Connected Ship Market by Application (Vessel Traffic Management, Fleet operations, Fleet Health Operations), Installation Type (Onboard, Onshore), Ship Type (Commercial, Defense), Fit (Linefit, Retrofit), Region (2017-2023)

The connected ship market was valued at USD 5.51 billion in 2017 and is projected to reach USD 7.19 billion by 2023, at a CAGR of 3.95% during the forecast period. The base year considered for the study is 2017, and the forecast period is from 2018 to 2023. The objective of this study is to analyze, define, describe, and forecast the connected ship market based on application, installation type, ship type, fit, and region. The report also focuses on the competitive landscape of this market by profiling the key market players based on their financial position, product portfolios, growth strategies, core competencies, and market shares to estimate the degree of competition prevailing in the connected ship market. This report also tracks and analyzes competitive developments such as partnerships, new product launches, and R&D activities in the market.

Research Methodology:

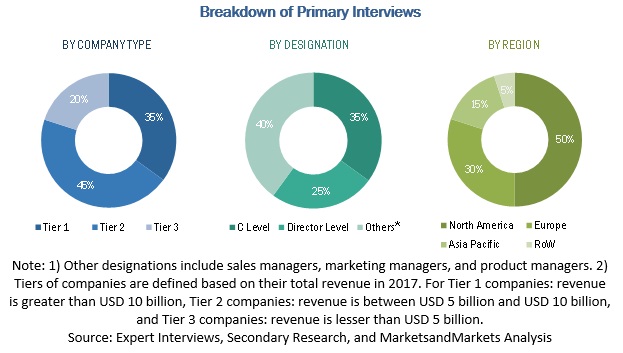

The research methodology used to estimate and forecast the size of the connected ship market begins with obtaining data on the key marine connectivity software and hardware components and system equipment through secondary sources, which include government agencies and organizations such as the International Maritime Organization (IMO), SEA Europe, the Shipbuilders' Association of Japan (SAJN), the International Organization for Standardization (ISO); corporate filings such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations, among others. The bottom-up approach was employed to arrive at the overall size of the connected ship market from the revenues of the key players and their shares in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with the market experts such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives of the leading companies operating in the market. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the connected ship market. The breakdown of profiles of primaries is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The key players operating in the market are Northrop Grumman (US), General Electric (US), Wartsila (Finland), Kongsberg Grumman (Norway), and Marlink (Norway), among others. These companies offer advanced technological systems, products, and services. They also provide a broad range of management, engineering, technical, communication, and training services.

Target Audience

- Manufacturers of Navigation Systems

- Naval Forces

- Suppliers of Ship Systems

- Shipbuilders

- Technology Support Providers

- Solution Providers

- Component Suppliers

- Maritime Shipping Companies

- Research Organizations

- Original Equipment Manufacturers (OEMs)

This study answers several questions for the stakeholders, primarily which market segments they should focus upon during the next 2 to 5 years to prioritize their efforts and investments.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

This research report categorizes the market into the following segments and subsegments:

Connected Ship Market, by Ship Type

- Commercial

- Defense

Connected Ship Market, by Application

- Vessel Traffic Management

- Fleet Operations

- Fleet Health Monitoring

Connected Ship Market, by Installation Type

- Onboard

- Onshore

Connected Ship Market, by Fit

- Linefit

- Retrofit

Connected Ship Market, by Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

The connected ship market is projected to grow from USD 5.92 billion in 2018 to USD 7.19 billion by 2023, at a CAGR of 3.95% from 2018 to 2023. Factors such as the incorporation of the Information and Communication Technology (ICT) in the global marine industry, increased budgets of shipping companies for digitalization of their vessels, growth of the seaborne trade across the globe, need for situational awareness among fleet operators, and growth of the maritime tourism industry are expected to drive the growth of the connected ship market during the forecast period.

Based on ship type, the defense segment of the connected ship market is projected to grow at a higher CAGR than the commercial segment from 2018 to 2023. The growth of this segment of the market can be attributed to the extensive use of connected ships by the naval forces of different countries. These ships have integrated systems, which are capable of linking various ship components and systems with one controlling and monitoring unit. Defense connected ships are different from commercial connected ships, in terms of their applications, designs, construction methods, and technologies. Investments are being made by different countries across the globe for the development of new and advanced naval connected ships and submarines.

Based on fit, the linefit segment of the connected ship market is projected to grow at a higher CAGR than the retrofit segment during the forecast period. The growth of the linefit segment of the connected ship market can be attributed to the increased investments in naval defense by various countries and rise in seaborne trade activities across the globe. Moreover, the increase in the number of orders for new ships is also expected to lead to the growth of the linefit segment of the market. China, India, and various other countries of South China Sea are enhancing their naval power by carrying out modernization of their naval fleets.

Based on application, the fleet health monitoring segment of the connected ship market is projected to grow at the highest CAGR during the forecast period. Connected ships enable smooth fleet operations by enabling effective communication with onshore stations and providing reliable information about safe and economical sea routes. This, in turn, leads to the effective fleet health monitoring.

Based on installation type, the onboard segment of the connected ship market is projected to grow at the highest CAGR from 2018 to 2023. The onboard segment of the market has been further classified into navigation positioning and tracking, automation, communication management systems, and ship information management systems.

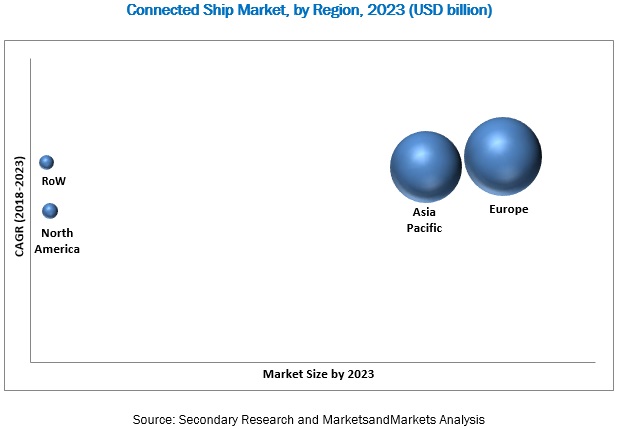

The European region is projected to lead the connected ship market during the forecast period. Although the shipbuilding industry in the region is going through a rough patch at present, the increased demand for autonomous ships and cruises from the region is expected to fuel the growth of the Europe market during the forecast period. The European region is one of the prime consumers of marine electronic equipment as some of the leading shipbuilding countries such as Germany, France, Italy, and Russia are in this region. The shipbuilding industry of the European region offers complex naval vessels such as cruises, ferries, mega yachts, submarines, and dredgers (offshore vessels) and hence, holds a strong position in the international market. Moreover, the marine equipment industry of the region also offers a wide range of products/ship components such as propulsion systems, diesel engines, environment safety systems, cargo handling systems, and related electronic products.

High costs of marine broadband connectivity and the vulnerability of connected ships to cyber threats due to their digitalization are expected to restrain the growth of the market across the globe.

Some of the key players operating in the market are Northrop Grumman (US), General Electric (US), Wartsila (Finland), Kongsberg Grumman (Norway), and Marlink (Norway). Leading companies in the connected ship market have adopted inorganic growth strategies to enhance their position in the market. They have adopted the strategy of acquisitions to enhance their position in the market. For instance, in May 2018, Wartsila acquired Transas, one of the leading providers of navigation solutions, to enhance its portfolio of bridge systems, digital products, and electronic charts.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 22)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Study Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 26)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 39)

4.1 Attractive Opportunities in Connected Ship Market

4.2 Connected Ship Market, By Ship Type

4.3 Europe Connected Ship Market, By Country & Application

4.4 Connected Ship Market, By Installation Type

4.5 Connected Ship Market, By Fit

4.6 Connected Ship Market, By Region

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Incorporation of ICT in the Global Marine Industry

5.2.1.2 Increased Budgets of Shipping Companies for Digitalization of Vessels

5.2.1.3 Increase in Seaborne Trade Across the Globe

5.2.1.4 Situational Awareness Requirement of Fleet Operators

5.2.1.5 Growing Maritime Tourism Industry

5.2.2 Restraints

5.2.2.1 High Costs of Marine Broadband Connectivity

5.2.2.2 Digitalization Renders Connected Ships Vulnerable to Cyber Threats

5.2.3 Opportunities

5.2.3.1 Initiatives for the Development of Connected Autonomous Ships

5.2.3.2 Adoption of Vessel Traffic Services (VTS) By Shipping Companies

5.2.3.3 Development of New Port Cities in Emerging Economies

5.2.4 Challenges

5.2.4.1 Limited Internet Facilities in Connected Ships

5.2.4.2 Lack of Skilled Personnel to Handle and Operate Connected Ships

5.2.4.3 Lack of Common Standards for Data Generated From Different Subsystems of Connected Ships

6 Industry Trends (Page No. - 51)

6.1 Introduction

6.2 Technology Roadmap

6.3 Technological Advancements in the Marine Industry

6.3.1 Artificial Intelligence

6.3.2 Big Data Analytics

6.3.3 Internet of Things (IoT)

6.3.4 Cloud-Based Solutions

6.3.5 Smart Ships Using Satellite Communication

6.4 Technology Trends

6.4.1 Global Navigation Satellite System (GNSS)

6.4.2 High Throughput Satellites (HTS)

6.4.3 Digital Marine Automation Systems

6.4.3.1 Sensor Fusion Solutions

6.4.3.2 Control Algorithms

6.4.3.3 Conning Systems

6.4.3.4 Connectivity Solutions

6.4.3.5 Autopilot

6.4.3.6 Mooring Control and Monitoring Systems

6.4.3.7 Automated Radar Plotting Aid

6.4.3.8 Electronic Chart Display and Information System

6.4.3.9 Communication Systems

6.4.3.10 Voyage Data Recorders

6.4.3.11 Decision Support Systems

6.4.4 Vessel Traffic Management System

6.4.5 Autonomous Marine Vessels

6.4.6 Integrated Ship Automation Systems

7 Connected Ship Market, By Application (Page No. - 58)

7.1 Introduction

7.2 Vessel Traffic Management

7.2.1 Demand for Safety and Efficiency of Vessels Will Drive the Growth for Vessel Traffic Management Systems

7.3 Fleet Operations

7.3.1 Need for Real-Time Situational Awareness to Fleet Operators Will Boost Demand for Fleet Operations

7.4 Fleet Health Monitoring

7.4.1 Increasing Demand for Remote Engine Monitoring System for Marine Engines to Drive the Growth of Fleet Health Monitoring System

8 Connected Ship Market, By Installation Type (Page No. - 63)

8.1 Introduction

8.2 Onboard

8.2.1 Navigation Positioning and Tracking

8.2.1.1 Integrated Bridge Systems

8.2.1.1.1 Increasing Use of Connectivity Solutions in the Integrated Bridge System is Driving the Growth of the Market

8.2.1.2 Navigation Systems

8.2.1.2.1 Need for Efficient Route Planning for Ships Will Boost Demand for Navigation Systems

8.2.2 Ship Information Management Systems

8.2.2.1 Voyage Data Recorders

8.2.2.1.1 Installation of Sensors in Vessel Systems Will Boost Demand for Voyage Data Recorders

8.2.2.2 Data Processors

8.2.2.2.1 Growing Demand for Big Data Analytics is Driving the Growth of Data Processors in the Market

8.2.3 Communication Management Systems

8.2.3.1 Very Small Aperture Terminal

8.2.3.1.1 Rise in the Use of Satellite Connectivity is Driving the Growth of Vsat

8.2.3.2 Mobile Satellite Systems

8.2.3.2.1 Deliveries of Mobile Satellite Devices for Marine Application Expected to Push the Demand for Mss

8.2.4 Automation

8.2.4.1 Surveillance and Safety Systems

8.2.4.1.1 Ensuring Safe and Secure Navigation of Ships Will Boost Demand for Surveillance and Safety

8.2.4.2 Power Management Systems

8.2.4.2.1 Importance of Continuing Power Supply in Vessels is Supporting the Growth of Pms

8.2.4.3 Propulsion Control Systems

8.2.4.3.1 Optimum Performance of Propulsion Systems is Driving the Demand for Propulsion Control System

8.2.4.4 Machinery Management Systems

8.2.4.4.1 Importance of Monitoring Health and Functions of Vessel Systems is Driving the Growth of the Machinery Management Systems

8.2.4.5 Alarm Management Systems

8.2.4.5.1 Controlling Faulty Alarm System and Preventing Critical System Failure Supports the Growth of the Segment

8.2.4.6 Ballast Management Systems

8.2.4.6.1 Strict Regulations to Treat Ballast Water in Ships is Driving the Growth of Ballast Management

8.2.4.7 Thruster Control Systems

8.2.4.7.1 Enhancing Easy Maneuvering of Ship is Driving the Demand for Thruster Control Systems

8.3 Onshore

8.3.1 Servers

8.3.1.1 Asia Pacific to Lead Connected Ship Market for Onshore Servers Between 2018 to 2023

8.3.2 Ship Data Analysis and Management

8.3.2.1 Software

8.3.2.1.1 Fleet Management Software

8.3.2.1.1.1 Increase in Marine Vessel Deliveries Will Boost Demand for Fleet Management Software

8.3.2.1.2 Data Analysis Software

8.3.2.1.2.1 IoT Based Sensors and Alarm Monitoring Sensors are Supporting the Growth of Data Analysis Software

8.3.2.2 Services

8.3.2.2.1 Health Monitoring Services

8.3.2.2.1.1 Increasing Awareness of Predictive Maintenance in Ships to Drive the Demand for Health Monitoring Services

8.3.2.2.2 Navigation Assistance Services

8.3.2.2.2.1 Smooth and Effective Navigation of Marine Vessels Will Boost Demand for Navigation Assistance Services

9 Connected Ship Market, By Ship Type (Page No. - 77)

9.1 Introduction

9.2 Commercial

9.2.1 Passenger Ships & Cruises

9.2.1.1 Growth in International Sea Travel Will Boost Demand in Passenger Ships & Cruises

9.2.2 Dry Cargos

9.2.2.1 Upgradation in the Dry Cargos for Real Time Data Exchange is Driving the Growth

9.2.3 Other Ships

9.2.3.1 Specialized Vessels

9.2.3.1.1 High Demand for Specialized Vessels in Maritime Tourism is Supporting the Growth in the Market

9.2.3.2 Offshore Vessels

9.2.3.2.1 Demand From Oil and Gas Industry is Driving the Growth of Offshore Vessels

9.3 Defense

9.3.1 Aircraft Carrier

9.3.1.1 Upgradation of Communication Devices is Driving the Growth in Aircraft Carrier

9.3.2 Corvettes

9.3.2.1 Rise in Situational Awareness to Drive the Demand in Corvettes

9.3.3 Frigates

9.3.3.1 Improvising the Co-Ordination in the Naval Fleet is Driving the Growth in Frigates

9.3.4 Submarine & Uuvs

9.3.4.1 Growing Applications of Unmanned and Underwater Ships are Driving the Demand in Submarines & Uuvs

10 Connected Ship Market, By Fit (Page No. - 83)

10.1 Introduction

10.2 Linefit

10.2.1 Increase in the Deliveries of New Ship is Expected to Drive the Demand in Linefit Segment

10.3 Retrofit

10.3.1 Rise in the Upgradation of Connected Systems for Older Vessels is Expected to Drive the Demand in Retrofit Segment

11 Regional Analysis (Page No. - 87)

11.1 Introduction

11.2 Asia Pacific

11.2.1 By Country

11.2.1.1 China

11.2.1.1.1 Increase in Naval Spending and Rise in Domestic Ship Production are Expected to Drive the Connected Ship Market in China

11.2.1.2 South Korea

11.2.1.2.1 Integration of Connected Ship System By Various Shipbuilding Players to Drive the Growth in South Korea

11.2.1.3 Japan

11.2.1.3.1 Increasing Deliveries of Naval Ship is Driving the Growth of Connected Ship Market in Japan

11.2.1.4 India

11.2.1.4.1 Upgradation of Old Ships With New Systems is Expected to Drive the Market in India

11.2.1.5 Rest of Asia Pacific

11.2.1.5.1 Demand for Upgradation of Legacy System to Boost the Demand for Connected Ship Systems in the Region

11.3 North America

11.3.1 By Country

11.3.1.1 US

11.3.1.1.1 Rise in Naval Ship Building in the Country is Driving the Growth of the Market

11.3.1.2 Canada

11.3.1.2.1 Canada Governments Strategic Decision to Develop Its Own Indigenous Marine Industry to Grow the Market

11.4 Europe

11.4.1 By Country

11.4.1.1 Germany

11.4.1.1.1 Ship Equipment Upgradation Will Boost the Demand for Connected Ship Systems in the Country

11.4.1.2 Italy

11.4.1.2.1 Retrofitting of Connected Ship Technologies in Vessels is Driving the Growth of the Market in Italy

11.4.1.3 UK

11.4.1.3.1 Growing Investment in the Upgradation of Marine System is Expected to Drive the Connected Ship Market in UK

11.4.1.4 Russia

11.4.1.4.1 Introduction of Automation Technologies in Naval Ships Will Boost Demand for Connected Systems in Russia

11.4.1.5 France

11.4.1.5.1 Increasing Development of Naval Vessels has Contributed to the Growth of the Connected Ship Market in France

11.4.1.6 Rest of Europe

11.4.1.6.1 Supply of Connected Ship Components and Systems From OEMs to Drive the Growth of the Market

11.5 Rest of the World

11.5.1 By Region

11.5.1.1 Middle East & Africa

11.5.1.1.1 Development of National Shipbuilding Companies Have Provided Momentum to the Shipbuilding Industry

11.5.1.2 Latin America

11.5.1.2.1 Rise in the Maritime Trade and Ship Overhauling is Driving the Demand for Connected Ship Market

12 Competitive Landscape (Page No. - 135)

12.1 Introduction

12.2 Rank Analysis of Companies in Connected Ship Market, 2017

12.3 Regional Mapping of Leading Companies in Connected Ship Market

12.4 Competitive Scenario

12.4.1 Contracts

12.4.2 New Product Launches

12.4.3 Acquisitions

12.4.4 Agreements, Partnerships, and Collaborations

13 Company Profiles (Page No. - 141)

(Business Overview, Products & Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 ABB

13.2 Emerson

13.3 General Electric (GE)

13.4 Hyundai Heavy Industries (HHI)

13.5 Jason

13.6 Kongsberg Gruppen

13.7 Marlink

13.8 Northrop Grumman

13.9 RH Marine

13.10 Rockwell Automation

13.11 Schneider Electric

13.12 Siemens

13.13 Ulstein

13.14 Valmet

13.15 Wartsila

13.16 Innovators

13.16.1 Iridium

13.16.2 Inmarsat

13.16.3 Viasat

13.16.4 Intelsat

*Details on Business Overview, Products & Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 176)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (145 Tables)

Table 1 Cost Comparison of Hardware and Broadband Plans, By Brand

Table 2 Timeline and Design Development Targets for Autonomous Ships With Connected Ship Technologies

Table 3 Comparison of Manual Ship Systems and Integrated Marine Automation Systems

Table 4 Connected Ship Market Size, By Application, 20162023 (USD Million)

Table 5 Connected Ship Market in Vessel Traffic Management, By Region, 20162023 (USD Million)

Table 6 Connected Ship Market in Fleet Operations, By Region, 20162023 (USD Million)

Table 7 Connected Ship Market in Fleet Health Monitoring, By Region, 20162023(USD Million)

Table 8 Connected Ship Market Size, By Installation Type, 20162023 (USD Million)

Table 9 Onboard Connected Ship Market Size, By Type, 20162023 (USD Million)

Table 10 Connected Ship Market for Onboard Navigation Positioning and Tracking, By Region, 20162023 (USD Million)

Table 11 Connected Ship Market for Onboard Navigation Positioning and Tracking, By Type, 20162023 (USD Million)

Table 12 Connected Ship Market for Onboard Ship Information Management Systems, By Region, 20162023 (USD Million)

Table 13 Connected Ship Market for Onboard Ship Information Management Systems, By Type, 20162023 (USD Million)

Table 14 Connected Ship Market for Onboard Communication Management Systems, By Region, 20162023 (USD Million)

Table 15 Connected Ship Market for Onboard Communication Management Systems, By Type, 20162023 (USD Million)

Table 16 Connected Ship Market for Onboard Automation, By Region, 20162023 (USD Million)

Table 17 Connected Ship Market for Onboard Automation, By Type, 20162023 (USD Million)

Table 18 Onshore Connected Ship Market Size, By Type, 20162023 (USD Million)

Table 19 Connected Ship Market for Onshore Servers, By Region, 20162023 (USD Million)

Table 20 Connected Ship Market for Onshore Ship Data Analysis and Management, By Region, 20162023 (USD Million)

Table 21 Connected Ship Market for Onshore Ship Data Analysis and Management, By Type, 20162023 (USD Million)

Table 22 Connected Ship Market for Onshore Ship Data Analysis and Management Software, By Type, 20162023 (USD Million)

Table 23 Connected Ship Market for Onshore Ship Data Analysis and Management Services, By Type, 2016-2023 (USD Million)

Table 24 Connected Ship Market Size, By Ship Type, 20162023 (USD Million)

Table 25 Commercial Connected Ship Market Size, By Type, 20162023 (USD Million)

Table 26 Commercial Connected Ship Market Size, By Region, 20162023 (USD Million)

Table 27 Defense Market Size, By Type, 20162023 (USD Million)

Table 28 Defense Market Size, By Region, 20162023 (USD Million)

Table 29 Connected Ship Market Size, By Fit, 20162023 (USD Million)

Table 30 Linefit Market Size, By Region, 20162023 (USD Million)

Table 31 Retrofit Market Size, By Region, 20162023 (USD Million)

Table 32 Connected Ship Market Size, By Region, 20162023 (USD Million)

Table 33 Asia Pacific Market Size, By Ship Type, 20162023 (USD Million)

Table 34 Asia Pacific Commercial Connected Ship Market, By Type, 20162023 (USD Million)

Table 35 Asia Pacific Defense Connected Ship Market, By Type, 20162023 (USD Million)

Table 36 Asia Pacific Market Size, By Application, 20162023 (USD Million)

Table 37 Asia Pacific Market Size, By Installation Type, 20162023 (USD Million)

Table 38 Asia Pacific Market for Onboard Solution, By Type, 20162023 (USD Million)

Table 39 Asia Pacific Market for Onboard Navigation Positioning & Tracking Solution, By Type, 20162023 (USD Million)

Table 40 Asia Pacific Market for Onboard Automation Solution, By Type, 20162023 (USD Million)

Table 41 Asia Pacific Market for Onboard Communication Management Systems, By Type, 20162023 (USD Million)

Table 42 Asia Pacific Market, By Onboard Ship Information Management Solution, By Type, 2016-2023 (USD Million)

Table 43 Asia Pacific Market for Onshore Solution, By Type, 20162023 (USD Million)

Table 44 Asia Pacific Market for Onshore Ship Data Analysis and Management, By Type, 20162023 (USD Million)

Table 45 Asia Pacific Market for Onshore Ship Data Analysis and Management Software, By Type, 20162023 (USD Million)

Table 46 Asia Pacific Market for Onshore Ship Data Analysis and Management Services, By Type, 20162023 (USD Million)

Table 47 Asia Pacific Market Size, By Fit, 20162023 (USD Million)

Table 48 Asia Pacific Market Size, By Country, 20162023 (USD Million)

Table 49 China Market Size, By Installation Type, 20162023 (USD Million)

Table 50 China Market Size, By Ship Type, 20162023 (USD Million)

Table 51 China Market Size, By Fit, 20162023 (USD Million)

Table 52 South Korea Market Size, By Installation Type, 20162023 (USD Million)

Table 53 South Korea Market Size, By Ship Type, 20162023 (USD Million)

Table 54 South Korea Market Size, By Fit, 20162023 (USD Million)

Table 55 Japan Market Size, By Installation Type, 20162023 (USD Million)

Table 56 Japan Market Size, By Ship Type, 20162023 (USD Million)

Table 57 Japan Market Size, By Fit, 20162023 (USD Million)

Table 58 India Market Size, By Installation Type, 20162023 (USD Million)

Table 59 India Market Size, By Ship Type, 20162023 (USD Million)

Table 60 India Market Size, By Fit, 20162023 (USD Million)

Table 61 Rest of Asia Pacific Market Size, By Installation Type, 2016-2023 (USD Million)

Table 62 Rest of Asia Pacific Market Size, By Ship Type, 2016-2023 (USD Million)

Table 63 Rest of Asia Pacific Market Size, By Fit, 20162023 (USD Million)

Table 64 North America Market Size, By Ship Type, 20162023 (USD Million)

Table 65 North America Commercial Market, By Type, 20162023 (USD Million)

Table 66 North America Defense Market, By Type, 20162023 (USD Million)

Table 67 North America Market Size, By Application, 20162023 (USD Million)

Table 68 North America Market Size, By Installation Type, 20162023 (USD Million)

Table 69 North America Market for Onboard Solution, By Type, 20162023 (USD Million)

Table 70 North America Market for Onboard Navigation Positioning and Tracking Solution, By Type, 20162023 (USD Million)

Table 71 North America Market for Onboard Automation Solution, By Type, 20162023 (USD Million)

Table 72 North America Market for Onboard Communication Management Solution, By Type, 20162023 (USD Million)

Table 73 North America Market for Onboard Ship Information Management Solution, By Type, 20162023 (USD Million)

Table 74 North America Market for Onshore Solution, By Type, 20162023 (USD Million)

Table 75 North America Market for Onshore Ship Data Analysis and Management Solution, By Type, 20162023 (USD Million)

Table 76 North America Market for Onshore Ship Data Analysis and Management Software, By Type, 20162023 (USD Million)

Table 77 North America Market for Onshore Ship Data Analysis and Management Services, By Type, 20162023 (USD Million)

Table 78 North America Market, By Fit, 20162023 (USD Million)

Table 79 North America Market Size, By Country, 20162023 (USD Million)

Table 80 US Connected Ship Market Size, By Installation Type, 20162023 (USD Million)

Table 81 US Market Size, By Ship Type, 20162023 (USD Million)

Table 82 US Market Size, By Fit, 20162023 (USD Million)

Table 83 Canada Connected Ship Market Size, By Installation Type, 20162023 (USD Million)

Table 84 Canada Market Size, By Ship Type, 20162023 (USD Million)

Table 85 Canada Market Size, By Fit, 20162023 (USD Million)

Table 86 Europe Market Size, By Ship Type, 20162023 (USD Million)

Table 87 Europe Commercial Market, By Type, 20162023 (USD Million)

Table 88 Europe Defense Market, By Type, 20162023 (USD Million)

Table 89 Europe Market Size, By Application, 20162023 (USD Million)

Table 90 Europe Market Size, By Installation Type, 20162023 (USD Million)

Table 91 Europe Market for Onboard Solution, By Type, 20162023 (USD Million)

Table 92 Europe Market for Onboard Navigation Positioning and Tracking Solution, By Type, 20162023 (USD Million)

Table 93 Europe Market for Onboard Automation Solution, By Type, 20162023 (USD Million)

Table 94 Europe Market for Communication Management Solution, By Type, 20162023 (USD Million)

Table 95 Europe Market for Ship Information Management Solution, By Type, 20162023 (USD Million)

Table 96 Europe Market for Onshore Solution, By Type, 20162023 (USD Million)

Table 97 Europe Market for Onshore Ship Data Analysis and Management Solution, By Type, 20162023 (USD Million)

Table 98 Europe Market for Onshore Ship Data Analysis and Management Software, 20162023 (USD Million)

Table 99 Europe Market for Ship Data Analysis and Management Services, By Type, 20162023 (USD Million)

Table 100 Europe Market Size, By Fit, 20162023 (USD Million)

Table 101 Europe Market Size, By Country, 2016-2023 (USD Million)

Table 102 Germany Market Size, By Installation Type, 20162023 (USD Million)

Table 103 Germany Market Size, By Ship Type, 20162023 (USD Million)

Table 104 Germany Market Size, By Fit, 20162023 (USD Million)

Table 105 Italy Market Size, By Installation Type, 20162023 (USD Million)

Table 106 Italy Market Size, By Ship Type, 20162023 (USD Million)

Table 107 Italy Market Size, By Fit, 20162023 (USD Million)

Table 108 UK Connected Ship Market Size, By Installation Type, 20162023 (USD Million)

Table 109 UK Market Size, By Ship Type, 20162023 (USD Million)

Table 110 UK Market Size, By Fit, 20162023 (USD Million)

Table 111 Russia Connected Ship Market Size, By Installation Type, 20162023 (USD Million)

Table 112 Russia Market Size, By Ship Type, 20162023 (USD Million)

Table 113 Russia Market Size, By Fit, 20162023 (USD Million)

Table 114 France Connected Ship Market Size, By Installation Type, 20162023 (USD Million)

Table 115 France: Connected Ship Market Size, By Ship Type, 20162023 (USD Million)

Table 116 France Connected Ship Market Size, By Fit, 20162023 (USD Million)

Table 117 Rest of Europe Market Size, By Installation Type, 20162023 (USD Million)

Table 118 Rest of Europe Market Size, By Ship Type, 20162023 (USD Million)

Table 119 Rest of Europe Market Size, By Fit, 20162023 (USD Million)

Table 120 Rest of the World Market Size, By Ship Type, 20162023 (USD Million)

Table 121 Rest of the World Commercial Market, By Type, 20162023 (USD Million)

Table 122 Rest of the World Defense Market, By Type, 20162023 (USD Million)

Table 123 Rest of the World Market Size, By Application, 20162023 (USD Million)

Table 124 Rest of the World Market Size, By Installation Type, 20162023 (USD Million)

Table 125 Rest of the World Market for Onboard Solution, By Type, 20162023 (USD Million)

Table 126 Rest of the World Market for Onboard Navigation Positioning and Tracking Solution, By Type, 20162023 (USD Million)

Table 127 Rest of the World Market for Onboard Automation Solution, By Type, 20162023 (USD Million)

Table 128 Rest of the World Market for Onboard Communication Management Systems, By Type, 20162023 (USD Million)

Table 129 Rest of the World Market for Onboard Ship Information Management Solution, By Type, 20162023 (USD Million)

Table 130 Rest of the World Market for Onshore Solution, By Type, 20162023 (USD Million)

Table 131 Rest of the World Market for Onshore Ship Data Analysis and Management, By Type, 20162023 (USD Million)

Table 132 Rest of the World Market for Onshore Ship Data Analysis and Management Software, By Type, 20162023 (USD Million)

Table 133 Rest of the World Market for Onshore Ship Data Analysis and Management Services, By Type, 2016-2023 (USD Million)

Table 134 Rest of the World Market, By Fit, 20162023 (USD Million)

Table 135 Rest of the World Market Size, By Region, 20162023 (USD Million)

Table 136 Middle East & Africa Market Size, By Installation Type, 20162023 (USD Million)

Table 137 Middle East & Africa Market Size, By Ship Type, 20162023 (USD Million)

Table 138 Middle East & Africa Market Size, By Fit, 20162023 (USD Million)

Table 139 Latin America Market Size, By Installation Type, 20162023 (USD Million)

Table 140 Latin America Market Size, By Ship Type, 20162023 (USD Million)

Table 141 Latin America Market Size, By Fit, 20162023 (USD Million)

Table 142 Contracts, July 2015August 2018

Table 143 New Product Launches, July 2015August 2018

Table 144 Acquisitions, July 2015August 2018

Table 145 Agreements, Partnerships, and Collaborations, July 2015August 2018

List of Figures (51 Figures)

Figure 1 Connected Ship Market Segmentation

Figure 2 Research Process Flow

Figure 3 Connected Ship Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Onboard Installation Type Segment Anticipated to Lead Market From 2018 to 2023

Figure 9 Commercial Ship Type Segment Estimated to Lead Market in 2018

Figure 10 Fleet Health Monitoring Application Segment Anticipated to Grow at Highest CAGR During Forecast Period

Figure 11 Linefit Segment Estimated to Lead Market in 2018

Figure 12 Europe Anticipated to Lead Market From 2018 to 2023

Figure 13 Growth in International Seaborne Trade Anticipated to Drive Connected Ship Market During Forecast Period

Figure 14 Commercial Segment Anticipated to Lead Connected Ship Market During Forecast Period

Figure 15 Fleet Operations Segment Estimated to Account for Largest Share of Europe Market in 2018

Figure 16 Onboard Segment to Lead Market From 2018 to 2023

Figure 17 Linefit Segment to Lead the Market From 2018 to 2023

Figure 18 Europe to Lead Connected Ship Market From 2018 to 2023

Figure 19 Drivers, Restraints, Challenges, and Opportunities for Connected Ship Market

Figure 20 Global Seaborne Trade, By Quantity Traded, 20062015

Figure 21 Cruise Fleets Across the Globe, By Ship and Berth, 20152020

Figure 22 Revenue Earned By Global Cruise Industry, 20082015 (USD Million)

Figure 23 Increase in Number of Cruise Passengers in Europe From 2007 to 2016

Figure 24 Global Cruise Industry Share, By Region, 2016 (%)

Figure 25 Potential Cyberattack Routes for Connected Ships

Figure 26 Technology Roadmap

Figure 27 Key Milestones of Technology Roadmaps

Figure 28 Fleet Health Monitoring Segment of Market to Grow at the Highest CAGR From 2018 to 2023

Figure 29 Onshore Segment Projected to Lead Market From 2018 to 2023

Figure 30 Commercial Segment to Lead Market From 2018 to 2023

Figure 31 Linefit Segment Projected to Lead Market From 2018 to 2023

Figure 32 Europe Estimated to Hold Largest Share of Global Market in 2018

Figure 33 Asia Pacific Market Snapshot

Figure 34 North America Market Snapshot

Figure 35 Europe Connected Ship Market Snapshot

Figure 36 Contracts Was Key Growth Strategy Adopted By Leading Market Players Between July 2015 and August 2018

Figure 37 Ranking Analysis of Top Players in Market for 2017

Figure 38 Leading Companies in Market, By Region

Figure 39 ABB: Company Snapshot

Figure 40 Emerson: Company Snapshot

Figure 41 General Electric: Company Snapshot

Figure 42 Hyundai Heavy Industries: Company Snapshot

Figure 43 Jason: Company Snapshot

Figure 44 Kongsberg Gruppen: Company Snapshot

Figure 45 Northrop Grumman: Company Snapshot

Figure 46 Rockwell Automation: Company Snapshot

Figure 47 Schneider Electric: Company Snapshot

Figure 48 Siemens: Company Snapshot

Figure 49 Ulstein: Company Snapshot

Figure 50 Valmet: Company Snapshot

Figure 51 Wartsila: Company Snapshot

Growth opportunities and latent adjacency in Connected Ship Market

I was wondering if your market research report included any information on shipments associated with the country France. More specifically, the number of importers/exporters and the frequency of shipments per year, and, that said, the importers/exporters engaged in, the top markets for importing/exporting, etc. Email correspondence works best, if and when possible. Thank you for your time.