Decision Intelligence Market (Platforms, Solutions (Integrated & Standalone), and Services), Deployment Type (Cloud, On-premises), Organization Size, Vertical (BFSI, Healthcare & Life Sciences, and Retail & eCommerce) and Region - Global Forecast to 2027

Updated on : May 3, 2023

Decision Intelligence Market Overview

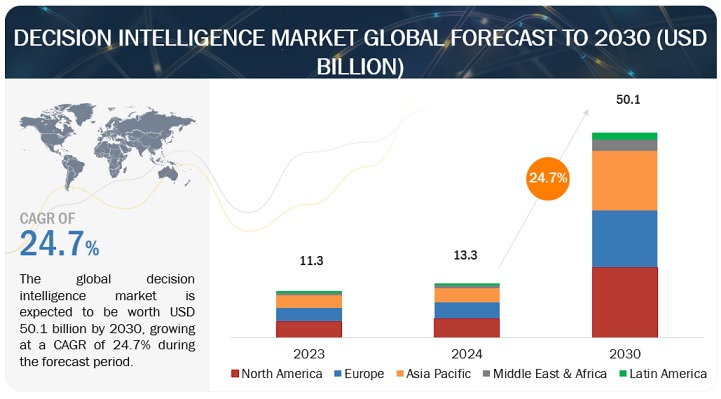

The global decision intelligence market size was valued at $10.0 billion in 2022 and is predicted to reach $22.7 billion by 2027, increasing at a CAGR of 17.8% from 2022 to 2027. Due to its efficacy, decision intelligence is becoming more and more popular among enterprises. Businesses that apply it can enhance organizational performance while giving customers a greater experience. It is an accurate and economical method for enhancing decision-making. The decision intelligence market is segmented based on components, deployment modes, organization sizes, verticals, and regions.

To know about the assumptions considered for the study, Request for Free Sample Report

Decision Intelligence Market Dynamics

Driver: Advent of ML and AI helping various industries to maximize the potential of decision intelligence

Decision intelligence is emerging as a solution that may combine decision support, decision management, and complex systems applications in response to the urgent need to digitize and benefit from new technologies such as AI and ML. AI and ML both support decision intelligence by improving forecasting and predictive ability. Decision intelligence is used by organizations to help automate and accelerate decision-making processes across a wide range of use cases and industries. Decision intelligence fills the gap between data and better decision making for organizations struggling to survive in a sea of data. Decision intelligence may help industries such as financial services, healthcare, and supply chain make the most of their data and maximize the potential of AI. These industries currently have a pressing need for accurate decision-making. The introduction and implementation of ML and AI have helped providers in understanding customer perceptions by analyzing the data collected from multiple sources. Enterprises have shifted their focus to deliver a unified customer experience across all channels and provide offers in real-time by analyzing customer buying patterns.

Restraint: Information overload and dependence on Decision Support Systems

Sometimes an automated decision-making system might lead to information overload. Since it examines every facet of a problem, a user is left unsure of what to consider and what to disregard. Not all information is required for decision-making. However, when it's there, a decision-maker finds it challenging to disregard information that isn't important. It is accurate to say that decision support systems (DSS) are incorporated into enterprises to facilitate and speed up routine decisions. Some decision-makers have a propensity to rely too heavily on automated decision-making and refuse to use their own judgement. There is undoubtedly a change in emphasis, and decision-makers may not be able to further develop their skills due to an overwhelming reliance on DSS.

Opportunity: Surge in the developments of big data technology for actionable business intelligence

Decision intelligence is a rapidly developing field of artificial intelligence and data science, many decisions intelligence-related software tasks have been successfully solved and integrated that are used on the internet, such as morphological and syntactic analysis. Decision intelligence and Big Data analytics can work together and form powerful systems for handling big data at massive scales to discover knowledge, perform text analysis and opinion mining, and facilitate decision-making for business and management.

Decision intelligence for big data can be leveraged to automatically find relevant information and summarize the content of documents in large volumes of information for collective insight. Users are no longer limited by having to choose or know the “right” keywords to retrieve what they are looking for but can interact with the content through search using queries in their own words. It helps faster access to information, speeds up all downstream processes that depend on timely information, and enables its use for real-time, actionable business intelligence. Thus, decision intelligence for big data presents an opportunity to take advantage of what is contained in large and growing stores of content to reveal patterns, connections, and trends across different sources of data. Moreover, decision intelligence is seen as the next big buzz in data analytics that can harness big data to derive information using innovative methods to produce useful insights on existing or projected market trends.

Challenge: Security of data and concerns on privacy to hinder the widespread adoption of Decision Intelligence

The backbone of Decision Intelligence solutions, data, remains a critically important aspect that most organizations find difficult to manage. The inefficiency of managing exabytes and petabytes of data has increased the chances of security breaches and data losses. In today’s competitive marketplace, marketing teams require real-time and secure data to deliver an outstanding customer experience. Organizations are gathering data through multiple touchpoints and measure them virtually. Such data is used in support and communication and may include a variety of data types. These data types comprise public information, big data, and small data collected from customers.

This data can include permissions, individual preferences, and updated contact information on products, services, and communication platforms. Hence, vendors need to ensure high-level data security to maintain customer trust. Recently, cybercriminals have gained access to widespread tools to obtain anything from passwords to secret questions and token-generated passwords. In such situations, marketing and IT teams need to work concurrently, providing each other with insights on when and how the data is gathered, processed, and used in operations.

Such potent cyber-attacks continue to hinder the widespread adoption of Decision Intelligence across data-intensive industrial sectors. However, this scenario is expected to gradually change throughout the forecast period as the benefits of technology adoption continue to outweigh the risks associated and with overall developments on the data security front.

Healthcare and Life Sciences vertical to register at the highest CAGR during the forecast period

The decision intelligence market by vertical is segmented into: BFSI, telecom, healthcare and life sciences, retail and e-commerce, government and defense, manufacturing, IT and ITeS, energy and utilities, transportation and logistics, and others (media and entertainment, travel and hospitality, and education and research). Among vertical, the healthcare & life sciences vertical registered to grow at a highest CAGR during the forecast period. The Decision Intelligence market is witnessing increased growth opportunities in the healthcare and life sciences vertical. AI has captivated the healthcare industry as the creative analytics tactics become increasingly accurate and relevant to a variety of jobs. The immediate demand driving AI development in the healthcare industry today is decision intelligence. AI, analytics, and data integration enable decision-making platforms to hold, augment, automate, and speed up judgments.

Platform segments register to account for the largest market size during the forecast period

The requirement for combining information from several independent sources expands quickly along with the number of data that businesses create and gather. IT giants like IBM, Microsoft, and Google were compelled to create and construct decision intelligence platform to assist IT teams in streamlining and managing the process due to the abundance of data that amounts to big data. Organizations must assess their data requirements considering the numerous decision intelligence available before deploying the program.

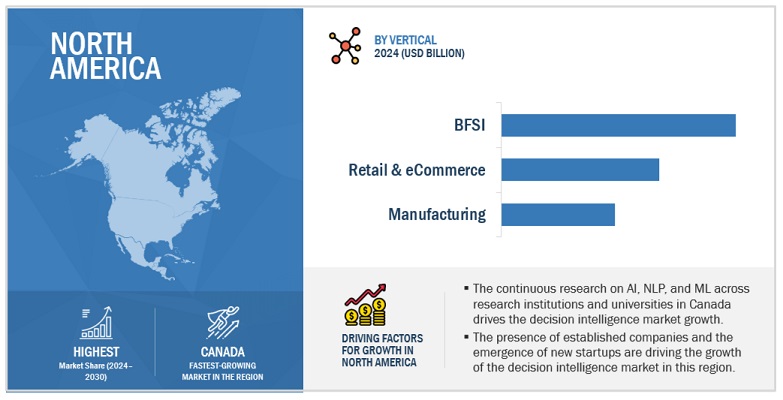

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in the decision intelligence market. North America is one of the leading marketrs for Decision Intelligence in terms of market share. Decision intelligence is expanding in this region as a result of the adoption of the technologies in nations like the US and Canada across a wide range of industry sectors. The region is expected to grow at a faster rate throughout the anticipated time due to rising expenditure in the procedure of research & development. The decision intelligence industry's expanding regional player base is anticipated to fuel additional market expansion. Moreover, the market is predicted to be supported by rising expenditures made by prominent vendors in product capabilities and company growth.

To know about the assumptions considered for the study, download the pdf brochure

Top Companies in Decision Intelligence Market

The decision intelligence vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global decision intelligence market include

- Google (US)

- IBM (US)

- Oracle (US)

- Microsoft (US)

- Board International (Switzerland)(US)

- Clarifai (US)

- Diwo.ai (US)

- Domo (US)

- H2O.AI (US)

- Intel (US)

- Metaphacts (Germany)

- Pace Revenue (UK)

- Paretos (Germany)

- Peak.ai (UK)

- Provenir (US)

Decision Intelligence Market Report Scope

|

Report Metrics |

Details |

|

Market Revenue in 2022 |

US $10.0 billion |

|

Market Revenue for 2027 |

US $22.7 billion |

|

Growth Rate |

17.8% CAGR |

|

Segments covered |

Component, Deployment Mode, Organization Size, Industry Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Google (US), IBM (US), Oracle (US), Microsoft (US), Board International (Switzerland), Cerebra (US), Clarifai (US), Diwo.ai (US), Domo (US), H2O.AI (US), Intel (US), Metaphacts (Germany), Pace Revenue (UK), Paretos (Germany), Peak.ai (UK), Provenir (US), Quantellia (US), Systems Technology Group (US), Pyramid Analaytics (Netherlands), Tellius (US) and Course5i (India). |

This research report categorizes the decision intelligence market based on components, solution, type, application, deployment mode, organization size, application, vertical, and regions.

By Component:

- Platform

- Solutions

- Services

By Solutions:

- Integrated

- Standalone

By Services:

- Consulting

- Deployment and Integrations

- Support and Maintenance

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large Enterprises

- SMEs

By Vertical:

- BFSI

- Retail & eCommerce

- Government & Defense

- Healthcare & Life Sciences

- Manufacturing

- Telecom

- IT & ITeS

- Energy & Utilities

- Transportation & Logistics

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In September 2022, Provenir Partnered with Inovatec. Through the Partnership, car borrowers will have access to Provenir's risk decisioning solutions through the LOS platform from Inovatec.

- In June 2022, Microsoft Collaborated with P&G. Through the partnership, P&G can digitize and integrate information from more than 100 production facilities worldwide and improve its edge computing, AI, and machine learning services for real-time visibility. Employees at P&G will be able to assess production data and use artificial intelligence to make fast decisions that enhance development and have an exponential effect.

- In June 2022, IBM acquired Databand.ai. Through the acquisition, Databand.ai will be able to increase the scope of its observability capabilities enabling deeper connections with more open source and for-profit products that drive the modern data stack, with the additional resources made available by this purchase. Additionally, businesses will have complete control over how Databand.ai is used, whether as a software-as-a-service (SaaS) or a self-hosted subscription.

- In April 2022, Sopra Steria and IBM launched the Sopra Steria Alive Intelligence (SSAI) offering. The IBM Watson Assistant, a customizable virtual agent for all fields, powers the Sopra Steria Alive Intelligence (SSAI) solution. This data is utilized to enhance decision-making and create new services that are tailored to the needs of consumers and users. The new artificial intelligence services will be accessible on Sopra Steria's Trusted Digital Platform in France for businesses and governmental organizations around Europe.

- In March 2022, Provenir with Francisco Franch declared to assist the rising number of financial services businesses looking for AI-powered risk decisioning tools. Franch will oversee managing Spain's sales operations, company growth, and marketing plans.

Frequently Asked Questions (FAQ):

What is a decision intelligence?

Decision Intelligence (DI) is the commercial application of AI to the decision-making process of every area in a business. It is outcome focused and must deliver on commercial objectives. Organizations are using Decision Intelligence to optimize every single department and improve business performance.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, and France in the European region.

Which are key verticals adopting decision intelligence solutions and services?

Key verticals adopting decision intelligence and services include BFSI, Retail & eCommerce, Healthcare & Life Sciences, Energy & Utilities, Telecom, IT & ITeS, Manufacturing, Transportation & Logistics and Other Verticals includes Media & Entertainment, Travel & Hospitality and Education & Research

Which are the key drivers supporting the growth of the decision intelligence market?

The key drivers supporting the growth of the decision intelligence market include Agility to meet peaks in demand and Emergence of cloud computing technologies.

Who are the key vendors in the decision intelligence market?

The key vendors in the global decision intelligence market include Google (US), IBM (US), Oracle (US), Microsoft (US), Board International (Switzerland), Cerebra (US), Clarifai (US), Diwo.ai (US), Domo (US), H2O.AI (US), Intel (US), Metaphacts (Germany), Pace Revenue (UK), Paretos (Germany), Peak.ai (UK), Provenir (US), Quantellia (US), Systems Technology Group (US), Pyramid Analaytics (Netherlands), Tellius (US) and Course5i (India).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This comprehensive research study on the decision intelligence market involved the use of extensive secondary sources, directories, and several magazines and journals to identify and collect relevant information; these included Decision Intelligence: Creating a Fit between Intelligence Requirements and Intelligence Processing Capacities, Intelligent Decision Technologies - An International Journal. Other publications referred to include: The ultimate decision intelligence guide, and Decision Analytics Journal, Primary sources included industry experts from the core and related industries, preferred decision intelligence providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering decision intelligence solutions and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as Omni-channel management in the new retailing era: A systematic review and future research agenda Journals and magazines, and Journal/Forums for Machine Learning (ML), AI India magazine, Customer Experience magazine, and other magazines. The decision intelligence spending of various countries was extracted from respective sources. Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain to identify key players based on solutions; services; market classification, and segmentation according to offerings of major players; industry trends related to solutions, services, deployment modes, applications, verticals, and regions; and key developments from both market and technology-oriented perspectives.

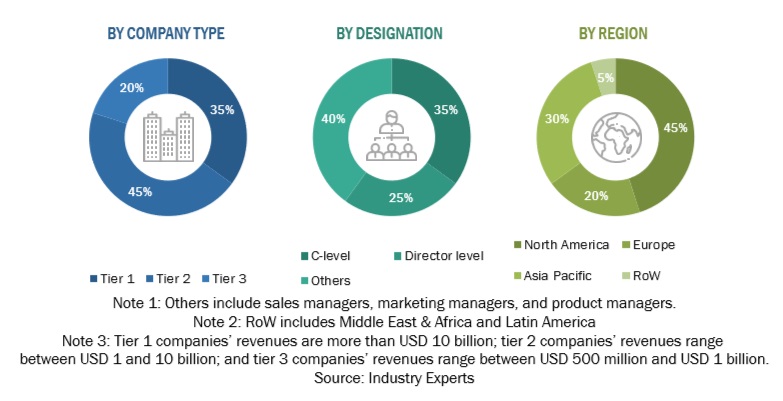

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, product development/innovation teams; related key executives from decision intelligence solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using decision intelligence solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of decision intelligence solutions and services, which would impact the overall decision intelligence.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global decision intelligence market and various other dependent subsegments. In the top-down approach, an exhaustive list of all the vendors offering tools and services in the decision intelligence was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on breadth of solutions and services, deployment modes, applications, and verticals. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation. In the bottom-up approach, the adoption rate of decision intelligence solutions among different end users in key countries with respect to their regions that contribute the most to the market share was identified. For cross-validation, the adoption of decision intelligence solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on decision intelligence solutions based on some of the key use cases. These factors for the decision intelligence tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the decision intelligence by component (software and services), application, deployment mode, organization size, vertical, and region.

- To provide detailed information about major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders.

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the decision intelligence

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American decision intelligence market

- Further breakup of the European decision intelligence market

- Further breakup of the Asia Pacific decision intelligence market

- Further breakup of the Latin American decision intelligence market

- Further breakup of the Middle East & Africa decision intelligence market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Decision Intelligence Market