Cloud Storage Market by Component (Solutions and Services), Application (Primary Storage, Backup and Disaster Recovery, and Archiving), Deployment Type (Public and Private Cloud), Organization Size, Vertical and Region - Global Forecast to 2027

Updated on : April 25, 2023

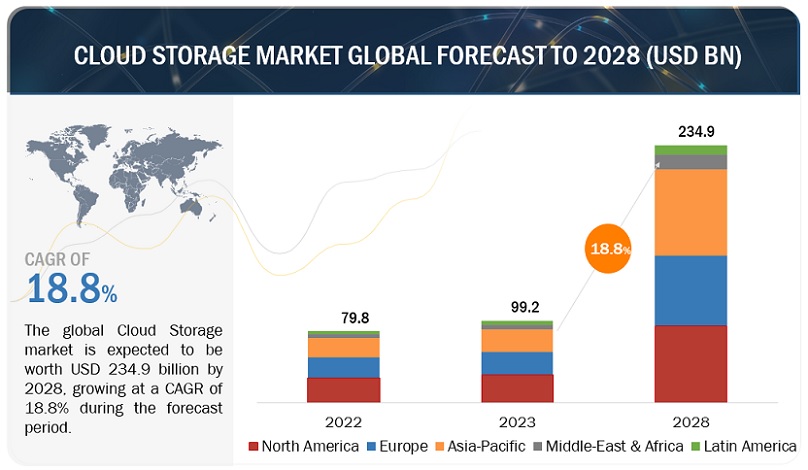

The global Cloud Storage Market size was valued at USD 78.6 billion in 2022 and it is projected to reach USD 183.7 billion by the end of 2027, growing at a CAGR of 18.5% during the forecast period.

The cloud storage market experienced a spike in cloud computing services and applications across regions, owing to surge in the volume of unstructured data, regular advanced and customized demand for advanced technologies such as IoT, analytics, AI, ML, automation, among others. Rising AI technology infusion and video analytics are catalysts for this market. Ease of sharing data and collaboration, enterprises equipped to have back-up and hold larger volumes of data for longer duration, scalability, agility, durability, accessibility, are few more driving forces that leverage cloud storage adoption, hence its growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID -19 Impact

With global lockdowns imposed, business continuity challenges, and rapidly increasing work from home trends, COVID-19 has forced organizations to move to cloud environments to cope-up with the crisis thereby facilitating daily data access, sharing, and work collaboration among geographically dispersed teams. Organizations have noticed an emerging need for cloud, cloud-based solutions and services, thereby embracing dynamic paradigm, cloud-based operating models are primed for increased competitiveness, especially in the current rapidly changing business environment, resulted especially as an effect of the pandemic outbreak. Only providers with robust and abundant architecture, infrastructure, advanced technological acumen in practice that deliver an uninterrupted customer/client experience will be able to manage the increased load which is highly dynamic in nature.

Market Dynamics

Driver: Growth in data volume demands cloud storage implementation and usability

The COVID-19 outbreak has led to a rise in the work from home culture. Companies must ensure business continuity, support increasing workloads, and facilitate better collaboration. With the exponential increase in the volume and variety of data and the growing number of data sprawl and data silos, enterprises face several data management and storage issues, majorly after remote workforce shift. The increase in data storage has led to the need for handling data effectively. The 2022 Data Storage Trends report released by EnterpriseForum has stated numerous emerging trends, such as multi-cloud, hybrid cloud, data silo management, consolidating database operations, growth of SaaS, and the emergence of flexible infrastructure and elastic services. Hence, organizations are increasingly moving toward the various cloud environments for their storage requirements as they enable the storage of large data sets irrespective of the data type.

Restraint: Lifetime storage and surge in costs associated with public cloud environments

Data across enterprises is exponentially increasing, owing to which companies are increasingly moving towards cloud infrastructure for storing their data. The fact that the data must be stored and accessed forever cannot be ignored. This brings about the problem of lifetime costs associated with efficiently storing and managing data. The upfront cost might appear less, but over a period, the rise in data volumes might require organizations to pay more in the future to keep the data in the cloud. This increasing data may also give rise to networking costs and latency issues in the case of retrievals. Most cloud storage vendors charge for the outbound bandwidth, with which regular access to the stored data and files might add up to the cloud storage costs.

Opportunity: Infusion of AI in order to achieve data integrity

While choosing cloud storage solutions mostly with the bulk data that has emerged due to remote workforce shift and enterprises shifting to cloud largely, companies look for AI and Machine Learning (ML) capabilities in the solutions. AI helps companies segment data based on its type, removing redundancy, filtering, and consolidating the data to solve data integrity issues. Moreover, several cloud storage vendors infused AI and ML algorithms in their solutions to help their customers solve data quality issues before moving to the cloud or in the cloud.

Challenge: Data privacy and security concerns

DDoS (Distributed Denial of Service) among other attacks seriously impact the availability of resources in cloud, owing to which most of the organizations that make use of public cloud storage solutions are worried about the privacy and security of their data. However, with a little Research and Development (R&D) on the Service-Level Agreements (SLAs) of the cloud storage vendors, companies can avoid data security breaches by identifying the general protections offered by vendors. Thus, companies can assess the security arrangements in cloud storage solutions in terms of maintaining compliance with important regulations, with several government associations, regulatory bodies, licensed authorities, such as ISO (International Organization for Standardization)/IEC (International Electrotechnical Commission) 9001 and 27001/27002/27017/20018 and adherence to industry regulations, such as Health Insurance Portability and Accountability Act (HIPPA), System and Organization Control (SOC) 1, 2, and 3, and Payment Card Industry Data Security Standard (PCI DSS), whichever applicable. In addition, by considering other regional regulations, such as Protection and Electronic Documents Act (PIPEDA), General Data Protection Regulation (GDPR), European Union (EU)-US Privacy Data Shield, Australian Privacy Principles (APPs), may further help to ensure that the data security is not breached.

Backup and disaster recovery segment to grow at the highest CAGR during the forecast period

Backup and disaster recovery applications protect enterprise application data during disasters. They enable customers and enterprises to store and run their systems on the cloud, reduce costs, accelerate the recovery process, and free up resources for other important tasks. These solutions are gaining popularity as they are more reliable and save enterprises the task of maintaining the costly hardware infrastructure needed for backup and disaster recovery. The use of mock drill platforms for disaster recovery enables the addition of resources that can be deployed online in the event of a disaster; this further reduces the recovery time after a major failure. The benefits offered by disaster recovery and backup solutions include data synchronization, online viewing, and easy accessibility.

Government and public sector vertical to grow exponentially during the forecast period

Organizations within the public sector are moving toward digitalization and adopting cloud-based technologies to improve service delivery and boost efficiency. Therefore, the government vertical anticipates significant opportunities for the growth of the cloud storage market because it provides efficient ways for the government and public sector to store and retrieve highly flexible and scalable services. Government organizations are implementing cloud storage solutions to store rising data volumes generated by publicly deployed equipment for surveillance and monitoring. Federal, central, and local government agencies are adopting cloud storage solutions to reduce costs and increase agility.

To know about the assumptions considered for the study, download the pdf brochure

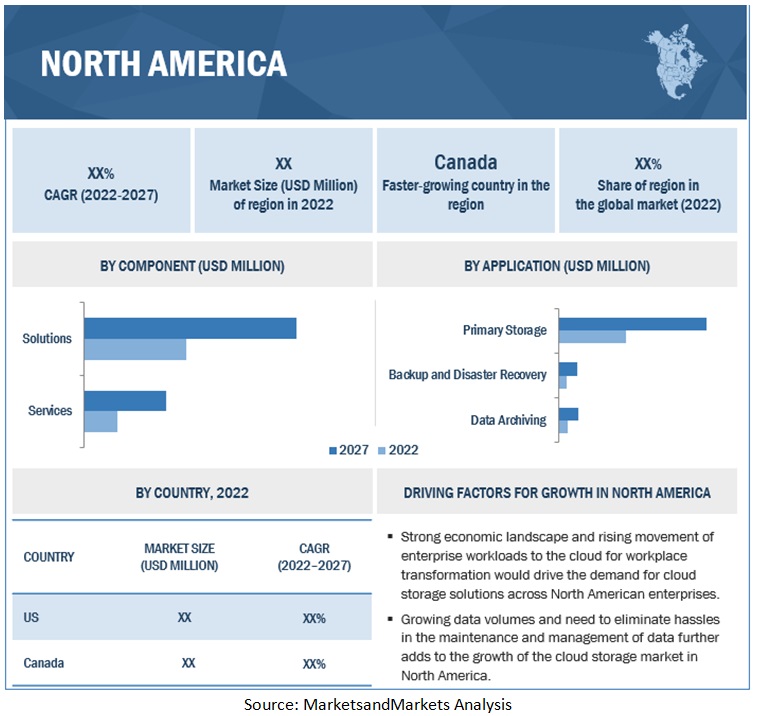

North America to hold the largest market share during the forecast period

The North American cloud storage market is already mature for cloud storage solutions as several small and large companies have moved their workload to the cloud. Factors such as organizations shifting towards cloud services, latest innovations in storage solutions offered by vendors both large-sized and SMEs, significant investment in this market, and the increasing adoption of digital business strategies are expected to drive the adoption of cloud storage offerings in North America. Enterprises are increasing the budget allocation for cloud storage solutions and services, favoring the growth of the cloud storage market in North America. The US and Canada are the top North American countries expected to contribute to the cloud storage market. The US government has developed the authoritarian body FedRAMP to provide a standardized approach to security assessment, authorization, and continuous monitoring of cloud products and services. Many leading vendors have also made their cloud storage solutions compliant with FedRAMP and other regional regulations, including SOC1 and 2 and HIPPA. As a major economy, the US holds significant market shares in the region, due to technological advancements and willingness to adopt innovations and new technologies. Moreover, large number of pureplay vendors operating out of this region providing solutions and services also contribute towards the region’s highest market share. And hence, North America is one among the leading markets when it comes to contemporary cloud-based solutions, services, in the global market.

Market Players:

Market players profiled in this report include AWS (US), Google (US), Microsoft (US), IBM (US), Alibaba Cloud (China), Oracle (US), Rackspace Technology (US), HPE (US), Dell Technologies (US), Dropbox (US), Box (US), Tencent Cloud (China), Fujitsu (Japan), VMware (US), Huawei (China), NetApp (US), Hitachi Vantara (US), Scality (US), Citrix (US), UpCloud (Finland), DigitalOcean (US), Vultr (US), MinIO (US), Zadara (US), pCloud (Switzerland), Wasabi (US), Sync (Canada), and Degoo (Sweden). These players offer various cloud storage solutions to cater to the demands and needs of the market. Major growth strategies adopted by the players include partnerships, business expansions, and new product launches/product enhancements.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 78.6 Billion |

|

Revenue forecast in 2027 |

USD 183.7 Billion |

|

Growth rate |

CAGR of 18.5% |

|

Segments covered |

Component, Application, Organization Size, Deployment Type, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

AWS (US), Google (US), Microsoft (US), IBM (US), Alibaba Cloud (China), Oracle (US), Rackspace Technology (US), HPE (US), Dell Technologies (US), Dropbox (US), Box (US), Tencent Cloud (China), Fujitsu (Japan) and many more. |

The research report categorizes the cloud storage market to forecast revenues and analyze trends in each of the following submarkets:

By component:

-

Solutions

- Object Storage

- Block Storage

- File Storage

-

Services

- Consulting

- Integration and Implementation

- Training, Support, and Maintenance

- Managed Services

By application:

- Primary Storage

- Backup and Disaster Recovery

- Archiving

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By vertical:

- BFSI

- IT and ITeS

- Telecommunications

- Healthcare and Life Sciences

- Media and Entertainment

- Consumer Goods and Retail

- Manufacturing

- Government and Public Sector

- Energy and Utilities

- Others (Education, and Travel and Hospitality)

By region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- Australia and New Zealand (ANZ)

- Japan

- China

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia (KSA)

- South Africa

- United Arab Emirates (UAE)

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In May 2022, Oracle announced the expansion of Oracle Infrastructure Cloud services' security services and capabilities to help customers protect data and cloud applications from growing threats.

- In May 2022, Object replication by Microsoft enhanced the offering which now supports premium block blobs to replicate data from clients’ blob container in one storage account to another anywhere in Azure (Azure blobs). The destination storage account can be a premium block blob or a general-purpose v2 storage account.

- In April 2022, Amazon (AWS) EFS integrated the new and improved launch experience on the EC2 Console. The user can now automatically attach Amazon EFS file systems to new Amazon EC2 instances created from the Configure storage section of the new and improved instance launch experience, making it simpler and easier to use serverless and elastic file storage with their EC2 instances.

Frequently Asked Questions (FAQ):

What is the projected market value of the global cloud storage market?

The global market for cloud storage is projected to reach USD 183.7 billion.

What is the estimated growth rate (CAGR) of the global cloud storage market for the next five years?

The global cloud storage market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% from 2022 to 2027.

What are the major revenue pockets in the cloud storage market currently?

The North American cloud storage market is already mature for cloud storage solutions as several small and large companies have moved their workload to the cloud. Factors such as organizations shifting towards cloud services, latest innovations in storage solutions offered by vendors both large-sized and SMEs, significant investment in this market, and the increasing adoption of digital business strategies are expected to drive the adoption of cloud storage offerings in North America. Enterprises are increasing the budget allocation for cloud storage solutions and services, favoring the growth of the cloud storage market in North America. The US and Canada are the top North American countries expected to contribute to the cloud storage market. The US government has developed the authoritarian body FedRAMP to provide a standardized approach to security assessment, authorization, and continuous monitoring of cloud products and services. Many leading vendors have also made their cloud storage solutions compliant with FedRAMP and other regional regulations, including SOC1 and 2 and HIPPA. As a major economy, the US holds significant market shares in the region, due to technological advancements and willingness to adopt innovations and new technologies. Moreover, large number of pureplay vendors operating out of this region providing solutions and services also contribute towards the region’s highest market share. And hence, North America is one among the leading markets when it comes to contemporary cloud-based solutions, services, in the global market.

What are the major factors for the growth of the cloud storage market in North America?

Factors, such as presence of a huge number of cloud storage solution providers and the rising inclination of enterprises towards cloud services to achieve business continuity drives the demand for cloud storage solutions in North America.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 CLOUD STORAGE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 2 CLOUD STORAGE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY–APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING CLOUD STORAGE SOLUTIONS AND SERVICES

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY–APPROACH 2 (BOTTOM-UP): REVENUE OF VENDORS FROM VERTICALS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE OF CLOUD STORAGE VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: CAGR PROJECTIONS FROM THE SUPPLY-SIDE

2.4 COMPANY EVALUATION MATRIX RESEARCH METHODOLOGY

FIGURE 7 CLOUD STORAGE COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.5 RESEARCH ASSUMPTIONS

TABLE 3 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 8 CLOUD STORAGE MARKET: GLOBAL SNAPSHOT

FIGURE 9 HIGH GROWTH SEGMENTS IN THE MARKET

FIGURE 10 FILE STORAGE SOLUTIONS SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SIZE BY 2027

FIGURE 11 TOP VERTICALS IN THE MARKET, 2022 VS. 2027

FIGURE 12 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CLOUD STORAGE MARKET

FIGURE 13 DEMAND FOR RESILIENT INFRASTRUCTURE TO ELIMINATE SYSTEM OUTAGES AND INCREASE SERVICE UPTIME TO DRIVE THE MARKET

4.2 MARKET, BY APPLICATION, 2022 VS. 2027

FIGURE 14 ENTERPRISE PLANNING AND BUDGETING SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2027

4.3 MARKET, BY DEPLOYMENT TYPE, 2022

FIGURE 15 PUBLIC CLOUD SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE

4.4 MARKET, BY ORGANIZATION SIZE, 2022

FIGURE 16 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE

4.5 MARKET, BY VERTICAL, 2022 VS. 2027

FIGURE 17 BFSI VERTICAL TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2027

4.6 MARKET: REGIONAL SCENARIO, 2022–2027

FIGURE 18 MIDDLE EAST AND AFRICA TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

4.7 CLOUD STORAGE MARKET: MAJOR COUNTRIES

FIGURE 19 MARKET IN UNITED ARAB EMIRATES TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CLOUD STORAGE MARKET

5.2.1 DRIVERS

5.2.1.1 Growing data volumes across enterprises

5.2.1.2 Increasing need to provide remote workforce with ubiquitous access to data and files

5.2.1.3 Cost saving and low TCO benefits

5.2.2 RESTRAINTS

5.2.2.1 Lifetime storage and egress costs associated with public cloud environments

5.2.2.2 Latency and network outage issues associated with public cloud environments

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of distributed storage arrays

5.2.3.2 Infusion of AI to achieve data integrity

5.2.3.3 Rise of containerization

5.2.4 CHALLENGES

5.2.4.1 Data privacy and security concerns

5.3 COVID-19 IMPACT ANALYSIS ON THE CLOUD STORAGE MARKET

TABLE 4 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN THE COVID-19 ERA

TABLE 5 CUMULATIVE GROWTH ANALYSIS

5.4 CASE STUDY ANALYSIS

5.4.1 CASE STUDY 1: IMPROVED PERFORMANCE THROUGH CLOUD STORAGE

5.4.2 CASE STUDY 2: DEPLOYING CLOUD STORAGE TO IMPROVE MANAGEABILITY OF HIGH-RESOLUTION IMAGERIES

5.4.3 CASE STUDY 3: SUPPORTING CONTINUOUS AVAILABILITY AT A LOW TOTAL COST OF OWNERSHIP

5.5 ECOSYSTEM

FIGURE 21 ECOSYSTEM: MARKET

TABLE 6 CLOUD STORAGE: ECOSYSTEM

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 22 SUPPLY CHAIN: MARKET

5.7 PRICING ANALYSIS

TABLE 7 CLOUD STORAGE MARKET: OBJECT AND BLOCK STORAGE PRICING LEVELS

TABLE 8 MARKET: FILE HOSTING CLOUD STORAGE PRICING LEVELS

5.8 PATENT ANALYSIS

FIGURE 23 NUMBER OF PATENTS PUBLISHED, 2011-2021

FIGURE 24 TOP FIVE PATENT OWNERS (GLOBAL)

TABLE 9 TOP PATENT OWNERS (US)

TABLE 10 PATENTS HELD BY KEY VENDORS

5.9 TECHNOLOGY ANALYSIS

5.9.1 ARTIFICIAL INTELLIGENCE

5.9.2 CONTAINERIZATION

5.10 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

5.10.1 TECHNOLOGY STANDARDS

5.10.1.1 International Organization for Standardization 9001 Quality Management

5.10.1.2 International Organization for Standardization/International Electrotechnical Commission 27000 Standards

5.10.1.3 Cloud security alliance controls

5.10.1.4 Distributed management task force—cloud infrastructure management interface

5.10.1.5 Storage networking industry association—cloud data management interface

5.10.2 INDUSTRY STANDARDS

5.10.2.1 Health Insurance Portability and Accountability Act

5.10.2.2 Payment Card Industry Data Security Standard

6 CLOUD STORAGE MARKET, BY COMPONENT (Page No. - 65)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

FIGURE 25 SOLUTIONS SEGMENT TO HAVE A LARGER MARKET SIZE IN 2022

TABLE 11 MARKET SIZE, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 12 MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

FIGURE 26 FILE STORAGE SEGMENT TO HAVE THE LARGEST MARKET SIZE IN 2022

TABLE 13 MARKET SIZE, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 14 MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 15 SOLUTIONS: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 16 SOLUTIONS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.2.1 OBJECT STORAGE

TABLE 17 OBJECT STORAGE: CLOUD STORAGE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 18 OBJECT STORAGE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.2.2 BLOCK STORAGE

TABLE 19 BLOCK STORAGE: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 BLOCK STORAGE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.2.3 FILE STORAGE

TABLE 21 FILE STORAGE: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 FILE STORAGE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

TABLE 23 SERVICES: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3.1 CONSULTING

6.3.2 INTEGRATION AND IMPLEMENTATION

6.3.3 TRAINING, SUPPORT, AND MAINTENANCE

7 CLOUD STORAGE MARKET, BY APPLICATION (Page No. - 74)

7.1 INTRODUCTION

7.1.1 APPLICATION: MARKET DRIVERS

7.1.2 APPLICATION: COVID-19 IMPACT

FIGURE 27 PRIMARY STORAGE SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 25 MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 26 MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 PRIMARY STORAGE

TABLE 27 PRIMARY STORAGE: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 PRIMARY STORAGE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3 BACKUP AND DISASTER RECOVERY

TABLE 29 BACKUP AND DISASTER RECOVERY: CLOUD STORAGE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 BACKUP AND DISASTER RECOVERY: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4 ARCHIVING

TABLE 31 ARCHIVING: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 ARCHIVING: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 CLOUD STORAGE MARKET, BY ORGANIZATION SIZE (Page No. - 80)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 28 LARGE ENTERPRISES SEGMENT TO HAVE A LARGER MARKET SIZE IN 2022

TABLE 33 MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 34 MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 35 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

TABLE 37 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 CLOUD STORAGE MARKET, BY DEPLOYMENT TYPE (Page No. - 85)

9.1 INTRODUCTION

9.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

9.1.2 DEPLOYMENT TYPE: COVID-19 IMPACT

FIGURE 29 PUBLIC CLOUD SEGMENT TO A HAVE LARGER MARKET SIZE IN 2022

TABLE 39 MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 40 MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

9.2 PUBLIC CLOUD

TABLE 41 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3 PRIVATE CLOUD

TABLE 43 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10 CLOUD STORAGE MARKET, BY VERTICAL (Page No. - 90)

10.1 INTRODUCTION

10.1.1 VERTICAL: MARKET DRIVERS

10.1.2 VERTICAL: COVID-19 IMPACT

FIGURE 30 REAL ESTATE VERTICAL TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 45 MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 46 MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 47 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.3 IT AND INFORMATION TECHNOLOGY-ENABLED SERVICES

TABLE 49 IT AND ITES: CLOUD STORAGE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 IT AND ITES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.4 TELECOMMUNICATIONS

TABLE 51 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.5 HEALTHCARE AND LIFE SCIENCES

TABLE 53 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.6 MEDIA AND ENTERTAINMENT

TABLE 55 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.7 CONSUMER GOODS AND RETAIL

TABLE 57 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.8 MANUFACTURING

TABLE 59 MANUFACTURING: CLOUD STORAGE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 MANUFACTURING: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.9 GOVERNMENT AND PUBLIC SECTOR

TABLE 61 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.10 ENERGY AND UTILITIES

TABLE 63 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.11 OTHER VERTICALS

TABLE 65 OTHER VERTICALS: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 OTHER VERTICALS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11 CLOUD STORAGE MARKET, BY REGION (Page No. - 104)

11.1 INTRODUCTION

FIGURE 31 MIDDLE EAST AND AFRICA TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

TABLE 67 MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: COVID-19 IMPACT

11.2.2 NORTH AMERICA: MARKET DRIVERS

11.2.3 NORTH AMERICA: REGULATIONS

FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

TABLE 69 NORTH AMERICA: CLOUD STORAGE MARKET SIZE, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

FIGURE 33 NORTH AMERICA: COUNTRY ANALYSIS

11.2.4 UNITED STATES

TABLE 83 UNITED STATES: CLOUD STORAGE MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 84 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 85 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 86 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.2.5 CANADA

TABLE 87 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 88 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 89 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 90 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: COVID-19 IMPACT

11.3.2 EUROPE: CLOUD STORAGE MARKET DRIVERS

11.3.3 EUROPE: REGULATIONS

TABLE 91 EUROPE: MARKET SIZE, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

FIGURE 34 EUROPE: COUNTRY ANALYSIS

11.3.4 UNITED KINGDOM

TABLE 105 UNITED KINGDOM: CLOUD STORAGE MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 106 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 107 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 108 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.3.5 GERMANY

TABLE 109 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 110 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 111 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 112 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.3.6 FRANCE

TABLE 113 FRANCE: CLOUD STORAGE MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 114 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 115 FRANCE: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 116 FRANCE: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 117 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 118 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 119 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 120 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: COVID-19 IMPACT

11.4.2 ASIA PACIFIC: MARKET DRIVERS

11.4.3 ASIA PACIFIC: REGULATIONS

TABLE 121 ASIA PACIFIC: CLOUD STORAGE MARKET SIZE, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 130 ASIA PACIFIC: CLOUD STORAGE MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.4 AUSTRALIA AND NEW ZEALAND

TABLE 135 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 136 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 137 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 138 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.4.5 JAPAN

TABLE 139 JAPAN: CLOUD STORAGE MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 140 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 141 JAPAN: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 142 JAPAN: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.4.6 CHINA

TABLE 143 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 144 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 145 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 146 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 147 REST OF ASIA PACIFIC: CLOUD STORAGE MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 148 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 149 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 150 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.2 MIDDLE EAST AND AFRICA: MARKET DRIVERS

11.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

FIGURE 35 MIDDLE EAST AND AFRICA: REGIONAL SNAPSHOT

TABLE 151 MIDDLE EAST AND AFRICA: CLOUD STORAGE MARKET SIZE, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 152 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 153 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 154 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 158 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 159 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA: CLOUD STORAGE MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.4 KINGDOM OF SAUDI ARABIA

TABLE 165 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 166 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 167 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 168 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.5.5 SOUTH AFRICA

TABLE 169 SOUTH AFRICA: CLOUD STORAGE MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 170 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 171 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 172 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.5.6 UNITED ARAB EMIRATES

TABLE 173 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 174 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 175 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 176 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.5.7 REST OF MIDDLE EAST AND AFRICA

TABLE 177 REST OF MIDDLE EAST AND AFRICA: CLOUD STORAGE MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 178 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 179 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 180 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: COVID-19 IMPACT

11.6.2 LATIN AMERICA: MARKET DRIVERS

11.6.3 LATIN AMERICA: REGULATIONS

TABLE 181 LATIN AMERICA: CLOUD STORAGE MARKET SIZE, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 190 LATIN AMERICA: CLOUD STORAGE MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.4 BRAZIL

TABLE 195 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 196 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 197 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 198 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.6.5 MEXICO

TABLE 199 MEXICO: CLOUD STORAGE MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 200 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 201 MEXICO: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 202 MEXICO: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11.6.6 REST OF LATIN AMERICA

TABLE 203 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 204 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 205 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 206 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 158)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 36 MARKET EVALUATION FRAMEWORK

12.3 MARKET SHARE OF TOP PLAYERS

FIGURE 37 MARKET SHARE OF MAJOR PLAYERS IN THE CLOUD STORAGE MARKET, 2021

12.4 HISTORIC REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 38 HISTORIC REVENUE ANALYSIS OF TOP PLAYERS

12.5 KEY MARKET DEVELOPMENTS

12.5.1 PRODUCT/SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 207 PRODUCT/SOLUTION LAUNCHES AND ENHANCEMENTS, 2019–2022

12.5.2 BUSINESS EXPANSIONS

TABLE 208 BUSINESS EXPANSIONS, 2019–2022

12.5.3 ACQUISITIONS

TABLE 209 ACQUISITIONS, 2019–2022

12.5.4 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 210 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2019-2022

12.6 COMPANY EVALUATION QUADRANT

12.6.1 DEFINITIONS AND METHODOLOGY

TABLE 211 COMPANY EVALUATION QUADRANT: CRITERIA

12.6.2 STARS

12.6.3 EMERGING LEADERS

12.6.4 PERVASIVE PLAYERS

12.6.5 PARTICIPANTS

TABLE 212 GLOBAL COMPANY FOOTPRINT

TABLE 213 COMPANY COMPONENT FOOTPRINT

TABLE 214 COMPANY VERTICAL FOOTPRINT (1/2)

TABLE 215 COMPANY VERTICAL FOOTPRINT (2/2)

TABLE 216 COMPANY REGION FOOTPRINT

FIGURE 39 CLOUD STORAGE MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

12.7 SME EVALUATION QUADRANT, 2021

TABLE 217 SME COMPANY EVALUATION QUADRANT: CRITERIA

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 40 CLOUD STORAGE (STARTUP): COMPANY EVALUATION QUADRANT, 2021

12.8 COMPETITIVE BENCHMARKING

TABLE 218 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 219 CLOUD STORAGE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES] (1/2)

TABLE 220 ENTERPRISE PERFORMANCE MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES] (2/2)

13 COMPANY PROFILES (Page No. - 178)

13.1 INTRODUCTION

13.2 KEY COMPANIES

(Business Overview, Solutions, Products & Services, Recent Developments, MnM View)*

13.2.1 AWS

TABLE 221 AWS: BUSINESS OVERVIEW

FIGURE 41 AWS: COMPANY SNAPSHOT

TABLE 222 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 223 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

13.2.2 IBM

TABLE 224 IBM: BUSINESS OVERVIEW

FIGURE 42 IBM: COMPANY SNAPSHOT

TABLE 225 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 226 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

13.2.3 GOOGLE

TABLE 227 GOOGLE: BUSINESS OVERVIEW

FIGURE 43 GOOGLE: COMPANY SNAPSHOT

TABLE 228 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 229 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 230 GOOGLE: DEALS

13.2.4 MICROSOFT

TABLE 231 MICROSOFT: BUSINESS OVERVIEW

FIGURE 44 MICROSOFT: COMPANY SNAPSHOT

TABLE 232 MICROSOFT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 233 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 234 MICROSOFT: DEALS

13.2.5 ALIBABA CLOUD

TABLE 235 ALIBABA CLOUD: BUSINESS OVERVIEW

FIGURE 45 ALIBABA CLOUD: COMPANY SNAPSHOT

TABLE 236 ALIBABA CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 237 ALIBABA CLOUD: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 238 ALIBABA CLOUD: DEALS

13.2.6 ORACLE

TABLE 239 ORACLE: BUSINESS OVERVIEW

FIGURE 46 ORACLE: COMPANY SNAPSHOT

TABLE 240 GOOGLE: SOLUTIONS OFFERED

TABLE 241 ORACLE: PRODUCT LAUNCHES

TABLE 242 ORACLE: DEALS

13.2.7 RACKSPACE TECHNOLOGY

TABLE 243 RACKSPACE TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 47 RACKSPACE: COMPANY SNAPSHOT

TABLE 244 RACKSPACE TECHNOLOGY: SOLUTIONS/SERVICES OFFERED

TABLE 245 RACKSPACE TECHNOLOGY: PRODUCT LAUNCHES AND EXPANSIONS

TABLE 246 RACKSPACE TECHNOLOGY: DEALS

13.2.8 HEWLETT PACKARD ENTERPRISE

TABLE 247 HPE: BUSINESS OVERVIEW

FIGURE 48 HPE: COMPANY SNAPSHOT

TABLE 248 HPE: SERVICES OFFERED

TABLE 249 HPE: CLOUD STORAGE MARKET: SERVICE LAUNCHES & BUSINESS EXPANSIONS

TABLE 250 HPE: MARKET: DEALS

13.2.9 DELL TECHNOLOGIES

TABLE 251 DELL TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 49 DELL TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 252 DELL TECHNOLOGIES: SERVICES & SOLUTIONS OFFERED

TABLE 253 DELL TECHNOLOGIES: MARKET: SERVICE LAUNCHES & BUSINESS EXPANSIONS

TABLE 254 DELL TECHNOLOGIES: MARKET: DEALS

*Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

13.3 OTHER COMPANIES

13.3.1 HUAWEI

13.3.2 DROPBOX

13.3.3 BOX

13.3.4 TENCENT CLOUD

13.3.5 FUJITSU

13.3.6 VMWARE

13.3.7 NETAPP

13.3.8 HITACHI VANTARA

13.3.9 SCALITY

13.3.10 CITRIX

13.3.11 UPCLOUD

13.3.12 DIGITALOCEAN

13.3.13 VULTR

13.3.14 MINIO

13.3.15 ZADARA

13.3.16 PCLOUD

13.3.17 WASABI

13.3.18 SYNC

13.3.19 DEGOO

14 ADJACENT MARKET (Page No. - 233)

14.1 INTRODUCTION

14.1.1 RELATED MARKETS

TABLE 255 RELATED MARKETS

14.1.2 LIMITATIONS

14.2 CLOUD COMPUTING MARKET

14.2.1 INTRODUCTION

14.2.2 CLOUD COMPUTING MARKET, BY SERVICE MODEL

TABLE 256 CLOUD COMPUTING MARKET SIZE, BY SERVICE MODEL, 2015–2020 (USD BILLION)

TABLE 257 CLOUD COMPUTING MARKET SIZE, BY SERVICE MODEL, 2021–2026 (USD BILLION)

14.2.2.1 Infrastructure as a service

TABLE 258 INFRASTRUCTURE AS A SERVICE: CLOUD COMPUTING MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 259 INFRASTRUCTURE AS A SERVICE: CLOUD COMPUTING MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

14.2.2.2 Platform as a service

TABLE 260 PLATFORM AS A SERVICE: CLOUD COMPUTING MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 261 PLATFORM AS A SERVICE: CLOUD COMPUTING MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

14.2.2.3 Software as a service

TABLE 262 SOFTWARE AS A SERVICE: CLOUD COMPUTING MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 263 SOFTWARE AS A SERVICE: CLOUD COMPUTING MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

14.2.3 CLOUD COMPUTING MARKET, BY VERTICAL

TABLE 264 CLOUD COMPUTING MARKET SIZE, BY VERTICAL, 2015–2020 (USD BILLION)

TABLE 265 CLOUD COMPUTING MARKET SIZE, BY VERTICAL, 2021–2026 (USD BILLION)

14.2.3.1 Banking, financial services, and insurance

TABLE 266 BANKING, FINANCIAL SERVICES, AND INSURANCE: CLOUD COMPUTING MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 267 BANKING, FINANCIAL SERVICES, AND INSURANCE: CLOUD COMPUTING MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

14.2.3.2 Telecommunications

TABLE 268 TELECOMMUNICATIONS: CLOUD COMPUTING MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 269 TELECOMMUNICATIONS: CLOUD COMPUTING MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

14.2.3.3 IT and ITeS

TABLE 270 IT AND ITES: CLOUD COMPUTING MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 271 IT AND ITES: CLOUD COMPUTING MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

14.2.3.4 Government and public sector

TABLE 272 GOVERNMENT AND PUBLIC SECTOR: CLOUD COMPUTING MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 273 GOVERNMENT AND PUBLIC SECTOR: CLOUD COMPUTING MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

14.2.3.5 Retail and consumer goods

TABLE 274 RETAIL AND CONSUMER GOODS: CLOUD COMPUTING MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 275 RETAIL AND CONSUMER GOODS: CLOUD COMPUTING MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

14.2.3.6 Manufacturing

TABLE 276 MANUFACTURING: CLOUD COMPUTING MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 277 MANUFACTURING: CLOUD COMPUTING MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

14.2.3.7 Energy and utilities

TABLE 278 ENERGY AND UTILITIES: CLOUD COMPUTING MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 279 ENERGY AND UTILITIES: CLOUD COMPUTING MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

14.2.3.8 Media and entertainment

TABLE 280 MEDIA AND ENTERTAINMENT: CLOUD COMPUTING MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 281 MEDIA AND ENTERTAINMENT: CLOUD COMPUTING MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

14.2.3.9 Healthcare and life sciences

TABLE 282 HEALTHCARE AND LIFE SCIENCES: CLOUD COMPUTING MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 283 HEALTHCARE AND LIFE SCIENCES: CLOUD COMPUTING MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

14.2.3.10 Others

TABLE 284 OTHERS: CLOUD COMPUTING MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 285 OTHERS: CLOUD COMPUTING MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

15 APPENDIX (Page No. - 246)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the cloud storage market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the cloud storage market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, and articles by recognized authors, industry standard organizations and associations, such as Cloud Security Alliance (CSA) and Distributed Management Task Force (DMTF), trade directories, and databases.

Primary Research

The cloud storage market comprises several stakeholders, such as cloud storage providers, Cloud Service Providers (CSP), System Integrators (SIs), Managed Service Providers (MSPs), professional service providers, resellers and distributors, government and research organizations, enterprise users, venture capitalists, private equity firms, and startup companies. The demand side of the cloud storage market consists of organizations from different verticals, such as Banking, Financial Services and Insurance (BFSI), Information Technology (IT) and Information Technology enabled Services (ITeS), telecommunications, government and public sector, healthcare and life sciences, consumer goods and retail, manufacturing, media and entertainment, energy and utilities and others (education, and travel and hospitality). The supply-side includes cloud storage providers, offering cloud storage solutions and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cloud storage market. The methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the cloud storage market based on components (solutions and services), applications, deployment types, organization size, verticals, and regions

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape of the major players

- To comprehensively analyze the core competencies of the key players in the market

- To track and analyze the competitive developments, such as product/solution launches and enhancements, business expansions, acquisitions, and partnerships, contracts and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle East & Africa market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Storage Market