Dairy Alternatives Market by Source (Soy, Almond, Coconut, Oats, Rice, Hemp), Application (Milk, Yogurt, Ice creams, Cheese, Creamers), Distribution Channel (Supermarkets, Health Food Stores, Pharmacies), Formulation and Region - Forecast to 2028

Click Here to get the recent update on Dairy Alternatives Market up to 2028

The dairy alternatives market is expected to grow substantially in the years to come, reaching a market value of $44.8 billion in 2027, up from $27.3 billion in 2022, with a 10.4% CAGR through 2022 to 2027. This growth is being driven by the growing demand for plant-based dairy alternatives, as consumers are becoming more health-conscious and environmentally aware. Dairy alternatives are used in food & beverages that are dairy-free or do not contain lactose. These food products are especially suitable for lactose-intolerant consumers. Globally, the health benefits of dairy alternatives have led to their large-scale adoption in numerous applications. Changing lifestyles, growing health awareness, increasing instances of lactose allergies, and growing application sectors are some factors driving the growth of the market.

The Dairy alternatives market refers to the market for plant-based alternatives to traditional dairy products such as milk, cheese, yogurt, and ice cream. This market has been growing rapidly in recent years, as more consumers are seeking out healthier, plant-based options for their diets. The Dairy Alternatives Market includes a range of products, including almond milk, soy milk, coconut milk, oat milk, and more. These products are typically made from plant-based ingredients and are free from dairy, lactose, and other animal products. The market is expected to continue to grow at a significant rate in the coming years, driven by increasing consumer demand for plant-based products that are healthier, more sustainable, and more ethical than traditional dairy products.

![Dairy Alternatives Market Forecast to 2027 Dairy Alternatives Market Size, Revenue [2022 - 2027]](https://www.marketsandmarkets.com/Images/dairy-alternative-plant-milk-beverages-market13.jpg)

To know about the assumptions considered for the study, Request for Free Sample Report

Dairy Alternatives Market Growth Dynamics

How growth of dairy alternatives closely related to nutritional benefits offered by plant-based dairy alternatives?

The nutritional benefits such as reduced cholesterol levels, improved cardiovascular health, and diabetes control of plant-based dairy alternatives have led to an increase in their consumption. Soy milk is widely consumed as a rich source of omega-3 fatty acids, protein, and fiber. It contains isoflavones that have anti-estrogenic and anticancer properties. Dairy-alternative milks tend to have fewer calories, less fat (except for coconut-based milk), more water content (for better hydration), and some products are fortified with other vitamins and nutrients. The low carb and low-fat varieties of dairy alternatives help reduce fat. Such nutritional benefits contribute to the growth of the dairy alternatives market.

Why is allergy concerns among consumers of soy products a critical restraining factor that is holding back growth of market of dairy alternatives?

Incidences of food allergies and intolerances have been witnessed for centuries. However, in recent years, the prevalence of food allergies has increased and has become a great concern for consumers and food manufacturers. According to the Food Allergy Research & Education Organization (US), soy is among the top eight major food allergens responsible for most of the serious food allergy reactions in the US. Soybeans are rich in nutrient content, such as vitamins, minerals, isoflavones, and proteins; however, anti-nutritional components in soy could cause health issues, such as soy allergy (which could also lead to itching and hives in people). Other symptoms include gas, bloating, and low levels of irritation of the intestinal tissue. These factors are expected to restrain the dairy alternatives market during the forecast period, as soy protein is one of the major sources used to produce dairy alternatives.

What opportunities does changes in lifestyles of consumers open up for companies?

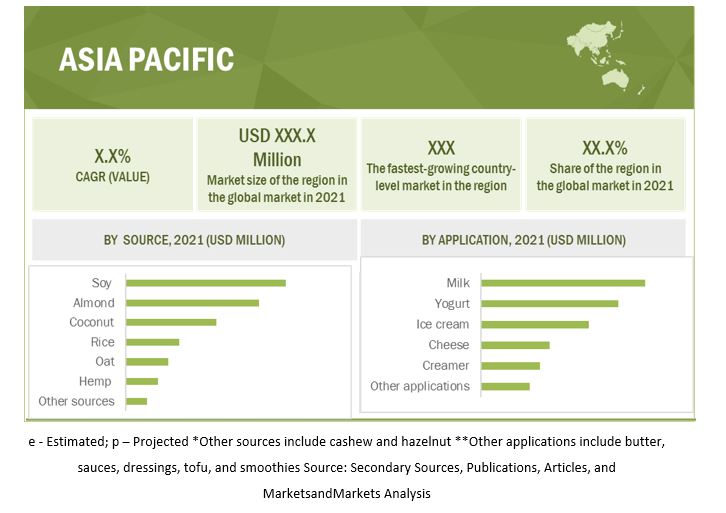

The global population is growing, putting more pressure on scarce resources. High energy prices and rising raw material costs impact food prices, thus affecting low-income consumers. The pressure on the food supply is being exacerbated by a water shortage, particularly across Africa and Northern Asia. Asia Pacific also provides a cost advantage in terms of production and processing. High demand, coupled with the low cost of production, is a key feature that will aid dairy alternatives suppliers and manufacturers target this market.

Due to rapidly changing lifestyles, people have started shifting toward nutritious and healthier versions of food products. Fast food is expected to increasingly become differentiated from junk food as consumers seek quick and easy healthy options. Identifying naturally high nutritional value products could be a key opportunity for suppliers and manufacturers. Apart from these, the growing disposable incomes are also fueling the demand for convenience, healthy, and highly nutritious products in the Asia Pacific countries. Developing economies present significant opportunities for the dairy alternatives market.

How is low awareness among consumers impacting growth of the market?

There is limited awareness about the nutritional benefits of dairy substitutes, which poses a challenge to the growth of the dairy alternatives market. Some dairy consumers feel that the nutritional content in dairy alternatives is lower than cow’s milk and contains lower content of essential nutrients.

Such misconceptions are more prevalent among consumers in underdeveloped and developing countries due to their lack of knowledge about the nutrition provided by dairy alternative products and the lack of efforts put into educating them. However, with the right marketing of plant-based beverages and by educating customers about the health benefits of these products, this challenge can be overcome.

By source, the coconut segment is projected to account for the second-largest market share in the dairy alternatives market during the forecast period

The virgin segment is expected to account for the second-largest market share in the dairy alternatives market. Virgin dairy alternatives is widely used in the baking, confectionery, and beverage industries due to its creamy and tropical flavor. The oil is also widely used in functional foods, cosmetic products, and pharmaceutical products due to its antioxidant properties, which serve to fight against free radicals in the human body. These factors are projected to drive the segment in the global dairy alternatives market during the study period.

By source, the coconut segment is projected to grow at second highest CAGR in the dairy alternatives market during the forecast period

Based on source, the coconut segment is projected to account the largest market share in the dairy alternatives market. The grated white flesh of a ripe coconut is used to make coconut milk. To extract the high-fat coconut cream, the grated meat is first pressed, then soaked in hot water and filtered through cheesecloth in order to strain out the ‘milk”. This milk offers a creamy texture and a rich taste. Coconut milk is highly popular in Asian, South American, and Caribbean countries as an alternative to dairy.

By formulation, flavored products segment is projected to account the largest market share during the forecast period

By formulation, the flavored segment is projected to account the largest market. Recognizing the role of natural, dairy-free dairy flavors in overcoming taste and texture drawbacks in dairy alternatives is important for both improving taste and shortening the commercialization of product launches. Flavors can be added at the beginning of the production process to neutralize an alternative dairy base, mask grassy or beany flavors, and balance astringency or chalkiness.

By application, ice cream segment is projected to grow at second highest CAGR in the dairy alternatives market during the forecast period

Growth in lactose intolerance among people, a rise in health consciousness, and an increase in demand for convenient, healthy, low-calorie products from consumers are the main factors driving the demand for dairy-free desserts. Manufacturers have recognized this opportunity and invested in developing new products to tap the market. Various flavors of dairy-free ice creams are available in the market, such as Neapolitan, cookies and cream, mint choco chip, vanilla, chocolate, butter pecan, strawberry, caramel, and various others.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific’s growth is attributed to the increasing demand for natural products that offer health benefits. The demand for dairy alternatives is increasing in the region due to the changing lifestyles of consumers and preference for dairy-free food & beverage products. Presence of major economies such as China and India is contributing to the growth of the market in the region. Chinese companies mostly export soy protein ingredients to Europe and Southeast Asia. The increasing purchasing power of consumers due to economic development in China has led to rising demand for high-quality dairy substitutes.

Dairy Alternatives Market Key Players:

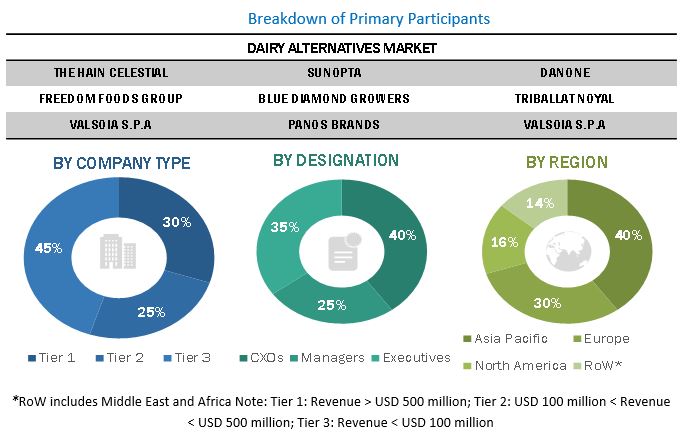

Key players in dairy alternatives market include Danone North America Public Benefit Corporation (US), The Hain Celestial Group, Inc. (US), Blue Diamond Growers (US), SunOpta (Canada), Sanitarium (New Zealand), Freedom Foods Group Limited (Australia), Eden Foods, Inc. (US), Nutriops, S.L. (Spain), Earth’s Own Food Company Inc. (Canada), Triballat Noyal (France), Valsoia S.p.A (Italy), Panos Brands (US), Green Spot Co., Ltd. (Thailand), and Hiland Dairy (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 27.3 billion |

|

Revenue forecast in 2027 |

USD 44.8 billion |

|

Growth rate |

CAGR of 10.4% |

|

Base year for estimation |

2021 |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Key companies profiled |

Danone North America Public Benefit Corporation (US), The Hain Celestial Group, Inc. (US), Blue Diamond Growers (US), SunOpta (Canada), Sanitarium (New Zealand), Freedom Foods Group Limited (Australia), Eden Foods, Inc. (US), Nutriops, S.L. (Spain), Earth’s Own Food Company Inc. (Canada), Triballat Noyal (France), Valsoia S.p.A (Italy), Panos Brands (US), Green Spot Co., Ltd. (Thailand), and Hiland Dairy (US).

|

|

Research Coverage |

This report segments the dairy alternatives market on the basis of source, formulation, application, distribution channel, brand, nutrients, and region. In terms of insights, this research report focuses on various levels of analyses-competitive landscape, pricing insights, end-use analysis, and company profiles-which together comprise and discuss the basic views on the emerging & high-growth segments of the dairy alternatives market, high-growth regions, countries, industry trends, drivers, restraints, opportunities, and challenges |

Target Audience:

- Processed food & beverage manufacturers

- Government and research organizations

- Dairy alternatives distributors

- Marketing directors

- Key executives from various key companies and organizations in dairy alternatives market

Dairy Alternatives Market Report Segmentation

This research report categorizes global dairy alternatives market based on source, formulation, application, distribution channel, brand, nutrients, and region.

|

By Source |

By Formulation |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

|

Dairy Alternatives Market Recent Developments

- In November 2021, Blue Diamond introduced Almond Breeze Extra Creamy Almondmilk. This product is made from almond oil made from quality California grown Blue Diamond almonds to give the product an extra creamy texture.

- In February 2021, SunOpta launched new organic oat creamer brand. These creamers are smooth, creamy and perfect as a delicious dairy alternative for coffee drinkers.

- In March 2020, Danone North America launched new pairings of coconut milk yogurt alternatives. These pairings are dairy-free, nut-free, soy-free, Certified Gluten-Free, Certified Vegan and Non-GMO Project Verified.

Frequently Asked Questions (FAQ):

What is the expected market size for the global Dairy Alternatives Market in the coming years?

The Dairy Alternatives Market is expected to experience significant growth in the coming years, leading to a market value of USD $44.8 billion in 2027, compared to the estimated value of USD $27.3 billion in 2022.

What is the estimated growth rate (CAGR) of the global Dairy Alternatives Market for the next five years?

The global Dairy Alternatives Market is set for significant growth, with a projected surge at a CAGR of 10.4% during 2022-2027.

What are the major revenue pockets in the Dairy Alternatives Market currently?

The Asia Pacific region is witnessing significant growth in the Dairy Alternatives Market, owing to the rising demand for natural products that offer health benefits. The changing lifestyle patterns and increasing preference for dairy-free food and beverage products among consumers in the region are further contributing to this growth. Additionally, the presence of major economies like China and India is bolstering the market growth in the region, with Chinese companies exporting soy protein ingredients to Europe and Southeast Asia.

Which are the major dairy alternatives sources considered in this study and which segments are projected to have promising growth rate in future?

All the major dairy alternatives sources such as soy, almond, rice, coconut, and hemp are considered in this study with other sources such as cashewnut and hazelnut. Soy is currently accounting for dominant share in the dairy alternatives market followed by almond.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION: DAIRY ALTERNATIVES MARKET

1.3.1 GEOGRAPHIC SCOPE

1.3.2 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED FOR THE STUDY, 2018–2021

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 DAIRY ALTERNATIVES MARKET: RESEARCH DESIGN CHART

2.1.1 DAIRY ALTERNATIVES MARKET: SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 DAIRY ALTERNATIVES MARKET: PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 3 EXPERT INSIGHTS

2.1.2.2 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

2.2 DAIRY ALTERNATIVES MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 DAIRY ALTERNATIVES MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 DAIRY ALTERNATIVES MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 8 DAIRY ALTERNATIVES MARKET SNAPSHOT, BY SOURCE, 2022 VS. 2027

FIGURE 9 DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 10 DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD MILLION)

FIGURE 11 EUROPE TO GROW AT THE HIGHEST CAGR (VALUE) IN THE DAIRY ALTERNATIVES MARKET

FIGURE 12 DAIRY ALTERNATIVES MARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN THE DAIRY ALTERNATIVES MARKET

FIGURE 13 RISE IN DEMAND DUE TO INCREASING CASES OF LACTOSE INTOLERANCE

4.2 EUROPE: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL & COUNTRY

FIGURE 14 SUPERMARKETS AND FRANCE ACCOUNTED FOR THE LARGEST RESPECTIVE SHARES IN THE EUROPEAN MARKET IN 2021

4.3 DAIRY ALTERNATIVES MARKET, BY SOURCE

FIGURE 15 SOY-BASED ALTERNATIVES TO DOMINATE THE DAIRY ALTERNATIVES MARKET DURING THE FORECAST PERIOD

4.4 DAIRY ALTERNATIVES MARKET, BY APPLICATION & REGION

FIGURE 16 ASIA PACIFIC TO DOMINATE ACROSS MOST APPLICATIONS DURING THE FORECAST PERIOD

4.5 DAIRY ALTERNATIVES MARKET, BY APPLICATION

FIGURE 17 DAIRY ALTERNATIVES FOR MILK TO DOMINATE THE DAIRY ALTERNATIVES MARKET DURING THE FORECAST PERIOD

4.6 DAIRY ALTERNATIVES MARKET, BY FORMULATION

FIGURE 18 FLAVORED DAIRY ALTERNATIVES TO DOMINATE THE DAIRY ALTERNATIVES MARKET DURING THE FORECAST PERIOD

4.7 DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL

FIGURE 19 SUPERMARKETS TO DOMINATE THE DISTRIBUTION DURING THE FORECAST PERIOD

5 DAIRY ALTERNATIVES MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DAIRY ALTERNATIVES MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growth in consumer preference for a vegan diet

FIGURE 21 UK: FASTEST-GROWING TAKEAWAY CUISINES, 2016–2019

5.2.1.2 Nutritional benefits offered by plant-based dairy alternatives

5.2.1.3 Increase in cases of lactose intolerance and milk allergies

TABLE 2 LACTOSE CONTENT IN DAIRY FOOD PRODUCTS

5.2.2 RESTRAINTS

5.2.2.1 Volatile prices of raw materials

5.2.2.2 Allergy concerns among consumers of soy products

5.2.3 OPPORTUNITIES

5.2.3.1 Growth in demand in emerging markets

5.2.3.2 Favorable marketing and correct positioning of dairy alternatives

5.2.3.3 Changes in lifestyles of consumers

5.2.4 CHALLENGES

5.2.4.1 Limited availability of raw materials

5.2.4.2 Low awareness among consumers

6 DAIRY ALTERNATIVES MARKET: INDUSTRY TRENDS (Page No. - 56)

6.1 OVERVIEW

6.2 TARIFF AND REGULATORY LANDSCAPE

6.2.1 CODEX ALIMENTARIUS COMMISSION

6.2.2 FOOD AND DRUG ADMINISTRATION (FDA)

6.2.3 THE SOYFOODS ASSOCIATION OF AMERICA

6.2.3.1 Classification of Soymilk

TABLE 3 SOYMILK COMPOSITION

6.2.4 FOOD STANDARDS AUSTRALIA NEW ZEALAND (FSANZ)

TABLE 4 SOME OF THE MANDATORY ADVISORY STATEMENTS GIVEN BY FSANZ

6.2.5 EUROPEAN COURT OF JUSTICE

TABLE 5 LIST OF KEY REGULATORY BODIES FOR DAIRY ALTERNATIVES MARKET

6.3 PATENT ANALYSIS

FIGURE 22 NO OF PATENTS GRANTED FOR DAIRY ALTERNATIVES MARKET, 2011–2021

FIGURE 23 DAIRY ALTERNATIVES MARKET: PATENT ANALYSIS, BY JURISDICTION, 2017–2021

TABLE 6 RECENT PATENTS GRANTED WITH RESPECT TO DAIRY ALTERNATIVES

6.4 DAIRY ALTERNATIVES MARKET: VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS

6.5 TREND/DISRUPTION IMPACTING BUYERS IN THE MARKET

FIGURE 25 REVENUE SHIFT FOR THE DAIRY ALTERNATIVES MARKET

6.6 DAIRY ALTERNATIVES MARKET: MARKET ECOSYSTEM

6.6.1 DAIRY ALTERNATIVES: ECOSYSTEM VIEW

TABLE 7 DAIRY ALTERNATIVES MARKET: ECOSYSTEM

FIGURE 26 MARKET MAP

6.7 TECHNOLOGY ANALYSIS

6.7.1 WET PROCESSING METHOD FOR PRODUCING DAIRY ALTERNATIVE MILK

6.7.2 DRY PROCESSING METHOD FOR PRODUCING DAIRY ALTERNATIVE MILK

6.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 PORTER’S FIVE FORCES ANALYSIS

6.8.1 INTENSITY OF COMPETITIVE RIVALRY

6.8.2 BARGAINING POWER OF SUPPLIERS

6.8.3 BARGAINING POWER OF BUYERS

6.8.4 THREAT FROM SUBSTITUTES

6.8.5 THREAT OF NEW ENTRANTS

6.9 CASE STUDY ANALYSIS

6.9.1 USE CASE 1: LAUNCH OF DIARY-LIKE SEGMENT BY INTRODUCING SILK NEXTMILK AND SO DELICIOUS WONDERMILK

6.9.2 USE CASE 1: BLUE DIAMOND GROWERS PARTNERED WITH GROUP LALA TO ESTABLISH A NETWORK IN MEXICO

6.10 KEY MARKETS FOR IMPORT/EXPORT

6.10.1 ALMONDS

TABLE 9 TOP TEN IMPORTERS AND EXPORTERS OF ALMONDS, 2020 (KT)

6.10.2 SOYBEANS

TABLE 10 TOP TEN IMPORTERS AND EXPORTERS OF SOYBEANS, 2020 (KT)

6.10.3 OATS

TABLE 11 TOP TEN IMPORTERS AND EXPORTERS OF OATS, 2020 (KT)

6.10.4 RICE

TABLE 12 TOP TEN IMPORTERS AND EXPORTERS OF RICE, 2020 (KT)

6.10.5 COCONUT

TABLE 13 TOP TEN IMPORTERS AND EXPORTERS OF COCONUT, 2019 (KT)

6.10.6 HEMP

TABLE 14 TOP TEN IMPORTERS AND EXPORTERS OF HEMP, 2020 (KT)

6.11 PRICING ANALYSIS: DAIRY ALTERNATIVES MARKET

TABLE 15 GLOBAL DAIRY ALTERNATIVES AVERAGE SELLING PRICE (ASP), BY APPLICATION, (USD/LITER)

FIGURE 27 GLOBAL AVERAGE PRICE OF RAW MATERIALS, 2015–2019 (USD/KG)

6.12 KEY CONFERENCES & EVENTS

TABLE 16 DAIRY ALTERNATIVES MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

6.13 KEY STAKEHOLDERS & BUYING CRITERIA

6.13.1 KEY STAKEHOLDERS IN THE BUYING PROCESS

TABLE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 MODES OF APPLICATIONS

6.13.2 BUYING CRITERIA

FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 18 KEY BUYING CRITERIA FOR THE TOP 3 SOURCES

7 DAIRY ALTERNATIVES MARKET, BY SOURCE (Page No. - 75)

7.1 INTRODUCTION

FIGURE 29 DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

TABLE 19 DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 20 DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

7.2 SOY

7.2.1 EASY AVAILABILITY AND ACCEPTABILITY OF SOY-BASED PRODUCTS

TABLE 21 SOY-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 22 SOY-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 ALMOND

7.3.1 RISE IN DEMAND AND AVAILABILITY OF BLENDED FORMS OF ALMOND-BASED PRODUCTS

TABLE 23 ALMOND-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 24 ALMOND-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 COCONUT

7.4.1 PROMISE OF PROPERTIES OF HIGH PALATABILITY AND NUTRITION OF COCONUT

TABLE 25 COCONUT-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 26 COCONUT-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 RICE

7.5.1 LOW RISK OF ALLERGIES AND COMPARATIVELY LIGHTER AND BLAND TASTE OF RICE-DERIVED PRODUCTS

TABLE 27 RICE-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 28 RICE-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 OATS

7.6.1 RICH NUTRITIONAL CONTENT OF OAT-DERIVED DAIRY ALTERNATIVES

TABLE 29 OAT-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 30 OAT-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 HEMP

7.7.1 RISE IN AWARENESS OF HEALTH BENEFITS OF HEMP-BASED DAIRY ALTERNATIVES AMONG CONSUMERS

TABLE 31 HEMP-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 32 HEMP-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.8 OTHER SOURCES

TABLE 33 NUTRITIONAL COMPARISON OF KEY COMMERCIALLY AVAILABLE PLANT-BASED MILK ALTERNATIVES

TABLE 34 FUNCTIONAL COMPONENTS OF PLANT-BASED MILK ALTERNATIVES AND THEIR HEALTH BENEFITS

TABLE 35 OTHER DAIRY ALTERNATIVES SOURCES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 OTHER DAIRY ALTERNATIVES SOURCES MARKET, BY REGION, 2022–2027 (USD MILLION)

8 DAIRY ALTERNATIVES MARKET, BY FORMULATION (Page No. - 93)

8.1 INTRODUCTION

FIGURE 30 DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2022 VS. 2027 (USD MILLION)

TABLE 37 DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2016–2021 (USD MILLION)

TABLE 38 DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2022–2027 (USD MILLION)

8.2 FLAVORED

8.2.1 GROWTH IN DEMAND FOR PALATABLE BUT HEALTHIER OPTIONS

TABLE 39 FLAVORED DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 FLAVORED DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 PLAIN

8.3.1 CONSUMPTION OF PLAIN SOY AND ALMOND PRODUCTS BY VEGAN AND LACTOSE-INTOLERANT POPULATION

TABLE 41 PLAIN DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 42 PLAIN DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

9 DAIRY ALTERNATIVES MARKET, BY APPLICATION (Page No. - 99)

9.1 INTRODUCTION

FIGURE 31 DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 43 DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 44 DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 MILK

9.2.1 RISE IN AWARENESS ABOUT HEALTH BENEFITS OF MILK ALTERNATIVES

TABLE 45 MILK ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 MILK ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 ICE CREAM

9.3.1 RISE IN DEMAND FOR CHOLESTEROL- AND FAT-FREE DESSERTS

TABLE 47 DAIRY ICE CREAM ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 48 DAIRY ICE CREAM ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 YOGURT

9.4.1 DEMAND FOR DAIRY-FREE AND FORTIFIED YOGURT

TABLE 49 DAIRY YOGURT ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 50 DAIRY YOGURT ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 CHEESE

9.5.1 DEMAND FOR DAIRY-FREE SPREADABLE AND NON-SPREADABLE CHEESE FROM LACTOSE-INTOLERANT CONSUMERS

TABLE 51 DAIRY CHEESE ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 DAIRY CHEESE ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 CREAMERS

9.6.1 LEADING MANUFACTURERS INVEST IN R&D TO MEET THE GROWING DEMAND FOR DAIRY-FREE CREAMERS

TABLE 53 DAIRY CREAMER ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 54 DAIRY CREAMER ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 OTHER APPLICATIONS

TABLE 55 OTHER APPLICATIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 56 OTHER APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

10 DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL (Page No. - 108)

10.1 INTRODUCTION

FIGURE 32 DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD MILLION)

TABLE 57 DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 58 DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

10.2 SUPERMARKETS

10.2.1 SUPERMARKETS ARE MOST PREFERRED DUE TO THE MULTIPLE OPTIONS OFFERED TO CONSUMERS

TABLE 59 SUPERMARKET DISTRIBUTION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 60 SUPERMARKET DISTRIBUTION MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 HEALTH FOOD STORES

10.3.1 HEALTH BENEFITS OF DAIRY ALTERNATIVE PRODUCTS INCREASE SALES THROUGH HEALTH FOOD STORES

TABLE 61 HEALTH FOOD STORE DISTRIBUTION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 62 HEALTH FOOD STORE DISTRIBUTION MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 PHARMACIES

10.4.1 RISE IN HEALTH ISSUES AND PRESCRIPTIONS FOR ALLERGIES INCREASE SALES THROUGH PHARMACIES

TABLE 63 PHARMACY DISTRIBUTION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 64 PHARMACY DISTRIBUTION MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 CONVENIENCE STORES

10.5.1 EASY ACCESS AND CONVENIENCE LEAD TO A RISE IN SALES THROUGH CONVENIENCE STORES

TABLE 65 CONVENIENCE STORE DISTRIBUTION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 66 CONVENIENCE STORE DISTRIBUTION MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 ONLINE STORES

10.6.1 SALES THROUGH ONLINE STORES OFFER FASTER ACCESSIBILITY AND COST-EFFECTIVENESS

TABLE 67 ONLINE STORE DISTRIBUTION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 68 ONLINE STORE DISTRIBUTION MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 OTHER DISTRIBUTION CHANNELS

TABLE 69 OTHER DISTRIBUTION CHANNELS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 70 OTHER DISTRIBUTION CHANNELS MARKET, BY REGION, 2022–2027 (USD MILLION)

11 DAIRY ALTERNATIVES MARKET, BY BRAND (Page No. - 117)

11.1 INTRODUCTION

11.2 SILK

11.3 DREAM

11.4 ALMOND BREEZE

11.5 SUNRICH

11.6 SO GOOD

11.7 SO DELICIOUS

11.8 AUSTRALIA’S OWN ORGANIC

11.9 ECOMIL

11.1 ALPRO

11.11 EDENSOY

12 DAIRY ALTERNATIVES MARKET, BY NUTRIENT (Page No. - 120)

12.1 INTRODUCTION

TABLE 71 NUTRIENT CONTENT IN DAIRY ALTERNATIVES

12.2 PROTEIN

12.3 STARCH

12.4 VITAMINS

12.5 OTHER NUTRIENTS

13 DAIRY ALTERNATIVES MARKET, BY REGION (Page No. - 122)

13.1 INTRODUCTION

FIGURE 33 FRANCE TO RECORD THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 72 DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 73 DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 74 DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (MILLION LITERS)

TABLE 75 DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (MILLION LITERS)

13.2 NORTH AMERICA

TABLE 76 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: DAIRY ALTERNATIVE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: DAIRY ALTERNATIVE MARKET, BY COUNTRY, 2016–2021 (MILLION LITERS)

TABLE 79 NORTH AMERICA: DAIRY ALTERNATIVE MARKET, BY COUNTRY, 2022–2027 (MILLION LITERS)

TABLE 80 NORTH AMERICA: DAIRY ALTERNATIVE MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 81 NORTH AMERICA: DAIRY ALTERNATIVE MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: SOY-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 83 NORTH AMERICA: SOY-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: ALMOND-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: ALMOND-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: COCONUT-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: COCONUT-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: RICE-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: RICE-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: OAT-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: OAT-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: HEMP-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 93 NORTH AMERICA: HEMP-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: OTHER DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: OTHER DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 96 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2016–2021 (USD MILLION)

TABLE 97 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2022–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 99 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 100 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 101 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

13.2.1 US

13.2.1.1 Presence of big players in the US dairy alternative market

TABLE 102 US: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 103 US: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.2.2 CANADA

13.2.2.1 Rise in demand for protein-rich dairy substitutes in Canada

TABLE 104 CANADA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 105 CANADA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.2.3 MEXICO

13.2.3.1 Rise in urbanization and demand for fortified dairy-free products in Mexico

TABLE 106 MEXICO: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 107 MEXICO: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.3 EUROPE

FIGURE 34 EUROPE: DAIRY ALTERNATIVE MARKET SNAPSHOT

TABLE 108 EUROPE: DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 109 EUROPE: DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 110 EUROPE: DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (MILLION LITERS)

TABLE 111 EUROPE: DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (MILLION LITERS)

TABLE 112 EUROPE: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 113 EUROPE: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 114 EUROPE: SOY-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 115 EUROPE: SOY-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 116 EUROPE: ALMOND-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 117 EUROPE: ALMOND-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 118 EUROPE: COCONUT-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 119 EUROPE: COCONUT-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 120 EUROPE: RICE-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 121 EUROPE: RICE-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 122 EUROPE: OAT-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 123 EUROPE: OAT-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 124 EUROPE: HEMP-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 125 EUROPE: HEMP-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 126 EUROPE: OTHER DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 127 EUROPE: OTHER DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 128 EUROPE: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2016–2021 (USD MILLION)

TABLE 129 EUROPE: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2022–2027 (USD MILLION)

TABLE 130 EUROPE: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 131 EUROPE: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 132 EUROPE: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 133 EUROPE: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

13.3.1 GERMANY

13.3.1.1 Growth of the plant-based and dairy alternatives industry in Germany

TABLE 134 GERMANY: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 135 GERMANY: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.3.2 UK

13.3.2.1 Consumer inclination toward healthy products is on the rise in the UK

TABLE 136 UK: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 137 UK: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.3.3 FRANCE

13.3.3.1 Increase in consumption of soy-based products in France

TABLE 138 FRANCE: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 139 FRANCE: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.3.4 ITALY

13.3.4.1 Large-scale consumption of cheese in the Italian cuisine

TABLE 140 ITALY: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 141 ITALY: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.3.5 SPAIN

13.3.5.1 Decline in meat consumption in Spain

TABLE 142 SPAIN: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 143 SPAIN: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.3.6 REST OF EUROPE

TABLE 144 REST OF EUROPE: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 145 REST OF EUROPE: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.4 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET SNAPSHOT

TABLE 146 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY COUNTRY/REGION, 2016–2021 (USD MILLION)

TABLE 147 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 148 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY COUNTRY/REGION, 2016–2021 (MILLION LITERS)

TABLE 149 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY COUNTRY/REGION, 2022–2027 (MILLION LITERS)

TABLE 150 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 151 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 152 ASIA PACIFIC: SOY-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY/REGION, 2016–2021 (USD MILLION)

TABLE 153 ASIA PACIFIC: SOY-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 154 ASIA PACIFIC: ALMOND-DERIVED DAIRY ALTERNATIVES MARKET SIZE, BY COUNTRY/REGION, 2016–2021 (USD MILLION)

TABLE 155 ASIA PACIFIC: ALMOND-DERIVED DAIRY ALTERNATIVES MARKET SIZE, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 156 ASIA PACIFIC: COCONUT-DERIVED DAIRY ALTERNATIVES MARKET SIZE, BY COUNTRY/REGION, 2016–2021 (USD MILLION)

TABLE 157 ASIA PACIFIC: COCONUT-DERIVED DAIRY ALTERNATIVES MARKET SIZE, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 158 ASIA PACIFIC: RICE-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY/REGION, 2016–2021 (USD MILLION)

TABLE 159 ASIA PACIFIC: RICE-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 160 ASIA PACIFIC: OAT-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY/REGION, 2016–2021 (USD MILLION)

TABLE 161 ASIA PACIFIC: OAT-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 162 ASIA PACIFIC: HEMP-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY/REGION, 2016–2021 (USD MILLION)

TABLE 163 ASIA PACIFIC: HEMP-DERIVED DAIRY ALTERNATIVES MARKET SIZE, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 164 ASIA PACIFIC: OTHER DAIRY ALTERNATIVES MARKET, BY COUNTRY/REGION, 2016–2021 (USD MILLION)

TABLE 165 ASIA PACIFIC: OTHER DAIRY ALTERNATIVES MARKET, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 166 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2016–2021 (USD MILLION)

TABLE 167 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2022–2027 (USD MILLION)

TABLE 168 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 169 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 170 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 171 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

13.4.1 CHINA

13.4.1.1 Applications of soy-derived dairy alternatives in various Chinese cuisines

TABLE 172 CHINA: DAIRY ALTERNATIVES, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 173 CHINA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.4.2 JAPAN

13.4.2.1 Rise in demand for high-protein healthy products in Japan

TABLE 174 JAPAN: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 175 JAPAN: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.4.3 INDIA

13.4.3.1 Growth in demand for dairy-free substitutes in traditional sweets in India

TABLE 176 INDIA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 177 INDIA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.4.4 AUSTRALIA & NEW ZEALAND

13.4.4.1 Rise in trend related to nutritional products in Australia & New Zealand

TABLE 178 AUSTRALIA & NEW ZEALAND: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 179 AUSTRALIA & NEW ZEALAND: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.4.5 REST OF ASIA PACIFIC

TABLE 180 REST OF ASIA PACIFIC: DAIRY ALTERNATIVE MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 181 REST OF ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.5 SOUTH AMERICA

TABLE 182 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 183 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 184 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (MILLION LITERS)

TABLE 185 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (MILLION LITERS)

TABLE 186 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 187 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 188 SOUTH AMERICA: SOY-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 189 SOUTH AMERICA: SOY-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 190 SOUTH AMERICA: ALMOND-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 191 SOUTH AMERICA: ALMOND-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 192 SOUTH AMERICA: COCONUT-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 193 SOUTH AMERICA: COCONUT-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 194 SOUTH AMERICA: RICE-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 195 SOUTH AMERICA: RICE-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 196 SOUTH AMERICA: OAT-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 197 SOUTH AMERICA: OAT-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 198 SOUTH AMERICA: HEMP-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 199 SOUTH AMERICA: HEMP-DERIVED DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 200 SOUTH AMERICA: OTHER DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 201 SOUTH AMERICA: OTHER DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 202 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2016–2021 (USD MILLION)

TABLE 203 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2022–2027 (USD MILLION)

TABLE 204 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 205 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 206 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 207 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

13.5.1 BRAZIL

13.5.1.1 Demand for clean labels and rise in soy production in Brazil

TABLE 208 BRAZIL: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 209 BRAZIL: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.5.2 ARGENTINA

13.5.2.1 Large local soybean production and demand for clean label products in Argentina

TABLE 210 ARGENTINA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 211 ARGENTINA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.5.3 REST OF SOUTH AMERICA

TABLE 212 REST OF SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 213 REST OF SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.6 REST OF THE WORLD (ROW)

TABLE 214 ROW: DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 215 ROW: DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 216 ROW: DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (MILLION LITERS)

TABLE 217 ROW: DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (MILLION LITERS)

TABLE 218 ROW: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 219 ROW: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 220 ROW: SOY-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 221 ROW: SOY-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 222 ROW: ALMOND-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 223 ROW: ALMOND-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 224 ROW: COCONUT-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 225 ROW: COCONUT-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 226 ROW: RICE-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 227 ROW: RICE-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 228 ROW: OAT-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 229 ROW: OAT-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 230 ROW: HEMP-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 231 ROW: HEMP-DERIVED DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 232 ROW: OTHER DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 233 ROW: OTHER DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 234 ROW: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2016–2021 (USD MILLION)

TABLE 235 ROW: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2022–2027 (USD MILLION)

TABLE 236 ROW: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 237 ROW: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 238 ROW: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2016–2021 (USD MILLION)

TABLE 239 ROW: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

13.6.1 MIDDLE EAST

13.6.1.1 High spending power and presence of health-conscious consumers in the Middle East

TABLE 240 MIDDLE EAST: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 241 MIDDLE EAST: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13.6.2 AFRICA

13.6.2.1 Rise in urbanization and growth of the retail chain to increase demand for dairy alternatives in Africa

TABLE 242 AFRICA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 243 AFRICA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 197)

14.1 OVERVIEW

14.2 MARKET SHARE ANALYSIS

TABLE 244 DAIRY ALTERNATIVES MARKET: DEGREE OF COMPETITION

14.3 KEY PLAYER STRATEGIES

14.4 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 36 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2019–2021 (USD BILLION)

14.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

14.5.1 STARS

14.5.2 EMERGING LEADERS

14.5.3 PERVASIVE PLAYERS

14.5.4 PARTICIPANTS

FIGURE 37 DAIRY ALTERNATIVES MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

14.6 PRODUCT FOOTPRINT

TABLE 245 COMPANY FORMULATION FOOTPRINT

TABLE 246 COMPANY SOURCE FOOTPRINT

TABLE 247 COMPANY APPLICATION FOOTPRINT

TABLE 248 COMPANY REGIONAL FOOTPRINT

TABLE 249 COMPANY OVERALL FOOTPRINT

14.7 STARTUP/SME EVALUATION QUADRANT (OTHER PLAYERS)

14.7.1 PROGRESSIVE COMPANIES

14.7.2 STARTING BLOCKS

14.7.3 RESPONSIVE COMPANIES

14.7.4 DYNAMIC COMPANIES

TABLE 250 DAIRY ALTERNATIVES: DETAILED LIST OF KEY STARTUP/SMES

14.8 COMPETITIVE BENCHMARKING

TABLE 251 DAIRY ALTERNATIVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES FOR SOURCE AND APPLICATION

TABLE 252 DAIRY ALTERNATIVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES FOR FORMULATION AND REGION

FIGURE 38 DAIRY ALTERNATIVES MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUP/SMES)

14.9 COMPETITIVE SCENARIO

14.9.1 NEW PRODUCT LAUNCHES

TABLE 253 DAIRY ALTERNATIVES MARKET: NEW PRODUCT LAUNCHES, JANUARY 2019–NOVEMBER 2021

14.9.2 DEALS

TABLE 254 DAIRY ALTERNATIVES MARKET: DEALS, JUNE 2018–OCTOBER 2021

14.9.3 OTHERS

TABLE 255 DAIRY ALTERNATIVES MARKET: OTHERS, AUGUST 2021

15 COMPANY PROFILES (Page No. - 214)

(Business overview, Products offered, Recent developments, SWOT analysis & MnM View)*

15.1 KEY PLAYERS

15.1.1 DANONE NORTH AMERICA PUBLIC BENEFIT CORPORATION

TABLE 256 DANONE NORTH AMERICA PUBLIC BENEFIT CORPORATION: BUSINESS OVERVIEW

FIGURE 39 DANONE NORTH AMERICA PUBLIC BENEFIT CORPORATION: COMPANY SNAPSHOT

TABLE 257 DANONE NORTH AMERICA PUBLIC BENEFIT CORPORATION: NEW PRODUCT LAUNCHES

15.1.2 THE HAIN CELESTIAL GROUP, INC.

TABLE 258 THE HAIN CELESTIAL GROUP, INC.: BUSINESS OVERVIEW

FIGURE 40 THE HAIN CELESTIAL GROUP, INC.: COMPANY SNAPSHOT

15.1.3 BLUE DIAMOND GROWERS

TABLE 259 BLUE DIAMOND GROWERS: BUSINESS OVERVIEW

FIGURE 41 BLUE DIAMOND GROWERS: COMPANY SNAPSHOT

TABLE 260 BLUE DIAMOND GROWERS: NEW PRODUCT LAUNCHES

15.1.4 SUNOPTA

TABLE 261 SUNOPTA: BUSINESS OVERVIEW

FIGURE 42 SUNOPTA: COMPANY SNAPSHOT

TABLE 262 DAIRY ALTERNATIVES MARKET: DEALS

TABLE 263 DAIRY ALTERNATIVES MARKET: NEW PRODUCT LAUNCHES

TABLE 264 DAIRY ALTERNATIVES MARKET: EXPANSIONS

15.1.5 FREEDOM FOODS GROUP LIMITED

TABLE 265 FREEDOM FOODS GROUP LIMITED: BUSINESS OVERVIEW

FIGURE 43 FREEDOM FOODS GROUP LIMITED: COMPANY SNAPSHOT

15.1.6 SANITARIUM

TABLE 266 SANITARIUM: BUSINESS OVERVIEW

15.1.7 EDEN FOODS, INC.

TABLE 267 EDEN FOODS, INC.: BUSINESS OVERVIEW

15.1.8 NUTRIOPS, S.L.

TABLE 268 NUTRIOPS, S.L.: BUSINESS OVERVIEW

15.1.9 EARTH’S OWN FOOD COMPANY INC.

TABLE 269 EARTH’S OWN FOOD COMPANY INC: BUSINESS OVERVIEW

TABLE 270 EARTH’S OWN FOOD COMPANY INC: NEW PRODUCT LAUNCHES

15.1.10 TRIBALLAT NOYAL

TABLE 271 TRIBALLAT NOYAL: BUSINESS OVERVIEW

15.1.11 VALSOIA S.P.A.

TABLE 272 VALSOIA SPA.: BUSINESS OVERVIEW

FIGURE 44 VALSOIA SPA: COMPANY SNAPSHOT

15.1.12 PANOS BRANDS

TABLE 273 PANOS BRANDS: BUSINESS OVERVIEW

TABLE 274 PANOS BRANDS: NEW PRODUCT LAUNCHES

15.1.13 GREEN SPOT CO., LTD.

TABLE 275 GREEN SPOT CO., LTD.: BUSINESS OVERVIEW

15.1.14 HILAND DAIRY

TABLE 276 HILAND DAIRY: BUSINESS OVERVIEW

15.2 STARTUPS/SMES/OTHER PLAYERS

15.2.1 RIPPLE FOODS

TABLE 277 RIPPLE FOODS: BUSINESS OVERVIEW

TABLE 278 RIPPLE FOODS: NEW PRODUCT LAUNCHES

15.2.2 KITE HILL

TABLE 279 KITE HILL: BUSINESS OVERVIEW

TABLE 280 KITE HILL: NEW PRODUCT LAUNCHES

15.2.3 WAYFARE

TABLE 281 WAYFARE: BUSINESS OVERVIEW

15.2.4 CALIFIA FARMS

TABLE 282 CALIFIA FARMS: BUSINESS OVERVIEW

TABLE 283 CALIFIA FARMS: NEW PRODUCT LAUNCHES

15.2.5 DAIYA FOODS INC.

TABLE 284 DAIYA FOODS INC.: BUSINESS OVERVIEW

15.2.6 PUREHARVEST

TABLE 285 PUREHARVEST: COMPANY OVERVIEW

15.2.7 ONE GOOD

TABLE 286 ONE GOOD: COMPANY OVERVIEW

15.2.8 VLY

TABLE 287 VLY: COMPANY OVERVIEW

15.2.9 MIYOKO’S CREAMERY

TABLE 288 MIYOKO’S CREAMERY: COMPANY OVERVIEW

15.2.10 OATLY INC.

TABLE 289 OATLY INC.: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

16 DAIRY ALTERNATIVES MARKET ADJACENT AND RELATED MARKETS (Page No. - 257)

16.1 INTRODUCTION

TABLE 290 ADJACENT MARKETS TO DAIRY ALTERNATIVES

16.2 LIMITATIONS

16.3 PLANT-BASED PROTEIN MARKET

16.3.1 MARKET DEFINITION

16.3.2 MARKET OVERVIEW

FIGURE 45 PLANT-BASED PROTEIN MARKET, 2017–2025 (USD MILLION)

TABLE 291 PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

16.4 ALMOND INGREDIENTS MARKET

16.4.1 MARKET DEFINITION

16.4.2 MARKET OVERVIEW

FIGURE 46 ALMOND INGREDIENTS MARKET, 2017–2025 (USD MILLION)

TABLE 292 ALMOND INGREDIENTS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

17 APPENDIX (Page No. - 261)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

The study involved four major activities in estimating dairy alternatives market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Dairy Alternatives Market Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Dairy Alternatives Market Primary Research

The market comprises several stakeholders in the supply chain, including food & beverage manufacturers, growers and suppliers, importers and exporters, and intermediary suppliers such as traders and distributors of dairy alternatives products. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include dairy alternatives manufacturers, exporters, and importers. The primary sources from the demand-side include reatilers, wholesellers, health food stores, and other distribution partners.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of dairy alternative market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of dairy alternative market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Dairy Alternatives Market Report Objectives

- To describe and forecast dairy alternatives market, in terms of source, formulation, application, distribution channel, and region

- To describe and forecast dairy alternatives market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the dairy alternatives market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of dairy alternatives market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of dairy alternatives market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in dairy alternative market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific dairy alternatives market, by key country

- Further breakdown of the Rest of European dairy alternative market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dairy Alternatives Market