Connected Toys Market by Application (Education, Entertainment, Other Applications), Age Group (1 -5 Years, 6 -8 Years, 9-12 Years, 13-19 Years), Interfacing Device (Smartphone/Tablet and PC/Laptop) and Region - Global Forecast to 2027

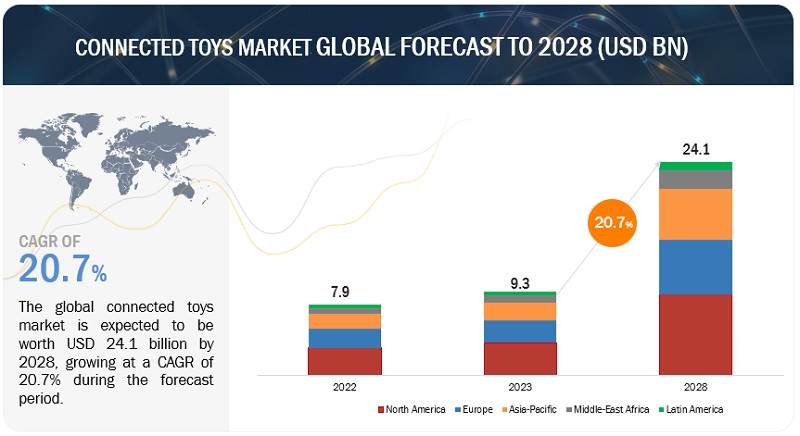

[220 Pages Report] The global Connected Toys Market size was evaluated at USD 8.0 billion in 2022 and projected to reach USD 20.7 billion by 2027, at a CAGR of 20.9% during the forecast period. The rising Inclination of children toward more interactive and self-engaging toys has fueled the demand of connected toys. Connected toys enable parents and families to monitor and participate in the children's development by delivering information that allows parents to comprehend the activities better their children are engaged in and construct links from play to parent-child dialogues.

To know about the assumptions considered for the study, Request for Free Sample Report

Connected Toys Market Dynamics:

Driver: Shift toward two-working-parent households giving rise to need for monitoring and tracking toy devices

In the current world, we are more interconnected than ever with the help of IoT. Our smartphones give unrestricted access to almost everything, including banking, GPS, social media, basic phone calls and texts, online shopping, and more. Technology has advanced beyond our screens in the previous decade. It can be found in our homes, cars, and children's toys. Parents and caregivers benefit greatly from IoT devices. The change in working culture over the years where heterosexual couples adopt two-working-parent households reduces the considerable time spent between parents and children.

Restraint: Connected toys raising issue for privacy concerns.

Children's toys are increasingly being sold with internet connectivity as a key feature. The most frequent are probably dolls, teddy bears, and "Action Heroes". The internet connection may be made via a cable that connects to a computer or router, but it is more likely to be made via an app on smartphone or a tablet that uses wi-fi. Connected toys and devices raise special concerns since they have the potential to gather and handle personal data through functionalities such as cameras and microphones. They are frequently used by many people of varying ages and very young children who are not supervised by an adult. Delivering transparency through a tangible product rather than a screen-based solution can also be difficult. These toys can listen and converse.

Opportunity: Increasing R&D spending on robots and toys

Programmable robots help students learn various skills, from designing and assembling a robot to programming and understanding robot concepts and working. Robotics includes multidisciplinary concepts of computer programming, engineering, mathematics, physics, and other branches of science. Various institutes and organizations are researching robotics applications in manufacturing, healthcare, agriculture, aerospace and defense, security, and entertainment. Furthermore, several vendors in connected toys offer reliable and sophisticated hardware and software playing toolkits.

Challenge: Negative effects on children's cognitive development.

According to a study on the decline of unstructured play over time, adults may acquire developmental deficiencies in problem-solving, flexibility, and coping abilities when adults do not encourage children to initiate playtimes on their own. All of these characteristics are necessary for prospering in later life, but smart toys may not necessarily develop them. Excessive screen usage among children harms their physical and mental health. In one study, brain scans revealed that kids who spent a lot of time on screens had less growth in areas linked to cognition and language than those who read books. Reaching for a tablet or a smartphone before reaching for a book could hinder a child's development.

By distribution channel, offline segment holds largest market size during forecast period

Offline distribution channel for connected toys includes various means for vendors to connect with their consumers. Participating in trade shows is one of the most frequent ways for connected toy providers to connect with local distributors and retailers. It is required for exporters to form working alliances and understand the demand of local distributors and retailers to accomplish a successful market entry, which may be difficult to do through an internet channel alone. Department stores cater to a broader spectrum of customers, offering a diverse selection of both domestic and foreign brands for consignment.

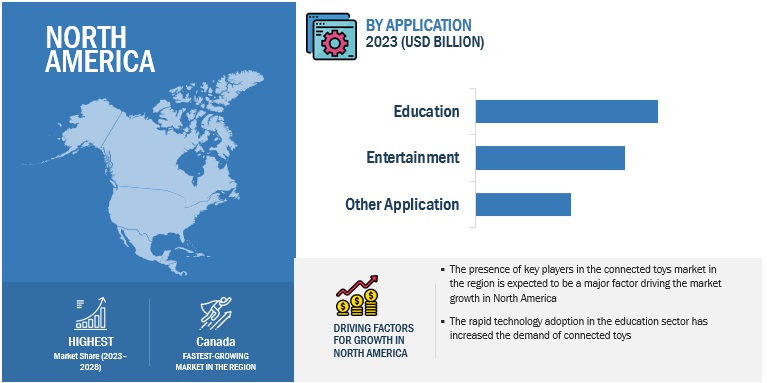

North America is expected to hold largest market share during forecast period

North American market has shown significant growth in terms of adoption of connected toys and is expected to continue till 2027. The presence of key players in connected toys is expected to be a major factor driving the market growth in North America. Key players, such as Sphero, Mattel, and Hasbro, along with several startups, are offering enhanced connected toys to cater to the customers' needs. The connected toys solution vendors are partnering with startups, universities, and schools, and the partnerships are also fueling the growth of the connected toys market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Market Players:

The major players in the connected toys market Mattel (US), Hasbro (US), LEGO (Denmark), Sony (Japan), VTech (Hong Kong), UBTECH (China), DJI (China), iRobot (US), Sphero (US), Digital Dream Labs (US), Pillar Learning (US), Wonder Workshop (US), TOSY Robotics (Vietnam), Workinman Interactive (New York), WowWee Group (Hong Kong), KEYi Technology (China), Miko (India), Makeblock (China), Smart Teddy (US), Intelino (US), Fischertechnik (Germany), Potensic (China), Mainbot (France), ROYBI (US), PlayShifu (India). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions, to expand their footprint in the connected toys market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments covered |

Application, Age Group, Distribution Channel, Interfacing Devices, Technology, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Major Vendors - Mattel (US), Hasbro (US), LEGO (Denmark), Sony (Japan), VTech (Hong Kong), UBTECH (China), DJI (China), and iRobot (US). Startup/SME Vendors - Sphero (US), Digital Dream Labs (US), Pillar Learning (US), Wonder Workshop (US), TOSY Robotics (Vietnam), Workinman (New York), WowWee Group (Hong Kong), KEYi Technology (China), Miko (India), Makeblock (China), Smart Teddy (US), Intelino (US), Fischertechnik (Germany), Potensic (China), Mainbot (France), ROYBI (US), and PlayShifu (India). |

This research report categorizes the Connected Toys market to forecast revenues and analyze trends in each of the following submarkets:

Based on application:

- Education

- Entertainment

- Other applications

Based on age group:

- 1- 5 years

- 6-8 years

- 9-12 years

- Teenagers (13-19 years)

Based on interfacing device:

- Smartphone/Tablet

- PC/Laptop

Based on distribution channel:

- Online

- Offline

Based on technology:

- Wi-Fi

- Bluetooth

- Other Technologies

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In August 2022, LEGO Group has teamed up with artist Hebru Brantley to install Fly Away Isles and create an innovative, playful experience for children.

- In July 2022, Mattel has announced multi-year agreement with SpaceX to develop collectables and toys for children.

- In May 2022, Mattel partnered with HBO Max and Cartoon Network on a new live-action American Girl based on the hit doll.

- In April 2022, iRobot has launched Create 3, that is an affordable, next-generation, all-in-one mobile robot development platform. User can communicate with products with Wi-Fi and Ethernet using USB. The product supports learning with iRobot Education’s SDK, python 3, iRobot coding app.

- In November 2021, Hasbro and Minecraft have entered into a partnership to bring all-new line of NERF Minecraft blasters with limitless possibilities to life and a world of adventures.

- In September 2021, Sony has launched the updated verions aibo system software and added new features such as Aibo Territory to teach boundaries of specific locations, Aibo Friends to learn local dance, improve the response of aibo to physical contact, and more.

Frequently Asked Questions (FAQ):

What is the definition of the connected toys market?

Connected toys is a hybrid object that sits between the toy and the communication tool. Connected toys are internet-enabled devices that operate with the help of Wi-Fi, Bluetooth, and other technologies. They aim to provide a more personalized experience through embedded software such as speech recognition and web search functions.

What is the market size of the connected toys market?

The connected toys market size is projected to grow from USD 8.0 billion in 2022 to USD 20.7 billion by 2027, at a CAGR of 20.9% during the forecast period.

What are the major drivers in the connected toys market?

Shift toward two-working-parent households giving rise to need for monitoring and tracking toy devices. In the current world, we are more interconnected than ever with the help of IoT. Our smartphones give unrestricted access to almost everything, including banking, GPS, social media, basic phone calls and texts, online shopping, and more. Technology has advanced beyond our screens in the previous decade. It can be found in our homes, cars, and children's toys. Parents and caregivers benefit greatly from IoT devices.

Who are the key players operating in the connected toys market?

The key market players profiled in the connected toys market report include Mattel (US), Hasbro (US), LEGO (Denmark), Sony (Japan), VTech (Hong Kong), UBTECH (China), DJI (China), iRobot (US), Sphero (US), Digital Dream Labs (US), Pillar Learning (US), Wonder Workshop (US), TOSY Robotics (Vietnam), Workinman Interactive (New York), WowWee Group (Hong Kong), KEYi Technology (China), Miko (India), Makeblock (China), Smart Teddy (US), Intelino (US), Fischertechnik (Germany), Potensic (China), Mainbot (France), ROYBI (US), PlayShifu (India).

What are the opportunities for new market entrants in the connected toys market?

The opportunities in the connected toys market are a growing inclination toward industry-specific solutions, increasing government initiatives, developing partnerships, penetration of advanced technologies, and increasing content protection policies. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 CONNECTED TOYS MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

FIGURE 2 MARKET: GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.3.4 YEARS CONSIDERED

1.4 CURRENCY

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.5 LIMITATIONS

1.6 SUMMARY OF CHANGES

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 3 CONNECTED TOYS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Primary sources

2.1.2.5 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM OF CONNECTED TOYS MARKET

2.2.2 TOP-DOWN APPROACH

FIGURE 6 TOP-DOWN APPROACH

2.2.3 MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

2.2.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.2.5 GROWTH FORECAST ASSUMPTIONS

TABLE 2 MARKET GROWTH ASSUMPTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.4.1 FACTOR ASSESSMENT

TABLE 3 FACTOR ASSESSMENT: CONNECTED TOYS MARKET

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 10 CONNECTED TOYS MARKET, 2020-2027 (USD MILLION)

FIGURE 11 MARKET, BY INTERFACING DEVICE 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY APPLICATION 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY AGE GROUP 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET, BY DISTRIBUTION CHANNEL 2022 VS. 2027 (USD MILLION)

FIGURE 15 MARKET, BY TECHNOLOGY 2022 VS. 2027 (USD MILLION)

FIGURE 16 MARKET, BY REGION 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 CONNECTED TOYS MARKET OVERVIEW

FIGURE 17 NEED TO PROTECT DIGITAL CONTENT TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY APPLICATION AND TECHNOLOGY (2022)

FIGURE 18 EDUCATION AND WI-FI SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

4.3 ASIA PACIFIC: MARKET, BY APPLICATION AND TECHNOLOGY (2022)

FIGURE 19 EDUCATION AND WI-FI SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

4.4 EUROPE: MARKET, BY APPLICATION AND COMPONENT (2022)

FIGURE 20 EDUCATION AND WI-FI SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

4.5 GEOGRAPHICAL SNAPSHOT OF CONNECTED TOYS MARKET

FIGURE 21 ASIA PACIFIC EXPECTED TO ACHIEVE FASTEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

5.2.1 DRIVERS

5.2.1.1 Shift toward two-working-parent households giving rise to monitoring and tracking of toy devices

5.2.1.2 Inclination of children toward interactive and self-engaging toys

5.2.2 RESTRAINTS

5.2.2.1 Connected toys raising privacy concerns

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing awareness of internet and technology

5.2.4 CHALLENGES

5.2.4.1 Negative effects on children's cognitive development

5.2.4.2 Heightened risks with constant connectivity

5.3 CONNECTED TOYS MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 23 MARKET: SUPPLY CHAIN

5.4 ECOSYSTEM

FIGURE 24 MARKET: ECOSYSTEM

TABLE 4 MARKET: ECOSYSTEM

5.5 PRICING MODEL ADOPTED BY PLAYERS IN MARKET PLAYERS

TABLE 5 PRICING MODELS AND INDICATIVE PRICE POINTS, 2021–2022

5.6 TECHNOLOGY ANALYSIS

5.6.1 INTRODUCTION

5.6.2 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.6.3 AUGMENTED/VIRTUAL REALITY

5.7 CASE STUDY ANALYSIS

5.7.1 CASE STUDY 1: SPHERO ROBOTS CREATE ENHANCED EXPERIENCE WHILE LEARNING COMPUTER SCIENCE

5.7.2 CASE STUDY 2: NTUC LEARNINGHUB TRAINING LEARNERS WITH UBTECH'S K12 MODEL

5.7.3 CASE STUDY 3: INDUCING PROBLEM-SOLVING ABILITIES IN CHILDREN WITH SPHERO'S LITTLEBITS

5.8 PATENT ANALYSIS

5.8.1 METHODOLOGY

5.8.2 TYPES OF PATENTS

TABLE 6 PATENTS FILED, 2019–2022

5.8.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 25 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2019–2022

5.8.3.1 Top applicants

FIGURE 26 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2022

TABLE 7 US: TOP TEN PATENT OWNERS IN CONNECTED TOYS MARKET, 2019–2022

TABLE 8 LIST OF PATENTS IN MARKET, 2020–2022

5.9 REVENUE SHIFT FOR MARKET

FIGURE 27 REVENUE IMPACT ON MARKET

5.10 PORTER'S FIVE FORCES ANALYSIS

TABLE 9 MARKET: PORTER'S FIVE FORCES MODEL

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF BUYERS

5.10.4 BARGAINING POWER OF SUPPLIERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 REGULATORY LANDSCAPE

5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11.1.1 North America

5.11.1.1.1 US

5.11.1.1.2 Canada

5.11.1.2 Europe

5.11.1.2.1 China

5.11.1.2.2 India

5.11.1.2.3 Australia

5.11.1.2.4 Japan

5.11.1.3 Middle East & Africa

5.11.1.3.1 Middle East

5.11.1.3.2 South Africa

5.11.1.4 Latin America

5.11.1.4.1 Brazil

5.11.1.4.2 Mexico

5.12 KEY STAKEHOLDERS & BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

5.12.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA

TABLE 16 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

5.13 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 17 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 CONNECTED TOYS MARKET, BY APPLICATION (Page No. - 80)

6.1 INTRODUCTION

6.1.1 APPLICATION: MARKET DRIVERS

FIGURE 30 ENTERTAINMENT SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 18 MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 19 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

6.2 EDUCATION

6.2.1 GENERATING INTEREST TO MAKE LEARNING FUN AND INTERACTIVE

TABLE 20 EDUCATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 21 EDUCATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 ENTERTAINMENT

6.3.1 CONNECTED TOYS HELP DISCOVER INTEREST WITH REDUCED SCREENTIME

TABLE 22 ENTERTAINMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 23 ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 OTHER APPLICATIONS

6.4.1 CONNECTED TOYS HELP BUILD HABITS AND KEEP TRACK OF CHILD’S ACTIVITIES

TABLE 24 OTHER APPLICATIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 CONNECTED TOYS MARKET, BY AGE GROUP (Page No. - 86)

7.1 INTRODUCTION

7.1.1 AGE GROUP: MARKET DRIVERS

FIGURE 31 9–12 YEARS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 26 MARKET, BY AGE GROUP, 2016–2021 (USD MILLION)

TABLE 27 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.2 1–5 YEARS

7.2.1 CONNECTED TOYS ENHANCE CURIOSITY OF KIDS TO LEARN, EXPLORE, AND DISCOVER NEW TOYS

TABLE 28 1-5: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 1-5: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 6–8 YEARS

TABLE 30 6-8: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 6-8: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 9–12 YEARS

7.4.1 CONNECTED TOYS DEVELOP CREATIVE THINKING AND IMPROVE PERSONALITY

TABLE 32 9-12: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 33 9-12: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 TEENAGERS (13-19 YEARS)

7.5.1 ENCOURAGE TEAMWORK AND DEVELOP PROBLEM-SOLVING SKILLS

TABLE 34 TEENAGERS (13-19 YEARS): MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 35 TEENAGERS (13-19 YEARS): MARKET, BY REGION, 2022–2027 (USD MILLION)

8 CONNECTED TOYS MARKET, BY INTERFACING DEVICE (Page No. - 93)

8.1 INTRODUCTION

8.1.1 INTERFACING DEVICE: MARKET DRIVERS

FIGURE 32 SMARTPHONE/TABLET SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 36 MARKET, BY INTERFACING DEVICE, 2016–2021 (USD MILLION)

TABLE 37 MARKET, BY INTERFACING DEVICE, 2022–2027 (USD MILLION)

8.2 SMARTPHONE/TABLET

8.2.1 ENHANCED NETWORK INFRASTRUCTURE AND SENSOR-BASED TECHNOLOGIES TO DRIVE GROWTH OF SMARTPHONE-CONNECTED TOYS

TABLE 38 SMARTPHONE/TABLET: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 39 SMARTPHONE/TABLET: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 PC/LAPTOP

8.3.1 DAILY LEARNING EXERCISES FOR KIDS TO SURGE DEMAND FOR PC/LAPTOP SEGMENT

TABLE 40 PC/LAPTOP: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 41 PC/LAPTOP: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 CONNECTED TOYS MARKET, BY DISTRIBUTION CHANNEL (Page No. - 98)

9.1 INTRODUCTION

9.1.1 DISTRIBUTION CHANNEL: MARKET DRIVERS

FIGURE 33 ONLINE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 42 MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 43 MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

9.2 ONLINE

9.2.1 ONLINE DISTRIBUTION TO CREATE FASTER RESPONSE TO BUYER/MARKET DEMANDS

TABLE 44 ONLINE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 ONLINE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 OFFLINE

9.3.1 HUGE PROFITS THROUGH DEPARTMENTAL DISTRIBUTION OF CONNECTED TOYS

TABLE 46 OFFLINE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 47 OFFLINE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 CONNECTED TOYS MARKET, BY TECHNOLOGY (Page No. - 103)

10.1 INTRODUCTION

10.1.1 TECHNOLOGY: MARKET DRIVERS

FIGURE 34 OTHER TECHNOLOGIES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 48 MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 49 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

10.2 WI-FI

10.2.1 FACILITATE COMMUNICATION AMONG PARENTS, CHILDREN, AND TEACHERS

TABLE 50 WI-FI: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 51 WI-FI: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 BLUETOOTH

10.3.1 BLUETOOTH-ENABLED TOYS ALLOW PARENTS TO MONITOR AND CONTROL THEIR CHILDREN’S ACTIVITIES

TABLE 52 BLUETOOTH: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 53 BLUETOOTH: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 OTHER TECHNOLOGIES

TABLE 54 OTHER TECHNOLOGIES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 55 OTHER TECHNOLOGIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 CONNECTED TOYS MARKET, BY REGION (Page No. - 109)

11.1 INTRODUCTION

FIGURE 35 MARKET: REGIONAL SNAPSHOT (2022)

FIGURE 36 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 56 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 57 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 37 NORTH AMERICA MARKET SNAPSHOT

TABLE 58 NORTH AMERICA: CONNECTED TOYS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET BY INTERFACING DEVICE, 2016–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY INTERFACING DEVICE, 2022–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY AGE GROUP, 2016–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY AGE GROUP, 2022–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.2 US

11.2.2.1 Remarkable growth of smart homes

11.2.3 CANADA

11.2.3.1 Connected toys improve kids learning activities at home

TABLE 70 CANADA: CONNECTED TOYS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 71 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 72 CANADA: MARKET, BY INTERFACING DEVICE, 2016–2021 (USD MILLION)

TABLE 73 CANADA: MARKET, BY INTERFACING DEVICE, 2022–2027 (USD MILLION)

TABLE 74 CANADA: MARKET, BY AGE GROUP, 2016–2021 (USD MILLION)

TABLE 75 CANADA: MARKET, BY AGE GROUP, 2022–2027 (USD MILLION)

TABLE 76 CANADA: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 77 CANADA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 78 CANADA: MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 79 CANADA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 PESTLE ANALYSIS: EUROPE

TABLE 80 EUROPE: CONNECTED TOYS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY INTERFACING DEVICE, 2016–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY INTERFACING DEVICE, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY AGE GROUP, 2016–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY AGE GROUP, 2022–2027 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 91 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Launch of framework for development of connected toys and adoption of emerging technologies

TABLE 92 UK: CONNECTED TOYS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 93 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 94 UK: MARKET, BY INTERFACING DEVICE, 2016–2021 (USD MILLION)

TABLE 95 UK: MARKET, BY INTERFACING DEVICE, 2022–2027 (USD MILLION)

TABLE 96 UK: MARKET, BY AGE GROUP, 2016–2021 (USD MILLION)

TABLE 97 UK: MARKET, BY AGE GROUP, 2022–2027 (USD MILLION)

TABLE 98 UK: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 99 UK: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 100 UK: MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 101 UK: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 Need to accelerate smart learning at home

11.3.4 FRANCE

11.3.4.1 Rising need to develop secure learning products for kids at home

11.3.5 REST OF EUROPE

11.4 ASIA-PACIFIC

11.4.1 PESTLE ANALYSIS: ASIA PACIFIC

TABLE 102 ASIA PACIFIC: CONNECTED TOYS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET, BY INTERFACING DEVICE, 2016–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY INTERFACING DEVICE, 2022–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY AGE GROUP, 2016–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY AGE GROUP, 2022–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Rising adoption of internet-connected toys

11.4.3 INDIA

11.4.3.1 Increasing investments to accelerate technological deployment

TABLE 114 INDIA: CONNECTED TOYS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 115 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 116 INDIA: MARKET, BY INTERFACING DEVICE, 2016–2021 (USD MILLION)

TABLE 117 INDIA: MARKET, BY INTERFACING DEVICE, 2022–2027 (USD MILLION)

TABLE 118 INDIA: MARKET, BY AGE GROUP, 2016–2021 (USD MILLION)

TABLE 119 INDIA: MARKET, BY AGE GROUP, 2022–2027 (USD MILLION)

TABLE 120 INDIA: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 121 INDIA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 122 INDIA: MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 123 INDIA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 To make coding compulsory in primary schools

11.4.5 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

TABLE 124 MIDDLE EAST AND AFRICA: CONNECTED TOYS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA: MARKET, BY INTERFACING DEVICE, 2016–2021 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA: MARKET, BY INTERFACING DEVICE, 2022–2027 (USD MILLION)

TABLE 128 MIDDLE EAST AND AFRICA: MARKET, BY AGE GROUP, 2016–2021 (USD MILLION)

TABLE 129 MIDDLE EAST AND AFRICA: MARKET, BY AGE GROUP, 2022–2027 (USD MILLION)

TABLE 130 MIDDLE EAST AND AFRICA: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 132 MIDDLE EAST AND AFRICA: MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 133 MIDDLE EAST AND AFRICA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 134 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 135 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.2 MIDDLE EAST

11.5.2.1 Increasing investments in technology to achieve digital vision 2030

TABLE 136 MIDDLE EAST: CONNECTED TOYS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 137 MIDDLE EAST: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 138 MIDDLE EAST: MARKET, BY INTERFACING DEVICE, 2016–2021 (USD MILLION)

TABLE 139 MIDDLE EAST: MARKET, BY INTERFACING DEVICE, 2022–2027 (USD MILLION)

TABLE 140 MIDDLE EAST: MARKET, BY AGE GROUP, 2016–2021 (USD MILLION)

TABLE 141 MIDDLE EAST: MARKET, BY AGE GROUP, 2022–2027 (USD MILLION)

TABLE 142 MIDDLE EAST: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 143 MIDDLE EAST: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 144 MIDDLE EAST: MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 145 MIDDLE EAST: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

11.5.3 AFRICA

11.5.3.1 Increasing demand for digitalized products in education industry

11.5.4 REST OF MIDDLE EAST AND AFRICA

11.6 LATIN AMERICA

11.6.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 146 LATIN AMERICA: CONNECTED TOYS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 147 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 148 LATIN AMERICA: MARKET, BY INTERFACING DEVICE, 2016–2021 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET, BY INTERFACING DEVICE, 2022–2027 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET, BY AGE GROUP, 2016–2021 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET, BY AGE GROUP, 2022–2027 (USD MILLION)

TABLE 152 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 154 LATIN AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 155 LATIN AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 156 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 157 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 Rising need to strengthen education system

TABLE 158 BRAZIL: CONNECTED TOYS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 159 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 160 BRAZIL: MARKET, BY INTERFACING DEVICE, 2016–2021 (USD MILLION)

TABLE 161 BRAZIL: MARKET, BY INTERFACING DEVICE, 2022–2027 (USD MILLION)

TABLE 162 BRAZIL: MARKET, BY AGE GROUP, 2016–2021 (USD MILLION)

TABLE 163 BRAZIL: MARKET, BY AGE GROUP, 2022–2027 (USD MILLION)

TABLE 164 BRAZIL: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 165 BRAZIL: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 166 BRAZIL: MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 167 BRAZIL: CONNECTED TOYS MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

11.6.3 MEXICO

11.6.3.1 Increasing number of internet users to drive market growth.

11.6.4 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 150)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES

TABLE 168 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN CONNECTED TOYS MARKET

12.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 169 MARKET: DEGREE OF COMPETITION

12.4 HISTORICAL REVENUE ANALYSIS

FIGURE 38 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2019–2021 (USD MILLION)

12.5 COMPETITIVE BENCHMARKING

TABLE 170 PRODUCT FOOTPRINT WEIGHTAGE

TABLE 171 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 172 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 173 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

TABLE 174 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/ SMES BY REGION

TABLE 175 MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS

12.6 MARKET RANKING OF KEY PLAYERS IN MARKET, 2022

FIGURE 39 MARKET RANKING OF KEY PLAYERS, 2022

12.7 COMPANY EVALUATION QUADRANT

12.7.1 STARS

12.7.2 EMERGING LEADERS

12.7.3 PERVASIVE PLAYERS

12.7.4 PARTICIPANTS

FIGURE 40 CONNECTED TOYS MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2022

12.8 STARTUP/SME EVALUATION QUADRANT

12.8.1 PROGRESSIVE COMPANIES

12.8.2 RESPONSIVE COMPANIES

12.8.3 DYNAMIC COMPANIES

12.8.4 STARTING BLOCKS

FIGURE 41 MARKET (STARTUP): COMPANY EVALUATION MATRIX, 2022

12.9 COMPETITIVE SCENARIO

12.9.1 PRODUCT LAUNCHES

TABLE 176 PRODUCT LAUNCHES, JANUARY 2019–JULY 2022

12.9.2 DEALS

TABLE 177 DEALS, JANUARY 2019–JULY 2022

13 COMPANY PROFILES (Page No. - 165)

13.1 MAJOR PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

13.1.1 MATTEL

TABLE 178 MATTEL: BUSINESS OVERVIEW

FIGURE 42 MATTEL: COMPANY SNAPSHOT

TABLE 179 MATTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 180 MATTEL: PRODUCT LAUNCHES

TABLE 181 MATTEL: DEALS

13.1.2 HASBRO

TABLE 182 HASBRO: BUSINESS OVERVIEW

FIGURE 43 HASBRO: COMPANY SNAPSHOT

TABLE 183 HASBRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 184 HASBRO: DEALS

13.1.3 LEGO

TABLE 185 LEGO: BUSINESS OVERVIEW

FIGURE 44 LEGO: COMPANY SNAPSHOT

TABLE 186 LEGO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 187 LEGO: PRODUCT LAUNCHES

TABLE 188 LEGO: DEALS

13.1.4 SONY CORPORATION

TABLE 189 SONY: BUSINESS OVERVIEW

FIGURE 45 SONY: COMPANY SNAPSHOT

TABLE 190 SONY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 191 SONY: PRODUCT LAUNCHES

TABLE 192 SONY: DEALS

13.1.5 VTECH

TABLE 193 VTECH: BUSINESS OVERVIEW

FIGURE 46 VTECH: COMPANY SNAPSHOT

TABLE 194 VTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 195 VTECH: PRODUCT LAUNCHES

TABLE 196 VTECH: DEALS

13.1.6 UBTECH

TABLE 197 UBTECH: BUSINESS OVERVIEW

TABLE 198 UBTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.7 DJI

TABLE 199 DJI: BUSINESS OVERVIEW

TABLE 200 DJI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 201 DJI: PRODUCT LAUNCHES

TABLE 202 DJI: DEALS

13.1.8 IROBOT

TABLE 203 IROBOT: BUSINESS OVERVIEW

FIGURE 47 IROBOT: COMPANY SNAPSHOT

TABLE 204 IROBOT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 205 IROBOT: PRODUCT LAUNCHES

TABLE 206 IROBOT: DEALS

TABLE 207 IROBOT: OTHERS

13.2 STARTUP/SME PLAYERS

13.2.1 SPHERO

TABLE 208 SPHERO: BUSINESS OVERVIEW

TABLE 209 SPHERO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 210 SPHERO: PRODUCT LAUNCHES

TABLE 211 SPHER0: DEALS

13.2.2 DIGITAL DREAM LABS

13.2.3 PILLAR

13.2.4 WONDER WORKSHOP

13.2.5 TOSY ROBOTICS

13.2.6 WORKINMAN INTERACTIVE

13.2.7 WOWWEE

13.2.8 KEYI TECH

13.2.9 MIKO

13.2.10 MAKEBLOCK

13.2.11 SMART TEDDY

13.2.12 INTELINO

13.2.13 FISCHERTECHNIK

13.2.14 POTENSIC

13.2.15 MAINBOT

13.2.16 ROYBI

13.2.17 PLAYSHIFU

* Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14 ADJACENT/RELATED MARKETS (Page No. - 207)

14.1 SMART LEARNING MARKET

14.1.1 MARKET OVERVIEW

14.1.2 SMART LEARNING MARKET, BY COMPONENT

TABLE 212 SMART LEARNING MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 213 SMART LEARNING MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

14.1.2.1 Hardware

TABLE 214 SMART LEARNING MARKET, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 215 SMART LEARNING MARKET, BY HARDWARE, 2021–2026 (USD MILLION)

14.1.2.2 Software

TABLE 216 SMART LEARNING MARKET, BY SOFTWARE, 2017–2020 (USD MILLION)

TABLE 217 SMART LEARNING MARKET, BY SOFTWARE, 2021–2026 (USD MILLION)

14.1.2.3 Smart learning market, by service

TABLE 218 SMART LEARNING MARKET, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 219 SMART LEARNING MARKET, BY SERVICE, 2021–2026 (USD MILLION)

14.1.3 SMART LEARNING MARKET, BY LEARNING TYPE

14.1.3.1 Introduction

TABLE 220 SMART LEARNING MARKET, BY LEARNING TYPE, 2017–2020 (USD MILLION)

TABLE 221 SMART LEARNING MARKET, BY LEARNING TYPE, 2021–2026 (USD MILLION)

14.1.4 SMART LEARNING MARKET, BY END USER

14.1.4.1 Introduction

TABLE 222 SMART LEARNING MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 223 SMART LEARNING MARKET, BY END USER, 2021–2026 (USD MILLION)

14.1.5 SMART LEARNING MARKET, BY REGION

14.1.5.1 Introduction

TABLE 224 SMART LEARNING MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 225 SMART LEARNING MARKET, BY REGION, 2021–2026 (USD MILLION)

15 APPENDIX (Page No. - 214)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun and Bradstreet (D&B), Hoovers, and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the Connected Toys market. The study involved four major activities in estimating the current size of the Connected Toys market. Exhaustive secondary research was done to collect information on the Connected Toys industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakup and data triangulation procedures were used to estimate the size of the segments and subsegments of the market.

Secondary Research

The market for the companies offering Connected Toys solutions and services is arrived at based on secondary data available through paid and unpaid sources and by analyzing the product portfolios of the major companies in the ecosystem and rating the companies based on performance and quality. In the secondary research process, various sources were referred to, for identifying and collecting information for this study. The secondary sources include annual reports, press releases and investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases. Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

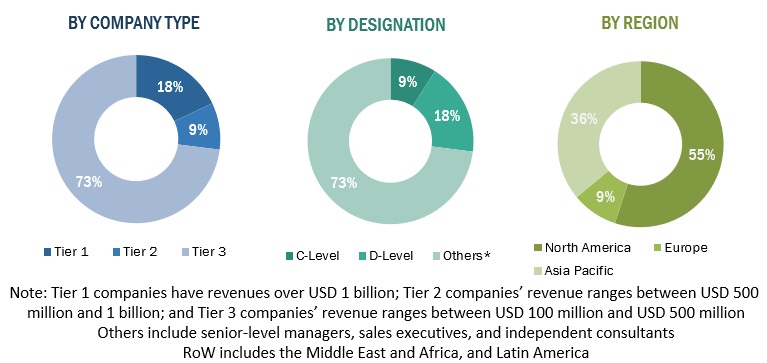

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the Connected Toys market. Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use Connected Toys, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of Connected Toys, which is expected to affect the overall market growth. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Connected Toys market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the overall Connected Toys market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Report Objectives

- To determine, segment, and forecast the global Connected Toys market based on component, application, organization size, deployment type, vertical, and region

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze macro and micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze industry trends, pricing data, and patents and innovations related to the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the Connected Toys market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Connected Toys Market

Wanted to know the North America market size of Connected Toys Market