Digital Agriculture Market by Technology (Peripheral and Core), Type (Hardware and Software), Operation (Farming & Feeding, Monitoring & Scouting, and Marketing & Demand Generation), Operation and Region - Global Forecast to 2027

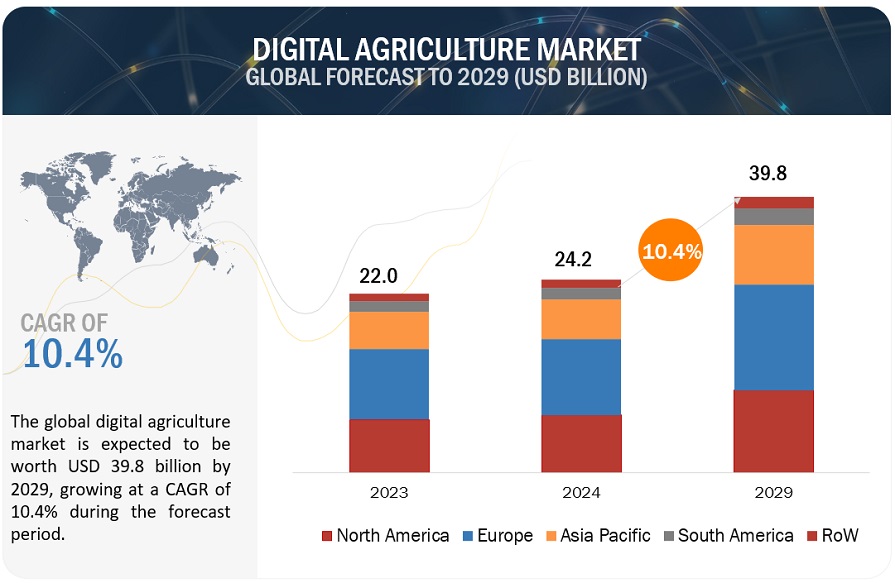

The global digital agriculture market as per revenue is estimated to be valued at USD 18.0 billion in 2022. It is projected to reach USD 29.8 billion by 2027, at a CAGR of 10.5%, in terms of value, between 2022 and 2027.

The new research study analyzes the current trends in the industry market, including an examination of pricing, patents, conference and webinar materials, key stakeholders, and consumer purchasing behavior.

The advancement in technology, minimizing wastage and efficient use of resources, yield maximization, and strategic governmental policy are increasing awareness about digital agriculture and helping in increasing adoption. These are some of the key trends in the global digital agriculture market due to which the market is expected to grow.

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Agriculture Market Dynamics

Drivers: Increasing initiatives by the government and key players operating in the digital agriculture market

The growth of the digital agriculture market is driven by the increasing agricultural activities and the growing need for real-time data for decision-making. In April 2019, Precision Hawk launched PrecisionAnalytics. Some of the start-ups in North America have also invested in developing software that would cater to the digital agriculture market. The US Global Development Lab and Bureau Food Security together joined hands for “Digital Development for Feed the Future, wherein they are demonstrating digital tools that can holistically leverage cost-effective agricultural practice. The European Commission 2020 launched Horizon Europe Program, under which research and innovation are key driving factors.

Restraints: Large number of fragmented lands

Developing countries such as India, China, and Africa account for many fragmented farmlands. Most farmers in these countries do not have access to fundamental farming technologies, such as yield monitoring, guidance technology, and variable rate technology. The fragmented nature of the digital agriculture industry makes it difficult to implement a standardized solution. Land fragmentation leads to an improper allocation of input and resources, which further leads to high costs.

Opportunities: Early detection of crop diseases and ease of farm management to further boost the digital agriculture market

The demand for automation in the livestock industry is increasing significantly to increase productivity, improve farm management, tackle the challenge of high labor costs, and address the need for real-time analysis and better decision-making. Automation has become necessary for modern-day operations, and the integration of AI and IoT in daily farming activity is impacting the efficiency and output of farm operations. The availability of real-time information leads to timely decisions, thereby reducing operations costs.

Challenges: Growing concerns regarding data management

Data management is the key to making smart farm management decisions and improving farm operations. The data is collected in a raw format, processed by context, relevance, and priority, and it is then presented in a manner that can be used to make decisions. Data management is a major challenge faced by farmers and other stakeholders in the digital agriculture market. The data obtained is crucial as it helps farmers and other stakeholders in the value chain to make productive decisions. Many growers or farmers are unaware of the effective use of data for decision-making purposes. Hence, it is essential to provide farmers and growers with proper data management tools and techniques.

By technology, the core technology segment is projected to grow at the highest CAGR in the digital agriculture market during the forecast period

Based on the technologies, the core technology segment is estimated to occupy the second-largest market share in 2022, in terms of value, and it is also projected to grow at the highest CAGR in the digital agriculture market. Digital agriculture involves optimized management of inputs such as robotics, drones, and AI in a farm according to its need. Factors facilitating the growth in the core technologies include the rising use of aerial imagery sensors, satellite imaging, hyperspectral imaging devices, big data and advanced analytics, and predictive farming techniques.

By type, the software segment holds the second-largest share in the digital agriculture market

Based on types, the software segment is expected to grow and occupy the second-largest market share in terms of value. Software has become one of the essential elements of digital agriculture and is used to interpret and analyze the gathered data. The use of software allows farmers to monitor and take control of their fields through smartphones, desktops, and laptops, eliminating field trips. This helps in saving time and additional analysis tools help derive information between yields, soil testing information, and application data.

By operations, the monitoring & scouting segment is projected to grow at the highest CAGR during the forecast period

By operations, the monitoring & scouting segment is projected to grow at the highest CAGR by 2027 in the digital agriculture market. Monitoring and scouting allow farmers and other stakeholders to remotely capture any disruption in the farm activity. The sensing and imagery use advanced sensors and drone imagery to provide remote sensing solutions to the growers. Traditionally, crop scouting involved walking and taking measurements in the fields; currently, crop scouting uses more sophisticated devices, such as a GPS receiver on a vehicle, which maneuvers through the fields marking field-specific information on pests and crop injury.

By offering, the advisory services segment is projected to grow at the highest CAGR in the digital agriculture market

Based on offerings, the advisory services segment is estimated to grow at the highest CAGR in terms of value in the digital agriculture market. Companies or farmers/agronomists outsource the responsibility of handling field-related operations to service providers. These service providers take care of most operations and provide suggestions to farmers to enhance production. Advisory services help generate records and integrate the unstructured data acquired by growers to improve and enhance their decisions.

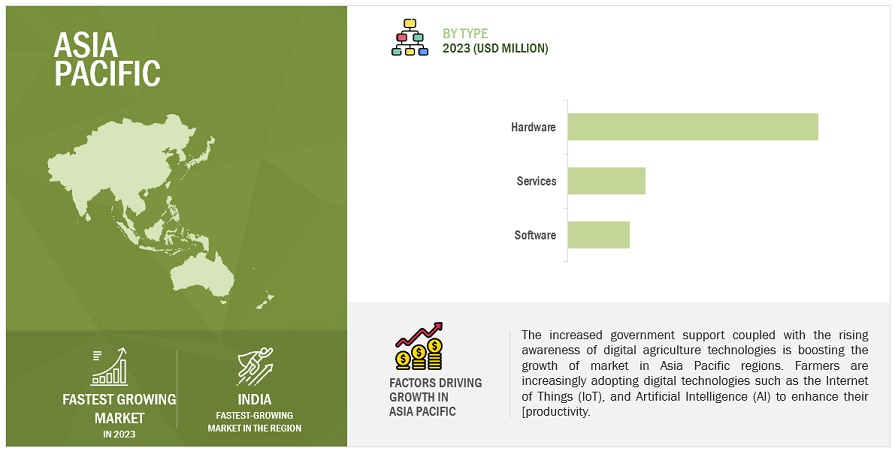

Asia Pacific is the fastest-growing region at a significant CAGR in the digital agriculture market

Increasing modernization in the agriculture industry is a major factor driving the region's growth. The region is dominated by agricultural-dependent countries such as India, China, and Bangladesh. China occupies the largest market share in the Asia Pacific digital agriculture market. The country is set to increase investment in its domestic agricultural industry from several technologies, from AI farming technology to auto-steering, sensors, and drones. Using these technologies helps optimize farm operations and increase agricultural output and profitability of the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players:

Key players in the digital agriculture market include CISCO Systems, Inc. (US), IBM Corporation (US), Accenture (Ireland), Deere & Company (US), Trimble INC. (US), DeLaval (Sweden), AKVA Group (Norway), Hexagon AB (Sweden), DJI (China), Epicor Software Corporation (US), Vodafone Group PLC. (UK), Bayer Cropscience AG (Germany), TELUS AGRICULTURE (Canada), Small Robot Company (England), Zemdirbiu Konsultacijos UAB (England), Raven Industries (US), Gamaya (Switzerland), AGCO Corporation (US), PrecisionHawk (US), Agreena (Denmark), Ceres Imaging (US), Agricultural Consulting Services (US), EC2CE (Spain), Eurofins Scientific (France), and Arable (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

| Market Size Value in 2022 | USD 18.0 billion |

| Market Size Value in 2027 | USD 29.8 billion |

| Market Growth Rate | 10.5% |

| Estimated Year | 2022 |

| Market size estimation | 2019–2027 |

| Base year considered | 2021 |

| Forecast period considered | 2022–2027 |

| Units considered | Value (USD Million/USD Billion) |

| Segments Covered | Technology, type, operation, offering, and region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

| Market Growth Drivers | The advancement in technology, minimizing wastage and efficient use of resources, yield maximization, and strategic governmental policy are increasing awareness about digital agriculture and helping in increasing adoption |

| Market Opportunities | Early detection of crop diseases and ease of farm management to further boost the market |

| Largest Growing Region | Asia Pacific |

| Companies studied |

|

Target Audience:

- Agriculture Equipment Component Suppliers

- Electronics Component and Device Manufacturers

- Original Equipment Manufacturers (OEMs)

- Product Manufacturers

- Agriculture Component and Device Suppliers and Distributors

- Software, Service, and Technology Providers

- Standardization and Testing Firms

- Government Bodies such as Regulatory Authorities and Policymakers

- Associations, Organizations, Forums, and Alliances Related to Semiconductor and Automotive Industries

- Research Institutes and Organizations

- Market Research and Consulting Firms

- Agri-food Buyers

Report Scope:

This research report categorizes the digital agriculture market based on technology, type, operation, offering, and region.

By Technology

-

Peripheral technologies

- Platforms

- Apps

-

Core technologies

- Automation

- Robotics

- Drones

- AI-ML

By Type

-

Hardware

-

Automation and control systems

- Drones/UAVs

- Irrigation controllers

- Global Positioning Systems (GPS)/ GNSS device

- Flow and application control devices

- Guidance and steering systems

- Handheld mobile devices/handheld computers

- Displays

- Harvesters & forwarders

- Variable rate controllers

- Control systems

- Robotics hardware

- HVAC systems

- LED grow lights

- Others

-

Sensing and monitoring device

- Yield monitor

- Soil sensors

- Water sensors

- Climate sensors

- Camera systems

- RFID and sensors for precision forestry

- Temperature and environmental monitoring sensors

- pH and dissolved oxygen sensors

- EC sensors

- RFID tags & readers for livestock monitoring

- Sensors for livestock monitoring

- Sensors for smart greenhouse

-

Automation and control systems

-

Software

- On-cloud

- On-premises

- AI and data analytics

-

Service

- System integration and consulting

- Managed services

- Connectivity services

- Assistant professional services

- Maintenance and support services

By Operation

-

Farming and feeding

- Precision agriculture

- Precision animal rearing and feeding

- Precision aquaculture

- Precision forestry

- Smart greenhouse

- Monitoring and scouting

- Marketing and demand generation

By Offering

- Advisory services

- Precision agriculture and farm management

- Quality management and traceability

- Digital procurement

- Agri eCommerce

- Financial services

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World

Recent Developments

- In June 2021, Deere & Company (US) partnered with Mobile Track Solution (US) to provide digital solutions for precision farming. Under this, Mobile Track Solutions provided John Deere & Company with greater than 27 cubic yard capacity towed scrapers for its distribution channels. This will help improve earthmoving efficiency and precision in large-scale applications.

- In April 2020, Trimble partnered with HORSCH (Germany) to develop automation solutions for the agriculture industry. HORSCH and Trimble, in collaboration, will focus on developing solutions, including autonomous machines and workflow management systems that improve farm productivity.

- In January 2020, IBM (US) and Yara International (Norway), a global leader in crop nutrition and digital farming solutions, invited farmer associations, industry players, academia, and NGOs from the food and agriculture industry to collaborate on developing digital agricultural solutions such as open data exchange platform for improving field efficiency, transparency, and sustainability of global food production.

Frequently Asked Questions (FAQ):

What is the projected market value of the global digital agriculture market?

Digital agriculture market is projected to generate USD 29.8 billion revenue by 2027.

What are the components of digital agriculture?

The components of digital agriculture are AI and data analytics, remote sensing, Internet of Things (IoT).

What are some drivers fueling the growth of the digital agriculture market?

Global digital agricultural market is characterized by the following drivers:

Drivers: Optimization of farm management by using agricultural services and software integration to drive the market

Digital agriculture is currently in practice to optimize the available resources with extreme efficiency. Digifarming is an integration of precision farming and smart agriculture, which is achieved through hardware and software implementation. To precisely operate these devices and software and increase their outcome, farmers opt for different services that help them enhance the farm output. Digital agriculture can be either through installing smart devices, a part of the Internet of Things (IoT) or through Software as a Service (SaaS). Software as a Service is more of an economical way, as it makes companies invest and learn in ML and software monitoring for performing predictive analysis and delivering customized reports. Some companies are becoming one-stop solutions for driving farm management, traceability, sales management, and risk management in the Agri sector.

What kind of information is provided in the competitive landscape section?

For the list of the below-mentioned players, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis, and MnM view to elaborate analyst view on the company. Some of the key players in the market are CISCO Systems, Inc. (US), IBM Corporation (US), Accenture (Ireland), Deere & Company (US), Trimble INC. (US), DeLaval (Sweden), AKVA Group (Norway), Hexagon AB (Sweden), DJI (China), Epicor Software Corporation (US), Vodafone Group PLC. (UK), Bayer Cropscience AG (Germany), TELUS AGRICULTURE (Canada), Small Robot Company (England), Zemdirbiu Konsultacijos UAB (England), Raven Industries (US), Gamaya (Switzerland), AGCO Corporation (US), PrecisionHawk (US), Agreena (Denmark), Ceres Imaging (US), Agricultural Consulting Services (US), EC2CE (Spain), Eurofins Scientific (France), and Arable (US). . . .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 DIGITAL AGRICULTURE MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.6 INCLUSIONS AND EXCLUSIONS

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 3 DIGITAL AGRICULTURE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Key data from primary sources

2.1.2.4 Breakdown of primary interviews

2.1.2.5 Key primary insights

2.2 MARKET SIZE ESTIMATION

FIGURE 4 APPROACH ONE: BOTTOM-UP (DEMAND SIDE)

FIGURE 5 APPROACH ONE: BOTTOM-UP (SUPPLY SIDE)

FIGURE 6 APPROACH TWO: TOP-DOWN (BASED ON GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 53)

TABLE 2 DIGITAL AGRICULTURE MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 8 MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET, BY OPERATION, MARKET SHARE 2022

FIGURE 10 MARKET, BY OFFERING, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES FOR DIGITAL AGRICULTURE MARKET PLAYERS

FIGURE 13 HIGH ADOPTION OF DIGITAL AGRICULTURE IN DEVELOPING MARKETS TO ESCALATE MARKET GROWTH

4.2 NORTH AMERICA: DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY & COUNTRY

FIGURE 14 US TO ACCOUNT FOR LARGEST SHARE IN NORTH AMERICAN MARKET IN 2021

4.3 MARKET, BY TYPE

FIGURE 15 DIGITAL AGRICULTURE HARDWARE TO DOMINATE DURING FORECAST PERIOD

4.4 MARKET, BY OPERATION

FIGURE 16 FARMING & FEEDING OPERATIONS TO DOMINATE IN 2022

4.5 MARKET, BY OFFERING

FIGURE 17 PRECISION AGRICULTURE & FARM MANAGEMENT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.6 DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY

FIGURE 18 PERIPHERAL TECHNOLOGIES TO DOMINATE MARKET DURING FORECAST PERIOD

4.7 MARKET, BY APPLICATION & REGION

FIGURE 19 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.1.1 MACROECONOMIC FACTORS

FIGURE 20 SMARTPHONE PENETRATION, BY REGION, 2019 VS 2025

FIGURE 21 GLOBAL GNSS DEMAND, 2021 VS 2031 (EUR BILLION)

5.2 MARKET DYNAMICS

FIGURE 22 DIGITAL AGRICULTURE MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Demand for optimization of farm management using agricultural services and software integration

5.2.1.2 Increase in initiatives by government and key players operating in market

5.2.1.3 Growth in concerns regarding ecosystem change

5.2.2 RESTRAINTS

5.2.2.1 Lack of technical knowledge and training activities

5.2.2.2 Large number of fragmented lands in developing countries

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in use of agricultural-based software via smartphones

5.2.3.2 Early detection of crop diseases and ease of farm management

5.2.4 CHALLENGES

5.2.4.1 High cost of devices and software to impact adoption among small-scale farmers

5.2.4.2 Rise in concerns regarding data management and requirement for adequate training

6 INDUSTRY TRENDS (Page No. - 68)

6.1 INTRODUCTION

6.2 CURRENT LANDSCAPE OF AGRICULTURAL INDUSTRY

6.3 VALUE CHAIN ANALYSIS

6.3.1 RESEARCH & DEVELOPMENT

6.3.2 DEVICE & COMPONENT MANUFACTURERS

6.3.3 SYSTEM INTEGRATORS

6.3.4 SERVICE PROVIDERS

6.3.5 END USERS

FIGURE 23 VALUE CHAIN ANALYSIS: DIGITAL AGRICULTURE MARKET

6.4 TECHNOLOGY ANALYSIS

6.4.1 ARTIFICIAL INTELLIGENCE

6.4.1.1 Crop yield productions & price forecasts

6.4.2 IOT

6.4.3 UNMANNED AERIAL VEHICLES

6.5 ECOSYSTEM MAPPING: DIGITAL AGRICULTURE MARKET

6.5.1 DEMAND SIDE

6.5.2 SUPPLY SIDE

FIGURE 24 MARKET: ECOSYSTEM

TABLE 3 MARKET: SUPPLY CHAIN (ECOSYSTEM)

6.6 TRENDS IMPACTING BUYERS

FIGURE 25 DIGITAL AGRICULTURE MARKET: TRENDS IMPACTING BUYERS

6.7 PATENT ANALYSIS

FIGURE 26 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2022

TABLE 4 PATENTS PERTAINING TO DIGITAL AGRICULTURE, 2020–2022

6.8 PRICING ANALYSIS

TABLE 5 AVERAGE SELLING PRICE (ASP) FOR ROV SYSTEM COMPONENTS, BY PRODUCT, 2022 VS. 2027 (USD/PIECE)

TABLE 6 ASP OF AQUACULTURE SENSORS, 2022 (USD/UNIT)

TABLE 7 ASP OF MILKING ROBOTS, 2022 VS. 2027 (USD/UNIT)

TABLE 8 ASP OF RFID TAGS & READERS, 2022 VS. 2027 (USD/UNIT)

6.9 TRADE DATA

TABLE 9 IMPORT DATA OF AGRICULTURAL MACHINERY, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 10 EXPORT DATA OF AGRICULTURAL MACHINERY, BY COUNTRY, 2019–2021 (USD MILLION)

6.9.1 GNSS DEVICES SHIPMENT

FIGURE 27 GLOBAL GNSS DEVICES SHIPMENT, BY REGION, 2021–2031 (MILLION)

6.10 KEY CONFERENCES & EVENTS

TABLE 11 KEY CONFERENCES & EVENTS, 2022–2023

6.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 12 DIGITAL AGRICULTURE MARKET: PORTER’S FIVE FORCES ANALYSIS

6.11.1 THREAT FROM NEW ENTRANTS

6.11.2 THREAT FROM SUBSTITUTES

6.11.3 BARGAINING POWER OF SUPPLIERS

6.11.4 BARGAINING POWER OF BUYERS

6.11.5 DEGREE OF COMPETITION

6.12 CASE STUDIES

6.12.1 INTERNAL PROCESS IMPROVEMENTS WITH DIGITAL AGRICULTURE

6.12.2 ANNA BINNA FARMS USED AGWORLD SOFTWARE PLATFORM FOR FARM RECORD-KEEPING

6.13 BUYING CRITERIA

6.13.1 BUYING CRITERIA ACROSS TYPES

FIGURE 28 KEY BUYING CRITERIA FOR DIGITAL AGRICULTURE TYPES

TABLE 13 KEY BUYING CRITERIA FOR DIGITAL AGRICULTURE TYPES

7 REGULATORY FRAMEWORK (Page No. - 91)

7.1 TARIFF & REGULATORY LANDSCAPE

TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

7.1.1 NORTH AMERICA

7.1.1.1 United States (US)

TABLE 18 US: ROBOTICS FOR AGRICULTURAL AND INDUSTRIAL USE

7.1.1.2 Canada

TABLE 19 CANADA: ROBOTIC MACHINERY AND ROBOT USAGE

7.1.1.3 Mexico

TABLE 20 MEXICO: DRONE CATEGORIES

7.1.2 EUROPEAN UNION (EU)

TABLE 21 EU: DRONE FLYING BASED ON INTENDED OPERATIONS

TABLE 22 EUROPE: AGRICULTURAL MACHINERY AND ROBOT PRODUCTION STANDARDS

7.1.3 ASIA PACIFIC

7.1.3.1 India

7.1.3.2 China

TABLE 23 CHINA: ARTICLES REGARDING AGRICULTURAL TECHNOLOGIES

TABLE 24 CHINA: DRONE CLASSIFICATION BASED ON WEIGHT

7.1.3.3 Australia

7.1.4 REST OF THE WORLD

8 DIGITAL AGRICULTURE MARKET, BY OFFERING (Page No. - 102)

8.1 INTRODUCTION

FIGURE 29 PRECISION AGRICULTURE & FARM MANAGEMENT TO DOMINATE DURING FORECAST PERIOD

TABLE 25 DIGITAL AGRICULTURE MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 26 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

8.2 ADVISORY SERVICES

8.2.1 ADVISORY SERVICES PROMOTE ADOPTION OF IMPROVED FARM TECHNOLOGIES

TABLE 27 ADVISORY SERVICES MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 28 ADVISORY SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 PRECISION AGRICULTURE & FARM MANAGEMENT

8.3.1 INCREASE IN DATA MANAGEMENT SERVICES TO IMPROVE DECISION-MAKING FOR SMART FARMS

TABLE 29 PRECISION AGRICULTURE & FARM MANAGEMENT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 30 PRECISION AGRICULTURE & FARM MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 QUALITY MANAGEMENT & TRACEABILITY

8.4.1 INNOVATION OF DIGI-LED DATA TO ENHANCE QUALITY MANAGEMENT OF FARMS

TABLE 31 QUALITY MANAGEMENT & TRACEABILITY MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 32 QUALITY MANAGEMENT TRACEABILITY MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 DIGITAL PROCUREMENT

8.5.1 PRODUCTION TRENDS THROUGH DIGITAL PROCUREMENT TO BOOST MARKET GROWTH

TABLE 33 DIGITAL PROCUREMENT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 34 DIGITAL PROCUREMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 AGRI ECOMMERCE

8.6.1 GROWTH IN AGRICULTURAL PRODUCE POPULARITY ON ECOMMERCE PLATFORMS

TABLE 35 AGRI ECOMMERCE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 36 AGRI ECOMMERCE MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 FINANCIAL SERVICES

8.7.1 INCREASE IN DEMAND FOR DIGITAL AGRICULTURE PAYMENT SERVICES TO BOOST MARKET GROWTH

TABLE 37 FINANCIAL SERVICES MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 38 FINANCIAL SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

9 DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY (Page No. - 112)

9.1 INTRODUCTION

FIGURE 30 PERIPHERAL TECHNOLOGY TO DOMINATE THE MARKET DURING FORECAST PERIOD

TABLE 39 DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 40 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 41 PERIPHERAL DIGITAL AGRICULTURE TECHNOLOGY MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 42 PERIPHERAL DIGITAL AGRICULTURE TECHNOLOGY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 43 CORE DIGITAL AGRICULTURE TECHNOLOGY MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 44 CORE DIGITAL AGRICULTURE TECHNOLOGY MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.2 PERIPHERAL TECHNOLOGY

9.2.1 PRECISION AGRICULTURE SOLUTIONS PROVIDE HIGH-VALUE INSIGHTS TO MAKE REAL-TIME DECISIONS

9.2.2 PLATFORMS

9.2.2.1 Platforms help farmers develop future field plans

9.2.3 APPS

9.2.3.1 Greater penetration of mobile devices in emerging economies to drive segment

TABLE 45 PERIPHERAL DIGITAL AGRICULTURE TECHNOLOGY MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 46 PERIPHERAL DIGITAL AGRICULTURE TECHNOLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 CORE TECHNOLOGY

9.3.1 INCREASE IN APPLICATION OF CORE TECHNOLOGIES IN REDUCING ENVIRONMENTAL IMPACT TO BOOST MARKET

9.3.2 AUTOMATION

9.3.2.1 Automation technology to increase yield and rate of farm production

9.3.3 DRONES

9.3.3.1 Ability of drones to survey crops and herds over vast areas to drive demand

9.3.4 ROBOTICS

9.3.4.1 Reduction in manual labor in farm activities to boost market

9.3.5 AI/ML

9.3.5.1 Real-time actionable insights to improve agriculture yield to boost segment

TABLE 47 CORE DIGITAL AGRICULTURE TECHNOLOGY MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 48 CORE DIGITAL AGRICULTURE TECHNOLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

10 DIGITAL AGRICULTURE MARKET, BY OPERATION (Page No. - 121)

10.1 INTRODUCTION

TABLE 49 DIGITAL AGRICULTURE MARKET, BY OPERATION, 2019–2021 (USD MILLION)

TABLE 50 MARKET, BY OPERATION, 2022–2027 (USD MILLION)

10.2 FARMING & FEEDING

10.2.1 INCREASE IN DEMAND FOR MONITORING OF FARMING AND FEEDING SYSTEMS TO DETERMINE CROP AND LIVESTOCK HEALTH

TABLE 51 FARMING & FEEDING OPERATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 52 FARMING & FEEDING OPERATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.2 PRECISION AGRICULTURE

10.2.2.1 Trend of using technology to improve agricultural yield to drive market

10.2.3 PRECISION ANIMAL REARING AND FEEDING

10.2.3.1 Growth in importance of animal health to propel segment

10.2.4 PRECISION AQUACULTURE

10.2.4.1 Adoption of technology to enhance aquaculture operations to drive demand

10.2.5 PRECISION FORESTRY

10.2.5.1 Ease of forestry operations and improved efficiency to drive segment

10.2.6 SMART GREENHOUSES

10.2.6.1 Use of technology to further improve smart agriculture operations to boost market growth

TABLE 53 FARMING & FEEDING OPERATIONS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 54 FARMING & FEEDING OPERATIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3 MONITORING & SCOUTING

10.3.1 GROWTH IN QUALITY CONCERNS TO IMPACT IMPORTANCE OF MONITORING & SCOUTING IN DIGITAL AGRICULTURE

TABLE 55 MONITORING & SCOUTING OPERATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 56 MONITORING & SCOUTING OPERATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 MARKETING & DEMAND GENERATION

10.4.1 SURGE IN DEMAND FOR ONLINE SELLING OF AGRICULTURAL OUTPUT TO DRIVE MARKETING AND DEMAND GENERATION

TABLE 57 MARKETING & DEMAND GENERATION OPERATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 58 MARKETING & DEMAND GENERATION OPERATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

11 DIGITAL AGRICULTURE MARKET, BY TYPE (Page No. - 130)

11.1 INTRODUCTION

FIGURE 31 DIGITAL AGRICULTURE MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 59 MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 60 MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2 HARDWARE

11.2.1 VARIETY OF AUTOMATION AND MONITORING TOOLS IN DIFFERENT TYPES OF AGRICULTURE TO BOOST DEMAND

TABLE 61 DIGITAL AGRICULTURE HARDWARE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 62 DIGITAL AGRICULTURE HARDWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 63 DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 64 DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2.2 AUTOMATION & CONTROL SYSTEMS

11.2.2.1 High demand for drones to monitor crop growth and pest control activity to boost demand

11.2.2.2 Drones/UAVs

11.2.2.3 Irrigation controllers

11.2.2.4 GPS/GNSS

11.2.2.5 Flow & application control devices

11.2.2.6 Guidance & steering

11.2.2.7 Handheld mobile device/handheld computers

11.2.2.8 Displays

11.2.2.9 Harvesters & forwarders

11.2.2.10 Variable rate controllers

11.2.2.11 Control systems

11.2.2.12 Robotic hardware

11.2.2.13 HVAC systems

11.2.2.14 LED grow lights

11.2.2.15 Other automation & control systems

TABLE 65 AGRICULTURE AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 66 AGRICULTURE AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2.3 SENSING & MONITORING DEVICES

11.2.3.1 High demand for sensors to make informed decisions to drive segment

11.2.3.2 Yield monitors

11.2.3.3 Soil sensors

11.2.3.4 Water sensors

11.2.3.5 Climate sensors

11.2.3.6 Camera systems

11.2.3.7 RFID & sensors for precision forestry

11.2.3.8 Temperature & environment monitoring sensors

11.2.3.9 pH & dissolved oxygen sensors

11.2.3.10 EC sensors

11.2.3.11 RFID tags & readers for livestock monitoring

11.2.3.12 Sensors for livestock monitoring

11.2.3.13 Sensors for smart greenhouses

11.2.3.14 Other sensing & monitoring devices

TABLE 67 AGRICULTURE SENSING & MONITORING DEVICES MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 68 AGRICULTURE SENSING & MONITORING DEVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3 SOFTWARE

11.3.1 KEY DEVELOPMENTS BY COMPANIES TO FURTHER BOOST ADOPTION OF SOFTWARE IN DIGITAL AGRICULTURE MARKET

TABLE 69 DIGITAL AGRICULTURE SOFTWARE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 70 DIGITAL AGRICULTURE SOFTWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3.2 ON-CLOUD

11.3.2.1 Easy data handling and storage to fuel demand for on-cloud software

11.3.3 ON-PREMISES

11.3.3.1 High data integrity, easy maintenance, and storage to be key drivers for on-premise software

11.3.4 AI & DATA ANALYTICS

11.3.4.1 Increase in trend of AI and data analytics to enhance farm operations to further boost adoption among farmers

TABLE 71 DIGITAL AGRICULTURE SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 72 DIGITAL AGRICULTURE SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4 SERVICES

11.4.1 INCREASE IN IMPORTANCE OF PRECISION TECHNIQUES IN DIFFERENT SEGMENTS TO FURTHER IMPACT NEED FOR SERVICES

TABLE 73 DIGITAL AGRICULTURE SERVICES MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 74 DIGITAL AGRICULTURE SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4.2 SYSTEM INTEGRATION & CONSULTING

11.4.2.1 Rise in importance of hardware and software integration for smooth farm functioning to propel growth

11.4.3 DATA COLLECTION & ANALYTICAL SERVICES

11.4.3.1 Need to integrate data in structured form to drive data collection and analytical services

11.4.4 CONNECTIVITY SERVICES

11.4.4.1 Opportunity for real-time data generation to impact demand for connectivity services

11.4.5 ASSISTANT PROFESSIONAL SERVICES

11.4.5.1 Need for improvements and professional services to manage entire value chain to increase demand

11.4.6 MAINTENANCE & SUPPORT SERVICES

11.4.6.1 Continuous need to maintain different digital agriculture systems to propel market

TABLE 75 DIGITAL AGRICULTURE SERVICES MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 76 DIGITAL AGRICULTURE SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

12 DIGITAL AGRICULTURE MARKET, BY REGION (Page No. - 147)

12.1 INTRODUCTION

FIGURE 32 INDIA TO BE FASTEST-GROWING COUNTRY IN THE MARKET

TABLE 77 MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 78 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 33 NORTH AMERICA: DIGITAL AGRICULTURE MARKET SNAPSHOT

TABLE 79 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY OPERATION, 2019–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY OPERATION, 2022–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.2.1 US

12.2.1.1 Rise in usage of digital agriculture technologies in US

TABLE 89 US: DIGITAL AGRICULTURE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 90 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Federal investments, accessibility, and favorable regulatory environment framework to propel market

TABLE 91 CANADA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 92 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 Limited resources driving demand for digital agriculture technologies

TABLE 93 MEXICO: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 94 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3 EUROPE

TABLE 95 EUROPE: DIGITAL AGRICULTURE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 99 EUROPE: MARKET, BY OPERATION, 2019–2021 (USD MILLION)

TABLE 100 EUROPE: MARKET, BY OPERATION, 2022–2027 (USD MILLION)

TABLE 101 EUROPE: MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Increase in funding for research projects to impact market

TABLE 105 GERMANY: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 106 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.2 RUSSIA

12.3.2.1 Agriculture 4.0 to increase demand for modern technologies

TABLE 107 RUSSIA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 108 RUSSIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Rise in awareness regarding technology and automation to support market growth

TABLE 109 FRANCE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 110 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.4 ITALY

12.3.4.1 ‘Made in Italy’ campaign to drive modernization

TABLE 111 ITALY: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 112 ITALY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.5 UK

12.3.5.1 Greater need to meet growing automation needs to boost market in the UK

TABLE 113 UK: DIGITAL AGRICULTURE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 114 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.6 SWEDEN

12.3.6.1 Growth in utilization of agricultural technologies for soil monitoring to boost market

TABLE 115 SWEDEN: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 116 SWEDEN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.7 NETHERLANDS

12.3.7.1 Utilization of drones in greenhouses to drive demand for digital agriculture

TABLE 117 NETHERLANDS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 118 NETHERLANDS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.8 REST OF EUROPE

TABLE 119 REST OF EUROPE: DIGITAL AGRICULTURE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 120 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: DIGITAL AGRICULTURE ADDITIVES MARKET SNAPSHOT

TABLE 121 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY OPERATION, 2019–2021 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY OPERATION, 2022–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Large population and increase in food demand to shape digital agriculture landscape

TABLE 131 CHINA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 132 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.2 JAPAN

12.4.2.1 Higher demand for digital agriculture to make country’s food industry self-sufficient

TABLE 133 JAPAN: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 134 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.3 AUSTRALIA & NEW ZEALAND

12.4.3.1 Thriving poultry industry and increasing exports to propel market

TABLE 135 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 136 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.4 INDIA

12.4.4.1 Government initiatives to provide great opportunities for digital agriculture in India

TABLE 137 INDIA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 138 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.5 REST OF ASIA PACIFIC

TABLE 139 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 140 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.5 SOUTH AMERICA

TABLE 141 SOUTH AMERICA: DIGITAL AGRICULTURE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 142 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 143 SOUTH AMERICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 144 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 145 SOUTH AMERICA: MARKET, BY OPERATION, 2019–2021 (USD MILLION)

TABLE 146 SOUTH AMERICA: MARKET, BY OPERATION, 2022–2027 (USD MILLION)

TABLE 147 SOUTH AMERICA: MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 148 SOUTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 149 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 150 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.5.1 BRAZIL

12.5.1.1 Growth in agriculture activities to boost market for digital agriculture

TABLE 151 BRAZIL: DIGITAL AGRICULTURE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 152 BRAZIL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.5.2 ARGENTINA

12.5.2.1 Increase in public-private partnerships for agriculture innovations

TABLE 153 ARGENTINA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 154 ARGENTINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.5.3 REST OF SOUTH AMERICA

TABLE 155 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 156 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.6 REST OF THE WORLD (ROW)

TABLE 157 ROW: DIGITAL AGRICULTURE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 158 ROW: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 159 ROW: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 160 ROW: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 161 ROW: MARKET, BY OPERATION, 2019–2021 (USD MILLION)

TABLE 162 ROW: MARKET, BY OPERATION, 2022–2027 (USD MILLION)

TABLE 163 ROW: MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 164 REST OF THE WORLD: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 165 ROW: DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 166 ROW: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.6.1 AFRICA

12.6.1.1 Increase in awareness and penetration of digitalization to drive market

TABLE 167 AFRICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 168 AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.6.2 MIDDLE EAST

12.6.2.1 Rise in adoption of smartphones for agriculture to fuel growth

TABLE 169 MIDDLE EAST: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 170 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 188)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS

TABLE 171 DIGITAL AGRICULTURE MARKET SHARE ANALYSIS, 2021

13.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 35 TOTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD BILLION)

13.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

13.4.1 STARS

13.4.2 PERVASIVE PLAYERS

13.4.3 EMERGING LEADERS

13.4.4 PARTICIPANTS

FIGURE 36 MARKET, COMPANY EVALUATION QUADRANT, 2021

13.4.5 COMPANY PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 172 DIGITAL AGRICULTURE COMPANY FOOTPRINT, BY OFFERING

TABLE 173 DIGITAL AGRICULTURE COMPANY FOOTPRINT, BY TYPE

TABLE 174 DIGITAL AGRICULTURE COMPANY FOOTPRINT, BY OPERATION

TABLE 175 DIGITAL AGRICULTURE COMPANY FOOTPRINT, BY TECHNOLOGY

TABLE 176 DIGITAL AGRICULTURE COMPANY FOOTPRINT, BY REGION

TABLE 177 OVERALL COMPANY FOOTPRINT

13.5 COMPANY EVALUATION QUADRANT (OTHER PLAYERS)

13.5.1 PROGRESSIVE COMPANIES

13.5.2 STARTING BLOCKS

13.5.3 RESPONSIVE COMPANIES

13.5.4 DYNAMIC COMPANIES

FIGURE 37 DIGITAL AGRICULTURE MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

TABLE 178 DIGITAL AGRICULTURE: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

13.6 COMPETITIVE SCENARIO

13.6.1 PRODUCT LAUNCHES

TABLE 179 MARKET: PRODUCT LAUNCHES, 2019–2022

13.6.2 DEALS

TABLE 180 MARKET: DEALS, 2019–2022

13.6.3 OTHERS

TABLE 181 MARKET: OTHERS, 2021–2022

14 COMPANY PROFILES (Page No. - 207)

14.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1.1 CISCO SYSTEMS, INC.

TABLE 182 CISCO SYSTEMS, INC.: BUSINESS OVERVIEW

FIGURE 38 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

TABLE 183 CISCO SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 184 CISCO SYSTEMS, INC.: NEW PRODUCT LAUNCHES

TABLE 185 CISCO SYSTEMS, INC.: DEALS

14.1.2 IBM CORPORATION

TABLE 186 IBM CORPORATION: DIGITAL AGRICULTURE MARKET BUSINESS OVERVIEW

FIGURE 39 IBM CORPORATION: COMPANY SNAPSHOT

TABLE 187 IBM CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 188 IBM CORPORATION: NEW PRODUCT LAUNCH

TABLE 189 IBM CORPORATION: DEALS

14.1.3 ACCENTURE

TABLE 190 ACCENTURE: BUSINESS OVERVIEW

FIGURE 40 ACCENTURE: COMPANY SNAPSHOT

TABLE 191 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.4 DEERE & COMPANY

TABLE 192 DEERE & COMPANY: BUSINESS OVERVIEW

FIGURE 41 DEERE & COMPANY: COMPANY SNAPSHOT

TABLE 193 DEERE & COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 194 DEERE & COMPANY: NEW PRODUCT LAUNCHES

TABLE 195 DEERE & COMPANY: DEALS

14.1.5 TRIMBLE INC.

TABLE 196 TRIMBLE INC.: BUSINESS OVERVIEW

FIGURE 42 TRIMBLE INC.: COMPANY SNAPSHOT

TABLE 197 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 198 TRIMBLE INC.: NEW PRODUCT LAUNCH

TABLE 199 TRIMBLE INC.: DEALS

14.1.6 DELAVAL

TABLE 200 DELAVAL: DIGITAL AGRICULTURE MARKET BUSINESS OVERVIEW

FIGURE 43 DELAVAL: COMPANY SNAPSHOT

TABLE 201 DELAVAL: PRODUCTS OFFERED

TABLE 202 DELAVAL: NEW PRODUCT LAUNCHES

TABLE 203 DELAVAL: DEALS

14.1.7 AKVA GROUP

TABLE 204 AKVA GROUP: BUSINESS OVERVIEW

FIGURE 44 AKVA GROUP: COMPANY SNAPSHOT

TABLE 205 AKVA GROUP: PRODUCTS OFFERED

TABLE 206 AKVA GROUP: DEALS

14.1.8 HEXAGON AB

TABLE 207 HEXAGON AB: BUSINESS OVERVIEW

FIGURE 45 HEXAGON AB: COMPANY SNAPSHOT

TABLE 208 HEXAGON AB: PRODUCTS OFFERED

14.1.9 DA JIANG INNOVATIONS SCIENCE & TECHNOLOGY CO. (DJI)

TABLE 209 DJI: BUSINESS OVERVIEW

TABLE 210 DJI: PRODUCTS OFFERED

14.1.10 EPICOR SOFTWARE CORPORATION

TABLE 211 EPICOR SOFTWARE CORPORATION: BUSINESS OVERVIEW

TABLE 212 EPICOR SOFTWARE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2 OTHER PLAYERS

14.2.1 VODAFONE GROUP PLC

TABLE 213 VODAFONE GROUP PLC: BUSINESS OVERVIEW

FIGURE 46 VODAFONE GROUP PLC: COMPANY SNAPSHOT

TABLE 214 VODAFONE GROUP PLC: PRODUCTS OFFERED

TABLE 215 VODAFONE GROUP PLC: NEW PRODUCT LAUNCHES

14.2.2 BAYER CROPSCIENCE AG

TABLE 216 BAYER CROPSCIENCE AG: BUSINESS OVERVIEW

FIGURE 47 BAYER CROPSCIENCE AG: COMPANY SNAPSHOT

TABLE 217 BAYER CROPSCIENCE AG: PRODUCTS OFFERED

TABLE 218 BAYER CROPSCIENCE AG: NEW PRODUCT LAUNCHES

TABLE 219 BAYER CROPSCIENCE AG: DEALS

14.2.3 TELUS AGRICULTURE

TABLE 220 TELUS AGRICULTURE: DIGITAL AGRICULTURE MARKET BUSINESS OVERVIEW

TABLE 221 TELUS AGRICULTURE: PRODUCTS OFFERED

TABLE 222 TELUS AGRICULTURE: DEALS

14.2.4 SMALL ROBOT COMPANY

TABLE 223 SMALL ROBOT COMPANY: BUSINESS OVERVIEW

TABLE 224 SMALL ROBOT COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 225 SMALL ROBOT COMPANY: NEW PRODUCT LAUNCH

14.2.5 ZEMDIRBIU KONSULTACIJOS UAB

TABLE 226 ZEMDIRBIU KONSULTACIJOS UAB: BUSINESS OVERVIEW

TABLE 227 ZEMDIRBIU KONSULTACIJOS UAB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.6 RAVEN INDUSTRIES

TABLE 228 RAVEN INDUSTRIES: BUSINESS OVERVIEW

FIGURE 48 RAVEN INDUSTRIES: COMPANY SNAPSHOT

TABLE 229 RAVEN INDUSTRIES: PRODUCTS OFFERED

TABLE 230 RAVEN INDUSTRIES: NEW PRODUCT LAUNCHES

TABLE 231 RAVEN INDUSTRIES: DEALS

TABLE 232 RAVEN INDUSTRIES: OTHERS

14.2.7 GAMAYA

TABLE 233 GAMAYA: DIGITAL AGRICULTUREBUSINESS OVERVIEW

TABLE 234 GAMAYA: PRODUCTS OFFERED

14.2.8 AGCO CORPORATION

TABLE 235 AGCO CORPORATION: BUSINESS OVERVIEW

FIGURE 49 AGCO CORPORATION: COMPANY SNAPSHOT

TABLE 236 AGCO CORPORATION: PRODUCTS OFFERED

TABLE 237 AGCO CORPORATION: DEALS

14.2.9 PRECISIONHAWK

TABLE 238 PRECISIONHAWK: BUSINESS OVERVIEW

TABLE 239 PRECISIONHAWK: PRODUCTS OFFERED

TABLE 240 PRECISIONHAWK: NEW PRODUCT LAUNCHES

TABLE 241 PRECISIONHAWK: DEALS

14.2.10 AGREENA

TABLE 242 AGREENA: DIGITAL AGRICULTURE MARKET BUSINESS OVERVIEW

TABLE 243 AGREENA: PRODUCTS OFFERED

TABLE 244 AGREENA: DEALS

14.2.11 CERES IMAGING

TABLE 245 CERES IMAGING: BUSINESS OVERVIEW

TABLE 246 CERES: PRODUCTS OFFERED

TABLE 247 CERES: NEW PRODUCT LAUNCHES

14.2.12 AGRICULTURAL CONSULTING SERVICES (ACS)

TABLE 248 AGRICULTURAL CONSULTING SERVICES: BUSINESS OVERVIEW

TABLE 249 AGRICULTURAL CONSULTING SERVICES (ACS): PRODUCTS OFFERED

14.2.13 EC2CE

TABLE 250 EC2CE: BUSINESS OVERVIEW

TABLE 251 EC2CE: PRODUCTS OFFERED

TABLE 252 EC2CE: NEW PRODUCT LAUNCHES

14.2.14 EUROFINS SCIENTIFIC

TABLE 253 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 50 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

TABLE 254 EUROFINS SCIENTIFIC: PRODUCTS OFFERED

14.2.15 ARABLE

TABLE 255 ARABLE: BUSINESS OVERVIEW

TABLE 256 ARABLE: PRODUCTS OFFERED

TABLE 257 ARABLE: NEW PRODUCT LAUNCHES

TABLE 258 ARABLE: DEALS

TABLE 259 ARABLE: OTHERS

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 288)

15.1 INTRODUCTION

TABLE 260 ADJACENT MARKETS TO DIGITAL AGRICULTURE MARKET

15.2 LIMITATIONS

15.3 PRECISION FARMING MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 261 PRECISION FARMING MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 262 PRECISION FARMING MARKET, BY OFFERING, 2022–2030 (USD MILLION)

15.4 SMART AGRICULTURE MARKET

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

TABLE 263 SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2017–2020 (USD MILLION)

TABLE 264 SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2021–2026 (USD MILLION)

15.5 FARM MANAGEMENT SOFTWARE MARKET

15.5.1 MARKET DEFINITION

15.5.2 MARKET OVERVIEW

TABLE 265 FARM MANAGEMENT SOFTWARE MARKET, BY FARM PRODUCTION PLANNING, 2017–2020 (USD MILLION)

TABLE 266 FARM MANAGEMENT SOFTWARE MARKET, BY FARM PRODUCTION PLANNING, 2021–2026 (USD MILLION)

16 APPENDIX (Page No. - 293)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

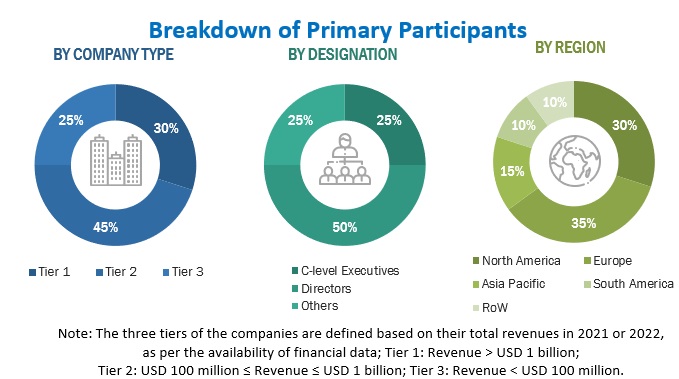

The study involved four major activities in estimating the digital agriculture market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information relevant to this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. The secondary research was done to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Secondary sources for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

Extensive primary research was conducted to gather information and verify and validate the critical market numbers. Various sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the smart agriculture market. The primary research was also conducted to identify segmentation types, industry trends, and key players, as well as to analyze the competitive landscape; key player strategies; key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the digital agriculture market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the digital agriculture market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall digital agriculture market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points, match the data is assumed to be correct.

Report Objectives

- To describe and forecast the digital agriculture market, in terms of technology, type, operation, offering, and region.

- To describe and forecast the digital agriculture market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries. To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market.

- To study the complete value chain of the digital agriculture market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the digital agriculture market.

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders.

- To analyze strategic approaches, such as expansions, product launches, acquisitions, and partnerships in the digital agriculture market.

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

-

Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of the European digital agriculture market by key countries Denmark, Spain, Finland, and Norway

- Further breakdown of the Rest of the Asia Pacific digital agriculture market by key countries Thailand, Vietnam, the Philippines, and Bangladesh

- Further breakdown of the Rest of South America’s digital agriculture market by key countries Peru, Bolivia, Paraguay, Chile, Ecuador, Colombia, and Venezuela

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Agriculture Market