Cloud Native Storage Market by Component (Solutions and Services), Deployment Mode (Public and Private), Organization Size, Vertical (BFSI, Retail & Consumer Goods, Telecommunications, IT & ITeS) and Region - Global Forecast to 2027

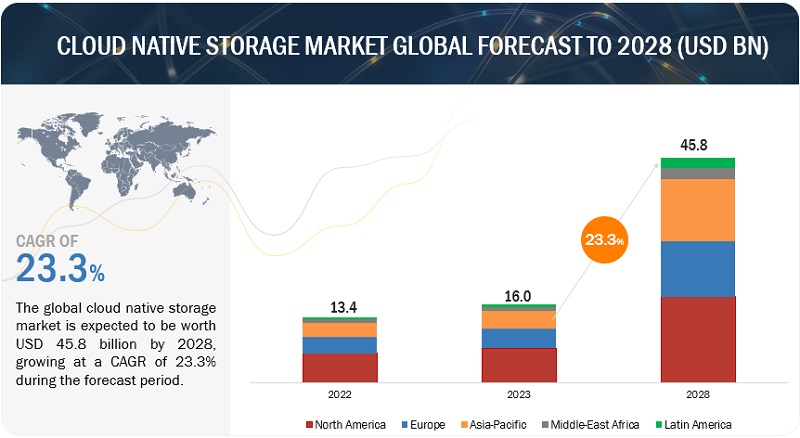

[267 Pages Report] The global cloud native storage market size to grow from USD 13.6 billion in 2022 to USD 38.5 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 23.1% during the forecast period. The major growing factor of cloud native storage market is an increase in investment of advanced technologies. The need of Kubernetes has significantly simplified the cloud infrastructure stack in terms of cloud native storage, and object storage which enables network and portable storage.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The COVID-19 led to work from home scenario, due to worldwide lockdown, this has fuelled the growth of the market. As cloud native storages offers scalability, flexibility, and reliability serviced at low cost. Businesses across regions have begun transferring their workloads, storing their data, and establishing business continuity to the cloud. As an outcome, the need for file storage solutions is expected to increase compared to the pre-COVID-19 scenario. The impact of Covid-19 is expected to result in considerably high market growth during the analysis period. As compared to pre-COVID the market is expected to growth 2.0 to 3.0 percent in 2020 and 2021, according to MarketsandMarkets analysis and data from numerous primary and secondary sources.

Market Dynamics

Driver: Automation in application updates is creating need for cloud native storage

Utilizing cloud native architecture, businesses may create automated environments for continuous testing and deployment. the implementation of system updates used to be extremely well planned out by banks every six months or so, and they would notify customers in advance of any anticipated downtime by publishing on banking websites. On the other hand, most banking and financial apps With cloud native storage would likely updated every week or even every day without the need to stop the service or warn consumers. the foundation for both the seamless update process and the in depth testing is the same technology that automates application provisioning and deployment. Working with containers and cloud native storage has many advantages, but one of the most significant is what developers refer to as a continuous deployment.

Restraint: Latency and network usage issues associated with public cloud environments

The public cloud has latency problems while storing and receiving data. when data is stored in the public cloud, one loses end-to-end network control, which when coupled with high latency can have a disruptive effect on how apps function. similar network issues on the part of the cloud native storage provider might stop storage solutions, which ultimately results in work halting and significant loses to enterprises. The failure of AWSs EC2 DNS resolutions in the Seoul are, the failure of its EC2 and EBS service in the Tokyo region, and other networking control panel congestions across the US were caused by network outstages in 2019 and June 2022, respectively. Inadequate Internet bandwidth, far-flung data centers location, add heavy network traffic are some additional causes of latency problems. Even while choosing a close by data center for data storage and high network bandwidth might help to reduce latency to some amount, the damages must be taken into consideration. In addition, a number of cloud storage companies allows users to build WAN links to help client get rid of latency problems. Customers can reduce the negative effects of latency issues on their work processes by using such innovations and preventive actions.

Opportunity: Faster recovery and data backup creating the need for cloud native storages

Cloud native storages automation and adaptability increase dependability, flexibility, and availability. Automation in cloud native storage has the benefit of being able to swiftly restore and lost data without having to stop the service if something goes wrong. Cloud native storage includes capabilities like cross-cluster disaster recovery, automatic updating, and volume encryption and enable simple introduction with the block storage to handle information. In all verticals, this is crucial. these technologies also make it easier to conduct operational audits and simplify the monitoring environments. Solutions for cloud native storage aid in scalability and swift execution of data workloads. Make it possible to set up storage boots and backups of stateful application. Organizations can automate the lifetime management of data layer components by using cloud native storage solutions. It is a complete system that makes organizations enterprise ready in addition to bringing stability and adaptability to them. it also provides compliance tools and active directory links, which is anticipated to increase demand over the course of the projected period.

Challenge: Complexity associated with cloud native concepts

The growth of Kubernetes, containers, and microservices has accelerated the adoption of cloud native technology, which is still in its infancy. Application fragmentation is encouraged by the microservices design. Applying changes is made simple by this. Deploying such components doesn't ultimately have a significant impact on the codebase. However, with the rate at which technology is developing, it has become increasingly challenging for more firm to obtain qualified IT cloud personal. Because it can be difficult to understand the fundamentals of cloud native technologies like microservices, serverless, or containers without the assistance of a cloud expert, businesses have slowed down their migration to the cloud in an effort to address this issue. In addition, unlike traditional apps where data is typically saved internally, cloud native workflows stored data externally. Developers must therefore redesign their data access and storage procedures, Which takes a lot of work during the planning phase. Therefore, the difficulties in comprehending and implementing cloud native technologies are impeding their adoption over the forecast period.

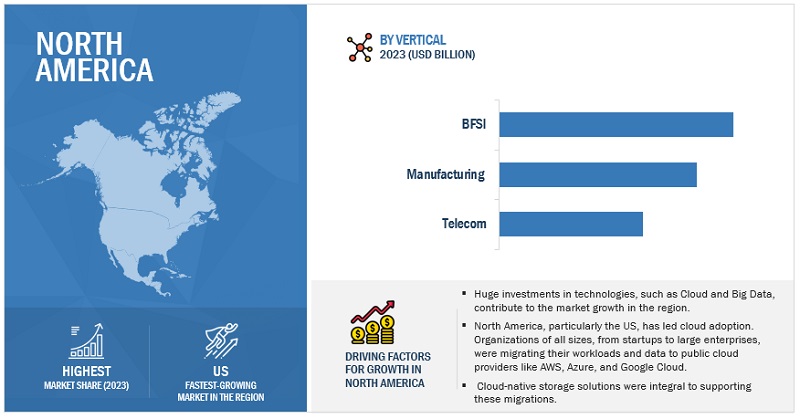

North America to account for largest market size during the forecast period

The geographic analysis of the cloud native storage market is segmented into regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. In 2022, North America has captured most of the share, as the US and Canada are rapidly adopting Cloud Native Storage. North America has the presence of top vendors, including Microsoft, IBM, AWS, and Google. The region is experiencing significant innovations in technologies.

To know about the assumptions considered for the study, download the pdf brochure

As per organization size, large enterprises segment to hold the largest market size during the forecast period

The cloud native storage market organization size segment is sub segmented into SMEs and large enterprises. As per organization size, large enterprises segment to hold largest market size during the forecast period. The adoption of cloud native storage in large enterprises is relatively higher than in SMEs. The reason for the low costs of adoption is the growth of new technologies, products, services, and solutions. This is generating demands for cloud native storage throughout SMEs and large enterprises. Being economically stable, large enterprises heavily invest in advanced technologies.

Key Market Players

Some of the major cloud native storage market vendors are Microsoft (US), IBM (US), AWS (US), Google (US), Alibaba Cloud (China), VMWare (US), Huawei (China), Citrix (US), Scality (US), Splunk (US), Linbit (US), Rackspace (US), and Robin.Io (US) among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

20172027 |

|

Base year considered |

2022 |

|

Forecast period |

20222027 |

|

Forecast units |

Million/Billion (USD) |

|

Segments covered |

Component, Organization Size, Deployment Type, Verticals, and Regions |

|

Geographies covered |

North America, Europe, APAC, Middle East & Agrica, and Latin America |

|

Companies covered |

Microsoft (US), IBM (US), AWS (US), Google (US), Alibaba Cloud (China), VMWare (US), Huawei (China), Citrix (US), Tencent Cloud (China), Scality (US), Splunk (US), Linbit (US), Rackspace (US), and Robin.Io (US), MayaData (US), Diamanti (US), Minio (US), Rook (US), Ondat (UK), Ionir (US), Trilio (US), Upcloud (Finland), Arrikto (US). |

This research report categorizes the Cloud Native Storage Market based on Component, Orgaization Size, Deployment Type, Verticals and Regions.

By Component:

- Solutions

- File Storage

- Block Storage

- Object Storage

- Services

- Consulting

- Integration and Implementation

- Training, Support and Maintenance

By Organization Size:

- Large Enterprises

- SMEs

By Deployment Type:

- Public Cloud

- Private Cloud

By Verticals:

- Banking, Financial Services, & Insurance

- Government

- Healthcare & Life Sciences

- Telecommunication

- IT & ITeS

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Retail & Consumer Goods

- Other Verticals

By Region:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- Rest of Asia Pacific

- Middle East & Africa

- Kingdom of Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2022, Alibaba Cloud unveiled a new cloud infrastructure system designed in-house to power its cloud native data centers.

- In May 2022, Microsoft Azure announced the general availability of backup for Write Accelerator-enabled disks. Azure customers widely use these disks with M-Series Virtual Machines (VMs) to improve the I/O latency of writes against Azure Premium Storage. Azure Backup has offered backup support for such disks to enrolled customers as part of the preview.

- In February 2022, IBM unveiled IBM FlashSystem Cyber Vault to help companies detect and recover quickly from ransomware and other cyberattacks. The company also announced new FlashSystem storage models based on IBM Spectrum Virtualize to provide a single and consistent operating environment designed to increase cyber resilience and application performance within a hybrid cloud environment.

- In October 2021, NetApp launched Astra Data Store, a Kubernetes-native, shared file, a unified data store for containers and VMs with advanced enterprise data management.

- In April 2021, Red Hat formed partnership with Bosten University. With this partnership RedHat would donate USD 551.9 million software subscriptions to Boston University to support the Mass Open Cloud (MOC) and other important open-source projects that make up an open research cloud program. It would benefit from different cloud native and hybrid cloud technologies such as RedHat OpenShift, OpenStack, Virtualization, and Ceph Storage.

Frequently Asked Questions (FAQ):

What is cloud native storage?

According to Ondat, the application-centric, platform-independent, API-driven, declarative and composable, agile, performant, natively secure, and always available are all characteristics of cloud native storage.

According to Seagate, An approach to creating software that is tailored for the cloud is called cloud native storage. To this end, cloud native storage is related software that was specifically created for cloud environments.

Which regions are early adopter of cloud native storage?

North America and Europe are at the initial stage towards adoption of Cloud Native Storage.

Which are key verticals adopting cloud native storage?

Key verticals adopting PIM solutions include BFSI, IT & ITeS, Telecom, Media & Entertainment, Government, Healthcare and Life Sciences, Manufacturing, Energy & Utilities, Retail & Consumer Goods, and Other Verticals, and Region.

Which are the key vendors exploring cloud native storage?

The key vendors exploring cloud native storage includes Microsoft (US), IBM (US), AWS (US), Google (US), Alibaba Cloud (China), VMWare (US), Huawei (China), Citrix (US), Scality (US), Splunk (US), Linbit (US), Rackspace (US), and Robin.Io (US) among others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 20172021

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 1 CLOUD NATIVE STORAGE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 2 CLOUD NATIVE STORAGE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING CLOUD NATIVE STORAGE SOLUTIONS AND SERVICES

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 2 (BOTTOM-UP): REVENUE OF VENDORS FROM VERTICALS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE OF CLOUD NATIVE STORAGE VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY-SIDE): CAGR PROJECTIONS FROM THE SUPPLY-SIDE

2.4 RESEARCH ASSUMPTIONS

TABLE 3 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 7 GLOBAL CLOUD NATIVE STORAGE MARKET SNAPSHOT, 20202027

FIGURE 8 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE

FIGURE 9 CLOUD NATIVE STORAGE SOLUTIONS TO BE LARGER THAN SERVICES DURING FORECAST PERIOD

FIGURE 10 LARGE ENTERPRISES TO BE THE LARGER MARKET DURING FORECAST PERIOD

FIGURE 11 PUBLIC CLOUD TO BE LARGER THAN PRIVATE CLOUD DURING FORECAST PERIOD

FIGURE 12 TOP VERTICALS IN THE MARKET, 20222027 (USD MILLION)

FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN CLOUD NATIVE STORAGE MARKET

FIGURE 14 DRASTIC GEOGRAPHIC CHANGE AND TECHNOLOGICAL EVOLUTION TO DRIVE CLOUD NATIVE STORAGE GROWTH

4.2 MARKET, BY COMPONENT

FIGURE 15 CLOUD NATIVE SOLUTIONS TO DOMINATE DURING FORECAST PERIOD

4.3 MARKET, BY ORGANIZATION SIZE

FIGURE 16 LARGE ENTERPRISES TO BE LARGER MARKET DURING FORECAST PERIOD

4.4 MARKET, BY DEPLOYMENT MODE

FIGURE 17 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET, BY VERTICAL

FIGURE 18 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO GROW AT A HIGHER RATE DURING FORECAST PERIOD

4.6 MARKET INVESTMENT SCENARIO

FIGURE 19 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CLOUD NATIVE STORAGE MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in data volume across enterprises

5.2.1.2 Ease of switching from on-premises to cloud native storage

5.2.1.3 Increase in automation in application updates

5.2.2 RESTRAINTS

5.2.2.1 Loss of data due to persistent data storing

5.2.2.2 Latency and network outage issues associated with public cloud environments

5.2.3 OPPORTUNITIES

5.2.3.1 Need for faster recovery and data backup

5.2.3.2 Proliferation of Kubernetes and containerization

5.2.4 CHALLENGES

5.2.4.1 Complexity associated with cloud native concepts

5.3 COVID-19 IMPACT ANALYSIS ON THE CLOUD NATIVE STORAGE MARKET

TABLE 4 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN THE COVID-19 ERA

TABLE 5 CUMULATIVE GROWTH ANALYSIS

5.4 CASE STUDY ANALYSIS

5.4.1 CASE STUDY 1: TRILIO ENABLED CSI-PIEMONTE TO OFFER NATIVE DATA PROTECTION AND MANAGEMENT SERVICES TO ITS CLIENTS

5.4.2 CASE STUDY 2: ROBIN.IO ENABLED MNO TO ACCELERATE DEPLOYMENT OF 5G SERVICES

5.4.3 CASE STUDY 3: ARISTA USES MAYADATAS OPENEBS WITH KUBERNETES TO SIMPLIFY DEVELOPERS RESPONSIBILITIES

5.4.4 CASE STUDY 4: MILLENNIUM SELECTED PORTWORX FOR A RELIABLE, FLEXIBLE STORAGE FOUNDATION

5.4.5 CASE STUDY 5: BIRDZ IMPROVED PERFORMANCE THROUGH CLOUD STORAGE

5.5 ECOSYSTEM

FIGURE 21 ECOSYSTEM: CLOUD NATIVE STORAGE MARKET

TABLE 6 CLOUD STORAGE: ECOSYSTEM

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 22 SUPPLY CHAIN: MARKET

5.7 PRICING ANALYSIS

5.7.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SOLUTION

TABLE 7 MARKET: OBJECT AND BLOCK STORAGE AVERAGE PRICING LEVELS

TABLE 8 MARKET: FILE HOSTING CLOUD STORAGE PRICING LEVELS

5.7.2 AVERAGE SELLING PRICE TRENDS

TABLE 9 CLOUD NATIVE STORAGE MARKET: PRICING LEVELS

5.8 PATENT ANALYSIS

FIGURE 23 NUMBER OF PATENTS PUBLISHED, 20122021

FIGURE 24 TOP TEN PATENT OWNERS, 2021

TABLE 10 TOP PATENT OWNERS

TABLE 11 PATENTS HELD BY KEY VENDORS

5.9 TECHNOLOGY ANALYSIS

5.9.1 ARTIFICIAL INTELLIGENCE

5.9.2 CONTAINERIZATION

5.10 REGULATORY LANDSCAPE

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

5.10.3 GENERAL DATA PROTECTION REGULATION

5.10.4 SEC RULE 17A-4

5.10.5 ISO/IEC 27001

5.10.6 SYSTEM AND ORGANIZATION CONTROLS 2 TYPE II COMPLIANCE

5.10.7 FINANCIAL INDUSTRY REGULATORY AUTHORITY

5.10.8 FREEDOM OF INFORMATION ACT

5.10.9 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.11 KEY CONFERENCES AND EVENTS

TABLE 16 CLOUD NATIVE STORAGE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2022

5.12 PORTERS FIVE FORCES ANALYSIS

FIGURE 25 PORTERS FIVE FORCES ANALYSIS: MARKET

TABLE 17 PORTERS FIVE FORCES ANALYSIS: MARKET

5.12.1 THREAT FROM NEW ENTRANTS

5.12.2 THREAT FROM SUBSTITUTES

5.12.3 BARGAINING POWER OF SUPPLIERS

5.12.4 BARGAINING POWER OF BUYERS

5.12.5 DEGREE OF COMPETITION

5.13 KEY STAKEHOLDERS & BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP VERTICALS

TABLE 18 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP VERTICALS

5.13.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

TABLE 19 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

5.14 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 28 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

6 CLOUD NATIVE STORAGE MARKET, BY COMPONENT (Page No. - 89)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

FIGURE 29 CLOUD NATIVE STORAGE SOLUTIONS TO BE LARGER MARKET IN 2022

TABLE 20 MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 21 MARKET, BY COMPONENT, 20222027 (USD MILLION)

6.2 SOLUTIONS

FIGURE 30 BLOCK STORAGE TO ACCOUNT FOR LARGEST SOLUTIONS MARKET IN 2022

TABLE 22 CLOUD NATIVE STORAGE SOLUTIONS MARKET, BY TYPE, 20172021 (USD MILLION)

TABLE 23 CLOUD NATIVE STORAGE SOLUTIONS MARKET, BY TYPE, 20222027 (USD MILLION)

6.2.1 OBJECT STORAGE

TABLE 24 CLOUD OBJECT STORAGE MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 25 CLOUD OBJECT STORAGE MARKET, BY REGION, 20222027 (USD MILLION)

6.2.2 BLOCK STORAGE

TABLE 26 CLOUD BLOCK STORAGE MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 27 CLOUD BLOCK STORAGE MARKET, BY REGION, 20222027 (USD MILLION)

6.2.3 FILE STORAGE

TABLE 28 CLOUD FILE STORAGE MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 29 CLOUD FILE STORAGE MARKET, BY REGION, 20222027 (USD MILLION)

6.3 SERVICES

TABLE 30 CLOUD NATIVE STORAGE SERVICES MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 31 CLOUD NATIVE STORAGE SERVICES MARKET, BY REGION, 20222027 (USD MILLION)

6.3.1 CONSULTING

6.3.2 INTEGRATION & IMPLEMENTATION

6.3.3 TRAINING, SUPPORT, AND MAINTENANCE

7 CLOUD NATIVE STORAGE MARKET, BY ORGANIZATION SIZE (Page No. - 97)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

7.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 31 LARGE ENTERPRISES TO ACCOUNT FOR LARGER MARKET IN 2022

TABLE 32 MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 33 MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

7.2 SMALL & MEDIUM-SIZED ENTERPRISES

TABLE 34 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 35 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 20222027 (USD MILLION)

7.3 LARGE ENTERPRISES

TABLE 36 LARGE ENTERPRISES MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 37 LARGE ENTERPRISES MARKET, BY REGION, 20222027 (USD MILLION)

8 CLOUD NATIVE STORAGE MARKET, BY DEPLOYMENT TYPE (Page No. - 101)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

8.1.2 DEPLOYMENT TYPE: COVID-19 IMPACT

FIGURE 32 PUBLIC CLOUD DEPLOYMENT TO HAVE LARGER MARKET SIZE IN 2022

TABLE 38 MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 39 MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

8.2 PUBLIC CLOUD

TABLE 40 PUBLIC MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 41 PUBLIC MARKET, BY REGION, 20222027 (USD MILLION)

8.3 PRIVATE CLOUD

TABLE 42 PRIVATE MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 43 PRIVATE MARKET, BY REGION, 20222027 (USD MILLION)

9 CLOUD NATIVE STORAGE MARKET, BY VERTICAL (Page No. - 106)

9.1 INTRODUCTION

9.1.1 VERTICAL: MARKET DRIVERS

9.1.2 VERTICAL: COVID-19 IMPACT

FIGURE 33 RETAIL & CONSUMER GOODS TO BE FASTEST-GROWING DURING FORECAST PERIOD

TABLE 44 MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 45 MARKET, BY VERTICAL, 20222027 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, & INSURANCE

TABLE 46 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 47 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL MARKET, BY REGION, 20222027 (USD MILLION)

9.3 TELECOMMUNICATIONS

TABLE 48 TELECOMMUNICATIONS VERTICAL MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 49 TELECOMMUNICATIONS VERTICAL MARKET, BY REGION, 20222027 (USD MILLION)

9.4 RETAIL & CONSUMER GOODS

TABLE 50 RETAIL & CONSUMER GOODS VERTICAL MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 51 RETAIL & CONSUMER GOODS VERTICAL MARKET, BY REGION, 20222027 (USD MILLION)

9.5 IT & ITES

TABLE 52 IT & ITES VERTICAL MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 53 IT & ITES VERTICAL MARKET, BY REGION, 20222027 (USD MILLION)

9.6 HEALTHCARE & LIFE SCIENCES

TABLE 54 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 55 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 20222027 (USD MILLION)

9.7 MANUFACTURING

TABLE 56 MANUFACTURING VERTICAL MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 57 MANUFACTURING VERTICALS MARKET, BY REGION, 20222027 (USD MILLION)

9.8 MEDIA & ENTERTAINMENT

TABLE 58 MEDIA & ENTERTAINMENT VERTICAL MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 59 MEDIA & ENTERTAINMENT VERTICAL MARKET, BY REGION, 20222027 (USD MILLION)

9.9 GOVERNMENT & PUBLIC SECTOR

TABLE 60 GOVERNMENT & PUBLIC SECTOR VERTICAL MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 61 GOVERNMENT & PUBLIC SECTOR VERTICAL MARKET, BY REGION, 20222027 (USD MILLION)

9.10 ENERGY & UTILITIES

TABLE 62 ENERGY & UTILITIES VERTICAL MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 63 ENERGY & UTILITIES VERTICAL MARKET, BY REGION, 20222027 (USD MILLION)

9.11 OTHER VERTICALS

TABLE 64 OTHER VERTICALS MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 65 OTHER VERTICALS MARKET, BY REGION, 20222027 (USD MILLION)

10 CLOUD NATIVE STORAGE MARKET, BY REGION (Page No. - 119)

10.1 INTRODUCTION

FIGURE 34 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 66 MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 67 MARKET, BY REGION, 20222027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATIONS

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 68 NORTH AMERICA: CLOUD NATIVE STORAGE MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 70 NORTH AMERICA: CLOUD NATIVE STORAGE SOLUTIONS MARKET, BY TYPE, 20172021 (USD MILLION)

TABLE 71 NORTH AMERICA: CLOUD NATIVE STORAGE SOLUTIONS MARKET, BY TYPE, 20222027 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY COUNTRY, 20172021 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

10.2.4 US

TABLE 80 US: CLOUD NATIVE STORAGE MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 81 US: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 82 US: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 83 US: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.2.5 CANADA

TABLE 84 CANADA: MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 85 CANADA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 86 CANADA: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 87 CANADA: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATIONS

TABLE 88 EUROPE: CLOUD NATIVE STORAGE MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 90 EUROPE: CLOUD NATIVE STORAGE SOLUTIONS MARKET, BY TYPE, 20172021 (USD MILLION)

TABLE 91 EUROPE: CLOUD NATIVE STORAGE SOLUTIONS MARKET, BY TYPE, 20222027 (USD MILLION)

TABLE 92 EUROPE: CLOUD NATIVE STORAGE MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY COUNTRY, 20172021 (USD MILLION)

TABLE 99 EUROPE: MARKET, BY COUNTRY, 20222027 (USD MILLION)

10.3.4 UK

TABLE 100 UK: CLOUD NATIVE STORAGE MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 101 UK: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 102 UK: AGE MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 103 UK: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.3.5 GERMANY

TABLE 104 GERMANY: MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 105 GERMANY: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 106 GERMANY: ORAGE MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 107 GERMANY: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.3.6 FRANCE

TABLE 108 FRANCE: CLOUD NATIVE STORAGE MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 109 FRANCE: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 110 FRANCE: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 111 FRANCE: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.3.7 REST OF EUROPE

TABLE 112 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 113 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 114 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 115 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 116 ASIA PACIFIC: CLOUD NATIVE STORAGE MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 118 ASIA PACIFIC: CLOUD NATIVE STORAGE SOLUTIONS MARKET, BY TYPE, 20172021 (USD MILLION)

TABLE 119 ASIA PACIFIC: CLOUD NATIVE STORAGE SOLUTIONS MARKET, BY TYPE, 20222027 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY COUNTRY/REGION, 20172021 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY COUNTRY, 20222027 (USD MILLION)

10.4.3 CHINA

TABLE 128 CHINA: CLOUD NATIVE STORAGE MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 129 CHINA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 130 CHINA: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 131 CHINA: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.4.4 JAPAN

TABLE 132 JAPAN: MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 133 JAPAN: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 134 JAPAN: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 135 JAPAN: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.4.5 AUSTRALIA & NEW ZEALAND

TABLE 136 AUSTRALIA & NEW ZEALAND: CLOUD NATIVE STORAGE MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 137 AUSTRALIA & NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 138 AUSTRALIA & NEW ZEALAND: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 139 AUSTRALIA & NEW ZEALAND: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 140 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 141 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 142 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 143 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

TABLE 144 MIDDLE EAST & AFRICA: CLOUD NATIVE STORAGE MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: CLOUD NATIVE STORAGE SOLUTIONS MARKET, BY TYPE, 20172021 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: CLOUD NATIVE STORAGE SOLUTIONS MARKET, BY TYPE, 20222027 (USD MILLION)

TABLE 148 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 149 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 154 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 20172021 (USD MILLION)

TABLE 155 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

10.5.3 KINGDOM OF SAUDI ARABIA

TABLE 156 KINGDOM OF SAUDI ARABIA: CLOUD NATIVE STORAGE MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 157 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 158 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 159 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.5.4 SOUTH AFRICA

TABLE 160 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 161 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 162 SOUTH AFRICA: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 163 SOUTH AFRICA: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.5.5 UAE

TABLE 164 UAE: CLOUD NATIVE STORAGE MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 165 UAE: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 166 UAE: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 167 UAE: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.5.6 REST OF THE MIDDLE EAST & AFRICA

TABLE 168 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 169 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 170 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 171 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 LATIN AMERICA: REGULATIONS

TABLE 172 LATIN AMERICA: CLOUD NATIVE STORAGE MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 174 LATIN AMERICA: CLOUD NATIVE STORAGE SOLUTIONS MARKET, BY TYPE, 20172021 (USD MILLION)

TABLE 175 LATIN AMERICA: CLOUD NATIVE STORAGE SOLUTIONS MARKET, BY TYPE, 20222027 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 177 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 181 LATIN AMERICA: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET, BY COUNTRY, 20172021 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

10.6.4 BRAZIL

TABLE 184 BRAZIL: CLOUD NATIVE STORAGE MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 185 BRAZIL: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 186 BRAZIL: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 187 BRAZIL: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.6.5 MEXICO

TABLE 188 MEXICO: MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 189 MEXICO: LOUD NATIVE STORAGE MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 190 MEXICO: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 191 MEXICO: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

10.6.6 REST OF LATIN AMERICA

TABLE 192 REST OF LATIN AMERICA: CLOUD NATIVE STORAGE MARKET, BY ORGANIZATION SIZE, 20172021 (USD MILLION)

TABLE 193 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 194 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 20172021 (USD MILLION)

TABLE 195 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 20222027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 168)

11.1 INTRODUCTION

FIGURE 37 MARKET EVALUATION FRAMEWORK

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

11.3 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 38 HISTORICAL REVENUE ANALYSIS, 20172021 (USD MILLION)

11.4 KEY COMPANY EVALUATION QUADRANT

FIGURE 39 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 40 CLOUD NATIVE STORAGE MARKET (GLOBAL): KEY COMPANY EVALUATION QUADRANT

11.4.5 KEY PLAYER COMPETITIVE BENCHMARKING

TABLE 196 COMPANY COMPONENT FOOTPRINT

TABLE 197 COMPANY REGION FOOTPRINT

TABLE 198 COMPANY FOOTPRINT

11.5 STARTUP/SME EVALUATION QUADRANT

FIGURE 41 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.5.1 RESPONSIVE VENDORS

11.5.2 PROGRESSIVE VENDORS

11.5.3 DYNAMIC VENDORS

11.5.4 STARTING BLOCKS

FIGURE 42 STARTUP EVALUATION MATRIX, ENTERPRISE PERFORMANCE MANAGEMENT MARKET

TABLE 199 COMPANY COMPONENT FOOTPRINT (SMES)

TABLE 200 COMPANY REGION FOOTPRINT (SMES)

TABLE 201 COMPANY FOOTPRINT (SMES)

11.5.5 STARTUP/SME COMPETITIVE BENCHMARKING

TABLE 202 CLOUD NATIVE STORAGE MARKET: DETAILED LIST OF KEY STARTUP/SMES

11.6 COMPETITIVE SCENARIO

TABLE 203 MARKET: NEW LAUNCHES, 20192022

TABLE 204 MARKET: DEALS, 20192022

12 COMPANY PROFILES (Page No. - 184)

12.1 INTRODUCTION

12.2 MAJOR PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, COVID-19 developments, MnM view, Key strengths/right to win, Strategic choices made, Weaknesses and competitive threats)*

12.2.1 MICROSOFT

TABLE 205 MICROSOFT: BUSINESS OVERVIEW

FIGURE 43 MICROSOFT: COMPANY SNAPSHOT

TABLE 206 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 207 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 208 MICROSOFT: DEALS

12.2.2 IBM

TABLE 209 IBM: BUSINESS OVERVIEW

FIGURE 44 IBM: COMPANY SNAPSHOT

TABLE 210 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 211 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 212 IBM: DEALS

12.2.3 AWS

TABLE 213 AWS: BUSINESS OVERVIEW

FIGURE 45 AWS: COMPANY SNAPSHOT

TABLE 214 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 215 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

12.2.4 GOOGLE

TABLE 216 GOOGLE: BUSINESS OVERVIEW

FIGURE 46 GOOGLE: COMPANY SNAPSHOT

TABLE 217 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 218 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 219 GOOGLE: DEALS

12.2.5 ALIBABA CLOUD

TABLE 220 ALIBABA CLOUD: BUSINESS OVERVIEW

FIGURE 47 ALIBABA CLOUD: COMPANY SNAPSHOT

TABLE 221 ALIBABA CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 222 ALIBABA CLOUD: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 223 ALIBABA CLOUD: DEALS

12.2.6 HEWLETT PACKARD ENTERPRISE

TABLE 224 HPE: BUSINESS OVERVIEW

FIGURE 48 HPE: COMPANY SNAPSHOT

TABLE 225 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 226 HPE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 227 HPE: DEALS

12.2.7 DELL TECHNOLOGIES

TABLE 228 DELL TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 49 DELL TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 229 DELL TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 230 DELL TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 231 DELL TECHNOLOGIES: DEALS

12.2.8 NETAPP

TABLE 232 NETAPP: BUSINESS OVERVIEW

FIGURE 50 NETAPP: COMPANY SNAPSHOT

TABLE 233 NETAPP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 234 NETAPP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 235 NETAPP: DEALS

12.2.9 PURE STORAGE

TABLE 236 PURE STORAGE: BUSINESS OVERVIEW

FIGURE 51 PURE STORAGE: COMPANY SNAPSHOT

TABLE 237 PURE STORAGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 238 PURE STORAGE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 239 PURE STORAGE: DEALS

12.2.10 SUSE

TABLE 240 SUSE: BUSINESS OVERVIEW

FIGURE 52 SUSE: COMPANY SNAPSHOT

TABLE 241 SUSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 242 SUSE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 243 SUSE: DEALS

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, COVID-19 developments, MnM view, Key strengths/right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12.3 OTHER PLAYERS

12.3.1 VMWARE

12.3.2 ORACLE

12.3.3 HUAWEI

12.3.4 CITRIX

12.3.5 TENCENT CLOUD

12.3.6 SCALITY

12.3.7 SPLUNK

12.3.8 LINBIT

12.3.9 RACKSPACE

12.4 STARTUP/SME PLAYERS

12.4.1 ROBIN.IO

12.4.2 MAYADATA

12.4.3 DIAMANTI

12.4.4 MINIO

12.4.5 ROOK

12.4.6 ONDAT

12.4.7 IONIR

12.4.8 TRILIO

12.4.9 UPCLOUD

12.4.10 ARRIKTO

13 ADJACENT MARKET (Page No. - 245)

13.1 INTRODUCTION

13.1.1 RELATED MARKETS

TABLE 244 RELATED MARKETS

13.1.2 LIMITATIONS

13.2 CLOUD COMPUTING MARKET

13.2.1 INTRODUCTION

13.2.2 CLOUD COMPUTING MARKET, BY SERVICE MODEL

TABLE 245 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 20152020 (USD BILLION)

TABLE 246 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 20212026 (USD BILLION)

13.2.2.1 Infrastructure-as-a-Service

TABLE 247 INFRASTRUCTURE-AS-A-SERVICE: CLOUD COMPUTING MARKET, BY REGION, 20152020 (USD BILLION)

TABLE 248 INFRASTRUCTURE-AS-A-SERVICE: CLOUD COMPUTING MARKET, BY REGION, 20212026 (USD BILLION)

13.2.2.2 Platform-as-a-Service

TABLE 249 PLATFORM-AS-A-SERVICE: CLOUD COMPUTING MARKET, BY REGION, 20152020 (USD BILLION)

TABLE 250 PLATFORM-AS-A-SERVICE: CLOUD COMPUTING MARKET, BY REGION, 20212026 (USD BILLION)

13.2.2.3 Software-as-a-Service

TABLE 251 SOFTWARE-AS-A-SERVICE: CLOUD COMPUTING MARKET, BY REGION, 20152020 (USD BILLION)

TABLE 252 SOFTWARE-AS-A-SERVICE: CLOUD COMPUTING MARKET, BY REGION, 20212026 (USD BILLION)

13.2.3 CLOUD COMPUTING MARKET, BY VERTICAL

TABLE 253 CLOUD COMPUTING MARKET, BY VERTICAL, 20152020 (USD BILLION)

TABLE 254 CLOUD COMPUTING MARKET, BY VERTICAL, 20212026 (USD BILLION)

13.2.3.1 Banking, financial services, and insurance

TABLE 255 BANKING, FINANCIAL SERVICES, AND INSURANCE: CLOUD COMPUTING MARKET, BY REGION, 20152020 (USD BILLION)

TABLE 256 BANKING, FINANCIAL SERVICES, AND INSURANCE: CLOUD COMPUTING MARKET, BY REGION, 20212026 (USD BILLION)

13.2.3.2 Telecommunications

TABLE 257 TELECOMMUNICATIONS: CLOUD COMPUTING MARKET, BY REGION, 20152020 (USD BILLION)

TABLE 258 TELECOMMUNICATIONS: CLOUD COMPUTING MARKET, BY REGION, 20212026 (USD BILLION)

13.2.3.3 IT & ITeS

TABLE 259 IT & ITES: CLOUD COMPUTING MARKET, BY REGION, 20152020 (USD BILLION)

TABLE 260 IT & ITES: CLOUD COMPUTING MARKET, BY REGION, 20212026 (USD BILLION)

13.2.3.4 Government & public sector

TABLE 261 GOVERNMENT & PUBLIC SECTOR: CLOUD COMPUTING MARKET, BY REGION, 20152020 (USD BILLION)

TABLE 262 GOVERNMENT & PUBLIC SECTOR: CLOUD COMPUTING MARKET, BY REGION, 20212026 (USD BILLION)

13.2.3.5 Retail & consumer goods

TABLE 263 RETAIL & CONSUMER GOODS: CLOUD COMPUTING MARKET, BY REGION, 20152020 (USD BILLION)

TABLE 264 RETAIL & CONSUMER GOODS: CLOUD COMPUTING MARKET, BY REGION, 20212026 (USD BILLION)

13.2.3.6 Manufacturing

TABLE 265 MANUFACTURING: CLOUD COMPUTING MARKET, BY REGION, 20152020 (USD BILLION)

TABLE 266 MANUFACTURING: CLOUD COMPUTING MARKET, BY REGION, 20212026 (USD BILLION)

13.2.3.7 Energy & utilities

TABLE 267 ENERGY & UTILITIES: CLOUD COMPUTING MARKET, BY REGION, 20152020 (USD BILLION)

TABLE 268 ENERGY & UTILITIES: CLOUD COMPUTING MARKET, BY REGION, 20212026 (USD BILLION)

13.2.3.8 Media & entertainment

TABLE 269 MEDIA & ENTERTAINMENT: CLOUD COMPUTING MARKET, BY REGION, 20152020 (USD BILLION)

TABLE 270 MEDIA & ENTERTAINMENT: CLOUD COMPUTING MARKET, BY REGION, 20212026 (USD BILLION)

13.2.3.9 Healthcare & life sciences

TABLE 271 HEALTHCARE & LIFE SCIENCES: CLOUD COMPUTING MARKET, BY REGION, 20152020 (USD BILLION)

TABLE 272 HEALTHCARE & LIFE SCIENCES: CLOUD COMPUTING MARKET, BY REGION, 20212026 (USD BILLION)

13.2.3.10 Others

TABLE 273 OTHERS: CLOUD COMPUTING MARKET, BY REGION, 20152020 (USD BILLION)

TABLE 274 OTHERS: CLOUD COMPUTING MARKET, BY REGION, 20212026 (USD BILLION)

13.3 CLOUD STORAGE MARKET

13.3.1 INTRODUCTION

TABLE 275 CLOUD STORAGE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 276 CLOUD STORAGE MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 277 CLOUD STORAGE MARKET, BY APPLICATION, 20182021 (USD MILLION)

TABLE 278 CLOUD STORAGE MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 279 CLOUD STORAGE MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 280 CLOUD STORAGE MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 281 CLOUD STORAGE MARKET, BY VERTICAL, 20182021 (USD MILLION)

TABLE 282 CLOUD STORAGE MARKET, BY VERTICAL, 20222027 (USD MILLION)

14 APPENDIX (Page No. - 260)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 APPENDIX

The study involved four major activities in estimating the size for cloud native storage market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, and whitepapers; certified publications; and articles from recognized associations and government publishing sources, such as the Cloud Native Computing Foundation (CNCF), Kubernetes and Cloud Native Associate (KCNA), Storage Networking Industry Association (SNIA) and Distributed Management Task Force (DMTF).

Secondary research was mainly used to obtain key information about the industrys value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the cloud native storage market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing cloud native storage offerings; associated service providers; and SIs operating in the targeted countries. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To make the estimates and forecasts for the cloud native storage market and other dependent submarkets, both top-down and bottom-up approaches were used. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of the other individual markets via percentage splits of the market segments.

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the BFSI, government & public sector, healthcare & life sciences, telecommunications, IT & ITeS, manufacturing, energy & utilities, retail & consumer goods, media & entertainment, and other verticals. Others include education, and travel & hospitality.

Report Objectives

- To describe and forecast the cloud native storage market based on components (solutions and services), deployment types, organization size, verticals, and regions

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape of the major players

- To comprehensively analyze the core competencies of the key players in the market

- To assess the impact of COVID-19 on the cloud native storage market

- To track and analyze the competitive developments, such as product/solution launches and enhancements, business expansions, acquisitions, partnerships, contracts, and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American digital map market

- Further breakup of the European digital map market

- Further breakup of the Asia Pacific digital map market

- Further breakup of the Latin American digital map market

- Further breakup of the Middle East & Africa digital map market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Native Storage Market