Edge AI Software Market by Component (Solution and Services), Data Source (Video & Image Recognition, Mobile Data), Organization Size, Vertical (Energy & Utilities, Manufacturing, Healthcare & Life Sciences) and Region - Global Forecast to 2027

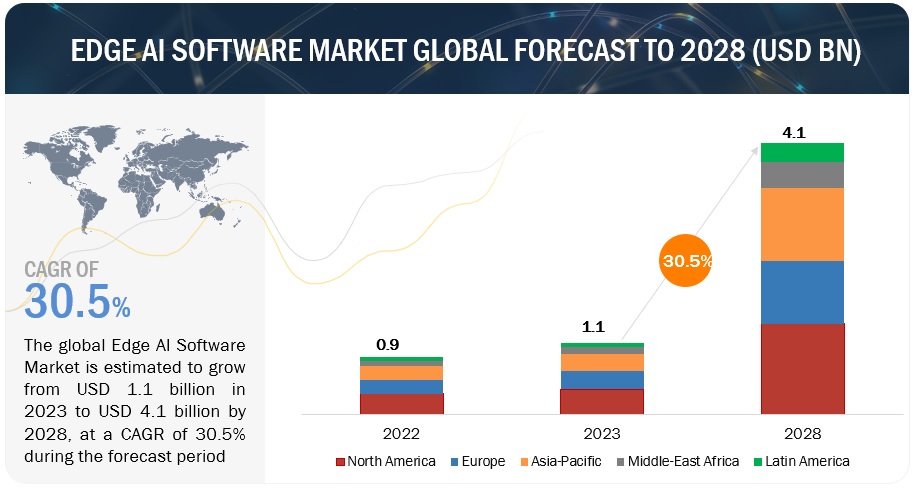

[287 Pages Report] The edge AI software market size, is projected to grow from USD 0.8 billion in 2022 to USD 3.1 billion by 2027, at a compound annual growth rate (CAGR) of 28.9% during the forecast period. Edge AI through the amalgamation of artificial intelligence and edge Computing will pave way for the future of efficient service delivery via collection and analysis of real-time data for business decision making. Edge AI software will witness growing traction across emerging use cases such as autonomous driving, smart metering, preditive maintenance, video surveillance, smart cities, etc, thereby enabling edge devices to provide insights and predictive analysis in real time for localized decision-making.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Ever-increasing enterprise workloads on cloud; rapid growth in intelligent applications

With the rapid adoption of cloud technology, cloud workloads are set to increase as the generated data is moved to the cloud daily. Edge AI software solutions enable organizations to store and access data that needs a real-time response and is required for a limited time on the edge nodes and devices. AI is witnessing significant growth with the emergence of numerous applications in different verticals. These applications require massive computing power for performing activities, such as capturing and processing data in real-time, to provide efficient and actionable results. AI applications, when running on cloud technology, face latency issues and result in difficulties in offering quick responses. Edge AI software places computing resources at the edge of the network, enabling applications to function with low latency and high bandwidth.

Restraints: Privacy and security concerns related to edge AI solutions

Developing, managing, and implementing AI systems require skilled personnel. One dealing with AI systems should also be aware of technologies such as cognitive computing, ML, deep learning, and image recognition. In addition, integrating AI solutions with existing systems is a difficult task, which requires extensive data processing. Even minute errors can result in a system failure or malfunction, which can affect the outcome of a process. Professional data scientists and developers are required to customize an existing ML-enabled AI service.

Edge AI devices and applications are at a risk of security threats such as data breaches, attacks and privacy disclosures. As most of the data is stored and processed on the cloud, including sensitive information, such systems are highly exposed to cyberattackers and hackers resulting in a questionable data security aspect involved. Owing to this factor, edge AI devices are also susceptible to other risks, such as viruses and malware, insider threats, and denial of service attacks. Another major risk associated is with the adversarial attacks where a disruption in the input to an AI system can result in an incorrect decision making or generation of a false result. Such attacks have dire consequences in use cases such as autonomous driving.

Opportunity: Emergence of 5G network to bring IT and telecom together

The success rate of Edge AI will hinge on the foundation of real-time data computation at a network connection level. In this regard, 5G is expected to emerge as a strong technology enabler in terms of achieving ultra-low latency across edge devices such as drones, telesurgery devices, self-driving vehicles, IoT gateways etc. The rollout and adoption of 5G will result in the proliferation of next generation of edge devices that would transform the workload and productivity across different industries. The convergence of 5G and Edge AI is expected to drive exciting use cases around autonomous driving, smart metering, remote patient monitoring and robot-assisted surgery, smart farming, etc with the list of use cases being endless, thus enabling smart devices to provide insights and predictive analysis in real time for localized decision-making

Challenge: Interoperability issues slowing adoption of edge AI software

Interoperability refers to the ability of a device or node to interact with other devices or nodes without any special integration efforts. Today, edge AI devices exist in isolation, making it difficult to realize an interconnected environment without device interoperability. This is a key challenge in the edge AI software market. Software providers must focus on ensuring technical compatibility with different network architectures to resolve this issue. In the manufacturing industry, software vendors should consider dimensions such as vertical integration (factory-internal integration starting from sensors and actuators up to Enterprise Resource Planning [ERP] systems), horizontal integration (business-level integration of production networks), and integration of engineering and product lifecycle applications. This would ensure easy knowledge sharing and synchronization between solution development and manufacturing ecosystems.

Solutions segment to account for larger market size during the forecast period

The edge AI software market has been divided into solutions and services based on components. Edge AI software solutions assist businesses in automating operational tasks, increasing efficiency, and lowering costs. Edge AI software solutions include integrated and standalone solutions, while services include training & consulting, system integration & testing, and support & maintenance. Edge AI is a combination of Edge computing and AI that is used to automate major decision-based, end-to-end business processes that require human intervention to complete. As firms use Edge AI software-based solutions to mechanize various workflow processes, these solutions are seeing a higher acceptance rate than services. This chapter thoroughly discusses the solutions and services segment’s market size.

Mobile data segment to register highest CAGR during the forecast period

Computing is increasingly omnipresent in all aspects of life, which adds additional functions to phones, tablets, and wearable devices. Computing requirements for mobile applications are increasing rapidly to meet the need for computational-extensive applications of mobile users, such as virtual reality and real-time online gaming. Mobile edge computing (MEC) is a promising solution to avail adequate computing and storage capabilities near mobile users. The main target of previous generations’ wireless networks was to provide adequate wireless speeds to make the transition from voice-centric to multimedia-centric viable. The mission of 5G networks is quite different and much more complex, namely, to uphold communications, computing, control and content delivery. In 5G wireless networks, ultra-dense edge devices, such as wireless access points and small-cell base stations, are deployed, each providing computation and storage capabilities at the network edge.

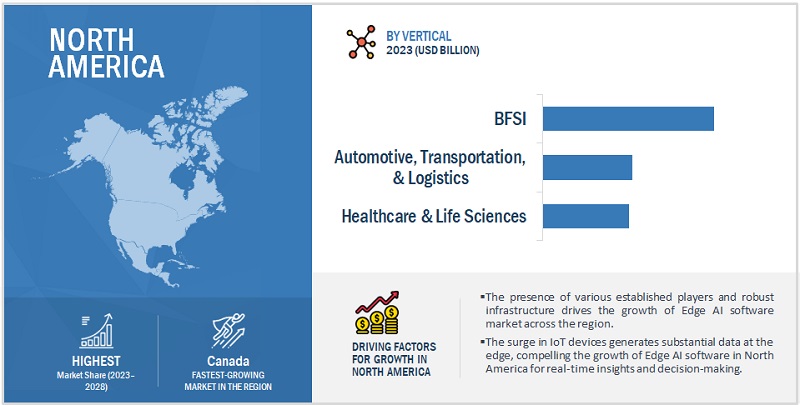

North America to have the largest market size during the forecast period

North America is one of the largest adopters among all the regions of edge AI software. The top countries contributing to the growth of the edge AI software market include the US and Canada. Organizations in this region, especially the US, have leveraged the benefits of AI, ML, and deep learning technologies to stay ahead in the market. The market is majorly driven by factors such as advancements in AI-powered Internet of Things (IoT) for intelligent systems and smart applications and the use of edge AI computing in the 5G network, which enables better data control, reduced costs, quick insights, and continuous operation. The region has well-established economies, which enable edge AI software vendors to invest in new technologies. Furthermore, it is regarded as the center of innovation where major IT players are rolling out intelligent devices and collaborating with other companies in the edge AI software market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Edge AI software and service providers have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships, and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the Edge AI Software market include Microsoft (US), IBM (US), Google (US), AWS (US), Nutanix (US), Synaptics (US), TIBCO (US), Octonion (Switzerland), Imagimob (Sweden), Anagog (Israel), Veea (US), Gorilla Technology (China), Foghorn Systems (Ireland), Azion (US), Bragi (Germany), Tact.ai (US), SixSq (Geneva), Clearblade (US), Alef Edge (US), Adapdix (US), byteLAKE (Poland), Reality AI (US), Deci (Israel), Edgeworx (US), Swim (US), Invision AI (Canada), Horizon Robotics (China), Kneron (US), and DeepBrainz (India).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

USD (Million/Billion) |

|

Segments covered |

Component, Data Source, Organization Size, Deployment Mode, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

|

Companies covered |

Microsoft (US), IBM (US), Google (US), AWS (US), Nutanix (US), Synaptics (US), TIBCO (US), Octonion (Switzerland), Imagimob (Sweden), Anagog (Israel), Veea (US), Gorilla Technology (China), Foghorn Systems (Ireland), Azion (US), Bragi (Germany), Tact.ai (US), SixSq (Geneva), Clearblade (US), Alef Edge (US), Adapdix (US), byteLAKE (Poland), Reality AI (US), Deci (Israel), Edgeworx (US), Swim (US), Invision AI (Canada), Horizon Robotics (China), Kneron (US), DeepBrainz (India) |

This research report categorizes the edge AI software market based on component, data source organization size, deployment mode, vertical, and region.

By Component:

- Solutions

- Services

By Data Source:

- Video & Image Recognition

- Iris & Facial Data

- Sensor Data

- Mobile Data

- Speech Recognition

By Organization Size:

- Large Enterprises

- SMEs

By Deployment Mode:

- On-premises

- Cloud

By Vertical:

- Government & Public Sector

- Manufacturing

- Healthcare & Life Sciences

- Energy & Utilities

- Telecom

- Media & Entertainment

- Transportation & Logistics

- Other Verticals (BFSI, Agriculture, and Retail & eCommerce)

By Region:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

- Asia Pacific

- India

- Japan

- China

- Singapore

- Rest of Asia Pacific

- Middle East & Africa

- United Arab Emirates

- Saudi Arabia

- South Africa

- Israel

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In May 2022, Microsoft and Meta extended the ongoing AI partnership, with Meta selecting Azure as “a strategic cloud provider” to accelerate its own AI research and development. Microsoft and Meta—when it was still known as Facebook—announced the ONNX (Open Neural Network Exchange) format in 2017 to enable developers to move deep-learning models between different AI frameworks. Microsoft open-sourced the ONNX Runtime, the inference engine for models in the ONNX format, in 2018. Meta officials have been using Azure to accelerate research & development across the Meta AI group. Meta plays to use a dedicated Azure cluster of 5400 GPUs using the latest virtual machine (VM) series in Azure.

- In July 2022, Web Werks, one of India’s leading independent data center providers, announced a strategic partnership with Nutanix (United States), a leader in hybrid multi-cloud computing, to further extend the benefits of the Web Werks cloud-ready platform to help enable businesses to speed up cloud adoption. The solution offered through ‘Web Werks VMX (Virtual Machine for Nutanix)’ will bridge the gap between public and hybrid cloud, focus on software add-ons, build the marketplace, and ultimately create a unique ecosystem and subscription model for cloud consumption.

- Nutanix, a leader in hybrid multicloud computing, announced the global availability of the simplified product portfolio to align with rapidly evolving customer requirements. The Nutanix Cloud Platform delivers a consistent operating model across all types of clouds: public, private, and hybrid. With this launch, the company has further streamlined customers’ digital transformations by delivering an easy-to-consume set of solutions.

- Gorilla Technology, in July 2022, announced that it has signed a distributor agreement with SUNTEL. Through this agreement, Gorilla aims to increase its foothold in the Japanese market with SUNTEL’s strong sales and support system. Gorilla is a Taiwanese company that develops and sells edge AI video analytics and cybersecurity solutions, led by the award-winning video analytics software IVAR. The efficiency, cost performance, usability and support systems of IVAR are highly valued, and it has many installation records in airport and highway monitoring systems, mainly in Taiwan and Southeast Asia. Gorilla entered the Japanese market in 2020.

- Gorilla Technology, in May 2022, announced that it would further expand into the Japanese market by becoming a Technology Partner with Konica Minolta’s FORXAI. FORXAI is an imaging IoT platform that combines successful imaging technology with IoT and AI solutions by leveraging Konica Minolta’s proprietary image recognition technology. FORXAI’s software products are installed and operated on edge devices, edge servers, and the cloud for the sectors of agriculture, medicine, industrial operations, and over-the-counter marketing.

Frequently Asked Questions (FAQ):

What is Edge AI Software?

Edge AI software enables the aggregation, processing, computation, and analysis of data present near or on edge devices by leveraging Artificial Intelligence (AI) and Internet of Things (IoT) technologies. The software helps process data on edge nodes, even in remote and decentralized networks, without cloud connectivity. Integrating AI with IoT in edge devices helps enterprises to minimize latency, reduce bandwidth, lessen threats, avoid duplication, improve reliability, and maintain compliance.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Italy, and other countries in the European region.

Which are the key drivers supporting the growth of the Edge AI software market?

Some factors driving the growth of the edge AI software market are ever-increasing enterprise workloads on the cloud, rapid growth in the number of intelligent applications, and exponentially growing data volume and network traffic.

Who are the key vendors in the Edge AI Software market?

The key players in the Edge AI Software market include Microsoft (US), IBM (US), Google (US), AWS (US), Nutanix (US), Synaptics (US), TIBCO (US), Octonion (Switzerland), Imagimob (Sweden), Anagog (Israel), Veea (US), Gorilla Technology (China), Foghorn Systems (Ireland), Azion (US), Bragi (Germany), Tact.ai (US), SixSq (Geneva), Clearblade (US), Alef Edge (US), Adapdix (US), byteLAKE (Poland), Reality AI (US), Deci (Israel), Edgeworx (US), Swim (US), Invision AI (Canada), Horizon Robotics (China), Kneron (US), and DeepBrainz (India). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 1 EDGE AI SOFTWARE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF EDGE AI SOFTWARE MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF EDGE AI SOFTWARE VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - ILLUSTRATION OF COMPANY’S EDGE AI REVENUE ESTIMATION I

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - ILLUSTRATION OF COMPANY’S EDGE AI REVENUE ESTIMATION II

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF EDGE AI SOFTWARE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF EDGE AI SOFTWARE THROUGH OVERALL EDGE AI SOFTWARE SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 EVALUATION MATRIX METHODOLOGY FOR KEY PLAYERS

FIGURE 11 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 EVALUATION MATRIX METHODOLOGY FOR STARTUPS/SMES

FIGURE 12 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 RESEARCH ASSUMPTIONS

2.8 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 57)

TABLE 4 GLOBAL EDGE AI SOFTWARE MARKET SIZE AND GROWTH RATE, 2018–2021 (USD MILLION, Y-O-Y %)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y %)

FIGURE 13 SOLUTIONS SEGMENT TO DOMINATE MARKET IN 2022

FIGURE 14 INTEGRATED SOLUTIONS TO ACCOUNT FOR LARGER SHARE IN 2022

FIGURE 15 TRAINING & CONSULTING SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2022

FIGURE 16 VIDEO & IMAGE RECOGNITION SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2022

FIGURE 17 TRAFFIC MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2022

FIGURE 18 PREDICTIVE MAINTENANCE SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2022

FIGURE 19 SUPPLY CHAIN MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2022

FIGURE 20 ENERGY OPTIMIZATION SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2022

FIGURE 21 NETWORK MANAGEMENT & OPTIMIZATION SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2022

FIGURE 22 IN-HOSPITAL PATIENT MONITORING SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2022

FIGURE 23 VIDEO STREAMING SEGMENT TO CAPTURE LARGEST SHARE IN 2022

FIGURE 24 CUSTOMER ENGAGEMENT SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2022

FIGURE 25 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2022

FIGURE 26 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 27 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 64)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EDGE AI SOFTWARE MARKET

FIGURE 28 INCREASING ENTERPRISE WORKLOADS ON CLOUD AND RAPID GROWTH IN NUMBER OF INTELLIGENT APPLICATIONS TO DRIVE MARKET GROWTH

4.2 MARKET, BY DATA SOURCE

FIGURE 29 MOBILE DATA SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 NORTH AMERICA: MARKET, BY COMPONENT AND VERTICAL

FIGURE 30 SOLUTIONS AND ENERGY & UTILITIES SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE IN 2022

4.4 MARKET, BY REGION

FIGURE 31 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 66)

5.1 INTRODUCTION

5.2 EDGE AI SOFTWARE MARKET EVOLUTION

FIGURE 32 MARKET EVOLUTION

5.3 MARKET ARCHITECTURE

FIGURE 33 MARKET ARCHITECTURE

5.4 MARKET DYNAMICS

FIGURE 34 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.4.1 DRIVERS

5.4.1.1 Increasing enterprise workload on cloud

5.4.1.2 Rapid growth in number of intelligent applications

5.4.1.3 Exponential growth in data volume and network traffic

5.4.2 RESTRAINTS

5.4.2.1 Privacy and security concerns related to edge AI solutions

5.4.2.2 Lack of AI expertise

5.4.3 OPPORTUNITIES

5.4.3.1 5G network to bring IT and telecom together

5.4.3.2 Advent of autonomous vehicles coupled with connected car infrastructure

5.4.3.3 Rising need for edge computing in IoT

5.4.4 CHALLENGES

5.4.4.1 Interoperability issues to restrict adoption of edge AI software

5.4.4.2 Multiple standardizations and consortium activities

5.5 ECOSYSTEM ANALYSIS

FIGURE 35 ECOSYSTEM ANALYSIS

5.6 CASE STUDY ANALYSIS

5.6.1 HEALTHCARE AND LIFE SCIENCES

5.6.1.1 Case Study 1: HCA clinicians collaborated with Red Hat to build Sepsis Prediction and Optimization of Therapy (SPOT)

5.6.1.2 Case Study 2: Top robotic and digital surgery startups implemented NVIDIA Medical Edge AI Computing platform for medical edge AI use cases

5.6.2 GOVERNMENT AND PUBLIC SECTOR

5.6.2.1 Case Study 1: Taoyuan Airport’s smart city approach

5.6.3 MANUFACTURING

5.6.3.1 Case Study 1: Schindler optimized elevator performance with On-board Edge Computing

5.6.3.2 Case Study 2: Leading food manufacturer turned to TIBCO Spotfire Analytics to ensure complex data visibility

5.6.3.3 Case Study 3: Brembo implemented TIBCO Spotfire analytics to accelerate and improve business processes with analytics

5.6.4 TRANSPORTATION AND LOGISTICS

5.6.4.1 Case Study 1: JetBlue created integration platform using TIBCO

5.6.4.2 Case Study 2: Inovasense deployed Imagimob edge AI solutions to build audio classification applications in automotive industry

5.6.4.3 Case Study 3: TIER Mobility brought edge computing to its micro-mobility fleet on AWS IoT and Greengrass

5.6.5 ENERGY AND UTILITIES

5.6.5.1 Case Study 1: Texmark deployed SparkCognition to improve safety and prevent failure of critical assets

5.6.5.2 Case Study 2: Hub Power implemented IBM Maximo edge AI software to manage its critical assets and support its large asset database

5.6.6 TELECOM

5.6.6.1 Case Study 1: XL Axiata called on Fast Data to disrupt Telco Markets

5.6.6.2 Case Study 2: Algar Telecom defined KPI accuracy and improved decisions, quality, and productivity

5.6.7 OTHER VERTICALS

5.6.7.1 Case Study 1: Omelete created dozens of edge applications on Azion platform to accelerate content delivery and broadcast mega events

5.6.7.2 Case Study 2: Lojas Renner used edge applications to deliver a large volume of requests on Black Friday

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 36 SUPPLY CHAIN ANALYSIS

TABLE 6 SUPPLY CHAIN ANALYSIS

5.8 REGULATORY IMPLICATIONS

5.8.1 GENERAL DATA PROTECTION REGULATION

5.8.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.8.3 FEDERAL TRADE COMMISSION ACT OF 1914

5.8.4 FEDERAL COMMUNICATIONS COMMISSION (FCC)

5.8.5 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION AND INTERNATIONAL ELECTROTECHNICAL COMMISSION - ISO/IEC JTC 1/SC 42

5.8.6 AIRAWAT (AI RESEARCH, ANALYTICS, AND KNOWLEDGE ASSIMILATION)

5.9 PATENT ANALYSIS

5.9.1 METHODOLOGY

5.9.2 DOCUMENT TYPE

TABLE 7 PATENTS FILED, 2019–2022

5.9.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 37 NUMBER OF PATENTS GRANTED ANNUALLY, 2019–2022

5.9.4 TOP APPLICANTS

FIGURE 38 TOP 10 PATENT APPLICANTS, 2019–2022

5.10 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 8 DETAILED LIST OF CONFERENCES AND EVENTS, 2022–2023

5.11 TECHNOLOGY ANALYSIS

5.11.1 EDGE AI AND INTERNET OF THINGS (IOT)

5.11.2 EDGE AI AND 5G

5.11.3 EDGE AI AND BLOCKCHAIN

5.11.4 AUGMENTED REALITY/VIRTUAL REALITY (AR/VR)

5.12 PRICING ANALYSIS

TABLE 9 AVERAGE SELLING PRICE ANALYSIS, 2022

5.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 IMPACT OF PORTER’S FIVE FORCES ON EDGE AI SOFTWARE MARKET

FIGURE 39 PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT OF NEW ENTRANTS

5.13.2 THREAT OF SUBSTITUTES

5.13.3 BARGAINING POWER OF SUPPLIERS

5.13.4 BARGAINING POWER OF BUYERS

5.13.5 INTENSITY OF COMPETITIVE RIVALRY

5.14 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF EDGE AI SOFTWARE SOLUTIONS AND SERVICES

FIGURE 40 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 41 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

5.15.2 BUYING CRITERIA

FIGURE 42 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 12 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 EDGE AI SOFTWARE MARKET, BY COMPONENT (Page No. - 94)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

FIGURE 43 SERVICES SEGMENT TO GROW AT HIGHER CAGR BY 2027

TABLE 13 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 14 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

FIGURE 44 STANDALONE SEGMENT TO GROW AT HIGHER CAGR BY 2027

TABLE 15 MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 16 MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 17 SOLUTIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 18 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1 STANDALONE

6.2.1.1 Growing demand to optimize corporate operations and fulfill customer requirements

TABLE 19 STANDALONE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 STANDALONE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 INTEGRATED

6.2.2.1 Edge AI software integrated with AI and ML to help organizations analyze data in real-time

TABLE 21 INTEGRATED: EDGE AI SOFTWARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 INTEGRATED: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

6.3.1 TRAINING & CONSULTING

6.3.1.1 Growing use of training & consulting services by organizations to gain expertise in strategic planning

6.3.2 SYSTEM INTEGRATION & IMPLEMENTATION

6.3.2.1 Rising need to test functioning of entire systems

6.3.3 SUPPORT & MAINTENANCE

6.3.3.1 Increasing need to upgrade and maintain edge AI ecosystem post-implementation

TABLE 31 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 EDGE AI SOFTWARE MARKET, BY DATA SOURCE (Page No. - 105)

7.1 INTRODUCTION

7.1.1 DATA SOURCES: MARKET DRIVERS

FIGURE 46 MOBILE DATA SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 33 MARKET, BY DATA SOURCE, 2018–2021 (USD MILLION)

TABLE 34 MARKET, BY DATA SOURCE, 2022–2027 (USD MILLION)

7.2 VIDEO & IMAGE RECOGNITION

7.2.1 GROWING NEED FOR IMPROVED RESPONSE TIME AND BANDWIDTH SAVINGS

TABLE 35 VIDEO & IMAGE RECOGNITION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 VIDEO & IMAGE RECOGNITION: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 IRIS & FACIAL DATA

7.3.1 GROWING DEMAND FOR ENHANCED VERIFICATION PERFORMANCE AND REDUCED ENROLLMENT FAILURE

TABLE 37 IRIS AND FACIAL DATA: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 IRIS AND FACIAL DATA: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 SENSOR DATA

7.4.1 INCREASING NEED TO ANALYZE SENSOR DATA TO ENABLE USERS PREDICT OUTCOME AND CAPTURE SYNCHRONIZED MOTION SENSOR DATA

TABLE 39 SENSOR DATA: EDGE AI SOFTWARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 SENSOR DATA: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 MOBILE DATA

7.5.1 GROWING POPULARITY OF SMARTPHONES COUPLED WITH NEED TO MANAGE SOARING SOCIAL MEDIA DATA

TABLE 41 MOBILE DATA: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 MOBILE DATA: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 SPEECH RECOGNITION

7.6.1 EDGE AI SOFTWARE TO OFFER HUGE OPPORTUNITIES AND PROVIDE BETTER USER EXPERIENCE

TABLE 43 SPEECH RECOGNITION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 SPEECH RECOGNITION: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 EDGE AI SOFTWARE MARKET, BY ORGANIZATION SIZE (Page No. - 113)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZES: MARKET DRIVERS

8.2 LARGE ENTERPRISES

8.2.1 AVAILABILITY OF IT INFRASTRUCTURE AND RISING NEED TO MANAGE PARTNERS

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.1 GROWING MARKET SHARE OF SMES ACROSS KEY INDUSTRIAL SECTORS

9 EDGE AI SOFTWARE MARKET, BY VERTICAL (Page No. - 118)

9.1 INTRODUCTION

9.1.1 VERTICALS: MARKET DRIVERS

9.2 ENTERPRISE USE CASES

FIGURE 48 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR BY 2027

TABLE 51 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 52 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.3 GOVERNMENT & PUBLIC SECTOR

9.3.1 RISING NEED TO IMPROVE PUBLIC SAFETY AND MANAGE TRAFFIC

TABLE 53 GOVERNMENT & PUBLIC SECTOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 GOVERNMENT & PUBLIC SECTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3.2 GOVERNMENT & PUBLIC SECTOR VERTICAL SUBAPPLICATIONS OF EDGE AI SOFTWARE

FIGURE 49 SMART CITY MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR BY 2027

TABLE 55 GOVERNMENT & PUBLIC SECTOR: MARKET, BY SUBAPPLICATION, 2018–2021 (USD MILLION)

TABLE 56 GOVERNMENT & PUBLIC SECTOR: MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

9.3.2.1 Traffic management

9.3.2.2 Waste or water management

9.3.2.3 Smart city management

9.3.2.4 Security & law enforcement

9.4 MANUFACTURING

9.4.1 EDGE AI SOFTWARE TO OFFER PREDICTIVE MAINTENANCE TECHNIQUES TO MANUFACTURING FIRMS

TABLE 57 MANUFACTURING: EDGE AI SOFTWARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4.2 MANUFACTURING VERTICAL SUBAPPLICATIONS OF EDGE AI SOFTWARE

FIGURE 50 CONDITION & PRECISION MONITORING SEGMENT TO GROW AT HIGHEST CAGR BY 2027

TABLE 59 MANUFACTURING: MARKET, BY SUBAPPLICATION, 2018–2021 (USD MILLION)

TABLE 60 MANUFACTURING: MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

9.4.2.1 Predictive maintenance

9.4.2.2 Yield optimization

9.4.2.3 Condition & precision monitoring

9.4.2.4 Quality control

9.5 HEALTHCARE & LIFE SCIENCES

9.5.1 RISING NEED TO SECURE SENSITIVE PATIENT DATA AND ENHANCE SERVICE

TABLE 61 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5.2 HEALTHCARE & LIFE SCIENCES VERTICAL SUBAPPLICATIONS OF EDGE AI SOFTWARE

FIGURE 51 RADIOLOGY SEGMENT TO GROW AT HIGHEST CAGR BY 2027

TABLE 63 HEALTHCARE & LIFE SCIENCES: EDGE AI SOFTWARE MARKET, BY SUBAPPLICATION, 2018–2021 (USD MILLION)

TABLE 64 HEALTHCARE & LIFE SCIENCES: MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

9.5.2.1 In-hospital patient monitoring

9.5.2.2 Fall detection

9.5.2.3 Radiology

9.5.2.4 Anomaly & injuries detection

9.6 ENERGY & UTILITIES

9.6.1 EDGE AI SOFTWARE SOLUTIONS TO OFFER ENHANCED PRODUCTION AND SAFETY

TABLE 65 ENERGY & UTILITIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 ENERGY & UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6.2 ENERGY & UTILITIES VERTICAL SUBAPPLICATIONS OF EDGE AI SOFTWARE

FIGURE 52 SMARTGRIDS SEGMENT TO GROW AT HIGHEST CAGR BY 2027

TABLE 67 ENERGY & UTILITIES: MARKET, BY SUBAPPLICATION, 2018–2021 (USD MILLION)

TABLE 68 ENERGY & UTILITIES: MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

9.6.2.1 Energy optimization

9.6.2.2 Distributed energy management

9.6.2.3 Smart grids

9.6.2.4 Pipeline optimization

9.7 TELECOM

9.7.1 EDGE AI SOFTWARE TO HELP TELECOM COMPANIES PROTECT CUSTOMER DATA AND ENHANCE EFFICIENCY

TABLE 69 TELECOM: EDGE AI SOFTWARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7.2 TELECOM VERTICAL SUBAPPLICATIONS OF EDGE AI SOFTWARE

FIGURE 53 FAULT DETECTION SEGMENT TO GROW AT HIGHEST CAGR BY 2027

TABLE 71 TELECOM: MARKET, BY SUBAPPLICATION, 2018–2021 (USD MILLION)

TABLE 72 TELECOM: MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

9.7.2.1 Network management & optimization

9.7.2.2 Customer churn prevention

9.7.2.3 Fault detection

9.7.2.4 Root cause analysis

9.8 MEDIA & ENTERTAINMENT

9.8.1 RISING DEMAND FOR EFFECTIVE VIDEO ADVERTISEMENTS AND BETTER CONTENT DELIVERY

TABLE 73 MEDIA & ENTERTAINMENT: EDGE AI SOFTWARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8.2 MEDIA & ENTERTAINMENT VERTICAL SUBAPPLICATIONS OF EDGE AI SOFTWARE

FIGURE 54 AR/VR/MR SEGMENT TO GROW AT HIGHEST CAGR BY 2027

TABLE 75 MEDIA & ENTERTAINMENT: MARKET, BY SUBAPPLICATION, 2018–2021 (USD MILLION)

TABLE 76 MEDIA & ENTERTAINMENT: MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

9.8.2.1 Video streaming

9.8.2.2 Cloud gaming

9.8.2.3 AR/VR/MR

9.8.2.4 Content rendering & caching

9.9 TRANSPORTATION & LOGISTICS

9.9.1 PRIORITIZING IMPROVEMENT IN VEHICLE ROUTING AND CUSTOMER SAFETY

TABLE 77 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9.2 TRANSPORTATION & LOGISTICS VERTICAL SUBAPPLICATIONS OF EDGE AI SOFTWARE

FIGURE 55 DEVICE FAILURE SEGMENT TO GROW AT HIGHEST CAGR BY 2027

TABLE 79 TRANSPORTATION & LOGISTICS: MARKET, BY SUBAPPLICATION, 2018–2021 (USD MILLION)

TABLE 80 TRANSPORTATION & LOGISTICS: EDGE AI SOFTWARE MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

9.9.2.1 Supply chain management

9.9.2.2 Autonomous vehicles

9.9.2.3 Device failure

9.9.2.4 Equipment management

9.10 OTHER VERTICALS

TABLE 81 OTHER VERTICALS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.10.1 OTHER VERTICALS SUBAPPLICATIONS OF EDGE AI SOFTWARE

FIGURE 56 FRAUD DETECTION & PREVENTION SEGMENT TO GROW AT HIGHEST CAGR BY 2027

TABLE 83 OTHER VERTICALS: MARKET, BY SUBAPPLICATION, 2018–2021 (USD MILLION)

TABLE 84 OTHER VERTICALS: MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

9.10.1.1 Weather monitoring

9.10.1.2 Identification & access management

9.10.1.3 Smart energy systems

9.10.1.4 Fraud detection & prevention

9.10.1.5 Customer engagement

10 EDGE AI SOFTWARE MARKET, BY REGION (Page No. - 147)

10.1 INTRODUCTION

10.1.1 KEY REGIONS: MARKET DRIVERS

FIGURE 57 ASIA PACIFIC SEGMENT TO GROW AT HIGHEST CAGR BY 2027

FIGURE 58 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 85 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 86 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: REGULATIONS

10.2.1.1 Gramm–Leach–Bliley Act

10.2.1.2 Personal Information Protection and Electronic Documents Act (PIPEDA)

10.2.1.3 Federal Information Security Management Act

10.2.1.4 Health Insurance Portability and Accountability Act, 1996

10.2.1.5 California Consumer Privacy Act (CCPA), 2018

FIGURE 59 NORTH AMERICA: MARKET SNAPSHOT

TABLE 87 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET, BY DATA SOURCE, 2018–2021 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET, BY DATA SOURCE, 2022–2027 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.2 US

10.2.2.1 Increasing innovations and building of state-of-the-art infrastructures

10.2.3 CANADA

10.2.3.1 Favorable startup ecosystem coupled with rising government investments

10.3 EUROPE

10.3.1 EUROPE: REGULATIONS

10.3.1.1 General Data Protection Regulation

10.3.1.2 European Committee for Standardization

10.3.1.3 European Technical Standards Institute

10.3.1.4 EU Data Governance Act

TABLE 101 EUROPE: EDGE AI SOFTWARE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY DATA SOURCE, 2018–2021 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY DATA SOURCE, 2022–2027 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Rising demand to increase networking infrastructure security across major verticals

10.3.3 GERMANY

10.3.3.1 Growing digital mobility and digital spending across major industries

10.3.4 FRANCE

10.3.4.1 Growing investments in technology

10.3.5 ITALY

10.3.5.1 Rising need to enhance process efficiency

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: REGULATIONS

10.4.1.1 Personal Data Protection Act

10.4.1.2 International Organization for Standardization 27001

10.4.1.3 Act on Protection of Personal Information

10.4.1.4 Critical Information Infrastructure

FIGURE 60 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 115 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY DATA SOURCE, 2018–2021 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY DATA SOURCE, 2022–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Growing need to manage huge amounts of edge data

10.4.3 JAPAN

10.4.3.1 Growing adoption of edge technologies to handle huge amounts of data

10.4.4 INDIA

10.4.4.1 Increasing government initiatives to support disruptive technologies

10.4.5 SINGAPORE

10.4.5.1 Increasing number of IoT and edge startups

10.4.6 REST OF ASIA PACIFIC

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: REGULATIONS

10.5.2.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

10.5.2.2 Cloud Computing Framework

10.5.2.3 GDPR Applicability in KSA

10.5.2.4 Protection of Personal Information Act

10.5.2.5 TRA’s IoT Regulatory Policy

TABLE 129 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 130 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 133 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 134 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 135 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY DATA SOURCE, 2018–2021 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: MARKET, BY DATA SOURCE, 2022–2027 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.3 UAE

10.5.3.1 Rapid IT resource deployment coupled with government initiatives

10.5.4 SAUDI ARABIA

10.5.4.1 Favorable startup ecosystem coupled with growing inclination toward advanced technology

10.5.5 SOUTH AFRICA

10.5.5.1 Rising investments by edge AI software vendors

10.5.6 ISRAEL

10.5.6.1 Presence of several AI startups coupled with strong regulatory landscape

10.5.7 REST OF MIDDLE EAST & AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: EDGE AI SOFTWARE MARKET DRIVERS

10.6.2 LATIN AMERICA: REGULATIONS

10.6.2.1 Brazil Data Protection Law

10.6.2.2 Argentina Personal Data Protection Law No. 25.326

TABLE 143 LATIN AMERICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 144 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 145 LATIN AMERICA: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 146 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 147 LATIN AMERICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 148 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET, BY DATA SOURCE, 2018–2021 (USD MILLION)

TABLE 152 LATIN AMERICA: MARKET, BY DATA SOURCE, 2022–2027 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 154 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 155 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 156 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.3 BRAZIL

10.6.3.1 Increasing need to incorporate edge AI solutions and services to boost businesses

10.6.4 MEXICO

10.6.4.1 Growing migration of applications and IT infrastructure to cloud

10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 185)

11.1 OVERVIEW

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 157 OVERVIEW OF STRATEGIES ADOPTED BY KEY EDGE AI VENDORS, 2022

11.3 REVENUE ANALYSIS

11.3.1 HISTORICAL REVENUE ANALYSIS

FIGURE 61 HISTORICAL REVENUE ANALYSIS OF TOP FIVE LEADING PLAYERS, 2019–2021 (USD MILLION)

11.4 MARKET SHARE ANALYSIS

FIGURE 62 MARKET SHARE ANALYSIS OF KEY COMPANIES, 2022

TABLE 158 EDGE AI SOFTWARE MARKET: DEGREE OF COMPETITION

11.5 MARKET EVALUATION FRAMEWORK

FIGURE 63 MARKET EVALUATION FRAMEWORK: EXPANSIONS AND CONSOLIDATIONS IN MARKET, 2020—2022

11.6 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2021

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 64 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

11.7 COMPETITIVE BENCHMARKING

11.7.1 COMPANY PRODUCT FOOTPRINT

FIGURE 65 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS

FIGURE 66 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS

TABLE 159 EDGE AI SOFTWARE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, 2022

11.8 EVALUATION QUADRANT FOR STARTUPS/SMES, 2021

11.8.1 PROGRESSIVE COMPANIES

11.8.2 RESPONSIVE COMPANIES

11.8.3 DYNAMIC COMPANIES

11.8.4 STARTING BLOCKS

FIGURE 67 EVALUATION QUADRANT FOR STARTUPS/SMES

11.9 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES, 2021

11.9.1 COMPANY PRODUCT FOOTPRINT

FIGURE 68 PRODUCT PORTFOLIO ANALYSIS OF STARTUPS/SMES

FIGURE 69 BUSINESS STRATEGY EXCELLENCE OF STARTUPS/SMES

TABLE 160 EDGE AI SOFTWARE MARKET: COMPETITIVE BENCHMARKING OF STARTUP/SMES, 2022

TABLE 161 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

11.1 COMPETITIVE SCENARIO AND TRENDS

11.10.1 PRODUCT LAUNCHES

TABLE 162 SERVICE/PRODUCT LAUNCHES, 2019–2022

11.10.2 DEALS

TABLE 163 DEALS, 2019–2022

12 COMPANY PROFILES (Page No. - 211)

12.1 INTRODUCTION

(Business Overview, Solutions/Services offered, Recent Developments, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats) *

12.2 KEY PLAYERS

12.2.1 MICROSOFT

TABLE 164 MICROSOFT: BUSINESS OVERVIEW

FIGURE 70 MICROSOFT: COMPANY SNAPSHOT

TABLE 165 MICROSOFT: SOLUTIONS/SERVICES OFFERED

TABLE 166 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 167 MICROSOFT: DEALS

12.2.2 IBM

TABLE 168 IBM: BUSINESS OVERVIEW

FIGURE 71 IBM: COMPANY SNAPSHOT

TABLE 169 IBM: SOLUTIONS/SERVICES OFFERED

TABLE 170 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 171 IBM: DEALS

12.2.3 GOOGLE

TABLE 172 GOOGLE: BUSINESS OVERVIEW

FIGURE 72 GOOGLE: COMPANY SNAPSHOT

TABLE 173 GOOGLE: SOLUTIONS/SERVICES OFFERED

TABLE 174 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 175 GOOGLE: DEALS

12.2.4 AWS

TABLE 176 AWS: BUSINESS OVERVIEW

FIGURE 73 AWS: COMPANY SNAPSHOT

TABLE 177 AWS: SOLUTIONS/SERVICES OFFERED

TABLE 178 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 179 AWS: DEALS

12.2.5 NUTANIX

TABLE 180 NUTANIX: BUSINESS OVERVIEW

FIGURE 74 NUTANIX: COMPANY SNAPSHOT

TABLE 181 NUTANIX: SOLUTIONS/SERVICES OFFERED

TABLE 182 NUTANIX: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 183 NUTANIX: DEALS

12.2.6 SYNAPTICS

TABLE 184 SYNAPTICS: BUSINESS OVERVIEW

FIGURE 75 SYNAPTICS: COMPANY SNAPSHOT

TABLE 185 SYNAPTICS: SOLUTIONS/SERVICES OFFERED

TABLE 186 SYNAPTICS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 187 SYNAPTICS: DEALS

12.2.7 GORILLA TECHNOLOGY

TABLE 188 GORILLA TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 76 GORILLA TECHNOLOGY: COMPANY SNAPSHOT

TABLE 189 GORILLA TECHNOLOGY: SOLUTIONS/SERVICES OFFERED

TABLE 190 GORILLA TECHNOLOGY: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 191 GORILLA TECHNOLOGY: DEALS

12.2.8 TIBCO SOFTWARE

TABLE 192 TIBCO: BUSINESS OVERVIEW

TABLE 193 TIBCO: SOLUTIONS/SERVICES OFFERED

TABLE 194 TIBCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 195 TIBCO: DEALS

12.2.9 OCTONION

TABLE 196 OCTONION: BUSINESS OVERVIEW

TABLE 197 OCTONION: SOLUTIONS/SERVICES OFFERED

TABLE 198 OCTONION: PRODUCT LAUNCHES AND ENHANCEMENTS

12.2.10 IMAGIMOB

TABLE 199 IMAGIMOB: BUSINESS OVERVIEW

TABLE 200 IMAGIMOB: SOLUTIONS/SERVICES OFFERED

TABLE 201 IMAGIMOB: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 202 IMAGIMOB: DEALS

12.2.11 ANAGOG

TABLE 203 ANAGOG: BUSINESS OVERVIEW

TABLE 204 ANAGOG: SOLUTIONS/SERVICES OFFERED

TABLE 205 ANAGOG: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 206 ANAGOG: DEALS

12.2.12 VEEA

TABLE 207 VEEA: BUSINESS OVERVIEW

TABLE 208 VEEA: SOLUTIONS/SERVICES OFFERED

TABLE 209 VEEA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 210 VEEA: DEALS

12.2.13 FOGHORN SYSTEMS

12.2.14 AZION

12.2.15 BRAGI

12.2.16 TACT.AI

12.2.17 SIXSQ

12.2.18 CLEARBLADE

12.2.19 ALEF EDGE

12.2.20 ADAPDIX

12.3 STARTUPS/SMES

12.3.1 BYTELAKE

12.3.2 REALITY AI

12.3.3 DECI

12.3.4 EDGEWORX

12.3.5 SWIM

12.3.6 INVISION AI

12.3.7 HORIZON ROBOTICS

12.3.8 KNERON

12.3.9 DEEPBRAINZ

12.3.10 STRATAHIVE

*Details on Business Overview, Solutions/Services offered, Recent Developments, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS (Page No. - 266)

13.1 INTRODUCTION

13.2 EDGE COMPUTING MARKET - GLOBAL FORECAST TO 2027

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

13.2.2.1 Edge computing market, by component

TABLE 211 EDGE COMPUTING MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 212 EDGE COMPUTING MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

13.2.2.2 Edge computing market, by application

TABLE 213 EDGE COMPUTING MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 214 EDGE COMPUTING MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

13.2.2.3 Edge computing market, by organization size

TABLE 215 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 216 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

13.2.2.4 Edge computing market, by vertical

TABLE 217 EDGE COMPUTING MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 218 EDGE COMPUTING MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

13.2.2.5 Edge computing market, by region

TABLE 219 EDGE COMPUTING MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 220 EDGE COMPUTING MARKET, BY REGION, 2021–2027 (USD MILLION)

13.3 ARTIFICIAL INTELLIGENCE MARKET - GLOBAL FORECAST TO 2027

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.2.1 Artificial intelligence market, by offering

TABLE 221 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2016–2021 (USD BILLION)

TABLE 222 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2022–2027 (USD BILLION)

13.3.2.2 Artificial intelligence market, by technology

TABLE 223 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2016–2021 (USD BILLION)

TABLE 224 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2022–2027 (USD BILLION)

13.3.2.3 Artificial intelligence market, by deployment mode

TABLE 225 ARTIFICIAL INTELLIGENCE MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD BILLION)

TABLE 226 ARTIFICIAL INTELLIGENCE MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD BILLION)

13.3.2.4 Artificial intelligence market, by organization size

TABLE 227 ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD BILLION)

TABLE 228 ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

13.3.2.5 Artificial intelligence market, by business function

TABLE 229 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2016–2021 (USD BILLION)

TABLE 230 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD BILLION)

13.3.2.6 Artificial intelligence market, by vertical

TABLE 231 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2016–2021 (USD BILLION)

TABLE 232 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

13.3.2.7 Artificial intelligence market, by region

TABLE 233 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 234 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2022–2027 (USD BILLION)

14 APPENDIX (Page No. - 278)

14.1 INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 CUSTOMIZATION OPTIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

The research study for the edge AI software market involved extensive secondary sources, directories, IEEE Communication-Efficient Edge AI: Algorithms and Systems, International Journal of Innovation and Technology Management and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred Edge AI software providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering Edge AI software and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to in order to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, information about the spending on edge AI software by various countries was extracted from respective sources.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendor websites. Additionally, Edge AI software spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, functionality, applications, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and Edge AI software expertise; related key executives from Edge AI software solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using Edge AI solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Edge AI software solutions and services, which would impact the overall edge AI software market.

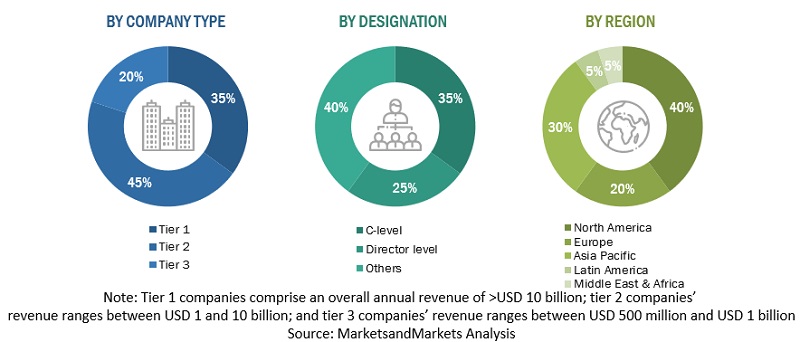

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this approach for market estimation, key edge AI software and service vendors such as Microsoft (US), Google (US), IBM (US), AWS (US), Nutanix (US), FogHorn Systems (US), and Imagimob (Sweden) were identified. These vendors contribute nearly 45%–55% to the global edge AI software market. The market is fragmented due to the presence of several vendors. After confirming these companies through primary interviews with industry experts, their total revenue through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases was estimated. The revenue pertaining to business units (BUs) that offer Edge AI software solutions was identified through similar sources. Then through primaries, the data of revenue generated from specific edge AI software solutions were collected. The collective revenue of key companies that offer Edge AI software solutions comprises 40–50% of the market, which was again confirmed through primary interviews with industry experts.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For converting various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on Edge AI software based on some key use cases. These factors for the edge AI software industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers & acquisitions, enterprise/SME adoption, start-up ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the edge AI market’s regional penetration. Based on secondary research, the regional spending on information and communications technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of major edge AI software providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall edge AI market size and subsegment were determined and confirmed using the study.

Report Objectives

- To define, describe, and predict the edge AI software market by component (solutions and services), deployment mode, vertical-wise applications, organization size, verticals, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the Edge AI software market

Customization Options

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American edge AI software market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle East & Africa market

- Further breakup of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Edge AI Software Market