Digital Twin Market by Application(Predictive Maintenance, Business Optimization, Performance Monitoring, Inventory Management), Industry(Automotive & Transportation, Healthcare, Energy & Utilities), Enterprise and Geography - Global Forecast to 2028

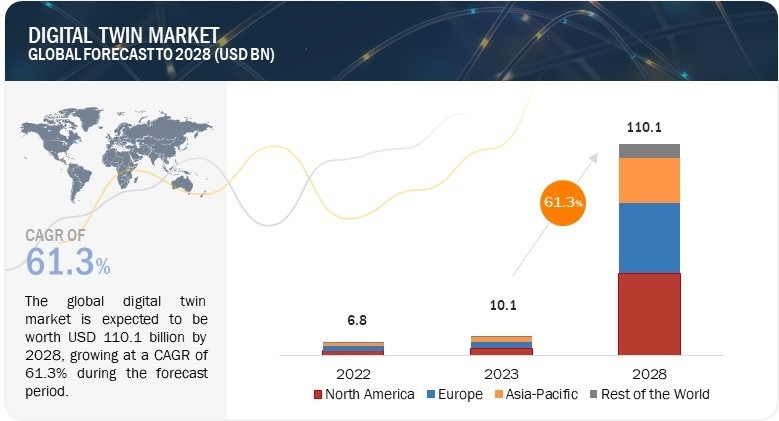

[220 Pages Report] The global digital twin market size is projected to grow from USD 10.1 billion in 2023 to USD 110.1 billion by 2028 at a CAGR of 61.3% during the forecast period. The growth of the digital twin market is driven by the growing demand for digital twin in the healthcare industry and the increasing focus on predictive maintenance.

Digital Twin Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Twin Market Dynamics:

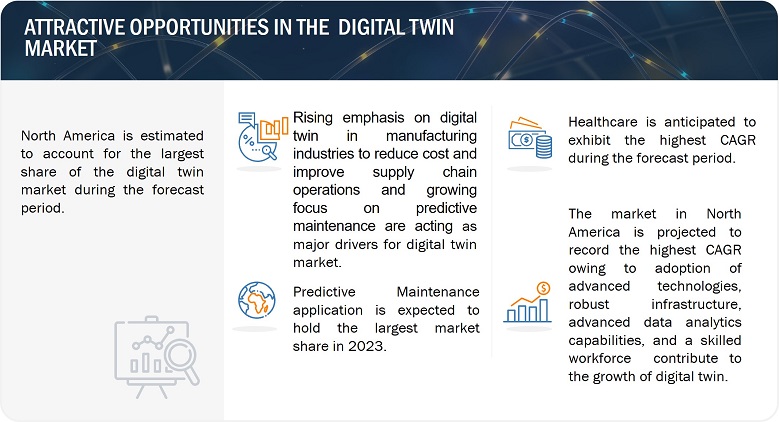

Driver: Growing focus on predictive maintenance

The utilization of digital twins for predictive maintenance is widespread across various industries. Predictive maintenance based on digital twins involves collecting real-time sensor data that provides information about the condition and performance of a product, process, or system. This data is then analyzed and compared to historical records of failure modes and their criticality. The insights gained from this analysis are used to predict maintenance needs. Apart from predicting failures, this technology offers several advantages that optimize maintenance. Digital twins enable the calculation of maintenance-related key performance indicators and forecast how machines perform under different conditions. By serving as accurate real-time models of a product, process, or system's condition and performance, digital twins facilitate simulations and predictions of behavior under specific factors such as runtime, exposure to extreme operating conditions, and temperature.

Restraint: High investments associated with the implementation of digital twin technology

The global market for digital twin solutions faces a growth restraint due to the substantial investment requirements in their deployment. The establishment and installation of digital twins, along with associated technologies such as smart automation, T-connected control, product lifecycle management (PLM), computer-aided design (CAD) and 3D CAD, manufacturing process management (MPM), manufacturing operations management (MOM), model-based system engineering (MBSE), enterprise resource planning (ERP), and augmented reality (AR)/virtual reality (VR)/extended reality (XR), demand significant capital. In cases where organizations need more infrastructure and supporting technology, the costs of implementing a digital twin become even higher, making it a considerably expensive endeavor. This can encourage manufacturers to adopt the technology.

Opportunity: Rising trend of 3D modeling and scanning across industries

IIoT combines machinery, advanced analytics, and human involvement in specific processes or products, creating a network of interconnected industrial devices through communication technologies. This network enables the development of systems that monitor, collect, exchange, analyze, and deliver valuable insights, enhancing decision-making capabilities. With its ability to cover the entire lifecycle of physical systems, processes, or products, IIoT provides businesses with a powerful analytical tool to thoroughly evaluate key performance indicators and identify areas for enhancements or upgrades. In the long run, the lessons and suggestions derived from digital twins are anticipated to generate significant opportunities for innovation and growth. Furthermore, by integrating digital twins with field performance monitoring, businesses gain constant visibility into actual product usage compared to the anticipated use based on design parameters. This approach offers valuable real-time feedback for improving the design process. It also improves product development efficiency by reducing the time and costs associated with manufacturing and testing prototypes in a physical environment. Virtual simulation models of products, processes, or units facilitate collaboration among experts from diverse fields during product development. For example, software developers, mechanical engineers, and user interface designers can simultaneously collaborate on the exact digital twin. Deploying IoT and digital twins enhances efficiency by predicting production failures and allowing engineering teams to address issues before they impact manufacturing targets.

Challenge: Lack of skilled workforce and awareness regarding cost benefits offered by digital twins

Companies need concrete implementation plans and significant investments for integrating digital twins into product management. Due to the novelty of the technology and the substantial changes it entails, end users are still determining the economic benefits, investment requirements, and future cost savings. Assessing the potential of a digital twin is considered complex and multifaceted, further impeding its widespread adoption. Creating a digital twin for assets or processes involves leveraging various technologies and skill sets alongside a workforce equipped to handle the latest equipment and software systems. The digital transformation necessitates a shift in employee skill requirements across the entire value chain, from development to sales and marketing. As processes increasingly rely on data and efficiency gains are expected, new employees must possess updated skill sets and higher qualifications. This situation can result in a skills gap between newly hired and experienced employees. Furthermore, industries are grappling with the dual challenge of embracing emerging technologies while also contending with a need for a more highly skilled and proficient workforce, creating a dynamic environment for implementation.

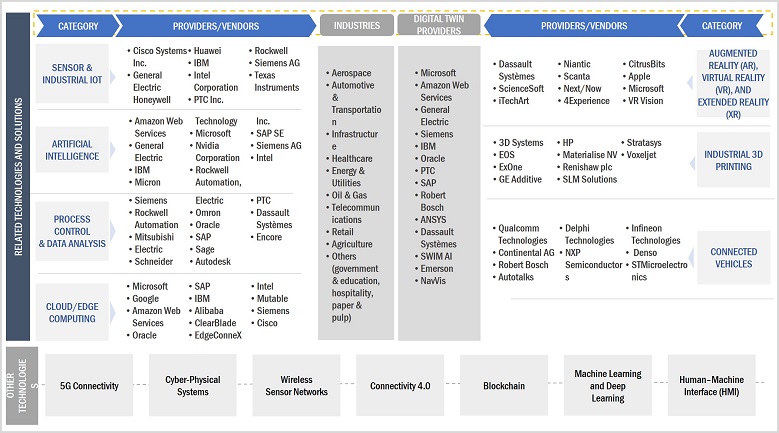

Digital Twin Market Ecosystem

This section describes the digital twin ecosystem and the deployment of digital twin solutions in different end-user industries, along with the impact of associated technologies on the digital twin market.

Predictive Maintenance Segment to hold the largest share of the digital twin market during 2023–2028

The predictive maintenance application is expected to account for the largest size of the digital twin market during the forecast period. Predictive maintenance offers substantial benefits in terms of cost savings, operational efficiency, and equipment uptime. By leveraging real-time sensor data and historical performance records, digital twins enable the analysis of equipment health and working conditions, facilitating the prediction of potential failures or malfunctions. This proactive approach optimizes organizations to schedule maintenance activities, reducing unplanned downtime and minimizing repair costs. Furthermore, advancements in artificial intelligence (AI) and machine learning (ML) algorithms enhance the accuracy and effectiveness of predictive maintenance with digital twins. These technologies enable the detection of patterns and anomalies in data, identifying early warning signs of equipment degradation or failure. As AI and ML capabilities continue to improve, the predictive maintenance capabilities of digital twins are expected to become even more precise and reliable.

Automotive & transport industry to dominate the market during the forecast period

The automotive & transportation industry is expected to account for the largest share of the digital twin market during the forecast period. It is expected to grow at a significant CAGR from 2023 to 2028. The automotivr & transport industry operates with a highly complex and interconnected supply chain involving numerous components, suppliers, and manufacturing processes. Digital twins offer a comprehensive and real-time view of the entire supply chain, enabling better monitoring, analysis, and optimization of operations. This capability enhances efficiency, reduces downtime, and improves overall supply chain management. Furthermore, digital twins provide significant benefits throughout the product lifecycle in the automotive and transportation sector. From design and prototyping to manufacturing, maintenance, and end-of-life, digital twins offer valuable insights into product performance, maintenance requirements, and potential improvements. This holistic approach allows manufacturers to enhance product quality, optimize processes, and deliver better customer experiences.

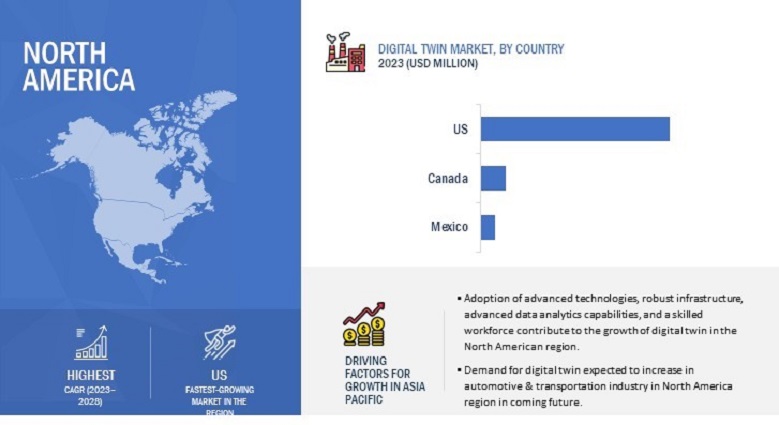

The Digital Twin market in North America is expected to maintain the highest share during 2023–2028

North America is expected to hold the largest share of the digital twin market throughout the forecast period. The region has demonstrated a proactive approach to digital transformation across industries, driving the adoption of advanced technologies such as digital twins. This forward-thinking mindset gives North America a competitive edge in the market. Furthermore, North America boasts a technologically mature ecosystem with robust digital infrastructure, advanced data analytics capabilities, and a skilled workforce. These factors provide a solid foundation for successfully implementing and utilizing digital twin solutions, enabling businesses to derive maximum value from the technology. In addition, the region's strong focus on the manufacturing and industrial sectors further contributes to its dominance in the digital twin market. Manufacturers in North America recognize the significant benefits that digital twins bring in terms of process optimization, operational efficiency, and cost reduction. This heightened awareness and demand for digital twin solutions drive market growth and reinforce North America’s position as a market leader.

Digital Twin Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The digital twin companies have implemented various types of organic and inorganic growth strategies, such as product launches, product developments, partnerships, and collaborations, to strengthen their offerings in the market. The major players are General Electric (US), Microsoft (US), Siemens (Germany), Amazon Web Services (US), ANSYS (US), Dassault Systèmes (France), PTC (US), and Robert Bosch (Germany). The study includes an in-depth competitive analysis of these key players in the digital twin market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Enterprise, Application, Industry, and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

Key players in the digital twin market are General Electric (US), Microsoft (US), Siemens (Germany), Amazon Web Services (US), ANSYS (US), Dassault Systèmes (France), PTC (US), Robert Bosch (Germany)-a total of 25 companies. |

Digital Twin Market Highlights

This report categorizes the Digital twin market based on enterprise, application, industry, and region.

|

Segment |

Subsegment |

|

By Enterprise: |

|

|

By Application: |

|

|

By Industry: |

|

|

By Region: |

|

Recent Developments

- In October 2022, Microsoft and Capgemini announced a strategic collaboration to create ReflectIoD, a cloud-native, serverless digital twin platform on Azure. It enhances operational efficiency, fosters intelligent industry practices, and delivers sustainable business value. ReflectIoD enables organizations to manage standardized brownfields throughout their life cycle, meeting industry demands effectively.

- In April 2022, General Electric (GE) Research (US) and GE Renewable Energy (France) joined forces to develop advanced artificial intelligence (AI) and machine learning (ML) technology. This innovative solution can potentially revolutionize the wind industry by significantly reducing logistical expenses worldwide. GE's AI/ML tool accurately predicts and streamlines logistics costs by leveraging a digital twin of the wind turbine logistics process. Industry growth forecasts indicate that this technology could lead to a remarkable 10% decrease in logistics costs. By 2030, the wind sector will benefit from global cost savings of up to USD 2.6 billion annually.

- In February 2022, ANSYS and Amazon Web Services (AWS) announced a strategic collaboration to transform cloud-based engineering simulations. This partnership enables the deployment of ANSYS products on the AWS platform, enhancing the user-friendliness and scalability of simulation workloads. Users can easily access software and storage solutions through any web browser, leveraging AWS's comprehensive framework encompassing computation, storage, Internet of Things (IoT), digital twin, analytics, and machine learning. The collaboration brings together the strengths of ANSYS and AWS to empower engineers with advanced simulation capabilities in the cloud.

Frequently Asked Questions (FAQ):

What is a digital twin?

A digital twin is an advanced concept that involves creating a virtual representation or digital counterpart of a physical object, process, or system. It entails capturing real-time data from various sources, such as sensors and devices, and using this information to build a simulation that accurately reflects the physical entity's behavior, characteristics, and performance.

What is the current size of the global digital twin market?

The global digital twin market is estimated to be around USD 10.1 billion in 2023 and is projected to reach USD 110.1 billion by 2028 at a CAGR of 61.3%.

Who are the top players in the digital twin market?

The major vendors operating in the digital twin market include General Electric (US), Microsoft (US), Siemens (Germany), Amazon Web Services (US), ANSYS (US), Dassault Systèmes (France), PTC (US), Robert Bosch (Germany).

Which major countries are considered in the North American region?

The report includes an analysis of the US, Canada, and Mexico countries.

Which are the major industries in which digital twin are used?

Significant industries for digital twin are Automotive & Transportation, Infrastructure, Healthcare, Energy & Utilities, and Aerospace.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involves four major activities for estimating the size of the digital twin market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the digital twin market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data has been collected and analyzed to determine the overall market size estimations, further validated by primary research.

Primary Research

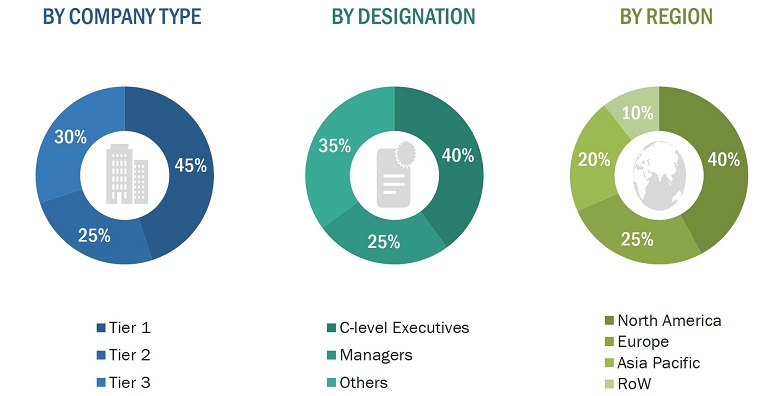

In the primary research process, several sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. Several primary interviews have been conducted with market experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and the Rest of the World. This primary data has been collected through questionnaires, emails, and telephonic interviews. Approximately 60% of the primary interviews have been conducted with the demand side and 40% with the supply side. This primary data has been collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Additionally, questionnaires and emails were used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the digital twin market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

A digital twin is a virtual replica or digital copy of a physical object, process, or system. It serves as a digital counterpart that accurately captures the essential characteristics and behaviors of the real-world entity. Digital twins utilize advanced technologies such as sensors, data analysis, and simulations to collect real-time data from their physical counterparts. This data is then used to create and maintain an up-to-date digital representation that closely resembles the behavior of the actual object or system. The primary purpose of digital twins is to provide valuable insights and drive operational improvements in business. By analyzing the digital twin, organizations can gain a deeper understanding of how the physical entity will perform, identify opportunities for enhancement, and test different strategies or scenarios before implementing them in the real world. Digital twins find applications in a wide range of industries, such as manufacturing, healthcare, transportation, energy, and construction.

Key Stakeholders

- Government bodies and policymakers

- Industry organizations, forums, alliances, and associations

- Market research and consulting firms

- Raw material suppliers and distributors

- Research institutes and organizations

- Analysts and strategic business planners

- End users of digital twins across various industries such as the aerospace, automotive & transportation, energy & utilities, oil & gas, infrastructure, healthcare, agriculture, retail, telecommunications, and other industries (semiconductors, chemicals, paper & pulp, and food & beverages)

Study Objectives:

- To define, describe, and forecast the digital twin market size, by industry, application, and enterprise, in terms of value

- To describe and forecast the size of the digital twin market across four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World, along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the process flow of the digital twin market

- To strategically analyze micromarkets1 for individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the digital twin market

- To analyze opportunities for stakeholders by identifying high-growth segments of the digital twin market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2

- To analyze competitive developments, such as product launches, deals (mergers, acquisitions, partnerships, cooperation, alliances, collaborations, agreements, contracts, and investments), and others (expansions) in the digital twin market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of 25 market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Twin Market

Understanding the potential of digital twins for creative industries and the environmental movement.