Connected Mining Market by Component (Solutions, Services), Solution (Asset Tracking and Optimization, Fleet Management), Service (Professional, Managed), Mining Type (Surface, Underground), Application, Deployment Mode & Region - Global Forecast to 2027

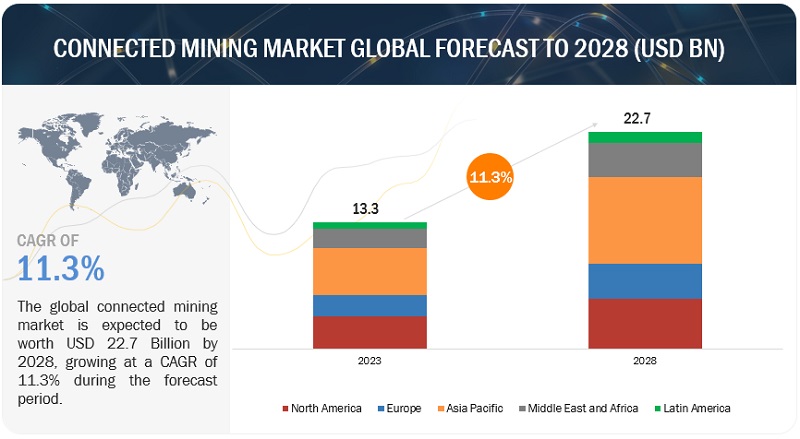

The Connected Mining Market size to grow from USD 12.7 billion in 2022 to USD 23.6 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 13.3% during the forecast period. The presence of various key players in the ecosystem has led to competitive and diverse market. Mining 4.0 initiatives in industries is paving the way for connecting mining market. Increasing adoption of IoT to accelerate the use of digital solutions to develop connected mines is driving the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Mining 4.0 initiatives in industries, paving the way for connecting mining

Today, the increasing adoption of Mining 4.0 to transform the mining process has been increased. To resolve the challenges faced by the mining industries from 17th century, such as safety of mine workers, sustainability of equipment’s, and onsite and underground decision-making, various technological developments have been done in the last few decades, and today mining companies are heavily investing in implementing Mining 4.0 solutions. Industry 4.0 enables Mining 4.0, which is involved in big data, IoT, 5G, cloud, and AI technologies to integrate operations in the mining industry. Industry 4.0 methods are implemented using Software Development Lifecycle (SDLC) process at mining companies to connect systems and assets such as manufacturing unit, grinding, exploration plant, mine operators, back-office team, and ERP. With the rapid advancements in technologies, there is a rise in digital solutions and the demand for connected devices and IoT systems. This rapid rise in the adoption of digital solutions has boosted for the growth of the connected mining market.

Restraint: Depletion of natural resources

Due to the rapid depletion of natural resources worldwide, miners would have to extract from deeper and remote mines. According to the World Counts, till today 13,047,408,900 tons resources has been extracted from the Earth and this number is increasing rapidly by every minutes. Every year 90 billion tons of fossil fuel, biomass, minerals, and metals are extracted from the Earth. However, the increasing population is responsible for the rising number of consumers and creating a big challenge in front of mining industries to increase their production.

Underground mining poses a different set of challenges on the technology front. Energy consumption increases as the depth of a mine increases. The temperature gets hotter, because of which air ventilation has to be increased. More energy is required to keep a reasonable temperature for people to work. Moreover, as the mine goes deeper, there is an increasing probability of rock bursts, damaging the tunnels, which act as entry/exit points to the ore.

Opportunity: Increasing demand for digitalization to boost the connected mining market

The mining industry is rapidly adopting digitalized solutions in this technological era. IoT, AI, cloud technologies are rapidly adopted by mining companies to survive and achieve high productivity target in this competitive era. Growing investment in IT infrastructure, virtual sensor, and AI tool is increasing opportunities in this market. Digital solutions provided by various companies enable mine operators to track health of assets, real-time visibility, predictive maintenance in the surface, and underground mining. New emerging trends of Industry 4.0 is boosting the adoption of technologies such as cloud computing, IoT, cybersecurity, big data, autonomous robots, additive manufacturing, and AR to support digital transformation of mining operations. Transformation of mines digitally is all about connecting every asset, equipment, and workforce and to support communication between mine operators leading to the increase in life cycle of asset by regularly monitoring asset health. Various companies have seen an incredible growth due to the adoption of digital solutions; for instance, Exxro has adopted digital solutions of Aviva to manage its mining operations and resolve the challenges related to digital transformation. In the beginning of 2018, Exxro has implemented digital and connected mine in Belfast Coal at South Africa and now they are able to operate mine with the help of digital twin. The company has observed 125% increase in the product quality.

Challenge: Shortage of skilled labor

The lack of qualified labor is the major issue faced by mining industries. According to Australian Mining, in June 2021, Silver Lake Resources has changed its strategy due to the unavailability of skilled labours at the Mount Monger gold mine. This issue has reduced the productivity and increased the overall cost. Mining companies were struggling and battling for the skilled professionals specially during the pandemic. Mine operators require experts to handle the transfer of huge amounts of critical data from remote sites. Companies are focusing on attracting skilled workers best talent to idealize, conceptualize, and innovate concrete solutions is this market. The necessity of today’s mining industry is skilled labor capable of developing and utilizing the tools necessary for greater return and increasing productivity. The increasing use of digital, automotive solutions in the mining industry is creating a skill gap in the present labor pool. Since automation is expected to replace the job of mine workers with automated equipment in the coming years, it is also creating new job opportunities aspiring a particular set of skills.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific to account for the highest market growth during the forecast period

APAC is expected to grow at the highest CAGR during the forecast period. In Asia Pacific, China, India, Indonesia, Papua New Guinea (PNG), and the Philippines are expected to drive the market with China as the most potential player in smart mining initiatives. India can be considered to be the next high potential preference for the major global connected mining market vendors as the country has increasing demand for minerals. New investments will drive the Indian market, following the country's ambitious target of adding USD 210 billion from the mining and mineral sectors to the country’s GDP by 2050. The increase in production capacities in the region is driven by investment programs. This region is witnessing a high rate of adoption of technologies, such as operational analytics and data processing, remote monitoring, and mine safety systems.

Key Market Players

The report covers the competitive landscape and profiling of the major players, namely, ABB (Switzerland), IBM (US), SAP (Germany), Cisco (US), Schneider Electric (France), Komatsu (Japan), Hexagon (Sweden), Caterpillar (US), Rockwell Automation (US), Trimble (US), Siemens (Germany), Howden (Scotland), Accenture (Ireland), PTC (US), Hitachi (Japan), Eurotech Communication (Israel), Wipro (India), MST Global (US), GE Digital (US), Symboticware (Canada), Getac (Taiwan), IntelliSense.io (UK), Zyfra (Finland), Axora (UK), GroundHog (US), SmartMining SpA (Chile), and Applied Vehicle Analysis (Africa). These companies have adopted various strategies such as acquisitions, expansions, new product launches, and product enhancements, partnerships, agreements, and collaborations to cater to the growing demand for connected mining market across the globe as well as to strengthen their position in the market. These strategies have also been tracked and mentioned in the report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Component, Solutions, Services, Mining Type, deployment mode, Application, Regions |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

ABB (Switzerland), IBM (US), SAP (Germany), Cisco (US), Schneider Electric (France), Komatsu (Japan), Hexagon (Sweden), Caterpillar (US), Rockwell Automation (US), Trimble (US), Siemens (Germany), Howden (Scotland), Accenture (Ireland), PTC (US), Hitachi (Japan), Eurotech Communication (Israel), Wipro (India), MST Global (US), GE Digital (US), Symboticware (Canada), Getac (Taiwan), IntelliSense.io (UK), Zyfra (Finland), Axora (UK), GroundHog (US), SmartMining SpA (Chile), and Applied Vehicle Analysis (Africa). |

This research report categorizes the Connected mining to forecast revenue and analyze trends in each of the following submarkets:

Based on Component:

- Solution

- Services

Based on Solution:

- Asset Tracking and Optimization

- Fleet Management

- Industrial Safety and Security

- Workforce Management

- Analytics and Reporting

- Process Control

- Others(Operational performance, Quality optimization solutions)

Based on Service:

-

Professional Services

- Advisory and Implementation

- Support and Maintenance

- Training

- Managed Services

Based on Mining Type:

- Surface

- Underground

Based on Deployment Mode:

- On-premises

- Cloud

Based on Application:

- Exploration

- Processing and Refining

- Transportation

Based on Regions:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Recent Developments:

- In February 2022, Accenture launched an Enterprise and Supplier Development (ESD) Marketplace Platform focused on the mining supply chain. The platform was developed in collaboration with Adapt Digital Solutions and with the Ministry of Mining, Resources and Energy (DMRE) to bridge the gap between mining companies and Small and Medium-sized Enterprises (SMEs).

- In November 2021, Hexagon introduced the Power of One, a unified technology platform and partnership, which connects all parts of the mine. The Power of One is Hexagon’s set of solutions that connects all processes of a mine from the pit to the plant. It happens through a platform that connects all sensors and software with an intelligent monitoring system that can be accessed from the field to the cloud.

- In November 2021, The recent version of Trimble Access, v2021.20, introduces new scanning functionality and critical usability updates to the Mines application.

- In September 2021, Modular Mining, a Komatsu technology brand, and Immersive Technologies, a Komatsu subsidiary announced support for ProVision Guided Spotting for Immersive Technologies. The Guided Spotting simulation was developed to accelerate the deployment of Modular Mining’s Guided Spotting system.

- In July 2020, IBM launched digital B2B marketplace for mining industry. Oren offers innovative, digital solutions to accelerate mining industry, enable digital transactions globally, drive valuable insights with industry experts.

Frequently Asked Questions (FAQ):

What is the projected market value of the Connected mining market?

Connected Mining Market size to grow from USD 12.7 billion in 2022 to USD 23.6 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 13.3% during the forecast period.

Which region have the highest market share in the Connected mining market?

Asia Pacific is expected to hold the largest market size in the Connected mining market during the forecast period. This region is witnessing a high rate of adoption of technologies, such as operational analytics and data processing, remote monitoring, and mine safety systems.

Which service segment is expected to hold a higher CAGR during the forecast period?

In the Connected mining market, professional services is expected to have a CAGR.

Who are the major vendors in the Connected mining market?

Major vendors in the Connected mining are ABB (Switzerland), IBM (US), SAP (Germany), Cisco (US), Schneider Electric (France), Komatsu (Japan), Hexagon (Sweden), Caterpillar (US), Rockwell Automation (US), Trimble (US), Siemens (Germany), Howden (Scotland), Accenture (Ireland), PTC (US), Hitachi (Japan), Eurotech Communication (Israel), Wipro (India), MST Global (US), GE Digital (US), Symboticware (Canada), Getac (Taiwan), IntelliSense.io (UK), Zyfra (Finland), Axora (UK), GroundHog (US), SmartMining SpA (Chile), and Applied Vehicle Analysis (Africa). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 6 CONNECTED MINING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Primary respondents

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.3 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 RESEARCH METHODOLOGY: APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY-SIDE): REVENUE OF OFFERINGS IN THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL THE OFFERINGS IN THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE): CONNECTED MINING MARKET

2.4 COMPANY EVALUATION MATRIX RESEARCH METHODOLOGY

FIGURE 11 CONNECTED MINING COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.5 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS

TABLE 4 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 12 CONNECTED MINING MARKET, 2020–2027

FIGURE 13 LEADING SEGMENTS IN THE MARKET IN 2022

FIGURE 14 MARKET: REGIONAL SNAPSHOT

FIGURE 15 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN DURING 2022–2027

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 BRIEF OVERVIEW OF THE MARKET

FIGURE 16 NEED FOR OPERATIONAL EFFICIENCY IN THE MINING SECTOR WOULD SIGNIFICANTLY IMPACT THE GROWTH IN THE MARKET

4.2 NORTH AMERICA: MARKET, TOP THREE SOLUTIONS AND BY MINING TYPE

FIGURE 17 ASSET TRACKING AND OPTIMIZATION AND SURFACE SEGMENT TO ACCOUNT FOR LARGE MARKET SHARES IN NORTH AMERICA IN 2022

4.3 EUROPE: MARKET, TOP THREE SOLUTIONS AND BY MINING TYPE

FIGURE 18 ASSET TRACKING AND OPTIMIZATION AND SURFACE MINING SEGMENT TO ACCOUNT FOR LARGE MARKET SHARES IN EUROPE IN 2022

4.4 ASIA PACIFIC: MARKET, TOP THREE SOLUTIONS AND BY MINING TYPE

FIGURE 19 ASSET TRACKING AND OPTIMIZATION AND SURFACE MINING SEGMENT TO ACCOUNT FOR LARGE MARKET SHARES IN ASIA PACIFIC IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 CONNECTED MINING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Mining 4.0 initiatives in industries, paving the way for connecting mining

5.2.1.2 Need to reduce cost and achieve operational efficiency to boost the adoption of connected mining solutions

5.2.1.3 Increasing adoption of IoT to accelerate the use of digital solutions to develop connected mines

5.2.1.4 To enhance the safety and security of mine workers

5.2.2 RESTRAINTS

5.2.2.1 Depletion of natural resources

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for digitalization to boost the market

5.2.3.2 Need of metals and minerals to increase the demand for connected mining solutions

5.2.3.3 Emerging 5G technology to help connected mining adoption globally

5.2.4 CHALLENGES

5.2.4.1 Shortage of skilled labor

5.2.4.2 Integrating information technology with operational technology

5.3 COVID-19 MARKET OUTLOOK FOR THE MARKET

FIGURE 21 MINING 4.0 INITIATIVES TO DRIVE THE GROWTH OF THE CONNECTED MINING MARKET

FIGURE 22 KEY ISSUES: INTEGRATING INFORMATION TECHNOLOGY WITH OPERATIONAL TECHNOLOGY RESTRICTING THE MARKET GROWTH

5.4 VALUE CHAIN ANALYSIS

FIGURE 23 MARKET: VALUE CHAIN ANALYSIS

5.5 ECOSYSTEM

TABLE 5 MARKET: ECOSYSTEM

5.6 PORTER’S FIVE FORCES MODEL

TABLE 6 MARKET: PORTER'S FIVE FORCES

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 COMPETITIVE RIVALRY

5.7 PATENT ANALYSIS

FIGURE 24 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 7 TOP TWENTY PATENT OWNERS (UNITED STATES)

FIGURE 25 NUMBER OF PATENTS GRANTED IN A YEAR, 2011–2021

5.8 PRICING ANALYSIS

5.8.1 PRICING BY INTEGRATED SOLUTIONS

TABLE 8 PRICING ANALYSIS BY INTEGRATED SOLUTIONS

5.8.2 PRICING BY STANDALONE SOLUTIONS

TABLE 9 PRICING ANALYSIS BY STANDALONE SOLUTIONS

5.9 TECHNOLOGY ANALYSIS

5.9.1 ARTIFICIAL INTELLIGENCE

5.9.2 BLOCKCHAIN

5.9.3 INTERNET OF THINGS

5.9.4 CLOUD COMPUTING

5.9.5 ROBOTICS

5.9.6 BIG DATA AND ANALYTICS

5.10 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 10 CONNECTED MINING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.11 REGULATIONS LANDSCAPE

5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11.1.1 Workplace Safety Law

5.11.1.2 Health and Safety at Work Act

5.11.1.3 Occupational Safety and Health Act

5.11.1.4 Small Business Regulatory Enforcement Fairness Act

5.11.1.5 General Data Protection Regulation

5.11.1.6 Cloud Standard Customer Council

5.11.1.7 Health Insurance Portability and Accountability Act

5.11.1.8 ISO 45001:2018

5.11.1.9 International Labour Organization

5.11.1.10 National Institute for Occupational Safety and Health

5.11.1.11 National Safety Council

5.12 CASE STUDY ANALYSIS

5.12.1 CASE STUDY 1: IMPLEMENTATION OF ACCENTURE LIFE SAFETY SOLUTION TO ACHIEVE OPERATIONAL EFFICIENCY

5.12.2 CASE STUDY 2: SHELL AND IBM DEVELOPED OREN TO SUPPORT DIGITAL TRANSFORMATION FOR THE MINING INDUSTRY

5.12.3 CASE STUDY 3: SIGNIFICANT GROWTH IN THE PRODUCTION CAPACITY HAS BEEN OBSERVED WITH THE HELP OF HITACHI MACHINERY

5.12.4 CASE STUDY 4: DEPLOYMENT OF CISCO’S CONNECTED MINING SOLUTIONS TO SUPPORT DIGITAL TRANSFORMATION

5.12.5 CASE STUDY 5: DEPLOYMENT OF VELOCITY EHS TO IMPROVE SAFETY STANDARDS

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS (%)

TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS (%)

5.13.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA

TABLE 12 KEY BUYING CRITERIA FOR CONNECTED MINING

6 CONNECTED MINING MARKET, BY COMPONENT (Page No. - 82)

6.1 INTRODUCTION

FIGURE 28 SOLUTIONS SEGMENT TO SHARE A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 13 MARKET SIZE, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 14 MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

6.2.1 SOLUTIONS: MARKET DRIVERS

6.2.2 SOLUTIONS: COVID-19 IMPACT

TABLE 15 SOLUTIONS: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 16 SOLUTIONS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES: MARKET DRIVERS

6.3.2 SERVICES: COVID-19 IMPACT

TABLE 17 SERVICES: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 18 SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7 CONNECTED MINING MARKET, BY SOLUTION (Page No. - 87)

7.1 INTRODUCTION

FIGURE 29 ASSET TRACKING AND OPTIMIZATION SEGMENT TO SHARE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 19 MARKET SIZE, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 20 MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

7.2 ASSET TRACKING AND OPTIMIZATION

7.2.1 ASSET TRACKING AND OPTIMIZATION: MARKET DRIVERS

7.2.2 ASSET TRACKING AND OPTIMIZATION: COVID-19 IMPACT

TABLE 21 ASSET TRACKING AND OPTIMIZATION: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 22 ASSET TRACKING AND OPTIMIZATION: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3 FLEET MANAGEMENT

7.3.1 FLEET MANAGEMENT: CONNECTED MINING MARKET DRIVERS

7.3.2 FLEET MANAGEMENT: COVID-19 IMPACT

TABLE 23 FLEET MANAGEMENT: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 24 FLEET MANAGEMENT: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4 INDUSTRIAL SAFETY AND SECURITY

7.4.1 INDUSTRIAL SAFETY AND SECURITY: MARKET DRIVERS

7.4.2 INDUSTRIAL SAFETY AND SECURITY: COVID-19 IMPACT

TABLE 25 INDUSTRIAL SAFETY AND SECURITY: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 26 INDUSTRIAL SAFETY AND SECURITY: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.5 WORKFORCE MANAGEMENT

7.5.1 WORKFORCE MANAGEMENT: MARKET DRIVERS

7.5.2 WORKFORCE MANAGEMENT: COVID-19 IMPACT

TABLE 27 WORKFORCE MANAGEMENT: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 28 WORKFORCE MANAGEMENT: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.6 ANALYTICS AND REPORTING

7.6.1 ANALYTICS AND REPORTING: CONNECTED MINING MARKET DRIVERS

7.6.2 ANALYTICS AND REPORTING: COVID-19 IMPACT DRIVERS

TABLE 29 ANALYTICS AND REPORTING: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 30 ANALYTICS AND REPORTING: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.7 PROCESS CONTROL

7.7.1 PROCESS CONTROL: MARKET DRIVERS

7.7.2 PROCESS CONTROL: COVID-19 IMPACT

TABLE 31 PROCESS CONTROL: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 32 PROCESS CONTROL: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.8 OTHER SOLUTIONS

7.8.1 OTHER SOLUTIONS: MARKET DRIVERS

7.8.2 OTHER SOLUTIONS: COVID-19 IMPACT

TABLE 33 OTHER SOLUTIONS: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 34 OTHER SOLUTIONS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 CONNECTED MINING MARKET, BY SERVICE (Page No. - 100)

8.1 INTRODUCTION

FIGURE 30 PROFESSIONAL SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 35 MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 36 MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

8.2 PROFESSIONAL SERVICES

8.2.1 PROFESSIONAL SERVICES: MARKET DRIVERS

8.2.2 PROFESSIONAL SERVICES: COVID-19 IMPACT

FIGURE 31 INTEGRATION AND DEPLOYMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 37 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 38 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 39 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 40 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2.3 CONSULTING

TABLE 41 CONSULTING: CONNECTED MINING MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 42 CONSULTING: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2.4 INTEGRATION AND DEPLOYMENT

TABLE 43 INTEGRATION AND DEPLOYMENT: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 44 INTEGRATION AND DEPLOYMENT: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2.5 SUPPORT AND MAINTENANCE

TABLE 45 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 46 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 MANAGED SERVICES

8.3.1 MANAGED SERVICES: MARKET DRIVERS

8.3.2 MANAGED SERVICES: COVID-19 IMPACT

TABLE 47 MANAGED SERVICES: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 48 MANAGED SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 CONNECTED MINING MARKET, BY APPLICATION (Page No. - 109)

9.1 INTRODUCTION

FIGURE 32 EXPLORATION SEGMENT TO SHARE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 49 MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 50 MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 EXPLORATION

9.2.1 EXPLORATION: MARKET DRIVERS

9.2.2 EXPLORATION: COVID-19 IMPACT

TABLE 51 EXPLORATION: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 52 EXPLORATION: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3 PROCESSING AND REFINING

9.3.1 PROCESSING AND REFINING: MARKET DRIVERS

9.3.2 PROCESSING AND REFINING: COVID-19 IMPACT

TABLE 53 PROCESSING AND REFINING: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 54 PROCESSING AND REFINING: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.4 TRANSPORTATION

9.4.1 TRANSPORTATION: MARKET DRIVERS

9.4.2 TRANSPORTATION: COVID-19 IMPACT

TABLE 55 TRANSPORTATION MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 56 TRANSPORTATION: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10 CONNECTED MINING MARKET, BY DEPLOYMENT MODE (Page No. - 116)

10.1 INTRODUCTION

FIGURE 33 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 57 MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 58 MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

10.2 ON-PREMISES

10.2.1 ON-PREMISES: MARKET DRIVERS

10.2.2 ON-PREMISES: COVID-19 IMPACT

TABLE 59 ON-PREMISES: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 60 ON-PREMISES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.3 CLOUD

10.3.1 CLOUD: MARKET DRIVERS

10.3.2 CLOUD: COVID-19 IMPACT

TABLE 61 CLOUD: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 62 CLOUD: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11 CONNECTED MINING MARKET, BY MINING TYPE (Page No. - 121)

11.1 INTRODUCTION

FIGURE 34 SURFACE SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 63 MARKET SIZE, BY MINING TYPE, 2017–2021 (USD MILLION)

TABLE 64 MARKET SIZE, BY MINING TYPE, 2022–2027 (USD MILLION)

11.2 SURFACE

11.2.1 SURFACE: MARKET DRIVERS

11.2.2 SURFACE: COVID-19 IMPACT

TABLE 65 SURFACE: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 66 SURFACE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11.3 UNDERGROUND

11.3.1 UNDERGROUND: MARKET DRIVERS

11.3.2 UNDERGROUND: COVID-19 IMPACT

TABLE 67 UNDERGROUND: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 68 UNDERGROUND: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12 CONNECTED MINING MARKET, BY REGION (Page No. - 126)

12.1 INTRODUCTION

FIGURE 35 ASIA PACIFIC TO HOLD THE LARGEST MARKET SIZE IN THE MARKET DURING THE FORECAST PERIOD

FIGURE 36 ASIA PACIFIC TO REGISTER THE HIGHEST CAGR FROM 2022 TO 2027

TABLE 69 MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 70 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

12.2.2 NORTH AMERICA: COVID-19 IMPACT

12.2.3 NORTH AMERICA: REGULATORY NORMS

FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

TABLE 71 NORTH AMERICA: CONNECTED MINING MARKET SIZE, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY MINING TYPE, 2017–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY MINING TYPE, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.4 UNITED STATES

TABLE 87 UNITED STATES: CONNECTED MINING MARKET SIZE, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 88 UNITED STATES: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 89 UNITED STATES: MARKET SIZE, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 90 UNITED STATES: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 91 UNITED STATES: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 92 UNITED STATES: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 93 UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

TABLE 94 UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 95 UNITED STATES: MARKET SIZE, BY MINING TYPE, 2017–2021 (USD MILLION)

TABLE 96 UNITED STATES: MARKET SIZE, BY MINING TYPE, 2022–2027 (USD MILLION)

TABLE 97 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 98 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 99 UNITED STATES: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 100 UNITED STATES: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

12.2.5 CANADA

12.3 EUROPE

12.3.1 EUROPE: CONNECTED MINING MARKET DRIVERS

12.3.2 EUROPE: IMPACT OF COVID-19

12.3.3 EUROPE: REGULATORY NORMS

TABLE 101 EUROPE: MARKET SIZE, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY MINING TYPE, 2017–2021 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY MINING TYPE, 2022–2027 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.4 RUSSIA

TABLE 117 RUSSIA: CONNECTED MINING MARKET SIZE, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 118 RUSSIA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 119 RUSSIA: MARKET SIZE, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 120 RUSSIA: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 121 RUSSIA: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 122 RUSSIA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 123 RUSSIA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

TABLE 124 RUSSIA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 125 RUSSIA: MARKET SIZE, BY MINING TYPE, 2017–2021 (USD MILLION)

TABLE 126 RUSSIA: MARKET SIZE, BY MINING TYPE, 2022–2027 (USD MILLION)

TABLE 127 RUSSIA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 128 RUSSIA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 129 RUSSIA: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 130 RUSSIA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.5 UNITED KINGDOM

12.3.6 GERMANY

12.3.7 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: CONNECTED MINING MARKET DRIVERS

12.4.2 ASIA PACIFIC: IMPACT OF COVID-19

12.4.3 ASIA PACIFIC: REGULATORY NORMS

FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 131 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY MINING TYPE, 2017–2021 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY MINING TYPE, 2022–2027 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.4 CHINA

TABLE 147 CHINA: CONNECTED MINING MARKET SIZE, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 148 CHINA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 149 CHINA: MARKET SIZE, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 150 CHINA: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 151 CHINA: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 152 CHINA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 153 CHINA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

TABLE 154 CHINA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 155 CHINA: MARKET SIZE, BY MINING TYPE, 2017–2021 (USD MILLION)

TABLE 156 CHINA: MARKET SIZE, BY MINING TYPE, 2022–2027 (USD MILLION)

TABLE 157 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 158 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 159 CHINA: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 160 CHINA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.5 AUSTRALIA

12.4.6 INDIA

12.4.7 REST OF ASIA PACIFIC

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: CONNECTED MINING MARKET DRIVERS

12.5.2 MIDDLE EAST AND AFRICA: IMPACT OF COVID-19

12.5.3 MIDDLE EAST AND AFRICA: REGULATORY NORMS

TABLE 161 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET SIZE, BY MINING TYPE, 2017–2021 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET SIZE, BY MINING TYPE, 2022–2027 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.4 MIDDLE EAST

TABLE 177 MIDDLE EAST: CONNECTED MINING MARKET SIZE, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 178 MIDDLE EAST: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 179 MIDDLE EAST: MARKET SIZE, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 180 MIDDLE EAST: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 181 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 182 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 183 MIDDLE EAST: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

TABLE 184 MIDDLE EAST: MARKET SIZE, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 185 MIDDLE EAST: MARKET SIZE, BY MINING TYPE, 2017–2021 (USD MILLION)

TABLE 186 MIDDLE EAST: MARKET SIZE, BY MINING TYPE, 2022–2027 (USD MILLION)

TABLE 187 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 188 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 189 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 190 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

12.5.5 AFRICA

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: CONNECTED MINING MARKET DRIVERS

12.6.2 LATIN AMERICA: IMPACT OF COVID-19

12.6.3 LATIN AMERICA: REGULATORY NORMS

TABLE 191 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET SIZE, BY MINING TYPE, 2017–2021 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY MINING TYPE, 2022–2027 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.4 BRAZIL

TABLE 207 BRAZIL: CONNECTED MINING MARKET SIZE, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 208 BRAZIL: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 209 BRAZIL: MARKET SIZE, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 210 BRAZIL: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 211 BRAZIL: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 212 BRAZIL: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 213 BRAZIL: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

TABLE 214 BRAZIL: MARKET SIZE, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 215 BRAZIL: MARKET SIZE, BY MINING TYPE, 2017–2021 (USD MILLION)

TABLE 216 BRAZIL: MARKET SIZE, BY MINING TYPE, 2022–2027 (USD MILLION)

TABLE 217 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 218 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 219 BRAZIL: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 220 BRAZIL: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

12.6.5 MEXICO

12.6.6 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 184)

13.1 OVERVIEW

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 39 MARKET EVALUATION FRAMEWORK, 2019–2022

13.3 KEY PLAYER STRATEGIES

13.3.1 PRODUCT LAUNCHES

TABLE 221 CONNECTED MINING MARKET: PRODUCT LAUNCHES, FEBRUARY 2019–FEBRUARY 2022

13.3.2 DEALS

TABLE 222 MARKET: DEALS, JANUARY 2019–FEBRUARY 2022

13.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 223 MARKET: DEGREE OF COMPETITION

13.5 HISTORICAL REVENUE ANALYSIS

FIGURE 40 HISTORICAL REVENUE ANALYSIS, 2018–2020

13.6 COMPANY EVALUATION MATRIX OVERVIEW

13.6.1 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 224 PRODUCT FOOTPRINT WEIGHTAGE

13.6.2 STAR

13.6.3 EMERGING LEADERS

13.6.4 PERVASIVE

13.6.5 PARTICIPANTS

FIGURE 41 CONNECTED MINING, COMPANY EVALUATION MATRIX, 2022

13.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 225 COMPANY PRODUCT FOOTPRINT

TABLE 226 COMPANY OFFERING FOOTPRINT

TABLE 227 COMPANY INDUSTRY FOOTPRINT

TABLE 228 COMPANY REGION FOOTPRINT

13.8 COMPANY MARKET RANKING ANALYSIS

FIGURE 42 RANKING OF KEY PLAYERS IN THE CONNECTED MINING MARKET, 2022

13.9 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

FIGURE 43 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

13.10 COMPETITIVE BENCHMARKING

TABLE 229 CONNECTED MINING: DETAILED LIST OF KEY STARTUP/SMES

TABLE 230 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

13.10.1 PROGRESSIVE COMPANIES

13.10.2 RESPONSIVE COMPANIES

13.10.3 DYNAMIC COMPANIES

13.10.4 STARTING BLOCKS

FIGURE 44 CONNECTED MINING MARKET (GLOBAL): STARTUP/SME EVALUATION MATRIX, 2022

14 COMPANY PROFILES (Page No. - 202)

(Business overview, Products/solutions/services offered, Recent developments, Response to COVID-19& MnM View)*

14.1 MAJOR COMPANIES

14.1.1 CISCO

TABLE 231 CISCO: BUSINESS OVERVIEW

FIGURE 45 CISCO: COMPANY SNAPSHOT

TABLE 232 CISCO: PRODUCTS /SOLUTIONS/SERVICES OFFERED

TABLE 233 CISCO: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES

TABLE 234 CISCO: DEALS

14.1.2 IBM

TABLE 235 IBM: BUSINESS OVERVIEW

FIGURE 46 IBM: COMPANY SNAPSHOT

TABLE 236 IBM: PRODUCTS /SOLUTIONS/SERVICES OFFERED

TABLE 237 IBM: PRODUCT/SOLUTION/SERVICE LAUNCH

14.1.3 ACCENTURE

TABLE 238 ACCENTURE: BUSINESS OVERVIEW

FIGURE 47 ACCENTURE: FINANCIAL OVERVIEW

TABLE 239 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 240 ACCENTURE: PRODUCT/SOLUTION/SERVICE LAUNCH

TABLE 241 ACCENTURE: DEALS

14.1.4 CATERPILLAR

TABLE 242 CATERPILLAR: BUSINESS OVERVIEW

FIGURE 48 CATERPILLAR: FINANCIAL OVERVIEW

TABLE 243 CATERPILLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 244 CATERPILLAR: PRODUCT/SOLUTION/SERVICE LAUNCH

TABLE 245 CATERPILLAR: DEALS

14.1.5 ABB

TABLE 246 ABB: BUSINESS OVERVIEW

FIGURE 49 ABB: COMPANY SNAPSHOT

TABLE 247 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 248 ABB: PRODUCT/SOLUTION/SERVICE LAUNCH

TABLE 249 ABB: DEALS

14.1.6 SAP

TABLE 250 SAP: BUSINESS OVERVIEW

FIGURE 50 SAP: COMPANY SNAPSHOT

TABLE 251 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 252 SAP: PRODUCT/SOLUTION/SERVICE LAUNCH

TABLE 253 SAP: DEALS

14.1.7 SCHNEIDER ELECTRIC

TABLE 254 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 51 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 255 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 256 SCHNEIDER ELECTRIC: DEALS

14.1.8 KOMATSU

TABLE 257 KOMATSU: BUSINESS OVERVIEW

FIGURE 52 KOMATSU: FINANCIAL OVERVIEW

TABLE 258 KOMATSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 259 KOMATSU: PRODUCT/SOLUTION/SERVICE LAUNCH

TABLE 260 KOMATSU: DEALS

14.1.9 HEXAGON

TABLE 261 HEXAGON: BUSINESS OVERVIEW

FIGURE 53 HEXAGON: FINANCIAL OVERVIEW

TABLE 262 HEXAGON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 263 HEXAGON: PRODUCT/SOLUTION/SERVICE LAUNCH

TABLE 264 HEXAGON: DEALS

14.1.10 ROCKWELL AUTOMATION

TABLE 265 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

FIGURE 54 ROCKWELL AUTOMATION: FINANCIAL OVERVIEW

TABLE 266 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 267 ROCKWELL AUTOMATION: PRODUCT/SOLUTION/SERVICE LAUNCH

TABLE 268 ROCKWELL AUTOMATION: DEALS

14.1.11 TRIMBLE

TABLE 269 TRIMBLE: BUSINESS OVERVIEW

FIGURE 55 TRIMBLE: FINANCIAL OVERVIEW

TABLE 270 TRIMBLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 271 TRIMBLE: PRODUCT/SOLUTION/SERVICE LAUNCH

TABLE 272 TRIMBLE: DEALS

14.1.12 HITACHI CONSTRUCTION MACHINERY

14.1.13 PTC

14.1.14 EUROTECH COMMUNICATION

14.1.15 GETAC

14.1.16 SIEMENS

14.1.17 HOWDEN

14.1.18 WIPRO

14.1.19 MST GLOBAL

14.1.20 GE DIGITAL

*Details on Business overview, Products/solutions/services offered, Recent developments, Response to COVID-19& MnM View might not be captured in case of unlisted companies.

14.2 STARTUP/SMES PLAYERS

14.2.1 ZYFRA

14.2.2 AXORA

14.2.3 GROUNDHOG

14.2.4 SMARTMINING

14.2.5 APPLIED VEHICLE ANALYSIS

14.2.6 SYMBOTICWARE

14.2.7 INTELLISENSE.IO

15 ADJACENT MARKET (Page No. - 260)

15.1 INTRODUCTION

15.2 LIMITATIONS

15.3 WORKPLACE SAFETY MARKET– GLOBAL FORECAST TO 2025

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

15.3.3 WORKPLACE SAFETY MARKET, BY COMPONENT

TABLE 275 HARDWARE: WORKPLACE SAFETY MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 281 SOFTWARE: WORKPLACE SAFETY MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 283 SERVICES: WORKPLACE SAFETY MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

15.3.4 WORKPLACE SAFETY MARKET, BY SYSTEM

TABLE 285 WORKPLACE SAFETY MARKET SIZE, BY SYSTEM, 2014–2019 (USD MILLION)

TABLE 286 WORKPLACE SAFETY MARKET SIZE, BY SYSTEM, 2019–2025 (USD MILLION)

15.3.5 WORKPLACE SAFETY MARKET, BY APPLICATION

TABLE 287 WORKPLACE SAFETY MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 288 WORKPLACE SAFETY MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

15.3.6 WORKPLACE SAFETY MARKET, BY REGION

TABLE 289 WORKPLACE SAFETY MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

15.4 IOT MARKET – GLOBAL FORECAST TO 2024

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

15.4.3 IOT MARKET, BY COMPONENT

TABLE 291 IOT MARKET, BY COMPONENT, 2015–2020 (USD BILLION)

TABLE 292 IOT MARKET, BY COMPONENT, 2021–2026 (USD BILLION)

TABLE 293 IOT HARDWARE MARKET, BY REGION, 2015–2020 (USD BILLION)

TABLE 294 IOT HARDWARE MARKET, BY REGION, 2021–2026 (USD BILLION)

TABLE 295 IOT SOFTWARE SOLUTIONS MARKET, BY REGION, 2015–2020 (USD BILLION)

TABLE 296 IOT SOFTWARE SOLUTIONS MARKET, BY REGION, 2021–2026 (USD BILLION)

TABLE 297 IOT SOFTWARE SOLUTIONS MARKET, BY COMPONENT, 2015–2020 (USD BILLION)

TABLE 298 IOT SOFTWARE SOLUTIONS MARKET, BY COMPONENT, 2021–2026 (USD BILLION)

15.4.4 IOT MARKET, BY ORGANIZATION SIZE

TABLE 299 IOT MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD BILLION)

TABLE 300 IOT MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

TABLE 301 SMALL AND MEDIUM-SIZED ENTERPRISES: IOT MARKET, BY REGION, 2015–2020 (USD BILLION)

TABLE 302 SMALL AND MEDIUM-SIZED ENTERPRISES: IOT MARKET, BY REGION, 2021–2026 (USD BILLION)

TABLE 303 LARGE ENTERPRISES: IOT MARKET, BY REGION, 2015–2020 (USD BILLION)

TABLE 304 LARGE ENTERPRISES: IOT MARKET, BY REGION, 2021–2026 (USD BILLION)

15.4.5 IOT MARKET, BY REGION

TABLE 305 IOT MARKET, BY REGION, 2015–2020 (USD BILLION)

TABLE 306 IOT MARKET, BY REGION, 2021–2026 (USD BILLION)

16 APPENDIX (Page No. - 273)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATION

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources, directories, and databases such as Dun and Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek to identify and collect information useful for a technical, market-oriented, and commercial study of the connected mining market. The primary sources were industry experts from the core and related industries and preferred suppliers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews were conducted with various primary respondents that included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information.

The following illustrative figure shows the market research methodology for making this report on Connected Mining Market.

Secondary Research

The market for companies offering connected mining for use in different verticals was estimated and projected based on the secondary data made available through paid and unpaid sources and by analyzing their product portfolios in the ecosystem of the connected mining market. It also involved rating services of companies based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study on the connected mining market. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, journals, and certified publications and articles by recognized authors, directories, and databases.

Secondary research was used to obtain key information about the supply chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottommost level, regional markets, and key developments from both, market and technology-oriented perspectives that were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from connected mining solution vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, deployment, and region. Stakeholders from demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Strategy Officers (CSOs), and installation teams of the governments/end users who are using connected mining solutions were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage of smart water management solutions, which will affect the overall connected mining market.

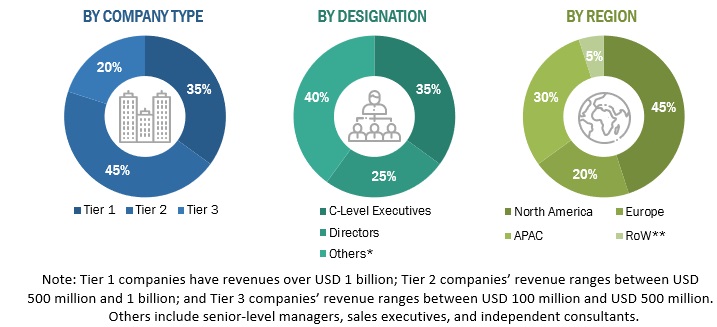

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of connected mining. The key players in the market were identified through secondary research, and their revenue contribution in the respective regions was determined through primary and secondary research. The entire procedure included the study of annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub segments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the connected mining market based on segments based on component, solutions, services, mining type, deployment mode, application, with regions covered.

- To forecast the size of the market segments with respect to five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To provide detailed information related to the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the global market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global connected mining market.

- To profile the key market players, such as top and emerging vendors; provide a comparative analysis based on their business overviews, regional presence, product offerings, and business strategies; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments in the market, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Geographic Analysis

- Further breakdown of the North American Connected Mining Market

- Further breakdown of the European Market

- Further breakdown of the Asia Pacific Market

- Further breakdown of the Middle east and Africa Market

- Further breakdown of the Latin American Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Connected Mining Market