Collaborative Robot Market share by Component, Payload (Up to 5 Kg, 5-10 Kg, and Above 10 Kg), Application (Handling, Processing), Industry (Automotive, Electronics, Healthcare, Furniture & Equipment) and Geography - Global Forecast to 2028

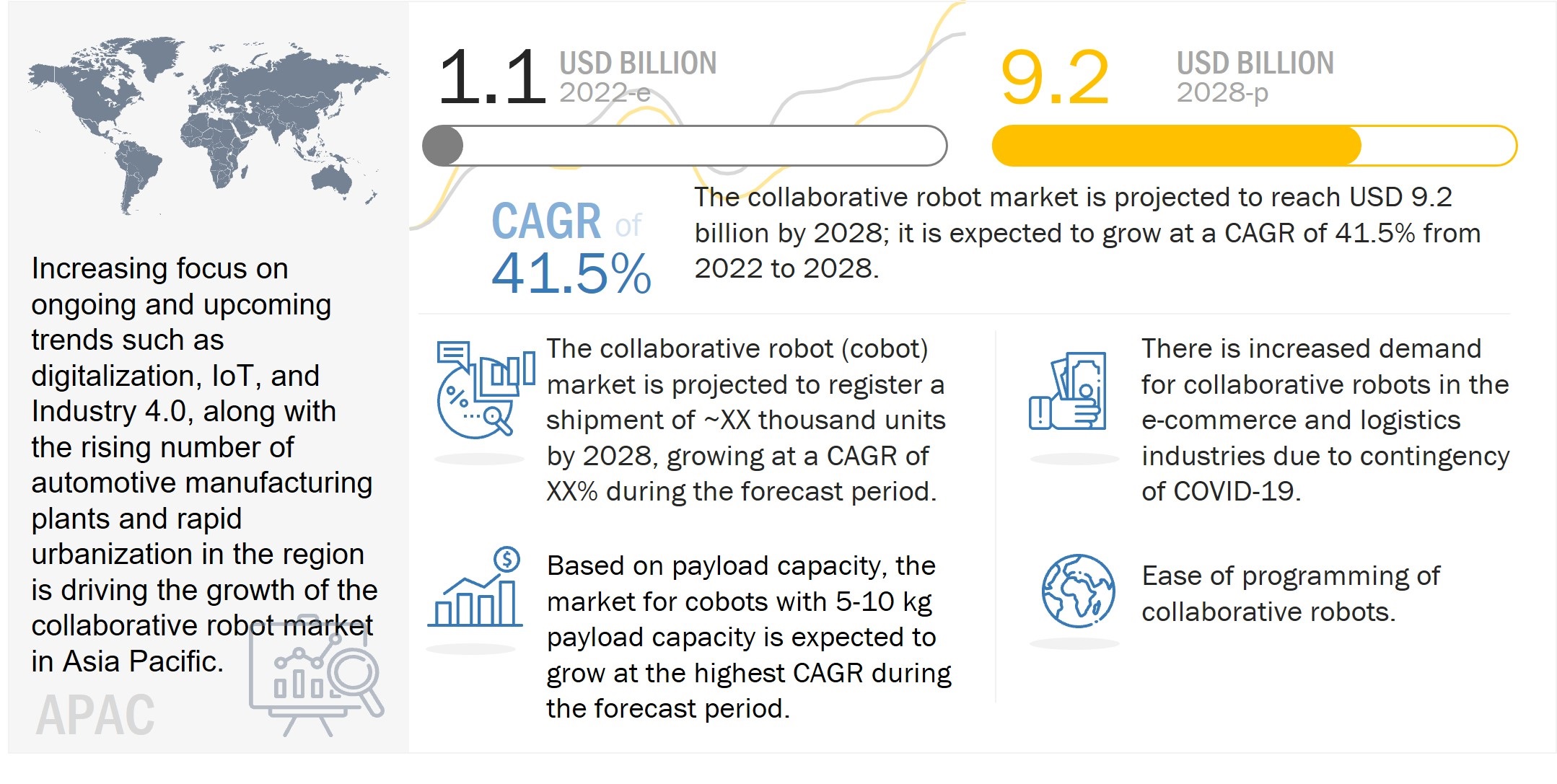

The Global Collaborative Robot Market share is projected to grow from USD 1.58 Billion in 2023 to USD 9.2 Billion by 2028, is expected to increase at a compound annual growth rate (CAGR) of 41.5% during the forecast period from 2022 to 2028.

The key drivers of the cobot market are high return on Investment compared to traditional industrial robotic systems, increasing demand in e-commerce and logistic industries due to COVID-19, providing benefits to businesses of all sizes, and increased ease of programming collaborative robot industry.

Collaborative Robot Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics of Cobots (Collaborative Robots) Market

Drivers: Collaborative robots to benefit businesses of all sizes

Small and medium-sized enterprises, especially in developed countries, are expected to quickly adopt collaborative robots market production processes. SMEs that are already using collaborative robots are seeing benefits in terms of general competitiveness, increased production, and enhanced product quality. For instance, Betacom Limited (New Zealand), a small manufacturer of lighting solutions for roads, areas, and tunnels, uses the UR10 collaborative robot from Universal Robots A/S (Denmark) to assemble LED lenses into the circuit board.

The robot can accurately place the LED lenses for the best spread of light, the company is able to take on high-volume jobs and enhance overall product quality. Similarly, V-ZUG Ltd (Switzerland), a manufacturer of household devices, uses the CR-7iA/L collaborative robot from FANUC Corporation (Japan) to improve the assembly and testing of control panels for electric cookers. Such small and mid-sized manufacturers also need adjustable automation solutions that can adapt to changing requirements.

Collaborative robots can be quickly moved and reprogrammed as they are lightweight and easy to program. Unlike traditional industrial robots, they do not require any extra space to operate as they are not required to be caged, thus utilizing floor space more efficiently. With growing labor shortages and rising wages, collaborative robots are enabling SMEs to compete with other large manufacturers while also remaining cost competitive. Employees are now given the opportunity to handle more intricate duties, leading to better employee satisfaction.

This has prompted even large manufacturing companies to deploy collaborative robots in their production process. For instance, the PSA Group (France) has been using the UR10 collaborative robot industry from Universal Robots for screw driving applications in vehicle assembly lines. This has resulted in cost savings and improved workplace ergonomic conditions. An MIT study titled ‘Breakthrough Factories’ estimates that collaborative robots could reduce a worker’s idle time by up to 85%.

For SMEs desiring to embrace robotics and automation, employee safety is crucial. Complex and heavy traditional industrial robots are usually locked behind fences or cages as their rapid and heavy movements are considered unsafe for human interaction, making them unbefitting for SMEs. Collaborative robot industry, on the other hand, are lightweight and abide by the standard ISO/TS 15066 safety guidelines. These guidelines help small-and-medium-sized manufacturers ensure that humans can safely work with the deployed cobots.

Restraints: High preference for low payload capacity traditional industrial robots

Traditional industrial cobots (collaborative robots) market are designed to handle heavier and larger materials and objects like those used in heavy-duty industries such as automotive, metals, and machinery manufacturing, owing to their greater payload capacities. But to operate safely in the work environment, cobots are designed to be less powerful compared to traditional industrial robots, making them less appropriate for heavy-duty applications.

With some exceptions, such as the FANUC CR-35iA, which can lift to 35 Kg, and H-SERIES cobots offered by Doosan Robotics Inc. (South Korea), which provides a payload capacity of up to 25KG, cobots are the best fit in applications with lower payloads. For example, the payload capacity of IRB 120 articulated robot from ABB (Switzerland) is up to 3 Kg. The MPP Series from Yaskawa Electric Corporation (Japan) has a payload capacity of 3 Kg. The KR 6 R500 Z200 is a SCARA robot from KUKA AG (Germany) having a payload capacity of up to 6 KG and has a speed of up to 2 m/s.

The payload capacity of IRB 910SC SCARA robot from ABB is up to 6 Kg; its speed is 7.6 m/s. As opposed to traditional industrial robots, the CR series collaborative robots offered by FANUC Corporation (Japan) has a maximum speed of 500 mm/s. The GoFa CRB 15000 collaborative robot has a TCP speed of up to 2.2 m/s. The total speed of Doosan Robotics Inc. (South Korea) M1013 collaborative robot arm is 1 m/s. The speed of Techman Robot’s TM series is 250 mm/s. The average speed of collaborative robots is around 1 m/s. Thus, for similar payload capacities, the speed offered by traditional industrial robots is higher compared to their collaborative counterparts.

Opportunities: Growing demand for automation in the healthcare industry post COVID-19

COVID-19 pandemic has fueled the growth of adoption of robots in the healthcare sector. During pandemic, automated robotic units were used to disinfect patient rooms and surgery suites. Robots were used by several hospitals for enforcing facemask and social-distancing rules and spraying disinfectant. In some hospitals, robots were programmed to use a thermal camera to perform a preliminary screening of patients to contain the spread of COVID-19.

Today, due to the pandemic, the use of robots for disinfection applications has risen significantly. Since the virus is highly infectious, patient rooms must be sanitized to prevent infection from spreading to other patients and hospital staff. From disinfecting rooms, delivering medication to measuring vital signs, these robots are proving to be highly efficient. Equipped with a sophisticated vision system, these robots can measure skin temperature, breathing rate, pulse rate, and blood oxygen to help detect the infection in time.

Challenges: Adapting to the new collaborative robot standards and rising cybersecurity challenges in connected robots

Manufacturers must consider new regulations and standards for collaborative robots, especially in the case of collaborative robots mounted to mobile units. For instance, the ANSI/RIA R15.08 standard that is currently being developed considers issues such as the position of the collaborative robot arm in relation to its mobile base. The previous standard did not consider robotic collisions with people and surroundings during navigation. The growth of collaborative robots has also given rise to increased interconnectivity between collaborative robots. Multiple robots working on a particular task are communicating with each other for sequencing and are also being connected to a centralized database to provide information on efficiency and downtime.

Interconnectivity is expected to become increasingly common in a few years, raising concerns over safety and cybersecurity, which will be a critical component in the operation of collaborative robots. As a collaborative robot can be connected to cloud servers via a web interface in unprotected computers or handheld devices, communication with the robots may be compromised. Although cybersecurity standards, such as the ISA/IEC 62443, have been developed recently by the International Electrotechnical Commission (IEC) and the International Society of Automation (ISA), implementation is still limited currently. Robot integrators are also expected to share responsibility when programming and deploying a collaborative robot with third-party peripherals such as controllers and vision systems.

Robotic arm is expected to hold the largest share of the market for hardware component during the forecast period

The robotic arm segment held the largest share of the hardware market for collaborative robots in 2021. This segment is also projected to grow at the highest CAGR during the forecast period. The robot arm is one of the most expensive hardware components in a collaborative robot, the design of which can often be time-consuming and complex. The arm must be built as per the ISO/TS 15066 standard and certified for the same.

When compared to traditional industrial robots, collaborative robots often have a curved arm to make it safe for human contact. Inside its complex design, the arm also must house the drives, motors, and sensors, while providing a maximum level of dust and water resistance, which can often be challenging. Thus, due to its higher overall cost, compared to other hardware components, the robotic arm is expected to dominate the cobots (collaborative robots) market analysis in terms of value, during the forecast period.

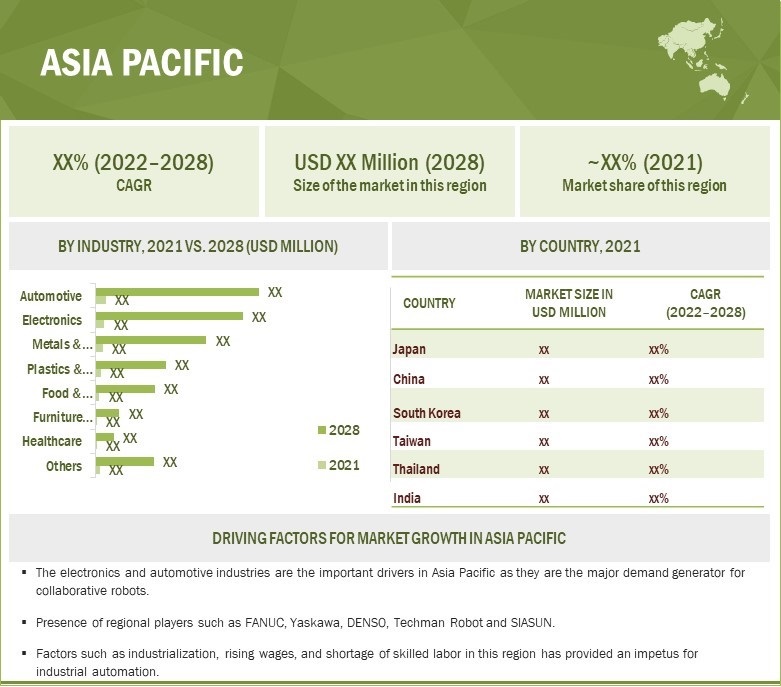

Asia Pacific to hold the largest share of collaborative robot industry for in 2022

Asia Pacific to hold the largest share of collaborative robots in 2022 both in terms of value and volume. The ageing population in China and Japan has resulted in rising labor costs, leading to the growing adoption of collaborative robots for automation in industries. Also, the presence of most of the prominent players of collaborative robot market space such as FANUC Corporation (Japan), Yaskawa Electric Corporation ( Japan), Denso Corporation ( Japan), Techman Robot, Inc. (Thailand) and so on is expected to boost the market in Asia Pacific region.

Collaborative Robot Market share by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Some of the top collaborative robot companies include Universal Robots A/S (Denmark), FANUC Corporation (Japan), ABB (Switzerland), Techman Robot Inc (Taiwan), KUKA AG (Germany), Doosan Robotics Inc. (South Korea), Denso Corporation (Japan), Yaskawa Electric Corporation (Japan), AUBO (Beijing) Robotics Technology Co., Ltd (China), and Rethink Robotics GmbH (US), Omron Adept Technologies, Inc. (US), Franka Emika GmbH (Germany), etc.

Cobots (Collaborative Robots) Market Report Scope

|

Report Metric |

Details |

| Market size value in 2022 | USD 1.1 Billion |

| Market size value in 2028 | USD 9.2 Billion |

| CAGR (2022-2028) | 41.5% |

|

Years Considered |

2022–2028 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2028 |

|

Forecast Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Component, Payload, Application, Industry, and Geography |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Other players include Omron Adept Technologies, Inc. (US) etc. Total 25 Major Players |

Collaborative Robot Market Insights Highlight

In this research report, the collaborative robot market analysis has been segmented based on Component, Payload, Application, Industry, and Geography.

|

Aspect |

Details |

|

Collaborative Robot Market, by Component: |

|

|

Collaborative Robot Market, by Payload: |

|

|

Collaborative Robot Market, by Application: |

|

|

Collaborative Robot Market, by Industry |

|

|

Geographic Analysis: |

|

See Also

- UK Collaborative Robot Industry to Grow at a CAGR 36.2% from 2022 to 2028

- Germany Collaborative Robot Industry to Grow at a CAGR 35.2% from 2022 to 2028

- France Collaborative Robot Industry to Grow at a CAGR 37.7% from 2022 to 2028

- China Collaborative Robot Industry to Grow at a CAGR 46.1% from 2022 to 2028

- Japan Collaborative Robot Industry to Grow at a CAGR 45.6% from 2022 to 2028

- South Korea Collaborative Robot Industry to Grow at a CAGR 44.5% from 2022 to 2028

Recent Developments

- In July 2022, FANUC America Corporation (US), a leading supplier of CNCs, robotics, and ROBOMACHINEs, announces a West Campus expansion that will push its operational space in Oakland County, Michigan to nearly two million square feet. The construction will include a 655,000 square foot state-of-the-art facility to house manufacturing, engineering, and R&D projects.

- In June 2022, Universal Robots A/S (Denmark) launched a new 20 kg cobot called the UR20 to its product range. A 20kg (44.1lbs.) payload capacity, which is 4kg more than UR’s previous heaviest load capability of 16kg with its UR16e cobot. Reach of 1750mm, which is 450mm more than the longest previous UR cobot reach of 1300mm with the UR10e.

- In February 2021, ABB is expanding its collaborative robot portfolio with the new GoFa and SWIFTI cobot families, offering higher payloads and speeds, to complement the YuMi and Single Arm YuMi in ABB’s cobot line-up. These stronger, faster, and more capable cobots are expected to accelerate the company’s expansion in high-growth segments including electronics, healthcare, consumer goods, logistics, and food & beverage, among others, meeting the rising demand for automation across multiple industries.

Frequently Asked Questions (FAQs):

What will be the dynamics for the adoption of collaborative robots based on payload?

The cobots having payload capacity up to 5 kg are expected to be the most widely adopted. They can be deployed across different industries such as automotive, metal & machinery, food and beverage, electronic industries for a wide range of applications owing to their versatility and ease of programming. The cobots having payload capacity between 5-10 kg are mainly used for variety of handling applications such as pick and place, material handling, palletizing, and machine tending majorly in automotive and electronic industries whereas the cobots with more than 10 kg payload capacity are used for applications such as heavy-duty material handling, heavy-part handling, multi-part handling, and machine tending.

Which component will contribute more to the overall market growth by 2028?

The robot arms are expected to contribute considerably to the collaborative robot market during the forecast period. The highest growth rate for robot arms during the forecast period can be largely attributed to its high cost on account of its functionality, time-consuming design process and complexities associated with its design. The arm must be built as per the ISO/TS 15066 standard and certified for the same. When compared to traditional industrial robots, collaborative robots often have a curved arm to make it safe for human contact. This feature is crucial as collaborative robots work in proximity with the human workers.

How will technological developments such as AI and 5G change the collaborative robot landscape in the future?

Advancement in AI is expected to drastically improve the operational capabilities of collaborative robots and provide a desired long-term outcome for increased production visibility, real-time guidance, and data-driven performance. AI is being leveraged for speech recognition, object detection, and enhancing locomotion in collaborative robots. 5G technology on the other hand is expected to enhance interconnectivity and coordination in many collaborative robots deployed in manufacturing facilities. Companies have already begun to test private 5G networks in their manufacturing facilities.

Which region is expected to adopt collaborative robots at a fast rate?

The Asia Pacific region is expected to adopt collaborative robots at the fastest rate. Developing countries such as China, India, Thailand, and Taiwan are expected to have a high potential for the future growth of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 SCOPE OF STUDY

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION: COBOTS (COLLABORATIVE ROBOTS) MARKET

1.4 GEOGRAPHIC SCOPE

1.4.1 YEARS CONSIDERED

1.4.2 INCLUSIONS AND EXCLUSIONS

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY & PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Primary interviews with experts

2.1.3.3 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 APPROACH FOR CAPTURING MARKET SIZE FROM SUPPLY-SIDE : COLLABORATIVE ROBOT INDUSTRY

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION: COLLABORATIVE ROBOT MARKET

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 7 COBOTS WITH PAYLOADS UP TO 5 KG TO DOMINATE THE COBOT MARKET DURING THE FORECAST PERIOD

FIGURE 8 SOFTWARE COMPONENT SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 9 HANDLING APPLICATION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 10 ELECTRONICS INDUSTRY SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

FIGURE 11 MARKET IN ASIA PACIFIC TO HOLD LARGEST SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 MAJOR OPPORTUNITIES FOR PLAYERS IN THE MARKET

FIGURE 12 HIGH RETURN ON INVESTMENT IN COLLABORATIVE ROBOTS COMPARED TO TRADITIONAL INDUSTRIAL ROBOTIC SYSTEMS EXPECTED TO FUEL MARKET GROWTH

4.2 COLLABORATIVE ROBOT MARKET, BY PAYLOAD

FIGURE 13 MARKET FOR COLLABORATIVE ROBOTS WITH PAYLOAD CAPACITY OF 5-10 KG TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY APPLICATION

FIGURE 14 HANDLING APPLICATION EXPECTED TO BE LARGEST SEGMENT OF MARKET IN 2022

4.4 MARKET, BY INDUSTRY

FIGURE 15 AUTOMOTIVE INDUSTRY PROJECTED TO BE LARGEST SEGMENT OF MARKET IN 2022

4.5 COBOT MARKET IN ASIA PACIFIC, BY INDUSTRY AND COUNTRY

FIGURE 16 AUTOMOTIVE INDUSTRY AND CHINA ACCOUNTED FOR LARGEST SHARES OF MARKET IN 2021

4.6 MARKET, BY COUNTRY

FIGURE 17 MARKET IN INDIA IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 COBOTS (COLLABORATIVE ROBOTS) MARKET : DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 High return on investment compared to traditional industrial robotic systems

5.2.1.2 Increased demand in e-commerce and logistics industries due to COVID-19

5.2.1.3 Providing benefits to businesses of all sizes

5.2.1.4 Increased ease of programming collaborative robots

5.2.2 RESTRAINTS

5.2.2.1 High preference for low payload capacity traditional industrial robots

5.2.3 OPPORTUNITIES

5.2.3.1 Provide significant market opportunity when paired with AMRs and AGVs

5.2.3.2 Robots-as-a-Service model to accelerate adoption of collaborative robots

5.2.3.3 Rise in demand for automation in the healthcare industry post COVID-19

5.2.4 CHALLENGES

5.2.4.1 Payload and speed limitations of collaborative robots owing to their inherent design

5.2.4.2 New collaborative robot standards and rise in cybersecurity challenges in connected robots

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR COLLABORATIVE ROBOT PROVIDERS

5.4 PRICING ANALYSIS

5.4.1 AVERAGE SELLING PRICE OF COLLABORATIVE ROBOTS OFFERED BY KEY PLAYERS, BY PAYLOAD

FIGURE 21 AVERAGE SELLING PRICES OF COLLABORATIVE ROBOTS OFFERED BY KEY PLAYERS WITH VARIOUS PAYLOAD CAPACITIES

TABLE 1 AVERAGE SELLING PRICES OF COLLABORATIVE ROBOTS OFFERED BY KEY PLAYERS WITH VARIOUS PAYLOAD CAPACITIES (USD)

5.4.2 AVERAGE SELLING PRICE TREND

FIGURE 22 COLLABORATIVE ROBOT MARKET: AVERAGE PRICE OF COBOTS

5.5 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY MANUFACTURING AND RESEARCH AND DEVELOPMENT STAGES

5.6 ECOSYSTEM/MARKET MAP

TABLE 2 COBOT MARKET: ECOSYSTEM

5.7 TECHNOLOGY ANALYSIS

5.7.1 KEY TECHNOLOGIES

5.7.1.1 Integration of embedded vision with collaborative robots

5.7.1.2 Integration of mobile robot technology with collaborative robots

5.7.2 COMPLEMENTARY TECHNOLOGIES

5.7.2.1 Penetration of Industrial Internet of Things (IIoT) and AI in industrial manufacturing

5.7.2.2 Adoption of innovative grippers in robotics manipulation

5.7.3 ADJACENT TECHNOLOGIES

5.7.3.1 Penetration of 5G in industrial manufacturing

5.8 CASE STUDY ANALYSIS

5.8.1 JAPANESE AUTOMOTIVE PARTS MANUFACTURER DOUBLES PRODUCTIVITY WITH COBOTS

5.8.2 COBOTS RESOLVED UNDERSTAFFING ISSUES THAT INCREASED DUE TO COVID-19 IN LABORATORIES

5.8.3 AUTOMATED SCREWDRIVING WITH COBOTS

5.8.4 HOUSEHOLD TEXTILE MANUFACTURER BENEFITS FROM LARGE-FORMAT JACQUARD SOLUTIONS

5.8.5 ELITE ROBOTS BOOST PRODUCTION FROM TRADITIONAL TO INTELLIGENT MANUFACTURING

5.9 PATENT ANALYSIS

TABLE 3 TOP 10 PATENT OWNERS IN THE US IN THE LAST 10 YEARS

5.9.1 LIST OF MAJOR PATENTS

TABLE 4 LIST OF MAJOR PATENTS IN THE COBOTS (COLLABORATIVE ROBOTS) MARKET

5.1 TRADE AND TARIFF ANALYSIS

5.10.1 TRADE ANALYSIS

5.10.1.1 Trade data for HS code 847950

5.10.2 TARIFF ANALYSIS

TABLE 5 MFN TARIFF FOR INDUSTRIAL ROBOTS, N.E.S., BY JAPAN, 2021

TABLE 6 MFN TARIFF FOR INDUSTRIAL ROBOTS, N.E.S., BY GERMANY, 2021

TABLE 7 MFN TARIFF FOR INDUSTRIAL ROBOTS, N.E.S., BY ITALY, 2021

5.11 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 8 COBOT MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.12 REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO COBOT MARKET

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.2 STANDARDS AND REGULATIONS RELATED TO COLLABORATIVE ROBOTS

TABLE 13 NORTH AMERICA: SAFETY STANDARDS FOR COLLABORATIVE ROBOTS

TABLE 14 EUROPE: SAFETY STANDARDS FOR COLLABORATIVE ROBOTS

TABLE 15 ASIA PACIFIC: SAFETY STANDARDS FOR COLLABORATIVE ROBOTS

TABLE 16 ROW: SAFETY STANDARDS FOR COLLABORATIVE ROBOTS

5.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 17 IMPACT OF PORTER’S FIVE FORCES ON THE COLLABORATIVE ROBOT MARKET ANALYSIS

FIGURE 28 PORTER’S FIVE FORCES ANALYSIS: COLLABORATIVE ROBOT INDUSTRY

5.13.1 THREAT OF NEW ENTRANTS

5.13.2 THREAT OF SUBSTITUTES

5.13.3 BARGAINING POWER OF SUPPLIERS

5.13.4 BARGAINING POWER OF BUYERS

5.13.5 INTENSITY OF COMPETITION RIVALRY

5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 INDUSTRIES

TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES (%)

5.14.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

TABLE 19 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

6 COLLABORATIVE ROBOT MARKET, BY PAYLOAD (Page No. - 96)

6.1 INTRODUCTION

FIGURE 31 MARKET: BY PAYLOAD

FIGURE 32 UP TO 5 KG SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 20 MARKET, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 21 MARKET, BY PAYLOAD, 2022–2028 (USD MILLION)

TABLE 22 MARKET, BY PAYLOAD, 2018–2021 (UNITS)

TABLE 23 MARKET, BY PAYLOAD, 2022–2028 (UNITS)

6.2 UP TO 5 KG

6.2.1 COBOTS WITH PAYLOAD CAPACITY BELOW 5 KG INHERENTLY SAFE

TABLE 24 COMPANIES OFFERING COBOTS WITH PAYLOAD CAPACITY UP TO 5 KG

TABLE 25 MARKET FOR UP TO 5 KG PAYLOAD, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 26 MARKET FOR UP TO 5 KG PAYLOAD, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 27 MARKET FOR UP TO 5 KG PAYLOAD, BY APPLICATION, 2018–2021 (UNITS)

TABLE 28 MARKET FOR UP TO 5 KG PAYLOAD, BY APPLICATION, 2022–2028 (UNITS)

TABLE 29 MARKET FOR UP TO 5 KG PAYLOAD, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 30 MARKET FOR UP TO 5 KG PAYLOAD, BY INDUSTRY, 2022–2028 (USD MILLION)

6.3 5–10 KG

6.3.1 MOST COBOTS WITH 5–10 KG PAYLOAD CAPACITY CAN BE EQUIPPED WITH IN-BUILT FORCE SENSORS

TABLE 31 COMPANIES OFFERING COBOTS WITH 5–10 KG PAYLOAD CAPACITY

TABLE 32 MARKET FOR 5–10 KG PAYLOAD, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 33 MARKET FOR 5–10 KG PAYLOAD, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 34 MARKET FOR 5–10 KG PAYLOAD, BY APPLICATION, 2018–2021 (UNITS)

TABLE 35 MARKET FOR 5–10 KG PAYLOAD, BY APPLICATION, 2022–2028 (UNITS)

TABLE 36 MARKET FOR 5–10 KG PAYLOAD, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 37 MARKET FOR 5–10 KG PAYLOAD, BY INDUSTRY, 2022–2028 (USD MILLION)

6.4 MORE THAN 10 KG

6.4.1 ADVANCES IN ROBOTIC HARDWARE ENABLING MANUFACTURERS TO DEVELOP COLLABORATIVE ROBOTS WITH PAYLOAD CAPACITY ABOVE 10 KG

TABLE 38 COMPANIES OFFERING COBOTS WITH PAYLOAD CAPACITY OF MORE THAN 10 KG

TABLE 39 MARKET FOR MORE THAN 10 KG PAYLOAD, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 40 COBOTS (COLLABORATIVE ROBOTS) MARKET SHARE FOR MORE THAN 10 KG PAYLOAD, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 41 MARKET FOR MORE THAN 10 KG PAYLOAD, BY APPLICATION, 2018–2021 (UNITS)

TABLE 42 MARKET FOR MORE THAN 10 KG PAYLOAD, BY APPLICATION, 2022–2028 (UNITS)

TABLE 43 MARKET FOR MORE THAN 10 KG PAYLOAD, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 44 MARKET FOR MORE THAN 10 KG PAYLOAD, BY INDUSTRY, 2022–2028 (USD MILLION)

7 COLLABORATIVE ROBOT MARKET, BY COMPONENT (Page No. - 111)

7.1 INTRODUCTION

FIGURE 33 MARKET: BY COMPONENT

FIGURE 34 HARDWARE SEGMENT TO CONTRIBUTE LARGER SHARE TO MARKET DURING FORECAST PERIOD

TABLE 45 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 46 MARKET, BY COMPONENT, 2022–2028 (USD MILLION)

7.2 HARDWARE

TABLE 47 MARKET FOR HARDWARE, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 48 MARKET FOR HARDWARE, BY COMPONENT, 2022–2028 (USD MILLION)

7.2.1 ROBOTIC ARM

7.2.1.1 Robotic arm design defined by ISO/TS 15066 standard

7.2.2 END EFFECTOR OR END OF ARM TOOL (EOAT)

7.2.2.1 Welding guns

7.2.2.1.1 Hand guidance feature of collaborative robots to make welding tasks easier

TABLE 49 PLAYERS MANUFACTURING ROBOTIC WELDING GUNS

7.2.2.2 Grippers

7.2.2.2.1 Pneumatic

7.2.2.2.2 Electric

TABLE 50 PLAYERS MANUFACTURING ELECTRIC GRIPPERS

7.2.2.2.3 Dexterous robotic hand

7.2.2.2.4 Vacuum

7.2.2.2.5 Magnetic

TABLE 51 PLAYERS MANUFACTURING MAGNETIC GRIPPERS

7.2.2.3 Robotic screwdrivers

7.2.2.3.1 Robotic screwdrivers apply consistent torque during screwdriving

7.2.2.4 Sanding and deburring tools

7.2.2.4.1 Sanding and deburring tools used for material removal

7.2.2.5 Others

7.2.2.5.1 Others include specialty and hybrid end effectors

7.2.3 DRIVES

7.2.3.1 Drives convert electrical energy into mechanical energy

7.2.4 CONTROLLERS

7.2.4.1 Controllers carry out necessary instructions required to operate cobots

7.2.5 SENSORS

7.2.5.1 Sensors help in measurement and translation of information into meaningful data

7.2.6 POWER SUPPLY

7.2.6.1 Most cobots operate at 24 V or 48 V

7.2.7 MOTORS

7.2.7.1 Cobots fitted with light but powerful motors

7.2.8 OTHERS

7.3 SOFTWARE

7.3.1 MANUFACTURERS TO INVEST SUBSTANTIAL EFFORTS TO DEVELOP INTUITIVE PROGRAMMING SOFTWARE

8 COBOTS (COLLABORATIVE ROBOTS) MARKET, BY APPLICATION (Page No. - 125)

8.1 INTRODUCTION

FIGURE 35 COLLABORATIVE ROBOT INDUSTRY : BY APPLICATION

TABLE 52 MARKET RANKING ANALYSIS, BY APPLICATION

FIGURE 36 MARKET FOR PROCESSING APPLICATIONS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 53 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 54 MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 55 MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 56 MARKET, BY APPLICATION, 2022–2028 (UNITS)

8.2 HANDLING

TABLE 57 COMPANIES OFFERING COLLABORATIVE ROBOTS FOR HANDLING APPLICATION

TABLE 58 MARKET FOR HANDLING APPLICATION, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 59 MARKET FOR HANDLING APPLICATION, BY INDUSTRY, 2022–2028 (USD MILLION)

TABLE 60 MARKET FOR HANDLING APPLICATION, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 61 MARKET FOR HANDLING APPLICATION, BY PAYLOAD, 2022–2028 (USD MILLION)

TABLE 62 MARKET FOR HANDLING APPLICATION, BY PAYLOAD, 2018–2021 (UNITS)

TABLE 63 COLLABORATIVE ROBOT MARKET ANALYSIS FOR HANDLING APPLICATION, BY PAYLOAD, 2022–2028 (UNITS)

8.2.1 PICK & PLACE

8.2.1.1 Pick and place task easiest to program for first-time users

8.2.2 MATERIAL HANDLING

8.2.2.1 Material handling consists of order fulfillment using mobile units

8.2.3 PACKAGING & PALLETIZING

8.2.3.1 Packing and palletizing require medium payload cobots

8.2.4 MACHINE TENDING

8.2.4.1 Cobots used alongside CNC, injection, and blow molding machines

TABLE 64 COBOTS (COLLABORATIVE ROBOTS) MARKET FOR HANDLING, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 65 MARKET FOR HANDLING, BY APPLICATION, 2022–2028 (USD MILLION)

8.3 ASSEMBLING & DISASSEMBLING

TABLE 66 COMPANIES OFFERING COLLABORATIVE ROBOTS FOR ASSEMBLING & DISASSEMBLING APPLICATION

8.3.1 SCREWDRIVING

8.3.1.1 Cobots can handle torque forces required for screwdriving applications

8.3.2 NUT FASTENING

8.3.2.1 Cobots suitable for nut fastening on medium and large workpieces

TABLE 67 COLLABORATIVE ROBOT MARKET FOR ASSEMBLING & DISASSEMBLING APPLICATION, BY INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 68 MARKET FOR ASSEMBLING & DISASSEMBLING APPLICATION, BY INDUSTRY, 2022–2028 (USD THOUSAND)

TABLE 69 MARKET FOR ASSEMBLING & DISASSEMBLING APPLICATION, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 70 MARKET FOR ASSEMBLING & DISASSEMBLING APPLICATION, BY PAYLOAD, 2022–2028 (USD MILLION)

TABLE 71 MARKET FOR ASSEMBLING & DISASSEMBLING APPLICATION, BY PAYLOAD, 2018–2021 (UNITS)

TABLE 72 MARKET FOR ASSEMBLING & DISASSEMBLING ASSEMBLING & DISASSEMBLING APPLICATION, BY PAYLOAD, 2022–2028 (UNITS)

8.4 WELDING AND SOLDERING

8.4.1 WELDING AND SOLDERING CONSIDERED NICHE APPLICATION FOR COBOTS

TABLE 73 COMPANIES OFFERING COLLABORATIVE ROBOTS FOR WELDING & SOLDERING APPLICATION

TABLE 74 MARKET FOR WELDING AND SOLDERING APPLICATION, BY INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 75 MARKET FOR WELDING AND SOLDERING APPLICATION, BY INDUSTRY, 2022–2028 (USD THOUSAND)

TABLE 76 MARKET FOR WELDING AND SOLDERING APPLICATION, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 77 MARKET FOR WELDING AND SOLDERING APPLICATION, BY PAYLOAD, 2022–2028 (USD MILLION)

TABLE 78 MARKET FOR WELDING AND SOLDERING APPLICATION, BY PAYLOAD 2018–2021 (UNITS)

TABLE 79 MARKET FOR WELDING AND SOLDERING APPLICATION, BY PAYLOAD 2022–2028 (UNITS)

8.5 DISPENSING

TABLE 80 COMPANIES OFFERING COLLABORATIVE ROBOTS FOR DISPENSING APPLICATION

8.5.1 GLUING

8.5.1.1 Robotic gluing ensures quality and consistency

8.5.2 PAINTING

8.5.2.1 Suitable for low-volume production

TABLE 81 MARKET FOR DISPENSING APPLICATION, BY INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 82 MARKET FOR DISPENSING APPLICATION, BY INDUSTRY, 2022–2028 (USD THOUSAND)

TABLE 83 MARKET FOR DISPENSING APPLICATION, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 84 MARKET FOR DISPENSING APPLICATION, BY PAYLOAD, 2022–2028 (USD MILLION)

TABLE 85 MARKET FOR DISPENSING APPLICATION, BY PAYLOAD, 2018–2021 (UNITS)

TABLE 86 MARKET FOR DISPENSING APPLICATION, BY PAYLOAD, 2022–2028 (UNITS)

8.6 PROCESSING

TABLE 87 COMPANIES OFFERING COLLABORATIVE ROBOTS FOR PROCESSING APPLICATION

8.6.1 GRINDING

8.6.1.1 Force/torque sensor often used along with end effector for grinding tasks

8.6.2 MILLING

8.6.2.1 Used in milling tasks for deburring, chamfering, and scraping

8.6.3 CUTTING

8.6.3.1 Used for cutting applications on a very small scale

TABLE 88 COLLABORATIVE ROBOT MARKET FOR PROCESSING APPLICATION, BY INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 89 MARKET FOR PROCESSING APPLICATION, BY INDUSTRY, 2022–2028 (USD THOUSAND)

TABLE 90 MARKET FOR PROCESSING APPLICATION, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 91 MARKET FOR PROCESSING APPLICATION, BY PAYLOAD, 2022–2028 (USD MILLION)

TABLE 92 MARKET FOR PROCESSING APPLICATION, BY PAYLOAD, 2018–2021 (UNITS)

TABLE 93 MARKET FOR PROCESSING APPLICATION, BY PAYLOAD, 2022–2028 (UNITS)

TABLE 94 MARKET FOR PROCESSING, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 95 MARKET FOR PROCESSING, BY APPLICATION, 2022–2028 (USD MILLION)

8.7 OTHERS

TABLE 96 COMPANIES OFFERING COLLABORATIVE ROBOTS FOR OTHER APPLICATIONS

8.7.1 INSPECTION AND QUALITY TESTING

8.7.1.1 Cobots used to inspect complex objects alongside human workers

8.7.2 DIE-CASTING AND MOLDING

8.7.2.1 Cobots ideal for automating injection molding tasks

TABLE 97 MARKET FOR OTHER APPLICATIONS, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 98 MARKET FOR OTHER APPLICATIONS, BY INDUSTRY, 2022–2028 (USD MILLION)

TABLE 99 MARKET FOR OTHER APPLICATIONS, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 100 MARKET FOR OTHER APPLICATIONS, BY PAYLOAD, 2022–2028 (USD MILLION)

TABLE 101 MARKET FOR OTHER APPLICATIONS, BY PAYLOAD, 2018–2021 (UNITS)

TABLE 102 MARKET FOR OTHER APPLICATIONS, BY PAYLOAD, 2022–2028 (UNITS)

9 COLLABORATIVE ROBOT MARKET, BY INDUSTRY (Page No. - 156)

9.1 INTRODUCTION

FIGURE 37 COBOTS (COLLABORATIVE ROBOTS) MARKET SHARE ANALYSIS : BY INDUSTRY

FIGURE 38 ELECTRONICS INDUSTRY SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 103 MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 104 MARKET, BY INDUSTRY, 2022–2028 (USD MILLION)

TABLE 105 MARKET, BY INDUSTRY, 2018–2021 (UNITS)

TABLE 106 MARKET, BY INDUSTRY, 2022–2028 (UNITS)

9.2 AUTOMOTIVE

9.2.1 USED TO PERFORM LIGHT AND REPETITIVE TASKS

TABLE 107 MARKET SIZE FOR AUTOMOTIVE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 108 MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2022–2028 (USD MILLION)

TABLE 109 MARKET SIZE FOR AUTOMOTIVE INDUSTRY, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 110 MARKET SIZE FOR AUTOMOTIVE INDUSTRY, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 111 MARKET SIZE FOR AUTOMOTIVE INDUSTRY, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 112 MARKET FOR THE AUTOMOTIVE INDUSTRY, BY PAYLOAD, 2022–2028 (USD MILLION)

9.3 ELECTRONICS

9.3.1 USED TO WORK ON SMALL AND FRAGILE COMPONENTS IN ELECTRONICS INDUSTRY

TABLE 113 MARKET SIZE FOR THE ELECTRONICS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 114 MARKET SIZE FOR ELECTRONICS INDUSTRY, BY REGION, 2022–2028 (USD MILLION)

TABLE 115 MARKET SIZE FOR ELECTRONICS INDUSTRY, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 116 MARKET SIZE FOR THE ELECTRONICS INDUSTRY, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 117 COLLABORATIVE ROBOT INDUSTRY SIZE FOR ELECTRONICS INDUSTRY, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 118 MARKET SIZE FOR ELECTRONICS INDUSTRY, BY PAYLOAD, 2022–2028 (USD MILLION)

9.4 METALS & MACHINING

9.4.1 USED ALONGSIDE CNC AND OTHER HEAVY MACHINERY TO AUTOMATE VARIOUS TASKS

TABLE 119 COLLABORATIVE ROBOT MARKET SIZE FOR METALS & MACHINING INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 120 MARKET SIZE FOR METALS & MACHINING INDUSTRY, BY REGION, 2022–2028 (USD MILLION)

TABLE 121 MARKET SIZE FOR METALS & MACHINING INDUSTRY, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 122 MARKET SIZE FOR METALS & MACHINING INDUSTRY, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 123 MARKET SIZE FOR METALS & MACHINING INDUSTRY, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 124 MARKET SIZE FOR METALS & MACHINING INDUSTRY, BY PAYLOAD, 2022–2028 (USD MILLION)

9.5 PLASTICS & POLYMERS

9.5.1 CAN BE DEPLOYED ALONGSIDE INJECTION AND BLOW MOLDING MACHINES

TABLE 125 COLLABORATIVE ROBOT INDUSTRY ANALYSIS SIZE FOR PLASTICS & POLYMERS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 126 MARKET SIZE FOR PLASTICS & POLYMERS INDUSTRY, BY REGION, 2022–2028 (USD MILLION)

TABLE 127 MARKET SIZE FOR PLASTICS & POLYMERS INDUSTRY, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 128 MARKET SIZE FOR PLASTICS & POLYMERS INDUSTRY, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 129 COLLABORATIVE ROBOT INDUSTRY SIZE FOR PLASTICS & POLYMERS INDUSTRY, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 130 COBOT MARKET SIZE FOR PLASTICS & POLYMERS INDUSTRY, BY PAYLOAD, 2022–2028 (USD MILLION)

9.6 FOOD & BEVERAGES

9.6.1 USED IN FOOD INDUSTRY FOR BOTH PRIMARY AND SECONDARY HANDLING APPLICATIONS

TABLE 131 MARKET SIZE FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 132 MARKET SIZE FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2022–2028 (USD MILLION)

TABLE 133 MARKET SIZE FOR FOOD & BEVERAGES INDUSTRY, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 134 MARKET SIZE FOR FOOD & BEVERAGES INDUSTRY, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 135 COLLABORATIVE ROBOT MARKET SIZE FOR FOOD & BEVERAGES INDUSTRY, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 136 MARKET SIZE FOR FOOD & BEVERAGES INDUSTRY, BY PAYLOAD, 2022–2028 (USD MILLION)

9.7 FURNITURE & EQUIPMENT

9.7.1 USED TO PERFORM VARIOUS PICK AND PLACE AND MACHINE TENDING APPLICATIONS

TABLE 137 MARKET SIZE FOR FURNITURE & EQUIPMENT INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 138 MARKET SIZE FOR FURNITURE & EQUIPMENT INDUSTRY, BY REGION, 2022–2028 (USD MILLION)

TABLE 139 MARKET SIZE FOR FURNITURE & EQUIPMENT INDUSTRY, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 140 MARKET SIZE FOR FURNITURE & EQUIPMENT INDUSTRY, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 141 MARKET SIZE FOR FURNITURE & EQUIPMENT INDUSTRY, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 142 COLLABORATIVE ROBOT SIZE FOR FURNITURE & EQUIPMENT INDUSTRY, BY PAYLOAD, 2022–2028 (USD MILLION)

9.8 HEALTHCARE

9.8.1 MAINLY DEPLOYED FOR NON-SURGICAL APPLICATIONS

TABLE 143 MARKET SIZE FOR HEALTHCARE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 144 MARKET SIZE IN HEALTHCARE INDUSTRY, BY REGION, 2022–2028 (USD MILLION)

TABLE 145 MARKET SIZE IN HEALTHCARE INDUSTRY, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 146 MARKET SIZE IN HEALTHCARE INDUSTRY, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 147 MARKET SIZE IN HEALTHCARE INDUSTRY, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 148 MARKET SIZE IN HEALTHCARE INDUSTRY, BY PAYLOAD, 2022–2028 (USD MILLION)

9.9 OTHERS

TABLE 149 MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 150 MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2022–2028 (USD MILLION)

TABLE 151 MARKET SIZE IN OTHER INDUSTRIES, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 152 MARKET SIZE IN OTHER INDUSTRIES, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 153 MARKET SIZE IN OTHER INDUSTRIES, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 154 COLLABORATIVE ROBOT MARKET SIZE IN OTHER INDUSTRIES, BY PAYLOAD, 2022–2028 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 185)

10.1 INTRODUCTION

FIGURE 39 COBOT MARKET: BY GEOGRAPHY

TABLE 155 MARKET RANKING ANALYSIS, BY REGION

FIGURE 40 ASIA PACIFIC TO HOLD LARGEST SHARE OF COBOT MARKET DURING FORECAST PERIOD

TABLE 156 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 157 MARKET, BY REGION, 2022–2028 (USD MILLION)

TABLE 158 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 159 COLLABORATIVE ROBOT INDUSTRY BY REGION, 2022–2028 (UNITS)

10.2 NORTH AMERICA

FIGURE 41 NORTH AMERICA: MARKET, BY COUNTRY

FIGURE 42 NORTH AMERICA: SNAPSHOT OF MARKET

TABLE 160 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 161 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 162 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (UNITS)

TABLE 163 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2028 (UNITS)

TABLE 164 MARKET IN NORTH AMERICA, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 165 MARKET IN NORTH AMERICA, BY INDUSTRY, 2022–2028 (USD MILLION)

10.2.1 US

10.2.1.1 US contributed largest share to market in North America

10.2.2 CANADA

10.2.2.1 Increased foreign investments in automotive sector to drive market

10.2.3 MEXICO

10.2.3.1 Market in Mexico expected to witness highest growth

10.3 EUROPE

FIGURE 43 EUROPE: COBOT MARKET, BY COUNTRY

FIGURE 44 EUROPE: SNAPSHOT OF MARKET

TABLE 166 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 167 MARKET IN EUROPE, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 168 COLLABORATIVE ROBOT MARKET IN EUROPE, BY COUNTRY, 2018–2021 (UNITS)

TABLE 169 MARKET IN EUROPE, BY COUNTRY, 2022–2028 (UNITS)

TABLE 170 COLLABORATIVE ROBOT MARKER IN EUROPE, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 171 COLLABORATIVE ROBOT MARKER IN EUROPE, BY INDUSTRY, 2022–2028 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany houses several collaborative robot manufacturers

10.3.2 ITALY

10.3.2.1 COMAU (Italy) offers collaborative robots with highest payload capacity

10.3.3 SPAIN

10.3.3.1 Spain to witness high growth due to adoption of automation in manufacturing industries

10.3.4 FRANCE

10.3.4.1 Increasing deployment of collaborative robots to increase competitiveness and drive market

10.3.5 UK

10.3.5.1 Investments in R&D to revive automotive industry offers high growth potential

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: SNAPSHOT OF COLLABORATIVE ROBOT MARKET

TABLE 172 MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 173 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 174 MARKET IN APAC, BY COUNTRY, 2018–2021 (UNITS)

TABLE 175 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2028 (UNITS)

TABLE 176 MARKET IN ASIA PACIFIC, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 177 MARKET IN ASIA PACIFIC, BY INDUSTRY, 2022–2028 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China accounted for largest share in Asia Pacific in 2021

10.4.2 SOUTH KOREA

10.4.2.1 Significant number of cobots deployed in automotive and electronics industries

10.4.3 JAPAN

10.4.3.1 Japan held the second-largest share of market in Asia Pacific in 2021

10.4.4 TAIWAN

10.4.4.1 Growth of electrical & electronics industry expected to drive market

10.4.5 THAILAND

10.4.5.1 Thailand 4.0 initiative expected to drive market for cobots

10.4.6 INDIA

10.4.6.1 India presents a huge market potential for deployment of cobots

10.4.7 REST OF ASIA PACIFIC

10.5 ROW

FIGURE 46 ROW: COBOT MARKET, BY COUNTRY

TABLE 178 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 179 MARKET IN ROW, BY REGION, 2022–2028 (USD MILLION)

TABLE 180 COBOTS (COLLABORATIVE ROBOTS) MARKET IN ROW, BY REGION, 2018–2021 (UNITS)

TABLE 181 MARKET IN ROW, BY REGION, 2022–2028 (UNITS)

TABLE 182 MARKET IN ROW, BY INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 183 MARKET IN ROW, BY INDUSTRY, 2022–2028 (USD THOUSAND)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Automation across industries expected to drive market

10.5.2 SOUTH AMERICA

10.5.2.1 South America expected to witness high growth in adoption of collaborative robots during forecast period

11 HUMAN-ROBOT COLLABORATIVE OPERATIONAL ENVIRONMENT (Page No. - 212)

11.1 INTRODUCTION

11.2 SAFETY-RATED MONITORED STOP

11.3 HAND GUIDING

11.4 SPEED REDUCTION AND SEPARATION MONITORING

11.5 POWER AND FORCE LIMITING

12 INTEGRATION OF COBOTS AND IOT (Page No. - 214)

12.1 INTRODUCTION

12.2 CONNECTIVITY TECHNOLOGY

12.2.1 ETHERNET

12.2.2 WI-FI

12.2.3 BLUETOOTH

12.2.4 CELLULAR

12.2.4.1 4G connectivity

12.2.4.2 5G connectivity

12.3 INTEROPERABILITY SOFTWARE

13 COMPETITIVE LANDSCAPE (Page No. - 218)

13.1 OVERVIEW

13.1.1 INTRODUCTION

13.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

13.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN COLLABORATIVE ROBOT MARKET

13.3 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 47 3-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN COBOT MARKET, 2019–2021

13.4 MARKET SHARE ANALYSIS OF KEY PLAYERS IN THE MARKET IN 2021

FIGURE 48 MARKET SHARE ANALYSIS OF KEY PLAYERS IN MARKET IN 2021

TABLE 184 COLLABORATIVE ROBOT MARKET: DEGREE OF COMPETITION

TABLE 185 COLLABORATIVE ROBOT INDUSTRY RANKING ANALYSIS

13.5 COMPANY EVALUATION QUADRANT, 2021

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE PLAYERS

13.5.4 PARTICIPANTS

FIGURE 49 COBOT MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

13.6 COMPETITIVE BENCHMARKING

13.6.1 COMPANY FOOTPRINT, BY PAYLOAD (18 COMPANIES)

13.6.2 COMPANY FOOTPRINT, BY INDUSTRY (18 COMPANIES)

13.6.3 COMPANY FOOTPRINT, BY REGION (18 COMPANIES)

13.6.4 COMPANY PRODUCT FOOTPRINT

13.7 STARTUP/SME EVALUATION QUADRANT, 2021

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 DYNAMIC COMPANIES

13.7.4 STARTING BLOCKS

FIGURE 50 COLLABORATIVE ROBOT MARKET (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2021

TABLE 186 MARKET: LIST OF KEY STARTUPS/SMES

TABLE 187 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

13.8 COMPETITIVE SCENARIO AND TRENDS

13.8.1 PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 188 COBOT MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020–2022

13.8.2 DEALS

TABLE 189 COBOT MARKET: DEALS, 2020–2022

14 COMPANY PROFILES (Page No. - 236)

14.1 INTRODUCTION

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)*

14.2 KEY PLAYERS

14.2.1 UNIVERSAL ROBOTS A/S

TABLE 190 UNIVERSAL ROBOTS A/S: BUSINESS OVERVIEW

TABLE 191 UNIVERSAL ROBOTS A/S: PRODUCT LAUNCHES

TABLE 192 UNIVERSAL ROBOTS A/S: DEALS

14.2.2 FANUC CORPORATION

TABLE 193 FANUC CORPORATION: BUSINESS OVERVIEW

FIGURE 51 FANUC CORPORATION: COMPANY SNAPSHOT

TABLE 194 FANUC CORPORATION: PRODUCT LAUNCHES

TABLE 195 FANUC CORPORATION: DEALS

14.2.3 ABB

TABLE 196 ABB: BUSINESS OVERVIEW

FIGURE 52 ABB: COMPANY SNAPSHOT

TABLE 197 ABB: PRODUCT LAUNCHES

TABLE 198 ABB: DEALS

14.2.4 TECHMAN ROBOT INC.

TABLE 199 TECHMAN ROBOT INC.: BUSINESS OVERVIEW

TABLE 200 TECHMAN ROBOT INC.: DEALS

14.2.5 KUKA AG

TABLE 201 KUKA AG: BUSINESS OVERVIEW

FIGURE 53 KUKA AG: COMPANY SNAPSHOT

TABLE 202 KUKA AG: PRODUCT LAUNCHES

TABLE 203 KUKA AG: DEALS

14.2.6 DOOSAN ROBOTICS INC.

TABLE 204 DOOSAN ROBOTICS INC.: BUSINESS OVERVIEW

TABLE 205 DOOSAN ROBOTICS INC.: PRODUCT LAUNCHES

TABLE 206 DOOSAN ROBOTICS INC.: DEALS

14.2.7 DENSO CORPORATION

TABLE 207 DENSO CORPORATION: BUSINESS OVERVIEW

FIGURE 54 DENSO CORPORATION: COMPANY SNAPSHOT

TABLE 208 DENSO CORPORATION: DEALS

14.2.8 YASKAWA ELECTRIC CORPORATION

TABLE 209 YASKAWA ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 55 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 210 YASKAWA ELECTRIC CORPORATION: DEALS

14.2.9 RETHINK ROBOTICS GMBH

TABLE 211 RETHINK ROBOTICS GMBH: BUSINESS OVERVIEW

TABLE 212 RETHINK ROBOTICS GMBH: PRODUCT LAUNCHES

TABLE 213 RETHINK ROBOTICS GMBH: DEALS

14.2.10 AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD

TABLE 214 AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD: BUSINESS OVERVIEW

14.3 OTHER KEY PLAYERS

14.3.1 SIASUN ROBOT & AUTOMATION CO. LTD.

14.3.2 FRANKA EMIKA GMBH

14.3.3 COMAU SPA

14.3.4 F&P ROBOTICS AG

14.3.5 STÄUBLI INTERNATIONAL AG

14.3.6 BOSCH REXROTH AG

14.3.7 PRODUCTIVE ROBOTICS, LLC

14.3.8 NEURA ROBOTICS GMBH

14.3.9 ELEPHANT ROBOTICS

14.3.10 ELITE ROBOT

14.3.11 KASSOW ROBOTS

14.3.12 HANWHA CORPORATION

14.3.13 OMRON ADEPT TECHNOLOGY, INC.

14.3.14 WYZO

14.3.15 MIP ROBOTICS

*Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 284)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

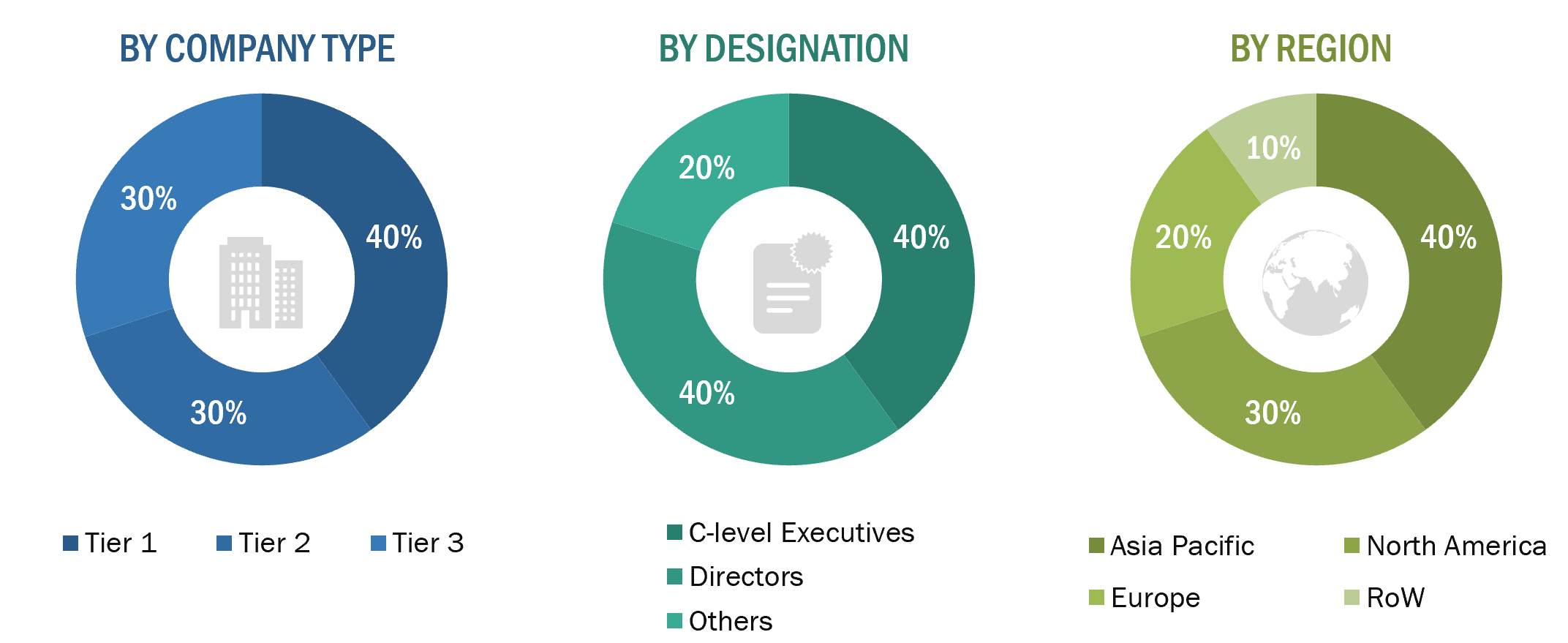

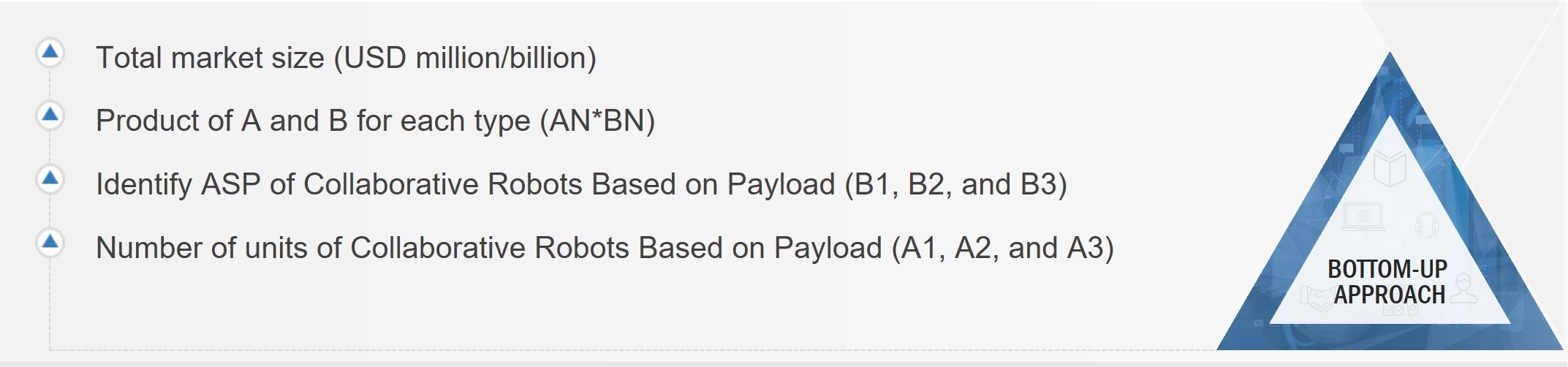

The study involved 4 major activities in estimating the size of the cobots (collaborative robots) market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Further, market breakdown and data triangulation were used to determine the market sizes of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include organizations such as Robotics Business Review, International Federation of Robotics (IFR), Association for Unmanned Vehicle Systems International (AUVSI), IEEE Robotics and Automation Society, The Robotics Society of Japan, Chinese Association of Automation, and so on; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, and business. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the collaborative robot market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (commercial application providers) and supply-side (equipment manufacturers and distributors) players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (South America, Middle East & Africa). Approximately 75% and 25% of primary interviews were conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In canvassing primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings described in the remainder of this report.

Breakdown of Primary Participants

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the collaborative robot market. These methods were also extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- The key players in the market were identified through extensive secondary research.

- In terms of value, the supply chain and market size were determined through primary and secondary research.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been considered while calculating and forecasting the market size.

Global Cobots (Collaborative Robots) Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes explained above-the market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To describe and forecast the collaborative robot market by payload, component, application, and industry, in terms of value

- To describe and forecast the market by payload, application, and industry, in terms of volume

- To describe and forecast the market for four main regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value and volume

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the value chain pertaining to the ecosystem of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players using various parameters within the broad categories of business and product strategy

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as acquisitions, product launches and developments, and research and developments in the market

Note:

1. Micromarkets are defined as further segments and subsegments of the collaborative robot market included in the report.

2. Core competencies of the companies are defined in terms of their key developments, products offered, and key strategies adopted by them to sustain in the

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Collaborative Robot Market

I teach a course titled "Technology, Innovation and Future of Work". It is a graduate level course in our Business School (elective course of Operations Management Area). Robots and Cobots in manufacturing is a module of the course. Your report will be useful in explaining the significance of cobots/robots in manufacturing. So, can you help me with a sample and few more insights on this?

I'm writing an article on cobots in Pharma labs (R&D and QC). Would you like to comment on data/trends/uses? Deadline Dec. 24.

hey guys, I'm working on an Augmented reality startup and we had the idea to enable robot collaboration with Augmented Reality glasses. Unfortunately we're bootstrapping (out of University) and cannot afford to buy a report in this price range. However it would be great to find a few more information about this arising industry.

I'm a New-York-based journalist working with a new science and technology magazine being launched this spring. I'm writing a piece about the rise of cobots, and would love to talk to one of your analysts about the report "Collaborative Robot Market worth $12,303 million by 2025", and quote them in this piece. Would someone be free to talk with me? If so, let me know a good time and we'll do it!

We are a robot drive manufacturing company and our specific interest lies in collaborative robot market for above 10 kg and their respective applications interlinked with regional analysis.

I wonder why there is completely missing Mitsubishi electric (one of the top robot producers).

My thesis for my EMBA is based on the cobot market. Would be great to be able to use some of the research in this report.

Dear Sir or Madam, I am a student at an University and writing my dissertation about collaborative robots. Therefore, I would like to ask you if it is possible to send me any information regarding the price forecast for collaborative robots? If so, it would be great and I would be very grateful since I am not able to buy your report due to my financial situation. However, I am really interested in Cobots.

I'm evaluating collaborative robot market for our company's new business area. So, I want to know the each region's market size and upcoming applications in detail.

I'm a course designer at an university for the subject 'industrial automation'. I am thinking of including some content on collaborative robots in our curriculum and hence would like to understand the role of collaborative robots in industrial automation. Few use cases also might be helpful.

Hi, I would request for a free sample report as I need to validate the collaborative robot market data for one of my clients. If found satisfactory, the client will buy it for sure.

We are looking for report focusing on Mexican collaborative robot market (overall and by industry) and after-market services of collaborative robots. Could you please quickly provide estimated fees and timeline for delivery?

We are looking to get into the business of collaborative robots as our clients face a big challenge to configure Industrial Robots. Does this cover the aspect of better RoI owing to adoption of collaborative robots compared to industrial robots?

I have been approached by a company that wants to hire me to sell Collaborative Robots. I am investigating the market before I make a decision.

Investigating the availability and capability of Collaborative Robots for applications in Body Shops in Automotive Assembly Plants, especially for assisting manual installations and assembly processes.

We are trying to identify the ideal collaborative robot for a material handling task for one of our clients. Can this report address our concern?

I am working on a project in industrial automation focusing on collaborative robots. My immediate task is a market sizing exercise. Hence would need insights on annual shipment and selling prices for various companies.

I would like to know more about COVID 19 impact on Cobots Industry.

I would like to know more about COVID 19 impact on Cobots Industry.

I'm looking to refer this study for understanding the growth opportunities specifically in machine tending and processing applications. The insights obtained will have a direct impact on our upcoming R&D investments for product development.

I intend to use the report for academic purpose, namely for the theoretical introduction of my master thesis. Can I get some insight about the collaborative robot market? I would cite your report as a part of references.

As I´m preparing a report about collaborative robots market developments, I would like to use some of the figures in your report. Can you help me with this?

Dear MarketsandMarkets, I am writing my PhD thesis about the collaborative robots, I would like to use your research result in the introduction chapter (main players, forecast in the future). Of course keeping the correct citation and reference rules. Please share your research with me.

Does the report cover information on, how you categorize revenues for different application types? Additionally, testing doesn’t seem to be that large last year. I will purchase the report if you can provide some insights specifically around this application – waiting for your reply and if you think the question can be answered I will purchase soon. High priority, urgent purchase requirement, I can specifically visit your premises post confirmation as I am currently working on a project in Pune.

We are a venture capital firm and are trying to understand the state of the art in AI for cobot vision, task definition, error handling etc. Further, insights on the new entrants with AI integrated vision products offered in the market would help us in making investment decisions.

I have recently joined a renowned robotics institute, and I am trying to get a perspective and an estimate of market sizes of various end use industries such as automotive, electronics, and food. Can you share a document with me for the same?

Since, covid has impacted the market for cobots, in what innovative ways can the companies bounce back?

I would like to check the collaborative robot market status and growth etc. as my company is preparing new 5G smart factory product.

I'm currently writing my thesis for bachelor in business and economics, where I'm analyzing the impact of the future technological advancements on the collaborative robot market and how is it going to affect the SMEs (small medium enterprises) worldwide. Therefore this forecast would be very valuable to me.

I'd like to get an idea on how have you incorporated impact of future technology trends for forecasting collaborative robots market.

Interested in partnering with other industrial and collaborative robot manufacturers. Can you help us with few crucial details?