Current Sensor Market by Loop Type (Closed Loop and Open Loop), Technology (Isolated and Non-Isolated Current Sensors), Output Type (Analog and Digital), End-User, and Geography (2021-2026)

Updated on : March 03, 2023

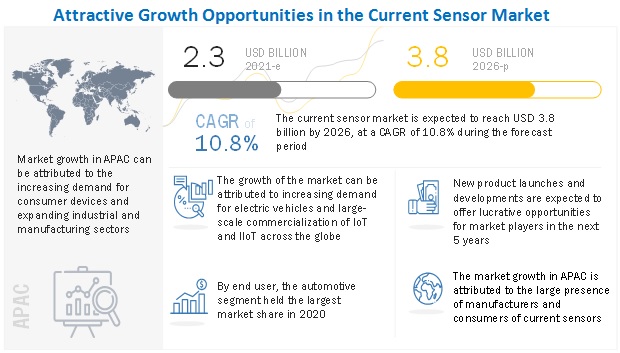

[255 Pages Report] The global current sensor market is expected to grow from USD 2.3 billion in 2021 to USD 3.8 billion by 2026; it is expected to grow at a CAGR of 10.8% during 2021–2026.

Key factors fueling this current sensor industry growth include growing use of battery-powered systems and increasing focus on renewable energy, high adoption of Hall-effect current sensors, and increasing demand in consumer electronics industry. Deployment of IoT and IIoT with current sensors and increasing manufacturing of hybrid and electric cars create a strong demand for current sensor for efficient industrial operations in the midst of COVID-19.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increasing demand in consumer electronics industry

The consumer electronics industry has witnessed considerable growth in recent years, and the trend is expected to continue in the future as well. Players from various consumer electronics segments are coming up with new technologies where current sensors are highly used. Consumer electronics, such as smartphones, tablets, TVs, wearables, and infotainment devices, require efficient power management ICs. With the increasing demand for portability, autonomy, and energy efficiency, GaN (gallium nitride) has become an important building block for power electronics by enabling companies to provide efficient solutions for their customers. Thus, the expanding consumer electronics industry is creating a prominent revenue pocket for the current sensor market.

Restraint: Intense pricing pressure resulting in decline in average selling prices (ASPs)

Although the increasing applications of current sensors in automated vehicles, telecommunication equipment, consumer electronics, and healthcare devices have increased their shipments, the sales growth has been significantly hampered due to price erosion. This is partially a result of the intense competition among the rising number of sensor manufacturers. While the reduction in ASP is beneficial for consumers, it results in shrinking profit margins for suppliers. Thus, intense pricing pressure results in a fall in average selling price (ASP), which hampers revenue growth in the highly competitive current sensor market.

Opportunity: Deployment of IoT and IIoT with current sensors

IoT plays an important role in the information technology sector. It refers to a network of sensors formed by the integration of various information-sensing devices with the internet. Moreover, IoT creates a huge demand for advanced connected devices enabling M2M and interoperation with other devices according to the requirement of the connected environment. The network traffic due to the interconnection of devices is expected to grow at a significant rate as the internet- and cloud-based content delivery, smart grid applications, healthcare and safety monitoring, resource and inventory management, home entertainment, connected transportation, and other M2M data applications are witnessing high adoption. Moreover, IoT technology has witnessed significant technological innovation and government funding in several nations in the last few years.

Challenge: Accuracy over different temperature ranges

Current sensors are extremely accurate at the temperature conditions with low variance. However, maintaining this accuracy over the temperature ranges commonly existing in automobile applications is the major challenge faced by the manufacturers. End users may use two main current measurement technologies—open-loop and closed-loop current sensors. With the open-loop sensors, the end users may experience problems with temperature shifts or at high temperatures. On the other end, closed-loop sensors provide the gain stability and handle short-duration, high-current transients well. However, the destructive overload capability favors open-loop current sensors. Moreover, the closed-loop sensors absorb significant quiescent current when the primary current is high, causing self-heating. Thus, the end users face multiple difficulties with respect to the working temperature of current sensors, which act as a challenge to the current sensor providers.

Isolated current sensor held the larger market share of current sensor market

The isolated current sensor is expected to account for the larger share of the current sensor market by 2026. The growth of the segment can be attributed to the increasing demand for magnetic current sensors worldwide due to their usability in a wide range of applications. Moreover, the isolation of current sensing circuitry is needed for technical and regulatory reasons in many applications, such as line-operated industrial and commercial motors, electric/hybrid electric vehicles (EVs/HEVs), solar arrays, home energy metering, and many other less-visible applications, where high voltages and currents are common.

Consumer Electonics end user holds the highest CAGR of current sensor market during the forecast period

The consumer electronics segment is projected to grow at the highest rate during the forecast period. Consumer electronics is one of the major verticals of the current sensor market; every electronic appliance requires power supply (AC/DC) and power management to utilize electrical energy efficiently. Power electronic devices are used in consumer electronics such as refrigerators, air conditioners, washing machines, TVs, induction cookers, dishwashers, and other smart home devices/connected devices. Smart devices include smartphones, tablets, wearables, IoT devices, adapters/chargers, routers/modems, gaming consoles, consumer drones, and battery-operated personal devices.

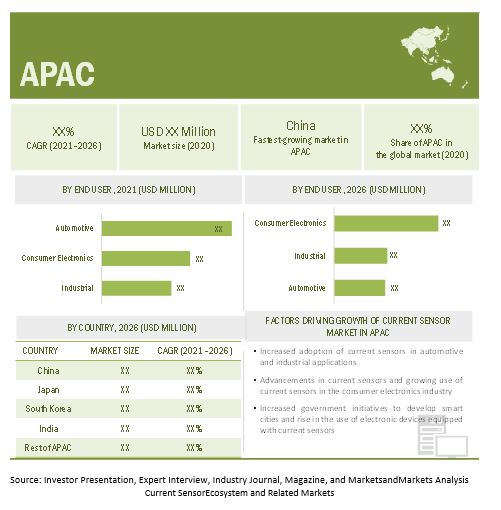

APAC is expected to hold a significant share of current sensor market by 2026

The current sensor market in APAC is expected to grow at the highest CAGR during the forecast periodattributed to the increased use of these sensors in the automotive, building automation, energy, and manufacturing industries. APAC is one of the important regions for the automotive industry due to increased passenger car manufacturing and sales in various countries such as China, Japan, and South Korea. The growing adoption of isolated current sensors for electric and hybrid vehicles in the automotive industry is driving the growth of the market for current sensors in APAC.

To know about the assumptions considered for the study, download the pdf brochure

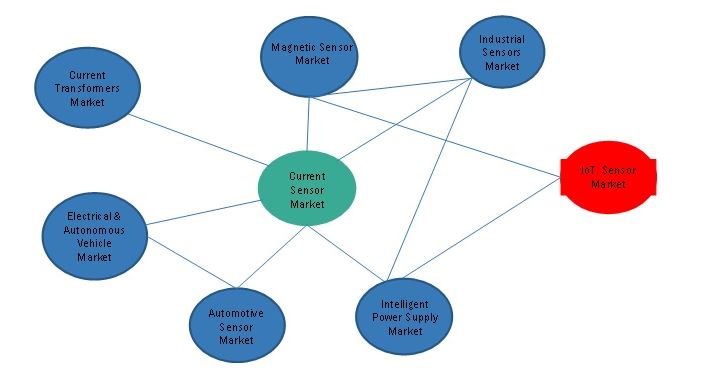

Current Sensor Ecosystem and Related Markets

Key Market Players

Asahi Kasei Microdevices (AKM) (Japan), ACEINNA (US), Melexis (Belgium), Allegro MicroSystems (US), TDK Corporation (Japan), LEM International (Switzerland), Infineon Technologies (Germany), Tamura Corp. (Japan), Texas Instruments (US), and Honeywell (US) are a few major players in the current sensor companies. Organic growth strategies, such as product launches and developments, is a focus of many of the companies mentioned above.

Prominent players have adopted product launches and developments, followed by acquisitions, partnerships, and expansionsas the key business strategy to expand their share in the current sensormarket. For instance, in April 2021, TDK Corporation (Japan) introduced its Micronas Hall-effect sensor portfolio with the CUR 4000 sensor. The sensor, developed for highly accurate current measurements in automotive and industrial applications, offers nonintrusive, galvanic isolated contactless current sensing.

Current Sensor Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2021 | USD 2.3 Billion |

| Revenue Forecast in 2026 | USD 3.8 Billion |

| Growth Rate | 10.8% |

|

Market size available for years |

2018–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast Unit |

Value (USD Million) |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Companies covered |

|

This report categorizes the Current sensor market based on loop type, technology, output type, end-user, and region.

Based on Loop Type, the Current Sensor Market been Segmented as follows:

- Open Loop

- Closed Loop

Based on Technology, the Current Sensor Market been Segmented as follows:

-

Isolated Current Sensor

-

Magnetic Current Sensor

- Hall-effect

- AMR

- GMR

- TMR

- Fluxgate

- Opto-isolated Op Amp

- Shunt-isolated Op Amp

-

Magnetic Current Sensor

-

Non-isolated Current Sensor

- Current Sensing Amplifier

- Analog-to-Digital Converter

Based on Output Type, the Current Sensor Market been Segmented as follows:

- Analog

- Digital

Based on End-user, the Current Sensor Market been Segmented as follows:

- Automotive

- Consumer Electronics

- Telecom & Networking

- Healthcare

- Industrial

- Energy

- Others (Railways, Aerospace & Defense, and Building Automation)

Based on Geography, the Current Sensor Market been Segmented as follows:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Major market developments

- In May 2021, Infineon Technologies expanded its XDP family by adding the first application-specific standard product based on an asymmetric half-bridge flyback topology. The XDPS2201 is a highly integrated, multi-mode, digital, and configurable hybrid flyback controller targeting high-density AC-DC power supplies, including USB PD fast charger and adapter applications.

- In November 2021, TDK Corporation introduced its Micronas Hall-effect sensor portfolio with the CUR 4000 sensor. The sensor, developed for highly accurate current measurements in automotive and industrial applications, offers nonintrusive, galvanic isolated contactless current sensing.

Frequently Asked Questions (FAQ):

Which are the major applications of current sensor? How huge is the opportunity for their growth in the next five years?

The major end users of current sensor include automotive, consumer electronics, telecom & networking, healthcare, industrial, energy, and others (railways, aerospace & defense, and building automation). These are expected to open new revenue pockets for the current sensor market, which will lead to market opportunity of USD 500 million.

Which are the major companies in the current sensor market? What are their major strategies to strengthen their market presence?

ACEINNA (US), Melexis (Belgium), Allegro MicroSystems (US), and TDK Corporation (Japan) are dominant players in the global current sensor market. Product launches is one of the key strategies adopted by these players. Apart from product launches and developments, these players extend their focus on partnerships, expansions, and acquisitions.

Which region is expected to witness significant demand for current sensor market in the coming years?

APAC is the highest growing region for this market. Most of the industrial manufacturing players present across the world have their headquarters in the APAC region. Similarly, end-user industries, such as automotive, healthcare, and consumer electronics, are expected to create enormous opportunities for current sensor providers.

What are the drivers and opportunities for the current sensor market?

growing use of battery-powered systems and increasing focus on renewable energy, high adoption of Hall-effect current sensors, and increasing demand in consumer electronics industry are key driving factors for the current sensor market growth. Opportunities for the manufacturers in the current sensor market include growth in adoption of current sensor in consumer electronics and deployment of IoT and IIoT with current sensors. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 CURRENT SENSOR MARKET SEGMENTATION

1.3.1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 VOLUME UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 2 CURRENT SENSOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1—BOTTOM-UP (DEMAND SIDE) – DEMAND FOR CURRENT SENSORS

2.2.1.1 Estimating market size by bottom-up approach (demand side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Estimating market size by top-down approach (supply side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—REVENUE GENERATED FROM CURRENT SENSORS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—ILLUSTRATION OF REVENUE ESTIMATION FOR ONE OF COMPANIES IN CURRENT SENSOR MARKET

2.2.3 MARKET PROJECTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 10 ASSUMPTION FOR STUDY

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 11 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

FIGURE 12 MARKET: GROWTH PROJECTION BY ADOPTING REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

FIGURE 13 ISOLATED CURRENT SENSOR SEGMENT, BY TECHNOLOGY, TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

FIGURE 14 MARKET, BY LOOP TYPE, 2021 VS. 2026

FIGURE 15 MARKET FOR CONSUMER ELECTRONICS SEGMENT TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

FIGURE 16 APAC TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES IN CURRENT SENSOR MARKET

FIGURE 17 GROWING DEMAND FOR ELECTRIC AND HYBRID VEHICLES TO BOOST GROWTH OF MARKET

4.2 MARKET, BY OUTPUT TYPE

FIGURE 18 DIGITAL SEGMENT TO REGISTER HIGHER CAGR FROM 2021 TO 2026

4.3 MARKET, BY LOOP TYPE

FIGURE 19 CLOSED LOOP SEGMENT TO HOLD LARGER SHARE OF MARKET BY 2026

4.4 MARKET IN APAC, BY END USER AND COUNTRY

FIGURE 20 AUTOMOTIVE END USER SEGMENT AND CHINA HELD LARGEST MARKET SHARES OF ASIA PACIFIC MARKET IN 2020

4.5 CURRENT SENSOR MARKET, BY REGION

FIGURE 21 CHINA CURRENT SENSOR MARKET TO EXHIBIT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 IMPACT OF DRIVERS AND OPPORTUNITIES ON MARKET

FIGURE 23 IMPACT OF CHALLENGES AND RESTRAINTS ON MARKET

5.2.1 DRIVERS

5.2.1.1 Growing use of battery-powered systems and increasing focus on renewable energy

5.2.1.2 High adoption of Hall-effect current sensors

5.2.1.3 Increasing demand in consumer electronics industry

5.2.2 RESTRAINTS

5.2.2.1 Intense pricing pressure resulting in decline in average selling prices (ASPs)

5.2.3 OPPORTUNITIES

5.2.3.1 Deployment of IoT and IIoT with current sensors

5.2.3.2 Increasing manufacturing of hybrid and electric cars

5.2.4 CHALLENGES

5.2.4.1 Accuracy over different temperature ranges

5.2.4.2 Need for product differentiation and development of innovative solutions

5.2.4.3 Disruption in supply chain of semiconductor devices due to COVID-19

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: MOST VALUE IS ADDED BY SENSOR AND SENSOR MODULE MANUFACTURERS

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 IMPACT OF EACH FORCE ON MARKET

5.5 AVERAGE SELLING PRICE ANALYSIS

TABLE 3 FEW CURRENT SENSOR SOLUTIONS AND THEIR COST

TABLE 4 AVERAGE SELLING PRICE OF CURRENT SENSORS, BY TYPE

5.6 TRADE ANALYSIS

5.6.1 IMPORT SCENARIO OF ELECTRICAL TRANSFORMERS, STATIC CONVERTERS, E.G., RECTIFIERS, AND INDUCTORS, PARTS THEREOF

TABLE 5 IMPORT DATA OF ELECTRICAL TRANSFORMERS, STATIC CONVERTERS, E.G., RECTIFIERS, AND INDUCTORS, PARTS THEREOF, BY COUNTRY, 2016–2020 (USD MILLION)

5.6.2 EXPORT SCENARIO OF ELECTRICAL TRANSFORMERS, STATIC CONVERTERS, E.G., RECTIFIERS, AND INDUCTORS, PARTS THEREOF

TABLE 6 EXPORT DATA OF ELECTRICAL TRANSFORMERS, STATIC CONVERTERS, E.G. RECTIFIERS, AND INDUCTORS, PARTS THEREOF, BY COUNTRY, 2016–2020 (USD MILLION)

5.7 REVENUE SHIFT & NEW REVENUE POCKETS FOR MARKET

FIGURE 25 REVENUE SHIFT IN MARKET

5.8 CURRENT SENSOR ECOSYSTEM

FIGURE 26 CURRENT SENSOR ECOSYSTEM

5.9 CASE STUDY ANALYSIS

5.9.1 TMR CURRENT SENSORS OFFERED BY TDK CORPORATION FOR BATTERY MONITORING

5.9.2 MAGNETIC CURRENT SENSORS OFFERED BY CROCUS TECHNOLOGY FOR APPLICATIONS IN CONSUMER ELECTRONICS INDUSTRY

5.10 PATENT ANALYSIS

5.10.1 PATENT REGISTRATIONS, 2018–2020

TABLE 7 SOME PATENT REGISTRATIONS, 2018–2020

5.10.2 CURRENT SENSOR: PATENT ANALYSIS

5.10.2.1 Methodology

5.10.2.2 Document Type

TABLE 8 PATENTS FILED

FIGURE 27 PATENTS FILED BETWEEN 2018 AND 2020

FIGURE 28 GRANTED PATENT TRENDS, 2016–2020

5.10.2.3 Insight

5.10.2.4 Allegro MicroSystems LLC

TABLE 9 LIST OF PATENTS BY ALLEGRO MICROSYSTEMS LLC

5.11 TECHNOLOGY TRENDS

5.11.1 KEY TECHNOLOGIES

5.11.1.1 MEMS current sensor

5.11.2 ADJACENT TECHNOLOGIES

5.11.2.1 Microprocessor-based current sensor

5.11.2.2 Current relay

5.12 TARIFFS AND REGULATIONS

5.12.1 TARIFFS

TABLE 10 MFN TARIFFS FOR ELECTRICAL TRANSFORMERS, STATIC CONVERTERS, E.G., RECTIFIERS, AND INDUCTORS, PARTS THEREOF EXPORTED BY CHINA

TABLE 11 MFN TARIFFS FOR ELECTRICAL TRANSFORMERS, STATIC CONVERTERS, E.G., RECTIFIERS, AND INDUCTORS, PARTS THEREOF IMPORTS BY US

5.12.2 NEGATIVE IMPACT OF TARIFFS ON MARKET

5.12.3 POSITIVE IMPACT OF TARIFFS ON MARKET

5.13 GOVERNMENT REGULATIONS AND STANDARDS

5.13.1 GOVERNMENT REGULATIONS

5.13.2 STANDARDS

5.13.2.1 International Electrotechnical Commission (IEC)

5.13.2.2 IEC 60364-4-43: Low-voltage electrical installations - Protection for safety - Protection against overcurrent

5.13.2.3 IEC 60269

6 VARIOUS CURRENT SENSING METHODS (Page No. - 83)

6.1 INTRODUCTION

6.2 DIRECT CURRENT SENSING

6.3 INDIRECT CURRENT SENSING

7 CURRENT SENSOR MARKET, BY LOOP TYPE (Page No. - 84)

7.1 INTRODUCTION

FIGURE 29 OPEN LOOP SEGMENT TO GROW AT HIGHER RATE DURING FORECAST PERIOD

TABLE 12 MARKET, BY LOOP TYPE, 2018–2020 (USD MILLION)

TABLE 13 MARKET, BY LOOP TYPE, 2021–2026 (USD MILLION)

TABLE 14 MARKET, BY LOOP TYPE, 2018–2020 (MILLION UNITS)

TABLE 15 MARKET, BY LOOP TYPE, 2021–2026 (MILLION UNITS)

7.2 OPEN LOOP

7.2.1 HIGH ADOPTION OF OPEN-LOOP CURRENT SENSORS IN CONSUMER ELECTRONICS INDUSTRY TO FUEL GROWTH OF SEGMENT

7.3 CLOSED LOOP

7.3.1 GROWING USE OF CLOSED-LOOP CURRENT SENSORS IN INDUSTRIAL SECTOR TO BOOST MARKET GROWTH

8 CURRENT SENSOR MARKET, BY TECHNOLOGY (Page No. - 88)

8.1 INTRODUCTION

FIGURE 30 ISOLATED TECHNOLOGY SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE BY 2026

TABLE 16 MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 17 MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

8.2 ISOLATED CURRENT SENSOR

TABLE 18 ISOLATED MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 19 ISOLATED CURRENT SENSOR MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

8.2.1 MAGNETIC CURRENT SENSOR

8.2.1.1 Magnetic sensors are ideal for power conversion applications in consumer electronics industry

FIGURE 31 HALL-EFFECT SENSOR SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE BY 2026

TABLE 20 MAGNETIC MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 21 MAGNETIC MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.2.1.2 Hall-effect current sensor

8.2.1.2.1 Hall-effect current sensors are suitable for automobile applications

TABLE 22 CHARACTERISTICS OF MAGNETORESISTIVE CURRENT SENSOR TECHNOLOGIES

8.2.1.3 Anisotropic magnetoresistive (AMR) current sensor

8.2.1.3.1 AMR sensors are ideal for monitoring power absorbed by load and controlling and protecting power supply

8.2.1.4 Giant magnetoresistive (GMR) current sensor

8.2.1.4.1 GMR sensors are used in automobile electrical equipment applications

8.2.1.5 Tunneling magnetoresistive (TMR) current sensor

8.2.1.5.1 Technological advancements in automotive, industrial, and consumer electronics segments are increasing demand for TMR current sensors

8.2.1.6 Fluxgate current sensor

8.2.1.6.1 High measurement accuracy of fluxgate sensors makes them ideal choice

8.2.2 OPTO-ISOLATED OP AMP

8.2.2.1 Operational amplifier is ideal choice for DC amplification

8.2.3 SHUNT-ISOLATED OP AMP

8.2.3.1 Photoionization technology is widely used in gas chromatography

8.3 NON-ISOLATED CURRENT SENSOR

FIGURE 32 CURRENT-SENSING AMPLIFIERS TO ACCOUNT FOR LARGER MARKET SIZE BY 2026

TABLE 23 NON-ISOLATED MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 24 NON- ISOLATED MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

8.3.1 CURRENT-SENSING AMPLIFIER

8.3.1.1 Current-sensing amplifier is ideal non-isolated current technology

8.3.2 ANALOG-TO-DIGITAL CONVERTER

8.3.2.1 ADC is emerging non-isolated technology for current measurement

9 CURRENT SENSOR MARKET, BY OUTPUT TYPE (Page No. - 99)

9.1 INTRODUCTION

FIGURE 33 DIGITAL CURRENT SENSOR SEGMENT TO GROW AT HIGHER RATE DURING FORECAST PERIOD

TABLE 25 MARKET, BY OUTPUT TYPE, 2018–2020 (USD MILLION)

TABLE 26 MARKET, BY OUTPUT TYPE, 2021–2026 (USD MILLION)

9.2 ANALOG

9.2.1 INCREASING DEMAND FOR ANALOG AC-DC OUTPUT SENSORS TO ANALYZE VARIATIONS IN CURRENT MEASUREMENTS TO FUEL MARKET GROWTH

9.3 DIGITAL

9.3.1 DIGITAL OUTPUT SEGMENT TO GROW AT HIGHER RATE DURING FORECAST PERIOD

10 CURRENT SENSOR MARKET, BY END USER (Page No. - 102)

10.1 INTRODUCTION

FIGURE 34 AUTOMOTIVE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2026

TABLE 27 MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 28 MARKET, BY END USER, 2021–2026 (USD MILLION)

10.2 AUTOMOTIVE

10.2.1 ACCELERATING GLOBAL ADOPTION OF ELECTRIC VEHICLES TO PROPEL GROWTH OF MARKET

TABLE 29 MARKET FOR AUTOMOTIVE SEGMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 30 MARKET FOR AUTOMOTIVE SEGMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 31 MARKET FOR AUTOMOTIVE SEGMENT, BY REGION, 2018–2020 (USD MILLION)

TABLE 32 MARKET FOR AUTOMOTIVE SEGMENT, BY REGION, 2021–2026 (USD MILLION)

TABLE 33 MARKET FOR AUTOMOTIVE SEGMENT IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 34 MARKET FOR AUTOMOTIVE SEGMENT IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 35 MARKET FOR AUTOMOTIVE SEGMENT IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 36 MARKET FOR AUTOMOTIVE SEGMENT IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 37 MARKET FOR AUTOMOTIVE SEGMENT IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 38 MARKET FOR AUTOMOTIVE SEGMENT IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 39 CURRENT SENSOR MARKET FOR AUTOMOTIVE SEGMENT IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 40 MARKET FOR AUTOMOTIVE SEGMENT IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.3 CONSUMER ELECTRONICS

10.3.1 GROWING INTEGRATION OF CURRENT SENSORS INTO CONSUMER ELECTRONICS TO DRIVE GROWTH OF MARKET

FIGURE 35 APAC TO LEAD CURRENT SENSORS MARKET FOR CONSUMER ELECTRONICS SEGMENT DURING FORECAST PERIOD

TABLE 41 MARKET FOR CONSUMER ELECTRONICS SEGMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 42 MARKET FOR CONSUMER ELECTRONICS SEGMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 43 MARKET FOR CONSUMER ELECTRONICS SEGMENT, BY REGION, 2018–2020 (USD MILLION)

TABLE 44 MARKET FOR CONSUMER ELECTRONICS SEGMENT, BY REGION, 2021–2026 (USD MILLION)

TABLE 45 MARKET FOR CONSUMER ELECTRONICS SEGMENT IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 46 MARKET FOR CONSUMER ELECTRONICS SEGMENT IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 47 MARKET FOR CONSUMER ELECTRONICS SEGMENT IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 48 MARKET FOR CONSUMER ELECTRONICS SEGMENT IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 49 MARKET FOR CONSUMER ELECTRONICS SEGMENT IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 50 MARKET FOR CONSUMER ELECTRONICS SEGMENT IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 51 MARKET FOR CONSUMER ELECTRONICS SEGMENT IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 52 MARKET FOR CONSUMER ELECTRONICS SEGMENT IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.4 TELECOM & NETWORKING

10.4.1 GROWING NEED FOR UPS AND BATTERY MANAGEMENT APPLICATIONS TO CREATE LUCRATIVE OPPORTUNITIES FOR CURRENT SENSOR MARKET

TABLE 53 MARKET FOR TELECOM & NETWORKING SEGMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 54 MARKET FOR TELECOM & NETWORKING SEGMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 55 MARKET FOR TELECOM & NETWORKING SEGMENT, BY REGION, 2018–2020 (USD MILLION)

TABLE 56 MARKET FOR TELECOM & NETWORKING SEGMENT, BY REGION, 2021–2026 (USD MILLION)

TABLE 57 MARKET FOR TELECOM & NETWORKING SEGMENT IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 58 MARKET FOR TELECOM & NETWORKING SEGMENT IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 59 MARKET FOR TELECOM & NETWORKING SEGMENT IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 60 MARKET FOR TELECOM & NETWORKING SEGMENT IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 61 MARKET FOR TELECOM & NETWORKING SEGMENT IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 62 MARKET FOR TELECOM & NETWORKING SEGMENT IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 63 MARKET FOR TELECOM & NETWORKING SEGMENT IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 64 MARKET FOR TELECOM & NETWORKING SEGMENT IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.5 HEALTHCARE

10.5.1 GROWING USE OF CURRENT SENSORS FOR MONITORING POWER CONSUMPTION IN MEDICAL EQUIPMENT TO BOOST MARKET GROWTH

TABLE 65 MARKET FOR HEALTHCARE SEGMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 66 CURRENT SENSOR MARKET FOR HEALTHCARE SEGMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 67 MARKET FOR HEALTHCARE SEGMENT, BY REGION, 2018–2020 (USD MILLION)

TABLE 68 MARKET FOR HEALTHCARE SEGMENT, BY REGION, 2021–2026 (USD MILLION)

TABLE 69 MARKET FOR HEALTHCARE SEGMENT IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD THOUSAND)

TABLE 70 MARKET FOR HEALTHCARE SEGMENT IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 71 MARKET FOR HEALTHCARE SEGMENT IN EUROPE, BY COUNTRY, 2018–2020 (USD THOUSAND)

TABLE 72 CURRENT SENSOR MARKET FOR HEALTHCARE SEGMENT IN EUROPE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 73 MARKET FOR HEALTHCARE SEGMENT IN APAC, BY COUNTRY, 2018–2020 (USD THOUSAND)

TABLE 74 MARKET FOR HEALTHCARE SEGMENT IN APAC, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 75 MARKET FOR HEALTHCARE SEGMENT IN ROW, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 76 MARKET FOR HEALTHCARE SEGMENT IN ROW, BY REGION, 2021–2026 (USD THOUSAND)

10.6 INDUSTRIAL

10.6.1 INDUSTRIAL AUTOMATION TO CREATE IMMENSE GROWTH OPPORTUNITIES FOR MARKET

FIGURE 36 APAC TO LEAD CURRENT SENSOR MARKET FOR INDUSTRIAL SEGMENT DURING FORECAST PERIOD

TABLE 77 MARKET FOR INDUSTRIAL SEGMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 78 MARKET FOR INDUSTRIAL SEGMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 79 MARKET FOR INDUSTRIAL SEGMENT, BY REGION, 2018–2020 (USD MILLION)

TABLE 80 MARKET FOR INDUSTRIAL SEGMENT, BY REGION, 2021–2026 (USD MILLION)

TABLE 81 MARKET FOR INDUSTRIAL SEGMENT IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 82 MARKET FOR INDUSTRIAL SEGMENT IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 83 MARKET FOR INDUSTRIAL SEGMENT IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 84 MARKET FOR INDUSTRIAL SEGMENT IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 85 MARKET FOR INDUSTRIAL SEGMENT IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 86 MARKET FOR INDUSTRIAL SEGMENT IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 87 MARKET FOR INDUSTRIAL SEGMENT IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 88 MARKET FOR INDUSTRIAL SEGMENT IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.7 ENERGY

10.7.1 CONTINUOUS RENEWABLE ENERGY GENERATION TO DRIVE GROWTH OF MARKET

TABLE 89 MARKET FOR ENERGY SEGMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 90 MARKET FOR ENERGY SEGMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 91 MARKET FOR ENERGY SEGMENT, BY REGION, 2018–2020 (USD MILLION)

TABLE 92 MARKET FOR ENERGY SEGMENT, BY REGION, 2021–2026 (USD MILLION)

TABLE 93 MARKET FOR ENERGY SEGMENT IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 94 CURRENT SENSOR MARKET FOR ENERGY SEGMENT IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 95 MARKET FOR ENERGY SEGMENT IN EUROPE, BY COUNTRY, 2018–2020 (USD THOUSAND)

TABLE 96 MARKET FOR ENERGY SEGMENT IN EUROPE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 97 MARKET FOR ENERGY SEGMENT IN APAC, BY COUNTRY, 2018–2020 (USD THOUSAND)

TABLE 98 MARKET FOR ENERGY SEGMENT IN APAC, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 99 MARKET FOR ENERGY SEGMENT IN ROW, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 100 MARKET FOR ENERGY SEGMENT IN ROW, BY REGION, 2021–2026 (USD THOUSAND)

10.8 OTHERS

TABLE 101 MARKET FOR OTHERS SEGMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 102 MARKET FOR OTHERS SEGMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 103 MARKET FOR OTHERS SEGMENT, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 104 MARKET FOR OTHERS SEGMENT, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 105 MARKET FOR OTHERS SEGMENT IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD THOUSAND)

TABLE 106 MARKET FOR OTHERS SEGMENT IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 107 MARKET FOR OTHERS SEGMENT IN EUROPE, BY COUNTRY, 2018–2020 (USD THOUSAND)

TABLE 108 MARKET FOR OTHER END USERS IN EUROPE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 109 MARKET FOR OTHERS SEGMENT IN APAC, BY COUNTRY, 2018–2020 (USD THOUSAND)

TABLE 110 MARKET FOR OTHERS SEGMENT IN APAC, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 111 MARKET FOR OTHERS SEGMENT IN ROW, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 112 MARKET FOR OTHERS SEGMENT IN ROW, BY REGION, 2021–2026 (USD THOUSAND)

11 CURRENT SENSOR MARKET, BY REGION (Page No. - 137)

11.1 INTRODUCTION

FIGURE 37 GEOGRAPHIC SNAPSHOT: APAC TO WITNESS HIGHEST GROWTH FROM 2021 TO 2026

FIGURE 38 APAC TO DOMINATE CURRENT SENSOR MARKET DURING FORECAST PERIOD

TABLE 113 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 114 MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA: CURRENT SENSOR MARKET SNAPSHOT

TABLE 115 MARKET IN NORTH AMERICA, BY END USER, 2018–2020 (USD MILLION)

TABLE 116 MARKET IN NORTH AMERICA, BY END USER, 2021–2026 (USD MILLION)

TABLE 117 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 118 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.1 US

11.2.1.1 US to be largest market for current sensors during forecast period

TABLE 119 MARKET IN US, BY END USER, 2018–2020 (USD MILLION)

TABLE 120 MARKET IN US, BY END USER, 2021–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Increasing demand from automotive, industrial, and consumer electronics segments to boost growth of Canadian market

TABLE 121 MARKET IN CANADA, BY END USER, 2018–2020 (USD THOUSAND)

TABLE 122 MARKET IN CANADA, BY END USER, 2021–2026 (USD THOUSAND)

11.2.3 MEXICO

11.2.3.1 Increasing industrialization in Mexico to drive growth of market

TABLE 123 MARKET IN MEXICO, BY END USER, 2018–2020 (USD THOUSAND)

TABLE 124 MARKET IN MEXICO, BY END USER, 2021–2026 (USD THOUSAND)

11.3 EUROPE

FIGURE 40 EUROPE: CURRENT SENSOR MARKET SNAPSHOT

TABLE 125 MARKET IN EUROPE, BY END USER, 2018–2020 (USD MILLION)

TABLE 126 MARKET IN EUROPE, BY END USER, 2021–2026 (USD MILLION)

TABLE 127 MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 128 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany to lead European current sensor market during forecast period

TABLE 129 MARKET IN GERMANY, BY END USER, 2018–2020 (USD THOUSAND)

TABLE 130 MARKET IN GERMANY, BY END USER, 2021–2026 (USD THOUSAND)

11.3.2 UK

11.3.2.1 Growing demand for current sensors in automotive and healthcare industries to fuel market growth during forecast period

TABLE 131 MARKET IN UK, BY END USER, 2018–2020 (USD THOUSAND)

TABLE 132 MARKET IN UK, BY END USER, 2021–2026 (USD THOUSAND)

11.3.3 FRANCE

11.3.3.1 Growing use of current sensors in automotive and aerospace industries to drive market growth

TABLE 133 MARKET IN FRANCE, BY END USER, 2018–2020 (USD THOUSAND)

TABLE 133 MARKET IN FRANCE, BY END USER, 2018–2020 (USD THOUSAND)

11.3.4 REST OF EUROPE

TABLE 135 MARKET IN REST OF EUROPE, BY END USER, 2018–2020 (USD THOUSAND)

TABLE 136 MARKET IN REST OF EUROPE, BY END USER, 2021–2026 (USD THOUSAND)

11.4 ASIA PACIFIC

FIGURE 41 APAC: CURRENT SENSOR MARKET SNAPSHOT

TABLE 137 MARKET IN APAC, BY END USER, 2018–2020 (USD MILLION)

TABLE 138 MARKET IN APAC, BY END USER, 2021–2026 (USD MILLION)

TABLE 139 MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 140 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Developing economy and growing implementation of sensors in various industries to boost market growth in China

TABLE 141 MARKET IN CHINA, BY END USER, 2018–2020 (USD MILLION)

TABLE 142 MARKET IN CHINA, BY END USER, 2021–2026 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 High demand for current sensors in automotive and industrial segments to boost market growth

TABLE 143 MARKET IN JAPAN, BY END USER, 2018–2020 (USD MILLION)

TABLE 144 MARKET IN JAPAN, BY END USER, 2021–2026 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Expanding manufacturing industries and government initiatives for industrial development to drive market growth

TABLE 145 MARKET IN INDIA, BY END USER, 2018–2020 (USD THOUSAND)

TABLE 146 MARKET IN INDIA, BY END USER, 2021–2026 (USD THOUSAND)

11.4.4 SOUTH KOREA

11.4.4.1 Consumer electronics and automobile manufacturing companies are playing a vital role in growth of market

TABLE 147 MARKET IN SOUTH KOREA, BY END USER, 2018–2020 (USD THOUSAND)

TABLE 148 MARKET IN SOUTH KOREA, BY END USER, 2021–2026 (USD THOUSAND)

11.4.5 REST OF APAC

TABLE 149 MARKET IN REST OF APAC, BY END USER, 2018–2020 (USD THOUSAND)

TABLE 150 MARKET IN REST OF APAC, BY END USER, 2021–2026 (USD THOUSAND)

11.5 REST OF THE WORLD

TABLE 151 MARKET IN ROW, BY END USER, 2018–2020 (USD THOUSAND)

TABLE 152 MARKET IN ROW, BY END USER, 2021–2026 (USD THOUSAND)

TABLE 153 MARKET IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 154 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

11.5.1 MIDDLE EAST & AFRICA

11.5.1.1 Increasing demand for current sensors attributed to growing renewable energy production to boost market growth

TABLE 155 MARKET IN MIDDLE EAST & AFRICA, BY END USER, 2018–2020 (USD THOUSAND)

TABLE 156 MARKET IN MIDDLE EAST & AFRICA, BY END USER, 2021–2026 (USD THOUSAND)

11.5.2 SOUTH AMERICA

11.5.2.1 Implementation of current sensors in automotive, infrastructure, and energy segment to drive market growth

TABLE 157 MARKET IN SOUTH AMERICA, BY END USER, 2018–2020 (USD THOUSAND)

TABLE 158 MARKET IN SOUTH AMERICA, BY END USER, 2021–2026 (USD THOUSAND)

12 COMPETITIVE LANDSCAPE (Page No. - 169)

12.1 INTRODUCTION

12.2 MARKET EVALUATION FRAMEWORK

TABLE 159 OVERVIEW OF STRATEGIES DEPLOYED BY KEY CURRENT SENSORS OEMS

12.2.1 PRODUCT PORTFOLIO

12.2.2 REGIONAL FOCUS

12.2.3 MANUFACTURING FOOTPRINT

12.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

12.3 MARKET SHARE ANALYSIS, 2020

TABLE 160 DEGREE OF COMPETITION

12.4 REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

FIGURE 42 5-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN CURRENT SENSOR MARKET

12.5 COMPANY EVALUATION MATRIX

12.5.1 STAR

12.5.2 PERVASIVE

12.5.3 EMERGING LEADER

12.5.4 PARTICIPANT

FIGURE 43 CURRENT SENSOR MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

12.6 START-UP/SME EVALUATION MATRIX

12.6.1 PROGRESSIVE COMPANY

12.6.2 RESPONSIVE COMPANY

12.6.3 DYNAMIC COMPANY

12.6.4 STARTING BLOCK

FIGURE 44 CURRENT SENSOR MARKET (GLOBAL), START-UP/SME EVALUATION MATRIX, 2020

12.7 COMPANY PRODUCT FOOTPRINT

TABLE 161 COMPANY PRODUCT FOOTPRINT

TABLE 162 FOOTPRINT OF DIFFERENT CURRENT SENSOR TECHNOLOGIES OFFERED BY DIFFERENT COMPANIES

TABLE 163 FOOTPRINT OF DIFFERENT END USER DEALS BY DIFFERENT COMPANIES

TABLE 164 REGIONAL FOOTPRINT OF DIFFERENT COMPANIES

12.8 COMPETITIVE SITUATIONS & TRENDS

FIGURE 45 STRATEGIES ADOPTED BY KEY PLAYERS FROM JANUARY 2018 TO MAY 2021

12.8.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 165 PRODUCT LAUNCHES AND DEVELOPMENTS (2018–2021)

12.8.2 DEALS

TABLE 166 DEALS, JANUARY 2018–MAY 2021

12.8.3 OTHERS

TABLE 167 OTHERS, 2018–2021

13 COMPANY PROFILES (Page No. - 195)

13.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, COVID-19-related developments, MNM view)*

13.1.1 ASAHI KASEI MICRODEVICES (AKM)

TABLE 168 ASAHI KASEI MICRODEVICES: BUSINESS OVERVIEW

FIGURE 46 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

13.1.2 ACEINNA

TABLE 169 ACEINNA: BUSINESS OVERVIEW

13.1.3 MELEXIS

TABLE 170 MELEXIS: BUSINESS OVERVIEW

FIGURE 47 MELEXIS: COMPANY SNAPSHOT

13.1.4 ALLEGRO MICROSYSTEMS LLC

TABLE 171 ALLEGRO MICROSYSTEMS: BUSINESS OVERVIEW

FIGURE 48 ALLEGRO MICROSYSTEMS: COMPANY SNAPSHOT

13.1.5 INFINEON TECHNOLOGIES

TABLE 172 INFINEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 49 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

13.1.6 TDK CORPORATION (TDK-MICRONAS GMBH)

TABLE 173 TDK CORPORATION: BUSINESS OVERVIEW

FIGURE 50 TDK CORPORATION: COMPANY SNAPSHOT

13.1.7 HONEYWELL

TABLE 174 HONEYWELL: BUSINESS OVERVIEW

FIGURE 51 HONEYWELL: COMPANY SNAPSHOT

13.1.8 TAMURA CORPORATION

TABLE 175 TAMURA CORPORATION: BUSINESS OVERVIEW

FIGURE 52 TAMURA CORPORATION: COMPANY SNAPSHOT

13.1.9 TEXAS INSTRUMENTS

TABLE 176 TEXAS INSTRUMENTS: BUSINESS OVERVIEW

FIGURE 53 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

13.1.10 LEM INTERNATIONAL

TABLE 177 LEM INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 54 LEM INTERNATIONAL: COMPANY SNAPSHOT

13.2 RIGHT TO WIN

13.3 OTHER COMPANIES

13.3.1 SILICON LABS

13.3.2 SENSITEC GMBH

13.3.3 KOHSHIN ELECTRIC CORPORATION

13.3.4 PULSE ELECTRONICS CORPORATION

13.3.5 VACUUMSCHMELZE GMBH & CO. KG

13.3.6 STMICROELECTRONICS N.V.

13.3.7 OMRON CORP (OMRON IA)

13.3.8 ICE COMPONENTS, INC.

13.3.9 MAGNESENSOR TECHNOLOGY

13.3.10 AMERICAN AEROSPACE CONTROLS INC. (AAC)

13.3.11 ELECTROHMS PVT. LTD.

13.3.12 DARE ELECTRONICS, INC.

13.3.13 SHANDONG YUANXING ELECTRONICS CO., LTD.

13.3.14 SENSOR ELECTRONIC TECHNOLOGY (SET)

13.3.15 TELL-I TECHNOLOGIES, INC.

*Details on Business overview, Products offered, Recent Developments, COVID-19-related developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 248)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

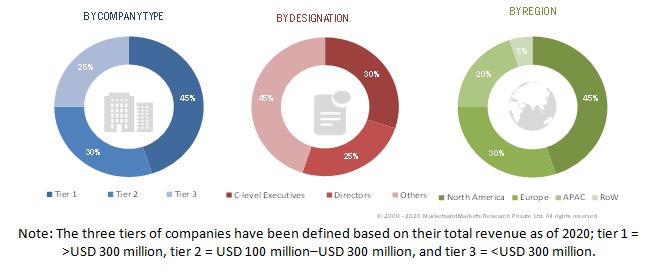

The study involved four major activities in estimating the size of the current sensor market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the current sensor market begins with capturing data on revenues of key vendors in the market through secondary research. This study incorporates extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for a technical, market-oriented, and commercial study of the current sensor market. Vendor offerings have also been taken into consideration to determine market segmentation. The entire research methodology includes studying annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

The Current sensor market comprises several stakeholders, such as suppliers of current monitoring solutions and current-senseing amplifiers. The demand side of this market is characterized by various end-users and regions. The supply side is characterized by advancements in types of current sensor technologies. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the current sensor market and its subsegments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Outlook And Growth Current Sensor and Voltage Sensor Market

Current sensors and voltage sensors are essential components in a wide range of industries and applications, including power electronics, automotive, renewable energy, and industrial automation. The market for these sensors is expected to see significant growth in the coming years due to several factors, including:

- Increasing Demand for Energy-Efficient Solutions: The demand for energy-efficient solutions is increasing across various industries, and current and voltage sensors play a crucial role in enabling energy efficiency by monitoring and controlling power consumption.

- Growing Adoption of Electric and Hybrid Vehicles: Electric and hybrid vehicles require sophisticated power electronics systems that rely on current and voltage sensors for accurate and reliable monitoring and control of power. As the adoption of electric and hybrid vehicles continues to grow, the demand for current and voltage sensors is expected to increase.

- Increasing Deployment of Renewable Energy Sources: Renewable energy sources such as wind and solar power require sophisticated power electronics systems that rely on current and voltage sensors for accurate and reliable monitoring and control of power. As the deployment of renewable energy sources continues to increase, the demand for current and voltage sensors is expected to grow.

- Advancements in Technology: The development of new technologies such as Hall-effect sensors, magnetic sensors, and shunt resistors is expected to increase the accuracy and reliability of current and voltage sensors while reducing their cost. These advancements are expected to make current and voltage sensors more accessible to a wider range of applications and industries, driving market growth.

Key Challenges for the Current and Voltage Sensor Market include:

- Integration with Existing Systems: Current and voltage sensors need to be integrated into existing systems, which can be a challenge in some cases. Integration challenges can include compatibility issues and the need for custom solutions.

- Competition from Other Sensing Technologies: Other sensing technologies such as temperature sensors and pressure sensors can be used for similar applications as current and voltage sensors, creating competition in the market.

- Cost: Current and voltage sensors can be relatively expensive, which can limit their adoption in certain applications and industries.

How is Voltage Sensor Market Going to Impact in Current Sensor?

Voltage sensors and current sensors are related but distinct components, and their markets are often considered separately. However, there is some overlap between the two markets, and changes in one market can have an impact on the other.

In general, voltage sensors measure the voltage or potential difference between two points, while current sensors measure the flow of electrical current through a circuit. Both types of sensors are important in power electronics, industrial automation, and other applications.

One way that the voltage sensor market may impact the current sensor market is through the development of new technologies. Many of the same technologies that are used in voltage sensors, such as Hall-effect sensors and magnetic sensors, can also be used in current sensors. As these technologies improve, they may lead to more accurate and reliable current sensors as well as voltage sensors.

Another way that the voltage sensor market may impact the current sensor market is through market dynamics. For example, if there is a significant increase in demand for voltage sensors in a particular industry or application, this may create new opportunities for current sensors as well. Conversely, if there is a decline in demand for voltage sensors, this may create a more competitive market for current sensors as companies look for new opportunities.

Some Futuristic Growth Use-cases Of Voltage Sensor Market?

The Voltage Sensor Market is expected to see significant growth in the coming years due to several futuristic growth use-cases, including:

- Electric and Hybrid Vehicles: As the adoption of electric and hybrid vehicles continues to grow, the demand for voltage sensors is expected to increase. Voltage sensors are used in electric and hybrid vehicles to monitor and control battery voltage and charging, as well as to monitor the performance of the power electronics systems.

- Renewable Energy: Renewable energy sources such as solar and wind power require sophisticated power electronics systems that rely on voltage sensors for accurate and reliable monitoring and control of voltage. As the deployment of renewable energy sources continues to increase, the demand for voltage sensors is expected to grow.

- Smart Grid: The development of smart grid technology is driving demand for voltage sensors that can monitor and control voltage in real-time. Smart grid technology is being used to improve the efficiency and reliability of power distribution systems, and voltage sensors play a critical role in this process.

- Industrial Automation: Voltage sensors are used in a wide range of industrial automation applications, including process control, motor control, and power quality monitoring. As the demand for automation continues to grow, the demand for voltage sensors is expected to increase.

- Consumer Electronics: Voltage sensors are used in a wide range of consumer electronics products, including smartphones, laptops, and tablets. As the demand for these products continues to grow, the demand for voltage sensors is expected to increase.

Industries That Will Be Impacted in The Future by Voltage Sensor

The Voltage Sensor Market is expected to impact several industries in the future, including:

- Automotive: As the demand for electric and hybrid vehicles continues to grow, the automotive industry will be a major consumer of voltage sensors. Voltage sensors are critical components in electric and hybrid vehicles, where they are used to monitor and control battery voltage and charging, as well as to monitor the performance of the power electronics systems.

- Renewable Energy: The renewable energy industry is expected to be a major user of voltage sensors in the coming years. Voltage sensors are used to monitor and control voltage in solar and wind power systems, as well as in other renewable energy applications.

- Industrial Automation: Voltage sensors are used in a wide range of industrial automation applications, including process control, motor control, and power quality monitoring. The growth of the industrial automation industry is expected to drive demand for voltage sensors.

- Smart Grid: The development of smart grid technology is driving demand for voltage sensors that can monitor and control voltage in real-time. Voltage sensors are critical components in smart grid systems, where they are used to improve the efficiency and reliability of power distribution systems.

- Consumer Electronics: Voltage sensors are used in a wide range of consumer electronics products, including smartphones, laptops, and tablets. The continued growth of the consumer electronics industry is expected to drive demand for voltage sensors.

Growth Opportunities and Key Challenges for Voltage Sensor Market in the Future

Growth Opportunities:

- Increasing Demand for Energy-efficient Solutions: The demand for energy-efficient solutions is expected to grow in the coming years, which will drive the demand for voltage sensors. Voltage sensors play a critical role in the development of energy-efficient solutions, such as smart homes and buildings, and the use of renewable energy sources.

- Growing Adoption of Electric and Hybrid Vehicles: The adoption of electric and hybrid vehicles is expected to continue to grow, which will drive the demand for voltage sensors. Voltage sensors are critical components in electric and hybrid vehicles, where they are used to monitor and control battery voltage and charging, as well as to monitor the performance of the power electronics systems.

- Development of Smart Grid Technology: The development of smart grid technology is expected to drive demand for voltage sensors that can monitor and control voltage in real-time. Voltage sensors are critical components in smart grid systems, where they are used to improve the efficiency and reliability of power distribution systems.

- Increasing Deployment of Renewable Energy Sources: The deployment of renewable energy sources is expected to continue to grow, which will drive demand for voltage sensors. Voltage sensors are used to monitor and control voltage in solar and wind power systems, as well as in other renewable energy applications.

Key Challenges:

- Competition: The voltage sensor market is highly competitive, with many established players and new entrants. Competition can lead to pricing pressures and reduced profit margins.

- Technological Advancements: The voltage sensor market is constantly evolving, and new technologies are emerging that can challenge the dominance of existing technologies. Companies that fail to keep up with technological advancements may struggle to remain competitive.

- Reliability and Accuracy: Voltage sensors must be highly reliable and accurate to ensure safe and efficient operation. Any issues with reliability or accuracy can lead to safety concerns and reputational damage for the manufacturer.

- Economic and Political Factors: The voltage sensor market can be impacted by economic and political factors, such as changes in trade policies or fluctuations in currency exchange rates. Companies that operate in multiple regions must be prepared to navigate these challenges.

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides of the current sensor market.

Research Objective

- To define, describe, and forecast the current sensor market, in terms of value, based on loop type, technology, output type, end user, and region

- To forecast the market size, in terms of value, with regard to 4 major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the current sensor market (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide a detailed overview of the value chain of current sensors

- To analyze the impact of COVID-19 on the current sensor market, its segments, and the players operating in the market

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape of the market

- To analyze competitive developments such as product launches and developments, partnerships, acquisitions, expansions, and R&D in the current sensor market

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Critical Questions

- What new application areas are Current sensor providers exploring?

- Who are the key market players, and how intense is the competition?

- Which applications and geographies would be the biggest markets for Current sensor?

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Current Sensor Market