLINICAL TRIALS MARKET, BY PHASE, 2019–2026

TABLE 241 LATIN AMERICA: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 242 LATIN AMERICA: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 243 LATIN AMERICA: MARKET, BY THERAPY AREA, 2019–2026

TABLE 244 LATIN AMERICA: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

10.6 MIDDLE EAST & AFRICA

10.6.1 GROWING PHARMACEUTICAL INDUSTRY TO DRIVE THE MARKET GROWTH IN MIDDLE EAST & AFRICA

TABLE 245 MEA: CLINICAL TRIALS MARKET, BY PHASE, 2019–2026

TABLE 246 MEA: MARKET, BY SERVICE TYPE, 2019–2026

TABLE 247 MEA: MARKET, BY BIOANALYTICAL SERVICES, 2019–2026

TABLE 248 MEA: MARKET, BY THERAPY AREA, 2019–2026

TABLE 249 MEA: CLINICAL TRIALS INDUSTRY, BY APPLICATION, 2019–2026

11 COMPETITIVE LANDSCAPE (Page No. - 211)

11.1 INTRODUCTION

11.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

FIGURE 44 CLINICAL TRIALS MARKET: STRATEGIES ADOPTED

11.3 MARKET SHARE ANALYSIS

FIGURE 45 GLOBAL MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS (2020)

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 46 GLOBAL MARKET: COMPANY EVALUATION MATRIX, 2020

11.5 COMPETITIVE BENCHMARKING

11.5.1 COMPANY SERVICE FOOTPRINT (20 COMPANIES)

FIGURE 47 SERVICE FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE GLOBAL MARKET

11.5.2 COMPANY REGIONAL FOOTPRINT (20 COMPANIES)

FIGURE 48 REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE GLOBAL MARKET

11.6 COMPETITIVE SCENARIO AND TRENDS

11.6.1 SERVICES LAUNCHES

TABLE 250 GLOBAL MARKET: SERVICE LAUNCHES (JANUARY 2017-NOVEMBER 2020)

11.6.2 DEALS

TABLE 251 GLOBAL MARKET: DEALS (JANUARY 2017-SEPTEMBER 2021)

11.6.3 OTHER DEVELOPMENTS

TABLE 252 MARKET: EXPANSIONS (JANUARY 2017-NOVEMBER 2020)

12 COMPANY PROFILES (Page No. - 222)

12.1 KEY COMPANIES

(Business Overview, Services, Recent Developments, MnM View)*

12.1.1 IQVIA

TABLE 253 IQVIA: BUSINESS OVERVIEW

FIGURE 49 IQVIA: COMPANY SNAPSHOT

TABLE 254 IQVIA: SERVICE OFFERINGS

TABLE 255 IQVIA: SERVICE LAUNCHES

TABLE 256 IQVIA: DEALS

TABLE 257 IQVIA: OTHER DEVELOPMENTS

12.1.2 LABCORP DRUG DEVELOPMENT (COVANCE)

TABLE 258 LABCORP: BUSINESS OVERVIEW

FIGURE 50 LABCORP: COMPANY SNAPSHOT

TABLE 259 LABCORP: SERVICE OFFERINGS

TABLE 260 LABCORP: SERVICE LAUNCHES

TABLE 261 LABCORP: DEALS

TABLE 262 LABCORP: EXPANSIONS

12.1.3 SYNEOS HEALTH INC.

TABLE 263 SYNEOS HEALTH INC.: BUSINESS OVERVIEW

FIGURE 51 SYNEOS HEALTH INC.: COMPANY SNAPSHOT

TABLE 264 SYNEOS HEALTH INC.: SERVICE OFFERINGS

TABLE 265 SYNEOS HEALTH INC: SERVICE LAUNCHES

TABLE 266 SYNEOS HEALTH INC.: DEALS

12.1.4 WUXI APPTEC

TABLE 267 WUXI APPTEC: BUSINESS OVERVIEW

FIGURE 52 WUXI APPTEC: COMPANY SNAPSHOT

TABLE 268 WUXI APPTEC: SERVICE OFFERINGS

TABLE 269 WUXI APPTEC: SERVICE LAUNCHES

TABLE 270 WUXI APPTEC: DEALS

TABLE 271 WUXI APPTEC: EXPANSIONS

12.1.5 CHARLES RIVER LABORATORIES

TABLE 272 CHARLES RIVER LABORATORIES: BUSINESS OVERVIEW

FIGURE 53 CHARLES RIVER LABORATORIES: COMPANY SNAPSHOT

TABLE 273 CHARLES RIVER LABORATORIES: SERVICE OFFERINGS

TABLE 274 CHARLES RIVER LABORATORIES: DEALS

TABLE 275 CHARLES RIVER LABORATORIES: EXPANSIONS

12.1.6 PAREXEL INTERNATIONAL

TABLE 276 PAREXEL INTERNATIONAL: BUSINESS OVERVIEW

TABLE 277 PAREXEL INTERNATIONAL: SERVICE OFFERINGS

TABLE 278 PAREXEL INTERNATIONAL: SERVICE LAUNCHES

TABLE 279 PAREXEL INTERNATIONAL: DEALS

TABLE 280 PAREXEL INTERNATIONAL: EXPANSIONS

12.1.7 PRA HEALTH SCIENCES

TABLE 281 PRA HEALTH SCIENCES: BUSINESS OVERVIEW

FIGURE 54 PRA HEALTH SCIENCES: COMPANY SNAPSHOT

TABLE 282 PRA HEALTH SCIENCES: SERVICE OFFERINGS

TABLE 283 PRA HEALTH SCIENCES: SERVICE LAUNCHES

TABLE 284 PRA HEALTH SCIENCES: DEALS

TABLE 285 PRA HEALTH SCIENCES: EXPANSIONS

12.1.8 PPD INC

TABLE 286 PPD INC: BUSINESS OVERVIEW

FIGURE 55 PPD INC: COMPANY SNAPSHOT

TABLE 287 PPD INC: SERVICE OFFERINGS

TABLE 288 PPD: SERVICE LAUNCHES

TABLE 289 PPD: DEALS

TABLE 290 PPD: EXPANSIONS

12.1.9 ICON PLC

TABLE 291 ICON PLC: BUSINESS OVERVIEW

FIGURE 56 ICON PLC: COMPANY SNAPSHOT

TABLE 292 ICON PLC: SERVICE OFFERINGS

TABLE 293 ICON PLC: SERVICE LAUNCHES

TABLE 294 ICON PLC: DEALS

12.1.10 MEDPACE HOLDINGS INC

TABLE 295 MEDPACE HOLDINGS INC: BUSINESS OVERVIEW

FIGURE 57 MEDPACE HOLDINGS INC: COMPANY SNAPSHOT

TABLE 296 MEDPACE HOLDINGS INC: SERVICE OFFERINGS

TABLE 297 MEDPACE HOLDINGS INC: DEALS

TABLE 298 MEDPACE HOLDINGS INC: EXPANSION

12.1.11 ACM GLOBAL LABORATORIES

TABLE 299 ACM GLOBAL LABORATORIES: BUSINESS OVERVIEW

TABLE 300 ACM GLOBAL LABORATORIES: SERVICE OFFERINGS

12.1.12 ADVANCED CLINICAL

TABLE 301 ADVANCED CLINICAL: BUSINESS OVERVIEW

TABLE 302 ADVANCED CLINICAL: SERVICE OFFERINGS

12.1.13 SGS

TABLE 303 SGS: BUSINESS OVERVIEW

FIGURE 58 SGS: COMPANY SNAPSHOT

TABLE 304 SGS: SERVICE OFFERINGS

TABLE 305 SGS: DEALS

12.1.14 FRONTAGE HOLDINGS CORPORATION

TABLE 306 FRONTAGE HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 59 FRONTAGE HOLDINGS CORPORATION: COMPANY SNAPSHOT

TABLE 307 FRONTAGE HOLDINGS CORPORATION: SERVICE OFFERINGS

TABLE 308 FRONTAGE HOLDINGS CORPORATION: DEALS

TABLE 309 FRONTAGE HOLDINGS CORPORATION: EXPANSION

12.1.15 PSI CRO AG

TABLE 310 PSI CRO AG: BUSINESS OVERVIEW

TABLE 311 PSI CRO AG: SERVICE OFFERINGS

TABLE 312 PSI CRO AG: EXPANSIONS

12.1.16 BIO AGILE THERAPEUTICS

TABLE 313 BIO AGILE THERAPEUTICS: BUSINESS OVERVIEW

TABLE 314 BIO AGILE THERAPEUTICS: SERVICE OFFERINGS

12.2 OTHER PLAYERS

12.2.1 AZELIX

TABLE 315 AZELIX: COMPANY OVERVIEW

12.2.2 CTSERV

TABLE 316 CTSERV: COMPANY OVERVIEW

12.2.3 PEPGRA

TABLE 317 PEPGRA: COMPANY OVERVIEW

12.2.4 AXCENT ADVANCED ANALYTICS (A3)

TABLE 318 AXCENT ADVANCED ANALYTICS (A3): COMPANY OVERVIEW

12.2.5 DOVE QUALITY SOLUTIONS

TABLE 319 DOVE QUALITY SOLUTIONS: COMPANY OVERVIEW

12.2.6 FIRMA CLINICAL RESEARCH

TABLE 320 FIRMA CLINICAL RESEARCH: COMPANY OVERVIEW

12.2.7 CELERION

TABLE 321 CELERION: COMPANY OVERVIEW

12.2.8 NOVOTECH HEALTH HOLDINGS

TABLE 322 NOVOTECH HEALTH HOLDINGS: COMPANY OVERVIEW

12.2.9 GENETICIST INC.

TABLE 323 GENETICIST INC.: COMPANY OVERVIEW

12.2.10 LINICAL AMERICAS

TABLE 324 LINICAL AMERICAS: COMPANY OVERVIEW

*Details on Business Overview, Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 297)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORT

13.5 AUTHOR DETAILS

This technical, market-oriented, and financial study of the global clinical trials market involved extensive secondary sources, directories, and databases to identify and collect relevant information. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess market growth prospects. The global size of the market (estimated through various research approaches) was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Data

The secondary sources referred to for this research study include publications from government sources, such as the Association of Clinical Research Organization (ACRO), Clinical Research Society (CRS), Clinical Research Association of Canada (CRAC), Association of International Contract Research Organizations (AICROS), Clinical and Contract Research Association (CCRA), American Association of Pharmaceutical Scientists (AAPS), Eurostat, Food and Drug Administration (FDA), Pharmaceutical Research and Manufacturers of America (PhRMA), Japan CRO Association, Chinese Association for Laboratory Animal Sciences (CALAS), and Indian Society for Clinical Research. Secondary sources include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global market, which was validated through primary research.

Primary Data

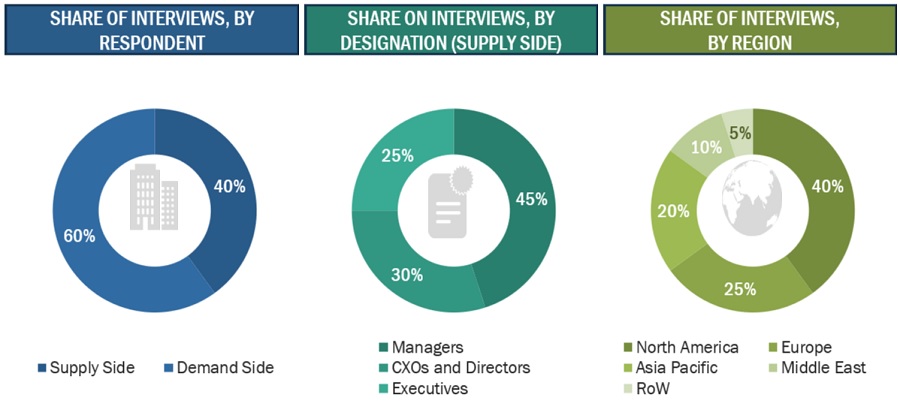

Extensive primary research was conducted after acquiring basic knowledge about the global market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (personnel from pharmaceutical & biopharmaceutical companies, medical device companies, and academic institutes) and supply-side (C-level and D-level executives, product managers, and marketing and sales managers of key manufacturers, distributors, and channel partners, among others, from tier 1 and tier 2 companies engaged in offering services) across five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Approximately 40% of primary interviews were conducted with supply-side representatives, while demand-side participants accounted for the remaining. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

Primary research was used in this report to:

- Validate the market segmentation defined through a product and service portfolio assessment of the leading players in the clinical trials market

- Understand key industry trends and issues defining the strategic growth objectives of market players

- Gather both demand- and supply-side validation of the key factors affecting the market growth (such as market drivers, challenges, and opportunities)

- Validate assumptions for the market sizing and forecasting model used for this study

- Understand the market position of leading players in the market and their market shares/rankings

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total clinical trials market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Report Objectives

- To define, describe, and forecast the global clinical trials market based on phase, service type, therapy area, application, and region.

- To provide detailed information regarding the major factors influencing the market growth (drivers, opportunities, and industry-specific challenges) along with the current trends

- To strategically analyze micromarkets with respect to their individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the revenue of market segments with respect to five major regions:

North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa - To profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments in the market, such as service launches, agreements, partnerships, collaborations, mergers & acquisitions, and research & development activities.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographical Analysis

- Further breakdown of the rest of Europe market, by country

- Further breakdown of the rest of Asia Pacific market, by country

- Further breakdown of the Latin American and Middle Eastern & African market, by country

Company Information

Detailed analysis and profiling of additional market players (up to 5) inclusive of:

- Business Overview

- Financial Information

- Product Offered

- Developments (Last three years)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Clinical Trials Market

Which segment, Based on the therapy area, accounted for the major share of the global Clinical Trials Market?

Can you share the detailed report on the geographical analysis of the global Clinical Trials Market?

Which of the global leaders holds the largest share of the global Clinical Trials Market?