Collagen Market by Product Type (Gelatin, Hydrolyzed Collagen, Native Collagen), Application, Source (Bovine, Porcine, Poultry, Marine, and Plant Sources), Form, Type, Extraction Process and Region - Global Forecast to 2030

Updated on : July 5, 2023

Collagen Market Report Summary, 2030

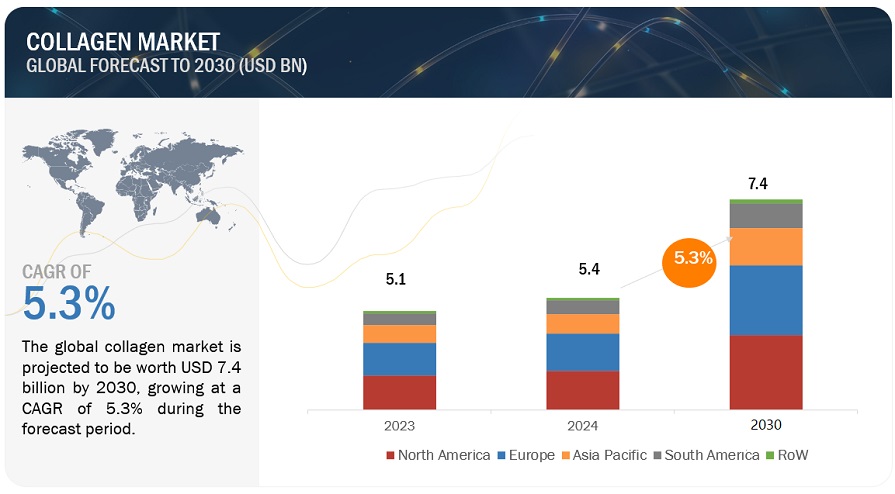

The global collagen market is projected to grow from USD 4.7 billion in 2022 growing at a CAGR of 5.3% from 2022 to 2030 to reach USD 7.2 billion by 2030. The global collagen market is experiencing significant growth due to increasing consumer awareness of the benefits of collagen in various applications such as food and beverages, cosmetics, and pharmaceuticals. Demand for collagen products is also anticipated to rise as gelatin and hydrolyzed collagen is being used in a variety of sectors, including healthcare, cosmetics, and food & beverages.

Collagen supplements have a wide range of uses in cosmetic procedures, anti-aging treatments, and aesthetic medications because they keep skin moisturized and keep it from aging. Additionally, collagen is crucial for pharmaceutical applications, including membranes and sponges used in drug delivery systems. Additionally, because these materials degrade naturally, it is safe to dispose of them without endangering the environment. However, technical advancements in the healthcare industry have boosted the efficiency of collagen products.

To know about the assumptions considered for the study, Request for Free Sample Report

Collagen Market Growth Dynamics

Drivers: Increasing demand for collagen-based cosmetics among the consumers globally

Collagen fibers present in the human skin are damaged with time, losing thickness and strength, which results in skin aging. Collagen is used in the cosmetic industry in creams as a nutritional supplement for bone and cartilage regeneration, vascular and cardiac reconstruction, skin replacement, and augmentation of soft skin, among others. Collagen is a common constituent of soaps, shampoos, facial creams, body lotions, and other cosmetics. Hydrolyzed collagen is an important ingredient in skin and hair care products. One important application of hydrolyzed collagen in the personal care sector is combined with surfactants and active washing agents in shampoos and shower gels. The diet choices people are making nowadays prevent the skin from receiving the vital nutrients it needs. Because of this, nutricosmetics, which give the human skin the nutrition it needs, are very popular. Along with this advantage, the collagen market for nutricosmetics is growing as more individuals are becoming conscious of their own health. For instance, Procter & Gamble (US), under its brand ‘Olay’ has recently announced a launch of a new collection, Olay Regenerist Collagen Peptide 24, which helps to deliver plump and bouncy skin in 2021.

Restraints: Cultural restriction prohibiting consumption of animal-sourced food & beverages

Collagen has varied applications in the food, pharmaceutical, cosmeceutical, and nutraceutical industries. However, they are animal by-products obtained from the slaughtering of animals, including the bones, hides, as well as hooves of cattle, pigs, fish, and poultry. Individuals with religious or dietary restrictions that forbid the consumption of animal products are not willing to consume these products. For instance, pork and pork-derived products are strictly forbidden in Muslim communities (including those in the Middle East). They instead prefer to consume halal-certified bovine-derived products. Therefore, the collagen market for collagen manufactured by pork skin is negligible in these regions. Similarly, in India, the consumption of cattle-derived products is largely culturally forbidden; the Hindu community does not generally consume beef and beef-derived products. Hence, pork-based gelatin and hydrolyzed collagen are mostly consumed in this country. These cultural and regional outlooks can sometimes pose a restraint on the growth of the collagen market.

Opportunities: Immense opportunities in emerging economies

The global collagen market is growing as the demand for collagen from developed economies has increased due to the changing consumer attitude toward the consumption of collagen derivatives. Consumers are more aware of the importance of collagen in maintaining their health, which has led to the sustained growth of collagen components in the market. Changing lifestyles, food habits, the adoption of western food habits, an increase in demand for functional ingredients in food products, and an increase in industrial activity leading to the need for process enhancement have contributed to the development of the market in developing economies. Emerging economies such as the Asia Pacific, South Africa, the Middle East, South America, and Eastern European countries provide excellent opportunities for the growth of the collagen market

Challenges: Insufficient processing technologies across the globe

The extraction and processing of collagen proteins require highly advanced technology. After extracting the edible collagen from porcine/bovine/fish skins, it is sent for filtration and ion exchange. The filtration process involves microfiltration technology, where the fluid can pass through a porous membrane. This is followed by heat sterilization, which requires high-temperature heat treatment and, ultimately, drying of the product through spray drying technology. All the above technologies are not largely developed throughout the regions of the world, especially in developing countries such as India, China, and the Rest of Asia Pacific. Hence, collagen peptides and gelatin production are largely restricted to some countries, such as the US, the UK, and Germany. Developing countries that have a huge demand for protein-based ingredients are lagging due to the absence of advanced technologies to manufacture and market products.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 4.7 billion |

|

Revenue Prediction in 2030 |

USD 7.2 billion |

|

Growth rate |

CAGR 5.3% from 2022 to 2030 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2030 |

|

Units considered |

Value (USD Million/Billion) and Volume (KT) |

|

Segments covered |

Product type, source, application, form, type and extraction process |

|

Regions covered |

North America, Europe, Asia Pacific, South America and RoW |

|

Companies studied |

|

Collagen Market Analysis

By source, bovine was the largest source in the global collagen market.

By source, bovine was the largest source in the global collagen market. Bovine collagen is extracted from bovine species such as water buffalo, yak, bison, and cows; it is a naturally occurring protein present in the cartilage, connective tissues, bones, and hides of these animals. The collagen present in these animals is similar to the collagen present in human bodies. Bovine collagen is highly rich in type I and III collagen. This type of collagen benefits the nails, skin, tendons, eyes, hair, muscles, bones, and blood vessels. Human skin is mainly made up of type I and III collagen, and hence bovine collagen is especially used in skincare products targeted towards reducing wrinkles, promoting elasticity, and increasing skin moisture.

By product type, gelatin is dominating the global collagen market.

By product type, gelatin is the largest market in the global collagen market. Gelatin is a colorless, flavorless, and translucent, brittle food ingredient, which is derived from collagen obtained from various animal body parts. It is obtained not only from animal skin but also from fish and insects. Manufacturing of gelatin includes two methods, which are the alkaline and acid processes, to manufacture type A and type B gelatin, respectively. Gelatin is widely used in foods to improve elasticity, consistency, and stability. Gelatin is used to make gelatinous desserts, gummy candies, many yogurts, and marshmallows. Gelatin is also found as a common ingredient in soups, broths, sauces, marshmallows, cosmetics, and medications. This common thickening and gelling agent are an animal-based product that contains high levels of protein.

By form, liquid segment is projected to witness a decent market growth rate during the forecast period

By form, liquid segment is projected to witness a decent market growth rate during the forecast period. Collagens are also available in liquid form. As compared to other proteins, collagen in liquid form is soluble. These can be used across a wide range of concentrations. Liquid forms of collagen typically have less collagen per serving than the powdered alternative. Independent from their average molecular weight, all collagens showcase almost the same low viscosity at lower protein concentrations. While with an increase in concentrations, the viscosity also increases. It gets transformed from watery to syrup-like liquids. These are used as variable agents for protein bars and beverages.

By region, Europe is projected to account largest share of the global collagen market during the forecast period

To know about the assumptions considered for the study, download the pdf brochure

The European region includes Germany, France, the UK, Italy, Spain, and the Rest of Europe. Rising awareness among consumers about the health benefits of collagen has led to the formation of the collagen supplements industry. The region has witnessed many collagen-infused drinks, such as cappuccino collagen and soy collagen, among others, launched by manufacturers. They are either marketed as the components of protein blends or in combination with fruits. The rising usage of collagen in a wide variety of food items & beverages and the changing consumer preference are accelerating market growth. Moreover, the preference for minimally invasive or non-invasive technologies, as well as the increasing use of collagen by biomedical industries in developed countries of Europe, are further fueling the market growth.

Key Players in Collagen Market:

Key players in this market include Tessenderlo Group (Belgium), Darling Ingredients (US), GELITA AG (Germany), Lapi Gelatine S.p.a. (Italy), Holista Colltech (Australia), Gelnex (Brazil), Nitta Gelatin N.A Inc. (Japan), Collagen Solutions plc (UK), Weishardt Holding SA (France), and Royal DSM N.V (The Netherlands).

Target Audience:

- Manufacturers, dealers, and suppliers of collagen

- Technology providers to collagen manufacturers

- Food & beverage, pharmaceuticals, and cosmetics & personal care products manufacturers

- Raw material suppliers

- Trade associations and industry bodies

- Importers and exporters of collagen

- Associations. regulatory bodies, and other industry-related bodies

- US Food and Drug Administration (US FDA)

- Gelatine Manufacturers of Europe (GME)

- US Department of Agriculture (USDA)

- European Food Safety Authority (EFSA)

- The International Food Additives Council (IFAC)

- Food Processing Suppliers Associations (FPSA)

- Center for Innovative Food Technology (CIFT)

- European Food Information Council (EUFIC)

- Food Standards Australia New Zealand (FSANZ)

Report Segmentation

This research report categorizes the collagen market based on product type, application, form, source,type, extraction process and region.

By Product Type

- Gelatine

- Hydrolysed Collagen

- Native Collagen

- Other Product Types

By Source

- Bovine

- Porcine

- Poultry

- Marine

- Plant Sources

By Application

- Nutritional Products

- Food & Beverages

- Pharmaceutical Products

- Cosmetics & Personal Care Products

- Medical Devices & Research Grades

By Form

- Dry

- Liquid

By Type

- Type I

- Type II

- Other Types

By Extraction Process

- Chemical Hydrolysis

- Enzymatic Hydrolysis

- Ultrasound

- Acid/Alkali Gelatin Hydrolysis

By Region

- North America

- Europe

- Asia Pacific

- South America

-

RoW

- Middle East

- Africa

Recent Developments

- In November 2022, PB Leiner a business segment of Tessenderlo Group (Belgium) and the Hainan Xiangtai Group (China) entered into a joint venture agreement to produce marine collagen peptides based on PB Leiner's technology starting in the fourth quarter of 2022, in accordance with the conditions of this agreement.

- In January 2022, Darling Ingredient’s Rousselot Health (US) and Terasaki Institute for Biomedical Innovation (TIBI) of the US worked together on the creation of gelatin-based treatments and their implementation in clinical settings.

- In July 2021, Gelita AG (Germany) expanded its biotech hub in Frankfurt is Main for the development of proteins, including collagen.

- In September 2020, Nitta Gelatin NA Inc. (Japan) introduced Replenwell, a new line of collagen peptide ingredients, to its Wellnex portfolio.

- In February 2020, PB Leiner, a business segment of Tessenderlo Group (Belgium), expanded its operation by opening a new production facility in Argentina. The production facility is for the collagen line of products.

Frequently Asked Questions (FAQ):

What is the projected market value of the collagen market?

The global collagen market size is projected to reach USD 7.2 billion by 2030.

What is the collagen market growth?

The collagen market is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2022 to 2030.

Which is the largest growing region in collagen market?

Europe is the largest region in the global collagen market in the forecast period. The presence of major collagen manufacturers such as Tessenderlo Group (Belgium), GELITA AG (Germany), Lapi Gelatine S.p.a. (Italy), Weishardt Holding SA (France), among others, further drives the market in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

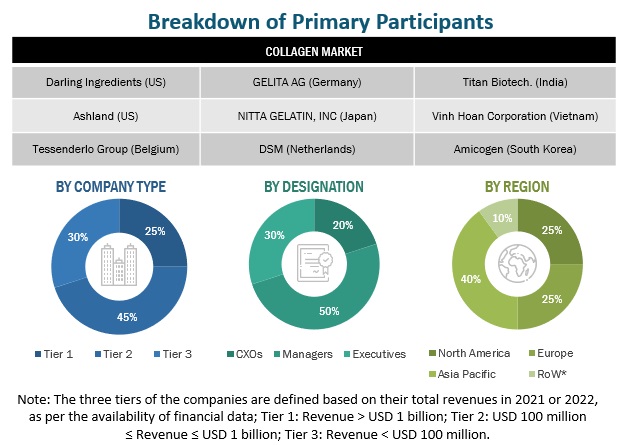

The study involved four major activities in estimating collagen market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources, such as the Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), European Food Safety Authority (EFSA), Trade Data, OECD-FAO, Nutrition Society of India (NSI), Medical Council of India (MCI), and academic references pertaining to collagen were referred to identify and collect information for this study. The secondary sources include clinical studies & journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain key information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The collagen market comprises several stakeholders in the supply chain, including dietary supplement manufacturers, food & beverage manufacturers, pharmaceutical manufacturers & suppliers, meat processors, importers & exporters, and intermediary suppliers such as traders and distributors of collagen products. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include collagen manufacturers, exporters, and importers. The primary sources from the demand side include pharmaceutical manufacturers, nutritional products manufacturers, food & beverage manufacturers, cosmetic & personal care products manufacturers, and other end-use sectors.

After the complete market engineering process (calculations for market statistics, market breakdown, market size estimations & projections, and data triangulation) was done, extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation, key players, competitive landscape, and market dynamics, such as drivers, restraints, opportunities, challenges, and strategies adopted by leading players.

To know about the assumptions considered for the study, download the pdf brochure

Collagen Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the collagen market. These approaches were also used extensively to determine the size of various subsegments in the market for the base year in terms of value. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- The revenues of the major players were determined through primary and secondary research, which were used as the basis for market sizing and estimation.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data

Collagen supplements market & Its impact on collagen market

Collagen supplements are a popular health and beauty product that has gained significant attention in recent years. Collagen is a protein that is found in the body's connective tissues, and it plays a crucial role in maintaining the skin's elasticity, joint health, and other important functions. Collagen supplements are marketed to boost collagen levels in the body and improve these functions.

The global collagen supplements market has experienced significant growth in recent years, and it is expected to continue to grow in the coming years.

The growing popularity of collagen supplements is due to several factors, including increasing consumer awareness of the health benefits of collagen, the rise of the wellness industry, and the aging population. Collagen supplements are marketed to improve skin health, reduce joint pain, and promote overall health and wellness.

The impact of the collagen supplements market on the overall collagen market is significant. The demand for collagen supplements has led to an increase in the production of collagen from various sources, including animal and marine sources. This has led to an increase in the availability of collagen for other industries, such as the food and beverage industry, which uses collagen as a food additive and in the production of various products.

The increasing demand for collagen supplements has also led to the development of new products and formulations, including collagen peptides, which are easier for the body to absorb and use than other forms of collagen. This has further increased the popularity of collagen supplements and expanded the market for collagen-based products.

Overall, the collagen supplements market has had a significant impact on the collagen market, driving growth and innovation in the industry. As the demand for collagen supplements continues to grow, it is likely that the market will continue to expand and evolve to meet consumer needs and preferences.

Recent Trends in collagen supplements market

-

Thorne Research Marine Collagen Peptides: This is a dietary supplement that helps to restore and maintain the health of your skin, hair, and nails. It is made from sustainably sourced cold-water fish with a hydrolyzed fish collagen peptides for optimized absorption.

-

Neocell Super Collagen+C Type 1 & 3: This dietary supplement contains 6,600 milligrams of hydrolyzed collagen type 1 & 3 per serving. It also contains vitamin C to help support collagen synthesis, as well as boron to help the body absorb calcium.

-

Healthforce Nutritionals Superfoods Collagen Renew: This powdered dietary supplement contains lion’s mane mushroom to help nourish your skin and hair, as well as vitamin C to support collagen production. It also contains hyaluronic acid, thiamine, and riboflavin to help support joint health as well as other body functions.

- Garden of Life Grass-Fed Collagen Beauty: This dairy-free collagen supplement contains 10 grams of grass-fed collagen per serving along with probiotics, vitamin B6 and biotin to support healthy skin, hair, and nails. It also contains organic ashwagandha and organic date fruit to help reduce stress levels and ensure hormone balance in your body.

Use cases of Nutritional Products along with adaption, market potential, and risk.

-

Personalized Nutritional Products: With the development of personalized nutrition, Nutritional products can be tailored to the individual’s needs, allowing for more effective and efficient supplementation. With the ability to track nutrient absorption, dietary adherence, and other biomarkers, personalized nutrition will allow customers to obtain optimal nutritional support and improved health outcomes.

- Adoption: This technology is already showing promising results in clinical settings and is beginning to be adopted by consumers. Market potential: As new technologies are developed; more people are likely to use personalized nutrition as part of their overall wellness routine.

- Risk: There is some potential risk associated with personalization as well as privacy concerns when dealing with sensitive data.

- Projected growth: Personalized nutrition is expected to continue to grow over the next several years with new advances in technology, data-driven services, and consumer demand for personalized products.

-

Plant-based Nutrition Products: Plant-based nutrition products are becoming increasingly popular as consumers look for healthier alternatives without compromising taste or quality. These products are often fortified with vitamins and minerals to provide essential nutrients needed for a balanced diet.

- Adoption: Plant-based nutrition has seen a surge in popularity in recent years as more people seek out plant-based foods for dietary or ethical reasons.

- Market potential: The market for plant-based nutrition products is expected to continue to grow as more people become aware of their health benefits and their availability at supermarkets and health food stores.

- Risk: As with any specialty product, there is a risk that the market could saturate or become crowded with competitors offering similar products.

- Projected growth: The market for plant-based nutrition is expected to continue its steady growth and remain an important part of the healthy eating trend in the coming years.

Future hypothetic growth opportunity, future use cases, niche growth drivers, niche threats for collagen Supplements Market in North America

-

Increasing Demand: The demand for collagen supplements has been increasing in recent years due to the growing awareness of the health benefits of collagen, such as improving skin health, reducing joint pain, and enhancing gut health.

-

Aging Population: With the aging population in North America, there is a significant potential for growth in the collagen supplement market. Collagen levels decline as people age, leading to various health issues, and supplements can help to replenish collagen levels.

-

Athletes and Fitness Enthusiasts: Collagen supplements can also benefit athletes and fitness enthusiasts by supporting joint health and promoting muscle recovery.

-

Diversification of Product Lines: Companies can diversify their product lines by adding collagen supplements to their portfolio. For example, beauty and skincare brands can introduce collagen-infused products.

-

Use Cases:

- Skin Health: Collagen supplements can help to improve skin health by increasing skin elasticity and hydration, reducing the appearance of fine lines and wrinkles.

- Joint Health: Collagen supplements can support joint health by reducing joint pain and inflammation, improving joint mobility and flexibility.

-

Gut Health: Collagen supplements can promote gut health by repairing and strengthening the gut lining, reducing gut inflammation, and supporting healthy digestion.

-

Niche Growth Drivers:

- Sustainable and Ethical Sourcing: Consumers are becoming increasingly conscious of sustainability and ethical sourcing. Companies that can offer sustainably sourced and ethically produced collagen supplements can gain a competitive advantage.

-

Innovative Delivery Methods: Companies that can offer innovative delivery methods, such as gummies, chews, and powders, can attract consumers looking for convenient and easy-to-use supplements.

-

Niche Threats:

- Regulatory Challenges: The collagen supplement market is not well-regulated, and companies must ensure they comply with regulations, including labelling and advertising claims.

- Competition: The collagen supplement market is becoming increasingly crowded, with many companies offering similar products. Companies must differentiate themselves by offering unique formulations or innovative delivery methods to stand out in the market.

Speak to our Analyst today to know more about "Collagen Supplements Market".

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall collagen market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches

Collagen Market Report Objectives

- To determine and project the size of the market with respect to source, product type, application, type, form, extraction process and region.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across the region.

- To provide detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide the regulatory framework and market entry process related to the market

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market.

- To identify and profile the key players in the collagen market

-

To provide a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape and identify the major growth strategies adopted by players across the country

- To provide insights on key product innovations and investments in the collagen market

Available Customizations:

MarketsandMarkets offers customizations according to client-specific scientific needs with the given market data.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of the European collagen market into Belgium, the Netherlands, Russia, Sweden and other EU and non-EU countries.

- Further breakdown of the Rest of the Asia Pacific market into Thailand, the Philippines, Malaysia, Singapore, and Vietnam

- Further breakdown of the Rest of South American market into Chile, Colombia, Paraguay, and other South American countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Collagen Market