Digital Scent Technology Market Size, Share and Industry Growth Analysis Report by Hardware Device (E-nose, Scent Synthesizer), End-use Product (Smartphone, Smelling Screen), Application (Medical, Entertainment, Food & Beverage), and Geography - Global Growth Driver and Industry Forecast to 2026

Updated on : April 24, 2023

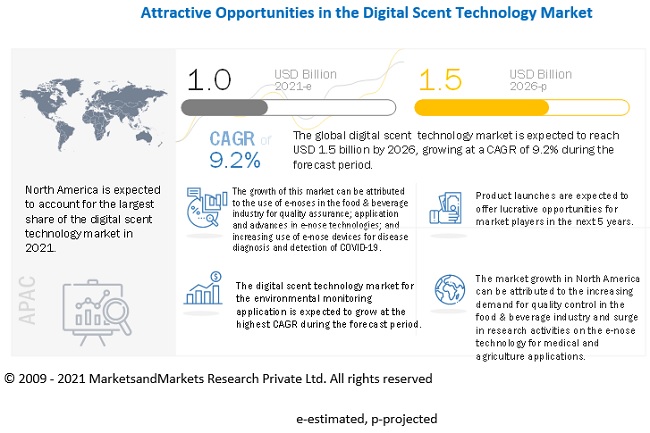

Digital Scent Technology Market is expected to reach USD 1.5 billion by 2026 from an estimated USD 1.0 billion in 2021, registering a compound annual growth rate (CAGR) of 9.2% during the forecast period.

The market growth can be attributed to several factors, such as expanding application and advancements in e-nose technologies, increasing use of e-nose devices for disease diagnostic applications, emerging R&D activities to invent e-nose to sniff out COVID-19, and rising use of e-nose in food industry for quality assurance in production, storage, and display.

To know about the assumptions considered for the study, Request for Free Sample Report

Digital scent technology, also known as olfactory technology or odor sensing technology, refers to the use of electronic devices to simulate or reproduce smells.

Factors driving the growth of the digital scent technology market include increasing demand for virtual reality and augmented reality applications, rising adoption of e-nose technology in healthcare and food and beverage industries, and growing use of digital scent technology in marketing and advertising.

COVID-19 Impact on the Global Digital scent technology market

The digital scent technology industry includes major Tier II and Tier III suppliers such as ams AG (Austria), Smiths Detection (US), Alpha MOS SA (France), AIRSENSE Analytics GmbH (Germany),ScentSational Technologies (US), Electronic Sensor Technology (US), Aromajoin Corporation (Japan), Scent Sciences Corporation (US), The eNose Company (The Netherlands), Odotech Inc. (Canada), and so on. These suppliers have their manufacturing facilities spread across various countries across North America, Europe, APAC, and RoW. COVID-19 has impacted their businesses as well.

Digital Scent Technology Market Dynamics

Driver: Expanding application and advancements in e-nose technologies

E-noses have received considerable attention in the field of sensor technology during the past 20 years, largely due to the discovery of numerous applications derived from research in diverse fields of applied sciences. Recent applications of e-nose technologies have come through advances in sensor design, material improvements, software innovations, and progress in microcircuitry design and systems integration. The invention of many new e-nose sensor types and arrays, based on different detection principles and mechanisms, is closely correlated with the expansion of new applications. E-noses have provided a plethora of benefits to a variety of commercial industries, including the agricultural, biomedical, cosmetics, environmental, food, manufacturing, military, pharmaceutical, regulatory, and various scientific research fields. Advancements produce improved product attributes, uniformity, and consistency as a result of increases in quality control capabilities afforded by e-nose monitoring of all phases of industrial manufacturing processes.

The demand for e-nose is rising due to many other benefits, such as anomaly detection and pattern recognition. The e-nose detects changes in the air composition, thereby holding potential to identify a risk of odor nuisance or other gas-related risks. By inserting alert levels, the e-nose will warn about anomalous air conditions. E-noses create signal patterns that correlate to the exposed gas mixture. It endeavors to assess the nature of the gas composition that caused an unusual air composition. Also, in recent years there has been a rise in the adoption of compact, portable, and IoT-enabled e-noses and platforms. Manufacturers are also focused on developing low-cost and low-power IoT-enabled portable noses. For instance, BreathBase Platform was developed by Breathomix (The Netherlands) in collaboration with its technology partners Microsoft and Tecknoworks. BreathBase is an IoT-based solution that works via the e-nose SpiroNose, which is connected to an internet-enabled IoT device (Gateway to BreathBase) that real-time routes the measurements to a processing component, which is necessary for analysis and interpretation. The results are presented in the BreathBase Web Application. BreathBase is uniquely designed to allow real-time analysis of the sensor data based on advanced signal processing and artificial intelligence (AI), providing diagnostic feedback to the user within a few seconds.

Restraint: Delay between successive tests while using e-nose

Another disadvantage of using the e-nose has been the delay between successive tests—between 2 and 10 minutes—during which time the sensor is to be washed by a reactivating agent, which is applied to the array so as to remove the odorant mixture from the surface and a bulk of the sensor’s active material.

Opportunity: Application of e-nose in security and military sectors

Digital scent technology is not only used for diagnosing diseases but also in security and military sectors. The rising numbers of bomb blasts is demanding a technology which can detect explosives quickly and effectively. Therefore, digital scent technology is used by the police and military to detect explosives in public areas as well as war fields. The growing adoption of digital scent technology in security and military sectors indicates a significant demand for this technology. Thus, the use of e-noses in security and military sectors can be a major growth opportunity for the digital scent technology market.

Challenge: Unpredictability of air flow

Digital scent technology is all about generating and sensing different types of smells. The generated smell can be affected by the flow of air, and that may reduce its original impact. Air flow can mix other smells present around, especially in public places. Hence, the unpredictability of air flow affects the experience of smell—unless air flow is controlled in a closed area. Thus, the impact of this challenge on the development of the digital scent technology market is medium.

E-nose segment to account for the largest share of digital scent technology market in 2020

On the basis of hardware device, the digital scent technology market is categorized into e-nose and scent synthesizer. E-nose is widely applied in various sectors, including military & defense, healthcare, and food & beverages, compared to scent synthesizers. Continuous technological advancements and the decreasing cost of e-nose are the main factors which would propel the growth of e-nose during the forecast period. In February 2020, a team of researchers from Australia developed a cheap, portable e-nose that used machine learning to quickly assess beer quality based on its aroma. The e-nose was designed to look like a small microchip and gave results with 97% accuracy.

Medical application to account for the largest share of digital scent technology market during forecast period

On the basis of applications, the digital scent technology market is categorized into food & beverage, military & defense, medical, marketing, environmental monitoring, entertainment, and others. The medical segment accounted for the largest market share in 2020 due to the increased adoption of digital scent technology in medical diagnosis, patient treatment selection, and metabolic disorders nutritional status. This application constitutes of the maximum developments and innovations of digital scent technology products by mostly start-ups and a few major companies. In October 2020, Koniku, a biotechnology start-up, developed robots that could sniff out COVID-19 infections faster than the conventional testing method. The technology fuses neurons with a silicon chip to create a “smell cyborg" capable of detecting scents ranging from explosives to pathogens.

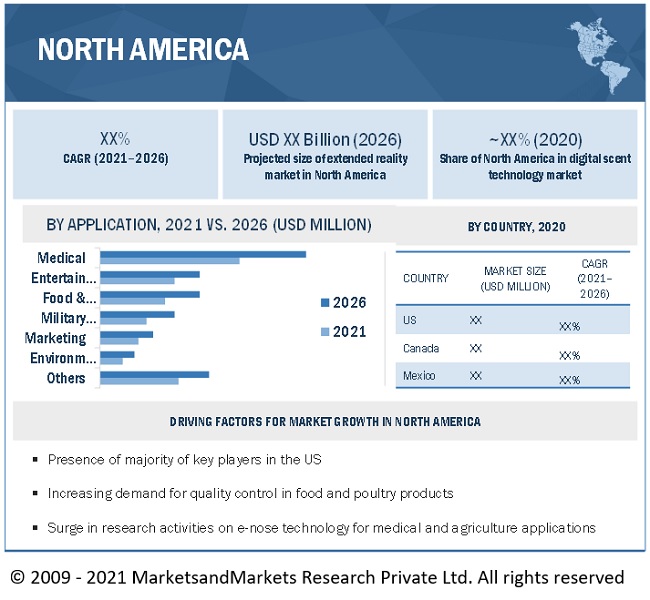

North America in digital scent technology market is leading the market in 2020

North America held the largest share in the digital scent technology market in 2020. North America is expected to continue to dominate the market during the forecast period due to the presence of various key players in the region. The major factors which are fueling the growth of the market are rising adoption of enhanced digital services by customers, use of biosensors for early detection of diseases, strict regulatory environment with regards to indoor air quality in the US, and significant e-nose developments with respect to applications in the medical and agriculture industries.

However, the size of the market in the US shrank remarkably in 2020 due to the adverse effects of COVID-19 on the food & beverages and agriculture sectors. The adoption of digital scent technology products was largely impacted in 2020 due to the shutdown of various ongoing production sites and supply chain disruptions.

To know about the assumptions considered for the study, download the pdf brochure

Top Digital Scent Technology Companies - Key Market Players

Digital scent technology companies include ams AG (Austria), Smiths Detection (US), Alpha MOS SA (France), AIRSENSE Analytics GmbH (Germany),ScentSational Technologies (US), and so on.

Digital Scent Technology Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2021 |

USD 1.0 Billion |

| Revenue Forecast in 2026 | USD 1.5 Billion |

| Growth Rate | 9.2% |

| Base Year Considered | 2020 |

| Historical Data Available for Years | 2017–2026 |

|

Forecast Period |

2021–2026 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Expanding application and advancements in e-nose technologies |

| Key Market Opportunity | Application of e-nose in security and military sectors |

| Largest Growing Region | North America |

| Largest Market Share Segment | E-nose Segment |

| Highest CAGR Segment | Smartphones Segment |

| Largest Application Market Share | Medical Application |

In this research report, the digital scent technology market has been segmented on the basis of hardware device, end-use product, application, and geography.

Digital scent technology market, by Hardware Device

- E-nose

- Scent Synthesizer

Digital scent technology market, by End-use Product

- Smartphones

- Smelling Screens

- Music and Video Games

- Explosives Detectors

- Quality Control Products

- Medical Diagnostic Products

- Others

Digital scent technology market, by Application

- Food & Beverage

- Military & Defense

- Medical

- Marketing

- Environmental Monitoring

- Entertainment

- Others

Geographic Analysis

- North America

- Europe

- APAC

- RoW

Recent Developments

- In November 2020, Alpha MOS SA partnered with John Morris Group, wherein the company appointed John Morris Group as a distributor of its sensory analysis solutions in Australia and New Zealand.

- In September 2020, ams AG launched AS7038RB SpO2, the thinnest sensor for blood oxygen saturation (SpO2) measurement, bringing the capability to remotely monitor this vital sign to small consumer products such as earbuds, smart watches, and wristbands, as well as to medical devices such as patches and oximeters.

- In July 2020, Aromajoin Corporation launched a new matte black version of Aroma Shooter, the company's flagship product. Aroma Shooter is primarily a tool for retail and entertainment applications.

Frequently Asked Questions (FAQ):

What is the current size of the global digital scent technology market?

The digital scent technology market is expected to grow from USD 1.0 billion in 2021 to USD 1.5 billion by 2026, at a CAGR of 9.2%.

Who are the winners in the global digital scent technology market?

Some of the key companies operating in the digital scent technology market are ams AG (Austria), Smiths Detection (US), Alpha MOS SA (France), AIRSENSE Analytics GmbH (Germany),ScentSational Technologies (US), Electronic Sensor Technology (US), Aromajoin Corporation (Japan), Scent Sciences Corporation (US), The eNose Company (The Netherlands), Odotech Inc. (Canada), and so on. These players have adopted various growth strategies such as product launches/developments, partnerships/acquisitions to expand their global presence and increase their share in the global digital scent technology market.

What are the major drivers for the digital scent technology market?

The factors such as expanding application and advancements in e-nose technologies, increasing use of e-nose devices for disease diagnostic applications, emerging R&D activities to invent e-nose to sniff out COVID-19, and rising use of e-nose in food industry for quality assurance in production, storage, and display have proved to be the major driving forces for digital scent technology market.

Which major countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, and rest of European countries.

What are the impact of COVID-19 on the global digital scent technology market?

Due to COVID-19, the manufacturing units of major players are highly hampered due to worldwide lockdown and limited availability of labor and raw material. A number of scheduled product launches and related developments have been postponed due to the pandemic. However, the impact of COVID-19 is expected to reduce during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.2.2 List of key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary sources

2.1.3.2 Key industry insights

2.1.3.3 Primary interviews with experts

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE OF KEY PLAYERS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 (DEMAND SIZE): BOTTOM-UP APPROACH FOR ESTIMATION OF SIZE OF DIGITAL SCENT TECHNOLOGY MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Estimating market size using bottom-up analysis (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Estimating market size using top-down approach (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 42)

3.1 DIGITAL SCENT TECHNOLOGY MARKET: PRE- AND POST-COVID-19 (REALISTIC, OPTIMISTIC, AND PESSIMISTIC) SCENARIOS

FIGURE 7 MARKET: PRE- AND POST-COVID-19 (REALISTIC, OPTIMISTIC, AND PESSIMISTIC) SCENARIO ANALYSIS, 2017–2026

FIGURE 8 E-NOSE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD IN MARKET, BY HARDWARE DEVICE

FIGURE 9 MARKET FOR ENVIRONMENTAL MONITORING APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN DIGITAL SCENT TECHNOLOGY MARKET

FIGURE 11 INCREASING USAGE OF E-NOSES IN FOOD & BEVERAGE APPLICATION FOR QUALITY ASSURANCE AND IN MEDICAL APPLICATION FOR DISEASE DIAGNOSIS TO DRIVE MARKET

4.2 MARKET, BY HARDWARE DEVICE

FIGURE 12 MARKET FOR E-NOSE TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

4.3 MARKET, BY APPLICATION

FIGURE 13 MEDICAL SEGMENT TO GARNER HIGH DEMAND IN COMING YEARS

4.4 MARKET, BY END-USE PRODUCT

FIGURE 14 MEDICAL DIAGNOSTIC PRODUCTS SEGMENT TO HOLD LARGEST SIZE OF MARKET FROM 2021 TO 2026

4.5 MARKET IN NORTH AMERICA, BY COUNTRY AND APPLICATION

FIGURE 15 US AND MEDICAL SEGMENTS LIKELY TO HOLD LARGEST SHARE OF MARKET IN NORTH AMERICA BY 2026

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 E-NOSE APPLICATION IN CLINICAL DIAGNOSTICS LIKELY TO SPUR DEMAND FOR DIGITAL SCENT TECHNOLOGY

5.2.1 DRIVERS

5.2.1.1 Rising use of e-nose in food industry for quality assurance in production, storage, and display

5.2.1.2 Expanding application and advancements in e-nose technologies

5.2.1.3 Increasing use of e-nose devices for disease diagnostic applications

5.2.1.4 Emerging R&D activities to invent e-nose to sniff out COVID-19

FIGURE 17 IMPACT ANALYSIS OF DRIVERS ON MARKET

5.2.2 RESTRAINTS

5.2.2.1 High cost of digital scent technology

5.2.2.2 Delay between successive tests while using e-nose

FIGURE 18 IMPACT ANALYSIS OF RESTRAINTS ON MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Application of e-nose in security and military sectors

5.2.3.2 Growth opportunities of e-noses in environmental monitoring

FIGURE 19 IMPACT ANALYSIS OF OPPORTUNITIES ON MARKET

5.2.4 CHALLENGES

5.2.4.1 Hazardous chemicals used by scent synthesizers generating different smells affects human health

5.2.4.2 Unpredictability of air flow

FIGURE 20 IMPACT ANALYSIS OF CHALLENGES ON MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 21 ALMOST 65% OF VALUE IS ADDED IN SUPPLY SIDE OF VALUE CHAIN

5.4 TECHNOLOGY ANALYSIS

5.5 PATENT ANALYSIS

TABLE 1 KEY PATENTS FROM 2013 TO 2021

5.6 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS, 2020

TABLE 2 MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 PORTER’S FIVE FORCES ANALYSIS: SUPPLIER’S BARGAINING POWER TO HAVE HIGH IMPACT ON MARKET DURING FORECAST PERIOD

5.6.1 INTENSITY OF COMPETITIVE RIVALRY

FIGURE 24 INTENSITY OF COMPETITIVE RIVALRY: MODERATE COMPETITION IN MARKET DUE TO GROWTH IN NUMBER OF PRODUCT LAUNCHES

5.6.2 THREAT OF SUBSTITUTES

FIGURE 25 THREAT OF SUBSTITUTE TO BE LOW DUE TO HIGH SWITCHING COST FOR BUYERS

5.6.3 BARGAINING POWER OF BUYERS

FIGURE 26 BARGAINING POWER OF BUYERS TO BE MODERATE DUE TO HIGH SWITCHING COST

5.6.4 BARGAINING POWER OF SUPPLIERS

FIGURE 27 BARGAINING POWER OF SUPPLIERS TO BE HIGH DUE TO CONTINUOUS TECHNOLOGICAL ADVANCEMENTS

5.6.5 THREAT OF NEW ENTRANTS

FIGURE 28 NEW ENTRANTS LIKELY TO ENTER DIGITAL SCENT MARKET DUE TO HIGH GROWTH RATE OF DIGITAL SCENT TECHNOLOGY MARKET

5.7 ECOSYSTEM ANALYSIS

TABLE 3 MARKET: ECOSYSTEM

FIGURE 29 KEY PLAYERS IN DIGITAL SCENT TECHNOLOGY MARKET ECOSYSTEM

5.8 TRENDS IMPACTING BUSINESSES OF CUSTOMERS

5.9 CASE STUDY ANALYSIS

5.9.1 CASE STUDY 1: AIRSENSE ANALYTICS GMBH

5.9.2 CASE STUDY 2: COMON INVENT

5.9.3 CASE STUDY 3: COMON INVENT

5.9.4 CASE STUDY 4: SMITHS DETECTION

5.10 AVERAGE SELLING PRICE TREND

5.11 TRADE ANALYSIS

FIGURE 30 IMPORT DATA OF GAS OR SMOKE ANALYSIS APPARATUS, BY COUNTRY, 2016–2019 (USD THOUSAND)

FIGURE 31 EXPORT DATA OF GAS OR SMOKE ANALYSIS APPARATUS, BY COUNTRY, 2016–2019 (USD THOUSAND)

5.12 REGULATORY LANDSCAPE

5.12.1 IMPORTANCE OF STANDARDS FOR SENSORY DEVICE

5.12.2 GUIDANCE FROM HUMAN ODOR AND TASTE STANDARDS

5.12.3 E-NOSE STANDARDIZATION EFFORTS

TABLE 4 SUMMARY OF PRIOR E-NOSE STANDARD EFFORTS

6 DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE (Page No. - 75)

6.1 INTRODUCTION

FIGURE 32 MARKET, BY HARDWARE DEVICE

FIGURE 33 E-NOSE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 5 MARKET, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 6 MARKET, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

TABLE 7 VOLUME INFORMATION FOR E-NOSE, 2017-2020 (THOUSAND UNITS)

TABLE 8 VOLUME INFORMATION FOR E-NOSE, 2021-2026 (THOUSAND UNITS)

6.2 E-NOSE

FIGURE 34 FUNCTIONING OF E-NOSE

FIGURE 35 FEATURES OF E-NOSE

6.2.1 E-NOSE, BY SENSOR TYPE

6.2.1.1 Polymer Sensor

6.2.1.2 Piezoelectric Sensor

6.2.1.3 MOSFET Sensor

6.2.1.4 Optical Fiber Sensor

TABLE 9 GAS SENSING METHODS

TABLE 10 MARKET FOR E-NOSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 11 MARKET FOR E-NOSE, BY REGION, 2021–2026 (USD MILLION)

TABLE 12 MARKET FOR E-NOSE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 13 MARKET FOR E-NOSE, BY APPLICATION, 2021–2026 (USD MILLION)

6.3 SCENT SYNTHESIZER

6.3.1 CARTRIDGE

TABLE 14 MARKET FOR SCENT SYNTHESIZER, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 MARKET FOR SCENT SYNTHESIZER, BY REGION, 2021–2026 (USD MILLION)

TABLE 16 MARKET FOR SCENT SYNTHESIZER, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 17 MARKET FOR SCENT SYNTHESIZER, BY APPLICATION, 2021–2026 (USD MILLION)

7 DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT (Page No. - 85)

7.1 INTRODUCTION

FIGURE 36 DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT

FIGURE 37 MARKET FOR MEDICAL DIAGNOSTIC PRODUCTS TO HOLD LARGEST MARKET SHARE IN 2021

TABLE 18 MARKET, BY END-USE PRODUCT, 2017–2020 (USD MILLION)

TABLE 19 MARKET, BY END-USE PRODUCT, 2021–2026 (USD MILLION)

7.2 SMARTPHONES

7.2.1 SMARTPHONES—MOST ADOPTED END-USE PRODUCT

TABLE 20 MARKET FOR SMARTPHONE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 21 MARKET FOR SMARTPHONE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 22 MARKET FOR SMARTPHONE, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 23 MARKET FOR SMARTPHONE, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

7.3 SMELLING SCREENS

7.3.1 SMELLING SCREEN USED TO ENHANCE ADVERTISING DISPLAYS AND MUSEUM EXHIBITS

TABLE 24 MARKET FOR SMELLING SCREEN, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 25 MARKET FOR SMELLING SCREEN, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 26 MARKET FOR SMELLING SCREEN, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 27 MARKET FOR SMELLING SCREEN, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

7.4 MUSIC AND VIDEO GAMES

7.4.1 DIGITAL SCENT TECHNOLOGY USED TO HEIGHTEN SENSE OF REALITY FOR MUSIC LISTENERS

TABLE 28 MARKET FOR MUSIC AND VIDEO GAMES, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 29 MARKET FOR MUSIC AND VIDEO GAMES, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 30 MARKET FOR MUSIC AND VIDEO GAMES, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 31 MARKET FOR MUSIC AND VIDEO GAMES, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

7.5 EXPLOSIVES DETECTORS

7.5.1 NANOSENSORS—POTENTIAL AND EFFECTIVE PLATFORM FOR TRACE DETECTION OF EXPLOSIVES

TABLE 32 MARKET FOR EXPLOSIVES DETECTORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 33 MARKET FOR EXPLOSIVES DETECTORS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 34 MARKET FOR EXPLOSIVES DETECTORS, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 35 MARKET FOR EXPLOSIVES DETECTORS, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

7.6 QUALITY CONTROL PRODUCTS

7.6.1 QUALITY CONTROL PRODUCTS PREDOMINANTLY USED FOR ANALYZING QUALITY AND HEALTH OF POULTRY PRODUCTS

TABLE 36 MARKET FOR QUALITY CONTROL PRODUCTS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 37 MARKET FOR QUALITY CONTROL PRODUCTS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 38 MARKET FOR QUALITY CONTROL PRODUCTS, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 39 MARKET FOR QUALITY CONTROL PRODUCTS, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

7.7 MEDICAL DIAGNOSTIC PRODUCTS

7.7.1 CANCER DETECTION

7.7.2 RESPIRATORY DISEASES

7.7.3 URINARY TRACT INFECTIONS

7.7.4 OTHER DISEASES

TABLE 40 MARKET FOR MEDICAL DIAGNOSTIC PRODUCTS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 41 MARKET FOR MEDICAL DIAGNOSTIC PRODUCTS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 42 MARKET FOR MEDICAL DIAGNOSTIC PRODUCTS, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 43 MARKET FOR MEDICAL DIAGNOSTIC PRODUCTS, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

7.8 OTHERS

7.8.1 PROJECTORS

7.8.2 THEATERS

7.8.3 EMAILS

7.8.4 STUDY MATERIALS

7.8.5 HOTELS AND RESTAURANTS

7.8.6 SMART HOME SYSTEMS

7.8.7 WEARABLES

TABLE 44 MARKET FOR OTHER END-USE PRODUCTS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 45 MARKET FOR OTHER END-USE PRODUCTS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 46 MARKET FOR OTHER END-USE PRODUCTS, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 47 MARKET FOR OTHER END-USE PRODUCTS, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

8 DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION (Page No. - 101)

8.1 INTRODUCTION

FIGURE 38 MARKET, BY APPLICATION

FIGURE 39 MARKET FOR MEDICAL APPLICATION TO HOLD LARGEST SIZE DURING FORECAST PERIOD

TABLE 48 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 49 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 FOOD & BEVERAGE

8.2.1 RISING R&D ACTIVITIES IN E-NOSE FOR EFFECTIVE QUALITY MONITORING AND PREVENTING WASTAGE OF FOOD

FIGURE 40 E-NOSE SYSTEM FOR DETECTION OF RIPENING STAGE OF CITRUS FRUITS

TABLE 50 MARKET FOR FOOD & BEVERAGE APPLICATION, BY END-USE PRODUCT, 2017–2020 (USD MILLION)

TABLE 51 MARKET FOR FOOD & BEVERAGE APPLICATION, BY END-USE PRODUCT, 2021–2026 (USD MILLION)

TABLE 52 MARKET FOR FOOD & BEVERAGE APPLICATION, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 53 MARKET FOR FOOD & BEVERAGE APPLICATION, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

TABLE 54 MARKET FOR FOOD & BEVERAGE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 MARKET FOR FOOD & BEVERAGE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.3 MILITARY & DEFENSE

8.3.1 NANOTECHNOLOGY-BASED E-NOSE—EMERGING TECHNOLOGY FOR MILITARY & DEFENSE APPLICATION

TABLE 56 MARKET FOR MILITARY & DEFENSE APPLICATION, BY END-USE PRODUCT, 2017–2020 (USD MILLION)

TABLE 57 MARKET FOR MILITARY & DEFENSE APPLICATION, BY END-USE PRODUCT, 2021–2026 (USD MILLION)

TABLE 58 MARKET FOR MILITARY & DEFENSE APPLICATION, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 59 MARKET FOR MILITARY & DEFENSE APPLICATION, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

TABLE 60 MARKET FOR MILITARY & DEFENSE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 MARKET FOR MILITARY & DEFENSE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.4 MEDICAL

8.4.1 E-NOSE—EMERGING BIOMARKER IN LUNG CANCER DIAGNOSTICS

TABLE 62 DESCRIPTIVE AROMAS PREVIOUSLY USED FOR DIAGNOSING HUMAN DISEASE

TABLE 63 MARKET FOR MEDICAL APPLICATION, BY END-USE PRODUCT, 2017–2020 (USD MILLION)

TABLE 64 MARKET FOR MEDICAL APPLICATION, BY END-USE PRODUCT, 2021–2026 (USD MILLION)

TABLE 65 MARKET FOR MEDICAL APPLICATION, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 66 MARKET FOR MEDICAL APPLICATION, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

TABLE 67 MARKET FOR MEDICAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 68 MARKET FOR MEDICAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.5 MARKETING

8.5.1 COSMETICS—MAJOR INDUSTRY ADOPTING DIGITAL SCENT TECHNOLOGY FOR MARKETING APPLICATION

TABLE 69 MARKET FOR MARKETING APPLICATION, BY END-USE PRODUCT, 2017–2020 (USD MILLION)

TABLE 70 MARKET FOR MARKETING APPLICATION, BY END-USE PRODUCT, 2021–2026 (USD MILLION)

TABLE 71 MARKET FOR MARKETING APPLICATION, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 72 MARKET FOR MARKETING APPLICATION, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

TABLE 73 MARKET FOR MARKETING APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 MARKET FOR MARKETING APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.6 ENVIRONMENTAL MONITORING

8.6.1 DIGITAL SCENT TECHNOLOGY PREDOMINANTLY USED FOR AIR QUALITY MONITORING BY PROVIDING REAL-TIME SENSING FOR PUBLIC HEALTH AND SAFETY ALERTS

FIGURE 41 E-NOSE APPLICATIONS IN ENVIRONMENTAL MONITORING

TABLE 75 MARKET FOR ENVIRONMENTAL MONITORING APPLICATION, BY END-USE PRODUCT, 2017–2020 (USD MILLION)

TABLE 76 MARKET FOR ENVIRONMENTAL MONITORING APPLICATION, BY END-USE PRODUCT, 2021–2026 (USD MILLION)

TABLE 77 MARKET FOR ENVIRONMENTAL MONITORING APPLICATION, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 78 MARKET FOR ENVIRONMENTAL MONITORING APPLICATION, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

TABLE 79 MARKET FOR ENVIRONMENTAL MONITORING APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 80 MARKET FOR ENVIRONMENTAL MONITORING APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.7 ENTERTAINMENT

8.7.1 VISUAL THEATER—KEY APPLICATION OF DIGITAL SCENT TECHNOLOGY IN ENTERTAINMENT INDUSTRY

TABLE 81 MARKET FOR ENTERTAINMENT APPLICATION, BY END-USE PRODUCT, 2017–2020 (USD MILLION)

TABLE 82 MARKET FOR ENTERTAINMENT APPLICATION, BY END-USE PRODUCT, 2021–2026 (USD MILLION)

TABLE 83 MARKET FOR ENTERTAINMENT APPLICATION, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 84 MARKET FOR ENTERTAINMENT APPLICATION, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

TABLE 85 MARKET FOR ENTERTAINMENT APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 86 MARKET FOR ENTERTAINMENT APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.8 OTHERS

TABLE 87 MARKET FOR OTHER APPLICATIONS, BY END-USE PRODUCT, 2017–2020 (USD MILLION)

TABLE 88 MARKET FOR OTHER APPLICATIONS, BY END-USE PRODUCT, 2021–2026 (USD MILLION)

TABLE 89 MARKET FOR OTHER APPLICATIONS, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 90 MARKET FOR OTHER APPLICATIONS, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

TABLE 91 MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 92 MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 122)

9.1 INTRODUCTION

FIGURE 42 DIGITAL SCENT TECHNOLOGY MARKET, BY REGION

FIGURE 43 REGIONAL SNAPSHOT: DIGITAL SCENT MARKET IN MEXICO TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 44 NORTH AMERICA TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 93 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 94 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 45 SNAPSHOT: DIGITAL SCENT MARKET IN NORTH AMERICA

TABLE 95 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 96 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 97 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 98 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 99 MARKET IN NORTH AMERICA, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 100 MARKET IN NORTH AMERICA, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

9.2.1 IMPACT OF COVID-19 ON DISPLAY SCENT TECHNOLOGY MARKET IN NORTH AMERICA

FIGURE 46 ANALYSIS OF MARKET IN NORTH AMERICA: PRE-COVID-19 VS POST-COVID-19

9.2.2 US

9.2.2.1 Presence of major players catalyzing market growth in US

9.2.3 CANADA

9.2.3.1 Demand from agriculture sector to substantiate market growth in Canada

9.2.4 MEXICO

9.2.4.1 Medical industry to support growth of market in Mexico

9.3 EUROPE

FIGURE 47 SNAPSHOT: SCENT TECHNOLOGY MARKET IN EUROPE

TABLE 101 DIGITAL SCENT MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 102 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 103 MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 104 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 105 MARKET IN EUROPE, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 106 MARKET IN EUROPE, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

9.3.1 IMPACT OF COVID-19 ON MARKET IN EUROPE

FIGURE 48 ANALYSIS OF MARKET IN EUROPE: PRE-COVID-19 VS POST-COVID-19

9.3.2 UK

9.3.2.1 Potential application in cancer diagnosis to support market growth in UK

9.3.3 GERMANY

9.3.3.1 Ongoing research activities to develop low-cost odor sensors to support market growth in Germany

9.3.4 FRANCE

9.3.4.1 Focus on development of electronic noses for applications in food industry to fuel market growth in France

9.3.5 REST OF EUROPE

9.4 APAC

FIGURE 49 SNAPSHOT: SCENT TECHNOLOGY MARKET IN ASIA PACIFIC

TABLE 107 DIGITAL SCENT MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 108 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 109 MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 110 MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 111 MARKET IN APAC, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 112 MARKET IN APAC, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

9.4.1 IMPACT OF COVID-19 ON DIGITAL SCENT MARKET IN APAC

FIGURE 50 ANALYSIS OF MARKET IN APAC: PRE-COVID-19 VS POST-COVID-19

9.4.2 CHINA

9.4.2.1 Booming chemicals industry augments demands for smell synthesizers in China

9.4.3 JAPAN

9.4.3.1 Startups are set to fuel market growth in Japan

9.4.4 INDIA

9.4.4.1 Government initiatives encouraging use of electronic noses in agriculture sector to augment market growth in India

9.4.5 REST OF APAC

9.5 ROW

9.5.1 IMPACT OF COVID-19 MARKET IN ROW

FIGURE 51 ANALYSIS OF MARKET IN ROW: PRE-COVID-19 VS POST-COVID-19

TABLE 113 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 114 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 115 MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 116 MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 117 MARKET IN ROW, BY HARDWARE DEVICE, 2017–2020 (USD MILLION)

TABLE 118 MARKET IN ROW, BY HARDWARE DEVICE, 2021–2026 (USD MILLION)

9.5.2 SOUTH AMERICA

9.5.2.1 Government measures to support digital citizen offerings in Brazil to boost market growth

9.5.3 MIDDLE EAST & AFRICA

9.5.3.1 Adoption of digital scent technology for environmental control applications to underpin market growth in Middle East & Africa

10 COMPETITIVE LANDSCAPE (Page No. - 146)

10.1 INTRODUCTION

FIGURE 52 COMPANIES ADOPTED PRODUCT LAUNCHES/DEVELOPMENTS, CONTRACTS/COLLABORATIONS/AGREEMENTS/ACQUISITIONS AS KEY GROWTH STRATEGIES FROM 2018 TO 2020

10.2 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 53 TOP PLAYERS IN MARKET, 2016–2020

10.3 MARKET SHARE AND RANKING ANALYSIS, 2020

TABLE 119 MARKET: DEGREE OF COMPETITION

TABLE 120 MARKET: RANKING ANALYSIS

10.4 COMPETITIVE LEADERSHIP MAPPING, 2020

10.4.1 STAR

10.4.2 PERVASIVE

10.4.3 EMERGING LEADER

10.4.4 PARTICIPANT

FIGURE 54 MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

10.5 COMPANY EVALUATION QUADRANT – PRODUCT FOOTPRINT

10.5.1 MARKET: COMPANY FOOTPRINT, BY APPLICATION

10.5.2 MARKET: COMPANY FOOTPRINT, BY REGION

10.5.3 TOTAL SCORE

10.6 STARTUP/SME EVALUATION MATRIX, 2020

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 55 MARKET (GLOBAL) STARTUP/SME EVALUATION MATRIX, 2020

10.7 COMPETITIVE SITUATIONS AND TRENDS

TABLE 121 MARKET: PRODUCT LAUNCHES

TABLE 122 DIGITAL SCENT MARKET: DEALS

11 COMPANY PROFILES (Page No. - 156)

11.1 INTRODUCTION

11.2 IMPACT OF COVID-19 ON PLAYERS OF DIGITAL SCENT TECHNOLOGY MARKET

(Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.3 KEY PLAYERS

11.3.1 AMS AG

FIGURE 56 AMS AG: COMPANY SNAPSHOT

TABLE 123 AMS AG: BUSINESS OVERVIEW

11.3.2 SMITHS DETECTION INC.

FIGURE 57 SMITHS DETECTION INC.: COMPANY SNAPSHOT

TABLE 124 SMITHS DETECTION INC.: BUSINESS OVERVIEW

11.3.3 ALPHA MOS SA

FIGURE 58 ALPHA MOS SA: COMPANY SNAPSHOT

TABLE 125 ALPHA MOS SA: BUSINESS OVERVIEW

11.3.4 AIRSENSE ANALYTICS GMBH

TABLE 126 AIRSENSE ANALYTICS GMBH: BUSINESS OVERVIEW

11.3.5 SCENTSATIONAL TECHNOLOGIES

TABLE 127 SCENTSATIONAL TECHNOLOGIES: BUSINESS OVERVIEW

11.3.6 ELECTRONIC SENSOR TECHNOLOGY

TABLE 128 ELECTRONIC SENSOR TECHNOLOGY: BUSINESS OVERVIEW

11.3.7 AROMAJOIN CORPORATION

TABLE 129 AROMAJOIN CORPORATION: BUSINESS OVERVIEW

11.3.8 SCENT SCIENCES CORPORATION

TABLE 130 SCENT SCIENCES CORPORATION: BUSINESS OVERVIEW

11.3.9 THE ENOSE COMPANY

TABLE 131 THE ENOSE COMPANY: BUSINESS OVERVIEW

11.3.10 ODOTECH INC.

TABLE 132 ODOTECH INC.: BUSINESS OVERVIEW

11.4 OTHER PLAYERS

11.4.1 COMON INVENT

11.4.2 ARYBALLE

11.4.3 PLASMION GMBH

11.4.4 OWLSTONE

11.4.5 SENSIGENT

11.4.6 VOLER SYSTEMS

11.4.7 STRATUSCENT INC.

11.4.8 SMELLDECT GMBH

11.4.9 PCA TECHNOLOGIES

11.4.10 ROBOSCIENTIFIC

11.4.11 AERNOS

11.4.12 INTELLGENT OPTICAL SYSTEMS

11.4.13 MYDX

11.4.14 GERSTEL

11.4.15 VAPORSENS

*Details on Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 184)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the size of the digital scent technology market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

The secondary sources referred to for this research study include organizations such as Digital Olfaction Society (DOS), Tokyo Institute of Technology, National Institute of Information and Communications Technology, and so on; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, and business. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

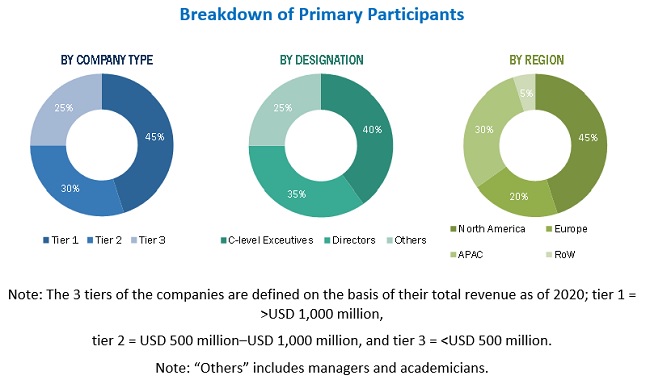

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the digital scent technology market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (food & beverage, military & defense, .edical, marketing, environmental monitoring, entertainment) and supply-side (OEM/ODM, system integrators, solution providers) players across four major regions, namely, North America, Europe, APAC, and Rest of the World (South America, Africa, Middle East). Approximately 75% and 25% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the digital scent technology market. These methods were also extensively used to estimate the sizes of various market sub-segments. The research methodology used to estimate the market sizes includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, segment, and forecast the digital scent technology market in terms of value based on hardware device, end-use product, and application

- To describe and forecast the size of the market for four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide qualitative information about different hardware devices

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed value chain for the digital scent technology market

- To analyze opportunities in the market for stakeholders, along with a detailed competitive landscape of the digital scent technology market

- To strategically profile the key players and comprehensively analyze their market share and core competencies2, along with the competitive leadership mapping chart

- To provide a detailed impact of COVID-19 on the digital scent technology market

- To provide the impact of COVID-19 on the market segments and the players operating in the digital scent technology market

- To analyze the competitive developments such as product launches/developments, partnerships/acquisitions in the digital scent technology market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Scent Technology Market