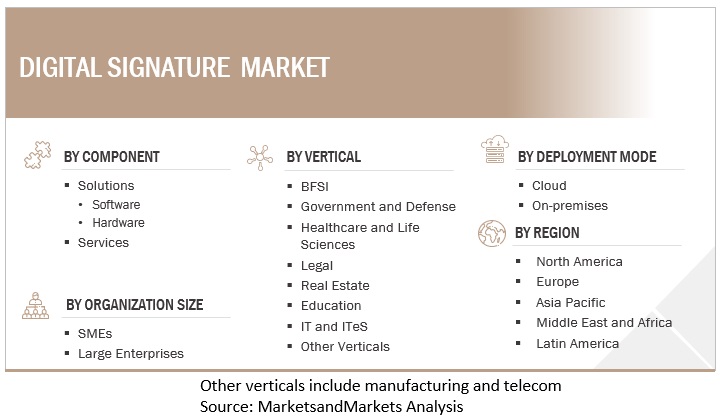

Digital Signature Market by Component (Solutions and Services), Solution (Software and Hardware), Deployment Mode, Organization Size, Vertical (BFSI, Government and Defense, Legal, Real Estate) and Region - Global Forecast to 2027

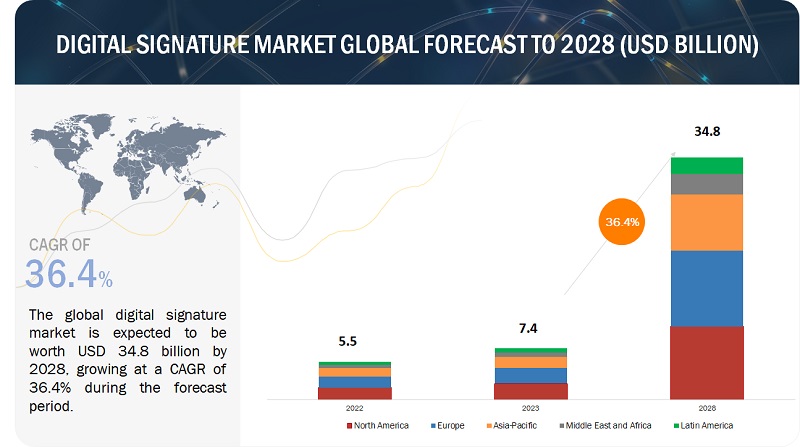

The global Digital Signature Market size was valued at $5.5 billion in 2022 and it is projected to reach $25.2 billion by 2027, growing at a CAGR of 35.6% from 2022 to 2027.

There has been a rise in the use of e-signatures in the recent years. This factor is expected to contribute to the growth of the digital signature market. Strict e-signature regulations are also contributing to the growth in the use of digital signature solutions. There is a significant demand for digital signature solutions across verticals, such as BFSI, government and defense, healthcare and life sciences, legal, and others.

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Signature Market Dynamics

Driver: Growing use of e-Signatures led to the need to eradicate fraud and signature forgery

The green movement has taken hold for the past decade across the globe, resulting in the shift of governments, corporate offices, and enterprises toward full or partial paperless workflows. Various offices started using electronic documentation, saving a massive amount of paper. eSign has been in the industry for several years, but COVID-19 has proved to be the reactant in increasing its adoption. Electronic signatures provide a secure and reliable system for remote people to sign approvals, contracts, and other documents easily and efficiently. A critical factor driving the demand for digital signatures is the need to eradicate fraud and signature forgery. With the growing use of eSignature services, eSignature scams and phishing attacks that compromise a user’s personal and financial information have risen. Such cyber incidents have elevated the need for digital signatures. Several regulation frameworks control the use of e-signatures. In the US, for instance, the Federal Reserve Bank, the Securities and Exchange Commission (SEC), and the Internal Revenue Service (IRS) have all released electronic signature guidance that enables more forms, documents, and transactions than ever before electronic signatures.

Restraint: Variation in digital signature rules and regulations across regions

Digital signature solutions automate the business processes for bringing about digital transformation; at the same time, users expect business processes to be easy-to-use, to be able to provide flexible accessibility with high security and to be compatible with all rules and regulations. The digital signature provides security and boosts trust in a business process, playing a crucial role in business transactional processes. Digital signature technology is related to documents that contain financial information, designs, product and service-related information, defense strategies, government policies, and other important documents. SMEs are focused on satisfying regional needs using digital signature technology. The government’s rules and regulations and the judiciary's acceptance of digital signatures as witnesses or proofs vary geographically. Region-wise, new rules and regulations are emerging. Changing rules and regulations are becoming a challenge for the digital signature market.

Opportunity: Growing number of partnerships and acquisitions

The digital signature market has witnessed unprecedented traction in recent years. There has been tremendous growth in inorganic growth strategies, such as partnerships, agreements, and acquisitions, among IT companies to establish themselves as digital signature solutions and service providers with competitive advantages. The latest trends show that the key players follow various inorganic strategies to stay competitive in the digital signature market. The demand for digital signature solutions and services has become one of the foremost concerns for security-centric organizations. Hence, the market offers abundant opportunities for digital signature providers to sell their digital signature solutions and services.

Challenge: Intensely entrenched traditional business practices

A long history of working with traditional paper-based business processes is entrenched deeply in the working culture of all businesses, which are reluctant to change their working patterns within a short interval. The other major challenges in adopting digital signature technology across all organizational processes include the lack of trust and ease of implementation, otherwise present in convenient business solutions. Traditional business practices need to route documents signed by all signatories, with additional suggestions/changes required; this process takes a lot of time and effort. Overcoming this deeply entrenched traditional business practice is becoming a hindrance or a challenge in the digital signature market.

Digital Signature Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By component, solutions segment to account for the largest market share during the forecast period

Digital signature solutions help authenticate digital documents and authenticate the identity of the signer. These solutions provide increased security and enable streamlining of the business processes. Customers across industries such as BFSI, government and defense, legal, real estate, and education are rapidly adopting digital signature solutions. Increasing incidents of data breaches being reported across the globe has prompted organizations to adopt digital signature solutions. Regulations and laws implemented related to digital signature has led to organizations increasingly adopting digital signature solutions. Several vendors including DigiCert, OneSpan, Thales, and DocuSign provide digital signature solutions. For instance, OneSpan provides OneSpan Sign in the digital signature market. OneSpan Sign helps handle all aspects of the signing process, from collecting consent to delivering and storing the eSigned document and a detailed audit trail of the transaction. The solution is managed by providing security and compliance.

By deployment mode, cloud segment is to grow at the highest CAGR during the forecast period

In the cloud deployment mode, all the hosting and maintenance requirements are taken care by a third-party service provider. The organization deploying solutions in the cloud deployment mode uses the pay as you use model. The deployment is flexible and scalable, and organizations can upgrade and downgrade their plans as per their business growth and scalability. There are no maintenance costs as such and the price is for the resources and space consumed. Organizations deploying the cloud mode need to be compliant with the digital signature market regulations and also check if their service providers comply with the industry standards and regulations. As the data is shared with the service provider, the security offered is lesser and the data is at a greater risk. The mode involves built-in, automated data backups and recovery. According to the report by IBM, Cost of a data breach 2022, nearly half of the data breaches happen in the cloud. While 45% of the data breaches take place in the cloud, organizations with a hybrid cloud model had a lower average data breach cost compared to the organizations with a public or private cloud model.

By solutions, software segment to grow at higher CAGR during the forecast period

Digital signature solution vendors provide software to organizations to help effectively create digital signatures that comply with the industry standards and further support collaboration with the accredited certified authorities. Digital signature software is becoming crucial as it enables organizations to digitally sign documents even from a remote or location and overcome the several challenges that are associated with the traditional paper-based signing. For instance, Zoho provides the Zoho Sign, which uses public key infrastructure technology to provide security for digitally signing and verifying documents. It helps digitally sign documents and email the signed copies; provide encryption and compliance with ESIGN and eIDAS regulations. It enables configuring of workflows, tracking of document status, and creation of customizable templates.

By region, North America to account for the largest market size during the forecast period

North America is expected to be the largest contributor in terms of the global digital signature market size. North America is the most advanced region in terms of security technology adoption and infrastructure. According to the World Bank, the internet usage rate in the US was 91% in 2020. In the US, a comprehensive digital government strategy aimed at delivering better digital services to citizens was launched and built on three main goals, including enabling the American people and an increasingly mobile workforce to access high-quality digital government information and services anywhere, anytime, on any device. The growing concerns for protecting critical communication infrastructure and sensitive data have increased government intervention in recent years. Various security-related regulatory compliances control the digital signature market. Title 21 CFR Part 11 is a part of the Code of Federal Regulations that establishes the United States Food and Drug Administration (FDA) regulations on electronic records and electronic signatures. The region also has the largest number of digital signature solution vendors. The vendors are engaging in partnerships and collaborations to expand their presence in the digital signature market. In April 2020, GlobalSign joined DocuSign’s agreement cloud partner ecosystem to deliver globally trusted digital identities. Cloud-based services from GlobalSign and DocuSign enable enterprises to leverage GlobalSign’s digital signing service integration to the DocuSign Trust Service Provider ecosystem. Countries analyzed for the digital signature market in this region are the US and Canada.

Key Market Players

The major vendors in the digital signature market include Adobe (US), OneSpan (US), Thales (France), DocuSign (US), Ascertia (UK), Zoho (India), GlobalSign (US), Entrust (US), DigiCert (US), IdenTrust (US), Secured Signing (New Zealand), Symtrax (US), AlphaTrust (US), Notarius (US), Actalis (US), ComSignTrust (Israel), SignWell (US), SIGNiX (US), RNTrust (UAE), Bit4id (Italy), LAWtrust (South Africa), SigniFlow (UK), vintegrisTECH (Spain), Signicat (Norway), and Signority (Canada).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 5.5 Billion |

|

Revenue forecast in 2027 |

USD 25.2 Billion |

|

Growth rate |

CAGR of 35.6% |

|

Segments covered |

Component, Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Major companies covered |

Adobe (US), OneSpan (US), Thales (France), DocuSign (US), Ascertia (UK), Zoho (India), GlobalSign (US), Entrust (US), DigiCert (US), IdenTrust (US), Secured Signing (New Zealand), Symtrax (US) and many more. |

Market Segmentation

Recent Developments

- In April 2021, OneSpan announced the launch of its OneSpan Sign Virtual Room for remote agreement collaboration and eSigning. The virtual room provides financial services organizations, with a single solution to deliver secure, video-enabled, customer interactions for completing complex financial agreements. Using the virtual room, financial institutions and their customers can digitally review and sign documents together without having to combine multiple tools and apps.

- In June 2022, Entrust announced the acquisition of Evidos, a leader in cloud-based electronic signatures and identity verification solutions. The acquisition combines Evidos’ cloud-based electronic signature workflow solutions with secure certificate-based electronic signature solutions from Entrust.

- In April 2020, GlobalSign joined DocuSign’s agreement cloud partner ecosystem to deliver globally trusted digital identities. Cloud-based services from GlobalSign and DocuSign enable business enterprises to leverage GlobalSign’s digital signing service integration to the DocuSign Trust Service Provider ecosystem.

Frequently Asked Questions (FAQ):

What is the projected market value of the global digital signature market?

Retrieving data. Wait a few seconds and try to cut or copy again.

What is the estimated growth rate (CAGR) of the global digital signature market for the next five years?

The global digital signature market is projected to grow at a Compound Annual Growth Rate (CAGR) of 35.6% from 2022 to 2027.

What are the major revenue pockets in the digital signature market currently?

The geographic analysis of the digital signature market is segmented into regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. In 2022, North America has captured most of the share, as the US and Canada are rapidly adopting cloud computing. North America has the presence of top vendors, including Adobe, Salesforce, Oracle, AWS, Google, and IBM. The region is experiencing significant innovations in technologies.

Who are the key companies influencing market growth?

Adobe, OneSpan, Thales, DocuSign, Ascertia, etc., are the leaders in the digital signature market, recognized as the star players. These companies account for a major share of the digital signature market. They offer wide solutions related to digital signature. These vendors offer customized solutions per user requirements and are adopting growth strategies to consistently achieve the desired growth and make their presence in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2022

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 46)

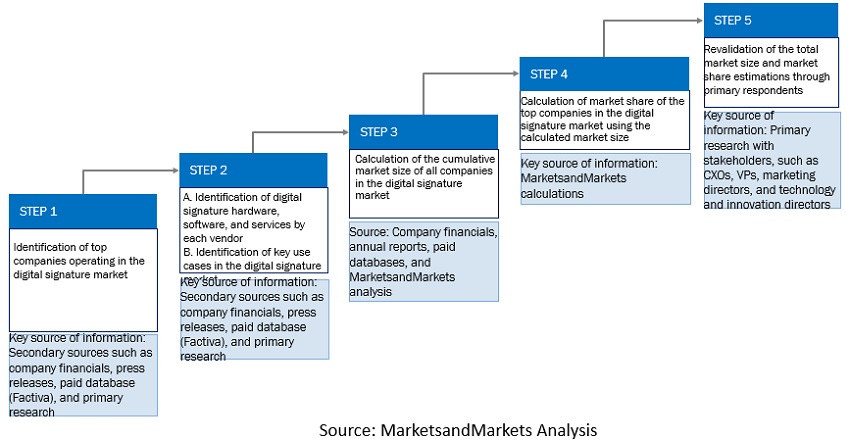

2.1 RESEARCH DATA

FIGURE 1 DIGITAL SIGNATURE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 2 MARKET: RESEARCH FLOW

2.3 MARKET SIZE ESTIMATION

2.3.1 REVENUE ESTIMATES

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY-SIDE): REVENUE OF SOLUTIONS/SERVICES OF DIGITAL SIGNATURE VENDORS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH, SUPPLY-SIDE ANALYSIS

FIGURE 5 DIGITAL SIGNATURE MARKET: MARKET ESTIMATION APPROACH—SUPPLY-SIDE ANALYSIS (COMPANY REVENUE ESTIMATION)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES OF DIGITAL SIGNATURE VENDORS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3— BOTTOM-UP (DEMAND-SIDE) VERTICALS

2.4 COMPANY EVALUATION QUADRANT METHODOLOGY

FIGURE 8 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.5 STARTUP EVALUATION QUADRANT METHODOLOGY

FIGURE 9 STARTUP EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.6 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 60)

TABLE 3 DIGITAL SIGNATURE MARKET SIZE AND GROWTH, 2022–2027 (USD MILLION, Y-O-Y GROWTH)

FIGURE 10 GLOBAL MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

FIGURE 12 FASTEST-GROWING SEGMENTS OF MARKET

4 PREMIUM INSIGHTS (Page No. - 66)

4.1 BRIEF OVERVIEW OF DIGITAL SIGNATURE MARKET

FIGURE 13 INCREASING ADOPTION OF DIGITAL PLATFORMS BY ENTERPRISES TO DRIVE MARKET GROWTH

4.2 MARKET, BY COMPONENT, 2022

FIGURE 14 SOLUTIONS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.3 MARKET, BY SOLUTION, 2022

FIGURE 15 SOFTWARE SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY ORGANIZATION SIZE, 2022

FIGURE 16 LARGE ENTERPRISES TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

4.5 MARKET, BY DEPLOYMENT MODE, 2022

FIGURE 17 ON-PREMISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

4.6 MARKET, BY VERTICAL, 2022

FIGURE 18 BFSI VERTICAL TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

4.7 MARKET INVESTMENT SCENARIO

FIGURE 19 EUROPE TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 69)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DIGITAL SIGNATURE MARKET

5.2.1 DRIVERS

5.2.1.1 Growing use of eSignatures prompted need to eradicate fraud and signature forgery

5.2.1.2 Stringent regulatory standards and data privacy compliances

5.2.1.3 Enhanced security with controlled and seamless workflow

5.2.1.4 Improved operational efficiency at lower OPEX

5.2.2 RESTRAINTS

5.2.2.1 Lack of awareness about legality of digital signatures

5.2.2.2 Variation in digital signature rules and regulations across regions

5.2.3 OPPORTUNITIES

5.2.3.1 Upgrade in end-to-end customer experience

5.2.3.2 Acceptance of cloud-based security solutions

5.2.3.3 Growing number of partnerships and acquisitions

5.2.3.4 Rise in artificial intelligence

5.2.4 CHALLENGES

5.2.4.1 Entrenched traditional business practices

5.2.4.2 Cost of implementation and legality issues

5.3 DIGITAL SIGNATURE ECOSYSTEM ANALYSIS

FIGURE 21 DIGITAL SIGNATURE MARKET ECOSYSTEM

TABLE 4 MARKET: ECOSYSTEM

5.4 ARCHITECTURE

FIGURE 22 DIGITAL SIGNATURE: ARCHITECTURE

5.5 TECHNOLOGY ANALYSIS

FIGURE 23 MARKET: TECHNOLOGY ANALYSIS

5.5.1 DIGITAL SIGNATURE AND INTERNET OF THINGS

5.5.2 DIGITAL SIGNATURE AND ARTIFICIAL INTELLIGENCE

5.5.3 DIGITAL SIGNATURE AND CLOUD

5.5.4 DIGITAL SIGNATURE AND BLOCKCHAIN

5.6 VALUE CHAIN ANALYSIS

5.6.1 COMPONENT/HARDWARE SUPPLIERS

5.6.2 TECHNOLOGY PROVIDERS

5.6.3 SECURITY SOLUTION AND SERVICE PROVIDERS

5.6.4 SYSTEM INTEGRATORS

5.6.5 SALES AND DISTRIBUTION CHANNELS

5.6.6 INDUSTRY VERTICALS

5.7 PATENT ANALYSIS

FIGURE 24 DIGITAL SIGNATURE MARKET: PATENT ANALYSIS

TABLE 5 MARKET: PATENTS

5.8 PRICING ANALYSIS

TABLE 6 MARKET: PRICING ANALYSIS

5.9 USE CASES

5.9.1 USE CASE 1: DOCUSIGN HELPED MEDICAL DEVICE MANUFACTURING COMPANY STREAMLINE PHYSICIAN SIGNATURES WITH DIGITAL TRANSACTION MANAGEMENT

5.9.2 USE CASE 2: SECURED SIGNING HELPED H&R BLOCK EASE TAX BURDEN

5.9.3 USE CASE 3: DOCUSIGN ESIGNATURE UPHELD IN COURT AS LEGAL AND ENFORCEABLE IN COMMON LAW JURISDICTIONS

5.9.4 USE CASE 4: DOCUSIGN ESIGNATURE HELPED SALESFORCE SPEED UP GLOBAL RECRUITING EFFORTS WITH WORKDAY

5.9.5 USE CASE 5: GLOBALSIGN HELPED CLOUGH HARBOR & ASSOCIATES LLP IMPROVE EFFICIENCY OF DOCUMENT DELIVERY

5.9.6 USE CASE 6: EMUDHRA HELPED MAURITIUS GOVERNMENT IMPLEMENT NATIONAL PKI INFRASTRUCTURE

5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 25 DIGITAL SIGNATURE MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 PORTER’S FIVE FORCES IMPACT ON MARKET

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS (%)

5.13 REGULATORY LANDSCAPE

5.13.1 INTRODUCTION

5.13.2 GENERAL DATA PROTECTION REGULATION

5.13.3 PERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACT

5.13.4 PAYMENT CARD INDUSTRY-DATA SECURITY STANDARD

5.13.5 SYSTEM AND ORGANIZATION CONTROLS (SOC) 2 TYPE II COMPLIANCE

5.13.6 ELECTRONIC IDENTIFICATION, AUTHENTICATION, AND TRUST SERVICES

5.13.7 ELECTRONIC SIGNATURES IN GLOBAL AND NATIONAL COMMERCE ACT

5.13.8 UNIFORM ELECTRONIC TRANSACTIONS ACT

5.13.9 SARBANES–OXLEY ACT

5.13.10 21 CFR PART 11

5.13.11 INFORMATION TECHNOLOGY ACT, 2000

5.13.12 DIGITAL SIGNATURE (END ENTITY) RULES, 2015

5.13.13 E-SIGN ONLINE SERVICE OR E-HASTAKSHAR

5.13.14 FFIEC AUTHENTICATION IN INTERNET BANKING ENVIRONMENT GUIDANCE

5.13.15 KNOW YOUR CUSTOMER

5.13.16 ANTI-MONEY LAUNDERING

5.14 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 9 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 DIGITAL SIGNATURE MARKET, BY COMPONENT (Page No. - 96)

6.1 INTRODUCTION

FIGURE 27 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 10 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 11 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

6.2.1 SOLUTIONS HELP MITIGATE CYBER RISKS AND COMPLY WITH REGULATIONS

6.2.2 SOLUTIONS: MARKET DRIVERS

TABLE 12 SOLUTIONS: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 13 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 28 SOFTWARE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 14 MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 15 MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

6.2.3 SOFTWARE

TABLE 16 SOFTWARE: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 17 SOFTWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.4 HARDWARE

TABLE 18 HARDWARE: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 19 HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES HELP IN DEPLOYMENT AND MAINTENANCE OF DIGITAL SIGNATURE SOLUTIONS

6.3.2 SERVICES: MARKET DRIVERS

TABLE 20 SERVICES: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 21 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 DIGITAL SIGNATURE MARKET, BY DEPLOYMENT MODE (Page No. - 104)

7.1 INTRODUCTION

FIGURE 29 CLOUD TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 22 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 23 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

7.2 CLOUD

7.2.1 LOW MAINTENANCE COSTS AND INCREASED SCALABILITY PROMOTES ADOPTION OF CLOUD-BASED DIGITAL SIGNATURES

7.2.2 CLOUD: MARKET DRIVERS

TABLE 24 CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 ON-PREMISES

7.3.1 ENHANCED SECURITY AND PRIVACY TO INCREASE NEED FOR ON-PREMISES SOLUTIONS

7.3.2 ON-PREMISES: MARKET DRIVERS

TABLE 26 ON-PREMISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 27 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 DIGITAL SIGNATURE MARKET, BY ORGANIZATION SIZE (Page No. - 109)

8.1 INTRODUCTION

FIGURE 30 LARGE ENTERPRISES TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 28 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 29 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

8.2.1 STRINGENT REGULATIONS AND NEED TO COMBAT CYBERCRIMES TO DRIVE MARKET GROWTH

8.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

TABLE 30 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

8.3.1 INCREASING CYBERATTACKS AND NEED TO ENHANCE CUSTOMER EXPERIENCE

8.3.2 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 32 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 33 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 DIGITAL SIGNATURE MARKET, BY VERTICAL (Page No. - 114)

9.1 INTRODUCTION

FIGURE 31 BFSI VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 34 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 35 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

9.2.1 DIGITAL SIGNATURES TO ENHANCE EFFICIENCY OF WORKFLOWS AND HELP COMPLY WITH REGULATIONS

9.2.2 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET DRIVERS

TABLE 36 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 GOVERNMENT AND DEFENSE

9.3.1 INCREASED DIGITALIZATION AND COMPLIANCE WITH ESIGNATURE LAWS TO BOOST MARKET GROWTH

9.3.2 GOVERNMENT AND DEFENSE: MARKET DRIVERS

TABLE 38 GOVERNMENT AND DEFENSE: DIGITAL SIGNATURE MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 39 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 HEALTHCARE AND LIFE SCIENCES

9.4.1 STRICT REGULATIONS FOR SECURING HEALTHCARE INFORMATION TO AID MARKET GROWTH

9.4.2 HEALTHCARE AND LIFE SCIENCES: MARKET DRIVERS

TABLE 40 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 41 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 LEGAL

9.5.1 INCREASED TRANSITION FROM PAPER-BASED SIGNING PROCESSES TO SECURE DIGITAL SIGNING METHODS

9.5.2 LEGAL: MARKET DRIVERS

TABLE 42 LEGAL: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 LEGAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 REAL ESTATE

9.6.1 TRANSITION TOWARD DIGITAL SIGNATURES TO PREVENT CYBER FRAUD

9.6.2 REAL ESTATE: MARKET DRIVERS

TABLE 44 REAL ESTATE: DIGITAL SIGNATURE MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 REAL ESTATE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 EDUCATION

9.7.1 DIGITAL SIGNATURES TO HELP EDUCATIONAL INSTITUTES STREAMLINE OPERATIONS AND REDUCE COSTS

9.7.2 EDUCATION: MARKET DRIVERS

TABLE 46 EDUCATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 47 EDUCATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 IT AND ITES

9.8.1 ADOPTION OF ADVANCED TECHNOLOGIES AND INCREASED CYBER RISK TO BOOST MARKET GROWTH

9.8.2 IT AND ITES: MARKET DRIVERS

TABLE 48 IT AND ITES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 49 IT AND ITES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 OTHER VERTICALS

9.9.1 OTHER VERTICALS: MARKET DRIVERS

TABLE 50 OTHER VERTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 51 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 DIGITAL SIGNATURE MARKET, BY REGION (Page No. - 128)

10.1 INTRODUCTION

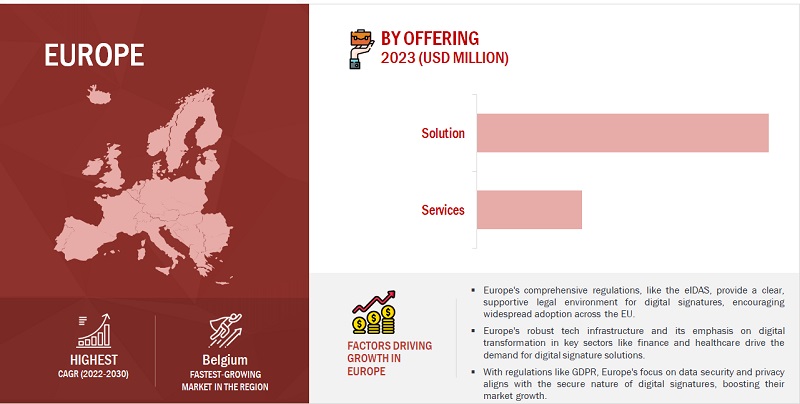

FIGURE 32 EUROPE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 52 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 53 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

TABLE 54 NORTH AMERICA: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.3 US

10.2.3.1 High awareness and presence of key MARKET vendors

TABLE 66 US: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 67 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 68 US: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 69 US: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 70 US: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 71 US: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 72 US: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 73 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 74 US: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 75 US: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2.4 CANADA

10.2.4.1 Increasing digitalization and strict regulations implemented

TABLE 76 CANADA: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 77 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 78 CANADA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 79 CANADA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 80 CANADA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 81 CANADA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 82 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 83 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 84 CANADA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 85 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: REGULATORY LANDSCAPE

TABLE 86 EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 91 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 92 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Growing digitalization initiatives by governments and organizations

TABLE 98 UK: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 99 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 100 UK: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 101 UK: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 102 UK: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 103 UK: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 104 UK: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 105 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 106 UK: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 107 UK: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.4 GERMANY

10.3.4.1 Increasing use of internet and digitalization strategies undertaken by government

TABLE 108 GERMANY: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 109 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 110 GERMANY: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 111 GERMANY: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 112 GERMANY: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 113 GERMANY: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 114 GERMANY: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 115 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 116 GERMANY: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 117 GERMANY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.5 FRANCE

10.3.5.1 Increasing use of digital signatures across verticals and strict regulations implemented

TABLE 118 FRANCE: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 119 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 120 FRANCE: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 121 FRANCE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 122 FRANCE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 123 FRANCE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 124 FRANCE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 125 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 126 FRANCE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 127 FRANCE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 128 REST OF EUROPE: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 129 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 130 REST OF EUROPE: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 131 REST OF EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 132 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 133 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 134 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 135 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 136 REST OF EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 137 REST OF EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 34 ASIA PACIFIC: DIGITAL SIGNATURE MARKET SNAPSHOT

TABLE 138 ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.3 CHINA

10.4.3.1 Increasing initiatives in 5G, AI, and emerging technologies

TABLE 150 CHINA: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 151 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 152 CHINA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 153 CHINA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 154 CHINA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 155 CHINA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 156 CHINA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 157 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 158 CHINA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 159 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.4 INDIA

10.4.4.1 Growth of eCommerce and retail sector

TABLE 160 INDIA: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 161 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 162 INDIA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 163 INDIA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 164 INDIA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 165 INDIA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 166 INDIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 167 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 168 INDIA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 169 INDIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.5 JAPAN

10.4.5.1 Investment in advanced technologies and regulations implemented related to digital signatures

TABLE 170 JAPAN: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 171 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 172 JAPAN: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 173 JAPAN: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 174 JAPAN: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 175 JAPAN: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 176 JAPAN: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 177 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 178 JAPAN: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 179 JAPAN: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 180 REST OF ASIA PACIFIC: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 181 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 182 REST OF ASIA PACIFIC: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 183 REST OF ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 184 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 185 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 186 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 187 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 188 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 189 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 190 MIDDLE EAST AND AFRICA: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 191 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 192 MIDDLE EAST AND AFRICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 193 MIDDLE EAST AND AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 194 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 195 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 196 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 197 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 198 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 199 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 200 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 201 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.3 MIDDLE EAST

10.5.3.1 Increasing digitalization initiatives by organizations

TABLE 202 MIDDLE EAST: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 203 MIDDLE EAST: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 204 MIDDLE EAST: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 205 MIDDLE EAST: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 206 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 207 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 208 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 209 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 210 MIDDLE EAST: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 211 MIDDLE EAST: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.4 AFRICA

10.5.4.1 Increasing efforts to create digital economy

TABLE 212 AFRICA: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 213 AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 214 AFRICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 215 AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 216 AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 217 AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 218 AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 219 AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 220 AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 221 AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 222 LATIN AMERICA: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 223 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 224 LATIN AMERICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 225 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 226 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 227 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 228 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 229 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 230 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 231 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 232 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 233 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.3 BRAZIL

10.6.3.1 Increasing cyberattacks and digitalization strategies implemented

TABLE 234 BRAZIL: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 235 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 236 BRAZIL: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 237 BRAZIL: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 238 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 239 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 240 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 241 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 242 BRAZIL: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 243 BRAZIL: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.6.4 MEXICO

10.6.4.1 Growing use of internet and concerns about organization’s data security

TABLE 244 MEXICO: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 245 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 246 MEXICO: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 247 MEXICO: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 248 MEXICO: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 249 MEXICO: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 250 MEXICO: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 251 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 252 MEXICO: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 253 MEXICO: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

TABLE 254 REST OF LATIN AMERICA: DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 255 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 256 REST OF LATIN AMERICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 257 REST OF LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 258 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 259 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 260 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 261 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 262 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 263 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 205)

11.1 OVERVIEW

11.2 HISTORICAL REVENUE ANALYSIS

FIGURE 35 FIVE-YEAR REVENUE ANALYSIS OF KEY DIGITAL SIGNATURE VENDORS (USD MILLION)

11.3 MARKET EVALUATION FRAMEWORK

FIGURE 36 MARKET EVALUATION FRAMEWORK BETWEEN 2020 AND 2022

11.4 MARKET SHARE ANALYSIS OF LEADING PLAYERS

FIGURE 37 DIGITAL SIGNATURE MARKET: REVENUE ANALYSIS

11.5 MARKET STRUCTURE

TABLE 264 DEGREE OF COMPETITION

11.6 RANKING OF KEY PLAYERS

FIGURE 38 RANKING OF KEY MARKET PLAYERS

11.7 COMPETITIVE SCENARIO

11.7.1 RECENT DEVELOPMENTS

TABLE 265 MARKET: PRODUCT LAUNCHES

TABLE 266 MARKET: DEALS

11.8 COMPANY EVALUATION QUADRANT

11.8.1 COMPANY EVALUATION QUADRANT DEFINITIONS AND METHODOLOGY

TABLE 267 EVALUATION CRITERIA

11.9 COMPETITIVE BENCHMARKING

11.9.1 COMPANY FOOTPRINT

FIGURE 39 COMPANY FOOTPRINT OF MAJOR PLAYERS IN DIGITAL SIGNATURE MARKET

11.10 COMPETITIVE LEADERSHIP MAPPING

11.10.1 STARS

11.10.2 EMERGING LEADERS

11.10.3 PERVASIVE PLAYERS

11.10.4 PARTICIPANTS

FIGURE 40 MARKET: COMPANY EVALUATION QUADRANT

11.11 STARTUP/SME EVALUATION QUADRANT

11.11.1 PROGRESSIVE COMPANIES

11.11.2 RESPONSIVE COMPANIES

11.11.3 DYNAMIC COMPANIES

11.11.4 STARTING BLOCKS

FIGURE 41 DIGITAL SIGNATURE MARKET: STARTUP/SME EVALUATION QUADRANT

11.12 COMPETITIVE BENCHMARKING OF STARTUP/SME

TABLE 268 DETAILED LIST OF SME/STARTUP

TABLE 269 SME/STARTUP COMPANY REGION FOOTPRINT

12 COMPANY PROFILES (Page No. - 222)

12.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Right to win, Strategic choices, Weakness/competitive threats) *

12.1.1 ADOBE

TABLE 270 ADOBE: BUSINESS OVERVIEW

FIGURE 42 ADOBE: COMPANY SNAPSHOT

TABLE 271 ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 272 ADOBE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 273 ADOBE: DEALS

12.1.2 ONESPAN

TABLE 274 ONESPAN: BUSINESS OVERVIEW

FIGURE 43 ONESPAN: COMPANY SNAPSHOT

TABLE 275 ONESPAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 276 ONESPAN: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 277 ONESPAN: DEALS

12.1.3 THALES

TABLE 278 THALES: BUSINESS OVERVIEW

FIGURE 44 THALES: COMPANY SNAPSHOT

TABLE 279 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 280 THALES: DEALS

12.1.4 DOCUSIGN

TABLE 281 DOCUSIGN: BUSINESS OVERVIEW

FIGURE 45 DOCUSIGN: COMPANY SNAPSHOT

TABLE 282 DOCUSIGN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 283 DOCUSIGN: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 284 DOCUSIGN: DEALS

12.1.5 ASCERTIA

TABLE 285 ASCERTIA: BUSINESS OVERVIEW

TABLE 286 ASCERTIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 287 ASCERTIA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 288 ASCERTIA: DEALS

12.1.6 ZOHO

TABLE 289 ZOHO: BUSINESS OVERVIEW

TABLE 290 ZOHO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 291 ZOHO: PRODUCT LAUNCHES AND ENHANCEMENTS

12.1.7 GLOBALSIGN

TABLE 292 GLOBALSIGN: BUSINESS OVERVIEW

TABLE 293 GLOBALSIGN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 294 GLOBALSIGN: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 295 GLOBALSIGN: DEALS

12.1.8 ENTRUST

TABLE 296 ENTRUST: BUSINESS OVERVIEW

TABLE 297 ENTRUST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 298 ENTRUST: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 299 ENTRUST: DEALS

12.1.9 DIGICERT

TABLE 300 DIGICERT: BUSINESS OVERVIEW

TABLE 301 DIGICERT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 302 DIGICERT: PRODUCT LAUNCHES AND ENHANCEMENTS

12.1.10 IDENTRUST

TABLE 303 IDENTRUST: BUSINESS OVERVIEW

TABLE 304 IDENTRUST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 305 IDENTRUST: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 306 IDENTRUST: DEALS

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Right to win, Strategic choices, Weakness/competitive threats might not be captured in case of unlisted companies.

12.2 SMES/STARTUPS

12.2.1 SECURED SIGNING

12.2.2 SYMTRAX

12.2.3 ALPHATRUST

12.2.4 NOTARIUS

12.2.5 ACTALIS

12.2.6 COMSIGN TRUST

12.2.7 SIGNWELL

12.2.8 SIGNIX

12.2.9 RNTRUST

12.2.10 BIT4ID

12.2.11 LAWTRUST

12.2.12 SIGNIFLOW

12.2.13 VINTEGRISTECH

12.2.14 SIGNICAT

12.2.15 SIGNORITY

13 ADJACENT MARKETS (Page No. - 266)

13.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 307 ADJACENT MARKETS AND FORECASTS

13.2 LIMITATIONS

13.3 PUBLIC KEY INFRASTRUCTURE MARKET

TABLE 308 PUBLIC KEY INFRASTRUCTURE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 309 PUBLIC KEY INFRASTRUCTURE MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 310 PUBLIC KEY INFRASTRUCTURE MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 311 PUBLIC KEY INFRASTRUCTURE MARKET, BY VERTICAL, 2020–2026 (USD MILLION)

13.4 CERTIFICATE AUTHORITY MARKET

TABLE 312 CERTIFICATE AUTHORITY MARKET, BY COMPONENT, 2016–2020 (USD THOUSAND)

TABLE 313 CERTIFICATE AUTHORITY MARKET, BY COMPONENT, 2021–2026 (USD THOUSAND)

TABLE 314 CERTIFICATE AUTHORITY MARKET, BY VERTICAL, 2016–2020 (USD THOUSAND)

TABLE 315 CERTIFICATE AUTHORITY MARKET, BY VERTICAL, 2021–2026 (USD THOUSAND)

14 APPENDIX (Page No. - 270)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved major activities in estimating the current market size of the digital signature market. Exhaustive secondary research was done to collect information on the digital signature industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down, bottom-up, etc., were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the digital signature market.

Secondary Research

The market size of companies offering digital signature solutions and services was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing major companies' product portfolios and rating them based on their performance and quality.

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers, journals, certified publications; and articles from recognized authors, directories, and databases.

The factors considered for estimating the market size are Gross Domestic Product (GDP) growth, Information and Communications Technology (ICT) spending, recent market developments, technology adoption rates for workplace safety, and market ranking analysis of major digital signature solution providers.

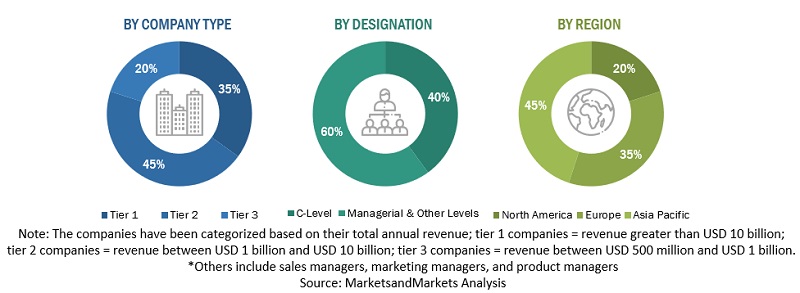

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the digital signature market.

In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. The complete market engineering process was extensive qualitative and quantitative analysis to list key information/insights throughout the report.

After the complete market engineering process (calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of the digital signature market players; and the key market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies.

Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To know about the assumptions considered for the study, Request for Free Sample Report

Multiple approaches were adopted to estimate and forecast the size of the digital signature market. In the market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and sub-segments listed in this report. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information/insights throughout the report. This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes, as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segments. The data was triangulated by studying various factors and trends from the demand and supply sides.

Report Objectives

- To describe and forecast the global digital signature market by component, deployment mode, organization size, verticals, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the digital signature market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the digital signature market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the digital signature market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements and new product launches; acquisitions; and partnerships and collaborations, in the digital signature market globally

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Signature Market