Drone Services Market by Type (Platform Service, MRO, and Training & Simulation), Application, Industry, Solution (End-to-End, Point), and Region ( North America, Europe, Asia Pacific, Middle East, and Row) - 2026

Updated on : April 04, 2023

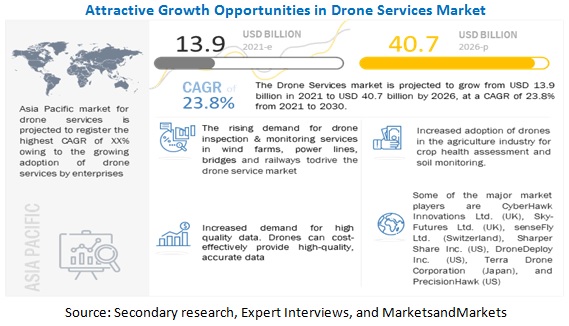

The Drone Services Market was valued at $13,900 Million in 2021 and is estimated to grow from $18,600 Million USD in 2023 to $40,700 Million USD by 2026 at a CAGR (Compound Annual Growth Rate) of 23.8%. North America is estimated to account for the largest share of the Drone Services Industry in 2021.

Drone services is an evolving market for services offered for flying drones that can be remotely controlled or flown autonomously by integrating software-controlled flight plans into their embedded systems. Commercial drone services support industries such as agriculture, insurance, construction, marine, aviation, oil & gas, mining, and infrastructure in performing tasks such as search and rescue, package delivery, industrial inspection, assembling imagery, spraying fertilizers, distributing healthcare supplies to remote places, and broadcasting shows.

The drone services market based on type of the service provided has been segmented into platform (which is sub-segmented into flights piloting & operation, data analysis, and data processing), MRO, and simulation & training. Based on application, drone services market has been segmented into inspection & monitoring, mapping & surveying, spraying & seeding, filming & photography, transport & delivery, and security, search, and rescue. Based on industry, the drone services market has been segmented into construction & infrastructure, agriculture, utility, oil & gas, mining, defense & law enforcement, media & entertainment, scientific research, insurance, aviation, marine, healthcare & social assistance, and transportation, logistics, & warehousing. These industries use a wide range of drone services, such as inspection & monitoring, mapping & surveying, and filming & photography. The drone services market based on solution has been segmented into end-to-end and point solutions. The scope of the end-to-end solution segment includes all platform services, such as piloting & operations, data analytics, and data processing. The point solutions are specific only to piloting or data processing for applications such as surveying, inspection, and monitoring.

The drone services market is segmented according to five key regions in this report, namely, North America, Europe, Asia Pacific, Middle East and the Rest of the World (RoW), along with their key countries.

Drone services are rapidly replacing the applications of legacy services in the commercial sector, such as aerial surveys, filmography, and search & rescue, as they can be operated for long periods and remotely by human operators or autonomously by onboard computers. The usage of drone services has increased in various civil and commercial applications due to their high endurance and low operational costs. Besides, the incorporation of new technologies, such as artificial intelligence, IoT, and cloud computing in drone services is expected to further fuel their demand in various sectors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Drone Services Market

Drones have proved to be an ideal solution for offering various services during the COVID-19 pandemic. From prompt delivery at peak hours and dispensing medicines and essentials to remote areas to screening an inaccessible location, drones are gradually demonstrating high work efficiency and productivity. Nevertheless, due to its low adoption, numerous countries have missed out on the potential of drone technology. The outbreak and widespread of the pandemic have led to an increase in demand for and use of drones, as their benefits outweigh their potential risks. Police departments and governments worldwide have utilized drones to achieve remote policing and impose social distancing. Although many law enforcement budgets have been adversely affected by diminished tax revenues and budget reallocations, current pilot programs are increasing drone experiments as organizations are turning toward the technology to tackle operational incompetence.

Drone Services Market Dynamics:

Driver: Increasing data for high-quality data

Companies in the agriculture, construction, mining, and other sectors require high-quality data. They rely on satellites and helicopters to gather photogrammetric and geospatial data to enhance their business operations. The spatial information collected is analyzed and used for decision-making related to information on hydrography, topography, soil type, and land development. Data collected using traditional procedures is costly and may not be accurate/detailed enough.

Drone service providers can cost-effectively provide high-quality, accurate data. Since drones can be equipped with high megapixel cameras, they can capture detailed information by flying at low heights. Besides, drones equipped with GPS and high-tech image processing software can capture high-quality images at a lower cost as compared to traditional techniques.

Opportunity: Development of urban air mobility services

In 2020, the global population comprised 56.2% of the urban population. With the growing urban population, transportation systems are required to be proficiently managed to enable mass mobility. Cities worldwide are, hence, looking for alternative modes of transportation to solve issues linked with traffic congestion. It is expected that urban air mobility with the use of autonomous drones can decrease pollution levels and reduce transport time, as well as lower the strain on existing transport systems. Cities, namely, Dubai, Singapore, Los Angeles, and Dallas, are already testing with Urban Air Mobility projects. Air taxis is expected to be a promising market in the upcoming era since they make traveling safe and comfortable. The chief objective of urban air mobility is to enable intracity transportation to reduce the strain on currently existing urban mobility solutions. Presently, most of the autonomous aircraft manufacturers are performing research and development for UAM technology. Lilium (Germany) has built the Lilium Jet, an electric vertical take-off and landing jet with a cruising speed of 300 km/h and a range of 300 km. The company plans to deploy this jet for intracity transportation initially and later for intercity transportation. Other aircraft manufacturing companies such as Boeing, Bell, Hyundai Motors, BAE Systems, and EHang are also planning to develop autonomous aircraft for intracity transportation.

Challenge: Lack of risk management framework and insurance cover for aerial delivery drones

Service providers and manufacturers of aerial delivery drones face the potential risk of losing parcels or delivery drones due to lack of insurance coverage. This requires the service providers and manufacturers to work closely with regulatory authorities to ensure that aerial delivery drones are used responsibly. In several countries, it is mandatory for drone users to have insurance cover to handle the liabilities in case of an accident. The current insurance for drones focuses on the risk of personal injury and property damage related to the drone itself or the damage caused by it. However, such laws have not been formulated for aerial delivery drones. Providers of delivery drone services and consumers availing these services need to enter a contract before the initiation of operations. Although the risk of damage or loss is low for the party availing the service, there may be serious consequences in case of an accident.

Insurance helps mitigate losses by providing liability within the policy period. Presently, insurers are facing challenges in terms of damage caused due to hacking, delayed arrival of emergency medical aid packages, loss of control of the drone, air collision, and BVLOS operations. It is expected that insurance will become a part of the risk management framework, regulating delivery drone services in the coming years and will cover physical losses to aerial delivery drones, ground stations, and equipment or packages.

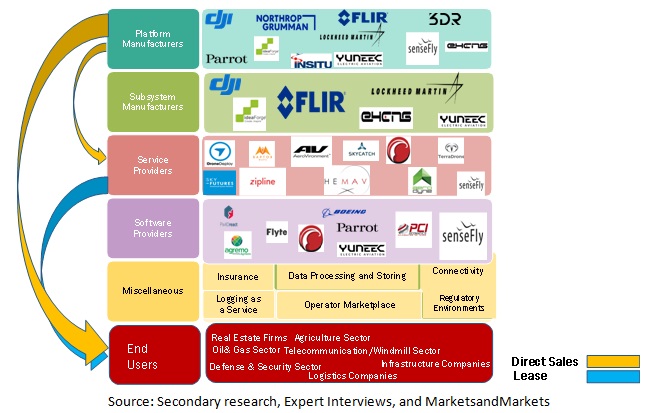

Market Ecosystem Map

The Drone Services market is dominated by a few globally established players such as the platform manufacturers, subsystem manufacturers, service providers, software providers, and miscellaneous (insurance companies) as well as the end users. The following figure lists some global platform manufacturers, subsystem providers, service providers, and software providers.

To know about the assumptions considered for the study, download the pdf brochure

“By type, platform segment is expected to register the highest CAGR during the forecast period ”

Based on type, the drone services market has been segmented into platform (which is sub-segmented into flights piloting & operation, data analysis, and data processing), MRO, and simulation & training. The platform segment is expected to register the highest CAGR during the forecast period attributed to its higher efficiency in data collection and affordability, as well as the accessibility of drone services across the globe

“ By industry, healthcare & social assistance segment is projected to record the highest growth”

Based on industry, the drone services market has been segmented into construction & infrastructure, agriculture, utility, oil & gas, mining, defense & law enforcement, media & entertainment, scientific research, insurance, aviation, marine, healthcare & social assistance, and transportation, logistics, & warehousing.

The healthcare & social assistance segment is projected to record the highest growth, attributed to the increased investments in the area during the COVID period to deliver test samples and vaccines.

“By solution, end-to-end solution segment would have the highest growth during the forecast period”

The drone services market based on solution has been segmented into end-to-end and point solutions.

The end-to-end solution segment would have the highest growth during the forecast period owing to the growing demand for complete package solutions, which include everything from piloting & operation, data analysis to data processing.

“ By application, transport & delivery segment is expected to dominate the market with the highest CAGR during the forecast period”

Based on application, the drone services market has been segmented into inspection & monitoring, mapping & surveying, spraying & seeding, filming & photography, transport & delivery, and security, search, and rescue. Among these applications, the transport & delivery segment is expected to dominate the market with the highest CAGR during the forecast period, owing to the escalating demand for fast package delivery services in the healthcare industry attributed to the outbreak of the COVID-19 pandemic

“ North America is expected to hold the highest market share in 2021.”

North America is expected to hold the highest market share in 2021. The growth of the regional market can be attributed to the increasing trend of online shopping from e-commerce platforms and favorable FAA regulations in the US. The rise in investments from key players to support start-ups in developing parcel service platforms is also expected to contribute to the growth of the regional market during the forecast period.

North America is projected to have the highest market share for drone services market in 2021

To know about the assumptions considered for the study, download the pdf brochure

Top Key Players in Drone Services Companies:

-

Sky-Futures Ltd. (UK),

-

senseFly Ltd. (Switzerland),

-

DroneDeploy Inc. (US),

-

Terra Drone Corporation (Japan),

-

PrecisionHawk (US), and

-

Aerodyne Group (Malaysia).

Drone Services Market Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 13.9 billion |

| Projected Market Size | USD 40.7 billion |

| Growth Rate | CAGR of 23.8% |

|

Market size available for years |

2018–2026 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By type, application, industry, and solution |

|

Base Year considered |

2020 |

This research report categorizes the drone services market based on applications, industry, type, and solution

Drone Services Market, By Type

- Platform Service

- Maintenance Repair Overhaul (MRO)

- Simulation & Training

Market, By Application

- Inspection & Monitoring

- Mapping & Surveying

- Spraying & Seeding

- Filming & Photography

- Transport & Delivery

- Security, Search & Rescue

Market, By Industry

- Construction & Infrastructure

- Agriculture

- Utilities

- Oil & Gas

- Mining

- Defense & Law Enforcement

- Media & Entertainment

- Scientific Research

- Insurance

- Aviation

- Marine

- Healthcare & Social Assistance

- Transport, Logistics & Warehousing

Market, By Solution

- End-to-End

- Point

Drone Services Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- RoW (Rest of the World)

Recent Developments

- In June 2021, Aerodyne Group publicized a collaboration to deliver global Drone-as-a-Service (Daas) and Software-as-a-Service (SaaS) solutions in the Italian asset inspection market for infrastructure maintenance and the agriculture (service offerings) sector.

- In June 2020, Cyberhawk announced that it has acquired a 5-year, multimillion-dollar software contract with Royal Dutch Shell PLC (Shell).

- In March 2019, senseFly Ltd. launched eBee X, a fixed-wing drone equipped with Red-Edge- MX sensors developed by MicaSense to provide high-resolution insights to customers in the agricultural industry.

Frequently Asked Questions (FAQ):

What is the current size of the drone services market?

The drone services market is estimated to grow from USD 13,991 million in 2021 to USD 40,737 million by 2026, at a CAGR of 23.8% from 2021 to 2026. North America is estimated to account for the largest share of the drone services market in 2021.

Who are the winners in the drone services market?

Cyberhawk (UK), Sky-Futures Ltd. (UK), senseFly Ltd. (Switzerland), Sharper Shape Inc. (US), DroneDeploy Inc. (US), Terra Drone Corporation (Japan), PrecisionHawk (US), and Aerodyne Group (Malaysia)

What is the COVID-19 impact on drone services market?

Drones have proved to be an ideal solution for offering various services during the COVID-19 pandemic. From prompt delivery at peak hours and dispensing medicines and essentials to remote areas to screening an inaccessible location, drones are gradually demonstrating high work efficiency and productivity. Nevertheless, due to its low adoption, numerous countries have missed out on the potential of drone technology. The outbreak and widespread of the pandemic have led to an increase in demand for and use of drones, as their benefits outweigh their potential risks.

What are some of the technological advancements in the market?

Aerial drones for package delivery services need charging stations to charge their batteries. Wireless charging pads are installed in the landing pads or docking stations of delivery drones. Wireless charging is expected to be of prime importance in the drone package delivery industry as it enables the extended flight capability of aerial delivery service drones. It also lowers the time taken for charging, thereby enabling drones to carry out the cost-effective transportation and delivery of packages over long distances. Wireless charging can also decrease the charging downtime required by aerial drones enabling efficient delivery of packages within cities.

What are the factors driving the growth of the market?

Cost-effectiveness, high precision, and excellent time efficiency make drones a trustworthy data acquisition tool that can deliver basic data and offer synchronous monitoring for various applications. The effective monitoring area of drones is nearly 100–10,0000 m2, and the corresponding error is about 2–20 cm. The usage of drones helps increase workforce safety and provides access to information related to assets deployed in various industries, such as construction & infrastructure, utility, aviation, mining, and oil & gas. They also help in reducing downtimes. Drones are widely used for inspection & monitoring purposes in various verticals, as stated below:

Wind Farms: Wind farm operators are largely benefitting from the advantages of drone services. Generally, industrial wind turbine blades are 115 ft. (35 m) in length, and the tower height can surpass 250 ft. (76 m)—the total height of the tower and blades is over 365 ft. (111 m). Their large size makes it difficult for workers to perform a thorough inspection. The use of drones helps to tackle these problems effortlessly. In just a short duration, drones can capture images of the wind turbine blades and transmit the footage to the technician, who can assimilate and analyze the turbines for any structural defects. They can reduce the inspection time by up to 70%.

Power Lines: Power lines and pylons are critical components of an infrastructure, which require continuous inspection and maintenance. As these power lines and pylons are often located in remote locations, such as mountain chains or thick forests, drones have become an ideal choice for their inspection and maintenance. Major utility companies, such as General Electric (US) and Duke Energy (US), are using drones to carry out power line inspections. Drone technology has also been employed in China’s mountainous Yunnan province. Previously, technicians could complete the inspection of only two pylons per day, which now has increased to ten pylons per day with the help of drones. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 DRONE SERVICES MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED FOR STUDY

1.4 INCLUSIONS AND EXCLUSIONS

1.5 CURRENCY

TABLE 1 USD EXCHANGE RATE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH PROCESS FLOW

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Insights from primary experts

2.1.2.2 Key data from primary sources

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND SIDE INDICATORS

2.2.3 SUPPLY SIDE INDICATORS

2.3 RESEARCH APPROACH AND METHODOLOGY

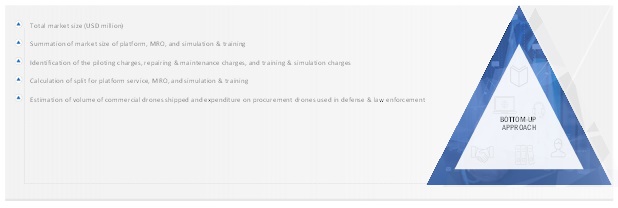

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Platform services market approach

2.3.1.2 MRO market approach

2.3.1.3 Simulation & training market approach

2.3.1.4 Regional split of drone services market

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 TRIANGULATION AND VALIDATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

FIGURE 5 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

FIGURE 6 ASSUMPTIONS FOR RESEARCH STUDY

2.5.1 ASSUMPTIONS USED IN MARKET SIZING AND FORECAST

2.6 RISKS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 7 PLATFORM SEGMENT TO ACCOUNT FOR LARGEST SHARE OF DRONE SERVICES MARKET IN 2021

FIGURE 8 INSPECTION & MONITORING SEGMENT TO DOMINATE DRONE SERVICES MARKET DURING FORECAST PERIOD

FIGURE 9 CONSTRUCTION & INFRASTRUCTURE SEGMENT TO LEAD DRONE SERVICES MARKET DURING FORECAST PERIOD

FIGURE 10 POINT SOLUTION SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 11 ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN DRONE SERVICES MARKET

FIGURE 12 GROWING NEED FOR DATA WITH HIGH ACCURACY TO DRIVE GROWTH OF DRONE SERVICES MARKET

4.2 DRONE SERVICES MARKET, BY TYPE

FIGURE 13 PLATFORM SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.3 DRONE SERVICES MARKET, BY APPLICATION

FIGURE 14 INSPECTION & MONITORING SEGMENT TO DOMINATE DRONE SERVICES MARKET DURING FORECAST PERIOD

4.4 DRONE SERVICES MARKET, BY INDUSTRY

FIGURE 15 HEALTHCARE & SOCIAL ASSISTANCE SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

4.5 DRONE SERVICES MARKET, BY REGION

FIGURE 16 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF DRONE SERVICES MARKET IN 2021

4.6 DRONE SERVICES MARKET, BY COUNTRY

FIGURE 17 US TO HOLD LARGEST SHARE OF NORTH AMERICAN DRONE SERVICES MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR DRONE SERVICES MARKET

5.2.1 DRIVERS

5.2.1.1 Increased adoption of drones in agriculture industry for crop health assessment and soil monitoring

5.2.1.2 Increasing demand for drone inspection & monitoring services

5.2.1.3 Increasing demand for high-quality data

5.2.2 RESTRAINTS

5.2.2.1 Liability issues associated with drone operations and services

5.2.2.2 Issues associated with drone safety and security

5.2.3 OPPORTUNITIES

5.2.3.1 Increased demand for drone delivery services during COVID-19 crisis

5.2.3.2 Development of urban air mobility services

TABLE 2 UAM-RELATED PROJECTS WORLDWIDE

TABLE 3 UAM-BASED SERVICES

5.2.4 CHALLENGES

5.2.4.1 Lack of risk management framework and insurance cover for aerial delivery drones

5.2.4.2 Requirement of high investments in construction of urban air mobility infrastructure network

5.3 IMPACT OF COVID-19 ON DRONE SERVICES MARKET

FIGURE 19 IMPACT OF COVID-19 ON DRONE SERVICES MARKET

5.3.1 USE OF DRONE TECHNOLOGY TO FIGHT AGAINST COVID-19 PANDEMIC

TABLE 4 KEY INITIATIVES TAKEN BY VARIOUS COUNTRIES TO CURB SPREAD OF COVID-19 PANDEMIC, JANUARY 2020–JUNE 2021

FIGURE 20 IMPACT OF COVID-19 ON SUPPLY AND DEMAND SIDES OF DRONE SERVICES MARKET

5.4 RANGE/SCENARIOS

FIGURE 21 PESSIMISTIC, REALISTIC, AND OPTIMISTIC SCENARIOS OF DRONE SERVICES MARKET WITH REGARDS TO COVID-19 PANDEMIC

5.5 AVERAGE SELLING PRICE

TABLE 5 AVERAGE PRICES OF DRONE SERVICES IN US FOR VARIOUS APPLICATIONS IN 2020–2021

5.6 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS FOR DRONE SERVICES MARKET

5.7 MARKET ECOSYSTEM MAP

FIGURE 23 MARKET ECOSYSTEM MAP FOR DRONE SERVICES MARKET

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

5.8.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DRONE SERVICES MARKET

FIGURE 24 REVENUE SHIFT CURVE FOR DRONE SERVICES MARKET

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS FOR DRONE SERVICES MARKET

5.9.1 THREATS OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWERS OF SUPPLIERS

5.9.4 BARGAINING POWERS OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 TRADE DATA STATISTICS

TABLE 6 LIST OF IMPORTERS FOR PRODUCTS: 880211 HELICOPTERS OF AN UNLADEN WEIGHT <= 2000 KG (NOTE: DRONES ARE ASSUMED TO BE A PART THIS HS CODE, SINCE THERE IS NO TRADE DATA RELATED TO DRONE SERVICES MARKET)

TABLE 7 LIST OF EXPORTERS FOR PRODUCTS: 880211 HELICOPTERS OF AN UNLADEN WEIGHT <= 2000 KG ((NOTE: DRONES ARE ASSUMED TO BE A PART THIS HS CODE, SINCE THERE IS NO TRADE DATA RELATED TO DRONE SERVICES MARKET)

5.11 TARIFF AND REGULATORY LANDSCAPE

TABLE 8 HSN CODE AND GST RATE FOR AIRCRAFT AND UAV DRONES – HSN CHAPTER 88

TABLE 9 DUTY RATES ACCORDING TO 2019 RATES FOR DRONES AND THEIR ACCESSORIES IN NORTH AMERICA

TABLE 10 DRONE REGULATIONS AND APPROVALS FOR COMMERCIAL SECTOR: BY COUNTRY

5.11.1 GUIDELINES BY FEDERAL AVIATION ADMINISTRATION FOR DRONE OPERATIONS

TABLE 11 US: RULES AND GUIDELINES BY FAA FOR OPERATION OF DRONES

6 INDUSTRY TRENDS (Page No. - 83)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 ADVANCEMENTS IN DRONE DATA

6.2.2 ARTIFICIAL INTELLIGENCE INCORPORATED DRONES

6.2.3 3D-PRINTED DRONES

6.2.4 ADVANCEMENTS IN LIDAR TECHNOLOGY AND DRONE PAYLOAD

6.2.5 SWARM DRONES

6.2.6 WIRELESS CHARGING

6.2.7 AUTOMATED DRONES

6.2.8 DRONE INSURANCE

TABLE 12 INSURANCE COVERAGE OFFERED

TABLE 13 FIVE COMPANIES PROVIDING DRONE INSURANCE

6.3 TECHNOLOGY ANALYSIS

6.3.1 HYDROGEN POWER

6.3.2 UPGRADATION IN DRONE TRACKING AND NAVIGATION

6.3.3 IMPROVED COMPUTER VISION AND MOTION PLANNING

6.3.4 UPGRADATION IN DRONE NOISE

6.4 CASE STUDY ANALYSIS FOR DRONE SERVICES MARKET

6.4.1 CASE STUDY ANALYSIS OF DRONE SERVICES FOR OIL & GAS INDUSTRY

6.4.2 CASE STUDY ANALYSIS OF DRONE SERVICES IN SURVEYING

6.4.3 CASE STUDY ANALYSIS OF DRONE SERVICES IN UTILITIES

6.4.4 CASE STUDY ANALYSIS OF DRONE SERVICES IN AGRICULTURE SECTOR

6.4.5 CASE STUDY ANALYSIS OF DRONE SERVICES IN URBAN PLANNING

6.4.6 CASE STUDY ANALYSIS OF DRONE SERVICES IN PACKAGE DELIVERY

6.5 IMPACT OF MEGATRENDS

6.5.1 GREEN INITIATIVE

6.5.2 INTERNET OF THINGS (IOT)

6.5.3 RAPID URBANIZATION

FIGURE 26 NDT-UAV APPLICATIONS IN BRIDGE CONDITION MONITORING

6.6 INNOVATIONS & PATENT REGISTRATIONS

TABLE 14 INNOVATIONS & PATENT REGISTRATIONS, 2015–2021

7 DRONE SERVICES MARKET, BY TYPE (Page No. - 94)

7.1 TYPE

TABLE 15 DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 16 DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

FIGURE 27 PLATFORM SEGMENT TO LEAD DRONE SERVICES MARKET DURING FORECAST PERIOD

7.1.1 PLATFORM

7.1.1.1 Growing need for high-quality data and analytics to drive growth of segment

TABLE 17 DRONE SERVICES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 18 DRONE SERVICES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

7.1.1.2 Piloting & operations

7.1.2 MAINTENANCE, REPAIR, AND OVERHAUL (MRO)

7.1.2.1 Growing need for maximizing operational efficiency to drive market growth

7.1.3 SIMULATION & TRAINING

7.1.3.1 Growing need for certified drone pilots to drive market growth

8 DRONE SERVICES MARKET, BY APPLICATION (Page No. - 100)

8.1 INTRODUCTION

FIGURE 28 TRANSPORT & DELIVERY SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 19 DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 20 DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.1.1 INSPECTION & MONITORING

8.1.1.1 Rising demand for inspection & monitoring in growing economies to boost market growth

8.1.2 MAPPING & SURVEYING

8.1.2.1 Cost-effective benefits of drone services to boost market growth

8.1.3 SPRAYING & SEEDING

8.1.3.1 Rising focus on cost-effective agricultural management to boost market growth

8.1.4 FILMING & PHOTOGRAPHY

8.1.4.1 Reasonable prices of drone-based filming and photography services to boost market growth

8.1.5 TRANSPORT & DELIVERY

8.1.5.1 Growing demand for fast delivery of products and need for a hassle-free travel experience to boost market growth

8.1.6 SECURITY, SEARCH, & RESCUE

8.1.6.1 Efficiency of drones in data collection and to navigate through inaccessible areas to boost market growth

9 DRONE SERVICES MARKET, BY INDUSTRY (Page No. - 106)

9.1 INTRODUCTION

FIGURE 29 CONSTRUCTION & INFRASTRUCTURE SEGMENT TO LEAD DRONE SERVICES MARKET DURING FORECAST PERIOD

TABLE 21 DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 22 DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

9.2 CONSTRUCTION & INFRASTRUCTURE

9.2.1 GROWING DEMAND FOR DRONES IN ASSESSMENT OF BRIDGES AND RAILWAYS TO DRIVE MARKET GROWTH

9.3 AGRICULTURE

9.3.1 USAGE OF MULTISPECTRAL AND INFRARED CAMERAS FOR HEALTH ASSESSMENT OF CROPS AND SOIL MONITORING TO FUEL MARKET GROWTH

9.4 UTILITY

9.4.1 INCREASING DEPLOYMENT OF DRONES IN UTILITIES FOR INSPECTING AND SURVEYING TOWERS, POWER TRANSMISSION LINES, AND WIND TURBINES TO DRIVE MARKET GROWTH

9.5 OIL & GAS

9.5.1 RISING OFFSHORE OIL AND GAS ACTIVITIES TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

9.6 MINING

9.6.1 COST-EFFECTIVE, QUICK, AND HIGH-QUALITY ORTHOIMAGES CAPTURED WITH DRONES TO FUEL THEIR DEMAND IN MINING INDUSTRY

9.7 DEFENSE & LAW ENFORCEMENT

9.7.1 GROWING USE OF DRONES IN SEARCH AND RESCUE OPERATIONS TO DRIVE MARKET GROWTH

9.8 MEDIA & ENTERTAINMENT

9.8.1 SURGE IN USAGE OF DRONES BY MEDIA AND PRODUCTION HOUSES FOR MAINSTREAM FILMMAKING TO DRIVE MARKET GROWTH

9.9 INSURANCE

9.9.1 RISING COMPETITION AMONG INSURANCE PROVIDERS AND GROWING NEED FOR EFFECTIVE POLICY UNDERWRITING TO BOOST ADOPTION OF DRONES IN INSURANCE INDUSTRY

9.10 AVIATION

9.10.1 GROWING USAGE OF DRONES FOR AIRCRAFT INSPECTION TO DRIVE MARKET GROWTH

9.11 MARINE

9.11.1 REDUCTION IN INSPECTION TIME AND COSTS TO DRIVE GROWTH OF DRONE SERVICES MARKET FOR MARINE INDUSTRY

9.12 HEALTHCARE & SOCIAL ASSISTANCE

9.12.1 GROWING DEMAND FOR FASTER DELIVERIES IN HEALTHCARE INDUSTRY TO DRIVE MARKET GROWTH

9.13 TRANSPORT, LOGISTICS, & WAREHOUSING

9.13.1 EASY APPROVAL FOR INDOOR DRONES AND INCREASED DEMAND IN WAREHOUSING TO FUEL MARKET GROWTH

10 DRONE SERVICES MARKET, BY SOLUTION (Page No. - 114)

10.1 INTRODUCTION

FIGURE 30 POINT SOLUTION SEGMENT TO DOMINATE DRONE SERVICES MARKET DURING FORECAST PERIOD

TABLE 23 DRONE SERVICES MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 24 DRONE SERVICES MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

10.2 END-TO-END

10.2.1 INCREASING DEMAND FOR END-TO-END DRONE SERVICES FROM ENTERPRISES TO DRIVE MARKET GROWTH

10.3 POINT

10.3.1 GROWING DEMAND FOR CUSTOMIZED SERVICES FOR INDUSTRY-SPECIFIC APPLICATIONS TO FUEL MARKET GROWTH

11 REGIONAL ANALYSIS (Page No. - 117)

11.1 INTRODUCTION

11.2 IMPACT OF COVID-19 ON DRONE SERVICES MARKET

TABLE 25 DRONE SERVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 26 DRONE SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

11.3 NORTH AMERICA

11.3.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 31 NORTH AMERICA: DRONE SERVICES MARKET SNAPSHOT

TABLE 27 NORTH AMERICA: DRONE SERVICES MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 28 NORTH AMERICA: DRONE SERVICES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 29 NORTH AMERICA: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 30 NORTH AMERICA: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 32 NORTH AMERICA: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 34 NORTH AMERICA: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.3.2 US

11.3.2.1 Growing demand for package delivery due to COVID-19 crisis to drive market growth

TABLE 35 US: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 36 US: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 37 US: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 38 US: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 39 US: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 40 US: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.3.3 CANADA

11.3.3.1 Growing demand for inspection & monitoring services to drive market growth

TABLE 41 CANADA: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 42 CANADA: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 43 CANADA: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 44 CANADA: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 45 CANADA: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 46 CANADA: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.4 EUROPE

11.4.1 PESTLE ANALYSIS: EUROPE

TABLE 47 EUROPE: DRONE SERVICES MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 48 EUROPE: DRONE SERVICES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 49 EUROPE: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 50 EUROPE: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 51 EUROPE: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 52 EUROPE: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 53 EUROPE: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 54 EUROPE: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.4.2 UK

11.4.2.1 Cost-saving benefit of drone services to drive market growth

TABLE 55 UK: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 56 UK: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 57 UK: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 58 UK: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 59 UK: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 60 UK : DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.4.3 FRANCE

11.4.3.1 Favorable government policies to drive market growth

TABLE 61 FRANCE: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 62 FRANCE: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 63 FRANCE: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 64 FRANCE: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 65 FRANCE: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 66 FRANCE: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.4.4 GERMANY

11.4.4.1 Government-led support for drone-based services to drive market growth

TABLE 67 GERMANY: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 68 GERMANY: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 69 GERMANY: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 70 GERMANY: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 71 GERMANY: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 72 GERMANY: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.4.5 RUSSIA

11.4.5.1 Expanding oil& gas and mineral sectors to create growth opportunities for market

TABLE 73 RUSSIA: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 74 RUSSIA: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 75 RUSSIA: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 76 RUSSIA: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 77 RUSSIA: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 78 RUSSIA: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.4.6 ITALY

11.4.6.1 Demand for COVID-19 relief to drive the market

TABLE 79 ITALY: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 80 ITALY: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 81 ITALY: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 82 ITALY: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 83 ITALY: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 84 ITALY: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.4.7 SWEDEN

11.4.7.1 Growing adoption of drone services in healthcare industry to drive market growth

TABLE 85 SWEDEN: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 86 SWEDEN: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 87 SWEDEN: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 88 SWEDEN: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 89 SWEDEN: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 90 SWEDEN: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.4.8 REST OF EUROPE

TABLE 91 REST OF EUROPE: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 92 REST OF EUROPE: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 93 REST OF EUROPE: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 94 REST OF EUROPE: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 95 REST OF EUROPE: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 96 REST OF EUROPE: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.5 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC DRONE SERVICES MARKET SNAPSHOT

TABLE 97 ASIA PACIFIC: DRONE SERVICES MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 98 ASIA PACIFIC: DRONE SERVICES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 99 ASIA PACIFIC: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 100 ASIA PACIFIC: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 101 ASIA PACIFIC: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 102 ASIA PACIFIC: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 103 ASIA PACIFIC: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 104 ASIA PACIFIC: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.5.1 CHINA

11.5.1.1 Increasing demand of commercial and consumer drones to drive market

TABLE 105 CHINA: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 106 CHINA: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 107 CHINA: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 108 CHINA: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 109 CHINA: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 110 CHINA: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.5.2 INDIA

11.5.2.1 Growing demand for drone services for agriculture to drive market

TABLE 111 INDIA: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 112 INDIA: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 113 INDIA: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 114 INDIA: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 115 INDIA: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 116 INDIA: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.5.3 JAPAN

11.5.3.1 Growing demand for drone services in agriculture, inspection, and entertainment to drive market

TABLE 117 JAPAN: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 118 JAPAN: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 119 JAPAN: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 120 JAPAN: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 121 JAPAN: MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 122 JAPAN: MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.5.4 AUSTRALIA

11.5.4.1 Easing of rules for commercial drones to drive market

TABLE 123 AUSTRALIA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 124 AUSTRALIA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 125 AUSTRALIA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 126 AUSTRALIA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 127 AUSTRALIA: MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 128 AUSTRALIA: MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.5.5 SOUTH KOREA

11.5.5.1 Growing demand for remote location delivery services to drive market

TABLE 129 SOUTH KOREA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 130 SOUTH KOREA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 131 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 132 SOUTH KOREA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 133 SOUTH KOREA: MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 134 SOUTH KOREA: MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.5.6 REST OF APAC

11.5.6.1 Growing demand for package delivery services to boost market

TABLE 135 REST OF APAC: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 136 REST OF APAC: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 137 REST OF APAC: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 138 REST OF APAC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 139 REST OF APAC: MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 140 REST OF APAC: MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.6 MIDDLE EAST

FIGURE 34 MIDDLE EAST MARKET SNAPSHOT

11.6.1 PESTLE ANALYSIS: MIDDLE EAST

TABLE 141 MIDDLE EAST: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 142 MIDDLE EAST: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 143 MIDDLE EAST: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 144 MIDDLE EAST: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 145 MIDDLE EAST: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 146 MIDDLE EAST: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 147 MIDDLE EAST: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 148 MIDDLE EAST: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.6.2 TURKEY

11.6.2.1 Growing demand for drone services across various business verticals to boost market growth

TABLE 149 TURKEY: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 150 TURKEY: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 151 TURKEY: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 152 TURKEY: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 153 TURKEY: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 154 TURKEY: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.6.3 UAE

11.6.3.1 Progressive development and implementation of regulations in Dubai to drive market

TABLE 155 UAE: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 156 UAE: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 157 UAE: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 158 UAE: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 159 UAE: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 160 UAE: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.6.4 ISRAEL

11.6.4.1 Ongoing drone innovations in the country to drive market

TABLE 161 ISRAEL: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 162 ISRAEL: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 163 ISRAEL: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 164 ISRAEL: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 165 ISRAEL: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 166 ISRAEL: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.6.5 REST OF MIDDLE EAST

11.6.5.1 Ease of drone regulations in several countries to drive market

TABLE 167 REST OF MIDDLE EAST: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 168 REST OF MIDDLE EAST: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 169 REST OF MIDDLE EAST: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 170 REST OF MIDDLE EAST: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 171 REST OF MIDDLE EAST: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 172 REST OF MIDDLE EAST: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.7 REST OF THE WORLD (ROW)

11.7.1 PESTLE ANALYSIS: REST OF THE WORLD (ROW)

TABLE 173 REST OF THE WORLD: DRONE SERVICES MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 174 REST OF THE WORLD: DRONE SERVICES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 175 REST OF THE WORLD: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 176 REST OF THE WORLD: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 177 REST OF THE WORLD: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 178 REST OF THE WORLD: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 179 REST OF THE WORLD: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 180 REST OF THE WORLD: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.7.2 AFRICA

11.7.2.1 Growing demand for drone services for various applications to drive market

TABLE 181 AFRICA: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 182 AFRICA: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 183 AFRICA: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 184 AFRICA: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 185 AFRICA: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 186 AFRICA: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.7.3 LATIN AMERICA

11.7.3.1 Increasing applicability of drones in defense and commercial sectors to drive market

TABLE 187 LATIN AMERICA: DRONE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 188 LATIN AMERICA: DRONE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 189 LATIN AMERICA: DRONE SERVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 190 LATIN AMERICA: DRONE SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 191 LATIN AMERICA: DRONE SERVICES MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 192 LATIN AMERICA: DRONE SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 202)

12.1 INTRODUCTION

12.2 RANKING OF LEADING PLAYERS, 2020

12.3 KEY PLAYERS IN DRONE SERVICES MARKET

FIGURE 35 RANKING OF KEY PLAYERS IN DRONE SERVICES MARKET, 2020

12.3.1 WINNING IMPERATIVES BY KEY PLAYERS

12.4 COMPETITIVE LEADERSHIP MAPPING

12.4.1 STAR

12.4.2 EMERGING LEADER

12.4.3 PERVASIVE

12.4.4 PARTICIPANT

FIGURE 36 DRONE SERVICES MARKET COMPETITIVE LEADERSHIP MAPPING, 2020

12.5 DRONE SERVICES MARKET COMPETITIVE LEADERSHIP MAPPING (START-UPS)

FIGURE 37 DRONE SERVICES MARKET (START-UPS) COMPETITIVE LEADERSHIP MAPPING, 2020

12.6 COMPETITIVE BENCHMARKING

TABLE 193 COMPANY PRODUCT FOOTPRINT

TABLE 194 COMPANY BY TYPE OF DRONE SERVICE FOOTPRINT

TABLE 195 COMPANY INDUSTRY FOOTPRINT

TABLE 196 COMPANY REGIONAL FOOTPRINT

12.7 COMPETITIVE SCENARIO

12.7.1 NEW PRODUCT LAUNCHES

TABLE 197 DRONE SERVICES MARKET, NEW PRODUCT LAUNCHES, JANUARY 2018–AUGUST 2021

TABLE 198 DRONE SERVICES MARKET, DEALS, JANUARY 2018–AUGUST 2021

TABLE 199 DRONE SERVICES MARKET, OTHERS, JANUARY 2018? AUGUST 2021

13 COMPANY PROFILES (Page No. - 224)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 INTRODUCTION

13.2 KEY PLAYERS

13.2.1 EDALL SYSTEMS

TABLE 200 EDALL SYSTEMS: BUSINESS OVERVIEW

TABLE 201 EDALL SYSTEMS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 202 EDALL SYSTEMS: PRODUCT LAUNCHES

13.2.2 PRECISIONHAWK

TABLE 203 PRECISION HAWK: BUSINESS OVERVIEW

TABLE 204 PRECISIONHAWK: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 205 PRECISIONHAWK: DEALS

TABLE 206 PRECISIONHAWK: OTHERS

13.2.3 CYBERHAWK

TABLE 207 CYBERHAWK: BUSINESS OVERVIEW

TABLE 208 CYBERHAWK: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 209 CYBERHAWK: DEALS

13.2.4 VERMEER

TABLE 210 VERMEER: BUSINESS OVERVIEW

TABLE 211 VERMEER: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 212 VERMEER: PRODUCT LAUNCHES

13.2.5 AGEAGLE AERIAL SYSTEMS

TABLE 213 AGEAGLE AERIAL SYSTEMS: BUSINESS OVERVIEW

FIGURE 38 AGEAGLE AERIAL SYSTEMS: COMPANY SNAPSHOT

TABLE 214 AGEAGLE AERIAL SYSTEMS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 215 AGEAGLE AERIAL SYSTEMS: DEALS

13.2.6 SKY-FUTURES LTD.

TABLE 216 SKY-FUTURES LTD: BUSINESS OVERVIEW

TABLE 217 SKY-FUTURES LTD.: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 218 SKY-FUTURES LTD: DEALS

13.2.7 SENSEFLY LTD.

TABLE 219 SENSEFLY LTD.: BUSINESS OVERVIEW

TABLE 220 SENSEFLY LTD.: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 221 SENSEFLY LTD.: DEALS

TABLE 222 SENSEFLY LTD.: PRODUCT LAUNCHES

13.2.8 SHARPER SHAPE INC.

TABLE 223 SHARPER SHAPE INC.: BUSINESS OVERVIEW

TABLE 224 SHARPER SHAPE INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 225 SHARPER SHAPE INC.: DEALS

13.2.9 DRONEDEPLOY INC.

TABLE 226 DRONEDEPLOY INC.: BUSINESS OVERVIEW

TABLE 227 DRONEDEPLOY INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 228 DRONEDEPLOY INC.: DEALS

13.2.10 INDENTFIED TECHNOLOGIES

TABLE 229 IDENTIFIED TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 230 IDENTIFIED TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 231 IDENTIFIED TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 232 IDENTIFIED TECHNOLOGIES : DEALS

13.2.11 TERRA DRONE CORPORATION

TABLE 233 TERRA DRONE CORPORATION: BUSINESS OVERVIEW

TABLE 234 TERRA DRONE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 235 TERRA DRONE CORPORATION: DEALS

TABLE 236 TERRA DRONE CORPORATION: OTHERS

13.2.12 THE SKY GUYS

TABLE 237 THE SKY GUYS: BUSINESS OVERVIEW

TABLE 238 THE SKY GUYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 239 THE SKY GUYS: DEALS

13.2.13 DEVERON UAS CORP.

TABLE 240 DEVERON UAS CORP.: BUSINESS OVERVIEW

FIGURE 39 DEVERON UAS CORP.: COMPANY SNAPSHOT

TABLE 241 DEVERON UAS CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 242 DEVERON UAS CORP.: DEALS

13.2.14 ZIPLINE

TABLE 243 ZIPLINE : BUSINESS OVERVIEW

TABLE 244 ZIPLINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 245 ZIPLINE: DEALS

TABLE 246 ZIPLINE: OTHERS

13.2.15 MATTERNET, INC.

TABLE 247 MATTERNET, INC.: BUSINESS OVERVIEW

TABLE 248 MATTERNET, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 249 MATTERNET, INC.: PRODUCT LAUNCHES

TABLE 250 MATTERNET, INC.: DEALS

TABLE 251 MATTERNET, INC.: OTHERS

13.2.16 AERODYNE GROUP

TABLE 252 AERODYNE GROUP: BUSINESS OVERVIEW

TABLE 253 AERODYNE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 254 AERODYNE GROUP: DEALS

TABLE 255 AERODYNE GROUP: OTHERS

13.2.17 FILRTEY

TABLE 256 FLIRTEY : BUSINESS OVERVIEW

TABLE 257 FLIRTEY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 258 FLIRTEY: PRODUCT LAUNCHES

TABLE 259 FLIRTEY: DEALS

TABLE 260 FLIRTEY: OTHERS

13.2.18 DRONEBASE

TABLE 261 DRONEBASE: BUSINESS OVERVIEW

TABLE 262 DRONEBASE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 263 DRONEBASE: DEALS

TABLE 264 DRONEBASE: OTHERS

13.2.19 DRONEGENUITY

TABLE 265 DRONEGENUITY: BUSINESS OVERVIEW

TABLE 266 DRONEGENUITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 267 DRONEGENUITY: OTHERS

13.2.20 MISTRAS GROUP INC.

TABLE 268 MISTRAS GROUP: BUSINESS OVERVIEW

FIGURE 40 MISTRAS GROUP: COMPANY SNAPSHOT

TABLE 269 MISTRAS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.21 AEROVIRONMENT

TABLE 270 AEROVIRONMENT: BUSINESS OVERVIEW

FIGURE 41 AEROVIRONMENT: COMPANY SNAPSHOT

TABLE 271 AEROVIRONMENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.22 HEMAV

TABLE 272 HEMAV: BUSINESS OVERVIEW

TABLE 273 HEMAV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.23 SKYCATCH

TABLE 274 SKYCATCH: BUSINESS OVERVIEW

TABLE 275 SKYCATCH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 276 SKYCATCH: DEALS

13.2.24 AUSTRALIAN UAV PTY LTD. (AUAV)

TABLE 277 AUSTRALIAN UAV PTY LTD. (AUAV): BUSINESS OVERVIEW

TABLE 278 AUSTRALIAN UAV PTY LTD. (AUAV): PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 279 AUSTRALIAN UAV PTY LTD. (AUAV): OTHERS

13.2.25 SKYSPECS

TABLE 280 SKYSPECS : BUSINESS OVERVIEW

TABLE 281 SKYSPECS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 282 SKYSPECS: OTHERS

13.2.26 ARCH AERIAL LLC

TABLE 283 ARCH AERIAL LLC: BUSINESS OVERVIEW

TABLE 284 ARCH AERIAL LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 285 ARCH AERIAL LLC: DEALS

TABLE 286 ARCH AERIAL LLC: OTHERS

13.3 OTHER PLAYERS

13.3.1 UNMANNED EXPERTS INC. (UMEX)

13.3.2 VIPER DRONES

13.3.3 RAPTOR MAPS

13.3.4 GARUDA UAV

13.3.5 MAVERICK INSPECTION SERVICES

13.3.6 CANADIAN UAV SOLUTIONS

13.3.7 DJM AERIAL SOLUTIONS

13.3.8 RELIABILITY MAINTENANCE SOLUTIONS LTD.

13.3.9 DRONEFLIGHT

13.3.10 FLYTREX

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 294)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

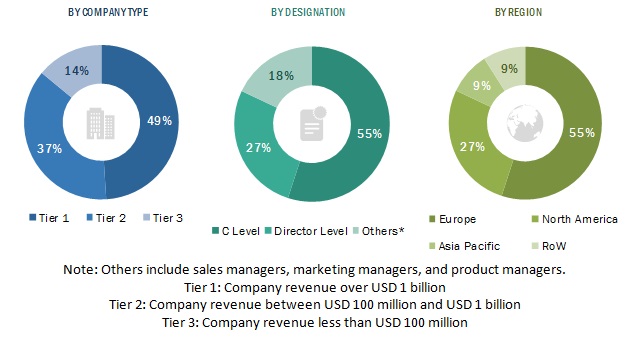

The research study conducted on the drone services market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, ITC Trade data and Factiva to identify and collect information relevant to the drone services market. The primary sources considered included industry experts from the drone services market as well as sub-component manufacturers, drone services raw material suppliers, government agencies, technology vendors, system integrators, research organizations, and original equipment manufacturers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives, have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the drone services market as well as to assess the growth prospects of the market. Sources from the supply side included various industry experts, such as chief X officers (CXOs), vice presidents (VPs), and directors from business development, marketing, and product development/innovation teams; related key executives from Edall Systems, PrecisionHawk, senseFly Ltd., and DroneDeploy Inc.; independent consultants; importers; distributors of drones; and key opinion leaders.

Secondary Research

Secondary sources referred for this research study included the Single European Sky ATM Research (SESAR), Association for Unmanned Vehicle Systems International (AUVSI), World Drone Organization, and corporate filings such as annual reports, investor presentations, and financial statements of trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the market, which was validated by primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- The top-down and bottom-up approaches were used to estimate and validate the size of the drone services market. The research methodology used to estimate the market size also included the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by representatives in MarketsandMarkets, and presented in this report.

Market Size Estimation Methodology: Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the drone services market from the market size estimation process explained above, the total market was split into several segments and subsegments.

Report Objectives

- To define, describe, segment, and forecast the size of the drone services market based on service, application, industry, solution, and region

- To forecast the size of different segments of the market with respect to five key regions, namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (RoW), along with their key country-level markets

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify technology trends currently prevailing in the market

- To provide an overview of the tariff and regulatory landscape with respect to drone services across different regions

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for the stakeholders by identifying key market trends

- To analyze the impact of the COVID-19 pandemic on the market and its stakeholders

- To profile the leading market players and comprehensively analyze their market share and core competencies2

- To analyze the degree of competition in the market by identifying key growth strategies, such as product launches, collaborations & expansions, contracts, partnerships, and agreements, adopted by the leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the drone services market, along with the ranking analysis, market share analysis, and revenue analysis of the key players

Micromarkets are referred to as the segments and subsegments of the drone services market considered in the scope of the report.

Core competencies of companies were captured in terms of their key developments and key strategies adopted to sustain their positions in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Drone Services Market

We are a survey company using drones for 3D mapping, we are aiming to start providing the local market with drone solutions for infrastructure, industrial inspection. We are studying the market.

We are trying to determine whether to continue in the UAS market given the volatility with insurance carriers.

We are a drone company addressing the unique needs of the worlds most complex industrial environments. While we already work in film and television, we want to expand in the oil and gas, and medical supply delivery. Starting with the oil and gas, our plan is to build autonomous platforms for surveillance and inspections. We need to create financial projections for costs and revenues. Please contact us to discuss further. Thank you

Does this report contain the following: Global Market Size and Growth Prospects (along with focus on Canada, the US, Europe, and Latin America), Value Chain Analysis, Regulatory Framework/Compliance (along with focus on Canada, US, Europe, and Latin America), Key Market Opportunities, Market Barriers, Industry Analysis & Outlook (global and regional), Market Driver Analysis, and Competitive Landscape (market leaders and analysis)

What is the current Australian market potential for the following: drone surveying, photogrammetry, robotic process automation consulting and development, business analytics consulting, and data analytics consulting.

We need to raise money for our startup. We need to know what is going on in the industry so that can convince investors that investing in us is a good bet.