Content Delivery Network Market by Component (Solutions (Web Performance Optimization, Media Delivery, Cloud Security) and Services), Content Type (Static and Dynamic), Provider Type, Application Area and Region - Global Forecast to 2027

Updated on : April 17, 2023

Content Delivery Network Market Size,Share,Trend Analysis

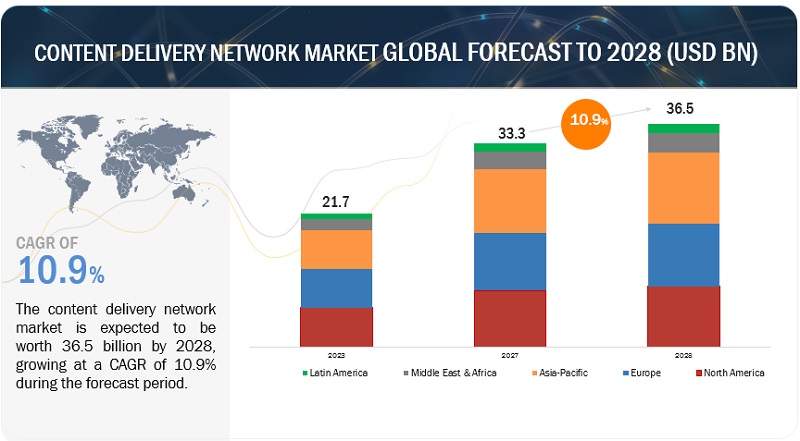

The global content delivery networks market was valued at USD 19.2 billion in 2022 and is projected to reach USD 34.5 billion by 2027, growing at a CAGR 12.5% from 2022 to 2027.

Content Delivery Network Market Growth

The increasing digitalization across the globe is expected to drive the adoption of CDN solutions. Digitalization trends, such as BYOD, CYOD, mobility, and social media marketing, have eased the operation of organizations and increased the traffic over the existing networks. CDNs provide faster load times, reduced bandwidth consumption, and many other benefits for web publishers, which will positively impact the CDN market.

To know about the assumptions considered for the study, Request for Free Sample Report

Content Delivery Network Market Dynamics

Driver: Increasing internet penetration and adoption of mobile devices leading to rising opportunities for mobile CDN

According to Cisco Annual Internet Report, there will be 5.3 billion total internet users (66% of the global population) by 2023, from 3.9 billion (51% of the global population) in 2018. Internet penetration is increasing due to the increasing adoption of mobile devices globally. According to Oberlo, as of October 2020, 48.62% of all web traffic comes through mobile phones. The increasing network traffic leads to the rising need for CDN solutions to deliver content to end users effectively. Mobile CDN has helped reduce mobile data traffic and enhance the mobile user experience. The quick development of internet-enabled portable devices, such as smartphones, tablets, and phablets, is one of the main influences expected to upsurge overall internet consumption. The rising use of internet services over mobile devices drives the need for mobile CDN to deliver an enhanced end-user experience and improved content. As the current CDNs need innovation and increased capabilities to offer a better user experience for providing content over the mobile internet, there is a huge opportunity for CDN providers to provide mobile CDN solutions in the market.

Restraint: Network connectivity and technical difficulties in live video streaming

On-demand videos are technically very complex to handle, especially on mobile devices. Mobile devices are divided into three types of Operating Systems (OS): Android, iPhone Operating System (iOS), and Windows. Different OS offers varied standards and protocols for the transcoding process; thus, maintaining an integration becomes slightly difficult for the CDN vendors. Low internet connection speed negatively impacts the quality and performance of a live video. Developing countries face severe connectivity issues, such as inconsistent speed, poor and fluctuating connectivity strength, and prolonged downtime. Such conditions hinder the efficient functioning of video streaming solutions, affecting their adoption and thus affecting the market growth.

Opportunity: Rising demand for cloud-enabled services

The acceptance of cloud solutions among organizations has reduced the efforts and expenses related to hardware installation and maintenance complexity, enhancing the company's business model. This convenient, easy-to-use, and flexible approach has led to the growth of the CDN market. CDN in the cloud is expected to simultaneously change the CDN and cloud market landscape. The demand for cloud services is increasing in emerging economies tremendously. Therefore, the CSPs have started deploying CDN to deliver software, applications, and infrastructure services, providing clients with better QoS and QoE. In addition, the CSPs manage CDN in their data centers and are licensing and reselling such CDN services under their brand name. The trend of CDN for personal use is expected to increase with the demand for cloud services. Furthermore, CSPs use CDN to provide customer data storage, security, and infrastructure services. Therefore, the rise in cloud adoption provides growth opportunities for the CDN market.

Challenge: Variations in website monetization and applications

Website and application monetization has helped organizations convert the network traffic to websites and apps into revenue. The companies have implemented methods such as Pay-Per-Click (PPC) or Cost Per Impression (CPI). However, the increasing trend of monetizing websites for various online web pages may result in low QoE for users of those sites. Monetization has given rise to several issues, such as slower page response, latency in receiving rich media files, and unbalanced loading of web pages. To avoid such issues and overcome the challenges, network operators and site administrators require new advertising content delivery methods useful to the users and provide a streamlined web experience.

The solutions to record a higher growth rate during the forecast period

In the Content Delivery Network market by component, the solutions are expected to record a higher growth rate during the forecast period. The solutions segment of the CDN market is segmented into web performance optimization, media delivery, and cloud security. The rise in the demand for online advertisements may accelerate the need for quality and speed, as every nanosecond of an ad is accountable for the advertiser's revenue. Hence, the online advertisement trend propels the demand for CDN solutions across all industry sectors. Moreover, CDN vendors provide various services, along with their CDN solutions, to maintain the high performance of CDN. Analytics and monitoring services have enabled CDN providers to analyze the performance of their pages and content over the existing network.

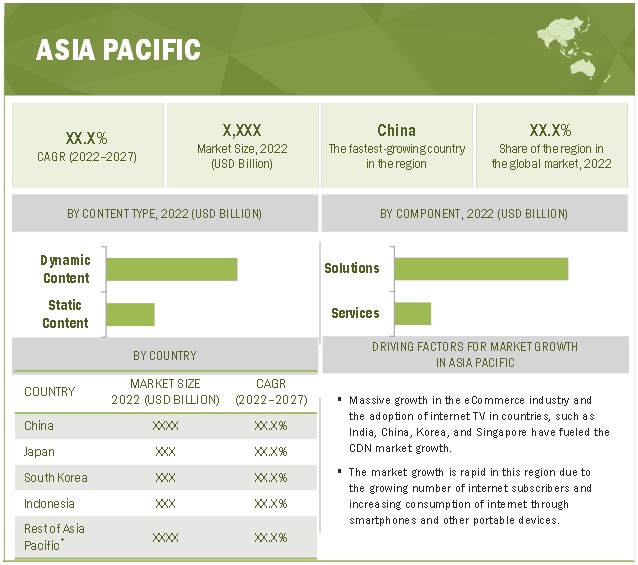

APAC to have a higher growth rate during the forecast period

Asia Pacific is projected to witness the highest growth rate due to the rapid development of IT infrastructure and the urge to adopt newer technologies. China offers a diversified ecosystem for online video content, with no single service yet coming close to attaining a market share comparable to Netflix's 87% in the U.S. The growing demand for continuous data streaming at the user's convenience and leisure, without downloading, is one of the main factors driving the growth of the video streaming industry in China. Consumers are increasingly watching short-form films on demand because of greater access to multimedia devices and the internet, which has caused a dramatic rise in online video traffic. With emerging countries such as China, Japan, and South Korea, the region is expected to witness high growth in the CDN market. The fastest growth rate of the Asia Pacific CDN market can be attributed to the ever-increasing content consumption in these emerging countries

Content Delivery Network Market Players

The report covers the competitive landscape and profiles major market players, as Akamai Technologies (US), Microsoft (US), IBM (US), Limelight networks (US), Google (US), AWS (US), AT&T (US), Cloudflare (US), Lumen Technologies (US), Deutsche Telekom (Germany), Fastly (US), Citrix systems (US), NTT Communications (Japan), Comcast Technologies (US), Rackspace Technology (US), CDNetworks (South Korea), Tata Communications (India), Imperva (US), Broadpeak (France), Quantil (US), StackPath (US), G-Core Labs SA (Luxembourg), Tencent Cloud (China), OnApp Limited (UK), Edgecast (US), Kingsoft Cloud (China), Bunny.net (Slovenia) and Baishan Cloud (US). These players have adopted several organic and inorganic growth strategies, including new product launches, partnerships and collaborations, and acquisitions, to expand their offerings and market shares in the global Content Delivery Network market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market value in 2027 |

USD 34.5 Billion |

|

Market value in 2022 |

USD 19.2 Billion |

|

Market growth rate |

12.5% CAGR |

|

Largest Market |

Asia Pacific |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Segments covered |

By Component, Content Type, Provider Type, Application Areas |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Akamai Technologies (US), Microsoft (US), IBM (US), Limelight networks (US), Google (US), AWS (US), AT&T (US), Cloudflare (US), Lumen Technologies (US), Deutsche Telekom (Germany), Fastly (US), Citrix systems (US), NTT Communications (Japan), Comcast Technologies (US), Rackspace Technology (US), CDNetworks (South Korea), Tata Communications (India) and more |

This research report categorizes the content delivery network to forecast revenue and analyze trends in each of the following submarkets:

Based on Component:

- Solutions

- Services

Based on Solution:

- Web Performance Optimization

- Media Delivery

- Cloud Security

Based on services:

- Designing and consulting services

- Storage Services

- Analytics and Performance Monitoring

- Website and API management

- Network Optimization Services

- Support & Maintenance

- Digital Rights Management

- Transparent caching

- Others

Based on Content Type:

- Static Content

- Dynamic Content

Based on Provider Type:

- Traditional CDN

- Telco CDN

- Cloud CDN

- P2P CDN

- Others

Based on Application Areas:

- Media and Entertainment

- Video Streaming

- OTT Platform

- Online Gaming

- Retail and eCommerce

- eLearning

- Healthcare

- Enterprises

- SMEs

- Large Enterprises

Based on Regions:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments:

- In April 2022, Google launched Media CDN to compete on content delivery. Google launched in general availability Media CDN, a platform for delivering content using the same infrastructure that powers YouTube. Media CDN marks a further expansion of the Alphabet, in this instance by commercializing the pipes that YouTube uses to deliver streaming video

- In November 2021, Akamai and Queue-it partnered to scale online transactions globally to meet the increased demand. This partnership will enable Akamai to offer enterprises a user-friendly experience to manage the challenges caused due to the increase in website traffic. This new partnership gives customers an easy-to-deploy solution that controls online traffic, treats site visitors fairly, and scales across Akamai's Intelligent Edge Platform.

- In October 2021, Limelight Networks announced that NTT DOCOMO, a Japanese mobile operator, has integrated Limelight's EdgeXtend to expand its content delivery and improve user experiences for ever-increasing viewers across Japan. The EdgeXtend will enable content delivery to DOCOMO customers by caching content from its ecosystem of 13 services.

Frequently Asked Questions (FAQ):

What is the projected market value of the global content delivery network market?

The global market of content delivery network is projected to reach USD 34.5 billion.

What is the estimated growth rate (CAGR) of the global content delivery network market for the next five years?

The global content delivery network market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% from 2022 to 2027.

What are the major revenue pockets in the content delivery network market currently?

Asia Pacific is projected to witness the highest growth rate due to the rapid development of IT infrastructure and the urge to adopt newer technologies. China offers a diversified ecosystem for online video content, with no single service yet coming close to attaining a market share comparable to Netflix's 87% in the U.S. The growing demand for continuous data streaming at the user's convenience and leisure, without downloading, is one of the main factors driving the growth of the video streaming industry in China. Consumers are increasingly watching short-form films on demand because of greater access to multimedia devices and the internet, which has caused a dramatic rise in online video traffic. With emerging countries such as China, Japan, and South Korea, the region is expected to witness high growth in the CDN market. The fastest growth rate of the Asia Pacific CDN market can be attributed to the ever-increasing content consumption in these emerging countries

Who are the major vendors in the content delivery network market?

The report covers the competitive landscape and profiles major market players, as Akamai Technologies (US), Microsoft (US), IBM (US), Limelight networks (US), Google (US), AWS (US), AT&T (US), Cloudflare (US), Lumen Technologies (US), Deutsche Telekom (Germany), Fastly (US), Citrix systems (US), NTT Communications (Japan), Comcast Technologies (US), Rackspace Technology (US), CDNetworks (South Korea), Tata Communications (India), Imperva (US), Broadpeak (France), Quantil (US), StackPath (US), G-Core Labs SA (Luxembourg), Tencent Cloud (China), OnApp Limited (UK), Edgecast (US), Kingsoft Cloud (China), Bunny.net (Slovenia) and Baishan Cloud (US). These players have adopted several organic and inorganic growth strategies, including new product launches, partnerships and collaborations, and acquisitions, to expand their offerings and market shares in the global Content Delivery Network market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 45)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 55)

2.1 RESEARCH DATA

FIGURE 6 GLOBAL CONTENT DELIVERY NETWORK MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PROFILES OF PRIMARY PARTICIPANTS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM–UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (BOTTOM-UP) (SUPPLY-SIDE): COLLECTIVE REVENUE OF SOLUTIONS AND SERVICES OF THE CONTENT DELIVERY NETWORK MARKET

2.3.2 TOP-DOWN APPROACH

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 64)

FIGURE 12 CONTENT DELIVERY NETWORK MARKET SIZE, 2022–2027

FIGURE 13 LARGEST SEGMENTS IN MARKET, 2022

FIGURE 14 MARKET ANALYSIS

FIGURE 15 ASIA PACIFIC TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 70)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CONTENT DELIVERY NETWORK MARKET

FIGURE 16 INTERNET PENETRATION AND ADOPTION OF MOBILE DEVICES TO DRIVE MARKET GROWTH

4.2 CONTENT TYPE MARKET, 2022

FIGURE 17 DYNAMIC CONTENT TO ACCOUNT FOR LARGE MARKET SHARES IN 2022 AND 2027

4.3 NORTH AMERICAN MARKET, 2022

FIGURE 18 SOLUTIONS SEGMENT AND US TO ACCOUNT FOR LARGER MARKET SHARES IN NORTH AMERICA IN 2022

4.4 ASIA PACIFIC MARKET, 2022

FIGURE 19 SOLUTIONS SEGMENT AND CHINA TO ACCOUNT FOR LARGER MARKET SHARES IN ASIA PACIFIC IN 2022

4.5 MARKET, BY COUNTRY

FIGURE 20 CHINA TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 73)

5.1 MARKET OVERVIEW

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CONTENT DELIVERY NETWORK MARKET

5.2.1 DRIVERS

5.2.1.1 Rising need for effective solutions to enable live and uninterrupted content delivery over a high-speed data network

5.2.1.2 Increasing demand for enhanced QoE and QoS

5.2.1.3 Proliferation of video and rich media over websites

5.2.1.4 Increasing demand for enhanced video content and latency-free online gaming experience

FIGURE 22 GLOBAL ONLINE GAMING ACCORDING TO AGE GROUP, 2018–2020

FIGURE 23 GLOBAL ONLINE GAMING ACCORDING TO DIFFERENT DEVICES, 2018–2020

5.2.1.5 Exponential increase in the consumption of online video content is expected to drive the growth of the market

FIGURE 24 GLOBAL INTERNET VIDEO CONSUMER TRAFFIC, 2016–2021

FIGURE 25 ONLINE GAMING INTERNET TRAFFIC

5.2.1.6 Increasing internet penetration and adoption of mobile devices leading to rising opportunities for mobile CDN

FIGURE 26 GLOBAL CONTENT DELIVERY NETWORK INTERNET TRAFFIC, 2017–2021

5.2.2 RESTRAINTS

5.2.2.1 Complex architecture and concern about QoS

5.2.2.2 Network connectivity and technical difficulties in live video streaming

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for cloud-enabled services

5.2.3.2 Increasing demand for integrated and next-generation security solutions and services

5.2.3.3 Growing interest of consumers in OTT platforms and VOD for entertainment

5.2.4 CHALLENGES

5.2.4.1 Data security and privacy concerns

5.2.4.2 Variations in website monetization and applications

5.3 INDUSTRY TRENDS

5.3.1 SUPPLY/VALUE CHAIN ANALYSIS

FIGURE 27 CONTENT DELIVERY NETWORK MARKET: VALUE CHAIN

5.3.2 ECOSYSTEM/MARKET MAP

TABLE 3 MARKET: ECOSYSTEM

5.3.3 PORTER’S FIVE FORCES MODEL

TABLE 4 IMPACT OF EACH FORCE ON THE MARKET

5.3.3.1 Threat of new entrants

5.3.3.2 Threat of substitutes

5.3.3.3 Bargaining power of suppliers

5.3.3.4 Bargaining power of buyers

5.3.3.5 Degree of competition

5.3.4 KEY STAKEHOLDERS AND BUYING CRITERIA

5.3.4.1 Key Stakeholders in buying process

FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS (%)

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS (%)

5.3.4.2 Buying criteria

TABLE 6 KEY BUYING CRITERIA FOR CDN APPLICATIONS

5.3.5 TECHNOLOGY ANALYSIS

5.3.5.1 Machine learning and artificial intelligence

5.3.5.2 Internet of things

5.3.5.3 Analytics

5.3.5.4 Cloud

5.3.5.5 Edge computing

5.3.5.6 Blockchain

5.3.6 TRENDS/ DISRUPTIONS IMPACTING CUSTOMERS BUSINESS

FIGURE 29 REVENUE SHIFT IN THE CONTENT DELIVERY NETWORK MARKET

5.3.7 PATENT ANALYSIS

FIGURE 30 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 7 TOP TWENTY PATENT OWNERS

FIGURE 31 NUMBER OF PATENTS GRANTED IN A YEAR OVER THE LAST TEN YEARS

TABLE 8 THE BELOW TABLE HIGHLIGHTS THE FEW PATENTS GRANTED TO VENDORS IN THE CDN MARKET

5.3.8 PRICING ANALYSIS

5.3.8.1 Average selling price trends

TABLE 9 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION BASED CONTENT DELIVERY NETWORK

5.3.9 USE CASE ANALYSIS

5.3.9.1 Use case 1: Akamai

5.3.9.2 Use case 2: Microsoft

5.3.9.3 Use case 3: Limelight Networks

5.3.9.4 Use case 4: AWS

5.3.9.5 Use case 5: Cloudflare

5.3.9.6 Use case 5: Lumen Technologies

5.3.10 TARIFF AND REGULATORY LANDSCAPE

5.3.10.1 Regulatory Bodies, Government Agencies, and other Organizations

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

TABLE 12 ASIA-PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

5.3.10.2 International Organization for Standardization STANDARD 27001

5.3.10.3 General Data Protection Regulation

5.3.10.4 California Consumer Privacy Act

5.3.10.5 Health Insurance Portability and Accountability Act

5.3.10.6 Health Level Seven

5.3.10.7 Sarbanes-Oxley Act

5.3.10.8 Communications Decency Act

5.3.10.9 Digital Millennium Copyright Act

5.3.10.10 Anti-Cybersquatting Consumer Protection Act

5.3.11 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 13 CONTENT DELIVERY NETWORK MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.4 COVID-19 PANDEMIC- DRIVEN MARKET DYNAMICS AND FACTOR ANALYSIS

5.4.1 OVERVIEW

5.4.2 DRIVERS AND OPPORTUNITIES

5.4.3 RESTRAINTS AND CHALLENGES

5.4.4 CUMULATIVE GROWTH ANALYSIS

TABLE 14 MARKET: CUMULATIVE GROWTH ANALYSIS

6 CONTENT DELIVERY NETWORK MARKET, BY COMPONENT (Page No. - 103)

6.1 INTRODUCTION

FIGURE 32 SOLUTIONS SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 15 MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 16 MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

6.2.1 SOLUTIONS: MARKET: COVID-19 IMPACT

TABLE 17 SOLUTIONS: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 18 SOLUTIONS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

FIGURE 33 WEB PERFORMANCE OPTIMIZATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 19 COMPONENT: MARKET SIZE, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 20 COMPONENT: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

6.2.2 WEB PERFORMANCE OPTIMIZATION

6.2.2.1 Web performance optimization: Content delivery network market drivers

TABLE 21 WEB PERFORMANCE OPTIMIZATION: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 22 WEB PERFORMANCE OPTIMIZATION: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.2.3 MEDIA DELIVERY

6.2.3.1 Media delivery: market drivers

TABLE 23 MEDIA DELIVERY: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 24 MEDIA DELIVERY: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.2.4 CLOUD SECURITY

6.2.4.1 Cloud security: market drivers

TABLE 25 CLOUD SECURITY: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 26 CLOUD SECURITY: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES: CONTENT DELIVERY NETWORK MARKET: COVID-19 IMPACT

TABLE 27 SERVICES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 28 SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

FIGURE 34 WEBSITE AND API MANAGEMENT SERVICES SEGMENT TO GROW WITH THE FASTEST CAGR DURING THE FORECAST PERIOD

TABLE 29 COMPONENT: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 30 COMPONENT: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

6.3.2 DESIGNING AND CONSULTING SERVICES

6.3.2.1 Designing and consulting services: market drivers

TABLE 31 DESIGNING AND CONSULTING SERVICES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 32 DESIGNING AND CONSULTING SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3.3 STORAGE SERVICES

6.3.3.1 Storage services: Content delivery network market drivers

TABLE 33 STORAGE SERVICES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 34 STORAGE SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3.4 ANALYTICS AND PERFORMANCE MONITORING SERVICES

6.3.4.1 Analytics and performance monitoring services: market drivers

TABLE 35 ANALYTICS AND PERFORMANCE MONITORING SERVICES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 ANALYTICS AND PERFORMANCE MONITORING SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3.5 WEBSITE AND API MANAGEMENT SERVICES

6.3.5.1 Website and API management services: market drivers

TABLE 37 WEBSITE AND API MANAGEMENT SERVICES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 38 WEBSITE AND API MANAGEMENT SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3.6 NETWORK OPTIMIZATION SERVICES

6.3.6.1 Network optimization services: Content delivery network market drivers

TABLE 39 NETWORK OPTIMIZATION SERVICES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 NETWORK OPTIMIZATION SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3.7 SUPPORT AND MAINTENANCE

6.3.7.1 Support and maintenance: market drivers s

TABLE 41 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 42 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3.8 DIGITAL RIGHTS MANAGEMENT

6.3.8.1 Digital rights management: market drivers

TABLE 43 DIGITAL RIGHTS MANAGEMENT: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 44 DIGITAL RIGHTS MANAGEMENT: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3.9 TRANSPARENT CACHING

6.3.9.1 Transparent caching: Content delivery network market drivers

TABLE 45 TRANSPARENT CACHING: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 TRANSPARENT CACHING: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3.10 OTHER SERVICES

TABLE 47 OTHER SERVICES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 48 OTHER SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7 CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE (Page No. - 126)

7.1 INTRODUCTION

FIGURE 35 DYNAMIC CONTENT SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 49 MARKET SIZE, BY CONTENT TYPE, 2016–2021 (USD MILLION)

TABLE 50 MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

7.2 STATIC CONTENT

7.2.1 STATIC CONTENT: MARKET DRIVERS

TABLE 51 STATIC CONTENT: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 STATIC CONTENT: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3 DYNAMIC CONTENT

7.3.1 DYNAMIC CONTENT: MARKET DRIVERS

TABLE 53 DYNAMIC CONTENT: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 54 DYNAMIC CONTENT: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE (Page No. - 131)

8.1 INTRODUCTION

8.1.1 PROVIDER TYPE: COVID-19 IMPACT

FIGURE 36 TRADITIONAL PROVIDER TYPE SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 55 MARKET SIZE, BY PROVIDER TYPE, 2016–2021 (USD MILLION)

TABLE 56 MARKET SIZE, BY PROVIDER TYPE, 2022–2027 (USD MILLION)

8.2 TRADITIONAL CDN

8.2.1 TRADITIONAL CDN: MARKET DRIVERS

TABLE 57 TRADITIONAL CDN: WORK MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 58 TRADITIONAL CDN: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 TELCO CDN

8.3.1 TELCO CDN: MARKET DRIVERS

TABLE 59 TELCO CDN: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 60 TELCO CDN: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.4 CLOUD CDN

8.4.1 CLOUD CDN: CONTENT DELIVERY NETWORK MARKET DRIVERS

TABLE 61 CLOUD CDN: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 62 CLOUD CDN: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.5 PEER-TO-PEER CDN

8.5.1 P2P CDN: MARKET DRIVERS

TABLE 63 P2P CDN: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 64 P2P CDN: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.6 OTHER PROVIDER TYPES

TABLE 65 OTHER PROVIDER TYPES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 66 OTHER PROVIDER TYPES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA (Page No. - 140)

9.1 INTRODUCTION

FIGURE 37 MEDIA AND ENTERTAINMENT SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 67 MARKET SIZE, BY APPLICATION AREA, 2016–2021 (USD MILLION)

TABLE 68 MARKET SIZE, BY APPLICATION AREA, 2022–2027 (USD MILLION)

9.2 APPLICATION AREAS: COVID-19 IMPACT

9.3 MEDIA AND ENTERTAINMENT

9.3.1 MEDIA AND ENTERTAINMENT: MARKET DRIVERS

9.3.2 VIDEO STREAMING

9.3.3 OTT PLATFORMS

TABLE 69 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 70 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.4 ONLINE GAMING

9.4.1 ONLINE GAMING: CONTENT DELIVERY NETWORK MARKET DRIVERS

TABLE 71 ONLINE GAMING: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 72 ONLINE GAMING: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.5 RETAIL AND ECOMMERCE

9.5.1 RETAIL AND ECOMMERCE: MARKET DRIVERS

TABLE 73 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 74 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.6 ELEARNING

9.6.1 ELEARNING: MARKET DRIVERS

TABLE 75 ELEARNING: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 76 ELEARNING: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.7 HEALTHCARE

9.7.1 HEALTHCARE: WORK MARKET DRIVERS

TABLE 77 HEALTHCARE: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 78 HEALTHCARE: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.8 ENTERPRISES

9.8.1 ENTERPRISES: MARKET DRIVERS

TABLE 79 ENTERPRISES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 80 ENTERPRISES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 81 MARKET SIZE, BY ENTERPRISE, 2016–2021 (USD MILLION)

TABLE 82 MARKET SIZE, BY ENTERPRISE, 2022–2027 (USD MILLION)

9.8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

9.8.2.1 Small and medium-sized enterprises: market drivers

TABLE 83 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 84 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.8.3 LARGE ENTERPRISES

9.8.3.1 Large enterprises: market drivers

TABLE 85 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 86 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10 CONTENT DELIVERY NETWORK MARKET, BY REGION (Page No. - 155)

10.1 INTRODUCTION

FIGURE 38 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

TABLE 87 MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 88 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET REGULATORY IMPLICATIONS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

TABLE 89 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET SIZE, BY CONTENT TYPE, 2016–2021 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY PROVIDER TYPE, 2016–2021 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY PROVIDER TYPE, 2022–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY APPLICATION AREA, 2016–2021 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY APPLICATION AREA, 2022–2027 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY ENTERPRISE SIZE, 2016–2021 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY ENTERPRISE SIZE, 2022–2027 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.3 UNITED STATES

10.2.3.1 Presence of major CDN solutions providers and significant government support will drive the growth of the market

10.2.3.2 United States: Content delivery network market drivers

TABLE 105 UNITED STATES: MARKET SIZE, BY CONTENT TYPE, 2016–2021 (USD MILLION)

TABLE 106 UNITED STATES: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 107 UNITED STATES: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 108 UNITED STATES: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 109 UNITED STATES: MARKET SIZE, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 110 UNITED STATES: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 111 UNITED STATES: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 112 UNITED STATES: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 113 UNITED STATES: MARKET SIZE, BY PROVIDER TYPE, 2016–2021 (USD MILLION)

TABLE 114 UNITED STATES: MARKET SIZE, BY PROVIDER TYPE, 2022–2027 (USD MILLION)

TABLE 115 UNITED STATES: MARKET SIZE, BY APPLICATION AREA, 2016–2021 (USD MILLION)

TABLE 116 UNITED STATES: MARKET SIZE, BY APPLICATION AREA, 2022–2027 (USD MILLION)

TABLE 117 UNITED STATES: MARKET SIZE, BY ENTERPRISE SIZE, 2016–2021 (USD MILLION)

TABLE 118 UNITED STATES: MARKET SIZE, BY ENTERPRISE SIZE, 2022–2027 (USD MILLION)

10.2.4 CANADA

10.2.4.1 Adoption of new technologies like AI and ML in content delivery will drive the growth of the market

10.2.4.2 Canada: Content delivery network market drivers

TABLE 119 CANADA: MARKET SIZE, BY CONTENT TYPE, 2016–2021 (USD MILLION)

TABLE 120 CANADA: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 121 CANADA: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 122 CANADA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 123 CANADA: MARKET SIZE, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 124 CANADA: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 125 CANADA: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 126 CANADA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 127 CANADA: MARKET SIZE, BY PROVIDER TYPE, 2016–2021 (USD MILLION)

TABLE 128 CANADA: MARKET SIZE, BY PROVIDER TYPE, 2022–2027 (USD MILLION)

TABLE 129 CANADA: MARKET SIZE, BY APPLICATION AREA, 2016–2021 (USD MILLION)

TABLE 130 CANADA: MARKET SIZE, BY APPLICATION AREA, 2022–2027 (USD MILLION)

TABLE 131 CANADA: MARKET SIZE, BY ENTERPRISE SIZE, 2016–2021 (USD MILLION)

TABLE 132 CANADA: MARKET SIZE, BY ENTERPRISE SIZE, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: CONTENT DELIVERY NETWORK MARKET REGULATORY IMPLICATIONS

10.3.2 EUROPE: COVID-19 IMPACT

TABLE 133 EUROPE: MARKET SIZE, BY CONTENT TYPE, 2016–2021 (USD MILLION)

TABLE 134 EUROPE: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 135 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 136 EUROPE: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 137 EUROPE: MARKET SIZE, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 138 EUROPE: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 139 EUROPE: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 140 EUROPE: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 141 EUROPE: MARKET SIZE, BY PROVIDER TYPE, 2016–2021 (USD MILLION)

TABLE 142 EUROPE: MARKET SIZE, BY PROVIDER TYPE, 2022–2027 (USD MILLION)

TABLE 143 EUROPE: MARKET SIZE, BY APPLICATION AREA, 2016–2021 (USD MILLION)

TABLE 144 EUROPE: MARKET SIZE, BY APPLICATION AREA, 2022–2027 (USD MILLION)

TABLE 145 EUROPE: MARKET SIZE, BY ENTERPRISE SIZE, 2016–2021 (USD MILLION)

TABLE 146 EUROPE: MARKET SIZE, BY ENTERPRISE SIZE, 2022–2027 (USD MILLION)

TABLE 147 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 148 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.3 UNITED KINGDOM

10.3.3.1 Rapid increase in the consumption of video content over different platforms to drive the growth of the market

10.3.3.2 United Kingdom: Content delivery network market drivers

TABLE 149 UNITED KINGDOM: MARKET SIZE, BY CONTENT TYPE, 2016–2021 (USD MILLION)

TABLE 150 UNITED KINGDOM: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 151 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 152 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 153 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 154 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 155 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 156 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 157 UNITED KINGDOM: MARKET SIZE, BY PROVIDER TYPE, 2016–2021 (USD MILLION)

TABLE 158 UNITED KINGDOM: MARKET SIZE, BY PROVIDER TYPE, 2022–2027 (USD MILLION)

TABLE 159 UNITED KINGDOM: MARKET SIZE, BY APPLICATION AREA, 2016–2021 (USD MILLION)

TABLE 160 UNITED KINGDOM: MARKET SIZE, BY APPLICATION AREA, 2022–2027 (USD MILLION)

TABLE 161 UNITED KINGDOM: MARKET SIZE, BY ENTERPRISE SIZE, 2016–2021 (USD MILLION)

TABLE 162 UNITED KINGDOM: MARKET SIZE, BY ENTERPRISE SIZE, 2022–2027 (USD MILLION)

10.3.4 GERMANY

10.3.4.1 The need for faster content delivery has increased demand for multi CDN services, which is expected to drive the growth of the market

10.3.4.2 Germany: Content delivery network market drivers

TABLE 163 GERMANY: MARKET SIZE, BY CONTENT TYPE, 2016–2021 (USD MILLION)

TABLE 164 GERMANY: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 165 GERMANY: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 166 GERMANY: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 167 GERMANY: MARKET SIZE, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 168 GERMANY: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 169 GERMANY: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 170 GERMANY: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 171 GERMANY: MARKET SIZE, BY PROVIDER TYPE, 2016–2021 (USD MILLION)

TABLE 172 GERMANY: MARKET SIZE, BY PROVIDER TYPE, 2022–2027 (USD MILLION)

TABLE 173 GERMANY: MARKET SIZE, BY APPLICATION AREA, 2016–2021 (USD MILLION)

TABLE 174 GERMANY: MARKET SIZE, BY APPLICATION AREA, 2022–2027 (USD MILLION)

TABLE 175 GERMANY: MARKET SIZE, BY ENTERPRISE SIZE, 2016–2021 (USD MILLION)

TABLE 176 GERMANY: MARKET SIZE, BY ENTERPRISE SIZE, 2022–2027 (USD MILLION)

10.3.5 FRANCE

10.3.5.1 Exponential rise in the use of the internet and mobile devices for the consumption of content will drive the growth of the market

10.3.5.2 France: Content delivery network market drivers

TABLE 177 FRANCE: MARKET SIZE, BY CONTENT TYPE, 2016–2021 (USD MILLION)

TABLE 178 FRANCE: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 179 FRANCE: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 180 FRANCE: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 181 FRANCE: MARKET SIZE, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 182 FRANCE: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 183 FRANCE: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 184 FRANCE: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 185 FRANCE: MARKET SIZE, BY PROVIDER TYPE, 2016–2021 (USD MILLION)

TABLE 186 FRANCE: MARKET SIZE, BY PROVIDER TYPE, 2022–2027 (USD MILLION)

TABLE 187 FRANCE: MARKET SIZE, BY APPLICATION AREA, 2016–2021 (USD MILLION)

TABLE 188 FRANCE: MARKET SIZE, BY APPLICATION AREA, 2022–2027 (USD MILLION)

TABLE 189 FRANCE: MARKET SIZE, BY ENTERPRISE SIZE, 2016–2021 (USD MILLION)

TABLE 190 FRANCE: MARKET SIZE, BY ENTERPRISE SIZE, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 191 REST OF EUROPE: CONTENT DELIVERY NETWORK MARKET SIZE, BY CONTENT TYPE, 2016–2021 (USD MILLION)

TABLE 192 REST OF EUROPE: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 193 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 194 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 195 REST OF EUROPE: MARKET SIZE, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 196 REST OF EUROPE: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 197 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 198 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 199 REST OF EUROPE: MARKET SIZE, BY PROVIDER TYPE, 2016–2021 (USD MILLION)

TABLE 200 REST OF EUROPE: MARKET SIZE, BY PROVIDER TYPE, 2022–2027 (USD MILLION)

TABLE 201 REST OF EUROPE: MARKET SIZE, BY APPLICATION AREA, 2016–2021 (USD MILLION)

TABLE 202 REST OF EUROPE: MARKET SIZE, BY APPLICATION AREA, 2022–2027 (USD MILLION)

TABLE 203 REST OF EUROPE: MARKET SIZE, BY ENTERPRISE SIZE, 2016–2021 (USD MILLION)

TABLE 204 REST OF EUROPE: MARKET SIZE, BY ENTERPRISE SIZE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET REGULATORY IMPLICATIONS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 205 ASIA PACIFIC: MARKET SIZE, BY CONTENT TYPE, 2016–2021 (USD MILLION)

TABLE 206 ASIA PACIFIC: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 207 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 208 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 209 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 210 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 211 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 212 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 213 ASIA PACIFIC: MARKET SIZE, BY PROVIDER TYPE, 2016–2021 (USD MILLION)

TABLE 214 ASIA PACIFIC: MARKET SIZE, BY PROVIDER TYPE, 2022–2027 (USD MILLION)

TABLE 215 ASIA PACIFIC: MARKET SIZE, BY APPLICATION AREA, 2016–2021 (USD MILLION)

TABLE 216 ASIA PACIFIC: MARKET SIZE, BY APPLICATION AREA, 2022–2027 (USD MILLION)

TABLE 217 ASIA PACIFIC: MARKET SIZE, BY ENTERPRISE SIZE, 2016–2021 (USD MILLION)

TABLE 218 ASIA PACIFIC: MARKET SIZE, BY ENTERPRISE SIZE, 2022–2027 (USD MILLION)

TABLE 219 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 220 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.3 CHINA

10.4.3.1 Growing usage of social media and OTT platforms will drive the growth of the market

10.4.3.2 China: Content delivery network market drivers

10.4.4 JAPAN

10.4.4.1 Increase in mobile usage and internet users will drive the growth of the market

10.4.4.2 Japan: market drivers

10.4.5 SOUTH KOREA

10.4.5.1 Increasing demand for video content across the OTT platforms live video streaming will drive the growth of the market

10.4.5.2 South Korea: market drivers

10.4.6 INDONESIA

10.4.6.1 Government initiatives and network infrastructure development will drive the growth of the market

10.4.6.2 Indonesia: market drivers

10.4.7 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: CONTENT DELIVERY NETWORK MARKET REGULATORY IMPLICATIONS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 221 MIDDLE EAST AND AFRICA: MARKET SIZE, BY CONTENT TYPE, 2016–2021 (USD MILLION)

TABLE 222 MIDDLE EAST AND AFRICA: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 223 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 224 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 225 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 226 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 227 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 228 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 229 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROVIDER TYPE, 2016–2021 (USD MILLION)

TABLE 230 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROVIDER TYPE, 2022–2027 (USD MILLION)

TABLE 231 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION AREA, 2016–2021 (USD MILLION)

TABLE 232 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION AREA, 2022–2027 (USD MILLION)

TABLE 233 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ENTERPRISE SIZE, 2016–2021 (USD MILLION)

TABLE 234 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ENTERPRISE SIZE, 2022–2027 (USD MILLION)

TABLE 235 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 236 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.3 MIDDLE EAST

10.5.3.1 Growing penetration of internet and smartphones is expected to drive the growth of the market

10.5.3.2 Middle East: Content delivery network market drivers

10.5.4 AFRICA

10.5.4.1 Increasing government awareness towards new technologies and infrastructure development will drive the growth of the market

10.5.4.2 Africa: market drivers

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET REGULATORY IMPLICATIONS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 237 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET SIZE, BY CONTENT TYPE, 2016–2021 (USD MILLION)

TABLE 238 LATIN AMERICA: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 239 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 240 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 241 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 242 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 243 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 244 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 245 LATIN AMERICA: MARKET SIZE, BY PROVIDER TYPE, 2016–2021 (USD MILLION)

TABLE 246 LATIN AMERICA: MARKET SIZE, BY PROVIDER TYPE, 2022–2027 (USD MILLION)

TABLE 247 LATIN AMERICA: MARKET SIZE, BY APPLICATION AREA, 2016–2021 (USD MILLION)

TABLE 248 LATIN AMERICA: MARKET SIZE, BY APPLICATION AREA, 2022–2027 (USD MILLION)

TABLE 249 LATIN AMERICA: MARKET SIZE, BY ENTERPRISE SIZE, 2016–2021 (USD MILLION)

TABLE 250 LATIN AMERICA: MARKET SIZE, BY ENTERPRISE SIZE, 2022–2027 (USD MILLION)

TABLE 251 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 252 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.3 BRAZIL

10.6.3.1 Increased adoption of new technologies and government initiatives to drive the growth of the market

10.6.3.2 Brazil: Content delivery network market drivers

10.6.4 ARGENTINA

10.6.4.1 Government initiatives and growing internet penetration will drive the growth of the market

10.6.4.2 Argentina: market drivers

10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 225)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 41 MARKET EVALUATION FRAMEWORK, 2018–2021

11.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 253 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE MARKET

11.4 COMPETITIVE SCENARIOS AND TRENDS

11.4.1 PRODUCT LAUNCHES

TABLE 254 MARKET: PRODUCT LAUNCHES, OCTOBER 2018–NOVEMBER 2021

11.4.2 DEALS

TABLE 255 MARKET: DEALS, OCTOBER 2018–NOVEMBER 2021

11.4.3 OTHERS

TABLE 256 MARKET: OTHERS, MARCH 2019–MARCH 2020

11.5 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 257 CONTENT DELIVERY NETWORK MARKET: DEGREE OF COMPETITION

FIGURE 42 MARKET SHARE ANALYSIS OF COMPANIES IN THE MARKET

11.6 HISTORICAL REVENUE ANALYSIS

FIGURE 43 HISTORICAL REVENUE ANALYSIS, 2017–2020

11.7 COMPANY EVALUATION MATRIX OVERVIEW

11.8 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 258 PRODUCT FOOTPRINT WEIGHTAGE

11.8.1 STAR

11.8.2 EMERGING LEADERS

11.8.3 PERVASIVE

11.8.4 PARTICIPANTS

FIGURE 44 CONTENT DELIVERY NETWORK MARKET, COMPANY EVALUATION MATRIX, 2021

11.9 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 259 COMPANY PRODUCT FOOTPRINT

TABLE 260 COMPANY OFFERING FOOTPRINT

TABLE 261 APPLICATION AREAS FOOTPRINT

TABLE 262 COMPANY REGION FOOTPRINT

11.10 COMPANY MARKET RANKING ANALYSIS

FIGURE 45 RANKING OF KEY PLAYERS IN THE MARKET, 2021

11.11 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

FIGURE 46 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

TABLE 263 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.11.1 PROGRESSIVE COMPANIES

11.11.2 RESPONSIVE COMPANIES

11.11.3 DYNAMIC COMPANIES

11.11.4 STARTING BLOCKS

FIGURE 47 MARKET, STARTUP EVALUATION, 2021

11.12 COMPETITIVE BENCHMARKING FOR SME/STARTUP

TABLE 264 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 265 CONTENT DELIVERY NETWORK MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

12 COMPANY PROFILES (Page No. - 249)

12.1 KEY VENDORS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, Response To COVID-19, and MnM View)*

12.1.1 AKAMAI

TABLE 266 AKAMAI: BUSINESS OVERVIEW

FIGURE 48 AKAMAI: COMPANY SNAPSHOT

TABLE 267 AKAMAI: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 268 AKAMAI: PRODUCT LAUNCHES

TABLE 269 AKAMAI: DEALS

12.1.2 MICROSOFT

TABLE 270 MICROSOFT: BUSINESS OVERVIEW

FIGURE 49 MICROSOFT: COMPANY SNAPSHOT

TABLE 271 MICROSOFT: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 272 MICROSOFT: DEALS

TABLE 273 MICROSOFT: OTHERS

12.1.3 IBM

TABLE 274 IBM: BUSINESS OVERVIEW

FIGURE 50 IBM: COMPANY SNAPSHOT

TABLE 275 IBM: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 276 IBM: PRODUCT LAUNCHES

TABLE 277 IBM: DEALS

12.1.4 LIMELIGHT NETWORKS

TABLE 278 LIMELIGHT NETWORKS: BUSINESS OVERVIEW

FIGURE 51 LIMELIGHT NETWORKS: COMPANY SNAPSHOT

TABLE 279 LIMELIGHT NETWORKS: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 280 LIMELIGHT NETWORKS: PRODUCT LAUNCHES

TABLE 281 LIMELIGHT NETWORKS: DEALS

TABLE 282 LIMELIGHT NETWORKS: OTHERS

12.1.5 GOOGLE

TABLE 283 GOOGLE: BUSINESS OVERVIEW

FIGURE 52 GOOGLE: COMPANY SNAPSHOT

TABLE 284 GOOGLE: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 285 GOOGLE: PRODUCT LAUNCHES

TABLE 286 GOOGLE: DEALS

12.1.6 AMAZON WEB SERVICES

TABLE 287 AMAZON WEB SERVICES: BUSINESS OVERVIEW

FIGURE 53 AMAZON WEB SERVICES: COMPANY SNAPSHOT

TABLE 288 AMAZON WEB SERVICES: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 289 AMAZON WEB SERVICES: PRODUCT LAUNCHES

TABLE 290 AMAZON WEB SERVICES: DEALS

TABLE 291 AMAZON WEB SERVICES: OTHERS

12.1.7 AT&T

TABLE 292 AT&T: BUSINESS OVERVIEW

FIGURE 54 AT&T: COMPANY SNAPSHOT

TABLE 293 AT&T: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 294 AT&T: DEALS

12.1.8 CLOUDFLARE

TABLE 295 CLOUDFLARE: BUSINESS OVERVIEW

FIGURE 55 CLOUDFLARE: COMPANY SNAPSHOT

TABLE 296 CLOUDFLARE: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 297 CLOUDFLARE: PRODUCT LAUNCHES

TABLE 298 CLOUDFLARE: DEALS

12.1.9 LUMEN TECHNOLOGIES

TABLE 299 LUMEN TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 56 LUMEN TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 300 LUMEN TECHNOLOGIES: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 301 LUMEN TECHNOLOGIES: PRODUCT LAUNCHES

12.1.10 DUETSCHE TELEKOM

12.1.11 FASTLY

12.1.12 CITRIX SYSTEMS

12.1.13 NTT COMMUNICATIONS

12.1.14 COMCAST

12.1.15 RACKSPACE TECHNOLOGY

12.1.16 CDNETWORKS

12.1.17 TATA COMMUNICATIONS

12.1.18 IMPERVA

12.1.19 TENCENT CLOUD

12.1.20 KINGSOFT CLOUD

12.2 SME/START-UPS

12.2.1 BROADPEAK

TABLE 302 BROADPEAK: BUSINESS OVERVIEW

TABLE 303 BROADPEAK: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 304 BROADPEAK: PRODUCT/SERVICE LAUNCHES

TABLE 305 BROADPEAK: DEALS

12.2.2 QUANTIL

12.2.3 STACKPATH

12.2.4 G-CORE LABS

12.2.5 ONAPP LIMITED

12.2.6 EDGECAST

12.2.7 BUNNY.NET

12.2.8 BAISHAN CLOUD TECHNOLOGY

* Business Overview, Products/Solutions/Services Offered, Recent Developments, Response To COVID-19, and MnM View might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKET (Page No. - 310)

13.1 INTRODUCTION

13.1.1 LIMITATIONS

13.2 LTE AND 5G BROADCAST MARKET WITH COVID 19 IMPACT ANALYSIS–GLOBAL FORECAST TO 2026

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

13.2.2.1 LTE and 5G broadcast market, by technology

TABLE 306 LTE AND 5G BROADCAST MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 307 LTE AND 5G BROADCAST MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

13.2.2.2 LTE and 5G broadcast market, by end use

TABLE 308 LTE AND 5G BROADCAST MARKET SIZE, BY END USE, 2017–2020 (USD MILLION)

TABLE 309 LTE AND 5G BROADCAST MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

13.2.2.3 LTE and 5G broadcast market, by region

TABLE 310 LTE AND 5G BROADCAST MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 311 LTE AND 5G BROADCAST MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

13.3 NETWORK SLICING MARKET – GLOBAL FORECAST 2025

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.2.1 Network slicing market, by component

TABLE 312 NETWORK SLICING MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 313 NETWORK SLICING MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

13.3.2.2 Network Slicing Market, by service

TABLE 314 NETWORK SLICING MARKET SIZE, BY SERVICE, 2017–2019 (USD MILLION)

TABLE 315 NETWORK SLICING MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 316 NETWORK SLICING MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2019 (USD MILLION)

TABLE 317 NETWORK SLICING MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

13.3.2.3 Network slicing market, by end user

TABLE 318 NETWORK SLICING MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 319 NETWORK SLICING MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

13.3.2.4 Telecom operators

TABLE 320 TELECOM OPERATORS: NETWORK SLICING MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 321 TELECOM OPERATORS: NETWORK SLICING MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

13.3.2.5 Network slicing market, by region

TABLE 322 NETWORK SLICING MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 323 NETWORK SLICING MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

13.4 COMMERCIAL P2P CDN MARKET — GLOBAL FORECAST 2023

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

13.4.2.1 Commercial P2P CDN market, by content type

TABLE 324 COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET SIZE, BY CONTENT TYPE, 2016–2023 (USD MILLION)

13.4.2.2 Commercial P2P CDN market, by solution

TABLE 325 COMMERCIAL P2P MARKET SIZE, BY SOLUTION, 2016–2023 (USD MILLION)

13.4.2.3 Commercial P2P CDN market, by service

TABLE 326 COMMERCIAL P2P MARKET SIZE, BY SERVICE, 2016–2023 (USD MILLION)

13.4.2.4 Professional services

TABLE 327 PROFESSIONAL SERVICES: COMMERCIAL P2P MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13.4.2.5 Maintenance and support services

TABLE 328 MAINTENANCE AND SUPPORT: COMMERCIAL P2P MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13.4.2.6 Commercial P2P CDN market, by end user

TABLE 329 COMMERCIAL P2P MARKET SIZE, BY END USER, 2016–2023 (USD MILLION)

13.4.2.7 Consumer

TABLE 330 CONSUMER: COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13.4.2.8 Business

TABLE 331 BUSINESS: COMMERCIAL P2P MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13.4.2.9 Commercial P2P CDN market, by vertical

TABLE 332 COMMERCIAL P2P MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

13.4.2.10 Commercial P2P CDN market, by region

TABLE 333 COMMERCIAL P2P MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 334 NORTH AMERICA: COMMERCIAL P2P MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

TABLE 335 EUROPE: COMMERCIAL P2P MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

TABLE 336 ASIA PACIFIC: COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

14 APPENDIX (Page No. - 327)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for this technical, market-oriented, and commercial study of the global content delivery network market. The primary sources were mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, Service Providers (SPs), technology developers, alliances, and organizations related to all the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents that included key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as assess prospects.

Secondary Research

The market size of companies that offer content delivery network solutions and services globally was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of the major companies and rating the companies based on their performance and quality.

In the secondary research process, various secondary sources were referred to, for identifying and collecting information for this study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources; journals and various associations, have also been referred to for consolidating the report. The data was also collected from secondary sources, such as The Association of International Internet of Things Consortium, Europe Research Cluster on Internet of Things, Bitkom-Germany’s Digital Association, and China Association for Science and Technology.

Secondary research was used to obtain key information about industry insights, market’s monetary chain, the overall pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides of the content delivery network market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing content delivery network software, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. After the complete market engineering (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

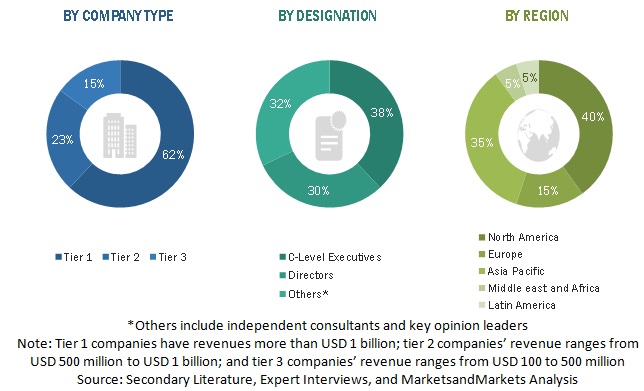

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of the Content Delivery Network Market. The first approach involves the estimation of the market size by summation of companies’ revenue generated through the content delivery network solutions and services. This entire procedure has studied the annual and financial reports of top market players and extensive interviews of industry leaders, such as CEOs, VPs, directors, and marketing executives of leading companies for key insights. All percentage splits and breakups have been determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets.

Top-down and bottom-up approaches were used to estimate and validate the size of the global content delivery network market and various other dependent subsegments. The key players such as Akamai Technologies (US), Microsoft Corporation (US), IBM Corporation (US), Limelight Networks (US), , Google (US), AT&T (US), Cloudflare, Inc. (US), , Lumen Technologies (US), Deutsche Telekom AG (Germany),QUANTIL (US), StackPath, LLC (US), Fastly (US), G-Core Labs S.A. (Luxembourg), OnApp Limited (UK), Broadpeak (France), Citrix Systems (US), NTT Communications Corporation (Japan), Comcast Technology Solutions (US), Tata Communications (India), Imperva (US), contribute almost 60% to the global content delivery network market. The major players in the market were identified through extensive secondary research, and their revenue contribution in the respective regions was determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

The collective revenue of key companies that offer content delivery network solutions comprised 60–65% of the market, further confirmed through industry experts' primary interviews. With the assumption that the rest of the market is contributed by smaller players (part of the unorganized market), the market size of organized players (55–60%), and unorganized players (40–45%) collectively was assumed to be the market size of the global content delivery network market for the Financial Year (FY) 2021.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub segments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global Content Delivery Network (CDN) market by component (solutions and services), content type, provider type, application areas, and region from 2022 to 2027, and analyze various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the CDN market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall CDN market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the CDN market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market.

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Geographic Analysis

- Further breakdown of the European Content Delivery Network Market

- Further breakdown of the APAC Market

- Further breakdown of the MEA Market

- Further breakdown of the Latin American Market

Futuristic Growth Use-Cases of Multi CDN Market

- Dynamic Content Delivery: Multi-CDN solutions can be used to dynamically switch between CDN providers based on real-time conditions, such as network congestion, location, and content type. This can optimize content delivery for specific users and devices, improving performance and user experience.

- Edge Computing: As more applications move to the edge, Multi-CDN solutions can be used to deliver content and applications from a distributed network of edge servers. This can improve performance, reduce latency, and support emerging technologies, such as the Internet of Things (IoT) and augmented reality (AR).

- Artificial Intelligence (AI) Integration: AI and machine learning (ML) can be used to optimize content delivery by analyzing real-time network and user data. Multi-CDN solutions can leverage AI to dynamically select the best CDN provider based on the current conditions, reducing downtime, improving performance, and providing a personalized user experience.

- Blockchain Integration: Multi-CDN solutions can leverage blockchain technology to create a secure and transparent network for content delivery. Blockchain can be used to verify content ownership, prevent unauthorized access, and facilitate payments between content providers and CDN providers.

- Hybrid Cloud: Multi-CDN solutions can be used to create a hybrid cloud network that combines the benefits of on-premise and cloud-based content delivery. This can provide greater flexibility, scalability, and security for enterprise applications and services.

Top Players in Multi CDN Market

- Akamai Technologies

- Limelight Networks

- Cloudflare

- CDNetworks

- Fastly

Other notable players in the Multi CDN market include Cedexis (now part of Citrix), NS1, ChinaCache, G-Core Labs, and Verizon Media (formerly EdgeCast).

Industries Getting Impacted in the future by Multi CDN Market

- E-commerce: Multi-CDN solutions can improve the speed and reliability of e-commerce websites, providing a better user experience and reducing cart abandonment rates. By leveraging multiple CDN providers, e-commerce companies can ensure that their websites and applications are always available, even during peak traffic periods.

- Media and entertainment: The demand for streaming video and audio content is rapidly growing, and Multi-CDN solutions can help media and entertainment companies to deliver high-quality content to users around the world. By using multiple CDN providers, these companies can ensure that their content is delivered quickly and efficiently, without buffering or lag.

- Healthcare: The healthcare industry is increasingly reliant on digital technologies, including telemedicine and remote patient monitoring. Multi-CDN solutions can improve the speed and reliability of these technologies, ensuring that patients receive high-quality care, even in remote areas.

- Gaming: Multi-CDN solutions can improve the performance of online gaming by reducing latency and providing a more stable connection. By using multiple CDN providers, gaming companies can optimize the delivery of game content, reducing the risk of lag, disconnections, and other issues that can negatively impact the gaming experience.

- Finance: The finance industry relies on high-speed, secure data transfer to support a range of applications, including trading, portfolio management, and risk analysis. Multi-CDN solutions can improve the speed and security of these applications, ensuring that financial institutions can make quick and informed decisions based on the latest market data.

New Business Opportunities in Multi CDN Market

- Multi-CDN Brokerage: Multi-CDN brokerage is a new business model that provides customers with a single point of contact for managing multiple CDN providers. This model enables customers to easily switch between providers and optimize their content delivery while reducing the administrative burden of managing multiple providers.

- Multi-CDN Optimization: Multi-CDN optimization is a new service that uses machine learning algorithms and real-time data to optimize the delivery of content across multiple CDN providers. This service can help customers to improve their website and application performance, reduce latency, and improve the user experience.

- Multi-CDN Analytics: Multi-CDN analytics is a new service that provides customers with real-time data on CDN performance, including availability, latency, and content delivery. This service can help customers to identify areas for improvement and optimize their content delivery for specific users and devices.

- Multi-CDN Security: Multi-CDN security is a new service that provides customers with enhanced security features, including DDoS protection, web application firewall (WAF), and SSL/TLS encryption. This service can help customers to improve the security of their applications and protect against cyber threats.

- Multi-CDN Reselling: Multi-CDN reselling is a new business model that enables companies to resell Multi-CDN solutions to their customers. This model can help companies to generate new revenue streams and offer value-added services to their customers.

Key Challenges for Growing Multi CDN Business in the Future Market

- Integration and Interoperability: As companies use multiple CDN providers, they will need to integrate them into their existing IT infrastructure, which can be complex and time-consuming. In addition, there is a need for interoperability between different CDNs, which could require standardization and collaboration between providers.

- Performance and Latency: While using multiple CDNs can improve content delivery performance, it can also create performance issues if the CDNs are not properly managed. This can include latency, downtime, and other issues that can negatively impact the user experience.

- Security: Using multiple CDN providers can increase the risk of security vulnerabilities, as companies will need to manage multiple points of access and monitor multiple security systems. This could increase the risk of cyber-attacks, data breaches, and other security issues.

- Cost: Using multiple CDN providers can be expensive, as companies need to pay for each provider they use. While the benefits of using multiple CDNs may outweigh the costs, some companies may struggle to justify the expense, particularly if they have limited resources.

- Vendor Management: As companies use multiple CDN providers, they will need to manage multiple vendors, which could increase the administrative burden and create additional costs. This could include negotiating contracts, monitoring performance, and resolving issues with each vendor.

Complexity: The use of multiple CDNs can increase the complexity of managing content delivery, which can make it difficult for companies to optimize their delivery strategies and ensure a consistent user experience across all devices and platforms.

Speak to our Analyst today to know more about the "Multi CDN Market".

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Content Delivery Network Market

Who are the major vendors in CDN Market?