ADAS Market by System (ACC, DMS, IPA, PDS< TJA, FCW,, RSR, LDW, AEB, BSD), Component (Camera, LiDAR, Ultrasonic, Radar), Vehicle Type, EV Type, Vehicle Class, Level of Autonomy, Offering, Sales Channel and Region - Global Forecast to 2030

The global ADAS Market was valued at USD 30.9 billion in 2022 and is expected to reach USD 65.1 billion by 2030 at a CAGR of 9.7 % during the forecast period 2022-2030. Software and hardware providers provide ADAS systems such as adaptive cruise control, adaptive front lights, automatic emergency braking, blind spot detection, cross traffic alert, among others to various global OEMs and component manufactures. Factors such as increased demand for road safety and strong government support have caused leading original equipment manufacturers (OEMs) to invest in development of ADAS systems.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: ADAS to increase vehicle safety

Safety features are an important prerequisite for automotive users. Governments have mandated the incorporation of features such as lane departure warning (LDW) and automatic emergency braking (AEB) globally. Therefore, different safety features have been developed to assist drivers and reduce the number of accidents. For example, the driver monitoring system supervises the driver and alerts or warns in case drowsiness and distraction.

A steady increase has been observed in the standards and norms linked to ADAS as these systems are widely incorporated in various vehicles.

ADAS is designed to reduce human errors that cause auto accidents. It can operate passively, by warning the driver of a potential collision, or actively, stopping the car and/or directing it. ADAS aims to save lives by alerting the driver or controlling the steering wheel and applies an emergency brake automatically. A fully autonomous car reduces the risk of drivers with alcohol or drug problems gripping the steering wheel of traditional vehicles, thereby decreasing driving issues, currently accounting for 17% of the total deaths caused by road traffic injuries. These vehicles use a system that finds the fastest route to their destination, resulting in better fuel economy and lower emissions and costs.

Opportunity: Increasing demand of autonomous vehicles

The introduction of autonomous vehicles is expected to transform commuting. ADAS technologies have significantly reduced the complexity of driving, with features such as lane monitoring, emergency braking, stability controls, and others. Autonomous vehicles rely on advanced technologies and systems such as LiDAR, radar, ultrasonic sensors, and high-definition cameras for data collection. This data is analyzed by an onboard smart autonomous driving system to maneuver the vehicle safely. The algorithms used in autonomous vehicles increase the driving accuracy by learning over time. These learnings and improvements of one vehicle are shared with all other vehicles.

One of the recent developments in the autonomous vehicle space is the Vehicular Ad hoc Network (VANET), a new subclass of MANET. VANET is used on roads where the vehicle is a mobile node. Active safety and intelligent transport are important VANET applications that require appropriate vehicle-to-vehicle communication technology, particularly routing technology. This includes accident notifications, advance warnings about accidents, construction sites, speed violations, traffic lights, fog warnings, darkening, and specific location-dependent services. These are mainly implemented by Google, Tesla, and Audi to develop self-driving car technology.

Restraint: Infrastructure for ADAS is still in the developing stage in many countries

ADAS requires basic infrastructure such as well-organized roads, lane marking, and GPS connectivity for effective functioning. V2V and V2X communications require adequate connectivity infrastructure. On highways, information such as lane change, object detection, distance between vehicles, traffic, and services such as navigation and connectivity are crucial in semi-autonomous and autonomous trucks. However, due to the limited network connectivity on highways, vehicles are not connected to each other or to the cloud data. In developing countries, such as Mexico, Brazil, and India, the IT infrastructure on highways is slowly developed compared to that in developed economies. The 3G and 4G-LTE communication networks, required for connectivity, are limited to urban and semi-urban areas. While several third-party logistics companies operate in semi-urban and rural areas, issues of low connectivity still persist. These developing countries need support from the government for adopting ADAS features in a vehicle. Therefore, lack of government regulations and information technology communication infrastructure in developing regions are major restraints for the growth of ADAS in developing regions.

Considering the diverse environment worldwide, ADAS faces numerous challenges. It may not function on all roads due to significant investment required in road infrastructure. The majority of neighborhood roads have scanty or no lane markers. Initially, ADAS will only be available on motorways and paved highways, but as the road infrastructure advances, car buyers will be able to fully utilize ADAS.

Challenge: Environmental constraints and security threats

Most safety features of ADAS comprise sensors, including radar, LiDAR, ultrasonic sensors, cameras, infrared, and several actuators. These sensors and actuators monitor fields in every direction and ensure the safety of the vehicle, driver, passengers, and pedestrians. The system functioning depends on the traffic and weather conditions. Lack of accurate methods could jeopardize occupant safety. A perfect balance between automation and manual override is necessary for the safe operation of ADAS.

In addition to its functional requirements, ADAS must be secured from hackers with malicious intent. A hacker that infiltrates the system could gain control of the vehicle. Several studies reported that vehicle control can be gained through Bluetooth, Wi-Fi, or even GPS. These security threats pose a significant challenge for system manufacturers and OEMs.

Drivers rely on their vehicle’s ADAS, such as lane-keeping, automatic emergency braking, adaptive cruise control, and proximity monitors, to help them navigate safely and more confidently during the extreme and rapidly deteriorating conditions. Drivers should be able to use ADAS features to increase awareness and help in safe lane movement, avoid hazards, and smoothly navigate turns when their visibility is impaired by deep snow, dense fog, and rain.

More and more ADAS systems have been included into cars in recent years for safe driving. However, these technologies are frequently rendered inoperable or unreliable in challenging driving situations. In fact, over 4,000 miles of drive in clear weather, automotive researchers discovered that a problem with the vehicle’s driving assistance systems occurred every 8 miles (and oftentimes less). These safety-related systems frequently disengage without warning, particularly in difficult driving situations where the driver is most likely to require help, increasing the risk to the vehicle, its occupants, and other road users.

L1 autonomy level to be the largest market during forecast period

Level 1 is the lowest level of autonomous driving defined by the Society of Automotive Engineers (SAE). An L1 vehicle can handle either steering or control the speed, not at the same time. The driver controls most of the driving tasks, and the driver assistance system helps the driver with tasks such as lane departure warnings. ADAS features such as adaptive cruise control, lane departure warning, tire pressure monitoring systems, and adaptive front lights are considered under level 1 driving systems. As of 2022, many higher-end mid-tier passenger and luxury vehicles have level 1 autonomous features. Mercedes (Germany), for instance, since 2018 provides level 1 autonomous for its S-class passenger car. Similarly, Toyota’s RAV4 has level 1 autonomous features in its 2022 model. Cars such as Jeep Wrangler 4Xe, Renault Arkana, and Nissan Qashqai are also available with level 1 autonomous systems.

Passenger Cars segment to be the largest segment during the forecast period

Passenger cars comprise sedans, hatchbacks, station wagons, sports utility vehicles (SUVs), multi-utility vehicles (MUVs), and vans. This is the most promising segment and largest market for ADAS due to the growing demand for safer and more comfortable vehicles. The increasing demand for luxury vehicles is another key driving factor. Governments in developed and developing countries are planning to mandate ADAS systems in passenger cars. For instance, the European Union has extended the scope of mandating ADAS systems such as AEB and LDW in passenger cars. This mandate has made it compulsory for automakers to provide certain ADAS features in the region. Countries such as South Korea have mandated AEB and LDW systems for all new passenger vehicles since 2019.

Automotive component manufacturers and electronic and software companies are putting substantial effort into developing driverless cars. Autonomous car technology is in development and has not yet been fully commercialized. Increasing focus on robo-taxis, a part of the passenger cars segment, has led many players to invest in the ADAS market. For instance, in October 2019, Hyundai announced plans to invest USD 35 billion in electric and autonomous vehicles by 2025 to become the major manufacturer and supplier of robo-taxi fleets. Toyota acquired Lyft’s self-driving division and will combine its expertise to speed up the commercialization of autonomous vehicles. Lyft has an extensive network of customers, data, and routes. Toyota is planning to launch rob taxi services in the US in 2023. Such strategies to enter the autonomous passenger cars market are expected to fuel the growth of the passenger cars ADAS segment.

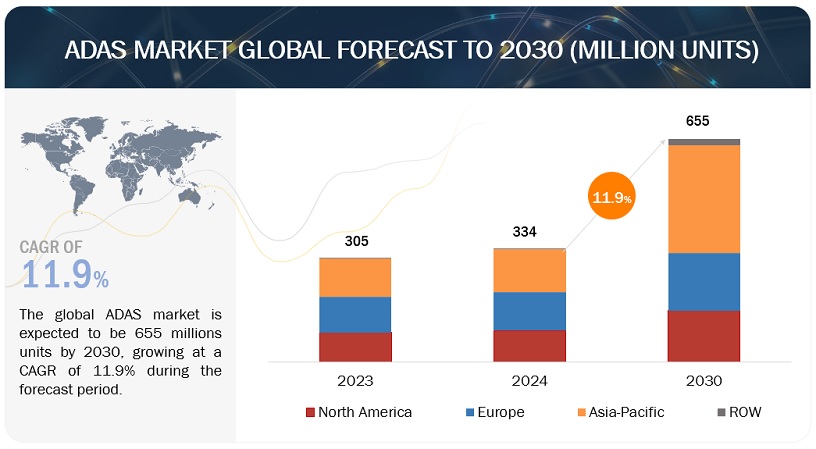

Asia Pacific to be the most potential market during the forecast period

Asia Pacific is estimated to account for the largest market share by 2030, followed by Europe and North America. Increasing demand for a safe, efficient, and convenient driving experience; rising disposable income in emerging economies; and stringent safety regulations worldwide drive the ADAS market. The Asia Pacific region saw significant developments in ADAS. China has made significant advancements in developing ADAS in recent years. Some of the major ADAS system manufacturers in China are Baidu Apollo, TuSimple, Momenta, Pony.ai, Xpeng, DiDi and NIO companies like Bosch, Continental, and Aisin. Some of the top ADAS developers have opened industries in the country to cater to Chinese OEMs, such as BYD, Geely, Chery, FAW, and GAC. Recently, several Chinese companies, such as Baidu, Tencent, and Alibaba, have widely invested in the research and development of ADAS technology, including autonomous driving and connected cars. Additionally, the Chinese government supports the development of ADAS through policies and regulations. Japan has been actively developing ADAS for several years. Japanese car manufacturers such as Honda, Toyota, and Nissan have been researching and implementing various ADAS features in their vehicles, such as lane departure warnings, adaptive cruise control, and automatic emergency braking. Additionally, the Japanese government promotes the development and adoption of ADAS technology through various initiatives and funding programs. In 2021, South Korea announced plans to develop and test autonomous vehicles on public roads by 2025 as part of its strategy for the Fourth Industrial Revolution (4IR). The country plans to develop and test Level 4 autonomous vehicles by 2023, which will be capable of navigating complex traffic scenarios, and then Level 5 vehicles by 2025, which will be fully self-driving without any human intervention. In addition to the efforts of car manufacturers and technology companies, South Korea also established several research centers and testbeds for developing and testing ADAS and autonomous vehicles. For example, the Korea Advanced Institute of Science and Technology (KAIST) has established the KAIST Autonomous Vehicle Center, which conducts research and development on advanced vehicle technologies such as ADAS and autonomous vehicles.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The ADAS market is dominated by established players such as Robert Bosch (Germany), Denso (Japan), Continental AG (Germany), Magna International (US), and ZF Friedrichshafen (Germany), among others. These companies provide ADAS components to global OEMs. These companies have set up R&D infrastructure and offer best-in-class products to their customers.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Revenue in 2022 |

USD 30.9 billion |

|

Estimated Value by 2030 |

USD 65.1 billion |

|

Growth Rate |

Poised to grow at a CAGR of 9.7% |

|

Market Segmentation |

System, Component, Offering, Electric Vehicle, Level of Autonomy, Vehicle Type, Vehicle Class, Sales Channel, and Region |

|

Market Driver |

ADAS to increase vehicle safety |

|

Market Opportunity |

Increasing demand of autonomous vehicles |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

This research report categorizes the ADAS Market based on System, Component, Offering, Electric Vehicle, Level of Autonomy, Vehicle Type, Vehicle Class, Sales Channel, and Region

Based on Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Buses

- Trucks

Based on Offering:

- Hardware

- Software

Based on Component:

- Camera Unit

- LiDAR

- Radar

- Ultrasonic Sensor

Based on System:

- Adaptive Cruise Control (ACC)

- Adaptive Front Lights (AFL)

- Automatic Emergency Breaking (AEB)

- Blind Spot Detection (BSD)

- Cross Traffic Alert (CTA)

- Driver Monitoring Systems (DMS)

- Forward Collision Warning (FCW)

- Intelligent Park Assist (IPA)

- Lane Departure Warning System (LDW)

- Night Vision System (NVS)

- Pedestrian Detection System (PDS)

- Road Sign Recognition (RSR)

- Tire Pressure Monitoring System (TPMS)

- Traffic Jam Assist (TJA)

Based on EV Type:

- BEV

- PHEV

- HEV

- FCEV

Based on Level of Autonomy:

- L1

- L2

- L3

- L4

- L5

Based on Sales Channel:

- OEM

- Outsourcing

Based on Vehicle Class:

- Asia Paciifc

- Europe

- North America

- Rest of the World

Based on Region:

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

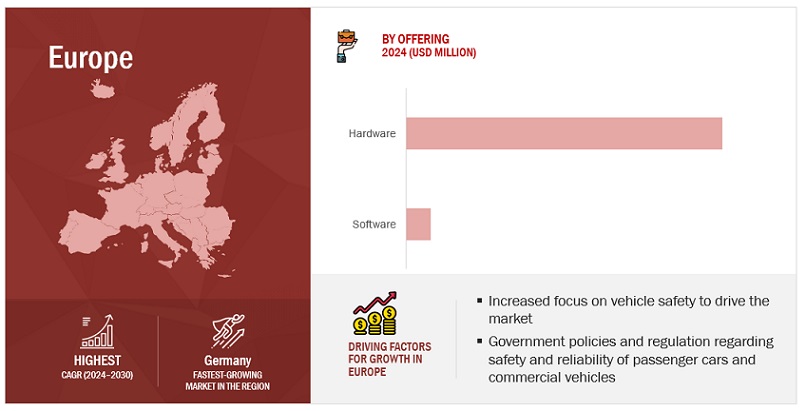

Europe

- France

- Germany

- Italy

- Russia

- Spain

- UK

- Turkey

- Rest of Europe

-

Rest of the World

- Brazil

- South Africa

- Others

Recent Developments

- In January 2023, ZF Friedrichshafen AG launched Smart Camera 4.8. It enables autonomous cars to have a wider field of view, enabling the vehicle to identify pedestrians, cyclists, and other vehicles.

- In December 2022, Robert Bosch GmbH launched the 6G-ICAS4 mobility project to integrate communication and radar systems into a single 6G system.

- In September 2022, ZF has presented its advanced new electric power steering (EPS) system for trucks, coaches, and city buses. The EPS was prepared for steer-by-wire and up to level 5 autonomous driving. eWorX, ZF’s electrified commercial vehicle power take-off (PTO) system for driving on-board work equipment, has also been presented, offering emission-free city and urban operation.

- In November 2021, Robert Bosch GmbH developed a Ridecare solution for vehicles to ensure a safe and pleasant driving experience. This solution will sense the smell of smoke, vehicle scratch, and dents.

- In July 2021, According to Magna International, the deployment of its Icon Radar in the Fisker Ocean early in 2022 introduced a digital radar for driver assistance. The radar improves an automobile’s ability to visualize its surroundings and identify possible threats, such as a car stuck in a dark tunnel or a pedestrian up to 150 meters distant. Higher levels of autonomy, according to Magna, would arise from digital radar. It can detect open passageways and low-lying items on congested, multi-lane roadways in addition to vehicles and pedestrians.

- In January 2021, Magna partnered with Fisker to develop an ADAS, which will be applied to the Fisker Ocean SUV, expected to be launched by 2023. This new business win demonstrates Magna’s ability to bring scale and efficiency to the mobility landscape and represents an important expansion of the EV platform sharing, vehicle engineering, and manufacturing cooperation between the two companies.

- In January 2021, Aptiv PLC launched its next-generation ADAS platform. It formalizes the interfaces for sensors and feature functions. The platform enables extensive reuse of base software components, lowering development costs. It works flawlessly with a zonal architecture in which I/O and compute are separated.

Frequently Asked Questions (FAQ):

How big is the ADAS market?

The global ADAS market is projected to grow from an estimated $30.9 billion in 2022 to $65.1 billion by 2030, registering a CAGR of 9.7% from 2022 to 2030.

Who are the winners in the ADAS market?

The ADAS market is dominated by established players such as Robert Bosch (Germany), Denso (Japan), Continental AG (Germany), Magna International (US), and ZF Friedrichshafen (Germany), among others.

Which region will have the largest market for ADAS market?

Asia Pacific will be the largest market in the ADAS market due to the huge volume of vehicle sales and government support for road safety in countries such as China, Japan and South Korea.

What are the key technologies affecting the ADAS market?

The key technologies affecting the ADAS market are the IOT, connected mobility, and autonomous vehicle technology.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

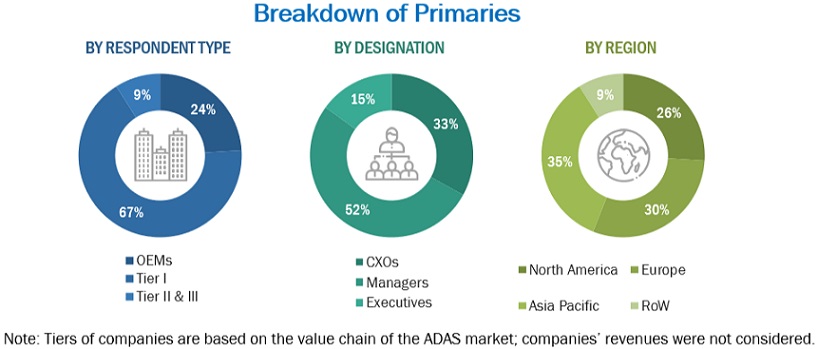

The study involved four major activities in estimating the current size of the ADAS Market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications (for example, publications of automobile OEMs), automotive component associations, American Automobile Association (AAA), European Alternative Fuels Observatory (EAFO), International Energy Agency (IEA), country-level automotive associations, automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines and Factiva) were used to identify and collect information for an extensive commercial study of the ADAS Market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the ADAS Market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, AES providers, trade associations, institutes, R&D centers, OEMs/vehicle manufacturers) and supply (component manufacturers, software providers) sides across four major regions, namely North America, Europe, Asia Pacific and Rest of the world. 21% of the experts involved in primary interviews were from the demand side, while the remaining 79% were from the supply side.

Primary data was collected through questionnaires, emails, and telephonic interviews. Primary interviews were conducted from various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint of the report. After interacting with industry participants, brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the rest of this report. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the total size of the ADAS Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of volume and value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the supply side.

Report Objectives

- To segment and forecast the size of the ADAS market in terms of volume (Thousand Units) and value (USD million)

- To define, describe, and forecast the size of the market based on system, component, offering, electric vehicle, level of autonomy, vehicle type, vehicle class, sales channel, and region

- To analyze regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market size, by system [Adaptive Cruise Control (ACC), Adaptive Front Light (AFL), Automatic Emergency Braking (AEB), Blind Spot Detection (BSD), Cross-traffic Alert (CTA), Driver Monitoring System (DMS), Forward Collision Warning (FCW), Intelligent Park Assist (IPA), Lane Departure Warning (LDW), Night Vision System (NVS), Pedestrian Detection System (PDS), Road Sign Recognition (RSR), Tire Pressure Monitoring System (TPMS), and Traffic Jam Assist (TJA)]

- To segment and forecast the market size, by component (Camera Units, LiDAR, Radar Sensors, Ultrasonic Sensors, and Infrared Sensors)

- To segment and forecast the market size, by offering (Hardware and Software)

- To segment and forecast the market size, by electric vehicle [Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs)]

- To segment and forecast the market size, by level of autonomy (L1, L2, L3, L4, and L5)

- To segment and forecast the market size, by vehicle type (Passenger Cars, Light Commercial Vehicles, Trucks, and Buses)

- To segment and forecast market size, by sales channel (OEM and Aftermarket)

- To forecast the market size by region [North America, Europe, Asia Pacific, and Rest of the World (RoW)]

- To analyze technological developments impacting the market

- To provide detailed information about the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market, considering individual growth trends, prospects, and contributions to the total market

-

To study the following concerning the market

- Supply Chain Analysis

- Ecosystem Analysis

- Porter’s Five Forces Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Average Service Price Analysis

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze the impact of the recession on the market

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), new product developments, and other activities carried out by key industry participants

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in line with a company’s specific needs.

- ADAS market, for electric vehicle by the system type level

- ADAS market, by vehicle type at country level (for countries not covered in the report)

-

Company Information:

- Profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in ADAS Market

Surround camera systems for blind spot detection -Buses Surround camera systems for blind spot detection on Cars

I am student from UniKL MFI, Malaysia, requesting for the sample report in order to make a research and analysis on the ADAS as required for my Final Year Project.

night vision sensor. Radar sensensors lidar , ultrasonic , pressure sensors markets in india for next five year

Front assist system, Adaptive Cruise Control (ACC,)Lane Departure Warning (LDWS), Drowsiness Monitor, Blind Spot Detection (BSD), By Technology [Ultrasonic, Image, RADAR, LIDAR, Infrared (IR)], vehicle collision avoidance