Avionics Market by System (Navigation, Payload & Mission Management, Traffic & Collision Management, Communication, Power & Data Management, Weather Detection, Flight Management, Electronic Flight Display), Fit, Platform & Region - Global Forecast to 2027

Updated on : April 03, 2023

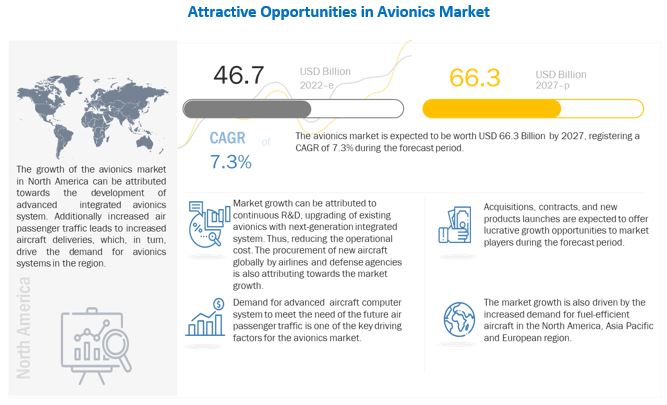

[277 Pages Report] The Avionics Market was valued at $46,700 Million in 2022 and is estimated to grow from $50,400 Million in 2023 to $66,300 Million by 2027 at a CAGR (Compound Annual Growth Rate) of 7.3% during forecast period. Avionics comprises of all the electronic components in an aircraft that manage operations and secure passenger safety. Advanced avionics are being developed to increase the aircraft's efficiency and safety by enhancing situational awareness. The adoption of avionics is driven by the demand for integration of sophisticated avionics onboard modern aircraft, thereby saving weight and reducing operational and maintenance costs for end users.

To know about the assumptions considered for the study, Request for Free Sample Report

Avionics Market Dynamics:

Driver: Increasing adoption of sophisticated flight management systems by aircraft OEMs

Aircraft manufacturers are increasingly adopting a new connected and digital avionics design wherein the integrated systems have smaller modular form factors. The adoption of digital systems is no longer limited to military and commercial aviation, as evident from the increasing launches of new products from avionics OEMs directed towards general aviation platforms, especially for light aircraft and business jets. For instance, at the 2022 Aircraft Electronics Association Convention held in Louisiana, US, around 30 new avionics products were introduced and most of them were aimed at the general aviation operators to provide them with new methods for acquiring, transmitting, and analysing critical flight operational and aircraft system maintenance data.

Honeywell has already pioneered the next-generation flight management systems (NG FMS) and has optimized it for future Air Traffic Management (ATM) functionality to and deliver improved fuel efficiency, reduced direct operating costs, reduced pilot workload and improved safety. The company has designed the NG FMS in such a way that the system can run the same core functionality on multiple platforms with little modification from the core FMS functionality, paving the way for its integration into upcoming models of business jets and light aircraft. The need to enhance the operational reliability of the flight management system in dense traffic areas has also fostered extensive R&D. For instance, since 2007, Thales has been working in close conjunction with ATR on the new cockpit systems as a tier-one system integrator and has been engaged in the development of a modular avionics architecture including a new cockpit equipped with five large LCD screens, a flight management system (FMS) and a latest-generation autopilot. Also, in July 2022, Jet2.com signed an agreement with ACSS, a joint venture company between L-3 Communications and Thales, for integrating both the flight management system (FMS) and integrated surveillance equipment (T3CAS) developed by ACSS as the selectable supplier furnished equipment (SSFE) on their A321neo orderbook, comprising 51 units. Such developments are anticipated to dive the adoption of modern avionics and drive both line fit and retrofit aspects of the market in focus during the forecast period.

Restraint: Stringent design regulations pertaining to avionics

Avionics is a vital part of the flight deck and, hence, the safety of the crew and passengers is dependent on the proper functioning of the system and its subcomponents. Thus, the systems are designed as per the guidelines formulated by the aviation regulatory authorities and their performance and accuracy are required to be validated prior to obtaining installation type certification. For instance, the US Federal Aviation Administration (FAA) states that for displaying the Primary Flight Information (PFI), there should be at least two independent displays to provide information pertaining to the attitude, airspeed, altitude, and heading (direction) to the pilot, and these displays must be arranged in the basic T arrangement, and the horizon reference line should be at least 3.25 inches wide for integrated displays. Nevertheless, the certification process requires significant R&D expenditure for ensuring compliance with existing regulations and is deemed lengthy and capital-intensive. This may restrain the growth of the avionics industry in the near future.

Opportunity: Planned fleet modernization programs

Since avionics retrofits encompass a comprehensive set of capabilities that can resemble the operational capabilities of factory fitments installed onboard new generation aircraft. Several airline operators consider retrofit options to boost the value of existing assets, extend the avionics lifecycle, and enhance overall aircraft performance. Hence, major avionics manufacturers are working with aviation service companies to integrate and install systems that can meet the demand of upcoming modern avionics enabled with advanced functionalities. Most airlines consider retrofit to boost the value of their fleet and enhance life of their aircraft. Nevertheless, major avionics manufacturers are collaborating with aviation service companies to integrate and install systems that can meet the demand of upcoming modern avionics enabled with advanced functionalities. Several contracts are being awarded to fulfill the demand for avionics for both linefit and retrofit aspects. For instance, in June 2019, the US National Guard and US Air Force Reserve Command awarded a USD 500 million contract to L3Harris Technologies Inc. (US) for major avionics upgrade of 176 Lockheed Martin C-130H tactical transports operated by the two agencies. Several similar contracts are also underway or are anticipated to be formalized in different parts of the globe, thereby creating numerous opportunities for avionic installations and upgrades during the forecast period.

Challenge: High system complexity requiring proper pilot training for optimum usage

A modern avionics system comprises several subsystems, and the data assimilated from several embedded sensors is displayed to the pilot using the different display systems installed onboard. However, these display systems are complex and vulnerable to signal errors. The complex nature of the system has a negative impact on situational awareness and increases the workload of the pilot as he is then required to manage several goals, tasks, and take many split-second decisions. There have been several instances where pilots have been confused by computer-generated messages. For example, in Aero Peru Flight 603, the pilots of the B757 received contradictory messages with most of the instruments inoperable, which ultimately resulted in a mid-air collision.

Though airlines have incorporated extensive training procedures for the pilots, the margin of computational error remains high in certain cases and the systems may malfunction abruptly. The US National Transport Safety Board has made six recommendations related to appropriate training for pilots to the Federal Aviation Administration (US). This includes conducting revision tests based on avionics operations and malfunctions to evaluate the knowledge of the pilots, publication and development of new guidance material for new generation avionics simulators.

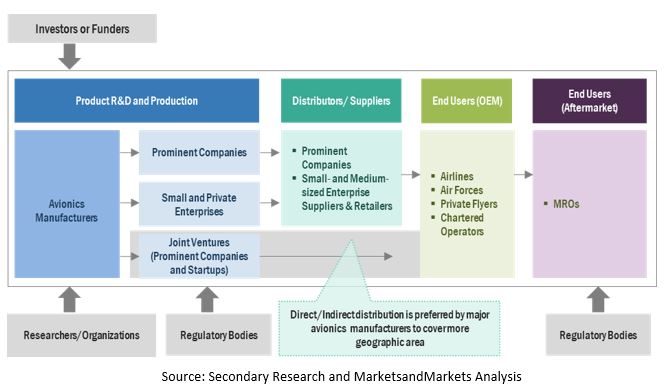

Avionics Market Ecosystem

Prominent companies that provide avionics, private and small enterprises, distributors/suppliers/retailers, and end customers (airlines, air forces, and MROs) are the key stakeholders in the avionics market ecosystem. Investors, funders, academic researchers, distributors, service providers, and defence procurement authorities are the major influencers in the avionics market.

The navigation segment is estimated to account for the largest share of the avionics market during the forecast period

Based on application, the avionics market is segmented into payload & mission management, traffic & collision management, communication, power & data management, weather detection, flight management, electronic flight display. The Navigation segment is estimated to lead the avionics market during the forecast period due to the enhancement of the existing aircraft fleet by major airline players with the latest electronic equipment for better safety and fuel efficiency.

Military aviation segment projected to lead avionics market during forecast period

Based on platform, the avionics market has been segmented into commercial aviation, military aviation, and general aviation. An increase in defence budgets of military powers such as the US, China, and Russia, is expected to lead to increased demand for military aircraft, thereby contributing to the growth of the military aviation segment of the avionics. Additionally, the emerging trends in military aircraft include the incorporation of fifth-generation technology, stealth technology, and advanced composite materials in are influencing the military aviation market.

Line Fit segment is expected to account for the largest share in 2022

Based on fit, the avionics market has been segmented into line fit and retrofit. Line-fit is the direct installation of avionics into the aircraft cockpit by aircraft OEMs, while retrofit refers to the modernization of cockpits of active aircraft fleet with avionics through MRO channels. Since the number of aircraft with provisions for avionics installation in the active fleet is limited to just commercial and military aviation as a large part of the older generation light aircraft did not have the necessary wiring and electrical design for avionics upgrade, the line-fit segment is projected to account for a larger market share throughout the forecast period.

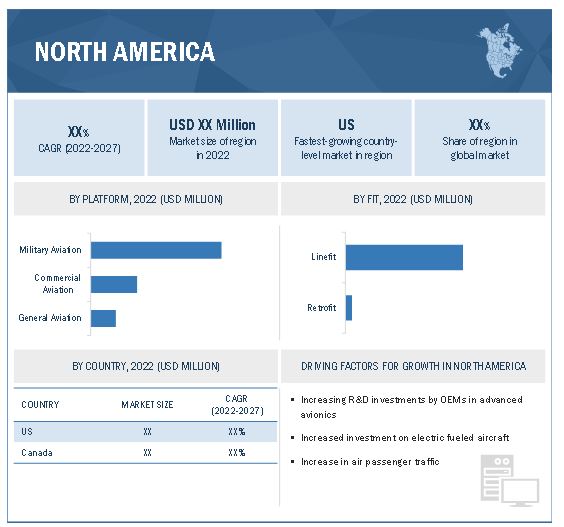

North America is projected to account for the largest share in 2022

North America accounted for the largest market share in 2022 due to significant R&D investments by domestic players in advanced avionics systems. The last five years, the US’ aerospace and aviation sector has increased its spending owing to the US government’s focus on the safety of air passengers. The US is likewise investing in the advancement of avionics. Major US-based market players, such as The Boeing Company, Lockheed Martin Corporation, Northrop Grumman Corporation, and Piper Aircraft Inc. are significantly investing in the development of advanced avionics as well as Avionics. These factors contribute to the growth of the avionics market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Top Avionics Companies - Key Market Players

The avionics companies are dominated by a few globally established players such as Raytheon Technologies Corporation (US), Curtiss-Wright Corporation (US), Honeywell International Inc. (US), L3Harris Technologies Inc. (US), General Electric Company (US), Safran SA (France), BAE Systems PLC (UK), Meggitt PLC (UK) Astronautics Corporation of America (US), and Garmin Limited (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By System, Platform, Fit, and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

|

Companies covered |

Raytheon Technologies Corporation (US), Curtiss-Wright Corporation (US), Honeywell Internationals Inc. (US), L3Harris Technologies Inc. (US), General Electric Company (US), Safran SA(France), BAE Systems PLC (UK), Meggitt PLC (UK), Astronautics Corporation of America (US), and Garmin Limited (US) among others |

This research report categorizes the Avionics Market based on System, Platform, Fit, and Region.

Avionics Market, By System

- Navigation

- Payload & Mission Management

- Traffic & Collision Management

- Communication

- Power & Data Management

- Weather Detection

- Flight Management

- Electric Flight Display

Avionics Market, By Platform

- Commercial Aviation

- Military Aviation

- General Aviation

Avionics Market, By Fit

- Line Fit

- Retrofit

Avionics Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In June 2022, Collins Aerospace, a part of Raytheon Technologies Corporation (US) introduced FlightHub, a scalable solution that can be integrated with the Flight Profile Optimization tool to provide real-time route suggestions and save fuel and time while reducing CO2 emissions.

- In February 2022, Garmin Ltd. (US) introduced the TXi EIS for the Pilatus PC-12 aircraft. It is an advanced cockpit retrofit solution that comprises GFCTM-600 autopilot, G600 TXi primary flight display, GTN-Xi navigators, GTX-ADS-B transponder, GWX-weather radar, and other equipment.

- In May 2021, Garmin Ltd. (US) launched the G3000H Integrated Flight Deck that features WAAS/SBAS, ILS approach capabilities, VFR and IFR helicopter charts, and a Connext wireless connection.

Frequently Asked Questions (FAQs):

What is the current size of the Avionics Market?

The avionics market size is projected to grow from USD 46.7 Billion in 2022 to USD 66.3 Billion by 2027, at a CAGR of 7.3% from 2022 to 2027.

Who are the winners in the Avionics Market?

Major players operating in the avionics market are Raytheon Technologies Corporation (US), Curtiss-Wright Corporation (US), Honeywell International Inc. (US), L3Hariss Technologies Inc. (US) General Electric Company (US), Safran SA (France), BAE Systems PLC (UK), and Meggitt PLC (UK).

What are some of the technological advancements in the market?

The avionics market is being revolutionized by the advent of modern navigation and avionics technologies such as the Attitude Heading Reference System (AHRS), Traffic Alert and Collision Avoidance System (TCAS), and several other technologies, that are designed to elevate the level of safety in an aircraft while minimizing the chances of manual error by automating several of the aircraft control parameters, thereby reducing the stress of the pilots.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY AND PRICING

TABLE 1 USD EXCHANGE RATES

1.5 INCLUSIONS AND EXCLUSIONS

TABLE 2 AVIONICS MARKET, BY SEGMENT

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH PROCESS FLOW

FIGURE 2 AVIONICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

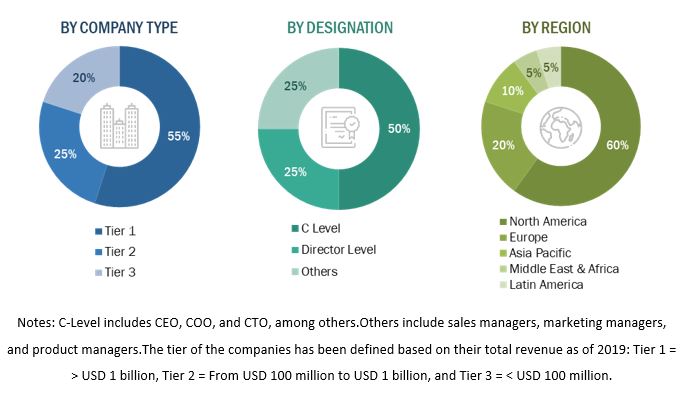

2.1.2.2 Breakdown of primary interviews: by company type, designation, and region

2.2 DEMAND- AND SUPPLY-SIDE ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increasing demand for aftermarket services

2.2.3 SUPPLY-SIDE INDICATORS

2.2.3.1 Advancements in avionics technologies

2.3 RESEARCH APPROACH & METHODOLOGY

TABLE 3 SEGMENTS AND SUBSEGMENTS

2.4 MARKET SIZE ESTIMATION

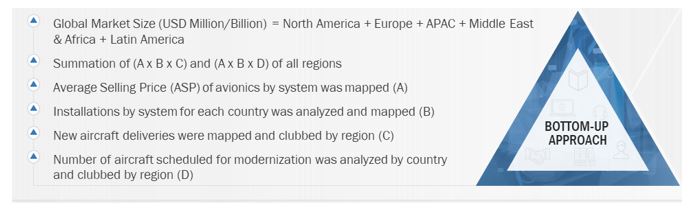

2.4.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND-SIDE)

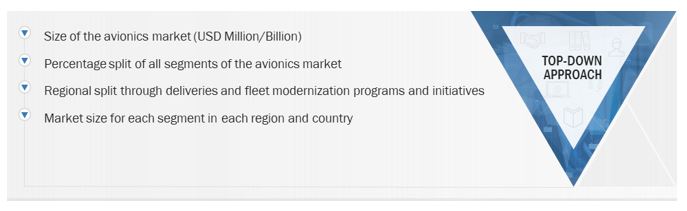

2.4.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (SUPPLY-SIDE)

2.5 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.6 GROWTH RATE ASSUMPTIONS

2.7 ASSUMPTIONS

FIGURE 6 PARAMETRIC ASSUMPTIONS MADE FOR MARKET FORECAST

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 7 NAVIGATION SYSTEMS PROJECTED TO LEAD MARKET FROM 2022 TO 2027

FIGURE 8 MILITARY AVIATION TO DOMINATE MARKET FROM 2022 TO 2027

FIGURE 9 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AVIONICS MARKET

FIGURE 10 INCREASING DEMAND FOR ADVANCED INTEGRATED AVIONICS TO DRIVE MARKET DURING FORECAST PERIOD

4.2 AVIONICS MARKET, BY SYSTEM

FIGURE 11 NAVIGATION SYSTEMS TO HOLD DOMINANT SHARE DURING FORECAST PERIOD

4.3 AVIONICS MARKET, BY PLATFORM

FIGURE 12 MILITARY AVIATION TO LEAD MARKET FROM 2022 TO 2027

4.4 AVIONICS MARKET, BY FIT

FIGURE 13 LINE FIT SEGMENT TO BE LARGEST DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 AVIONICS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing adoption of sophisticated flight management systems by aircraft OEMs

5.2.1.2 Growing fleets of commercial and military aircraft

TABLE 4 REGIONAL OUTLOOK OF AIR TRAFFIC GROWTH, FLEET GROWTH, AND AIRCRAFT DELIVERIES

FIGURE 15 AIRCRAFT DELIVERIES, BY AIRCRAFT TYPE

FIGURE 16 AIRCRAFT FLEET SIZE, BY REGION (2021)

5.2.1.3 Enhanced safety and situational awareness offered by avionics

5.2.2 RESTRAINTS

5.2.2.1 Stringent design regulations pertaining to avionics

5.2.2.2 High installation cost due to ongoing technological disruptions

5.2.3 OPPORTUNITIES

5.2.3.1 Planned fleet modernization programs

5.2.3.2 Implementation of ACAS in general aviation aircraft

5.2.4 CHALLENGES

5.2.4.1 High system complexity, requiring proper pilot training for optimum usage

5.2.4.2 Complex design of embedded systems for military applications

5.3 TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESS

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AVIONICS MANUFACTURERS

FIGURE 17 REVENUE SHIFT IN AVIONICS MARKET

5.4 TRADE ANALYSIS

TABLE 5 IMPORT VALUE OF AIRCRAFT AND SPACECRAFT PARTS, USD MILLION (2017–2021)

TABLE 6 EXPORT VALUE OF AIRCRAFT AND SPACECRAFT PARTS, USD MILLION (2017–2021)

5.5 PRICING ANALYSIS

TABLE 7 AVERAGE SELLING PRICE RANGE: AVIONICS MARKET (BY SYSTEM)

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 18 AVIONICS MARKET ECOSYSTEM MAP

TABLE 8 AVIONICS MARKET ECOSYSTEM

5.7 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS: AVIONICS MARKET

5.8 TECHNOLOGY ANALYSIS

5.8.1 AUTOMATIC DEPENDENT SURVEILLANCE – BROADCAST (ADS-B)

5.8.2 INTEGRATED MODULAR AVIONICS

5.9 CASE STUDY ANALYSIS

5.9.1 NEXT-GENERATION OPEN FLIGHT DECK

5.9.2 PILOTED DISTRIBUTED APERTURE SENSOR SYSTEM

5.10 PORTER'S FIVE FORCES MODEL

TABLE 9 AVIONICS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 KEY STAKEHOLDERS & BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AVIONICS TECHNOLOGIES

TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AVIONICS TECHNOLOGIES (%)

5.11.2 BUYING CRITERIA

FIGURE 21 KEY BUYING CRITERIA FOR AVIONICS TECHNOLOGIES

TABLE 11 KEY BUYING CRITERIA FOR AVIONICS TECHNOLOGIES

5.12 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 12 AVIONICS MARKET: CONFERENCES & EVENTS, 2022–2023

5.13 TARIFF & REGULATORY LANDSCAPE FOR AEROSPACE INDUSTRY

TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS (Page No. - 80)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 22 SUPPLY CHAIN ANALYSIS OF AVIONICS MARKET

6.3 TECHNOLOGY TRENDS

6.3.1 ATTITUDE HEADING REFERENCE SYSTEM (AHRS)

6.3.2 TRAFFIC ALERT AND COLLISION AVOIDANCE SYSTEM (TCAS)

6.3.3 TERRAIN AWARENESS AND WARNING SYSTEMS (TAWS)

6.3.4 ENHANCED VISION SYSTEM (EVS)

6.3.5 AUTOMATIC FLIGHT CONTROL SYSTEM (AFCS)

6.4 IMPACT OF MEGATRENDS

6.4.1 IMPLEMENTATION OF INDUSTRY 4.0

6.4.2 GLOBALIZATION OF SUPPLY CHAIN FOR AVIONICS MANUFACTURING

6.5 AVIONICS MARKET: PATENT ANALYSIS

TABLE 17 KEY PATENTS, 2018–2022

7 AVIONICS MARKET, BY SYSTEM (Page No. - 86)

7.1 INTRODUCTION

FIGURE 23 NAVIGATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 18 AVIONICS MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 19 AVIONICS MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

7.2 NAVIGATION

TABLE 20 NAVIGATION SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 21 NAVIGATION SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.2.1 ALTIMETERS

7.2.1.1 High demand for advanced radar altimeters for enhanced efficiency

7.2.2 ANALOG TURN INDICATORS

7.2.2.1 Modern turn indicators integrated with micro-electromechanical system technology

7.2.3 INERTIAL REFERENCE UNITS

7.2.3.1 Advancements in inertial guidance technology for aerospace systems anticipated to drive market

7.2.4 AIR DATA COMPUTERS

7.2.4.1 Integration into modern aircraft to drive market

7.2.5 OTHERS

7.2.5.1 Demand for advanced sensors and distance measuring equipment to fuel market

7.3 PAYLOAD & MISSION MANAGEMENT

TABLE 22 PAYLOAD & MISSION MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 23 PAYLOAD & MISSION MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.3.1 PAYLOAD MANAGEMENT COMPUTERS

7.3.1.1 Integration with mission management computers for enhanced operational efficiency to drive market

7.3.2 MISSION COMPUTERS

7.3.2.1 Integrated mission computers with enhanced situational awareness to boost market

7.3.3 ELECTRO-OPTICS

7.3.3.1 Deployment in unmanned aircraft to fuel market

7.3.4 SONAR

7.3.4.1 Tactical defense activities drive up demand for sonobuoys

7.3.5 RADAR

7.3.5.1 Advanced MIMO radar to replace conventional radar

7.4 TRAFFIC & COLLISION MANAGEMENT

TABLE 24 TRAFFIC & COLLISION MANAGEMENT SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 25 TRAFFIC & COLLISION MANAGEMENT SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.4.1 AIRCRAFT COMMUNICATION ADDRESSING AND REPORTING SYSTEM

7.4.1.1 Increased demand for technologically advanced aircraft to drive market

7.4.2 COLLISION AVOIDANCE SYSTEM

7.4.2.1 Market driven by increased air traffic & strict regulatory standards

7.5 COMMUNICATION

TABLE 26 COMMUNICATION SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 27 COMMUNICATION SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.5.1 TRANSPONDERS

7.5.1.1 Improved technology & service quality with enhanced data exchange to drive market

7.5.2 TRANSCEIVERS

7.5.2.1 Advanced transceivers designed to enhance aircraft communication aid market growth

7.5.3 ANTENNAS

7.5.3.1 Increasing airspace modernization programs to drive market

7.5.4 TRANSMITTERS

7.5.4.1 Advanced next-generation technologies to boost growth of market

7.5.5 RECEIVERS

7.5.5.1 Modern receivers with high integrity and enhanced efficiency – segment drivers

7.5.6 DATALINK & FREQUENCY SELECTORS

7.5.6.1 Integration of frequency selectors with advanced cockpit solutions fuels growth

7.6 POWER & DATA MANAGEMENT

TABLE 28 POWER & DATA MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 29 POWER & DATA MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.6.1 POWER CONVERSION DEVICES

7.6.1.1 Increase in operational efficiency and reduction in total aircraft system weight drive demand

7.6.2 COCKPIT VOICE RECORDERS

7.6.2.1 Stringent safety standards and sophisticated systems aid market growth

7.6.3 FLIGHT DATA RECORDERS

7.6.3.1 Technologically advanced FDR being developed for enhanced safety

7.6.4 DATA TRANSFER SYSTEMS

7.6.4.1 Need for advanced transfer capabilities in aircraft may influence market

7.7 WEATHER DETECTION SENSORS

TABLE 30 WEATHER DETECTION SENSORS MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 31 WEATHER DETECTION SENSORS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.7.1 WEATHER RADAR

7.7.1.1 Growing need for protection from adverse weather to drive market expansion

7.7.2 LIGHTNING DETECTION SENSORS

7.7.2.1 Integration of advanced lightning sensors with weather radar to drive market

7.8 FLIGHT MANAGEMENT

TABLE 32 FLIGHT MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 33 FLIGHT MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.8.1 FLIGHT MANAGEMENT COMPUTERS

7.8.1.1 Advancements in flight management system technology to boost market

7.8.2 AUTOPILOT COMPUTERS

7.8.2.1 Rising demand for automation systems and improved aircraft performance to drive segment

7.8.3 I/O AND INTERFACE CONTROLLERS

7.8.3.1 Modern lightweight, low-power consuming interface controllers to drive market

7.8.4 ANALOG ATTITUDE INDICATORS

7.8.4.1 Rise in demand for new technology to fuel market

7.8.5 ANALOG VERTICAL SPEED INDICATORS

7.8.5.1 Increased demand for improved efficiency aids market growth

7.9 ELECTRONIC FLIGHT DISPLAY

TABLE 34 ELECTRONIC FLIGHT DISPLAY SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 35 ELECTRONIC FLIGHT DISPLAY SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.9.1 PRIMARY FLIGHT DISPLAY

7.9.1.1 Rising system efficiency and technologically advanced cockpit systems to drive market

7.9.2 MULTI-FUNCTION DISPLAY

7.9.2.1 Increased demand for aircraft and investment in development of new technology to drive market

7.9.3 NAVIGATION DISPLAY

7.9.3.1 Enhanced display systems with vertical flight profile addition to drive market

7.9.4 OTHERS

7.9.4.1 Demand for lightweight, advanced components for modern aircraft to propel market

8 AVIONICS MARKET, BY PLATFORM (Page No. - 103)

8.1 INTRODUCTION

FIGURE 24 COMMERCIAL AVIATION PROJECTED TO WITNESS RAPID GROWTH DURING FORECAST PERIOD

TABLE 36 AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 37 AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

8.2 MILITARY AVIATION

FIGURE 25 COMBAT AIRCRAFT TO ACCOUNT FOR LARGEST MARKET SHARE

TABLE 38 MILITARY AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 39 MILITARY AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

8.2.1 COMBAT AIRCRAFT

8.2.1.1 Growing procurement of combat aircraft due to increasing geopolitical rift

8.2.2 MILITARY DRONES

8.2.2.1 Increasing proliferation of drones for ISR missions

8.2.3 TRAINING AIRCRAFT

8.2.3.1 Pilot shortage to drive demand for training aircraft

8.2.4 TRANSPORT AIRCRAFT

8.2.4.1 Increasing use in military operations to drive demand

8.2.5 SPECIAL MISSION AIRCRAFT

8.2.5.1 Evolving warfare techniques to drive demand

8.2.6 MILITARY HELICOPTERS

8.2.6.1 Increasing use in combat and search & rescue operations to drive demand

8.3 COMMERCIAL AVIATION

FIGURE 26 NARROW-BODY AIRCRAFT TO HOLD DOMINANT MARKET SHARE DURING FORECAST PERIOD

TABLE 40 COMMERCIAL AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 41 COMMERCIAL AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

8.3.1 NARROW-BODY AIRCRAFT

8.3.1.1 Demand for narrow-body aircraft in short-haul travel to drive avionics installations

8.3.2 WIDE-BODY AIRCRAFT

8.3.2.1 Increase in passenger travel leads to need for wide-body aircraft

8.3.3 REGIONAL JETS

8.3.3.1 Increased use of fly-by-wire technology to fuel demand for regional jets worldwide

8.4 GENERAL AVIATION

FIGURE 27 BUSINESS JETS TO DOMINATE MARKET

TABLE 42 GENERAL AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 43 GENERAL AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

8.4.1 BUSINESS JETS

8.4.1.1 Growth of private aviation companies to drive demand

8.4.2 LIGHT AIRCRAFT

8.4.2.1 Low cost of maintenance and operations to boost demand

8.4.3 UNMANNED AERIAL MOBILITY

8.4.3.1 Frequent traffic congestion to drive adoption of UAM

8.4.4 COMMERCIAL HELICOPTERS

8.4.4.1 Increasing corporate and civil applications to drive demand

9 AVIONICS MARKET, BY FIT (Page No. - 114)

9.1 INTRODUCTION

FIGURE 28 LINE FIT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 44 AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 45 AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

9.2 LINE FIT

9.2.1 INCREASING AIRCRAFT DEMAND TO DRIVE SEGMENT

9.3 RETROFIT

9.3.1 INCREASING WEAR & TEAR OF SYSTEMS AND COMPONENTS TO DRIVE REPAIR & REPLACEMENT OF AVIONICS

10 REGIONAL ANALYSIS (Page No. - 117)

10.1 INTRODUCTION

FIGURE 29 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

TABLE 46 AVIONICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 AVIONICS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 30 NORTH AMERICA: AVIONICS MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: AVIONICS MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 49 NORTH AMERICA: AVIONICS MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 51 NORTH AMERICA: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: AVIONICS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: AVIONICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.2 US

10.2.2.1 Increased spending on electric-powered aircraft for cargo operations to drive market

TABLE 56 US: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 57 US: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 58 US: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 59 US: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.2.3 CANADA

10.2.3.1 Increased focus on development of advanced avionics systems for modern aircraft to drive market

TABLE 60 CANADA: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 61 CANADA: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 62 CANADA: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 63 CANADA: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 31 EUROPE: AVIONICS MARKET SNAPSHOT

TABLE 64 EUROPE: AVIONICS MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 65 EUROPE: AVIONICS MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 66 EUROPE: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 67 EUROPE: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 68 EUROPE: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 69 EUROPE: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 70 EUROPE: AVIONICS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 71 EUROPE: AVIONICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Ongoing development of vertical lift airborne technology to drive market

TABLE 72 UK: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 73 UK: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 74 UK: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 75 UK: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Increased competition in airline industry to drive market

TABLE 76 FRANCE: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 77 FRANCE: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 78 FRANCE: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 79 FRANCE: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.3.4 GERMANY

10.3.4.1 Advancements in avionics and procurement of advanced fighter jets to boost market

TABLE 80 GERMANY: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 81 GERMANY: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 82 GERMANY: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 83 GERMANY: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.3.5 ITALY

10.3.5.1 Growing developments in aviation industry to drive market

TABLE 84 ITALY: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 85 ITALY: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 86 ITALY: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 87 ITALY: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.3.6 RUSSIA

10.3.6.1 Focus on increasing manufacturing capabilities of commercial aircraft to drive market

TABLE 88 RUSSIA: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 89 RUSSIA: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 90 RUSSIA: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 91 RUSSIA: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.3.7 REST OF EUROPE

10.3.7.1 Growing air passenger traffic to drive market

TABLE 92 REST OF EUROPE: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 93 REST OF EUROPE: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 94 REST OF EUROPE: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 95 REST OF EUROPE: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: AVIONICS SNAPSHOT

TABLE 96 ASIA PACIFIC: AVIONICS MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 97 ASIA PACIFIC: AVIONICS MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 99 ASIA PACIFIC: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 100 ASIA PACIFIC: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 101 ASIA PACIFIC: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: AVIONICS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 103 ASIA PACIFIC: AVIONICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Increased investment in helicopter medical services to drive market

TABLE 104 CHINA: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 105 CHINA: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 106 CHINA: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 107 CHINA: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Improving domestic connectivity under UDAAN scheme to drive market

TABLE 108 INDIA: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 109 INDIA: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 110 INDIA: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 111 INDIA: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.4.4 JAPAN

10.4.4.1 Investment in development of electric-powered aircraft to drive market

TABLE 112 JAPAN: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 113 JAPAN: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 114 JAPAN: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 115 JAPAN: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.4.5 AUSTRALIA

10.4.5.1 Procurement of different types of aircraft to meet demand to fuel market

TABLE 116 AUSTRALIA: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 117 AUSTRALIA: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 118 AUSTRALIA: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 119 AUSTRALIA: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.4.6 SOUTH KOREA

10.4.6.1 Increased investments in development of defense aircraft electronics technologies to drive market

TABLE 120 SOUTH KOREA: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 121 SOUTH KOREA: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 122 SOUTH KOREA: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 123 SOUTH KOREA: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.4.7 REST OF ASIA PACIFIC

10.4.7.1 Government support for development of advanced avionics to drive market

TABLE 124 REST OF ASIA PACIFIC: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 125 REST OF ASIA PACIFIC: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 126 REST OF ASIA PACIFIC: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 127 REST OF ASIA PACIFIC: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

FIGURE 33 MIDDLE EAST & AFRICA: AVIONICS MARKET SNAPSHOT

TABLE 128 MIDDLE EAST & AFRICA: AVIONICS MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 129 MIDDLE EAST & AFRICA: AVIONICS MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 130 MIDDLE EAST & AFRICA: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 133 MIDDLE EAST & AFRICA: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 134 MIDDLE EAST & AFRICA: AVIONICS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 135 MIDDLE EAST & AFRICA: AVIONICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.2 SAUDI ARABIA

10.5.2.1 Aviation sector modernization program vision 2030 to drive market

TABLE 136 SAUDI ARABIA: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 137 SAUDI ARABIA: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 138 SAUDI ARABIA: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 139 SAUDI ARABIA: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.5.3 UAE

10.5.3.1 Development and acquisition of modern aircraft and helicopters for national security to drive market

TABLE 140 UAE: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 141 UAE: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 142 UAE: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 143 UAE: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.5.4 ISRAEL

10.5.4.1 Modernization of Israeli Air Force aircraft fleet with advanced avionics systems to drive market

TABLE 144 ISRAEL: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 145 ISRAEL: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 146 ISRAEL: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 147 ISRAEL: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.5.5 SOUTH AFRICA

10.5.5.1 Rising demand for commercial aircraft and business jets to drive market

TABLE 148 SOUTH AFRICA: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 149 SOUTH AFRICA: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 150 SOUTH AFRICA: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 151 SOUTH AFRICA: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.5.6 NIGERIA

10.5.6.1 Upgrading outdated avionics with next-gen advanced systems to drive market

TABLE 152 NIGERIA: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 153 NIGERIA: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 154 NIGERIA: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 155 NIGERIA: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.5.7 REST OF MIDDLE EAST & AFRICA

10.5.7.1 Rising need for modern commercial aircraft to drive market

TABLE 156 REST OF MIDDLE & AFRICA: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 157 REST OF MIDDLE & AFRICA: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 158 REST OF MIDDLE & AFRICA: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 159 REST OF MIDDLE & AFRICA: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 34 LATIN AMERICA: AVIONICS MARKET SNAPSHOT

TABLE 160 LATIN AMERICA: AVIONICS MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 161 LATIN AMERICA: AVIONICS MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 162 LATIN AMERICA: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 163 LATIN AMERICA: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 164 LATIN AMERICA: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 165 LATIN AMERICA: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 166 LATIN AMERICA: AVIONICS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 167 LATIN AMERICA: AVIONICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.2 BRAZIL

10.6.2.1 Increasing demand for modern narrow-body aircraft for tourism industry to drive market

TABLE 168 BRAZIL: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 169 BRAZIL: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 170 BRAZIL: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 171 BRAZIL: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.6.3 MEXICO

10.6.3.1 Domestic airline demand for commercial aircraft to boost market growth

TABLE 172 MEXICO: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 173 MEXICO: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 174 MEXICO: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 175 MEXICO: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

10.6.4 REST OF LATIN AMERICA

10.6.4.1 Modernization of electronic systems of existing aircraft fleet to drive market

TABLE 176 REST OF LATIN AMERICA: AVIONICS MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 177 REST OF LATIN AMERICA: AVIONICS MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 178 REST OF LATIN AMERICA: AVIONICS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 179 REST OF LATIN AMERICA: AVIONICS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 171)

11.1 INTRODUCTION

11.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

TABLE 180 AVIONICS MARKET: DEGREE OF COMPETITION

FIGURE 35 SHARE OF TOP PLAYERS IN AVIONICS MARKET, 2021

TABLE 181 KEY DEVELOPMENTS BY LEADING PLAYERS IN AVIONICS MARKET, 2016–2022

11.3 TOP FIVE PLAYERS RANKING ANALYSIS, 2021

FIGURE 36 MARKET RANKING OF LEADING PLAYERS IN AVIONICS MARKET, 2021

FIGURE 37 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2021

11.4 KEY COMPANY EVALUATION QUADRANT

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 38 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

TABLE 182 COMPANY PRODUCT FOOTPRINT

TABLE 183 COMPANY SOLUTION TYPE FOOTPRINT

TABLE 184 COMPANY REGIONAL FOOTPRINT

11.5 START-UP/SME EVALUATION QUADRANT

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 STARTING BLOCKS

11.5.4 DYNAMIC COMPANIES

FIGURE 39 AVIONICS MARKET (START-UPS) COMPETITIVE LEADERSHIP MAPPING, 2021

11.5.5 COMPETITIVE BENCHMARKING

TABLE 185 AVIONICS MARKET: KEY START-UPS/SMES

11.6 COMPETITIVE SCENARIO

11.6.1 MARKET EVALUATION FRAMEWORK

11.6.2 NEW PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 186 NEW PRODUCT LAUNCHES AND DEVELOPMENTS, 2016–2022

11.6.3 DEALS

TABLE 187 DEALS, 2016–2022

11.6.4 OTHERS

TABLE 188 OTHERS, 2016–2022

12 COMPANY PROFILES (Page No. - 198)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

12.2.1 RAYTHEON TECHNOLOGIES CORPORATION

TABLE 189 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 40 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 190 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

TABLE 191 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

12.2.2 CURTISS-WRIGHT CORPORATION

TABLE 192 CURTISS-WRIGHT CORPORATION: BUSINESS OVERVIEW

FIGURE 41 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

TABLE 193 CURTISS-WRIGHT CORPORATION.: DEALS

12.2.3 HONEYWELL INTERNATIONAL INC.

TABLE 194 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 42 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 195 HONEYWELL INTERNATIONAL INC.: DEALS

12.2.4 L3HARRIS TECHNOLOGIES INC.

TABLE 196 L3HARRIS TECHNOLOGIES INC.: BUSINESS OVERVIEW

FIGURE 43 L3HARRIS TECHNOLOGIES INC.: COMPANY SNAPSHOT

TABLE 197 L3HARRIS TECHNOLOGIES INC.: PRODUCT LAUNCHES

TABLE 198 L3HARRIS TECHNOLOGIES INC.: DEALS

12.2.5 GENERAL ELECTRIC COMPANY

TABLE 199 GENERAL ELECTRIC COMPANY: BUSINESS OVERVIEW

FIGURE 44 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

TABLE 200 GENERAL ELECTRIC COMPANY: DEALS

12.2.6 SAFRAN SA

TABLE 201 SAFRAN SA: BUSINESS OVERVIEW

FIGURE 45 SAFRAN SA: COMPANY SNAPSHOT

TABLE 202 SAFRAN SA: DEALS

12.2.7 BAE SYSTEMS PLC

TABLE 203 BAE SYSTEMS PLC: BUSINESS OVERVIEW

FIGURE 46 BAE SYSTEMS PLC: COMPANY SNAPSHOT

TABLE 204 BAE SYSTEMS PLC: DEALS

12.2.8 MOOG INC.

TABLE 205 MOOG INC.: BUSINESS OVERVIEW

FIGURE 47 MOOG INC.: COMPANY SNAPSHOT

TABLE 206 MOOG INC.: DEALS

12.2.9 MEGGITT PLC

TABLE 207 MEGGITT PLC: BUSINESS OVERVIEW

FIGURE 48 MEGGITT PLC: COMPANY SNAPSHOT

TABLE 208 MEGGITT PLC: DEALS

12.2.10 GARMIN LTD.

TABLE 209 GARMIN LTD.: BUSINESS OVERVIEW

FIGURE 49 GARMIN LTD.: COMPANY SNAPSHOT

TABLE 210 GARMIN LTD.: PRODUCT LAUNCHES

TABLE 211 GARMIN LTD.: DEALS

12.2.11 CMC ELECTRONICS INC.

TABLE 212 CMC ELECTRONICS INC.: BUSINESS OVERVIEW

TABLE 213 CMC ELECTRONICS INC.: DEALS

12.2.12 CHELTON LTD.

TABLE 214 CHELTON LTD.: BUSINESS OVERVIEW

TABLE 215 CHELTON LTD.: DEALS

12.2.13 ASTRONAUTICS CORPORATION OF AMERICA

TABLE 216 ASTRONAUTICS CORPORATION OF AMERICA: BUSINESS OVERVIEW

TABLE 217 ASTRONAUTICS CORPORATION OF AMERICA: DEALS

12.2.14 UAVIONIX CORPORATION

TABLE 218 UAVIONIX CORPORATION: BUSINESS OVERVIEW

12.2.15 NORTHROP GRUMMAN CORPORATION

TABLE 219 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 50 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

12.2.16 UNIVERSAL AVIONICS SYSTEMS CORPORATION

TABLE 220 UNIVERSAL AVIONICS SYSTEMS CORPORATION: BUSINESS OVERVIEW

TABLE 221 UNIVERSAL AVIONICS SYSTEMS CORPORATION: PRODUCT LAUNCHES

TABLE 222 UNIVERSAL AVIONICS SYSTEMS CORPORATION: DEALS

12.2.17 AVIDYNE CORPORATION

TABLE 223 AVIDYNE CORPORATION: BUSINESS OVERVIEW

12.2.18 ASPEN AVIONICS INC.

TABLE 224 ASPEN AVIONICS INC.: BUSINESS OVERVIEW

12.2.19 DYNON AVIONICS INC.

TABLE 225 DYNON AVIONICS INC.: BUSINESS OVERVIEW

12.2.20 MGL AVIONICS

TABLE 226 MGL AVIONICS: BUSINESS OVERVIEW

12.3 OTHER PLAYERS

12.3.1 SUZHOU CHANGFENG INSTRUMENTS CO., LTD.

TABLE 227 SUZHOU CHANGFENG INSTRUMENTS CO., LTD.: COMPANY OVERVIEW

12.3.2 KANARDIA D.O.O.

TABLE 228 KANARDIA D.O.O.: COMPANY OVERVIEW

12.3.3 TALOS AVIONICS P.C.

TABLE 229 TALOS AVIONICS P.C.: COMPANY OVERVIEW

12.3.4 GRT AVIONICS

TABLE 230 GRT AVIONICS: COMPANY OVERVIEW

12.3.5 TASKEM CORPORATION

TABLE 231 TASKEM CORPORATION: BUSINESS OVERVIEW

12.3.6 AVMAP S.R.L.

TABLE 232 AVMAP S.R.L.: COMPANY OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 272)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for the avionics market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulators databases.

Primary Research

The avionics market comprises several stakeholders, such as raw material providers, avionics manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in avionics systems. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the avionics market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up approach

The bottom-up approach was employed to arrive at the overall size of the avionics market from the demand for avionics systems by the end users in each country, and the average cost of integration for both line-fit and retrofit installation was multiplied by new aircraft deliveries and MRO fleet, respectively. These calculations led to the estimation of the overall market size.

Market size estimation methodology: Top-down approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in market segmentation) through percentage splits obtained from secondary and primary research.

The most appropriate and immediate parent market size was used to calculate the specific market segments to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

Market shares were then estimated for each company to verify the revenue shares used earlier in the bottom-up approach. With data triangulation procedure and data validation through primaries, the overall parent market size and each market size were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the avionics market.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the avionics market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, expansions, and new product developments

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 6)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Avionics Market

Topics: General aviation retrofit, forward-fit, and/or conventional gauges market values for piston engine (only) aircraft. Avionics, more specifically electronic flight instrument systems (EFIS). Data: Market share, number of tails, growth rates, sales history, etc. Thank you in advance!