Diagnostic Imaging Market by Product (MRI (Open, Closed), Ultrasound (2D, 4D, Doppler), CT, X-Ray (Digital, Analog), SPECT, Hybrid PET, Mammography), Application (OB/Gyn, Cardiology, Oncology), End User (Hospitals, Imaging Centers) & Region - Global Forecast to 2026

Updated on : March 28, 2023

The global diagnostic imaging market in terms of revenue was estimated to be worth $26.6 billion in 2021 and is poised to grow at a CAGR of 5.7% from 2021 to 2026.

The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The latest edition of the diagnostic imaging market report includes an assessment of the impact of the COVID-19 outbreak on the market and the players operating in it. The report also analyzes the effect of the COVID-19 pandemic for the forecast period. Market growth is driven by the increasing demand for early and effective disease diagnosis, expansion in the application profile of imaging modalities coupled with the growing prevalence of infectious diseases, ongoing technological advancements in the field of diagnostic imaging, and continued integration of imaging modalities with AI and other digital tools.

To know about the assumptions considered for the study, Request for Free Sample Report

Diagnostic Imaging Market Dynamics

Drivers: growing geriatric population and the rising prevalence of associated diseases

The risk of developing diseases increases proportionately with age. According to the Centers for Disease Control and Prevention (CDC), nearly 80% of the elderly in the US suffer from at least one chronic condition. In addition, the American Medical Association (AMA) estimates that at least 60% of individuals aged 65 and above will be living with more than one chronic condition by 2030. This increase in the aging population will drive the demand for improved healthcare facilities and advanced treatment options and medications.

With With the rapid growth in the global geriatric population, the prevalence of age-associated diseases such as Alzheimer's disease, Parkinson's disease, arthritis, and dementia, along with CVDs and cancer, is expected to increase.

Restraints: Technical limitations associated with standalone systems

Technological limitations associated with standalone imaging modalities deter researchers from purchasing them, negatively affecting their market growth. For instance, MRI takes longer to scan large volumes or high-resolution images, whereas PET has a lower spatial resolution. Ultrasound systems are heavily operator-dependent, require direct contact with the body, and have limited tissue penetration. SPECT has low detection sensitivity, and CT has poor soft-tissue contrast, providing less information about functional characteristics and carrying the risk of radiation exposure for physicians and patients.

Opportunities: Growth opportunities in emerging countries

Developing economies such as India, China, Brazil, South Korea, Turkey, Russia, and South Africa offer high growth opportunities for major players in the diagnostic imaging market. Although the cost factor is a concern in these developing countries, their vast population bases—especially in India and China—offer a sustainable market for diagnostic imaging devices. The higher incidence of chronic diseases—such as cancer, stroke, and neurological and cardiovascular diseases—and the higher death rates in these countries show the need for early detection. For instance, GLOBOCAN 2020 data estimates that roughly 50% of the global cancer population belongs to developing regions. The key market players are adopting various growth strategies to strengthen their foothold in this region. Siemens Healthineers, for instance, reported that China is one of their biggest markets and major incremental growth drivers. Moreover, in 2019, as part of its India expansion plan, Siemens Healthcare opened its manufacturing facility in India with two production lines—one for its mobile C-arm for a surgery called Cios Fit and one for CT systems based on its Somatom. Go platform.

Challenges: Hospital Budget Cuts

In response to increasing government pressure to reduce healthcare costs, several healthcare providers have aligned themselves with group purchasing organizations (GPOs), integrated health networks (IHNs), and integrated delivery networks (IDNs). These organizations aggregate the purchasing volume of their members and bargain for a competitive price with the suppliers and manufacturers of medical devices. GPOs, IHNs, and IDNs negotiate heavily for bulk purchases of diagnostic imaging devices.

The rising cost of prescription drugs and a sharp decline in the proposed budget allocations for Health and Human Services in the US, as of 2019, have significantly reduced hospital budgets. A study by the American Hospital Association estimates that federal payment cuts to hospitals would amount to USD 218 billion by 2028, forcing hospitals to allocate smaller budgets annually.

CT scanners are the most rapidly expanding technology in the global diagnostic imaging market.

The market is divided into six product categories: X-ray, CT scanners, ultrasound, MRI, nuclear imaging, and mammography systems. CT scanners are poised to be the fastest-growing technology during the forecast period. Their significant growth potential is owing to their widespread usage in hospitals and imaging clinics for cancer and pulmonary screening, the expansion of their application horizon across dentistry and interventional procedures, the availability of reimbursements in mature countries, and the ongoing digitalization of healthcare systems.

The general radiography application of X-ray systems, of the diagnostic imaging market, accounted to be the fastest market during the forecast period.

Based on application, the market is segmented into the respective modalities, viz., MRI systems, ultrasound systems, X-ray imaging systems, CT scanners, nuclear imaging systems, and mammography systems, and their respective applications. Among the applications, the largest share in 2020 was accounted for by cardiology under CT scanners, brain and neurological MRI under MRI systems, radiology and general imaging under ultrasound systems, general radiography applications under X-ray imaging systems, and oncology under nuclear imaging systems. In 2020, general radiography applications under the X-ray imaging systems application accounted for the largest market share among all application segments of the diagnostic imaging market.

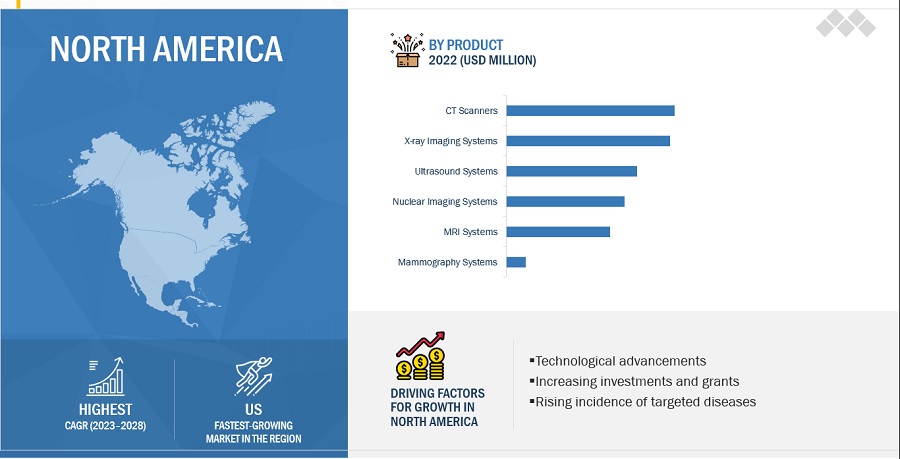

North America is expected to be the largest segment of the diagnostic imaging market during the forecast period.

North America accounted for the largest share of the market in 2022, followed by the Asia Pacific region. The dominant geographic position of North America in the diagnostic imaging market is mainly attributed to the rising prevalence of chronic diseases, easy patient accessibility to diagnostic imaging modalities, and rising adoption of technologically advanced modalities.

To know about the assumptions considered for the study, download the pdf brochure

The major players in the diagnostic imaging market are GE Healthcare (US), Siemens Healthineers (Germany), Koninklijke Philips N.V. (Netherlands), Agfa-Gevaert N.V. (Belgium), Canon Medical Systems Corporation (Japan), Hitachi Ltd. (Japan), Carestream Health, Inc. (US), Esaote S.p.A (Italy), Hologic, Inc. (US), FUJIFILM Holdings Corporation (Japan), Samsung Electronics (South Korea), Mindray Medical International (China), Planmed Oy (Finland), CurveBeam LLC (US), Shimadzu Corporation (Japan) among others.

Diagnostic Imaging Market Report Scope

|

Report Metrics |

Details |

|

Market Revenue in 2021 |

$26.6 billion |

|

Projected Revenue by 2026 |

$35.0 billion |

|

Revenue Growth Rate |

Poised to grow at a CAGR of 5.7% |

|

Market Segmentation |

By Product, Application, End User, And Region |

|

Market Driver |

growing geriatric population and the rising prevalence of associated diseases |

|

Market Opportunity |

Growth opportunities in emerging countries |

|

Geographies covered |

North America, Europe, Latin America, Asia Pacific, and Middle East & Africa |

This research report categorizes the global diagnostic imaging market to forecast revenue and analyze trends in each of the following submarkets

By Product

- X-ray Imaging Systems

-

By Technology

-

X-ray Digital Imaging Systems

- Direct Radiography (DR)

- Computed Radiography (CR)

- X-ray Analog Imaging Systems

-

X-ray Digital Imaging Systems

-

By Portability

- Stationary Systems

- Portable Systems

- Computed Tomography (CT) Scanners

-

By Technology

- Conventional CT systems

- Cone Beam CT Systems (CBCT)

-

Conventional CT Systems Market, by Technology

- High-slice CT Scanners

- Mid-slice CT Scanners

- Low-slice CT Scanners

- Ultrasound Systems

-

By Technology

- 2D Ultrasound

- 3D and 4D Ultrasound

- Doppler Ultrasound

-

By Portability

- Trolley/Cart-based Ultrasound Systems

- Compact/Portable Ultrasound Systems

- Magnetic Resonance Imaging (MRI) Systems

-

By Architecture

- Closed MRI

- Open MRI

-

By Field Strength

- High- and Very-high-field MRI Systems

- Low-to-mid-field MRI Systems

- Ultra-high-field MRI Systems

- Nuclear Imaging Systems

-

SPECT Systems

- Standalone SPECT Systems

- Hybrid SPECT Systems

- Hybrid PET Systems

- Mammography Systems

By Application

-

X-ray Imaging Systems

- General Radiography

- Dental

- Fluoroscopy

-

MRI Systems

- Brain & Neurological MRI

- Spine & Musculoskeletal MRI

- Vascular MRI

- Pelvic & Abdominal MRI

- Breast MRI

- Cardiac MRI

-

Ultrasound Systems

- Radiology/General Imaging

- Cardiology

- Obstetrics/Gynecology

- Urology

- Vascular

- Other Applications

-

CT Scanners

- Cardiology

- Oncology

- Neurology

- Other Applications

-

Nuclear Imaging Systems

- Cardiology

- Oncology

- Neurology

- Other Applications

- Mammography Systems

By End User

- Hospitals

- Diagnostic Imaging Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- RoE

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

- Middle East and Africa (MEA)

Recent Developments

- Philips and Carestream Health: In July 2022, Philips announced it was acquiring Carestream Health, a provider of diagnostic imaging systems, for $2.2 billion. This acquisition will strengthen Philips’ position in the medical imaging technology sector, as Carestream Health is a global leader in medical imaging and IT solutions.

- Hitachi and Canon Medical Systems: In November 2022, Hitachi announced it was acquiring Canon Medical Systems, a global leader in diagnostic imaging systems, for $6.5 billion. This acquisition will help Hitachi expand its medical imaging technology portfolio and provide the company with greater access to the global healthcare market.

- Siemens Healthineers and Varian Medical Systems: In March 2023, Siemens Healthineers announced it was acquiring Varian Medical Systems, a provider of medical imaging systems, for $16.4 billion. This acquisition will strengthen Siemens Healthineers’ position in the medical imaging market, as Varian Medical Systems is a leading provider of medical imaging solutions.

Frequently Asked Questions (FAQ):

What is the projected market value of the global diagnostic imaging market?

The global diagnostic imaging market boasts a total revenue value of $26.6 billion in 2021 and is projected to register a revenue value of $35.0 billion by 2026.

What is the estimated growth rate (CAGR) of the global diagnostic imaging market for the next five years?

The global diagnostic imaging market in terms of revenue is poised to grow at a CAGR of 5.7%.

What are the major revenue pockets in the diagnostic imaging market currently?

North America accounted for the largest share of the global market in 2022, followed by the Asia Pacific region. The dominant geographic position of North America in the diagnostic imaging market is mainly attributed to the rising prevalence of chronic diseases, easy patient accessibility to diagnostic imaging modalities, and rising adoption of technologically advanced modalities.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 46)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKETS SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 STANDARD CURRENCY CONVERSION RATES

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 51)

2.1 RESEARCH DATA

FIGURE 1 DIAGNOSTIC IMAGING MARKET: RESEARCH METHODOLOGY STEPS

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 4 BREAKDOWN OF SUPPLY-SIDE PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2 MARKET SIZE ESTIMATION

2.2.1 PRODUCT-BASED MARKET ESTIMATION

2.2.2 VOLUME-BASED MARKET ESTIMATION

FIGURE 6 MARKET SIZE ESTIMATION: GLOBAL MARKET

FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.2.3 PRIMARY RESEARCH VALIDATION

2.3 COVID-19 HEALTH ASSESSMENT

2.4 COVID-19 ECONOMIC ASSESSMENT

2.5 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 8 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 9 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

2.6 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO IN THE DIAGNOSTIC IMAGING MARKET

2.7 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 GLOBAL MARKET: DATA TRIANGULATION METHODOLOGY

2.8 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.8.1 ASSUMPTIONS FOR THE STUDY

2.9 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: GLOBAL MARKET

3 EXECUTIVE SUMMARY (Page No. - 68)

FIGURE 11 DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 12 GLOBAL MARKET, BY APPLICATION, 2021 VS 2026 (USD MILLION)

FIGURE 13 GLOBAL MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 14 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 72)

4.1 DIAGNOSTIC IMAGING: MARKET OVERVIEW

FIGURE 15 INCREASING GERIATRIC POPULATION AND SUBSEQUENT RISE IN ASSOCIATED DISEASES IS DRIVING MARKET GROWTH

4.2 DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 16 THE ULTRASOUND SYSTEMS SEGMENT IS EXPECTED TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

4.3 EUROPE GLOBAL MARKET SHARE, BY PRODUCT AND COUNTRY, 2021

FIGURE 17 ULTRASOUND SYSTEMS TO DOMINATE THE GLOBAL MARKET IN EUROPE

4.4 GEOGRAPHIC SNAPSHOT OF THE GLOBAL MARKET

FIGURE 18 ASIA PACIFIC TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 76)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DIAGNOSTIC IMAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing geriatric population and the rising prevalence of associated diseases

TABLE 3 AGE-RELATED DISEASES AND ASSOCIATED DIAGNOSTIC MODALITIES

5.2.1.2 Increasing demand for early diagnosis and widening scope of clinical applications

5.2.1.3 Technological advancements in diagnostic imaging modalities

TABLE 4 TECHNOLOGICAL ADVANCEMENTS IN DIAGNOSTIC IMAGING SYSTEMS

5.2.1.4 Increasing investments, funds, and grants by public-private organizations

TABLE 5 KEY INVESTMENTS BY GOVERNMENT BODIES IN THE DIAGNOSTIC IMAGING MARKET

5.2.2 RESTRAINTS

5.2.2.1 High cost of diagnostic imaging systems

5.2.2.2 Technological limitations associated with standalone systems

5.2.2.3 Declining reimbursements and increasing regulatory burden in the US

TABLE 6 MEDICARE REIMBURSEMENT TRENDS, BY IMAGING MODALITY, 2007–2019

5.2.2.4 Shortage of helium

5.2.3 OPPORTUNITIES

5.2.3.1 Growth opportunities in emerging countries

5.2.3.2 Adoption of AI and analytics in diagnostic imaging

5.2.3.3 Use of blockchain in diagnostic imaging

5.2.3.4 Increasing adoption of teleradiology

5.2.3.5 Contract-based radiology solutions and mobile solutions

5.2.4 CHALLENGES

5.2.4.1 Hospital budget cuts

5.2.4.2 Increasing adoption of refurbished diagnostic imaging systems

5.2.4.3 Dearth of trained professionals

5.3 TRENDS & BURNING ISSUES

5.3.1 INCREASING ADOPTION OF HYBRID DIAGNOSTIC IMAGING MODALITIES

5.3.2 OVERUTILIZATION OF DIAGNOSTIC IMAGING SERVICES AROUND THE WORLD

5.4 PRICING ANALYSIS

TABLE 7 REGIONAL PRICING ANALYSIS OF KEY DIAGNOSTIC IMAGING MODALITIES, 2020 (USD)

5.5 VALUE CHAIN ANALYSIS

5.5.1 RESEARCH & DEVELOPMENT

5.5.2 MANUFACTURING & ASSEMBLY

5.5.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

FIGURE 20 VALUE CHAIN ANALYSIS

5.6 ECOSYSTEM ANALYSIS

5.7 SUPPLY CHAIN ANALYSIS

5.7.1 PROMINENT COMPANIES

5.7.2 SMALL & MEDIUM-SIZED ENTERPRISES

5.7.3 END USERS

FIGURE 21 SUPPLY CHAIN ANALYSIS

5.7.4 ROLE IN ECOSYSTEM

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 DIAGNOSTIC IMAGING MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 BARGAINING POWER OF BUYERS

5.8.2 BARGAINING POWER OF SUPPLIERS

5.8.3 THREAT OF NEW ENTRANTS

5.8.4 THREAT OF SUBSTITUTES

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 REGULATORY ANALYSIS

5.9.1 NORTH AMERICA

5.9.1.1 US

TABLE 9 US FDA: MEDICAL DEVICE CLASSIFICATION

TABLE 10 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.9.1.2 Canada

TABLE 11 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.9.2 EUROPE

5.9.3 ASIA PACIFIC

5.9.3.1 Japan

TABLE 12 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

5.9.3.2 China

TABLE 13 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.9.3.3 India

5.10 REIMBURSEMENT SCENARIO

TABLE 14 MEDICAL REIMBURSEMENT CPT CODES FOR MRI PROCEDURES IN THE US (AS OF 2021)

TABLE 15 MEDICAL REIMBURSEMENT CPT CODES FOR CT IMAGING PROCEDURES IN THE US (AS OF 2021)

TABLE 16 MEDICAL REIMBURSEMENT CODES FOR PET/CT IMAGING PROCEDURES IN THE US (AS OF 2021)

TABLE 17 MEDICAL REIMBURSEMENT CODES FOR ULTRASOUND IMAGING PROCEDURES IN THE US (AS OF 2021)

TABLE 18 MEDICAL REIMBURSEMENT CODES FOR MAMMOGRAPHY IMAGING PROCEDURES IN THE US (AS OF 2021)

TABLE 19 MEDICAL REIMBURSEMENT CODES FOR RADIOLOGY PROCEDURES IN THE US (AS OF 2021)

5.11 IMPACT OF COVID-19 ON THE DIAGNOSTIC IMAGING MARKET

5.11.1 PATENT ANALYSIS

FIGURE 22 MAJOR PATENTS HOLDERS FOR ULTRASOUND IMAGING SYSTEMS (JANUARY 2011-MAY 2021)

FIGURE 23 MAJOR PATENTS HOLDERS FOR MRI SYSTEMS (JANUARY 2011-MAY 2021)

FIGURE 24 MAJOR PATENTS HOLDERS FOR CT SCANNERS (JANUARY 2011-MAY 2021)

FIGURE 25 MAJOR PATENTS HOLDERS FOR MAMMOGRAPHY SYSTEMS (JANUARY 2011-MAY 2021)

FIGURE 26 MAJOR PATENTS HOLDERS FOR NUCLEAR IMAGING SYSTEMS (JANUARY 2011-MAY 2021)

FIGURE 27 MAJOR PATENTS HOLDERS FOR X-RAY IMAGING SYSTEMS (JANUARY 2011-MAY 2021)

FIGURE 28 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR DIAGNOSTIC IMAGING PATENTS, 2011–2021

5.12 TRADE ANALYSIS

5.12.1 TRADE ANALYSIS FOR COMPUTED TOMOGRAPHY SYSTEMS

5.12.1.1 Import Data for Computed Tomography Systems, by Country, 2016-2020 (USD Million)

5.12.1.2 Export Data for Computed Tomography Systems, by Country, 2016-2020 (USD Million)

5.12.2 TRADE ANALYSIS FOR ULTRASOUND SYSTEMS

5.12.2.1 Import Data for Magnetic Resonance Imaging Systems, by Country, 2016-2020 (USD Million)

5.12.2.2 Export Data for Ultrasound Systems, by Country, 2016-2020 (USD Million)

5.12.3 TRADE ANALYSIS FOR MAGNETIC RESONANCE IMAGING SYSTEMS

5.12.3.1 Import Data for Magnetic Resonance Imaging Systems, by Country, 2016-2020 (USD Million)

5.12.3.2 Export Data for Magnetic Resonance Imaging Systems, by Country, 2016-2020 (USD Million)

5.12.4 TRADE ANALYSIS FOR X- RAY SYSTEMS

5.12.4.1 Import Data for X-ray Systems, by Country, 2016-2020 (USD Million)

5.12.4.2 Export Data for X-ray Systems, by Country, 2016-2020 (USD Million)

6 DIAGNOSTIC IMAGING MARKET, BY PRODUCT (Page No. - 117)

6.1 INTRODUCTION

TABLE 20 GLOBAL MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

6.2 CT SCANNERS

TABLE 21 CT SCANNERS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 CT SCANNERS MARKET, BY REGION, 2019–2026 (UNITS)

TABLE 23 CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.2.1 CONVENTIONAL CT SCANNERS

TABLE 24 CONVENTIONAL CT SCANNERS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 25 CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.2.1.1 High-slice CT scanners

6.2.1.1.1 High imaging resolution and wide applications of high-slice scanners have made them popular among end users

TABLE 26 HIGH-SLICE CT SCANNERS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2.1.2 Mid-slice CT scanners

6.2.1.2.1 The affordability of mid-slice CT has driven its adoption in emerging markets

TABLE 27 MID-SLICE CT SCANNERS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2.1.3 Low-slice CT scanners

6.2.1.3.1 Low-slice CT scanners are being replaced with mid-slice CT systems

TABLE 28 LOW-SLICE CT SCANNERS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2.2 CONE-BEAM CT SCANNERS

6.2.2.1 Lower radiation exposure and increasing applications in dental and limb scanning have driven CBCT adoption

TABLE 29 CBCT SCANNERS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3 ULTRASOUND SYSTEMS

TABLE 30 ULTRASOUND SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 31 ULTRASOUND SYSTEMS MARKET, BY REGION, 2019–2026 (UNITS)

6.3.1 ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY

TABLE 32 ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

6.3.1.1 2D ultrasound systems

6.3.1.1.1 2D ultrasound systems dominate the global ultrasound systems market

TABLE 33 2D ULTRASOUND SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.1.2 3D & 4D ultrasound systems

6.3.1.2.1 Technological advancements and potential are driving the demand for 3D & 4D ultrasound

TABLE 34 3D & 4D ULTRASOUND SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.1.3 Doppler ultrasound systems

6.3.1.3.1 While noninvasive, Doppler imaging can heat tissues being scanned

TABLE 35 DOPPLER ULTRASOUND SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.2 ULTRASOUND SYSTEMS MARKET, BY PORTABILITY

TABLE 36 ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

6.3.2.1 Trolley/cart-based ultrasound systems

6.3.2.1.1 Wide applications and technological advancements in trolley/cart-based systems are driving market growth

TABLE 37 TROLLEY/CART-BASED ULTRASOUND SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.2.2 Compact/portable ultrasound systems

6.3.2.2.1 High portability and ease of use is contributing to the demand for compact systems

TABLE 38 COMPACT/PORTABLE ULTRASOUND SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.4 X-RAY IMAGING SYSTEMS

TABLE 39 X-RAY IMAGING SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 40 X-RAY IMAGING SYSTEMS MARKET, BY REGION, 2019–2026 (UNITS)

6.4.1 X-RAY IMAGING SYSTEMS MARKET, BY TYPE

TABLE 41 X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.4.1.1 Digital X-ray imaging systems

FIGURE 29 COMPUTED RADIOGRAPHY VS. DIRECT RADIOGRAPHY

TABLE 42 DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 43 DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.4.1.1.1 Direct radiography systems

6.4.1.1.1.1 High-throughput capabilities and quick operations have propelled the demand for DR systems

TABLE 44 DIRECT RADIOGRAPHY SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.4.1.1.2 Computed radiography systems

6.4.1.1.2.1 CR technology is rapidly replacing analog systems acting in the emerging economies

TABLE 45 COMPUTED RADIOGRAPHY SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.4.1.2 Analog X-ray imaging systems

6.4.1.2.1 Higher risk of radiation exposure and technological limitations impede the market growth

TABLE 46 ANALOG X-RAY IMAGING SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.4.2 X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY

TABLE 47 X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

6.4.2.1 Stationary X-ray imaging systems

6.4.2.1.1 Greater integration of configurations makes stationary X-ray systems preferable in a diagnostic clinic

TABLE 48 STATIONARY X-RAY IMAGING SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.4.2.2 Portable X-ray imaging systems

6.4.2.2.1 Portable systems show high adoption in trauma care and emergency departments

TABLE 49 PORTABLE X-RAY IMAGING SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.5 MRI SYSTEMS

TABLE 50 MRI SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 51 MRI SYSTEMS MARKET, BY REGION, 2019–2026 (UNITS)

6.5.1 MRI SYSTEMS MARKET, BY ARCHITECTURE

TABLE 52 MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

6.5.1.1 Closed MRI systems

6.5.1.1.1 Closed MRI systems are widely adopted across the globe

TABLE 53 CLOSED MRI SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.5.1.2 Open MRI systems

6.5.1.2.1 Open MRI can reduce anxiety in claustrophobic individuals

TABLE 54 OPEN MRI SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.5.2 MRI SYSTEMS MARKET, BY FIELD STRENGTH

TABLE 55 MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

6.5.2.1 High & very-high-field MRI systems

6.5.2.1.1 High & very-high-field MRI systems dominate the global MRI systems market

TABLE 56 HIGH & VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.5.2.2 Low-to-mid-field MRI systems

6.5.2.2.1 Technological limitations have reduced the adoption of low-to-mid-field MRI systems

TABLE 57 LOW TO MID-FIELD (<1.5T) SYSTEMS OFFERED IN THE MARKET

TABLE 58 LOW-TO-MID-FIELD SYSTEMS MRI SYSTEMS, BY REGION, 2019–2026 (USD MILLION)

6.5.2.3 Ultra-high-field MRI systems

6.5.2.3.1 Innovation and advancements in applications have supported the demand for ultra-high-field systems

TABLE 59 ULTRA-HIGH-FIELD MRI SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.6 NUCLEAR IMAGING SYSTEMS

TABLE 60 NUCLEAR IMAGING SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 61 NUCLEAR IMAGING SYSTEMS MARKET, BY REGION, 2019–2026 (UNITS)

TABLE 62 NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.6.1 SPECT SYSTEMS

TABLE 63 SPECT SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 64 SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.6.1.1 Hybrid SPECT systems

6.6.1.1.1 High cost and shortage of Technetium-99m have hindered market growth

TABLE 65 HYBRID SPECT SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.6.1.2 Standalone SPECT systems

6.6.1.2.1 Low cost, technological advancements, and long radiotracer half-life have all contributed to market growth

TABLE 66 STANDALONE SPECT SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.6.2 HYBRID PET SYSTEMS

6.6.2.1 Hybrid PET systems hold greater prospects of dominating the nuclear imaging systems market

TABLE 67 HYBRID PET SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.7 MAMMOGRAPHY SYSTEMS

6.7.1 MAMMOGRAPHY SYSTEMS SEGMENT TO GROW AT THE HIGHEST CAGR

TABLE 68 MAMMOGRAPHY SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 69 MAMMOGRAPHY SYSTEMS MARKET, BY REGION, 2019–2026 (UNITS)

7 DIAGNOSTIC IMAGING MARKET, BY APPLICATION (Page No. - 154)

7.1 INTRODUCTION

7.2 X-RAY IMAGING SYSTEMS

FIGURE 30 GENERAL RADIOGRAPHY APPLICATIONS TO WITNESS THE HIGHEST GROWTH IN THE X-RAY IMAGING SYSTEMS MARKET DURING THE FORECAST PERIOD

TABLE 70 X-RAY IMAGING SYSTEMS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

7.2.1 GENERAL RADIOGRAPHY

7.2.1.1 General radiography applications account for the largest share of the X-ray imaging systems market

7.2.2 DENTISTRY

7.2.2.1 High prevalence of dental disorders to drive the growth of this application segment

7.2.3 FLUOROSCOPY

7.2.3.1 Product launches and approvals of fluoroscopy systems to support the growth of this application segment

7.3 MRI SYSTEMS

FIGURE 31 BRAIN & NEUROLOGICAL MRI SEGMENT HOLDS THE LARGEST SHARE OF THE MRI SYSTEMS MARKET

TABLE 71 MRI SYSTEMS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

7.3.1 BRAIN & NEUROLOGICAL MRI

7.3.1.1 Brain & neurological MRI dominates the MRI systems market

7.3.2 SPINE & MUSCULOSKELETAL MRI

7.3.2.1 MRI is the most-preferred imaging method for the diagnosis and prognosis of MSK disorders and spinal injuries

7.3.3 VASCULAR MRI

7.3.3.1 Rising incidence of vascular disorders to drive the market for this application segment

7.3.4 PELVIC & ABDOMINAL MRI

7.3.4.1 Increasing incidence of pelvic & abdominal diseases to support market growth

7.3.5 BREAST MRI

7.3.5.1 Rising prevalence of breast cancer and increasing awareness about early breast cancer screening—key drivers for the breast MRI market

7.3.6 CARDIAC MRI

7.3.6.1 The rising incidence of CVD and technological advancements in cardiac MRI are the key factors supporting the growth of this application segment

7.4 ULTRASOUND SYSTEMS

FIGURE 32 VASCULAR APPLICATIONS SEGMENT WILL GROW AT THE HIGHEST CAGR IN THE ULTRASOUND SYSTEMS MARKET, BY APPLICATION

TABLE 72 ULTRASOUND SYSTEMS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

7.4.1 RADIOLOGY/GENERAL IMAGING

7.4.1.1 Radiology/general imaging is the largest application segment of the ultrasound market

7.4.2 OBSTETRICS/GYNECOLOGY

7.4.2.1 Increasing demand for minimally invasive techniques in gynecological diagnostic procedures to support market growth

7.4.3 CARDIOLOGY

7.4.3.1 Cardiology is one of the largest and most widely used ultrasound application segments

7.4.4 VASCULAR APPLICATIONS

7.4.4.1 Vascular ultrasound is one of the fastest-growing application segments for ultrasound technologies across major markets

7.4.5 UROLOGY

7.4.5.1 The rising incidence of prostate disorders & kidney stones will drive the market for this application segment

7.4.6 OTHER APPLICATIONS

7.5 CT SCANNERS

FIGURE 33 CARDIOLOGY SEGMENT TO REGISTER THE HIGHEST GROWTH IN THE CT SCANNERS MARKET DURING THE FORECAST PERIOD

TABLE 73 CT SCANNERS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

7.5.1 CARDIOLOGY

7.5.1.1 Cardiac CT is one of the largest and most widely used CT application segments across the globe

7.5.2 ONCOLOGY

7.5.2.1 The rising incidence of cancer and technological advancements in CT scanners to support market growth

7.5.3 NEUROLOGY

7.5.3.1 Increasing adoption of CT scanners for diagnosing various neurological conditions to drive market growth

7.5.4 OTHER APPLICATIONS

7.6 NUCLEAR IMAGING SYSTEMS

FIGURE 34 ONCOLOGY SEGMENT DOMINATE THE NUCLEAR IMAGING SYSTEMS MARKET, BY APPLICATION

TABLE 74 NUCLEAR IMAGING SYSTEMS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

7.6.1 ONCOLOGY

7.6.1.1 Nuclear imaging systems can distinguish between benign and malignant tumors, supporting precise diagnosis

7.6.2 CARDIOLOGY

7.6.2.1 The high prevalence of CVD is the major factor driving the growth of this segment

7.6.3 NEUROLOGY

7.6.3.1 The increasing demand for nuclear imaging procedures for diagnosing neurological disorders is supporting the growth of this segment

7.6.4 OTHER APPLICATIONS

7.7 MAMMOGRAPHY SYSTEMS

7.7.1 GROWING ADVANCEMENTS IN MAMMOGRAPHY TO SUPPORT THE GROWTH OF THIS SEGMENT

8 DIAGNOSTIC IMAGING MARKET, BY END USER (Page No. - 172)

8.1 INTRODUCTION

TABLE 75 GLOBAL MARKET, BY END USER, 2019–2026 (USD MILLION)

8.2 HOSPITALS

8.2.1 LARGE HOSPITALS HAVE BEEN EARLY ADOPTERS OF ADVANCED DIAGNOSTIC IMAGING SYSTEMS

TABLE 76 GLOBAL MARKET FOR HOSPITALS, BY REGION, 2019–2026 (USD MILLION)

8.3 DIAGNOSTIC IMAGING CENTERS

8.3.1 THE INCREASING NUMBER OF PRIVATE IMAGING CENTERS IS CONTRIBUTING TO MARKET GROWTH

TABLE 77 GLOBAL MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY REGION, 2019–2026 (USD MILLION)

8.4 OTHER END USERS

TABLE 78 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2019–2026 (USD MILLION)

9 DIAGNOSTIC IMAGING MARKET, BY REGION (Page No. - 178)

9.1 INTRODUCTION

FIGURE 35 ASIA PACIFIC MARKET TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 79 DIAGNOSTIC IMAGING MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 36 NORTH AMERICA: CANCER PREVALENCE, 2012–2020

FIGURE 37 NORTH AMERICA: DIAGNOSTIC IMAGING MARKET SNAPSHOT

TABLE 80 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 85 NORTH AMERICA: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 89 NORTH AMERICA: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 91 NORTH AMERICA: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2.1 US

9.2.1.1 The US dominated the North American market in 2020

TABLE 94 US: KEY MACROINDICATORS

TABLE 95 US: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 96 US: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 US: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 US: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 99 US: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 100 US: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 US: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 102 US: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 103 US: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 104 US: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 105 US: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 106 US: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 A shortage of radiologists and long wait time for scans are the major challenges in the Canadian market

TABLE 107 CANADA: KEY MACROINDICATORS

TABLE 108 CANADA: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 109 CANADA: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 CANADA: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 CANADA: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 112 CANADA: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 113 CANADA: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 114 CANADA: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 CANADA: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 116 CANADA: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 117 CANADA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 118 CANADA: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 CANADA: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.3 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: CANCER PREVALENCE, 2012–2020

FIGURE 39 ASIA PACIFIC: DIAGNOSTIC IMAGING MARKET SNAPSHOT

TABLE 120 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 122 ASIA PACIFIC: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 123 ASIA PACIFIC: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 124 ASIA PACIFIC: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 125 ASIA PACIFIC: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 126 ASIA PACIFIC: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 ASIA PACIFIC: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 ASIA PACIFIC: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 ASIA PACIFIC: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 130 ASIA PACIFIC: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 131 ASIA PACIFIC: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 132 ASIA PACIFIC: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 133 ASIA PACIFIC: DIAGNOSTIC IMAGING MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.1 JAPAN

9.3.1.1 Japan dominates the APAC market for diagnostic imaging

TABLE 134 JAPAN: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 135 JAPAN: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 136 JAPAN: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 137 JAPAN: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 138 JAPAN: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 139 JAPAN: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 140 JAPAN: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 141 JAPAN: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 142 JAPAN: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 JAPAN: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 JAPAN: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 145 JAPAN: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.3.2 CHINA

9.3.2.1 Government initiatives and the rapidly growing aging population to drive the growth of the market in China

TABLE 146 CHINA: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 147 CHINA: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 148 CHINA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 149 CHINA: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 150 CHINA: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 151 CHINA: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 152 CHINA: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 153 CHINA: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 154 CHINA: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 155 CHINA: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 156 CHINA: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 157 CHINA: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.3.3 INDIA

9.3.3.1 Uncertainties in healthcare policies might restrict the growth of the Indian market

TABLE 158 INDIA: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 159 INDIA: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 160 INDIA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 161 INDIA: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 162 INDIA: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 163 INDIA: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 164 INDIA: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 165 INDIA: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 166 INDIA: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 167 INDIA: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 168 INDIA: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 169 INDIA: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.3.4 SOUTH KOREA

9.3.4.1 Initiatives to increase access to imaging services in the country are expected to have a positive impact on the market growth

TABLE 170 SOUTH KOREA: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 171 SOUTH KOREA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 172 SOUTH KOREA: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 173 SOUTH KOREA: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 174 SOUTH KOREA: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 175 SOUTH KOREA: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 176 SOUTH KOREA: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 177 SOUTH KOREA: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 178 SOUTH KOREA: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 179 SOUTH KOREA: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 180 SOUTH KOREA: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 181 SOUTH KOREA: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.3.5 AUSTRALIA

9.3.5.1 Supporting government initiatives in the country are the key factors supporting the market

TABLE 182 AUSTRALIA: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 183 AUSTRALIA: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 184 AUSTRALIA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 185 AUSTRALIA: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 186 AUSTRALIA: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 187 AUSTRALIA: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 188 AUSTRALIA: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 189 AUSTRALIA: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 190 AUSTRALIA: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 191 AUSTRALIA: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 192 AUSTRALIA: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 193 AUSTRALIA: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.3.6 ROAPAC

TABLE 194 ROAPAC: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 195 ROAPAC: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 196 ROAPAC: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 197 ROAPAC: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 198 ROAPAC: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 199 ROAPAC: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 200 ROAPAC: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 201 ROAPAC: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 202 ROAPAC: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 203 ROAPAC: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 204 ROAPAC: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 205 ROAPAC: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.4 EUROPE

TABLE 206 EUROPE: DIAGNOSTIC IMAGING MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 207 EUROPE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 208 EUROPE: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 209 EUROPE: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 210 EUROPE: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 211 EUROPE: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 212 EUROPE: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 213 EUROPE: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 214 EUROPE: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 215 EUROPE: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 216 EUROPE: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 217 EUROPE: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 218 EUROPE: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 219 EUROPE: DIAGNOSTIC IMAGING MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Germany accounted for the largest share of the European market

TABLE 220 GERMANY: KEY MACROINDICATORS

TABLE 221 GERMANY: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 222 GERMANY: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 223 GERMANY: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 224 GERMANY: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 225 GERMANY: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 226 GERMANY: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 227 GERMANY: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 228 GERMANY: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 229 GERMANY: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 230 GERMANY: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 231 GERMANY: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 232 GERMANY: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.4.2 UK

9.4.2.1 Government initiatives to support market growth in the UK

TABLE 233 UK: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 234 UK: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 235 UK: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 236 UK: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 237 UK: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 238 UK: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 239 UK: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 240 UK: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 241 UK: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 242 UK: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 243 UK: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 244 UK: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.4.3 FRANCE

9.4.3.1 Uncertainties over the pricing strategy of diagnostic companies to limit market growth in France to a certain extent

TABLE 245 FRANCE: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 246 FRANCE: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 247 FRANCE: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 248 FRANCE: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 249 FRANCE: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 250 FRANCE: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 251 FRANCE: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 252 FRANCE: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 253 FRANCE: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 254 FRANCE: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 255 FRANCE: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 256 FRANCE: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.4.4 ITALY

9.4.4.1 Well-established healthcare infrastructure to support overall market growth

TABLE 257 ITALY: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 258 ITALY: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 259 ITALY: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 260 ITALY: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 261 ITALY: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 262 ITALY: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 263 ITALY: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 264 ITALY: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 265 ITALY: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 266 ITALY: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 267 ITALY: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 268 ITALY: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.4.5 SPAIN

9.4.5.1 Spain is an important importer of medical equipment

TABLE 269 SPAIN: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 270 SPAIN: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 271 SPAIN: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 272 SPAIN: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 273 SPAIN: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 274 SPAIN: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 275 SPAIN: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 276 SPAIN: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 277 SPAIN: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 278 SPAIN: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 279 SPAIN: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 280 SPAIN: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.4.6 ROE

TABLE 281 ROE: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 282 ROE: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 283 ROE: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 284 ROE: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 285 ROE ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 286 ROE: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 287 ROE: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 288 ROE: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 289 ROE: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 290 ROE: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 291 ROE: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 292 ROE: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.5 LATIN AMERICA

TABLE 293 LATIN AMERICA: DIAGNOSTIC IMAGING MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 294 LATIN AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 295 LATIN AMERICA: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 296 LATIN AMERICA: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 297 LATIN AMERICA: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 298 LATIN AMERICA: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 299 LATIN AMERICA: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 300 LATIN AMERICA: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 301 LATIN AMERICA: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 302 LATIN AMERICA: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 303 LATIN AMERICA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 304 LATIN AMERICA: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 305 LATIN AMERICA: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 306 LATIN AMERICA: DIAGNOSTIC IMAGING MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Brazil is the largest market for diagnostic imaging in LATAM

TABLE 307 BRAZIL: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 308 BRAZIL: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 309 BRAZIL: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 310 BRAZIL: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 311 BRAZIL: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 312 BRAZIL: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 313 BRAZIL: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 314 BRAZIL: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 315 BRAZIL: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 316 BRAZIL: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 317 BRAZIL: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 318 BRAZIL: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.5.2 MEXICO

9.5.2.1 Rising government initiatives to support the market growth

TABLE 319 MEXICO: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 320 MEXICO: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 321 MEXICO: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 322 MEXICO: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 323 MEXICO: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 324 MEXICO: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 325 MEXICO: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 326 MEXICO: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 327 MEXICO: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 328 MEXICO: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 329 MEXICO: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 330 MEXICO: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.5.3 REST OF LATIN AMERICA

TABLE 331 ROLATAM: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 332 ROLATAM: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 333 ROLATAM: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 334 ROLATAM: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 335 ROLATAM: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 336 ROLATAM: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 337 ROLATAM: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 338 ROLATAM: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 339 ROLATAM: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 340 ROLATAM: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 341 ROLATAM: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 342 ROLATAM: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 INVESTMENTS BY KEY MARKET PLAYERS TO SUPPORT THE MARKET GROWTH

TABLE 343 MIDDLE EAST & AFRICA: DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 344 MIDDLE EAST & AFRICA: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2019–2026 (USD MILLION)

TABLE 345 MIDDLE EAST & AFRICA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2019–2026 (USD MILLION)

TABLE 346 MIDDLE EAST & AFRICA: ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 347 MIDDLE EAST & AFRICA: ULTRASOUND SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 348 MIDDLE EAST & AFRICA: X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 349 MIDDLE EAST & AFRICA: DIGITAL X-RAY IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 350 MIDDLE EAST & AFRICA: X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY, 2019–2026 (USD MILLION)

TABLE 351 MIDDLE EAST & AFRICA: CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 352 MIDDLE EAST & AFRICA: CONVENTIONAL CT SCANNERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 353 MIDDLE EAST & AFRICA: NUCLEAR IMAGING SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 354 MIDDLE EAST & AFRICA: SPECT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 355 MIDDLE EAST & AFRICA: DIAGNOSTIC IMAGING MARKET, BY END USER, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 294)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 356 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MANUFACTURERS

10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 40 REVENUE SHARE ANALYSIS OF THE TOP PLAYERS IN THE DIAGNOSTIC IMAGING MARKET

10.4 MARKET SHARE ANALYSIS, BY KEY PLAYERS

10.4.1 GLOBAL MARKET

FIGURE 41 DIAGNOSTIC IMAGING MARKET SHARE, BY KEY PLAYER, 2020

10.4.2 X-RAY IMAGING SYSTEMS MARKET

FIGURE 42 X-RAY IMAGING SYSTEMS MARKET SHARE, BY KEY PLAYER, 2020

10.4.3 MRI SYSTEMS MARKET

FIGURE 43 MRI SYSTEMS MARKET SHARE, BY KEY PLAYER, 2020

10.4.4 CT SCANNERS MARKET

FIGURE 44 CT SCANNERS MARKET SHARE, BY KEY PLAYERS, 2020

10.4.5 ULTRASOUND SYSTEMS MARKET

FIGURE 45 ULTRASOUND SYSTEMS MARKET SHARE, BY KEY PLAYER, 2020

10.4.6 NUCLEAR IMAGING SYSTEMS MARKET

FIGURE 46 NUCLEAR IMAGING SYSTEMS MARKET SHARE, BY KEY PLAYER, 2020

10.4.7 MAMMOGRAPHY SYSTEMS MARKET

FIGURE 47 MAMMOGRAPHY SYSTEMS MARKET SHARE, BY KEY PLAYERS, 2020

TABLE 357 GLOBAL MARKET: DEGREE OF COMPETITION

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 48 DIAGNOSTIC IMAGING MARKET: COMPANY EVALUATION QUADRANT, 2020

10.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2020)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

FIGURE 49 GLOBAL MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2020

10.7 COMPANY PRODUCT & GEOGRAPHIC FOOTPRINT

FIGURE 50 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS OF TOP PLAYERS IN THE GLOBAL MARKET

TABLE 358 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 359 COMPANY GEOGRAPHIC FOOTPRINT

10.8 COMPETITIVE SITUATION AND TRENDS

TABLE 360 PRODUCT LAUNCHES AND APPROVALS

TABLE 361 DEALS

TABLE 362 OTHER DEVELOPMENTS

11 COMPANY PROFILES (Page No. - 309)

11.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

11.1.1 SIEMENS HEALTHINEERS

TABLE 363 SIEMENS AG: BUSINESS OVERVIEW

FIGURE 51 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT

11.1.2 GE HEALTHCARE (GENERAL ELECTRIC COMPANY)

TABLE 364 GE HEALTHCARE: BUSINESS OVERVIEW

FIGURE 52 GE HEALTHCARE: COMPANY SNAPSHOT

11.1.3 KONINKLIJKE PHILIPS N.V.

TABLE 365 KONINKLIJKE PHILIPS N.V: BUSINESS OVERVIEW

FIGURE 53 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

11.1.4 CANON

TABLE 366 CANON: BUSINESS OVERVIEW

FIGURE 54 CANON: COMPANY SNAPSHOT

11.1.5 FUJIFILM HOLDINGS CORPORATION

TABLE 367 FUJIFILM HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 55 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT

11.1.6 HITACHI

TABLE 368 HITACHI LTD: BUSINESS OVERVIEW

FIGURE 56 HITACHI, LTD.: COMPANY SNAPSHOT

11.1.7 SAMSUNG ELECTRONICS

TABLE 369 SAMSUNG ELECTRONICS: BUSINESS OVERVIEW

FIGURE 57 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

11.1.8 SHIMADZU CORPORATION

TABLE 370 SHIMADZU CORPORATION: BUSINESS OVERVIEW

FIGURE 58 SHIMADZU CORPORATION: COMPANY SNAPSHOT

11.1.9 AGFA-GEVAERT

TABLE 371 AGFA-GEVAERT: BUSINESS OVERVIEW

FIGURE 59 AGFA-GEVAERT GROUP: COMPANY SNAPSHOT

11.1.10 MINDRAY MEDICAL INTERNATIONAL LIMITED

TABLE 372 MINDRAY MEDICAL: BUSINESS OVERVIEW

11.1.11 ESAOTE SPA

TABLE 373 ESAOTE SPA: BUSINESS OVERVIEW

11.1.12 CARESTREAM HEALTH

TABLE 374 CARESTREAM HEALTH: BUSINESS OVERVIEW

11.1.13 HOLOGIC

TABLE 375 HOLOGIC: BUSINESS OVERVIEW

FIGURE 60 HOLOGIC: COMPANY SNAPSHOT

11.1.14 PLANMED OY

TABLE 376 PLANMED OY: BUSINESS OVERVIEW

11.1.15 CURVEBEAM

TABLE 377 CURVEBEAM LLC: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 KONICA MINOLTA

FIGURE 61 KONICA MINOLTA: COMPANY SNAPSHOT

11.2.2 STERNMED

11.2.3 ALLENGERS

11.2.4 NP JSC AMICO

11.2.5 NEUSOFT MEDICAL SYSTEMS

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 394)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

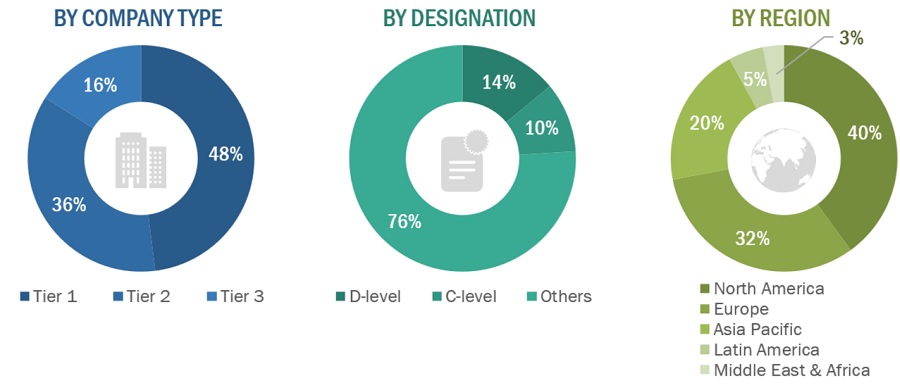

This study involved four major activities in estimating the current size of the diagnostic imaging market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to determine the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the diagnostic imaging market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The diagnostic imaging market comprises several stakeholders, such as end-product manufacturers, raw material providers, and end-users in the supply chain. The demand-side of this market is characterized by its end-users, such as hospitals, and diagnostic imaging centers among others. The supply-side is characterized by raw material providers, integrators, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents are given below:

To know about the assumptions considered for the study, download the pdf brochure

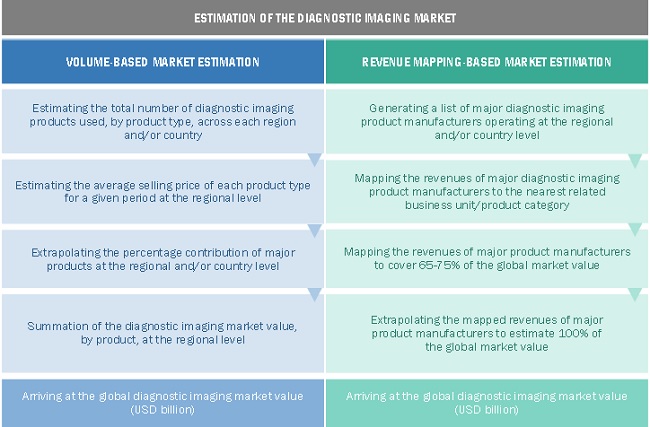

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the diagnostic imaging market and its dependent submarkets. These methods were also used extensively to determine the extent of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and demand have been identified through extensive secondary research, and their market share has been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market segments covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

- The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the end-use industries.

Report Objectives

- To define, describe, and forecast the diagnostic imaging market based on product, application, end-user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall diagnostic imaging market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five major regions and their countries—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To strategically profile the key global players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches, upgrades, and approvals; partnerships, agreements, and collaborations; acquisitions; and expansions in the diagnostic imaging market

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes players on various parameters within the broad categories of business and product excellence strategy

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for the diagnostic imaging market report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Diagnostic Imaging Market

What are the countries across major regions globally covered into the Diagnostic Imaging Market Report ?

Which is the fastest growing market of Diagnostic Imaging Market ?

Can you elaborate on some of the recent major developments the diagnostic imaging market has witnessed?

According to this report, what are some significant growth factors that drive the adoption of diagnostic imaging devices?