Decorative Concrete Market by Type (Stamped Concrete, Stained Concrete, Colored Concrete, Polished Concrete, Epoxy Concrete, Concrete Overlays), Application, End-use Sector, and Region - Global Forecast to 2025

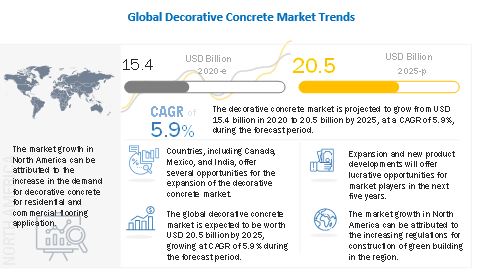

Decorative Concrete Market is projected to reach USD 20.5 billion by 2025, at a cagr 5.9%. The decorative concrete market is expected to witness significant growth in the future due to its increased demand in residential and commercial construction. Growth in construction of new residential & commercial spaces, and increase in the demand for durable, strong, and low maintainence flooring systems, are likely to support the growth of the decorative concrete market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global decorative concrete market

The global decorative concrete market is expected to witness the impact of the pandemic on its demand, in 2020-2021. In 2020, the decorative concrete market has a nominal impact due to COVID-19 and expected to witness a nominal decline in demand in 2020. Moreover, due to the COVID-19, the market is being hampered owing to slowing raw material production, supply chain disruption, hampered trade movements, declining construction demand, and reduced demand for new projectss.

Decorative Concrete Market Dynamics

Driver: Increased demand for stamped concrete for flooring applications

The high demand for stamped concrete, especially for constructing hotel flooring and other commercial buildings, is a primary factor resulting in an upsurge in demand. This is mainly due to the widespread benefits of the stamped concrete, such as good esthetic appeal to floors, along with its resistance to skidding and wear & tear caused by heavy footfall. The demand is expected to grow significantly in Asia Pacific and Middle East & Africa. High investments in housing developments and rapid industrialization in developing countries of these regions are expected to boost the demand for stamped concrete. Stamped concrete improves the esthetic appeal of an establishment or facility, thereby enhancing its demand over the coming years.

Restraint: Volatility in raw materials prices

Raw material and energy used in manufacturing decorative concrete have volatile prices and the trend is set to continue during the forecast period. The instability of petroleum and crude oil costs may cause the price of raw materials to rise, and, in turn, increase the cost of coatings, color pigments, cement, adhesives, and sealants used in decorative concrete. Hence, the prices of these materials have a direct impact on the cost of decorative concrete. With an increase in the cost of raw materials, vendors increase the price of their products or reduce their profit margins, which will have an adverse effect on market growth.

Opportunity: Rise in renovation and remodelling activities globally

Increasing remodelling and renovation operations in non-residential spaces will accelerate the demand for decorative concrete during the forecast year. Furthermore, hotel and resort owners are engaged in renovating the structures of their outlets for improving their customer base and enhancing the accommodation experience. For instance, In September 2019, JW Marriot opened a new hotel in Canberra (Australia), featuring the latest design accents and polished concrete flooring, which further enhances the visual appeal of the floors. Rising investments from industry players in the retail sector and residential construction are further expected to propel the adaptation of decorative concrete.

Challenge: Lack of awareness about decorative concrete across emerging economies

The decorative concrete market has a positive outlook due to the high growth in the construction industry. However, in some developing or underdeveloped countries of APAC, Africa, and South America, people are less aware of these decorative concrete applications and the benefits it offers. There is a lack of awareness about the durability, longevity, and flexibility of the decorative concrete products & solutions in emerging economies in APAC and South America. For the growth of this industry, it is important to educate customers regarding the positive effects and benefits of decorative concrete on the environment and the way it can contribute to a healthy lifestyle.

Stamped concrete widely preferred type of decorative concrete

Based on type, stamped concrete is projected to be the largest segment in the decorative concrete market. It is commonly used for new constructions or renovations in the residential sector, owing to its properties. It offers a wide range of products pertaining to concrete patterns or colors. It is ideal for outdoor usages and is commonly used for beautifying pool decks, driveways, courtyards, and patios. This type of concrete is easy to maintain and is cost-effective

Floors to dominate the global decorative concrete market

The floors segment to lead the global decorative concrete market by 2025. Decorative concrete can replace the need for traditional flooring systems (such as tiles and plywood), due to its life-span, longevity, durability. The esthetic look of the floor along with the low maintenance of decorative concrete makes it popular for the flooring applications.

Significant increase in the demand for decorative concrete for non-residential construction

By End-use sector, the non-residential segment is projected to be the largest segment in the decorative concrete market. The non-residential segment generates higher demand for the decorative concrete products, majorly for the flooring application. Decorative concrete is preferred for driveways, patios, and sidewalks. The growth in the non-residential segment is due to the longevity, esthetic appeal, and high-performance properties of decorative concrete.

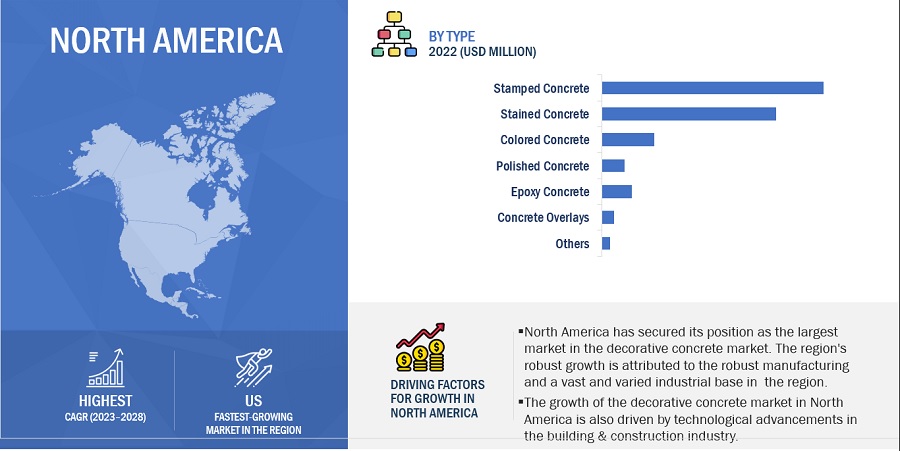

North American region to lead the global decorative concrete market by 2025

The North American region accounted for the largest market share in 2019. The growth of the decorative concrete market in North America is driven by technological advancements in the building & construction industry. In the US, single-family homes are growing, especially in Florida, Georgia, North Carolina, Washington, Utah, Tennessee, Ohio, California, Idaho, and South Carolina. The usage of decorative and esthetic appeal flooring systems in residential applications has been a key factor driving the decorative concrete market.

Decorative Concrete Market Players

The decorative concrete market is dominated by a few globally established players, such as CEMEX, S.A.B. de C.V. (Mexico), DuPont (US), HeidelbergCement AG (Germany), BASF SE (Germany), 3M Company (US), Sika AG (Switzerland), RPM International Inc. (US), The Sherwin Williams Company (US), PPG Industries, Inc. (US), Huntsman International LLC (US), Arkema SA (France), and Ultratech Cement Limited (India), amongst others.

Decorative Concrete Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 15.4 billion |

|

Revenue Forecast in 2025 |

USD 20.5 billion |

|

CAGR |

5.9% |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) and Volume (Million Square Feet) |

|

Segments covered |

Type, Application, End-use Sector, and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies covered |

CEMEX, S.A.B. de C.V. (Mexico), DuPont (US), HeidelbergCement AG (Germany), BASF SE (Germany), 3M Company (US), Sika AG (Switzerland), RPM International Inc. (US), The Sherwin Williams Company (US), PPG Industries, Inc. (US), Huntsman International LLC (US), Arkema SA (France), Ultratech Cement Limited (India), and Boral Limited (Australia) |

This research report categorizes the decorative concrete market based on type, application, end-use sector, and region.

On the basis of type:

- Stamped Concrete

- Stained Concrete

- Concrete Overlays

- Colored Concrete

- Polished Concrete

- Epoxy Concrete

- Others (include concrete dyes, engravings, and knockdown finish)

On the basis of application

- Floors

- Walls

- Driveways & sidewalks

- Patios

- Pool decks

- Others (include ceilings and countertops)

On the basis of end-use Sector

- Residential

- Non-residential

On the basis of region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments

- In December 2020, PPG Industries is acquiring Tikkurila (Finland), a finish paint and coatings manufacturer. The acquisition is expected to close in the second quarter of 2021. Tikkurila’s has strong and established decorative brands and product offerings in several Northern and Eastern European countries where PPG has a minimal presence. This acquisition is expected to provide PPG Industries with new cross-selling opportunities, growth opportunities for employees, and product solutions for new segments and customers.

- In December 2020, CEMEX launched Vertua, its brand of low carbon ready-mix concrete, in the US after successful introductions in Mexico and Europe. The range consists of Vertua Classic, Vertua Plus and Vertua Ultra. Furthermore, the company sells Vertua Classic (which offers a 20–30% reduction in CO2 emissions), in Bay Area, Central Valley, Los Angeles, Sacramento and San Diego, California. The products Vertua Plus and Vertua Ultra are expected to be introduced in 2021.

- In September 2020, Arkema strengthens Bostik with the acquisition of Ideal Work (Italy), specialized in decorative flooring technologies. This project is in line with Arkema’s targeted growth strategy in adhesives, based on cutting-edge technologies that perfectly complete Bostik’s existing offering for the construction market. Ideal Work’s solutions complement existing ranges in the field of floor preparation and flooring adhesives, will allow Bostik to expand its offering and position itself in a niche market in flooring renovation and decoration.

- In November 2020, Sika expands its production capacity in the United Arab Emirates with the commissioning of a new manufacturing facility in Dubai. In addition to concrete admixtures, epoxy resins will be produced locally for the Target Market Flooring. Sika invested in the expansion of its manufacturing facilities at the Dubai site in order to increase flexibility in production, shorten delivery times, optimize cost structures, and reduce inventories.

Frequently Asked Questions (FAQ):

What is the current size of global decorative concrete market?

The global decorative concrete market size is projected to grow from USD 15.4 billion in 2020 to USD 20.5 billion by 2025, at a CAGR of 5.9% from 2020 to 2025.

How is the decorative concrete market aligned?

The decorative concrete market is highly fragmented, and has a large number of global, regional and domestic players who have a very strong presence in the market. These players have strong and well-established procurement and distribution networks, which help in cost-efficient production.

Who are the key players in the global decorative concrete market?

The key players operating in the decorative concrete market are CEMEX, S.A.B. de C.V. (Mexico), DuPont (US), HeidelbergCement AG (Germany), BASF SE (Germany), 3M Company (US), Sika AG (Switzerland), RPM International Inc. (US), The Sherwin Williams Company (US), PPG Industries, Inc. (US), Huntsman International LLC (US), Arkema SA (France), and Ultratech Cement Limited (India), amongst others.

What are the latest ongoing trends in the decorative concrete market?

The players operating in the decorative concrete market aim to offer a low-cost, durable, and environmentally friendly decorative concrete solutions, owing to a shift in trend (construction of green building, and increase in the demand for attractive flooring solutions) among the end-users who are engaged in the residential and commercial construction. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 DECORATIVE CONCRETE MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

FIGURE 2 DECORATIVE CONCRETE MARKET, BY REGION

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

2.2 MARKET SIZE ESTIMATION

FIGURE 3 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 4 DECORATIVE CONCRETE MARKET: DATA TRIANGULATION

FIGURE 5 KEY MARKET INSIGHTS

FIGURE 6 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 7 STAMPED CONCRETE TO REMAIN LARGEST DECORATIVE CONCRETE MARKET

FIGURE 8 FLOORS TO BE THE LARGEST SEGMENT IN THE DECORATIVE CONCRETE MARKET DURING THE FORECAST PERIOD

FIGURE 9 NON-RESIDENTIAL TO GROW AT HIGHER CAGR IN THE DECORATIVE CONCRETE MARKET

FIGURE 10 NORTH AMERICA LED THE DECORATIVE CONCRETE MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 EMERGING ECONOMIES TO WITNESS A RELATIVELY HIGHER DEMAND FOR DECORATIVE CONCRETE

FIGURE 11 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES DURING THE FORECAST PERIOD

4.2 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 12 US WAS THE LARGEST MARKET FOR DECORATIVE CONCRETE IN NORTH AMERICA IN 2019

4.3 DECORATIVE CONCRETE MARKET, BY TYPE

FIGURE 13 STAMPED CONCRETE TO LEAD THE DECORATIVE CONCRETE MARKET DURING THE FORECAST PERIOD

4.4 DECORATIVE CONCRETE MARKET, BY APPLICATION

FIGURE 14 FLOORS TO BE THE LARGEST MARKET FOR THE GLOBAL DECORATIVE CONCRETE MARKET BY 2025

4.5 DECORATIVE CONCRETE MARKET, BY END-USE SECTOR

FIGURE 15 NON-RESIDENTIAL SEGMENT TO LEAD THE DECORATIVE CONCRETE MARKET

4.6 DECORATIVE CONCRETE MARKET, BY COUNTRY

FIGURE 16 CHINA TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DECORATIVE CONCRETE MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for stamped concrete for flooring applications

5.2.1.2 Rise in demand for green buildings

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

FIGURE 18 CRUDE OIL PRICE TREND

5.2.2.2 High cost of treatment

5.2.3 OPPORTUNITIES

5.2.3.1 Population growth and rapid urbanization translating to large number of construction projects

TABLE 1 APAC URBANIZATION TREND, 1990–2050

5.2.3.2 Rise in renovation and remodeling activities

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness about decorative concrete in developing economies

6 YC-YCC DRIVERS (Page No. - 48)

FIGURE 19 YC-YCC DRIVERS

7 INDUSTRY TRENDS (Page No. - 49)

7.1 INTRODUCTION

7.2 SUPPLY CHAIN ANALYSIS

FIGURE 20 DECORATIVE CONCRETE SUPPLY CHAIN

7.2.1 PROMINENT COMPANIES

7.2.2 SMALL & MEDIUM-SIZED ENTERPRISES

7.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 PORTER’S FIVE FORCES ANALYSIS

7.3.1 THREAT OF NEW ENTRANTS

7.3.2 THREAT OF SUBSTITUTES

7.3.3 BARGAINING POWER OF SUPPLIERS

7.3.4 BARGAINING POWER OF BUYERS

7.3.5 INTENSITY OF COMPETITIVE RIVALRY

8 COVID-19 IMPACT ON DECORATIVE CONCRETE MARKET (Page No. - 54)

8.1 INTRODUCTION

FIGURE 22 IMPACT OF COVID-19 IN 2020 (Q1) ON DIFFERENT COUNTRIES

8.2 COVID-19 IMPACT ON DECORATIVE CONCRETE MARKET

9 DECORATIVE CONCRETE MARKET, BY TYPE (Page No. - 57)

9.1 INTRODUCTION

FIGURE 23 POLISHED CONCRETE SEGMENT TO EXHIBIT HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 2 DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 3 DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

9.2 STAMPED CONCRETE

9.3 STAINED CONCRETE

9.4 CONCRETE OVERLAYS

9.5 COLORED CONCRETE

9.6 POLISHED CONCRETE

9.7 EPOXY CONCRETE

9.8 OTHERS

10 DECORATIVE CONCRETE MARKET, BY APPLICATION (Page No. - 61)

10.1 INTRODUCTION

FIGURE 24 FLOORS TO LEAD THE GLOBAL DECORATIVE CONCRETE MARKET BY 2025

TABLE 4 DECORATIVE CONCRETE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 5 DECORATIVE CONCRETE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE FEET)

10.2 FLOORS

10.3 WALLS

10.4 DRIVEWAYS & SIDEWALKS

10.5 POOL DECKS

10.6 PATIOS

10.7 OTHERS

11 DECORATIVE CONCRETE MARKET, BY END-USE SECTOR (Page No. - 65)

11.1 INTRODUCTION

FIGURE 25 NON-RESIDENTIAL SEGMENT TO DOMINATE DECORATIVE CONCRETE MARKET BY 2025

TABLE 6 DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 7 DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

11.2 RESIDENTIAL

11.2.1 DEMAND FOR SIPS FOR ENERGY-EFFICIENT BUILDINGS

11.3 NON-RESIDENTIAL

11.3.1 INCREASING SPENDING ON COMMERCIAL AND INSTITUTIONAL CONSTRUCTIONS

12 DECORATIVE CONCRETE MARKET, BY REGION (Page No. - 69)

12.1 INTRODUCTION

FIGURE 26 REGIONAL SNAPSHOT: CHINA TO BE THE FASTEST-GROWING MARKET DURING 2020-2025

TABLE 8 DECORATIVE CONCRETE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 DECORATIVE CONCRETE MARKET SIZE, BY REGION, 2018–2025 (MILLION SQUARE FEET)

TABLE 10 DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 11 DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 12 DECORATIVE CONCRETE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 13 DECORATIVE CONCRETE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE FEET)

TABLE 14 DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 15 DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.2 APAC

FIGURE 27 APAC: DECORATIVE CONCRETE MARKET SNAPSHOT

TABLE 16 APAC: DECORATIVE CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 17 APAC: DECORATIVE CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE FEET)

TABLE 18 APAC: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 19 APAC: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 20 APAC: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 21 APAC: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.2.1 CHINA

12.2.1.1 Increasing applicability of decorative concrete in residential applications

TABLE 22 CHINA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 23 CHINA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 24 CHINA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 25 CHINA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.2.2 JAPAN

12.2.2.1 Infrastructure and commercial building products to boost the market

TABLE 26 JAPAN: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 27 JAPAN: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 28 JAPAN: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 29 JAPAN: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.2.3 AUSTRALIA

12.2.3.1 Growing residential construction activities to propel demand

TABLE 30 AUSTRALIA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 31 AUSTRALIA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 32 AUSTRALIA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 33 AUSTRALIA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.2.4 INDIA

12.2.4.1 Increase in renovation activities to boost market growth

TABLE 34 INDIA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 35 INDIA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 36 INDIA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 37 INDIA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.2.5 INDONESIA

12.2.5.1 Significant opportunities for decorative concrete manufacturers

TABLE 38 INDONESIA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 39 INDONESIA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 40 INDONESIA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 41 INDONESIA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.2.6 REST OF APAC

TABLE 42 REST OF APAC: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 43 REST OF APAC: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 44 REST OF APAC: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 45 REST OF APAC: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.3 NORTH AMERICA

TABLE 46 NORTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 NORTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE FEET)

TABLE 48 NORTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 NORTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 50 NORTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 51 NORTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.3.1 US

12.3.1.1 Increased demand for decorative concrete for flooring applications

TABLE 52 US: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 53 US: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 54 US: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 55 US: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.3.2 CANADA

12.3.2.1 Rise in remodeling activities in residential sector to boost the demand

TABLE 56 CANADA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 57 CANADA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 58 CANADA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 59 CANADA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.3.3 MEXICO

12.3.3.1 Changing lifestyles of consumers bringing opportunities

TABLE 60 MEXICO: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 61 MEXICO: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 62 MEXICO: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 63 MEXICO: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.4 EUROPE

TABLE 64 EUROPE: DECORATIVE CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 65 EUROPE: DECORATIVE CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE FEET)

TABLE 66 EUROPE: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 67 EUROPE: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 68 EUROPE: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 69 EUROPE: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.4.1 GERMANY

12.4.1.1 Growing investments in construction sector

TABLE 70 GERMANY: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 GERMANY: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 72 GERMANY: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 73 GERMANY: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.4.2 UK

12.4.2.1 Rising renovation activities to accelerate demand

TABLE 74 UK: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 75 UK: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 76 UK: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 77 UK: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.4.3 FRANCE

12.4.3.1 Non-residential projects to provide opportunities to players

TABLE 78 FRANCE: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 79 FRANCE: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 80 FRANCE: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 81 FRANCE: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.4.4 RUSSIA

12.4.4.1 Increase in construction activities to drive the consumption

TABLE 82 RUSSIA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 83 RUSSIA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 84 RUSSIA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 85 RUSSIA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.4.5 ITALY

12.4.5.1 Growing housing market to boost the demand for decorative concrete

TABLE 86 ITALY: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 87 ITALY: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 88 ITALY: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR,2018–2025 (USD MILLION)

TABLE 89 ITALY: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.4.6 REST OF EUROPE

TABLE 90 REST OF EUROPE: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 91 REST OF EUROPE: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 92 REST OF EUROPE: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 93 REST OF EUROPE: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.5 MIDDLE EAST & AFRICA

TABLE 94 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE FEET)

TABLE 96 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 98 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 99 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.5.1 UAE

12.5.1.1 Strong demand for low-maintenance flooring systems

TABLE 100 UAE: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 101 UAE: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 102 UAE: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 103 UAE: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.5.2 SAUDI ARABIA

12.5.2.1 Increasing construction activities to drive the market for

TABLE 104 SAUDI ARABIA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 105 SAUDI ARABIA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 106 SAUDI ARABIA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 107 SAUDI ARABIA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.5.3 SOUTH AFRICA

12.5.3.1 Increasing use of decorative products to enhance esthetics

TABLE 108 SOUTH AFRICA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 109 SOUTH AFRICA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 110 SOUTH AFRICA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 111 SOUTH AFRICA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.5.4 TURKEY

12.5.4.1 Significant infrastructural investments to augment demand

TABLE 112 TURKEY: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 113 TURKEY: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 114 TURKEY: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 115 TURKEY: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 116 REST OF MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 117 REST OF MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 118 REST OF MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 119 REST OF MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.6 SOUTH AMERICA

TABLE 120 SOUTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 121 SOUTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE FEET)

TABLE 122 SOUTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 123 SOUTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 124 SOUTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 125 SOUTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.6.1 BRAZIL

12.6.1.1 Rise in demand for decorative concrete from residential sector

TABLE 126 BRAZIL: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 127 BRAZIL: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 128 BRAZIL: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 129 BRAZIL: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.6.2 ARGENTINA

12.6.2.1 Growth in non-residential construction to boost the demand

TABLE 130 ARGENTINA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 131 ARGENTINA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 132 ARGENTINA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 133 ARGENTINA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.6.3 REST OF SOUTH AMERICA

TABLE 134 REST OF SOUTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 135 REST OF SOUTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 136 REST OF SOUTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 137 REST OF SOUTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

13 COMPETITIVE LANDSCAPE (Page No. - 123)

13.1 OVERVIEW

FIGURE 28 COMPANIES ADOPTED EXPANSION AS THE KEY GROWTH STRATEGY BETWEEN 2017 AND 2020

13.2 MARKET RANKING

FIGURE 29 MARKET RANKING OF KEY PLAYERS, 2019

13.3 COMPETITIVE LEADERSHIP MAPPING

13.3.1 STAR

13.3.2 EMERGING LEADERS

13.3.3 PERVASIVE

13.3.4 EMERGING COMPANIES

FIGURE 30 DECORATIVE CONCRETE MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

13.4 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 31 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN DECORATIVE CONCRETE MARKET

13.5 BUSINESS STRATEGY EXCELLENCE

FIGURE 32 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN DECORATIVE CONCRETE MARKET

13.6 COMPETITIVE SCENARIO

13.6.1 ACQUISITION

TABLE 138 ACQUISITION

13.6.2 NEW PRODUCT DEVELOPMENT

TABLE 139 NEW PRODUCT DEVELOPMENT

13.6.3 EXPANSION & INVESTMENT

TABLE 140 EXPANSION & INVESTMENT

13.6.4 PARTNERSHIPS & AGREEMENTS

TABLE 141 PARTNERSHIPS & AGREEMENTS

14 COMPANY PROFILES (Page No. - 133)

(Business Overview, financial Assessment, Operational Assessment, Products Offered, Recent Developments, SWOT Analysis, winning imperatives, current focus and strategies, threat from competition, right to win)*

14.1 PPG INDUSTRIES, INC.

FIGURE 33 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

TABLE 142 MANUFACTURING SITE LOCATIONS (INDUSTRIAL COATING)

TABLE 143 MANUFACTURING SITE LOCATION (ARCHITECTURAL COATING)

TABLE 144 PERFORMANCE COATING: PRIMARY END-USERS

TABLE 145 PERFORMANCE AND INDUSTRIAL COATINGS: MAJOR DISTRIBUTION METHODS

FIGURE 34 PPG INDUSTRIES, INC.: SWOT ANALYSIS

FIGURE 35 WINNING IMPERATIVES: PPG INDUSTRIES, INC.

14.2 BASF SE

FIGURE 36 BASF SE: COMPANY SNAPSHOT

FIGURE 37 BASF SE: SWOT ANALYSIS

FIGURE 38 WINNING IMPERATIVES: BASF SE

14.3 3M COMPANY

FIGURE 39 3M COMPANY: COMPANY SNAPSHOT

FIGURE 40 3M COMPANY: SWOT ANALYSIS

FIGURE 41 WINNING IMPERATIVES: 3M COMPANY

14.4 THE SHERWIN-WILLIAMS COMPANY

FIGURE 42 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

FIGURE 43 THE SHERWIN-WILLIAMS COMPANY: SWOT ANALYSIS

FIGURE 44 WINNING IMPERATIVES: THE SHERWIN-WILLIAMS COMPANY

14.5 RPM INTERNATIONAL INC.

FIGURE 45 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 46 RPM INTERNATIONAL INC.: SWOT ANALYSIS

FIGURE 47 WINNING IMPERATIVES: RPM INTERNATIONAL INC.

14.6 DUPONT

FIGURE 48 DUPONT: COMPANY SNAPSHOT

14.7 HUNTSMAN INTERNATIONAL LLC

FIGURE 49 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

14.8 BORAL LIMITED

FIGURE 50 BORAL LIMITED: COMPANY SNAPSHOT

14.9 SIKA AG

FIGURE 51 SIKA AG: COMPANY SNAPSHOT

TABLE 146 SIKA AG’S KEY INVESTMENTS SINCE 2015 (OVERALL)

14.10 ULTRATECH CEMENT LIMITED

FIGURE 52 ULTRATECH CEMENT LIMITED: COMPANY SNAPSHOT

14.11 CEMEX, S.A.B. DE C.V.

FIGURE 53 CEMEX, S.A.B. DE C.V.: COMPANY SNAPSHOT

14.12 ARKEMA S.A.

FIGURE 54 ARKEMA S.A.: COMPANY SNAPSHOT

14.13 HEIDELBERGCEMENT AG

FIGURE 55 HEIDELBERGCEMENT AG: COMPANY SNAPSHOT

*Details on Business Overview, financial Assessment, Operational Assessment, Products Offered, Recent Developments, SWOT Analysis, winning imperatives, current focus and strategies, threat from competition, right to win might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 169)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

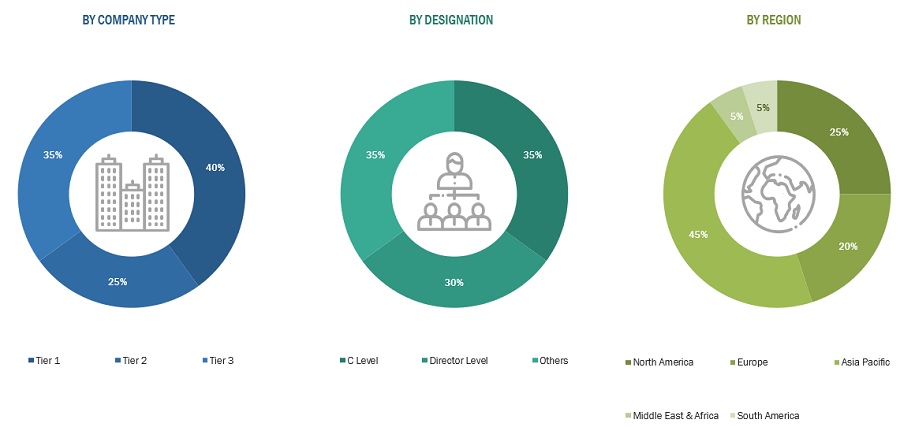

The study involved four major activities for estimating the current global size of the decorative concrete market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of decorative concrete through primary research. The top-down approach was employed to estimate the overall size of the decorative concrete market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the decorative concrete market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the decorative concrete market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the decorative concrete industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the global size of the decorative concrete market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the decorative concrete market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the decorative concrete market in terms of value and volume based on type, application, end-use sector, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as expansions, investments, partnerships, agreements, new product developments, and acquisitions, in the decorative concrete market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the decorative concrete report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the decorative concrete market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Decorative Concrete Market