Composites Market by Fiber Type (Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites), Resin Type (Thermoset Composites, Thermoplastic Composites), Manufacturing Process, End-use Industry and Region - Global Forecast to 2028

Get the updated report with forecasts to 2028 : Inquire Now

Composites Market

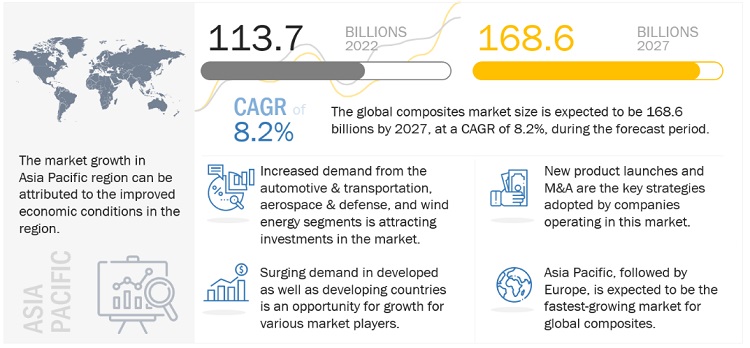

The global composites market is valued at USD 113.7 billion in 2022 and is projected to reach USD 168.6 billion by 2027, growing at a cagr 8.2% from 2022 to 2027. The market is growing because of the rise in the demand from wind energy, aerospace & defense, and automotive & transportation industries.

Attractive Opportunities in the Composites Market

To know about the assumptions considered for the study, Request for Free Sample Report

Increasing demand from aerospace applications

Composites are increasingly used in the aerospace industry as they decrease weight and increase fuel efficiency. The capability of aerospace composites to maintain a greater strength-to-weight ratio allows for more efficient structural and aerodynamic designs. There has been a paradigm shift in aircraft design at Boeing and Airbus, with aerospace composites considered primary structures. All wide-body airplanes designed by both manufacturers are now based on the new paradigm. In new aircraft programs of Boeing and Airbus, such as the 787 Dreamliner, 777X, and A350XWB groups, composites comprise 50% of all materials used in the aircraft. The extensive usage of these advanced aircraft is attributed to higher fatigue tolerance, which helps improve or increase the structural components, such as bigger passenger windows and a lower cabin altitude on cruises than conventional jetliners. Boeing and Airbus are projecting multibillion-dollar markets for new airplanes over the next 20 years, which would drive the composites market. They have shown assuring numbers of increased orders and production plans for the next few years. The recovering aerospace market is increasing the demand for composites across the world.

High processing & manufacturing costs to restrict the market growth

The use of composites has been increasing significantly in aerospace, transportation, and other industries such as construction and electronics. Currently, composites account for over 50% of the structural weight in large transport airplanes. However, the high costs related to material and manufacturing limit their use. Therefore, it is necessary to use tools to accurately determine costs in the early design stages to reduce the cost of composite products.

The manufacturing of composites is a capital-intensive process and requires heavy investment. The molding of composites is slow, as the curing time required for making composites is high. In addition, the cost of raw materials such as carbon fibers and thermoplastic resins is high. Therefore, despite its several advantages over traditional materials, such as steel and aluminum, the use of composites is still low in the automotive industry. The high investment associated with composite production is restricting the market's growth in the automotive industry.

High demand for environmentally friendly electric vehicles to create lucrative opportunities for the market

Car manufacturers have considered electric vehicles an effective alternative to fuel vehicles to curtail greenhouse gas emissions. Composite materials are considered the best substitute for traditional materials, such as steel and aluminum, to meet the weight constraints of electric vehicles. Companies such as 2050 Motors (US) and Detroit Electric (US) use carbon fibers to fabricate electric car bodies.

For instance, 2050 Motors has manufactured an electric car with an all-carbon-fiber body that weighs under 700 kg, including a battery pack, compared to a non-electric traditional material vehicle weighing approximately 1,400 kg. Detroit Electric has also produced SP: 01, a two-seat pure-electric sports vehicle with carbon fiber bodywork. Using carbon fiber in the bodywork has helped reduce weight and improve the fuel efficiency and speed of the car. The lightweight SP: 01 sports car has a speed of 155 mph.

Furthermore, the companies involved in the fuel cell car market, such as Toyota, Hyundai, and Honda, plan to develop electric vehicles, in addition to hydrogen-powered vehicles. The growing regulations in the US toward environmentally friendly vehicles are expected to act as an opportunity for electric vehicles, further boosting the market for composites in electric vehicles. For instance, in Oct 2022, the US government announced nearly USD 1 billion in awards to US school districts to replace aging, gas-fueled school buses with cleaner, electric models. The awards would support the purchase of 2,463 buses, 95% of which will be electric.

Recycling of composites to be a major challenge for market growth

Using composites in various end-use industries helps in the reduction of weight and increases its performance and fuel efficiency, lowers CO2 emission, and increases safety against accidents. However, composites are difficult to recycle. The complex material compositions and the cross-linked nature of thermoset resins make recycling composites used in automotive applications difficult. Thermoset resins are difficult to recycle as they are not easy to remold. One such issue concerns end-of-life aircraft structures that contain carbon fiber composites coated with hexavalent chromium primer. These composites coated with hexavalent chromium can be classified as hazardous waste and thus may not be disposed of on land due to possible leaching of the chrome into the ground.

Glass fiber is the major segment of the market in terms of value and volume

Owing to its superior attributes, such as strength, flexibility, durability, stability, low weight, and resistance to heat, temperature, and moisture. The glass fiber composites segment accounts for the largest share of the composites market in terms of value and volume due to low cost, mass production, and high demand from wind energy installation, construction & infrastructure, and other industries such as sporting goods. It is used in different applications, such as underbody systems, deck lids, front-end modules, bumper beams, engine covers, instrument panels, and air ducts in the transportation industry.

Thermoset resin is the largest segment of composites in terms of value and volume.

The resin type segment of the composites market was led by thermoset resins. Different types of thermoset polymer matrices, such as epoxy, polyester, and vinyl esters, are used in manufacturing composites. Fibers formulated using thermoset resins as a matrix produce thermoset composites with high toughness, impact strength, and resist moisture. These composites are widely used in the construction, transportation, Pipes & Tanks, electronics, and infrastructure industries. These composites are widely used in construction & infrastructure, marine, wind energy, transportation, and other end-use industries such as sporting goods and medicine. Thermoset composites do not expand under high-heat and moist conditions, making them suitable for highly corrosive and high-temperature applications.

RTM process is expected to register the highest CAGR during the forecast period

RTM is a vacuum-assisted resin transfer process that uses a flexible solid counter tool for surface compression. This process yields increased laminate compression, a high glass-to-resin ratio, and outstanding strength-to-weight characteristics. It is mainly used to mold components with large surface areas, complex shapes, and smooth finishes. This process is used to produce structures for automotive, construction and infrastructure, and aerospace applications. The growth prospects of the RTM process are high in the next five years due to increasing applications in the automotive and construction industries in emerging countries. It is the most promising technology, as it can yield large, complex three-dimensional components with high mechanical performance, tight dimensional tolerance, and high surface finish.

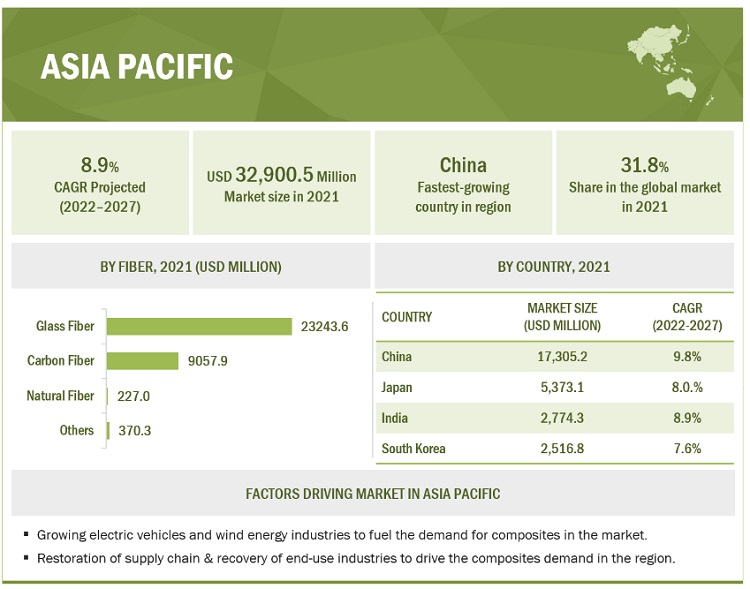

Asia Pacific region held the largest market share in the Composites market

Pacific accounts for the largest share of the global composites market due to major carbon and glass fiber manufacturers in China and Japan and the emerging economies of China and India. The market in the wind energy sector, which is a prominent user of composites, is growing significantly in the region. The transportation end-use industry, which is also among the major users of composites, is witnessing significant growth in the Asia Pacific region due to the growing focus of OEMs on manufacturing electric vehicles. These factors have helped the demand for composites to grow in the region.

To know about the assumptions considered for the study, download the pdf brochure

Composites Market Players

The key players in the global composites market are Owens Corning (US), Toray Industries, Inc. (Japan), Teijin Limited (Japan), Mitsubishi Chemical Holdings Corporation (Japan), Hexcel Corporation (US), SGL Group (Germany), Nippon Electrical Glass Co. Ltd. (Japan), Huntsman International LLC. (US), and Solvay (Belgium). These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the composites industry. The study includes an in-depth competitive analysis of these companies in the composites market, with their company profiles, recent developments, and key market strategies.

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the Composites industry. The study includes an in-depth competitive analysis of these key players in the Composites market, with their company profiles, recent developments, and key market strategies.

Composites Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD), Volume (Kiloton) |

|

Segments |

Fiber Type, Resin Type, Manufacturing Process, End-use Industry and Region |

|

Regions |

Europe, North America, Asia Pacific, Middle East & Africa, and South America |

|

Companies |

Owens Corning (US), Toray Industries, Inc. (Japan), Teijin Limited (Japan), Mitsubishi Chemical Holdings Corporation (Japan), Hexcel Corporation (US), SGL Group (Germany), Nippon Electric Glass Co. Ltd. (Japan), Huntsman International LLC. (US), and Solvay (Belgium) |

This research report categorizes the composites market based on fiber type, resin type, manufacturing process, end-use industry, and region.

By Fiber Type:

- Glass Fiber Composites

- Carbon Fiber Composites

- Natural Fiber Composites

- Other Fiber Composites

By Resin Type:

- Thermoset Composites

- Thermoplastic Composites

By end-use industry:

- Aerospace & defense

- Wind Energy

- Automotive & Transportation

- Construction & Infrastructure

- Marine

- Pipe & Tank

- Electrical & Electronics

- Others

By Manufacturing Process:

- Lay-up

- Filament Winding

- Injection Molding

- Pultrusion

- Compression Molding

- RTM

- Others

By region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In December 2022, Solvay SA partnered with Electronic Fluorocarbons (EFC) to gain exclusive distribution rights for its products in North America.

- In October 2022, Toray Advanced Composites strengthened its commercial partnership with Specialty Materials. This commercial partnership enables engineers to easily control and manage key variables for unique solution innovations using high-quality domestically produced products in the US supply chain.

- In April 2022, Owens Corning acquired US-based WearDeck, which manufactures weather-resistant decks. The acquisition of WearDeck is a significant step forward in the strategy to drive continued growth at Owens Corning while pivoting the Composites business to focus on high-value material solutions in the building and construction space.

- In April 2022, Gurit Holding AG acquired 60% stake in Fiberline Composites A/S, a technology provider for the pultruded manufacture of carbon and glass products.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the Composites market?

Increasing demand from the aerospace industry to boost the Composites market.

Which is the largest country-level market for Composites market?

China is the largest Composites market due to high demand from well-established end-use industries.

What are the factors contributing to the final price of Composites market?

Raw materials and type of manufacturing process decide the final pricing of composites in the market.

What are the challenges in the Composites market?

Recycling of composite materials is a major challenge for the composites market.

Which type of resin holds the highest growth prospect?

Thermoplastic resin composites possess high growth prospects in the market owing to their remolding and reusable properties.

How is the Composites market aligned?

The market is expanding significantly. Recognizing this potential, several manufacturers are developing business approaches to expand their business.

Who are the major manufacturers?

Owens Corning (US), Toray Industries, Inc. (Japan), Teijin Limited (Japan), Mitsubishi Chemical Holdings Corporation (Japan), Hexcel Corporation (US), SGL Group (Germany), Nippon Electric Glass Co. Ltd. (Japan)

What are the manufacturing process types for composites?

Lay-up, pultrusion, compression molding, RTM, injection molding, filament winding are the major manufacturing process types used for composites manufacturing.

What are the major end-use industry for composites?

The major end-use industries for composites are aerospace & defense, wind energy, automotive & transportation, construction & infrastructure, pipes & tanks, and marine.

What is the biggest restraint in the composites market?

Lack of standardization in manufacturing technology is the major restraint in the composites market . .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved two major activities in estimating the current size of the composites market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The composites market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly the transportation, wind energy, aerospace & defense, construction & infrastructure end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

Notes: Tiers of companies are selected based on their ownership and revenues in 2021.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total composites market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall composites market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the automotive & transportation, wind energy, aerospace & defense, construction & infrastructure end-use industries.

Report Objectives

- To define, describe, and forecast the size of the composites market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on resin type, fiber type, manufacturing process, and end-use industry

- To analyze and project the market based on five regions, namely, Europe, North America, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Asia Pacific composites market

- Further breakdown of Rest of Europe composites market

- Further breakdown of Rest of North American composites market

- Further breakdown of Rest of Middle East & Africa composites market

- Further breakdown of Rest of South American composites market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Composites Market

General information on green composite market

Composite Market

Global composites market insights

Working on a research project looking for general information on the market

Data on Indian composite market size by value and share of Glass Fibre and Carbon Fibre composites.

Competitive intelligence on composite industry

Report title not mentioned

is there any availability of UHMWPE composites for medical applications?

Market estimation on types resin types, and application at global and regional level in the composites market

Natural fiber-reinforced polymer composite - Demand & Challenges facing composite materials and applications

Interested in understanding manufacturing processes of various composites.

Information about composite market by type; by matrix; by fiber; and by applications.

Thermoset UPR market in North America

Specific information on technical ceramics used in semiconductor application

General information on composites with specific focus on recycled carbon fiber