Digital Oilfield Market by Solution (Hardware, Software & Service, and Data Storage Solutions), Processes (Reservoir, Production, Drilling Optimizations, Safety Management), Application (Onshore and Offshore), and Region - Global Forecast to 2026

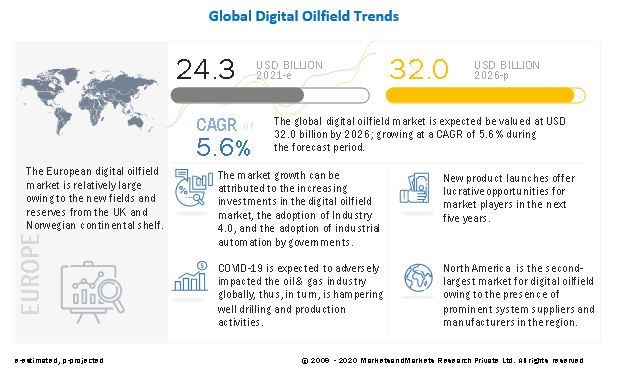

[293 Pages Report] The global digital oilfield market in terms of revenue was estimated to be worth $24.3 billion in 2021 and is poised to reach $32.0 billion by 2026, growing at a CAGR of 5.6% from 2021 to 2026. The key drivers for the digital oilfield market include new technological advancements in oil & gas industry; increased return on investment in oil & gas industry; and growing need for maximizing production potential from mature wells.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Digital Oilfield Market

The market for digital oilfield is expected to witness a drop in 2020, resulting from the outbreak of COVID-19. The worldwide propagation of COVID-19 has slowed down the growth of numerous industries. The effects of the COVID-19 pandemic, including actions taken by businesses and governments to contain the spread of the virus, have resulted in a significant and swift reduction in demand for oil and gas. As of May 28, 2020, 212 countries had been impacted by the pandemic, and the governments of individual countries had ordered nationwide lockdowns. This resulted in a considerable decline in transportation and related activities, which impacted the demand for oil and gas. According to the International Energy Agency (IEA) report, the geopolitical events increased the supply of low-priced oil to the global market, and at the same time, the demand declined due to the outbreak of the pandemic, leading to a collapse in oil prices in March 2020. These events together adversely affected the demand for oil and natural gas, as well as for well intervention services and products, and have caused significant volatility in the oil prices. As of December 31, 2019, West Texas Intermediate’s (WTI) oil price was at USD 61.1, and by March 23, 2020, it was at USD 23.4, falling by more than 60.0%. As of April 2020, OPEC and other oil-producing countries had agreed to reduce oil production by 10 million bpd, which is about 23.0% of their production levels.

The effects of the pandemic have led to disruptions in digital oilfield operations, such as suspension or deferral of drilling activities; shutdown of oil and gas exploration and production by oilfield operators; and decrease in upstream capital expenditure. Oil companies such as Shell (Netherlands) and Exxon Mobil (US) are taking measures to counteract oversupply issues by delaying the construction of LNG projects. For instance, BP has witnessed a loss of USD 1 billion during the first quarter of 2020. The company is expected to reduce its annual budget approximately by a quarter, to USD 12 billion. In contrast, Shell has secured a USD 12 billion loan facility to preserve its shareholder payouts, owing to the current oil price crisis and coronavirus pandemic. Well construction and planned maintenance are witnessing severe delays and withdrawal in a few cases owing to capital discipline among oilfield operators. Hence, COVID-19 has stalled the growth of the digital oilfield market. The crisis has forced some existing production to halt because the production at low oil prices is uneconomical and does not support continued operation. Additionally, a rapid build-up of oil stocks has saturated the available storage capacity in a few parts of the world, even leading to negative prices. Several digital oilfield service providers have filed for bankruptcy protection and are undergoing a restructuring of capital assets. Besides, they have witnessed sharp declines in revenue in 2020 as compared to 2019. For instance, in 2020, Halliburton (US) reported a 55.1% decrease in its revenue, whereas Schlumberger (US), Baker Hughes (US), and Weatherford International (US) witnessed a decline of 39.5%, 15.1%, and 34.5%, respectively, in their annual revenues.

Digital Oilfield: Dynamics

Driver: Increased return on investment in oil & gas industry

Digital oilfield is a technology-centric concept that allows companies to leverage limited resources. Integrated operations in smart fields of the oil & gas industry unite operational technology (OT) with information technology (IT) to improve the decision-making process and enhance operational performance; thus, improving the RoI. It reduces downtime and the total cost of ownership (TCO) and improves the productivity of operations. Digital oilfield encompasses both tools and processes to gather data across the entire set of upstream activities. Operational technology (OT) with information technology (IT) captures data with greater frequency from all parts of the oil and gas value chain and analyzes it on a real-time basis. Thus, optimizing reservoir, well, and facility performance, which results in an increased RoI.

The oil & gas industries across countries are preparing to accelerate their investments primarily in digital technologies as they seek to double their cost-savings. Similarly, companies are subjecting their investments to far more intensive scrutiny and looking for solutions to slim down the cost-per-barrel, aid recovery rates, and reduce non-productive time to increase returns. For instance, in 2018, GE and Noble Corporation plc entered into a partnership to launch the world’s first digital drilling vessel, targeted to achieve 20.0% operational expenditure reduction across the targeted equipment and improve drilling efficiency. This is a concrete step forward to unlock the immense potential of digital solutions for offshore drilling operations.

In North America, the vast oil reserves of Western Canada including ARC Resources have multiple digital assets deployed for the exploration, development, and production of conventional oil and natural gas. At one of its large multi-well sites, the company wanted to optimize control operations and gain access to valuable production information to support business decision-making and equipment troubleshooting. The company’s optimization team deployed Rockwell Automation’s Connected Production solution using analytics software to mitigate wax build-up and reduce chemical injection on its wells. After implementing analytics, ARC Resources has reduced operational costs by approximately USD 30,000 a year per well and plans to include this as a key part of its optimization strategy. Digital oilfield technologies employed both in fields and control centers must be robust, scalable, and upgradable to handle additional wells and advances in technologies. Thus, it helps to achieve a high rate of return and ensures long-term project success for field operators and engineers.

Restraint: Data retrieval, analysis, and scarcity of quality information hampering decision-making process

The demand for operational digital oilfield solutions is increasing due to the limited fuel supply in the market, thus compelling the oil industry to adopt new and improved technologies. The collection of real-time data and its productive analysis is one of the major hurdles in the digital oilfield market. Predictive analytics condense large data making it more valuable in the digital oilfield market but knowing how to make the information cross-functional would be vital to provide useful insights to assets. Generally, a huge collection of raw data due to digitalized production facilities, such as digital wells, seismic imaging, and the deployment of ground sensors leads to the scarcity of quality information. It thus hampers the decision-making process for upstream production. Data integrity is one of the important aspects of the data analytics process. It achieves the accuracy and usefulness of analytical data results. The information collected should be able to validate data from the field as well as minimize the gaps/errors in data. This could impact the result of the analytic software and hence, the decision made by the operators. The use of various analytical tools and their operational ability makes software prone to cyberattacks as a considerable amount of data is being collected from the field.

The operator must have proper knowledge about the collection and analysis of data. The oil & gas companies must ensure that they are targeting the right data. Another necessary element is the industry’s ability to derive value from intelligent oilfield data. It helps in evaluating prior decisions to improve future operations. In Asia Pacific, governments are planning to install new technologies to monitor and analyze the sale of subsidized fuel. For instance, in Asia Pacific, an Indonesian state-owned oil and natural gas corporation, Pertamina installed real-time digital nozzles to collect and monitor data. The modern digital oilfield collects data on a real-time basis from the field. A huge amount of digital data is extracted from automation technologies such as SCADA or distributed control systems. Data retrieval and analysis is a continuous process that requires special care and an adequate skill set to make effective decisions. Thus, making it the biggest restraint for the digital oilfield market.

Opportunity: Growing demand for offshore/ultra-deep-water discoveries

The oil & gas industry is going through a phase of technological advancements in exploration technology for deepwater exploration and production activities and the commercial viability of the projects. Current advances are allowing oil companies to improve recovery and accelerate production. Offshore wells may have a different level of automation, which can range from simple one-way monitoring to complex subsurface controls with intelligent completions. Foreseeing near future opportunities, Petrobras has created a corporate program dedicated to studying, developing, and implementing digital integrated field management (GeDIg) among its production assets. Petrobras selected the Carapeba field as a pilot project. It is a mature field composed of three wells located in the northeastern part of the Campos Basin, which has installed automated subsurface sensors in the wells. Oil companies are heavily investing in command centers and remote monitoring so that operation specialists, engineers, and geoscientists do not need to travel to remote oilfields. Cross-disciplinary teams composed of geoscientists, engineers, operation managers, and financial analysts now interact through remote command centers encouraging teamwork and collaboration by solving problems faster.

The oil & gas producers are looking to deploy deepwater analytical tools while determining efficient information solutions. Operators need to upgrade the existing offshore infrastructure to completely utilize data through the analytical approach. For instance, Rockwell Automation collaborated with Schlumberger to create a production advisory system. Combining connected production technology with oil and gas software, services, and domain expertise from Schlumberger, the digital solution helps to optimize production by connecting upstream operators with critical, real-time analytics, and domain insights to reduce deployment risks and costs.

Challenge: Interoperability of multiple system components from different solution providers

Digital oilfield systems have found their way into the upstream sector of the oil & gas industry because of their effective monitoring and supervisory capabilities. In efforts to streamline and integrate dispersed assets across the oil & gas well pad, pipeline, and terminal markets, a wide range of digital oilfield solutions, which include SCADA software, flow computers, RTUs, and application and configuration software, are offered by different vendors in the oil & gas industry.

Companies operating in the upstream segment often buy and assemble components from different vendors depending upon customer requirements. This makes the market highly consumer-dominated, and as a result, no standard or generalized product can be developed by a single player. In that case, interoperability with other systems and components turns out to be a challenge for upstream operators. Most of the time, it becomes a constraint to add any alternative system, hardware, or software that is not compatible with some of the digital oilfield systems, such as the SCADA system, as it has to seamlessly integrate with the existing system for optimum results. Developments with respect to the integration of various services with each other are expected to overcome this challenge faced by oilfield operators.

By solution, the software & service solutions segment is the second largest contributor in the digital oilfield during the forecast period.

The software & service solutions segment is further categorized into IT outsourcing, software, IT services & commissioning, and CPM. The software segment includes various software solutions provided by the integrators and service providers to the oilfield operators. It is required for data exchange, data handling, seismic mapping, remote surveillance, video conferencing, and automation support, among other functionalities. IT outsourcing includes business intelligence support, knowledge support, and other data-dependent work. IT services & commissioning is carried out by external service providers who use third-party software to handle operations. The computer equipment and hardware find use in data centers, surveillance centers, and operation centers. North America and Europe held the maximum shares of the digital oilfield market.

By process, the production optimization segment is expected to be the fastest growing market during the forecast period.

The production optimization is expected to dominate the digital oilfield market during the forecast period. The oil & gas producers are currently facing intense challenges of low oil prices and an imbalance in supply and demand, combined with the slowing demand growth. The implementation of digital oilfields has become an essential tool for operators to sustain their business margins. Companies are leveraging advanced simulation and analytic tools to derive their production allocation through well-gathering network and process conditions in their surface facilities. Production allocation not only allows proper production recording and planning but also helps uncover production potential in existing assets with improved insight.

By application, the offshore segment is expected to be the second largest contributor during the forecast period.

The offshore segment accounted for a second highest share of the digital oilfield market in 2020. The companies operating in the market have been exploring offshore locations for oil and gas production owing to the fact that offshore locations have a large number of untapped reserves. Moreover, the activities in offshore oilfield environments are comparatively more complex than onshore oil and gas fields. This is why offshore applications are lower than onshore applications. The major players operating in the offshore market include Halliburton, Schlumberger, and Baker Hughes. Despite fluctuating oil prices, the application of offshore digital oilfield services is expected to rise, attributed to the increasingly deep and ultradeep water drilling and production activities and an increase in the number of maturing subsea wells. Thus, offshore activities require advanced technologies for making the offshore well conditions safer.

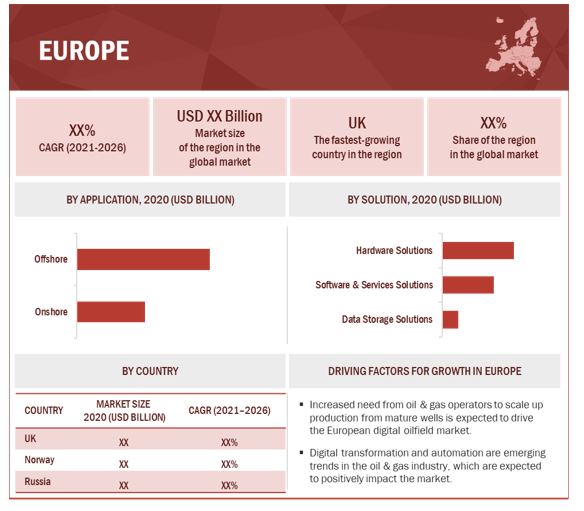

Europe held the largest share of the digital oilfield market in 2020.

Europe accounted for the largest share of the global digital oilfield market in 2020. The European market includes the UK, Norway, Russia, and Rest of Europe. Most of the region’s oil production is characterized by mature fields, thus, to renew the oil fields, companies are planning to increase the pace of digitalization and the use of new technologies. This, is likely to increase the digitalization of oil fields in the region. Also the European Unconventional Oil and Gas Assessment (EUGOA) study incorporates data for a total of 82 shale formations within 38 geological basins covering 21 countries of Europe. These untapped sources create opportunities for new field developments in the region, which will demand the digitalization of the oil fields.

Key Market Players

The key players profiled in this report are Halliburton (US), Schlumberger (US), Baker Hughes (US), Weatherford International (US), and NOV (US) are the leading players in the digital oilfield market. ABB (Switzerland), Emerson (US), Rockwell Automation (US), Siemens (Germany), Honeywell International (US), CGG (France), Kongsberg (Norway), and Digi International (US) and others players operating in the market are the leading players in the global digital oilfield market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Coverage |

Details |

|

Market size: |

USD 24.3 billion in 2021 to USD 32.0 billion by 2026 |

|

Growth Rate: |

5.6% |

|

Largest Market: |

Europe |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2021-2026 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

Solution, Process, Application, and Region |

|

Geographies Covered: |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Report Highlights:

|

Updated financial information / product portfolio of players |

|

Key Market Opportunities: |

Growing demand for offshore/ultra-deep-water discoveries |

|

Key Market Drivers: |

Increased return on investment in oil & gas industry |

This research report categorizes the digital oilfield market based on Solution, Process, Application, and Region.

Based on the solution:

- Hardware Solutions

- Software & Service Solutions

- Data Storage Solutions

Based on the process:

- Production Optimization

- Drilling Optimization

- Reservoir Optimization

- Safety Management

- Others

Based on the application:

- Onshore

- Offshore

Based on the region:

- North America

- Asia Pacific

- Europe

- Middle East

- Africa

- South America

Recent Developments

- In November 2020, Schlumberger introduced MagniSphere, a high-definition NMR logging-while-drilling service. This new service delivers accurate, real-time producibility analysis for optimum well placement, resulting in improved production and recovery in complex reservoirs.

- In October 2020, Weatherford International launched ForeSite Sense, a comprehensive reservoir monitoring solution showing real-time information and critical downhole data that determines profit from pressure, temperature, and flow.

- In September 2019, Baker Hughes and C3.ai launched BHC3 Reliability, the first artificial intelligence (AI) software application developed by the BakerHughesC3.ai joint venture.

- In February 2020, Halliburton launched SPIDRlive, a self-powered intelligent data retriever, an unconventional well testing and fracture interaction monitoring technology that acquires real-time well data without the need for intervention to reduce costs and improve fracture understanding for greater recovery.

Frequently Asked Questions (FAQ):

What is the current market size of the digital oilfield market?

The size of the global digital oilfield is USD 20.4 billion in 2020.

What are the major drivers for the digital oilfield market?

The digital oilfield is driven by factors such as new technological advancements in oil & gas industry; increased return on investment in oil & gas industry; and growing need for maximizing production potential from mature wells.

Which region dominates during the forecasted period in the digital oilfield market?

According to the International Energy Agency, the total crude oil produced by the region in 2019 was 17.1 million barrels per day, which declined by 0.05% as compared to 2018. Moreover, new explorations and field development activities are increasing, thus increasing the opportunities for developing new fields digitally. Moreover, Europe is a leading region for offshore activities as the oil operators and oilfield service (OFS) providers are targeting the new fields and reserves from the UK and Norwegian continental shelf. For instance, Equinor, a Norwegian oil upstream operator, explored oil in the Johan Sverdrup field, which was under development, and started production in 2019. In the Johan Sverdrup, Equinor awarded a contract to Alcatel Submarine for reservoir management. Such projects create a strong market for digital oilfields in Europe.

Which is the fastest-growing solution segment during the forecasted period in the digital oilfield market?

The hardware segment is the fastest-growing during the forecasted period. The market for hardware is driven by the due to the growing need to reduce nonproductive time, which increases emphasis on such hardware components.

Who are the leading players in the global digital oilfield market?

Halliburton (US), Schlumberger (US), Baker Hughes (US), Weatherford International (US), and NOV (US) are the leading players in the digital oilfield market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 DIGITAL OILFIELD MARKET, BY SOLUTION: INCLUSIONS VS. EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 DIGITAL OILFIELD MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.2 PRIMARY DATA

2.3 SCOPE

2.3.1 IMPACT OF COVID-19 ON OIL & GAS INDUSTRY

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 DEMAND-SIDE METRICS

FIGURE 5 MAIN METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR DIGITAL OILFIELD

2.5.1 DEMAND-SIDE CALCULATIONS

2.5.2 ASSUMPTIONS

2.5.3 SUPPLY-SIDE ANALYSIS

FIGURE 6 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF DIGITAL OILFIELD

FIGURE 7 DIGITAL OILFIELD MARKET: SUPPLY-SIDE ANALYSIS

2.5.4 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 1 DIGITAL OILFIELD MARKET SNAPSHOT

FIGURE 8 EUROPE ACCOUNTED FOR LARGEST SHARE OF DIGITAL OILFIELD MARKET IN 2020

FIGURE 9 HARDWARE SOLUTIONS SEGMENT, BY SOLUTION, TO HOLD LARGEST SHARE OF MARKET FROM 2021 TO 2026

FIGURE 10 PRODUCTION OPTIMIZATION SEGMENT, BY PROCESS, TO HOLD LARGEST SHARE OF MARKET FROM 2021 TO 2026

FIGURE 11 ONSHORE SEGMENT TO REGISTER HIGHER CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN DIGITAL OILFIELD MARKET

FIGURE 12 GROWING NEED TO ENHANCE PRODUCTION FROM MATURE OIL AND GAS FIELDS TO DRIVE GROWTH OF MARKET FROM 2021 TO 2026

4.2 MARKET IN EUROPE, BY APPLICATION AND COUNTRY

FIGURE 13 OFFSHORE SEGMENT AND NORWAY WERE LARGEST SHAREHOLDERS IN EUROPEAN MARKET IN 2020

4.3 MARKET, BY REGION

FIGURE 14 MARKET IN MIDDLE EAST TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

4.4 MARKET, BY SOLUTION

FIGURE 15 HARDWARE SOLUTIONS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2026

4.5 MARKET, BY PROCESS

FIGURE 16 PRODUCTION OPTIMIZATION SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2026

4.6 MARKET, BY APPLICATION

FIGURE 17 ONSHORE SEGMENT TO HOLD LARGER SHARE OF DIGITAL OILFIELD MARKET IN 2026

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 18 COVID-19 GLOBAL PROPAGATION

FIGURE 19 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 20 RECOVERY ROAD FOR 2020

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 21 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 22 MARKET DYNAMICS: DIGITAL OILFIELD MARKET

5.5.1 DRIVERS

FIGURE 23 WORLD OIL CONSUMPTION, 2016–2020

5.5.2 RESTRAINTS

5.5.3 OPPORTUNITIES

5.5.4 CHALLENGES

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DIGITAL OILFIELD SERVICE PROVIDERS

FIGURE 24 REVENUE SHIFT FOR DIGITAL OILFIELD

5.7 MARKET MAP

FIGURE 25 MARKET MAP FOR DIGITAL OILFIELD

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 26 DIGITAL OILFIELD SUPPLY CHAIN ANALYSIS

5.8.1 KEY INFLUENCERS

5.9 TECHNOLOGY ANALYSIS

5.9.1 DIGITAL OILFIELDS BASED ON DIFFERENT TECHNOLOGIES

5.10 CASE STUDY ANALYSIS

5.10.1 PRODUCTION OPTIMIZATION

5.10.1.1 Problem statement: 2020

5.10.1.2 Solution

5.11 DIGITAL OILFIELD: CODES AND REGULATIONS

TABLE 2 DIGITAL OILFIELD: CODES AND REGULATIONS

5.12 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 3 ADJACENT MARKETS: INNOVATIONS AND PATENT REGISTRATIONS, NOVEMBER 2016–MARCH 2021

5.13 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS FOR MARKET

TABLE 4 DIGITAL OILFIELD MARKET: PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT OF SUBSTITUTES

5.13.2 BARGAINING POWER OF SUPPLIERS

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 THREAT OF NEW ENTRANTS

5.13.5 INTENSITY OF COMPETITIVE RIVALRY

6 DIGITAL OILFIELD MARKET, BY SOLUTION (Page No. - 82)

6.1 INTRODUCTION

FIGURE 28 DIGITAL OILFIELD MARKET SHARE, BY SOLUTION, 2020 (%)

TABLE 5 MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 6 MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

6.2 HARDWARE SOLUTIONS

TABLE 7 MARKET FOR HARDWARE SOLUTIONS, BY REGION, 2016–2019 (USD BILLION)

TABLE 8 MARKET FOR HARDWARE SOLUTIONS, BY REGION, 2020–2026 (USD BILLION)

6.2.1 DISTRIBUTED CONTROL SYSTEMS

6.2.2 SUPERVISORY CONTROL AND DATA ACQUISITION

6.2.3 SMART WELLS

6.2.4 SAFETY SYSTEMS

6.2.5 WIRELESS SENSORS

6.2.6 PROGRAMMABLE LOGIC CONTROLLER

6.2.7 COMPUTER EQUIPMENT & APPLICATION HARDWARE

6.2.8 PROCESS AUTOMATION MANAGER

6.2.9 HUMAN–MACHINE INTERACTION INSTRUMENT

TABLE 9 MARKET FOR HARDWARE SOLUTIONS, BY COMPONENT, 2016–2019 (USD BILLION)

TABLE 10 MARKET FOR HARDWARE SOLUTIONS, BY COMPONENT, 2020–2026 (USD BILLION)

6.3 SOFTWARE & SERVICE SOLUTIONS

TABLE 11 MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY REGION, 2016–2019 (USD BILLION)

TABLE 12 MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY REGION, 2020–2026 (USD BILLION)

6.3.1 IT OUTSOURCING

6.3.2 SOFTWARE

6.3.3 IT SERVICES & COMMISSIONING

6.3.4 COLLABORATIVE PRODUCT MANAGEMENT

TABLE 13 MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY COMPONENT, 2016–2019 (USD BILLION)

TABLE 14 MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY COMPONENT, 2020–2026 (USD BILLION)

6.4 DATA STORAGE SOLUTIONS

TABLE 15 MARKET FOR DATA STORAGE SOLUTIONS, BY REGION, 2016–2019 (USD BILLION)

TABLE 16 MARKET FOR DATA STORAGE SOLUTIONS, BY REGION, 2020–2026 (USD BILLION)

6.4.1 HOSTED

6.4.2 ON PREMISES

TABLE 17 MARKET FOR DATA STORAGE SOLUTIONS, BY COMPONENT, 2016–2019 (USD BILLION)

TABLE 18 MARKET FOR DATA STORAGE SOLUTIONS, BY COMPONENT, 2020–2026 (USD BILLION)

7 DIGITAL OILFIELD MARKET, BY PROCESS (Page No. - 93)

7.1 INTRODUCTION

FIGURE 29 MARKET SHARE, BY PROCESS, 2020 (%)

TABLE 19 MARKET, BY PROCESS, 2016–2019 (USD BILLION)

TABLE 20 MARKET, BY PROCESS, 2020–2026 (USD BILLION)

7.2 PRODUCTION OPTIMIZATION

7.2.1 NEED TO IMPROVE PRODUCTION EFFICIENCY IS LIKELY TO DRIVE MARKET

TABLE 21 MARKET FOR PRODUCTION OPTIMIZATION, BY REGION, 2016–2019 (USD BILLION)

TABLE 22 MARKET FOR PRODUCTION OPTIMIZATION, BY REGION, 2020–2026 (USD BILLION)

7.3 DRILLING OPTIMIZATION

7.3.1 NEED FOR REDUCED DRILLING COSTS AND OPTIMIZING DRILLING TECHNIQUES IS LIKELY TO BOOST MARKET GROWTH

TABLE 23 MARKET FOR DRILLING OPTIMIZATION, BY REGION, 2016–2019 (USD BILLION)

TABLE 24 MARKET FOR DRILLING OPTIMIZATION, BY REGION, 2020–2026 (USD BILLION)

7.4 RESERVOIR OPTIMIZATION

7.4.1 ENHANCING RESERVOIR RECOVERABILITY BY CONTINUOUS MONITORING OF VARYING RESERVOIR CONDITIONS IS LIKELY TO ENHANCE MARKET GROWTH

TABLE 25 MARKET FOR RESERVOIR OPTIMIZATION, BY REGION, 2016–2019 (USD BILLION)

TABLE 26 MARKET FOR RESERVOIR OPTIMIZATION, BY REGION, 2020–2026 (USD BILLION)

7.5 SAFETY MANAGEMENT

7.5.1 GROWING NEED TO MONITOR MAINTENANCE AND REPAIR OF EQUIPMENT OR FACILITIES IS LIKELY TO DRIVE MARKET

TABLE 27 MARKET FOR SAFETY MANAGEMENT, BY REGION, 2016–2019 (USD BILLION)

TABLE 28 MARKET FOR SAFETY MANAGEMENT, BY REGION, 2020–2026 (USD BILLION)

7.6 OTHERS

TABLE 29 MARKET FOR OTHERS, BY REGION, 2016–2019 (USD BILLION)

TABLE 30 MARKET FOR OTHERS, BY REGION, 2020–2026 (USD BILLION)

8 DIGITAL OILFIELD MARKET, BY APPLICATION (Page No. - 102)

8.1 INTRODUCTION

FIGURE 30 MARKET SHARE, BY APPLICATION, 2020 (%)

TABLE 31 MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 32 MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

8.2 ONSHORE

8.2.1 INCREASING NUMBER OF ONSHORE OIL & GAS AND MATURE FIELDS TO DRIVE GROWTH OF MARKET

TABLE 33 MARKET FOR ONSHORE APPLICATION, BY REGION, 2016–2019 (USD BILLION)

TABLE 34 MARKET FOR ONSHORE APPLICATION, BY REGION, 2020–2026 (USD BILLION)

8.3 OFFSHORE

8.3.1 GROWING DEEPWATER DRILLING AND PRODUCTION ACTIVITIES TO BOOST MARKET GROWTH

TABLE 35 MARKET FOR OFFSHORE APPLICATION, BY REGION, 2016–2019 (USD BILLION)

TABLE 36 MARKET FOR OFFSHORE APPLICATION, BY REGION, 2020–2026 (USD BILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 107)

9.1 INTRODUCTION

FIGURE 31 MARKET IN MIDDLE EAST TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

FIGURE 32 MARKET SHARE, BY REGION, 2020 (%)

TABLE 37 MARKET, BY REGION, 2016–2019 (USD BILLION)

TABLE 38 MARKET, BY REGION, 2020–2026 (USD BILLION)

9.2 EUROPE

FIGURE 33 EUROPE: MARKET SNAPSHOT, 2020

TABLE 39 EUROPE: MARKET, BY PROCESS, 2016–2019 (USD BILLION)

TABLE 40 EUROPE: MARKET, BY PROCESS, 2020–2026 (USD BILLION)

TABLE 41 EUROPE: MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 42 EUROPE: MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

TABLE 43 EUROPE: MARKET FOR HARDWARE SOLUTIONS, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 44 EUROPE: MARKET FOR HARDWARE SOLUTIONS, BY COUNTRY, 2020–2026 (USD BILLION)

TABLE 45 EUROPE: MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 46 EUROPE: MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY COUNTRY, 2020–2026 (USD BILLION)

TABLE 47 EUROPE: MARKET FOR DATA STORAGE SOLUTIONS, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 48 EUROPE: DIGITAL OILFIELD MARKET FOR DATA STORAGE SOLUTIONS, BY COUNTRY, 2020–2026 (USD BILLION)

TABLE 49 EUROPE: MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 50 EUROPE: MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

TABLE 51 EUROPE: MARKET, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 52 EUROPE: MARKET, BY COUNTRY, 2020–2026 (USD BILLION)

9.2.1 NORWAY

TABLE 53 NORWAY: MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 54 NORWAY: MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

TABLE 55 NORWAY: MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 56 NORWAY: MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

9.2.2 RUSSIA

TABLE 57 RUSSIA: MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 58 RUSSIA: MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

TABLE 59 RUSSIA: MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 60 RUSSIA: MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

9.2.3 UK

TABLE 61 UK: MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 62 UK: MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

TABLE 63 UK: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 64 UK: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.2.4 REST OF EUROPE

TABLE 65 REST OF EUROPE: MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 66 REST OF EUROPE: MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

TABLE 67 REST OF EUROPE: MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 68 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

9.3 NORTH AMERICA

FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT, 2020

TABLE 69 NORTH AMERICA: MARKET, BY PROCESS, 2016–2019 (USD BILLION)

TABLE 70 NORTH AMERICA: MARKET, BY PROCESS, 2020–2026 (USD BILLION)

TABLE 71 NORTH AMERICA: MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 72 NORTH AMERICA: MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

TABLE 73 NORTH AMERICA: MARKET FOR HARDWARE SOLUTIONS, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 74 NORTH AMERICA: MARKET FOR HARDWARE SOLUTIONS, BY COUNTRY, 2020–2026 (USD BILLION)

TABLE 75 NORTH AMERICA: MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 76 NORTH AMERICA: MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY COUNTRY, 2020–2026 (USD BILLION)

TABLE 77 NORTH AMERICA: MARKET FOR DATA STORAGE SOLUTIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET FOR DATA STORAGE SOLUTIONS, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 80 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

TABLE 81 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 82 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2026 (USD BILLION)

9.3.1 US

TABLE 83 US: MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 84 US: MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

TABLE 85 US: MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 86 US: MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

9.3.2 CANADA

TABLE 87 CANADA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 88 CANADA: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 89 CANADA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 90 CANADA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.3.3 MEXICO

TABLE 91 MEXICO: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 92 MEXICO: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 93 MEXICO: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 94 MEXICO: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.4 ASIA PACIFIC

TABLE 95 ASIA PACIFIC: MARKET, BY PROCESS, 2016–2019 (USD BILLION)

TABLE 96 ASIA PACIFIC: MARKET, BY PROCESS, 2020–2026 (USD BILLION)

TABLE 97 ASIA PACIFIC: MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 98 ASIA PACIFIC: MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

TABLE 99 ASIA PACIFIC: MARKET FOR HARDWARE SOLUTIONS, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 100 ASIA PACIFIC: MARKET FOR HARDWARE SOLUTIONS, BY COUNTRY, 2020–2026 (USD BILLION)

TABLE 101 ASIA PACIFIC: MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 102 ASIA PACIFIC: MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY COUNTRY, 2020–2026 (USD BILLION)

TABLE 103 ASIA PACIFIC: MARKET FOR DATA STORAGE SOLUTIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET FOR DATA STORAGE SOLUTIONS, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2026 (USD BILLION)

9.4.1 CHINA

TABLE 109 CHINA: MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 110 CHINA: MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

TABLE 111 CHINA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 112 CHINA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.4.2 MALAYSIA

TABLE 113 MALAYSIA: MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 114 MALAYSIA: MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

TABLE 115 MALAYSIA: MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 116 MALAYSIA: MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

9.4.3 INDIA

TABLE 117 INDIA: MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 118 INDIA: MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

TABLE 119 INDIA: MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 120 INDIA: MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

9.4.4 AUSTRALIA

TABLE 121 AUSTRALIA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 122 AUSTRALIA: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 123 AUSTRALIA: MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 124 AUSTRALIA: MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

9.4.5 REST OF ASIA PACIFIC

TABLE 125 REST OF ASIA PACIFIC: MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 126 REST OF ASIA PACIFIC: MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

TABLE 127 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 128 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

9.5 MIDDLE EAST

TABLE 129 MIDDLE EAST: MARKET, BY PROCESS, 2016–2019 (USD MILLION)

TABLE 130 MIDDLE EAST: MARKET, BY PROCESS, 2020–2026 (USD MILLION)

TABLE 131 MIDDLE EAST: MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 132 MIDDLE EAST: MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

TABLE 133 MIDDLE EAST: MARKET FOR HARDWARE SOLUTIONS, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 134 MIDDLE EAST: MARKET FOR HARDWARE SOLUTIONS, BY COUNTRY, 2020–2026 (USD BILLION)

TABLE 135 MIDDLE EAST: MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 136 MIDDLE EAST: MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 137 MIDDLE EAST: MARKET FOR DATA STORAGE SOLUTIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 138 MIDDLE EAST: MARKET FOR DATA STORAGE SOLUTIONS, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 139 MIDDLE EAST: MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 140 MIDDLE EAST: MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

TABLE 141 MIDDLE EAST: MARKET, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 142 MIDDLE EAST: MARKET, BY COUNTRY, 2020–2026 (USD BILLION)

9.5.1 OMAN

TABLE 143 OMAN: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 144 OMAN: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 145 OMAN: MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 146 OMAN: MARKET SIZE, BY APPLICATION, 2020–2026 (USD BILLION)

9.5.2 SAUDI ARABIA

TABLE 147 SAUDI ARABIA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 148 SAUDI ARABIA: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 149 SAUDI ARABIA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 150 SAUDI ARABIA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.5.3 KUWAIT

TABLE 151 KUWAIT: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 152 KUWAIT: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 153 KUWAIT: MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 154 KUWAIT: MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

9.5.4 UAE

TABLE 155 UAE: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 156 UAE: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 157 UAE: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 158 UAE: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.5.5 REST OF THE MIDDLE EAST

TABLE 159 REST OF THE MIDDLE EAST: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 160 REST OF THE MIDDLE EAST: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 161 REST OF THE MIDDLE EAST: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 162 REST OF THE MIDDLE EAST: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.6 SOUTH AMERICA

TABLE 163 SOUTH AMERICA: MARKET, BY PROCESS, 2016–2019 (USD MILLION)

TABLE 164 SOUTH AMERICA: MARKET, BY PROCESS, 2020–2026 (USD MILLION)

TABLE 165 SOUTH AMERICA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 166 SOUTH AMERICA: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 167 SOUTH AMERICA: MARKET FOR HARDWARE SOLUTIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 168 SOUTH AMERICA: MARKET FOR HARDWARE SOLUTIONS, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 169 SOUTH AMERICA: MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 170 SOUTH AMERICA: MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 171 SOUTH AMERICA: MARKET FOR DATA STORAGE SOLUTIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 172 SOUTH AMERICA: MARKET FOR DATA STORAGE SOLUTIONS, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 173 SOUTH AMERICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 174 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 175 SOUTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 176 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

9.6.1 BRAZIL

TABLE 177 BRAZIL: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 178 BRAZIL: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 179 BRAZIL: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 180 BRAZIL: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.6.2 ARGENTINA

TABLE 181 ARGENTINA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 182 ARGENTINA: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 183 ARGENTINA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 184 ARGENTINA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.6.3 VENEZUELA

TABLE 185 VENEZUELA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 186 VENEZUELA: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 187 VENEZUELA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 188 VENEZUELA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.6.4 REST OF SOUTH AMERICA

TABLE 189 REST OF SOUTH AMERICA: DIGITAL OILFIELD MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 190 REST OF SOUTH AMERICA: DIGITAL OILFIELD MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 191 REST OF SOUTH AMERICA: DIGITAL OILFIELD MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 192 REST OF SOUTH AMERICA: DIGITAL OILFIELD MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.7 AFRICA

TABLE 193 AFRICA: MARKET, BY PROCESS, 2016–2019 (USD MILLION)

TABLE 194 AFRICA: MARKET, BY PROCESS, 2020–2026 (USD MILLION)

TABLE 195 AFRICA: MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 196 AFRICA: MARKET, BY SOLUTION, 2020–2026 (USD BILLION)

TABLE 197 AFRICA: MARKET FOR HARDWARE SOLUTIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 198 AFRICA: MARKET FOR HARDWARE SOLUTIONS, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 199 AFRICA: MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 200 AFRICA: MARKET FOR SOFTWARE & SERVICE SOLUTIONS, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 201 AFRICA: MARKET FOR DATA STORAGE SOLUTIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 202 AFRICA: MARKET FOR DATA STORAGE SOLUTIONS, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 203 AFRICA: MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 204 AFRICA: MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

TABLE 205 AFRICA: MARKET, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 206 AFRICA: MARKET, BY COUNTRY, 2020–2026 (USD BILLION)

9.7.1 NIGERIA

TABLE 207 NIGERIA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 208 NIGERIA: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 209 NIGERIA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 210 NIGERIA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.7.2 ANGOLA

TABLE 211 ANGOLA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 212 ANGOLA: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 213 ANGOLA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 214 ANGOLA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.7.3 REST OF AFRICA

TABLE 215 REST OF AFRICA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 216 REST OF AFRICA: MARKET, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 217 REST OF AFRICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 218 REST OF AFRICA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 179)

10.1 KEY PLAYERS’ STRATEGIES

TABLE 219 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, JANUARY 2018–JULY 2021

10.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 220 DIGITAL OILFIELD MARKET: DEGREE OF COMPETITION

FIGURE 35 DIGITAL OILFIELD MARKET SHARE ANALYSIS, 2020

10.3 MARKET EVALUATION FRAMEWORK

TABLE 221 MARKET EVALUATION FRAMEWORK

10.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 36 TOP FIVE PLAYERS IN DIGITAL OILFIELD MARKET FROM 2016 TO 2020

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 37 COMPETITIVE LEADERSHIP MAPPING: DIGITAL OILFIELD MARKET, 2020

TABLE 222 PROCESS FOOTPRINT OF COMPANIES

TABLE 223 SOLUTION FOOTPRINT OF COMPANIES

TABLE 224 REGIONAL FOOTPRINT OF COMPANIES

TABLE 225 OVERALL FOOTPRINT OF COMPANIES

10.6 COMPETITIVE SCENARIO

TABLE 226 DIGITAL OILFIELD MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2018–JULY 2021

TABLE 227 DIGITAL OILFIELD MARKET: DEALS, JANUARY 2018–JULY 2021

TABLE 228 DIGITAL OILFIELD MARKET: OTHERS, JANUARY 2018–JULY 2020

11 COMPANY PROFILES (Page No. - 194)

(Business overview, Products offered, Recent Developments, MNM view)*

11.1 KEY COMPANIES

11.1.1 SCHLUMBERGER

TABLE 229 SCHLUMBERGER: BUSINESS OVERVIEW

FIGURE 38 SCHLUMBERGER: COMPANY SNAPSHOT

TABLE 230 SCHLUMBERGER: PRODUCTS/SERVICES OFFERED

TABLE 231 SCHLUMBERGER: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 232 SCHLUMBERGER: DEALS

TABLE 233 SCHLUMBERGER: OTHERS

11.1.2 WEATHERFORD INTERNATIONAL

TABLE 234 WEATHERFORD INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 39 WEATHERFORD INTERNATIONAL: COMPANY SNAPSHOT

TABLE 235 WEATHERFORD INTERNATIONAL: PRODUCTS/SERVICES OFFERED

TABLE 236 WEATHERFORD INTERNATIONAL: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 237 WEATHERFORD INTERNATIONAL: OTHERS

11.1.3 BAKER HUGHES

TABLE 238 BAKER HUGHES: BUSINESS OVERVIEW

FIGURE 40 BAKER HUGHES: COMPANY SNAPSHOT

TABLE 239 BAKER HUGHES: PRODUCTS/SERVICES OFFERED

TABLE 240 BAKER HUGHES: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 241 BAKER HUGHES: OTHERS

TABLE 242 BAKER HUGHES: DEALS

11.1.4 HALLIBURTON

TABLE 243 HALLIBURTON: BUSINESS OVERVIEW

FIGURE 41 HALLIBURTON: COMPANY SNAPSHOT

TABLE 244 HALLIBURTON: PRODUCTS/SERVICES OFFERED

TABLE 245 HALLIBURTON: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 246 HALLIBURTON: DEALS

TABLE 247 HALLIBURTON: OTHERS

11.1.5 NOV

TABLE 248 NOV: BUSINESS OVERVIEW

FIGURE 42 NOV: COMPANY SNAPSHOT

TABLE 249 NOV: PRODUCTS/SERVICES OFFERED

TABLE 250 NOV: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 251 NOV: OTHERS

TABLE 252 NOV: DEALS

11.1.6 ABB

TABLE 253 ABB: BUSINESS OVERVIEW

FIGURE 43 ABB: COMPANY SNAPSHOT

TABLE 254 ABB: PRODUCTS/SERVICES OFFERED

TABLE 255 ABB: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 256 ABB: DEALS

TABLE 257 ABB: OTHERS

11.1.7 EMERSON

TABLE 258 EMERSON: BUSINESS OVERVIEW

FIGURE 44 EMERSON: COMPANY SNAPSHOT

TABLE 259 EMERSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 260 EMERSON: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 261 EMERSON: DEALS

TABLE 262 EMERSON: OTHERS

11.1.8 ROCKWELL AUTOMATION

TABLE 263 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

FIGURE 45 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

TABLE 264 ROCKWELL AUTOMATION: PRODUCTS/SERVICES OFFERED

TABLE 265 ROCKWELL AUTOMATION: DEALS

11.1.9 SIEMENS

TABLE 266 SIEMENS: BUSINESS OVERVIEW

FIGURE 46 SIEMENS: COMPANY SNAPSHOT

TABLE 267 SIEMENS: PRODUCTS/SERVICES OFFERED

TABLE 268 SIEMENS: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 269 SIEMENS: DEALS

11.1.10 HONEYWELL INTERNATIONAL

TABLE 270 HONEYWELL INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 47 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

TABLE 271 HONEYWELL INTERNATIONAL: PRODUCTS/SERVICES OFFERED

TABLE 272 HONEYWELL INTERNATIONAL: DEALS

TABLE 273 HONEYWELL INTERNATIONAL: OTHERS

11.1.11 KONGSBERG

TABLE 274 KONGSBERG: BUSINESS OVERVIEW

FIGURE 48 KONGSBERG: COMPANY SNAPSHOT

TABLE 275 KONGSBERG: PRODUCTS/SERVICES OFFERED

TABLE 276 KONGSBERG: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 277 KONGSBERG: DEALS

TABLE 278 KONGSBERG: OTHERS

11.1.12 CGG

TABLE 279 CGG: BUSINESS OVERVIEW

FIGURE 49 CGG: COMPANY SNAPSHOT

TABLE 280 CGG: PRODUCTS/SERVICES OFFERED

TABLE 281 CGG: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 282 CGG: DEALS

TABLE 283 CGG: OTHERS

11.1.13 DIGI INTERNATIONAL

TABLE 284 DIGI INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 50 DIGI INTERNATIONAL: COMPANY SNAPSHOT

TABLE 285 DIGI INTERNATIONAL: PRODUCTS/SERVICES OFFERED

TABLE 286 DIGI INTERNATIONAL: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 287 DIGI INTERNATIONAL: DEALS

11.1.14 PASON

TABLE 288 PASON: BUSINESS OVERVIEW

FIGURE 51 PASON: COMPANY SNAPSHOT

TABLE 289 PASON: PRODUCTS/SERVICES OFFERED

TABLE 290 PASON: DEALS

11.1.15 REDLINE

TABLE 291 REDLINE: BUSINESS OVERVIEW

FIGURE 52 REDLINE: COMPANY SNAPSHOT

TABLE 292 REDLINE: PRODUCTS/SERVICES OFFERED

TABLE 293 REDLINE: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 294 REDLINE: DEALS

11.1.16 EDG

TABLE 295 EDG: COMPANY OVERVIEW

TABLE 296 EDG: PRODUCTS/SERVICES OFFERED

11.1.17 OLEUMTECH

TABLE 297 OLEUMTECH: COMPANY OVERVIEW

TABLE 298 OLEUMTECH: PRODUCTS/SERVICES OFFERED

TABLE 299 OLEUMTECH: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 300 OLEUMTECH: DEALS

11.1.18 PETROLINK

TABLE 301 PETROLINK: COMPANY OVERVIEW

TABLE 302 PETROLINK: PRODUCTS/SERVICES OFFERED

TABLE 303 PETROLINK: PRODUCT LAUNCHES AND DEVELOPMENTS

11.1.19 KATALYST

TABLE 304 KATALYST: COMPANY OVERVIEW

TABLE 305 KATALYST: PRODUCTS/SERVICES OFFERED

TABLE 306 KATALYST: OTHERS

11.1.20 IBM

TABLE 307 IBM: COMPANY OVERVIEW

FIGURE 53 IBM: COMPANY SNAPSHOT

TABLE 308 IBM: PRODUCTS/SERVICES OFFERED

TABLE 309 IBM: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 310 IBM: DEALS

TABLE 311 IBM: OTHERS

11.1.21 ACCENTURE

TABLE 312 ACCENTURE: COMPANY OVERVIEW

FIGURE 54 ACCENTURE: COMPANY SNAPSHOT

TABLE 313 ACCENTURE: PRODUCTS/SERVICES OFFERED

TABLE 314 ACCENTURE: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 315 ACCENTURE: OTHERS

TABLE 316 ACCENTURE: DEALS

11.1.22 ORACLE

TABLE 317 ORACLE: COMPANY OVERVIEW

FIGURE 55 ORACLE: COMPANY SNAPSHOT

TABLE 318 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.1.23 INTEL

TABLE 319 INTEL: COMPANY OVERVIEW

FIGURE 56 INTEL: COMPANY SNAPSHOT

TABLE 320 INTEL: PRODUCTS/SERVICES OFFERED

TABLE 321 INTEL: DEALS

11.1.24 MICROSOFT

TABLE 322 MICROSOFT: COMPANY OVERVIEW

FIGURE 57 MICROSOFT: COMPANY SNAPSHOT

TABLE 323 MICROSOFT: PRODUCTS/SERVICES OFFERED

TABLE 324 MICROSOFT: DEALS

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 285)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

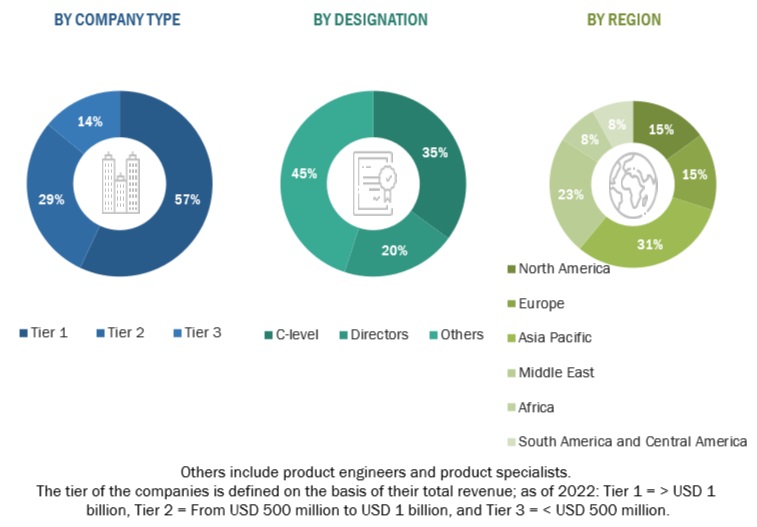

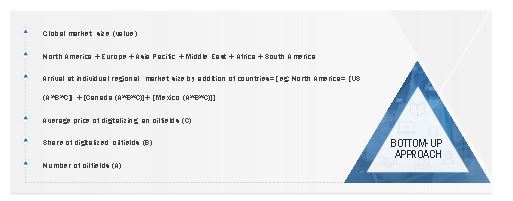

This study involved four major activities in estimating the current market size for digital oilfield. Exhaustive secondary research was done to collect information on the market and the peer market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, World Bank, US DOE, IEA, to identify and collect information useful for a technical, market-oriented, and commercial study of the global digital oilfield market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The digital oilfield market comprises several stakeholders, such as public and private electric utilities, distribution companies, digital oilfield manufacturers, dealers, and suppliers, digital oilfield component manufacturers, energy & power sector consulting companies and others. The demand side of this market is characterized by estimating the total number of oilfields, share of digitalized oilfields, and average price of digitalizing an oilfields. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as following—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global digital oilfield market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Digital Oilfield Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, digital oilfield market, based on solution, process, and

- To provide detailed information on the major factors influencing the growth of the digital oilfield market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the digital oilfield market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze the impact of COVID-19 on the digital oilfield market for the estimation of the market size

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the digital oilfield market with respect to the major regions (Asia Pacific, Europe, North America, South America, Middle East, and Africa)

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments, such as new product launches, contracts & agreements, investments & expansions, and mergers & acquisitions, in the digital oilfield market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Oilfield Market