Controlled Release Fertilizer Market by Type (Slow Release, Coated And Encapsulated, Nitrogen Stabilizers), End Use (Agricultural and Non Agricultural), Mode of Application (Foliar, Fertigation, Soil), and Region - Global Forecast to 2026

Controlled Release Fertilizer Market

The global controlled release fertilizers market was valued at $2.4 billion in 2021 and is projected to reach $3.3 billion by 2026, growing at a cagr 6.4% from 2021 to 2026.

This represents a compound annual growth rate of 6.4% during the forecast period, highlighting the increasing demand and adoption of these innovative fertilizers. The rise in the global population, growing application rates in developing countries, and rising demand for high-value crops are key factors that are projected to drive the growth of the controlled release fertilizer market during the forecast period.

The Controlled Release Fertilizers (CRFs) Market is projected to grow at a significant pace in the next few years. Controlled release fertilizers are special types of fertilizers that release nutrients gradually over an extended period, ensuring that plants receive a consistent supply of nutrients, without any wastage. This type of fertilizer reduces the risk of over-fertilization and minimizes the leaching of nutrients into groundwater, thus providing a more sustainable and environmentally friendly solution for crop production.

Growing demand for food to feed the world's growing population, coupled with the increasing concern over environmental degradation, is driving the growth of the controlled release fertilizer market. The increasing use of modern farming techniques and the need for efficient nutrient management have also contributed to the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Controlled Release Fertilizers Market Dynamics

Driver: Necessity for highly efficient fertilizers

Nutrient loss to the environment is one of the major concerns faced by farmers across the world. Heavily fertilized crops such as corn tend to have large losses relative to non-intensive uses such as pasture. Agricultural uses associated with poor land management practices that lead to erosion also produce significant nutrient losses. Nutrient losses can occur in many ways, which can have an extensive impact on the environment.

Atmospheric losses: Nutrients can be lost to the atmosphere through chemical and biological processes, wherein volatile nutrients can be easily lost as gases when exposed to the atmosphere.

Direct loss: Direct or incidental loss is the loss of fertilizer or manure to water before interacting significantly with soil. It can result from over-application, heavy rainfall immediately following application, or application directly into a waterway (including ditches).

Runoff: Runoff occurs when rainfall or snowmelt exceeds the infiltration rate of the soil. Runoff carries away the dissolved nutrients into the nearby water bodies.

Leaching: Leaching is the downward movement of water and soluble substances in the soil below the root zone. It is an environmental concern as it contributes to groundwater contamination.

Nutrient losses into the water trigger eutrophication on the surfaces of water bodies, which in turn ruins the aquatic ecosystem. This concern associated with fertilizers and nutrients used on soil has risen in recent years, owing to which Fertilizer Best Management Practices are promoted by fertilizer industries and associations across the globe, under which enhanced efficiency fertilizers (EEF) are developed, and farmers are encouraged to adopt these fertilizers. These practices are related to the proper use of fertilizers at the right quantity, at the right time, and at the right place. Thus they are driving the use of controlled release fertilizers in the market.

Restraint: Cost ineffectiveness

The cost of production of controlled-release fertilizers is much higher than that of conventional soil-applied fertilizers due to the requirement of complex production processes. According to the International Fertilizer Association (IFA), the prices of controlled-release fertilizers have remained higher by four to six times than the conventional NPK (nitrogen, phosphorus, and potassium) prices. This is one of the major restraints for this market. Unlike conventional fertilizers, repeated application of these fertilizers is not required, owing to their programmed and predefined release pattern; the initial cost required to be invested by the farmer is very high. This limits the use of controlled-release fertilizers only to high-value cash crops, thereby restraining the growth of the market in other broad-acre crops such as rice and wheat since the return of investment for these crops has been quite low for the farmers in developing countries.

Opportunity: Strong growth in emerging economies

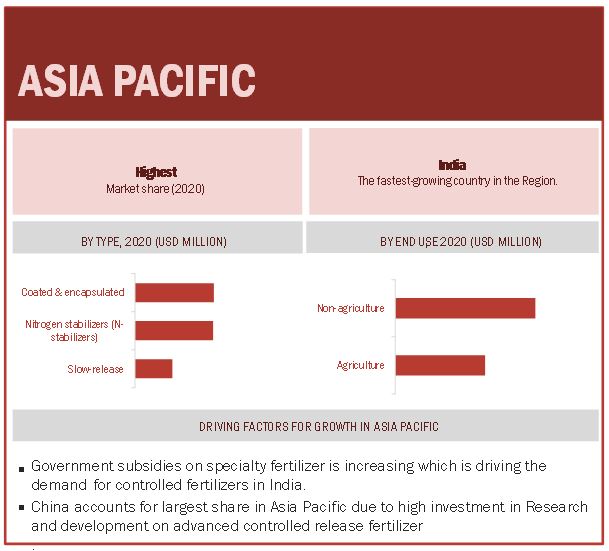

The Asia Pacific region is the largest consumer of fertilizers. The increasing population in the region has led to a surge in demand for food products, which is projected to increase the consumption of fertilizers. However, the major concerns in this region include the pollution and contamination of soil, as well as their harmful effects on humans and the environment. To combat these harmful effects, governments in this region are focusing on the use of fertilizers that are less harmful to the soil. The Asia Pacific region consists of developing countries, in which the average landholding of farmers is significantly low. The rise in population, the shrinking agricultural land due to industrialization and urbanization, low farm yields, environmental and soil degradation, and infrastructure inadequacy are some of the factors that are encouraging farmers to produce more in the limited land area, which is projected to increase the demand for specialty fertilizers.

Challenge: Lack of awareness among farmers

Awareness about specialty fertilizers among farmers in developing countries remains limited. Farmers are not aware of the method of usage and the cost-effective benefits of specialty fertilizers. In developing countries, they are often unaware of the basic nutrient requirements of soil as well. Farmers are accustomed to the method of usage of primary nutrients, and the nutrient response ratio of these is not encouraging due to the imbalanced fertilization and the lack of use of secondary macronutrients.

Furthermore, there is limited awareness about the brands, as the market is highly fragmented at the regional level. Despite considerable efforts by agronomists across the globe in recent years, farmers are unaware or have limited knowledge about secondary macronutrients and their benefits of increasing yield. On the other hand, in countries such as India and China, where agriculture is a major source of income for more than half of the country’s population, farmers are not willing to take risks in terms of production capacity. In addition, the high costs deter farmers from using these fertilizers. Farmers need to change their perspective to understand the use and benefits of specialty fertilizers. This serves as a challenge for the growth of the specialty fertilizers market.

The coated and encapsulated subsegment in the by type segment is estimated to account for the largest market share in the controlled release fertilizer market.

The coated and encapsulated segment is estimated to dominate the controlled release fertilizer market. The adoption of these fertilizers has been increasing continuously in the global market, due to the growing awareness about the benefits associated with coated fertilizers and government support provided by the nation in terms of subsidies and policy amendment. Such government policies and well-defined regulations act as a boosting factor for the growth of this market at the global level.

The fertigation subsegment in the application segment is projected to account for the fastest growth during the forecast period.

This is mainly driven by factors such as enhanced productivity and better yields. This mode of application is gaining importance due to its reliability and efficacy. Fertigation mode of application also reduces the application cost by 29% to 78% due to improved efficiency. Fertigation is a technique that has been adopted by major countries, wherein the fertilizer is included with irrigation water and applied through systems. This technique witnesses better application than broadcasting and subsurface placement.

The non agriculture segment is estimated to account for the largest market share in the controlled release fertilizer market during the forecast period.

The growth in purchasing power and the rising environmental issues have led to an increase in the demand for CRFs in non-agricultural. However, as a result of government rules governing controlled-release fertilizers, their use on agricultural crops has expanded significantly in developing countries also. Growing usage of controlled-release fertilizers for turf & ornamental grass is driving the market. For more than a decade, CRF has been used for turf & ornamental grass in the US; however, its demand has been increasing recently in developing countries. Thus, the easy application of controlled-release fertilizers on ornamental crops is a major factor driving its market

Asia Pacific is projected to account for the largest share in the controlled release fertilizer market during the forecast period.

Asia Pacific accounted for the largest share; during the forecast period, in terms of volume and value, respectively. Increasing growth of high-value crops and rising awareness among farmers about the environmental benefits of controlled-release fertilizers are expected to provide more scope for market expansion. The government policies adopted by Asia Pacific countries and the large subsidies, sometimes up to 100% for marginal farmers, provided on fertilizers are the major factors triggering the growth of this market in the region

To know about the assumptions considered for the study, download the pdf brochure

Top Companies in Controlled Release Fertilizer Market

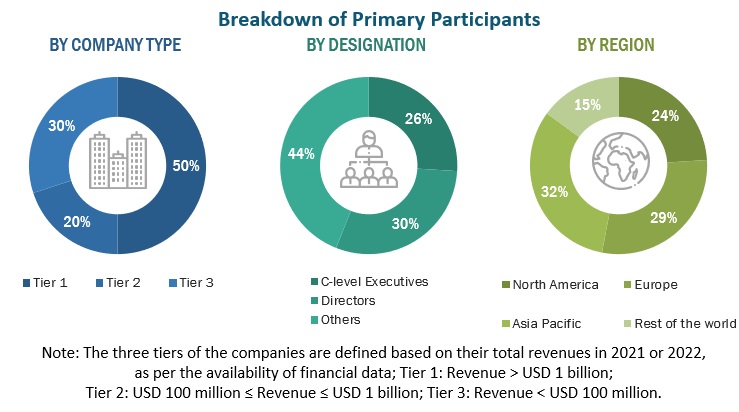

The key players in this market include Yara International ASA (Norway), Nutrien Ltd. (Canada), The Mosaic Company (US), ICL Group (Israel), Nufarm Ltd. (Australia), Kingenta (China), ScottsMiracle-Gro (US), Koch Industries (US), Helena Chemical (US), and SQM (Chile). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 2.4 billion |

|

Revenue Forecast in 2026 |

USD 3.3 billion |

|

Growth Rate |

CAGR of 6.4 % from 2021 to 2026 |

|

Forecast Period |

2021-2026 |

|

Historical Base Year |

2020 |

|

Currency and Unit |

USD |

|

Segmentation |

|

|

Growing Market Geographies |

|

|

Dominant Geography |

North America |

|

Key Companies Profiled |

|

This research report categorizes the controlled release fertilizers market based on type, application, form, source, and region.

Based on type, the market has been segmented as follows:

-

Slow release

- Urea formaldehyde

- Urea isobutyraldehyde

- Urea acetaldehyde

- Other slow release fertilizer

-

Nitrogen stabilizers (N-Stabilizers)

- Nitrification inhibitors

- Urease inhibitors

-

Coated and encapsulated

- Sulfar coated

- Polymer coated

- Sulfar polymer coated

- Other coated and encapsulated fertilizers

Based on End Use, the market has been segmented as follows:

-

Agricultural

- Cereals and grains

- Oilseed and pulses

- Vegetables

- Fruits

- Plantation crops

-

Non agricultural

- Turfs and ornamentals

- Nurseries and greenhouses

- Other non agricultural end uses

Based on the mode of application, the market has been segmented as follows:

- Foliar

- Fertigation

- Soil

- Other modes of application

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (the Middle East & Africa)

Recent Developments

- In 2021 December, Yara international ASA collaborated with Sumitomo chemicals Co.Ltd. The collaboration with Sumitomo Chemicals accelerated Japan’s green energy transition and built upon the growing momentum associated with clean ammonia

- In 2021 April, Nufarm Ltd collaborated with Crop Zone. This collaboration is to bring alternative weed control to major European markets. Nufarm and crop.zone combines chemical and physical processes to create a compelling and sustainable method of weed control. By pre-treating plants with an organic, regulated liquid that is conductive and then applying electrical charge, the company would be able to control weeds with a very high degree of efficiency and lower energy consumption than conventional weeding technologies

- In 2021 March, Mosaic Company entered into partnership with sound agriculture. The partnership was to develop and distribute a nutrient efficiency product. The product would activate the soil microbiome to give plants access to important nutrients and allow growers to optimize fertilizer inputs.

Key Benefits of this report for you:

- Determining and projecting the size of the controlled release fertilizer market, with respect to type, application, end use, and regional markets, over a five-year period, ranging from 2021 to 2026

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the controlled release fertilizer market

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products offered across key regions and their impact on the growth of the prominent market players

- Providing insights on key product innovations and investments in the controlled release fertilizer market

Frequently Asked Questions (FAQ):

Who are some of the key players operating in the controlled release fertilizers (crfs) market and how intense is the competition?

The key players in this market include Yara International ASA (Norway), Nutrien Ltd. (Canada), The Mosaic Company (US), ICL Group (Israel), Nufarm Ltd. (Australia), Kingenta (China), ScottsMiracle-Gro (US), Koch Industries (US), Helena Chemical (US), and SQM (Chile). The controlled release fertilizer market is highly competitive with the leading companies working hard in order to maintain their market positions while parallelly there are local and domestic companies arising in every region. The strong manufacturing regions such as Europe and North America show a high rise in the development of new companies in the market which strongly are emerging as ey exporters.

What kind of stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

The key stakeholders to controlled release fertilizer market would be:

- Fertilizer manufacturers, formulators, and blenders

- Fertilizer traders, suppliers, distributors, importers, and exporters

- Fertilizer coating technology providers and polymer manufacturers

- Polymer coating technology-focused market entrants

- Agricultural co-operative societies

- Commercial research & development (R&D) organizations and financial institutions

- Fertilizer associations and industry bodies such as the International Fertilizer Association (IFA) and Association of American Plant Food Control Officials (AAPFCO)

- Government agricultural departments and regulatory bodies such as the US Environmental Protection Agency (EPA), US Department of Agriculture (USDA) - Animal and Plant Health Inspection Service (APHIS), and Canadian Food Inspection Agency (CFIA)

What are the benefits of controlled release fertilizers?

Controlled release fertilizers can reduce the amount of fertilizer required for a given crop, reduce the frequency of fertilizer application, improve nutrient uptake by plants, and reduce the potential for leaching of nutrients into groundwater.

What are the factors driving the growth of the controlled release fertilizers market?

Factors driving the growth of the controlled release fertilizers market include increasing demand for food due to population growth, the need to improve crop yields and reduce the environmental impact of fertilizers, and the increasing adoption of precision farming practices.

What are the key development strategies undertaken by companies in the controlled release fertilizers market?

Strategies such as new product launches, investments into expansion and development, research initiatives are the key strategies being used by large players in order to achieve differential positioning in the global market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION: CONTROLLED-RELEASE FERTILIZERS MARKET

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.3.2 GEOGRAPHIC SCOPE

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 UNITS CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2.1 RESEARCH DATA

FIGURE 2 CONTROLLED-RELEASE FERTILIZERS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primary interviews

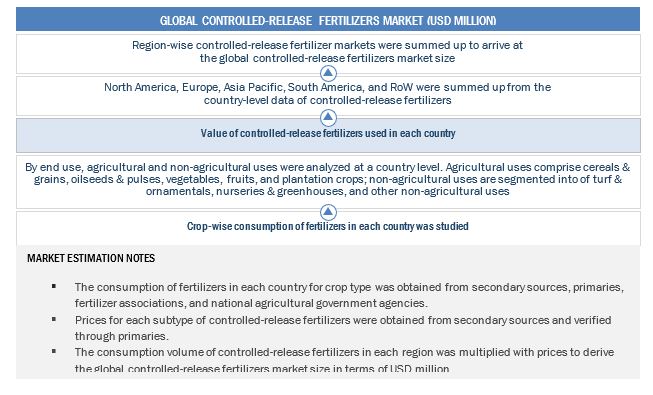

2.2 MARKET SIZE ESTIMATION

FIGURE 3 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE ESTIMATION, BY TYPE: SUPPLY SIDE (1/2)

FIGURE 4 MARKET SIZE ESTIMATION, BY TYPE: SUPPLY SIDE (2/2)

FIGURE 5 MARKET SIZE ESTIMATION: DEMAND SIDE

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

FIGURE 9 SCENARIO-BASED MODELLING

2.7 INTRODUCTION TO COVID-19

2.8 COVID-19 HEALTH ASSESSMENT

FIGURE 10 COVID-19: GLOBAL PROPAGATION

FIGURE 11 COVID-19 PROPAGATION: SELECT COUNTRIES

2.9 COVID-19 ECONOMIC ASSESSMENT

FIGURE 12 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.9.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 13 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 14 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

FIGURE 15 CONTROLLED-RELEASE FERTILIZERS MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 16 MARKET, BY MODE OF APPLICATION, 2021 VS 2026 (USD MILLION)

FIGURE 17 MARKET, BY END USE, 2021 VS 2026

FIGURE 18 MARKET: REGIONAL SNAPSHOT

4.1 ATTRACTIVE OPPORTUNITIES IN THE CONTROLLED-RELEASE FERTILIZERS MARKET

FIGURE 19 INCREASE IN DEMAND FOR HIGH-EFFICIENCY FERTILIZERS TO DRIVE THE MARKET DURING THE FORECAST PERIOD

4.2 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION

FIGURE 20 ASIA PACIFIC TO DOMINATE THE CONTROLLED-RELEASE FERTILIZERS MARKET FROM 2021 TO 2026 (USD MILLION)

FIGURE 21 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026 (KT)

4.3 CONTROLLED-RELEASE FERTILIZERS MARKET, BY TYPE

FIGURE 22 THE COATED & ENCAPSULATED FERTILIZERS SEGMENT IS ESTIMATED TO BE THE LARGEST THROUGHOUT THE FORECAST PERIOD (USD MILLION)

FIGURE 23 COATED & ENCAPSULATED FERTILIZERS ARE PROJECTED TO GROW AT THE HIGHEST CAGR THROUGHOUT THE FORECAST PERIOD (KT)

4.4 CONTROLLED-RELEASE FERTILIZERS MARKET, BY MODE OF APPLICATION

FIGURE 24 THE FERTIGATION SEGMENT IS ESTIMATED TO BE THE LARGEST SEGMENT DURING THE FORECAST 2021–2026 (USD MILLION)

4.5 CONTROLLED-RELEASE FERTILIZERS MARKET, BY END USE

FIGURE 25 THE NON-AGRICULTURE SEGMENT IS ESTIMATED TO BE THE LARGEST SEGMENT DURING THE FORECAST 2021–2026 (USD MILLION)

4.6 ASIA PACIFIC: CONTROLLED-RELEASE FERTILIZERS MARKET, BY TYPE & KEY COUNTRY

FIGURE 26 THE N-STABILIZERS SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC CONTROLLED-RELEASE FERTILIZERS MARKET IN 2021

FIGURE 27 MARKETS IN INDIA, ARGENTINA, AND AUSTRALIA & NEW ZEALAND ARE PROJECTED TO GROW AT THE HIGHEST RATES DURING THE FORECAST PERIOD

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 CONTROLLED-RELEASE FERTILIZERS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Necessity for highly efficient fertilizers

FIGURE 29 FACTORS CONTRIBUTING TO WATER POLLUTION

5.2.1.2 Favorable government policies and regulations

5.2.1.3 Increase in environmental concerns

5.2.1.4 Uniform nutrient application

5.2.1.5 Increase in adoption of precision farming technology

5.2.2 RESTRAINTS

5.2.2.1 Cost ineffectiveness

5.2.2.2 Improper management of controlled-release fertilizers

5.2.2.3 Growth of the organic fertilizer industry

5.2.3 OPPORTUNITIES

5.2.3.1 Product innovations in controlled-release technology

FIGURE 30 GROWTH OF ORGANIC LAND, 2001–2019 (MILLION HA)

5.2.3.2 Strong growth in emerging economies

5.2.3.3 Crop-specific nutrient management through precision farming

5.2.3.4 Need to improve pasture production

5.2.4 CHALLENGES

5.2.4.1 Limited adoption of controlled-release technology

5.2.4.2 Lack of awareness among farmers

5.2.4.3 Supply of counterfeit and less effective products

5.2.4.4 Subsidies on fertilizers provided by the government of developing economies

FIGURE 31 SUBSIDIZED PRICES OF FERTILIZERS, 2011–2020 (INR/KG)

5.3 MACROECONOMIC INDICATORS

5.3.1 RISE IN PRODUCTION OF FERTILIZER AND UREA PRODUCTS ACROSS THE GLOBE

FIGURE 32 ANNUAL NITROGEN FERTILIZER NUTRIENT PRODUCTION, 2009–2020 (MILLION TON)

5.3.2 INCREASE IN APPLICATION RATES OF FERTILIZERS IN DEVELOPING COUNTRIES

FIGURE 33 NITROGEN FERTILIZER APPLICATION RATE IN KEY AGRICULTURAL MARKETS, 2014–2020 (KG/HA)

5.3.3 GROWTH IN MARKET DEMAND FOR HIGH-VALUE CROPS

FIGURE 34 AREA HARVESTED UNDER IMPORTANT HIGH-VALUE CROPS, 2014–2020 (MILLION HA)

5.4 IMPACT OF COVID-19 ON THE MARKET DYNAMICS

5.4.1 IMPACT OF COVID-19 ON FERTILIZER IMPORTATION AND SUPPLY CHAIN

5.4.2 IMPACT OF COVID-19 ON SOIL FERTILITY AND FERTILIZER APPLICATION

5.4.3 IMPACT OF COVID-19 ON CROP YIELD

6.1 INTRODUCTION

6.2 VALUE CHAIN

FIGURE 35 CONTROLLED RELEASE FERTILIZERS MARKET: VALUE CHAIN ANALYSIS

6.2.1 RESEARCH & DEVELOPMENT

6.2.2 REGISTRATION

6.2.3 FORMULATION & MANUFACTURING

6.2.4 DISTRIBUTION, MARKETING & SALES, AND POST-SALE SERVICES

6.3 MARKET ECOSYSTEM AND SUPPLY CHAIN

FIGURE 36 PRODUCT R&D AND PRODUCTION ARE VITAL COMPONENTS OF THE SUPPLY CHAIN

TABLE 2 CONTROLLED RELEASE FERTILIZERS MARKET: SUPPLY CHAIN (ECOSYSTEM)

FIGURE 37 CONTROLLED-RELEASE FERTILIZERS: MARKET MAP

6.4 TECHNOLOGY ANALYSIS

6.4.1 PRECISION TECHNOLOGY IN FERTILIZER APPLICATION

6.4.2 VARIABLE-RATE TECHNOLOGY/APPLICATION

6.5 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

FIGURE 38 REVENUE SHIFT FOR THE CONTROLLED-RELEASE FERTILIZERS MARKET

6.6 PORTER’S FIVE FORCES ANALYSIS

6.6.1 THREAT OF NEW ENTRANTS

6.6.2 THREAT OF SUBSTITUTES

6.6.3 BARGAINING POWER OF SUPPLIERS

6.6.4 BARGAINING POWER OF BUYERS

6.6.5 INTENSITY OF COMPETITIVE RIVALRY

6.7 PATENT ANALYSIS

FIGURE 39 INCREASE IN PATENT GRANTS FOR CONTROLLED RELEASE FERTILIZERS, 2010–2020

FIGURE 40 KEY APPLICANTS FOR CONTROLLED RELEASE FERTILIZERS PATENTS IN THE MARKET, 2018–2021

FIGURE 41 CONTROLLED RELEASE FERTILIZER PATENTS, BY KEY JURISDICTION, 2018–2021

TABLE 3 LIST OF IMPORTANT PATENTS FOR FOOD PROCESSING EQUIPMENT, 2019–2020

6.8 PRICING TREND

FIGURE 42 CONTROLLED RELEASE FERTILIZERS MARKET: GLOBAL AVERAGE SELLING PRICE (ASP), BY REGION, 2018–2020 (USD PER TON)

FIGURE 43 MARKET: AVERAGE SELLING PRICE (ASP), BY TYPE, 2018–2020 (USD PER TON)

FIGURE 44 SLOW-RELEASE FERTILIZERS MARKET: AVERAGE SELLING PRICE (ASP), BY REGION, 2018–2020 (USD PER TON)

FIGURE 45 COATED ENCAPSULATED FERTILIZERS MARKET: AVERAGE SELLING PRICE (ASP), BY REGION, 2018–2020 (USD PER TON)

FIGURE 46 NITROGEN STABILIZERS FERTILIZERS MARKET: AVERAGE SELLING PRICE (ASP), BY REGION, 2018–2020 (USD PER TON)

6.9 CASE STUDIES

6.9.1 INCREASING PLANT ABSORBTION OF UREA

6.9.2 USE OF CRF TO CONTROL HBL IN CITRUS PLANTATIONS

6.10 REGULATORY LANDSCAPE

6.10.1 NORTH AMERICA

6.10.1.1 US

6.10.1.2 Canada

6.10.2 EUROPE

6.10.2.1 Australia

6.10.2.2 China

6.10.2.3 Israel

7.1 INTRODUCTION

FIGURE 47 CONTROLLED-RELEASE FERTILIZERS MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 4 MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 5 MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 6 MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 7 MARKET SIZE, BY TYPE, 2021–2026 (KT)

7.1.1 COVID-19 IMPACT ON THE CONTROLLED RELEASE FERTILIZERS MARKET, BY TYPE

7.2 COVID-19 IMPACT ON THE CONTROLLED-RELEASE FERTILIZERS MARKET, BY TYPE

7.2.1 OPTIMISTIC SCENARIO

TABLE 8 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

7.2.2 PESSIMISTIC SCENARIO

TABLE 9 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

7.2.3 REALISTIC SCENARIO

TABLE 10 REALISTIC SCENARIO: COVID-19 IMPACT ON THE CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

7.3 SLOW-RELEASE

7.3.1 LARGE-SCALE COMMERCIAL PRODUCTION AND HIGH EFFECTIVENESS ON THE CROPS TO DRIVE MARKET DEMAND

TABLE 11 SLOW-RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 12 SLOW-RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 13 SLOW-RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2018–2020 (KT)

TABLE 14 SLOW-RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2021–2026 (KT)

TABLE 15 SLOW-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 16 SLOW-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

7.3.1.1 Urea-formaldehyde

TABLE 17 UREA-FORMALDEHYDE FERTILIZERS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 18 UREA-FORMALDEHYDE FERTILIZERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3.1.2 Urea Isobutyraldehyde

TABLE 19 UREA ISOBUTYRALDEHYDE FERTILIZERS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 20 UREA ISOBUTYRALDEHYDE SLOW-RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3.1.3 Urea acetaldehyde

TABLE 21 UREA ACETALDEHYDE FERTILIZERS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 22 UREA ACETALDEHYDE FERTILIZERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3.1.4 Other slow-release fertilizers

TABLE 23 OTHER SLOW-RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 24 OTHER SLOW-RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4 NITROGEN STABILIZERS (N-STABILIZERS)

7.4.1 OWING TO THE DECLINE IN PRICES OF CORN, FARMERS HAVE BEEN ADOPTING N-STABILIZERS AS A SUBSTITUTE FOR COATED FERTILIZERS

TABLE 25 NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 26 NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 27 NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY REGION, 2018–2020 (KT)

TABLE 28 NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY REGION, 2021–2026 (KT)

TABLE 29 NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 30 NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

7.4.1.1 Nitrification inhibitors

7.4.1.1.1 The reduced cost of the nitrification inhibitors leads to their extensive usage in the Asia Pacific region

TABLE 31 NITRIFICATION INHIBITORS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 32 NITRIFICATION INHIBITORS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4.1.2 Urease inhibitors

7.4.1.2.1 Owing to the wide usage in cereals crops and grasslands for temperate grasslands, the demand for urease inhibitors is growing

TABLE 33 UREASE INHIBITORS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 34 UREASE INHIBITORS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4.2 COATED & ENCAPSULATED

7.4.2.1 increase in adoption in developed countries led the polymer-coated segment to be the largest

TABLE 35 COATED & ENCAPSULATED CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 36 COATED & ENCAPSULATED CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 37 COATED & ENCAPSULATED CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2018–2020 (KT)

TABLE 38 COATED & ENCAPSULATED CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2021–2026 (KT)

TABLE 39 COATED & ENCAPSULATED CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 40 COATED & ENCAPSULATED CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

7.4.2.2 Sulfur-coated

TABLE 41 SULFUR-COATED CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 42 SULFUR-COATED CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4.2.3 Polymer-coated

TABLE 43 POLYMER-COATED CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 44 POLYMER-COATED CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4.2.4 Sulfur polymer-coated

TABLE 45 SULFUR POLYMER-COATED CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 46 SULFUR POLYMER-COATED CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4.2.5 Other coated & encapsulated fertilizers

TABLE 47 OTHERS COATED & ENCAPSULATED CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 48 OTHERS COATED & ENCAPSULATED CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.1 INTRODUCTION

FIGURE 48 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY MODE OF APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 49 MARKET SIZE, BY MODE OF APPLICATION, 2018–2020 (USD MILLION)

TABLE 50 MARKET SIZE, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

8.2 FERTIGATION

8.2.1 FACTORS SUCH AS ENHANCED PRODUCTIVITY, BETTER YIELDS IS FUELING THE DEMAND FOR FERTIGATION MODE OF APPLICATION

TABLE 51 CONTROLLED RELEASE FERTILIZERS MARKET SIZE IN FERTIGATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 52 MARKET SIZE IN FERTIGATION, BY REGION, 2021–2026 (USD MILLION)

8.3 FOLIAR

TABLE 53 CONTROLLED RELEASE FERTILIZERS MARKET SIZE IN FOLIAR APPLICATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 54 MARKET SIZE IN FOLIAR APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.4 SOIL

8.4.1 LABOR INTENSIVE AGRARIAN ECONOMIES PREFER SOIL MODE OF APPLICATION

TABLE 55 CONTROLLED RELEASE FERTILIZERS MARKET SIZE IN SOIL APPLICATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 56 MARKET SIZE IN SOIL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.5 OTHER MODES OF APPLICATION

TABLE 57 MARKET SIZE IN OTHER MODES OF APPLICATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 58 MARKET SIZE IN OTHER MODES OF APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.1 INTRODUCTION

FIGURE 49 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY END USE, 2021 VS. 2026 (USD MILLION)

TABLE 59 MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 60 MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

9.2 NON-AGRICULTURAL END USES

TABLE 61 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 62 MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

9.2.1 TURF & ORNAMENTALS

TABLE 63 CONTROLLED RELEASE FERTILIZERS MARKET SIZE IN TURF & ORNAMENTAL APPLICATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 64 MARKET SIZE IN TURF & ORNAMENTAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.2.2 NURSERIES & GREENHOUSES

TABLE 65 CONTROLLED RELEASE FERTILIZERS MARKET SIZE IN NURSERIES & GREENHOUSES, BY REGION, 2018–2020 (USD MILLION)

TABLE 66 MARKET SIZE IN NURSERIES & GREENHOUSES, BY REGION, 2021–2026 (USD MILLION)

9.2.3 OTHER NON-AGRICULTURAL END USES

TABLE 67 CONTROLLED RELEASE FERTILIZERS MARKET SIZE IN OTHER NON-AGRICULTURAL END USES, BY REGION, 2018–2020 (USD MILLION)

TABLE 68 CONTROLLEDRELEASE FERTILIZERS MARKET SIZE IN OTHER NON-AGRICULTURAL END USES, BY REGION, 2021–2026 (USD MILLION)

9.3 AGRICULTURAL END USES

TABLE 69 CONTROLLED RELEASE FERTILIZERS MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 70 MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

9.3.1 CEREALS & GRAINS

TABLE 71 CONTROLLED RELEASE FERTILIZERS MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 72 MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY REGION, 2021–2026 (USD MILLION)

9.3.2 OILSEEDS & PULSES

TABLE 73 CONTROLLED RELEASE FERTILIZERS MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 74 MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY REGION, 2021–2026 (USD MILLION)

9.3.3 VEGETABLES

TABLE 75 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE IN VEGETABLE CULTIVATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 76 MARKET SIZE IN VEGETABLE CULTIVATION, BY REGION, 2021–2026 (USD MILLION)

9.3.4 FRUITS

TABLE 77 CONTROLLED RELEASE FERTILIZERS MARKET SIZE IN FRUIT CULTIVATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 78 MARKET SIZE IN FRUIT CULTIVATION, BY REGION, 2021–2026 (USD MILLION)

9.3.5 PLANTATION CROPS

TABLE 79 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE IN PLANTATION CROP CULTIVATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 80 MARKET SIZE IN PLANTATION CROP CULTIVATION, BY REGION, 2021–2026 (USD MILLION)

10.1 INTRODUCTION

TABLE 81 CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 82 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 83 MARKET SIZE, BY REGION, 2018–2020 (KT)

TABLE 84 MARKET SIZE, BY REGION, 2021–2026 (KT)

TABLE 85 MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 86 MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 87 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 88 MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 89 SLOW-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 90 SLOW-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 91 COATED & ENCAPSULATED CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 92 COATED & ENCAPSULATED CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 93 NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 94 NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 95 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY MODE OF APPLICATION, 2018–2020 (USD MILLION)

TABLE 96 MARKET SIZE, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

TABLE 97 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 98 MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 99 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 100 MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 101 CONTROLLED RELEASE FERTILIZERS MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 102 MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 103 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 104 MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 105 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 106 MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 107 CONTROLLED RELEASE FERTILIZERS MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 108 MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 109 CONTROLLED RELEASE FERTILIZERS MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 110 MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

FIGURE 50 ASIA PACIFIC ESTIMATED TO DOMINATE THE CONTROLLED-RELEASE FERTILIZERS MARKET IN 2021

10.1.1 COVID-19 IMPACT ON THE CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION

10.2 COVID-19 IMPACT ON THE CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION

TABLE 111 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 112 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 113 REALISTIC SCENARIO: COVID-19 IMPACT ON THE CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.3 NORTH AMERICA

TABLE 114 NORTH AMERICA: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2020 (KT)

TABLE 117 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 118 NORTH AMERICA: MARKET SIZE, TYPE, 2018–2020 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 121 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 122 NORTH AMERICA: SLOW-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 123 NORTH AMERICA: SLOW-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 124 NORTH AMERICA: COATED & ENCAPSULATED CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 125 NORTH AMERICA: COATED & ENCAPSULATED CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 126 NORTH AMERICA: NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 127 NORTH AMERICA: NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 128 NORTH AMERICA: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY MODE OF APPLICATION, 2018–2020 (USD MILLION)

TABLE 129 NORTH AMERICA: MARKET SIZE, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

TABLE 130 NORTH AMERICA: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 131 NORTH AMERICA: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 132 NORTH AMERICA: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 133 NORTH AMERICA: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 134 NORTH AMERICA: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 135 NORTH AMERICA: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 136 NORTH AMERICA: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 137 NORTH AMERICA: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 138 NORTH AMERICA: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 139 NORTH AMERICA: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 140 NORTH AMERICA: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 141 NORTH AMERICA: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 142 NORTH AMERICA: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 143 NORTH AMERICA: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.3.1 US

10.3.1.1 Environmentally friendly agricultural inputs are driving the demand for CRFs

TABLE 144 US: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 145 US: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 146 US: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 147 US: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 148 US: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 149 US: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 150 US: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 151 US: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 152 US: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 153 US: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 154 US: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 155 US: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 156 US: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 157 US: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 158 US: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 159 US: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 160 US: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 161 US: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Increase in demand for better maintenance of turf & ornamental is driving the demand for CRFs

TABLE 162 CANADA: CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 163 CANADA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 164 CANADA: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 165 CANADA: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 166 CANADA: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 167 CANADA: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 168 CANADA: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 169 CANADA: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 170 CANADA: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 171 CANADA: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 172 CANADA: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 173 CANADA: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 174 CANADA: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 175 CANADA: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 176 CANADA: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 177 CANADA: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 178 CANADA: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 179 CANADA: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.3.3 MEXICO

10.3.3.1 Increase in export of processed food products projected to drive the demand for CRFs

TABLE 180 MEXICO: CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 181 MEXICO: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 182 MEXICO: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 183 MEXICO: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 184 MEXICO: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 185 MEXICO: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 186 MEXICO: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 187 MEXICO: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 188 MEXICO: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 189 MEXICO: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 190 MEXICO: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 191 MEXICO: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 192 MEXICO: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 193 MEXICO: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 194 MEXICO: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 195 MEXICO: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 196 MEXICO: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 197 MEXICO: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.4 EUROPE

TABLE 198 EUROPE: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 199 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 200 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2020 (KT)

TABLE 201 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 202 EUROPE: MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 203 EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 204 EUROPE: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 205 EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 206 EUROPE: SLOW-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 207 EUROPE: SLOW-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 208 EUROPE: COATED & ENCAPSULATED CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, 2018–2020 (USD MILLION)

TABLE 209 EUROPE: COATED & ENCAPSULATED CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 210 EUROPE: NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 211 EUROPE: NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 212 EUROPE: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY MODE OF APPLICATION, 2018–2020 (USD MILLION)

TABLE 213 EUROPE: MARKET SIZE, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

TABLE 214 EUROPE: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 215 EUROPE: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 216 EUROPE: MARKET SIZE IN NON-AGRICULTURAL END USES, SUBTYPE, 2018–2020 (USD MILLION)

TABLE 217 EUROPE: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 218 EUROPE: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 219 EUROPE: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 220 EUROPE: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 221 EUROPE: MARKET SIZE IN AGRICULTURAL END USES IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 222 EUROPE: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 223 EUROPE: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 224 EUROPE: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 225 EUROPE: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 226 EUROPE: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 227 EUROPE: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.4.1 UK

TABLE 228 UK: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 229 UK: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 230 UK: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 231 UK: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 232 UK: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 233 UK: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 234 UK: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 235 UK: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 236 UK: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 237 UK: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 238 UK: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 239 UK: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 240 UK: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 241 UK: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 242 UK: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 243 UK: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 244 UK: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 245 UK: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.4.2 FRANCE

10.4.2.1 Rise in demand for better quality crops is driving the demand for CRFs

TABLE 246 FRANCE: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 247 FRANCE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 248 FRANCE: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 249 FRANCE: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 250 FRANCE: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 251 FRANCE: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 252 FRANCE: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 253 FRANCE: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 254 FRANCE: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 255 FRANCE: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 256 FRANCE: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 257 FRANCE: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 258 FRANCE: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 259 FRANCE: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 260 FRANCE: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 261 FRANCE: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 262 FRANCE: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 263 FRANCE: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.4.3 GERMANY

10.4.3.1 Decrease in area harvested and increase in demand for better yields in driving the market for CRFs

TABLE 264 GERMANY: CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 265 GERMANY: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 266 GERMANY: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 267 GERMANY: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 268 GERMANY: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 269 GERMANY: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 270 GERMANY: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 271 GERMANY: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 272 GERMANY: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 273 GERMANY: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 274 GERMANY: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 275 GERMANY: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 276 GERMANY: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 277 GERMANY: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 278 GERMANY: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 279 GERMANY: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 280 GERMANY: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 281 GERMANY: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.4.4 SPAIN

10.4.4.1 Need for environmental solutions and improvements is driving the demand for non-agricultural CRFs

TABLE 282 SPAIN: CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 283 SPAIN: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 284 SPAIN: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 285 SPAIN: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 286 SPAIN: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 287 SPAIN: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 288 SPAIN: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 289 SPAIN: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 290 SPAIN: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 291 SPAIN: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 292 SPAIN: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 293 SPAIN: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 294 SPAIN: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 295 SPAIN: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 296 SPAIN: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 297 SPAIN: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 298 SPAIN: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 299 SPAIN: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.4.5 ITALY

10.4.5.1 Increase in area under turf and nurseries and scientific upkeep of the nurseries fuels the demand for CRFs

TABLE 300 ITALY: CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 301 ITALY: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 302 ITALY: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 303 ITALY: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 304 ITALY: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 305 ITALY: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 306 ITALY: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 307 ITALY: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 308 ITALY: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 309 ITALY: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 310 ITALY: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 311 ITALY: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 312 ITALY: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 313 ITALY: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 314 ITALY: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 315 ITALY: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 316 ITALY: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 317 ITALY: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.4.6 REST OF EUROPE

TABLE 318 REST OF EUROPE: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 319 REST OF EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 320 REST OF EUROPE: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 321 REST OF EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 322 REST OF EUROPE: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 323 REST OF EUROPE: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 324 REST OF EUROPE: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 325 REST OF EUROPE: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 326 REST OF EUROPE: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 327 REST OF EUROPE: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 328 REST OF EUROPE: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 329 REST OF EUROPE: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 330 REST OF EUROPE: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 331 REST OF EUROPE: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 332 REST OF EUROPE: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 333 REST OF EUROPE: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 334 REST OF EUROPE: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 335 REST OF EUROPE: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

FIGURE 51 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 336 ASIA PACIFIC: CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY COUNTRY/REGION, 2018–2020 (USD MILLION)

TABLE 337 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

TABLE 338 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2018–2020 (KT)

TABLE 339 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2021–2026 (KT)

TABLE 340 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 341 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 342 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 343 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 344 ASIA PACIFIC: SLOW-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 345 ASIA PACIFIC: SLOW-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 346 ASIA PACIFIC: COATED & ENCAPSULATED CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 347 ASIA PACIFIC: COATED & ENCAPSULATED CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 348 ASIA PACIFIC: NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 349 ASIA PACIFIC: NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 350 ASIA PACIFIC: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY MODE OF APPLICATION, 2018–2020 (USD MILLION)

TABLE 351 ASIA PACIFIC: MARKET SIZE, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

TABLE 352 ASIA PACIFIC: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 353 ASIA PACIFIC: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 354 ASIA PACIFIC: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 355 ASIA PACIFIC: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 356 ASIA PACIFIC: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 357 ASIA PACIFIC: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 358 ASIA PACIFIC: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 359 ASIA PACIFIC: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 360 ASIA PACIFIC: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 361 ASIA PACIFIC: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 362 ASIA PACIFIC: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 363 ASIA PACIFIC: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 364 ASIA PACIFIC: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 365 ASIA PACIFIC: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.5.1 AUSTRALIA & NEW ZEALAND

10.5.1.1 With the application of CRFs, farmers could overcome the degradation problem

TABLE 366 AUSTRALIA & NEW ZEALAND: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 367 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 368 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 369 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 370 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 371 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 372 AUSTRALIA & NEW ZEALAND: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 373 AUSTRALIA & NEW ZEALAND: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 374 AUSTRALIA & NEW ZEALAND: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 375 AUSTRALIA & NEW ZEALAND: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 376 AUSTRALIA & NEW ZEALAND: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 377 AUSTRALIA & NEW ZEALAND: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 378 AUSTRALIA & NEW ZEALAND: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 379 AUSTRALIA & NEW ZEALAND: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 380 AUSTRALIA & NEW ZEALAND: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 381 AUSTRALIA & NEW ZEALAND: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 382 AUSTRALIA & NEW ZEALAND: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 383 AUSTRALIA & NEW ZEALAND: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.5.2 CHINA

10.5.2.1 Investments in new technologies, better agricultural inputs has increased the demand for CRFs

TABLE 384 CHINA: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 385 CHINA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 386 CHINA: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 387 CHINA: MARKET SIZE, BY TYPE, 2021–2026 (KT)

FIGURE 52 CHINA: CROPS WITH MAJOR AREA HARVESTED, 2013–2018 (MILLION HA)

TABLE 388 CHINA: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 389 CHINA: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 390 CHINA: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 391 CHINA: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 392 CHINA: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 393 CHINA: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 394 CHINA: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 395 CHINA: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 396 CHINA: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 397 CHINA: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 398 CHINA: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 399 CHINA: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 400 CHINA: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 401 CHINA: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.5.3 INDIA

10.5.3.1 Multinational companies are penetrating the market by way of expansion, given the growing demand for CRFs

TABLE 402 INDIA: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 403 INDIA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 404 INDIA: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 405 INDIA: MARKET SIZE, BY TYPE, 2021–2026 (KT)

FIGURE 53 INDIA: CROPS WITH MAJOR AREA HARVESTED, 2013–2018 (MILLION HA)

TABLE 406 INDIA: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 407 INDIA: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 408 INDIA: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 409 INDIA: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 410 INDIA: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 411 INDIA: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 412 INDIA: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 413 INDIA: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 414 INDIA: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 415 INDIA: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 416 INDIA: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 417 INDIA: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 418 INDIA: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 419 INDIA: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.5.4 JAPAN

10.5.4.1 Advance agricultural practices are driving the demand for CRFs

TABLE 420 JAPAN: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 421 JAPAN: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 422 JAPAN: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 423 JAPAN: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 424 JAPAN: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 425 JAPAN: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 426 JAPAN: MARKET SIZE IN NON-AGRICULTURAL END USES, BY TYPE, 2018–2020 (USD MILLION)

TABLE 427 JAPAN: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 428 JAPAN: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 429 JAPAN: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 430 JAPAN: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 431 JAPAN: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 432 JAPAN: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 433 JAPAN: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 434 JAPAN: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 435 JAPAN: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 436 JAPAN: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 437 JAPAN: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.5.5 REST OF ASIA PACIFIC

TABLE 438 REST OF ASIA PACIFIC: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 439 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 440 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 441 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 442 REST OF ASIA PACIFIC: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 443 REST OF ASIA PACIFIC: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 444 REST OF ASIA PACIFIC: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 445 REST OF ASIA PACIFIC: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 446 REST OF ASIA PACIFIC: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 447 REST OF ASIA PACIFIC: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 448 REST OF ASIA PACIFIC: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 449 REST OF ASIA PACIFIC: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 450 REST OF ASIA PACIFIC: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 451 REST OF ASIA PACIFIC: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 452 REST OF ASIA PACIFIC: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 453 REST OF ASIA PACIFIC: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 454 REST OF ASIA PACIFIC: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 455 REST OF ASIA PACIFIC: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.6 SOUTH AMERICA

FIGURE 54 SOUTH AMERICA: MARKET SNAPSHOT

TABLE 456 SOUTH AMERICA: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 457 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 458 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2020 (KT)

TABLE 459 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 460 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 461 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 462 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 463 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 464 SOUTH AMERICA: SLOW-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 465 SOUTH AMERICA: SLOW-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 466 SOUTH AMERICA: COATED & ENCAPSULATED CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 467 SOUTH AMERICA: COATED & ENCAPSULATED CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 468 SOUTH AMERICA: NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 469 SOUTH AMERICA: NITROGEN STABILIZERS (N-STABILIZERS) MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 470 SOUTH AMERICA: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY MODE OF APPLICATION, 2018–2020 (USD MILLION)

TABLE 471 SOUTH AMERICA: MARKET SIZE, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

TABLE 472 SOUTH AMERICA: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 473 SOUTH AMERICA: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 474 SOUTH AMERICA: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 475 SOUTH AMERICA: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 476 SOUTH AMERICA: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 477 SOUTH AMERICA: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 478 SOUTH AMERICA: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 479 SOUTH AMERICA: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 480 SOUTH AMERICA: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 481 SOUTH AMERICA: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 482 SOUTH AMERICA: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 483 SOUTH AMERICA: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 484 SOUTH AMERICA: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 485 SOUTH AMERICA: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.6.1 BRAZIL

10.6.1.1 Easy adoption of controlled-release fertilizers by farmers in the country due to its ease to apply, increase IN yield resulting in market growth

TABLE 486 BRAZIL: CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 487 BRAZIL: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

FIGURE 55 BRAZIL: CROP AREA HARVESTED, BY KEY CROP, 2013–2018 (MILLION HA)

TABLE 488 BRAZIL: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 489 BRAZIL: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 490 BRAZIL: MARKET SIZE, BY END USE, 2018–2020 (USD MILLION)

TABLE 491 BRAZIL: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 492 BRAZIL: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 493 BRAZIL: MARKET SIZE IN NON-AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 494 BRAZIL: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 495 BRAZIL: MARKET SIZE IN AGRICULTURAL END USES, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 496 BRAZIL: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 497 BRAZIL: MARKET SIZE IN CEREAL & GRAIN CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 498 BRAZIL: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 499 BRAZIL: MARKET SIZE IN OILSEED & PULSE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 500 BRAZIL: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 501 BRAZIL: MARKET SIZE IN VEGETABLE CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 502 BRAZIL: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2018–2020 (USD MILLION)

TABLE 503 BRAZIL: MARKET SIZE IN FRUIT CULTIVATION, BY SUBTYPE, 2021–2026 (USD MILLION)

10.6.2 ARGENTINA

10.6.2.1 The increase in the adoption of agrochemicals and advancements in farming techniques in Argentina projected to contribute to the growth of the market

TABLE 504 ARGENTINA: CONTROLLED RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 505 ARGENTINA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 506 ARGENTINA: MARKET SIZE, BY TYPE, 2018–2020 (KT)

TABLE 507 ARGENTINA: MARKET SIZE, BY TYPE, 2021–2026 (KT)