Drone Logistics and Transportation Market by Solution (System, Software and Infrastructure), Platform (Freight Drone, Passenger Drone and Air Ambulance Drone), Application (Logistics and Transportation), Range, User - Global Forecast to 2030

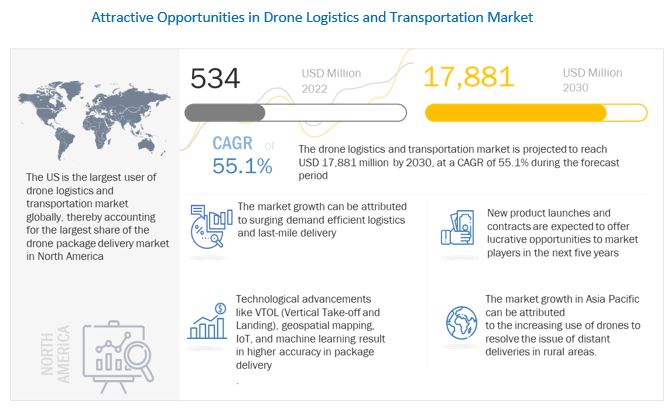

[276 Pages Report] The drone logistics and transportation market is projected to grow from USD 534 million in 2022 to USD 17,881 million by 2030, at a CAGR of 55.1% from 2022 to 2030.

Drone logistics and transportation refer to the delivery of packages, cargo, and/or passengers using drones. Freight drones can be used to deliver several types of cargo, while transportation drones are used for patient and passenger transport. Route planning and optimizing software, fleet management software, and computer vision software are some of the major software, whereas ground control stations, charging stations, and landing pads include the major infrastructure required for the implementation of drone logistics and transportation.

To know about the assumptions considered for the study, Request for Free Sample Report

Drone Logistics and Transportation Market Dynamics:

Driver: Demand for efficient logistics and last-mile delivery

An increase in the demand for faster and more efficient delivery at low costs is being witnessed, especially in the e-commerce sector, with customers willing to pay extra to get packages delivered on the same day. This demand is likely to increase the usage and acceptance of drones in the logistics and transportation market. According to a survey performed by Clutch, 36% of online users were more likely to place orders if drone delivery was offered. Drones for use in logistics & transportation are being widely tested across the globe for postal delivery; healthcare & pharmacy packages such as medicines, blood, and organ & equipment transport; and retail & food packages such as e-commerce, grocery delivery, and food delivery.

According to Valdani Vicari & Associati s.r.l. (Belgium), a consulting firm that performed a cost analysis of the delivery of biomedical products through drones vs. electric vans, drones would take around 15 minutes and cost USD 2.3 dollars, whereas an e-van would take around 42 minutes and cost USD 5.58 for the same destination. This means drone delivery is expected to be around 60% cheaper. It is also more efficient to manage a fleet of drones as compared to a ground-based vehicle fleet.

Restraint: Lack of skilled & trained personnel for operation

Personnel operating drones need to ensure the reliability of the entire unmanned aerial system, which includes UAVs, ground control stations, and communication equipment. Drones can fly at different altitudes and require skilled personnel to control and operate them remotely. The number of pilots available for high-precision operations is comparatively low. An increase in drone adoption in the commercial drone delivery and transportation verticals adds to the growing need for skilled drone pilots. Presently, to reduce the number of accidents caused due to the poor control skills of drone operators, efforts are being made to improve the autonomy of these systems, thereby reducing the involvement of human operators. Drones should be equipped with systems that offer them autonomous sense & avoid capabilities to prevent collisions during operation.

Opportunity: Increasing zero-emission initiatives

Cities across the globe are facing transportation challenges due to the increasing road traffic. Growth in disposable income, coupled with decreasing automobile costs, is one of the prime causes of the increasing percentage of greenhouse gases in the Earth's atmosphere, resulting in global warming. Increasing air pollution in major cities has an adverse effect on the urban population, thereby compelling governments to take strict action to tackle it.

As per Bloomberg Vehicle Outlook, transportation, which is responsible for significant energy consumption, is the second-largest polluting sector. Significant greenhouse gas emissions from this sector are adversely affecting the climate. Drone taxis, which use electric vertical takeoff and landing (eVTOL), can offer a viable solution to such problems. Volocopter (Germany) is developing VoloCity, a fully electric multirotor air taxi for connecting transport hubs like main stations and airports. It will be emission-free, faster, and a more convenient mode of transport when it comes to traffic congestion. Recent technological developments in this sector hold a promising future, with cities adopting unmanned systems for next-generation transportation. For instance, in December 2020, Toray Advanced Composites (US) announced that it completed a long-term supply agreement with Joby Aviation (US) for the composite material used in its aircraft. Joby Aviation will use Toray's carbon fiber composite materials to develop fast, affordable, and zero-emission aerial ridesharing for global communities.

Challenge: Restrictions imposed on commercial use in various countries

The major challenge to the growth of the drone logistics and transportation industry across the globe is the rules and regulations imposed by various government agencies on their use in commercial applications. The Federal Aviation Administration (FAA) has offered three pathways for the lawful use of UAVs in US airspace, which include a Certificate of Authorization (CoA) issued by the Federal Aviation Administration (FAA) for public agencies, permission from the Federal Aviation Administration (FAA) in the form of special airworthiness certification for private entities, and adherence to model aircraft standards by UAV users.

The laws for UAVs in the UK are like those in the US. According to CAP 722, jurisdiction is to be followed for UAVs in the UK. In other European countries, such as France, Germany, and Italy, the European Aviation Safety Agency (EASA) regulates the use of UAVs by issuing certificates for flying UAVs in European airspace. Similar regulations have been imposed on UAVs in other regions for civil & commercial applications.

Based on user, the defense segment is projected to grow at the highest CAGR during the forecast period.

Based on user, the drone logistics and transportation market has been segmented into defense and commercial. Drones are being increasingly used on the battlefield for a wide range of applications, such as intelligence, surveillance & reconnaissance (ISR), combat operations, and battle damage management. Militaries are also exploring the use of drones for logistics applications as well as to supply soldiers with food, ammunition, fuel, and spare parts. Defense logistics can be a dangerous task, and thus, defense organizations are trying to adopt autonomous drones to reduce the number of personnel required for logistics. Most ships and aircraft taken out of mission-capable status when deployed lack simple components like electronics or wiring assemblies, 90% of which weigh less than 50 pounds, according to Navy statistics, and can be delivered using drones rather than a manned aircraft. In August 2021, the US Navy demonstrated that small drones could take the place of manned platforms in delivering critical spare parts and food supplies between ships at sea.

Based on range, close-range segment is estimated to account for the largest share in 2022.

Based on range, the drone logistics and transportation market has been segmented into close-range (<50 kilometers), short-range (50 to 150 kilometers), mid-range (151 to 650 kilometers), and long-range (>650 kilometers). Delivery drones with a longer range help in reducing the overall operational cost of package delivery service providers. Demand for instant delivery of packages in a cost-effective manner is anticipated to boost the growth of the drone logistics and transportation market during the forecast period. Close-range delivery drones are used for close-range local delivery of packages. These drones, capable of traveling up to 50 kilometers on a single charge, enable instantaneous delivery of products after their online order. There is a rising demand for instant delivery of products and packages such as medicines and food. For instance, according to Statista, China registered USD 99.6 billion worth of on-demand food delivery in 2020. The rise in demand for instant package delivery is anticipated to drive the market for close-range delivery drones.

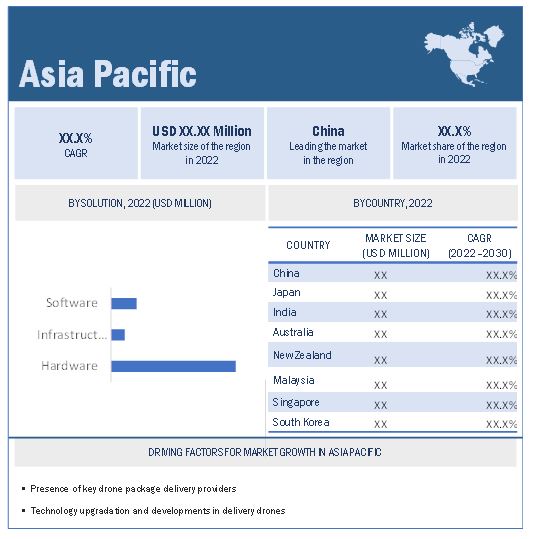

The Asia Pacific region is projected to Grow at highest CAGR during the forecast period

Asia Pacific drone logistics and transportation market is expected to witness substantial growth and register the highest CAGR during the forecast period. The growth of the market in this region can be attributed to the rise in political tensions in various countries of the Asia Pacific region have led to the deployment of UAVs to ensure border security. This serves as one of the most significant factors driving the growth of the Asia Pacific drone logistics and transportation market. China is developing innovative technologies to manufacture low-cost drones. In 2017, the China Aerospace Science and Technology Corporation (CASC) (China) started the mass production of a UAV known as CH-5, which successfully underwent its first flight test in August 2015.

The increasing trend of automation and globalization in India, Australia, and China is fueling the growth of the Asia Pacific drone logistics and transportation market. UAVs are being increasingly used in the real estate and agriculture sectors to carry out inspections.

To know about the assumptions considered for the study, download the pdf brochure

Top Drone Logistics and Transportation Companies - Key Market Players

The drone logistics and transportation companies are dominated by a few globally established players such as Alphabet Inc. (US), Hardis Group (France), Zipline (US), Volocopter GmbH (Germany), and Textron Inc. (US) These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to further expand their presence in the drone logistics and transportation Market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019-2030 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2030 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Platform, By Solution, By Application, By User, By Range and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, the Middle East, Latin America, and Africa |

|

Companies covered |

Alphabet Inc. (US), Hardis Group (France), Zipline (US), Volocopter GmbH (Germany), and Textron Inc. (US) |

|

Companies covered (Drone start-ups and drone transportation and logistics ecosystem) |

Skycraft Inc. (US), Infinium Robotics (Singapore), AgEagle Aerial System (US), Air Map Inc. (US), Skyport Limited (UK), Skysense (US) |

This research report categorizes the Drone transportation and logistics Market based on platform, solution, application, user, range, and region.

By Platform

- Freight Drones

- Passenger Drones

- Air Ambulance Drones

By Solution

- System

- Software

- Infrastructure

By Application

- Logistics

- Transportation

By User

- Defense

- Commercial

By Range

- Close- Range (<50 Kilometers)

- Short-Range (50 to 150 Kilometers)

- Mid-Range (151 to 650 Kilometers)

- Long-Range (>650 Kilometers)

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

- Africa

Recent Developments

- In February 2022, Wing Aviation LLC teamed up with KFC (Australia) to deliver a range of menu items direct to homes and workplaces in Logan, Queensland.

- In March 2022, The drone-based inventory solution, Eyesee, designed and patented by Hardis Group and co-developed with Squadrone System, announced the creation of a new company, Darwin Drones, to take the Eyesee inventory drone solution forward.

- In April 2022, Zipline and Toyota Tsusho Corporation, a member of Toyota Group, partnered to distribute medical supplies to pharmacies and hospitals across Japan's Gotô Islands using Zipline's autonomous aircraft.

- In February 2022, Volocopter GmbH entered into an agreement in principle to develop financial solutions to assist the sale of the Volocopter family of eVTOL aircraft.

- In December 2020, The Bell Innovation flight test team at its Mirabel, Quebec, Canada, facility conducted the first flight of an alternate configuration of the APT in collaboration with ARA Robotics.

Frequently Asked Questions (FAQs):

What is the current size of the drone logistics and transportation market?

The drone logistics and transportation market is projected to grow from USD 534 million in 2022 to USD 17,881 million by 2030, at a CAGR of 55.1% from 2022 to 2030

Who are the winners in the drone logistics and transportation market?

Alphabet Inc. (US), Hardis Group (France), Zipline (US), Volocopter GmbH (Germany), and Textron Inc. (US) are some of the winners in the market.

What are some of the technological advancements in the market?

Several technological advancement has been taking place such as wireless charging. It can prove to be important in the drone logistics industry, as it can enhance the endurance of drones, thus enabling them to make deliveries to rural properties, construction sites, and rural residential neighborhoods.

Multi-sensor data fusion in which the sensors measure critical parameters such as the speed and direction of delivery drones to avoid accidents. Sensor fusion is a technology that combines information obtained from two or more sensors to help aerial drones in navigation.

What are the factors driving the growth of the market?

Demand for efficient logistics and last-mile delivery, drastic increase in investment in drone industry, decline in prices of drone components are some factors that driving the growth of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 DRONE LOGISTICS AND TRANSPORTATION MARKET: INCLUSIONS & EXCLUSIONS

1.4 CURRENCY CONSIDERED

1.5 USD EXCHANGE RATES

1.6 STUDY SCOPE

1.6.1 MARKETS COVERED

FIGURE 1 DRONE LOGISTICS AND TRANSPORTATION MARKET SEGMENTATION

1.6.2 REGIONAL SCOPE

1.6.3 YEARS CONSIDERED

1.7 LIMITATIONS

1.8 MARKET STAKEHOLDERS

1.9 SUMMARY OF CHANGES

FIGURE 2 DRONE LOGISTICS AND TRANSPORTATION MARKET TO GROW SLOWER THAN PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH PROCESS FLOW

FIGURE 4 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

TABLE 2 KEY PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.3 SUPPLY-SIDE INDICATORS

2.3 RESEARCH APPROACH AND METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Market size estimation & methodology for delivery drones

TABLE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.1.2 Market size estimation & methodology for cargo drones

2.3.1.3 Market size estimation & methodology for passenger drones and air ambulance drones

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.1.4 Regional split of drone logistics and transportation market

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 8 FREIGHT DRONES ESTIMATED TO HOLD LEADING SHARE IN 2022

FIGURE 9 SYSTEM SEGMENT PROJECTED TO DOMINATE MARKET

FIGURE 10 LOGISTICS SEGMENT PROJECTED TO HAVE HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 11 COMMERCIAL SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

FIGURE 12 CLOSE-RANGE SEGMENT PROJECTED TO HOLD LARGEST SHARE

FIGURE 13 ASIA PACIFIC ESTIMATED TO HOLD LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DRONE LOGISTICS AND TRANSPORTATION MARKET

FIGURE 14 DEMAND FOR EFFICIENT LOGISTICS AND LAST-MILE DELIVERY DRIVES MARKET

4.2 FREIGHT DRONE LOGISTICS AND TRANSPORTATION MARKET

FIGURE 15 DELIVERY DRONES PROJECTED TO DOMINATE DURING FORECAST PERIOD

4.3 PASSENGER DRONE LOGISTICS AND TRANSPORTATION MARKET

FIGURE 16 DRONE TAXIS PROJECTED TO HOLD LARGEST SHARE DURING FORECAST PERIOD

4.4 DRONE LOGISTICS MARKET APPLICATIONS

FIGURE 17 RETAIL & FOOD DELIVERY PROJECTED TO LEAD DURING FORECAST PERIOD

4.5 DRONE TRANSPORTATION MARKET APPLICATIONS

FIGURE 18 PATIENT TRANSPORT SEGMENT TO GROW FASTER DURING FORECAST PERIOD

4.6 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SYSTEM

FIGURE 19 PROPULSION SEGMENT PROJECTED TO BE LARGEST DURING FORECAST PERIOD

4.7 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOFTWARE

FIGURE 20 ROUTE PLANNING & OPTIMIZING SOFTWARE – DOMINANT SEGMENT

4.8 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY INFRASTRUCTURE

FIGURE 21 CHARGING STATIONS SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRONE LOGISTICS AND TRANSPORTATION MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Demand for efficient logistics and last-mile delivery

5.2.1.2 Drastic increase in investment in drone industry

FIGURE 23 INVESTMENT IN DRONE INDUSTRY (USD MILLION) (2011-2021)

5.2.1.3 Rising need to lower carbon emissions in transport

5.2.1.4 Decline in prices of drone components

FIGURE 24 DECREASING PRICE OF DRONE COMPONENTS (USD)

5.2.1.5 Increasing demand for autonomous air ambulance drones

5.2.2 RESTRAINTS

5.2.2.1 Lack of skilled & trained personnel for operation

5.2.2.2 Safety and security issues

5.2.2.3 Uncertainty in regulatory frameworks

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing zero-emission initiatives

5.2.3.2 Use for cargo delivery in military and commercial applications

5.2.3.3 Rise in number of smart cities

TABLE 4 SMART CITY INITIATIVES, BY COUNTRY

5.2.3.4 Technological advancements to enhance accuracy of package delivery

5.2.4 CHALLENGES

5.2.4.1 Restrictions imposed on commercial use in various countries

TABLE 5 RESTRICTIONS IMPOSED ON USE OF UAVS IN VARIOUS COUNTRIES

5.2.4.2 Limited implementation of ground infrastructure

5.2.4.3 Lack of proper air traffic management for UAVs

5.2.4.4 Possible threats to safety and violation of privacy

5.2.4.5 Delivery authentication and cybersecurity concerns

5.3 DRONE LOGISTICS AND TRANSPORTATION MARKET ECOSYSTEM

5.3.1 PROMINENT COMPANIES

5.3.2 PRIVATE AND SMALL ENTERPRISES

5.3.3 START-UPS

5.3.4 END USERS

FIGURE 25 DRONE LOGISTICS AND TRANSPORTATION MARKET ECOSYSTEM MAP

TABLE 6 DRONE LOGISTICS AND TRANSPORTATION MARKET ECOSYSTEM

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DRONE LOGISTICS AND TRANSPORTATION MARKET

FIGURE 26 REVENUE SHIFT IN DRONE LOGISTICS AND TRANSPORTATION MARKET

5.5 TECHNOLOGY ANALYSIS

5.5.1 AI IN DRONES

TABLE 7 COMPANIES WORKING TOWARD DEVELOPMENT OF DRONE SOFTWARE WITH AI

TABLE 8 COMPANIES WORKING TOWARD DEVELOPMENT OF DRONE EQUIPMENT WITH AI

5.5.2 SENSE & AVOID IN AUTONOMOUS DRONES

5.6 DRONE LOGISTICS AND TRANSPORTATION MARKET: VALUE CHAIN ANALYSIS

FIGURE 27 VALUE CHAIN ANALYSIS

5.7 PORTER'S FIVE FORCES ANALYSIS

TABLE 9 DRONE LOGISTICS AND TRANSPORTATION MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 28 DRONE LOGISTICS AND TRANSPORTATION MARKET: PORTER'S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 KEY STAKEHOLDERS & BUYING CRITERIA

5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE PLATFORMS

TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE PLATFORMS (%)

5.8.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

TABLE 11 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

5.9 TARIFF AND REGULATORY LANDSCAPE

5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 DRONE REGULATION AND APPROVAL FOR COMMERCIAL SECTOR, BY COUNTRY

5.9.2 NORTH AMERICA

5.9.2.1 US

TABLE 18 US: RULES AND GUIDELINES BY FAA FOR OPERATION OF DRONES

5.9.2.2 Canada

TABLE 19 CANADA: RULES AND GUIDELINES FOR OPERATION OF DRONES

5.9.3 EUROPE

5.9.3.1 UK

TABLE 20 UK: RULES AND GUIDELINES BY CAA FOR OPERATION OF DRONES

5.9.3.2 Germany

TABLE 21 GERMANY: RULES AND GUIDELINES FOR OPERATION OF DRONES

5.9.3.3 France

TABLE 22 FRANCE: RULES AND GUIDELINES FOR OPERATION OF DRONES

TABLE 23 DRONE REGULATIONS, BY COUNTRY

5.10 DRONE LOGISTICS AND TRANSPORTATION MARKET: TRADE DATA

TABLE 24 US, CHINA, AND ISRAEL: IMPORT AND EXPORT STATISTICS FOR MILITARY DRONES

5.11 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 25 DRONE LOGISTICS AND TRANSPORTATION MARKET: CONFERENCES & EVENTS

5.12 OPERATIONAL DATA

FIGURE 31 GLOBAL PARCEL VOLUME SHIPPED IN 2020, % YEAR OVER YEAR (YOY) CHANGE

FIGURE 32 COMMERCIAL DRONE VOLUME, UNITS IN THOUSAND, 2017-2021

5.13 DRONE LOGISTICS AND TRANSPORTATION MARKET: PRICING ANALYSIS

5.13.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

FIGURE 33 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE APPLICATIONS

TABLE 26 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD)

6 INDUSTRY TRENDS (Page No. - 84)

6.1 INTRODUCTION

6.2 EMERGING TECHNOLOGY TRENDS

6.2.1 AUTONOMY LEVELS IN UNMANNED AERIAL SYSTEMS

6.2.1.1 Level 1

6.2.1.2 Level 2

6.2.1.3 Level 3

6.2.1.4 Level 4

6.2.1.5 Level 5

TABLE 27 AUTONOMY LEVELS OF UNMANNED AERIAL SYSTEMS

6.2.2 CLOUD COMPUTING

6.2.3 WIRELESS CHARGING

6.2.4 AUTOMATED GROUND CONTROL STATIONS

6.2.5 DRONE SWARM TECHNOLOGY

6.2.6 COMPUTER VISION

6.2.7 MULTI-SENSOR DATA FUSION

6.2.8 ADVANCED ALGORITHMS AND ANALYTICS

FIGURE 34 ALGORITHMS AND ANALYTICS FOR DRONE DELIVERY

6.2.9 MACHINE LEARNING-POWERED ANALYTICS

6.2.10 GPS-DENIED SYSTEMS

6.2.11 5G TECHNOLOGY

6.2.12 3D PRINTING

6.2.13 ADVANCED BATTERY TECHNOLOGY

6.2.14 SUPPLY CHAIN 4.0

6.2.15 DRONE INSURANCE

TABLE 28 INSURANCE COVERAGE OFFERED

TABLE 29 COMPANIES PROVIDING DRONE INSURANCE

6.2.16 INFLATABLE DRONES

6.2.17 HYDROGEN PROPULSION

6.3 USE CASE ANALYSIS

6.3.1 ZIPLINE DRONES USED TO DELIVER COVID-19 VACCINES

TABLE 30 COVID-19 VACCINES DELIVERED TO GHANA BY ZIPLINE

6.3.2 TRANSFER OF MEDICAL PRESCRIPTIONS USING DRONES FROM MANNA AERO

TABLE 31 ESSENTIAL SUPPLIES DELIVERED BY MANNA AERO IN RURAL AREAS

6.3.3 REGULATORS APPROVE BRAZIL'S FIRST DRONE DELIVERY OPERATION

TABLE 32 BRAZIL APPROVES SPEEDBIRD AERO DELIVERY DRONES

6.3.4 DELIVERY DRONES USED TO REACH PATIENTS IN REMOTE AREAS OF MALAWI

TABLE 33 BIDIRECTIONAL DELIVERY OF MEDICAL SUPPLIES USING DRONES TO ACHIEVE LAST-MILE DELIVERY

6.3.5 LOGISTICS COMPANY USES DRONES TO DELIVER MEDICAL ESSENTIALS

TABLE 34 SINCRONIA LOGISTICA DEPLOYS DRONES TO DELIVER PROTECTIVE GEAR TO HEALTHCARE WORKERS

6.3.6 CARGO DRONE FIELD TESTS IN AMAZON FOREST IN PERU

TABLE 35 FIELD TESTS USING CARGO DRONES TO DELIVER VACCINES AND BLOOD SAMPLES

6.4 CONNECTED USE CASES

6.4.1 NURO PROVIDES COST-EFFECTIVE GROCERY DELIVERY SERVICES FOR KROGER

6.4.2 PEPSICO DELIVERS SNACKS TO COLLEGE STUDENTS USING GROUND ROBOTS

6.4.3 FEDEX DELIVERS PARCELS USING SAMEDAY DELIVERY BOT

6.4.4 DOMINO'S USES GROUND DELIVERY ROBOTS TO DELIVER PIZZA

6.4.5 STARSHIP TECHNOLOGY OFFERS FOOD DELIVERIES AT GEORGE MASON UNIVERSITY'S FAIRFAX CAMPUS

6.4.6 JD.COM STARTS DELIVERIES USING AI-EQUIPPED GROUND ROBOTS

6.5 IMPACT OF MEGATRENDS

6.6 DRONE LOGISTICS AND TRANSPORTATION: PATENT ANALYSIS

TABLE 36 PATENT ANALYSIS

7 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM (Page No. - 104)

7.1 INTRODUCTION

FIGURE 35 PASSENGER DRONES PROJECTED TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 37 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 38 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

7.2 FREIGHT DRONES

7.2.1 EMERGENCE OF E-COMMERCE AND SAME-DAY DELIVERY

TABLE 39 FREIGHT DRONE LOGISTICS AND TRANSPORTATION MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 40 FREIGHT DRONE LOGISTICS AND TRANSPORTATION MARKET, BY TYPE, 2022–2030 (USD MILLION)

7.2.2 DELIVERY DRONES

7.2.3 CARGO AIR VEHICLES

7.3 PASSENGER DRONES

7.3.1 CONVENIENT MEANS OF HIGH-SPEED AERIAL TRANSPORTATION

TABLE 41 PASSENGER DRONE LOGISTICS AND TRANSPORTATION MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 42 PASSENGER DRONE LOGISTICS AND TRANSPORTATION MARKET, BY TYPE, 2022–2030 (USD MILLION)

7.3.2 DRONE TAXIS

7.3.3 AIR SHUTTLES

7.3.4 PERSONAL AIR VEHICLES

7.4 AIR AMBULANCE DRONES

7.4.1 USEFUL FOR EMERGENCY PATIENT TRANSPORT

8 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION (Page No. - 109)

8.1 INTRODUCTION

FIGURE 36 SYSTEM SEGMENT TO LEAD MARKET FROM 2022 TO 2030

TABLE 43 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 44 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

8.2 SYSTEM

TABLE 45 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 46 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SYSTEM, 2022–2030 (USD MILLION)

8.2.1 AIRFRAME

8.2.1.1 e-commerce drives demand for high payload capacity airframe structures

8.2.2 AVIONICS

8.2.2.1 Offer advanced flight control and communications systems

8.2.3 PROPULSION

8.2.3.1 Use of electric power sources on the rise

8.2.4 SOFTWARE

8.2.4.1 Use across applications leads to development of industry-specific drone software

8.3 SOFTWARE

TABLE 47 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOFTWARE, 2019–2021 (USD MILLION)

TABLE 48 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOFTWARE, 2022–2030 (USD MILLION)

8.3.1 ROUTE PLANNING & OPTIMIZING

8.3.1.1 Innovation in route planning software to drive segment

8.3.2 INVENTORY MANAGEMENT

8.3.2.1 Need for efficiency in drone package delivery services

8.3.3 LIVE TRACKING

8.3.3.1 Used to locate drones in real time to enable smooth operation

8.3.4 FLEET MANAGEMENT

8.3.4.1 Successful delivery requires sophisticated solutions

8.3.5 COMPUTER VISION

8.3.5.1 AI and deep learning-based software that analyzes drone operations

8.4 INFRASTRUCTURE

TABLE 49 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY INFRASTRUCTURE, 2019–2021 (USD MILLION)

TABLE 50 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY INFRASTRUCTURE, 2022–2030 (USD MILLION)

8.4.1 GROUND CONTROL STATIONS

8.4.1.1 Used for remote monitoring and route planning

8.4.2 CHARGING STATIONS

8.4.2.1 Wireless stations increase range and efficiency

8.4.3 LANDING PADS

8.4.3.1 Used for docking drones

8.4.4 MICRO-FULFILLMENT CENTERS

8.4.4.1 Provide multiple benefits for drone operation

9 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY APPLICATION (Page No. - 119)

9.1 INTRODUCTION

FIGURE 37 LOGISTICS SEGMENT ANTICIPATED TO LEAD MARKET IN 2022

TABLE 51 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 52 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

9.2 LOGISTICS

TABLE 53 DRONE LOGISTICS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 54 DRONE LOGISTICS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

9.2.1 POSTAL & PACKAGE DELIVERY

9.2.1.1 Trials underway to assess feasibility and profitability

9.2.2 HEALTHCARE & PHARMACY DELIVERY

9.2.2.1 Demand for easy access to medical supplies fuels segment

9.2.3 RETAIL & FOOD DELIVERY

9.2.3.1 Increasing use in e-commerce & food deliveries

9.2.4 PRECISION AGRICULTURE

9.2.4.1 Disinfectant spraying, planting seeds through delivery drones

9.2.5 INDUSTRIAL DELIVERY

9.2.5.1 Need to reduce transit time between production units

9.2.6 WEAPONS & AMMUNITION DELIVERY

9.2.6.1 Demand for precise material delivery capability for frontline squads

9.2.7 MARITIME DELIVERY

9.2.7.1 Need for autonomous ship-to-ship and shore-to-ship aerial delivery services

9.3 TRANSPORTATION

TABLE 55 DRONE TRANSPORTATION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 56 DRONE TRANSPORTATION MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

9.3.1 PATIENT TRANSPORT

9.3.1.1 Special emergency permits for critical patients – segment driver

9.3.2 PASSENGER TRANSPORT

9.3.2.1 Passenger drones to complement other transportation modes

10 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY USER (Page No. - 127)

10.1 INTRODUCTION

FIGURE 38 COMMERCIAL SEGMENT TO COMMAND MARKET IN 2022

TABLE 57 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY USER, 2019–2021 (USD MILLION)

TABLE 58 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY USER, 2022–2030 (USD MILLION)

10.2 DEFENSE

10.2.1 USED TO SUPPLY FOOD, AMMUNITION, FUEL, AND SPARE PARTS TO SOLDIERS

10.3 COMMERCIAL

10.3.1 SPEEDY DELIVERY OF EMERGENCY SERVICES BOOSTS SEGMENT

11 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY RANGE (Page No. - 130)

11.1 INTRODUCTION

FIGURE 39 CLOSE-RANGE SEGMENT TO DOMINATE MARKET FROM 2022 TO 2030

TABLE 59 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY RANGE, 2019–2021 (USD MILLION)

TABLE 60 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY RANGE, 2022–2030 (USD MILLION)

11.2 CLOSE-RANGE (<50 KILOMETERS)

11.2.1 RISE IN DEMAND FOR ON-DEMAND FOOD DELIVERY

11.3 SHORT-RANGE (50 TO 150 KILOMETERS)

11.3.1 EVTOL UAVS USED FOR INTRACITY PASSENGER COMMUTE AND CARGO TRANSFER

11.4 MID-RANGE (151 TO 650 KILOMETERS)

11.4.1 CAPABLE OF INTERCITY TRANSPORT

11.5 LONG RANGE (>650 KILOMETERS)

11.5.1 NEED FOR EMISSION REDUCTION TO BOOST SEGMENT

12 REGIONAL ANALYSIS (Page No. - 134)

12.1 INTRODUCTION

FIGURE 40 ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 61 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 62 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY REGION, 2022–2030 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 41 NORTH AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET SNAPSHOT

TABLE 63 NORTH AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 64 NORTH AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 65 NORTH AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 66 NORTH AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 67 NORTH AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 68 NORTH AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.2.2 US

12.2.2.1 Growing adoption of drones for commercial and military applications

TABLE 69 US: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 70 US: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 71 US: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 72 US: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Licensing constraints for commercial applications

TABLE 73 CANADA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 74 CANADA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 75 CANADA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 76 CANADA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.3 EUROPE

12.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 42 EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET SNAPSHOT

TABLE 77 EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 78 EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 79 EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 80 EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 81 EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 82 EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.3.2 UK

12.3.2.1 Technological developments by key players

TABLE 83 UK: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 84 UK: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 85 UK: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 86 UK: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.3.3 GERMANY

12.3.3.1 High demand for commercial drone services

TABLE 87 GERMANY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 88 GERMANY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 89 GERMANY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 90 GERMANY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.3.4 FRANCE

12.3.4.1 Development of fully autonomous drones for commercial and defense applications

TABLE 91 FRANCE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 92 FRANCE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 93 FRANCE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 94 FRANCE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.3.5 ITALY

12.3.5.1 Rising demand for drones from healthcare industry

TABLE 95 ITALY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 96 ITALY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 97 ITALY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 98 ITALY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.3.6 SWITZERLAND

12.3.6.1 Development of modern infrastructure for safe landing and take-off of cargo drones

TABLE 99 SWITZERLAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 100 SWITZERLAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 101 SWITZERLAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 102 SWITZERLAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.3.7 NORWAY

12.3.7.1 Favorable government initiatives to drive market

TABLE 103 NORWAY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 104 NORWAY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 105 NORWAY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 106 NORWAY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.3.8 SWEDEN

12.3.8.1 Surge in demand for emergency medical transportation services

TABLE 107 SWEDEN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 108 SWEDEN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 109 SWEDEN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 110 SWEDEN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.3.9 REST OF EUROPE

12.3.9.1 Growing need to meet demand for emergency medical services

TABLE 111 REST OF EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 112 REST OF EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 113 REST OF EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 114 REST OF EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 43 ASIA PACIFIC: DRONE LOGISTICS AND TRANSPORTATION MARKET SNAPSHOT

TABLE 115 ASIA PACIFIC: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 116 ASIA PACIFIC: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 117 ASIA PACIFIC: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 118 ASIA PACIFIC: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 119 ASIA PACIFIC: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 120 ASIA PACIFIC: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.4.2 CHINA

12.4.2.1 Presence of leading drone manufacturers and service providers

TABLE 121 CHINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 122 CHINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 123 CHINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 124 CHINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Increasing investments in advanced UAVs and associated components

TABLE 125 INDIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 126 INDIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 127 INDIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 128 INDIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.4.4 JAPAN

12.4.4.1 Increasing adoption of drones for defense applications

TABLE 129 JAPAN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 130 JAPAN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 131 JAPAN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 132 JAPAN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.4.5 AUSTRALIA

12.4.5.1 Market-supportive government initiatives to drive market

TABLE 133 AUSTRALIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 134 AUSTRALIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 135 AUSTRALIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 136 AUSTRALIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.4.6 NEW ZEALAND

12.4.6.1 Growing demand for aerial transportation & logistics

TABLE 137 NEW ZEALAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 138 NEW ZEALAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 139 NEW ZEALAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 140 NEW ZEALAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.4.7 MALAYSIA

12.4.7.1 Rising usage of UAVs for air cargo transportation

TABLE 141 MALAYSIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 142 MALAYSIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 143 MALAYSIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 144 MALAYSIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.4.8 SINGAPORE

12.4.8.1 Established regulatory framework to enhance market prospects

TABLE 145 SINGAPORE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 146 SINGAPORE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 147 SINGAPORE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 148 SINGAPORE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.4.9 SOUTH KOREA

12.4.9.1 Need for transportation and healthcare services in remote areas

TABLE 149 SOUTH KOREA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 150 SOUTH KOREA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 151 SOUTH KOREA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 152 SOUTH KOREA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.5 MIDDLE EAST

12.5.1 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 44 MIDDLE EAST: DRONE LOGISTICS AND TRANSPORTATION MARKET SNAPSHOT

TABLE 153 MIDDLE EAST: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 154 MIDDLE EAST: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 155 MIDDLE EAST: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 156 MIDDLE EAST: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 157 MIDDLE EAST: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 158 MIDDLE EAST: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.5.2 UAE

12.5.2.1 Increasing adoption of drones for recreational activities

TABLE 159 UAE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 160 UAE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 161 UAE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 162 UAE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.5.3 ISRAEL

12.5.3.1 Investments by key players to improve drone services to fuel market

TABLE 163 ISRAEL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 164 ISRAEL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 165 ISRAEL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 166 ISRAEL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.5.4 SAUDI ARABIA

12.5.4.1 Rising focus of key players on drones for commercial application

TABLE 167 SAUDI ARABIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 168 SAUDI ARABIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 169 SAUDI ARABIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 170 SAUDI ARABIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 45 LATIN AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET SNAPSHOT

TABLE 171 LATIN AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 172 LATIN AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 173 LATIN AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 174 LATIN AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 175 LATIN AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 176 LATIN AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.6.2 BRAZIL

12.6.2.1 Rising end user interest in drone services

TABLE 177 BRAZIL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 178 BRAZIL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 179 BRAZIL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 180 BRAZIL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.6.3 MEXICO

12.6.3.1 Increase in use of drones for emergency medical services

TABLE 181 MEXICO: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 182 MEXICO: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 183 MEXICO: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 184 MEXICO: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.6.4 COLOMBIA

12.6.4.1 Growing demand from healthcare and enterprise sectors

TABLE 185 COLOMBIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 186 COLOMBIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 187 COLOMBIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 188 COLOMBIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.6.5 ARGENTINA

12.6.5.1 Surge in adoption of UAVs by healthcare authorities witnessed

TABLE 189 ARGENTINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 190 ARGENTINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 191 ARGENTINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 192 ARGENTINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.6.6 PERU

12.6.6.1 Growing focus on addressing medical challenges in Amazon Rainforest

TABLE 193 PERU: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 194 PERU: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 195 PERU: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 196 PERU: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

12.7 AFRICA

12.7.1 PESTLE ANALYSIS: AFRICA

FIGURE 46 AFRICA: DRONE LOGISTICS AND TRANSPORTATION MARKET SNAPSHOT

TABLE 197 AFRICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, 2019–2021 (USD MILLION)

TABLE 198 AFRICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, 2022–2030 (USD MILLION)

TABLE 199 AFRICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 200 AFRICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 201 AFRICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 202 AFRICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 197)

13.1 INTRODUCTION

13.2 OVERVIEW

TABLE 203 KEY DEVELOPMENTS OF LEADING PLAYERS IN DRONE LOGISTICS AND TRANSPORTATION MARKET (2019–2021)

13.3 RANKING ANALYSIS OF KEY PLAYERS

FIGURE 47 RANKING OF KEY PLAYERS IN DRONE LOGISTICS AND TRANSPORTATION MARKET, 2021

13.4 REVENUE ANALYSIS, 2021

FIGURE 48 REVENUE ANALYSIS OF KEY COMPANIES IN DRONE LOGISTICS AND TRANSPORTATION MARKET

13.5 MARKET SHARE ANALYSIS, 2021

FIGURE 49 MARKET SHARE ANALYSIS

TABLE 204 DRONE LOGISTICS AND TRANSPORTATION MARKET: DEGREE OF COMPETITION

13.6 COMPETITIVE EVALUATION QUADRANT

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 50 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

13.7 START-UP/SME EVALUATION QUADRANT

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 STARTING BLOCKS

13.7.4 DYNAMIC COMPANIES

FIGURE 51 DRONE LOGISTICS AND TRANSPORTATION MARKET (START-UP/SME) COMPETITIVE LEADERSHIP MAPPING, 2021

13.8 COMPETITIVE BENCHMARKING

TABLE 205 DRONE LOGISTICS AND TRANSPORTATION MARKET: KEY START-UPS/SMES

TABLE 206 DRONE LOGISTICS AND TRANSPORTATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

TABLE 207 DRONE LOGISTICS AND TRANSPORTATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [MAJOR PLAYERS]

13.9 COMPETITIVE SCENARIO

13.9.1 MARKET EVALUATION FRAMEWORK

13.9.2 NEW PRODUCT LAUNCHES

TABLE 208 NEW PRODUCT LAUNCHES, 2017–MAY 2022

13.9.3 CONTRACTS, PARTNERSHIPS, AND AGREEMENTS

TABLE 209 CONTRACTS, PARTNERSHIPS, AND AGREEMENTS, 2017–MAY 2022

TABLE 210 OTHERS, 2017–MAY 2022

14 COMPANY PROFILES (Page No. - 222)

14.1 INTRODUCTION

(Business overview, Products/Services/Solutions offered, Recent developments & MnM View)*

14.2 KEY PLAYERS

14.2.1 ALPHABET INC.

TABLE 211 ALPHABET INC.: BUSINESS OVERVIEW

FIGURE 52 ALPHABET INC.: COMPANY SNAPSHOT

TABLE 212 ALPHABET INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 213 ALPHABET INC.: NEW PRODUCT LAUNCHES

TABLE 214 ALPHABET INC.: DEALS

TABLE 215 ALPHABET INC.: OTHERS

14.2.2 HARDIS GROUP

TABLE 216 HARDIS GROUP: BUSINESS OVERVIEW

TABLE 217 HARDIS GROUP: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 218 HARDIS GROUP: OTHERS

14.2.3 ZIPLINE

TABLE 219 ZIPLINE: BUSINESS OVERVIEW

TABLE 220 ZIPLINE: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 221 ZIPLINE: NEW PRODUCT LAUNCHES

TABLE 222 ZIPLINE: DEALS

14.2.4 VOLOCOPTER GMBH

TABLE 223 VOLOCOPTER GMBH: BUSINESS OVERVIEW

TABLE 224 VOLOCOPTER GMBH: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 225 VOLOCOPTER GMBH: DEALS

TABLE 226 VOLOCOPTER GMBH: OTHERS

14.2.5 TEXTRON INC.

TABLE 227 TEXTRON INC.: BUSINESS OVERVIEW

FIGURE 53 TEXTRON INC.: COMPANY SNAPSHOT

TABLE 228 TEXTRON INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 229 TEXTRON INC: NEW PRODUCT LAUNCHES

14.2.6 THE BOEING COMPANY

TABLE 230 THE BOEING COMPANY: BUSINESS OVERVIEW

FIGURE 54 THE BOEING COMPANY: COMPANY SNAPSHOT

TABLE 231 THE BOEING COMPANY: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 232 THE BOEING COMPANY: NEW PRODUCT LAUNCHES

TABLE 233 THE BOEING COMPANY: DEALS

14.2.7 AIRBUS

TABLE 234 AIRBUS: BUSINESS OVERVIEW

FIGURE 55 AIRBUS: COMPANY SNAPSHOT

TABLE 235 AIRBUS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 236 AIRBUS: NEW PRODUCT LAUNCHES

TABLE 237 AIRBUS: DEALS

14.2.8 JOBY AVIATION

TABLE 238 JOBY AVIATION: BUSINESS OVERVIEW

FIGURE 56 JOBY AVIATION: COMPANY SNAPSHOT

TABLE 239 JOBY AVIATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 240 JOBY AVIATION: DEALS

TABLE 241 JOBY AVIATION: OTHERS

14.2.9 MATTERNET, INC.

TABLE 242 MATTERNET, INC.: BUSINESS OVERVIEW

TABLE 243 MATTERNET, INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 244 MATTERNET, INC.: NEW PRODUCT LAUNCHES

TABLE 245 MATTERNET, INC.: DEALS

14.2.10 FLIRTEY INC.

TABLE 246 FLIRTEY: BUSINESS OVERVIEW

TABLE 247 FLIRTEY INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 248 FLIRTEY INC.: DEALS

TABLE 249 FLIRTEY INC.: OTHERS

14.2.11 EHANG

TABLE 250 EHANG: BUSINESS OVERVIEW

FIGURE 57 EHANG: COMPANY SNAPSHOT

TABLE 251 EHANG: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 252 EHANG: NEW PRODUCT LAUNCHES

TABLE 253 EHANG: DEALS

TABLE 254 EHANG: OTHERS

14.2.12 KALERIS

TABLE 255 KALERIS: BUSINESS OVERVIEW

TABLE 256 KALERIS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 257 KALERIS: DEALS

TABLE 258 KALERIS: OTHERS

14.2.13 CANA LLC

TABLE 259 CANA LLC: BUSINESS OVERVIEW

TABLE 260 CANA LLC: PRODUCT/SOLUTIONS/SERVICES OFFERED

14.2.14 DRONESCAN

TABLE 261 DRONESCAN: BUSINESS OVERVIEW

TABLE 262 DRONESCAN: PRODUCT/SOLUTIONS/SERVICES OFFERED

14.2.15 DRONE DELIVERY CANADA CORP.

TABLE 263 DRONE DELIVERY CANADA CORP.: BUSINESS OVERVIEW

FIGURE 58 DRONE DELIVERY CANADA CORP.: COMPANY SNAPSHOT

TABLE 264 DRONE DELIVERY CANADA CORP.: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 265 DRONE DELIVERY CANADA CORP.: NEW PRODUCT LAUNCHES

TABLE 266 DRONE DELIVERY CANADA CORP.: DEALS

TABLE 267 DRONE DELIVERY CANADA CORP.: OTHERS

*Details on Business overview, Products/Services/Solutions offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14.3 OTHER PLAYERS

14.3.1 FLYTREX

TABLE 268 FLYTREX: COMPANY OVERVIEW

14.3.2 SKYCART INC.

TABLE 269 SKYCART INC.: COMPANY OVERVIEW

14.3.3 ALTITUDE ANGEL

TABLE 270 ALTITUDE ANGEL: COMPANY OVERVIEW

14.3.4 SPEEDBIRD AERO

TABLE 271 SPEEDBIRD AERO: COMPANY OVERVIEW

14.3.5 SKYPORTS LIMITED

TABLE 272 SKYPORTS LIMITED: COMPANY OVERVIEW

14.3.6 INFINIUM ROBOTICS

TABLE 273 INFINIUM ROBOTICS: COMPANY OVERVIEW

14.3.7 WORKHORSE GROUP INC.

TABLE 274 WORKHORSE GROUP INC.: COMPANY OVERVIEW

14.3.8 AGEAGLE AERIAL SYSTEMS INC.

TABLE 275 AGEAGLE AERIAL SYSTEMS INC.: COMPANY OVERVIEW

14.3.9 AIRMAP INC.

TABLE 276 AIRMAP INC.: COMPANY OVERVIEW

14.3.10 SKYSENSE

TABLE 277 SKYSENSE: COMPANY OVERVIEW

15 APPENDIX (Page No. - 271)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

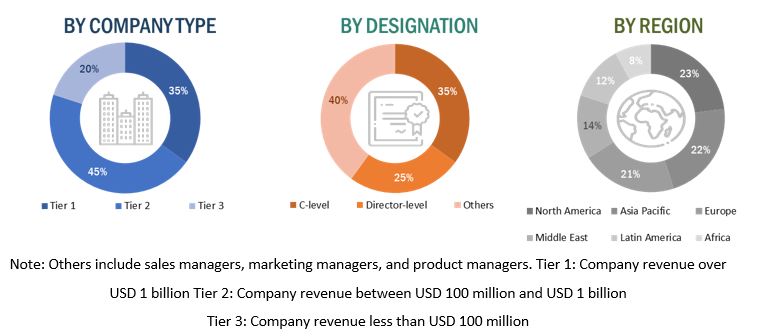

This research study on the drone transportation and logistics market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. The primary sources considered included industry experts as well as service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the drone transportation and logistics market as well as assess its growth prospects.

Secondary Research

The secondary sources referred for this research study on the drone transportation and logistics market included financial statements of companies offering delivery drones software, drone transportation and logistics services, and transportation and logistics solution providers, along with various trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall size of the drone transportation and logistics market, which was validated by primary respondents.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as chief X officers (CXOs), vice presidents (VPs), directors, regional managers, and business development and product development teams, distributors, and vendors.

Extensive primary research was conducted to obtain qualitative and quantitative information such as market statistics, average selling price, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to platform, solution, technologies, and regions. Stakeholders from the demand side include logistics companies, end consumers, healthcare industry, and quick-service restaurants who are willing to adopt drone delivery by participating in various trials. These interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market size forecasting, and data triangulation. These interviews also helped analyze the solution, platform, architecture, and deployment segments of the market for six key regions.

To know about the assumptions considered for the study, download the pdf brochure

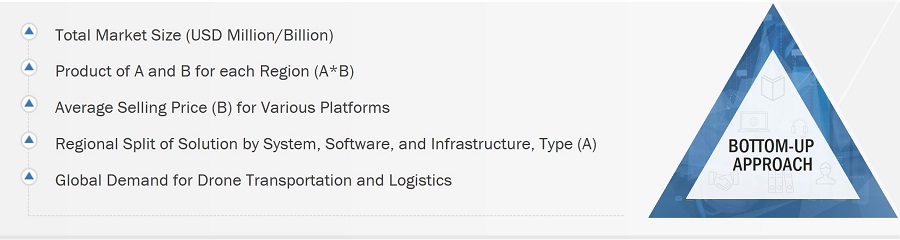

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the drone transportation and logistics market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following details:

- Key players in this market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the drone transportation and logistics market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Market size estimation methodology: Bottom-up approach

Data Triangulation

After arriving at the overall size of the drone transportation and logistics market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the drone transportation and logistics market.

Report Objectives

- To define, describe, segment, and forecast the size of the drone transportation and logistics market based on solution, platform, architecture, deployment, and region

- To forecast the size of different segments of the market with respect to various regions, including North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa, along with key countries in each of these regions

- To identify and analyze key drivers, opportunities, and challenges influencing the growth of the market

- To identify technology trends that are currently prevailing in the drone transportation and logistics market

- To provide an overview of the tariff and regulatory landscape with respect to the drone regulations across regions

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, new product launches, new service launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the drone transportation and logistics market, along with a ranking analysis, market share analysis, and revenue analysis of key players

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Drone Logistics and Transportation Market

We are focusing on semi-urban airborne electric logistics at first before transporting people, and would like to see if this report crosses our own findings.

I would like a sample of your drone delivery and/or drone industry report.