Digital Therapeutics Market by Application (Prediabetes, Nutrition, Care, Diabetes, CVD, CNS, CRD, MSD, GI, Substance Abuse, Rehabilitation), Sales Channel (B2C (Patient, Caregiver), B2B (Providers, Payer, Employer, Pharma)) & Region - Global Forecast to 2027

Updated on : June 18, 2023

The global digital therapeutics market in terms of revenue was estimated to be worth $4.5 billion in 2022 and is poised to reach $17.7 billion by 2027, growing at a CAGR of 31.6% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in this market is primarily driven by the rising incidence of preventable chronic diseases, the need to control healthcare costs, increasing venture capital investment, and the benefits of digital therapeutics.

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Therapeutics Market Dynamics

Driver: Need to control healthcare costs

The need to control healthcare costs is one of the primary drivers of the market. Digital therapeutics are non-invasive and cost-effective alternatives to traditional medicine. They provide patients with access to personalized and affordable care. Digital therapeutics are also being used to reduce the cost of care and increase the efficiency of care delivery. With the rising cost of healthcare, digital therapeutics offer a cost-effective solution to providing care. Digital therapeutics can also be used to improve patient outcomes and reduce hospital readmissions. This can result in a significant reduction in healthcare costs. Furthermore, digital therapeutics can provide improved access to care for underserved populations and enable providers to better manage chronic conditions.

Opportunity: Unexplored therapeutic applications

Digital therapeutics are becoming increasingly popular as an alternative to traditional treatments. The market is expected to grow significantly in the next few years, driven by the increasing acceptance of digital therapeutics among healthcare providers and patients. Digital therapeutics offer a wide range of unexplored therapeutic applications. For example, digital therapeutics can be used to treat conditions such as autism, Alzheimer's disease, depression, anxiety, and chronic pain. Digital therapeutics also offer opportunities for personalized healthcare, as they are able to tailor treatments to an individual’s specific needs. In addition, digital therapeutics have the potential to reduce healthcare costs, as they can be used to replace or supplement more expensive treatments such as medications or surgery. Additionally, they can be used to address public health issues, such as obesity and smoking cessation. Finally, digital therapeutics can also be applied to mental health, where they can be used to deliver cognitive behavioural therapy (CBT) and other evidence-based treatments. This could not only help individuals manage their mental health but also reduce their risk of developing mental health disorders.

Restraint: Patient data security concerns

Digital therapeutics is a rapidly growing market, however, patient data security concerns remain a major restraint. As digital therapeutics involve storing and processing sensitive patient information, there is a need to ensure that the data is securely stored and managed. Any security breach can lead to misuse of patient data, leading to potential legal and financial liabilities for the companies involved. Moreover, the lack of clear regulatory guidelines for digital therapeutics is another factor that is expected to impede the growth of the market.

Challenge: Unstable payment Models

The market is facing several challenges due to its unstable payment models. Currently, most digital therapeutics are paid for on a fee-for-service basis, meaning that providers are paid a flat fee for each patient, regardless of the outcome. This model does not incentivize providers to invest in the development of new treatments or technologies, and it also makes it difficult for providers to accurately assess the cost-effectiveness of digital therapeutics. Additionally, the lack of long-term data in the digital therapeutics field makes it difficult to establish a sustainable pricing model. Many payers are also reluctant to invest in digital therapeutics, as they are uncertain of the long-term efficacy of these treatments. As a result, digital therapeutics companies must find innovative ways to attract payers, such as offering discounts or outcomes-based payment models. Furthermore, digital therapeutics companies must focus on developing reliable data models to demonstrate the efficacy of their treatments in order to gain broader acceptance from payers.

B2B segment is expected to account for the largest share of digital therapeutics industry, by Sales

The digital therapeutics market is divided based on sales channel into business-to-consumer (B2C) and business-to-business (B2B). This is attributed to growing awareness among providers, payers, and employers about the benefits of digital therapeutics and the inclination of pharmaceutical companies to incorporate digital therapeutics into their drug products.

Treatment/Care related applications are the largest share of the digital therapeutics industry, by applications

The digital therapeutics market is divided based on applications into preventive and treatment or care-related applications. The treatment and care-related applications segment is expected to hold the highest share in the market, attributed to the increasing economic burden of their treatment and investments in digital therapeutics to promote the advancement of cost-effective and scalable treatment platforms for these conditions.

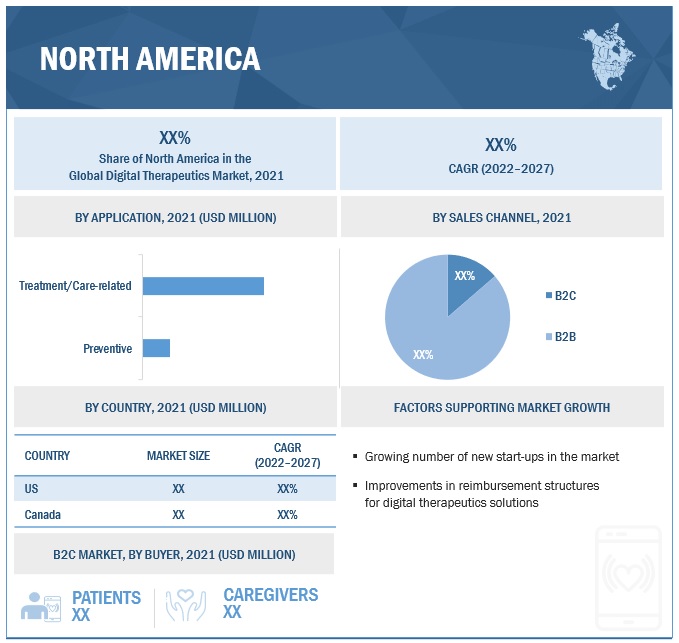

North America to dominate the digital therapeutics industry

The digital therapeutics market is divided based on regions into North America, Europe, the Asia Pacific, and the Rest of the World (RoW). North America accounted for the largest share of the market, followed by Europe. The high growth rate of the North American market can primarily be attributed to rising enhancements in the reimbursement structure for digital therapeutics, a growing number of new start-ups in the global market investments in digital therapeutics, and government initiatives to encourage technological advancements that drive market growth in this region.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in the digital therapeutics market include Noom, Inc (US), Teladoc Health, Inc. (US), Omada Health, Inc. (US), WellDoc, Inc (US), Pear Therapeutics, Inc. (US), CogniFit Inc (US), Ginger (US), Propeller Health (US), 2Morrow, Inc. (US), Canary Health (US), Click Therapeutics, Inc. (US), Akili, Inc. (US), Cognoa, Inc (US), Wellthy Therapeutics Pvt. Ltd. (India), Twill Inc. (US), Better Therapeutics, Inc (US), Mindstrong (US), Kaia Health (Germany), BehaVR Inc (US), Ayogo (Canada), Mindable Health GmbH (Germany), Virta Health Corp (US), Hinge Health, Inc. (US), Orexo AB (Sweden) and Freespira (US).

Scope of the Digital Therapeutics Industry

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$4.5 billion |

|

Projected Revenue by 2027 |

$17.7 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 31.6% |

|

Market Driver |

Need to control healthcare costs |

|

Market Opportunity |

Unexplored therapeutic applications |

This study categorizes the global digital therapeutics market to forecast revenue and analyze trends in each of the following submarkets:

By Sales Channel

- B2C

- Patients

- Caregivers

- B2B

- Providers

- Payers

- Employers

- Pharmaceutical Companies

- Other Buyers

By Application

-

Preventive Applications

- Prediabetes

- Obesity

- Nutrition

- Lifestyle Management

- Other Preventive Applications

-

Treatment/Care-related Applications

- Diabetes

-

CNS Disorders

- Mental Health Disorder

- Other CNS Disorders

- Chronic Respiratory Disorders

- Musculoskeletal Disorders

- Cardiovascular Diseases

- Smoking Cessation

- Medication Adherence

- Gastrointestinal Disorders

- Substance Use & Addiction Management

- Rehabilitation & Patient Care

- Other Treatment/Care-related Applications

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Spain

- Italy

- Rest of Europe (RoE)

-

APAC

- Japan

- China

- India

- Rest of the APAC

- Rest of the World (RoW)

Recent Developments of Digital Therapeutics Industry

- Philips and Wellbeing Digital Solutions: In April 2021, Philips announced the acquisition of Wellbeing Digital Solutions (WDS). WDS is a digital therapeutics company that develops digital solutions to improve patient engagement and outcomes in chronic conditions. The acquisition will allow Philips to expand its portfolio of digital health solutions and capabilities in chronic disease management and remote care.

- Novartis and Akili Interactive Labs: In June 2021, Novartis announced that it has entered into a definitive agreement to acquire Akili Interactive Labs, a digital therapeutics company focused on developing treatments for neurological and psychological conditions. Through the acquisition, Novartis will gain access to Akili’s digital therapeutics platform, which includes a library of clinical evidence and a portfolio of digital therapeutics programs in development.

- Merck and HealthPrize Technologies: In January 2021, Merck announced that it has entered into a definitive agreement to acquire HealthPrize Technologies, a digital therapeutics company focused on helping patients stay on top of their medications. The acquisition will enable Merck to enhance its digital health offerings and expand its presence in the market.

- Illumina and GRAIL: In January 2021, Illumina announced that it has entered into a definitive agreement to acquire GRAIL, a digital therapeutics company focused on developing and commercializing multi-cancer early detection products. Through the acquisition, Illumina will gain access to GRAIL’s patented technologies and products, which will enable the company to expand its portfolio of healthcare solutions.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global digital therapeutics market?

The global digital therapeutics market boasts a total revenue value of $17.7 billion by 2027.

What is the estimated growth rate (CAGR) of the global digital therapeutics market?

The global digital therapeutics market has an estimated compound annual growth rate (CAGR) of 31.6% and a revenue size in the region of $4.5 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 DIGITAL THERAPEUTICS INDUSTRY DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

FIGURE 3 KEY INDUSTRY INSIGHTS

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY TYPE OF BUYER AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach one: Revenue mapping-based estimation

FIGURE 6 DIGITAL THERAPEUTICS: REVENUE MAPPING-BASED ESTIMATION

2.2.1.2 Approach two: Buyer adoption-based estimation

FIGURE 7 DIGITAL THERAPEUTICS ESTIMATION: BUYER ADOPTION-BASED ESTIMATION

2.2.2 TOP-DOWN APPROACH: PaENETRATION RATE-BASED MARKET SIZE ESTIMATION

FIGURE 8 PENETRATION RATE-BASED MARKET ESTIMATION

2.2.3 GROWTH FORECAST

TABLE 1 FACTOR ANALYSIS

FIGURE 9 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022–2027)

FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 11 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 12 DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2022 VS. 2027 (USD MILLION)

FIGURE 13 DIGITAL THERAPEUTICS INDUSTRY FOR B2C SALES CHANNEL, 2022 VS. 2027 (USD MILLION)

FIGURE 14 GLOBAL MARKET FOR B2B SALES CHANNEL, 2022–2027

FIGURE 15 GLOBAL MARKET, BY APPLICATION (2022–2027)

FIGURE 16 GLOBAL MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, 2022 VS. 2027 (USD MILLION)

FIGURE 17 GEOGRAPHICAL SNAPSHOT OF MARKET

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 MARKET OVERVIEW

FIGURE 18 INCREASING INCIDENCE OF CHRONIC DISEASES & TECHNOLOGICAL ADVANCEMENTS TO DRIVE ADOPTION OF DIGITAL THERAPEUTICS

4.2 GLOBAL MARKET, BY SALES CHANNEL, 2022–2027

FIGURE 19 B2B SALES DOMINATE GLOBAL MARKET

4.3 DIGITAL THERAPEUTICS INDUSTRY: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 20 NORTH AMERICA TO GROW AT HIGHEST RATE

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 DIGITAL THERAPEUTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing incidence of preventable chronic diseases

5.2.1.2 Rising focus on preventive healthcare

5.2.1.3 Need to control healthcare costs

5.2.1.4 Significant increase in venture capital investments

5.2.1.5 Benefits of digital therapeutics

5.2.1.5.1 Ability to induce behavioral change

5.2.1.5.2 Improved drug adherence

5.2.1.5.3 Patient convenience and user-friendliness

5.2.2 RESTRAINTS

5.2.2.1 Patient data privacy concerns

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets

5.2.3.2 Large undiagnosed and untreated population

5.2.3.3 Unexplored therapeutic applications

5.2.4 CHALLENGES

5.2.4.1 Unstable payment models

5.2.4.2 Reluctance among patients to adopt digital therapeutics

5.2.4.3 Lack of awareness and access to digital therapeutics programs in developing countries

5.2.4.4 Resistance from traditional healthcare providers

5.3 SUPPLY/VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 23 ECOSYSTEM ANALYSIS

5.5 PIPELINE PRODUCTS

5.6 CASE STUDIES

5.7 PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 BARGAINING POWER OF SUPPLIERS

5.7.3 BARGAINING POWER OF BUYERS

5.7.4 THREAT OF SUBSTITUTES

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 REGULATORY LANDSCAPE

5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 2 DIGITAL THERAPEUTICS REGULATORY FRAMEWORK

TABLE 3 GLOBAL MARKET: REGULATORY DATA NEEDED FOR CLASS II DEVICES

5.9 TECHNOLOGY TRENDS

TABLE 4 TECHNOLOGY ENABLERS, BENEFITS, AND EXAMPLES

5.10 INDUSTRY TRENDS

5.10.1 VIRTUAL REALITY

5.10.2 INCREASING DEMAND FOR DIGITAL DELIVERY OF BEHAVIORAL THERAPY

5.10.3 GROWING COLLABORATIONS BETWEEN STAKEHOLDERS

TABLE 5 DIGITAL THERAPEUTICS: RECENT COLLABORATIONS

5.11 PRICING ANALYSIS & REIMBURSEMENT SCENARIO

5.11.1 AVERAGE SELLING PRICE

TABLE 6 DIGITAL THERAPEUTICS PRODUCTS: REIMBURSEMENT & PRICE BY COUNTRY

5.11.2 REIMBURSEMENT SCENARIO

TABLE 7 DIGITAL THERAPEUTICS: GLOBAL COVERAGE DETERMINATION STANDARDS

5.12 PATENT ANALYSIS

5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 8 GLOBAL MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 24 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR SALES CHANNEL

TABLE 9 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR SALES CHANNEL

5.14.2 BUYING CRITERIA

FIGURE 25 KEY BUYING CRITERIA FOR SALES CHANNEL

TABLE 10 KEY BUYING CRITERIA FOR SALES CHANNEL

6 DIGITAL THERAPEUTICS MARKET, BY APPLICATION (Page No. - 80)

6.1 INTRODUCTION

TABLE 11 DIGITAL THERAPEUTICS INDUSTRY , BY APPLICATION, 2020–2027 (USD MILLION)

6.2 TREATMENT/CARE-RELATED APPLICATIONS

TABLE 12 GLOBAL MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 13 GLOBAL MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

6.2.1 DIABETES

6.2.1.1 Rising prevalence of diabetes to drive market growth

TABLE 14 GLOBAL MARKET FOR DIABETES, BY REGION, 2020–2027 (USD MILLION)

6.2.2 CENTRAL NERVOUS SYSTEM DISORDERS

TABLE 15 GLOBAL MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 16 GLOBAL MARKET FOR CNS DISORDERS, BY REGION, 2020–2027 (USD MILLION)

6.2.2.1 Mental health disorders

6.2.2.1.1 Benefits of digital therapeutics in managing mental health disorders to drive R&D

TABLE 17 GLOBAL MARKET FOR MENTAL HEALTH DISORDERS, BY REGION, 2020–2027 (USD MILLION)

6.2.2.2 Other CNS disorders

TABLE 18 MARKET FOR OTHER CNS DISORDERS, BY REGION, 2020–2027 (USD MILLION)

6.2.3 SMOKING CESSATION

6.2.3.1 Focus on providing validated, effective mobile applications to help quit smoking to aid market growth

TABLE 19 MARKET FOR SMOKING CESSATION, BY REGION, 2020–2027 (USD MILLION)

6.2.4 CHRONIC RESPIRATORY DISEASES

6.2.4.1 Growing prevalence of COPD and asthma to drive market growth

TABLE 20 GLOBAL MARKET FOR CHRONIC RESPIRATORY DISEASES, BY REGION, 2020–2027 (USD MILLION)

6.2.5 MUSCULOSKELETAL DISORDERS

6.2.5.1 Dearth of physiotherapists to support market growth

TABLE 21 GLOBAL MARKET FOR MUSCULOSKELETAL DISORDERS, BY REGION, 2020–2027 (USD MILLION)

6.2.6 CARDIOVASCULAR DISEASE

6.2.6.1 High burden of CVD to drive demand for digital therapeutics solutions

TABLE 22 GLOBAL MARKET FOR CVD, BY REGION, 2020–2027 (USD MILLION)

6.2.7 MEDICATION ADHERENCE

6.2.7.1 Growing number of medication non-adherence cases to propel market growth

TABLE 23 GLOBAL MARKET FOR MEDICATION ADHERENCE, BY REGION, 2020–2027 (USD MILLION)

6.2.8 GASTROINTESTINAL DISORDERS

6.2.8.1 High prevalence of gastrointestinal disorders to ensure strong interest in developing targeted solutions

TABLE 24 MARKET FOR GASTROINTESTINAL DISORDERS, BY REGION, 2020–2027 (USD MILLION)

6.2.9 REHABILITATION & PATIENT CARE

6.2.9.1 Benefits of digital therapeutics have induced startups to develop platforms for patient care

TABLE 25 GLOBAL MARKET FOR REHABILITATION & PATIENT CARE, BY REGION, 2020–2027 (USD MILLION)

6.2.10 SUBSTANCE USE DISORDERS & ADDICTION MANAGEMENT

6.2.10.1 Potential to improve efficiency of behavioral interventions to drive market growth

TABLE 26 MARKET FOR SUBSTANCE USE DISORDERS & ADDICTION MANAGEMENT, BY REGION, 2020–2027 (USD MILLION)

6.2.11 OTHER TREATMENT/CARE-RELATED APPLICATIONS

TABLE 27 GLOBAL MARKET FOR OTHER TREATMENT/CARE-RELATED APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

6.3 PREVENTIVE APPLICATIONS

TABLE 28 GLOBAL MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 29 GLOBAL MARKET FOR PREVENTIVE APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

6.3.1 PREDIABETES

6.3.1.1 Influx of startups to provide effective prevention against prediabetes to support market

TABLE 30 GLOBAL MARKET FOR PREDIABETES, BY REGION, 2020–2027 (USD MILLION)

6.3.2 OBESITY

6.3.2.1 Availability of cost-effective solutions for obesity management to propel market growth

TABLE 31 MARKET FOR OBESITY, BY REGION, 2020–2027 (USD MILLION)

6.3.3 NUTRITION

6.3.3.1 Importance of nutrition in preventing a wide range of ailments to drive demand for digital therapeutic solutions

TABLE 32 GLOBAL MARKET FOR NUTRITION, BY REGION, 2020–2027 (USD MILLION)

6.3.4 LIFESTYLE MANAGEMENT

6.3.4.1 Ability of digital therapeutics solutions to induce positive behavioral changes to contribute to rising demand

TABLE 33 GLOBAL MARKET FOR LIFESTYLE MANAGEMENT, BY REGION, 2020–2027 (USD MILLION)

6.3.5 OTHER PREVENTIVE APPLICATIONS

TABLE 34 GLOBAL MARKET FOR OTHER PREVENTIVE APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

7 DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL (Page No. - 98)

7.1 INTRODUCTION

TABLE 35 DIGITAL THERAPEUTICS INDUSTRY, BY SALES CHANNEL, 2020–2027 (USD MILLION)

7.2 B2B

TABLE 36 GLOBAL MARKET FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 37 GLOBAL MARKET FOR B2B SALES CHANNEL, BY REGION, 2020–2027 (USD MILLION)

7.2.1 PAYERS

7.2.1.1 Payers to hold largest share of B2B market

TABLE 38 GLOBAL MARKET FOR PAYERS, BY REGION, 2020–2027 (USD MILLION)

7.2.2 EMPLOYERS

7.2.2.1 Rising importance of employee health management to drive adoption of digital therapeutics among employers

TABLE 39 MARKET FOR EMPLOYERS, BY REGION, 2020–2027 (USD MILLION)

7.2.3 PHARMACEUTICAL COMPANIES

7.2.3.1 Growing cross-industry collaborations between digital therapeutics start-ups and pharmaceutical companies to drive market growth

TABLE 40 GLOBAL MARKET FOR PHARMACEUTICAL COMPANIES, BY REGION, 2020–2027 (USD MILLION)

7.2.4 PROVIDERS

7.2.4.1 Potential for better patient management and cost-reduction to drive demand for digital therapeutics among providers

TABLE 41 MARKET FOR PROVIDERS, BY REGION, 2020–2027 (USD MILLION)

7.2.5 OTHER BUYERS

TABLE 42 GLOBAL MARKET FOR OTHER BUYERS, BY REGION, 2020–2027 (USD MILLION)

7.3 B2C

TABLE 43 MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 44 GLOBAL MARKET FOR B2C SALES CHANNEL, BY REGION, 2020–2027 (USD MILLION)

7.3.1 CAREGIVERS

7.3.1.1 Ease of managing health conditions to drive demand for solutions among caregivers

TABLE 45 GLOBAL MARKET FOR CAREGIVERS, BY REGION, 2020–2027 (USD MILLION)

7.3.2 PATIENTS

7.3.2.1 Awareness of preventive health among patients to support segment growth

TABLE 46 GLOBAL MARKET FOR PATIENTS, BY REGION, 2020–2027 (USD MILLION)

8 DIGITAL THERAPEUTICS MARKET, BY REGION (Page No. - 107)

8.1 INTRODUCTION

TABLE 47 GLOBAL MARKET, BY REGION, 2020–2027 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 26 NORTH AMERICA: MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: DIGITAL THERAPEUTICS INDUSTRY FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.2.1 US

8.2.1.1 Strong start-up base to ensure high product access for end users

TABLE 56 US: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 57 US: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 US: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 59 US: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 60 US: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 61 US: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 62 US: DIGITAL THERAPEUTICS INDUSTRY FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Government initiatives to support digital therapeutics to drive market growth in Canada

TABLE 63 CANADA: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 64 CANADA: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 65 CANADA: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 66 CANADA: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 67 CANADA: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 68 CANADA: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 69 CANADA: MARKET FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.3 EUROPE

FIGURE 27 EUROPE: MARKET SNAPSHOT

TABLE 70 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 72 EUROPE: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 EUROPE: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 74 EUROPE: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 76 EUROPE: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 77 EUROPE: DIGITAL THERAPEUTICS INDUSTRY FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Germany forms largest market for digital therapeutics in Europe due to supportive government initiatives

TABLE 78 GERMANY: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 79 GERMANY: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 GERMANY: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 GERMANY: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 GERMANY: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 83 GERMANY: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 84 GERMANY: DIGITAL THERAPEUTICS INDUSTRY FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.3.2 UK

8.3.2.1 Well-established healthcare system and government support to propel market

TABLE 85 UK: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 86 UK: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 UK: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 UK: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 UK: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 90 UK: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 91 UK: MARKET FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.3.3 FRANCE

8.3.3.1 Growing healthcare expenditure and favorable health insurance system to support market

TABLE 92 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 93 FRANCE: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 94 FRANCE: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 95 FRANCE: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 FRANCE: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 97 FRANCE: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 98 FRANCE: DIGITAL THERAPEUTICS INDUSTRY FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.3.4 SPAIN

8.3.4.1 Initiatives by emerging digital therapeutics startups to drive market

TABLE 99 SPAIN: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 100 SPAIN: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 101 SPAIN: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 SPAIN: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 SPAIN: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 104 SPAIN: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 105 SPAIN: DIGITAL THERAPEUTICS INDUSTRY FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.3.5 ITALY

8.3.5.1 Need for alternative and effective treatment to drive market

TABLE 106 ITALY: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 107 ITALY: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 ITALY: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 ITALY: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 110 ITALY: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 111 ITALY: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 112 ITALY: MARKET FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 113 ROE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 114 ROE: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 115 ROE: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 116 ROE: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 ROE: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 118 ROE: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 119 ROE: DIGITAL THERAPEUTICS INDUSTRY FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.4 ASIA PACIFIC

TABLE 120 APAC: DIGITAL THERAPEUTICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 121 APAC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 122 APAC: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 123 APAC: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 APAC: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 125 APAC: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 126 APAC: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 127 APAC: DIGITAL THERAPEUTICS INDUSTRY FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.4.1 JAPAN

8.4.1.1 Rising diabetes incidence and collaborations to drive market growth

TABLE 128 JAPAN: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 129 JAPAN: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 JAPAN: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 131 JAPAN: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 132 JAPAN: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 133 JAPAN: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 134 JAPAN: MARKET FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.4.2 CHINA

8.4.2.1 Growing geriatric population and incidence of chronic conditions to drive demand

TABLE 135 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 136 CHINA: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 137 CHINA: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 138 CHINA: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 139 CHINA: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 140 CHINA: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 141 CHINA: DIGITAL THERAPEUTICS INDUSTRY FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.4.3 INDIA

8.4.3.1 Rising chronic disease incidence and need for better disease management to drive market

TABLE 142 INDIA: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 143 INDIA: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 INDIA: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 145 INDIA: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 146 INDIA: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 147 INDIA: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 148 INDIA: DIGITAL THERAPEUTICS INDUSTRY FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.4.4 REST OF ASIA PACIFIC

TABLE 149 ROAPAC: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 150 ROAPAC: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 151 ROAPAC: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 152 ROAPAC: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 153 ROAPAC: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 154 ROAPAC MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 155 ROAPAC: DIGITAL THERAPEUTICS INDUSTRY FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

8.5 REST OF THE WORLD

TABLE 156 ROW: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 157 ROW: MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 ROW: MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 ROW: MARKET FOR CNS DISORDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 160 ROW: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

TABLE 161 ROW: MARKET FOR B2C SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

TABLE 162 ROW: DIGITAL THERAPEUTICS INDUSTRY FOR B2B SALES CHANNEL, BY BUYER, 2020–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 164)

9.1 OVERVIEW

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 28 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN DIGITAL THERAPEUTICS

9.3 MARKET SHARE ANALYSIS

TABLE 163 DIGITAL THERAPEUTICS MARKET: DEGREE OF COMPETITION

FIGURE 29 MARKET SHARE ANALYSIS: GLOBAL MARKET

9.4 MARKET RANKING ANALYSIS, 2022

FIGURE 30 GLOBAL DIGITAL THERAPEUTICS INDUSTRY RANKING ANALYSIS, 2022

9.5 COMPETITIVE BENCHMARKING

TABLE 164 GLOBAL MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 165 GLOBAL MARKET: SALES CHANNEL FOOTPRINT OF KEY PLAYERS

TABLE 166 GLOBAL MARKET: REGIONAL FOOTPRINT OF KEY PLAYERS

9.5.1 COMPANY EVALUATION MATRIX: DEFINITIONS AND METHODOLOGY

TABLE 167 DIGITAL THERAPEUTICS MARKET: CRITERIA CONSIDERED FOR EVALUATION

9.5.1.1 Stars

9.5.1.2 Emerging leaders

9.5.1.3 Pervasive players

9.5.1.4 Participants

FIGURE 31 GLOBAL DIGITAL THERAPEUTICS INDUSTRY: GLOBAL COMPETITIVE LEADERSHIP MAPPING, 2022

9.5.2 COMPETITIVE LEADERSHIP MAPPING: START-UPS/SMES (2022)

9.5.2.1 Progressive companies

9.5.2.2 Starting blocks

9.5.2.3 Responsive companies

9.5.2.4 Dynamic companies

FIGURE 32 GLOBAL DIGITAL THERAPEUTICS INDUSTRY: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2022

9.6 COMPETITIVE SCENARIO

TABLE 168 KEY PRODUCT LAUNCHES AND APPROVALS, JANUARY 2019– AUGUST 2022

9.6.1 DEALS

TABLE 169 GLOBAL MARKET: DEALS, JANUARY 2019 - AUGUST 2022

9.6.2 OTHER DEVELOPMENTS

TABLE 170 GLOBAL MARKET: OTHER DEVELOPMENTS, JANUARY 2019 - AUGUST 2022

10 COMPANY PROFILES (Page No. - 177)

10.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

10.1.1 NOOM

TABLE 171 NOOM: BUSINESS OVERVIEW

10.1.2 TELADOC HEALTH

TABLE 172 TELADOC HEALTH: BUSINESS OVERVIEW

FIGURE 33 TELADOC HEALTH: COMPANY SNAPSHOT (2021)

10.1.3 OMADA HEALTH

TABLE 173 OMADA HEALTH: BUSINESS OVERVIEW

10.1.4 WELLDOC

TABLE 174 WELLDOC: BUSINESS OVERVIEW

10.1.5 PEAR THERAPEUTICS

TABLE 175 PEAR THERAPEUTICS: BUSINESS OVERVIEW

10.1.6 COGNIFIT

TABLE 176 COGNIFIT: BUSINESS OVERVIEW

10.1.7 GINGER

TABLE 177 GINGER: BUSINESS OVERVIEW

10.1.8 PROPELLER HEALTH

TABLE 178 PROPELLER HEALTH: BUSINESS OVERVIEW

10.1.9 2MORROW

TABLE 179 2MORROW: BUSINESS OVERVIEW

10.1.10 CANARY HEALTH

TABLE 180 CANARY HEALTH: BUSINESS OVERVIEW

10.1.11 CLICK THERAPEUTICS

TABLE 181 CLICK THERAPEUTICS: BUSINESS OVERVIEW

10.1.12 AKILI

TABLE 182 AKILI: BUSINESS OVERVIEW

10.1.13 WELLTHY THERAPEUTICS

TABLE 183 WELLTHY THERAPEUTICS: BUSINESS OVERVIEW

10.1.14 COGNOA

TABLE 184 COGNOA: BUSINESS OVERVIEW

10.1.15 TWILL

TABLE 185 TWILL: BUSINESS OVERVIEW

10.1.16 KAIA HEALTH

TABLE 186 KAIA HEALTH: BUSINESS OVERVIEW

10.1.17 BETTER THERAPEUTICS

TABLE 187 BETTER THERAPEUTICS: BUSINESS OVERVIEW

10.1.18 MINDSTRONG HEALTH

TABLE 188 MINDSTRONG HEALTH: BUSINESS OVERVIEW

10.1.19 BEHAVR

TABLE 189 BEHAVR: BUSINESS OVERVIEW

10.1.20 AYOGO

TABLE 190 AYOGO: BUSINESS OVERVIEW

10.2 OTHER PLAYERS

10.2.1 MINDABLE HEALTH

10.2.2 VIRTA HEALTH CORP

10.2.3 HINGE HEALTH

10.2.4 OREXO AB

10.2.5 FREESPIRA

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 224)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 CUSTOMIZATION OPTIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the global digital therapeutics market. Exhaustive secondary research was conducted to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing values with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was mainly used to identify and collect information for the extensive, technical, market-oriented, and commercial study of the digital therapeutics market. Secondary sources include directories, databases such as Bloomberg Businessweek, Factiva, and the Wall Street Journal, white papers, and annual reports that were used to obtain key information about major players, market classification, and segmentation according to industry trends, regional and country-level markets, market developments, and technology perspectives.

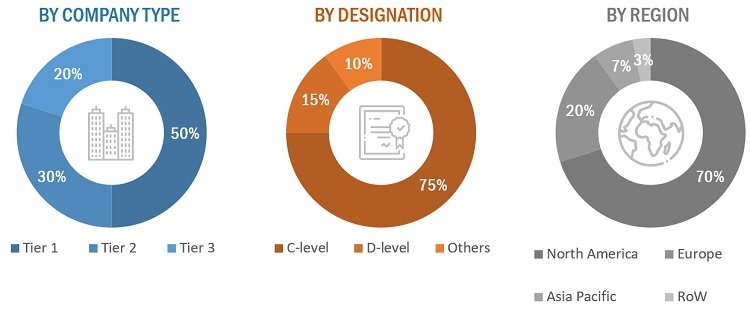

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess the prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of primary respondents:

Note 1: C-level primaries include CEOs, CFOs, and COOs.

Note 2: Others include sales, marketing, and product and service managers.

Note 3: Tiers are defined based on a company’s total revenue, as of 2021: Tier 1 = >USD 100 million, Tier 2 = USD 100 million to USD 10 million, and Tier 3 =

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the digital therapeutics market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The research methodology included the study of annual and quarterly financial reports and regulatory filings, data books of major market players, as well as interviews with industry experts for detailed market insights.

- All percentage shares, splits, and breakdowns for the global digital therapeutics market were determined by using secondary sources and verified through primary sources

- All key macro indicators affecting the revenue growth of market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get validated and verified quantitative and qualitative data

- The gathered market data was consolidated and added with detailed inputs and analysis, and presented in this report

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the digital therapeutics market based on sales channel, application, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall digital therapeutics market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to four main regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)2

- To profile key players and analyze their market shares and core competencies3

- To track and analyze competitive developments such as product launches, partnerships, agreements, expansions, mergers, and acquisitions in the digital therapeutics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Therapeutics Market

Which is the fastest growing market of Digital Therapeutics Market?

Which are the key factors driving the growth of the Global Digital Therapeutics Market?

What are the growth estimates for Digital Therapeutics Market till 2026?