Desiccant Dehumidifier Market by Product Type (Fixed or Mounted Desiccant Dehumidifier, Portable Desiccant Dehumidifier), Application (Energy, Food and Pharmaceutical, Electronics, Chemical, Construction), End User & Region - Global Forecast to 2028

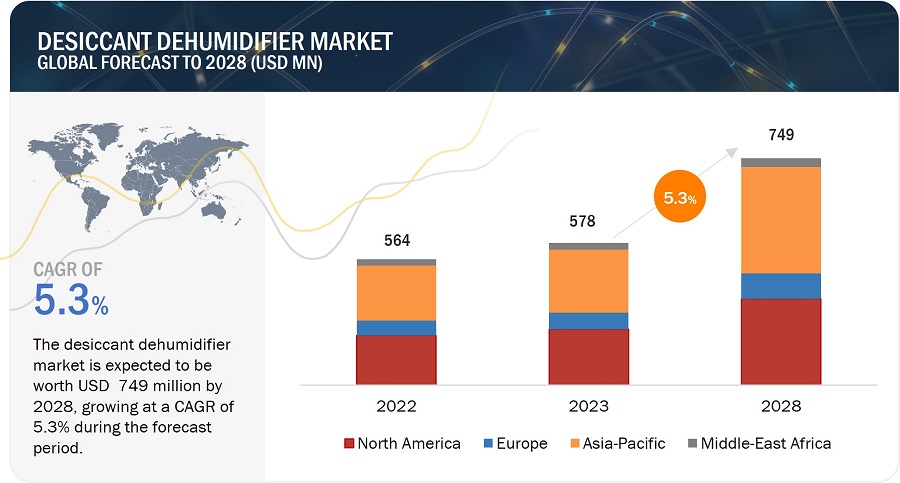

[232 Pages Report] The desiccant dehumidifier market was valued at USD 578 million in 2023 and is estimated to reach USD 749 million by 2028, registering a CAGR of 5.3% during the forecast period.

The growth of the desiccant dehumidifier market is governed by the increasing adoption of desiccant dehumidifiers in various industries, increasing government regulatory policies, and incentives for clean energy.

Desiccant Dehumidifier Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increasing adoption of desiccant dehumidifiers in various industries

Desiccant dehumidifiers are primarily deployed in pharmaceuticals, food & beverages, electronics manufacturing, chemical plants, and construction sites. Consistent and reliable control of humidity levels in pharmaceutical manufacturing, regardless of ambient air conditions, leads to a more efficient production line, increased yields, and decreased waste.

In food & beverage industries, accurate humidity control is essential in many baking processes, from proofing through oven baking and storage and packing. The moisture content of the dough frequently determines the qualities of a baked product, and this is dramatically affected by the ambient humidity levels in the environment. Dehumidification of baking facilities is essential to control the possibility of condensation in wet areas, resulting in mold and unhygienic operations.

In construction industries, waiting for the natural drying process is often unfeasible due to the time it can take to dry, causing delays. Unless the concrete's moisture content specifications are met, the next floor cannot be constructed, sealers cannot be applied, and flooring subcontractors cannot proceed. This chain reaction of delays pushes up costs and risks over-running deadlines for completion. To avoid construction delays and tackle moisture issues, desiccant dehumidifiers are employed to control the moisture level.

Restraint: High initial cost of desiccant dehumidifiers

Desiccant dehumidifiers are often more expensive than traditional refrigerant-based dehumidifiers, which can make them less attractive to price-sensitive consumers. This is because desiccant dehumidifiers use a more complex and advanced technology that requires more expensive components and materials. Desiccant dehumidifiers may be more suitable for certain environments and applications, such as extremely low humidity settings or areas with sensitive equipment that require precise humidity control. In these cases, improved performance and efficiency may justify the higher initial cost of a desiccant dehumidifier.

Opportunity: Ongoing developments in the desiccant dehumidifier technology to contribute to the market growth

Recent advancements in desiccant dehumidification technology, like liquid desiccant dehumidification technology, are becoming increasingly attractive due to their highly efficient utilization of low-grade heat and its effectiveness in dehumidification. Using this technology, energy-efficient air conditioning systems have been developed, which demonstrated superiority over the traditional vapor compression type system by allowing both temperature and humidity to be controlled independently.

The desiccant-coated heat exchangers (DCHEs) performance strongly depends on the adsorption and desorption characteristics of the employed desiccant material. While several attempts have been made to synthesize superior desiccants, the DCHE performance has not reached its highest potential due to challenges associated with the limited working capacity of conventional pure/composite desiccants. Two novel advanced desiccants, composite superabsorbent polymers (SAPs) and metal-organic frameworks (MOFs), have been under development. The composite SAPs offer superior sorption capacity, faster kinetics, and low regeneration possibility while the MOFs provide excellent hydrophilicity and tailorable structures. These desiccants are deemed to be the next generation of advanced materials in thermally driven dehumidifiers.

Challenge: Limitations in terms of applications for desiccant dehumidifiers

Desiccant dehumidifiers are best suited for low-temperature and low-humidity environments, such as industrial or commercial settings. They may not be as effective in residential or high-humidity environments. Additionally, refrigerant-based dehumidifiers are typically more effective at removing moisture from the air in residential spaces. The desiccant dehumidifiers tend to be more expensive to operate than compressor-based dehumidifiers. This is because they require a constant supply of energy to heat and regenerate the desiccant material, which can drive up the energy bills over time.

Desiccant Dehumidifier Ecosystem

Fixed or mounted type desiccant dehumidifiers to hold larger market share during the forecast period.

In 2022, the Fixed or Mounted Desiccant Dehumidifier segment accounted for the larger share of the desiccant dehumidifier market. This can be attributed to the growing expansion of manufacturing units, warehouses, water treatment facilities, and lithium-ion battery production plants across the globe. These plants and facilities require large desiccant dehumidifiers, which cannot be moved owing to the large area. Furthermore, fixed desiccant dehumidifiers have a larger capacity, centralized operation, and longer lifespan. Fixed desiccant dehumidifiers have fewer moving parts than refrigerant-based dehumidifiers. This means they require less maintenance, and there are fewer components that can break or wear out over time. These advantages and factors are anticipated to drive the demand for fixed desiccant dehumidifiers.

Industrial end user segment account for the largest share of the desiccant dehumidifier market for during the forecast period

In 2022, the Industrial segment held the largest share of the desiccant dehumidifier market owing to the wide range of applications for desiccant humidifiers for industries such as pharmaceuticals, manufacturing, food and beverage, energy and utility, and electronics. Additionally, desiccant dehumidifiers can provide effective humidity control in a cost-effective and energy-efficient manner while offering greater flexibility and reduced maintenance requirements compared to other techniques, such as refrigerant dehumidifiers. This enables the companies to choose a desiccant dehumidifier for their facilities. These factors are boosting market growth.

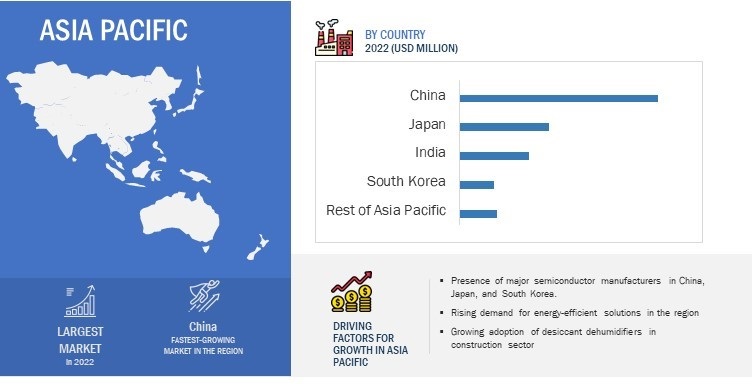

Desiccant dehumidifier market in Asia Pacific estimated to grow at the fastest rate during the forecast period

The desiccant dehumidifier market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. China, Japan, and India are among a few major contributors to Asia Pacific's desiccant dehumidifier system market. Growing construction activities and industrialization are a few key factors boosting the growth of the desiccant dehumidifier systems market in the region. The presence of many electronics industries across countries like China and South Korea is likely to fuel the demand for desiccant dehumidifiers in these industries for humidity control and protecting electronic control equipment from corrosion and problems caused by flashovers. Asia Pacific is experiencing significant growth in commercial construction activities, which is being driven by a combination of factors such as increasing urbanization, growing population, and rising economic development in the region. The growing need for infrastructure development is also driving commercial construction activities in Asia Pacific. Governments in the region are investing heavily in transportation, energy, and communication infrastructure to support economic growth and improve the quality of life for citizens. This includes the construction of airports, highways, power plants, and telecommunication networks. The rapidly growing construction sector would pave the way for the adoption of desiccant dehumidifiers and climate control solutions.

Desiccant Dehumidifier Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major vendors in the desiccant dehumidifier companies include Munters (Sweden), Bry-Air (India), Condair Group (Switzerland), Cotes (Denmark), Seibu Giken DST (Sweden), Trotec (Austria), DehuTech AB™ (Sweden), Fisen Corporation (US), Atlas Copco (Sweden). Apart from this, Parker Hannifin Corporation (US), Airwatergreen AB (Sweden), Sunpentown Inc. (US), SPX Flow Technology Germany GmbH (US), Quincy Compressor (US), Zeks Compressed Air Solutions (US), Desiccant Technologies Group (Lithuania), Shanghai Rotorcomp Screw Compressor Co., Ltd. (China), Sullair LLC (US), NiGen International L.L.C (US), Innovate Air Technologies (U S), De'Longhi Appliances S.r.l. (Italy), STULZ Air Technology Systems, Inc. (US), Fisair (Spain), Dantherm Group (Denmark), Meaco (UK), PT Denusa Sejahtera (Indonesia), Therma-Stor LLC (US), HuTek(Asia) Company Ltd (Thailand), Andrew Sykes Group (UK), Ebac Industrial Products Limited (US), Ecor Pro (Netherlands), Trane Technologies (US), FläktGroup SEMCO (US), NovelAire Technologies (US), Humiscope (Australia) are among a few emerging companies in the desiccant dehumidifier market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Forecast Units |

Value (USD Million), Volume (Thousand Units) |

|

Segments Covered |

Product Type, Application, End User, and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Munters (Sweden), Bry-Air (India), Condair Group (Switzerland), Cotes (Denmark), Seibu Giken DST (Sweden), Trotec (Austria), DehuTech AB™ (Sweden), Fisen Corporation (US), Atlas Copco (Sweden), Parker Hannifin Corporation (US), Airwatergreen AB (Sweden), Sunpentown Inc. (US), SPX Flow Technology Germany GmbH (US), Quincy Compressor (US), Zeks Compressed Air Solutions (US), Desiccant Technologies Group (Lithuania), Shanghai Rotorcomp Screw Compressor Co., Ltd. (China), Sullair LLC (US), NiGen International L.L.C (US), Innovate Air Technologies (U S), De'Longhi Appliances S.r.l. (Italy), STULZ Air Technology Systems, Inc. (US), Fisair (Spain), Dantherm Group (Denmark), Meaco (UK), PT Denusa Sejahtera (Indonesia), Therma-Stor LLC (US), HuTek(Asia) Company Ltd (Thailand), Andrew Sykes Group (UK), Ebac Industrial Products Limited (US), Ecor Pro (Netherlands), Trane Technologies (US), FläktGroup SEMCO (US), NovelAire Technologies (US), Humiscope (Australia) |

Desiccant Dehumidifier Market Highlights

This research report categorizes the desiccant dehumidifier market based on Product Type, Application, End-user, and Region.

|

Segment |

Subsegment |

|

Desiccant Dehumidifier Market, Product Type: |

|

|

Desiccant Dehumidifier Market, by Application: |

|

|

Desiccant Dehumidifier Market, by End User: |

|

|

Desiccant Dehumidifier Market, By Region: |

|

Recent Developments

- In November 2022, Munters acquired Hygromedia and Rotor Source to strengthen its position as a leading supplier of desiccant dehumidification technology systems for numerous industrial processes. These acquisitions provide Munters with an additional channel to market to serve it even better.

- In September 2022, Bry-Air launched a new product, 'BryShield' for preventing electronic corrosion in small server rooms by removing gaseous contaminants. The innovative air filtration system has been aesthetically designed and easily fits into a false ceiling, and can be compactly ceiling mounted.

- In February 2022, DehuTech AB™ introduced a new version of the DehuTech DT-210 desiccant dehumidifier. The new version has a more cost-efficient casing. The unit also has a pushing reactivation air fan instead of a pulling wet air fan, which will increase the lifetime of the fan and enable the users to use the unit even when the wet air outlet temperature is high.

Frequently Asked Questions (FAQ):

What will be the dynamics for the adoption of the desiccant dehumidifier market based on product type?

The fixed or mounted is expected to hold the largest share of the desiccant dehumidifier market during the forecast period. This can be attributed to the growing expansion of manufacturing units, warehouses, water treatment facilities, and lithium-ion battery production plants across the globe. These plants and facilities require large desiccant dehumidifiers that cannot be moved due to the large area.

Which application will contribute more to the overall market share by 2028?

The energy segment will contribute the most to the desiccant dehumidifier market. The market for energy segment is expected to account for the largest share of the desiccant dehumidifier market during the forecast period owing to their growing adoption in power plants as desiccant dehumidifiers can provide the ideal low humidity environment for preservation and deactivation of power plants, as they can maintain RH as low as 1% or even lower at a constant level, regardless of ambient conditions.

How will technological developments such as cloud computing technology, and artificial intelligence (AI) technology change the desiccant dehumidifier market landscape in the future?

Cloud computing technology utilizes IOT connected to IoT gateway modules and Edge computing devices, which collect data from the system and send it for analysis for different AI applications. Most commercial companies and factories are starting to manage energy efficiency better using AI and IoT solutions for building desiccant dehumidifiers to minimize and save on unnecessary operation costs without sacrificing ambient comfort status. With cloud computing, the AI model can predict maintenance requirements for the system, reducing downtime and improving the efficiency of the system. With cloud computing technology, desiccant dehumidifiers can be connected to the internet, allowing for remote monitoring and control. This can enable users to monitor the performance and status of their dehumidifiers from anywhere with an internet connection.

Which region is expected to adopt desiccant dehumidifier systems at a fast rate?

Asia Pacific region is expected to adopt desiccant dehumidifiers at the fastest rate. Developing countries such as India and China are expected to have a high potential for the future growth of the market.

What are the key market dynamics influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

The construction sector is booming with an upsurge in residential, commercial, and infrastructure projects worldwide. The demand for construction is rising due to huge economic growth in developing countries and low-interest rates in a number of developed countries. Also, factors such as increasing private sector investments in construction, technological development, and rising disposable income are expected to provide momentum to construction activities worldwide. As the construction industry has evolved, and through practical application, it has been evident that a desiccant dehumidifier is much more effective at drying construction materials than a heater. Because a desiccant dehumidifier reduces both humidity and vapor pressure, it is the most effective method for providing a construction environment where materials dry at an accelerated pace, and the potential for mold growth is considerably decreased.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the size of the desiccant dehumidifier market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry's supply chain, the total pool of market players, the classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the desiccant dehumidifier market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

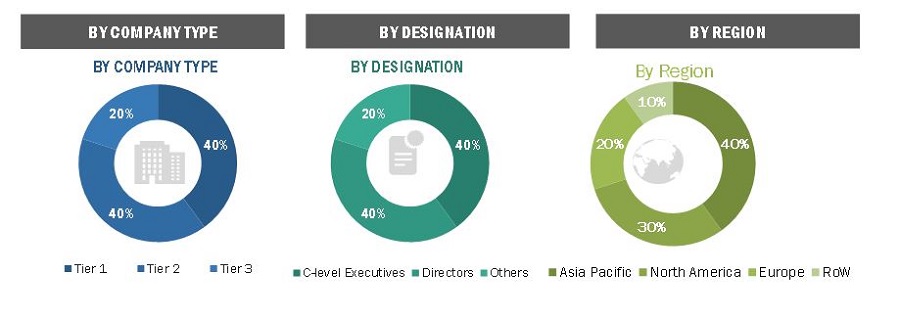

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the desiccant dehumidifier market scenario through secondary research. Several primary interviews have been conducted with experts from both the demand (end users) and supply side (desiccant dehumidifier providers) across 4 major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews have been conducted from the supply and demand side. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both the top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the desiccant dehumidifier market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Desiccant Dehumidifier Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

A desiccant dehumidifier operates using the adsorption properties of a rotating desiccant wheel, similar to a sponge soaking up moisture directly from the air. Air is drawn into the dehumidifier and passes through the slowly revolving desiccant wheel. The desiccant absorbs moisture, and the dried air is returned to the room. To allow the desiccant wheel to absorb moisture indefinitely, the wheel passes through a regeneration area, where a secondary hot airstream heats it. A frequent electric heater heats this secondary airstream to around 120°C before passing it through the wheel. The hot air absorbs the moisture from the desiccant and is then vented externally.

Key Stakeholders

- Senior Management

- Application

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and estimate the desiccant dehumidifier market based on product type, application, end-user, and region in terms of value.

- To forecast the size of the market by region—North America, Europe, Asia Pacific, and the Rest of the World (RoW)—in terms of value

- To forecast the desiccant dehumidifier market size, in terms of volume, by product type

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the desiccant dehumidifier market

- To strategically analyze the micromarkets1 with respect to the individual growth trends, prospects, and their contribution to the desiccant dehumidifier market

- To map the competitive landscape based on company profiles, key player strategies, and key developments

- To provide a detailed overview of the desiccant dehumidifier value chain and ecosystem

- To provide information about the key technology trends and patents related to the desiccant dehumidifier market

- To provide information regarding trade data related to the desiccant dehumidifier market

- To identify the key players operating in the desiccant dehumidifier market and comprehensively analyze their market shares and core competencies2

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the desiccant dehumidifier market

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes them on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments such as contracts, acquisitions, product launches, collaborations, partnerships, and research and development (R&D) in the desiccant dehumidifier market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Growth opportunities and latent adjacency in Desiccant Dehumidifier Market